On first inspection, data support the transaction costs hypothesis, though further analysis (e.g., statistical significance) and discussion is merited. Since few studies use this transaction costs approach, This paper emphasizes potential factors that are included in

fc(•), and then assess transaction costs using nonparametric regression. The relevant variables are mostly about agents’ characteristics, though transaction costs analyses usually focus on the production decision itself. Here, what characteristics will affect real investment is investigated rigorously. These factors are potential options that will be included in the transaction cost function. According to

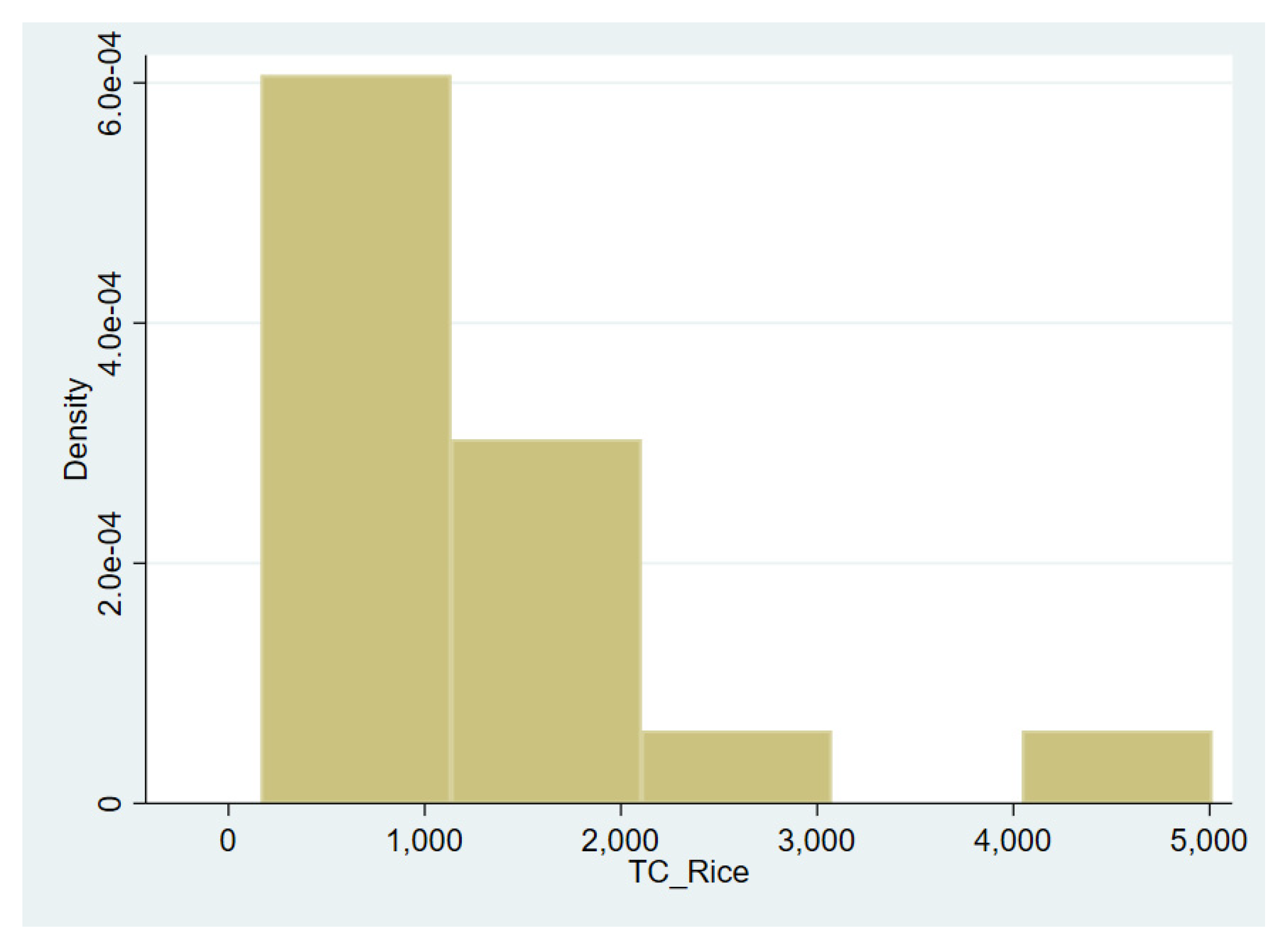

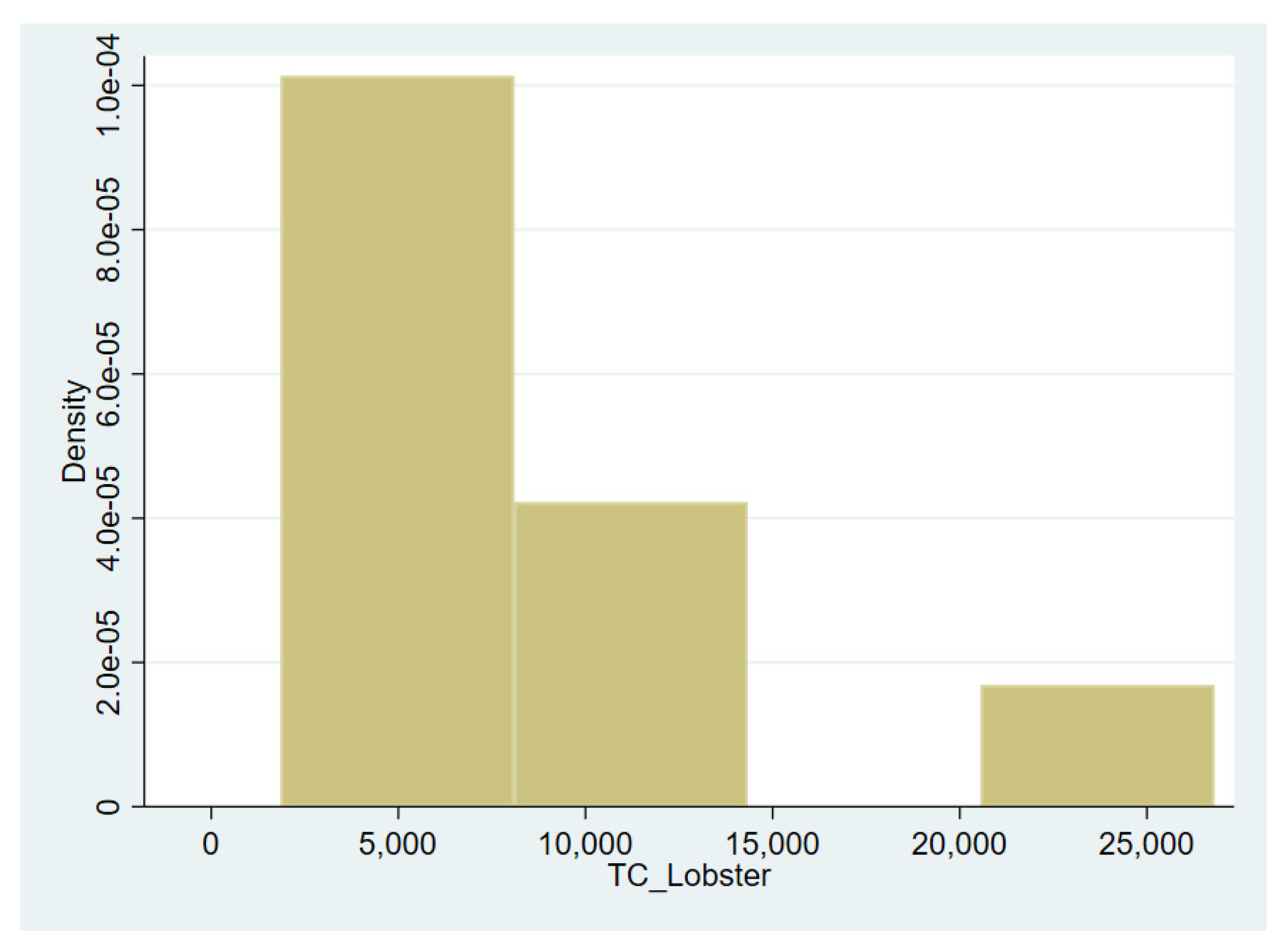

Figure 2, profits in 191 contracts obviously deviated from a normal distribution. Therefore, according to the typical analytic approach of employing factor analysis or principal components analysis, the statistical significance of the results may have little economic meaning. This paper instead use rank analysis, a form of nonparametric analysis, to inquire into the property of

fc(•). In estimating transaction cost statistics,

Cc is defined as the capital

C corresponding to Coase and Cheung, both of whom are pioneers of the transaction costs paradigm.

4.2.1. Transaction Costs and Farmer’s Investment Decision: Proof from Rank Statistics

From the view of mathematical statistics, as the rank number grows,

Cc will follow a chi-square distribution asymptotically. That is,

Cc can be approximated as follows:

In this expression,

