Urban Land Use Transitions and the Economic Spatial Spillovers of Central Cities in China’s Urban Agglomerations

Abstract

1. Introduction

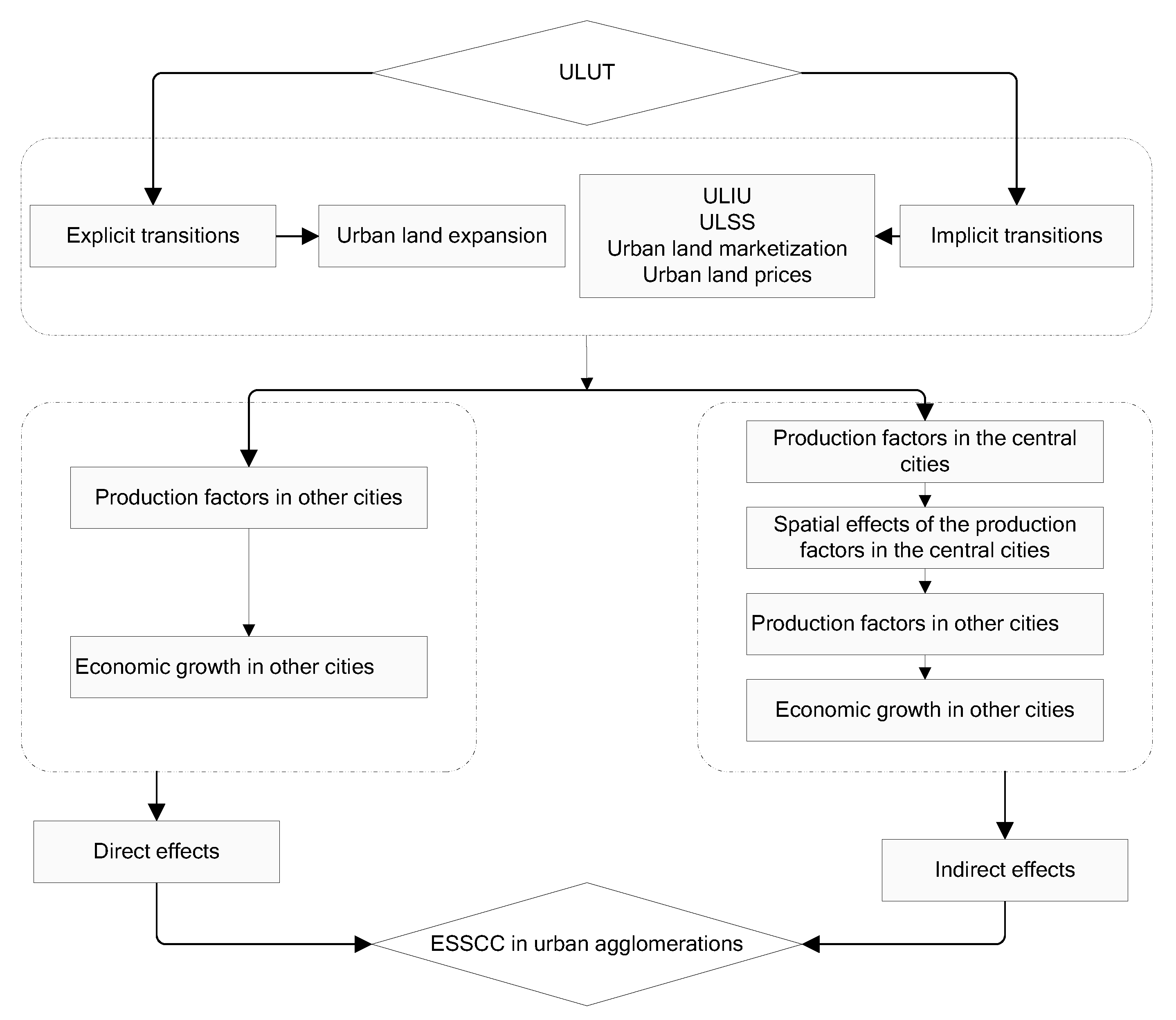

2. Influence Mechanism of ULUT on ESSCC

3. Methodology

3.1. Spatial Autocorrelation Analysis

3.2. The Econometric Model to Examine the Impacts of ULUT on ESSCC

3.3. The Econometric Model to Examine the Intermediate Mechanism

3.4. Solution of Endogeneity and Collinearity

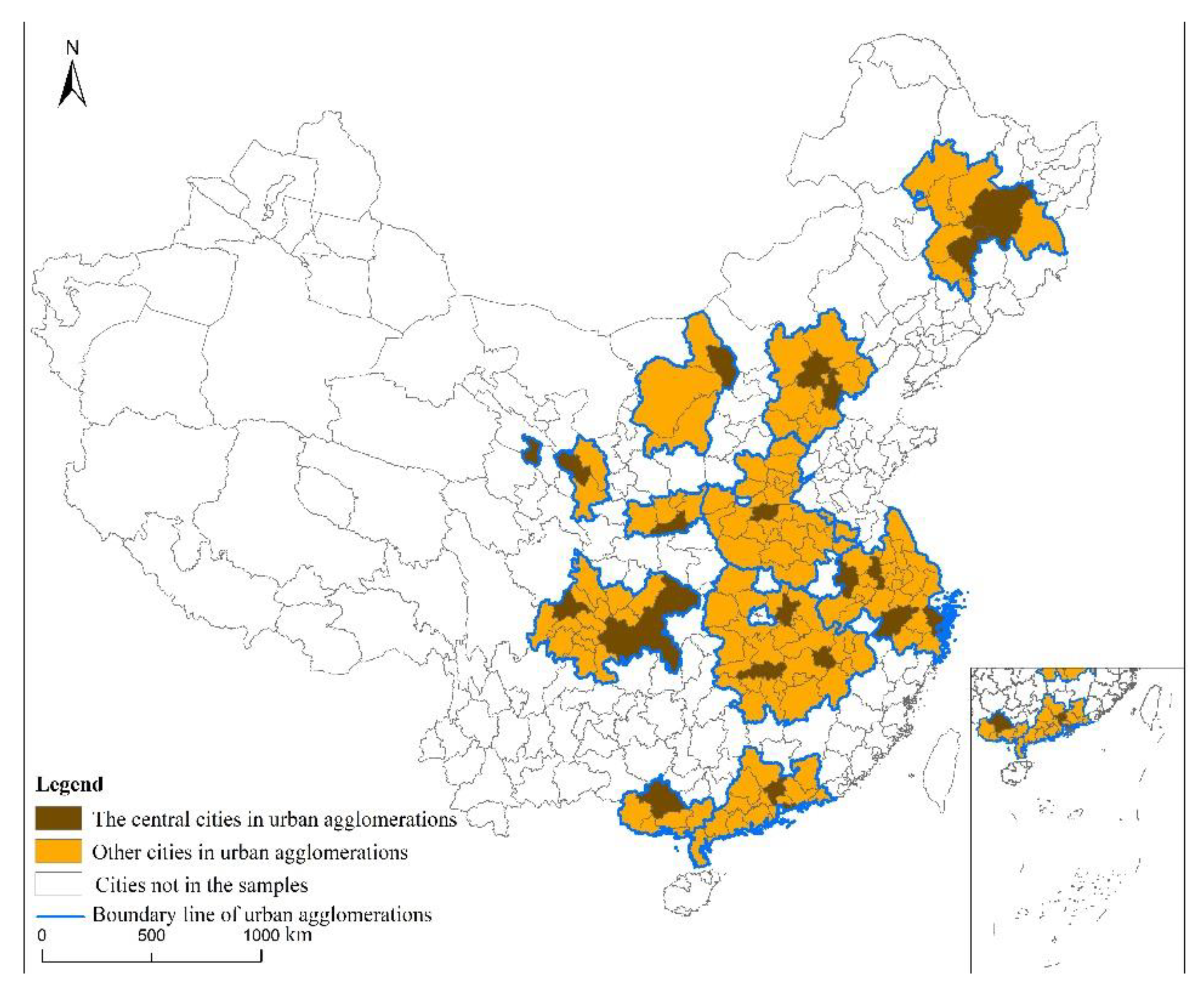

3.5. Variables and Data

4. Results

4.1. ULUT in China during 2003–2016

4.2. The Impacts of ULUT on the ESSCC in Urban Agglomerations

