German Farmers’ Perspectives on Price Drivers in Agricultural Land Rental Markets—A Combination of a Systematic Literature Review and Survey Results

Abstract

1. Introduction

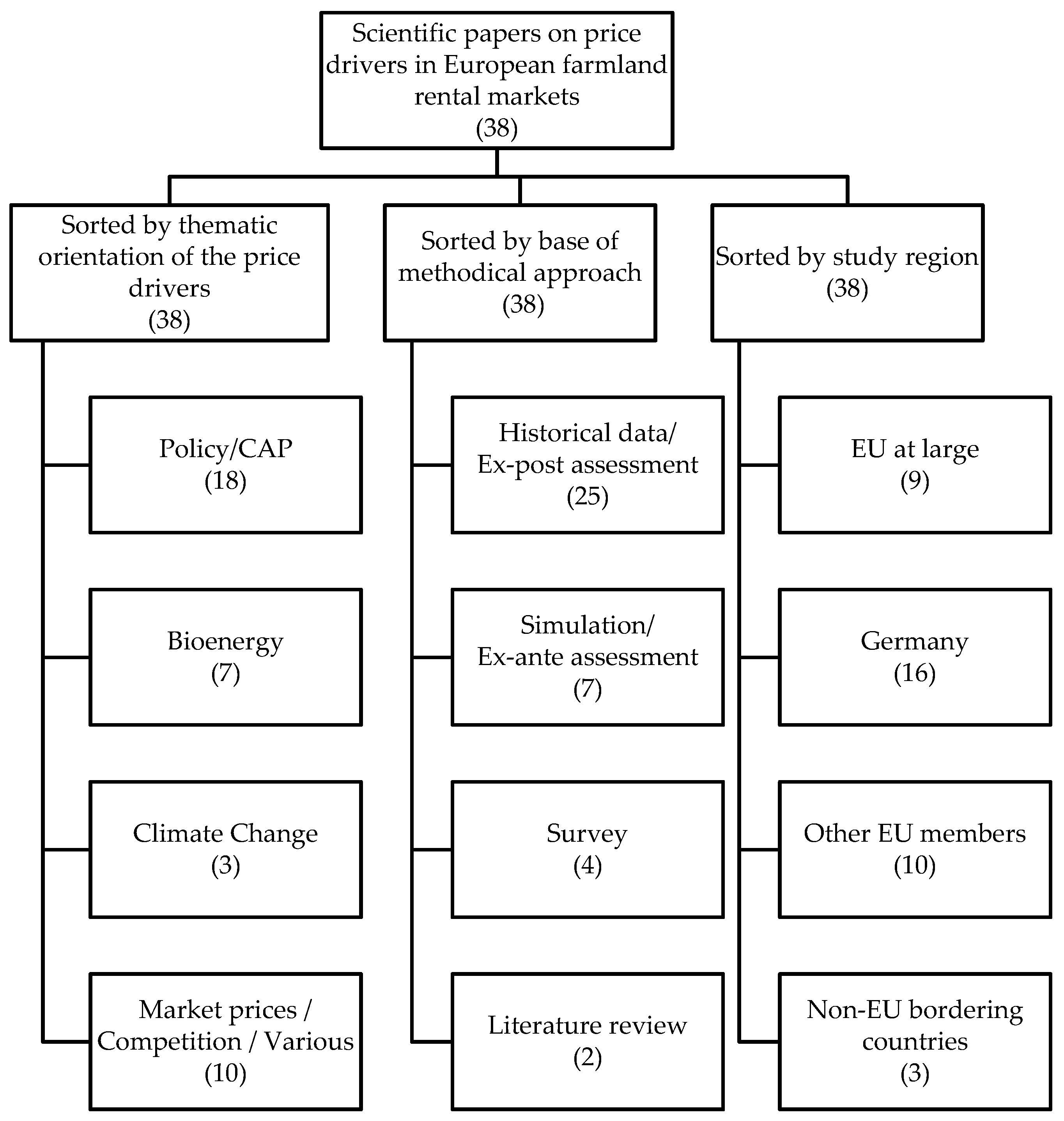

2. Systematic Literature Review

2.1. Methodological Approach

2.2. Results

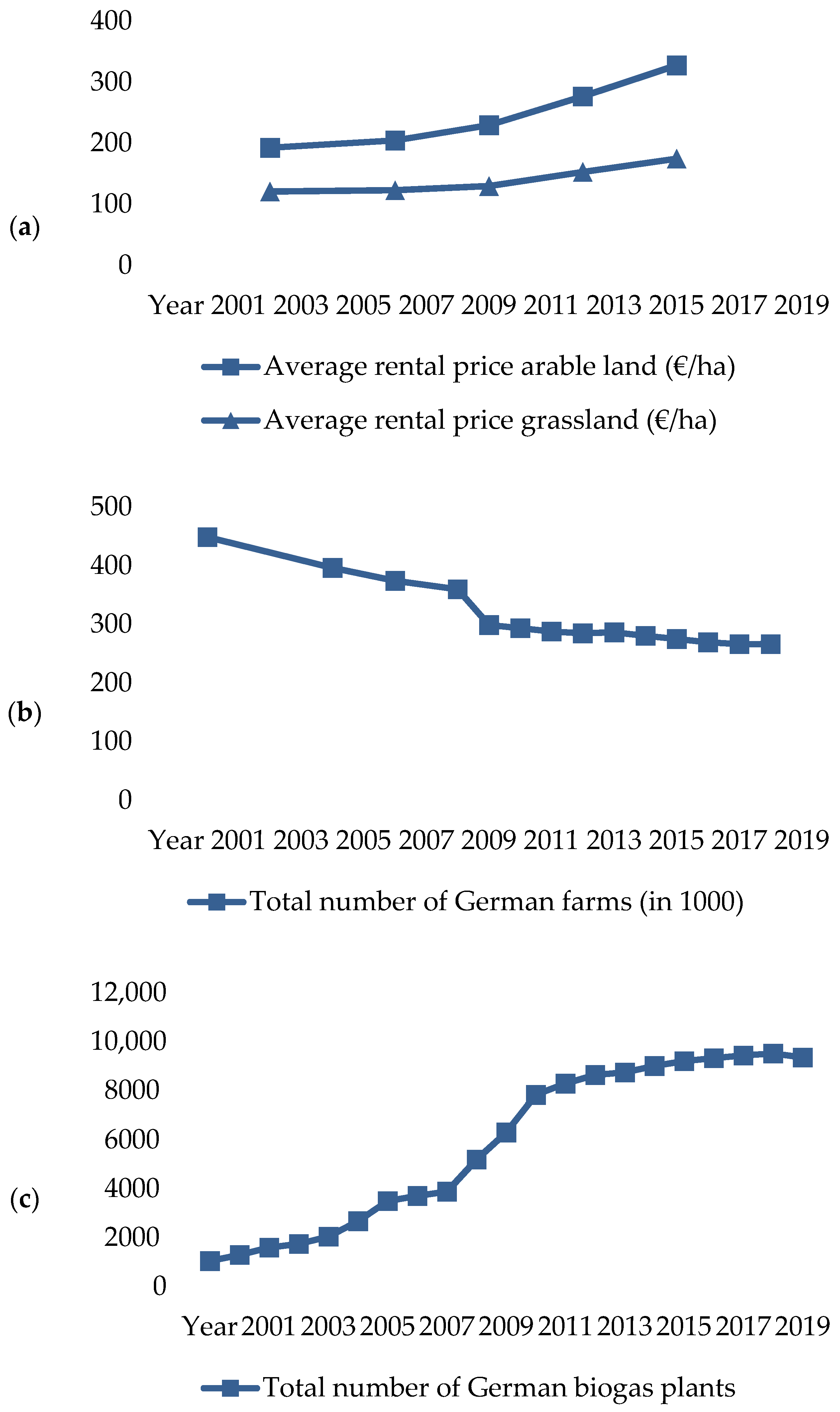

2.3. Statistics on German Land Rental Market

3. Survey

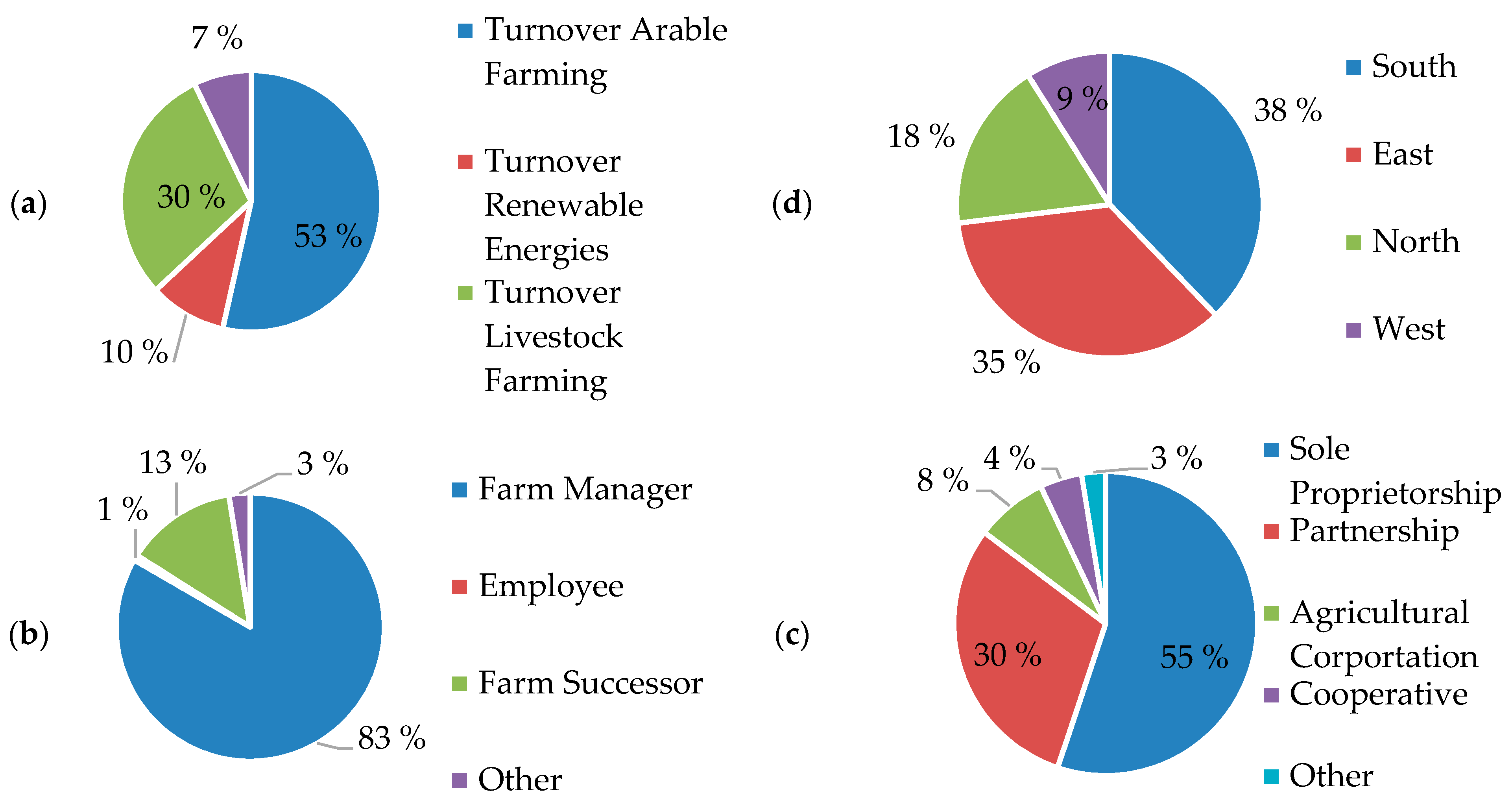

3.1. Descriptive Results of the Sample

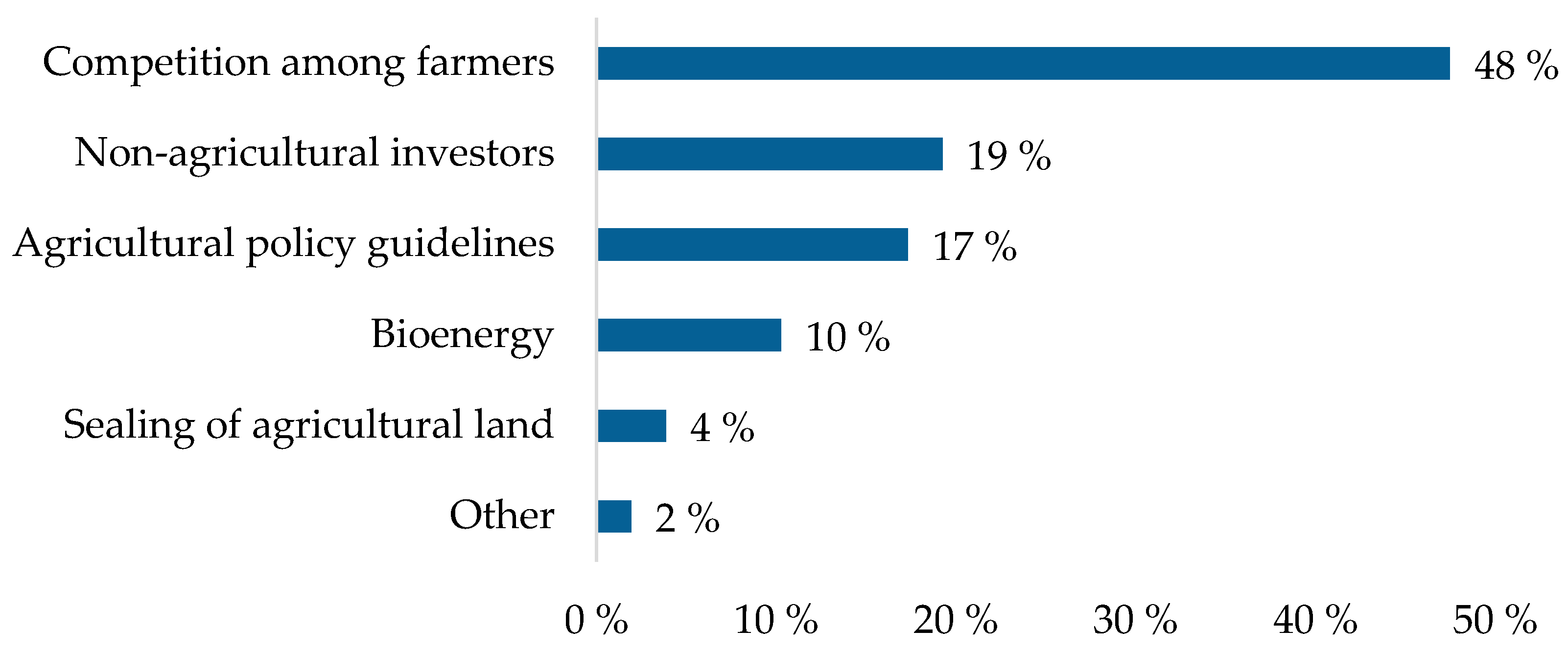

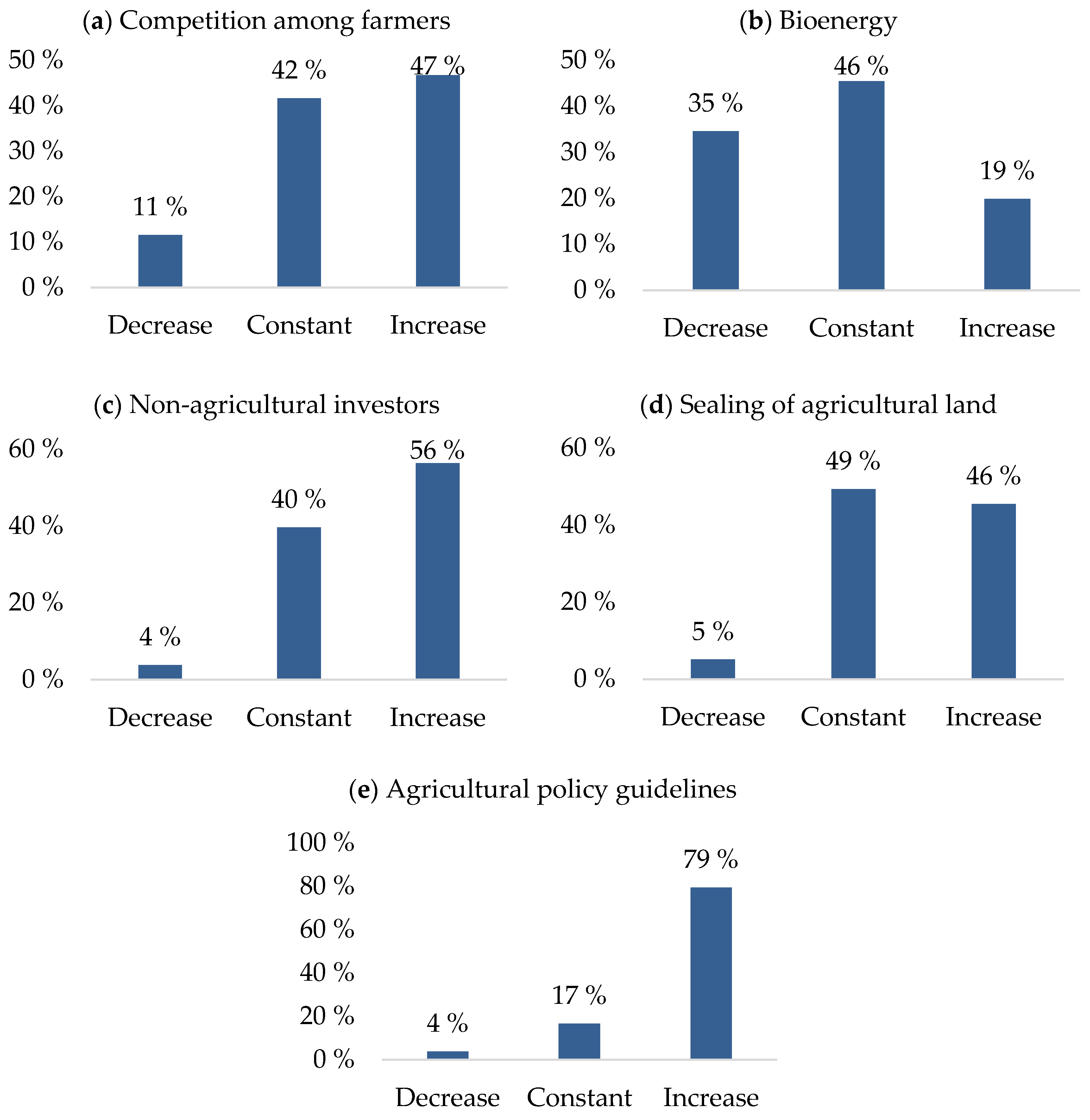

3.2. Results on Agricultural Land Rental Market

4. Discussion and Implications

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Van der Ploeg, J.D.; Franco, J.C.; Borras, S.M. Land concentration and land grabbing in Europe: A preliminary analysis. Can. J. Dev. Stud./Revue Canadienne D’études Du Développement 2015, 36, 147–162. [Google Scholar] [CrossRef]

- Yang, X.; Odening, M.; Ritter, M. The Spatial and Temporal Diffusion of Agricultural Land Prices. Land Econ. 2019, 95, 108–123. [Google Scholar] [CrossRef]

- Baker, T.G.; Boehlje, M.D.; Langemeier, M.R. Farmland: Is It Currently Priced as an Attractive Investment? Am. J. Agric. Econ. 2014, 96, 1321–1333. [Google Scholar] [CrossRef]

- Tietz, A.; Forstner, B.; Weingarten, P. Non-Agricultural and Supra-Regional Investors on the German Agricultural Land Market: An Empirical Analysis of their Significance and Impacts. Ger. J. Agric. Econ. 2013, 2, 86–98. [Google Scholar] [CrossRef]

