1. Introduction

During the 17th and 18th centuries, the English crown introduced a variety of new taxes to raise revenue and fund military campaigns. One of the most famous, the ‘window tax,’ was meant to tax subjects based on the size of their properties—size estimated by the number of windows. This measure had rather unintended consequences—many people bricked-up their windows in order to avoid the tax, so much so that bricked up windows is a common architectural feature of the period. From 1766 the tax only included properties with seven or more windows— in the subsequent period, the number of houses in England and Wales with exactly seven windows fell by two thirds [

1,

2]. Much of academic inquiry into following rules tend to focus on the dichotomy between obeying and breaking the rule, but the example above illustrates the ubiquitous practice of obeying the rule in order to disobey its scope. In this paper, we provide an empirical investigation into this practice of ‘creatively complying’ with the law and the social and psychological factors that underpin it. We attempt to distinguish the behaviours of (1) playing the system (interpreting the rules in one’s favour, i.e., tax avoidance, tax planning) and (2) breaking the rules, in the context of small business owners’ compliance with tax regulations (i.e., tax evasion). Specifically, we look at business owners’ attitudes involved and the social and psychological factors related to these behaviours.

1.1. The Social Nature of Compliance and the Case of Creative Compliance

The present work broadly deals with the way people behave in relation to laws and regulations. A large literature on the topic regards laws as external influences on individuals in society—faced with these external prescriptions, individuals can choose to either follow or defy them [

3]. However, particularly in the last few decades, a movement of scholars of sociology, anthropology, psychology, among others, have emphasized the social nature of the legal process [

4]. On the one hand, the drafting of laws is influenced by the lobbying of different groups in society as well as the current social practice. On the other hand, the understanding and application of laws or rules is a subjective process where many social inferences are involved (for instance, one’s social class, ethnic group, or their seemingly defiant/apologetic attitude can all play a role). Tax laws and regulations are no exception, as they are subject to be influenced by powerful actors within the field [

5], and their application can be influenced by a range of existing social practices [

6].

One fascinating illustration of compliance as a social practice is the case of individuals or organisations complying with the ‘legal letter’ with the very purpose of disregarding the principle it is based on. This behaviour has been labelled ‘creative compliance’ [

7]. For example, [

8] cites the case of UK financial sector companies paying large bonuses in shares to salaried employees in order to avoid employment taxes that were only levied on salary payments. She also recounts the way several organisations avoided the value added tax imposed on domestic fuel used for the heating buildings by selling their boilers (which would remain on-site) to external companies who would then sell the fuel to heat the water back to the organisation. The external company would be able to reclaim the value added tax. Organisations would justify this type of arrangement with a “‘where does it say I can’t do that?’ argument” (p. 231), being ready to demonstrate their complete compliance with existing regulations while at the same time avoiding making payments that would have otherwise been due.

1.2. Creative Compliance with Tax Law: Distinction Between Tax Planning, Tax Avoidance, and Tax Evasion

The wider tax literature focuses on a binary distinction regarding tax compliance decisions: compliance and non-compliance. However, it is advisable to consider the nuances between the two extremes to gain a deeper understanding of tax decisions (i.e., ‘creative compliance’: tax planning, tax avoidance). There is no agreed-upon definition of tax avoidance [

8,

9,

10]. In the following, we review the various approaches, as one of the aims of the study is to empirically investigate the stability of the ‘tax avoidance’ construct.

Mostly, tax avoidance is defined as the creative design of the tax statement in a legal way with the aim of income reduction and/or an increase of expenditures [

11]. It may seem at first glance that the tax arrangements to reduce the tax burden are only relevant to a small number of taxpayers who possess the resources to employ legal professionals who will help them negotiate tax law. However, for instance, it was cited as the widespread practice of avoiding tax in the UK in the early 1990s for some employees to cease being employed and in turn, perform the same work for their former employer through a limited company, thus avoiding employer and income tax [

12]. Despite changes in the law, these practices continued and remain controversial. In most cases above, the legislators or tax authorities have stepped in to stop these means of avoiding tax. However, tackling tax avoidance through challenging it in court, introducing new regulation, and pursuing avoiders for debt is not only costly for the regulator, but it can also have a detrimental effect on taxpayers’ future cooperation due to feelings of unfairness [

13,

14].

