Abstract

Seawater reverse osmosis (SWRO) desalination generates a concentrated brine byproduct rich in dissolved salts and minerals. This study presents an extensive economic and technical analysis of recovering all major ions from SWRO brine, which includes Na, Cl, Mg, Ca, SO4, K, Br, B, Li, Rb, and Sr in comparison to conventional mining and chemical production of these commodities. Data from recent literature and case studies are compiled to quantify the composition of a typical SWRO brine and the potential yield of valuable products. A life-cycle cost framework is applied, incorporating capital expenditure (CAPEX), operational expenditure (OPEX), and total water cost (TWC) impacts. A representative simulation for a large 100,000 m3/day SWRO plant shows that integrated “brine mining” systems could recover on the order of 3.8 million tons of salts per year. At optimistic recovery efficiencies, the gross annual revenue from products (NaCl, Mg(OH)2/MgO, CaCO3, KCl, Br2, Li2CO3, etc.) can reach a few hundred million USD. This revenue is comparable to or exceeds the added costs of recovery processes under favorable conditions, potentially offsetting desalination costs by USD 0.5/m3 or more. We compare these projections with the economics of obtaining the same materials through conventional mining and chemical processes worldwide. Major findings indicate that recovery of abundant low-value salts (especially NaCl) can supply bulk revenue to cover processing costs, while extraction of scarce high-value elements (Li, Rb, Sr, etc.) can provide significant additional profit if efficient separation is achieved. The energy requirements and unit costs for brine recovery are analyzed against those of terrestrial or conventional mining; in many cases, brine-derived production is competitive due to avoided raw material extraction and potential use of waste or renewable energy. CAPEX for adding mineral recovery to a desalination plant is significant but can be justified by revenue and by strategic benefits such as reduced brine disposal. Our analysis, drawing on global data and case studies (e.g., projects in Europe and the Middle East), suggests that metals and salts recovery from SWRO brine is technically feasible and, at sufficient scale, economically viable in many regions. We provide detailed comparisons of cost, yield, and market value for each target element, along with empirical models and formulas for profitability. The results offer a roadmap for integrating brine mining into desalination operations and highlight key factors such as commodity prices, scale economies, energy integration, and policy incentives that influence the competitiveness of brine recovery against traditional mining.

1. Introduction

Desalination of seawater is expanding globally to meet rising freshwater demand, but it produces large volumes of concentrated brine waste [1,2]. Nearly 16,000 desalination plants worldwide generate about 142 million cubic meters of hypersaline brine every day, compared to 95 million m3 of fresh water output [1,3] This brine (the SWRO reject stream) is typically considered a waste product, often discharged to the ocean. Brine disposal raises environmental concerns due to high salinity, chemical additives, and thermal effects in the receiving waters [4]. At the same time, brine can be viewed as a resource because it retains essentially the same ionic constituents as seawater but at roughly double concentration in a SWRO process with 50% water recovery [5,6]. In line with circular economy principles, there is growing interest in “mining” these dissolved salts and metals from brine to create valuable products, turning an environmental liability into an economic asset [4].

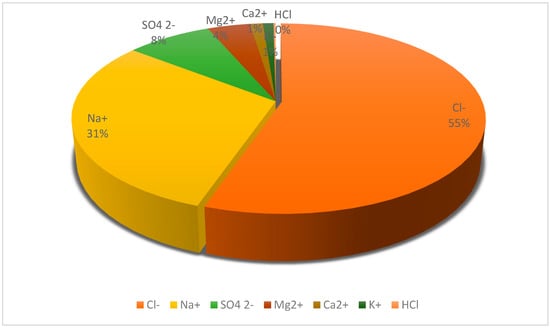

A typical SWRO brine of 70 g/L total dissolved solids (TDS) contains predominantly sodium and chloride ions (from NaCl), along with significant sulfate, magnesium, calcium, potassium, and smaller amounts of bromide, boron, and trace elements [7]. Figure 1 illustrates the composition of a representative SWRO brine by major ion fraction. Chloride and sodium together account for approximately 85% of the total salt mass (around 35 g/L Cl− and 19 g/L Na+ in brine) [5]. Sulfate (5 g/L), magnesium (2.5 g/L), calcium (0.8 g/L), and potassium (0.8 g/L) constitute most of the remaining mass [5]. Minor constituents include bicarbonate (0.2 g/L as CO32−) and bromide (0.12 g/L) [4,5], as well as trace levels of boron (as boric acid, on the order of 0.01–0.02 g/L), lithium (0.0003–0.0005 g/L), rubidium (0.0002 g/L), and strontium (0.016 g/L) in seawater-derived brine [4,5]. These dissolved minerals correspond to a diverse array of potential recoverable products from abundant commodities like sodium chloride salt and gypsum, to infrequent but high-value materials like lithium compounds and rubidium salts [5].

Figure 1.

Major ion composition of a typical SWRO brine (70 g/L salinity).

Sodium and chloride dominate (85% of total salts), with sulfate, magnesium, calcium, and potassium comprising most of the remaining constituents [5]. Minor constituents such as bromide, bicarbonate, boron, etc., collectively account for <2%.

Recovering these elements from brine offers a dual benefit: (1) mitigating the environmental impact of brine disposal by reducing salinity and removing contaminants, and (2) improving desalination economics by producing saleable commodities. By extracting resources from what is currently a waste stream, SWRO plants can offset operating costs and move toward more sustainable, zero-liquid-discharge (ZLD) operations. However, realizing this “brine mining” potential requires overcoming technical and economic challenges. The concept of harvesting minerals from the ocean is not new. Historically, sea salt has been produced via solar evaporation for millennia, and magnesium metal was extracted from seawater in the 20th century (e.g., Dow Chemical’s Freeport plant in Texas began extracting magnesium from seawater in 1941) [8]. The key advancement with modern SWRO brine is that the feed is already partially concentrated, which is roughly twice the salinity of raw seawater, and which, in principle, reduces the energy or effort needed to further concentrate or isolate valuable components [7]. Despite this advantage, relatively few full-scale implementations of brine resource recovery exist yet, due to concerns about cost-effectiveness and process complexity [7].

This study examines the cost–benefit balance and market viability of extracting metals and salts from SWRO brine in comparison to conventional terrestrial mining and chemical production routes. We focus on all major constituents (Na, Cl, Mg, Ca, SO4, K, Br) as well as important minor or trace elements (B, Li, Rb, Sr) present in brine. For each of these, we analyze the recoverable quantities, feasible extraction methods, energy requirements, and the potential revenue based on current market prices. These factors are then compared with how the same commodity is obtained from land-based sources or industrial chemical processes, with typical costs and environmental footprints. The analysis uses a global perspective, drawing data from worldwide operations and studies to avoid regional bias. We also incorporate real-world case studies and pilot projects (e.g., in Europe and the Middle East) that have tested brine recovery, to ground the discussion in operational reality. By integrating technical performance data with economic models such as CAPEX, OPEX, and lifecycle costs, we aim to determine under what conditions brine recovery makes business sense. The overarching goal is to provide clarity on whether “mining” SWRO brine can compete with traditional mining, and to identify key drivers or barriers for its commercial adoption.

2. Methods

Our approach combines literature-derived data, empirical modeling, and original simulations to evaluate the cost–benefit metrics of brine mineral recovery versus conventional production. The analysis follows these general steps:

2.1. Characterization of SWRO Brine Composition

Representative data for ion concentrations in SWRO brine were compiled based on standard seawater chemistry and reported measurements [9]. Table 1 summarizes the target ions and their typical concentrations in a 70 g/L TDS brine, along with the corresponding compounds that could be produced. This composition serves as the basis for calculating potential yields of each mineral per unit volume of brine.

2.2. Identification of Recovery Technologies

For each element or salt, proven or emerging extraction methods suitable for brine processing were identified. These include membrane separations such as reverse osmosis (Toray Industries, Tokyo, Japan), nanofiltration (DuPont, Wilmington, DE, USA), and electrodialysis stacks (SUEZ Water Technologies, Trevose, PA, USA) for selective concentration, chemical precipitation using sodium hydroxide (NaOH, Sigma-Aldrich, St. Louis, MO, USA) or lime (Ca(OH)2, Merck, Darmstadt, Germany), carbonate dosing with sodium carbonate (Na2CO3, Sigma-Aldrich, St. Louis, MO, USA) for CaCO3 recovery, thermal processes such as evaporators and crystallizers (GEA Group, Düsseldorf, Germany) for salts like NaCl and KCl), and electrochemical methods such as chlor-alkali electrolysis units (Asahi Kasei Chemicals, Tokyo, Japan) for chlorine and sodium hydroxide recovery, bipolar membrane electrodialysis for acid/base production) [10]. Typical energy requirements and chemical inputs for these methods were considered from the literature, as these factors directly affect cost.

