Patient-Reported Financial Distress in Cancer: A Systematic Review of Risk Factors in Universal Healthcare Systems

Abstract

:Simple Summary

Abstract

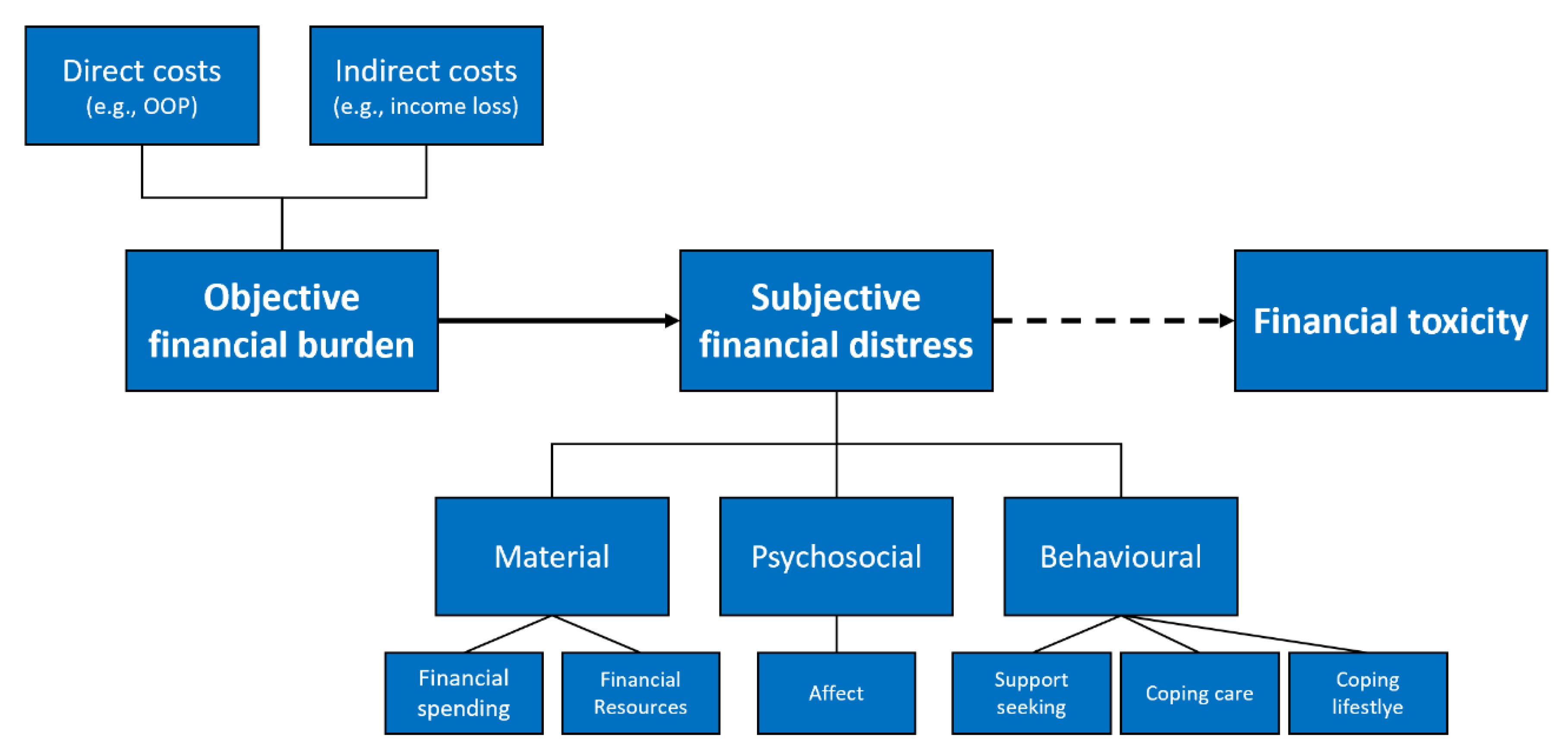

1. Introduction

- (a)

- Material conditions: impact of individual financial spending and financial resources used (e.g., more expenses than expected, use of saving to cover spending)

- (b)

- Psychosocial response: individual perception and psychological consequences of financial burden (e.g., concerns or worry about financial situation)

- (c)

- Coping behaviour: personal approach to cope with financial burden (e.g., using financial assistance or reducing leisure activities)