Even when tax avoidance is only relevant to a smaller number of wealthy individuals or corporations, it’s very presence can have a detrimental effect on tax morale [

15], as well as wider trust in government and the democratic process [

16]. As in reaction, tax authorities try to close those loopholes with new regulations in law, according to [

17], this results in a kind of cat-and-mouse legal drafting culture of loophole closing and reopening by creative compliance.

By contrast, tax evasion is generally defined as the illegal act to reduce tax burden [

18]. Therefore, it seems easy to demarcate illegal evasion from legal avoidance in theory. In reality, these practices are not as clearly separate. As proposed in the Aggressive Tax Planning: Indicators report by the [

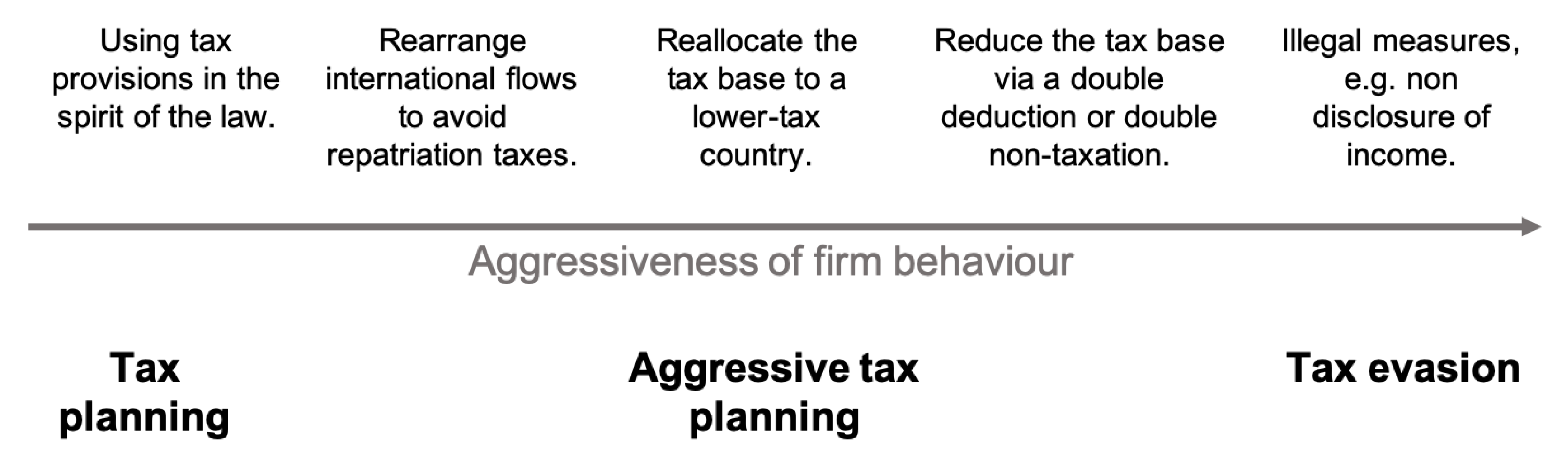

19], tax planning can have different shadings on the compliance/non-compliance continuum depending on the aggressiveness of the procedure (see

Figure 1). Aggressive tax planning is a general term used to describe tax avoidance strategies that comply with the letter but not the spirit of the law. More precisely, the aim of those strategies is to reduce the level of a certain taxable income below the one intended by the legislator [

10]. The true rationale of aggressive tax planning is to reduce the effective tax rate at any price by exploiting loopholes, weaknesses or ambiguities in the law (i.e., movement of funds, construction of fictious or shell companies). Since these transactions sail at least close to the wind, it can be assumed that aggressive tax planning contains both elements of tax avoidance and tax evasion [

20] and is therefore located between those practices.

Former research on creative compliance puts focus on organisations but has some shortcomings concerning the relevant factors that drive individuals’ tax decisions. A possible explanation for this research gap is that many creative compliance strategies require the use of resources and are, therefore, less frequently used by individuals. Further, the role of individual factors is difficult to assess in larger organisational structures where decisions are complex and distributed among many actors. To further investigate the role of psychological factors, hence, we focus on the behaviour of individuals in simple business structures such as sole traders and very small incorporated businesses, and the case of income tax. Although only little past research has looked at the tax avoidance of individuals, a wider literature has been more generally concerned with tax compliance/evasion and the social and psychological factors involved.