- Myrna, O.; Odening, M.; Ritter, M. The Influence of Wind Energy and Biogas on Farmland Prices. Land 2019, 8, 19. [Google Scholar] [CrossRef]

- Hüttel, S.; Wildermann, L.; Croonenbroeck, C. How do institutional market players matter in farmland pricing? Land Use Policy 2016, 59, 154–167. [Google Scholar] [CrossRef]

- Croonenbroeck, C.; Odening, M.; Hüttel, S. Farmland Values and Bidder Behavior in First-Price Land Auctions. Work. Pap. 2018. [Google Scholar] [CrossRef]

- Deininger, K.W.; Byerlee, D. Rising Global Interest in Farmland. Can It Yield Sustainable and Equitable Benefits? World Bank: Washington, DC, USA, 2011; ISBN 9780821385913. [Google Scholar]

- Federal Statistical Office of Germany. Statistisches Jahrbuch 2018: Deutschland Und Internationales. 2018. Available online: https://www.destatis.de/DE/Themen/Querschnitt/Jahrbuch/statistisches-jahrbuch-2018-dl.pdf?__blob=publicationFile (accessed on 12 December 2020).

- German Farmers Association. Status Report 2019/2020. 2020. Available online: https://www.bauernverband.de/situationsbericht (accessed on 12 December 2020).

- Marks-Bielska, R. Factors shaping the agricultural land market in Poland. Land Use Policy 2013, 30, 791–799. [Google Scholar] [CrossRef]

