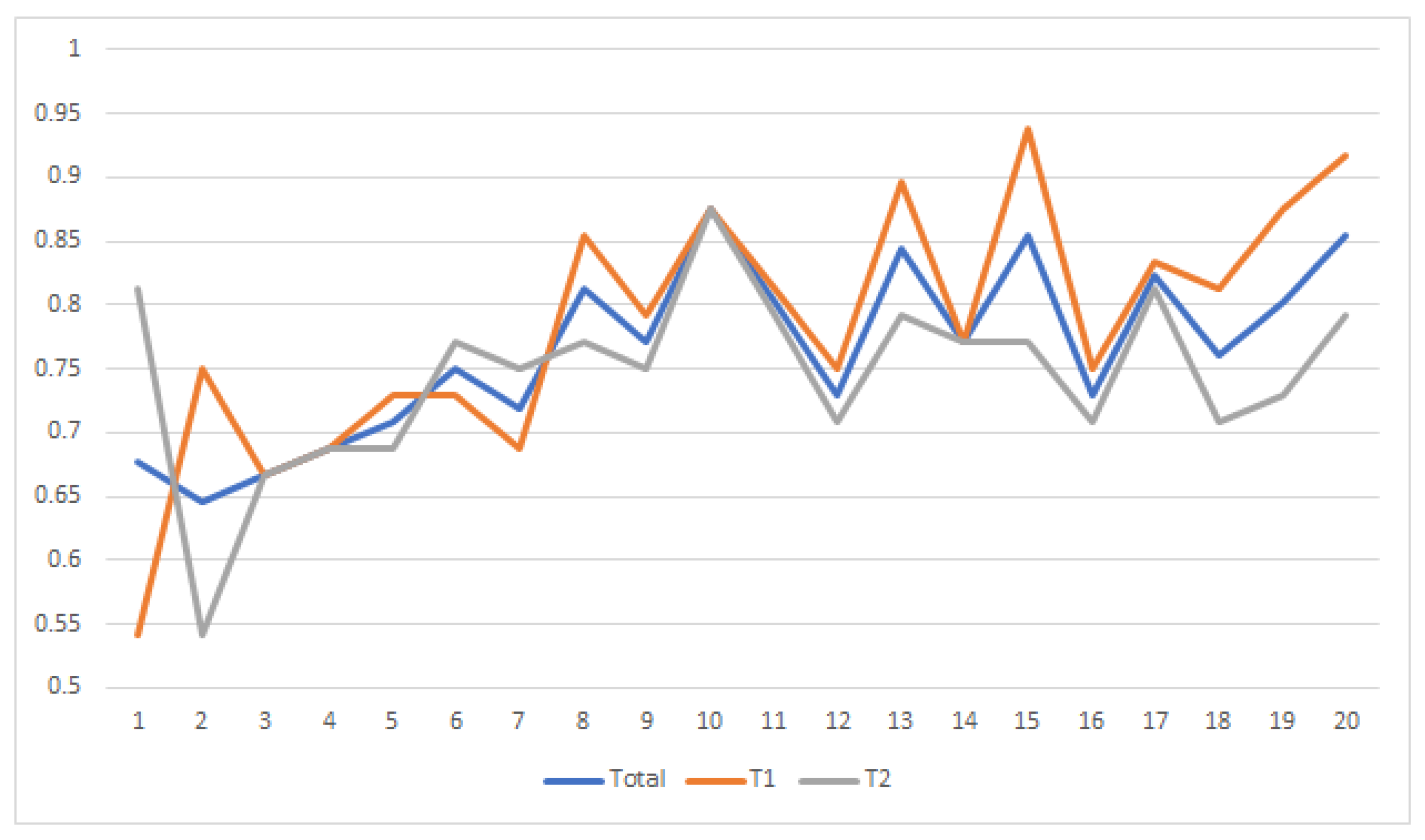

The mean payment of monopoly players was 46.86 TL (IBU 43.71, METU 49.96) in T1 and 71.5 TL (IBU 69.59, METU 73.42) in T2. The mean payment of entrants was 28.17 TL (IBU 28.71, METU 27.62) in T1 and 27.06 TL (IBU 26.63, METU 27.5) in T2. The lowest payoff earned by the METU monopoly players is 41 TL, exceeding the 40 TL that might have been earned by adhering to ‘Cooperative-In’. Except for two of the IBU monopoly players (although each played ‘Aggressive’ at least 12 times), all participants gained more than 40 TL. The mean entrant payoff is approximately 12 TL, which is also less than the amount possible by the ‘Cooperative-In’ sequential equilibrium.

