When Is Green Too Rosy? Evidence from a Laboratory Market Experiment on Green Goods and Externalities

Abstract

1. Introduction

2. Framing within Economic Experiments

3. Experimental Framework and Procedures

4. Results

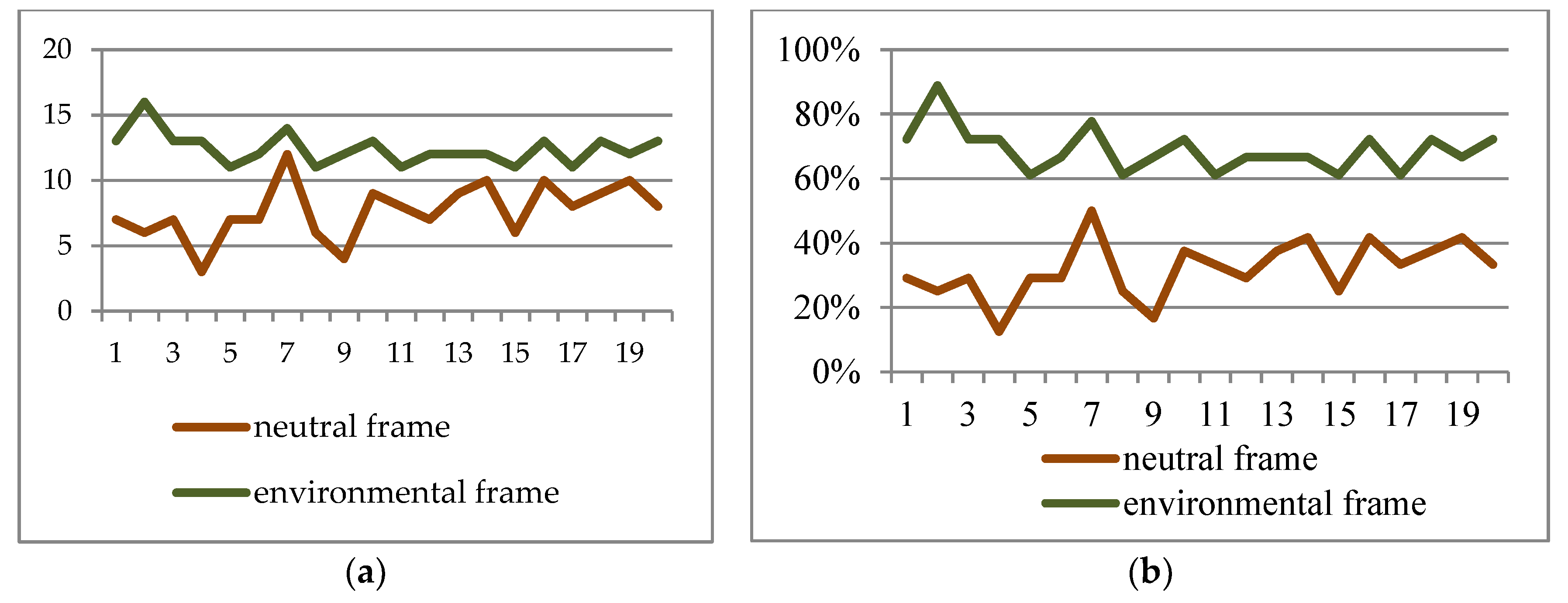

4.1. Market Outcomes

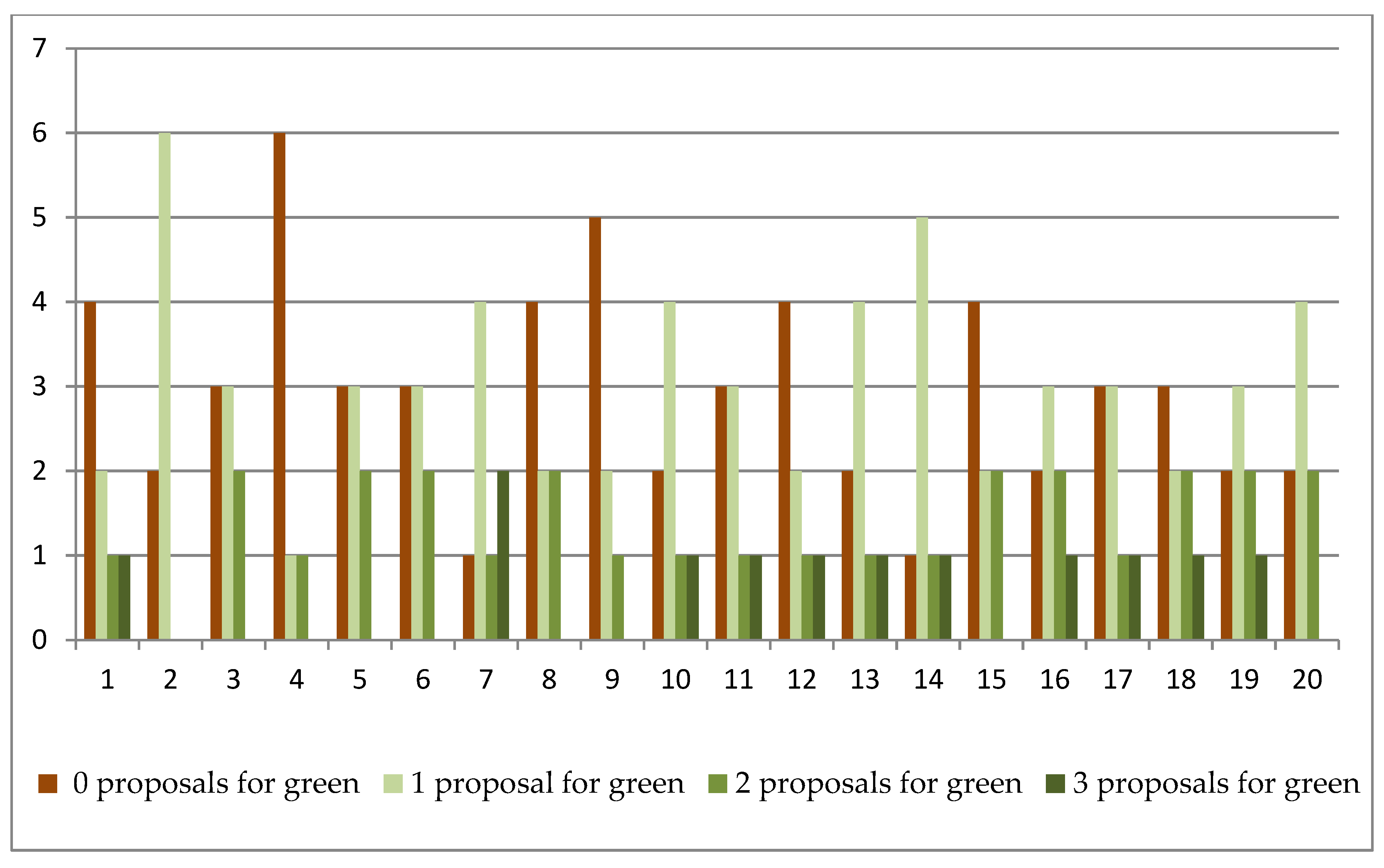