- Takáč, I.; Lazíková, J.; Rumanovská, Ľ.; Bandlerová, A.; Lazíková, Z. The Factors Affecting Farmland Rental Prices in Slovakia. Land 2020, 9, 96. [Google Scholar] [CrossRef]

- Koester, U.; Cramon-Taubadel, S.V. Preisbildung auf dem Bodenmarkt. Discussion Paper No. 181. 2019. Available online: http://hdl.handle.net/10419/191813 (accessed on 12 December 2020).

- Escalante, C.L.; Barry, P.J. Farmland leasing decisions and successful debt repayment strategies. J. ASFMRA 2003, 9–18. Available online: https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.628.4407&=rep1&type=pdf (accessed on 12 December 2020).

- Nicholas, D.P.; Gary, D.S.; Paulson, N. Farmland rental markets: Trends in contract type, rates, and risk. Agric. Financ. Rev. 2013, 73, 32–44. [Google Scholar] [CrossRef]

- Vranken, L.; Swinnen, J. Land rental markets in transition: Theory and evidence from Hungary. World Dev. 2006, 34, 481–500. [Google Scholar] [CrossRef]

- Sadoulet, E. Access to land via land rental markets. In Access to Land, Rural Poverty, and Public Action; Oxford University Press: Oxford, UK, 2001; pp. 196–229. [Google Scholar]

- Ciaian, P.; Kancs, A.; Swinnen, J.F.M.; van Herck, K.; Vranken, L. Key Issues and Developments in Farmland Rental Markets in EU Member States and Candidate Countries. Cent. Eur. Policy Stud. Work. Pap. 2012. [Google Scholar] [CrossRef]

- Hartvigsen, M. Land reform and land fragmentation in Central and Eastern Europe. Land Use Policy 2014, 36, 330–341. [Google Scholar] [CrossRef]

