Carbon Pricing Strategies and Policies for a Unified Global Carbon Market

Abstract

1. Introduction

2. Literature Review

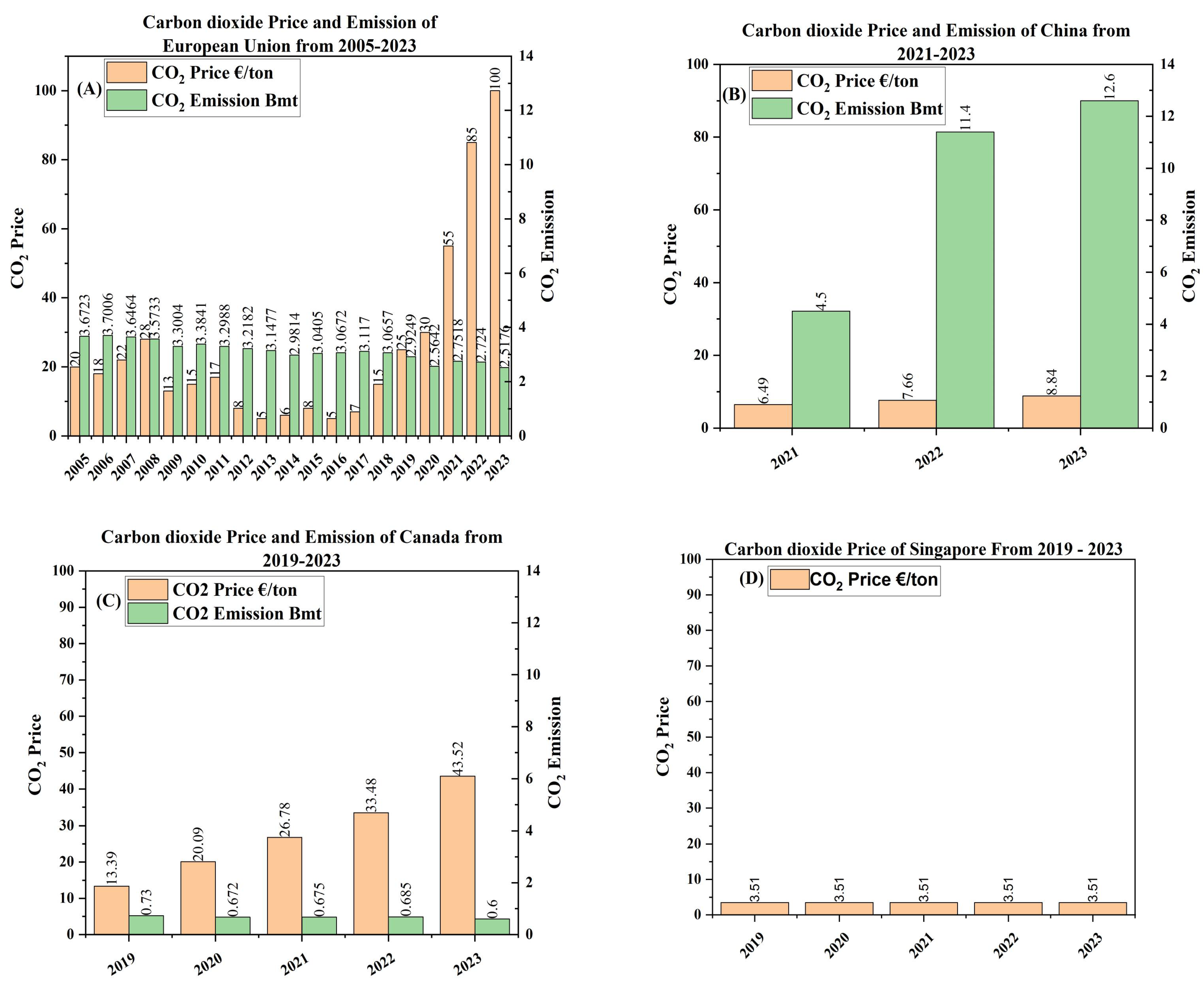

2.1. European Union

2.2. China

2.3. Canada

2.4. Singapore

3. Methods

3.1. Data Collection

- Quantitative Data:

- 2.

