Abstract

Technological innovation in the energy sector is highly needed to reduce carbon emission costs, which requires knowledge spillovers, financial development, and carbon pricing to achieve a green developmental agenda. The current study examines the role of knowledge innovations in achieving the environmental sustainability agenda under financial development and carbon pricing in a panel of 21 selected R&D economies from 1990 to 2018. The study constructed a composite index of financial development and knowledge innovation in the carbon pricing model. The results show that carbon pricing, a financial development index, innovation index, and energy demand fail to achieve stringent carbon reduction targets. A U-shaped relationship is found between carbon emissions and per capita income in the absence of a financial development index and trade openness. At the same time, this study shows the monotonic decreasing function in the presence of all factors. The causality estimates confirmed the feedback relationship between carbon pricing and carbon emissions, carbon pricing and the financial index, and the financial development index and innovation index. Further, the causality results established the carbon-led financial development and innovation, growth-led carbon emissions, and trade-led emissions, pricing, and financial development in a panel of selected countries. The estimates of the innovation accounting matrix (forecasting mechanism) confirmed the viability of the environmental sustainability agenda through carbon pricing, knowledge innovation, and financial development over a time horizon. However, these factors are not achievable carbon reduction targets in a given period. The study concludes that carbon pricing may provide a basis for achieving an environmental sustainability agenda through market-based innovations, green financing options, and improved energy resources. This would ultimately help desensitize carbon emissions across countries.

1. Introduction

The 21st joint session of the Conference of the Parties (COP-21) binds the legal agreement among nations to limit global warming to below 2 °C through global action plans by 2100. The dream of achieving sustainability in energy, agriculture, manufacturing, and services is promising to invest in ‘green economy’ projects at national and international levels. This is one way to limit GHG emissions by using the summit’s ‘climate fund’, which will decrease environmental resource depletion and achieve socio-economic objectives [1]. The public and private sectors may raise trillions of dollars as new investments to reach towards the COP-21 agenda; thus, ‘pricing carbon’ seems like an opportunity to open the windows of innovation and cut emissions to derive a low-carbon future [2]. The radical move towards climate solutions strengthens the country’s resource portfolio, preserving natural habitats and biodiversity [3]. The new technological advancement, sustainable energy sources, renewable fuels, and climate-smart agriculture practices would give healthier alternatives to transform environmental policies to become more inclusive and beneficial [4,5].

Distributed energy systems (DES) are essential for reducing adverse environmental externalities through innovative technologies and stringent environmental regulations to achieve emissions target, which helps to balance higher energy demand in the future. The higher need to prioritize DES in the national policy agenda help to centralize power systems. The optimization of DES in energy grids provides a free flow of electricity and reduces losses. The conventional energy resources are limited in supply and attach higher costs of carbon emissions. DES improve energy delivery systems and operations for managing electricity and its storage system to support a sustainable energy mix worldwide. There is a need for a global shift towards a sustainable resilience energy system that helps displace coal, gas, and oil resources with alternative sources of renewable energy, including solar panels and wind turbine manufacturing [6,7].

The earlier literature has widely documented the role of market-based innovation in a country’s economic growth (EG) and environmental resource agenda. However, no direct study is available in carbon cost modeling by including various innovation factors, financial development (FD) indicators, and carbon pricing factors. This study is unique because it included six diversified knowledge-based innovation factors, three broad-level FD indicators, and an exclusive carbon pricing factor. It would help to critically analyze the post-Paris agreement’s performance (COP-21) regarding climate change in a panel of 21 selected R&D countries. The study constructed a composite index for knowledge innovations and FD to assess their role in carbon mitigation agendas under carbon pricing modeling. The literature divides into three subsections. The first section shows the role of innovation in achieving the environmental sustainability agenda (ESA). The second section presents the viability of FD in carbon mitigation, and the third section discusses the importance of carbon pricing in resource mobilization and combating climate change. The study covers all three stated aspects in reviewing the past literature.

1.1. The Role of Innovations in Achieving the Environmental Sustainability Agenda

The importance of market-based innovations in achieving economic and environmental sustainability is widely documented in the earlier literature. At the same time, differences are mainly visible in the varied use of the innovation’s substitute factors in different economic settings [8,9]. For instance, Huisingh et al. [10] argued that technological innovations help reduce carbon emissions through improved energy, public policy monitoring, emission assessment, and defined carbon mitigating modeling. Thus, implementing a low-fossil carbon energy system is desirable to mitigate carbon emissions through stringent policy regulations. Irandoust [11] considered a Nordic countries’ case study to analyze the role of R&D innovations in the energy sector. He found that technological innovation positively correlated with renewable energy (RE) demand and the country’s EG that resulted impacted on achieving the sustainability agenda through a massive reduction in carbon emissions across countries. The results are based on Granger causality estimates and support the technology-led RE demand and EG across countries. Calel and Dechezleprêtre [12] concluded that the European Union Emissions Trading System (EU-ETS) mainly brings down GHG emissions via the intermediation of reinvesting carbon money on low-carbon innovation technologies. Thus, the ETS’s basis stands out as the primary antecedent that stimulates innovation across the region. Miao et al. [13] collected data from 21 emerging industrial segments in China between 2000 and 2015 to analyze the role of technology innovation in energy saving and emissions reduction targets. The results show that technology innovations achieved energy efficiency through public spending on developing new green products in the mediation of investment to reduce emissions treatment. The study concludes that emerging industries need to adopt optimal technological innovation to improve environmental quality through energy scale efficiency. Mensah et al. [14] explored the dynamic impact of innovations on carbon emissions in a panel of 28 OECD countries for the period 1990–2014. The results show that innovations improve environmental quality in RE sources, while continued EG and non-renewable energy (NRE) increase carbon emissions. Thus, the creation of economic and environmental policies is desirable to mitigate carbon emission through increased R&D spending in low-carbon technology. Du and Li [15] collected data from 71 globalized countries from 1992 to 2012 to analyze the role of EG, urbanization, industrial production, trade, and energy consumption on green innovation. The results show that high-income countries endow themselves with green technology innovation that helps to mitigate the more significant concern of emissions’ production. However, contrary to this, the results do not positively signify total factor carbon productivity through green innovation in low-income countries. Thus, the degree of patenting variation to mitigate emissions varied from high-income countries to low-income countries. Du et al. [16] verified the EKC hypothesis across a panel of 71 countries by using data from the years 1996–2012. They found an inverted U-shaped EKC relationship between carbon emissions and per capita income under green technology innovations. In contrast, the income factor is still dominant in technology–emissions modeling. Technology-intensive countries exert a more significant impact on mitigating carbon emissions, while technology-avoidant countries achieve less environmental benefit. Thus, the study modestly explained the technology behavior of high-income countries that devote more spending on environmental protection. The technology shift towards low-income countries is imperative for global prosperity. Balsalobre-Lorente et al. [17] surveyed the 17 OECD countries to analyze the technology–emissions nexus from 1990 to 2012. They found that continued EG, use of RE, and innovations improve environmental quality. Institutional factors linked with the innovation process are helpful to re-correct environmental policies for long-term sustainable development across countries. Parveen et al. [18] found that waste recycling and composting are severe issues in developing countries that mostly overlook the unavailability of adequate innovation technology while usually putting waste within landfill without any proper mechanism for the sorting or segregation of wastes, which causes global GHG emissions. Thus, strict environmental laws, green awareness campaigns, innovative mechanisms, and technological up-gradation would help manage solid waste to achieve the sustainability agenda. Khan et al. [19] concluded that technological innovation and financial development play an important role in optimizing energy resources, leading to green energy infrastructure across countries. Kihombo et al. [20] argued that technological innovation helps to reduce the human footprint on arable land and improves economic and environmental resources that are a way forward towards long-term collaboration in sustainable development initiatives worldwide. Qayyum et al. [21] found that green energy sources improved environmental quality via the mediation of technological advancements in cleaner production to achieve energy efficiency.

Based on concrete discussions, this study proposed a tentative statement in order to analyze it through empirical investigation, i.e.,

Hypothesis 1 (H1).

Innovations will be likely to improve environmental quality in stringent environmental regulations.

