1. Introduction

Information asymmetries are fundamentally important for many markets. In the labor market, firms seek to hire outstanding employees, but there is no way they can accurately predict which candidates will turn out best. Insurance companies or banks need to minimize their risk exposure by selecting their customers appropriately. However, they cannot easily distinguish between clients they should do business with and clients they should avoid. Hence, all these companies face the same basic problem. They need personal information on their prospective trade partners—information that enables them to make adequate decisions.

One possible way to resolve such information asymmetries is that agents

voluntarily provide the other party with

credible information on their type. In the economics literature this is sometimes referred to as the “certification solution to the lemons problem.” The general idea is that the agent acquires a potentially costly certificate which can be passed on to the other party. The other party then decides whether and at which price they will trade with the agent. In theory, this will trigger an unraveling process in that more and more agents will find it in their interest to disclose similar information. If the price of such certification is negligible there will be complete unraveling. That means, in equilibrium all player types are correctly identified. This approach was first suggested by Viscusi [

1]. Similar concepts have, for example, been analyzed by Milgrom [

2] or Milgrom and Roberts [

3]. Jovanovic [

4] points out that a game where revelation comes at a positive cost may result in complete, incomplete or even non-existent unraveling.

If the information to be disclosed is sensitive, unraveling may constitute a severe threat to personal privacy.

1 For instance, the insurance industry has developed novel tariffs where customers may save on their premiums if they provide credible information on their behavior. In the case of car insurance, this is typically achieved using GPS devices which automatically upload data relaying the driving behavior to the insurer. Naturally, this also implies that the insurer will receive personal information such as geographical location and movement patterns. A similar innovation has been introduced in the domain of life insurance. Here, some tariffs use customers’ smartphones to measure and upload activity levels and other data. Again, customers get a discount if they disclose sensitive data about their personal lifestyle. A different example relates to the labor market. Online services such as

www.mybackgroundcheck.com enable applicants to provide potential employers with verified information on their personal background. Currently, such checks are mostly limited to criminal records, but additional information may be considered if such certification becomes more popular. In theory, agents may have an incentive to provide more detailed information possibly including medical records and drug or pregnancy tests.

2In all examples, it is usually emphasized that the disclosure of personal data takes place on a voluntary basis, but because of unraveling such decisions may not be as voluntary as it initially seems. The reason is that not providing personal information may be interpreted as a bad signal such that consumers seeking insurance may find it difficult to find a tariff which does not jeopardize their privacy at a reasonable price. The intuition for this is as follows. Since the new tariffs are most attractive to those with lowest risks, such customers should sort themselves into the new tariffs. This may cause the premiums for the classical tariffs to rise because the low-risk customers are no longer participating in them. In other words, not providing similar information may be interpreted as a signal of high risk and those who do not wish to share sensitive personal information with their insurance company may face rising premiums. A similar problem may occur in the labor market. In a world where (nearly) everybody has the possibility to provide credible personal information, the refusal to do so may be interpreted as a bad signal. In this case, applicants who refuse to provide sensitive information may find it more difficult to get a job.

3In the present paper, we analyze unraveling of privacy in a laboratory experiment. We use a labor market with a lemons structure where

workers have the possibility to provide

employers with credible information on their

productivity. We examine the unraveling problem from two different perspectives. First, we compare the degree of unraveling in the full game with a game where the computer plays the role of the employers. This enables us to infer whether the behavior of the receivers affects unraveling in a dampening or in a reinforcing manner. Note that we are not aware of another study with a direct comparison of both situations. The second dimension is the cost of revelation. We compare the situation where revelation comes at a substantial cost to a situation where the cost of revelation is negligible. The motivation for this comparison is twofold. First, in the field both situations are applicable. While installing an app on a smartphone or sharing a password for a website are practically free of charge, the other examples may involve the work of experts such as medical doctors, which may result in a significant cost of revelation. The second reason to vary the cost of revelation lies in the related literature. So far, there is only one experiment that assumes a significant cost of revelation [

13]. However, the same paper also refrains from modeling employers as players such that the results cannot really be related to those of other studies which assume that revelation is free of charge and consider the full game (e.g., [

14,

15]).

There are three experiments which are closely related to our research.

4 All these studies analyze the unraveling of private information in experimental lemons markets. The first paper is an early contribution by Forsythe et al. [

14] which focuses on the bidding behavior of the buyers (employers) and which observes a substantial degree of unraveling. The experiments are framed neutrally (generic goods and valuations) and the cost of revelation is assumed to be zero. Moreover, there is only one parameterization that is repeated in each period. These aspects may have encouraged the high degree of unraveling reported by Forsythe et al. [

14]. An experiment by Jin et al. [

15] also tackles unraveling in a framework where revelation is free of charge and where the parameterization does not change over time. The authors report that there is less unraveling than predicted by theory. The third paper is an experiment by Benndorf et al. [

13]. The authors not only use a loaded labor market frame, their setup also comprises different parameterizations and assumes positive costs of revelation. Like Jin et al. [

15] the authors report that there is less unraveling than predicted by economic theory. However, the study focuses exclusively on the disclosure behavior of the workers. Employers are not played by actual lab participants, they are substituted by the computer using a suitable payoff function. This may, of course, also influence the degree of unraveling observed. In the present study, we close the gap between the papers by Forsythe et al. [

14], Jin et al. [

15], and Benndorf et al. [

13]. We not only provide a direct comparison between the games with and without employers, but we also test whether the cost of revelation has any unpredicted effect on unraveling.

