Abstract

Informal groundwater markets, where farmers with wells sell surplus water to neighbors, are a widespread adaptive response to water scarcity, particularly in South Asia where they are most prevalent and well-documented. This review (1990–2025) examines the evolving patterns of these markets by synthesizing global literature and viewing them through the lens of three transformative trends: energy transition (especially solar pumps), digital innovations (e.g., blockchain and IoT), and new policy pathways. We synthesize literature to evaluate market structures, contract forms, efficiency and equity outcomes, environmental impacts, and the influence of energy policies and digital tools. The review assesses whether these informal trades fulfill their promise of enhancing water productivity and equity or if new challenges are creating pitfalls. Key objectives include documenting historical evolution, analyzing market performance, discussing externalities like aquifer depletion, examining policy interactions, reviewing digital pilots, exploring social inclusion, comparing governance frameworks, identifying research gaps linked to SDGs, and proposing a policy roadmap for harnessing benefits while ensuring sustainability.

1. Introduction

Groundwater constitutes a critical resource for global food security, supplying approximately 43% of the world’s irrigation water and sustaining millions of agricultural livelihoods [1]. This dependence is particularly acute in South Asia, where pumped groundwater underpins dry-season cropping [2]. However, this vital resource is under severe threat, with aquifer levels declining at alarming rates in key agricultural regions, including North India [3], Pakistan [4], and the North China Plain [5]. The increasing frequency of climate-driven droughts further exacerbates this pressure, rendering current extraction patterns unsustainable [6].

In response to water scarcity, informal groundwater markets—local arrangements where well owners sell surplus water to neighbors—have emerged as a widespread, grassroots adaptive strategy [7,8]. This review contends that these informal institutions are now at a critical turning point, simultaneously influenced by three disruptive and overlapping transformations: energy transitions, digital innovations, and evolving policy pathways.

First, the ongoing energy transition is fundamentally altering pumping economics. The historic reliance on subsidized grid electricity and diesel is giving way to solar-powered irrigation, promoted through large-scale government initiatives such as India’s PM-KUSUM program [9]. While solar pumps reduce carbon emissions and operational costs, their near-zero marginal cost of pumping presents an “environmental paradox,” creating powerful incentives for over-extraction if not managed effectively [10,11]. Second, recent digital innovations offer unprecedented tools for managing this once-invisible resource. Technologies such as advanced metering infrastructure (AMI), the Internet of Things (IoT), and blockchain-based trading platforms are being piloted from California to South Asia, enabling transparent, real-time water accounting and new forms of regulated trading [12,13]. Third, new policy pathways are emerging globally. Governance is shifting away from a de facto open-access regime toward active management, exemplified by California’s Sustainable Groundwater Management Act (SGMA), Gujarat’s use of electricity rationing to control pumping, and new draft water laws in several South Asian states [14,15].

This review speaks to that turning point. It asks, How are informal groundwater markets adapting in the era of energy and digital transitions, and what policy choices can harness their benefits while ensuring long-term sustainability? To answer this, this paper synthesizes literature from 1990–2025. It begins by documenting the historical roots and evolution of these markets before describing their structure and contract forms. Subsequently, the analysis assesses their efficiency and equity outcomes and discusses key environmental externalities. The review then examines how energy policies and solar pumps are reshaping market dynamics, reviews the application of digital technologies, and explores critical issues of social inclusion. Finally, the paper compares emerging governance frameworks, identifies research gaps in relation to the SDGs, and concludes with a practical policy roadmap.

2. Historical Roots of Informal Groundwater Markets

Informal trading of groundwater for irrigation has surprisingly deep historical roots. In South Asia, local water-sale arrangements have existed since the early 20th century: in India, informal markets in groundwater date back to the 1920s [16]. Early well owners would sell water to neighbors using rope-and-bucket wells or primitive pumps. However, the phenomenon expanded greatly with the mid-20th century Green Revolution. The introduction of high-yielding crop varieties in the 1960s–1970s was coupled with a boom in tube well drilling and pump technology, often supported by government subsidies. As drilling technology became cheaper and rural electrification expanded, many farmers invested in private wells [7,17]. This led to a proliferation of surplus pumping capacity and, in parallel, a rise in water selling to nearby farmers who lacked their own wells. By the 1980s, informal groundwater markets were widespread in certain regions of India, Pakistan, Bangladesh, and China, prompting researchers to study them systematically [8].

A foundational study by Tushaar Shah [7], Groundwater Markets and Irrigation Development, was among the first to document the scope and functioning of these markets in India. Shah described how enterprising farmers, particularly in water-scarce but aquifer-rich areas like Gujarat, had turned groundwater into an informal commodity. In Gujarat, thousands of small farmers were purchasing irrigation water from neighbors’ wells, leading Shah to term it the “Gujarat model” of water markets an ostensibly efficient redistribution of water access that boosted irrigation on water-scarce farms. Similarly, in Pakistan, researchers observed informal water sales emerging soon after the introduction of private tube wells in the 1960s–1970s. Meinzen-Dick [2] noted that in Punjab, Pakistan, wealthier farmers who installed diesel pumps often sold water to sharecroppers or smallholders, improving the latter’s access to irrigation. These early studies highlighted a key driver: heterogeneity in resource endowments (some farmers have capital to install wells; others do not) combined with unmet irrigation demand naturally gives rise to trading [8]. Water-scarce environments with fragmented landholdings and unreliable canal supply (as in much of South Asia) were particularly fertile ground for informal markets [2,8,18,19].

By the late 1980s and 1990s, informal irrigation water markets had been reported across large parts of South Asia and in parts of East Asia. In India’s Gangetic plain (eastern Uttar Pradesh, Bihar, West Bengal) and in Bangladesh, shallow tube well owners commonly sold water to neighbors on various payment terms (detailed in Section 3). In Pakistan’s Punjab and Sindh provinces, studies estimated that 20–40% of farmers were involved in water trading as buyers or sellers by the 1990s [20,21]. In China’s north plain, a 2007 study found groundwater markets functioning in approximately 100,000 villages [5], driven by village entrepreneurs drilling deep wells to sell water to surrounding farmers (often due to the collapse or unreliability of collective irrigation systems post-reform). Thus, informal markets were not unique to South Asia, though South Asia had the heaviest concentration. There were even accounts from the Middle East (e.g., parts of Yemen [22,23] and Iran [24]) of farmers informally selling pumped groundwater to neighbors, and anecdotal evidence of limited water trading in parts of Mexico [25] and the Andean region [26] (although formal water rights regimes in Latin America overshadowed informal trades).

By the 1990s, academic and policy interest in these markets was rising. Early assessments were somewhat optimistic: informal water markets were seen as a spontaneous institution that could improve efficiency and equity by reallocating water to those who need it most. Water economists noted that such markets might function as a “demand management” tool, encouraging productive use of each unit of water [8]. Indeed, evidence was cited that these markets expanded irrigated area and benefited poorer farmers. For instance, smallholders who previously had no dry-season crop could, by purchasing water, grow an extra crop and increase their income. Shah [7] argued that in water-abundant areas with under-used wells, markets accelerated agricultural growth by sharing water access; in water-scarce areas, they at least improved equity of access if not conserving water.

However, even early on, some observers warned of downsides. Rosegrant and Binswanger [27] pointed out that in thin local markets, water sellers could become monopolists or “water lords,” potentially exploiting buyers, a concern borne out by studies in Bangladesh (e.g., Jacoby et al. [28], discussed later). Also, because pumping costs were subsidized or externalized (especially electricity), the selling price of water often did not reflect environmental costs, potentially encouraging over-extraction. By the turn of the millennium, the narrative around groundwater markets became more nuanced: they clearly improved access to irrigation for many, but issues of monopoly pricing, uncontrolled aquifer depletion, and unequal bargaining power were also identified as challenges.

Key Contextual Factors for Market Expansion

The expansion of these markets has been driven by a confluence of historical and contemporary factors:

- Green Revolution Technologies (c. 1960s–1990s): The push for high-yield cropping created a massive demand for reliable irrigation beyond what canals could supply. Groundwater met this need, and those with wells could profit by selling to those without [7,17,29].