4.2.1. The Impacts of Urban Land Expansions on the ESSCC in Urban Agglomerations

4.2.2. The Influences of the ULIU on the ESSCC in Urban Agglomerations

4.2.3. The Effects of the ULSS on the ESSCC in Urban Agglomerations

4.2.4. The Impacts of Urban Land Marketization on the ESSCC in Urban Agglomerations

4.2.5. The Influences of the Urban Land Prices on the ESSCC in Urban Agglomerations

4.3. The Intermediate Mechanism of the ULUT Affect the ESSCC in Urban Agglomerations

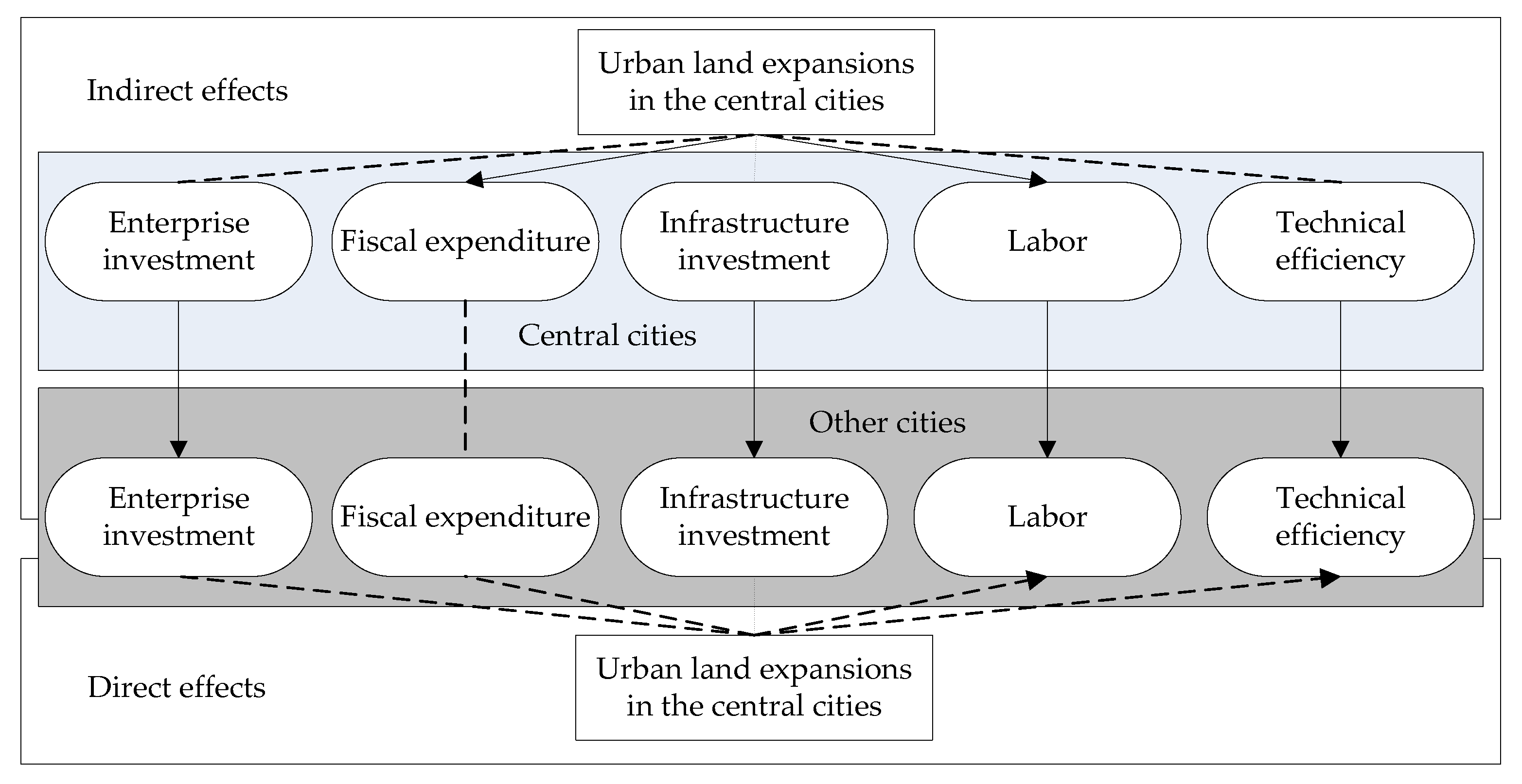

4.3.1. The Influences of the Urban Land Expansions on the Production Factors and Their Spatial Effects in Urban Agglomerations