8 monopoly players (8%) always played ‘Cooperative’, while none of the monopoly players always played ‘Aggressive’ and only 3 monopoly players (4%) played ‘Aggressive’ at least 17 times. The ones who played a 50-50 mix of ‘Cooperative’ and ‘Aggressive’ are 5 out of 96 monopoly players (5%) and those who played ‘Aggressive’ at least 10 times are 17 out of 96 monopoly players (18%). Hence, approximately 86% of the monopoly players played a different mixed strategy than 50-50. A one-sided t-test rejects the hypothesis that subjects mix ‘Cooperative’ and ‘Aggressive’ with equal probabilities: ‘Cooperative’ is played significantly more frequently than ‘Aggressive’ (p-value ). Moreover, I also focused on the post-behavior of the monopoly players who reached a 40 payoff within the first 17 rounds. After gaining a 40 payoff, the monopoly players played ‘Aggressive’ less frequently than how they played before the 40 payoff (p-value 0.037).

The number of the entrants who always played ‘In’ is 194 out of 480 entrants (40%), while only 12 entrants (2.5%) always played ‘Out’, and 77 entrants (16%) played a 50-50 mix of ‘In’ and ‘Out’. Among these 77 entrants, 46 entrants (9.5%) chose ‘Out’ as the first two decisions. Hence, approximately 41.5% of the entrants played a different mixed strategy than 50-50. A one-sided t-test rejects the hypothesis that subjects mix ‘In’ and ‘Out’ with equal probabilities: ‘In’ is played significantly more frequently than ‘Out’ (p-value ).

It is also important to determine whether the behavior of the entrants varies over sections. For this purpose, for each section I listed the numbers of ‘In’ responses to each monopoly player during the section. The Kruskal-Wallis H (one-way) test was conducted on these four lists to determine whether there are statistically significant differences between their means. The null hypothesis of equal means across all 4 sections is soundly rejected (p-value ). Hence, the choices of the entrants are not the same across the four sections.