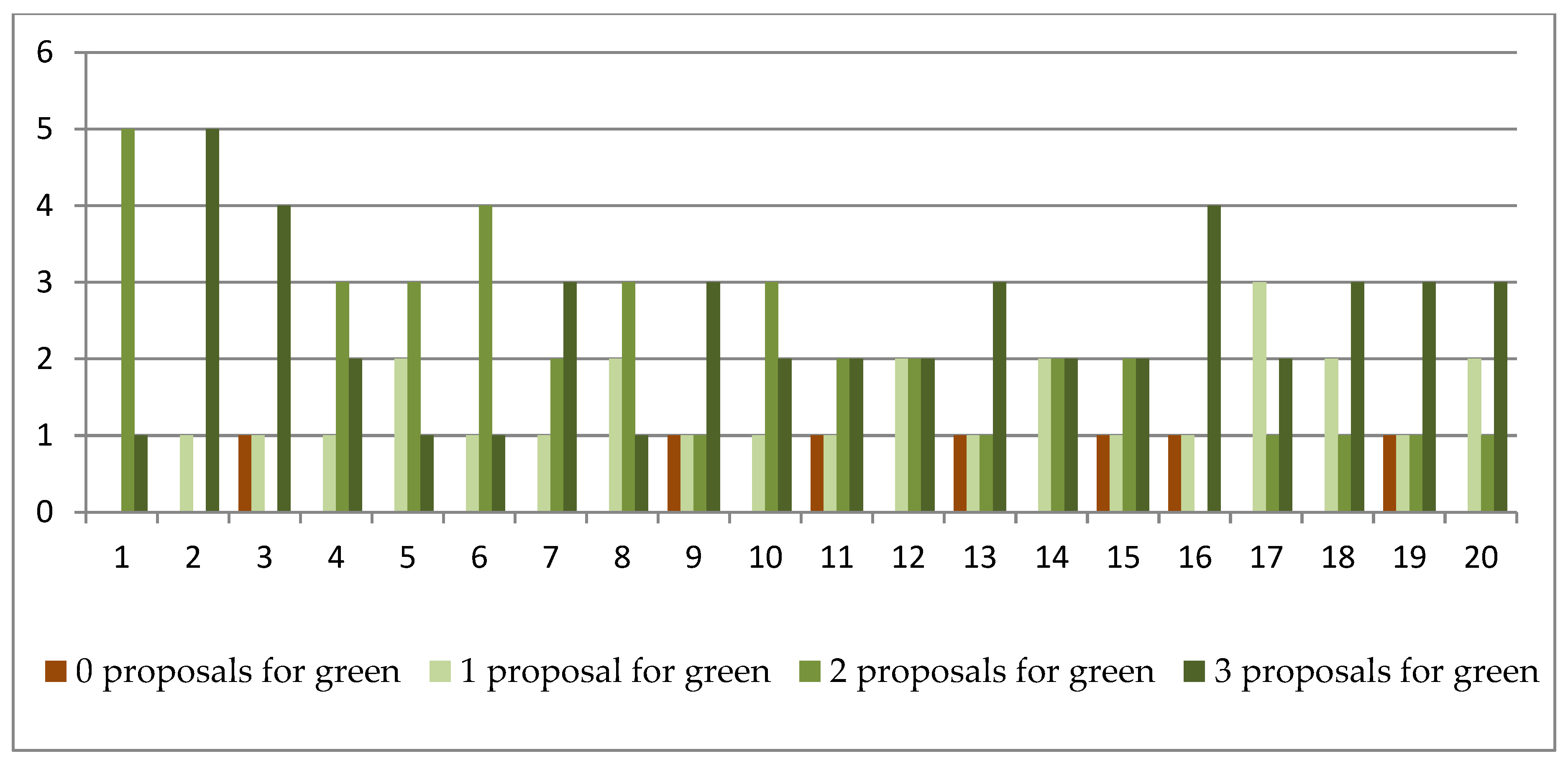

4.2. Supply Side Behaviour

4.3. Demand Side Behaviour

5. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Instructions for Treatment NEUTRAL FRAME

- If a Producer does not sell anything, his earnings for that period are Zero.

- If a Producer sells something, he receives the unit price minus the production cost per unit sold.

- If buyer buys one unit:

- If buyer does not buy one unit:

Appendix B. Instructions for Treatment ENVIRONMENTAL FRAME

- If a Producer does not sell anything, his earnings for that period are Zero.

- If a Producer sells something, he receives the unit price minus the production cost per unit sold.

