1. Introduction

The residential sector contributes 12% to the total U.S. energy consumption [

1]. Electricity pricing is an important instrument for managing electricity demand [

2] as well as ensuring sufficient revenues for electric utilities [

3], especially with increasing energy efficiency and distributed renewable energy generation (e.g., rooftop photovoltaic solar) [

4]. This trend of penetration has imposed significant challenges for utilities to recoup their large upfront cost of capital investment [

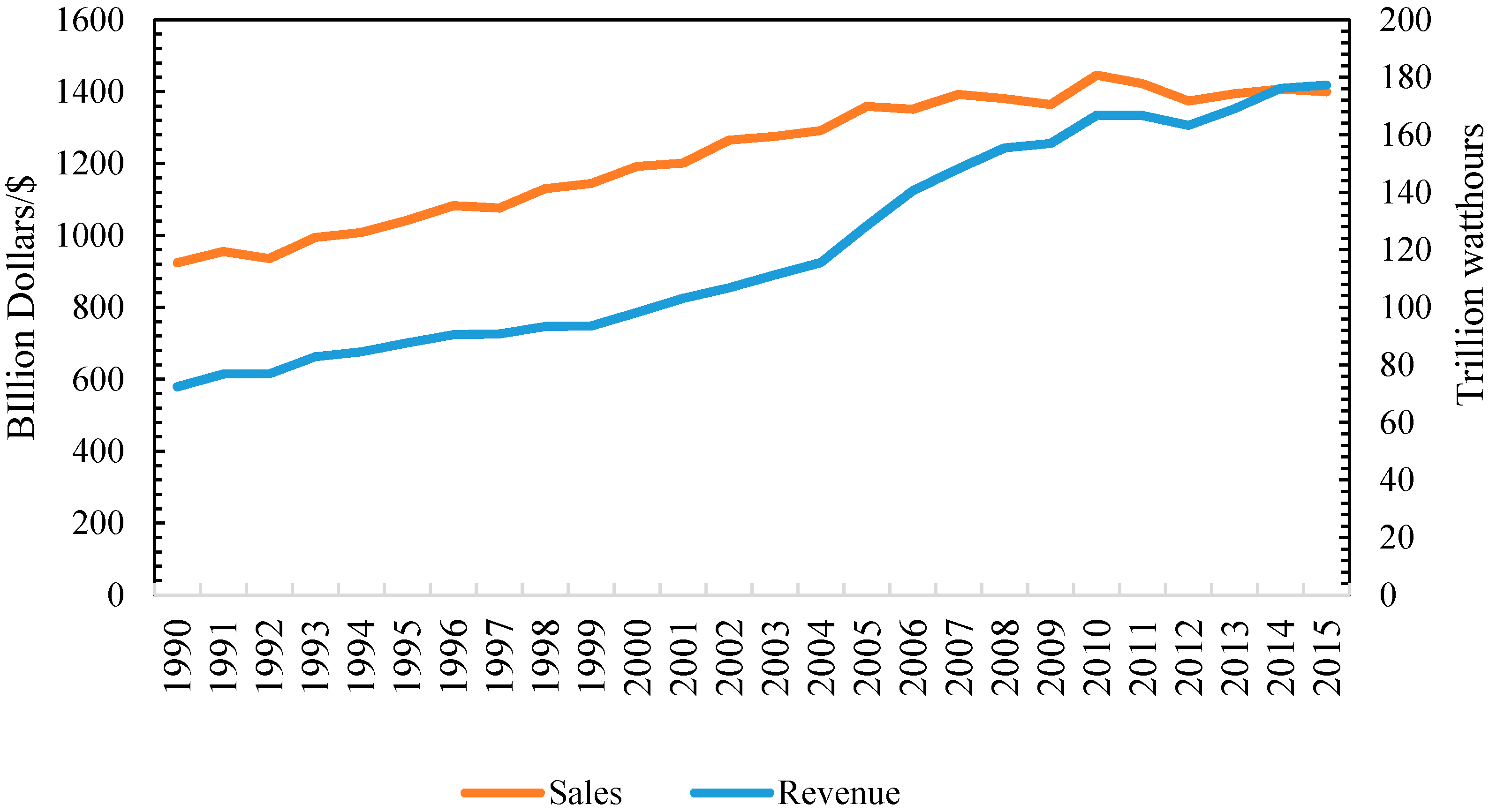

3]. According to the U.S. Energy Information Administration (EIA), electricity sale and revenues from residential sectors have stagnated during the past few years (see

Appendix,

Figure A1).