p is the rank number and

is the average rank of the

jth column, while

ρ and

σ2 are the mean and variance of the rank table respectively. Statistical significance can be judged by chi-square distribution table (Any further inquiry into the mathematical statistical foundation of nonparametric tests is welcome. Traditionally, the rank method is used to analyze consumption data, as Friedman has shown. In this investigation, statistic “

C” is based on investment data to verify the naïve hypothesis, such as the transaction cost criterion. An additional contribution lies in the explanation for negative investment [

33]). Notably, most popular software solutions address rank data rather roughly. In regard to the rank statistical test, the adequate method is to appeal to the chi-square distribution table. However, it is apparent that the “rank test” order in Stata 16.0 still depends on ANOVA. As it will be shown, ANOVA misses the mark in the samples covered. Another alternative is to compute the “z-statistic” in the Kruskal–Wallis Test, but a deficiency lies in the fact that the statistic itself changes as the rank groups shifts. Because relevant software is rarely available, investigators manually calculate the corresponding rank statistics for seven potential factors. For the critical transaction cost variables, they are classified into 12 different groups in

Table 4.

The group averages decrease monotonically from the top to the bottom, and except for a minor outlier, the variance also decreases in one direction. Recall that a well-established finding in economics is that consumption variation increases with an increase in people’s income class, which precisely mirrors the results of grouping transaction costs. It is remarkable that all 19 observations in group 12 are negative. It is novel not only from statistical considerations but also from the available research on contract theory, while consistent with maximum problem (1) proposed in

Section 4. According to

Table 2, investigators set

p = 12, so rank statistic (3) can be reduced to:

To save space, now the statistical results based on Formula (4) are shown. Before estimation, the cost information in the original table are classified into six items broad categories, and distinguishing between “Own” (e.g., provided by the farmer) and “Outsourcing” (e.g., paying for the good or service) where relevant. Statistical significance in the sub-items can be used to assess the relevance of transaction costs to production decisions.

To emphasize the robustness of rank statistic (4), the F-test based on ANOVA is also provided, though the rank statistic (4) is preferred both for economic and statistical interpretation (see

Table 4). While the ANOVA results demonstrate that Transaction Costs are relevant to every item, the rank test narrows its influence to six items. The story about Subtraction is almost the converse. Given the transaction cost criterion (1), six rank statistics of the subtraction variable are significant at the 5% level, which shows that this cognitive ability has a considerable influence on investment. However, when turning to Stata’s ANOVA order, this ability can only impact pesticide investment.