- Forbord, M.; Bjørkhaug, H.; Burton, R.J.F. Drivers of change in Norwegian agricultural land control and the emergence of rental farming. J. Rural Stud. 2014, 33, 9–19. [Google Scholar] [CrossRef]

- Ilbery, B.; Maye, D.; Watts, D.; Holloway, L. Property matters: Agricultural restructuring and changing landlord-tenant relationships in England. Geoforum 2010, 41, 423–434. [Google Scholar] [CrossRef]

- Emmann, C.H.; Surmann, D.; Theuvsen, L. Charakterisierung und Bedeutung außerlandwirtschaftlicher Investoren: Empirische Ergebnisse aus Sicht des landwirtschaftlichen Berufsstandes. In No 1504, DARE Discussion Papers; Georg-August University of Göttingen, Department of Agricultural Economics and Rural Development: Göttingen, Germany, 2015. [Google Scholar]

- Anastassiadis, F.; Feil, J.-H.; Musshoff, O.; Schilling, P. Analysing Farmers’ Use of Price Hedging Instruments: An Experimental Approach. J. Agric. Food Ind. Organ. 2014, 12, 181–192. [Google Scholar] [CrossRef]

- Michels, M.; Möllmann, J.; Musshoff, O. German Farmers’ Perspectives on Direct Payments in the Common Agricultural Policy. EuroChoices 2019, 19, 48–52. [Google Scholar] [CrossRef]

- Higgins, J.P. Cochrane Handbook for Systematic Reviews of Interventions. Version 5.1. 0 [Updated March 2011]. The Cochrane Collaboration. 2011. Available online: www.cochrane-handbook.org (accessed on 12 December 2020).