- Subsidized Energy (c. 1970s–2000s): Government programs often subsidized pumps, wells, or electricity/diesel fuel. Cheap (sometimes free) electricity in regions like Indian Punjab made pumping costs very low for well owners, so any revenue from selling water was attractive profit [30,31], a dynamic now being reshaped by the solar transition.

- Socio-Economic Structure: In regions where landholdings are small and fragmented, not every plot can have its own well. Furthermore, many tenant and marginal farmers who cannot afford wells turn to water markets, creating a natural demand [2,24,32].

- Weak Formal Governance: Historically, a lack of clear legal frameworks governing groundwater use meant that anyone with land could extract and sell water at will. Informal trading filled this governance void without legal barriers [33], a situation now being challenged by new policy initiatives.

- The Solar Revolution (c. 2015–Present): The recent, rapid proliferation of solar-powered irrigation pumps is a new key driver. By providing energy at a near-zero marginal cost, solar pumps are fundamentally altering pumping economics and creating new incentives for water extraction and sales [10,11].

- Digital Innovations (c. 2018–Present): The advent of digital tools, including smart meters, IoT sensors, and online trading platforms, is for the first time enabling transparent monitoring of groundwater use. These technologies are creating a new context where informal trades can potentially be integrated into managed or regulated systems [12,13].

3. Market Structure and Contract Forms

Informal groundwater markets are typically localized [18,34,35], occurring within villages or among neighboring farms due to the practical constraints of water conveyance by channels or pipes [8,36,37]. This small scale often results in imperfect competition; many groundwater markets are essentially bilateral monopolies or oligopolies, where one seller might cater to several buyers and can exert significant market power [8,38,39,40,41].

3.1. Market Participants and Structure

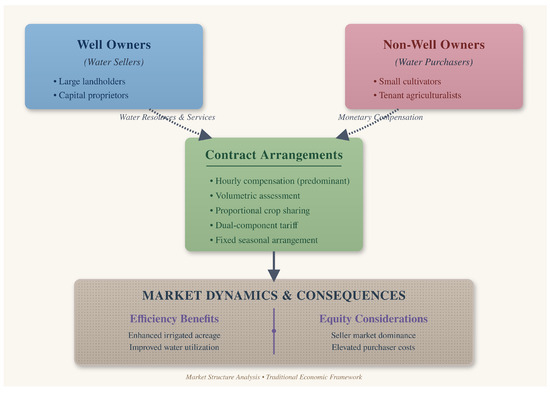

The market is fundamentally composed of two groups, as depicted in Figure 1. Generally, the sellers in these markets are farmers who own operational tubewells, and the purchasers are those without their own well. This often correlates with farm size: larger landowners are more likely to own wells, while smallholders and tenant farmers form the bulk of buyers [41]. In Pakistan’s Punjab, for instance, 85% of tubewells are owned by medium-to-large farmers [18,42]. This dynamic, where wealthier farmers sell to less-resourced ones, forms the core of the market relationship. Figure 1 provides a conceptual overview, illustrating these key actors, the contractual arrangements that connect them, and the resulting market dynamics, which involve both efficiency gains and equity challenges.

Figure 1.

Conceptual framework of informal groundwater markets showing market actors, contract types, and outcomes.

A rich body of literature describes the contractual arrangements by which groundwater is traded. Unlike formal markets that use standardized units, informal markets employ a variety of ingenious contract forms suited to local conditions. Table 1 summarizes common contract types and their regional prevalence.

Table 1.

Common contract types in informal groundwater irrigation markets (by region).

3.2. Explanation of Contract Forms

The hourly-charge (time-based) contract is extremely common in South Asia. The buyer pays an agreed rate per hour of pumping from the seller’s well, and the rate usually factors in the cost of fuel or electricity and some profit for the well owner. This contract is straightforward and was observed by Shah [7] as the predominant mode in western India. It is still widespread, especially where pumps are diesel-powered [2,39,41,43]. A traditional form has been the output-share (crop-share) contract, where instead of cash, the water buyer pays a share of the harvest (for example, one-fourth of the rice yield) to the water seller [8,40]. This offers a risk-sharing element (if the crop fails, the buyer does not owe water fees), but studies show buyers under this arrangement pay an effective water price much higher than under fixed hourly contracts [38]. A more complex contract is the two-part tariff, where the buyer pays an initial fixed fee for access plus a per-hour charge for each use. The fixed part helps the seller cover capital costs, while the variable part covers operating costs. This has been documented in Bangladesh by scholars such as Fujita [44]. In some areas, water is sold per unit area for an entire crop season; for example, a seller might charge a lump sum per acre for providing all necessary irrigation for wheat [41,47]. Finally, the pump-hire/service contract model, reported in parts of Africa, is more akin to renting equipment and labor, where an entrepreneur is paid to bring a pump and irrigate a field, a response to a lack of pump access rather than water scarcity itself [46].

3.3. Pricing, Market Power, and Under-Studied Geographies

Prices in informal markets are typically unregulated and can vary seasonally and with water availability. Due to the thinness of markets, prices are often set by local convention or by the most influential seller. Empirical research reveals substantial price mark-ups by sellers above their cost of pumping. For example, in India, Saleth [48] and Kajisa & Sakurai [38] found that water sale prices were between 1.9 to 3.3 times the marginal cost of pumping, indicating sellers extract large surpluses. Such mark-ups have led to the characterization of powerful sellers as “water lords” [8]. The bargaining power of buyers increases if an alternative source is available (another well nearby or some public irrigation), which can force a seller to negotiate a lower rate [8,41]. Conversely, if a buyer is captive to one supplier, the seller’s monopoly can impose high prices or unfavorable terms.

Where literature is scant, such as in Africa and Latin America, it is unclear what forms contracts take. One can hypothesize that in African contexts, observed arrangements resemble service contracts for pump rental rather than water sales [46]. In Latin America, smallholder irrigation often involves communal management rather than bilateral markets, so such contracts may not be prevalent [25,26]. Understanding the extent to which informal irrigation water markets exist and their functional forms in Africa and Latin America remains a critical knowledge gap.

4. Efficiency and Equity Outcomes of Informal Water Trading

A central question in the literature is whether informal groundwater markets improve the efficiency of water use and agricultural production, and how they affect equity, particularly the welfare of small and marginal farmers.

4.1. Evidence of Efficiency Gains

There is considerable evidence that informal trading allows more complete and intensive use of available irrigation infrastructure, thereby boosting agricultural output. When a farmer with a well has more water than he needs (or land less than what the well capacity could irrigate), selling the excess to neighbors results in additional cropped area and production that otherwise would not occur [49]. For example, a meta-analysis of global water market studies found that in many developing country contexts, water trading increased the overall irrigated area and cropping intensity in a community [50]. A recent study in Pakistan’s Punjab used farm survey data and found that farmers participating in groundwater markets had significantly higher cropping intensity (169% for buyers; 165% for sellers) than those who only used their own wells (136% cropping intensity for self-users) [49]. This indicates that water buyers and sellers cultivated more of their land (often double-cropping) thanks to water trading, whereas non-participants left more land fallow due to water constraints. The same study also noted that water markets enabled small and marginal farmers to diversify into higher-value crops; buyers were able to grow water-intensive crops like rice or potatoes, or engage in timely planting which they could not have done without access to purchased water [18,49]. In West Bengal, India, researchers observed that water-sharing arrangements led to expansion of boro (dry-season) rice cultivation among land-poor farmers who previously had no irrigation, thereby increasing total grain output in the village [51].

Importantly, informal markets can improve the productivity of water by reallocating it to those who can use it more effectively. A notable finding in the Pakistan study was that water buyers achieved higher water productivity (crop yield per unit water) than well owners [49]. Buyers used on average less water to produce a given crop yield compared to those who had their own wells, presumably because buyers face a marginal cost for every unit of water and thus avoid over-irrigation. In contrast, well owners pumping for themselves often incur low marginal cost (especially if electricity is flat-rate), which can lead to wasteful over-watering. The study found that for wheat, buyers had the highest water productivity, followed by seller-cum-self-users, with pure self-users lowest [49]. This suggests an efficiency gain: water is conserved or used more sparingly when it is priced through market exchange. Similarly, evidence from India (Uttar Pradesh) showed that plots irrigated with purchased water received closer-to-optimal irrigation (in terms of quantity and timing) than those irrigated by owners “flooding” their fields. The buyers economized due to cost, and sellers, wanting to maximize area served, also became more efficient in water delivery [52,53]. These micro-level efficiencies imply that informal markets can contribute to higher water-use efficiency (SDG 6.4) in agriculture, at least at the farm level.