- If buyer buys one unit:

- If buyer does not buy one unit:

References

- Mishan, E.J. The postwar literature on externalities: An interpretative essay. J. Econ. Lit. 1971, XXII, 1–28. [Google Scholar]

- Cropper, M.L.; Oates, W.E. Environmental economics: A survey. J. Econ. Lit. 1992, XXX, 675–740. [Google Scholar]

- Lancaster, K.J. A new approach to consumer theory. J. Political Econ. 1966, 74, 132–157. [Google Scholar] [CrossRef]

- Kotchen, M.J. Green markets and the private provision of public goods. J. Political Econ. 2006, 114, 816–834. [Google Scholar] [CrossRef]

- Cornes, R.; Sandler, T. The comparative static properties of the impure public good model. J. Public Econ. 1994, 54, 403–421. [Google Scholar] [CrossRef]

- OECD (Organisation for Economic Co-Operation and Development). Greening Household Behaviour: The Role of Public Policy; OECD Publishing: Paris, France, 2011. [Google Scholar]

- OECD (Organisation for Economic Co-operation and Development). Household Behaviour and the Environment: Reviewing the Evidence; 1997–0900; OECD Publishing: Paris, France, 2014. [Google Scholar]

- Selectra. Renewable Energy Supply Options in France. Available online: https://en.selectra.info/energy-france/guides/electricity-green-suppliers (accessed on 16 July 2018).

- NEF. Green Energy Supply Certification Scheme. Available online: http://www.nef.org.uk/service/search/result/green-energy-supply-certification-scheme (accessed on 16 July 2018).

- IFOAM (International Federation of Organic Agriculture Movements). Leading Change Organically—Consolidated Annual Report of IFOAM—Organics International; IFOAM: Bonn, Germany, 2017. [Google Scholar]

- NYT (New York Times). Flying Is Bad for the Planet. You Can Help Make It Better. Available online: https://www.nytimes.com/2017/07/27/climate/airplane-pollution-global-warming.html (accessed on 16 July 2018).

- European Commission. Flash Eurobarometer 367—Attitudes of Europeans towards Building the Single Market for Green Products; European Commission: Brussels, Belgium, 2013. [Google Scholar]

- Boulstridge, E.; Carrigan, M. Do consumers really care about corporate responsibility? Highlighting the attitude-behaviour gap. J. Commun. Manag. 2000, 4, 355–368. [Google Scholar] [CrossRef]

- Devinney, T.M.; Auger, P.; Eckhardt, G.M. The Myth of the Ethical Consumer; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Gleim, M.; Lawson, S.J. Spanning the gap: An examination of the factors leading to the green gap. J. Consumer Market. 2014, 31, 503–514. [Google Scholar] [CrossRef]

- European Commission. Special Eurobarometer 416—Attitudes of European Citizens towards the Environment; European Commission: Brussels, Belgium, 2014. [Google Scholar]

- Bartling, B.; Valero, V.; Weber, R. On the scope of externalities in experimental markets. Exper. Econ. 2017. [Google Scholar] [CrossRef]

- Bartling, B.; Weber, R.A.; Yao, L. Do markets erode social responsibility? Q. J. Econ. 2015, 130, 219–266. [Google Scholar] [CrossRef]

- Bougherara, D.; Piguet, V. Market behavior with environmental quality information costs. J. Agric. Food Ind. Org. 2009, 7. [Google Scholar] [CrossRef]

- Cason, T.N.; Gangadharan, L. Environmental labeling and incomplete consumer information in laboratory markets. J. Environ. Econ. Manag. 2002, 43, 113–134. [Google Scholar] [CrossRef]

- Plott, C.R. Externalities and corrective policies in experimental markets. Econ. J. 1983, 93, 106–127. [Google Scholar] [CrossRef]

- Alekseev, A.; Charness, G.; Gneezy, U. Experimental methods: When and why contextual instructions are important. J. Econ. Behav. Org. 2017, 134, 48–59. [Google Scholar] [CrossRef]

- Smith, V.L. Experimental economics: Induced value theory. Am. Econ. Rev. 1976, 66, 274–279. [Google Scholar]

- Tversky, A.; Kahneman, D. The framing of decisions and the psychology of choice. Science 1981, 211, 453–458. [Google Scholar] [CrossRef] [PubMed]

- Tversky, A.; Kahneman, D. Rational choice and the framing of decisions. J. Bus. 1986, 59, S251–S278. [Google Scholar] [CrossRef]

- Smith, V.L. Theory and experiment: What are the questions? J. Econ. Behav. Organ. 2010, 73, 3–15. [Google Scholar] [CrossRef]