2. Methods

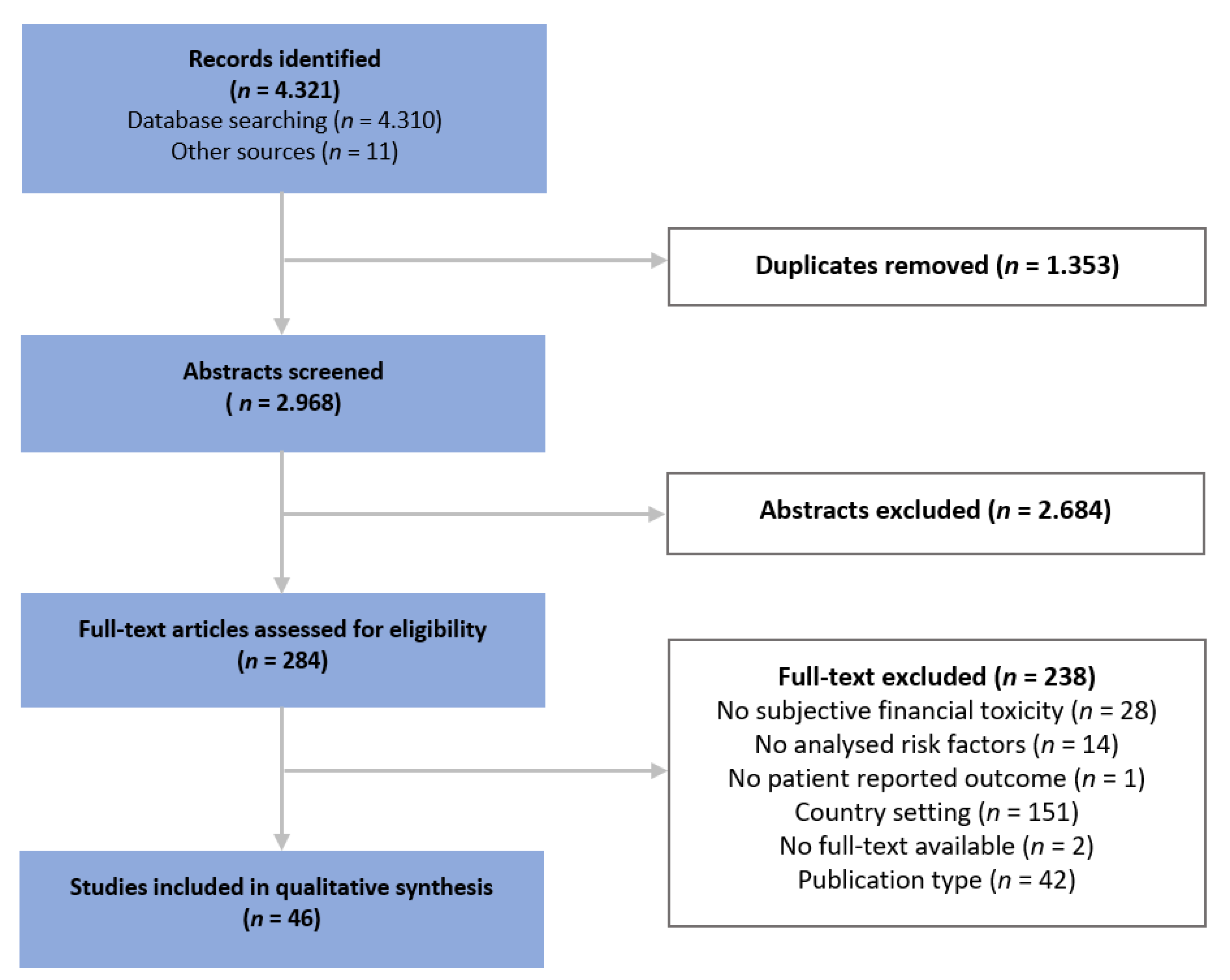

2.1. Information Sources, Search Strategy and Study Selection

2.2. Eligibility Criteria

2.3. Quality Appraisal

2.4. Data Extraction and Qualitative Synthesis

3. Results

3.1. Measuring Subjective Financial Distress

3.2. Quality Appraisal

3.3. Risk Factors for Experiencing Financial Toxicity

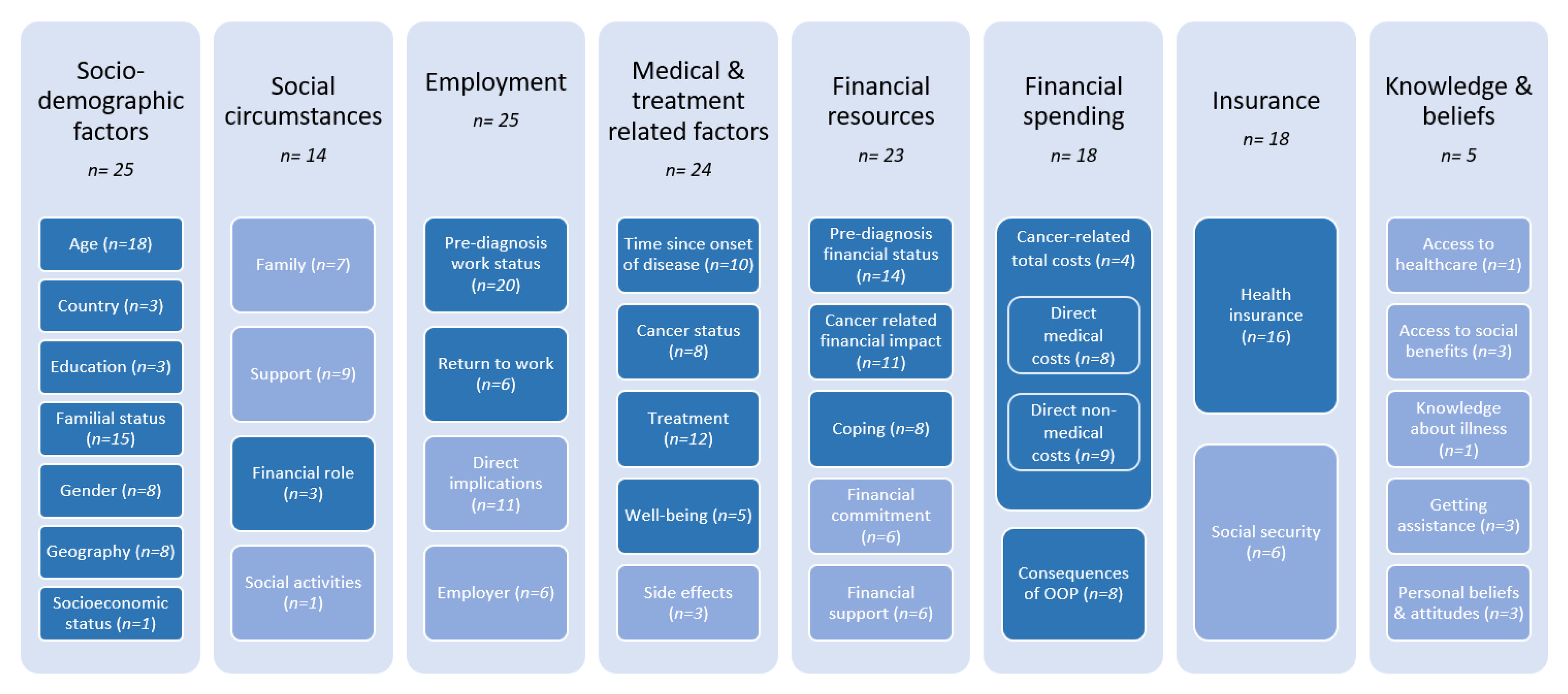

3.3.1. Categories of Risk Factors and Their Prevalence

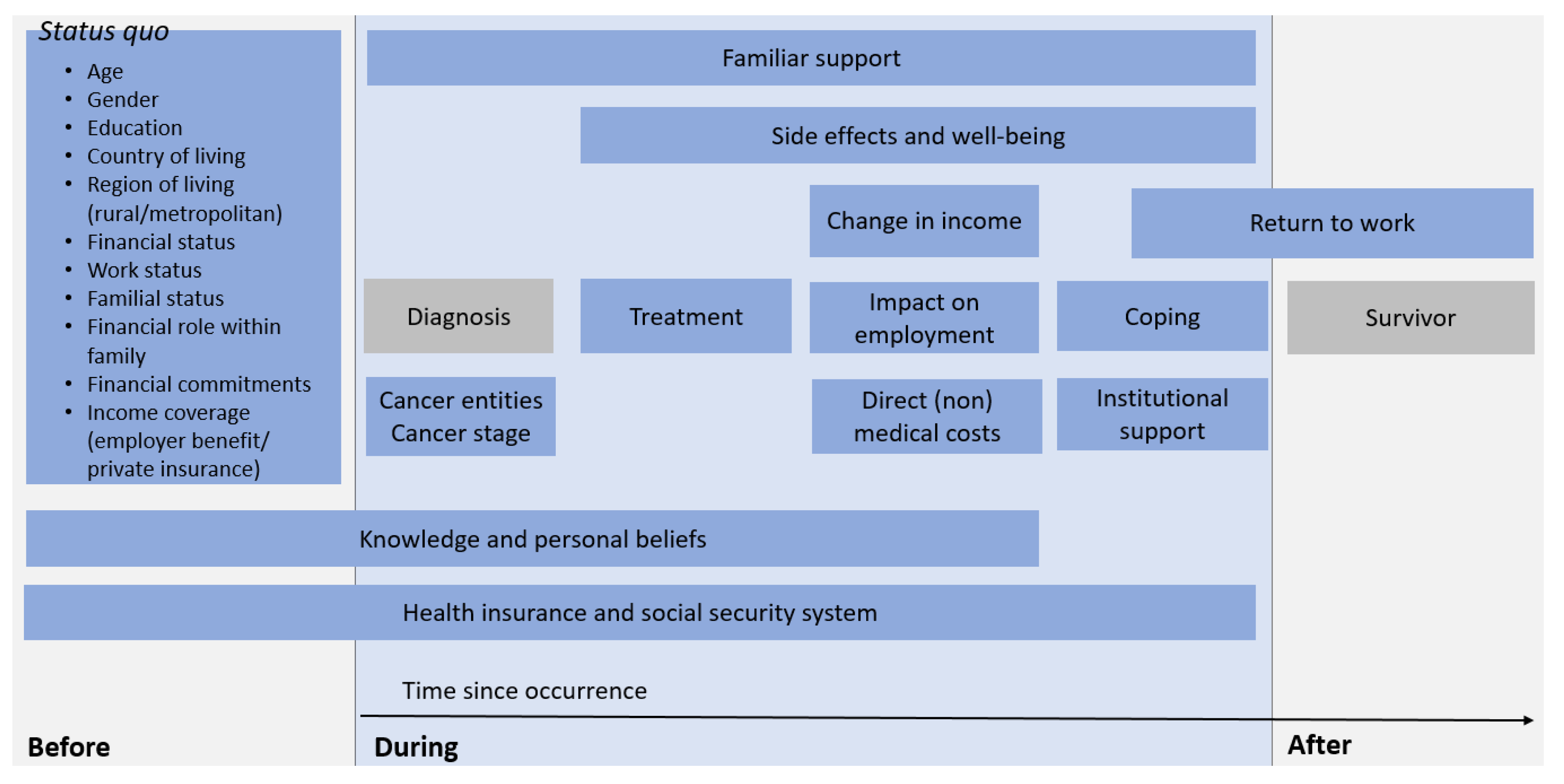

3.3.2. Incidence of Risk Factors during the Course of the Disease

3.3.3. Quantified Influence of Risk Factors

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zafar, S.Y. Financial Toxicity of Cancer Care: It’s Time to Intervene. J. Natl. Cancer Inst. 2016, 108, djv370. [Google Scholar] [CrossRef] [Green Version]

- Azzani, M.; Roslani, A.C.; Su, T.T. The perceived cancer-related financial hardship among patients and their families: A systematic review. Support. Care Cancer 2015, 23, 889–898. [Google Scholar] [CrossRef]

- Zafar, S.Y.; Abernethy, A.P. Financial Toxicity, Part I: A New Name for a Growing Problem. Oncology 2013, 27, 80–149. [Google Scholar] [PubMed]

- Witte, J.; Mehlis, K.; Surmann, B.; Lingnau, R.; Damm, O.; Greiner, W.; Winkler, E.C. Methods for measuring financial toxicity after cancer diagnosis and treatment: A systematic review and its implications. Ann. Oncol. 2019, 30, 1061–1070. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Lueckmann, S.L.; Kowalski, C.; Schumann, N. Finanzielle Toxizität einer Krebserkrankung. Onkologe 2021, 27, 759–765. [Google Scholar] [CrossRef]