4.2. Evidence on Equity and Smallholder Benefits

One of the most cited merits of groundwater markets is that they democratize access to irrigation. Studies broadly agree that these markets have allowed many resource-poor farmers to access groundwater who otherwise could not [8,41]. By renting water by the hour or season, a small farmer avoids the lumpy investment of drilling a well and buying a pump (which might be an insurmountable cost). For instance, Shah [7] estimated that in Gujarat villages, every well was on average providing irrigation to 3–4 other farmers’ fields. Similarly, in Bangladesh, hundreds of thousands of small farmers in the 1990s gained dry-season irrigation via shallow tube wells owned by someone else, under share-crop or cash contracts, substantially raising their incomes and food production [44,54]. More recently, in eastern India, a study found that smallholders with access to groundwater (either their own or through markets) achieved greater crop commercialization and income than those relying solely on rain [55].

However, critical studies have highlighted that inequities can persist or be exacerbated in groundwater markets. The pricing often means poorer farmers pay a significant share of their production as water fees, transferring wealth to water-rich farmers. For example, Jacoby, Murgai, and Rehman [28] examined water markets in Bangladesh and found strong evidence of monopolistic pricing: well owners charged prices high above cost, extracting much of the surplus generated by irrigation. In essence, they found that water sellers captured the lion’s share of the gains, limiting the net benefit to buyers. Buyers were still better off than having no water, but the division of benefits was unequal. Another study in peninsular India by Diwakara [56] concluded that emerging groundwater markets sometimes had negative social outcomes, such as reducing local food security and causing unemployment, because water was being sold away from labor-intensive local cropping to larger farms (though this is a less common finding) [57].

Concrete evidence of yield and income effects adds further insight. In Pakistan, a 2022 study by Razzaq et al. measured the impact of groundwater market participation on farm outcomes using propensity score matching. It found that participating in water markets increased farmers’ cropping intensity (as noted) and also improved wheat yields for water buyers relative to similar non-buyers [49]. Essentially, buying water allowed timely irrigation that raised yields. On the equity side, the study did note that large farmers still enjoyed better overall groundwater access (via own wells), but the gap in productivity between large and small farms was narrowed by the smaller farms’ ability to buy water. In Indian Punjab, however, recent data reveal a more sobering equity issue: small farmers who rely on purchasing groundwater end up with lower net earnings per acre for certain crops than those who have their own well [58]. This indicates that while water markets grant access, the cost can reduce farm profitability for buyers.

To conclude this section, we present a summary table of select studies (Table 2) to illustrate the range of efficiency and equity outcomes found.

Table 2.

Efficiency and equity outcomes of informal groundwater markets—selected studies.

5. Environmental Footprint: Aquifers, Energy, and Climate Impacts

The rise of informal groundwater markets raises concerns about the environmental sustainability of groundwater use. By facilitating additional extraction, these markets can contribute to aquifer stress if unmanaged.

5.1. Aquifer Depletion and Water Sustainability

Globally, groundwater resources are under severe strain, with many major aquifers declining as extraction exceeds recharge [59,60]. The areas of most intensive groundwater use, such as northern India and Pakistan, overlap significantly with where informal groundwater irrigation is prevalent [3]. Informal water markets, by increasing access, can accelerate this depletion. When well owners have the opportunity to sell water, their incentive is to pump as much as possible to maximize income, unlike a self-user who might stop when their own crop needs are met [49,61]. However, correlation is not causation; markets often emerge in already water-scarce areas. The core issue is the absence of governing rules, which allows cumulative pumping to exceed recharge [60].

5.2. Energy Use and Emissions

Groundwater pumping for irrigation is a major consumer of energy. In India, for example, an estimated 20 million electric pumps and 9 million diesel pumps are in operation, and farm irrigation accounts for about 18% of the nation’s electricity consumption [62]. When water markets intensify irrigation, they also intensify energy use and associated greenhouse gas emissions, especially where energy is subsidized, a dynamic observed in contexts as varied as India and Mexico [63]. For instance, in Indian Punjab, where farm electricity has been provided virtually free for decades, tube well usage is unconstrained, leading to significant groundwater decline [64]. The carbon footprint of this pumping is large—one estimate for India is over 45–62 million tons of carbon emissions per year [65].

However, there is a flip side: by increasing the efficiency of water use on-farm, markets can indirectly reduce wasted energy. If previously a farmer over-pumped water, but now sells that excess water to someone who uses it productively, the energy is at least going into useful production. Yet, the energy footprint still tends to increase with market activity unless mitigated by other technologies.

The shift to solar-powered irrigation pumps presents an environmental paradox: while it provides zero-carbon energy, the near-zero marginal cost of pumping can diminish the incentive to conserve groundwater, potentially worsening aquifer depletion unless other controls are in place [10,11]. There is evidence of this paradox from Western India, where farmers with solar pumps were observed to pump longer hours than those with costly diesel, sometimes even over-irrigating because there is no fuel cost [10]. The water-energy-food nexus is thus at the heart of the policy challenge: breaking the vicious cycle of cheap energy leading to over-pumping and water stress. The policy debate includes options like metering and charging for electricity to provide a conservation signal, or promoting technological fixes like high-efficiency pumps and irrigation methods.

5.3. Other Environmental Impacts and Links to SDGs

Over-extraction, facilitated by markets, can cause other externalities like declining water quality. As water tables fall, saline water or naturally occurring contaminants like arsenic can intrude into the aquifer. In parts of Pakistan’s Punjab, for instance, falling water tables have led to increased salinity in pumped water, which degrades soil and crop yields over time [66]. Land subsidence is another concern in regions with heavy pumping. On a more positive note, some argue that because groundwater markets create shared reliance on a few wells, they could, in theory, foster collective action for resource management, though this is rare without external support.

At a global level, informal groundwater irrigation connects directly to the Sustainable Development Goals (SDGs). For these goals, particularly Target 6.4 on water-use efficiency and scarcity, informal markets present a duality. They can improve on-farm efficiency (more crop per drop) but often exacerbate regional water stress and scarcity by encouraging total extraction to surpass sustainable levels. Achieving sustainable withdrawals likely requires integrating these informal arrangements into a formal governance framework.

Similarly, for sustainable resource management, the market’s interaction with the energy transition is critical. The shift to solar-powered pumping is a key climate mitigation strategy, as it cuts direct carbon emissions from agriculture. However, if this leads to unsustainable use of groundwater—a key resource for climate adaptation—then climate and water goals are not being pursued in harmony. The challenge is to advance “climate-smart irrigation” that provides renewable energy while ensuring the underlying water resource is managed sustainably.

6. Energy Subsidy Reforms and the Solar Pumping Shift

Energy policy and groundwater irrigation have always been intertwined. This section reviews how reforms in energy pricing and the introduction of solar pumps are reshaping informal groundwater markets.

6.1. Electricity Subsidies and Their Reform

In South Asia, heavily subsidized or free electricity for agriculture has led to uncontrolled pumping and fueled water markets by making water sales profitable for well owners paying flat rates [67,68]. Reforms like Gujarat’s Jyotirgram scheme, which rationed power supply to farms, showed that indirect energy-based regulation can slow groundwater extraction, though it does not eliminate markets [14,69,70,71]. Other proposed reforms, like Direct Benefit Transfers (DBT) for electricity, aim to make farmers cost-conscious, but remain politically sensitive. In Pakistan, where diesel pumps dominate, farmers face a real marginal cost for pumping, which naturally limits water sales to some extent [72,73].

6.2. Solar Pumps—Promise and Peril

Solar pumps are a transformative technology, offering reliable, zero-carbon energy for irrigation [74,75]. This dramatically lowers the operating cost of pumping, which can make irrigation water cheaper for buyers and improve equity [76]. However, this also creates a “double-edged sword”: the incentive to pump more water increases, potentially exacerbating aquifer depletion [10,77]. An innovative policy solution being tested is connecting solar pumps to the grid and allowing farmers to sell surplus power back. This “Solar Power as a Remunerative Crop (SPaRC)” model, piloted in Gujarat’s Dhundi cooperative, creates a direct financial incentive to conserve water by making energy itself a saleable crop [78,79]. Such schemes, now part of India’s PM-KUSUM program, offer a promising pathway to align clean energy and groundwater sustainability goals [80,81].