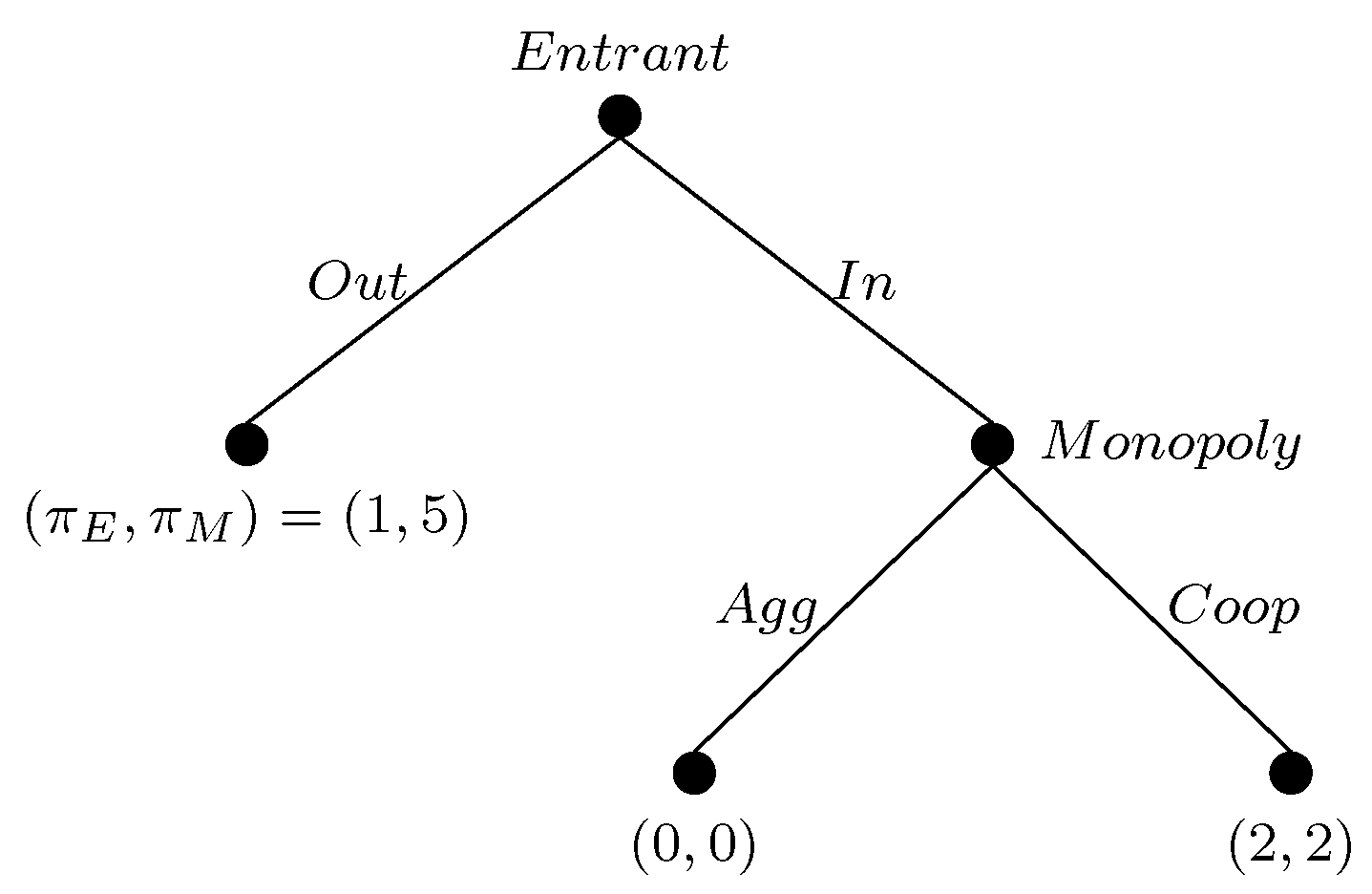

The present experiment includes two treatments that differ from each other in their payoff (either 5 or 10) to the monopoly player when the outcome is ‘Aggressive-Out’. An increase in the proportion of ‘Aggressive’ choices is expected with the increase in payoff from 5 to 10, and the proportion of ‘In’ play is expected to decrease. A Kruskal-Wallis H (one-way) test was conducted on the number of ‘Aggressive’ play and separately on the number of ‘In’ play to test these two hypotheses about the effect of change in payoff. The results of the test show that monopoly players do not play the same way in the two treatments (p-value 0.0001). As expected, they support an increase in the proportion of ‘Aggressive’ play for the monopoly player. However, the expected statistically significant decrease in the ‘In’ play of the entrants is not supported (p-value 0.28). As a result, in ‘Aggressive-Out’ games, the choice of the entrants is not affected by the payoff of the monopoly player, while the choice of the monopolies is affected.

3.1. Logistic Regression Analysis

In this section, I present the results of logistics regression analyses conducted on the probability of an ‘In’ decision of the entrants or of an ‘Aggressive’ decision of the monopoly players. In the analyses, I use the fixed-effects and the random-effects model, which differ in the approach on the effects of the time-invariant variables. In fixed-effects model, the effects of the time-invariant variables are assumed to be time-invariant (so they are omitted), while it does not hold for the random-effects model. For example, one can suppose that the effect of the university in which a student studies does not vary through the rounds (fixed effect), but on the other hand, since a woman is expected to be more risk-averse than a man, she may change her behavior within the stages of an experiment under the pressure of losing(random effect).

Below, first you may find the results of two different logistics regression analyses of the entrants with each of two models, and later, the results of two different logistics regression analyses of the monopoly players with each of two models. In each table below, the first row of an independent variable presents the results of the fixed-effects model; and its second row belongs to the analysis with the random-effects model.