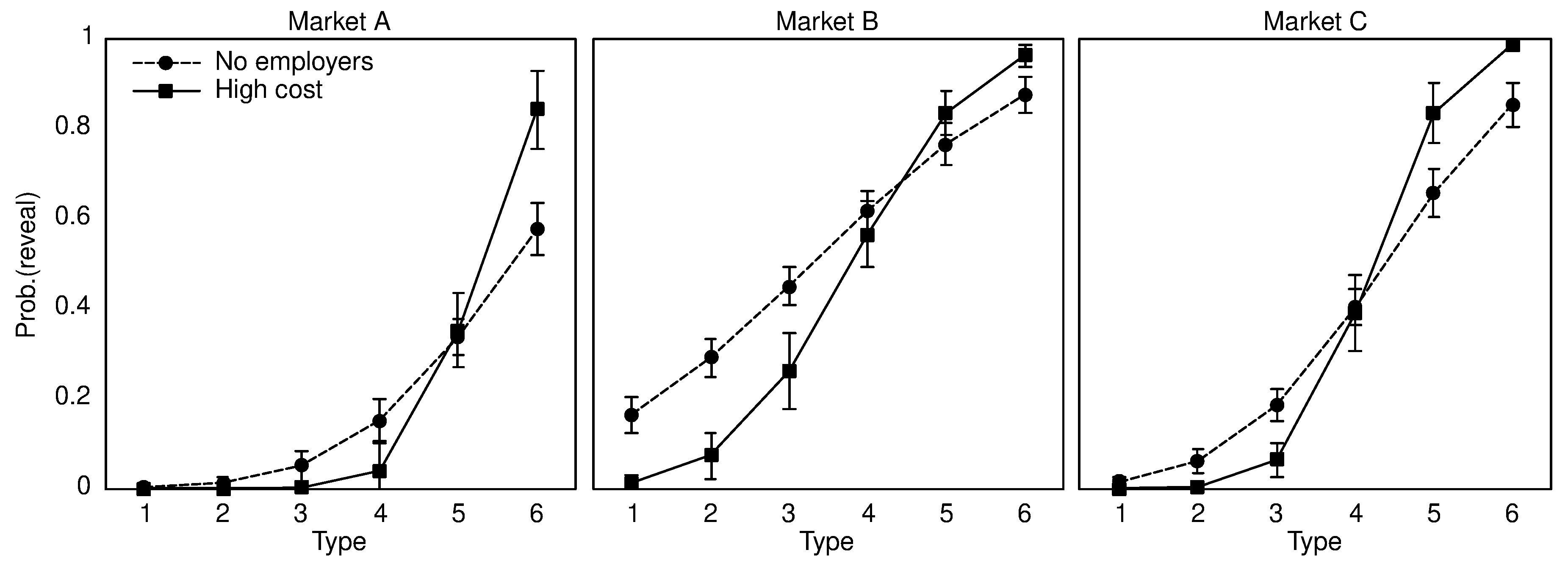

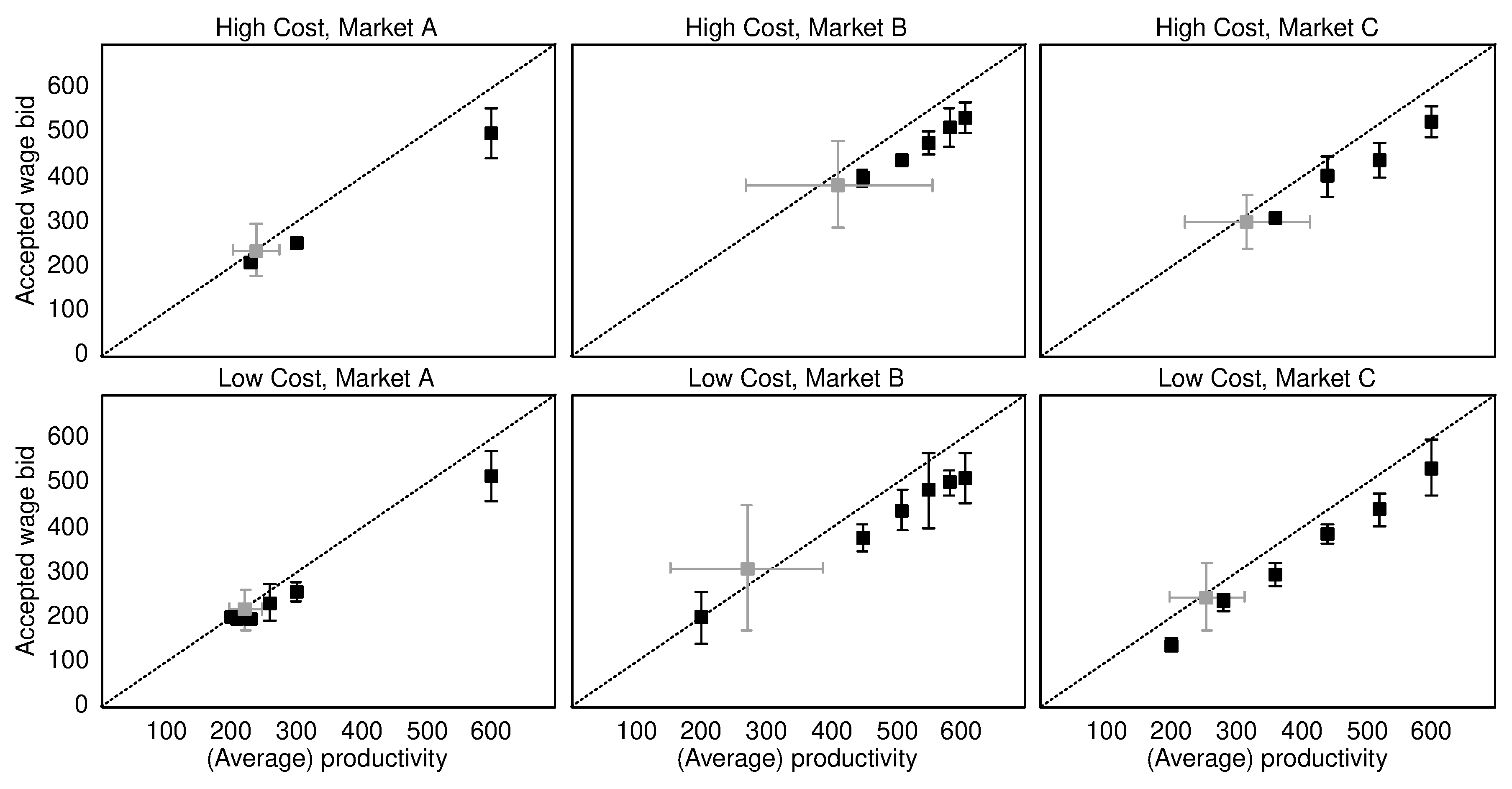

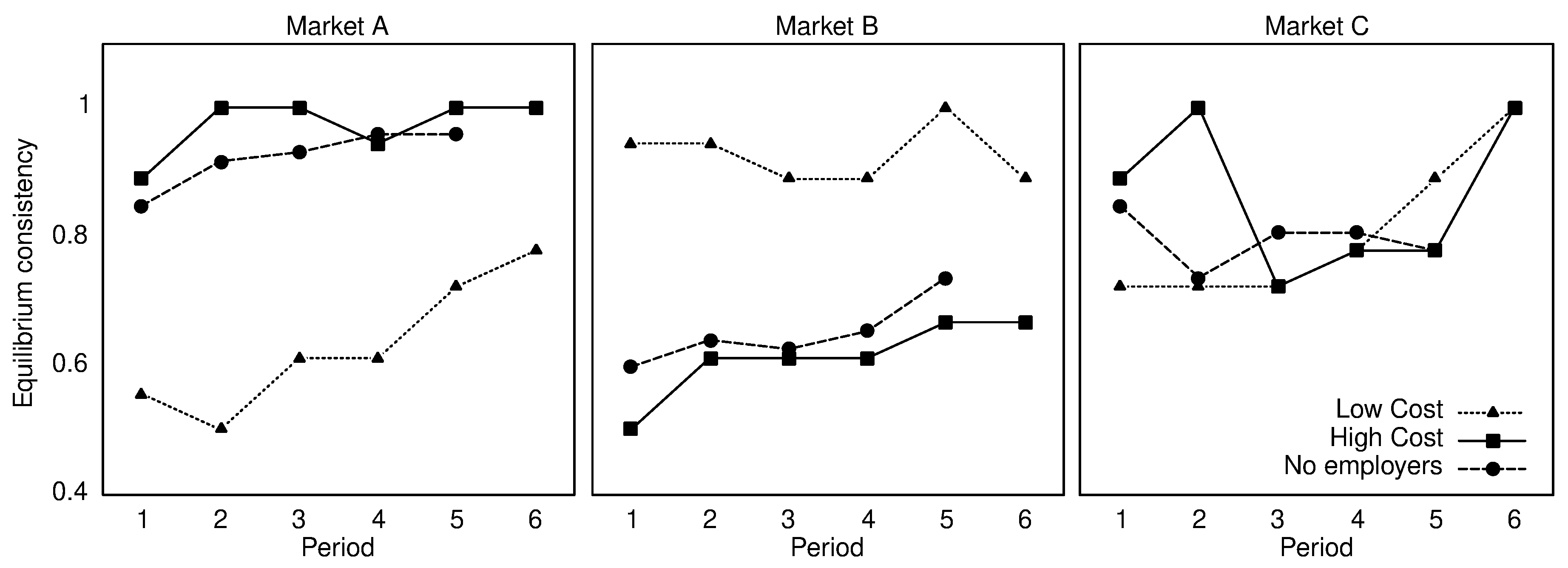

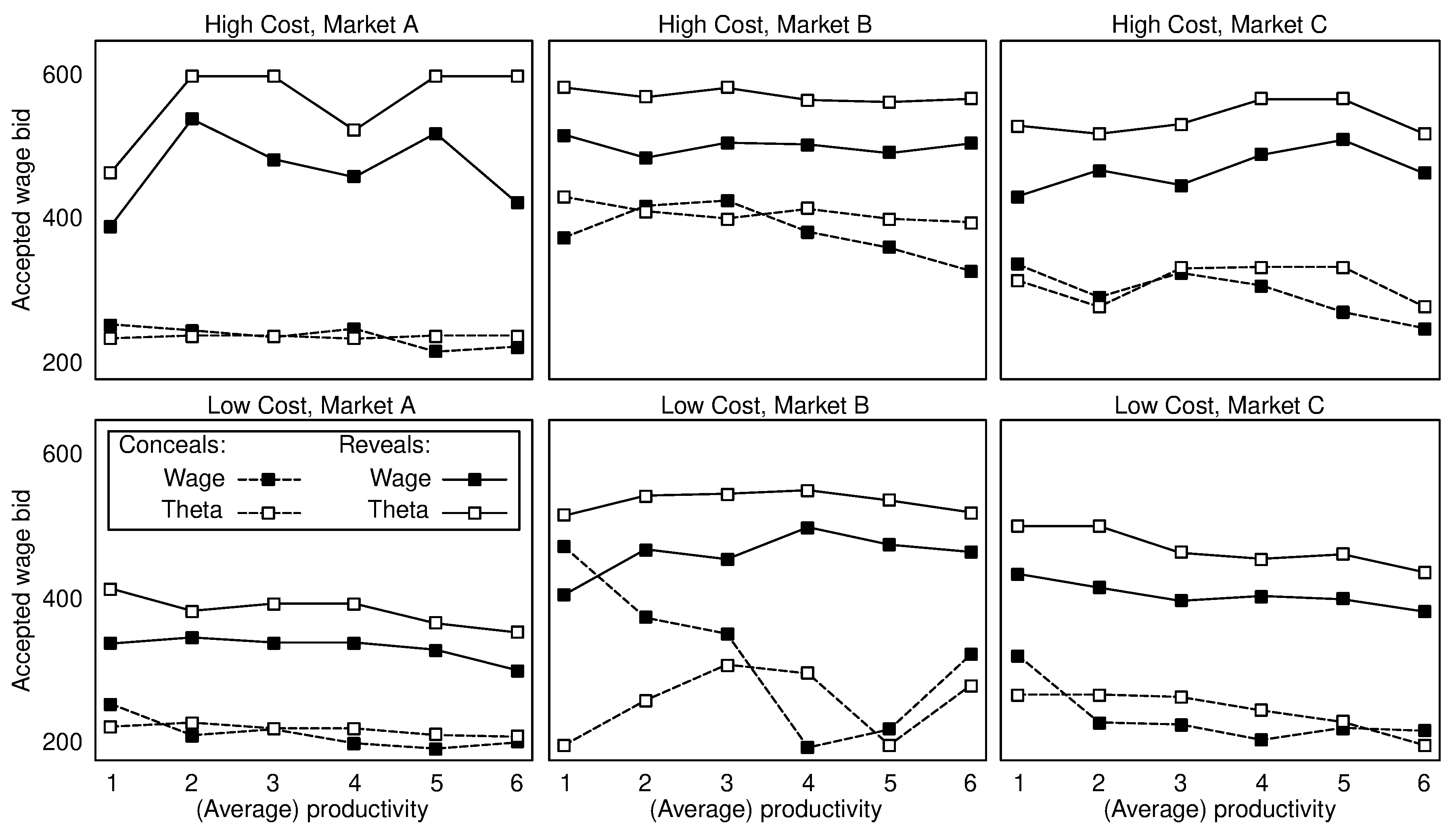

We find that introducing employers as human players promotes the early steps of unraveling but dampens later ones. In our labor market framing this means that high types of workers are more likely, and low types of workers are less likely, to disclose their productivity in the game with employers compared to the game without employers. We will argue that the latter effect is driven by the behavior of the employers who bid less competitively if the productivity of the worker is known. In other words, employers are able to extract a positive rent if the worker discloses her productivity, but they are unable to do so if the worker does not disclose her private information. These (unpredicted) profits of the employers may therefore be interpreted as an additional cost of revelation which causes the unraveling process to stop earlier than the standard model suggests. We also find that reducing the costs of revelation to a negligible degree results in a dramatic increase of unraveling, which is in line with the theoretical predictions. This is, however, not to suggest that reducing the costs generally increases the consistency of the theoretical predictions and the experimental results. In some conditions, experimental behavior is more in line with the theoretical predictions if the cost of revelation is low, but there is also one parameterization where decreasing the costs reduces consistency.