7. Digital Metering and Trading Pilots

Digital technology offers new tools to modernize water management and informal markets. A fundamental challenge in managing groundwater is the lack of data on withdrawals. To address this, projects are deploying digital tools ranging from smart meters on wells to blockchain-based trading platforms [82]. These tools promise to improve the monitoring of groundwater extraction, facilitate more formal trading, and bring transparency to an opaque system.

7.1. Advanced Metering and Pilot Cases

In places like California, advanced metering infrastructure (AMI) is being paired with water markets. For example, the Fox Canyon Groundwater Management Agency equipped agricultural wells with telemetry units that automatically record and transmit pumping volumes in real-time. This pilot allowed farmers with pumping allocations to securely buy or sell unused credits via an online exchange, with the telemetry ensuring that all trades were backed by verified data [12].

7.2. Blockchain, IoT, and Trading Platforms

Blockchain (distributed ledger) technology has gained attention for its potential to provide a transparent, tamper-proof record of water rights and transactions. The IBM-Freshwater Trust pilot in California combines IoT sensors on pumps with a blockchain platform to track usage and allow farmers to trade groundwater credits under a basin-wide cap [83,84]. Similarly, the Environmental Defense Fund (EDF) has developed an open-source Groundwater Accounting Platform for water districts in California to track pumping allocations and enable easier trading [85]. While these U.S.-based pilots are driven by formal regulations like SGMA, the technology offers a potential pathway to formalize and secure informal trades elsewhere. In India, remote monitoring systems are now being mandated for new solar pumps under the PM-KUSUM scheme, creating a rich data stream that could be used for future water management and trading applications [9].

Mobile applications are also emerging. In Kenya, the company SunCulture uses an IoT-based system and a mobile app to offer solar-powered irrigation on a pay-as-you-go basis, demonstrating a digitized, service-based water market model in an African context [86]. Table 3 provides further examples of these digital pilots.

Table 3.

Select digital innovations in groundwater irrigation management.

8. Social Inclusion and Bargaining Dynamics

Groundwater markets operate within social contexts that affect who participates and who benefits. Key social dimensions include gender roles, the position of tenant farmers, caste or community relations, and the bargaining power each party holds. Because these markets are informal, outcomes for different social groups often depend on pre-existing power relations.

8.1. Gender and Groundwater Markets

Traditionally, irrigation has been a male-dominated sphere due to gendered land ownership and control of technology [87]. Consequently, women farmers have generally been water buyers rather than sellers. Recent case studies reveal both specific barriers and emerging opportunities.

Among the barriers, limited land rights and capital mean women seldom invest in pumps, excluding them from the income stream of water selling. Social norms in some regions can also discourage women from negotiating directly with male pump owners or handling equipment, forcing them to rely on male intermediaries and disempowering them further [88].

However, there are positive examples of collective action improving water access, such as women-led self-help groups investing in shared pumps, which shows a pathway to empowerment [89,90]. In Bihar, India, these groups leased land and invested in a shared solar pump, successfully irrigating crops and sharing profits [89]. In Nepal’s Terai, a pilot that transferred solar pumps to women’s groups found that women managers achieved high pump utilization and improved crop outcomes, bolstering their social status and decision-making power at home [90]. Even where women manage pumps, social norms can limit their control over proceeds, suggesting that meaningful inclusion requires conscious efforts to include them in governance structures [91,92].

8.2. Tenant Farmers and Sharecroppers

Another marginalized group is tenant farmers. Their access to irrigation often depends entirely on the landlord or on the terms available in informal markets [28]. Their access and the fairness of terms depend heavily on the competitiveness of the local water market and their tenure security [2,41]. Insecure land tenure can intersect negatively with water access; some landlords with tubewells have refused to sell water to their tenants for other plots the tenants cultivate, limiting their production [93]. If multiple sellers exist, a tenant might negotiate a reasonable price; if one landlord controls water, tenants are at their mercy [38].

8.3. Bargaining Power and Market Power

The bargaining dynamic between sellers and buyers is central to market outcomes. In uncompetitive local markets, sellers can become “water lords,” charging prices far above their pumping costs and capturing most of the economic surplus, which raises significant equity concerns [8]. Key determinants of a buyer’s bargaining power include the number of alternative water sources, the urgency of their water need, and their social relationship to the seller. A seller’s power grows if they have the only well in reasonable distance, especially if the buyer’s crop is at a critical stage needing water [8]. This is why water prices often spike during droughts.

The “water lord” concept is supported by evidence of significant price–cost margins. Saleth (1998) found that water sale prices were between 1.9 to 3.3 times the marginal cost of pumping in parts of India [48], and Somanathan (2006) found about 40% of sellers in Karnataka/Andhra Pradesh charged prices well above their average costs, capturing significant rents [94]. This implies a substantial transfer of surplus from buyers to sellers, which can negatively impact the life satisfaction of rural farmers [95].

However, the presence of multiple sellers, alternative water sources, or strong community norms can increase the bargaining power of buyers [8]. Buyers also employ strategies like grouping together to collectively negotiate a bulk rate, using social pressure, or investing in small-scale pump-sharing arrangements to reduce dependence on a single seller. Recognizing these power imbalances, policies aimed at improving inclusion could involve facilitating collective pump ownership for marginalized groups, strengthening tenants’ rights, and promoting community-level mediation of water prices.

9. Policy and Governance Options for Groundwater Markets

Before discussing policy options, it is useful to explicitly compare the informal markets that are the focus of this review with the formal, rights-based water markets emerging in other contexts. The comparison helps the reader see at a glance how today’s informal village-level trade [7,28] differs from the new rights-based systems now forming under laws such as California’s SGMA [12] and Chile’s water-rights code [96]. Table 4 summarizes the key distinctions.

Table 4.

Key differences between informal and formal groundwater markets.

This comparison makes it clear that stronger rights definition, metering, and an overarching sustainability cap allow formal markets to address aquifer stress in a way that informal trade alone cannot.

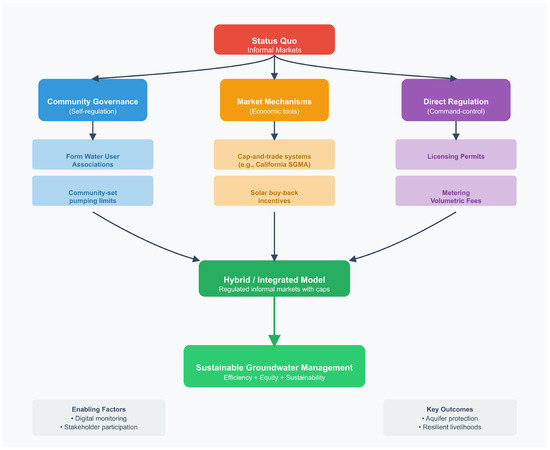

Policymakers face the dilemma of harnessing the benefits of informal markets while mitigating their downsides. This section reviews notable policy models. Figure 2 illustrates how these different governance approaches can converge toward a sustainable hybrid model.

Figure 2.

Policy roadmap showing pathways from informal markets to sustainable groundwater management through community, market, and regulatory approaches.

9.1. Formalizing Through Cap-and-Trade: California’s SGMA Example

The California Sustainable Groundwater Management Act (SGMA) of 2014 provides a blueprint for integrating markets into governance. It mandates that over-drafted basins reach sustainable yield by ∼2040 [12]. Local Groundwater Sustainability Agencies (GSAs) can establish pumping quotas and allow trading. In practice, several GSAs are exploring cap-and-trade systems, where farmers with an allocation can buy or sell unused pumping credits [12,97,98]. This formalizes the resource, provides flexibility, and creates an incentive for conservation.

9.2. Licensing, Energy-Based Regulation, and Community Management

Other approaches include licensing and permit systems, though enforcement in developing nations has been historically weak [4,15,99]. Energy-based regulation, like Gujarat’s Jyotirgram scheme, uses power rationing as an indirect control on pumping [14]. Another approach is strengthening community-based regulation, where user associations collectively manage aquifer use, as seen in parts of Mexico and Spain [100,101,102].