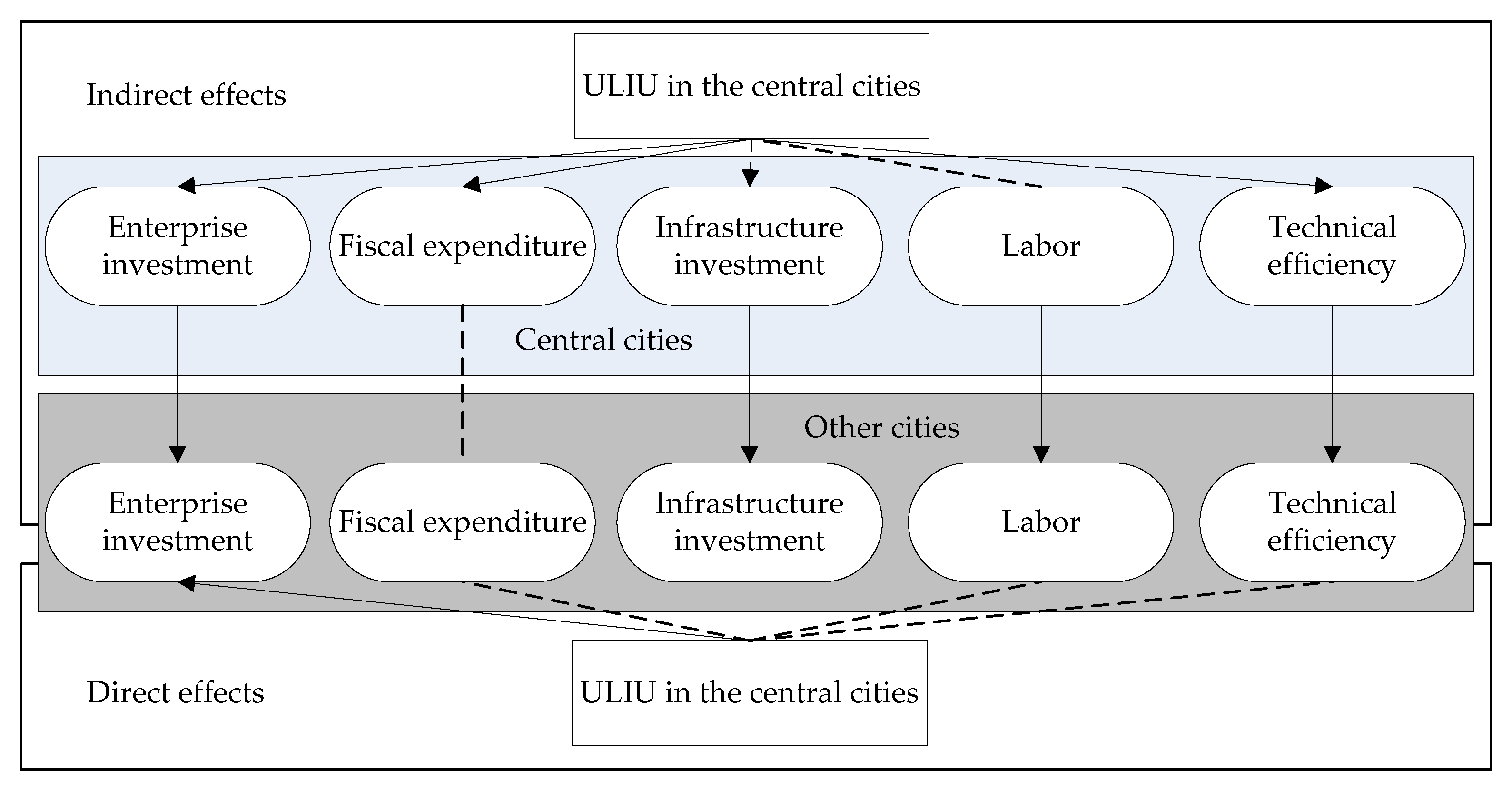

4.3.2. The Influences of the ULIU on the Production Factors and Their Spatial Effects in Urban Agglomerations

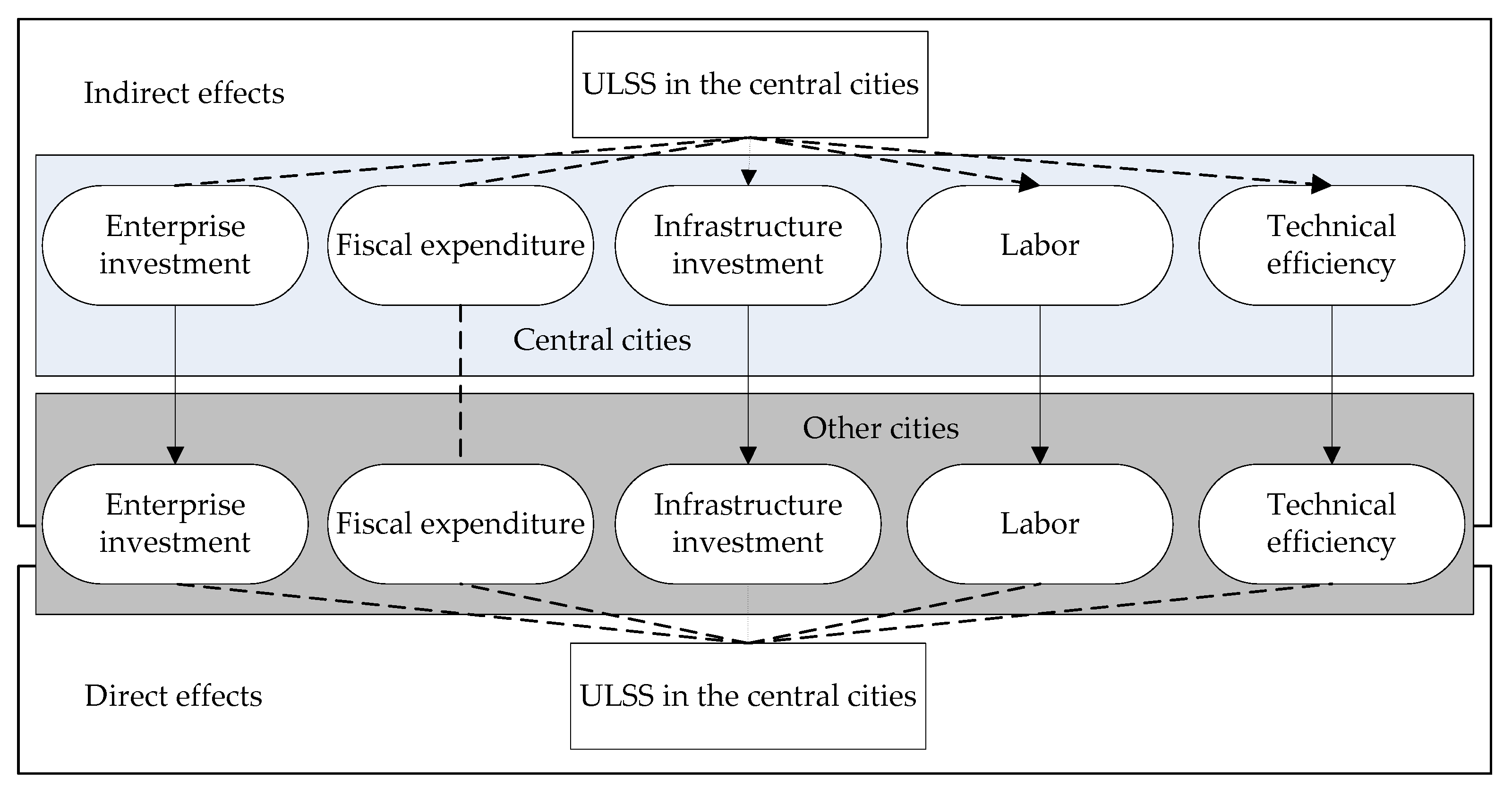

4.3.3. The Influences of the ULSS on the Production Factors and Their Spatial Effects in Urban Agglomerations

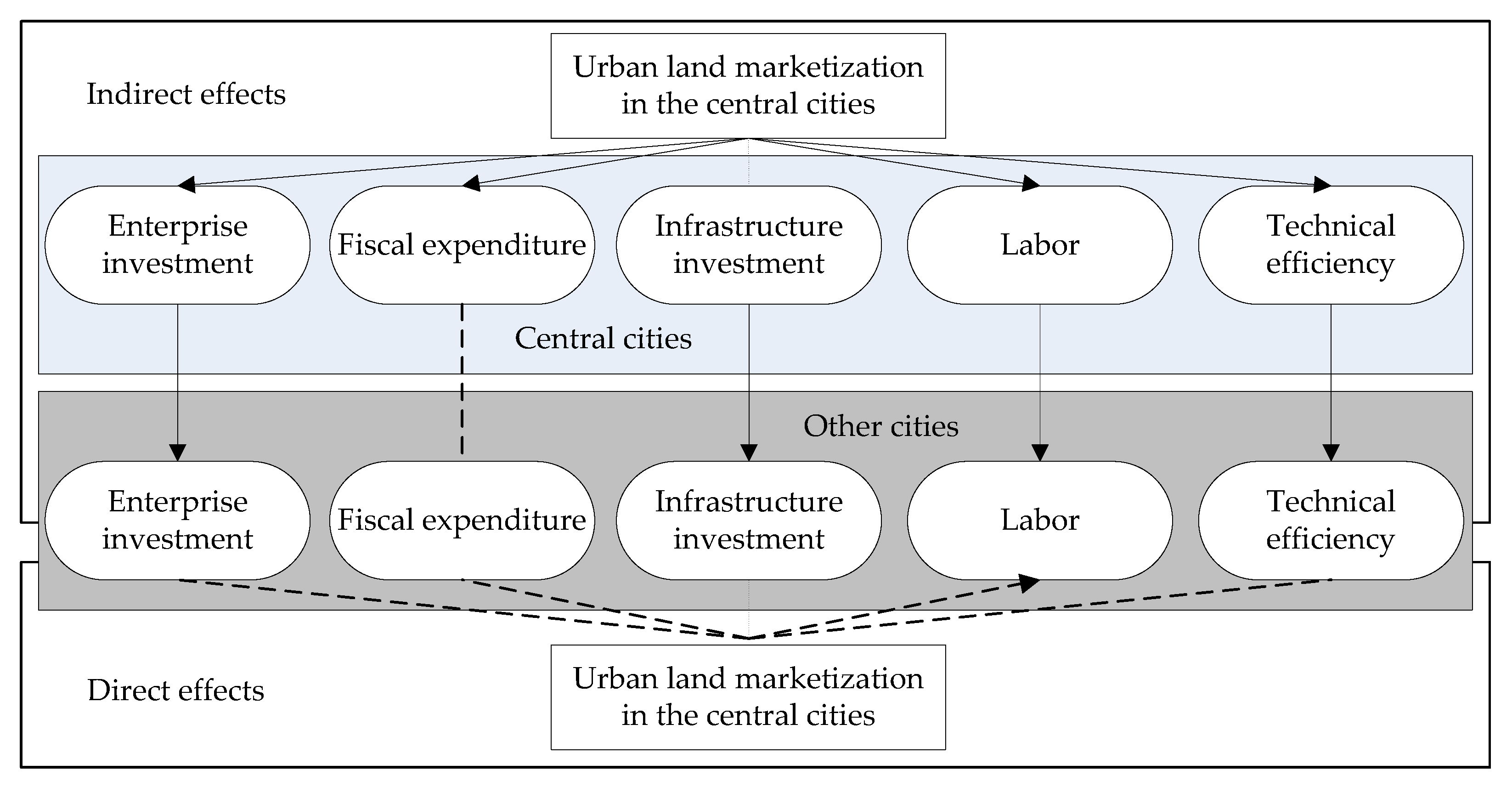

4.3.4. The Influences of the Urban Land Marketization on the Production Factors and Their Spatial Effects in Urban Agglomerations