- Longhi, S.; Nijkamp, P.; Poot, J. A meta-analytic assessment of the effect of immigration on wages. J. Econ. Surv. 2005, 19, 451–477. [Google Scholar] [CrossRef]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G.; Prisma Group. Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. PLoS Med. 2009, 6, e1000097. [Google Scholar] [CrossRef]

- Graubner, M. Lost in space? The effect of direct payments on land rental prices. Eur. Rev. Agric. Econ. 2018, 45, 143–171. [Google Scholar] [CrossRef]

- Ciaian, P.; Kancs, A.; Swinnen, J.F.M. EU land markets and the Common Agricultural Policy; CEPS Paperbacks; CEPS: Brussels, Belgium, 2010. [Google Scholar]

- O’Neill, S.; Hanrahan, K. The capitalization of coupled and decoupled CAP payments into land rental rates. Agric. Econ. 2016, 47, 285–294. [Google Scholar] [CrossRef]

- Kilian, S.; Antón, J.; Salhofer, K.; Röder, N. Impacts of 2003 CAP reform on land rental prices and capitalization. Land Use Policy 2012, 29, 789–797. [Google Scholar] [CrossRef]

- Breustedt, G.; Habermann, H. The Incidence of EU Per-Hectare Payments on Farmland Rental Rates: A Spatial Econometric Analysis of German Farm-Level Data. J. Agric. Econ. 2011, 62, 225–243. [Google Scholar] [CrossRef]

- Hennig, S.; Breustedt, G. The Incidence of Agricultural Subsidies on Rental Rates for Grassland. Jahrbücher Für Natl. Stat. 2018, 238, 125–156. [Google Scholar] [CrossRef]

- Ciaian, P.; Kancs, A. The Capitalization of Area Payments into Farmland Rents: Micro Evidence from the New EU Member States. Can. J. Agric. Econ. Rev. Can. D’agroeconomie 2012, 60, 517–540. [Google Scholar] [CrossRef]

- Van Herck, K.; Swinnen, J.; Vranken, L. Capitalization of direct payments in land rents: Evidence from New EU Member States. Eurasian Geogr. Econ. 2013, 54, 423–443. [Google Scholar] [CrossRef]

- Guastella, G.; Moro, D.; Sckokai, P.; Veneziani, M. The Capitalisation of Fixed per hectare Payment into Land Rental Prices: A Spatial Econometric Analysis of Regions in EU. In Proceedings of the 2014 Italian Association of Agricultural and Applied Economics (AIEAA) Conference, Alghero, Italy, 25–27 June 2014. [Google Scholar] [CrossRef]

- Michalek, J.; Ciaian, P.; Kancs, D. Capitalization of the Single Payment Scheme into Land Value: Generalized Propensity Score Evidence from the European Union. Land Econ. 2014, 90, 260–289. [Google Scholar] [CrossRef]

- Feichtinger, P.; Salhofer, K. Decoupled Single Farm Payments of the CAP and Land Rental Prices; Discussion Paper; Institute for Sustainable Economic Development, Department of Economics and Social Sciences, University of Natural Resources and Life Sciences: Vienna, Austria, 2016. [Google Scholar]

- Salhofer, K.; Feichtinger, P. Regional differences in the capitalisation of first and second pillar payments of the CAP into land rental prices. Eur. Rev. Agric. Econ. 2020, 48, 8–41. [Google Scholar] [CrossRef]

- Guastella, G.; Moro, D.; Sckokai, P.; Veneziani, M. The Capitalisation of CAP Payments into Land Rental Prices: A Panel Sample Selection Approach. J. Agric. Econ. 2018, 69, 688–704. [Google Scholar] [CrossRef]

- Valenti, D.; Bertoni, D.; Cavicchioli, D.; Olper, A. The capitalization of CAP payments into land rental prices: A grouped fixed-effects estimator. Appl. Econ. Lett. 2021, 28, 231–236. [Google Scholar] [CrossRef]

- Mack, G.; Möhring, A.; Ferjani, A.; Zimmermann, A.; Mann, S. Transfer of single farm payment entitlements to farm successors: Impact on structural change and rental prices in Switzerland. Bio-Based Appl. Econ. 2013, 2, 113–130. [Google Scholar]

- De Wit, M.; Faaij, A. European biomass resource potential and costs. Biomass Bioenergy 2010, 34, 188–202. [Google Scholar] [CrossRef]

- Hennig, S.; Latacz-Lohmann, U. The incidence of biogas feed-in tariffs on farmland rental rates—evidence from northern Germany. Eur. Rev. Agric. Econ. 2016, 44, 231–254. [Google Scholar] [CrossRef]

- Appel, F.; Ostermeyer-Wiethaup, A.; Balmann, A. Effects of the German Renewable Energy Act on structural change in agriculture—The case of biogas. Util. Policy 2016, 41, 172–182. [Google Scholar] [CrossRef]

- Demartini, E.; Gaviglio, A.; Gelati, M.; Cavicchioli, D. The Effect of Biogas Production on Farmland Rental Prices: Empirical Evidences from Northern Italy. Energies 2016, 9, 965. [Google Scholar] [CrossRef]

- Habermann, H.; Breustedt, G. Einfluss der Biogaserzeugung auf landwirtschaftliche Pachtpreise in Deutschland: Impact of Biogas Production on Farmland Rental Rates in Germany. Ger. J. Agric. Econ. 2011, 60, 85–100. [Google Scholar] [CrossRef]

- Troost, C.; Walter, T.; Berger, T. Climate, energy and environmental policies in agriculture: Simulating likely farmer responses in Southwest Germany. Land Use Policy 2015, 46, 50–64. [Google Scholar] [CrossRef]