9.3. Hybrid Models

The likely trend is towards hybrid models where informal markets continue but under a regulatory umbrella. For instance, a state could declare a “groundwater conservation area” where water sales are reported and total extraction is capped. Farmers could still trade water amongst themselves, but within this cap. This is essentially what California is doing. In developing countries, a softer hybrid approach might be to formalize water user groups, have them collectively monitor usage, and if the aquifer is stressed, the group must figure out how to reduce pumping, perhaps through price adjustments or rotational supply, with government providing data and legal backing [103,104]. Table 5 provides a comparative look at different governance models.

Table 5.

Policy and governance models for groundwater management and markets.

10. Research Gaps and Future Agenda

A review of the existing literature reveals that the study of informal groundwater markets has been dominated by specific methodological approaches. Much of the foundational and contemporary knowledge is derived from qualitative research and surveys that often rely on recall data. While these methods have been invaluable for describing market functions and documenting outcomes, the field has seen less application of, analysis of, or calls for policy evaluation. A key part of the future research agenda therefore involves diversifying this methodological toolkit.

Despite decades of study, numerous gaps remain in our understanding of informal groundwater markets. To steer them toward sustainability and equity, future research should prioritize several key areas.

First, there is a pressing need for an expanded scope of research that captures longitudinal data and that explores less-studied geographical contexts. Many conclusions are based on one-time surveys; future work should deploy sensors and IoT technology to capture real-time pumping and trading data, enabling a more dynamic understanding of market functions. This also requires expanding the geographic scope of research beyond Asia to contexts such as Africa and Latin America, where informal water sharing may exist in different forms.

Second, research must better clarify the role of markets in climate-driven drought conditions. Longitudinal analysis is needed to understand if markets enhance resilience during droughts or collapse under prolonged water stress. This includes a deeper investigation into social inclusion, using panel data to track long-term impacts on vulnerable groups like women and tenant farmers to see if markets offer a pathway out of poverty or entrench inequality.

Third, future studies require more conceptual depth, combining hydrogeological models with qualitative case studies to understand the nexus of water, energy, and community norms. This is particularly important for the rigorous study of economic incentives, such as blockchain trading or solar buy-back schemes. Rather than relying on anecdotal reports, academic evaluations using quasi-experimental methods are needed to generate generalizable lessons.

Finally, research should explicitly connect the micro-level functioning of these markets to macro-level development goals by encouraging sustainability in developing countries. This involves analyzing the trade-offs between water-use efficiency (SDG 6.4) and ecosystem protection (SDG 6.6), and aligning climate mitigation efforts (SDG 13) with sustainable water use for adaptation. Promoting sustainability goals in developing countries will be essential to facilitate this urgent research agenda.

11. Conclusions and Roadmap for Policy and Research

Informal groundwater markets have proven to be a resilient and adaptive institution. This review found that while these markets are most widespread in Asia, they exist in various forms globally. They generally improve on-farm water use efficiency and can uplift smallholder incomes, but often at the cost of accelerating aquifer drawdown and enabling rent extraction by powerful sellers. Critically, the review shows that these dynamics are being reshaped by new forces. Solar pumps and energy subsidies greatly influence extraction incentives, with solar buy-back schemes showing promise in realigning them toward conservation. Digital tools like smart meters and trading platforms are creating new possibilities for transparent oversight, while policy experiments from California’s SGMA to South Asia’s energy reforms illustrate a growing menu of governance options.

Based on these findings, a multi-pronged policy roadmap is essential. The foundation of this roadmap is strengthening governance. This begins with officially recognizing and monitoring informal markets to build a knowledge base, and using that to regulate these markets through local Groundwater User Associations (GUAs). In critically over-exploited basins, this can evolve toward introducing incentive-based regulation, which uses market mechanisms to stay within a science-based limit. These efforts must be underpinned by socially-informed policy that treats groundwater as a common-pool resource and includes regulatory safeguards to ensure equity.

Crucially, this governance framework must be aligned with ongoing energy transition. Policymakers must coordinate to create incentives for water conservation. The most innovative path is to scale up solar pump programs with grid optimization. By expanding initiatives like India’s PM-KUSUM program to provide attractive feed-in tariffs, farmers gain a direct financial incentive to sell surplus electricity instead of using it to pump and sell surplus water. Replicating successes like the Dhundi solar cooperative, where farmers earn more from selling power than water, is key. This approach essentially pays farmers for the ecosystem service of not over-pumping and represents a critical tool for breaking the water–energy–depletion nexus.

In conclusion, informal groundwater markets are at the center of multiple converging transitions. By implementing smart policies that integrate community-led governance with technological and energy-based incentives, we can move toward groundwater markets that not only keep crops alive and farmers prosperous, but also keep aquifers healthy for future generations. The challenge now is collective action to achieve the vision of a water-secure and climate-resilient agriculture in the energy-digital age.

Author Contributions

Conceptualization, A.R. and H.L.; methodology, A.R., H.L., and D.Y.; software, A.R.; validation, A.R. and D.Y.; formal analysis, A.R.; investigation, A.R., H.L., and D.Y.; resources, A.R.; data curation, A.R.; writing—original draft preparation, A.R.; writing—review and editing, A.R., H.L., and D.Y.; visualization, A.R.; supervision, A.R.; project administration, A.R.; funding acquisition, A.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article as all information is based on previously published research cited herein.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| AMI | Advanced Metering Infrastructure |

| DBT | Direct Benefit Transfer |

| EDF | Environmental Defense Fund |

| GSA | Groundwater Sustainability Agency |

| GUA | Groundwater User Association |

| ICIMOD | International Centre for Integrated Mountain Development |

| IoT | Internet of Things |

| IWMI | International Water Management Institute |

| NAQUIM | National Aquifer Mapping and Management program |

| NGO | Non-Governmental Organization |

| PM-KUSUM | Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan |

| RMS | Remote Monitoring System |

| SDG | Sustainable Development Goal |

| SGMA | Sustainable Groundwater Management Act |

| SPARC | Solar Power as a Remunerative Crop |

| SPICE | Solar Pump Irrigators’ Cooperative Enterprise |

| WUA | Water User Association |

References

- Gleeson, T.; Cuthbert, M.; Ferguson, G.; Perrone, D. Global Groundwater Sustainability, Resources, and Systems in the Anthropocene. Annu. Rev. Earth Planet. Sci. 2020, 48, 431–463. [Google Scholar] [CrossRef]

- Meinzen-Dick, R.S. Groundwater Markets in Pakistan: Participation and Productivity; International Food Policy Research Institute: Washington, DC, USA, 1996; Volume 105. [Google Scholar]

- Rodell, M.; Velicogna, I.; Famiglietti, J.S. Satellite-based estimates of groundwater depletion in India. Nature 2009, 460, 999–1002. [Google Scholar] [CrossRef] [PubMed]

- Rana, A.W.; Gill, S.; Meinzen-Dick, R.S.; ElDidi, H. Strengthening Groundwater Governance in Pakistan; Discussion Paper 2240; International Food Policy Research Institute: Washington, DC, USA, 2024. [Google Scholar]

- Wang, J.; Huang, J.; Rozelle, S.; Huang, Q.; Blanke, A. Agriculture and Groundwater Development in Northern China: Trends, Institutional Responses, and Policy Options. Water Policy 2007, 9, 61–74. [Google Scholar] [CrossRef]

- Alghafli, K.; Shi, X.; Sloan, W.; Ali, A.M. Investigating the role of ENSO in groundwater temporal variability across Abu Dhabi Emirate, United Arab Emirates using machine learning algorithms. Groundw. Sustain. Dev. 2025, 28, 101389. [Google Scholar] [CrossRef]

- Shah, T. Groundwater Markets and Irrigation Development: Political Economy and Practical Policy; Oxford University Press: Bombay, Indian, 1993. [Google Scholar]

- Yashodha. Do buyers have bargaining power? Evidence from informal groundwater contracts. PLoS ONE 2020, 15, e0236696. [Google Scholar] [CrossRef]

- Press Information Bureau, Government of India. PM-KUSUM: A New Green Revolution. Press Release, Government of India. 2022. Available online: https://static.pib.gov.in/WriteReadData/specificdocs/documents/2022/apr/doc202242548601.pdf (accessed on 9 June 2025).