2.3. Economic Data Collection

The current market prices and production cost estimates for the relevant commodities (such as salt, magnesium compounds, potash, bromine, boron, lithium, etc.) were gathered from industry reports and databases. For example, the average global price of industrial salt is on the order of USD 30–60 per ton for bulk rock salt or solar salt, high-purity magnesium oxide can command around USD 300/ton [11], bromine prices are roughly USD 3–5 per kg (import value) [12]; and lithium carbonate prices in 2022–2024 ranged from USD 14,000 to USD 46,000 per ton amid market volatility [13]. These price points, with references, form the basis for calculating potential revenues from brine-derived products. Likewise, we reviewed cost models for mining or producing these materials conventionally (e.g., mining cost of potash ore, energy cost for lithium extraction from continental brines, etc.) to have benchmarks for comparison.

2.4. Simulation of Integrated Brine Recovery in a Desalination Plant

A simplified simulation for a hypothetical large SWRO plant, a 100,000 m3/day fresh water production at 45% recovery, was developed to quantify the annual amounts of each mineral that could be recovered. This scenario assumes the plant takes in 250,000 m3/day of seawater and produces 150,000 m3/day of brine (70 g/L). By applying reasonable recovery efficiencies for a multi-step extraction process (e.g., NaCl crystallization followed by Mg(OH)2 precipitation, etc.), we estimated the tonnage of each product per year and the energy or chemical consumption required. A full material balance was not available from a single source, so we synthesized data from multiple studies to approximate yields. This simulation provides concrete values for CAPEX/OPEX analysis (for instance, sizing evaporators or reactors) and for revenue calculation.

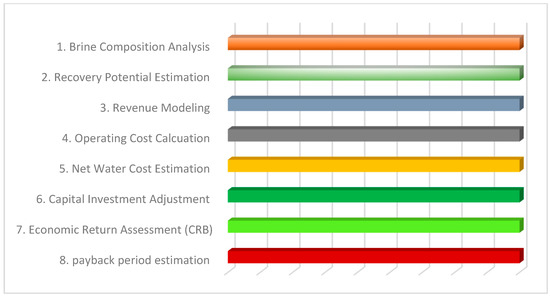

Figure 2 presents the structured simulation workflow adopted for assessing the cost–benefit and market viability of mineral and salt recovery from SWRO brine. Each stage corresponds to a critical modeling task.

Figure 2.

Simulated workflow for cost benefit modeling of brine recovery.

The process begins with brine composition analysis to determine available mineral concentrations. This is followed by estimating the technical recovery potential based on literature-derived efficiencies. Product revenue modeling uses prevailing market prices to project earnings per cubic meter. Operating costs are calculated separately for desalination and brine recovery processes. These are integrated to derive the net water cost. Capital investment is accounted for in subsequent steps to simulate long-term returns using cost–benefit ratios and payback period estimation. The workflow serves as the computational backbone for the techno-economic evaluation and supports the decisions discussed in the results section.

2.4.1. Simulation and Economic Modeling

To evaluate the financial viability of mineral and salt recovery from seawater reverse osmosis (SWRO) brine, a simulation-based modeling framework was developed. This framework integrated chemical mass balances, revenue forecasting, operating cost estimation, and standard financial evaluation tools. This model was applied to a representative high-capacity SWRO facility and used to quantify the techno-economic outcomes associated with the recovery of key constituents such as sodium chloride (NaCl), magnesium hydroxide [Mg(OH)2], and bromine (Br2).

Mineral Mass Balance

The quantity of recoverable mineral per unit volume of brine was estimated using a simple mass balance equation, as shown in Equation (1).

where:

Mr = Cb·Vb·ηr

- Mr = mass of recoverable mineral (kg)

- Cb = concentration of the target ion in brine (kg/m3)

- Vb = volume of brine treated (m3)

- ηr = recovery efficiency (dimensionless, 0–1)

For instance, with magnesium concentration at 1.3 kg/m3 and a recovery efficiency of 50%, the recoverable mass is 0.65 kg/m3.

Product Revenue Estimation

The economic value of recovered materials was calculated by multiplying the recovered quantity by prevailing market prices for industrial-grade minerals. The following global average prices were used: NaCl—USD 60/ton, MgO—USD 300/ton, and Li2CO3—USD 4500/ton. Revenue per cubic meter of treated brine was then determined using Equation (2):

where:

- R = total revenue from product sales (USD)

- Pi = market price of mineral i (USD/kg or USD/ton)

- Mr,i = mass of mineral i recovered (kg or tons)

- n = number of different minerals recovered

Operating Cost Calculation (OPEX)

Operating costs included the base desalination cost and additional brine processing expenditures. The base SWRO operating cost was assumed to be USD 0.80/m3, consistent with industry averages. Brine processing added an estimated USD 1.00/m3 [14], resulting in a total operational cost of USD 1.80/m3 using Equation (3).

Net Water Cost Evaluation

To reflect the impact of product revenue on desalination economics, net water cost was calculated using Equations (4) and (5) by subtracting revenue from the total cost:

where

Net Water Cost = OPEX − R

- = net water cost after byproduct credit (USD/m3)

- = revenue per m3 of brine treated (USD/m3)

For a total revenue of USD 1.50/m3 and OPEX of USD 1.80/m3, the net cost was reduced to USD 0.30/m3.

Cost–Benefit Ratio (CBR)

The long-term economic viability was assessed using the cost–benefit ratio (see Equations (7) and (8)):

- R = total revenue over period t (USD)

- = capital expenditure (USD)

- t = number of years of plant operation

Assuming a capital expenditure of USD 150 million and a 20-year project lifetime, a CBR greater than 1 was considered indicative of economic attractiveness.

Payback Period (PBP) Estimation

The investment recovery timeline was calculated using Equation (9):

This modeling approach formed the quantitative basis for evaluating recovery feasibility under realistic industrial conditions. Results derived from these calculations were used to analyze capital intensity, resource yield, and financial returns, as presented in Section 3.

2.5. Cost–Benefit Analysis Framework (CAPEX/OPEX and LCC Modeling)

To evaluate the economic viability of integrated brine recovery, we employ a cost–benefit analysis (CBA) framework that accounts for both capital and operating costs, as well as potential revenues from recovered products. This framework is based on life-cycle cost (LCC) modeling, which involves considering the total costs over the project’s lifetime and comparing them to the total expected income or savings, appropriately discounted. Key components of the analysis include:

2.5.1. Capital Expenditures (CAPEX)

The up-front investment needed to add mineral/salt recovery processes to a desalination plant. This encompasses equipment such as additional membrane modules, chemical reactors, evaporators or crystallizers, brine handling and storage facilities, and any integration costs for retrofitting existing infrastructure. For example, adding a brine processing unit might require significant pumps, tanks, and corrosion-resistant materials, which can amount to tens or hundreds of millions of dollars in large-scale facilities. These estimates were benchmarked against reported CAPEX for desalination and chemical plants. Panagopoulos [15] estimated that implementing a zero-liquid-discharge system on a 100,000 m3/d RO plant would necessitate capital investment on the order of the base desalination plant itself, although modular designs can spread this cost depending on which minerals are targeted. The adopted model amortizes the CAPEX over the plant life (e.g., 20–30 years) to incorporate it into the unit cost of water and products.

2.5.2. Operating Expenditures (OPEX)

The recurring costs of running the brine recovery processes, added to the normal SWRO operating costs. OPEX includes energy consumption (often the largest component), chemicals and reagents (e.g., antiscalants, precipitants like NaOH or lime, acids for pH adjustment, etc.), membrane replacement or other consumables, labor, maintenance, and waste disposal for any solid residues. Energy usage estimates for each process step were compiled from literature studies. Additional RO/NF stages might consume 2–5 kWh/m3, electrodialysis may consume 5–15 kWh/m3, depending on the degree of concentration, thermal crystallizers consume 50–80 kWh/m3 of brine evaporated, etc. [16]. Chemical costs are estimated based on dosage rates (e.g., precipitating magnesium with lime requires 1.4 kg of lime per m3 of brine) and current reagent prices. It was also considered that some processes yield byproducts that offset costs. A good example is precipitating Mg(OH)2, which removes magnesium that might reduce anti-scalant needs in downstream equipment. All these OPEX factors are summed to determine the incremental cost per cubic meter of water processed, or per cubic meter of brine treated for the resource recovery system.

2.5.3. Revenue and Credits

The economic benefit side of the ledger comes from the sale of recovered minerals and salts. For each target product, market price data from recent years were used to estimate revenue. Major commodity prices were gathered from industry and government sources (e.g., bulk industrial salt at USD 30–60 per ton, magnesium hydroxide or oxide around USD 300/ton, bromine USD 3–5 per kg (i.e., USD 3000–5000/ton), potash (KCl) roughly USD 250–300/ton, lithium carbonate highly volatile from USD 14,000/ton in 2020 up to over USD 40,000/ton in the 2022 spike, etc.). These figures are cross-checked with mineral commodity reports and recent trading data. For example, the U.S. Geological Survey reported the average lithium carbonate price in 2022 was in the tens of thousands of dollars per ton, reflecting the lithium boom [17]. It was noted that some markets are region-specific (e.g., bromine prices vary by region and contract), so a range was adopted. The revenue from each product is calculated as (recovery rate) × (concentration in brine) × (flow of brine) × (price per unit). In cases where recovered products do not meet purity specifications or require additional refinement, appropriate discount factors or supplementary processing costs are incorporated. Within the cost–benefit analysis (CBA), revenues from recovered materials are treated as financial credits that offset the overall desalination expenditure. When these credits exceed the operating expenses (OPEX) of the recovery system, the process is considered economically profitable; otherwise, it represents a net operational cost.