1.3. Psychological Factors: Distinguishing Tax Compliance, Avoidance, and Evasion in Individuals

Looking at why individuals do or do not comply with tax law, past research has overwhelmingly focused on understanding tax evasion decisions (unusually in relation to income tax), for instance, by looking at the intentional non-declaration of income received. This literature broadly aims to tease out the factors that lead individuals to become involved in the criminal activity of tax evasion, for reviews, see [

21,

22,

23,

24,

25].

Creative compliance, by contrast, is comparably under-investigated in the tax compliance literature. One barrier is perhaps the fact that, as already mentioned, there is no clear definition of ‘tax avoidance’ or ‘(aggressive) tax planning’ [

8,

9,

10,

26]. Although tax avoidance is usually defined as a business arrangement set up with the principal purpose of avoiding tax [

19], tax arrangements that are considered by some people in some historical periods to be legitimate business practices constitute in other historical periods deeply immoral avoidance of contributing to the public good. [

19] argues that such shifts in attitude are cyclical, such that periods of widespread avoidance will follow periods of relatively high commitment to the tax system.

Authors relate tax avoidance to a lack of commitment to the tax system and erosion of tax morale in wider society, e.g., [

19,

26]. Nonetheless, tax arrangements that cause public outcries can be challenged in court by authorities to find that they are ruled to be ‘not illegal’ [

8]. From the perspective of many researchers, these behaviours then become ‘compliant’ with tax law and do not warrant further investigation. Some authors argue that the use of such emotional terms as ‘aggressive tax planning’ is misleading and unhelpful [

27]. These complexities surrounding the definition of tax avoidance are probably one reason for the lack of research into this behaviour. It may seem to some that there really is no such thing as ‘tax avoidance,’ but what some call ‘avoidance’ constitutes either ‘compliance’ or ‘evasion’ depending on the ruling of courts or interpretation by authorities.

However, [

28] looked at the way that evasion and avoidance are perceived by entrepreneurs, tax officers, business students, and lawyers by assessing social representations of these behaviours. They found that people distinguish tax evasion, tax avoidance (use of ‘loopholes’) and tax flight (i.e., relocating one’ business in a different country with a more favourable tax system, which fits under our definition of tax avoidance/creative compliance) as separate types of behaviours, clearly distinguishing the first as illegal and the latter two as legal, but immoral (particularly so for tax flight). In addition, they found that tax avoidance and tax flight were perceived as fairer than tax evasion. The distinction between tax avoidance and evasion is not only apparent in people’s lay representations of others’ behaviour, but also in their attitudes toward their own tax compliance. [

29] has found that some people exhibit an attitude of ‘game playing’ towards tax authorities. This attitude is distinct from the stance of disengaging with the tax system and operating outside of the system (i.e., evading tax). People displaying an attitude of ‘game playing’ are, in a way, engaged with the tax system while using existing regulations to defy the system itself. This practice is often seen by those who become involved as clever business innovations and the mark of entrepreneurship, not as committing fraud [

19]. Further to this work on game-playing, [

29] measured behaviours related to tax avoidance (activities that are not illegal but aim at minimising tax) and tax evasion (illegal withholding of income/overstating expenses) to find that these behaviours are seen as qualitatively distinct by taxpayers, and are both further distinct from compliance. This research demonstrates that although ‘tax avoidance’ may be at times difficult to define from a legal perspective, tax avoidance is psychologically distinct from both compliance and evasion.

Tax avoidance does not just ‘exist’ in the minds of individuals as an attitude toward the tax system, it forms a distinct category in public discourse. [

15] investigated public reactions to a tax avoidance scandal on social media to show that a large majority of commentators distinguish tax avoidance (arrangements described in terms of ‘it may be legal, but it’s immoral’) from both compliance (‘paying one’s fair share’) and evasion. Of course, capturing what is moral at any given time is difficult. As shown earlier, the definition of what is acceptable practice is socially-situated and will shift in different historical periods or social groups [

26]. To attempt to capture what may be seen as tax avoidance in public discourse at one specific point in time, it may be helpful to think of the boundaries of acceptable-unacceptable practice negotiated among different actors in the tax field at a given time [

6]. Tax avoidance is likely to be the type of activity that situated itself at the boundary and pushes the boundary [

19]. Analyses of lay social representations [

28] and public discourse [

15] can be helpful for capturing social attitudes in relation to different tax arrangements and current definitions of tax avoidance.