1.2. The Role of Financial Development in Carbon Cost Modeling

Financial development plays a crucial role in mitigating carbon emissions by disbursing loans for green technology innovation, sustainable production, and the utilization of RE projects. The earlier work mostly moves around the socio-economic and environmental factors of green financing with strategic wisdom and sustainable corporate policies [22]. For instance, Ghisetti et al. [23] argued that FD is imperative to stimulate innovations in the country’s economic agenda, translating into firm-level production where finance works as a catalyst to incentivize the producers to develop green policies through increased innovative capabilities. Moreover, environmental regulations and an unprecedented demand for green production would energize the process of sustainability that strengthens environmental innovations. Alam et al. [24] discussed the importance of FD in the environmental resource agenda. They concluded that FD is vital to mitigate carbon emissions. At the same time, there is a dire need to define green energy policies that catch up with finance and translate into improving environmental quality. Shahbaz et al. [25] examined the role of FD and energy-based innovations in carbon cost modeling by using data from 1955 to 2016 in the context of France. The results verify the ‘pollution haven’ hypothesis in the account of a positive relationship between FDI inflows and carbon emissions. At the same time, FD and energy-associated innovations improve environmental quality. Thus, they reasonably conclude the viability of ESA factors, which are imperative for green development. Ghisetti et al. [26] found that financial barriers restrain environmental innovation capabilities while placing further hurdles in the way of adopting cleaner production choices. Thus, there is a high need to improve the capital market to provide credit to firms to stimulate innovation capabilities in order to support environmental quality. Adams and Klobodu [27] identified the main determinants of environmental degradation in a panel of 26 African countries using data from 1985 to 2011. The results show that continued EG, rapid urbanization, low access to finance, and political uncertainty are the crucial factors that negatively impact environmental quality. Thus, environmental policies should plan to control urbanization, strengthen political factors, improve access to green finance, and ensure sustainable development. Pan et al. [28] considered a case study of Bangladesh to analyze the role of FD and technological innovation in achieving energy efficiency from 1976 to 2014. The results show that technological innovation works under FD, and trade amplifies energy intensity into a country’s high EG. The forecast relationship suggests that EG exerts a more significant influence on energy intensity in the shorter period, while this influence goes down in subsequent years. On the other hand, technological factors and trade openness stimulate associated energy innovations to reap economic payoffs under FD mediation. Thus, the more significant role of technological innovation cannot be ignored in the sound capital market to utilize credit in a better way to increase the energy efficiency level countrywide. Koçak and Ulucak [29] analyzed the role of energy-associated R&D spending in mitigating carbon emissions in a panel of 19 high-income OECD countries between 2003 and 2015. The results revealed that R&D spending on the power and storage sector vastly decreases carbon emissions stock, guided towards power stabilization reforms for energy storage through innovative technologies. Dauda et al. [30] analyzed the impact of innovations on carbon emissions in a panel of 18 diversified countries that represented BRICS countries, MENA countries, and G-6 countries from 1990 to 2016. The results verified the EKC hypothesis for BRICS countries, while the pollution haven hypothesis and energy-associated emissions were established across a panel of countries. The positive impact of innovation on mitigating carbon emissions is found in G-6 countries, while the negative impact of innovation on environmental quality is found in the MENA countries. Thus, it is evident that innovation capabilities varied across a panel of countries that translated into either a positive or negative impact based on a country’s specific income level and other structural attributes. Stringent environmental policies and an innovation infrastructure are desirable to attain ESA across countries. Yang et al. [31] argued that financial development and international remittances negatively influenced the environmental quality because of the easing of environmental regulations in BICS nations. Shen et al. [32] found that energy demand, natural resource rents, and financial development increased China’s carbon intensity, leading to worse economic output. The greenfield investment in the energy sector helps mitigate the carbon costs of pollution, which is a way forward towards cleaner technological progression in a country.

The above discussion confirms the importance of FD and innovations in the climate change agenda. Thus, the following hypothesis substantiates the finance–emissions nexus across a panel of R&D associated economies, i.e.,

Hypothesis 2 (H2).

FD will exert a positive impact on environmental quality through investment in knowledge innovations.

1.3. The Impact Assessment of Carbon Pricing on Environmental Pollution

Carbon pricing helps to restore economic activities under environmental policies backed by a pollution tax on dirty production and cutting GHG emissions through an emissions trading system. Thus, it stimulates innovation capabilities and provides cleaner options to conserve the environment. The earlier work presented diverse aspects of carbon pricing to achieve economic and environmental objectives across different economic settings. For instance, Rezaee et al. [33] proposed a network design for the green supply chain process to include a carbon pricing scheme in the modeling framework. They found positive insights between the carbon credit price and supply chain reconfiguration. Thus, the process suggests the viability of carbon pricing in the configuration of the supply chain process to deploy greening in the network to combat climate change. Kök et al. [34] suggested that RE stock would mitigate carbon emissions under the control of carbon pricing, which conveys that the energy market’s desirable pricing policies are pivotal to lessening negative environmental externality through green energy investment. Zeng et al. [35] analyzed the role of carbon pricing, coal prices, and economic development in Beijing, China. The results showed that carbon allowances would positively impact the country’s economic development, while coal prices substantially increasing carbon prices would help to secure the environment. The study concluded that carbon pricing is the sustainable policy instrument for restraining unsustainable economic activity corrected by imposing a pollution tax to achieve the sustainability agenda. Cong and Lo [36] argued that emissions trading and environmental regulations could fix sustainability issues and improve market efficiency to eliminate market distortion forces through pricing policy schemes. Böhringer et al. [37] concluded that the imposition of a total carbon tax on traded goods would amplify GHG emissions rather than cut them due to shifting the economic burden of the developed world’s climate policies to developing countries. Thus, there is a high need to improve climate policies’ global cost-effectiveness to impose carbon pricing for environmental resource conservation. Wang et al. [38] surveyed the possible impact of carbon pricing on poor rural households and the transportation fuel sector. They found that carbon pricing burdens poor households most as they bear the costs from their total consumption. In contrast, carbon pricing is highly effective in transportation fuel as it progressively impacts the urban population primarily. The study concludes that revenue received from carbon pricing should be devoted to low-income households so that it can sustain their lives out of misery. Baloch et al. [39] concluded that financialization in the energy market encourages electricity production innovation that improves ecological indicators. Globalization helps to increase value-added innovation capabilities through the knowledge-sharing process, which helps cut GHG emissions in OECD countries. Lilliestam et al. [40] argued that carbon pricing is the subject of theoretical argument and its feasibility is limited on the practical side, which means there remains a need to prioritize environmental policies through stringent ecological regulations to mitigate carbon emissions worldwide.

There is limited work available on carbon pricing and mitigating emissions under financial and innovation factors, and thus, based on the given limitations, this study proposes a tentative statement to fill the literature gap by analyzing the pricing–emissions nexus through an empirical exercise focused on a panel of 21 selected R&D economies, i.e.,

Hypothesis 3 (H3).

Efficient carbon pricing is likely to achieve an environmental sustainability agenda by stimulating innovations and access to green finance.

1.4. Research Question(s), Objectives, and Contribution of the Study

Based on an extensive review of the literature, the study moves forward to the main research question, i.e., to what extent knowledge innovations and FD would help achieve the environmental sustainability agenda? The transmission mechanism through which innovations and FD could mitigate carbon emissions is the way of ‘carbon pricing’ that works under two fundamental principles. First, a ‘carbon tax’ imposed on dirty production raises carbon money to reinvest in environmental protection, conservation of forest ecology, and environmental awareness campaigns. These factors positively link to the different patent families, including trademark applications, patents, and industrial sustainable design applications. Secondly, the ‘emissions trading systems’ establishes a monetary price on GHG emissions to mitigate emissions within their pre-allocated carbon budget. Thus, putting a price on carbon pollution to bring down emissions is the basis for sufficient investment in cleaner production options for the sustained environment. The following research questions have been proposed in the light of the ESA that is imperative for long-term growth, i.e.,

- —

- Does market innovation fuel low-carbon drivers and stimulate clean technology options for the country’s economic growth?

- —

- Does carbon pricing provide the basis to mobilize financial investment and give economic incentives for clean development?

- —

- Does outcome-based climate financing associated with trade policies help scale GHG emissions to achieve environmental sustainability?

These questions provide the basis to develop the study’s objectives focused on a panel of 21 selected R&D economies, i.e.,

- (i)

- To examine the role of technological innovations and financial development in the carbon mitigation agenda.

- (ii)

- To analyze the impact of carbon taxes, trade openness, and energy demand on carbon emissions.

- (iii)

- To substantiate the EKC hypothesis across countries.

- (iv)

- To determine the causality and inter-temporal relationship between the variables.

The stated objectives and research questions provide a foundation to combat climate changes achieved through energy efficiency. The panel cointegrating regression is employed to obtain parameter estimates. At the same time, the VAR approach is used to decompose the stated relationship in detecting causal and inter-temporal relationships between the variables.