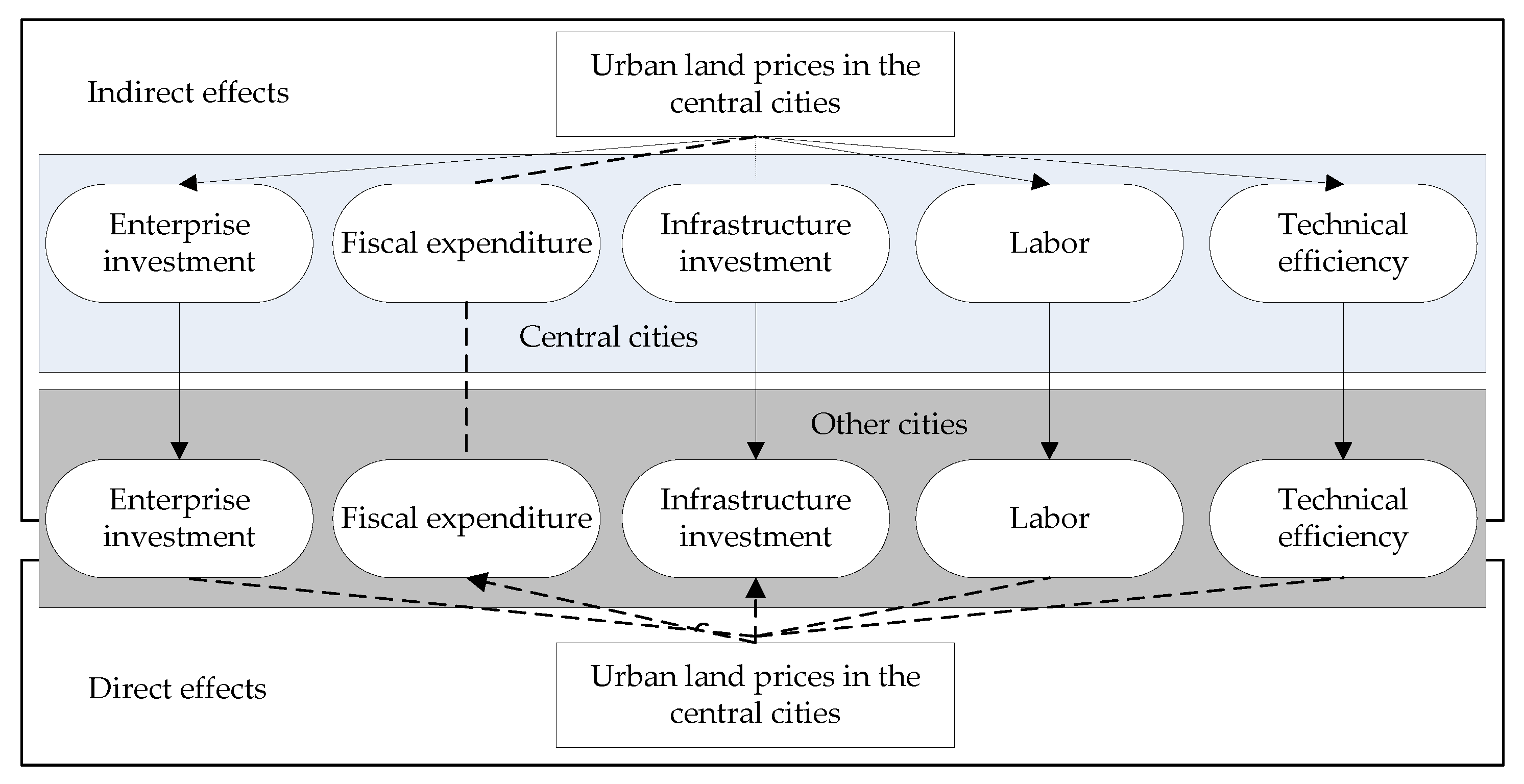

4.3.5. The Influences of the Urban Land Prices on the Production Factors and Their Spatial Effects in Urban Agglomerations

5. Discussion

5.1. Why Are the Positive Effects of ULUT on the ESSCC Small?

5.2. Suggestions for ULUT to Promote the ESSCC

5.3. Limitations and Future Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Deng, X.; Huang, J.; Rozelle, S.; Uchida, E. Economic Growth and the Expansion of Urban Land in China. Urban Stud. 2009, 47, 813–843. [Google Scholar] [CrossRef]

- Ji, Y.; Guo, X.; Zhong, S. Land Financialization, Uncoordinated Development of Population Urbanization and Land Urbanization, and Economic Growth: Evidence from China. Land 2020, 9, 481. [Google Scholar] [CrossRef]

- Xiao, J.; Shen, Y.; Ge, J.; Tateishi, R.; Tang, C.; Liang, Y.; Huang, Z. Evaluating urban expansion and land use change in Shijiazhuang, China, by using GIS and remote sensing. Landsc. Urban Plan. 2006, 75, 69–80. [Google Scholar] [CrossRef]

- Yu, Y.; Xu, T.; Wang, T. Outmigration Drives Cropland Decline and Woodland Increase in Rural Regions of Southwest China. Land 2020, 9, 443. [Google Scholar] [CrossRef]

- Yan, L.; Hong, K.; Chen, K.; Li, H.; Liao, L. Benefit distribution of collectively-owned operating construction land entering the market in rural China: A multiple principal–agent theory-based analysis. Habitat Int. 2021, 109, 102328. [Google Scholar] [CrossRef]

- Yan, L.; Hong, K.; Li, H. Transfer of Land Use Rights in Rural China and Farmers’ Utility: How to Select an Optimal Payment Mode of Land Increment Income. Land 2021, 10, 450. [Google Scholar] [CrossRef]

- Ning, J.; Liu, J.; Kuang, W.; Xu, X.; Zhang, S.; Yan, C.; Li, R.; Wu, S.; Hu, Y.; Du, G.; et al. Spatiotemporal patterns and characteristics of land-use change in China during 2010–2015. J. Geogr. Sci. 2018, 28, 547–562. [Google Scholar] [CrossRef]

- Zhang, X.; Wu, Y.; Shen, L. An evaluation framework for the sustainability of urban land use: A study of capital cities and municipalities in China. Habitat Int. 2011, 35, 141–149. [Google Scholar] [CrossRef]

- Long, H.; Li, Y.; Liu, Y.; Woods, M.; Zou, J. Accelerated restructuring in rural China fueled by ‘increasing vs. decreasing balance’ land-use policy for dealing with hollowed villages. Land Use Policy 2012, 29, 11–22. [Google Scholar] [CrossRef]

- Yu, J.; Zhou, K.; Yang, S. Land use efficiency and influencing factors of urban agglomerations in China. Land Use Policy 2019, 88. [Google Scholar] [CrossRef]

- Lu, X.; Ke, S. Evaluating the effectiveness of sustainable urban land use in China from the perspective of sustainable urbanization. Habitat Int. 2018, 77, 90–98. [Google Scholar] [CrossRef]

- Wang, J.; Chen, Y.; Shao, X.; Zhang, Y.; Cao, Y. Land-use changes and policy dimension driving forces in China: Present, trend and future. Land Use Policy 2012, 29, 737–749. [Google Scholar] [CrossRef]

- Gong, J.; Chen, W.; Liu, Y.; Wang, J. The intensity change of urban development land: Implications for the city master plan of Guangzhou, China. Land Use Policy 2014, 40, 91–100. [Google Scholar] [CrossRef]

- Wei, Y.H.D. Restructuring for growth in urban China: Transitional institutions, urban development, and spatial transformation. Habitat Int. 2012, 36, 396–405. [Google Scholar] [CrossRef]

- Liu, T.; Cao, G.; Yan, Y.; Wang, R.Y. Urban land marketization in China: Central policy, local initiative, and market mechanism. Land Use Policy 2016, 57, 265–276. [Google Scholar] [CrossRef]

- Gao, J.; Wei, Y.D.; Chen, W.; Chen, J. Economic transition and urban land expansion in Provincial China. Habitat Int. 2014, 44, 461–473. [Google Scholar] [CrossRef]

- Long, H. Land use policy in China: Introduction. Land Use Policy 2014, 40, 1–5. [Google Scholar] [CrossRef]

- The Ministry of Land and Resources of China. Regulations on the Transfer of State-Owned Construction Land Use Rights by Bidding, Auction and Listing. Available online: http://www.gov.cn/gongbao/content/2008/content_970300.htm (accessed on 28 September 2007).