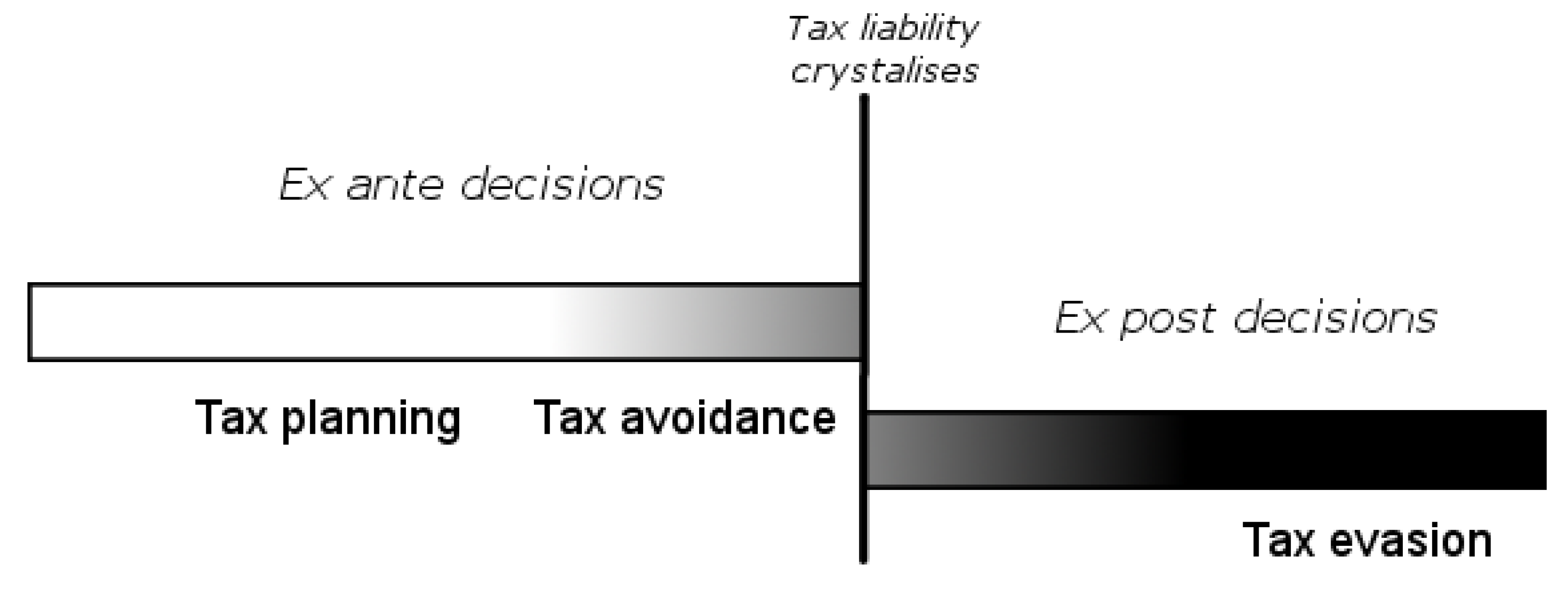

As shown above, tax avoidance is psychologically distinct to both evasion and compliance. [

8] construes ‘creative compliance’ or tax avoidance to be placed in the ‘grey area’ of the continuum of activities between committed compliance and illegal noncompliance. This also applies to (aggressive) tax planning regarding the report of [

19] mentioned above. This continuum approach can be helpful as it aligns with social representations of tax avoidance as being ‘less serious’ than tax evasion [

28]. However, it does not capture the complexity of behaviours involved. In particular, we highlight an essential distinction between behaviours on the continuum. Tax evasion is an act of non-compliance once a tax liability has arisen, it is ex post behaviour. For example, income is received that is subject to income tax but is not declared to the tax authorities. The receipt triggers a tax obligation, but the decision is made not to comply with that obligation by concealing the income. Tax planning, on the other hand, is behaviour that occurs before the crystallisation of tax liability. It is ex ante activity, which allows the taxpayer to choose between alternative ways of arranging their affairs so as to reduce future tax liability, and may or may not be successful in achieving this in the long run. We present an illustration in

Figure 2.

1.4. Factors Involved in Tax Avoidance and Evasion Decisions

To further explore how tax avoidance differs from evasion, but also how to change these behaviours, we next turn to the factors that may facilitate or impede both avoidance and evasion. Since tax planning may contain elements of both strategies, the factors listed below may equally affect the tax planning behaviour.