The study has a novel contribution to carbon–finance–innovation modeling from different perspectives. First, the study constructed a composite index of FD by using three substitute factors that were previously used as a single regressor in the carbon–financing modeling, i.e., money supply [41], domestic credit to the private sector [42], and market capitalization [43]. The composite financial index served as a more comprehended factor that attributed many financial factors in a relative weighted form and derived the maximum potential of the impact of carbon cost modeling. Besides the financial index, the study further developed an innovation index with six constituent factors amalgamated to make a relative weighted factor, i.e., residents and nonresident industrial design applications, patent applications, and trademark applications. The earlier studies used different substitutes for constructing the innovation index [44,45,46,47], while this study broadly used these stated factors to make a knowledge innovations index that is assumed to be more comprehensive and efficient in carbon-financing modeling. The vital factor document in carbon cost modeling is the introduction of ‘carbon pricing’ in achieving ESA [48,49], including a carbon tax in reducing carbon emissions. Nevertheless, there are several challenges faced by the R&D economies to implement carbon pricing under political constraint factors [50], which are observed in this study by the inclusion of the country’s trade liberalization policies, energy demand, and EG. Thus, the creation of economic and environmental policies is deemed to be desirable to achieve energy efficiency through cleaner options [51].

2. Materials and Methods

The study used six innovation factors, three FD indicators, two environmental variables, and three growth-specific factors to analyze the dynamic linkages between innovations, FD, and environmental degradation in the context of 21 R&D countries for a period of 1990–2018. The innovation factors include nonresident and resident industrial design applications, patent applications, and trademark applications. FD factors include the broad money supply, domestic credit to the private sector, and market capitalization. The environmental and growth–specific factors include carbon emissions, carbon pricing, GDP per capita, energy demand, and trade openness. The earlier studies widely used the stated factors in different economic settings; for instance, Amin et al. [52] used different financialization factors in pollution damage function to assess the green developmental agenda. Khurshid et al. [53] used trademark applications and eco-patents in the carbon mitigation agenda to move towards cleaner technologies. Mundaca et al. [54] suggested carbon pricing as a sustainable instrument to improve international transportation. Ali et al. [55] assessed trade-induced carbon emissions and ecological footprints to support the EKC hypothesis. Based on the stated studies, the study considered the following variables in empirical illustrations. The study’s population is the entire world, where all countries are equally eligible to be selected as a sample. The study selected 21 economies as a sample based on greater R&D spending on environmental protection. Table 1 shows the list of sample countries for ready reference.

Table 1.

List of Sample Countries by R&D Spending.

The data of the variables are collected from the World Bank [56]. The missing data are filled by succeeding and preceding values of the same variables where required. Table 2 shows the list of variables for ready reference.

Table 2.

List of Variables.

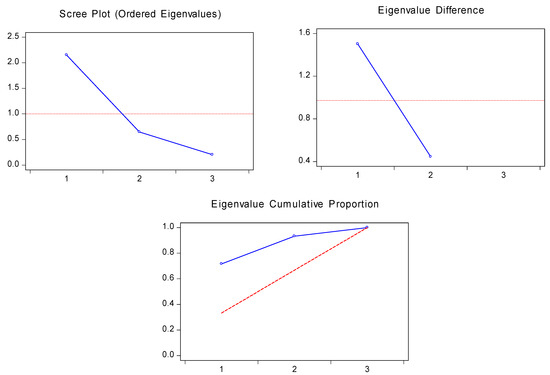

Table 3 shows the construction of the relative weighted index for FD and innovations by the PCA matrix. The statistics show that in the FD index (FINDEX) construction, the first Principal Component (PC) value has an eigenvalue more than unity, i.e., 2.148, while the remaining two PC values are 0.647 and 0.203, respectively. Further, each FD factor has three vector loadings represented by PC1, PC2, and PC3. PC1 is considered the higher additive value that is used for making FINDEX.

Table 3.

Construction of FDINDEX and Innovation Index by Principal Components Analysis (PCA).

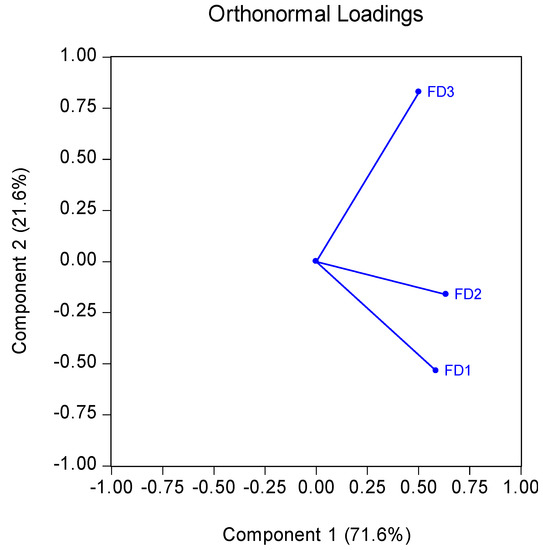

Table 3 shows the construction of a relative weighted index for innovations and found that out of 6 PCs, the first PC has a maximum eigenvalue of 4.448, followed by 0.889, 0.347, 0.214, 0.074, and 0.025 for PC2 to PC6, respectively. There were six vector loadings for INOVINDEX; however, we present only three vector loadings, as we considered PC1 a higher additive value to making an innovations index. Figure 1 shows the eigenvalue plots and vector loadings for FINDEX.

Figure 1.

Eigenvalue Plots and Loadings for FDINDEX. Source: Authors’ estimate.

The scree plot shows the ordered eigenvalue, which shows that only a single FINDEX factor is above the red dotted line. In contrast, the remaining two factors fall below the red dotted line with an eigenvalue less than unity. The second and third plots in the same figure show the eigenvalue differences and cumulative proportion of eigenvalue for the ready reference. The orthonormal loadings clearly show that the first component has a more significant percentage variance in the PCA, i.e., 71.6%, while component 2 exhibits only 21.6%. The remaining is a 6.5% percentage variation attributed to the third component not shown in the orthonormal loadings. Similarly, Figure 2 shows the eigenvalue plots and eigenvalue loadings for the construction of INOVINDEX. The scree plot shows that only a single component is above the dotted unity line, while the rest are less than unity and fall below the red dotted line. Subsequently, eigenvalue differences and their cumulative proportions are also reported in the same figure for ready reference. The orthonormal loadings in the same figure illustrate that component-1 has a more significant percentage variance, i.e., 74.1%, while component-2 has 14.8%. The remaining percentage variance in making INOVINDEX is attributed to the four other components that occupied a low variance.

Figure 2.

Eigenvalue Plots and Loadings for INOVINDEX. Source: Author’s estimate.

Theoretical Consideration

The importance of FD in the resource conservation agenda is primarily discussed in the academic and research arena; however, the continued EG and trade liberalization policies hamper the ESA that increases carbon emissions stock across countries [57,58,59]. The previous literature widely used different FD indicators that support socio-economic and environmental factors in green financing. For instance, Tsaurai [60] used three different measures of FD in carbon emissions modeling, including broad money, domestic credit to the private sector, and domestic credit provided by the financial sector, and found that FD works as a mediator to influence carbon emissions under energy and macroeconomic factors. Bhuiyan et al. [61] used different bank dimensions, specific factors, including money supply and credit creation in resource conservation agendas, and concluded that financial factors help promote environmentally sustainable agendas across countries. Rahman et al. [62] constructed an FD index using five broad measures closely related to the bank-specific factors and monetary policy instruments in EKC modeling and confirmed green financing viability in the carbon mitigation agenda. Khan et al. [50] included money supply as an FD measure in natural disaster modeling and found significant linkages with countries’ socio-economic and environmental factors.

Innovation is another essential aspect that moderately impacts environmental quality. The previous literature predominantly used different innovation indicators in carbon mitigating agenda; for instance, Zhang et al. [63] presented four different types of innovation in order to improve environmental performance, i.e., (i) innovation performance measured by energy efficiency, (ii) innovation resources measured by R&D expenditures, (iii) knowledge innovations measured by patent applications, and (iv) innovation environment measured by pollution governance. Ganda [64] used different innovation investments in the carbon mitigating model and argued that R&D expenditures, R&D personnel, and patent rights have a differential impact on carbon emissions across countries. Similarly, the earlier studies primarily used different innovation formulations to achieve energy efficiency and ESA, i.e., R&D expenditures, environmental technology, and green products [65], eco-innovation and green R&D practices [66], technology-based innovation [67], low-carbon innovation [68], green patents [69], triadic patent family [70], and RE technology innovation [71].