The panel data is obtained by combining the observations collected from IBU and METU participants, and then panel logistic regression analyses were conducted to estimate the probability of an entrant choosing ‘In’. The binary dependent variable is 1 if the decision is ‘In’, and 0 if it is ‘Out’. The independent variables are as followings: Agg is the number of ‘Aggressive’ decisions of the current monopoly player in the previous rounds, Uncertain is the number of Uncertain decisions of the current monopoly player in the previous rounds

2, Round represents the number of the playing round, PRP is the payoff gained from the last play, LRA is a binary variable indicating if the last decision of the current monopoly player is ‘Aggressive’ or not, LRU is a binary variable indicating if the last decision of the current monopoly player is ‘Uncertain’ or not, Order represents the total number of consecutive decisions of the entrants (i.e., 1st or 2nd decision), Uni indicates at which university the entrant studies (at METU or not), Faculty represents in which faculty the entrant studies (Arts and Sciences/Social Sciences, Engineering, Architecture, Economics and Administrative Sciences/Business, Communication, Law or Education), Gender represents whether the entrant is female or not, Game Theory indicates if the entrant took a course on Game Theory or not, and ID is the identity number of the student.

Table 4 presents the result of logistic regression analysis with the fixed-effect model on the panel data gathered from the entrants. The model is meaningful (

p-value < 0.01) and all variables contribute significantly to the probability of an ‘In’ decision. While Round and PRP have positive effects on the probability, the other variables have a negative effect.

The odd ratio of the variable Agg is approximately 0.79 as shown in

Table 4. If Agg increases by 1 unit, then the odd ratio of an ‘In’ decision decreases by a factor of 21%. That means that an increase in Agg observations results in a decrease in the probability of an ‘In’ decision. Hence, it is evident that the entrants are affected by the decisions of the monopoly players and, accordingly, they decide to either enter or stay out of the market. Furthermore, the entrants are affected by the undetermined decisions of the monopoly players in the same manner as they are affected by the ‘Aggressive’ decisions since the odd ratio of the variable Uncertain is approximately 0.81. If Uncertain increases by 1 unit, then the odd ratio of an ‘In’ decision decreases approximately by a factor of 19%. In other words, an increase in Uncertain observations decreases the probability of an ‘In’ decision. The entrants are reinforced to enter the market when they observe more ‘Cooperative’ decisions; alternatively, they decide not to enter the market (i.e., are deterred from entering the market) when they observe more ‘Aggressive’ play.

The variable Round is one of the positive-effect variables with the odd ratio approximately 1.16. Whenever Round increases by 1 unit, the odd ratio of the ‘In’ decision increases approximately by a factor of 16%. The probability of an ‘In’ decision increases if Round increases. One can infer that this result is evidence that entrants were sensitive to the round number or the information changing as a result of the increase in the round number.

The other positive-effect-predictor is PRP: the odd ratio is approximately 1.22. The probability of an ‘In’ decision is higher if PRP is high. This variable and its effect can be interpreted as a risk attitude, since entering the market is simultaneously the decision of risking the investment. If there is something in the ‘pocket’, one may assume risk more often; i.e., an entrant may have an incentive to choose ‘In’ again if she has already earned 1 more point with ‘In’.

Another logistics regression analysis was conducted with the random-effects model by using the same predictor variables. In

Table 4, you may also find the results of it. All the predictor variables of the fixed-effects model to estimate the probability of ‘Aggressive’ decision are also predictor variables of the random-effects model. Among the time-invariant variables, Uni, Gender have a negative effect on the probability, while Game Theory has positive effect.

In

Table 4, the odd ratio of the variable Uni is approximately 0.73, i.e., the probability of an METU entrant to have an ‘In’ decision is less than the probability of an IBU entrant. As stated in

Table 4, the odd ratio of the variable Gender is approximately 0.65. This implies that a female entrant’s probability of an ‘In’ decision is smaller than a male entrant. This observation can be explained by the difference in the risk attitudes between the genders.

Some of the participants were the students who already took some courses on Game Theory. According to the odd ratio greater than 1, the probability of an ‘In’ decision is higher if an entrant had already learnt some basic concepts of Game Theory.

In

Table 5, the result of the second logistic regression analysis on the entrants’ panel data with fixed-effects model is presented. The model is meaningful (

p-value < 0.01). The variables PRP, LRA and LRU contribute significantly to the probability of an ‘In’ decision. While PRP has positive effects on the probability, LRA and LRU have a negative effect.

The odd ratio of the variable PRP is approximately 1.37 as shown in

Table 5. This means that the probability of an ‘In’ decision is higher if PRP is high. In other words, an entrant may have an incentive to choose ‘In’ again if she has already earned 1 more point with ‘In’.