Deterrence. One of the most frequently researched factors to influence compliance decisions are penalties imposed on evaders and the perceived likelihood of incurring such penalties. Taxpayers are thought to be deterred from becoming involved in tax evasion by the fines incurred if they are found to evade, as well as other potentially serious implications such as having a criminal record or even imprisonment. In their classic model of tax compliance, [

30] propose that people take into account the level of penalty and probability of being found to evade (and sometimes reputational concerns) to calculate the financial benefit of evasion and make a rational profit-driven decision. Although the model was very influential, evidence on the role of audits and penalties is mixed. Reviewing the literature on tax compliance, [

31] argue that levels of audits observed in reality are insufficient to explain the high compliance levels observed in society, thus, casting doubt on the validity of the model. Taxpayers may, however, overestimate audit probabilities so that the subjective belief about audit likelihood will influence their decisions [

32].

While penalties may constitute a deterrent for tax evaders, these penalties may not apply to avoidance. Avoidance is often presented to taxpayers as an arrangement that can save tax in a ‘perfectly legal’ way with no financial loss [

19]. To explain tax evasion decisions where deterrence seems insufficient, some scholars have turned to the role of social and psychological factors, which we discuss below. These factors become even more important where financial implications seem absent to taxpayers, such as in the case of tax avoidance.

Tax morale. To explain why people comply even when penalties and audits are low, and the rational decision would be to evade, several authors have proposed that taxpayers may comply out of intrinsic motivation to contribute to the public good [

33,

34], otherwise centred as a personal commitment to tax system [

29,

35], for instance, shows that such a personal norm to comply with the system explains compliance. Given that both tax avoidance and tax evasion are forms of rejecting cooperation with tax authorities, it is expected that both avoidance and evasion will be related to a sense of low tax morale.

Social norm. Taxpayers may not be committed to the tax system themselves, but they may still be influenced by moral norms in society, for instance, because their reputation as traders would be affected, and they would incur losses in the longer term [

36]. Although some studies have shown that both personal and social norm are important in explaining compliance intentions e.g., [

35,

37] found that positive effects of social norms can be explained by the fact that taxpayers possess a personal norm (i.e., high tax morale) consistent with a high compliance norm, and therefore the positive effects are ultimately due to personal norms. When personal norms are low, social moral norms are ineffective if people believe their evasion or avoidance remains private rather than becoming public knowledge [

38]. Social norms are only effective if people hold the group as important, i.e., if they identify with the group, [

39].

Fairness. Another important factor that has been shown to affect compliance intentions is a sense of fairness – a sense that one receives adequate services for taxes paid and that one is treated fairly e.g., [

40,

41,

42]. Since tax evasion represents disengagement with the tax system, the role of fairness may be less marked than in the case of avoidance. For instance, research on those becoming involved in mass-marketed avoidance schemes shows that their involvement can constitute a defiant stance towards a tax system that is seen not to serve citizens [

16,

19].

Knowledge and beliefs about the tax system. Surveying taxpayer attitudes toward tax authorities, [

43] shows that some taxpayers defy the tax system by ‘playing games’ and seeking to take advantage of loopholes in tax law. What underlies this attitude is a belief that the tax system has loopholes to be exploited, and one is confident and knowledgeable enough to exploit these loopholes.

Crime perception. While tax avoiders seek to take advantage of loopholes and avoid contributing to the tax system in a ‘legal’ way, tax evaders are committing tax fraud by breaking the rules. One factor that may explain people’s willingness to evade tax is the perception that tax evasion is not a serious crime [

44], given that it can be perceived as a victimless crime [

45].

To summarise, both tax avoidance and tax evasion are related to a lack of willingness to cooperate with the tax system, low ‘tax morale.’ However, avoidance and evasion may also be subject to different factors. Evasion may be related to beliefs that penalties are severe, and audits are likely, and that evasion is not a serious crime. Conversely, avoidance should not be influenced by these factors but be related to a belief that the tax system can be exploited for financial gain and that the imposition of taxes is unfair.

1.5. The Current Study

Given that compliance attitudes and the factors influencing these attitudes are most likely to be relevant at an individual level as opposed to larger businesses, in the current study, we look at self-employed individuals and owners of very small businesses. Our focus population is owners of micro-businesses in the UK. Micro-businesses are defined as businesses (incorporated or not incorporated) with under 10 employees and turnover under £ 1.6 million (‘Commission Recommendation 2003/361/EC’, 2003).