- Bassi, N. Solarizing groundwater irrigation in India: A growing debate. Econ. Political Wkly. 2018, 53, 15–18. [Google Scholar] [CrossRef]

- Shah, T.; Rajan, A.; Rai, G.P.; Verma, P.; Durga, N. Solar pumps and India’s energy-groundwater nexus: Exploring the environmental and social impacts of the KUSUM scheme. Energy Policy 2022, 163, 112836. [Google Scholar] [CrossRef]

- The Nature Conservancy; California Lutheran University, Center for Economic Research & Forecasting; Fox Canyon Groundwater Management Agency. SGMA’s First Groundwater Market: An Early Case Study from Fox Canyon; Technical Report; Groundwater Resource Hub: San Francisco, CA, USA, 2018; Available online: https://www.groundwaterresourcehub.org/content/dam/tnc/nature/en/documents/groundwater-resource-hub/TNC_FoxCanyon_GroundwaterMarketCaseStudy.pdf (accessed on 9 June 2025).

- Holland, M.; Thomas, C.; Livneh, B.; Tatge, S.; Johnson, A.; Thomas, E. Development and validation of an in situ groundwater abstraction sensor network, hydrologic statistical model, and blockchain trading platform: A demonstration in Solano County, California. ACS ES&T Water 2022, 2, 2345–2358. [Google Scholar] [CrossRef]

- Shah, T.; Verma, S. Co-management of electricity and groundwater: An assessment of Gujarat’s Jyotirgram Scheme. Econ. Political Wkly. 2008, 43, 59–66. [Google Scholar]

- Cullet, P. The Groundwater Model Bill—Rethinking Regulation for the Primary Source of Water. Econ. Political Wkly. 2012, 47, 40–47. [Google Scholar]

- Saleth, R.M. Water Markets in India: Extent and Impact. In Water Markets for the 21st Century: What Have We Learned? Easter, K.W., Huang, Q., Eds.; Springer: Dordrecht, The Netherlands, 2014; pp. 239–261. [Google Scholar] [CrossRef]

- Mukherji, A. Sustainable Groundwater Management in India Needs a Water-Energy-Food Nexus Approach. Appl. Econ. Perspect. Policy 2022, 44, 394–410. [Google Scholar] [CrossRef]

- Razzaq, A.; Qing, P.; ur Rehman Naseer, M.A.; Abid, M.; Anwar, M.; Javed, I. Can the informal groundwater markets improve water use efficiency and equity? Evidence from a semi-arid region of Pakistan. Sci. Total Environ. 2019, 666, 849–857. [Google Scholar] [CrossRef] [PubMed]

- Razzaq, A.; Zhou, Y. Groundwater Markets in the Era of Environmental Challenges: Pathways to Sustainability. In Proceedings of the 6th International Symposium on Water Resource and Environmental Management, Sanya, China, 27–29 December 2024. [Google Scholar]

- Rinaudo, J.D.; Strosser, P.; Rieu, T. Linking water market functioning, access to groundwater and farm investments: Empirical evidence from Pakistan. Irrig. Drain. Syst. 1997, 11, 261–280. [Google Scholar] [CrossRef]

- Shah, T. Groundwater Markets and Agricultural Development: A South Asian Perspective; International Water Management Institute (IWMI): Colombo, Sri Lanka, 2003. [Google Scholar]

- Lichtenthäler, G.; Turton, A. Water Demand Management, Natural Resource Reconstruction and Traditional Value Systems: A Case Study from Yemen; Occasional Paper 14; Water Issues Study Group, School of Oriental and African Studies, University of London: London, UK, 1999. [Google Scholar]

- Hellegers, P.; Perry, J.N.; Al-Aulaqi, N.; Al-Hebshi, M.O. Incentives to Reduce Groundwater Extraction in Yemen; Research Report 2008-058; LEI Wageningen UR: The Hague, The Netherlands, 2008. [Google Scholar]

- Jaghdani, T.J.; Brümmer, B. Determinants of Water Purchases by Pistachio Producers in an Informal Groundwater Market: A Case Study from Iran. Water Policy 2016, 18, 599–618. [Google Scholar] [CrossRef]

- Kloezen, W.H. Water Markets between Mexican Water User Associations. Water Policy 1998, 1, 437–455. [Google Scholar] [CrossRef]

- Bauer, C.J. Bringing Water Markets Down to Earth: The Political Economy of Water Rights in Chile, 1976–95. World Dev. 1997, 25, 639–656. [Google Scholar] [CrossRef]

- Rosegrant, M.W.; Binswanger, H.P. Markets in Tradable Water Rights: Potential for Efficiency Gains in Developing Country Water Resource Allocation. World Dev. 1994, 22, 1613–1625. [Google Scholar] [CrossRef]

- Jacoby, H.G.; Murgai, R.; Rehman, S.U. Monopoly Power and Distribution in Fragmented Markets: The Case of Groundwater. Rev. Econ. Stud. 2004, 71, 783–808. [Google Scholar] [CrossRef]

- Dhawan, B.D. Development of Tubewell Irrigation in India; Agricole Publishing Academy: New Delhi, India, 1982. [Google Scholar]

- Badiani, R.; Jessoe, K. Electricity Prices, Groundwater and Agriculture: The Environmental and Agricultural Impacts of Electricity Subsidies in India. In Agricultural Productivity and Rural Development; National Bureau of Economic Research: Cambridge, MA, USA, 2018. [Google Scholar]

- Singh, K. Electricity Subsidy in Punjab Agriculture: Extent and Impact. Indian J. Agric. Econ. 2012, 67, 16. [Google Scholar] [CrossRef]

- Razzaq, A.; Xiao, M.; Zhou, Y.; Anwar, M.; Liu, H.; Luo, F. Towards Sustainable Water Use: Factors Influencing Farmers’ Participation in the Informal Groundwater Markets in Pakistan. Front. Environ. Sci. 2022, 10, 944156. [Google Scholar] [CrossRef]

- Khara, D.S. Groundwater Governance in India: A Legal and Institutional Perspective. Indian J. Public Adm. 2023, 69, 204–220. [Google Scholar] [CrossRef]

- Easter, K.W.; Rosegrant, M.W.; Dinar, A. Formal and Informal Markets for Water: Institutions, Performance, and Constraints. World Bank Res. Obs. 1999, 14, 99–116. [Google Scholar] [CrossRef]

- Matinju, M.H.; Alizadeh, H.; Loch, A.; Aghaie, V. Analysis of social network effects on water trade in an informal water market. J. Clean. Prod. 2023, 425, 138917. [Google Scholar] [CrossRef]

- Khair, S.M.; Mushtaq, S.; Culas, R.J.; Hafeez, M. Groundwater markets under the water scarcity and declining watertable conditions: The upland Balochistan Region of Pakistan. Agric. Syst. 2012, 107, 21–32. [Google Scholar] [CrossRef]

- Foster, A.D.; Sekhri, S. Can Expansion of Markets for Groundwater Decelerate the Depletion of Groundwater Resource in Rural India? Working Paper; Population Studies and Training Center, Brown University: Providence, RI, USA, 2008. [Google Scholar]

- Kajisa, K.; Sakurai, T. Efficiency and equity in groundwater markets: The case of Madhya Pradesh, India. Environ. Dev. Econ. 2005, 10, 801–819. [Google Scholar] [CrossRef][Green Version]

- Kajisa, K.; Sakurai, T. Determinants of groundwater price under bilateral bargaining with multiple modes of contracts: A case from Madhya Pradesh, India. Jpn. J. Agric. Econ. 2003, 5, 1–11. [Google Scholar] [CrossRef]

- Steinmetz, A.M. Three Essays on Groundwater and Tenancy Contracts in Rural Economies. Ph.D. Thesis, University of Heidelberg, Heidelberg, Germany, 2003. [Google Scholar] [CrossRef]

- Razzaq, A.; Liu, H.; Zhou, Y.; Xiao, M.; Qing, P. The Competitiveness, Bargaining Power, and Contract Choice in Agricultural Water Markets in Pakistan: Implications for Price Discrimination and Environmental Sustainability. Front. Environ. Sci. 2022, 10, 917984. [Google Scholar] [CrossRef]

