1. Introduction

By promising to mediate interactions of mutually distrusting individuals without a trusted third party, blockchain could be one of the most disruptive technologies since the Internet in its ability to revolutionize the way human beings view their relationships.

Blockchain may be considered as a secure shared crypto-graphical ledger that allows users to make transactions without any third party authorizations and in which users have access to all past transactions (but without the possibility of altering or controlling them). This ledger is built on a chain of blocks (i.e., the pages of that ledger), which have multiple transactions on them, similar to a brick wall where every brick contains timestamps of the transactions and their validation by the network itself. All transactions across the system are thus public and anyone who uses the blockchain can check them at any time. Following the analogy used by [

1], imagine that you have a notebook whose content is exactly reproduced in other notepads around the globe, and everything written in those notepads also appears in your notebook. The other notepads would then keep track of what was written on your notebook, and its content would always be available even if it was destroyed. In the same way, if someone tried to write something in one notepad that did not follow the rules governing what we would allow to be written, then all other notepads would reject it.

This technology was developed by “Satoshi Nakamoto” (which later was found to be a pseudonym) and appeared during the 2008 recession, a period characterized by a growing distrust of financial institutions and intermediaries. Nakamoto invented the blockchain for the use of cryptocurrencies—and mainly bitcoin—in order to provide users an easier way to make transactions across a secure network without reliance on traditional trust-building institutions. The main challenge concerning bitcoins was to create a shared and decentralized database in which anyone could access the data, while ensuring the accuracy of the database and the authenticity of users’ identities. This challenge was met by creating a ledger of past financial transactions that is public, open, and protected through cryptography and a complex architecture of required tasks [

2].

Blockchain acts as an infrastructure for self-executing

smart contracts, which are programs allowing contractual clauses, transactions or agreements defined

ex-ante to be automatically executed through computer codes. In other words, an agreement encoded in a smart contract will be executed irrevocably without the need for a central authority to enforce it.

1 The fundamental difference between a traditional legal contract and a smart contract is precisely related to the enforcement of contractual terms. The fact that smart contractual terms are written into an executable programming language implies that the agreed transaction can take place automatically after the occurrence of an event or after a specified time period. Suppose, for example, that the contract by which a traveler purchases a plane ticket is encoded into a smart contract. Following a computer script, the smart contract can use data about the flight’s departure and arrival times as an

oracle to determine whether the flight’s schedule has been fulfilled.

2 The smart contract could then be programmed to immediately transfer the price back to the traveler as compensation if a delay has occurred [

3].

However, while blockchain can be seen as a way to “complete contracts”, by making agreements self-enforced through codes instead of courts, it may enhance other sources of

transaction costs, so that the problem of incompleteness remains and new unanswered questions arise. Smart contracts create bargaining costs by requiring parties to fully define

ex-ante all future contingencies, which is in any case not possible, and raise the costs of responding to a breach by removing enforcement flexibility [

4].

3 In this context, disagreements will inevitably arise regarding the content and execution of smart contracts, due to coding errors, security issues, etc., leading to some issues regarding dispute resolution. For example, we can wonder what happens if the code does not perform according to the contractual agreement due to unforeseen contingencies. In the same way, we do not know what happens if an event occurs that the contract did not anticipate. Overall, there is uncertainty about how to resolve disputes arising from smart contracts. In this context, the implementation of smart contracts can create a new type of dispute that requires alternative dispute resolution mechanisms, which are precisely based on the blockchain. As underlined by [

7], blockchain-based contracts create a source of new disputes requiring resolution, but also constitutes a technology that allows the development of new methods of dispute resolution.

The aim of this article is to present and analyze one of these emerging blockchain-based dispute resolution mechanisms, namely “Kleros”, which is the first “decentralized justice platform” to have become operational and the most widely used at present [

8].

4Overall, decentralized justice platforms are

digital courts using blockchain technology and aimed to settle disputes by crowdsourced jurors whose incentives to take fair decisions have been designed through game theory. The dispute resolution process in these platforms is encrypted as smart contracts on a blockchain in order to remove any legal uncertainty. From this point of view, these mechanisms are largely inspired by

online dispute resolution (hereafter, ODR) processes, such as online negotiation or mediation, which emerged in the early 2000s to resolve disputes arising from Internet-based transactions. As it is the case today with smart contracts and blockchain, the development of e-commerce in the late 1990s generated new disputes that made traditional dispute resolution through judicial procedures unsatisfactory and required the development of new settlement methods based on the electronic environment.

