3.1. Separate GSP Auctions

We compare the efficiency of the auctions starting with the separate GSP auctions. For this auction, we first establish the existence of an equilibrium given that each buyer has already decided which of his connected seller’s auctions he will participate in. This Lemma is based on Theorem 2 of Edelman, Ostrovsky, and Schwarz [

7], which assumes a single seller with

.

Lemma 1. In each separate auction, there is a unique Bayes–Nash equilibrium where a buyer j who receives a good with priority position k will drop out of the auction at price for all and for when . In all other cases, . Any buyer j such that receives the good and receives priority position j; any buyer for which does not receive a good.

All proofs can be found in the Appendx

Appendix A.

Lemma 1 shows the existence of a unique equilibrium in each separate auction and provides the maximum bid a buyer will place (called the drop out bid). Notice that the agent with the largest valuation will stay in the auction the longest and will win the top priority position.

Next, we consider the efficiency of the separate GSP auctions. First, we show by Proposition 1 that there exists an efficient separate auction equilibrium. In Propositions 2 and 3, we give conditions under which the separate auction B-N equilibrium is inefficient, which is the result of an incorrect assignment of buyers to sellers’ auctions. If only one assignment of buyers to seller’s auctions is efficient and if the number of sellers is large, then most equilibria will be inefficient.

Proposition 1. There exists a feasible assignment of buyers to sellers in graph g such that the Bayes–Nash equilibrium of the separate auctions results in an efficient allocation of goods.

Proposition 1 ensures that there exists a separate auction equilibrium which is efficient. To see this, note that, in a given efficient allocation of goods, each buyer purchases from one particular seller. An efficient equilibrium is achieved in the separate auctions game, if each buyer is placed in his “correct” seller’s auction. Notice that if only one allocation is efficient and if there are many buyers and sellers, then it should be unlikely that each buyer is assigned to the correct auction. Although efficiency is always possible, it may be difficult to achieve in the separate auctions case.

Consider a buyer j with links to multiple sellers in g. Let all buyers in g have already decided which auctions to participate in except for buyer j. We say that j displaces if and if would win a unit in i’s auction if j does not participate in this auction and would not win a unit in i’s auction if j does participate in the auction.

Proposition 2. Let there exist a buyer j with multiple links in graph g and let all other buyers have already decided which auctions to participate in. Assume for all . Assume if j chooses to participate in ’s auction, then j displaces another buyer but j does not displace a buyer if he chooses any other auction. If j does not participate in ’s auction, the resulting B-N equilibrium of the separate auctions will result in an inefficient allocation of goods.

Proposition 2 gives conditions under which the separate auctions result in an inefficient equilibrium. Specifically, Proposition 2 considers the case where all items are sold. Here, efficiency requires that a buyer join an auction where he displaces another buyer rather than join an auction where he does not displace a buyer. If a buyer displaces another buyer, then, by Lemma 1, he must value the good more than the other bidders and efficiency requires that he ends up with the good, while if a buyer does not displace another buyer then he must value the good less and there is no efficiency gain from him joining this auction.

Proposition 3. Let there exist a buyer j with multiple seller links such that j displaces another buyer if he participates in any of these separate auctions. Assume that all other buyers have already decided efficiently which auctions to participate in. The resulting B-N equilibrium allocation will be efficient for j joining at least one seller’s auction and will be inefficient for j joining the remaining auctions.

Proposition 3 also gives conditions under which the separate auctions result in an inefficient equilibrium. Proposition 3 assumes that there is a buyer who always displaces another buyer no matter which auction he chooses. Efficiency requires that he choose the auction that will maximize social welfare, otherwise the resulting equilibrium will be inefficient. If the number of such sellers is large, then again it should be unlikely that efficiency is achieved.

Note that we assumed in Proposition 3 that all other buyers have already made the efficient choice of which auction to participate in. We could instead assume that some of these buyers had chosen to participate in an auction such that the resulting B-N equilibrium allocation would not be efficient regardless of j’s choice. Then, buyer j’s choice of which auction to join would still affect social welfare given the choices already made by the other buyers. It would still be the case that j’s joining at least one seller’s auction would maximize social welfare given the constraint of the choices made by the other buyers and joining any other auctions would not.

We consider an environment where a buyer is not able to accurately estimate which auction would be best and thus a buyer chooses which auction to participate in at random or with limited information. In the radio spectrum example, a cell phone customer may not know which other customers are currently in the proximity of a given tower and so does not know what his payoff would be from participating in a given auction.

Next, we formalize this by incorporating random first-stage assignments of auction participation into our analysis. Define the two-stage separate auction game as follows. In the first stage, each buyer randomly chooses to participate in one of his linked seller’s auctions. In the second stage, the separate auctions take place as described in

Section 2.