- Qualitative Data:

3.2. Calculation of CO2 Price to GDP per Capita Ratio

3.3. Justification for Indicator Selection

3.4. Data Analysis

4. Results and Discussion

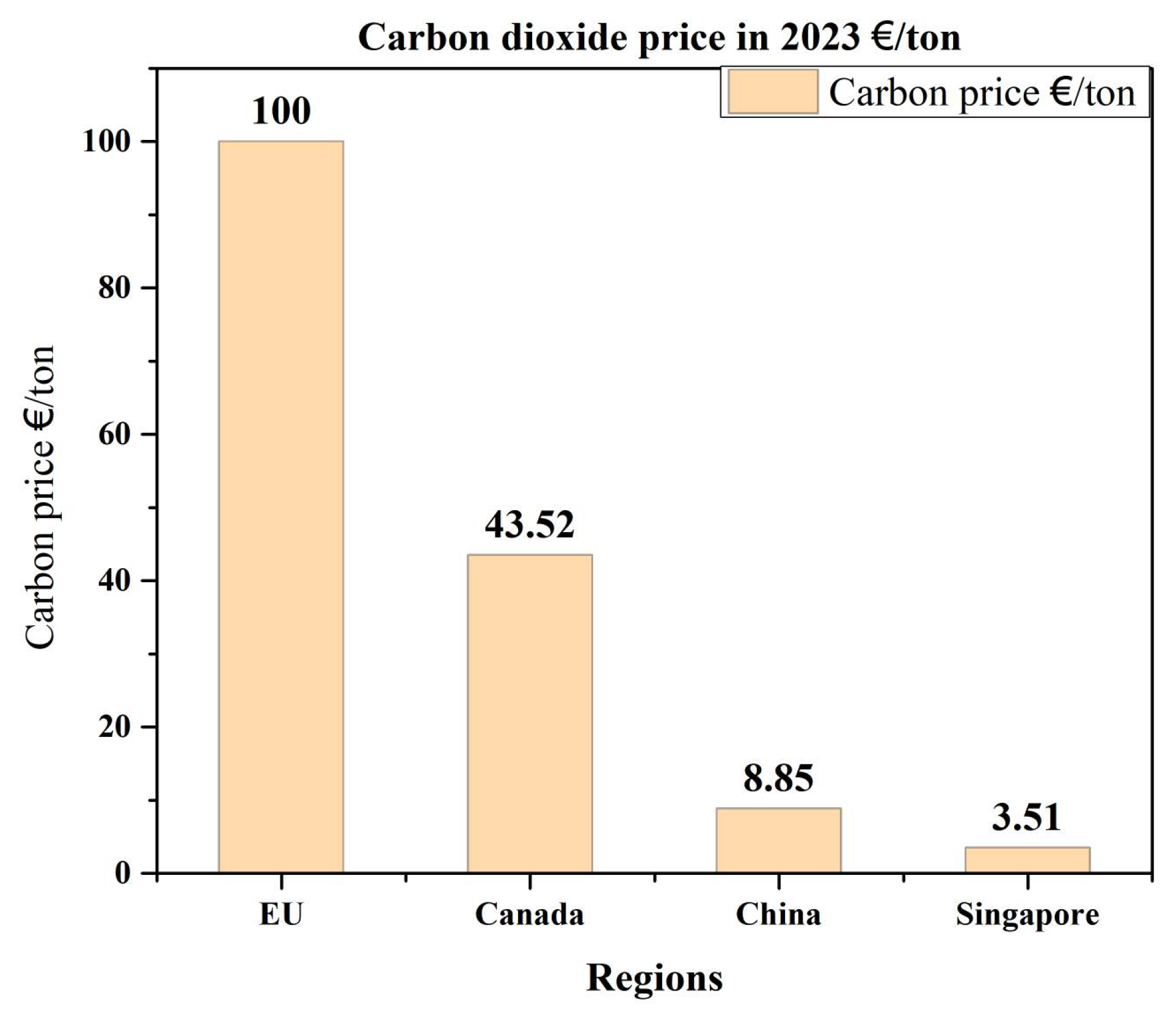

4.1. Carbon Pricing Mechanisms in the EU, China, Canada, and Singapore

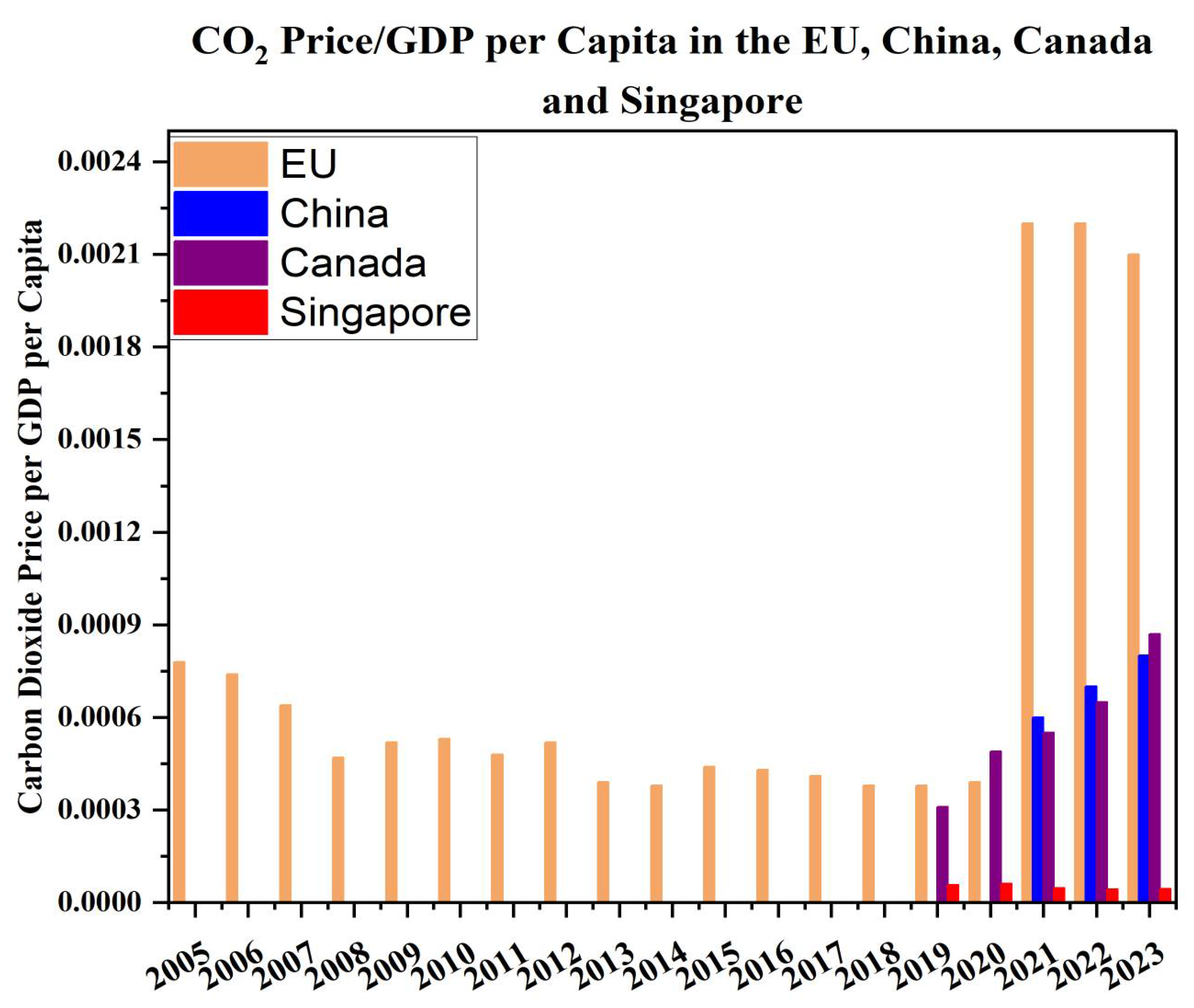

4.2. Carbon Price/GDP per Capita of the EU, China, Canada, and Singapore