5 Following the question that arose during the development of e-commerce twenty years ago, the objective of our paper is to discuss whether digital courts, such as Kleros, might be able to regulate blockchain-based transactions (in the same way that ODR claimed to be able to regulate Internet-based ones).

6The remainder of the paper is organized as follows.

Section 2 displays the way Kleros works.

Section 3 takes a critical perspective on this new approach to dispute resolution.

Section 4 concludes and raises further questions.

2. Kleros and Decentralized Justice

Founded in 2017, Kleros is a DAO built on the Ethereum blockchain that works as a decentralized third party to arbitrate disputes in a wide variety of cases such as e-commerce, insurance and finance.

7 For example, in November 2020, almost 500 disputes were resolved using Kleros and about 400 users participated as jurors. This generated about

$123,000 in arbitration fees paid to jurors [

8].

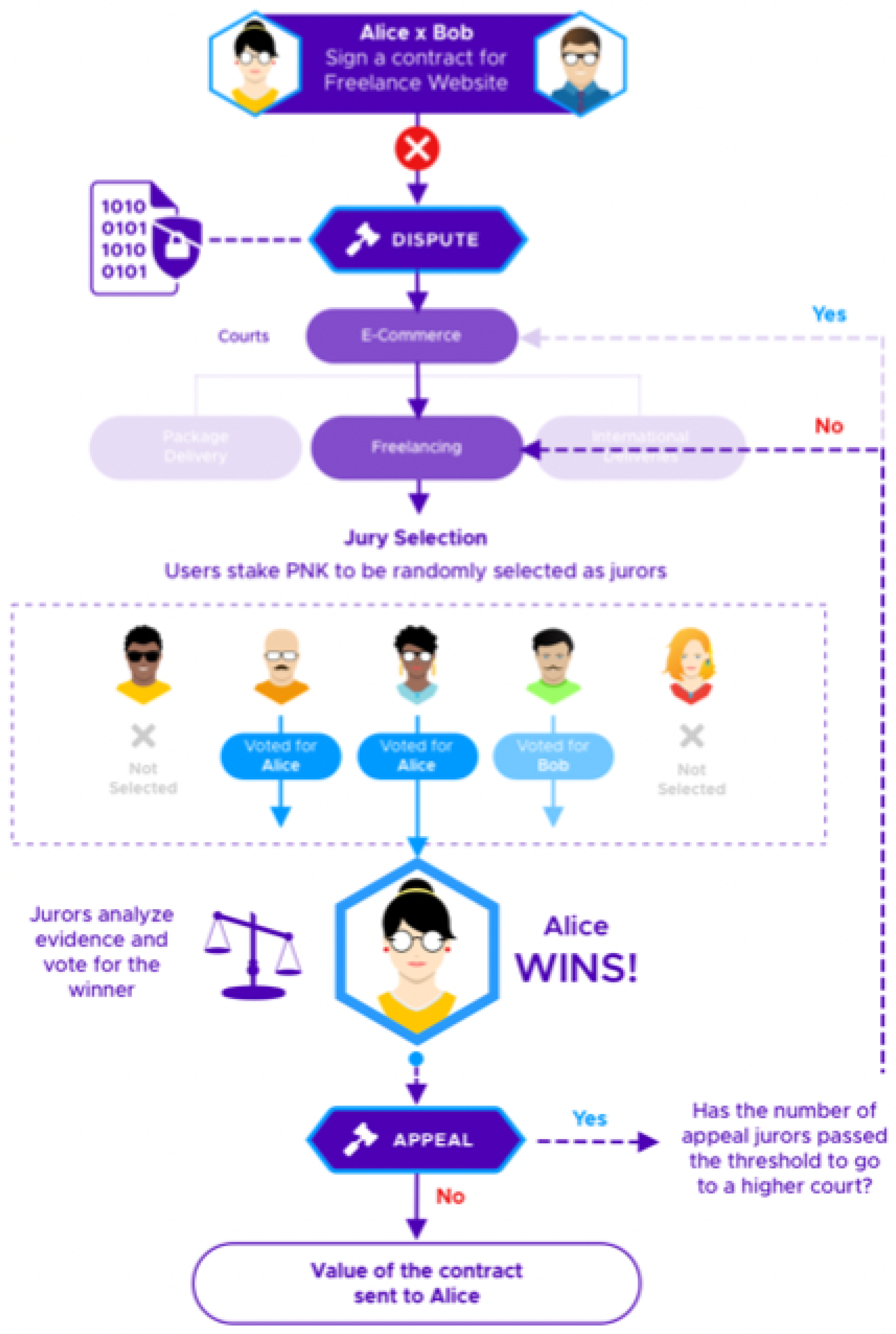

Let us elaborate how the dispute resolution system works. As mentioned above, the Kleros process is designed to handle smart contract disputes and can therefore be activated as soon as a dispute arises in the execution of a smart contract (freezing monetary transfers until the dispute is settled). To do so, the contracting parties must select Kleros as the dispute resolution service provider in their smart contract ex-ante and agree on some basic features of the process (e.g., the Kleros sub-court in which the dispute will be handled, the size of the court, etc.). In the case of an agreement, Kleros randomly assigns the dispute to self-selected jurors who will study the evidence and vote for a decision.

Let us take the example provided by [

15] in their white paper describing the mechanism.

8 Alice (a French entrepreneur) hires Bob (a Guatemalan programmer) on a P2P freelancing marketplace to create a new website for her company. After agreeing on a price and some conditions, Bob starts building the website. A few weeks later, he delivers a result that Alice is not satisfied with. She argues that the quality of Bob’s work is much lower than expected, but Bob replies that he has met the terms of the agreement. If the contract has a clause stating that a Kleros court will intervene in the event of a dispute, then Alice can request Kleros and explain her case. Far from here, Chief (a Kenyan software developer) checks the Kleros Court website (

https://court.kleros.io/ accessed on 1 January 2022) to find some arbitration work, knowing that he usually settles disputes in the Website Quality sub-court (which requires some of his skills). Chief invests 2000 PNK (i.e., ’Pinakion’, which is the crypto-token used by Kleros to select jurors for disputes), knowing that the likelihood of being selected as a juror increases with the amount invested.

9 Shortly thereafter, Chief is informed that he has been selected as a juror. He can then check the evidence and has three days to send a decision. Two other jurors are selected randomly from a large pool of candidates, and each of them must vote for one of the options which has been stipulated in the contract (e.g., ‘Pay Alice back’, ‘Give Bob an extra week to complete the website’ and ‘Pay Bob’). The smart contract is then executed according to the decision that represents the most votes. Once this decision is made, the tokens are redistributed among the jurors depending on whether their vote is in accordance with the majority: a given juror is paid only if his vote is consistent with that of the others. The aim of this process is to align telling the truth with economic incentives by considering that the correct decision will become a