- State Council of China. Outline of National Overall Land Use Planning in China (2006–2020). Available online: http://www.gov.cn/zxft/ft149/content_1144625.htm (accessed on 24 October 2008).

- The Ministry of Land and Resources of China. Guiding Opinions of the Ministry of Land and Resources on Promoting Land Conservation and Intensive Utilization. Available online: http://www.gov.cn/xinwen/2014-09/26/content_2756852.htm (accessed on 26 September 2014).

- Zhou, Y.; Huang, X.; Chen, Y.; Zhong, T.; Xu, G.; He, J.; Xu, Y.; Meng, H. The effect of land use planning (2006–2020) on construction land growth in China. Cities 2017, 68, 37–47. [Google Scholar] [CrossRef]

- Chen, Y.; Chen, Z.; Xu, G.; Tian, Z. Built-up land efficiency in urban China: Insights from the General Land Use Plan (2006–2020). Habitat Int. 2016, 51, 31–38. [Google Scholar] [CrossRef]

- Yang, Y.; Bao, W.; Li, Y.; Wang, Y.; Chen, Z. Land Use Transition and Its Eco-Environmental Effects in the Beijing–Tianjin–Hebei Urban Agglomeration: A Production–Living–Ecological Perspective. Land 2020, 9, 285. [Google Scholar] [CrossRef]

- Allen, J. Global City-Regions: Trends, Theory, Policy; Oxford University Press: Oxford, UK, 2001. [Google Scholar]

- Zhen, F.; Cao, Y.; Qin, X.; Wang, B. Delineation of an urban agglomeration boundary based on SinaWeibo microblog ‘check-in’ data: A case study of the Yangtze River Delta. Cities 2017, 60, 180–191. [Google Scholar] [CrossRef]

- The Central Committee of the Communist Party of China, State Council of China. The National New Urbanization Plan (2014–2020). Available online: http://www.gov.cn/zhengce/2014-03/16/content_2640075.htm (accessed on 16 March 2014).

- Long, H.; Tang, G.; Li, X.; Heilig, G.K. Socio-economic driving forces of land-use change in Kunshan, the Yangtze River Delta economic area of China. J. Environ. Manag. 2007, 83, 351–364. [Google Scholar] [CrossRef]

- Ding, C.; Lichtenberg, E. Land and Urban Economic Growth in China. J. Reg. Sci. 2010, 51, 299–317. [Google Scholar] [CrossRef]

- Seto, K.C.; Kaufmann, R.K. Modeling the Drivers of Urban Land Use Change in the Pearl River Delta, China: Integrating Remote Sensing with Socioeconomic Data. Land Econ. 2003, 79, 106–121. [Google Scholar] [CrossRef]

- Long, H.; Heilig, G.; Li, X.; Zhang, M. Socio-economic development and land-use change: Analysis of rural housing land transition in the Transect of the Yangtze River, China. Land Use Policy 2007, 24, 141–153. [Google Scholar] [CrossRef]

- Wang, J.; He, T.; Lin, Y. Changes in ecological, agricultural, and urban land space in 1984–2012 in China: Land policies and regional social-economical drivers. Habitat Int. 2018, 71, 1–13. [Google Scholar] [CrossRef]

- Kuang, W.; Liu, J.; Dong, J.; Chi, W.; Zhang, C. The rapid and massive urban and industrial land expansions in China between 1990 and 2010: A CLUD-based analysis of their trajectories, patterns, and drivers. Landsc. Urban Plan. 2016, 145, 21–33. [Google Scholar] [CrossRef]

- Lin, G.; Zhang, A. Emerging spaces of neoliberal urbanism in China: Land commodification, municipal finance and local economic growth in prefecture-level cities. Urban Stud. 2015, 52, 2774–2798. [Google Scholar] [CrossRef]

- Lichtenberg, E.; Ding, C. Local officials as land developers: Urban spatial expansion in China. J. Urban Econ. 2009, 66, 57–64. [Google Scholar] [CrossRef]

- He, C.; Huang, Z.; Wang, R. Land use change and economic growth in urban China: A structural equation analysis. Urban Stud. 2014, 51, 2880–2898. [Google Scholar] [CrossRef]

- Ke, S. Agglomeration, productivity, and spatial spillovers across Chinese cities. Ann. Reg. Sci. 2009, 45, 157–179. [Google Scholar] [CrossRef]

- Han, W.; Zhang, X.; Zheng, X. Land use regulation and urban land value: Evidence from China. Land Use Policy 2020, 92, 104432. [Google Scholar] [CrossRef]

- Nichols, A. Land and economic growth. Am. Econ. Rev. 1970, 60, 332–340. [Google Scholar]

- McCain, A. Land in Fellner’s model of economic growth: Comment. Am. Econ. Rev. 1970, 60, 495–499. [Google Scholar]

- Drazen, A.; Eckstein, Z. On the organization of rural markets and the process of economic development. Am. Econ. Rev. 1988, 78, 431–443. [Google Scholar]

- Rhee, C. Dynamic Inefficiency in an Economy with Land. Rev. Econ. Stud. 1991, 58, 791–797. [Google Scholar] [CrossRef]

- Ihlanfeldt, R. The effect of land use regulation on housing and land prices. J. Urban Econ. 2007, 61, 420–435. [Google Scholar] [CrossRef]

- Kok, N.; Monkkonen, P.; Quigley, J.M. Land use regulations and the value of land and housing: An intra-metropolitan analysis. J. Urban Econ. 2014, 81, 136–148. [Google Scholar] [CrossRef]

- Irwin, G.; Bockstael, N. The problem of identifying land use spillovers: Measuring the effects of open space on residential property values. Am. J. Agric. Econ. 2001, 83, 698–704. [Google Scholar] [CrossRef]

- Hui, E.; Liang, C. Spatial spillover effect of urban landscape views on property price. Appl. Geogr. 2016, 72, 26–35. [Google Scholar] [CrossRef]

- Glaeser, E.; Henderson, V. Urban economics for the developing world: An introduction. J. Urban Econ. 2017, 98, 1–5. [Google Scholar] [CrossRef]

- Anas, A.; Kim, I. General equilibrium models of polycentric urban land use with endogenous congestion and job agglomeration. J. Urban Econ. 1996, 40, 232–256. [Google Scholar] [CrossRef]

- Tian, L.; Ma, W. Government intervention in city development of China: A tool of land supply. Land Use Policy 2009, 26, 599–609. [Google Scholar] [CrossRef]

- Liu, M.; Tao, R.; Yuan, F.; Cao, G. Instrumental land use investment-driven growth in China. J. Asia Pac. Econ. 2008, 13, 313–331. [Google Scholar] [CrossRef]

- Gao, H. Public land leasing, public productive spending and economic growth in Chinese cities. Land Use Policy 2019, 88, 104076. [Google Scholar] [CrossRef]