- Levitt, S.D.; List, J.A. What do laboratory experiments measuring social preferences reveal about the real world? J. Econ. Perspect. 2007, 21, 153–174. [Google Scholar] [CrossRef]

- Harrison, G.W.; List, J.A. Field experiments. J. Econ. Lit. 2004, 42, 1009–1055. [Google Scholar] [CrossRef]

- Engel, C.; Rand, D.G. What does “clean” really mean? The implicit framing of decontextualized experiments. Econ. Lett. 2014, 122, 386–389. [Google Scholar] [CrossRef]

- Cason, T.N.; Raymond, L. Framing effects in an emissions trading experiment with voluntary compliance. In Experiments on Energy, the Environment, and Sustainability; Emerald Group Publishing Limited: Bingley, UK, 2011; pp. 77–114. [Google Scholar]

- Cookson, R. Framing effects in public goods experiments. Exper. Econ. 2000, 3, 55–79. [Google Scholar] [CrossRef]

- Pevnitskaya, S.; Ryvkin, D. Environmental context and termination uncertainty in games with a dynamic public bad. Environ. Dev. Econ. 2013, 18, 27–49. [Google Scholar] [CrossRef]

- Raymond, L.; Cason, T.N. Can affirmative motivations improve compliance in emissions trading programs? Policy Stud. J. 2011, 39, 659–678. [Google Scholar] [CrossRef]

- Holt, C.A. Industrial organization: A survey of laboratory research. Handbook Exp. Econ. 1995, 349, 402–403. [Google Scholar]

- Etilé, F.; Teyssier, S. Signaling corporate social responsibility: Third-party certification versus brands. Scand. J. Econ. 2016, 118, 397–432. [Google Scholar] [CrossRef]

- Rode, J.; Hogarth, R.M.; Le Menestrel, M. Ethical differentiation and market behavior: An experimental approach. J. Econ. Behav. Org. 2008, 66, 265–280. [Google Scholar] [CrossRef]

- Valente, M. Ethical differentiation and consumption in an incentivized market experiment. Rev. Ind. Organ. 2015, 47, 51–69. [Google Scholar] [CrossRef]

- Cartwright, E. A comment on framing effects in linear public good games. J. Econ. Sci. Assoc. 2016, 2, 73–84. [Google Scholar] [CrossRef]

- Fischbacher, U. Z-tree: Zurich toolbox for ready-made economic experiments. Exper. Econ. 2007, 10, 171–178. [Google Scholar] [CrossRef]

- Friedman, D.; Cassar, A. Economics Lab—An Intensive Course in Experimental Economics; Routledge: London, UK; New York, NY, USA, 2004. [Google Scholar]

- Cooper, D.J.; Kagel, J.H. Other-regarding preferences: A selective survey of experimental results. In The Handbook of Experimental Economics, Volume 2; Kagel, J.H., Roth, A.E., Eds.; Princeton University Press: Princeton, NJ, USA, 2016. [Google Scholar]

| Neutral Frame |

| In each market, in each period, fictitious goods will be traded. There are two types of goods available to be produced, Type A and Type B. Each producer will choose one type, propose a price and will be able to sell up to three units. Each buyer decides from whom to buy one unit. There are two types of goods which differ in their production costs and the fact that during production they may cause negative impacts on the earnings of buyers in the group:

|

| Environmental Frame |

| In each market, in each period, fictitious goods will be traded. There are two types of goods available to be produced, Green Goods and Brown Goods. Each producer will choose one type, propose a price and will be able to sell up to three units. Each buyer decides from whom to buy one unit. The two types of goods in this market have identical characteristics, in terms of quality and performance, therefore, are worth the same for consumers. However, the two goods differ in their production costs because of the technology used: either cleaner and more expensive technologies or polluting and cheaper techniques. Brown Goods are cheaper to produce but impact negatively on the environment through pollution and waste generation, which in turn has a negative effect on other individuals in society (due to health problems caused by pollution, for instance, or the adverse effects caused by the loss of environmental quality). For that reason, in this experiment, when a Brown Good is purchased, the earnings of the other buyers in a group are negatively affected. Green goods have higher production costs, but since they do not harm the environment, there is no negative impact on the other buyers in the group.