focal point on which individuals coordinate their behavior in the absence of communication [

16].

10 The assumption behind this incentive mechanism is that anyone who did not vote with the majority was either engaged in a sub-court in which he or she did not have enough expertise, did not evaluate the evidence in the right way, or did not seek to make an appropriate decision.

11If a party is dissatisfied with the verdict of the jury, then they may appeal and have the dispute ruled again. An appeal panel is composed of the previous number of jurors plus one. This way to proceed aims to discourage parties from appealing repeatedly, since costs increase as the number of jurors increase. Based on the example of the dispute between Alice and Bob, the Kleros process is summarized in

Figure 1, taken from [

15].

3. Some Analytical Considerations

From a normative standpoint, we can highlight interesting elements in the way Kleros implements a decision (even if some of these elements could be questioned, as we will see below). First, the immutability of blockchain and the decentralization of the decision-making process imply that dispute resolution seeks to comply with two key features that would be expected from any justice system: the procedure aims to ensure some kind of “fair treatment” since no single individual can make the decision on his own, and the result of this procedure is predictable since disputing parties are sure that the process will follow the computer code.

Second, the decentralized nature of the dispute resolution mechanism is relevant, as the ruling is not delegated to a central authority (e.g., a judge, an arbitrator, etc.), which is inherently perfectible, but to a community of individuals who do not have to be honest by assumption. Jurors are not expected to act honestly (i.e., be neutral in their votes) because of moral considerations, but because the decision-making environment is thought of as to encourage them to act honestly.

Third, traditional legal systems are relatively expensive, partly because they are based on the existence of monopolies in the provision of legal services. The profession of lawyers has a monopoly on legal consultation and judges have a monopoly on rulings. The development of blockchain-based dispute resolution methods could make it possible to expand the provision of legal services, and hence to reduce both market prices and court delays.

12 As underlined by [

8], this does not mean that decentralized justice platforms should replace the legal profession in the resolution of civil disputes, but it implies that they are able to solve some dispute types for which legal professionals are not a good fit because their intervention induces high costs.

Finally, following the arguments exposed in the introduction, Kleros is based on smart contracts, which implies that the dispute resolution outcomes are self-executed without the need to enforce them by resorting to state courts or centralized alternatives (such as escrows, chargebacks or reputational sanction mechanisms, according to what characterized ODR processes in the early 2000s).