- Lathan, C.S.; Cronin, A.; Tucker-Seeley, R.; Zafar, S.Y.; Ayanian, J.Z.; Schrag, D. Association of Financial Strain with Symptom Burden and Quality of Life for Patients with Lung or Colorectal Cancer. J. Clin. Oncol. 2016, 34, 1732–1740. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Mehlis, K.; Witte, J.; Surmann, B.; Kudlich, M.; Apostolidis, L.; Walther, J.; Jäger, D.; Greiner, W.; Winkler, E.C. The patient-level effect of the cost of Cancer care—Financial burden in German Cancer patients. BMC Cancer 2020, 20, 529. [Google Scholar] [CrossRef] [PubMed]

- Tucker-Seeley, R.D.; Li, Y.; Subramanian, S.V.; Sorensen, G. Financial hardship and mortality among older adults using the 1996–2004 Health and Retirement Study. Ann. Epidemiol. 2009, 19, 850–857. [Google Scholar] [CrossRef] [Green Version]

- Ramsey, S.D.; Bansal, A.; Fedorenko, C.R.; Blough, D.K.; Overstreet, K.A.; Shankaran, V.; Newcomb, P. Financial Insolvency as a Risk Factor for Early Mortality Among Patients with Cancer. J. Clin. Oncol. 2016, 34, 980–986. [Google Scholar] [CrossRef] [Green Version]

- Carrera, P.M.; Kantarjian, H.M.; Blinder, V.S. The financial burden and distress of patients with cancer: Understanding and stepping-up action on the financial toxicity of cancer treatment. CA Cancer J. Clin. 2018, 68, 153–165. [Google Scholar] [CrossRef]

- Smith, G.L.; Lopez-Olivo, M.A.; Advani, P.G.; Ning, M.S.; Geng, Y.; Giordano, S.H.; Volk, R.J. Financial Burdens of Cancer Treatment: A Systematic Review of Risk Factors and Outcomes. J. Natl. Compr. Canc. Netw. 2019, 17, 1184–1192. [Google Scholar] [CrossRef]

- Longo, C.J.; Fitch, M.I.; Banfield, L.; Hanly, P.; Yabroff, K.R.; Sharp, L. Financial toxicity associated with a cancer diagnosis in publicly funded healthcare countries: A systematic review. Support. Care Cancer 2020, 28, 4645–4665. [Google Scholar] [CrossRef]

- Mols, F.; Tomalin, B.; Pearce, A.; Kaambwa, B.; Koczwara, B. Financial toxicity and employment status in cancer survivors. A systematic literature review. Support. Care Cancer 2020, 28, 5693–5708. [Google Scholar] [CrossRef] [PubMed]

- Gordon, L.G.; Merollini, K.M.D.; Lowe, A.; Chan, R.J. A Systematic Review of Financial Toxicity Among Cancer Survivors: We Can’t Pay the Co-Pay. Patient 2017, 10, 295–309. [Google Scholar] [CrossRef] [Green Version]

- Fitch, M.I.; Sharp, L.; Hanly, P.; Longo, C.J. Experiencing financial toxicity associated with cancer in publicly funded healthcare systems: A systematic review of qualitative studies. J. Cancer Surviv. 2021. [Google Scholar] [CrossRef] [PubMed]

- Büttner, M.; König, H.-H.; Löbner, M.; Briest, S.; Konnopka, A.; Dietz, A.; Riedel-Heller, S.; Singer, S. Out-of-pocket-payments and the financial burden of 502 cancer patients of working age in Germany: Results from a longitudinal study. Support. Care Cancer 2019, 27, 2221–2228. [Google Scholar] [CrossRef]

- Baili, P.; Di Salvo, F.; de Lorenzo, F.; Maietta, F.; Pinto, C.; Rizzotto, V.; Vicentini, M.; Rossi, P.G.; Tumino, R.; Rollo, P.C.; et al. Out-of-pocket costs for cancer survivors between 5 and 10 years from diagnosis: An Italian population-based study. Support. Care Cancer 2016, 24, 2225–2233. [Google Scholar] [CrossRef] [PubMed]

- Iragorri, N.; de Oliveira, C.; Fitzgerald, N.; Essue, B. The Out-of-Pocket Cost Burden of Cancer Care-A Systematic Literature Review. Curr. Oncol. 2021, 28, 1216–1248. [Google Scholar] [CrossRef]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G. Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. PLoS Med. 2009, 6, e1000097. [Google Scholar] [CrossRef] [Green Version]

- The World Bank. The World Bank Atlas Method—Detailed Methodology. Available online: https://datahelpdesk.worldbank.org/knowledgebase/articles/378832-what-is-the-world-bank-atlas-method (accessed on 7 June 2021).

- World Health Organization. Universal Health Coverage (UHC). Available online: https://www.who.int/news-room/fact-sheets/detail/universal-health-coverage-(uhc) (accessed on 7 June 2021).

- National Institutes of Health; National Heart, Lung, and Blood Institute. Study Quality Assessment Tools. Available online: https://www.nhlbi.nih.gov/health-topics/study-quality-assessment-tools (accessed on 28 April 2021).

- Critical Appraisal Skills Programme. CASP-Qualitative-Checklist. 2018. Available online: https://casp-uk.net/wp-content/uploads/2018/01/CASP-Qualitative-Checklist-2018.pdf (accessed on 22 May 2021).

- OECD. Health at a Glance 2019; OECD: Paris, France, 2019; ISBN 9789264382084. [Google Scholar]

- Mayring, P. Qualitative Content Analysis. Forum Qual. Soc. Res. 2000, 1, 20. [Google Scholar] [CrossRef]

- National Cancer Institute. Understanding Cancer Prognosis. Available online: https://www.cancer.gov/about-cancer/diagnosis-staging/prognosis (accessed on 15 June 2021).