Based on the above-cited studies, we developed an empirical model to analyze the dynamic interaction among innovation factors, FD factors, growth-specific factors, and their resulting impact on carbon emissions in a panel of 21 selected R&D countries. The study extended the Solow growth model [72], where the output (Y) depends upon capital (K), labor (L), energy (E), and technology (T). The resulting impact of these factor inputs leads to increased undesirable outcomes () in the form of carbon emissions (C); thus, the production function becomes as follows

Equation (1) shows that economic growth (Y) could be achieved by utilizing factor inputs. However, this increases environmental costs that are mitigated by imposing carbon pricing (P) on polluted industrial goods. Thus Equation (1) is re-modified in terms of carbon costs modeling where different country-specific macro-environmental factors account for carbon intensity to analyze the plausible and alternative hypotheses, i.e., (i) Environmental Kuznets Curve (EKC) hypothesis, (ii) Pollution Haven Hypothesis (PHH), (iii) capital associated emissions, and (iv) technology-driven carbon emissions hypothesis across a panel of selected countries. The capital is replaced with FD factors, while knowledge innovations substitute technology. Equation (2) shows the following form

where C shows carbon emissions, F shows financial development, P shows carbon pricing, E shows energy demand, I shows innovation, Y shows the country’s output, and N shows the number of countries.

Equation (2) shows that carbon emissions (and carbon abatement costs) will vastly increase when factors continue to support increasing the country’s output, affecting environmental quality. Thus, this equation provides the basis to empirically estimate the dynamics of knowledge innovations, FD, and carbon pricing in carbon costs modeling across a panel of selected countries, i.e.,

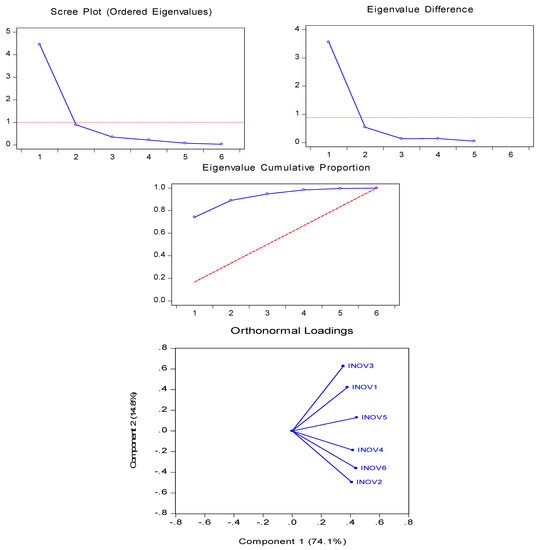

where CO2 shows carbon emissions, GDPPC shows GDP per capita, SQGDPPC shows a square of GDP per capita, FINDEX shows a composite index of FD, INOVINDEX shows a composite index of knowledge innovation, CPRICE shows carbon pricing, ENRG shows energy demand, TOP shows trade openness, ‘i’ shows a panel of selected countries (21 countries), and ‘t’ shows the period from 1990–2018.

Equation (3) shows that carbon emissions influence continued income, FD, knowledge innovations, carbon pricing, energy demand, and trade liberalization policies. The study evaluated the inverted U-shaped EKC relationship between carbon emissions and the country’s EG, as it is expected that the second-order coefficient value of GDP per capita would be negative, while, initially, it would be positive. Further, the study assumed a positive association between trade openness and carbon emissions to verify the ‘pollution haven’ hypothesis across countries. The knowledge innovations and FD are assumed to positively impact reducing the intensity level of carbon emissions that is further visible with the imposition of carbon pricing on dirty production. The impact of energy demand on carbon emissions is expected to increase the carbon emissions intensity with NRE. Figure 3 shows the research framework of the study for ready reference.

Figure 3.

Research Framework of the Study. Source: Author’s extraction from the previous literature.

Figure 3 shows that FD and knowledge innovations both have a differential impact on carbon emissions. Financial development is directed to reduce carbon emissions by adopting green financial instruments to support industrial production, ultimately supporting the country’s ESA of low carbon emissions; however, FD supports EG on the cost of carbon emissions. Thus, it would affect the sustainability agenda across countries. Similarly, knowledge innovations would positively or negatively impact carbon emissions via the two main mechanisms, i.e., first, knowledge innovations would help diffuse knowledge about environmental sustainability among the masses that help limit carbon emissions. In contrast, the second possible mechanism ignores environmental regulations to achieve economic gains; thus, it would increase carbon emissions. It is assumed that both the positive and negative outcomes are likely to get under the innovation–finance–carbon nexus across countries. The growth-specific factors, i.e., EG, energy demand, and trade openness, are expected to positively correlate with carbon emissions as continued EG, NRE, and trade liberalization policies would negatively impact environmental quality; thus, damaging ESA. Finally, carbon pricing would likely achieve desirable positive policy-oriented outcomes to limit carbon emissions across countries. The two-way linkages between the stated factors would be expected in the causal mechanism. Based on the research framework of the study, the study proposed three more research hypotheses for empirical analysis, i.e.,

Hypothesis 4 (H4).

It is assumed that an inverted U-shaped EKC relationship exists between carbon emissions and per capita income.

Hypothesis 5 (H5).

There is a likelihood that knowledge innovation, FD, and carbon pricing both will have a negative relationship with the carbon emissions to support the country’s environmental sustainability agenda.

Hypothesis 6 (H6).

Trade openness and energy demand will escalate carbon emissions to verify the ‘pollution haven’ hypothesis and energy-associated emissions.

To achieve the study objectives, the study employed the following schematic empirical techniques, which are discussed below:

(i) Panel Unit Root Summary: The four alternative panel unit root tests are used to assess the order of integrating the respective variables. The Levin, Lin, and Chu [73] (LLC) test follows the basis of ADF unit root test specification that assumes a standard unit root process with homogenous cross-section across the panel. While Im, Pesaran, and Shin [74] (IPS), ADF Fisher, and PP tests give alternative specifications that work in varied cross-sections across the panel with individual unit root processes. Thus, the flair of unit root tests give valuable insights to understand the variable’s unit root properties of de-trending across time and cross-sections. The general equation to test panel unit root tests is as follows

where m is the lag operator, xit is the deterministic vector terms and is the exogenous variable’s coefficients.

(ii) Panel Cointegration Tests: The study used panel cointegration tests to assess the long-run relationship between the stated variables. Pedroni’s residual cointegration test is based on ‘within dimensions’ and ‘between dimensions’ methods, while Kao residual is based on standard ADF statistics at the level. The Fisher cointegration test specifies the trace statistics and maximum eigenvalue statistics. These three methods imply whether the given model is accompanied by long-run linkages and cointegration processes between the variables. The acceptance of a cointegration relationship leads towards parameter estimates for sound policy inferences.

(iii) Panel Fully Modified OLS (FMOLS) Estimator: The panel FMOLS estimator was developed by Pedroni [75] in the account of rectification of the two main problems that are reasonably visible in the conventional OLS estimator, i.e., one of the issues is heterogeneity that is corrected by including individual-specific intercepts in the modeling framework, while the second issue is a serial correlation that is autocorrected by across individual cross-section identifiers in the panel of member countries. Thus, it minimizes the problem of spurious regression. The basic equation is as follows

where is a the covariance matrix ΩI, ΓI a weighted amount of autocovariances, with and . is an FMOLS estimator.

(iv) VAR Granger Causality and Innovation Accounting Matrix: This test works on VAR specification where the lag structure designates the block Exogeneity Wald tests in order to restrict the regressors and obtain causality estimates to support one out of three possible outcomes, i.e., (i) whether the two variables have a bidirectional relationship between them, (ii) whether there will be a unidirectional relationship between the variables, and (iii) whether there will be no causal relationship between the two variables. The innovation accounting matrix comprises impulse response function (IRF) and variance decomposition analysis (VDA). They work in VAR specification and occupy the regressors’ variance error shocks in the regressand’s inter-temporal settings for the following assigned time forecasting range. Both the tests help make policies to designate the factors in the unrestricted VAR mechanism.

3. Results

Table 4 shows the descriptive statistics of the candidate variables and found that FD_2 has a greater average value, i.e., 86.603% of GDP as compared to FD_1, i.e., 84.558% of GDP and FD_3, i.e., 81.479% of GDP. The composite FDINDEX falls in the range of values, a maximum of 3.624 and minimum of −2.309, with an average value of 0.002. The greater mean value is INOV_6 is 74,167.93, followed by INOV_4, i.e., 40,167.72, and INOV_2, i.e., 15,924.88, while, in terms of nonresident applications, the greatest value count is 29,072.22 for INOV_1, followed by INOV_3, i.e., 20,558.63, and INOV_5, 16,285.71. The INOVINDEX has a maximum of 7.702 and minimum of −0.403.

Table 4.

Descriptive Statistics.

Table 4 further shows that the mean value of GDP per capita, EUSE, and TOP is USD 19,381.48, 2799.604 kg of oil equivalent per capita, and 76.751% of GDP. The maximum value of CO2 emissions is about 20.178 metric tons per capita and a minimum value of 0.616 metric tons per capita, with an average value of 6.652 metric tons per capita. The CPRICE is about to reach 54.172% on average in a panel of countries over the period 1990–2018. The high carbon pricing generally shows the strict environmental regulations adopted by the panel of selected R&D economies, which further reinvest ‘carbon money‘ in clean, sustainable options to mitigate carbon abatement costs. Table 5 shows the summary results of the panel unit root test.