The odd ratio of the variable LRA is approximately 0.40, i.e., if LRA takes a 0 value, the probability of an ‘In’ decision is higher in comparison to the situation where LRA is 1. The same is also valid for LRU. In other words, the probability of an ‘In’ decision decreases when the entrants observe that the last round action is not ‘Cooperative’.

In

Table 5, you may also find the results of the same logistics regression analysis with random-effects model. The time-invariant variables Gender and Game Theory are significant predictors along with PRP, LRA and LRU as in the analysis with the fixed-effects model.

As in the results of the previous random-effects model, a female entrant’s probability of an ‘In’ decision is smaller than a male entrant’s (the odd ratio is 0.67); and the probability of an ‘In’ decision is higher if an entrant had already learnt some basic concepts of Game Theory (the odd ratio is 1.36).

Four panel logistic regression analyses with the fixed-effects and random-effects model were conducted to estimate the probability of a monopoly player choosing ‘Aggressive’ on the panel data gathered from the monopoly players. The binary dependent variable is 1 if the decision is ‘Aggressive’, and 0 if it is ‘Cooperative’. The independent variables are the following: Agg-In is the number of Agg-In outcomes observed in the previous rounds, Coop-In is the number of Coop-In outcomes observed in the previous rounds, Agg-Out is the number of Agg-Out outcomes observed in the previous rounds, Round represents the number of the playing round, LRI is a binary variable indicating whether the decision of the previously played entrant in the previous round against the monopoly player about to be faced is ‘In’ or not, Uni indicates at which university the entrants studies (at METU or not), Faculty represents in which faculty the entrant studies (Arts and Sciences/Social Sciences, Engineering, Architecture, Economics and Administrative Sciences/Business, Communication, Law or Education), Gender represents whether the entrant is female or not, Game Theory indicates if the entrant took a course on Game Theory or not, and ID is the identity number of the student.

Table 6 summarizes the results of the panel logistic regression analysis of the monopoly player with the fixed-effects model. The model is meaningful (

p-value < 0.01). Agg-In and Agg-Out are statistically significant predictors of the probability of an ‘Aggressive’ decision. While Agg-Out has a positive effect on the probability, Agg-In has a negative effect on the probability.

The odd ratio of the variable Agg-In approximately 0.79. If Agg-In increases by 1 unit, the odd ratio of the ‘Aggressive’ decision decreases approximately by a factor of 21%, i.e., an increase in the number of Agg-In observations causes a lower probability of an ‘Aggressive’ decision.

Table 6 also shows that the odd ratio of the variable Agg-Out as approximately 1.50. If the number of Agg-Out increases by 1 unit, the odd ratio of the ‘Aggressive’ decision increases approximately by a factor of 50%. Thus, the probability of an ‘Aggressive’ decision increases if the number of Agg-Out observations increases.

I replicated the logistic regression analysis by using the random-effects model.

Table 6 also presents the results of this analysis: none of the time-invariant variables has a predictive power on the independent variable. As mentioned above, in the analysis with the fixed-effects model, Agg-In and Agg-Out are the significant predictor variables. However, this is not valid for the analysis with the random-effects model: instead of Agg-In, Coop-In is a significant predictor variable along with Agg-Out. Like Agg-In, Coop-In has negative effect on the probability of an ‘Aggressive’ play. If Coop-In increases by 1 unit, the odd ratio of the ‘Aggressive’ decision decreases approximately by a factor of 12%. This is the only difference between two models I observed in all analyses done in this study.

In

Table 7, you may find the results of the second logistic regression analysis on the monopoly players’ panel data with fixed-effects model. The model is meaningful (

p-value < 0.01) and LRI is not a significant predictor of the dependent variable.

It is an important observation that LRI has no predictive power on the probability of ‘Aggressive’ play. One can interpret this result as follows: The monopoly players did not take the one-round reactions of the entrants as one of the main driving forces of their decisions; i.e., they were not myopic.

The second logistics regression of the monopoly players is also replicated by the random-effects model. In

Table 7, the result of this analysis is presented. LRI as well as none of the time-invariant variables have a significant effect on the probability of an ‘Aggressive’ decision.