4.2.1. GDP per Capita of the European Union from 2003 to 2023

4.2.2. GDP per Capita of China from 2021 to 2023

4.2.3. GDP per Capita of Canada from 2019 to 2023

4.2.4. GDP per Capita of Singapore from 2019 to 2023

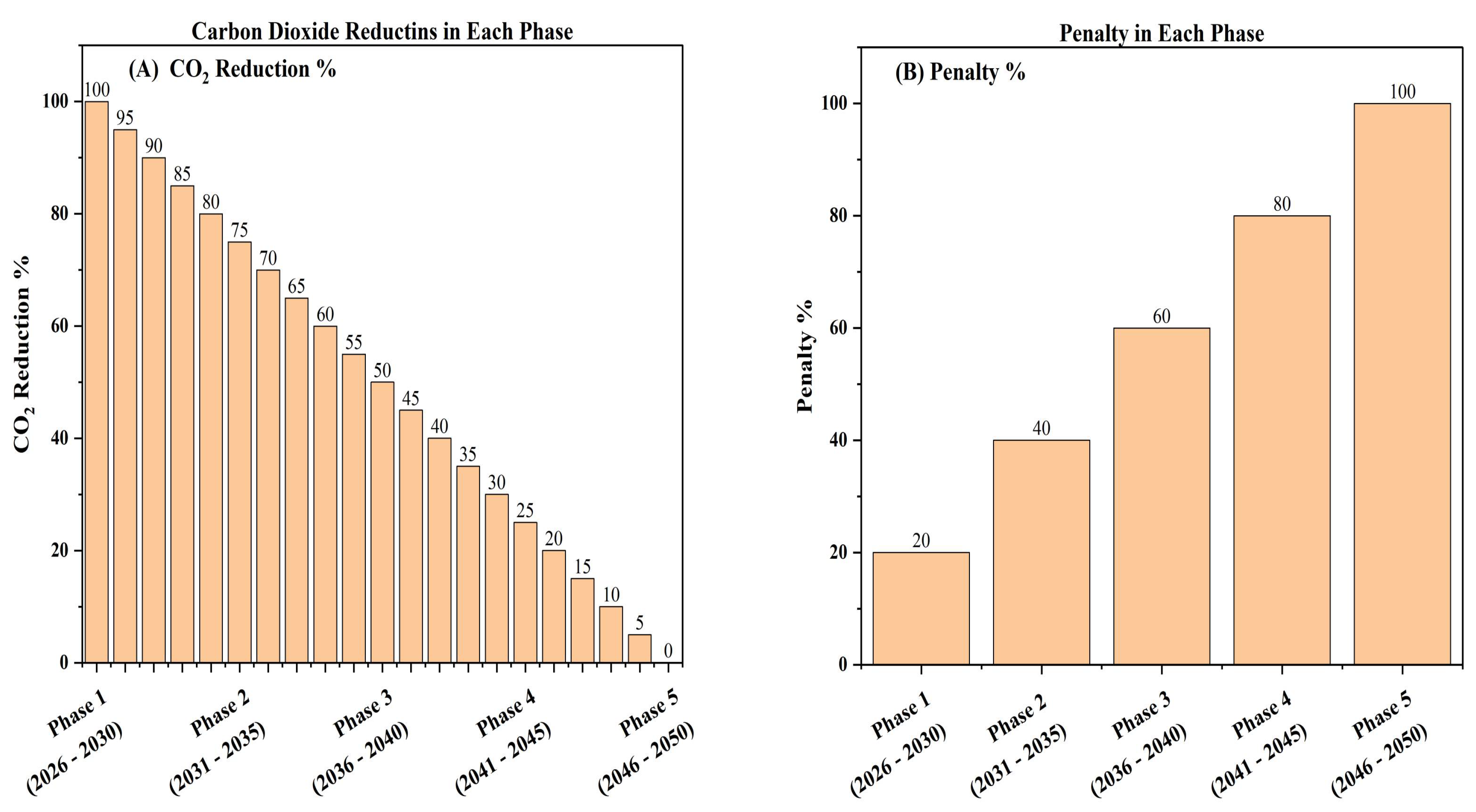

4.3. Recommendation

Structure for the Establishment of the Global Carbon Market

- 1.

- Uniform Carbon Pricing Mechanism

- Rules for Carbon Price Policy

- Phase 1: (2026–2030)

- Increase in Emissions: If emissions rise, the new carbon price = current carbon price + 5% of the current price + percentage increase in emissions.

- Emissions Equal to Last Year: If emissions remain the same, the new carbon price = current carbon price + 5% of the current price.

- Emissions Reduced by 5%: If emissions decrease by 5%, the carbon price remains unchanged for the new year.