- Bartoli, A.; Cavicchioli, D.; Kremmydas, D.; Rozakis, S.; Olper, A. The impact of different energy policy options on feedstock price and land demand for maize silage: The case of biogas in Lombardy. Energy Policy 2016, 96, 351–363. [Google Scholar] [CrossRef]

- Aurbacher, J.; Lippert, C.; Krimly, T. Assessing the impact of climate change on agriculture in Germany—A Ricardian analysis. In Proceedings of the 2010 International Trade Research Consortium, Stuttgart-Hohenheim, Germany, 26–29 June 2010. [Google Scholar] [CrossRef]

- Schmidtner, E.; Dabbert, S.; Lippert, C. Do Different Measurements of Soil Quality Influence the Results of a Ricardian Analysis?—A Case Study on the Effects of Climate Change on German Agriculture. Ger. J. Agric. Econ. 2015, 2, 89–106. [Google Scholar] [CrossRef]

- Mazzocchi, C.; Borghi, A.; Monaco, F.; Gaviglio, A.; Filippini, R.; Demartini, E.; Sali, G. Land rent values determinants: A Hedonic Pricing approach at local scale. Aestimum 2019, 235–255. [Google Scholar] [CrossRef]

- Dupraz, P.; Temesgen, C. Farmland Rental Rate and Marginal Return to Land: A French FADN Perspective. In Proceedings of the 86th Annual Agricultural Economics Society Conference, Coventry, UK, 16–18 April 2012. [Google Scholar] [CrossRef]

- März, A.; Klein, N.; Kneib, T.; Musshoff, O. Analysing farmland rental rates using Bayesian geoadditive quantile regression. Eur. Rev. Agric. Econ. 2016, 43, 663–698. [Google Scholar] [CrossRef]

- Graubner, M.; Ostapchuk, I.; Gagalyuk, T. Agroholdings and Land Rental Markets: A Spatial Competition Perspective. In Proceedings of the 165th EAAE Seminar Agricultural Land Markets, Berlin, Germany, 4–5 April 2019. [Google Scholar] [CrossRef]

- Habermann, H.; Ernst, C. Developments and determinants of farmland rental rates in Germany. Ber. Über Landwirtsch. 2010, 88, 57–85. [Google Scholar]

- Hüttel, S.; Ritter, M.; Esaulov, V.; Odening, M. Is there a term structure in land lease rates? Eur. Rev. Agric. Econ. 2016, 43, 165–187. [Google Scholar] [CrossRef]

- Heinrich, F.; Appel, F. Do investors ruin Germany s peasant agriculture? In Proceedings of the 2018 International Association of Agricultural Economists Conference, Vancouver, BC, Canada, 28 July–2 August 2018. [Google Scholar] [CrossRef]

- Federal Statistical Office of Germany. Anzahl der Landwirtschaftlichen Betriebe und Bauernhöfe in Deutschland bis 2019. Available online: https://de.statista.com/statistik/daten/studie/36094/umfrage/landwirtschaft---anzahl-der-betriebe-in-deutschland/ (accessed on 20 January 2020).

- Federal Statistical Office of Germany. Anzahl der Biogasanlagen in Deutschland in den Jahren 1992 bis 2020. Available online: https://de.statista.com/statistik/daten/studie/167671/umfrage/anzahl-der-biogasanlagen-in-deutschland-seit-1992/ (accessed on 21 January 2021).

- Odening, M.; Hüttel, S. Müssen landwirtschaftliche Bodenmärkte vor Investoren geschützt werden? Eine ökonomische Perspektive. Policy Brief 2018. [Google Scholar] [CrossRef]

- Schulz, N.; Breustedt, G.; Latacz-Lohmann, U. Assessing farmers’ willingness to accept “greening”: Insights from a discrete choice experiment in Germany. J. Agric. Econ. 2014, 65, 26–48. [Google Scholar] [CrossRef]

- Hermann, D.; Sauthoff, S.; Musshoff, O. Ex-ante evaluation of policy measures to enhance carbon sequestration in agricultural soils. Ecol. Econ. 2017, 140, 241–250. [Google Scholar] [CrossRef]

- Sauthoff, S.; Danne, M.; Mußhoff, O. To Switch or not to Switch? Understanding German Consumers’ Willingness to Pay for Green Electricity Tariff Attributes; Dare Working Paper; DARE Diskussionsbeiträge, Department für Agrarökonomie und Rurale Entwicklung (DARE), Universität Göttingen: Göttingen, Germany, 2017. [Google Scholar]

- Möllmann, J.; Michels, M.; von Hobe, C.-F.; Mußhoff, O. Status quo des Risikomanagements in der deutschen Landwirtschaft: Besteht Bedarf an einer Einkommensversicherung? Ber. Über Landwirtsch. Z. Für Agrarpolit. Und Landwirtsch. 2018, 96, 1–25. [Google Scholar]

- Buchholz, M.; Danne, M.; Musshoff, O. An experimental analysis of German farmers’ decisions to buy or rent farmland. Work. Pap. 2020. [Google Scholar] [CrossRef]

| 1 | It should be noted that there is, of course, literature available on agricultural land rental markets before 2010. However, due to substantial growth in research regarding agricultural land (rental) markets and several other developments (e.g. agricultural policies, support of bioenergy etc.) affecting agricultural land (rental) markets, we focused on the most current research in this review. |

| 2 | Other locational factors (e.g., soil quality) that do not change in the short–medium-term were not included in the analysis, as this study focuses on changing drivers over the course of time. |

| 3 | Results of the pre-test were deleted and the farmers who had participated in the pre-test were asked to not take part again in the survey. |

| 4 | For a plausibility check of the answers, a test question was integrated into the survey, for which the answer was provided. Eight participants who answered the test question incorrectly were removed from the sample. |

| 5 | Heinrich and Appel [58] conclude based on a simulation that the presence of a non-agricultural investor increases the rental prices in the considered region. However, it should be clearly stated that the non-agricultural investor in this case invested in bioenergy and, thus, does not act directly on the land rental market. |