However, despite these interesting aspects, several possible issues can be highlighted about Kleros’ conception of the exercise of justice. First, following the arguments by [

17], the relevance of the dispute resolution process is based on a very questionable hypothesis. It is assumed that the potentially very different opinions of jurors—who are anonymous, scattered all over the world, do not share the same legal culture—would converge towards a “correct/fair result” (because this outcome would be a focal point). In fact, there is no reason to believe that the fair decision is a focal point since the jurors are strategically involved in a

beauty contest game. Individuals are incited to rely on the judgment of others (and not to reveal their true preferences), which may result in so-called

herding behavior or

informational cascade, and hence engender consensus on an incorrect collective decision [

18].

13 In other words, Kleros creates incentives for jurors not to take their decision according to the evidence and their own opinion, but rather to figure out what would be the conventional decision (i.e., what other jurors might decide), which may cause jurors’ objectives to diverge from the search for truth. As underlined by Eyal Winter in an online conference, this opens the door to the influence of

stereotypes, or other biases, that can be used as a way to obtain a consensus: jurors in Kleros may converge on stereotypes, not because they themselves are victims of such stereotypes, but because they think that others are.

14In this regard, jurors are not necessarily encouraged to vote according to what they consider as honest and fair, since the Schelling focal point in Kleros can be different from honesty and fairness. Eyal Winter highlights some other behavioral issues related to jury decision-making in decentralized justice systems. For example, some jurors may have cognitive difficulties in processing information/evidence correctly, may identify themselves with disputing parties from their own social/ethnic group, and may vote on the basis of their self-image rather than evidence (e.g., we can imagine a juror who could not vote in favor of the firm in a dispute with a consumer because it would make him feel bad about himself).

Second, from a technical viewpoint, the anonymous nature of the users, the fact that one person may generate multiple accounts, and the complete absence of personal reputation means that various forms of manipulation could appear on blockchain dispute resolution platforms [

22]. For instance, some jurors might decide to collude with revealing their vote, an agent could attempt to corrupt the jurors’ decision through a promise to pay those voting for a specific decision, or one juror could create multiple pseudonymous accounts to gain a disproportionately large influence (which is known as the “Sybil attack”). Several mechanisms have been proposed to prevent such attacks [

8]. For example, Kleros uses its own token (i.e., the Pinakion) which is considered as a protection against Sybil attacks: an attacker wishing to flood the juror pool would have to buy enough PNK to be selected a high enough number of times as a juror in the same case to be able to alter the outcome. This means that the attacks needs 51% of the total staked tokens (knowing that the price of a token increases with demand). It remains true, however, that the absence of an identity validation mechanism does not allow preventing some manipulations to occur, such as unobservable agreements or coalitions.

Finally, some points are related to legal issues, since the way blockchain dispute resolution platforms work does not seem to be compatible with the law of some countries. For example, in France, following the code of civil procedure (article 16), the judge must, in all circumstances, ensure that adversarial debates are observed. However, these debates imply that the defendant receives enough time to organize their defense, that the identity of parties is authenticated, and that the documents in the case can be examined by the parties. These conditions are not fulfilled on these platforms, where each party—whose identity is neither authenticated nor certified—provides evidence in support of their case without it being put up for debate. The decision-maker is then placed in an inquisitive position, insofar as the elements transmitted can only be discussed between the parties

ex-post [

23]. In the same way, article 22 of the French civil code requires that a judgment be made public, which is not the case here. For these reasons, the issue of how to legally enforce rulings from decentralized justice systems remains open, especially in civil law countries (e.g., Belgium, France, Germany, Italy, Sweden, etc.), and claiming to be able to provide an effective self-applying dispute resolution mechanism—beyond national laws—remains questionable.

15 4. Conclusions

Robert D. Luce and Howard Raiffa wrote in their famous game theory book, “In all of man’s written record there has been a preoccupation with conflict of interest” [

24], and we can expect that this concern will not disappear with blockchain technology. Contrary to the initial promise, the modern world of blockchain and smart contracts cannot—and will not—be a world without disputes. Indeed, even if a smart contract is automatically implemented through a computer code, disagreements may arise regarding its content and execution. However, this gap between the promise of a dispute-free world and the reality—characterized by the occurrence of inevitable disputes within the blockchain network—could be bridged by the thoughtful development of appropriate dispute resolution mechanisms. This paper has explored a particular solution, namely Kleros, which is the best known/most developed platform using blockchain technology specifically to resolve blockchain-related disputes. To the best of our knowledge, our approach is the first one to assess some of the contributions and limitations of a central actor in the decentralized justice industry by using both legal considerations and microeconomic arguments (based on game theory and behavioral economics).