Corollary 1. In the two-stage separate auction game, there is a positive probability that the separate auctions results in an efficient allocation of goods.

Corollary 2. In the two-stage separate auction game, let there be a buyer j with multiple seller links such that j displaces another buyer if he participates in any of these separate auctions. There is a positive probability that the separate auctions results in an inefficient allocation of goods.

These corollaries follow directly from Propositions 1 and 3.

Note that one could extend this analysis to the repeated game case which would allow buyers to learn information regarding past payoffs from different sellers or auctions. Buyers could then use past payoffs to guide their decision of which auction to participate in. However, in such a repeated game, one would expect for the network to change over time which would make the analysis quite complex. For instance, in the radio spectrum example, buyers would continually change locations and so past payoff success may not guarantee future payoff success. For simplicity, we consider a fixed network and a one-shot game. Additional discussion of such a repeated game can be found in the conclusion.

Remark 2. In Corollaries 1 and 2, buyers randomly decide which seller’s auction to participate in. Alternatively, one could allow buyers to choose sellers by best responding to the choices of other buyers. Here, each buyer would have full information about everything except for other buyers’ valuations. Instead, each buyer would simply know the distribution from which other buyers’ valuations were drawn from. One could then ask if inefficient equilibria resist to reasonable equilibrium selection criteria. Example 1 below illustrates that in fact such inefficient equilibria would resist reasonable equilibrium selection criteria. In this example, there is one buyer who is linked to two different sellers. Each seller has the same number of goods for sale and the same number of additional buyer links. Thus, a priori there is no way for the multiple linked buyers to distinguish between the two sellers. Thus, if he is given the opportunity to choose which seller he will purchase from, he can do no better than to choose at random. However, such a random choice would be inefficient half of the time as, given the other buyers actual valuations, one auction is clearly more efficient for him to participate in. Thus, the separate auctions do not provide the buyer with the information needed to make an efficient choice.

The following example illustrates Proposition 3 and Corollary 2.