2.5.4. Net Present Value and Profitability Metrics

Using the above elements, we compute metrics like net present value (NPV), internal rate of return (IRR), payback period, and levelized cost of water (LCOW) with and without the brine mining component. Future cash flows were discounted using a chosen discount rate, such as 6–8%, and include any salvage values or decommissioning costs at the end of life. The life-cycle cost (LCC) analysis provides a holistic view of the economics. Ojo et al. [18] applied LCC analysis to evaluate SWRO desalination economics and highlighted that any added process must be weighed over the full project life to see true cost impacts. Following such approaches, the brine recovery’s CAPEX and OPEX were integrated into the overall desalination project cash flow. This allows the calculation of how much the total water cost (USD/m3) changes when brine mining is implemented. The cost–benefit ratio was also examined (i.e., total revenue divided by total cost for the brine recovery system) as a straightforward indicator. A ratio above 1.0 means the recovery pays for itself, while below 1.0 means it operates at a net cost.

The framework is structured to evaluate whether the economic value derived from mineral and salt recovery from SWRO brine exceeds the associated incremental costs of recovery. It further quantifies the extent to which such recovery reduces the net cost of water production or contributes to overall system profitability. By modeling on a per-m3-of-water and per-year basis, scenarios can be directly compared and sensitivity analyses can also be performed to identify the most influential factors. This type of techno-economic modeling aligns with methods used in recent assessments of ZLD and resource recovery systems, ensuring that our approach is consistent with best practices in the literature.

2.6. Costs and Revenues in the Model

Based on the CAPEX/OPEX framework described earlier, costs were assigned to each part of the integrated process. The SWRO desalination is assumed to have a baseline water cost around USD 0.5–0.8 per m3, which is consistent with large modern plants [19]. The brine recovery system adds extra operating cost. The base estimate is about USD 1.0 per m3 of feed water treated, which covers the reagents, energy, and additional maintenance for the recovery processes, which is in line with estimates from previous studies for multi-step mineral recovery on seawater brine. Therefore, total OPEX with brine mining becomes roughly USD 1.5–1.8 per m3. On the revenue side, summing the products, it is estimated that the gross revenue will be USD 1.5–2.0 per m3 of water processed under mid-range price assumptions. In this case study, for every cubic meter of water processed, the plant could earn on the order of USD 0.7 from NaCl, USD 0.5 from Mg(OH)2, USD 0.1 from K salts, USD 0.3 from Br2, and a few cents from Li and other trace elements. In total, about USD 1.5 of revenue per m3 of water is projected in the base case, against approximately USD 1.0 of added cost per m3. This implies the recovered products could offset about USD 0.5 per m3 of the total water cost. If the base desalination cost was USD 0.8, it could drop to a net USD 0.3 per m3 after credits, a 62.5% reduction in water cost. The model calculates a payback period of around 6–8 years for the added investment, given these cash flows. Specifically, for a CAPEX of about USD 150 million for the recovery system, an annual net revenue on the order of USD 20–30 million would yield payback in under a decade. These values are within a similar range to those reported by [4] for hypothetical brine mining in Spanish desalination plants, which found that under optimistic assumptions, product revenues could be 1.5–2.8 times the additional costs.

It is essential to note that these estimates are highly sensitive to the assumptions made. A range of scenarios were explored; for example, if commodity prices are at the low end of historical ranges or if recovery efficiencies are lower, the revenue might only be USD 0.8–1.0 per m3. In a case where revenue is USD 0.8 and added OPEX is USD 1.0, the net cost per m3 could increase slightly, yielding no economic benefit. On the flip side, in a boom market (e.g., lithium prices spiking or bromine shortage driving up prices) and with high recovery performance, revenues could far exceed USD 2/m3, greatly improving profitability [20]. The base-case simulation suggests that, under normal conditions, integrated brine valorization can make a SWRO plant’s water 30–60% cheaper per unit or equivalently, provide a new revenue stream of order a few hundred million USD per year for a large plant. This aligns with the notion that desalination could transition from just water production to a dual water-and-minerals operation that potentially pays for itself. In our Results section below, we delve deeper into these outcomes and also compare them to the costs of conventional production of the same minerals.

Beyond the economics, the simulation tracks material flows and energy use to feed into environmental analysis. It was asserted that recovering nearly all salts moves the plant toward zero-liquid discharge, with only a small purge stream or concentrated bittern remaining. The energy consumption for the entire integrated system in the base case comes out to around 5 kWh/m3 for SWRO + 10 kWh/m3 for brine processing (mostly for thermal steps and ED), totaling 15 kWh/m3, which is higher than standalone RO but still within range if cheap electricity is available. This is because energy cost is a major determinant in the economic viability, as we examine later. Lastly, the brine mining scenario is compared against terrestrial mining or chemical production for each commodity: e.g., we calculate how the cost per ton of each recovered product from brine stacks up against typical production costs or market prices if sourced conventionally. This comparative analysis, summarized in the next section, helps identify which minerals are most economically sensible to obtain from brine and which are better suited to traditional sources under current conditions.

2.7. Market Viability Analysis (Price Volatility, Market Size, Strategic Value)

In evaluating the market viability of recovering minerals from SWRO brine, several market factors must be considered: commodity price levels and volatility, the size of the market relative to potential brine-derived supply, and the strategic importance of the materials in question.

Commodity Price Volatility

Many of the minerals targeted in brine are commodities subject to cyclical and sometimes extreme price fluctuations. This volatility directly impacts revenue projections and investment risk. A prime example is lithium. Lithium prices have seen dramatic swings in recent years due to surging demand for lithium-ion batteries. Lithium carbonate, which sold for around USD 10,000–15,000 per ton in the late 2010s, spiked to over USD 60,000/ton in 2022, then fell back toward USD 20,000/ton by mid-2023 as new supply came online [17,21]. Designing a brine recovery project around lithium when prices are high could lead to disappointment if prices crash during operation. Our analysis uses conservative mid-range price scenarios to mitigate this risk, and we perform sensitivity analysis on price (see results in Section 3) to see how much a drop in lithium or bromine price erodes profitability. Any viable project would secure offtake agreements to manage volatility to reduce exposure to market swings. This approach is common in mining/mineral projects to ensure bankability. The market analysis accounts for this by considering long-term average prices and noting which products have futures or contract markets.

2.8. Life-Cycle Cost and Total Water Cost Analysis

We incorporated the additional capital and operating costs of brine recovery into the desalination plant’s economics. Using a 30-year project life and discount rate assumptions, we annualized CAPEX and summed with annual OPEX to compute the total water cost (TWC) in USD/m3 of product water, both with and without mineral recovery. The baseline desalination costs (without recovery) were taken from published studies for large SWRO plants; investment costs are around USD 900–1200 per m3/day of capacity and baseline water costs range USD 0.5–1.2 per m3. We then added the brine mining system costs. For example, if brine processing adds an estimated USD 1.0 per m3 in operating cost [9,15] and requires a capital investment similar to adding a chemical plant, we include those in the model. Against these costs, we credit the revenue from the sale of recovered products, effectively treating the minerals as negative cost (or co-product revenue). This allows calculation of a net TWC for the water produced when brine mining is implemented.

2.9. Comparison with Terrestrial Mining

For each material, we compared the brine-derived cost per ton (implied by the above analysis) with the cost of producing one ton via conventional means. We leveraged data such as the energy and reagent consumption for mining and refining (e.g., mining ore, performing chemical conversions), existing production cost estimates, and any environmental or regulatory costs. This comparison is presented qualitatively in terms of whether brine recovery is likely to be cheaper, competitive, or more expensive than the status quo, considering current technology.

2.10. Case Study and Sensitivity Analysis

We incorporated real case study data, such as the SEA4VALUE project results which achieved >90% recovery of Mg, B, Li in lab-scale tests [22] and the Acciona MINERALS pilot which projected recovery of >90% of Li, Rb, B and 65–80% of Mg, Ca, K in a 200,000 m3/day plant [23]. These provide validation points for our assumed recovery efficiencies. Additionally, we conducted a sensitivity analysis on key parameters: commodity prices to see how a price drop or spike affects its viability; energy cost for scenarios with cheap renewable energy against high energy costs; and scale to see how a smaller plant’s economics compare. This analysis used empirical models from the literature; for example, the observed economies of scale show that larger plants have 5–8× lower unit costs for recovery than small ones [4].

Table 1.

Major ions in SWRO brine and potential recovered products, with typical extraction methods [7,24].

Table 1.