The remainder of the paper is organized as follows:

Section 2 discusses the theoretic aspects of the game with employers and derives the equilibrium predictions.

Section 3 describes the experimental design and procedures and comments on the parameterizations used in the experiment. In

Section 4, we derive a few behavioral hypotheses. The results are presented in

Section 5 and discussed in

Section 6 and

Section 7 concludes.

2. The Game

There are three players: one worker and two employers, and there are n different types of workers. These types are heterogeneous with respect to their productivity which is drawn from a set of possible productivities with . The exact realization is ex ante private information of the worker, but the set and the fact that all possible productivities are equally likely are common knowledge. The employers will competitively bid wages in order to hire the worker. They are identical and move simultaneously. All players are assumed to be risk neutral.

We first consider the timing of the revelation game. The first two stages are depicted in

Figure 1. In stage zero, nature determines the worker’s type. In stage one, the worker decides whether or not to disclose her type (in other words, whether to reveal or to conceal her productivity) to the employers. In stage two, the employers simultaneously bid wages in order to hire the worker. In the final stage, the worker accepts one of the offers she received.

5Next, we describe the notation of players’ strategies. A revelation strategy of the worker is denoted by

where

is the probability that the worker will choose to reveal as type

.

6 Employers’ bidding strategies are denoted by

where

H refers to the different information sets the employers may reach.

Players’ payoffs can be summarized as follows: a worker accepting an employer’s bid will receive that bid as a wage payment but, if she reveals, she has to pay a fixed cost

c for the certification process. The employers have an endowment

that is independent of their decisions. However, all further profits depend on whether or not an employer hires the worker (determined by whose bid is accepted). If

b denotes the wage bid accepted by the worker, while

c and

represent the cost of revelation and the worker’s productivity, respectively, the profits of the worker (

) and the employers (

) are given by:

The employers need to form a system of beliefs specifying a probability

to all decision nodes

x in information set

H with

for all information sets

, where

is the set of employers’ information sets. From

Figure 1 we learn that employers have

information sets including

n singletons that are reached upon revelation. These information sets are denoted by

where

is the information set where the worker is of type

. At

employers’ beliefs are trivially equal to one. In our formal notation, that is,

. The only non-singleton information set is labeled

, and it is reached if the worker chooses to conceal. Here, employers need to form non-degenerate beliefs, i.e., they need to assign a probability to each of the

n decision nodes. Let

denote the employers’ belief at

where

is the probability the employers will assign to being matched with a worker of type

. Reaching the non-singleton

is on the equilibrium path since at least type

will conceal in equilibrium.

7 Hence, the beliefs can be calculated using Baye’s rule. Employers’ beliefs after reaching the information set

are therefore given by:

The revelation game is a dynamic game with incomplete information such that the Perfect Bayesian Equilibrium (PBE) is an appropriate solution concept. In such an equilibrium, players’ strategies have to be sequentially rational, and beliefs need to be consistent with the strategies on the equilibrium path.

8 Hence, any PBE of the revelation game comprises the following components:

- (i)

The worker’s revelation strategy : a function mapping into reveal decisions.

- (ii)

The employers’ bidding strategy : a function mapping all information sets into bids.

- (iii)

The worker’s acceptance strategy: a function mapping bids into accept decisions (not formalized further for brevity).

- (iv)

A system of beliefs as described above.

In the third stage, the worker will accept the higher wage if the employers choose different bids or a random bid if they are identical. As a consequence, in the second stage, employers will bid the observed productivity if the worker chose to reveal, as the corresponding information sets are all singletons. If the worker concealed her productivity, employers need to base their decision on their beliefs

and will bid the expected productivity given

. Hence, employers will choose the following bidding function in equilibrium:

These bidding strategies imply that the worker will receive the entire (expected) rent, independent of her revelation decision. The employers gain nothing from hiring the worker. Apart from their endowment , they will both receive zero (expected) profits, independent of whether or not their bid is accepted.

