1. Introduction

This paper examines the political and economic drivers surrounding Chinese State-Owned Enterprises’ (SOE) activities in Mekong Basin hydropower, and the implications of these forces across the water, energy and food nexus, hereafter the nexus. The interconnections between water, energy and food have more recently been grouped together as “

the nexus” [

1,

2,

3]. Policy makers, international organizations, NGOs, academics and farmers, however, have been grappling with how to manage the interdependencies and trade-offs in the development of natural resources and transboundary rivers for decades [

4,

5]. One value of the nexus perspective is that it focuses attention on the interdependencies, choke points and trade-offs, thereby helping to understand leverage points and possible solutions [

1,

2,

3].

The nexus concept takes on different manifestations depending on the context, scale and geography where it is examined [

1,

2,

3]. For the purpose of this paper, we analyze the nexus between rivers (water), hydropower development (energy), and fish (food). Hydropower dams in the Mekong Basin provide an ideal case study to unpack nexus connections, interdependencies and trade-offs. Although the direct benefits of dams in the Mekong are often disputed, they are regarded by many states as a reliable and cheap source of electricity, and an important revenue stream [

6]. There have also been well documented socioeconomic and environmental impacts that revolve around fisheries’ losses, which are a key source of food security and livelihoods for millions of people [

7].

Smajgl and Ward [

8] provide a detailed assessment of how development-directed investments in the wider Mekong Region impact across water, energy and food. Keskinen

et al., (this issue) also demonstrate nexus connections in the Mekong by showing how hydropower will impact the region’s annual floods, thereby affecting the flood-pulse of Tonle Sap, which will likely cause degradation of fisheries. In this paper, we aim to provide a link to these studies and others by illuminating the political and economic drivers of hydropower in order to better understand why some dams are built despite their well-known impacts at both transboundary and local scales. We demonstrate that the pace of Chinese SOEs’ involvement in hydropower construction and the location of investments is heavily influenced by powerful political and economic forces. These forces emerge from both within China and the Greater Mekong Subregion (GMS). We argue that although China purports to recognize nexus interdependencies and trade-offs in its policies, the political and economic forces that drive Chinese SOEs’ to build hydropower dams in the GMS Basin offer little space for the consideration of their impacts across the nexus. In this way, the political and economic realities in which hydropower is developed, and in which SOEs operate in the Mekong, often recreate and entrench the original silo approaches to development that nexus policies and dialogues are aiming to address.

The remainder of the paper is divided into four sections.

Section 2 provides a brief overview of the methods used in the study, and of the political economy approach.

Section 3 highlights the growth of renewable energy in China. This section also examines the policies and actions that are being deployed to respond to the challenges created by rapid economic growth that is driving Chinese SOEs’ involvement along the Lancang-Mekong and in the GMS. The Lancang-Mekong is chosen because it is a transboundary river undergoing rapid hydropower development by SOEs. This section additionally critically examines the “

win-win” narratives that emerge from China and SOEs surrounding hydropower development on the Lancang-Mekong. These narratives frame or ignore risks and uncertainties across the nexus in ways that buttress and endorse central, top down decision-making and the agendas of powerful actors.

Section 4 examines the political and economic drivers of Chinese SOEs’ rapid development of hydropower projects throughout the GMS with a focus on Cambodia and the implications of this development across the nexus. Cambodia is chosen as a focus because it is one of China’s key allies in the GMS and increasingly a destination for Chinese investment. Finally,

Section 5 concludes by reviewing how political and economic factors have shaped the application of nexus policies in the GMS and the negative implications this has had and will potentially have on water, energy and food.

2. Method

This paper uses a broad global political economy approach to analyze the key political and economic forces that drive and shape the ways water, food and energy are managed by Chinese SOE in hydropower development in the Mekong Basin. This political economy approach helps to explore the constellation of interests, motivations and histories that shape the institutions, governance and contestations across the nexus.