Major ions in SWRO brine and potential recovered products, with typical extraction methods [7,24].

| ION (Symbol) | Conc. in Brine (g/L) | Fraction of Total Salts (%) | Potential Products | Extraction Methods |

|---|---|---|---|---|

| Chloride (Cl−) | 35 | 55% | Chlorine gas (Cl2); HCl acid; NaCl salt | Electrochlorination; membrane electrolysis (chlor-alkali); crystallization (NaCl) |

| Sodium (Na+) | 19 | 30% | Sodium chloride (NaCl); Caustic soda (NaOH); Soda ash (Na2CO3) | Crystallization (solar or forced); bipolar electrodialysis (NaOH/HCl from NaCl) |

| Sulfate (SO42−) | 5 | 8% | Gypsum (CaSO4·2H2O); Epsom salt (MgSO4·7H2O) | Precipitation with Ca2+ (gypsum); fractional crystallization for salts |

| Magnesium (Mg2+) | 2.5 | 4% | Magnesium hydroxide (Mg(OH)2)/oxide (MgO); MgCl2; Mg metal | Alkaline precipitation (using lime or dolime); thermal decomposition; electrolytic reduction |

| Calcium (Ca2+) | 0.8 | 1.20% | Calcium carbonate (CaCO3); Gypsum (CaSO4·2H2O) | Carbonate precipitation (soda ash addition for CaCO3); selective crystallization (gypsum) |

| Potassium (K+) | 0.8 | 1.10% | Potash (KCl salt or K2SO4 fertilizer) | Evaporative crystallization from bittern; ion exchange to concentrate K+ |

| Bicarbonate (HCO3−) | 0.2 (as CO32−) | 0.30% | Calcium carbonate (CaCO3); CO2 (gas) | Lime dosing to precipitate CaCO3 (releasing CO2 gas) |

| Bromide (Br−) | 0.12 | 0.20% | Bromine (Br2); Sodium bromide (NaBr) | Chemical oxidation (e.g., with chlorine) + air stripping of Br2; selective adsorption on resin |

| Minor traces: Boron (as B(OH)3); Lithium (Li+); Rubidium (Rb+); Strontium (Sr2+) | ppm levels | <0.2% combined | Boric acid (H3BO3); Lithium carbonate (Li2CO3); Rb salts; SrCO3 | Specialized methods (boron-selective resin; lithium ion-sieves or selective adsorption precipitation for Sr) |

3. Results

This sections presents the quantitative findings derived from techno-economic assessments, numerical simulations, and cost modeling of metals and salts recovery from SWRO brine. Key variables such as product yield, energy consumption, CAPEX, OPEX, and unit recovery cost are analyzed across multiple scenarios. Comparative cost–benefit metrics are developed for both brine-based extraction and conventional production methods.

3.1. Composition of Brine and Potential Recoverable Products

The major constituents of SWRO brine and their potential recovery pathways are summarized in Table 1. This table highlights the approximate concentration of each ion in a typical seawater brine (70 g/L salinity) and example products that could be obtained:

As shown in Table 1, sodium chloride (NaCl) is the dominant salt in the brine. Consequently, any extensive resource recovery strategy will be centered on extracting NaCl first [7]. Removing a large fraction of NaCl (e.g., via crystallization) yields not only a valuable salt product but also produces a bittern, the residual brine enriched in the other, less abundant components. Sequential processing is advantageous; once NaCl, which makes up 85% of the salts by mass, is crystallized out, the volume of the remaining solution is much smaller, and the concentrations of Mg2+, K+, Br−, etc. become much higher relative to the resulting volume [7]. The removal of major constituents such as sodium and magnesium facilitates the subsequent recovery of minor elements by reducing volume and simplifying chemical interactions, thereby enhancing process efficiency. A representative process sequence may include preliminary brine concentration (if required); sodium chloride recovery via solar evaporation or mechanical crystallization; magnesium extraction from the resulting bittern through alkaline precipitation as Mg(OH)2 or conversion to MgCl2; followed by calcium removal as CaCO3 or CaSO4. The reduction of Mg2+ activity typically promotes the crystallization of calcium-based compounds, including gypsum and strontium-bearing phases [8,24]. Recovery of potassium salts, such as KCl or K2SO4, is achieved from the further concentrated bittern solution, where elevated ionic strength and reduced solubility enable the precipitation of these compounds during subsequent evaporation stages [4,23]. Bromine is recovered by oxidizing bromide ions (Br−) to elemental bromine (Br2), typically through chemical oxidation using chlorine gas or electrochemical anodic methods, followed by vapor-phase stripping. Trace constituents such as boron and lithium may subsequently be extracted from the remaining concentrate, contingent upon technical feasibility and economic justification, using methods such as boron-selective adsorption resins or lithium-specific adsorption and crystallization techniques [7,25].

In parallel with designing recovery processes, one must consider the purity requirements and market form of each product. Some recovered salts can be sold in their crude form (e.g., deicing salt or raw gypsum) with minimal purification. In contrast, others require high purity (e.g., >99% MgO for specialty applications, or battery-grade Li2CO3), which demands more intensive processing. These compromises directly impact cost and viability, as shall be discussed later.

3.2. Simulation and Case Study: 100,000 m3/Day Desalination Plant with Brine Mining

This section details the simulation of a large-scale seawater reverse osmosis (SWRO) desalination plant with an integrated brine recovery system. The case study models a facility treating 100,000 cubic meters of seawater per day, incorporating salt and metal extraction processes to assess economic performance. The simulation includes mass balance calculations, product yield estimates, capital and operating costs, and financial return indicators. This model serves to demonstrate how brine mining can impact the economic profile of a full-scale desalination plant.

3.2.1. Simulated Economic Outputs for Brine Recovery

The simulated economic performance indicators of a high-capacity SWRO desalination facility integrated with mineral and salt recovery systems are presented in Table 2. The simulation quantifies key variables including daily brine volume treated, unit revenue from recovered products, operating expenditures, net water cost, capital investment, and expected payback period. The figures are based on industry benchmarks, reported literature, and conservative assumptions for recovery efficiency and market pricing. The results are intended to support financial viability assessments and guide decision-making for integrated resource recovery in desalination infrastructure.

Table 2.

Simulated economic outputs for brine recovery.

Table 2 presents a consolidated overview of the key quantitative parameters derived from the economic modeling of a seawater reverse osmosis (SWRO) plant equipped with mineral and salt recovery systems.

The plant under consideration is modeled at a throughput capacity of 100,000 cubic meters per day (m3/day), representative of a large-scale commercial SWRO facility. The revenue streams were divided into three leading product categories; sodium chloride (NaCl), magnesium hydroxide [Mg(OH)2], and bromine (Br2), with respective earnings of USD 0.70, USD 0.50, and USD 0.30 per cubic meter of treated brine. These values were derived using realistic recovery efficiencies and current market prices sourced from verified industry benchmarks and peer-reviewed economic studies.

The total estimated product revenue was calculated at USD 1.50 per m3, while operational costs were divided into base SWRO expenditure (USD 0.80/m3) and incremental brine processing costs (USD 1.00/m3), producing a total operating expenditure (OPEX) of USD 1.80 per m3. The net water cost, defined as the difference between OPEX and revenue credit, was projected at USD 0.30 per m3, demonstrating a significant reduction from the baseline desalination cost and indicating strong economic leverage from resource recovery.

A capital investment of USD 150 million was assumed for the combined desalination and recovery system. Based on the projected revenue-to-cost dynamics, the estimated payback period was calculated at approximately 6.9 years. This duration falls within acceptable thresholds for infrastructure investments in water treatment and extractive industries, highlighting the project’s potential financial viability under moderate market and technological assumptions.

The values presented in Table 2 form the empirical basis for the broader techno-economic analysis discussed below and in the discussion section of this study. They also support strategic recommendations regarding capital allocation, process design, and policy incentives for integrating mineral recovery into desalination infrastructure.

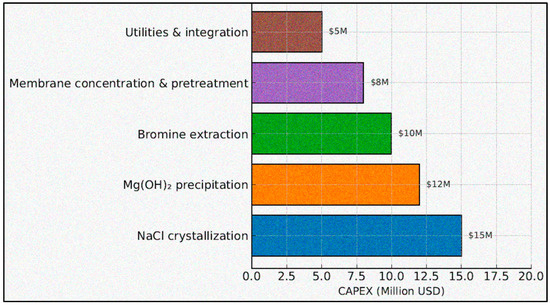

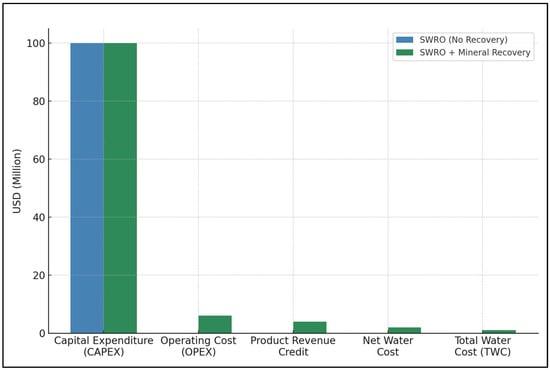

3.2.2. CAPEX Derivation and Breakdown

The reported total CAPEX of USD 150 million was constructed from a baseline SWRO plant investment of USD 100 million for a 100,000 m3 d facility (intake, pretreatment, high-pressure trains, ERDs, post-treatment, civil/MEP) and an incremental USD 50 million for integrated mineral-recovery systems. The latter comprises (i) NaCl crystallization (forced-circulation/MVR crystallizer package, solids handling); (ii) Mg(OH)2 precipitation (lime handling, reactors, thickeners/filters); (iii) bromine oxidation/stripping and purification train; (iv) membrane concentration and ancillary pretreatment debottlenecking driven by higher brine-side throughputs; and (v) utilities and plant integration (piping, electrical, controls, tie-ins). The allocation used in the model is NaCl crystallization USD 15 M, Mg(OH)2 precipitation USD 12 M, bromine extraction USD 10 M, membrane concentration and pretreatment USD 8 M, utilities and integration USD 5 M, summing to USD 50 M incremental CAPEX (Figure 3). These magnitudes are consistent with factor-based estimates and vendor-class budgetary quotations for ZLD/MVR trains and precipitation lines at the modeled scale; sensitivity to ±25–30% capex variance is analyzed in Sensitivity Analysis.