- Arndt, V.; Koch-Gallenkamp, L.; Bertram, H.; Eberle, A.; Holleczek, B.; Pritzkuleit, R.; Waldeyer-Sauerland, M.; Waldmann, A.; Zeissig, S.R.; Doege, D.; et al. Return to work after cancer. A multi-regional population-based study from Germany. Acta Oncol. 2019, 58, 811–818. [Google Scholar] [CrossRef] [Green Version]

- Arndt, V.; Koch-Gallenkamp, L.; Jansen, L.; Bertram, H.; Eberle, A.; Holleczek, B.; Schmid-Höpfner, S.; Waldmann, A.; Zeissig, S.R.; Brenner, H. Quality of life in long-term and very long-term cancer survivors versus population controls in Germany. Acta Oncol. 2017, 56, 190–197. [Google Scholar] [CrossRef] [PubMed]

- Arndt, V.; Merx, H.; Stegmaier, C.; Ziegler, H.; Brenner, H. Quality of life in patients with colorectal cancer 1 year after diagnosis compared with the general population: A population-based study. J. Clin. Oncol. 2004, 22, 4829–4836. [Google Scholar] [CrossRef] [PubMed]

- Doege, D.; Thong, M.S.-Y.; Koch-Gallenkamp, L.; Bertram, H.; Eberle, A.; Holleczek, B.; Pritzkuleit, R.; Waldeyer-Sauerland, M.; Waldmann, A.; Zeissig, S.R.; et al. Health-related quality of life in long-term disease-free breast cancer survivors versus female population controls in Germany. Breast Cancer Res. Treat. 2019, 175, 499–510. [Google Scholar] [CrossRef] [PubMed]

- Koch, L.; Jansen, L.; Herrmann, A.; Stegmaier, C.; Holleczek, B.; Singer, S.; Brenner, H.; Arndt, V. Quality of life in long-term breast cancer survivors—A 10-year longitudinal population-based study. Acta Oncol. 2013, 52, 1119–1128. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Schmidt, M.E.; Scherer, S.; Wiskemann, J.; Steindorf, K. Return to work after breast cancer: The role of treatment-related side effects and potential impact on quality of life. Eur. J. Cancer Care 2019, 28, e13051. [Google Scholar] [CrossRef]

- Amir, Z.; Wilson, K.; Hennings, J.; Young, A. The meaning of cancer: Implications for family finances and consequent impact on lifestyle, activities, roles and relationships. Psychooncology 2012, 21, 1167–1174. [Google Scholar] [CrossRef] [PubMed]

- Grinyer, A. The biographical impact of teenage and adolescent cancer. Chronic Illn. 2007, 3, 265–277. [Google Scholar] [CrossRef]

- Moffatt, S.; Noble, E. Work or welfare after cancer? Explorations of identity and stigma. Sociol. Health Illn. 2015, 37, 1191–1205. [Google Scholar] [CrossRef] [PubMed]

- Moffatt, S.; Noble, E.; Exley, C. "Done more for me in a fortnight than anybody done in all me life." How welfare rights advice can help people with cancer. BMC Health Serv. Res. 2010, 10, 259. [Google Scholar] [CrossRef] [Green Version]

- Moffatt, S.; Noble, E.; White, M. Addressing the financial consequences of cancer: Qualitative evaluation of a welfare rights advice service. PLoS ONE 2012, 7, e42979. [Google Scholar] [CrossRef]

- Gordon, L.G.; Walker, S.M.; Mervin, M.C.; Lowe, A.; Smith, D.P.; Gardiner, R.A.; Chambers, S.K. Financial toxicity: A potential side effect of prostate cancer treatment among Australian men. Eur. J. Cancer Care 2017, 26. [Google Scholar] [CrossRef]

- Ivanauskienė, R.; Padaiga, Ž.; Šimoliūnienė, R.; Smailytė, G.; Domeikienė, A. Well-being of newly diagnosed women with breast cancer: Which factors matter more? Support. Care Cancer 2014, 22, 519–526. [Google Scholar] [CrossRef]

- Gray, R.E.; James, P.; Manthorne, J.; Gould, J.; Fitch, M.I. A consultation with Canadian rural women with breast cancer. Health Expect. 2004, 7, 40–50. [Google Scholar] [CrossRef] [Green Version]

- McGrath, P.; Patterson, C.; Yates, P.; Treloar, S.; Oldenburg, B.; Loos, C. A study of postdiagnosis breast cancer concerns for women living in rural and remote Queensland. Part II: Support issues. Aust. J. Rural Health 1999, 7, 43–52. [Google Scholar] [CrossRef]

- Akechi, T.; Okuyama, T.; Uchida, M.; Nakaguchi, T.; Ito, Y.; Yamashita, H.; Toyama, T.; Komatsu, H.; Kizawa, Y.; Wada, M. Perceived needs, psychological distress and quality of life of elderly cancer patients. Jpn. J. Clin. Oncol. 2012, 42, 704–710. [Google Scholar] [CrossRef] [Green Version]

- Honda, K.; Gyawali, B.; Ando, M.; Kumanishi, R.; Kato, K.; Sugiyama, K.; Mitani, S.; Masuishi, T.; Narita, Y.; Bando, H.; et al. Prospective Survey of Financial Toxicity Measured by the Comprehensive Score for Financial Toxicity in Japanese Patients with Cancer. J. Glob. Oncol. 2019, 5, 1–8. [Google Scholar] [CrossRef]

- Mandaliya, H.; Ansari, Z.; Evans, T.; Oldmeadow, C.; George, M. Psychosocial Analysis of Cancer Survivors in Rural Australia: Focus on Demographics, Quality of Life and Financial Domains. Asian Pac. J. Cancer Prev. 2016, 17, 2459–2464. [Google Scholar] [PubMed]

- McNeil, R.J.; McCarthy, M.; Dunt, D.; Thompson, K.; Kosola, S.; Orme, L.; Drew, S.; Sawyer, S. Financial Challenges of Cancer for Adolescents and Young Adults and Their Parent Caregivers. Soc. Work. Res. 2019, 43, 17–30. [Google Scholar] [CrossRef]