|

| Parameters | Green (A) | Brown (B) |

|---|---|---|

| (−) production cost | 50 | 40 |

| (−) externalities | 0 | 20 |

| (+) benefit | 100 | 100 |

| (=) net social benefit | 50 | 40 |

| Treatments | # Groups or Markets | # Subjects | # Sellers | # Buyers |

|---|---|---|---|---|

| neutral frame | 2 sessions × 4 groups | 48 | 24 | 24 |

| environmental frame | 2 sessions × 3 groups | 36 | 18 | 18 |

| Total | 14 | 84 | 42 | 42 |

| Treatment | Proposals | Market Share |

|---|---|---|

| neutral frame | 31.9% | 18.1% |

| environmental frame | 68.9% | 70.0% |

| Price green goods | N | Mean | sd | Min. | Max. |

| neutral frame | 87 | 53.3 | 4.3867 | 45 | 70 |

| environmental frame | 252 | 55.7 | 5.7568 | 44 | 80 |

| Price Brown goods | N | Mean | sd | Min. | Max. |

| neutral frame | 390 | 44.2 | 5.6504 | 20 | 65 |

| environmental frame | 106 | 44.3 | 4.9810 | 15 | 70 |

| VARIABLES | |

|---|---|

| Proposed price | −0.334 *** |

| (0.0371) | |

| Proposed Price * Environmental Frame | 0.221 *** |

| (0.0416) | |

| Lowest competitors’ price | 0.331 *** |

| (0.0368) | |

| Lowest Competitors’ Price * Environmental Frame | −0.292 *** |

| (0.0404) | |

| Green good proposed (1: yes 0: no) | 0.965 *** |

| (0.358) | |

| Green good proposed * Environmental Frame | 0.168 |

| (0.491) | |

| Relative green reputation | 0.175 *** |

| (0.0470) | |

| Relative Green Reputation * Environmental Frame | −0.0903 |

| (0.0642) | |

| Environmental Frame (1: yes 0: no) | 2.828 * |

| (1.578) | |

| Constant | 1.003 |

| (1.209) | |

| Observations | 840 |

| Number of subjects | 42 |

| VARIABLES | Green Announcements |

|---|---|

| Environmental Consciousness (1: yes 0: no) | 0.577 |

| (0.505) | |

| Environmental Consciousness * Environmental Frame | 0.142 |

| (1.195) | |

| Environmental Frame (1: yes 0: no) | 1.792 * |

| (1.041) | |

| Constant | −1.201 *** |

| (0.357) | |

| Observations | 840 |

| Number of subjects | 42 |

| VARIABLES | |

|---|---|

| Number of sellers announcing green | 0.470 |

| (0.352) | |

| Green units bought by other consumers (lagged) | 0.236 |

| (0.219) | |

| Lowest price for green good | −0.216 *** |

| (0.0593) | |

| Lowest price for brown good | 0.239 *** |

| (0.0581) | |

| Environmental consciousness | 1.228 |

| (0.928) | |

| Environmental Frame | 2.898 *** |

| (1.115) | |

| Constant | −2.460 |

| (2.452) | |

| Observations | 435 |

| Number of subjects | 42 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fernandes, M.E.; Valente, M. When Is Green Too Rosy? Evidence from a Laboratory Market Experiment on Green Goods and Externalities. Games 2018, 9, 70. https://doi.org/10.3390/g9030070

Fernandes ME, Valente M. When Is Green Too Rosy? Evidence from a Laboratory Market Experiment on Green Goods and Externalities. Games. 2018; 9(3):70. https://doi.org/10.3390/g9030070

Chicago/Turabian StyleFernandes, Maria Eduarda, and Marieta Valente. 2018. "When Is Green Too Rosy? Evidence from a Laboratory Market Experiment on Green Goods and Externalities" Games 9, no. 3: 70. https://doi.org/10.3390/g9030070

APA StyleFernandes, M. E., & Valente, M. (2018). When Is Green Too Rosy? Evidence from a Laboratory Market Experiment on Green Goods and Externalities. Games, 9(3), 70. https://doi.org/10.3390/g9030070