In equilibrium, the worker’s revelation strategy

will have a special pattern. Since

, the first few types will choose to conceal while the last few types prefer to reveal. Assume w.l.o.g that

m is the highest wage either of the employers offer after observing concealment. If type

prefers concealing to revealing for a given amount

m, all other types

with

prefer to conceal as well. If

prefers to conceal, we have

. If this inequality is satisfied for

, it is also satisfied for all types with lower productivities, i.e., for all

. An analogous argument can be made for the case where

and all types of higher productivities prefer to reveal. Hence, for any realization of

m there will always be exactly one threshold

such that all types

with

weakly prefer concealing to revealing, while all types

with

strictly prefer revealing to concealing. Note that depending on

m, type

herself may also be indifferent between revealing and concealing. As a consequence, in any PBE of the revelation game, the worker’s revelation strategy

has the form:

Applying this form of the worker’s revelation strategy to the employers’ system of beliefs as defined above, we obtain the employers’ beliefs upon observing concealment:

and their bidding function:

The revelation strategy , the bidding function , the verbal description of the worker’s acceptance strategy, and employers’ set of beliefs define a PBE of the revelation game, if constitutes a best response for each type of the worker given the employers’ set of beliefs and bidding function .

The equilibria depend on the parameters

and

c which define the threshold

k and the corresponding

. Note that the equilibria and the thresholds

k are not necessarily unique. If there are several thresholds

k, the game will also have multiple equilibria. This does not, however, occur in the parameterizations used in the experiments.

9 However, multiplicity of equilibria may also arise even if there is only one threshold

k. Whenever there is an equilibrium system of beliefs resulting in a bid after observing concealment leaving type

indifferent between revealing and concealing (i.e.,

), there will be up to three equilibria: one where

conceals (

), one where

reveals (

), and possibly one where

chooses a completely mixed strategy with

.

10 This also occurs in one of the combinations we use in the experiments. In

Section 3 the corresponding parameterization is introduced as

High Cost—Market C and the equilibria are described in

Table 1 of that section.

3. Experimental Design and Procedures

In the experiments, a random matching routine was used in combination with a fixed-roles-but-random-types design. In each session, there were 18 participants who were divided into 12 employers and six workers. This role assignment remained constant during the entire experiment, the productivity of the workers and the matching were, however, subject to change at the beginning of each period. Note that the random matching only determined which employers interacted with which workers, and that there were always the same six workers in one session.

We used six different parameterizations, each comprising a set of six possible productivities. The productivity of a worker was determined by a random draw of the computer,

11 where each of the six possible productivities was chosen with equal probability. The random draw was conducted without replacement, such that each of the six possible productivities was attributed to exactly one worker in each period (as was mentioned in the instructions). Finally, six groups, each consisting of two employers and one worker, were randomly formed by the computer at the beginning of each period. Because of the random matching we conservatively count one session of 18 subjects as one independent observation.

The timing of the base game was as described in

Section 2. The matching took place at the beginning of each period and the productivities of the workers were also determined then. Afterwards, everybody was presented with the parameterization to be played that period, and workers were informed about their productivities. In the first stage, workers decided whether or not to disclose their productivities. In the second stage, employers were informed of the decision of the worker in their group and needed to simultaneously bid wages for that worker. The support for the wage bids was the interval

, it did not depend on the current parameterization or the decision of the worker. In the third stage, the workers had to accept one of the two wage bids they had received. Finally, subjects were given a summary of the results in that period. Nobody received any information about the decisions of players outside their group.

Subjects’ payoff functions were equivalent to those presented in

Section 2. In the experiments, employers received an endowment of

ECU each period to avoid biased behavior due to zero profits or losses.

During all experiments, we varied the set of possible productivities (labeled

in

Section 2). The different parameterizations were referred to as

markets and were addressed using a within-subjects design. That is, they were played on a rotating basis.

12 Subjects played six repetitions of each market such that there were 18 periods in total. The only difference between the markets was the set of possible productivities

.