Figure 3.

CAPEX breakdown for integrated SWRO + mineral recovery facility 100,000 m3/d.

Baseline SWRO: USD 100 M; incremental mineral-recovery CAPEX: USD 50 M decomposed as NaCl crystallization (USD 15 M), Mg(OH)2 precipitation (USD 12 M), bromine extraction (USD 10 M), membrane concentration and pretreatment (USD 8 M), utilities and integration (USD 5 M). Units: million USD.

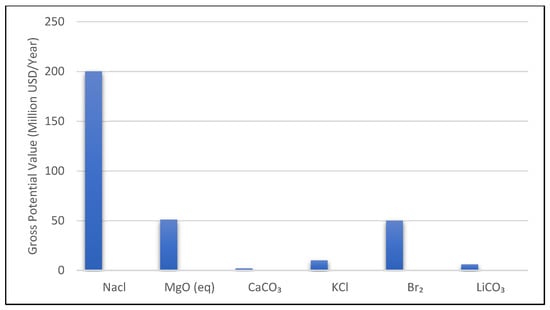

The hypothetical plant produces 100,000 m3/day of freshwater at 45% recovery, yielding about 150,000 m3/day of brine (at 70 g/L salinity). Over one year, this amounts to 54.75 million m3 of brine containing approximately 3.8 × 106 tonnes of dissolved salts. If we assume near-complete recovery of all major constituents, the annual quantities of products would be on the order of 2 million tons of NaCl; 170,000 tons of MgO (or equivalent, from magnesium); 50,000 tons of CaCO3; 40,000 tons of KCl; 10,000 tons of bromine (Br2); and 300 tons of lithium carbonate (assuming 5 mg/L Li in the brine after concentration steps). These figures are compiled in Figure 4 and form the basis for a gross revenue estimate.

Figure 4.

Estimated annual gross value of recoverable products from a 100,000 m3/day SWRO brine (150,000 m3/d brine flow).

NaCl (salt) dominates by mass (2 million tons/year), but its low price yields a moderate USD 100–300 million in value. High-value products like bromine contribute significantly despite a much smaller volume [4]. Mg(OH)2/MgO recovery could add USD 50 million. Lithium is a very high value per ton but extremely low quantity from seawater brine, yielding only a few million USD in this scenario [4].

From Figure 4, we see that the total potential gross revenue (summing mid-range price estimates) is approximately USD 200–400 million per year for this plant’s brine. Sodium chloride, by virtue of sheer mass, could contribute on the order of USD 100–300 million (the wide range reflects bulk salt against refined salt pricing). Bromine, at USD 5000/ton, yields about USD 50 million. Magnesium compounds as high-grade MgO, at USD 300/ton, add USD 50 million. Potassium as KCl fertilizer at USD 250/ton is around USD 10 million. Calcium carbonate, assuming it is sold as low-grade filler at USD 20/ton, is only USD 1–3 million. Lithium, even at a high USD 20,000/ton, contributes USD 6 million due to the tiny amount present [4,26]. Notably, we excluded boron, rubidium, and strontium from the figure; while they exist in the brine, their total recoverable masses are very small (boron 500–600 tons B2O3/year, strontium 800–900 tons Sr/year, rubidium only 10–15 kg/year in this case). Even though rubidium has an extremely high price per kg (purity Rb salts can exceed USD 25,000/kg in specialty markets) [27], the negligible quantity from seawater means it would only add a few hundred thousand dollars at most. Strontium could be recovered as strontium carbonate used in ceramics and pyrotechnics; at market prices of a few hundred dollars per ton for SrCO3, the 800 tons might yield on the order of USD 0.5–1 million. These “icing on the cake” elements have high unit value but do not drive the overall economics due to limited abundance [28]. The bulk of revenue comes from Na, Mg, Ca, K, Br, in agreement with the findings of del Villar et al. [4] who classified Na, Mg, Ca, B as abundant low-price components and Li, Rb, Sr, Ga as scarce high-price components.

It must be emphasized that the above represents an ideal maximum revenue, assuming 100% recovery and no purity or market constraints. In reality, achieving complete recovery of everything is impractical. Recovery rates might range from 50% to 90% for different elements using current technologies [26]. Also, flooding the market with large quantities of salt could reduce prices. For example, a single 100,000 m3/d plant producing 2 million tons of salt per year would be a significant new supply (world salt production is on the order of 300 million tons/year, so it’s <1% of global output, but regionally it could saturate a market) [29]. The capacity to sell all recovered products is a vital assumption; otherwise, some products would effectively become waste or require disposal if they exceed demand.

3.3. Cost–Benefit Outcomes in Base and Variant Scenarios

In the base scenario (100,000 m3/d plant, moderate commodity prices, high recovery efficiency), the annual gross revenue from all products was estimated at about USD 300 million (mid-range) to USD 400+ million (optimistic) [26]. The corresponding annual operating cost for the recovery system is preliminarily estimated in the order of USD 100–USD 180 million. This yields a net annual benefit on the order of USD 120–220 million, which is a substantial secondary income for the desalination plant. In terms of the water production economics, the brine mining turns a baseline water cost of USD 0.80/m3 into a net cost of USD 0.30–0.40/m3 after credits [26]. The cost–benefit ratio (CBR), defined as total product value divided by total added cost, comes out to approximately 1.5 in the base case. del Villar et al. [4] reported a CBR in the range of 1.5 to nearly 3.0 for Spanish brine scenarios under favorable pricing, which is consistent with our findings. This indicates that, under the right conditions, brine resource recovery can pay for itself and even generate profit.

With an assumed brine treatment capacity of 100,000 m3/day and a net benefit of USD 1.20/m3 (revenue–cost differential), the payback period was estimated at approximately 6.9 years.

This approach conceptually transforms the desalination facility from a sole water production unit into an integrated minerals recovery system, wherein revenues from recovered salts and metals substantially offset the operational costs associated with freshwater generation. This transformative finding indicates that, under certain conditions, seawater desalination may transition from a cost-intensive water supply process to a net value-generating operation where the combined economic value of potable water and recovered mineral byproducts exceeds the total operational expenditure. However, this outcome is not universally guaranteed. A sensitivity analysis was conducted to examine the influence of key variables, including market prices for recovered commodities, process recovery efficiencies, energy input costs, and plant capacity. The results of sensitivity scenarios are summarized in Section 3.5.

3.4. Simulation Parameters

The results presented in Table 2 are derived from a hypothetical seawater reverse osmosis (SWRO) facility treating 100,000 m3/day with an integrated system for brine-derived mineral recovery.

All financial values were modeled using a structured framework combining mass balance calculations for individual minerals, market price benchmarks for extracted products, and operational cost estimates based on documented energy and reagent inputs from the literature and commercial practice. The recovery efficiency for each mineral was conservatively set at 50%, representing a realistic performance range for commercial membrane, crystallization, and chemical precipitation technologies [3].

Verification of the model was conducted through internal consistency checks across material and energy balances, as well as cross-comparison with published financial data from reference-scale projects such as the Ras Al Khair plant and the South Korean hybrid brine recovery trials [30,31]. The underlying simulation parameters for the cost–benefit analysis and economic modeling, including brine composition, energy consumption, reagent use, recovery yields, and market prices, are now summarized in Table 3.

Table 4 consolidates these parameters, showing the numerical value used in the simulation, the calculation basis or derivation method, and the original reference source.

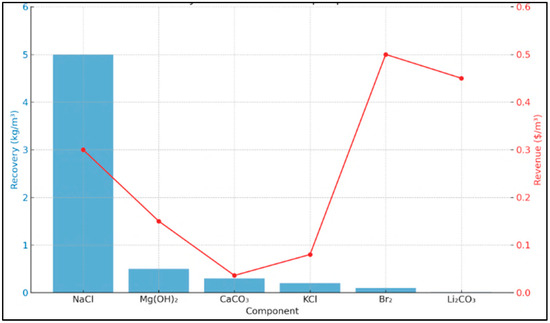

Figure 5 shows the recovered quantities (kg/m3) and corresponding revenue (USD/m3) for each mineral. The bar chart (blue) shows the mass recovery potential of each component, while the line graph (red) illustrates the estimated revenue generation per cubic meter of brine treated.

Figure 5.

Simulated recovery and economic output per m3 of SWRO brine.

Table 3.