Political economy has been usefully employed to analyze or compliment nexus issues and approaches at varying scales. Allouche

et al. [

2], for example, highlight the importance of political economy considerations when examining nexus issues by arguing that the nexus does not adequately engage with the global political economy of energy and food. They argue that policy documents tend to promote economic and technological solutions that ignore the inequalities across the political economy. The nexus’ recognition of trade-offs may also be used by decision-makers to justify negative environmental impacts as an unavoidable cost to ensuring water, food and energy security. Foran [

9] recognizes the need for “

more vigorous thinking around the political economy of energy, water and food”. Using a political economy approach coupled with historical and institutional analysis helps to uncover how power and inequality play out in the nexus [

9]. Dupar and Oates [

10] also use global political economy considerations to argue that the nexus approach must take account of rights-based approaches and transparent negotiation to ensure that resources are not commodified in ways that justify ignoring the environmental costs of their consumption. The importance of rights-based approaches including transparency, participation and fair negotiation in the Mekong setting has been well documented [

11,

12,

13].

Political economy has also been used at more regional and local scales to examine nexus trade-offs and drivers. Middleton and Allen [

14] use a political economy lens to demonstrate that the politics inherent in the nexus require that nexus approaches must consider both bottom-up analysis as well as historical, political and economic frames in order to understand the drivers and distribution of trade-offs. Political economy analysis of nexus issues is also complimented by an environmental justice lens [

13]. Environmental justice helps to draw attention to the winners and losers of trade-offs. As we examine below, hydropower narratives that are driven by political and economic forces can strengthen powerful actors while excluding other stakeholders such as local people and the environment.

Political economy analysis helps to illuminate the power and economics embedded within water management and hydropower development. Mitchell’s [

15] analysis of the political economy of Mekong Basin development focuses on the political aspects of decision making and how the benefits and impacts of decisions have uneven distributions. Importantly, Mitchell identified the emergence of conflict between basin-wide coordination, promoted by the MRC (Mekong River Commission) and its donors, and the individual national agendas. As will be explored in this paper, this conflict continues today and is shaped by Chinese SOE investment. Political economy can also help to highlight the different manifestations of the nexus. Verhoeven’s [

16] analysis of the nexus in the highly political transboundary Nile context reminds us that the nexus is a human construct and the interconnections within it are understood in a multitude of ways and scales by different social and ethnic groups across societies, and this can result in contestation between the nexus components.

In addition to the political economy approach and a broad literature review, this paper draws from 25 informal interviews carried out from 2012 to 2014. The authors used both elite and normal interviewing to triangulate data with literature reviews and observation. Interviewees were identified by their prominent positions within organizations relevant to hydropower development and nexus issues. Interviews included senior and junior policy makers, employees of Chinese SOEs, bureaucrats, consultants, NGO staff and academics. The interview type was semi-structured using small sets of open ended questions. The questions focused around case studies and key events associated with nexus issues specifically linked to Chinese SOEs and hydropower development. The majority of interviews were carried out face-to-face in the Mekong Region, with some conducted by telephone and Skype. Several interviewees were interviewed multiple times. English was used for the majority of interviews, but some interviews and clarifying questions were done in Mandarin.

The authors take note that there are many different configurations of SOEs from China involved in hydropower development in the Mekong Basin and each have their own characteristics. We do not wish to brand all these SOEs or the Chinese government as always disregarding or downplaying the impacts of their investments and activities across the nexus. Rather, we are aiming to provide some insights into the forces that shape Chinese SOEs’ decision-making and subsequent involvement in hydropower across the Basin. Our hope is that these insights might provide lessons for understanding the implications of hydropower investment in other regions. Throughout the article, we use the word China to refer to the Chinese government in a broad sense and Chinese SOEs to refer to the larger SOE hydropower developers that are representative of the main developers in the Basin. We have intentionally avoided naming many of the SOEs that we studied in this research in order to avoid any attribution to the people we interviewed. Where information came primarily from literature reviews we mention specific SOEs by name, but this does not indicate that these are the only SOEs to which the findings apply. Finally, it is worth noting that this paper focuses mainly on qualitative analysis because hydropower is deeply entwined with politics, economics and security issues across the nexus.

3. The Nexus, Hydropower and Chinese SOEs’ Activities on the Lancang-Mekong

The Chinese government is well aware of the need to balance the trade-offs in the nexus as clearly shown by the first paragraph from the main targets of the 12th Five Year Plan (FYP):

We will maintain farmland reserves at 1.818 billion mu (approximately 121,260,600 hectares). We will cut water consumption per unit of value-added industrial output by 30%, and increase the water efficiency coefficient in agricultural irrigation to 0.53. Non-fossil fuel resources will rise to 11.4% of primary energy consumption. Energy consumption per unit of Gross Domestic Product (GDP) will decrease 16% and CO2 emissions per unit of GDP will decrease 17%.

