1. Introduction

The problems concerning portfolio selection (PS) are referred to with the formation of portfolio satisfaction. The availability of uncertainty on the securities’ returns makes it difficult to ensure which portfolio should be chosen (Simammora and Sashanti [

1]).

In numerous application-related areas, for instance, system analytics and optimization, an optimization model is formulated by employing the data that is disclosed with some approximation. Fuzzy sets theory, as invented by Zadeh [

2] helps to deal with the possible uncertainty in the model using the fuzzy numbers. Dubois and Prade [

3] studied the fuzzification rule to deal with the mathematical operations in the domain of real numbers to the co-domain of fuzzy numbers. Rommelfonger et al. [

4] presented an efficient methodology to solve the multi-objective linear programming (MOLP) problem. Zhao et al. [

5] determined the solution for the most generalized symmetrical fuzzy LP problem, where both fuzzy (non-fuzzy) equality and inequality constraints are included. Fuzzy LP with multiple objective functions was introduced by Zimmermann [

6]. The neutrosophic sets, which are the generalized forms of fuzzy sets, are employed to solve the fuzzy multi-objective linear programming model (Ahmadini and Ahmad, [

7]).

Due to the uncertainty available in the parameters of real-world application models, the actual return of each security is not prespecified well in advance. The theory of optimal portfolios has been developed by Markowitz [

8], where he has firstly studied the mean-variance model. The PS problem is typically an LP model when the return of each security is constant. Tanaka et al. [

9] extended the probability into a fuzzy probability for the Markowitz’s model. Hassuike et al. [

10] proposed several models for PS problems, particularly a scenario model including ambiguous factors. Ammar and Khalifa [

11] developed a fuzzy PS problem using an LP approach. Khalifa and Zein [

12] proposed a PS problem assuming the fuzzy objective function coefficients and implemented the fuzzy approach to determine the

optimal compromise solutions. Luengo [

13] studied the PS problem under the fuzzy environment. Bermudez et al. [

14] developed the PS problem with three objective functions to find tradeoffs between risk, return, and the number of securities in the portfolio. Xu and Li [

15] introduced a class of stochastic multi-objective problems considering a quadratic, various types of linear objectives with linear constraints and its application on the PS model.

Chalco et al. [

16] suggested a two-parameter representation for interval number representations, for instance, decreasing/increasing convex constraint functions. Fard and Ramezanzadeh [

17] investigated the constrained fuzzy-valued optimization problems. Glensk and Madlener [

18] introduced different types of PS models with the return rates as well as the investors’ aspiration levels of portfolio return and risk as fuzzy numbers. Moghadam et al. [

19] studied a two-stage model, which in the first stage computes the required per cent of investment in every industrial group utilizing the return as well as the risk measure. Panwar et al. [

20] introduced a hybrid methodology for the allocation of asset, providing a combination of many methodologies to facilitate ranking the assets. Qian and Yin [

21] proposed a new method to research the PS problem in the fuzzy environment. Sardou et al. [

22] presented a study on multi-objective PS problems based on a multi-objective fuzzy method with a genetic algorithm. London et al. [

23] investigated the Markowitz PS problem and implemented several estimators to determine the expected return of a portfolio. Kumar and Doja [

24] and then Wei et al. [

25] showed that the feasibility of replacing expert subjectiveness with knowledge based on the given information.

PS problems in an uncertain environment have been investigated by a number of hybrid metaheuristics methods, for instance, bat algorithm (Chen and Xu [

26]), ICA-FA algorithm (Chen et al. [

27]), DEA cross-efficiency model (Chen et al. [

28]), data envelopment analysis (Mehlawat et al. [

29]), Rangel et al. [

30], etc. In the recent past, Deng and Li [

31] studied a probabilistic hesitant fuzzy PS model, where they considered the value-at-risk criteria. Srizongkhram et al. [

32] investigated the fuzzy stochastic constrained programming problem for the PS model. Several authors considered the fuzzy as well as intuitionistic fuzzy sets in PS models, for instance, Zhang et al. [

33], Zhou and Xu [

34], Zhou et al. [

35], etc. Khalifa et al. [

36] suggested a novel solution methodology to deal with a PS problem in a fuzzy situation, where Dymova et al. [

37], Gong et al. [

38] and Mehrjerdi [

39] dealt with a methodology for the PS problem using risk-benefit analysis in the fuzzy environment.