- Zhu, J. Changing Land Policy and its Impact on Local Growth: The Experience of the Shenzhen Special Economic Zone, China, in the 1980s. Urban Stud. 1994, 31, 1611–1623. [Google Scholar] [CrossRef]

- Liu, J.; Guo, Q. A spatial panel statistical analysis on cultivated land conversion and Chinese economic growth: Integrating, monitoring, assessment and management. Ecol. Indic. 2015, 51, 20–24. [Google Scholar] [CrossRef]

- Overmars, K.; Koning, G.; Veldkamp, A. Spatial autocorrelation in multi-scale land use models. Ecol. Model. 2003, 164, 257–270. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, X.; Skitmore, M.; Song, Y.; Hui, E.C. Industrial land price and its impact on urban growth: A Chinese case study. Land Use Policy 2014, 36, 199–209. [Google Scholar] [CrossRef]

- Huang, Z.; Du, X. Strategic interaction in local governments’ industrial land supply: Evidence from China. Urban Stud. 2017, 54, 1328–1346. [Google Scholar] [CrossRef]

- Li, C.; He, J.; Duan, X. Modeling the Collaborative Evolution of Urban Land Considering Urban Interactions under Intermediate Intervention, in the Urban Agglomeration in the Middle Reaches of the Yangtze River in China. Land 2020, 9, 184. [Google Scholar] [CrossRef]

- Wei, Y.D.; Li, H.; Yue, W. Urban land expansion and regional inequality in transitional China. Landsc. Urban Plan. 2017, 163, 17–31. [Google Scholar] [CrossRef]

- Long, H.; Li, T. The coupling characteristics and mechanism of farmland and rural housing land transition in China. J. Geogr. Sci. 2012, 22, 548–562. [Google Scholar] [CrossRef]

- Long, H.; Liu, Y.; Hou, X.; Li, T.; Li, Y. Effects of land use transitions due to rapid urbanization on ecosystem services: Implications for urban planning in the new developing area of China. Habitat Int. 2014, 44, 536–544. [Google Scholar] [CrossRef]

- Long, H.; Qu, Y. Land use transitions and land management: A mutual feedback perspective. Land Use Policy 2018, 74, 111–120. [Google Scholar] [CrossRef]

- Chen, K.; Long, H.; Liao, L.; Tu, S.; Li, T. Land use transitions and urban-rural integrated development: Theoretical framework and China’s evidence. Land Use Policy 2020, 92, 104465. [Google Scholar] [CrossRef]

- Long, H.; Qu, Y.; Tu, S.; Zhang, Y.; Jiang, Y. Development of land use transitions research in China. J. Geogr. Sci. 2020, 30, 1195–1214. [Google Scholar] [CrossRef]

- Long, H. Land Use Transitions and Rural Restructuring in China; Springer: Singapore, 2020; pp. 3–29. [Google Scholar]

- Ke, S.; Feser, E. Count on the Growth Pole Strategy for Regional Economic Growth? Spread–Backwash Effects in Greater Central China. Reg. Stud. 2009, 44, 1131–1147. [Google Scholar] [CrossRef]

- Tao, R.; Su, F.; Liu, M.; Cao, G. Land Leasing and Local Public Finance in China’s Regional Development: Evidence from Prefecture-level Cities. Urban Stud. 2010, 47, 2217–2236. [Google Scholar]

- Ye, C.; Zhu, J.; Li, S.; Yang, S.; Chen, M. Assessment and analysis of regional economic collaborative development within an urban agglomeration: Yangtze River Deltaas a case study. Habitat Int. 2019, 83, 20–29. [Google Scholar] [CrossRef]

- Yu, N.; Jong, M.; Storm, S.; Mi, J. Spatial spillover effects of transport infrastructure: Evidence from Chinese regions. J. Transp. Geogr. 2013, 28, 56–66. [Google Scholar] [CrossRef]

- Hui, E.C.; Wu, Y.; Deng, L.; Zheng, B. Analysis on coupling relationship of urban scale and intensive use of land in China. Cities 2015, 42, 63–69. [Google Scholar] [CrossRef]

- Zhang, P.; Yang, D.; Qin, M.; Jing, W. Spatial heterogeneity analysis and driving forces exploring of built-up land development intensity in Chinese prefecture-level cities and implications for future Urban Land intensive use. Land Use Policy 2020, 99, 104958. [Google Scholar] [CrossRef]

- Cheng, X.; Shao, H.; Li, Y.; Shen, C.; Liang, P. Urban Land Intensive Use Evaluation Study Based on Nighttime Light—A Case Study of the Yangtze River Economic Belt. Sustainability 2019, 11, 675. [Google Scholar] [CrossRef]

- Lai, Y.; Chen, K.; Zhang, J.; Liu, F. Transformation of Industrial Land in Urban Renewal in Shenzhen, China. Land 2020, 9, 371. [Google Scholar] [CrossRef]

- Lin, G.C.S.; Yi, F. Urbanization of Capital or Capitalization on Urban Land? Land Development and Local Public Finance in Urbanizing China. Urban Geogr. 2011, 32, 50–79. [Google Scholar] [CrossRef]

- Du, J.; Thill, J.-C.; Peiser, R.B. Land pricing and its impact on land use efficiency in post-land-reform China: A case study of Beijing. Cities 2016, 50, 68–74. [Google Scholar] [CrossRef]

- Rong, Z.; Wang, W.; Gong, Q. Housing price appreciation, investment opportunity, and firm innovation: Evidence from China. J. Hous. Econ. 2016, 33, 34–58. [Google Scholar] [CrossRef]

- Ansenlin, L. Spatial externalities, spatial multipliers, and spatial econometrics. Int. Reg. Sci. Rev. 2003, 26, 153–166. [Google Scholar] [CrossRef]

- Anselin, L. Thirty years of spatial econometrics. Pap. Reg. Sci. 2010, 89, 3–25. [Google Scholar] [CrossRef]

- Corrado, L.; Fingleton, B. Where is the economics in spatial economics? J. Reg. Sci. 2011, 52, 210–239. [Google Scholar] [CrossRef]

- Pinkse, J.; Slade, M.E. The Future of Spatial Econometrics. J. Reg. Sci. 2010, 50, 103–117. [Google Scholar] [CrossRef]

- Feng, J.; Lichtenberg, E.; Ding, C. Balancing act: Economic incentives, administrative restrictions, and urban land expansion in China. China Econ. Rev. 2015, 36, 184–197. [Google Scholar] [CrossRef]

- Yang, Q.; Zhuo, P.; Yang, J. Industrial land transfer and competition quality bottom line competition: An empirical study based on panel data of prefecture-level cities in China from 2007 to 2011. Manag. World 2014, 11, 24–34. (In Chinese) [Google Scholar]

- Ke, S.; Xiang, J. Estimation of the fixed capital stocks in Chinese cities for 1996–2009. Stat. Res. 2012, 29, 19–24. (In Chinese) [Google Scholar]

- Battese, G.E.; Coelli, T.J. Frontier production functions, technical efficiency and panel data: With application to paddy farmers in India. J. Prod. Anal. 1992, 3, 153–169. [Google Scholar] [CrossRef]

- Battese, G.E.; Coelli, T.J. A model for technical inefficiency effects in a stochastic frontier production function for panel data. Empir. Econ. 1995, 20, 325–332. [Google Scholar] [CrossRef]

- Liu, Y.; Li, J.T.; Yang, Y. Strategic adjustment of land use policy under the economic transformation. Land Use Policy 2018, 74, 5–14. [Google Scholar] [CrossRef]

- Yuan, F.; Wei, Y.; Xiao, W. Land marketization, fiscal decentralization, and the dynamics of urban land prices in transitional China. Land Use Policy 2019, 89, 104208. [Google Scholar] [CrossRef]

- Fan, X.; Qiu, S.; Sun, Y. Land finance dependence and urban land marketization in China: The perspective of strategic choice of local governments on land transfer. Land Use Policy 2020, 99, 105023. [Google Scholar] [CrossRef]

- Shu, C.; Xie, H.; Jiang, J.; Chen, Q. Is Urban Land Development Driven by Economic Development or Fiscal Revenue Stimuli in China? Land Use Policy 2018, 77, 107–115. [Google Scholar] [CrossRef]