Table 5.

Summary of Panel Unit Root Tests.

The results show that, except CPRICE, the remaining variables have a unit root process among the prescribed panel unit root tests. For instance, CO2, EUSE, FDINDEX, and TOP are differenced stationary at the IPS, ADF, and PP unit root tests, while these variables are level stationary at the LLC unit root test. The GDP per capita and INOVINDEX are the first difference variables at all four prescribed unit root tests. However, the CPRICE exhibits the level stationary at the LLC, IPS, ADF, and PP unit root tests. However, we conducted another unit root test, i.e., the Breitung t-stat, and found that the given variable is first difference stationary. Thus, the overall results show that the given variables are differenced stationary in most panel unit root tests. Thus, there is a substantial need to use panel cointegration tests to see the long-run relationship between the variables. Table 6 shows three different panel cointegration test results for ready reference.

Table 6.

Estimates of Pedroni Residual Cointegration Test.

The results show that panel-PP and ADF statistics and group-PP and ADF statistics in Pedroni’s cointegration test are significant at the confidence interval’s 1% level. Thus, it has confirmed the 99% significance level, which exhibits the long-run and cointegrated relationship between the given model variables. The study further used the Kao cointegration test and confirmed the significance of ADF t-statistics. Thus, it shows the acceptability of the null hypothesis of the long-run relationship hold between the stated variables. Finally, the study used the Johansen Fisher panel cointegration test and found seven cointegrating equations in the trace test, while six cointegrating equations were found in the maximum eigenvalue test. Thus, it confirmed the cointegration relationship between the variables in the long run. Based on confirming the cointegration relationship between the variables, Table 7 shows the FMOLS estimates for the ready reference panel.

Table 7.

Panel FMOLS Estimates.

The results show a positive relationship between CPRICE and CO2 emissions in the absence of EUSE in the FMOLS-4 estimator, while in the remaining equations, the impact is not statistically significant. The result implies that a carbon tax imposition on dirty production is powerless to impact environmental quality positively. Thus, a high carbon pricing charge is not a desirable sustainable policy goal to mitigate carbon emissions. The earlier studies have documented the constraints of carbon pricing imposition in different socio-economic and environmental settings to achieve ESA. For instance, Bailey et al. [76] found that the carbon pricing scheme was not sufficient to address climate change issues due to the failure of policy design and structural issues that need strong legislation and effective political strategies to counter political opposition. Campiglio [41] argued that carbon pricing is necessary but does not address a sufficient condition of achieving carbon money to reinvest in cleaner production options. Thus, there is a substantial need to strengthen the capital market and macroeconomic policies to improve credit creation and its allocation in green financing projects, ultimately helping achieve the greening agenda. Jenkins [50]) concluded that carbon pricing policies are primarily influenced by the country’s political scene, and it is an environmental decision that needs to be overcome by making legislative mechanisms to improve economic, environmental, and climate policy designs. Andrew [77] emphasized the need to take re-corrective measures to improve associated environmental measures for designing an ‘emissions-trading system’ for climate change mitigation. Newman and Head [78] commented on ‘public policy failure’ that cannot translate positively into tackling associated environmental challenges. Thus, sound public policy that is powerful enough to combat climate change may achieve the sustainability agenda. Fang [79] concluded that market failure mainly impacts on climate change because an efficient carbon pricing scheme could limit high GHG emissions. However, it requires political will to proactively implement a carbon pricing scheme that would make the public more willing to pay more for public goods.

The study results show that EUSE positively impacts carbon emissions, implying that energy demand vastly increases carbon emissions. There needs to be more focus on initiating RE-associated projects to decarbonize the economy. Much scholarly work is available with a given perspective where the importance of RE sources is shown to desensitize carbon through sustainable energy policy options across countries. For instance, Naz et al. [80] highly promoted the importance of RE demand in mitigating carbon emissions in the presence of FDI inflows and continued EG. Zaman [81] emphasized the need to use wind–hydro–biofuel energy demand in order to promote green business. Apergis et al. [82] suggested the need to reinvest carbon money in healthcare infrastructure and RE-associated projects, which would help sustain the country’s EG. Emir and Bekun [83] found that RE demand is a sustainable energy option to mitigate carbon emissions by achieving energy efficiency. Pata [84] concluded that continued EG is the foremost factor that negatively affects environmental quality, followed by FD and urbanization. The results further highlight the importance of RE demand in achieving the ESA. However, there needs to be some serious policy changes to define energy resource abundance in a country and utilize them to impact environmental quality positively. Kabir et al. [85] discussed the importance of utilizing solar energy in economic, environmental, and institutional settings to achieve energy efficiency by reducing technical barriers.

4. Discussion

Technological innovation played a vital role in optimizing energy systems into renewable energy. Financial development and carbon pricing support cleaner technology infrastructure that reduces negative environmental externalities. A technological breakthrough in the energy sector is needed to decarbonize industrial production and meet global energy demand. The go for green energy policies are greatly needed to prioritize national energy systems coupling with cleaner technologies to move towards green development [86,87].

The study constructed a composite index of FD by a principal component matrix. The results show a positive relationship between FDINDEX and CO2 emissions, implying that FD is powerless to mitigate carbon emissions stock that needs macroprudential economic policies to strengthen the capital market to reduce carbon stocks. The earlier studies largely supported the argument in varied economic and environmental settings. For instance, Farhani and Ozturk [88] confirmed the positive relationship between FD and carbon emissions, an account of continued EG, energy demand, trade liberalization policies, and urbanization. Salahuddin et al. [89] suggested the need to improve FD indicators for mitigating carbon emissions by balancing electricity demand and investing in solar and wind energy utilization for combating environmental challenges. Ali et al. [90] discussed the global environmental challenges that increase over time due to unsustainable financial market instruments, which negatively impact environmental quality. The green financing agenda and sustainable energy fuels are legitimate policy drivers to attain the greening agenda across the globe. Hishan et al. [59] confirmed the ‘pollution haven’ hypothesis regarding the positive impact of FDI inflows on carbon emissions, sabotaging the United Nation’s ESA across countries. Thus, the development of an economic and financial policy mix is desirable to impact environmental quality positively.

The knowledge economy is diverse, and its impact is mostly positive on the country’s EG. This positivity turned back with the ESA when a mixture of growth-enhancing activities could be generated. The study results show that knowledge innovations (used here as a composite index of six innovation factors) positively correlate with carbon emissions in a panel of selected countries. The result implies that a knowledge economy stimulates the country’s EG at the cost of environmental degradation. Thus, innovations could combat environmental uncertainty through an increase in sustainable policy instruments across countries. The earlier studies supported the argument that innovation mechanisms should be eco-friendly and long-lasting. Li et al. [71] concluded that the innovations process should be green to ensure environmental sustainability. Hashmi and Alam [91] enforced the need for associated environmental reforms through which a carbon pricing scheme could efficiently control negative environmental externality in the form of high mass carbon emissions. Thus, knowledge innovations can take part in figuring out environmental challenges and would be able to mitigate carbon stocks. Ling Guo et al. [92] confirmed the viability of innovation indicators in achieving the ESA by mediating carbon regulations and sustainable regional growth. Costantini et al. [93] illustrated the positive linkages between eco-innovations and environmental performance through the right policy governance strategies.

Finally, the study results show a monotonic decreasing relationship between GDP per capita and carbon emissions in the FMOLS-1, 2, and 3 estimators. In contrast, the result exhibits the absence of FDINDEX and TOP U-shaped relationships between the two stated factors. Further, there is a negative relationship between TOP and CO2 emissions, rejecting the ‘pollution haven’ hypothesis across countries. The result implies that R&D economies invest highly in pollution-free traded goods that are less likely to witness dirty production across countries. Sustainable policy measures and green net exports are imperative to achieve the long-term sustainable development agenda across countries [94,95,96]. Table 8 shows the VAR Granger causality estimates for ready reference.

Table 8.

VAR Granger Causality Estimates.

The results show that a bidirectional causality exists between the following factors: (i) CO2 emissions and CPRICE, (ii) CO2 emissions and EUSE, (iii) CPRICE and FDINDEX, (iv) FDINDEX and GDPPC, and (v) GDPPC and TOP, while there is a unidirectional causality running from (i) CO2 emissions to FDINDEX, (ii) CO2 emissions to INOVINDEX, (iii) GDPPC to CO2 emissions, (iv) TOP to CO2 emissions, CPRICE, and FDINDEX, (v) EUSE to CPRICE, FDINDEX, and TOP, and (vi) INOVINDEX to FDINDEX. The rest of the variables showed no cause–effect relationship was established during the given period. The following results emerged from the casualty estimates:

(I) There is mutual coordination between carbon pricing and carbon emissions, as carbon emissions cause carbon pricing and carbon pricing cause carbon emissions. Thus, there is a need to invest carbon money in the resource conservation agenda for achieving environmental sustainability across countries.