- Asghar, S.; Tsusaka, T.W.; Sasaki, N. Factors affecting farmers’ choice of tube well ownership in Punjab, Pakistan. In Natural Resource Governance in Asia: From Collective Action to Resilience Thinking; Ullah, R., Sharma, S., Inoue, M., Asghar, S., Shivakoti, G., Eds.; Elsevier: Amsterdam, The Netherlands, 2021; pp. 239–254. [Google Scholar]

- Strosser, P.; Kuper, M. Water Markets in the Fordwah/Eastern Sadiqia Area: An Answer to Perceived Inefficiencies in Canal Water Distribution? Technical Report Working Paper 30; International Irrigation Management Institute: Lahore, Pakistan, 1994. [Google Scholar]

- Fujita, K. The economics of water markets in Bangladesh: A case study of shallow tubewells. Asian Econ. J. 1995, 9, 129–144. [Google Scholar][Green Version]

- Shuvo, R.M.; Chowdhury, R.R.; Chakroborty, S.; Das, A.; Kafy, A.A.; Altuwaijri, H.A.; Rahman, M.T. Geospatially Informed Water Pricing for Sustainability: A Mixed Methods Approach to the Increasing Block Tariff Model for Groundwater Management in Arid Regions of Northwest Bangladesh. Water 2024, 16, 3298. [Google Scholar] [CrossRef]

- Enokela, S.O.; Salifu, E. Evaluation of groundwater quality for fadama irrigation lands in River Niger–Benue confluence of Lokoja–Nigeria. Int. J. Sci. Res. Publ. 2012, 2, 1–4. [Google Scholar][Green Version]

- Singh, O.P.; Kumar, M.D. Using Energy Pricing as a Tool for Efficient, Equitable and Sustainable Use of Groundwater for Irrigation: Evidence from Three Locations of India. In Managing Water in the Face of Growing Scarcity, Inequity and Declining Returns: Exploring Fresh Approaches; Kumar, M.D., Ed.; International Water Management Institute: Hyderabad, India, 2008; pp. 413–438. [Google Scholar]

- Saleth, R.M. Water markets in India: Economic and institutional aspects. In Markets for Water; Easter, K.W., Rosegrant, M.W., Dinar, A., Eds.; Springer: Boston, MA, USA, 1998; pp. 187–205. [Google Scholar]

- Razzaq, A.; Xiao, M.; Zhou, Y.; Liu, H.; Abbas, A.; Liang, W.; ur Rehman Naseer, M.A. Impact of Participation in Groundwater Market on Farmland, Income, and Water Access: Evidence from Pakistan. Water 2022, 14, 1832. [Google Scholar] [CrossRef]

- Manjunatha, A.V.; Speelman, S.; Chandrakanth, M.G.; Huylenbroeck, G.V. Impact of groundwater markets in India on water use efficiency: A data envelopment analysis approach. J. Environ. Manag. 2011, 92, 2924–2929. [Google Scholar] [CrossRef]

- Mukherji, A. The energy-irrigation nexus and its impact on groundwater markets in eastern Indo-Gangetic basin: Evidence from West Bengal, India. Energy Policy 2007, 35, 6413–6430. [Google Scholar] [CrossRef]

- Singh, D.R.; Singh, R.P. Structure, determinants and efficiency of groundwater markets in Western Uttar Pradesh. Agric. Econ. Res. Rev. 2006, 19, 129–144. [Google Scholar]

- Srivastava, S.K.; Kumar, R. Groundwater extraction for use efficiency in crop production under different water market regimes: A case study of Uttar Pradesh state (India). In Water Management in Agriculture: Lessons Learnt and Policy Implications; Meena, M.S., Singh, K.M., Bhatt, B.P., Eds.; Jaya Publishing House: Delhi, India, 2015; pp. 125–139. [Google Scholar]

- Mandal, M.A.S.; Parker, D.E. Evolution and Implications of Decreased Public Involvement in Minor Irrigation Management in Bangladesh; Research Report H016921; International Water Management Institute: Colombo, Sri Lanka, 1995. [Google Scholar]

- Rajkhowa, P. From subsistence to market-oriented farming: The role of groundwater irrigation in smallholder agriculture in eastern India. Food Secur. 2024, 16, 353–369. [Google Scholar] [CrossRef]

- Diwakara, H.; Nagaraj, N. Negative Impacts of Emerging Informal Groundwater Markets in Peninsular India: Reduced Local Food Security and Unemployment. J. Soc. Econ. Dev. 2003, 5, 90–105. [Google Scholar]

- Bajaj, A.; Singh, S.P.; Nayak, D. Impact of water markets on equity and efficiency in irrigation water use: A systematic review and meta-analysis. Agric. Water Manag. 2022, 259, 107182. [Google Scholar] [CrossRef]

- Khara, D.S. Assessing the Functionality of Groundwater Markets in Green Revolution States of India: A Case Study of Punjab and Haryana. Millenn. Asia 2024, 09763996241295409. [Google Scholar] [CrossRef]

- Wada, Y.; van Beek, L.P.H.; Bierkens, M.F.P. Global depletion of groundwater resources. Geophys. Res. Lett. 2010, 37, L20402. [Google Scholar] [CrossRef]

- Aeschbach-Hertig, W.; Gleeson, T. Regional strategies for the accelerating global problem of groundwater depletion. Nat. Geosci. 2012, 5, 853–861. [Google Scholar] [CrossRef]

- Mukherji, A. Groundwater markets in Ganga–Meghna–Brahmaputra Basin: Theory and evidence. Econ. Political Wkly. 2004, 39, 3514–3520. [Google Scholar]

- Sharma, D.; Tiwari, P.; Chandel, S.S. Perspectives of solar photovoltaic water pumping for irrigation in India. Energy Strategy Rev. 2020, 29, 100494. [Google Scholar] [CrossRef]

- Scott, C.A.; Shah, T. Groundwater overdraft reduction through agricultural energy policy: Insights from India and Mexico. Int. J. Water Resour. Dev. 2004, 20, 149–164. [Google Scholar] [CrossRef]

- Bhanja, S.N.; Mukherjee, A.; Rodell, M.; Wada, Y.; Chattopadhyay, S.-L.; Velicogna, I.; Pangaluru, K.; Famiglietti, J.S. Groundwater recharge and depletion in northwestern India. Sci. Total Environ. 2019, 674, 255–265. [Google Scholar]

- Rajan, A.; Shah, A. Carbon footprint of India’s groundwater irrigation. Carbon Manag. 2020, 11, 265–280. [Google Scholar] [CrossRef]

- Qureshi, A.S.; Shah, T.; Akhtar, M. Managing salinity and waterlogging in the Indus Basin of Pakistan. Agric. Water Manag. 2008, 95, 1–10. [Google Scholar] [CrossRef]

- Bandyopadhyay, S.; Palrecha, A.; Dixit, A.M. Water in poverty alleviation (SDG 1). In Water Matters; Danert, K., Ed.; Elsevier: Amsterdam, The Netherlands, 2024; pp. 165–178. [Google Scholar] [CrossRef]

- Bajaj, A.; Singh, S.; Nayak, D.; Nagar, A. Economic perspectives on groundwater conservation: Insights from farmers in western Uttar Pradesh, India. Groundw. Sustain. Dev. 2025, 29, 101412. [Google Scholar] [CrossRef]

- Shah, T.; Bhatt, S.; Shah, R.K.; Talati, J. Groundwater Governance through Electricity Supply Management: Assessing an Innovative Intervention in Gujarat, India. Agric. Water Manag. 2008, 95, 1233–1242. [Google Scholar] [CrossRef]

- Fishman, R.; Lall, U.; Modi, V.; Parekh, N. Can electricity pricing save India’s groundwater? Field evidence from a novel policy mechanism in Gujarat. J. Assoc. Environ. Resour. Econ. 2016, 3, 819–855. [Google Scholar] [CrossRef]

- Gupta, D. Free power, irrigation, and groundwater depletion: Impact of farm electricity policy of Punjab, India. Agric. Econ. 2023, 54, 515–541. [Google Scholar] [CrossRef]