Nevertheless, from a more rigorous perspective, it would have been interesting to develop a more quantitative analysis by attempting to empirically evaluate the efficiency of Kleros. However, the lack of a counterfactual situation and the difficulty in obtaining data due to the confidentiality that often characterizes dispute resolution make this objective difficult to achieve. In this regard, the experimental methodology would be an interesting way to obtain original data and therefore to shed some empirical light on how people respond to the incentives created by the Kleros environment. Such an analysis could be conducted as part of future research. In the same way, we can regret that the analysis presented in our paper focuses only on the specific case of Kleros. However, it should be noted that many of our arguments—both favorable and unfavorable—apply to many decentralized justice platforms based on the blockchain (e.g., Aragon, Jur, Juris, …).

16 Indeed, all these mechanisms use smart contracts, which implies that dispute resolution outcomes are self-executed without having to enforce them by resorting to traditional courts. Furthermore, behavioral issues due to stereotypes and cognitive difficulties in processing evidence correctly may occur in any decentralized justice system. In the same way, the legal issues raised by the dispute resolution using blockchain technology concern a large set of existing mechanisms. Nevertheless, a form of heterogeneity obviously exists between the procedures and, following an extension that has already been highlighted, a well-developed experimental protocol would make it possible to capture this heterogeneity (and its impact).

Beyond these considerations, the development of the decentralized justice platforms demonstrates that the blockchain world cannot do without ODR procedures, inspired by what emerged in the early 2000s to resolve e-commerce disputes. In other words, the (old) idea that a totally unregulated cyber world is possible is a myth, and the blockchain dispute resolution platforms can be seen as mechanisms of

regulation. While some important issues may be highlighted, regarding the decentralized nature of the process, these platforms may be a good fit with smart contracts, notably because redress processes can be built directly into the contracts themselves (independent of legal jurisdictions). If technology is used to develop the smart contract, for instance within a marketplace or a legal services website, then a clause can be inserted from the beginning specifying the use of a dispute resolution system within that website in the event of a dispute (following, for instance, arbitration clauses that have existed in traditional contracts for a long time).

17 As argued by [

1], the dispute resolution clause in smart contracts can operate in the same way as the “Andon system” in the field of quality control. The Andon system is part of the Japanese Jidoka quality-control method, implemented by Toyota, in which any worker can press a button to stop a production line if they notice a problem. In the world of smart contracts, such a clause encrypted into the contract could allow both parties to press a virtual button to stop its execution, triggering the redress process. The procedure of dispute resolution could then proceed as previously agreed by the parties: if one of the parties pushes the Andon button, then the execution of the smart contract is frozen and a—neutral—third party (i.e., the dispute resolution service provider) is empowered to decide on the outcome of the dispute.

To summarize, even though the design of Kleros is not perfect (some issues are raised in this paper), the perspective adopted by such platforms seems interesting and could be the basis for promising future developments. As argued by [

15], Kleros might have the potential to bring “justice for the unjusticed” just as bitcoin brought “banking for the unbanked”. Nevertheless, some questions are still open, particularly regarding how the decentralized justice market might evolve over time. Given that dispute resolution and its enforcement are not limited to one single institutional possibility, it is likely that a competition will arise between blockchain-based dispute resolution systems, the nature and outcome of which are difficult to anticipate. In particular, following [

8], an open question is whether decentralized justice will be a

winner-takes-all market, due to network externalities: a blockchain-based dispute resolution platform that takes the lead would obtain more cases and jurors, which would allow for efficiency gains, bringing in turn more cases and encouraging more users to join the existing jury panel. However, cost-efficiency is not the only relevant competitive variable since the firm’s ability to comply with certain institutional requirements, related to ethical and regulatory issues, may be crucial. For example, even though Uber has managed to build the largest network of drivers, it has been banned from many jurisdictions that consider that it does not meet certain regulatory requirements. Blockchain-based dispute resolution platforms could face such types of considerations that are critical when it comes to delivering justice.

Overall, we can say that the legal services industry is entering a period of significant disruption, notably related to the emergence of artificial intelligence and blockchain, and this paper is just a first step in thinking through the various implications of this emergence. Much more work needs to be carried out to understand the influence that innovation and technological progress should have on the evolution of the judicial world and its stakeholders.