Simulation parameters.

Table 3.

Simulation parameters.

| S/N | Parameter | Value | Unit/Remarks | References |

|---|---|---|---|---|

| 1 | Plant capacity | 100,000 m3/day | Input design capacity | |

| 2 | Brine volume processed | 45,000 m3/day (assuming 45% recovery in SWRO) | Brine available for mineral recovery | |

| 3 | NaCl concentration in brine | 30 g/L | For salt recovery (NaCl) | [3] |

| 4 | Mg2+ concentration in brine | 1.3 g/L | For Mg(OH)â, precipitation | [3] |

| 5 | Br− concentration in brine | 65 mg/L | For bromine extraction | [3] |

| 6 | Average recovery efficiency (all minerals) | 50% | Applied uniformly across products | [32] |

| 7 | Energy consumption for SWRO only | 3.5 kWh/mÂ3 | Desalination energy baseline | [33,34] |

| 8 | Energy for brine processing (added) | 2.0 kWh/mÂ3 | Incremental energy for recovery | [33,34] |

| 9 | Reagent use (lime for Mg recovery) | 1.4 kg/mÂ3 | Reagent for Mg precipitation | [35] |

| 10 | Price of NaCl | USD 60/ton | Market average (bulk, industrial) | [36] |

| 11 | Price of MgO | USD 300/ton | Market average (high purity, refractories) | [37] |

| 12 | Price of Br2 | USD 2000/ton | Market average (industrial bromine) | [38] |

Table 4.

Product prices used in modeling.

Table 4.

Product prices used in modeling.

| Product | Price (USD/ton) | Grade/Basis | Reference |

|---|---|---|---|

| Sodium Chloride (NaCl) | 60 | Bulk Industrial | [39] |

| Magnesium Oxide (MgO) | 300 | High Purity (Refractories) | [37] |

| Calcium Carbonate (CaCO3) | 30 | Industrial Grade | [4,26] |

| Potassium Chloride (KCl) | 400 | Fertilizer Grade | [39] |

| Bromine (Br2) | 2000 | Industrial Grade | [11,12,37] |

| Lithium Carbonate (Li2CO3) | 4500 | Battery Grade | [15,40] |

3.5. Commodity Price Sensitivity Analysis

Scenarios were tested with lower-bound prices (e.g., lithium USD 10,000/ton, bromine USD 2/kg, salt USD 30/ton, etc.) and upper-bound prices (e.g., lithium USD 40,000/ton, bromine USD 5/kg, salt USD 60/ton). In the low-price scenario, the total revenue per m3 dropped to about USD 0.8, while costs remained USD 1.0–1.1, making the operation slightly uneconomic (CBR—0.8). The net water cost in that case would be around USD 1.0/m3 (essentially no improvement over the base SWRO cost). In the high-price scenario, revenue per m3 rose to USD 2+, and CBR—2.0, greatly improving profitability. The break-even point appears to be around a revenue of USD 1.0 per m3 for a cost of USD 1.0. If revenues fall below that, the business case fails. Notably, among the products, the ones that influence this most are salt and magnesium because they contribute the largest share of revenue in absolute terms. If, for example, bulk salt prices halved or if it became difficult to sell all the salt, the revenue would drop significantly. Conversely, a rise in bromine or lithium prices has less effect on total revenue because their volumes are smaller, though they can contribute additional upside profit.

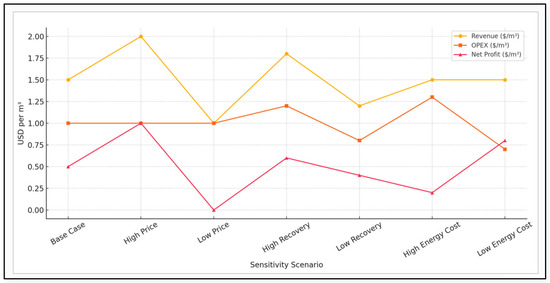

Figure 6 below shows the outcomes of various sensitivity scenarios in brine recovery economics. It evaluates how changes in key parameters such as product prices, recovery efficiency, and energy costs impact the revenue, operational expenditure (OPEX), and net profit per cubic meter of desalinated water. Each line illustrates a distinct economic metric across all scenarios, highlighting the potential for profitability under varying market and operational conditions. The equation used in the analysis is shown below:

Net Profit m3 = Revenue m3 − OPEX m3

Figure 6.

Sensitivity analysis of brine recovery economics.

Sensitivity Scenario Assumptions

High Price: Increased revenue due to higher commodity prices

Low Price: Reduced revenue from commodity market dips

High/Low Recovery: Adjusted revenue due to increased/decreased mineral recovery efficiency

High/Low Energy Cost: OPEX adjusted for energy price fluctuations

This analysis highlights the importance of market risk management (discussed further in the Risk section). Long-term offtake agreements or diversification of product portfolio can mitigate the impact of any one commodity price swing.

3.6. Recovery Efficiency and Yield

The study investigated the impact of reduced extraction efficiencies on overall system performance by evaluating scenarios in which the recovery processes operate below the baseline assumptions. For example, if only 50% of magnesium is actually recovered due to process losses or purity issues, or if salt recovery is deliberately limited to avoid flooding the market. Lower recoveries directly reduce product output and sometimes can also reduce costs a bit, e.g., less chemical used. It was confirmed that moderate drops in recovery, e.g., 10–20% lower yields, do not ruin the economics; the CBR might go from 1.5 to 1.3, which is still positive. But if recovery of multiple major components were simultaneously low, the revenue could fall below the cost. A particularly sensitive one is magnesium; if Mg is not recovered at all, not only would its revenue (0.4–0.5 USD/m3) be lost, but the cost to remove it would also be incurred. That scenario was much less favorable, showing maybe only USD 0.8 revenue against USD 0.9 cost, which is essentially break-even. Lithium and other trace elements had almost no impact on the overall economics in our model unless extremely high prices were assumed because their quantities are too low. Previous research efforts have noted that the bulk of the economic potential in seawater brine lies in the abundant elements (Na, Mg, Ca, K, Br). These drive the revenue, whereas rare elements (Li, Rb, etc.) are “icing on the cake” that might add a few percent of extra value at best. This aligns with Sharkh et al. [7] classification of Na, Mg, Ca as abundant-low-price components and Li, Rb, etc. as scarce-high-price but low-availability components.

3.7. Energy Cost Sensitivity

Energy is a major part of OPEX, especially for thermal processes and ED. Scenarios with cheap renewable energy, e.g., USD 0.05 per kWh effective, were considered against high energy cost renewable energy, e.g., USD 0.20 per kWh or using expensive fuel. With cheap energy, the brine processing cost can be kept low, enhancing profitability. With expensive energy, the cost per m3 can increase by USD 0.5 or more, quickly eroding margins. For example, if energy cost doubled in our base case, the OPEX would rise from USD 1.0 to around USD 1.3 per m3, pushing the net benefit down to maybe USD 0.2 per m3. If energy were essentially free (renewables fully powering the system), the OPEX could drop to USD 0.6–USD 0.7, and the net benefit would jump. This indicates that energy integration (use of waste heat, renewable power purchase agreements, etc.) is an important factor in making brine mining economically and environmentally sustainable. Gadalla et al. [41] demonstrated a concept where a renewable-powered ZLD system achieved zero liquid discharge with minimal net energy cost; such approaches could significantly boost CBA results for brine recovery by removing fuel expenses from the equation.

3.8. Scale Effects

The size of the plant and system has a strong influence. Many costs, especially CAPEX per unit throughput, improve with scale due to economies of scale. A very large plant can spread fixed costs (engineering, overhead, certain equipment) over a larger volume. We compared our 100,000 m3/d case to a smaller 10,000 m3/d plant case (a plant one-tenth the size). In the smaller case, the CAPEX per m3 was much higher, and OPEX per m3 was also higher because operating staff, maintenance, etc., do not scale down fully linearly. As a result, a small plant might have added costs of USD 2–3 per m3 for brine mining, which, given a similar revenue of maybe USD 1–1.5, results in a net negative outcome. Indeed, the simulation suggests that below a threshold scale (perhaps on the order of 50,000 m3/d of water production, depending on the process configuration), it is difficult to economically justify the full multi-product recovery approach. This is consistent with real-world observations that large integrated solutions (like those considered in the Middle East mega-plants) have better chances of viability than retrofitting very small desalination plants. Certain targeted recovered minerals, such as magnesium or salt recovery, could still make an impact at a smaller scale if the process is simple enough. Scale-up also positively affects the ability to market products. A large, consistent output can secure big buyers and more favorable contracts. For example, producing 1000 tons of salt a day can attract industrial buyers directly, whereas 100 tons a day might only sell to local markets at lower margins.