- Emissions Reduced by More Than 5%: If emissions decrease by more than 5%, the new carbon price = current carbon price + 5% of the current price − total percentage of reduced emissions.

- Phase 2: (2031–2035)

- Increase in Emissions: If emissions rise, the new carbon price = current carbon price + 10% of the current price + percentage increase in emissions.

- Emissions Equal to Last Year: If emissions remain the same, the new carbon price = current carbon price + 10% of the current price.

- Emissions Reduced by 5%: If emissions decrease by 5%, the carbon price remains unchanged for the new year.

- Emissions Reduced by More Than 5%: If emissions decrease by more than 5%, the new carbon price = current carbon price − total reduction percentage + 5% of the current price.

- 2.

- Mandatory Carbon Emission Reduction (CER) Requirement

- Phase 1: Over 1600 tons/month

- Phase 2: Over 1300 tons/month

- Phase 3: Over 1000 tons/month

- Phase 4: Over 700 tons/month

- Phase 5: Over 400 tons/month

- 3.

- Penalty System for Non-Compliance

- Phase 1: Original price + 20%

- Phase 2: Original price + 40%

- Phase 3: Original price + 60%

- Phase 4: Original price + 80%

- Phase 5: Original price + 100%

4.4. Scenarios

4.4.1. Scenario 1: Exponential Carbon Price Increases Amid Stable or Rising Emissions

4.4.2. Scenario 2: Stable Carbon Pricing with Moderate Emission Reductions

4.4.3. Scenario 3: Dynamic Carbon Pricing with Enhanced Emission Reductions

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Okedele, P.O.; Aziza, O.R.; Oduro, P.; Ishola, A.O. Carbon pricing mechanisms and their global efficacy in reducing emissions: Lessons from leading economies. Open Access Res. J. Sci. Technol. 2024, 7, 114–125. [Google Scholar] [CrossRef]

- Digitemie, W.N.; Ekemezie, I.O. Assessing the role of carbon pricing in global climate change mitigation strategies. Magna Sci. Adv. Res. Rev. 2024, 10, 022–031. [Google Scholar] [CrossRef]

- Emeka-Okoli, S.; Otonnah, C.A.; Nwankwo, T.C.; Nwankwo, E.E. Review of carbon pricing mechanisms: Effectiveness and policy implications. Int. J. Appl. Res. Soc. Sci. 2024, 6, 337–347. [Google Scholar] [CrossRef]

- Simpa, P.; Solomon, N.O.; Adenekan, O.A.; Obasi, S.C. Strategic implications of carbon pricing on global environmental sustainability and economic development: A conceptual framework. Int. J. Adv. Econ. 2024, 6, 139–172. [Google Scholar] [CrossRef]

- Biresselioğlu, M.E.; Solak, B.; Savaş, Z.F. Framing the Impacts of the European Green Deal: Reflections on the EU as a “Normative Power” and Beyond. Ank. Avrupa Çalışmaları Derg. 2023, 23, 91–134. [Google Scholar] [CrossRef]

- Tkachuk, O. The European Union in its pursuit of being a global leader in climate neutrality. Glob. Policy 2024, 15, 69–74. [Google Scholar] [CrossRef]

- Wolf, S.; Teitge, J.; Mielke, J.; Schütze, F.; Jaeger, C. The European Green Deal—More than climate neutrality. Intereconomics 2021, 56, 99–107. [Google Scholar] [CrossRef]

- Wang, S.; Li, Q.; Fang, C.; Zhou, C. The relationship between economic growth, energy consumption, and CO2 emissions: Empirical evidence from China. Sci. Total Environ. 2016, 542, 360–371. [Google Scholar] [CrossRef]

- Byrne, J.; Shen, B.; Li, X. The challenge of sustainability: Balancing China’s energy, economic and environmental goals. Energy Policy 1996, 24, 455–462. [Google Scholar] [CrossRef]

- Cook, C.; Prystajecky, N.; Feze, I.N.; Joly, Y.; Dunn, G.; Kirby, E.; Özdemir, V.; Isaac-Renton, J. A comparison of the regulatory frameworks governing microbial testing of drinking water in three Canadian provinces. Can. Water Resour. J. 2013, 38, 185–195. [Google Scholar] [CrossRef]