| Databases | Keywords | |

|---|---|---|

| Google Scholar | Farmland rental prices * | Europe |

| AgEcon Search | Agricultural land rental markets * | Farmer |

| Elsevier ScienceDirect | Price drivers * | Farmland |

| Wiley Online Database | Agriculture | Policy |

| Scopus | Contractual arrangements | Climate change |

| Risk management | Common Agricultural Policy | |

| Bioenergy | ||

| Year | Study | Author | Study Region | Price Driver Category | Methodical Approach Category |

|---|---|---|---|---|---|

| 2010 | EU Land Markets and the Common Agricultural Policy | Ciaian et al. [29] | European Union | Policy/CAP | Literature review |

| 2010 | European biomass resource potential and costs | de Wit and Faaij [43] | European Union + Ukraine | Bioenergy | Simulation/ Ex-ante assessment |

| 2010 | Assessing the impact of climate change on agriculture in Germany—a Ricardian analysis | Aurbacher et al. [50] | Germany | Climate change | Historical data/ Ex-post assessment |

| 2010 | Developments and determinants of farmland rental rates in Germany | Habermann and Ernst [56] | Western Germany | Market prices/ Competition/Various | Historical data/ Ex-post assessment |

| 2010 | Property matters: Agricultural restructuring and changing landlord–tenant relationships in England | Ilbery et al. [21] | England | Policy/CAP | Survey |

| 2011 | The Incidence of EU Per-Hectare Payments on Farmland Rental Rates: A Spatial Econometric Analysis of German Farm-Level Data | Breustedt and Habermann [32] | Germany | Policy/CAP | Historical data/ Ex-post assessment |

| 2011 | Einfluss der Biogaserzeugung auf landwirtschaftliche Pachtpreise in Deutschland | Habermann and Breustedt [47] | Germany | Bioenergy | Historical data/ Ex-post assessment |

| 2012 | Impacts of 2003 CAP reform on land rental prices and capitalization | Kilian et al. [31] | Bavaria, Germany | Policy/CAP | Historical data/ Ex-post assessment |

| 2012 | The Capitalization of Area Payments into Farmland Rents: Micro Evidence from the New EU Member States | Ciaian and Kancs [34] | New EU member States | Policy/CAP | Historical data/ Ex-post assessment |

| 2012 | Key Issues and Developments in Farmland Rental Markets in EU Member States and Candidate Countries | Ciaian et al. [18] | European Union | Policy/CAP | Literature Review |

| 2012 | Farmland Rental Rate and Marginal Return to Land: A French FADN Perspective | Dupraz and Temesgen [53] | France | Market prices/Competition/Various | Historical data/ Ex-post assessment |

| 2013 | Factors shaping the agricultural land market in Poland | Marks-Bielska [11] | Poland | Market prices/Competition/Various | Survey |

| 2013 | Transfer of single farm payment entitlements to farm successors: impact on structural change and rental prices in Switzerland | Mack et al. [42] | Switzerland | Policy/CAP | Simulation/ Ex-ante assessment |

| 2014 | Capitalization of the Single Payment Scheme into Land Value: Generalized Propensity Score Evidence from the European Union | Michalek et al. [37] | European Union | Policy/CAP | Historical data/ Ex-post assessment |

| 2014 | Land reform and land fragmentation in Central and Eastern Europe | Hartvigsen [19] | Central and Eastern Europe | Policy/CAP | Historical data/ Ex-post assessment |

| 2014 | Drivers of change in Norwegian agricultural land control and the emergence of rental farming | Forbord et al. [20] | Norway | Market prices/Competition/Various | Survey |

| 2014 | The Capitalisation of Fixed per hectare Payment into Land Rental Prices: a Spatial Econometric Analysis of Regions in EU | Guastella et al. [36] | European Union | Policy/CAP | Historical data/ Ex-post assessment |

| 2014 | Capitalization of direct payments in land rents: evidence from New EU Member States | van Herck et al. [35] | New EU member States | Policy/CAP | Historical data/ Ex-post assessment |

| 2015 | Do Different Measurements of Soil Quality Influence the Results of a Ricardian Analysis?—A Case Study on the Effects of Climate Change on German Agriculture | Schmidtner et al. [51] | Germany | Climate Change | Historical data/ Ex-post assessment |

| 2015 | Charakterisierung und Bedeutung außerlandwirtschaftlicher Investoren: Empirische Ergebnisse aus Sicht des landwirtschaftlichen Berufsstandes | Emmann et al. [22] | Germany | Market prices/Competition/Various | Survey |

| 2015 | Climate, energy and environmental policies in agriculture: Simulating likely farmer responses in Southwest Germany | Troost et al. [48] | Germany | Bioenergy | Simulation/ Ex-ante assessment |

| 2016 | The Effect of Biogas Production on Farmland Rental Prices: Empirical Evidences from Northern Italy | Demartini et al. [46] | Province Cremona, Italy | Bioenergy | Historical data/ Ex-post assessment |

| 2016 | Is there a term structure in land lease rates? | Hüttel et al. [57] | Germany | Market prices/Competition/Various | Historical data/ Ex-post assessment |

| 2016 | Analysing farmland rental rates using Bayesian geoadditive quantile regression | März et al. [54] | Germany | Market prices/Competition/Various | Historical data/ Ex-post assessment |

| 2016 | Decoupled Single Farm Payments of the CAP and Land Rental Prices | Feichtinger and Salhofer [38] | Bavaria, Germany | Policy/CAP | Historical data/ Ex-post assessment |

| 2016 | The capitalization of coupled and decoupled CAP payments into land rental rates | O’Neill and Hanrahan [30] | Ireland | Policy/CAP | Historical data/ Ex-post assessment |

| 2016 | The impact of different energy policy options on feedstock price and land demand for maize silage: The case of biogas in Lombardy | Bartoli et al. [49] | Province Lombary, Italy | Bioenergy | Simulation/ Ex-ante assessment |

| 2016 | Effects of the German Renewable Energy Act on structural change in agriculture–The case of biogas | Appel et al. [45] | Germany | Bioenergy | Simulation/ Ex-ante assessment |

| 2017 | The incidence of biogas feed-in tariffs on farmland rental rates—evidence from northern Germany | Hennig and Latacz-Lohmann [44] | Northern Germany | Bioenergy | Historical data/ Ex-post assessment |

| 2017 | Lost in space? The effect of direct payments on land rental prices | Graubner [28] | European Union | Policy/CAP | Simulation/ Ex-ante assessment |