(II) The causality estimates established the emissions-led financial and innovation hypothesis across countries.

(III) The growth-led emissions and trade-led emissions hypothesis is established under causality estimates.

(IV) The innovation-led FD hypothesis was verified to be under the carbon pricing mechanism, and

(V) Carbon pricing moves with FD while FD moves with the country’s per capita income, which shows FD is the key to both carbon pricing and economic growth in the long run.

These results would be helpful to propose sound policy inferences for long-term sustainable growth across countries. Table 9 shows the IRF estimates under VAR decomposition for ready reference.

Table 9.

IRF Estimates.

The results show that CPRICE and the country’s per capita income will mainly decrease carbon emissions stock for the next ten years, while EUSE, FDINDEX, and INOVINDEX will substantially increase CO2 emissions over time. TOP will first increase CO2 emissions from 2019 to 2026, then bring down the carbon stock for subsequent years. It is a likelihood that for the next 8- to 10-year-time-period, the FDINDEX and INOVINDEX will both increase CPRICE in a panel of selected countries. In addition, there will be a negative relationship between CPRICE and EUSE, while EUSE will positively correlate with FINDEX and INOVINDEX over time. The inter-temporal results further displayed that the FDINDEX will positively influence the INOVINDEX, TOP, and GDPPC. In contrast, the INOVINDEX will increase the country’s GDPPC and decrease TOP for the next ten years. Thus, this examination gives food for thought for decision makers to make future policies lean more towards green development. Finally, Table 10 reports the VDA estimates for ready reference.

Table 10.

VDA Estimates.

The results show that CPRICE will exert a more significant influence on CO2 emissions with a variance error shock of 3.041%, followed by INOVINDEX, 2.912%, FDINDEX, 1.506%, GDPPC, 1.226%, and EUSE, 0.196%. The least influence on CO2 emissions will be TOP with a magnitude of 0.067% for the next ten years. The FDINDEX will significantly influence CPRICE with a magnitude value of 2.068%, while the INOVINDEX will be less likely to influence CPRICE with a magnitude value of 0.003% over a time horizon. The CO2 emissions will strongly influence EUSE, while the country’s GDPPC will be the least influenced on EUSE in a selected country panel. There will be a more significant influence of a country’s GDPPC on the FDINDEX with a magnitude value of 1.487%, while CO2 emissions will influence the least influenced FDINDEX across countries. The FDINDEX will be the primary antecedent of the INOVINDEX to be influenced with a magnitude value of 1.174%. In contrast, TOP will be less likely to impact the INOVINDEX over a longer time period. Finally, CO2 emissions will largely be influenced by trade liberalization activities, while the INOVINDEX will be less likely to affect trade activities for the next ten years. Thus, the forecasting relationship needs policymakers to understand and observe the estimated relationships between the key factors and make them policy, accordingly, for long-term sustainable growth.

5. Conclusions and Policy Implications

This study examined the role of knowledge innovations, FD, and carbon pricing in achieving ESA by selecting a panel of 21 R&D-based economies from 1990 to 2018. The study employed a panel FMOLS estimator, VAR Granger causality, impulse response function, and variance decomposition analysis for robust inferences. The FMOLS results show that carbon pricing fails to achieve carbon reduction targets due to political constraints. Financial development and knowledge innovation on carbon emissions are positive in the weak governance system and market failures. The energy demand escalates carbon emissions due to the high use of NRE fueling to generate economic production. RE sources need to be explored to desensitize carbon emissions stock through abundant renewable resources in a country profile. The study does not verify the inverted U-shaped EKC hypothesis as the results show the monotonic decreasing relationship between carbon emissions and EG. Simultaneously, it is unable to verify the ‘pollution haven’ hypothesis as trade openness decreases carbon emissions in the panel of selected countries. The VAR Granger causality established the bidirectional relationship between (i) CPRICE and CO2 emissions, (ii) CPRICE and FDINDEX, and (iii) FDINDEX and GDPPC. The Granger causality estimates further established one-way linkages between the variables, CO2 emissions Granger cause FDINDEX and INOVINDEX; GDPPC Granger causes CO2 emissions; TOP Granger cause CO2 emissions, CPRICE, and FDINDEX in a panel of selected countries. The IRF estimates show that CPRICE and GDPPC will decrease CO2 when the FDINDEX and INOVINDEX positively impact CPRICE for the next ten years. The efficient carbon tax will decrease energy demand; however, knowledge innovations and FD would directly impact energy demand across countries. The FDINDEX will positively influence the INOVINDEX, TOP, and country’s GDPPC, while the INOVINDEX will further support the country’s EG over a time horizon. The VDA estimates show that CPRICE will exert a greater magnitude in influencing CO2 emissions with a variance shock of 3.041%. In comparison, CO2 emissions would have the least influence on TOP with a variance of 0.067% for the next ten years. The FDINDEX will have the most influence on the CPRICE, while the INOVINDEX will have the least influence on it. Carbon emissions will be the foremost factor that impacts EUSE and TOP. The inter-temporal (forecast) estimates provide the policymakers with the information to devise long-term sustainable policies, which are pivotal for achieving the ESA across countries.

Based on the study result, we propose the following set of strategic actions in order to devise long-term sustainable policies to combat global warming and manage the COP21 agenda for controlling the global average temperature in the range between 1.5–2 °C.

(i) Carbon market reforms are needed to achieve the environmental sustainability agenda by capitalizing on the international joint venture of environmental protection, national climate mitigating policies, regional drives, and local awareness campaigns. The stringent environmental regulations and polluter-pays principles would be likely to improve environmental quality. Carbon taxes and emissions-cap trading are the sustainable policy instruments to achieve zero net carbon emissions targets across countries.

(ii) The advancement in innovative technologies, clean energy drives, stringent carbon reduction targets, and environmental regulations would help counter climate change and manage global environmental challenges, including energy and non-energy emissions, waste deposition and recycling, material pricing, and land-use changes. The technological up-gradation and knowledge spillovers help decarbonize industrial production, leading to eco-patents for green production processes.

(iii) The carbon pollution pricing, cutting of GHG emissions, and energy-related mandates are desirable to stimulate eco-friendly technologies. The go for green energy policies would be helpful to achieve energy efficiency in the production processes. The incentive-based regulations and command-and-control mechanism are imperative for mitigating carbon emissions.

(iv) The power sector requires more policy-oriented actions to reduce further the costs of adaptation to renewable energy sources that could be met with the energy R&D innovation budget allocation. The distributed energy system manages global energy demand and meets the targets of carbon reduction through sustainable energy applications and processes, which supports the green growth agenda, and

(v) Financial openness could play a pivotal role in disbursing credit to enterprises to improve environmental quality during the production process, which adopts cleaner production technologies through financing in low-carbon technology innovation. The financialization in energy systems enables manufacturers to use alternative energy mixes in production to reduce negative environmental externalities.

These policies would help manage global average temperature as per the legally binding agreement made in the Paris Agreement (COP-21). Environmentalists are the stakeholders who need to design appropriate policies to manage the average global temperature of less than 2 °C. The following strategic actions are vital for achieving the green developmental agenda:

- Substituting non-renewable fuels with renewable energy to decarbonize industrial production.

- Financialization in the ecological resource market would be beneficial for conserving economic resources.

- Technological innovation helps to reduce carbon emissions and improve the supply chain process.

- Carbon taxes reduce carbon abatement costs and improve economic restructuring.

- Trade regulations are highly needed to limit polluting firms from dirty production.

Carbon pricing is necessary but not sufficient for mitigating GHG emissions; thus, there is a high need to embark on the development of sustainable innovation technologies and green financing options to transform environmental legislative reforms for environmental protection. The study is limited to 21 selected R&D economies that can be extended to some regional clusters of groups of countries, including BRICS, G-7 economies, GCC countries, Europe, and Asian countries. Further, the study can be extended by evaluating technology-induced carbon emissions to substantiate the ‘technology Kuznets curve’ across countries. Finally, the study may be extended by adding emissions-cap trading and renewable energy demand to achieve more green policy initiatives in many countries. The stated limitations of the study give a future direction to researchers to extend the given model to propose sound policy inferences at a global scale.