We assess tax avoidance and tax evasion using the inventory developed and validated by [

46]. The items in the inventory were asking respondents to answer a series of scenario questions about tax avoidance and tax evasion, a method that is advantageous as it may mitigate the desirability bias involved in asking people directly to assess their compliance [

47].

We expect to find that tax avoidance and evasion are distinct constructs consistent with [

46]. In regard to tax avoidance, the scale employed by [

46] focuses on activities that are ‘perfectly legal’ but allow one to pay less tax than would be due if a different course of action was taken. For instance, they consider the case of a business owner purchasing assets that are not needed for their business in one particular year (but will be needed in the future) in order to decrease their profit, and thus their tax bill, to constitute tax avoidance. However, as discussed earlier, what constitutes ‘tax avoidance’ shifts in different historical and social contexts. Drawing on analyses of analyses of social media reactions [

15] and analyses of online discussions among the self-employed [

48], we find that the notion of ‘tax avoidance’ is rather related to more complex arrangements – for instance, one such case related to the avoidance of income tax and social insurance contributions of an employee by ceasing to be employed in the UK, but instead being contracted by an off-shore company which then hires the services of the employee back to the initial employer. Such ‘schemes’ are argued as legal by their proponents but can be contested by authorities in court or though general anti-avoidance rules [

15], for a similar example of ‘aggressive tax planning’ in Australia see [

16]. This type of ‘artificial’ arrangement to avoid tax is argued in public discourse to be distinct from ‘legitimate tax planning’ [

15]. Given that many scenarios used by [

46] to measure tax avoidance capture such ‘legitimate tax planning,’ we adapted some of the items to fit the perception of ‘tax avoidance’ (i.e., ‘aggressive tax planning’) in public discourse at the time of running the survey in the UK. As suggested by [

19], we may thus find in the structure of our scale measuring tax avoidance that people differentiate ‘legitimate tax planning’ and ‘aggressive tax planning.’

While avoidance and evasion are expected to be perceived as distinct by respondents, they both constitute forms of non-compliance, so they are expected to be negatively related to people’s self-reported compliance. However, given that avoidance and evasion are placed differently on the compliance-noncompliance continuum (see

Figure 2), we expect this negative relation to compliance to be stronger for evasion than avoidance.

Finally, as discussed above, we expect several factors to be related to avoidance and evasion. Both evasion and avoidance should be negatively related to people’s personal moral norms to contribute to the tax system. We may also find that evasion and avoidance are negatively related to perceived social norms to contribute to the public good. Tax evasion is expected to be related to beliefs that audits are frequent, and penalties are severe and to perceiving evasion as a less serious crime. Tax avoidance, on the other hand, should relate to a belief that the tax system has ‘loopholes’ that can be exploited and may relate to a sense that the tax system is unfair.

4. Discussion

Inquiries into the nature of tax compliance behaviour have focused overwhelmingly on the dichotomy between compliance and evasion [

46], between ‘following the rule’ and ‘breaking the rule.’ Tax compliance research is not unique in this respect, much of the literature on organisational compliance with regulations has construed behaviour as binary - compliance/noncompliance with rules. However, it is not uncommon for people to use rules in order to avoid being compliant [

8]. Overall, we know little about the nature of this ‘creative compliance’ behaviour and its facilitating factors. Our analysis has attempted to disentangle noncompliance (i.e., tax evasion) and creative compliance (i.e., tax avoidance, tax planning) and look at their predictors.

Our study contributes empirical evidence to the field of tax behaviour and in particular, the under-investigated area of tax avoidance [

28,

43,

46]. We replicate past results showing that people distinguish evasion and avoidance as separate forms of non-compliance [

46], while additionally showing that people distinguish tax avoidance from legitimate tax planning. Furthermore, we provide novel evidence of the factors associated with people’s reported likelihood to be involved in evasion and avoidance, providing empirical evidence to support the ‘creative compliance’ model proposed in the legal literature [

7,

8] and contributing more broadly to the literature on the nature of compliance [

3]. We detail these contributions below.