While China has policies that attempt to address all three aspects of the nexus, a significant focus of its policies are on energy [

17,

18]. This is primarily due to China’s prioritization of unimpeded economic growth, which is currently dependent on energy intensive industries. Stresses on water and food security due to air, water, and soil pollution are all viewed within the context of emissions from energy intensive industries, and constitute concerns shared by both domestic and international communities [

17,

18].

China’s Ministry of Environmental Protection was not given ministerial level status until 2007, and remains comparatively weak. The environmental and climate policies that do exist can be seen more as by-products of China’s energy security worries. Energy security worries are also linked to concerns over social unrest due to widespread and persistent environmental degradation including air quality issues in the capital, and the policy responses to address these concerns initiated under the Hu Jintao administration [

19]. China’s ability to meet energy demands domestically is further threatened by the agricultural and industrial sectors’ massive water and energy demands [

20]. The energy intensive economy has also propelled China to become the world’s leading carbon emitter, which increasingly places pressure on China’s administration to play a more leading role in climate change goals as an emergent superpower within the context of global geopolitics.

Environmental policies and pollutant regulation may be viewed as an obstacle and a nuisance to development in China. This is especially true at the local levels where officials are valued and promoted primarily based on GDP increases. Renewable energy, however, is a priority pillar industry for the government’s national development plan [

21]. Renewable energy and especially hydropower is seen by Chinese scholars and the government not as an impediment to development, but as a solution to the challenges it faces across the nexus and is the dominant goal of energy security [

21]. In addition, renewable energy is perceived as an important sector for China’s economic expansion, trade, and technological enhancement [

22].

While there have been massive investments into all three main sources of renewable energy in China (hydropower, wind and solar), many of the investments are geared towards GDP increases at the local and corporate levels, and lack the planning and collaboration necessary to contribute effectively to the country’s macro-economic targets. Despite China being the world’s largest investor in wind and solar power, 23% of the turbines and 28% of the panels are not connected to the grid, and therefore do not actually contribute to national power production [

23]. If around a quarter of the billions of dollars of renewable energy projects are not actually contributing energy to the grid, it may be argued that these industries are not being driven by environmental policy alone. Although policy might be aimed at energy security, the investment does not necessarily contribute to the expected energy goals, an argument that this article will return to with regards to the Mekong Basin.

China has been unable to shift its economy to less energy intensive production higher up the value chain, which will make it increasingly difficult for renewable energy targets to be met. The renewable energy sector only contributed to around 1% of China’s total energy consumption (not including hydropower) in 2010. Renewable energy is projected to contribute 15% of the energy supply by 2020 (See

Table 1). Although there has been large investment in the solar and wind sectors, China’s inability to shift the economy to less energy intensive production means that wind and solar energy will contribute only minimally to the overall energy supply. The vast majority of renewable energy supply that is needed to meet China’s energy targets will come from hydropower production. The majority of which exists in the west and southwest of China on transboundary rivers.

Table 1.

Key energy targets enacted in China’s 12th FYP (2011–2015).

Table 1.

Key energy targets enacted in China’s 12th FYP (2011–2015).

| Energy | 2010 Target | 2010 Realized | 2015 Target | 2020 Target |

|---|

| Hydropower | 190 | 272.6 | 290 | 420 |

| Non-fossil fuel share in energy supply | 10% | 9.4% | 11.4% | 15% |

| Non-fossil fuel share in energy supply (excluding hydropower) | 1% | 1.2% | Unknown | 3% |

China’s domestic hydropower expansion strategy is partially a response designed to alleviate the current stressors across the nexus. To legitimize this strategy, the Chinese government and its SOEs have employed a number of domestic and regional narratives that couch the impacts of hydropower on the transboundary Lancang River as a “

win-win” for both China and the GMS [

24]. These narratives have been developed and employed over decades of domestic dam construction [

24]. For example, the Chinese government has couched its rigid policy stance on hydropower in a rhetoric of regional “

peace”, highlighting the “

win-win” outcomes for downstream riparian states [

24,

25]. Although China still rarely discusses the negative impacts of dams and their consequences within the nexus, it has recently been visibly more communicative with the Lower Basin states such as Thailand, Laos, Cambodia and Vietnam through the MRC [

26].