Normally, good memory can improve decision making. However, little evidence is found to support this conjecture by the rank method. There are no items that are influenced by this variable, although the corresponding number under ANOVA is 13 items. However, when focusing on Transaction Cost, the numbers of relevant items decrease, as

Table 4 shows. The pattern does not appear to be random, but instead calls into question the value of the memory variable. The results from the Knowledge are similar to those of the Subtraction variable, which confirms findings about the influence of cognitive ability on various investments. In regard to results in

Table 5 concerning farming Experience, the significant investment items that were affected in the rank test “

Ce” column are seven, while the corresponding figure in ANOVA is 2. When observing the “Transaction Costs–BMI” table, the Transaction Costs statistics show the same pattern, but in terms of the health measure, superiority between these two methods cannot be decided. According to the rank statistic, BMI only impacts four investment items, a slightly poorer efficiency than that of ANOVA. Owing to space limitation, results concerning “Memory–Transaction Costs”, “Knowledge–Transaction Costs”, and “BMI–Transaction Costs” are in

Appendix A (

Table A1 and

Table A2).

Generally, there have been two ways to deal with risk. The first is to attribute so-called risk into opportunity sets, based on the “Friedman–Savage” axiom. The drawback of this line of reasoning is that sometimes the opportunity sets are vague, giving positive transaction costs. The role for contract theory is apparent here. Alternatively, transaction costs can be ignored and instead producer risk type can be assessed as an explanatory variable. Having done this, risk is typically incorporated into the agent’s utility function, leading to terms such as “Individual Rational” and “Incentive Compatible”, which is central to this kind of equilibrium analysis. This approach may lead to the conclusion that “Risk Tolerance” (Data on risk tolerance are extracted from a gamble question basing on the “Expected utility hypothesis” invented by Friedman and Savage [

34]). contributes enormously to investment fluctuations. This is a derived implication of the asymmetric information assumption, which is the theoretical foundation of the “Stiglitz–Spence–Akerlof” paradigm. However, there is evidence that challenges this paradigm. Staten, Gilley, and Umbeck rejected the so-called “Credit Ration” hypothesis of Stiglitz and his co-author, and Fang, Keane, and Silverman also verified Stiglitz and Rothchild’s “Adverse Selection” hypothesis [

35,

36,

37,

38]. However, as have been indicated in the literature review, these studies still leave some obscure room for the risk type analysis, so a direct test based on rank statistic may serve to extend the research agenda. As the results show, risk tolerance is unnecessary in interpreting the farmer’s investment.

Needless to say, the results in

Table 5 reject the second line of inquiry into risk, while it does not contradict the “Friedman–Savage” axiom and transaction costs hypothesis based on contract theory. The rank statistic

Cr is significant in only one item, and the statistical significance is 10%, which is rather weak and can be attributed to measurement error. It also implies that Chinese farmers in the sample covered behave as if they gamble and buy insurance at the same time. In regard to the Transaction Costs, the efficiency is rather robust, as anticipated.

The rank test of Area fails to be significant, which is in direct contrast to many popular views. Setting failure of corporation farming at “Red River Valley” in the 1900s aside [

28], the current academic atmosphere in China is inclined to consider the exit of small farmers as a time-consuming job rather than an orientation problem. There is a considerable body of relevant research on economies of scale of agricultural operations, while inquiries into decision margins of farmers are rare. From the lens of economic theory, taking time and interest into consideration makes the so-called scale operation argument futile. That is, the importance of the scale of the operation is one implication of transaction costs criterion. When farmers need to harvest crops urgently, having rented much larger plots than average is advantageous in the short run. However, when demand is stable and permanent, farmers can harvest as expected rather. If officials order small farmers to surrender their lands and then parcel them out according to a scale operation rule, a significant social cost may appear. This is also a feature of agricultural policy in the West (e.g., in France, where the multi-functionality concept has been used to economically support a patchwork of many small farms).

The social importance of farms and farmers is also seen in the United States. For example, Knoeber analyzed bans on corporate farming in 10 states and incentives for small farms [

39]. Here, when testing the relation between area and various investment items, interesting results appear (see

Table 6). Choosing 10% as the statistical significance level, the number of items influenced is zero. This result is in part explained by recognizing that sown area and area under cultivation can differ, particularly when considering a diversity of land characteristics (e.g., slope and soil condition) and land management (e.g., rotation and inter-planting). This can also explain the insignificant effect of land consolidation on rental price of land in Slovakia [

40].