Based on the above literature reviewed, there is a need to investigate some mathematical development for PS problems. The existing PS literature has a scarcity of such PS problems. The proposed research work will bridge this critical gap in the fuzzy PS literature. This study contributes to the existing PS model literature in the following ways:

Proposing a PS problem in an uncertain situation represented by fuzzy sets.

Determining the minimum risk in an uncertain situation in the proposed PS model. This is crucial as uncertainties in PS models make decision-making very challenging.

Developing a methodology based on the weighted Tchebycheff for the proposed PS model.

The rest of this paper is designed as follows:

Section 2 presents some preliminary considerations.

Section 3 introduces an extended fuzzy PS problem formulation.

Section 4 provides the present method to evaluate the model parameters.

Section 5 performs a numerical experimentation to explain its utility. Finally, some conclusions and future research scope are given in

Section 6.

3. Problem Formulation and Solution Concepts

A typically extended multi-objective portfolio selection model as developed by Xu and Li [

35] is considered with fuzzy parameters as follows:

Subject to

where

,

, and

. It is observed that

is a function of the

ith security liquidity,

and

. If the liquidity is greater, then

is greater, otherwise,

is smaller.

Definition 4. (Dubois and Prade [

3]).

A solution is referred to as a fuzzy efficient solution to an FEVL problem if there is no other for which , or , and , or .

Assuming that these parameters

, and

are designated by trapezoidal fuzzy numbers, the respective membership functions are

, and

. We introduced the

level set of fuzzy numbers

and

defined as the ordinary set

where the grade of membership is greater than level

.

For some degree of , the FEVL problem is expressed as the below crisp form:

Definition 5. (Dubois and Prade [

3]).

( Efficient solution). , is called an efficient solution to the (EVL) problem, if another does not exist, so that and Here, the respective parameter values of and are termed as level optimal parameters.

The problem (EVL) can be rewritten as below

Implementing the weighted Tchebycheff method, the (

EVL)′ problem is resolved as below:

or equivalently,

where

, and

are the ideal targets, which are estimated as under:

4. Proposed Solution Methodology

In this section, a solution methodology is developed to premise the best compromise solution. The proposed solution methodology possesses the minimum joint deviation from the ideal points

, where the following things are defined as:

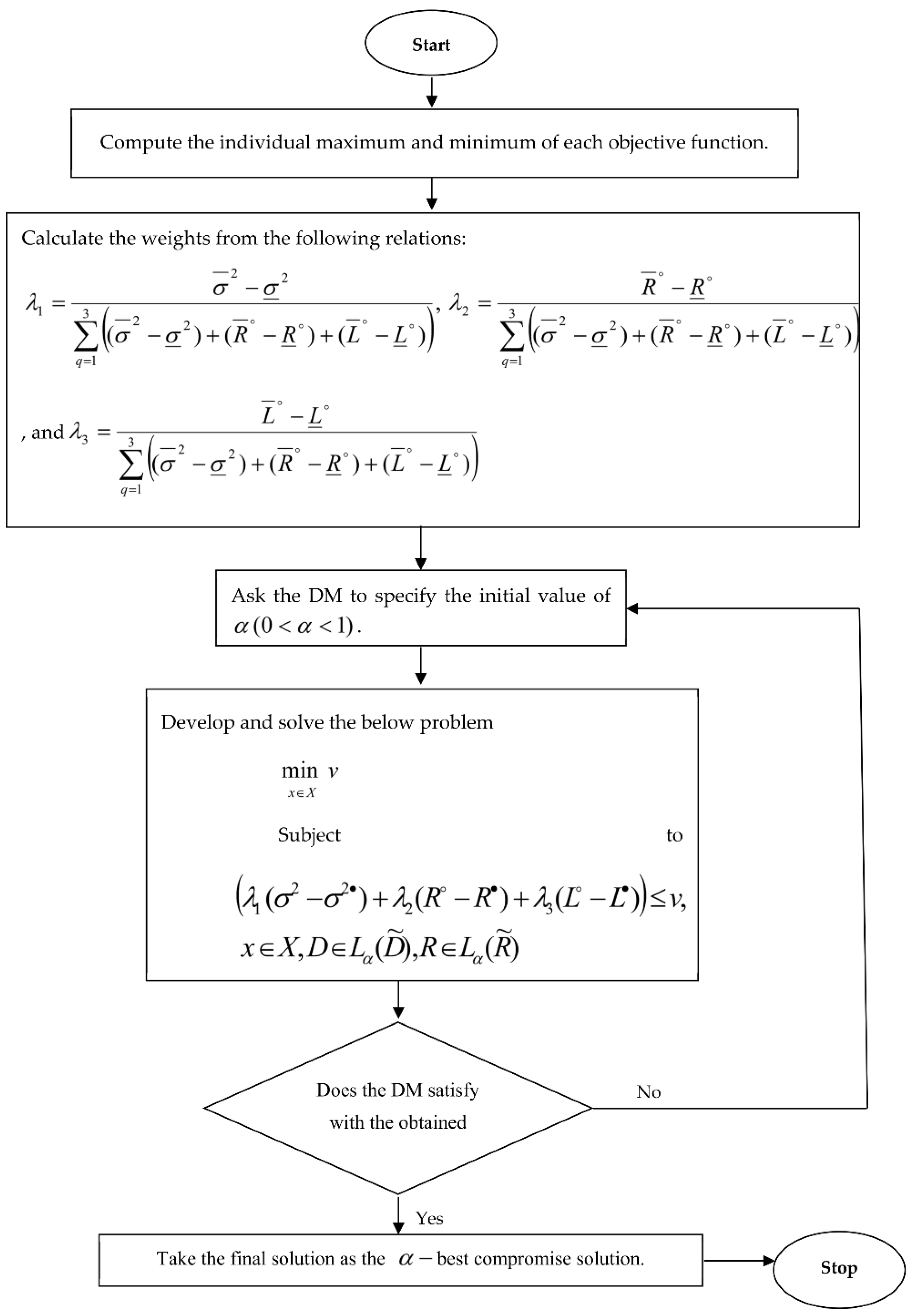

The steps of the procedure are as follows:

Step 1: Compute the independent maximum as well as minimum of all objective functions following the prescribed constraints for , and , respectively.

Step 2: Calculate the weights using the following relations:

and

where

are individual maximum, and

are individual minimum.

Step 3: Consult the decision maker (DM) to point out an initial value of .

Step 4: Develop and solve the below problem

Step 5: If DM satisfies with the obtained results in Step 4, then terminate the procedure with the final solution as the best compromise solution. Otherwise, go to Step 3.

A flow chart representation of the above interactive approach is also provided in

Figure 1 below:

5. Numerical Experimentation

Consider a customer who recognized three mutual funds with attractive opportunities. From the past 5 years’ data, the dividend payments (USD) are shown in the following

Table 1:

The weighting coefficients vector is equal to .

Step 1: The individual maximum and minimum can be calculated as in

Table 2:

The individual maximum values are presented as follows

Hence, the individual maximum value of each objective is summarized in

Table 3.

The investment stock is summarized in

Table 4.

The individual minimum values are computed as follows:

Thus, the individual minimum value of each objective is summarized in

Table 5.

Step 2: The weights are computed as follows:

Step 3: Suppose that the DM selects

and based on the center of the intervals of confidence, we obtain the results as shown in

Table 6 below.

The corresponding model is described as follows:

Step 4: Formulate and solve the following problem:

Suppose that the DM agreed with the

current solution, therefore we terminate the procedure and the

best compromise solution as in

Table 7 below.

In order to estimate the fuzzy optimum value, let us follow

Table 8 below.

Thereafter, we evaluate the parameter values of the proposed mathematical model as follows:

The results show that the fuzzy return is , which means that the total expected return is greater than the value of and less than the value of , and the maximum return lies between , and . Furthermore, the fuzzy risk is , meaning that the total risk will be greater than and less than . In addition, the minimum risk lies between and .