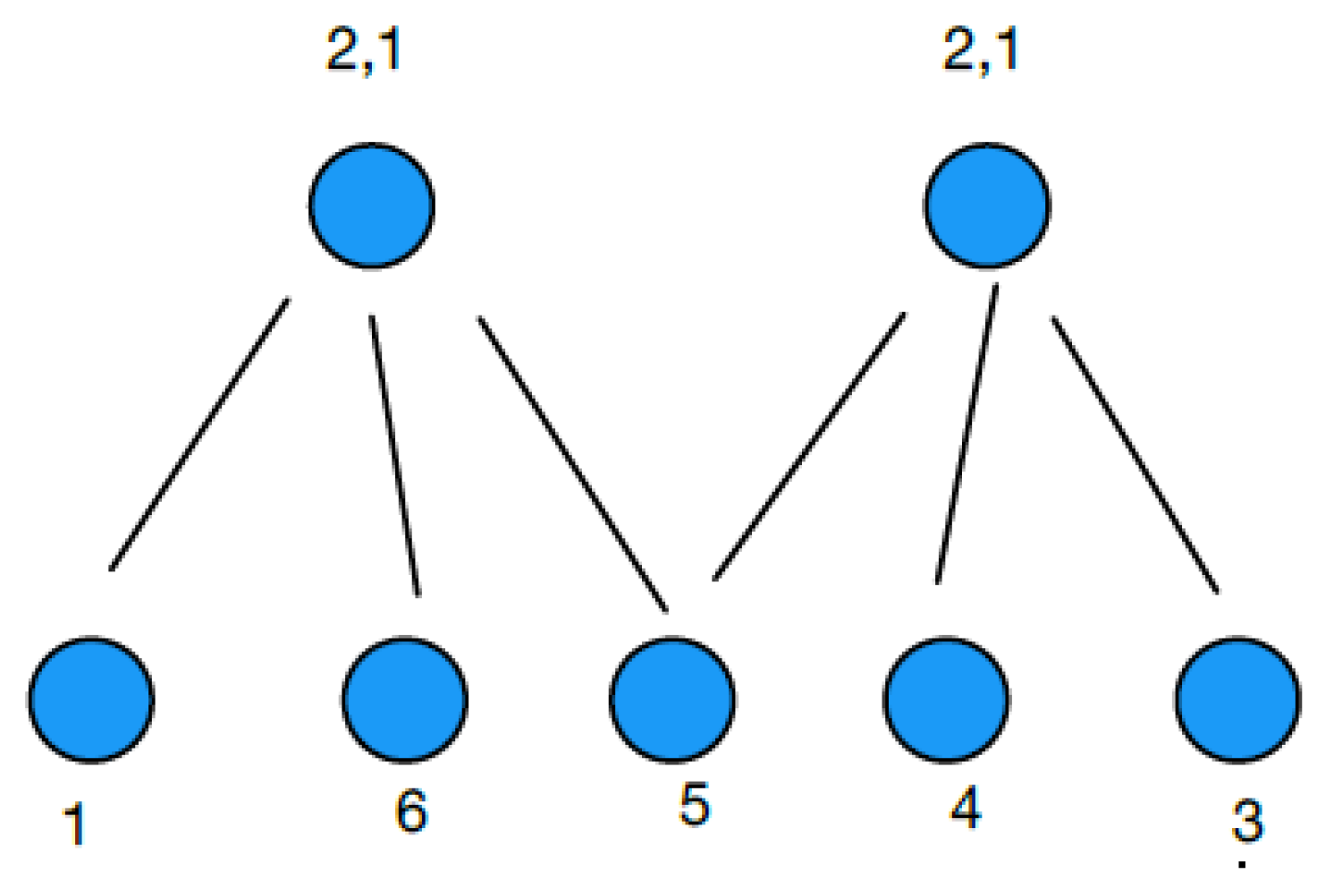

Example 1. Let , , , , , , and ; this graph is represented by Figure 1. In Figure 1, the nodes and numbers on the bottom represent buyers and their corresponding valuations. The nodes and numbers on the top represent sellers and the , values; both and appear above each seller as each has two goods for sale which are of two different priorities. Efficiency requires that buyer 3 participate in seller 1’s auction. Such an allocation results in the sum of the payoffs to all buyers and sellers equal to , while, if 3 chooses seller 2’s auction, the sum of payoffs equals 27. Here, if 3 chooses seller 1’s auction, then he displaces buyer 1 who has quite a low valuation while, if 3 chooses seller 2’s auction, then he displaces buyer 5 whose valuation is much higher. Thus, it would only be efficient if he chooses auction 1.

3.2. Integrated Auction with Pauses

Next, we consider the integrated auction with pauses and show that its unique Bayes–Nash equilibrium allocation is efficient. We assume here that is unique for all k and j.

Proposition 4. In the integrated auction with pauses, there is a unique Bayes–Nash equilibrium in bids.

In the integrated auction with pauses, buyers with multiple links will participate in all of their linked sellers’ auctions. These buyers will eventually have their auctions paused at their corresponding drop out prices or bids. These buyers can then choose to participate in the auction which is best. As we have assumed that is unique, this choice will also be unique as will be the corresponding bids, thus resulting in a unique Bayes–Nash equilibrium.

Proposition 5. The Bayes–Nash equilibrium of the integrated auction with pauses is efficient.

The proof proceeds by induction showing that if all other buyers have made the efficient decision, then the buyer with the highest valuation will also make the correct decision of which auction to participate in when his auctions are paused at his drop out prices. Inductively, the buyer with the second highest valuation will also have incentive to make the correct or efficient decision of which auction to join. Thus, the integrated auction with pauses has an efficient equilibrium.

Next, we consider an example in which one buyer is linked to or in range of two different sellers and efficiency requires that he buy from the second seller which will result in not all goods being sold. If the buyer makes such a decision randomly, then efficiency will result only half of the time. However, we show that the equilibrium of the integrated auction with pauses is efficient.