Author Contributions

Conceptualization, M.K.A. and S.A.; methodology, M.K.A. and S.A.; software, K.Z.; validation, A.A.N., M.H. and M.M.Q.A.; formal analysis, M.K.A., S.A., A.A.N., M.H., K.Z. and M.M.Q.A.; investigation, K.Z.; resources, M.K.A.; data curation, M.H.; writing—original draft preparation, M.K.A., S.A., A.A.N. and M.H.; writing—review and editing, M.K.A., S.A., A.A.N., M.H., K.Z. and M.M.Q.A.; visualization, K.Z.; supervision, M.K.A. and A.A.N.; project administration, M.K.A., S.A. and A.A.N.; funding acquisition, M.K.A. and A.A.N. All authors have read and agreed to the published version of the manuscript.

Funding

Researchers Supporting Project number (RSP-2021/87), King Saud University, Riyadh, Saudi Arabia.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data are freely available at World Development Indicators published by World Bank (2019) at https://databank.worldbank.org/source/world-development-indicators (accessed on 17 June 2021).

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

| COP-21 | 21st Conference of the Parties |

| DES | Distributed energy system |

| GHG Emissions | Greenhouse gas emissions |

| EG | Economic growth |

| FD | Financial development |

| R&D | Research and development |

| ESA | Environmental sustainability agenda |

| RE | Renewable energy |

| ETS | Emissions trading system |

| NRE | Non-renewable energy |

| EKC | Environmental Kuznets curve |

| EUSE | Energy use |

| TOP | Trade openness |

| CO2 emissions | Carbon dioxide emissions |

| CPRICE | Carbon pricing |

| PHH | Pollution haven hypothesis |

| FDINDEX | Financial development index |

| PCA | Principle component analysis |

| INOVINDEX | Innovation index |

| FMOLS | Fully Modified OLS |

| IRF | Impulse response function |

| VDA | Variance decomposition analysis |

| VAR | Vector autoregressive |

References

- FCS. COP21 Summit: Highlights and Key Takeaways. First Carbon Solutions, Newsletters, United States. 2016. Available online: https://www.firstcarbonsolutions.com/resources/newsletters/january-2016-cop21-summit-highlights-and-key-takeaways/cop21-summit-highlights-and-key-takeaways/ (accessed on 15 August 2019).

- World Bank. Carbon Pricing: Building on the Momentum of the Paris Agreement. Washington, DC, USA. 2016. Available online: https://www.worldbank.org/en/news/feature/2016/04/15/carbon-pricing-building-on-the-momentum-of-the-paris-agreement (accessed on 15 August 2019).

- Awan, U. Steering for Sustainable Development Goals: A Typology of Sustainable Innovation. In Industry, Innovation and Infrastructure. Encyclopedia of the UN Sustainable Development Goals; Filho, W.L., Azul, A.M., Brandli, L., Salvia, A.L., Wall, T., Eds.; Springer: Cham, Switzerland, 2020. [Google Scholar] [CrossRef]

- United Nations. UN Climate Action Summit. United Nation Climate Action Summit 2019. 2019. Available online: https://www.un.org/en/climatechange/un-climate-summit-2019.shtml (accessed on 15 August 2019).

- Cheng, Y.; Awan, U.; Ahmad, S.; Tan, Z. How do technological innovation and fiscal decentralization affect the environment? A story of the fourth industrial revolution and sustainable growth. Technol. Forecast. Soc. Chang. 2020, 162, 120398. [Google Scholar] [CrossRef]

- De Mel, I.; Demis, P.; Dorneanu, B.; Klymenko, O.; Mechleri, E.; Arellano-Garcia, H. Global Sensitivity Analysis for Design and Operation of Distributed Energy Systems. 30th European Symposium on Computer Aided Process Engineering. In Computer Aided Chemical Engineering; Pierucci, S., Manenti, F., Bozzano, G.L., Manca, D., Eds.; Elsevier: Amsterdam, The Netherlands, 2020; Volume 48, pp. 1519–1524. [Google Scholar]

- Chwieduk, D.; Bujalski, W.; Chwieduk, B. Possibilities of Transition from Centralized Energy Systems to Distributed Energy Sources in Large Polish Cities. Energies 2020, 13, 6007. [Google Scholar] [CrossRef]

- Awan, U.; Khattak, A.; Rabbani, S.; Dhir, A. Buyer-Driven Knowledge Transfer Activities to Enhance Organizational Sustainability of Suppliers. Sustainability 2020, 12, 2993. [Google Scholar] [CrossRef] [Green Version]

- Kanwal, N.; Awan, U. Role of Design Thinking and Biomimicry in Leveraging Sustainable Innovation. In Industry, Innovation and Infrastructure, Encyclopedia of the UN Sustainable Development Goals (UNSDGs); Leal Filho, W., Azul, A., Brandli, L., Lange Salvia, A., Wall, T., Eds.; Springer Nature: Cham, Switzerland, 2020. [Google Scholar] [CrossRef]

- Huisingh, D.; Zhang, Z.; Moore, J.C.; Qiao, Q.; Li, Q. Recent advances in carbon emissions reduction: Policies, technologies, monitoring, assessment and modeling. J. Clean. Prod. 2015, 103, 1–12. [Google Scholar] [CrossRef]

- Irandoust, M. The renewable energy-growth nexus with carbon emissions and technological innovation: Evidence from the Nordic countries. Ecol. Indic. 2016, 69, 118–125. [Google Scholar] [CrossRef]

- Calel, R.; Dechezlepretre, A. Environmental policy and directed technological change: Evidence from the European carbon market. Rev. Econ. Stat. 2016, 98, 173–191. [Google Scholar] [CrossRef] [Green Version]

- Miao, C.; Fang, D.; Sun, L.; Luo, Q.; Yu, Q. Driving effect of technology innovation on energy utilization efficiency in strategic emerging industries. J. Clean. Prod. 2018, 170, 1177–1184. [Google Scholar] [CrossRef]

- Mensah, C.N.; Long, X.; Boamah, K.B.; Bediako, I.A.; Dauda, L.; Salman, M. The effect of innovation on CO2 emissions of OCED countries from 1990 to 2014. Environ. Sci. Pollut. Res. 2018, 25, 29678–29698. [Google Scholar] [CrossRef]

- Du, K.; Li, J. Towards a green world: How do green technology innovations affect total-factor carbon productivity. Energy Policy 2019, 131, 240–250. [Google Scholar] [CrossRef]

- Du, K.; Li, P.; Yan, Z. Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technol. Forecast. Soc. Chang. 2019, 146, 297–303. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D.; Álvarez-Herranz, A.; Shahbaz, M. The Long-Term Effect of Economic Growth, Energy Innovation, Energy Use on Environmental Quality. In Energy and Environmental Strategies in the Era of Globalization; Springer: Cham, Switzerland, 2019; pp. 1–34. [Google Scholar]

- Parveen, N.; Singh, D.V.; Azam, R. Innovations in Recycling for Sustainable Management of Solid Wastes. In Innovative Waste Management Technologies for Sustainable Development; IGI Global: Hershey, PA, USA, 2020; pp. 177–210. [Google Scholar]

- Khan, A.; Chenggang, Y.; Hussain, J.; Kui, Z. Impact of technological innovation, financial development and foreign direct investment on renewable energy, non-renewable energy and the environment in belt & Road Initiative countries. Renew. Energy 2021, 171, 479–491. [Google Scholar]

- Kihombo, S.; Ahmed, Z.; Chen, S.; Adebayo, T.S.; Kirikkaleli, D. Linking financial development, economic growth, and ecological footprint: What is the role of technological innovation? Environ. Sci. Pollut. Res. 2021, 28, 61235–61245. [Google Scholar] [CrossRef] [PubMed]

- Qayyum, M.; Ali, M.; Nizamani, M.M.; Li, S.; Yu, Y.; Jahanger, A. Nexus between Financial Development, Renewable Energy Consumption, Technological Innovations and CO2 Emissions: The Case of India. Energies 2021, 14, 4505. [Google Scholar] [CrossRef]

- Awan, U.; Nauman, S.; Sroufe, R. Exploring the effect of buyer engagement on green product innovation: Empirical evidence from manufacturers. Bus. Strategy Environ. 2021, 30, 463–477. [Google Scholar] [CrossRef]

- Ghisetti, C.; Mazzanti, M.; Mancinelli, S.; Zoli, M. Do Financial Constraints Make the Environment Worse Off? Understanding the Effects of Financial Barriers on Environmental Innovations; Working Paper Series; SEEDS: Ferrara, Italy, 2015; 19p. [Google Scholar]

- Alam, A.; Azam, M.; Abdullah, A.B.; Malik, I.A.; Khan, A.; Hamzah, T.A.A.T.; Khan, M.M.; Zahoor, H.; Zaman, K. Environmental quality indicators and financial development in Malaysia: Unity in diversity. Environ. Sci. Pollut. Res. 2015, 22, 8392–8404. [Google Scholar] [CrossRef] [PubMed]