While attempting to capture tax avoidance behaviour we found that people distinguish two different behaviours:

tax planning as the legitimate practice of finding tax efficiencies and

tax avoidance as the practice of finding ‘loopholes’ in the law in order to significantly minimise tax contributions. These two behaviours are also distinct from

tax evasion. We found that the three behaviours – planning, avoidance, and evasion – are situated on the compliance-noncompliance continuum, as illustrated in

Figure 2. While tax planning is unrelated to compliance, suggesting that the likelihood to be involved in tax planning is not related to noncompliance, both avoidance and evasion are situated in the noncompliance area, with evasion further to the noncompliance end of the spectrum (see

Figure 2).

Although planning, avoidance, and evasion can all be placed on the compliance-noncompliance spectrum, it is important to stress that they are distinct behaviours with different facilitating factors. Unsurprisingly, both tax planning and tax avoidance are underlined by a belief that the tax law is flexible and can be used to find tax savings. In addition, people likely to be involved in tax planning feel more confident in their knowledge of tax law. Tax evasion, on the other hand, is unrelated to beliefs about the tax system. As expected, both avoidance and evasion are related to a low personal norm to contribute to the public good, or low ‘tax morale,’ while no such negative relation underlies tax planning. However, avoidance and evasion differ in relation to other predictors. Avoidance is associated with a sense of unfairness (that one is not receiving adequate services for taxes paid and is treated unfairly). Evasion, on the other hand, is associated with the perception that tax evasion is not a serious crime.

These results are consistent with our initial expectations and previous literature that tax avoidance, as well as evasion, are underlined by an attitude of noncompliance – a low moral norm to contribute to the tax system [

8,

35,

54]. However, avoidance and evasion are driven by different factors. In effect, they are different routes to contribute less to the tax system. People who believe the tax system allows interpretation in order to minimise tax contributions and who assess the tax system as unfair are more likely to say they would become involved in tax avoidance. These results are consistent with previous conceptualisations of creative compliance as determined by both a negative attitude towards the tax system [

8], as well as feelings that the tax system may not serve citizens [

16]. By contrast, such factors are unrelated to tax evasion. People who said they are likely to become involved in evasion are those who see evasion as a less serious crime. This result is consistent with previous research that found that tax evasion to be perceived as a trivial offence [

55] or a victimless crime, and thus less serious by people likely to become involved in evasion [

45].

It may be surprising that tax evasion was not associated with perceptions of deterrence factors such as audits and penalties [

30]. On closer inspection, we found that when deterrence factors were considered independently of other variables, there was a significant relationship between the belief that audits are likely and tax evasion. Penalty beliefs did not have a significant effect, perhaps because penalties are public knowledge, but audit rates are private so that subjective beliefs about audits are more likely to have an effect than subjective beliefs about penalties. An alternative explanation may be that penalties would be perceived not as deterrents but as fair compensation for evasion [

56]. However, when other predictors are considered, this audit belief effect is mediated by a low compliance personal norm as well as the perception that evasion is not a serious crime. The mediation by personal norm and evasion as serious crime suggests that people may express a belief that they are less likely to get caught to rationalise their involvement in tax evasion, but the primary factors driving their behaviour is to be consistent with their personal standard of behaviour and pre-existing attitudes. Previous research has suggested that people may offer post-hoc rationalisations of evading tax - although they may make rational self-interested decisions, they may then ‘make up’ a moral reason to justify their actions for an analysis of these processes see [

57]. The current result suggests the opposite – that people evade in order to be consistent with personal norms of behaviour and existing attitudes but will rationalise their behaviour as ‘business savvy.’ This result is novel, but consistent with the fact that personal norms are a strong predictor of behaviour in a variety of domains see [

38] as are attitudes in certain instances [

58]. Although people may be driven by personal norms or attitudes, they may offer a post-hoc rationalisation of their action by saying they made a rational decision given that many people seek to appear to act in a rational profit-driven way which is valued in society as entrepreneurial, norm of self-interest [

59]. While this result is interesting, further research is needed to investigate such post-hoc rationalisation of evasion as a rational decision in more detail.

Based on previous research, we also explored the possibility of a negative relationship between social norms to contribute to the public good and avoidance and evasion [

16,

35]. One possible explanation for the lack of a social norm effect is that moral norms are only effective drivers of behaviour when the behaviour is public, but people may expect their tax affairs to remain private. We also found an unexpected negative association between tax knowledge and tax evasion. One explanation for the effect may be that some of our sample had low knowledge of tax and may have honestly not realised that some scenarios listed constitute tax evasion (for instance, [

60], found that there is genuine confusion among hairdressers as to whether tips should be declared as income or not). Furthermore, we found a positive association between tax knowledge and tax planning, on which we could suggest that people with higher text knowledge use their knowledge to plan their tax behaviour a priori instead of evading taxes.