- Mercadante, S.; Aielli, F.; Adile, C.; Bonanno, G.; Casuccio, A. Financial distress and its impact on symptom expression in advanced cancer patients. Support. Care Cancer 2021, 29, 485–490. [Google Scholar] [CrossRef] [PubMed]

- Pearce, A.; Tomalin, B.; Kaambwa, B.; Horevoorts, N.; Duijts, S.; Mols, F.; van de Poll-Franse, L.; Koczwara, B. Financial toxicity is more than costs of care: The relationship between employment and financial toxicity in long-term cancer survivors. J. Cancer Surviv. 2019, 13, 10–20. [Google Scholar] [CrossRef]

- Bennett, J.A.; Brown, P.; Cameron, L.; Whitehead, L.C.; Porter, D.; McPherson, K.M. Changes in employment and household income during the 24 months following a cancer diagnosis. Support. Care Cancer 2009, 17, 1057–1064. [Google Scholar] [CrossRef] [PubMed]

- Ezeife, D.A.; Morganstein, B.J.; Lau, S.; Law, J.H.; Le, L.W.; Bredle, J.; Cella, D.; Doherty, M.K.; Bradbury, P.; Liu, G.; et al. Financial Burden Among Patients with Lung Cancer in a Publically Funded Health Care System. Clin. Lung Cancer 2019, 20, 231–236. [Google Scholar] [CrossRef]

- Gordon, L.G.; Elliott, T.M.; Wakelin, K.; Leyden, S.; Leyden, J.; Michael, M.; Pavlakis, N.; Mumford, J.; Segelov, E.; Wyld, D.K. The Economic Impact on Australian Patients with Neuroendocrine Tumours. Patient 2020, 13, 363–373. [Google Scholar] [CrossRef] [PubMed]

- McLean, L.; Hong, W.; McLachlan, S.-A. Financial toxicity in patients with cancer attending a public Australian tertiary hospital: A pilot study. Asia Pac. J. Clin. Oncol. 2020, 17, 245–252. [Google Scholar] [CrossRef]

- Fitch, M.I.; Longo, C.J.; Chan, R.J. Cancer patients’ perspectives on financial burden in a universal healthcare system: Analysis of qualitative data from participants from 20 provincial cancer centers in Canada. Patient Educ. Couns. 2021, 104, 903–910. [Google Scholar] [CrossRef] [PubMed]

- de Souza, J.A.; Yap, B.J.; Wroblewski, K.; Blinder, V.; Araújo, F.S.; Hlubocky, F.J.; Nicholas, L.H.; O’Connor, J.M.; Brockstein, B.; Ratain, M.J.; et al. Measuring financial toxicity as a clinically relevant patient-reported outcome: The validation of the COmprehensive Score for financial Toxicity (COST). Cancer 2017, 123, 476–484. [Google Scholar] [CrossRef] [PubMed]

- Barbaret, C.; Brosse, C.; Rhondali, W.; Ruer, M.; Monsarrat, L.; Michaud, P.; Schott, A.M.; Delgado-Guay, M.; Bruera, E.; Sanchez, S.; et al. Financial distress in patients with advanced cancer. PLoS ONE 2017, 12, e0176470. [Google Scholar] [CrossRef]

- Barbaret, C.; Delgado-Guay, M.O.; Sanchez, S.; Brosse, C.; Ruer, M.; Rhondali, W.; Monsarrat, L.; Michaud, P.; Schott, A.M.; Bruera, E.; et al. Inequalities in Financial Distress, Symptoms, and Quality of Life Among Patients with Advanced Cancer in France and the U.S. Oncologist 2019, 24, 1121–1127. [Google Scholar] [CrossRef] [Green Version]

- Hanly, P.; Maguire, R.; Ceilleachair, A.O.; Sharp, L. Financial hardship associated with colorectal cancer survivorship: The role of asset depletion and debt accumulation. Psychooncology 2018, 27, 2165–2171. [Google Scholar] [CrossRef] [Green Version]

- Lu, L.; O’Sullivan, E.; Sharp, L. Cancer-related financial hardship among head and neck cancer survivors: Risk factors and associations with health-related quality of life. Psychooncology 2019, 28, 863–871. [Google Scholar] [CrossRef]

- Sharp, L.; Timmons, A. Pre-diagnosis employment status and financial circumstances predict cancer-related financial stress and strain among breast and prostate cancer survivors. Support. Care Cancer 2016, 24, 699–709. [Google Scholar] [CrossRef] [PubMed]

- Gordon, L.G.; Beesley, V.L.; Mihala, G.; Koczwara, B.; Lynch, B.M. Reduced employment and financial hardship among middle-aged individuals with colorectal cancer. Eur. J. Cancer Care 2017, 26, e12744. [Google Scholar] [CrossRef]

- Egestad, H.; Nieder, C. Undesirable financial effects of head and neck cancer radiotherapy during the initial treatment period. Int. J. Circumpolar Health 2015, 74, 26686. [Google Scholar] [CrossRef]

- Kaptein, A.A.; Yamaoka, K.; Snoei, L.; van der Kloot, W.A.; Inoue, K.; Tabei, T.; Kroep, J.R.; Krol-Warmerdam, E.; Ranke, G.; Meirink, C.; et al. Illness perceptions and quality of life in Japanese and Dutch women with breast cancer. J. Psychosoc. Oncol. 2013, 31, 83–102. [Google Scholar] [CrossRef]

- Paul, C.L.; Hall, A.E.; Carey, M.L.; Cameron, E.C.; Clinton-McHarg, T. Access to care and impacts of cancer on daily life: Do they differ for metropolitan versus regional hematological cancer survivors? J. Rural Health 2013, 29, s43–s50. [Google Scholar] [CrossRef] [PubMed]