- Razzaq, A.; Liu, H.; Xiao, M.; Mehmood, K.; Shahzad, M.A.; Zhou, Y. Analyzing Past and Future Trends in Pakistan’s Groundwater Irrigation Development: Implications for Environmental Sustainability and Food Security. Environ. Sci. Pollut. Res. 2023, 30, 35413–35429. [Google Scholar] [CrossRef]

- Shah, T.; Singh, O.P.; Mukherji, A. Some aspects of South Asia’s groundwater irrigation economy: Analyses from a survey in India, Pakistan, Nepal Terai and Bangladesh. Hydrogeol. J. 2006, 14, 286–309. [Google Scholar] [CrossRef]

- Gupta, V.; Singh, S. Exploring the multiple dimensions of solar irrigation in South-Asian countries: Insights from a systematic review. Renew. Energy Focus 2025, 54, 100711. [Google Scholar] [CrossRef]

- Chatterjee, R. How state governance can offer a new paradigm to energy transition in Indian agriculture? Energy Policy 2024, 185, 113965. [Google Scholar] [CrossRef]

- Dhundi Saur Urja Sahkari Majdali (DSUUSM). Dhundi Solar Energy Producers’ Cooperative Society: Tri-Annual Report, 2015–18; Technical Report; Retrieved from CGSpace; International Water Management Institute: Colombo, Sri Lanka, 2019. [Google Scholar]

- Balasubramanya, S.; Garrick, D.; Brozović, N.; Ringler, C.; Zaveri, E.; Rodella, A.S.; Buisson, M.C.; Schmitter, P.; Durga, N.; Kishore, A.; et al. Risks from solar-powered groundwater irrigation. Science 2024, 383, 256–258. [Google Scholar] [CrossRef]

- Paranjothi, T.; Mishra, H.K. Dhundi Solar Pump Irrigators’ Cooperative: A Preliminary Study; Technical Report; Retrieved from ICA Asia and Pacific; International Cooperative Alliance—Asia and Pacific: New Delhi, India, 2018. [Google Scholar]

- Shah, T.; Durga, N.; Verma, S.; Rathod, R. Solar Power as a Remunerative Crop; Technical Report 10; Retrieved from IWMI-Tata; IWMI-Tata Water Policy Program: Anand, India, 2016. [Google Scholar]

- Dutt, A.; Krishnan, D.S. Mapping the Impacts of Solar Water Pumps on Farmers’ Lives: Building a Results Framework for Components A and C of Pradhan Mantri Kisan Urja Suraksha Evam Utthaan Mahabhiyan (PM-KUSUM); Working Paper; World Resources Institute: Washington, DC, USA, 2023. [Google Scholar] [CrossRef]

- Pasupalati, N.; Magal, A.; Subramanian, D.; Krishnan, D.S. Learnings for Tamil Nadu From Grid-Connected Agricultural Solar Photovoltaic Schemes in India; Working Paper; World Resources Institute: Washington, DC, USA, 2022. [Google Scholar] [CrossRef]

- Molle, F.; Closas, A. Groundwater metering: Revisiting a ubiquitous ’best practice’. Hydrogeol. J. 2021, 29, 1857–1870. [Google Scholar] [CrossRef]

- Ledger Insights. IBM, Freshwater Trust to Track Groundwater Using Blockchain. 2019. Available online: https://www.ledgerinsights.com/ibm-freshwater-trust-to-track-groundwater-using-blockchain/ (accessed on 9 June 2025).

- Chohan, U.W. Blockchain and Environmental Sustainability: Case of IBM’s Blockchain Water Management; Notes on the 21st Century (CBRI); SSRN; CBRI: Roorkee, India, 2019. [Google Scholar]

- Environmental Science Associates. Groundwater Accounting Platform. Available online: https://esassoc.com/services/technology/esa-software-platforms/groundwateraccounting/ (accessed on 9 June 2025).

- Energy & Environment Partnership Programme in Southern and East Africa. The Solar RainMaker: A Pay-as-You-Grow Solar Powered Irrigation Solution. EEP S&EA Case Study Reg. 8043. 2017. Available online: https://eepafrica.org/documents/Case-Studies/sunculture.pdf (accessed on 9 June 2025).

- Agarwal, B.; Anthwal, P.; Mahesh, M. How Many and Which Women Own Land in India? Inter-gender and Intra-gender Gaps. J. Dev. Stud. 2021, 57, 1807–1829. [Google Scholar] [CrossRef]

- Theis, S.; Lefore, N.; Meinzen-Dick, R.; Bryan, E. What Happens After Technology Adoption? Gendered Aspects of Small-Scale Irrigation Technologies in Ethiopia, Ghana, and Tanzania. Agric. Hum. Values 2018, 35, 671–684. [Google Scholar] [CrossRef]

- Leder, S.; Sugden, F.; Raut, M.; Ray, D.; Saikia, P. Ambivalences of Collective Farming: Feminist Political Ecologies from Eastern India and Nepal. Int. J. Commons 2019, 13, 105–129. [Google Scholar] [CrossRef]

- Shrestha, G.; Uprety, L.; Khadka, M.; Mukherji, A. Technology for Whom? Solar Irrigation Pumps, Women, and Smallholders in Nepal. Front. Sustain. Food Syst. 2023, 7, 1143546. [Google Scholar] [CrossRef]

- Shah, T.; Durga, N.; Rai, G.P.; Verma, S.; Rathod, R. Promoting Solar Power as a Remunerative Crop. Econ. Political Wkly. 2017, 52, 14–19. [Google Scholar]

- Westermann, O.; Ashby, J.; Pretty, J. Gender and Social Capital: The Importance of Gender Differences for the Maturity and Effectiveness of Natural Resource Management Groups. World Dev. 2005, 33, 1783–1799. [Google Scholar] [CrossRef]

- Nasim, S.; Helfand, S.M.; Dinar, A. Groundwater Management under Heterogeneous Land Tenure Arrangements. Resour. Energy Econ. 2020, 62, 101198. [Google Scholar] [CrossRef]

- Somanathan, E.; Ravindranath, R. Measuring the marginal value of water and elasticity of demand for water in agriculture. Econ. Political Wkly. 2006, 41, 2712–2715. [Google Scholar]

- Nadeem, A.M.; Rafique, M.Z.; Bakhsh, K.; Makhdum, M.S.A.; Huang, S. Impact of socio-economic and water access conditions on life satisfaction of rural farmers in Faisalabad district of Pakistan. Water Policy 2020, 22, 686–701. [Google Scholar] [CrossRef]

- Araos, A.; Roco, L. Identifying the determinants of water rights price: The Chilean case. Water 2025, 17, 395. [Google Scholar] [CrossRef]

- Moore, S.; Hughes, D.M. Advanced metering infrastructure: Lifeblood for water utilities. J. AWWA 2008, 100, 64. [Google Scholar] [CrossRef]

- Mix, N.; Thompson, K.A. Improving water system resiliency and security: Advanced metering infrastructure. J. AWWA 2016, 108, E310–E317. [Google Scholar] [CrossRef]

- Mukherji, A.; Shah, T. Political ecology of groundwater: The contrasting case of water-abundant West Bengal and water-scarce Gujarat, India. Hydrogeol. J. 2006, 14, 392–406. [Google Scholar] [CrossRef]

- Wester, P.; Sandoval-Minero, R.; Hoogesteger, J. Assessment of the development of aquifer management councils (COTAS) for sustainable groundwater management in Guanajuato, Mexico. Hydrogeol. J. 2011, 19, 889–899. [Google Scholar] [CrossRef]

- López-Gunn, E. The Role of Collective Action in Water Governance: A Comparative Study of Groundwater User Associations in La Mancha Aquifers in Spain. Water Int. 2003, 28, 367–378. [Google Scholar] [CrossRef]

- Kumar, M.D.; Singh, O.P. Groundwater Management in India: Physical, Institutional and Policy Alternatives; Sage Publications: New Delhi, India, 2007. [Google Scholar]

- Fernández-Aracil, P.; Melgarejo-Moreno, J.; López-Ortiz, M.I. From private company to water user association and natural park over a century: The case of Riegos de Levante, Izquierda del Segura (Spain). Water 2021, 13, 680. [Google Scholar] [CrossRef]

- World Bank. Mexico—The ’COTAS’: Progress with Stakeholder Participation in Groundwater Management in Guanajuato (Report No. 38810); Technical Report; World Bank: Washington, DC, USA, 2004. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).