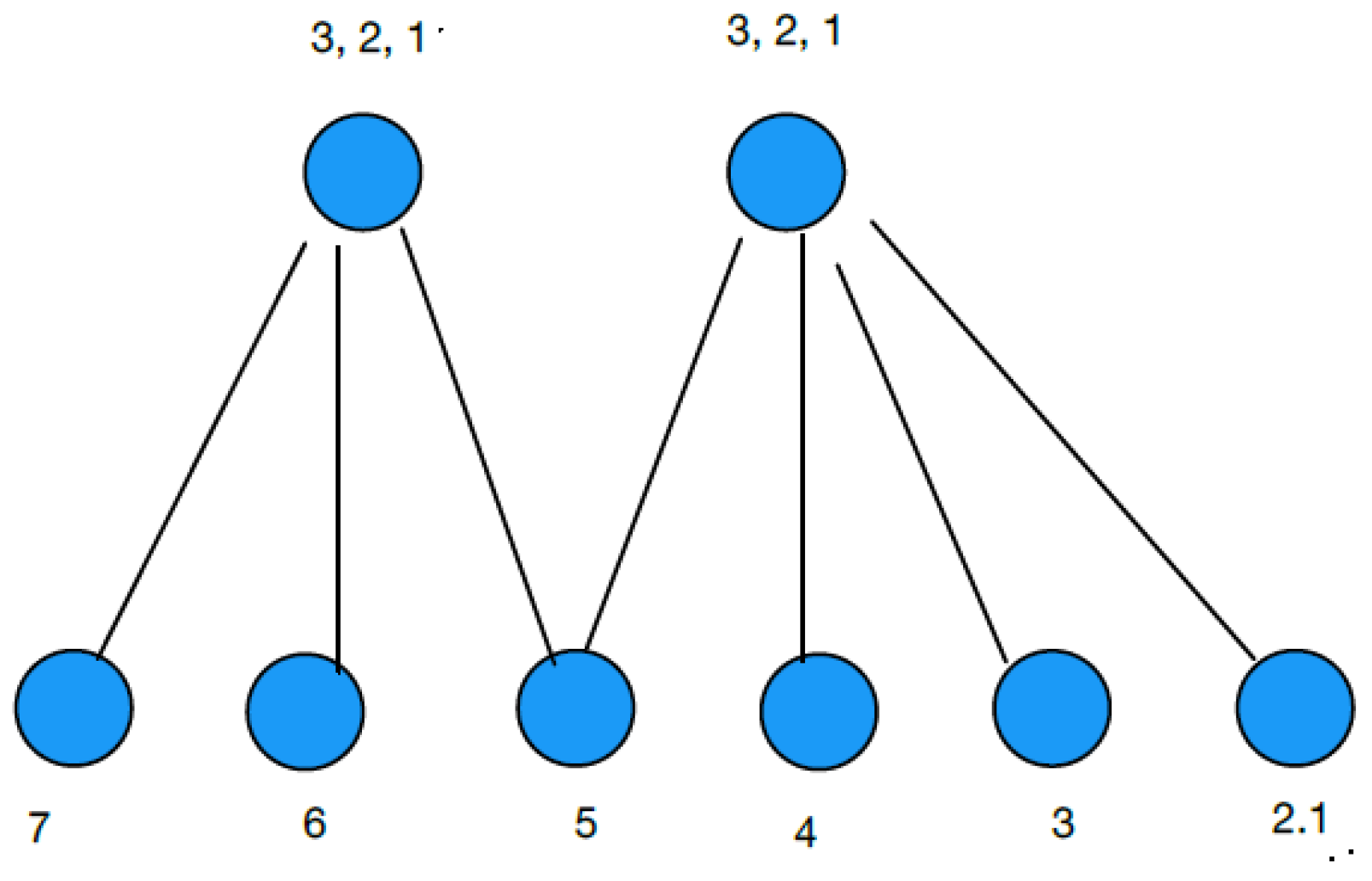

Example 2. Let , , , , , , , and ; see Figure 2. In this graph, buyer 3 can buy from either seller 1 or 2. However, it is efficient for buyer 3 to buy from seller 2 and thus not all of the goods will be sold. To see this, we sum up the buyers’ valuations. If buyer 3 purchases from seller 1, then the buyer with the highest valuation is assigned the top priority from each seller and this results in a sum of buyers’ valuations of . If instead buyer 3 purchases from seller 2, then the sum of the buyers’ valuations is Even though seller 1 is unable to sell his last unit, the sum of the payoffs is highest when buyer 3 purchases from seller 2 and is able to receive the top priority for the good. Consider the integrated auction with pauses. Here, the two auctions will take place separately with buyer 3 bidding in both and with both auctions paused at his corresponding drop out bids. Bidder 3 will then compare his payoff in the two auctions. In 1’s auction, and . In 2’s auction, buyer 4 will drop out at price . Thus, 3’s drop out price in this auction is with corresponding payoff . Thus, bidder 3 will choose to participate in 2’s auction, which is efficient.

Remark 3. We determine which auctions are efficient when people have limited information ahead of time about others. For instance, a buyer may not know or have a good estimate of how many other buyers are linked to each seller and also may not know or have a good estimate of what these other buyers’ valuations are. In the wireless data example, people frequently change locations and so a buyer may not be able to accurately estimate which other buyers are in a given cell tower’s range and may not be able to accurately estimate auction payoffs in advance.

When information is limited, the integrated auction with pauses seems to be the best auction if efficiency is the main goal; Proposition 5 shows that this auction’s equilibrium is efficient. Note that this auction does not require a buyer to have information ahead of time, but rather a multiple linked buyer will learn during the auction’s pauses which seller’s auction is best to remain in. Alternatively, in the separate auctions case, a buyer with limited information will not know or learn which auction is best. Such a buyer is likely to make his decision of which auction to participate in randomly, and the resulting equilibrium may be inefficient as shown in Propositions 2 and 3.