3.9. Cost Comparison: Brine Recovery Against Conventional Mining

A core question is whether extracting a given mineral from SWRO brine is more cost-effective than the traditional route (mining or chemical production from conventional/terrestrial sources). We assess this for each major component:

3.9.1. Sodium Chloride (Salt)

Conventional production is typically through mining rock salt deposits or solar evaporation of seawater in large ponds. These methods are extremely low-cost, on the order of USD 10–30/ton production cost in regions with cheap labor and land, because they harness natural evaporation [7]. Recovering NaCl from RO brine can be achieved by thermal crystallizers or evaporative ponds. If waste heat or abundant land (for ponds) is available at the desalination site, the cost can be quite low. For example, using existing waste heat from a power plant to evaporate brine could produce salt at competitive costs. Some Middle East SWRO facilities are exploring solar ponds for brine, effectively producing salt as a byproduct. On the other hand, using mechanical evaporators or crystallizers requires significant energy (>60 kWh per m3 of water evaporated, depending on technology) [26], which could translate to >USD 10 of energy cost per ton of salt if electricity is USD 0.05/kWh. Given that bulk salt sells for USD 30–60/ton, the profit margin is slim unless energy is very cheap or subsidized. Therefore, salt recovery from brine is economically feasible mainly when low-cost evaporation can be achieved (through sun or waste heat) or when the alternative is paying for brine disposal (offsetting disposal cost). A special case is producing high-purity salt for industrial use (e.g., chlor-alkali feedstock); such salt can fetch USD 100–150/ton, improving profitability [9,26,42]. Regions that currently import salt such as some island nations or land-scarce countries, could benefit by producing it locally from brine.

3.9.2. Magnesium (Mg Compounds or Metal)

Terrestrial sources include mined magnesite (MgCO3) or brucite and extraction from natural brines (e.g., the Dead Sea or certain lake brines), which contain high Mg. Producing magnesium metal is energy-intensive (typically through electrolysis of MgCl2 molten salt, consuming 35–40 MWh/ton) and is only performed economically where electricity is cheap. However, producing magnesium hydroxide (Mg(OH)2) from seawater is a relatively established process. Historically, the Dow process added calcined dolomite (CaO·MgO) to seawater to precipitate Mg(OH)2, which was then calcined to MgO or converted to magnesium metal. The cost of magnesium hydroxide from seawater depends on lime or dolime cost and filtration, but it can be competitive for making products like magnesium oxide. High-purity MgO used in refractories or as an additive can sell for a few hundred USD/ton, making this an attractive target. Our analysis indicates that Mg in brine (2.5 g/L) yields 2.5 kg Mg per m3, which could be 4.1 kg Mg(OH)2 (if fully recovered). At 50% recovery and USD 300/ton MgO, that’s USD 0.62 of value per m3. The processing cost involves lime addition (1.4 kg lime per m3 brine) and handling of solids; lime costs maybe USD 0.1–0.2 per m3, plus some energy for pumping/mixing [24,26,43]. Overall, magnesium recovery as Mg(OH)2 appears favorable, especially since it also aids subsequent processes by removing an alkaline earth that would otherwise interfere with salt crystallization or scaling. Compared to mining, which requires blasting, calcining ore, etc., the brine route could have lower unit energy. Indeed, regions lacking magnesite deposits (e.g., many coastal countries) see brine-derived Mg as a strategic opportunity. The EU lists magnesium as a critical raw material, and brine recovery could reduce import dependence [8,44].

3.9.3. Calcium (CaCO3 and CaSO4)

Calcium is abundant in limestone and gypsum deposits globally, which are very cheap to extract (cement-grade limestone can be <USD 10/ton). From brine, Ca2+ can be precipitated by adding carbonate (forming CaCO3) or sulfate (forming CaSO4 if sulfate is in excess). One intriguing synergy is using brine to capture CO2. Adding sodium carbonate (soda ash) to brine will precipitate CaCO3 (solid) and release Na+ and HCO3; if the soda ash is produced through a CO2 absorption process, this can lock carbon into solid form while yielding CaCO3 [45]. The produced CaCO3 could potentially be used in the remineralization of desalinated water (post-treatment) or as a filler material. However, selling CaCO3 or gypsum from brine is challenging because of the low market value and competition from mined sources. The benefit of recovering calcium is more to reduce scaling in downstream equipment and recover alkalinity than to generate profit. We found that even at 100% recovery (0.8 g/L Ca yields 0.8 kg/m3, or 50,000 tons/year as CaCO3 in the case study), the revenue is only a couple of million USD. Thus, calcium recovery can be justified as part of process optimization and perhaps for internal reuse, but not as a major revenue contributor [4,24,45].

3.9.4. Potassium (Potash Salts)

Potassium chloride (KCl) and potassium sulfate (K2SO4) are important fertilizers known as potash. Conventional production comes from mining evaporite deposits (e.g., in Canada, Russia, Belarus) or brine (the Dead Sea is a significant source of potash through solar ponds). Market prices for potash have fluctuated; they were around USD 250–300/ton in the late 2010s, spiked to over USD 800/ton in 2022 due to geopolitical supply issues, and are around USD 400–500/ton in 2024 [46]. Seawater brine has only 1 g/L K+, so even complete recovery yields 1 kg per m3. Our scenario of 40,000 tons KCl/year from the plant would be worth USD 10–20 million. The extraction of K from seawater brine typically happens after NaCl removal, in the concentrated bittern. Traditional saltworks often get a bittern rich in Mg and K; one method is to use fractional crystallization (K2SO4·MgSO4·6H2O can crystallize, or sylvite KCl can precipitate if managed well). Another approach is selective ion exchange or nanofiltration to separate monovalent ions. Research has shown that NF can preferentially pass Na+ and K+ while rejecting divalents, thus one could generate a K-rich stream [11,16]. The cost of recovering potash from seawater is generally higher than from mining, except in places where conventional potash is not accessible. If a brine mining facility is integrated with fertilizer production or local agriculture, it could find a niche (for instance, island nations paying high import costs for fertilizer might benefit) [46].

3.9.5. Bromine

Bromine is a high-value element traditionally extracted from brines. The US and Israel/Jordan have dominated bromine production, sourcing from underground brines and the Dead Sea, respectively [12]. Seawater has 65 ppm bromide, and SWRO brine has 120–130 ppm. Industrial bromine extraction involves oxidizing bromide to bromine (using chlorine or electrolysis) and then stripping it out with air or steam. The bromine is condensed and purified. The estimated energy requirement for bromine extraction is modest (mainly for blowing air and some heating), and reagent cost is mainly chlorine, which could be generated on-site through a chlor-alkali process that in turn uses the NaCl. Bromine prices average around USD 3–4 per kg in recent years [12], which is very high compared to typical salt prices, making bromine a lucrative target. Our case study’s 10,000 tons Br2/year is significant. It represents about 2–3% of world bromine output (global bromine production is 400,000 t/year) [12]. That amount of bromine would be valued around USD 30–50 million. If multiple desalination plants implemented bromine recovery, they could collectively become a major source. Importantly, bromine from brine is directly competitive with bromine from subterranean brines, since the processes are similar. The Middle East desalination hub is actually geographically near the main bromine-producing region (Dead Sea). One consideration is market saturation; bromine demand is growing slowly (for flame retardants, drilling fluids, etc.), so new supply must displace existing producers. Technologically, integrating bromine recovery into SWRO could be straightforward if chlorine is already being produced for disinfection, and that chlorine can double-duty to liberate bromine [4,23]. In summary, bromine is one of the most promising elements to recover, with relatively low incremental cost and high price.

3.9.6. Boron

Boron in desalination is usually seen as a contaminant to remove because drinking water guidelines require less than 1 mg/L boron. SWRO permeate often needs a secondary pass or specific adsorbents to reduce the boron. Thus, boron removal technology is present, but the concentration in brine (5–10 mg/L B) is very low to make a pure product. Boron could be concentrated by evaporation (boron remains in the mother liquor as other salts crystallize) and then use ion exchange resin tailored for boron (e.g., N-methylglucamine resin) [25]. The recovered boron could be in the form of boric acid. However, the global market for borates is well-supplied by large mines in Turkey and California, and the price of boric acid (USD 700/ton) is not high enough to justify an elaborate extraction from such dilute streams in most cases. Unless boron regulations force removal, capturing it and selling as a byproduct (even at loss) could offset waste handling. In our evaluation, boron recovery is likely not economically driven. It would be performed only as part of meeting discharge/spec requirements, with any sales being a minor bonus [7,25].

3.9.7. Lithium

Lithium has gained enormous attention due to battery demand. Standard sources are continental brines, e.g., in Chile’s Atacama, 1000 ppm Li, where solar evaporation yields lithium chloride which is processed to carbonate, and hard rock mines (spodumene in Australia). Seawater Li (0.17 ppm in seawater, 0.3–0.5 ppm in SWRO brine) is four orders of magnitude lower concentration than Chilean salars. This huge gap makes direct economic recovery extremely challenging. Many research efforts like adsorbents such as manganese oxide ion-sieves [7,16,22], electrochemical intercalation, solvent extraction, etc., have been explored to pull lithium from seawater, but none are yet cost-competitive at scale [7]. The S.A. [23] pilot reported over 90% lithium recovery in tests, but did not disclose cost. A rough analysis: if our plant has 0.3 ppm Li and we could concentrate it tenfold, e.g., using selective NF to strip out other ions, we get 3 ppm; still, processing 50 million m3/year to collect a few hundred tons of Li2CO3 is a massive effort. The case study indicated 300 tons Li2CO3/year might be achievable, which is trivial compared to world demand (720,000 tons LCE in 2024) [13]. The cost per kg of lithium from seawater likely exceeds USD 1000, far above current prices, which after a spike are back to USD 14–20/kg range [13]. Thus, lithium from seawater brine is not currently viable economically. It could become viable if lithium prices skyrocket again or if coupled with a policy need. For example, a country with large desalination capacity but no local lithium sources might subsidize development for supply security. For the foreseeable future, lithium extraction efforts will likely focus on higher-concentration sources such as geothermal brines, produced water from oilfields, etc., rather than normal SWRO brine.