| 2018 | The Capitalisation of CAP Payments into Land Rental Prices: A Panel Sample Selection Approach | Guastella et al. [40] | Italy | Policy/CAP | Historical data/ Ex-post assessment |

| 2018 | The Incidence of Agricultural Subsidies on Rental Rates for Grassland | Hennig and Breustedt [33] | Western Germany | Policy/CAP | Historical data/ Ex-post assessment |

| 2018 | Do investors ruin Germany s peasant agriculture? | Heinrich and Appel [58] | Germany | Market prices/Competition/Various | Simulation/ Ex-ante assessment |

| 2019 | Agroholdings and Land Rental Markets: A Spatial Competition Perspective | Graubner et al. [55] | Ukraine | Market prices/Competition/Various | Historical data/ Ex-post assessment |

| 2019 | Land rent values determinants: a Hedonic Pricing approach at local scale | Mazzocchi et al. [52] | Region Milan, Italy | Climate change | Historical data/ Ex-post assessment |

| 2020 | The Factors Affecting Farmland Rental Prices in Slovakia | Takáč et al. [12] | Slovakia | Market prices/Competition/Various | Historical data/ Ex-post assessment |

| 2020 | Regional differences in the capitalisation of first and second pillar payments of the CAP into land rental prices | Salhofer and Feichtinger [39] | Germany | Policy/CAP | Historical data/ Ex-post assessment |

| 2021 | The capitalization of CAP payments into land rental prices: a grouped fixed-effects estimator | Valenti et al. [41] | Italy | Policy/CAP | Historical data/ Ex-post assessment |

| Variable | Description | Mean | SD | Min | Max | Ger. Avg. a |

|---|---|---|---|---|---|---|

| Age | Farmers age in years | 44.26 | 12.83 | 23 | 65 | 53 |

| AgriUni | 1, if the farmer has an agricultural university degree; 0 otherwise | 0.50 | - | 0 | 1 | 0.12 |

| ArableLand | Hectares of arable land | 578.33 | 709.23 | 5 | 3360 | 65 |

| Gender | 1, if the farmer is male; 0 otherwise | 0.92 | - | 0 | 1 | 0.90 |

| GrassLand | Hectares of grass land | 72.91 | 153.40 | 0 | 967 | 34 |

| Invest | 1, if the farmer has made an investment in the agricultural holding worth more than €100,000 in the last five years; 0 otherwise | 0.88 | - | 0 | 1 | n.a. |

| Leased | % of leased arable land of total land managed | 0.55 | 0.23 | 0 | 1 | 0.59 |

| Objective | Objectives in the operation of the agricultural holding | |||||

| “I would like to reduce my farming activities” | 0.02 | - | 0 | 1 | n.a. | |

| “I would like to maintain the level of my farming activities” | 0.47 | - | 0 | 1 | n.a. | |

| “I would like to expand my farming activities” | 0.51 | - | 0 | 1 | n.a. | |

| Precipitation | Precipitation in mm per year | 684.42 | 170.58 | 250 | 1255 | 730 |

| SoilQuality | Soil quality of arable land given in the soil quality index (7;100) | 47.96 | 15.20 | 18 | 91 | n.a. |

| Successor | 1, if the agricultural holding succession has been clarified; 0 otherwise | 0.56 | - | 0 | 1 | n.a. |

| Variable | Description | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| Rent | Rental amount in € per hectare arable land and year (existing rental agreements) | 484.43 | 241.38 | 91 | 1494 |

| Duration | Term of lease in years | 9.21 | 2.91 | 2 | 30 |

| FlexRent | 1, if the farmer uses a flexible cash lease agreement; 0 otherwise | 0.26 | - | 0 | 1 |

| PriceLevel | The rent I am currently paying is what I perceive to be… b | 3.61 | 0.69 | 2 | 5 |

| …too low | 0 | - | - | - | |

| …somewhat too low | 0.01 | - | - | - | |

| …fair | 0.46 | - | - | - | |

| …somewhat too high | 0.41 | - | - | - | |

| …too high | 0.10 | - | - | - |

| Relative Frequencies % | ||||||

|---|---|---|---|---|---|---|

| Statement | Strongly Disagree (1) | Disagree (2) | Neither Agree nor Disagree (3) | Agree (4) | Strongly Agree (5) | Mean |

| Increasing extreme weather events have an influence on my actions on the regional agricultural land rental market | 0.19 | 0.26 | 0.20 | 0.23 | 0.09 | 2.76 |

| Political reforms have an influence on my actions on the regional agricultural land rental market | 0.08 | 0.25 | 0.18 | 0.32 | 0.26 | 3.52 |

| The social image of agriculture has an influence on my actions on the regional agricultural land rental market | 0.30 | 0.33 | 0.11 | 0.16 | 0.08 | 2.38 |

| Fluctuating prices for agricultural products and inputs have an influence on my actions on the regional agricultural land rental market | 0.07 | 0.21 | 0.16 | 0.40 | 0.15 | 3.35 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

von Hobe, C.-F.; Michels, M.; Musshoff, O. German Farmers’ Perspectives on Price Drivers in Agricultural Land Rental Markets—A Combination of a Systematic Literature Review and Survey Results. Land 2021, 10, 180. https://doi.org/10.3390/land10020180

von Hobe C-F, Michels M, Musshoff O. German Farmers’ Perspectives on Price Drivers in Agricultural Land Rental Markets—A Combination of a Systematic Literature Review and Survey Results. Land. 2021; 10(2):180. https://doi.org/10.3390/land10020180

Chicago/Turabian Stylevon Hobe, Cord-Friedrich, Marius Michels, and Oliver Musshoff. 2021. "German Farmers’ Perspectives on Price Drivers in Agricultural Land Rental Markets—A Combination of a Systematic Literature Review and Survey Results" Land 10, no. 2: 180. https://doi.org/10.3390/land10020180

APA Stylevon Hobe, C.-F., Michels, M., & Musshoff, O. (2021). German Farmers’ Perspectives on Price Drivers in Agricultural Land Rental Markets—A Combination of a Systematic Literature Review and Survey Results. Land, 10(2), 180. https://doi.org/10.3390/land10020180