- Watson, T.M.; Hyshka, E.; Bonato, S.; Rueda, S. Early-stage cannabis regulatory policy planning across Canada’s four largest provinces: A descriptive overview. Subst. Use Misuse 2019, 54, 1691–1704. [Google Scholar] [CrossRef] [PubMed]

- Doern, G.B.; Johnson, R. Rules, Rules, Rules, Rules: Multilevel Regulatory Governance; University of Toronto Press: Toronto, ON, Canada, 2006; Volume 26. [Google Scholar]

- Raihan, A.; Muhtasim, D.A.; Farhana, S.; Hasan, A.U.; Paul, A.; Faruk, O. Toward environmental sustainability: Nexus between tourism, economic growth, energy use and carbon emissions in Singapore. Glob. Sustain. Res. 2022, 1, 53–65. [Google Scholar] [CrossRef]

- Lau, H.C.; Ramakrishna, S.; Zhang, K.; Hameed, M.Z.S. A decarbonization roadmap for Singapore and its energy policy implications. Energies 2021, 14, 6455. [Google Scholar] [CrossRef]

- Ellerman, A.D.; Marcantonini, C.; Zaklan, A. The European Union emissions trading system: Ten years and counting. Rev. Environ. Econ. Policy 2016, 10, 89–107. [Google Scholar] [CrossRef]

- Egenhofer, C.; Alessi, M.; Georgiev, A.; Fujiwara, N. The EU Emissions Trading System and Climate Policy Towards 2050: Real Incentives to Reduce Emissions and Drive Innovation; CEPS Special Reports; Elsevier: Amsterdam, The Netherlands, 2011. [Google Scholar]

- Moya, J.A.; Boulamanti, A. Production Costs from Energy-Intensive Industries in the EU and Third Countries; Publications Office of the European Union: Luxembourg, 2016. [Google Scholar]

- Skjærseth, J.B.; Wettestad, J. The origin, evolution and consequences of the EU emissions trading system. Glob. Environ. Politics 2009, 9, 101–122. [Google Scholar] [CrossRef]

- Portal, T.E.R. European Carbon Price at an All-Time High; BNP Paribas: Paris, France, 2023. [Google Scholar]

- Statista, Energy & Environment. Carbon Dioxide Emissions in the European Union from 1965 to 2023 (in Million Metric Tons); Statista: Hamburg, Germany, 2024. [Google Scholar]

- Engels, A.; Knoll, L.; Huth, M. Preparing for the ‘real’market: National patterns of institutional learning and company behaviour in the European Emissions Trading Scheme (EU ETS). Eur. Environ. 2008, 18, 276–297. [Google Scholar] [CrossRef]

- Liu, J.-Y.; Zhang, Y.-J. Has carbon emissions trading system promoted non-fossil energy development in China? Appl. Energy 2021, 302, 117613. [Google Scholar] [CrossRef]

- Wang, C.; Wang, F. China can lead on climate change. Science 2017, 357, 764. [Google Scholar] [CrossRef]

- Kopra, S. A Responsible Developing Country: China’s National Image Building and International Negotiations on Climate. Q. J. Chin. Stud. 2013, 1, 121. [Google Scholar]

- Ding, G.; Deng, Y.; Lin, S. A study on the classification of China’s provincial carbon emissions trading policy instruments: Taking Fujian province as an example. Energy Rep. 2019, 5, 1543–1550. [Google Scholar] [CrossRef]

- Wang, H. Evaluating regional emissions trading pilot schemes in China’s two provinces and five cities. AGI Work. Pap. Ser. 2016, 2016, 1–51. [Google Scholar]

- Han, G.; Olsson, M.; Hallding, K.; Lunsford, D. China’s Carbon Emission Trading: An Overview of Current Development; Fores: Stockholm, Sweden, 2012. [Google Scholar]

- Lo, A.Y. Carbon emissions trading in China. Nat. Clim. Chang. 2012, 2, 765–766. [Google Scholar] [CrossRef]

- Mo, J.-L.; Agnolucci, P.; Jiang, M.-R.; Fan, Y. The impact of Chinese carbon emission trading scheme (ETS) on low carbon energy (LCE) investment. Energy Policy 2016, 89, 271–283. [Google Scholar] [CrossRef]