- Li, H.; Liu, Y.; He, Q.; Peng, X.; Yin, C. Simulating Urban Cooperative Expansion in a Single-Core Metropolitan Region Based on Improved CA Model Integrated Information Flow: Case Study of Wuhan Urban Agglomeration in China. J. Urban Plan. Dev. 2018, 144, 05018002. [Google Scholar] [CrossRef]

- Li, L.; Bao, H.X.; Robinson, G.M. The return of state control and its impact on land market efficiency in urban China. Land Use Policy 2020, 99, 104878. [Google Scholar] [CrossRef]

| Variables | Year | Total | Beijing–Tianjin–Hebei | Yangtze River Delta | Pearl River Delta | Middle Reaches of Yangtze River | Central Plain | Guanzhong Plain | Chengdu–Chongqing | Harbin–Changchun |

|---|---|---|---|---|---|---|---|---|---|---|

| ule (hm2) | 2003 | 324.22 | 583.53 | 846.62 | 92.55 | 146.22 | 125.41 | 261.56 | 74.53 | 99.96 |

| 2016 | 573.87 | 884.33 | 645.44 | 439.09 | 598.77 | 524.65 | 573.49 | 569.41 | 294.58 | |

| uliu (102millionyuan/hm2) | 2003 | 316.83 | 284.37 | 344.14 | 644.72 | 245.05 | 209.08 | 247.85 | 264.79 | 314.08 |

| 2016 | 701.18 | 692.05 | 768.95 | 1462.23 | 653.03 | 421.83 | 557.46 | 526.34 | 481.01 | |

| pil (%) | 2003 | 32.28 | 41.94 | 37.28 | 24.09 | 40.22 | 25.97 | 23.63 | 26.62 | 35.46 |

| 2016 | 26.01 | 29.17 | 25.07 | 19.76 | 27.35 | 30.60 | 18.66 | 17.66 | 35.10 | |

| psl (%) | 2003 | 16.31 | 20.79 | 16.69 | 21.88 | 11.70 | 14.27 | 26.60 | 19.08 | 14.36 |

| 2016 | 7.52 | 8.80 | 7.65 | 4.81 | 8.10 | 8.29 | 7.51 | 7.11 | 8.83 | |

| phl (%) | 2003 | 24.40 | 18.91 | 24.35 | 23.09 | 23.21 | 27.74 | 27.52 | 27.26 | 22.07 |

| 2016 | 17.38 | 23.08 | 16.69 | 13.93 | 16.34 | 20.96 | 14.93 | 20.05 | 13.04 | |

| ulm (%) | 2003 | 35.79 | 33.26 | 32.68 | 53.48 | 37.76 | 36.38 | 33.04 | 32.24 | 38.38 |

| 2016 | 92.52 | 91.87 | 97.42 | 84.58 | 94.81 | 94.48 | 93.96 | 95.55 | 86.58 | |

| ulp (10 thousand yuan/hm2) | 2003 | 256.12 | 297.66 | 300.85 | 233.58 | 243.72 | 228.91 | 178.39 | 277.22 | 188.86 |

| 2016 | 1386.86 | 1657.22 | 2299.41 | 2417.77 | 789.72 | 618.45 | 522.07 | 953.41 | 476.21 |

| Variables | Total | Beijing–Tianjin–Hebei | Yangtze River Delta | Pearl River Delta | Middle Reaches of Yangtze River | Central Plain | Guanzhong Plain | Chengdu–Chongqing | Harbin–Changchun |

|---|---|---|---|---|---|---|---|---|---|

| ule | 0.222 *** | 0.321 *** | 0.321 *** | 0.042 | 0.170 | 0.270 *** | 0.678 *** | 0.077 * | 0.12 * |

| (3.54) | (5.55) | (9.43) | (0.74) | (1.00) | (8.84) | (4.25) | (1.94) | (1.80) | |

| uliu | 0.389 *** | 0.418 *** | 0.388 *** | 0.010 | −0.327 | 0.249 *** | 0.400 *** | 0.329 *** | −0.023 |

| (6.23) | (6.98) | (11.54) | (0.23) | (1.89) | (8.06) | (2.53) | (7.73) | (0.20) | |

| pil | 0.323 *** | 0.064 | 0.104 *** | 0.094 | 0.631 *** | 0.080 *** | 0.022 | 0.204 *** | 0.067 |

| (5.14) | (1.14) | (3.10) | (1.56) | (3.69) | (2.64) | (0.21) | (4.84) | (1.01) | |

| psl | 0.002 | 0.065 | 0.089 *** | 0.022 | −0.337 * | 0.071 *** | 0.482 *** | 0.234 *** | −0.033 |

| (0.04) | (1.22) | (2.72) | (0.44) | (1.97) | (2.43) | (3.12) | (5.79) | (0.35) | |

| phl | 0.036 | 0.002 | 0.092 *** | −0.085 | −0.006 | 0.029 | 0.121 | 0.113 *** | 0.044 |

| (0.58) | (0.13) | (2.77) | (1.29) | (0.02) | (1.02) | (0.83) | (2.75) | (0.72) | |

| ulm | 0.757 *** | 0.839 *** | 0.842 *** | 0.517 *** | 0.880 *** | 0.751 *** | 0.822 *** | 0.815 *** | 0.736 *** |

| (12.02) | (13.85) | (24.51) | (8.18) | (5.13) | (24.11) | (5.10) | (18.89) | (10.02) | |

| ulp | 0.276 *** | 0.048 | 0.198 *** | 0.468 *** | 0.269 | 0.320 *** | −0.116 | 0.334 *** | 0.019 |

| (4.47) | (1.07) | (6.08) | (7.77) | (1.60) | (10.62) | (0.65) | (7.85) | (0.49) |

| Variables | Total | Beijing Tianjin Hebei | Yangtze River Delta | Pearl River Delta | Middle Reaches of the Yangtze River | Central Plains | Guanzhong Plain | Chengdu Chongqing | Harbin Changchun |

|---|---|---|---|---|---|---|---|---|---|

| wclnule | 3.785 *** | 42.327 | 5.632 | 5.308 ** | 0.482 | 13.483 ** | 5.721 | −7.551 * | 3.461 |

| (3.81) | (1.10) | (1.56) | (2.09) | (0.22) | (2.28) | (0.51) | (1.93) | (0.06) | |

| wclnuliu | 7.709 * | 469.958 *** | −21.237 | −22.800 | −0.505 | −166.681 ** | 55.958 | 48.209 | −1081.976 |

| (1.71) | (3.32) | (0.56) | (1.00) | (0.14) | (2.26) | (1.32) | (0.37) | (1.52) | |

| wcpil | −7.594 | 114.457 | 81.976 * | 70.497 | −9.224 | 67.758 | 16.321 | 87.596 | 614.922 |

| (1.50) | (0.54) | (1.92) | (1.24) | (1.44) | (1.16) | (0.28) | (0.90) | (0.77) | |

| wcpsl | −7.533 | 286.438 | −165.571 * | −165.238 | −16.225 | 5.1 | −3.311 | 420.252 ** | 119.619 |

| (0.54) | (0.83) | (1.67) | (1.24) | (0.88) | (0.04) | (0.03) | (2.34) | (0.06) | |

| wcphl | −9.386 | 508.635 * | 90.394* | 135.784 ** | −10.862 | −59.918 | −66.129 | 9.942 | −56.784 |

| (1.13) | (1.71) | (1.69) | (2.16) | (1.06) | (0.64) | (0.73) | (0.11) | (0.07) | |

| wculm | 0.671 | −354.712 ** | 137.364 *** | 6.782 | 9.909 | 150.606 ** | 68.478 | 194.865 | 2659.256 ** |

| (0.13) | (2.46) | (3.58) | (0.15) | (1.33) | (2.56) | (0.97) | (1.61) | (2.59) | |

| wclnulp | −0.470 | 79.048 | −29.839 | 22.916 | −6.690 | −30.321 | −26.007 | −62.948 | 543.726 |