Liebman [

27] argues that in communicating with the GMS, China has used narratives that frame the benefits of hydropower as being shared between governments to avoid appearing as a hegemon within the region. Examples of this position can be seen in Chinese political speeches. During a speech at the MRC in 2010, H.E. Song Tao, Vice Minister of Foreign Affairs of the People’s Republic of China stated that “

hydropower development of the Lancang River can improve navigation conditions and help with flood prevention, drought relief and farmland irrigation of the lower reaches” and that dam construction would include “equal consultation, stronger cooperation, mutual benefit and common development” [

28]. The speech made no mention of trade-offs across the nexus or how impacts would be mitigated.

In contrast to these narratives, studies show that China’s cascade of dams on the Lancang is having a significant transboundary impact downstream by impeding vital sediment flows and reducing water levels by as much as 30% during the rainy season [

29]. By ignoring or downplaying the fact that all energy production has trade-offs and that in the Mekong these are potentially significant and transboundary in nature, these narratives reinforce and empower decision-making that ignores nexus connections. These narratives not only legitimize silo decision-making, they also delegitimize civil society and environmental groups who attempt to place a grounded environmental justice lens into the nexus to speak for and illuminate who wins and loses from trade-offs [

13]. As we will examine next, these narratives and political and economic drivers of Chinese SOEs’ hydropower development extend past China’s border into the GMS. We argue that the Chinese state is using its political and economic power to reshape science to legitimize its policy agendas and international and domestic strategies. This strategy and the political and economic forces that drive it has important implications for how SOEs address the trade-offs of hydropower development in both local and transboundary contexts. SOEs are able to use the ambiguous and contested discourses surrounding the nexus to further their political and economic interests, while disadvantaged actors are continually marginalized [

9].

4. Chinese SOE Hydropower Expansion in the Greater Mekong Subregion and its Implications across the Nexus

The GMS is currently experiencing a surge in hydropower development, with more than 50 on-going large-scale dam projects (over 50 MW) being built and managed by Chinese companies, and many more in the proposal phase [

30]. The distribution of large-scale Chinese dams in the region is as follows: Myanmar 30, Lao PDR 13, Cambodia 7, Vietnam 3, and Thailand with some Chinese dam projects, but none over 50 MW [

30]. These projects are financed, developed, constructed, and contracted out primarily to Chinese SOEs. Sinohydro plays at least one of these roles in 30% of the large dam projects in the LMB, and handles the entirety of financing, developing, and building of five of the 13 large Chinese dams in the Lao PDR [

30]. Large SOEs like Sinohydro often have higher capacity, scalability, greater political backing, more experience gained from domestic construction projects, and can usually build dams at a lower price than their competitors [

31]. These large-scale projects usually require approval from the highest levels of government in both Beijing and in the LMB nations, and thus connections with the state serve as an asset. In the LMB, almost every major dam project has SOE involvement from well-known large enterprises, but Myanmar shows some contrast with much smaller and less well-known provincial level SOEs [

30].

Beijing originally pushed its SOEs to go abroad and invest through the “

Going Global Policy”, which was proposed at the 5th plenary session of the 15th central committee in 2000. This policy acts as a roadmap for Chinese foreign investment. The ambitions of this policy were not articulated until the following FYP in 2005, when the Ministry of Foreign Trade and Economic Cooperation (MOFCOM), National Development and Reform Commission (NDRC) and Export-Import Bank of China policies began streamlining the process for investment to reach overseas markets [

32]. From 2001 to 2005, China’s ODI was $22.3 billion USD in total. As part of this policy, ODI rapidly increased to $18.7 billion USD in 2007 alone, $87.8 billion in 2012, $90.17 billion in 2013 and reaching a staggering $102.89 billion in 2014 [

32,

33,

34,

35].

China’s “

Going Global” strategy does not simply pertain to SOEs. China’s overseas investments, trade, and aid must be viewed as a package rather than separate initiatives. ODI provides a conduit for China to invest its vast capital supplies and at the same time develop strategic partnerships and secure access to resources. Urban

et al. [

30] describe how these elements are packaged together in hydropower deals in the GMS:

The Chinese practice is hence often to bundle aid, trade and investment by providing, for example, both investments and concessional loans for dam building and linking this to the export of electricity coupled with the import of Chinese manufactured goods and trade deals for Chinese firms.