- Ni, L.; Li, J.; Xu, H.; Wang, X.; Zhang, J. Fraud feature boosting mechanism and spiral oversampling balancing technique for credit card fraud detection. IEEE Trans. Comput. Soc. Syst. 2023, 11, 1615–1630. [Google Scholar] [CrossRef]

- Yun, P.; Liang, X.; Jia, L.; Jiexin, Y.; Hongwei, L. Status and trend of global carbon pricing mechanism and its impacts on petroleum industry. China Pet. Explor. 2022, 27, 41. [Google Scholar]

- Wang, Q.; Wang, L.; Li, R. Trade protectionism jeopardizes carbon neutrality–decoupling and breakpoints roles of trade openness. Sustain. Prod. Consum. 2023, 35, 201–215. [Google Scholar] [CrossRef]

- He, J.; Li, Z.; Zhang, X.; Wang, H.; Dong, W.; Chang, S.; Ou, X.; Guo, S.; Tian, Z.; Gu, A.; et al. Comprehensive report on China’s long-term low-carbon development strategies and pathways. Chin. J. Popul. Resour. Environ. 2020, 18, 263. [Google Scholar] [CrossRef]

- Wang, K.; Wang, Z.; Xian, Y.; Shi, X.; Yu, J.; Feng, K.; Hubacek, K.; Wei, Y.-M. Optimizing the rolling out plan of China’s carbon market. Iscience 2023, 26, 105823. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. Does the different sectoral coverage matter? An analysis of China’s carbon trading market. Energy Policy 2020, 137, 111164. [Google Scholar] [CrossRef]

- Zhang, Z. China’s carbon market: Development, evaluation, coordination of local and national carbon markets, and common prosperity. J. Clim. Financ. 2022, 1, 100001. [Google Scholar] [CrossRef]

- IEA. CO2 Emissions in 2022; IEA: Paris, France, 2023; Available online: https://www.iea.org/reports/co2-emissions-in-2022 (accessed on 15 October 2024).

- Slater, H.; Shu, W.; Li, R. China Carbon Pricing Survey; ICF: Beijing, China, 2022. [Google Scholar]

- Insights, S.P.G.C. Commodities 2024: China’s Domestic Carbon Market set for Revamp; Article 6 in Limbo. 2024. Available online: https://www.spglobal.com (accessed on 15 October 2024).

- Chew, Y.E.; Gan, Z.W.; Heng, H.; Nair, P.N.S.B.; Tan, R.R.; Foo, D.C. Carbon emissions pinch analysis (CEPA) for emissions reduction and energy planning in Canada. Clean Technol. Environ. Policy 2023, 25, 2413–2431. [Google Scholar] [CrossRef]

- Gans, W.; Hintermann, B. Market effects of voluntary climate action by firms: Evidence from the Chicago Climate Exchange. Environ. Resour. Econ. 2013, 55, 291–308. [Google Scholar] [CrossRef]

- Martinez-Alier, J.; Temper, L.; Del Bene, D.; Scheidel, A. Is there a global environmental justice movement? J. Peasant. Stud. 2016, 43, 731–755. [Google Scholar] [CrossRef]

- Sabbaghi, O.; Sabbaghi, N. Carbon financial instruments, thin trading, and volatility: Evidence from the Chicago climate exchange. Q. Rev. Econ. Financ. 2011, 51, 399–407. [Google Scholar] [CrossRef]

- Vaillancourt, K.; Bahn, O.; Sigvaldason, O. The Canadian contribution to limiting global warming below 2 °C: An analysis of technological options and regional cooperation. In Limiting Global Warming to Well Below 2 °C: Energy System Modelling and Policy Development; Springer: Cham, Switzerland, 2018; pp. 227–244. [Google Scholar]

- Parry, I.W.; Mylonas, V. Canada’s carbon price floor. Natl. Tax J. 2017, 70, 879–900. [Google Scholar] [CrossRef]

- Government of Canada. Canada’s Preliminary Greenhouse Gas Emissions (1990–2023). 2025. Available online: https://www.canada.ca/en/environment-climate-change/services/climate-change/greenhouse-gas-emissions/inventory/preliminary-emissions-1990-2023.html (accessed on 15 October 2024).