| (0.12) | (0.99) | (1.38) | (1.36) | (1.31) | (0.75) | (0.68) | (1.54) | (1.03) | |

| wclny | 45.670 * | 185.569 | 50.292 | 52.938 | −59.757 | 760.988 *** | −81.858 * | −992.131 *** | 723.047 |

| (1.89) | (1.06) | (0.51) | (0.94) | (0.51) | (4.15) | (1.81) | (−5.06) | (0.45) | |

| lnule | 0.004 *** | 0.003 | 0.007 ** | 0.001 | 0.002 | 0.007* | 0.014 ** | −0.002 | 0.004 |

| (3.72) | (0.19) | (2.52) | (0.41) | (0.76) | (1.92) | (2.37) | (1.07) | (0.66) | |

| lnuliu | 1.028 *** | 0.230 * | −0.029 | −0.046 | −0.219 *** | 0.132 | −0.015 | 0.345 * | −0.032 |

| (3.92) | (1.75) | (0.84) | (0.91) | (3.74) | (1.30) | (0.14) | (1.70) | (0.17) | |

| pil | 0.001 *** | 9 × 10−4 | 3 × 10−4 | −7 × 10−4 | −1 × 10−4 | 5 × 10−4 | 7 × 10−4 | −6 × 10−4 | 0.003 ** |

| (4.11) | (1.52) | (0.65) | (1.09) | (0.15) | (1.49) | (1.02) | (1.26) | (2.54) | |

| psl | 2 × 10−4 | 8 × 10−4 | −0.002 *** | 0.003 ** | 2 × 10−4 | 4 × 10−4 | −0.002 | −6 × 10−4 | −0.002 |

| (0.57) | (1.12) | (2.81) | (2.54) | (0.15) | (0.70) | (1.09) | (0.66) | (1.03) | |

| phl | 0.000 | −2 × 10−4 | −6 × 10−4 | 8 × 10−4 | −9 × 10−4 | −4 × 10−4 | 0.001 | −0.001 | 0.001 |

| (0.12) | (0.25) | (1.29) | (1.08) | (1.41) | (0.82) | (1.01) | (1.46) | (0.66) | |

| ulm | 0.001 *** | 0.001 ** | −4 × 10−4 | −4 × 10−4 | 0.002 *** | 4 × 10−4 | 3 × 10−4 | 0.003 *** | −6 × 10−4 |

| (6.23) | (2.36) | (−0.91) | (0.73) | (2.69) | (0.78) | (0.40) | (3.93) | (0.47) | |

| lnulp | 0.054 *** | 0.030 | 0.061 *** | −0.002 | 0.149 *** | 0.098 *** | 0.016 | −0.040 * | 0.069 |

| (6.49) | (1.23) | (3.10) | (0.07) | (4.49) | (4.20) | (0.36) | (1.65) | (1.54) | |

| id-effects | yes | yes | yes | yes | yes | yes | yes | yes | yes |

| contorls | yes | yes | yes | yes | yes | yes | yes | yes | yes |

| sargan-p | 0.11 | 0.11 | 0.20 | 0.13 | 0.13 | 0.29 | 0.13 | 0.24 | 0.25 |

| Obs | 2128 | 154 | 378 | 224 | 392 | 364 | 70 | 224 | 126 |

| R-squared | 0.92 | 0.95 | 0.95 | 0.92 | 0.91 | 0.95 | 0.98 | 0.97 | 0.87 |

| Variables | Enterprise Investment | Fiscal Expenditure | Infrastructure Investment | Labor | Technical Efficiency |

|---|---|---|---|---|---|

| wclnule | 0.430 | −1.168 | 1.701 | −0.090 ** | −0.009 *** |

| (0.21) | (0.98) | (0.34) | (2.54) | (2.83) | |

| wclnuliu | 0.941 ** | −2.421 | 13.986 | −0.258 | 1 × 10−4 |

| (2.05) | (0.58) | (0.96) | (0.17) | (0.02) | |

| wcpil | 6.250 | 11.637 * | −36.089 | −5.049 | −0.004 |

| (0.55) | (1.92) | (1.40) | (1.11) | (0.26) | |

| wcpsl | 37.611 | 5.831 | −18.192 | −6.335 | −0.053 |

| (1.14) | (0.28) | (0.26) | (0.80) | (1.15) | |

| wcphl | 11.470 | 15.214 | −1.742 | 30.476 | −0.052* |

| (0.71) | (1.54) | (0.04) | (1.40) | (1.88) | |

| wculm | −3.369 | 7.469 | 37.428 | −65.053 *** | 0.007 |

| (0.29) | (1.05) | (1.42) | (5.03) | (0.43) | |

| wclnulp | −8.398 | −9.814 ** | −49.653 *** | −9.959 | 0.019 |

| (1.21) | (2.23) | (2.64) | (1.20) | (1.50) | |

| wcf | 10.765 ** | 2.303 | 1.093 ** | 12.731 ** | 179.882 *** |

| (2.29) | (0.68) | (2.29) | (2.03) | (4.28) | |

| lnule | 0.003 | 0.004 *** | −0.106 | 39.797 *** | 0.000 |

| (1.46) | (2.77) | (0.90) | (4.42) | (1.22) | |

| lnuliu | 1.039 *** | 0.081 ** | 0.014 ** | 2 × 10−4 | 1.65 × 10−5 *** |

| (2.82) | (2.45) | (2.54) | (0.11) | (3.14) | |

| pil | 2 × 10−4 | 0.000 | −0.001 | −2 × 10−4 | −1.49 × 10−6 ** |

| (0.47) | (0.14) | (1.36) | (0.73) | (2.39) | |

| psl | −3 × 10−4 | −0.001 *** | 13 × 10−4 | −0.001 ** | −3.60 × 10−6 *** |

| (0.44) | (2.78) | (0.82) | (−2.13) | (3.37) | |

| phl | 7 × 10−4 | −3 × 10−4 | 3 × 10−4 | −0.001 *** | −4.40 × 10−6 *** |

| (1.64) | (1.07) | (0.25) | (2.85) | (6.09) | |

| ulm | 0.001 *** | 14 × 10−4*** | 14 × 10−4 | 0.002 *** | 7.36 × 10−6 *** |

| (3.01) | (6.06) | (1.48) | (6.75) | (12.21) | |

| lnulp | 0.032 ** | −0.015 | 0.069 | 0.133 *** | 1 × 10−4 *** |

| (1.98) | (1.48) | (1.63) | (9.93) | (4.32) | |

| id-effects | yes | yes | yes | yes | yes |

| controls | yes | yes | yes | yes | yes |

| sargan-p | 0.29 | 0.34 | 0.19 | 0.41 | 0.33 |

| Obs | 1976 | 2128 | 2128 | 2128 | 2128 |

| R-squared | 0.88 | 0.95 | 0.31 | 0.59 | 0.86 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, H.; Chen, K.; Yan, L.; Zhu, Y.; Liao, L.; Chen, Y. Urban Land Use Transitions and the Economic Spatial Spillovers of Central Cities in China’s Urban Agglomerations. Land 2021, 10, 644. https://doi.org/10.3390/land10060644

Li H, Chen K, Yan L, Zhu Y, Liao L, Chen Y. Urban Land Use Transitions and the Economic Spatial Spillovers of Central Cities in China’s Urban Agglomerations. Land. 2021; 10(6):644. https://doi.org/10.3390/land10060644

Chicago/Turabian StyleLi, Hui, Kunqiu Chen, Lei Yan, Yulin Zhu, Liuwen Liao, and Yangle Chen. 2021. "Urban Land Use Transitions and the Economic Spatial Spillovers of Central Cities in China’s Urban Agglomerations" Land 10, no. 6: 644. https://doi.org/10.3390/land10060644

APA StyleLi, H., Chen, K., Yan, L., Zhu, Y., Liao, L., & Chen, Y. (2021). Urban Land Use Transitions and the Economic Spatial Spillovers of Central Cities in China’s Urban Agglomerations. Land, 10(6), 644. https://doi.org/10.3390/land10060644