Overall, we provide empirical evidence of the distinction between tax planning, avoidance and evasion, and factors related to the three behaviours. Our results are interesting to scholars looking at tax compliance decisions, where tax avoidance has received relatively little attention [

16,

28,

46]. Nonetheless, tax avoidance is a particularly interesting case of noncompliance for scholarly research. The tax compliance literature has largely focused on two types of factors affecting tax compliance: deterrence (i.e., fines) and socio-psychological factors (e.g., attitudes, norms, fairness) for a review see [

24]. Those involved in avoidance perceive it as ‘perfectly legal’ and unlikely to incur any financial risk [

46]. Therefore, financial deterrents are perceived to be. However, despite this belief, not all taxpayers become involved in tax avoidance, as many perceive it to be ‘immoral’ [

16]. Thus, the role of social and psychological factors is even more relevant in understanding why people do or do not choose to be involved in tax avoidance than in the case of evasion, so it becomes particularly fertile ground for studying the role of social and psychological factors in tax compliance.

More broadly, we contribute to the literature on the nature of compliance [

3] and ‘creative compliance’ in particular [

7,

8]. We do not only find that people construe avoidance and evasion as distinct forms of noncompliance, but that they further distinguish ‘tax planning’ as a separate category. ‘Creative compliance’ (in this case, ‘tax avoidance’ or ‘aggressive tax planning’) may be difficult to define from a legal point of view, as one takes the view that ‘creative compliance’ is rendered compliance or non-compliance by a court verdict e.g., [

27]. However, we find that people distinguish ‘creative compliance’ with tax law (i.e., avoidance) as a distinct behaviour and a form of avoiding to contribute to the tax system. Scholars have also noted that, beyond the nature of the law, attitudes are important to understand people’s involvement in ‘creative compliance’ e.g., [

8,

26]. Our results confirm this proposition as we find people who report being more likely to be involved in avoidance have a negative attitude towards contributing to the tax system as well as a belief that the law can be taken advantage of.

We provide novel evidence regarding the factors associated with tax avoidance that may be useful to tax authorities. The results suggest that in order to tackle involvement in tax avoidance, tax authorities need to tackle the belief that the system has loopholes that are easy to exploit for profit. At the same time, taxpayers may be less likely to become involved in tax avoidance if they perceive the tax system as providing adequate services for taxes paid and that they are treated fairly by authorities.

Although we provide initial insights into nature and factors driving of tax avoidance, as well as tax planning and tax evasion, it is important to note that further research is necessary to increase certainty in the current results. Our questionnaire data is correlational, we interpreted results in line with previous research (i.e., where variables such as audit beliefs or personal norms constitute predictors and evasion/avoidance the outcome), but it is not unconceivable that some relations would be reversed so that respondents’ ratings of their personal moral norms are mere post-hoc justifications of behaviour, although for an analysis providing evidence against the rationalisation argument, see [

57]. Field or laboratory experiments would further provide evidence in support of the directions of the effects presented here. It is also important to note that we have only measured people’s reported intentions to become involved in avoidance or evasion. First, this measure may be subject to social desirability biases as people may be unwilling to report the true extent of their intentions [

61], although we mitigate this effect by respondents being anonymous and by employing scenario measures. Second, and maybe more pertinent to predicting behaviour, people may entertain the idea of avoidance or evasion, but many other variables are involved in whether they actually become involved [

62], such as having the opportunity to do so, employing an adviser willing to support them, etc. Further research on institutional data related to people having been involved in tax avoidance may be used to corroborate findings relating to attitudes or intentions e.g., [

16].

Tax avoidance has important social implications for the erosion of confidence in the tax system [

14] and the democratic process [

16], and can also constitute lost revenue for the state through non-payment e.g., [

63] and through the cost of pursuing avoiders in court and recovering tax debt. Despite its implications and, at times, intense public interest in tax avoidance, the topic has received relatively little attention from scholars. We hope that the present study will be useful in catalysing further research on the psychological nature of tax avoidance in particular, as well as ‘gaming the system’ in contexts other than tax.