One example of this ODI policy, related to hydropower, is the Kamchay Dam in Cambodia, which was the first Build Operate Transfer (BOT) hydropower project in the country. Sinohydro is the primary SOE involved in the construction and operation of the Kamchay Dam project. The $280 million that was required to construct the dam, however, was part of a $600 million aid package given to Cambodia by China in 2006 [

36].

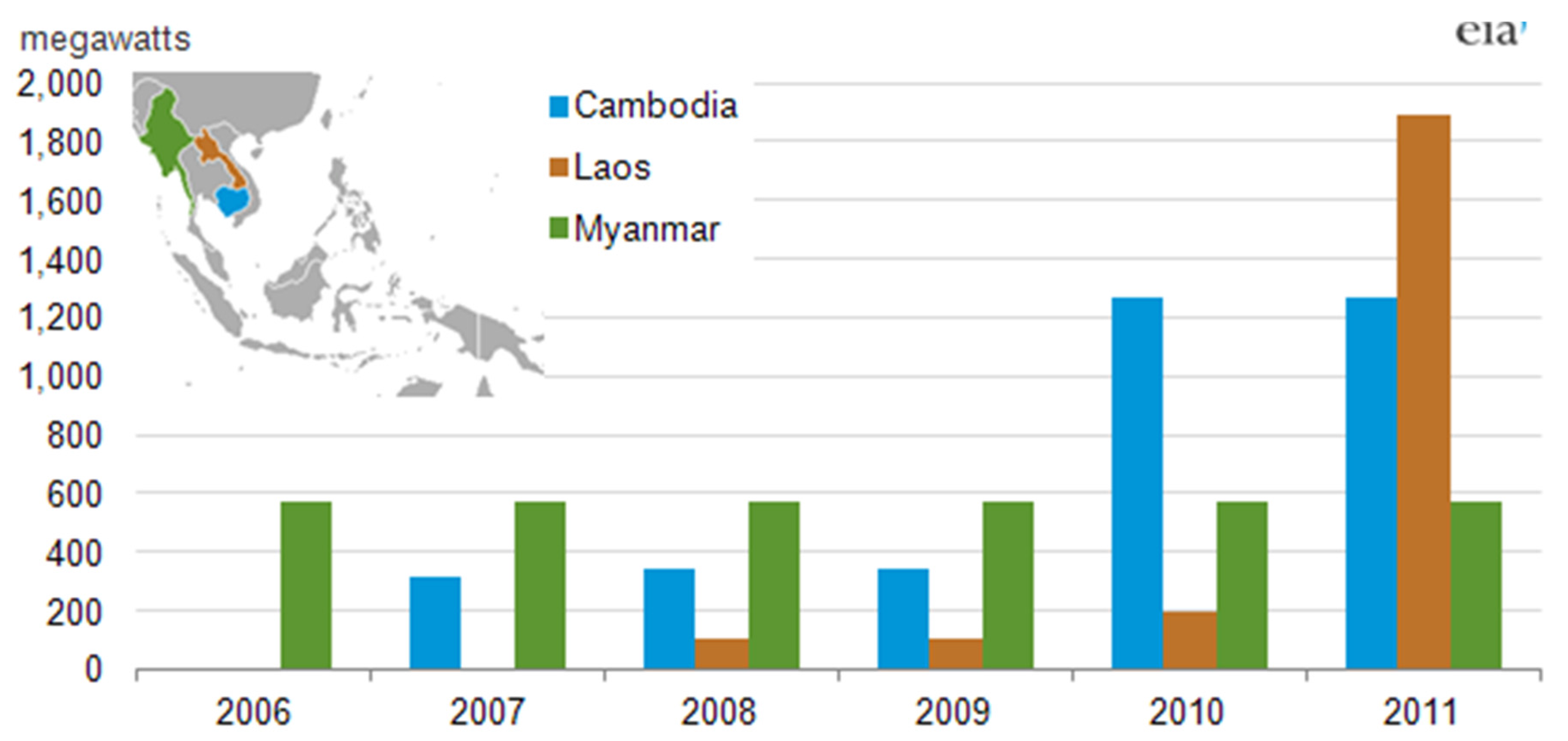

Chinese investment in hydroelectric development in the GMS has expanded rapidly in the past decade. McNally

et al. [

37] argue that this investment should also be understood as exporting Chinese policies, expertise and ideologies, as discussed above, into developing countries. China has gone from having very few investments in Cambodia, Laos and Myanmar to becoming all three countries’ largest foreign direct investor [