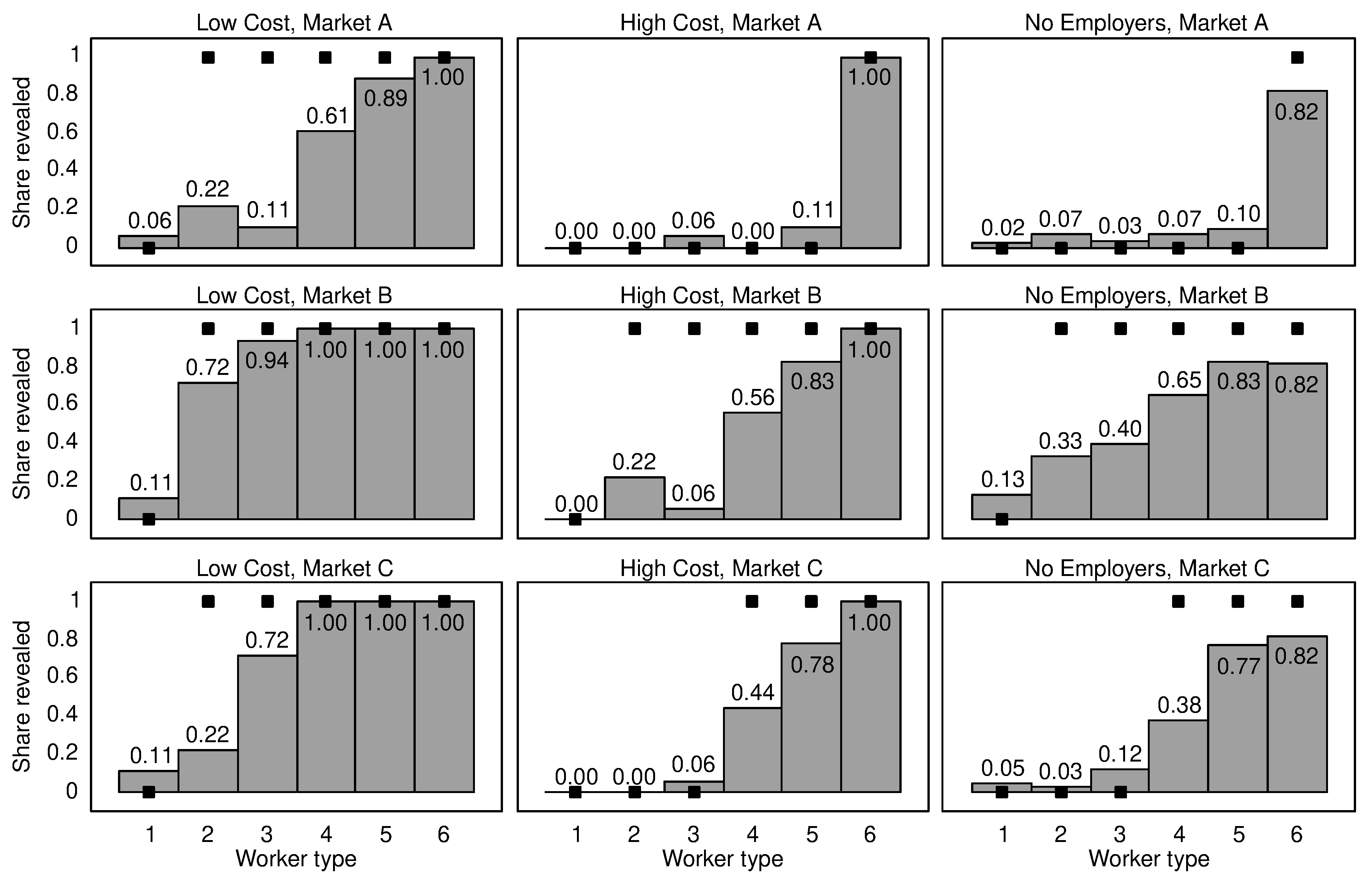

We considered three different treatments labeled High Cost (or HC), Low Cost (or LC), and No Employers (or NE) in a between-subjects design. In HC and NE, disclosing one’s productivity comes at a cost of . In LC, these costs are reduced to . Apart from that, HC and LC are identical. The NE treatment is equivalent to HC except that the employers are played not by actual participants, but by a computer which is programmed to best-respond against workers’ behavior. In the game without employers, workers received their own productivity minus the cost of revelation if they decided to reveal, and the average productivity of all concealing workers if they decided not to reveal. Note that the equilibrium revelation rates in HC and NE are identical.

Table 1 summarizes the productivities and equilibrium predictions for the three markets in both treatments. We use the notation introduced in

Section 2. Apart from the thresholds

k and

, we also report the revelation strategy of the worker

and employers’ beliefs and bids upon observing concealment. There is always a unique equilibrium, except for Market C in High Cost where we have three equilibria. In the table, these equilibria are denoted by HC1, HC2, and HC3. In the remainder of this paper, we only refer to HC1 and we neglect the other equilibria. HC1 is the one best in line with the experimental data, and the deviations would only be larger when comparing the data to the other equilibria.

Since the data for NE was gathered by Benndorf et al. [

13] there are a few differences to the other treatments. First, the framing in NE is slightly different compared to the treatments with employers. In HC and LC, the productivity of the worker was simply referred to as “productivity” whereas it was framed as worker’s “health condition” in NE. This loaded framing might cause workers to reveal less often in the game without employers because it emphasizes the privacy aspect of the disclosure decision. We will come back to this issue in the results section. Second, there were fewer repetitions of the game (only five repetitions of each market instead of six) in NE than in other treatments. We do find that there is more learning in the game with employers compared to the game without employers, but this is not driven by the additional periods (see

Section 5.3 for more details). The third difference is that we elicited subjects’ risk preferences for the game with employers, but not for the game without employers.

13 Since this was separate from the main experiment, it does not appear very likely that it will affect the results in a meaningful way. Finally, the data for NE was elicited in Berlin whereas the data for HC and LC was gathered in Düsseldorf. While comparing data from two different subject pools is of course not ideal, we are, however, confident that there are no substantial subject-pool effects.