- Timmons, A.; Gooberman-Hill, R.; Sharp, L. "It’s at a time in your life when you are most vulnerable": A qualitative exploration of the financial impact of a cancer diagnosis and implications for financial protection in health. PLoS ONE 2013, 8, e77549. [Google Scholar] [CrossRef] [Green Version]

- Timmons, A.; Gooberman-Hill, R.; Sharp, L. The multidimensional nature of the financial and economic burden of a cancer diagnosis on patients and their families: Qualitative findings from a country with a mixed public-private healthcare system. Support. Care Cancer 2013, 21, 107–117. [Google Scholar] [CrossRef] [PubMed]

- Fitch, M.; Longo, C.J. Exploring the impact of out-of-pocket costs on the quality of life of Canadian cancer patients. J. Psychosoc. Oncol. 2018, 36, 582–596. [Google Scholar] [CrossRef]

- Kane, D.; Rajacich, D.; Andary, C. Experiences of cancer patients’ return to work. Can. Oncol. Nurs. J. 2020, 30, 113–118. [Google Scholar] [CrossRef]

- Schröder, S.L.; Schumann, N.; Fink, A.; Richter, M. Coping mechanisms for financial toxicity: A qualitative study of cancer patients’ experiences in Germany. Support. Care Cancer 2020, 28, 1131–1139. [Google Scholar] [CrossRef] [PubMed]

- McGrath, P. "It’s horrendous--but really, what can you do?" Preliminary findings on financial impact of relocation for specialist treatment. Aust. Health Rev. 2000, 23, 94–103. [Google Scholar] [CrossRef] [PubMed]

- Koskinen, J.-P.; Färkkilä, N.; Sintonen, H.; Saarto, T.; Taari, K.; Roine, R.P. The association of financial difficulties and out-of-pocket payments with health-related quality of life among breast, prostate and colorectal cancer patients. Acta Oncol. 2019, 58, 1062–1068. [Google Scholar] [CrossRef] [PubMed]

- Zucca, A.; Boyes, A.; Newling, G.; Hall, A.; Girgis, A. Travelling all over the countryside: Travel-related burden and financial difficulties reported by cancer patients in New South Wales and Victoria. Aust. J. Rural Health 2011, 19, 298–305. [Google Scholar] [CrossRef] [PubMed]

- Slavova-Azmanova, N.S.; Newton, J.C.; Saunders, C.; Johnson, C.E. ’Biggest factors in having cancer were costs and no entitlement to compensation’-The determinants of out-of-pocket costs for cancer care through the lenses of rural and outer metropolitan Western Australians. Aust. J. Rural Health 2020, 28, 588–602. [Google Scholar] [CrossRef] [PubMed]

- Janßen, A.; Schneider, S.; Stäudle, J.; Walther, J. Probleme der beruflichen (Re-)Integration von Krebserkrankten: Wie können wir unterstützen? Onkologe 2021, 27, 802–808. [Google Scholar] [CrossRef]

- Riva, S.; Bryce, J.; de Lorenzo, F.; Del Campo, L.; Di Maio, M.; Efficace, F.; Frontini, L.; Giannarelli, D.; Gitto, L.; Iannelli, E.; et al. Development and validation of a patient-reported outcome tool to assess cancer-related financial toxicity in Italy: A protocol. BMJ Open 2019, 9, e031485. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Hueniken, K.; Douglas, C.M.; Jethwa, A.R.; Mirshams, M.; Eng, L.; Hope, A.; Chepeha, D.B.; Goldstein, D.P.; Ringash, J.; Hansen, A.; et al. Measuring financial toxicity incurred after treatment of head and neck cancer: Development and validation of the Financial Index of Toxicity questionnaire. Cancer 2020, 126, 4042–4050. [Google Scholar] [CrossRef]

| Characteristics | Quantitative Studies (n = 30) | Qualitative Studies (n = 16) |

|---|---|---|

| Study design Cross-sectional study Cohort study | 23 7 | 15 1 |

| Continent setting Asia Australia/New Zealand Europe North America | 3 8 19 1 | 0 4 8 4 |

| Cancer entities Gastrointestional Gynaecological Head and neck Haematological malignancies Skin Thorac Urogenital Other Unspecified | 17 17 8 5 3 8 12 7 0 | 4 9 0 2 0 6 6 0 6 |

| Time since diagnosis 0–2 years after diagnosis 2–5 years after diagnosis >5 years after diagnosis Unspecified | 21 4 5 8 | 2 1 0 13 |

| Sample size Minimum Median Arithmetic mean Maximum | 43 278.5 915.3 8830 | 8 22.5 80.75 378 |

| Definition Instrument | Material | Psychosocial | Behavioural | Not Reported |

|---|---|---|---|---|

| Full questionnaire (n = 6) Validated Non-validated | 5 1 | 5 1 | 0 1 | 0 0 |

| Subscale (n = 28) Validated Non-validated | 15 6 | 0 9 | 0 3 | 0 0 |

| Interviews (n = 13) Individual interviews Focus groups | 10 0 | 5 1 | 5 0 | 2 0 |

| Categories | Subcategories | Promotive | Preventive |

|---|---|---|---|

| Sociodemographic factors | Age | Age < 65 [31,45,49] Age > 65 [31] Increasing age (until 60 years) [47] Increasing age [46,47] | Greater Age [55] Age > 64 [42,57] Increasing Age [43,47,51,54,69] |

| Country | Depending on country of living [61] | ||

| Education | High Education [69] | ||

| Familial status | Being single [54,55] Being divorced or separated [46] Having one or more dependants [56,58] | Living in a family home [45] Being married, living with partner [47,69] | |

| Gender | Male [47] Female [7,54] | ||

| Geography | Living in a major city [62] Living away from treatment center [70] | ||