38]. From 2006 to 2011, China invested over $6.1 billion into the three countries in their hydropower sectors alone [

39] (See

Figure 1 below). This figure is likely a low estimate as some concession agreements were signed but not counted during that time. Furthermore, it does not include the currently on hold Myitsone project in Myanmar valued at over $3.6 billion USD.

Figure 1.

Cumulative hydroelectric capacity additions financed by China (2006–2011) (Source EIA, 2013 [

39]).

Figure 1.

Cumulative hydroelectric capacity additions financed by China (2006–2011) (Source EIA, 2013 [

39]).

When Chinese ideologies and policies that disregard or downplay connections and trade-offs across the nexus, as outlined in the narratives above, are exported to the LMB, there are potentially significant consequences for livelihoods, food security and the environment across the region. An example of how these policies, expertise and ideologies are exported can be seen in how Beijing’s outward investment policies are mirrored in Lao PDR’s hydropower sector. Chinese corporations had just two projects completed as of February 2015, for a combined 210 MW. However, there is 1010 MW under construction, and 3892 MW that have MOUs signed but have yet to begin construction, including three out of six of the dams planned for the Mekong mainstream. If all of these projects are realized, the scale of China’s installed capacity within the Lao PDR will have increased nearly 25 times between 2015 and 2030 [

7]. We argue that China’s lack of recognition of trade-offs across the nexus has driven many of these hydropower projects to disregard or downplay the evidence of their impacts on fisheries, livelihoods and the environment [

7,

40].

The scale of the projects that the Chinese are pursuing is also increasing as shown by Myanmar’s hydropower climate. Chinese companies signed the contract for the Yeywa dam in 2005, finishing the construction of the 790 MW project in 2011, making it the largest dam in the country. There are 46 dams planned from 2016 to 2030 with 12 of these over 1000 MW of installed capacity. Of these dozen 1000 MW plus projects, Chinese companies have 11, including the Mong Tong Dam, which is 7110 MW [

41].

The potential and current negative implications of these investments across the nexus is significant [

42,

43,

44]. Governments in Cambodia, Laos and Myanmar face major challenges in monitoring and regulating investment and its social and environmental impacts at this scale and speed [

42,

43,

44]. The countries still have very young governments and judicial systems that are going through major institutional changes and improvements, but are currently not capable of holding large corporations accountable. In terms of transboundary impacts, different and often competing political and economic goals and historical and cultural issues compound opportunities for cooperation at the basin scale [

45]. Transboundary water law also offers limited opportunities to challenge the transboundary impacts of upstream states on the water and food especially when legal frameworks across the basin states are based on different variables and rationales [

46], and only Vietnam has signed up to the United Nations Watercourses Convention. An indication of the limitations and challenges of promoting good water governance and holding SOEs accountable can be seen in Transparency International’s World Ranking indices as demonstrated in

Table 2 [

47,

48,

49].

Table 2.

An overview of three international indices where China is heavily investing in hydropower in the GMS.

Table 2.

An overview of three international indices where China is heavily investing in hydropower in the GMS.

| Country | Ease of Doing Business Rating (Out of 189) | Corruption Index (Out of 177) | Freedom of Press (Out of 179) |

|---|

| Cambodia | 137th | 160th | 143rd |

| Lao PDR | 159th | 140th | 168th |

| Myanmar | 182nd | 157th | 151st |

Cambodia, Lao PDR, and Myanmar have portrayed large-scale hydropower development as essential for their own economic development and their citizens’ livelihood improvement [

50,

51]. However, there have been very little independent data or studies that directly equate large-scale dam construction in these countries to the improvement of livelihoods. The more realistic driving force behind the domestic government support for these projects is the need for capital through foreign direct investment (FDI). This FDI comes with key revenue opportunities for national governments generated through energy export to neighboring countries, primarily Thailand, that have much higher energy demands [

52,

53,

54].