According to the rank statistics results shown in

Table 5 and

Table 6, the number of investment items influenced by factors other than transaction costs is 3.15 on average. To select proper variables in the sense of both statistics and economics, a simple average rule is applied: any characteristic variable whose double-factor rank test is equal or above 4 is a candidate variable in the transaction costs function,

fc(•). As already outlined, the most important factor in

fc(•) is Subtraction ability, with eight significant results. The second most important factor is farming Experience, and the corresponding number is 7. The remaining two central variables are the BMI index and Knowledge successively. It seems that Memory and Area variables are irrelevant in Transaction Costs function: According to rank test results reported in

Table 6 and

Table A1, none of the 20 investment items are significantly influenced.

4.2.2. Transaction Costs Function: Nonparametric Approach

Using the nonparametric order of Stata 16.0, univariate, bivariate regressions on Transaction Costs are estimated, and results are summarized in

Table 6. As expected, Transaction Costs in all four models are significant at the 1% level, while there are differences among statistical significance values among the coefficients of the four characteristics noted. The t-value of BMI is 1.34, which is significant at this level, while the corresponding t-value of Knowledge in nonparametric Model 2 is only 0.41, a much poorer result than both the corresponding results of the rank statistic and ANOVA results. Subtraction and Farming Experience have strong results, where the correlation coefficients are 1140 and −682.7, respectively, and both are statistically significant at the 5% level. The robustness

p-value of the correlation coefficient of farming experience is <0.001. Interestingly, the sign of these two variables are inversely related: in Model 3, the ability of Subtraction co-moves with the Transaction Costs of the contract, while in Model 4, farming Experience can reduce Transaction Costs rather effectively.

To be cautious, investigators also employed bivariate, trivariate, and four-variable regressions on Transaction Costs before focusing on these two characters. It seems that the inclusion of the BMI variable as an independent variable reduces the effective observations considerably, such that the iteration process cannot be completed, and the inclusion of knowledge in Model 3 and 4 result in the same problem. Therefore, in

Table 7 not only the regression of Subtraction, Farming Experience, and Knowledge on Transaction Costs are reported, but also the regression of Subtraction and Farming Experience on Transaction Costs, as tabulated in Model 5 and Model 6, respectively.

As expected, the correlation coefficient of Knowledge in Model 5 is not significant even at the 10% level, and it worth noting that it also makes the p-values implied in robustness standard errors of other variables increase above 10%. This statistical finding is rather idiosyncratic. However, in a purely statistical sense, the sample covered does not offer solid evidence of Knowledge’s role in Transaction Costs.

Model 6 considers only the regression of Subtraction and farming Experience on Transaction Costs, in which all three variables are statistically significant. The correlation coefficient of Subtraction is 174.1, slightly less than its counterpart in Model 3, while the correlation coefficient of Farming Experience is −89.0, which is approximately three twentieth lower than its counterpart in Model 4. In addition, Model 6′s R-squared (R2) is higher than the total R2 of Model 3 and Model 4. These suggest that the addition of Farming Experience improves the usual omitted variable bias. Combining all of these findings in Models 1–6, it is confirmed that among the four factors, transaction costs statistics and other rank statistics are recommended. Moreover, farming Experience and Subtraction are most powerful in explaining the magnitude of and variation in Transaction Costs. The significance of BMI and Knowledge is left unclear given the statistical evidence of the nonparametric regression in the context of the economic implication inherent in these two variables.

Combining the “margin” results and “contrast” results in these two tables, the effect of one unit change in the level of factors can be predicted. According to

Table 8, increasing Subtraction ability by one unit will increase transaction costs by US

$513.40, ceteris paribus. Moreover, a one-year increase of Farming Experience will save US

$116.20 in transaction costs, assuming subtraction ability otherwise remains constant.