14The experiments using the game with employers (HC and LC) were conducted at the DICELab on the campus of the University of Düsseldorf. A total of 108 participants took part in these experiments, 54 of these in HC and LC, respectively. One session of the game with employers comprises 18 subjects: six workers and 12 employers. Because of the random matching, one session counts as one independent observation. Hence, we gathered a total of three independent observations for either treatment. Subjects’ earnings from the revelation game were aggregated over the 18 periods and converted into Euro at an exchange rate of ECU 400 = EUR 1. At the end of the experiment, subjects simultaneously received their payments from the revelation game and from the risk elicitation task. Average earnings were about EUR for an experiment that lasted about 90 min.

The data for the game without employers originates from Benndorf et al. [

13]. The corresponding experiments took place in the lab at the

Technical University Berlin. One session lasted about 60 min and another 72 subjects (12 independent observations) participated in these experiments.

15 Average earnings in the game without employers were about EUR

.

4. Hypotheses

We expect revelation rates in Low Cost to be higher compared to the High Cost treatment. This expectation is in line with the theoretical predictions which suggest a global revelation rate of 83.33% in LC compared to only 50% in HC. The reason for this is as follows. The higher the cost of revelation, the less the types will have an incentive to reveal. Low-productivity types in particular would not find it in their interest to reveal their type if the cost of revelation was high.

Hypothesis 1. Revelation rates in LC will be higher compared to HC.

The revelation rates will be lowest in Market A and highest in Market B in both our treatments. In HC, this pattern is in line with the predictions. Here, the equilibrium revelation rates are 16.67%, 83.33%, and 50% for the markets A, B, and C, respectively. This is in contrast to LC where the predicted rates are identical for all markets. However, there is still considerable variation in workers’ incentives to stick to their equilibrium actions. For instance, when deviating from revelation, a type-2 worker loses ECU 9 in Market A compared to ECU 79 and ECU 247 in markets C and B, respectively. Similar trade-offs also exist for the other types that should conceal in HC, but not in LC. Hence, we expect the ranking of revelation rates across markets to be identical in both treatments.

Hypothesis 2. In both treatments, the degree of unraveling will be highest in Market B and lowest in Market A.

We expect to observe a positive correlation between the revelation rate and the productivity of the worker. This hypothesis is also consistent with economic theory. In our parameterizations, all worker types choose pure strategies in equilibrium. Since any pure-strategy equilibrium of the revelation game includes concealment of the first few types and revelation of types with higher productivities, the experimental data should show that low-productivity types reveal at lower frequencies compared to high-productivity types.

Hypothesis 3. In all treatments and in all markets, we expect the revelation rates to increase in the type of the worker.

We refrain from formulating hypotheses concerning the behavior of the employers and the comparison of the games with and without employers. The reason is that it is not clear if introducing human employers affects behavior at all or whether or not there will be systematic differences when comparing the bidding behavior in the cases where the worker reveal or conceals. We will address these aspects in the results section, but these parts of the study are exploratory.

7. Conclusions

In this paper, we analyze workers’ willingness to disclose private information in a lab experiment. We follow Benndorf et al. [

13] by using a similar game with a similar parameterization. We extend their work in two dimensions and close the gap to the existing literature.

Comparing the games with and without human employers, we find a somewhat inconclusive effect on unraveling. In the game with employers, high-productivity types reveal more frequently whereas low-productivity types reveal less frequently. The first aspect might be explained by differences in the framing and/or by horizontal fairness considerations, which are less likely to play a role in the game with employers. The explanation for the second aspect is the bidding behavior of the employers whose bids after observing revelation are less competitive than their bids upon concealment. This behavior causes fewer types of workers to reveal. Hence, while the overall effect of introducing employers is inconclusive, the consequences induced by their behavior are unambiguous. Employers’ wage bids impede unraveling.

The second dimension we consider is the cost of revelation. We find that reducing the cost of revelation to a negligible degree increases the revelation rates dramatically. However, this is already captured by the game-theoretic predictions. Averaging across all markets, the degree of equilibrium consistency appears to be rather independent of this cost. There is, however, one further interesting aspect. While the degree of consistency is highest in Market A and lowest in Market B in High Cost, the opposite is true for Low Cost. Here, the equilibrium consistency of workers’ revelation decision is lowest in Market A and highest in Market B. This suggests that reducing the cost of revelation results in more revelation, but may result in a lower, higher, or equal share of equilibrium-consistent revelation decisions.

The policy implications we can derive from our results are as follows. The unraveling problem is not quite as severe as suggested by economic theory. In all our experiments, we find a bias against revelation in that those who should reveal in equilibrium deviate from their equilibrium action more frequently than those who should conceal. The result is consistent with other experimental studies on unraveling [

13,

15]. It is, however, not to suggest that unraveling is unproblematic from a privacy point of view. Our experiments document that there is a substantial degree of unraveling even though the behavior of workers and employers impedes the process. Hence, the voluntary disclosure of personal information does constitute a threat to privacy. The ex-ante uninformed parties are able to use the information to their benefit, and only relatively few types of the worker manage to conceal their private information. Overall, we agree with Peppet [

12] in that further regulation may be required.