Chinese ODI in hydropower development in the GMS is often partly justified as supplying technology to developing countries or as an important strategy for China to increase its domestic energy supply and security. Despite this justification, China was a net exporter of energy to the region in 2010 [

55]. In Lao PDR and Myanmar, the majority of the energy exported is destined for Thailand. There are no transmission lines from Cambodia to China, yet the Kingdom of Cambodia has recently begun an ambitious hydroelectric expansion with the help of Chinese SOEs.

Sinohydro completed construction of the country’s first large-scale project, the Kamchay Dam, in 2011 [

36]. Rather than having a vast array of small and medium projects (Lao PDR has more of this makeup), Cambodia is instead hosting a few large and controversial Chinese dam projects, including the Lower Sesan 2. These large-scale projects allow for greater injections of ODI into the Cambodian government and the scale and technical nature of the projects ensure that the Chinese companies involved will be central level SOEs.

Burgos and Sophal [

56] argue that Hun Sen’s relationship with China creates an opportunity for the country to develop its economy without conditional loans and grants from Western donors that may include calls for reform or restructuring of existing powerbases. Government-sanctioned projects give the Chinese SOEs political security and the ability to operate with greater autonomy in the country [

55,

56]. Examples of this can be seen in the Lower Sesan 2, where reservoir clearing began inside the concession area before dam designs were even approved [

57]. The tree clearing at the Lower Sesan 2 was also illegal as it extended well beyond the borders defined in the concession agreement [

58]. Many speculate that the central government and the SOEs are signing dam concession agreements in order to access the valuable timber reserves. The Ministry of Environment has the responsibility to hold SOEs responsible for producing and implementing Environmental Impact Assessments (EIAs) and Environmental Management Plan (EMPs). In the case of the Kamchay Dam, however, which was signed by Wen Jiabao and Hun Sen, construction went on for years without either an EIA or EMP [

36].

Cambodia is China’s most important political ally in the region and this relationship likely creates favourable conditions for Chinese SOEs operating in the country. In 2013, after ASEAN attempted to unite in its discussion with China over the South China Sea issues, Wang Yi, the Chinese foreign minister to Cambodia, refused to attend. Wang Yi explained in a statement to reporters that China is interested in protecting Cambodia from outside interests, hence his refusal to attend the ASEAN discussion [

59]. As the main driver of the South China Sea tension is the potential undersea oil and gas reserves, it is possible to link China’s interests in Cambodia back to China’s domestic nexus. These examples demonstrate how hydropower investment can serve as a placeholder for larger political and economic issues that are not necessarily energy security or profit driven.

China is politically stronger in Cambodia than in the Lao PDR or Myanmar—the other two GMS nations where Chinese hydropower development is extensive. Chinese SOEs in Cambodia have a relatively large stake in the hydropower industry due to the scale of their projects and the lack of developer diversity in the sector. China has invested over $1.6 billion in just six projects, with four now operational, and two expected to complete construction in 2015 [

58]. The Chinese Chamber of Commerce in Cambodia is dominated by hydroelectric SOEs and the industry will likely continue to expand. China’s political and economic strategy within the region and ASEAN, and the Cambodian government’s dependence on Chinese investment highlight some of the drivers behind hydropower decision-making. The analysis also shows that individual projects do not necessarily need to be profitable to be approved, but rather contribute to grander relationship goals that are key for both governments and their political and economic strategies.

Foreign Exchange Reserves as an Economic Driver of Investment

One of the issues around Chinese ODI meriting greater attention is the link between large-scale infrastructure projects and China’s vast foreign exchange reserves (forex). China’s forex has increased tenfold over the past decade, reaching $3.82 trillion at the end of 2013 [

60]. This is by far the largest stockpile of forex in the world, three times that of the next largest held by Japan [

61]. This large stock of forex threatens to cause the yuan to inflate, which in turn threatens China’s export market and foreign investment. To prevent the yuan’s inflation, China’s central bank regulates fluctuations while purchasing large quantities of foreign reserves [

62]. One of the main sources of foreign reserves are low-interest treasury bonds from the US and Japan, which can be as low as 2.8% over 10 years [

61]. This huge amount of forex also makes China vulnerable to fluctuations in global forex markets, especially in instabilities of USD and JNY.