- Zaman, S.; Howlett, M.; Migone, A. Regulating the wild west? Management consulting reform in Canadian government. Can. Public Adm. 2023, 66, 455–477. [Google Scholar] [CrossRef]

- Teague, F. Transitions to Belonging: Evaluating the Impacts of a Community-Based Physical Activity Program Through the Lens of Newcomer Youths’ Definitions of Mental Health. Master’s Thesis, Brock University, St. Catharines, ON, Canada, 2023. [Google Scholar]

- Böhringer, C.; Bye, B.; Fæhn, T.; Rosendahl, K.E. Output-based rebating of carbon taxes in a neighbour’s backyard: Competitiveness, leakage and welfare. Can. J. Econ. 2017, 50, 426–455. [Google Scholar] [CrossRef]

- Safton, R. Modeling Policy Pathways to Carbon Neutrality in Canada. Ph.D. Thesis, Simon Fraser University, Burnaby, BC, Canada, 2021. [Google Scholar]

- Pham, H.; Nguyen, V.; Ramiah, V.; Mudalige, P.; Moosa, I. The effects of environmental regulation on the Singapore stock market. J. Risk Financ. Manag. 2019, 12, 175. [Google Scholar] [CrossRef]

- NCCS. Carbon Tax. 2019. Available online: https://www.nccs.gov.sg/singapores-climate-action/mitigation-efforts/carbontax/ (accessed on 15 October 2024).

- Tseng, S. Appraising Singapore’s Carbon Tax Through the Lens of Sustainability; National University of Singapore: Singapore, 2022. [Google Scholar]

- David, D.; Yoshino, M.; Varun, J.P. Developing FinTech ecosystems for voluntary carbon markets through nature-based solutions: Opportunities and barriers in ASEAN. In Green Digital Finance and Sustainable Development Goals; Springer: Singapore, 2022; pp. 111–142. [Google Scholar]

- Gupta, P.; Muenkel, H. The Role of Financial Institutions and the Environment. In Peace with Nature: 50 Inspiring Essays on Nature and the Environment; World Scientific: Singapore, 2024; pp. 95–101. [Google Scholar]

- Woo, J. Gradations of organizational autonomy in Singapore: A comparison of the Monetary Authority of Singapore, Temasek Holdings, and the Development Bank of Singapore. Glob. Public Policy Gov. 2023, 3, 375–389. [Google Scholar] [CrossRef]

- CLIMATE WATCH Historical GHG Emissions. CO2 Emissions (Kt)—Singapore, 1990–2020; World Resources Institute: Washington, DC, USA, 2023; Available online: https://www.climatewatchdata.org/ghg-emissions (accessed on 15 October 2024).

- Macrotrends. European Union GDP per Capita 1960–2024. 2024. Available online: https://www.macrotrends.net (accessed on 15 October 2024).

- Macrotrends. China GDP per Capita 1960–2024. 2024. Available online: https://www.macrotrends.net (accessed on 15 October 2024).

- Macrotrends. Canada GDP per Capita 1960–2024. 2024. Available online: https://www.macrotrends.net (accessed on 15 October 2024).

- Macrotrends. Singapore GDP per Capita 1960–2024. 2024. Available online: https://www.macrotrends.net (accessed on 15 October 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Azizi, M.I.; Xu, X.; Duan, X.; Qin, H.; Xu, B. Carbon Pricing Strategies and Policies for a Unified Global Carbon Market. Atmosphere 2025, 16, 836. https://doi.org/10.3390/atmos16070836

Azizi MI, Xu X, Duan X, Qin H, Xu B. Carbon Pricing Strategies and Policies for a Unified Global Carbon Market. Atmosphere. 2025; 16(7):836. https://doi.org/10.3390/atmos16070836

Chicago/Turabian StyleAzizi, Mohammad Imran, Xize Xu, Xuehui Duan, Haotian Qin, and Bin Xu. 2025. "Carbon Pricing Strategies and Policies for a Unified Global Carbon Market" Atmosphere 16, no. 7: 836. https://doi.org/10.3390/atmos16070836

APA StyleAzizi, M. I., Xu, X., Duan, X., Qin, H., & Xu, B. (2025). Carbon Pricing Strategies and Policies for a Unified Global Carbon Market. Atmosphere, 16(7), 836. https://doi.org/10.3390/atmos16070836