- Shahbaz, M.; Nasir, M.A.; Roubaud, D. Environmental degradation in France: The effects of FDI, financial development, and energy innovations. Energy Econ. 2018, 74, 843–857. [Google Scholar] [CrossRef] [Green Version]

- Ghisetti, C.; Mancinelli, S.; Mazzanti, M.; Zoli, M. Financial barriers and environmental innovations: Evidence from EU manufacturing firms. Clim. Policy 2017, 17 (Suppl. 1), S131–S147. [Google Scholar] [CrossRef]

- Adams, S.; Klobodu, E.K.M. Capital flows and economic growth revisited: Evidence from five Sub-Saharan African countries. Int. Rev. Appl. Econ. 2018, 32, 620–640. [Google Scholar] [CrossRef]

- Pan, X.; Uddin, M.K.; Han, C.; Pan, X. Dynamics of financial development, trade openness, technological innovation and energy intensity: Evidence from Bangladesh. Energy 2019, 171, 456–464. [Google Scholar] [CrossRef]

- Koçak, E.; Ulucak, Z.Ş. The effect of energy R&D expenditures on CO2 emission reduction: Estimation of the STIRPAT model for OECD countries. Environ. Sci. Pollut. Res. 2019, 26, 14328–14338. [Google Scholar]

- Dauda, L.; Long, X.; Mensah, C.N.; Salman, M. The effects of economic growth and innovation on CO2 emissions in different regions. Environ. Sci. Pollut. Res. 2019, 26, 15028–15038. [Google Scholar] [CrossRef]

- Yang, B.; Jahanger, A.; Ali, M. Remittance inflows affect the ecological footprint in BICS countries: Do technological innovation and financial development matter? Environ. Sci. Pollut. Res. 2021, 28, 23482–23500. [Google Scholar] [CrossRef]

- Shen, Y.; Su, Z.W.; Malik, M.Y.; Umar, M.; Khan, Z.; Khan, M. Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total Environ. 2021, 755, 142538. [Google Scholar] [CrossRef] [PubMed]

- Rezaee, A.; Dehghanian, F.; Fahimnia, B.; Beamon, B. Green supply chain network design with stochastic demand and carbon price. Ann. Oper. Res. 2017, 250, 463–485. [Google Scholar] [CrossRef]

- Kök, A.G.; Shang, K.; Yücel, Ş. Impact of electricity pricing policies on renewable energy investments and carbon emissions. Manag. Sci. 2016, 64, 131–148. [Google Scholar] [CrossRef] [Green Version]

- Zeng, S.; Nan, X.; Liu, C.; Chen, J. The response of the Beijing carbon emissions allowance price (BJC) to macroeconomic and energy price indices. Energy Policy 2017, 106, 111–121. [Google Scholar] [CrossRef]

- Cong, R.; Lo, A.Y. Emission trading and carbon market performance in Shenzhen, China. Appl. Energy 2017, 193, 414–425. [Google Scholar] [CrossRef] [Green Version]

- Böhringer, C.; Carbone, J.C.; Rutherford, T.F. Embodied carbon tariffs. Scand. J. Econ. 2018, 120, 183–210. [Google Scholar] [CrossRef]

- Wang, Q.; Hubacek, K.; Feng, K.; Guo, L.; Zhang, K.; Xue, J.; Liang, Q.M. Distributional impact of carbon pricing in Chinese provinces. Energy Econ. 2019, 81, 327–340. [Google Scholar] [CrossRef] [Green Version]

- Baloch, M.A.; Ozturk, I.; Bekun, F.V.; Khan, D. Modeling the dynamic linkage between financial development, energy innovation, and environmental quality: Does globalization matter? Bus. Strategy Environ. 2021, 30, 176–184. [Google Scholar] [CrossRef]

- Lilliestam, J.; Patt, A.; Bersalli, G. The effect of carbon pricing on technological change for full energy decarbonization: A review of empirical ex-post evidence. Wiley Interdiscip. Rev. Clim. 2021, 12, e681. [Google Scholar] [CrossRef]

- Campiglio, E. Beyond carbon pricing: The role of banking and monetary policy in financing the transition to a low-carbon economy. Ecol. Econ. 2016, 121, 220–230. [Google Scholar] [CrossRef] [Green Version]

- Boutabba, M.A. The impact of financial development, income, energy and trade on carbon emissions: Evidence from the Indian economy. Econ. Model. 2014, 40, 33–41. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Y.J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Grupp, H.; Schubert, T. Review and new evidence on composite innovation indicators for evaluating national performance. Res. Policy 2010, 39, 67–78. [Google Scholar] [CrossRef]

- Lee, S.Y.; Florida, R.; Gates, G. Innovation, human capital, and creativity. Int. Rev. Public Adm. 2010, 14, 13–24. [Google Scholar] [CrossRef]

- Makkonen, T.; van der Have, R.P. Benchmarking regional innovative performance: Composite measures and direct innovation counts. Scientometrics 2013, 94, 247–262. [Google Scholar] [CrossRef] [Green Version]

- Batool, R.; Sharif, A.; Islam, T.; Zaman, K.; Shoukry, A.M.; Sharkawy, M.A.; Gani, S.; Aamir, A.; Hishan, S.S. Green is clean: The role of ICT in resource management. Environ. Sci. Pollut. Res. 2019, 26, 25341–25358. [Google Scholar] [CrossRef]

- Tietenberg, T.H. Reflections—Carbon pricing in practice. Rev. Environ. Econ. Policy 2013, 7, 313–329. [Google Scholar] [CrossRef]

- Baranzini, A.; Van den Bergh, J.C.; Carattini, S.; Howarth, R.B.; Padilla, E.; Roca, J. Carbon pricing in climate policy: Seven reasons, complementary instruments, and political economy considerations. Wiley Interdiscip. Rev. Clim. Chang. 2017, 8, e462. [Google Scholar] [CrossRef] [Green Version]

- Jenkins, J.D. Political economy constraints on carbon pricing policies: What are the implications for economic efficiency, environmental efficacy, and climate policy design? Energy Policy 2014, 69, 467–477. [Google Scholar] [CrossRef]

- Zaman, K.; Moemen, M.A.E.; Islam, T. Dynamic linkages between tourism transportation expenditures, carbon dioxide emission, energy consumption and growth factors: Evidence from the transition economies. Curr. Issues Tour. 2017, 20, 1720–1735. [Google Scholar] [CrossRef]

- Amin, A.; Dogan, E.; Khan, Z. The impacts of different proxies for financialization on carbon emissions in top-ten emitter countries. Sci. Total Environ. 2020, 740, 140127. [Google Scholar] [CrossRef]

- Khurshid, A.; Rauf, A.; Calin, A.C.; Qayyum, S.; Mian, A.H.; Fatima, T. Technological innovations for environmental protection: Role of intellectual property rights in the carbon mitigation efforts. Evidence from western and southern Europe. Int. J. Environ. Sci. Technol. 2021. [Google Scholar] [CrossRef]

- Mundaca, G.; Strand, J.; Young, I.R. Carbon pricing of international transport fuels: Impacts on carbon emissions and trade activity. J. Environ. Econ. Manag. 2021, 110, 102517. [Google Scholar] [CrossRef]

- Ali, S.; Yusop, Z.; Kaliappan, S.R.; Chin, L. Trade-environment nexus in OIC countries: Fresh insights from environmental Kuznets curve using GHG emissions and ecological footprint. Environ. Sci. Pollut. Res. 2021, 28, 4531–4548. [Google Scholar] [CrossRef]

- World Bank. World Development Indicators; World Bank: Washington, DC, USA, 2019. [Google Scholar]

- Khan, H.U.R.; Zaman, K.; Usman, B.; Nassani, A.A.; Aldakhil, A.M.; Abro, M.M.Q. Financial management of natural resource market: Long-run and inter-temporal (forecast) relationship. Resour. Policy 2019, 63, 101452. [Google Scholar] [CrossRef]

- Khan, H.U.R.; Islam, T.; Yousaf, S.U.; Zaman, K.; Shoukry, A.M.; Sharkawy, M.A.; Gani, S.; Aamir, A.; Hishan, S.S. The impact of financial development indicators on natural resource markets: Evidence from two-step GMM estimator. Resour. Policy 2019, 62, 240–255. [Google Scholar] [CrossRef]

- Hishan, S.S.; Khan, A.; Ahmad, J.; Hassan, Z.B.; Zaman, K.; Qureshi, M.I. Access to clean technologies, energy, finance, and food: Environmental sustainability agenda and its implications on Sub-Saharan African countries. Environ. Sci. Pollut. Res. 2019, 26, 16503–16518. [Google Scholar] [CrossRef] [PubMed]