| Socioeconomic status | Medium or high socioeconomic status [47] | ||

| Social circumstances | Support | Support by family and friends [56] | |

| Medical and treatment related factors | Time since occurrence | Short time since diagnosis (<1 year) [31] Longer time since diagnosis (>5 years) [31] Long-term survivor (5–9 years) [30,31] Very long-term survivor (>10 years) [28,30,31] | Medium time since diagnosis (3 years since diagnosis) [31] |

| Cancer Status | Metastatic cancer [54,55] Cancer entity [47] | ||

| Treatment | Combination therapy (surgery + X) [39,57], Surgery [55] Stoma [56] | Undergoing psychological counselling [39] | |

| Well-being | Comorbidities > 2 [39] Higher scores of HADS or ESAS [46,55] Poor social/family well-being [46] | Low HADS-D score [55] High emotional, cognitive, social functioning [47,55] Better functional and social well-being [55] | |

| Financial resources | Pre-diagnosisfinancial status | Lower income [54,58,62] Less income in metropolitan region [62] Pre-diagnosis financial stress [57,58] | Having savings [43] |

| Financial impact | Objective financial burden [7,54] Subjective financial difficulties [54,59] | ||

| Coping | Using up savings [56] Having no savings to use up [56] | ||

| Financial spending | Cancer-related total costs | Total costs [69] OOP costs [49,69] | |

| Direct medical costs | High direct medical costs [58] | Low direct medical costs [58] | |

| Direct non-medical costs | Increased household bills [58] | ||

| Consequences of OOP | Coping strategies used to cover expenses [43] | ||

| Financial commitment | Having a mortgage and/or personal loan(s) [58] | ||

| Employment | Return to work | Change in: - Working hours [27] - Leaving former employment [27,32] | |

| Pre-diagnosis work status | Change in work status because of cancer: - Becoming unemployed [39] - Retiring [39,43] - Disabled [39] Working part-time [43] | Work status before diagnosis: - Having paid employment [47] - Not working [58] - Being retired [58] | |

| Insurance | Health insurance | Obtaining healthcare assistance after diagnosis [58] | Private health insurance [7,44,49,58] |

| Categories | Subcategories | Risk Factors |

|---|---|---|

| Social circumstances | Family | Distress through children at home or in education [36,65] Illness of further family members [52] Work adjustments of carers [35] Social isolation [64] |

| Financial role | Cancer patient as previous main earner of family [36,41,68] | |

| Social activities | Reduction in leisure activities [36] | |

| Support | Financial support by family members [35,36] Community and NGOs’ support [68,71] | |

| Financial resources | Pre-diagnosis financial status | Income of partner [36] |

| Financial commitment | Home owner/mortgage [41,52,64,68] Repayments of credits [68] Expenses for dependant children [33] | |

| Financial support | Contributions through social security system [64,68] Receiving sick pay [33,64] Coverage of private insurance [36,68,71] | |

| Financial spending | Consequences of OOP costs | Economising on household expenditure [35,36] - Expenses for daily living [33,65,67] - Transportation [67] - Major purchases [67] - Medical remedies [67] - Holidays [67] - Leisure acitivities [67] |

| Employment | Return to work | Return to work during disease [65,67] |

| Direct implications | Changes in employment during disease [33,35,41,48,52,63,65,71] Loss/reduction in income [35,36,37,48,52,63,65,66] Changes in partner’s employment [63,65,71] | |

| Employer | Employer benefit scheme [35,36,52,65,71] Supportive employer [48] Working in public sector [36] | |

| Insurance | Health insurance | Increased insurance premiums [33] Time between travel expenses and reimbursement [52] |

| Social security system | Disability coverage [34,65,66] Institutional support [36,48,64,67] Ineligible for social welfare benefits [64] | |

| Knowledge | Access to healthcare | Treatment provider [71] Expenses [71] |

| Access to social benefits | Lack of knowledge about available benefits [34,36,37] Dealing with bureaucratic system [34] | |

| Assistance | Assistance by social worker/welfare rights advisor [34,36] Time between diagnosis and receipt of advice [36,37] Professionals who did not alert patients to benefit entitlements [37] | |

| Knowledge about illness | Cancer-related financial distress [33] Course of disease [33] | |

| Personal beliefs and attitudes | Stigma of financial distress [33] Negative attitudes benefit system [36,37] Beliefs about the extent and severity of illness [36] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pauge, S.; Surmann, B.; Mehlis, K.; Zueger, A.; Richter, L.; Menold, N.; Greiner, W.; Winkler, E.C. Patient-Reported Financial Distress in Cancer: A Systematic Review of Risk Factors in Universal Healthcare Systems. Cancers 2021, 13, 5015. https://doi.org/10.3390/cancers13195015

Pauge S, Surmann B, Mehlis K, Zueger A, Richter L, Menold N, Greiner W, Winkler EC. Patient-Reported Financial Distress in Cancer: A Systematic Review of Risk Factors in Universal Healthcare Systems. Cancers. 2021; 13(19):5015. https://doi.org/10.3390/cancers13195015

Chicago/Turabian StylePauge, Sophie, Bastian Surmann, Katja Mehlis, Andrea Zueger, Luise Richter, Natalja Menold, Wolfgang Greiner, and Eva C. Winkler. 2021. "Patient-Reported Financial Distress in Cancer: A Systematic Review of Risk Factors in Universal Healthcare Systems" Cancers 13, no. 19: 5015. https://doi.org/10.3390/cancers13195015

APA StylePauge, S., Surmann, B., Mehlis, K., Zueger, A., Richter, L., Menold, N., Greiner, W., & Winkler, E. C. (2021). Patient-Reported Financial Distress in Cancer: A Systematic Review of Risk Factors in Universal Healthcare Systems. Cancers, 13(19), 5015. https://doi.org/10.3390/cancers13195015