3.9.8. Rubidium and Cesium

These alkali metals are present in trace amounts in seawater. Rubidium is 0.2 ppb, cesium even less. They are expensive (Rb2CO3 can cost USD 1000+ per kg) because they are rare, typically obtained as byproducts of lithium or potash mining. Some researchers like Xing et al. [47,48] have looked at extracting rubidium from RO brine using ion exchange and solvent extraction. The science is intriguing, but the scale is so small (as noted, a large plant might yield only 10 kg Rb per year) that it is not a practical revenue stream. We mention them mainly for completeness: if extraction systems are extremely selective and already in place for Li or K, perhaps Rb could be incidentally captured. However, Rb/Cs recovery would be performed only if future technologies make it essentially cost-free to perform as part of another process [48,49].

3.9.9. Strontium

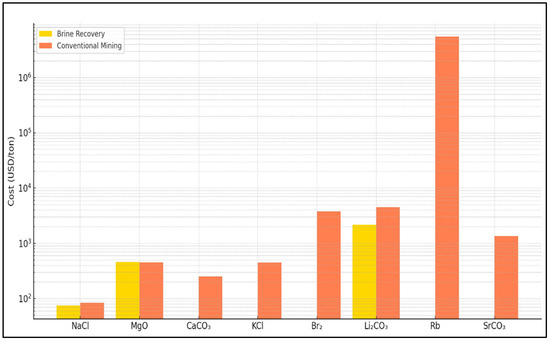

Strontium (Sr2+ 8 mg/L in seawater) could be recovered from brine along with calcium. One possible route is during the carbonate precipitation step. The Sr will co-precipitate with CaCO3 to some extent, or one could add a sulfate source to precipitate SrSO4 (celestite). Strontium’s main use historically was in CRT glass, which has collapsed; current uses are ceramics, fireworks (red colorant as Sr nitrate), and some medical imaging chemicals. World production of strontium as celestite is modest at 300k t/year of celestite ore [28]. If our plant recovered 800 tons SrCO3, which is roughly the annual Sr content, that might be valued around USD 0.8–1.0 million. The cost to separate Sr from Ca might not be justified just for that revenue. However, if zero-liquid-discharge is pursued, one might deliberately precipitate all alkaline earths (Ca, Sr, Ba) together. In doing so, strontium could be isolated from the mixed solids by leaching or other chemical means. This is likely a focus as strontium from seawater brine is technically feasible but economically minor. It might find use locally, e.g., providing Sr for a nearby ceramics industry, but is not a primary driver. Figure 6 and Figure 7 present a comparative analysis of minerals recovered from SWRO brine and those obtained through conventional mining methods. See Supplementary Materials for cost comparison of SWRO brine recovery vs. conventional mineral production table.

Figure 7.

Cost comparison: SWRO brine recovery vs. conventional mineral production.

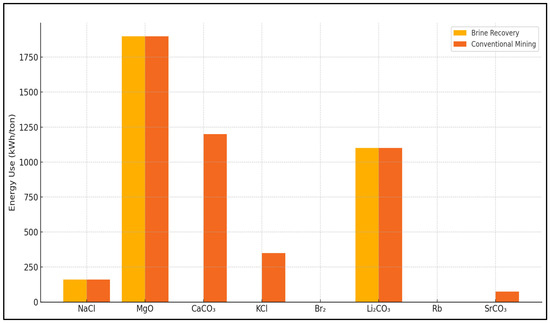

Figure 7 and Figure 8 present a clear comparison between seawater reverse osmosis (SWRO) brine recovery and conventional mining or chemical production in terms of both cost and energy demand across several key minerals and salts.

Figure 8.

Energy use comparison of brine recovery vs. conventional mining.

For the cost comparison, sodium chloride (NaCl) and magnesium oxide (MgO) are obviously the two most viable minerals for recovery from SWRO brine. For NaCl, the cost of recovery from brine is estimated at USD 75 per ton, which is slightly lower than the USD 84.5 per ton associated with conventional mining. This cost advantage, although modest, can become significant at scale. For MgO, the brine recovery cost stands at USD 793 per ton, which is higher than the USD 455 per ton from conventional sources. Despite the higher cost, brine-based recovery may offer environmental advantages that justify the premium, particularly in locations where sustainability is a strategic priority.

In the case of lithium carbonate (Li2CO3) and rubidium (Rb), the conventional production costs are extremely high, around USD 4500 per ton and USD 5.5 million per ton, respectively, due to the complex and resource-intensive extraction processes involved. While detailed cost figures for brine-based recovery of these elements are limited, emerging research suggests that selective recovery from brine could become economically favorable, especially if integrated with desalination infrastructure.

The energy comparison further reinforces the viability of brine recovery for certain minerals. Both brine recovery and conventional production of NaCl require roughly 160 kWh per ton, showing no significant energy compromise. For MgO, energy demands are again equal at about 1900 kWh per ton. This consistency suggests that the brine pathway can match conventional efficiency while reducing environmental impacts associated with mining and calcination. For other compounds like calcium carbonate (CaCO3), brine-based precipitation techniques avoid the carbon-intensive processes typically required in lime production, leading to a more energy-efficient profile.

Environmental considerations also shape the narrative. The extraction of minerals from brine generally results in fewer emissions, lower land disturbance, and reduced waste generation compared to traditional mining. For instance, in the case of boron and magnesium, the brine pathway avoids the use of open-pit mines and tailing ponds, which are common in conventional methods. Additionally, the use of industrial waste heat or solar evaporation in brine processing can significantly reduce the carbon footprint.

Overall, the figures suggest that while not all minerals are currently economically competitive to recover from brine, several, particularly NaCl and Mg-based compounds, already show cost and energy advantages or parity. Coupled with environmental benefits, brine recovery holds strong potential, especially in desalination-intensive regions or where resource imports are costly. Further technological development and market stability could expand this feasibility to high-value but low-abundance elements such as lithium and rubidium.

In summary, the cost comparison reveals a spectrum of viability. Sodium, magnesium, potassium, and bromine recovery from brine can often be competitive with traditional production, especially when factoring in that brine recovery has some sunk costs already covered by the desalination process, like feed intake and initial concentration. Lithium, rubidium, and cesium are currently not competitive due to extremely low concentrations, although their high prices keep interest alive in advanced extraction research. Calcium and strontium fall in between, as they are easy to recover but have low value, their recovery may be justified for process reasons rather than profit.

3.10. Regional Economics

Regional economics must also be considered. In regions where mining those minerals is difficult or where all materials are imported, brine recovery’s comparative advantage increases. For example, island states with no mining industry might find brine to be their local “ore body” for salt and minerals, whereas a country with large mineral deposits might find it uneconomical to invest in brine extraction. Additionally, if brine disposal is heavily regulated or costly, then the “avoidance” of disposal can be counted as a benefit offsetting recovery costs.

3.11. Energy Use and Environmental Aspects

The energy consumption of brine recovery processes is a critical factor in cost. A fully integrated brine mining flowsheet could include energy-intensive steps such as evaporation (thermal or mechanical) and electrochemical separations. The specific energy (kWh per m3 brine) will vary depending on how far one pushes towards ZLD. Studies have shown that going to zero liquid discharge (all water evaporated, all salts solidified) is very energy-heavy, on the order of 20–60 kWh/m3 for thermal crystallization beyond what RO can achieve [40]. However, our scenario does not require evaporating all water; we only evaporate enough to crystallize NaCl and maybe concentrate bittern to a manageable volume. By using waste heat or solar energy, the effective energy cost can be reduced. In contrast, conventional or terrestrial mining energy costs are associated with digging, grinding, chemical processing and sometimes thermal refining. For example, mining and processing a ton of potash or salt might use a few tens of kWh (mostly diesel and electricity), whereas obtaining that ton from seawater brine might use a similar order if performed efficiently (e.g., using free solar evaporation). Each element’s comparison is unique; magnesium metal production is energy-intense whether from brine or ore, bromine production from brine is actually less energy than mining bromine since bromine is not found as a solid ore—you always need to extract from brine or bittern.

An important observation is that integrating brine recovery with the desalination plant opens opportunities for energy synergy. For instance, the desalination plant’s output includes high-pressure brine, which can be used in energy recovery devices, and sometimes available heat (if an RO plant is co-located with power plants or uses warm intake water). Some innovative proposals include using renewable energy specifically for driving crystallizers during peak solar hours or coupling a thermal brine concentrator with a solar pond. The use of renewable energy can reduce OPEX and enhance the sustainability profile of the operation [41,50,51].