During the global economic recession both the U.S. and Japan responded to the crisis through monetary easing, or in other words, by aggressively running the printing presses, churning out cash, and devaluing their currencies. This concerns Beijing, which is sitting on huge sums of U.S. and Japanese forex while vast amounts of investment continue to flood into the country, threatening the yuan and therefore China’s economic stability.

In order to alleviate these concerns, the Chinese banking system quickly pushes money out of the country to its SOEs in the form of ODI, and the easiest way to move large quantities of money outward is through large-scale infrastructure projects, such as hydropower dams. The Export-Import Bank of China (China Exim) is one of three policy banks that was established in 1994 along with the China Development Bank (CDB) and the Agricultural Development Bank of China. China Exim and CDB are the primary lenders for overseas investment in resource development. China Exim’s mandate states that it is to “

assist Chinese companies with comparative advantages in their offshore project contracting and outbound investment, and promote international economic cooperation and trade” [

63]. In the last decade, China Exim’s lending has increased dramatically and the bank is now the largest export credit agency in the world [

64]. China Exim has been able to increase lending by 30%–40% year on year, fueling the ever expanding ODI under China’s Going Global Strategy [

64].

Long term payback systems are generally preferred by banks, which coincides well with large-scale hydropower projects where the Build Operate Transfer contract is usually a few decades in duration. Some of the large infrastructure projects carried out by SOEs might not be profitable, but this is inconsequential as the government has a mandate to spend money. Additionally, many of these concessional loans are attached to natural resource access [

65]. Therefore, China’s ODI into large-scale hydropower projects is not necessarily based on alleviating nexus pressures as its policies state, but can be seen as part of a strategy to ensure the country’s greater economic security against global currency fluctuations that threaten the value of the RMB, and the depreciation of China’s forex reserves.

5. Conclusions

This paper examined some of the key political and economic drivers behind Chinese SOEs’ hydropower activities and the implications of these drivers on the recognition and management of nexus interconnections and trade-offs. Chinese SOEs are amongst the biggest players in global hydropower development and are heavily involved in dozens of projects across the Mekong Basin. The political economy approach used in this analysis reveals the forces that drive the pace, location and scale of this hydropower development both domestically in China and in the GMS. These forces include how hydropower projects are linked to bigger packages of trade and aid and FDI, which are important sources of revenue for developing countries such as Lao PDR, Myanmar and Cambodia. In addition, hydropower projects also provide a guise to access lucrative natural resources such as timber. Other key forces analyzed include the link between large-scale infrastructure projects and China’s vast foreign exchange reserves, which facilitate SOEs to make hydropower investments abroad. The benefits of hydropower investments for both SOEs and domestic states are also linked to political alliances that have geopolitical dimensions.

When the political economy and nexus approaches are combined, the analysis reveals some of the key drivers that cause narratives surrounding hydropower to downplay or disregard trade-offs and interconnections across water, energy and food. These narratives, which position hydropower as a win-win for both upstream and downstream states, are in contrast to hundreds of scientific studies that demonstrate the substantial trade-offs of hydropower development. Hydropower dams in the Mekong Basin have been shown to have significant negative impacts on livelihoods, food security and the hydrology and ecosystems of the Mekong River and its tributaries [

7,

42,

43,

44].

Hydropower development by SOEs in the Mekong Basin also has potentially important transboundary impacts across water and food [

42,

43,

44]. Domestic and transboundary water law currently has limited influence to address these impacts. Lower Basin states are challenged by limited capacity and often weak and underfunded institutions to negotiate or manage large-scale impacts across the nexus. Furthermore, diverse political and economic goals and important cultural and historical differences have impended basin-wide cooperation surrounding mainstream dams despite the best efforts of the MRC [

45].

Chinese SOEs’ hydropower investments and activities are part of an increasing trend for both individual state and private sector led infrastructure financing and development that is expected to reach as much as four trillion dollars by 2017 [

66,

67,

68]. The Asian Infrastructure and Investment Bank and the Silk Road Fund, for example, will soon bring an additional $140 billion dollars of investment for development, a large proportion of which will be aimed at hydropower. By using a nexus and political economy approach this study provides a useful link to studies that examine impacts of hydropower development on water and food through its analysis of the drivers and implications of silo decision-making. Further research is needed to consider the opportunities and challenges the enormous investment by SOEs and the private sector will have on the interconnected spheres of water, energy and food.