Demand charges are already widely adopted in the commercial and industrial sectors, but not in the residential sector [

4]. Traditionally, fixed costs have been recovered through volumetric energy pricing for residential customers. However, recently, demand charges are being proposed with increasing frequency by utilities. For example, there are 21 cases in 13 states in 2015 where electric utilities proposed demand charges on distributed generation [

5]. The utilities proposing surcharges argue that solar customers are not paying their proportion for the access to the grid. Since 65% of solar output does not coincide with maximum demand imposed by these solar consumers [

6], the maximum peak is left unchanged by solar installation. The unchanged load and reduced total electricity lead to reduced revenues for utilities without changing the upfront costs [

7]. Utilities would prefer to collect revenues through the fixed charge because it keeps their revenues stable. However, only a few utilities have successfully implemented demand charges up until now. Arizona Public Service (APS) charges solar consumers an extra

$0.70/kW. Salt River Project (SRP) passed a new pricing plan that charges demand rates, which depend on consumers’ peak demand, to solar consumers that install solar panels after December 2014. Other examples include Lakeland Electric in Florida charging solar consumers a demand charge of

$5.60/kW and Intermountain Rural Electric Association in Colorado charging a “Load Factor Adjustment” to solar consumers.

There are existing studies focusing on consumers’ preferences or attitudes towards electricity pricing. Extant literature shows that consumers’ attitudes towards electricity pricing are impacted by their demographic characteristics. For example, Wang et al. [

8] conclude that middle-income residents, compared to low-income and high-income consumers are more against a tiered electricity price reform in China. Stenner et al. [

9] find that demographics characteristics have impacts on the acceptance of different tariffs. The more well-educated consumers, compared to their counterparts, are more accepting of more dynamic tariffs. Moreover, Stenner et al. [

9] investigate consumers’ possible responses to electricity pricing impacted by risk relief (e.g., money-back guarantees) and demographics. Hobman et al. [

10] discuss the cognitive and psychological factors that influence consumers’ responses to cost-effective pricing. Although these studies provide good insights into how consumers perceive pricing schemes and the impacting factors of the attitudes, energy-related behaviors are not included as impacting factors in these studies. In addition, these studies focus on dynamic electricity pricing. Meanwhile, there is a large number of studies on consumers’ preference or willingness to pay for renewable energy and other services utilities offer [

11,

12]. However, specific studies focusing on consumers’ attitudes towards surcharges on renewable energy and energy efficiency are lacking. This is significant for energy policymakers because knowledge on consumers’ attitudes towards these surcharges could help with judgments regarding their acceptance of new surcharges.

This study is timely by adding to the heated policy debates about levying fixed demand charges on consumers that participate in energy efficiency programs or install solar panels. Proper surcharge options can help utilities solve the problem of loss of revenues while considering the acceptance of the consumers. Residential fixed charges are the most frequently proposed policy changes with the penetration of distributed energy generation and energy efficiency programs [

13]. However, demand charges were either denied or scaled back considerably by the commissioners [

14] because charging extra fixed demand charges has the potential of discouraging investment in energy efficiency or solar panels, and negatively impacting low-usage customers [

15]. However, a surcharge, if designed properly, is not supposed to unreasonably increase electricity prices and causes a burden on low-usage consumers [

16].

In this study, nationwide participants are surveyed through Amazon Mechanical Turk. The survey results show that most consumers (85% of the survey participants for energy efficiency and 87% for solar energy) agree that energy efficiency programs and installation of solar panels save them money on their energy bills. The number of consumers agreeing that solar panels (74%) reduce the revenues for utilities is significantly higher compared to energy efficiency programs (41%). However, most consumers disagree that it is fair for utilities to cover losses of revenues from energy efficiency or solar panels by increasing volumetric electricity prices. Additionally, the consumers prefer a demand charge (74% for energy efficiency and 75% for solar panels) to an increase in volumetric energy price if they hypothetically participate in energy efficiency program or install solar panels. To understand the impacting factors, we apply probit models and regress consumers’ attitudes on socio-demographic variables (e.g., gender, age, income, and education) and behavioral variables (e.g., knowledge on bills, attempt to save, plan to invest, and participation in clean energy programs). The demographics and behavioral factors also impact how much the consumers agree that there are savings, and how consumers perceive whether it is fair for utilities to recover the revenue losses incurred by energy efficiency or solar panels by increasing volumetric energy price. We demonstrate there is heterogeneity among consumers in terms of preferences towards surcharges on solar consumers and energy efficient adopters. Policy makers should be aware of such preference heterogeneity and apply policy targeting based on the demographics and behavioral factors identified in this paper that impact such preferences.

3. Results

3.1. Summary of Survey Results

3.1.1. Consumers’ Attitudes towards Energy Efficiency and Solar Panels

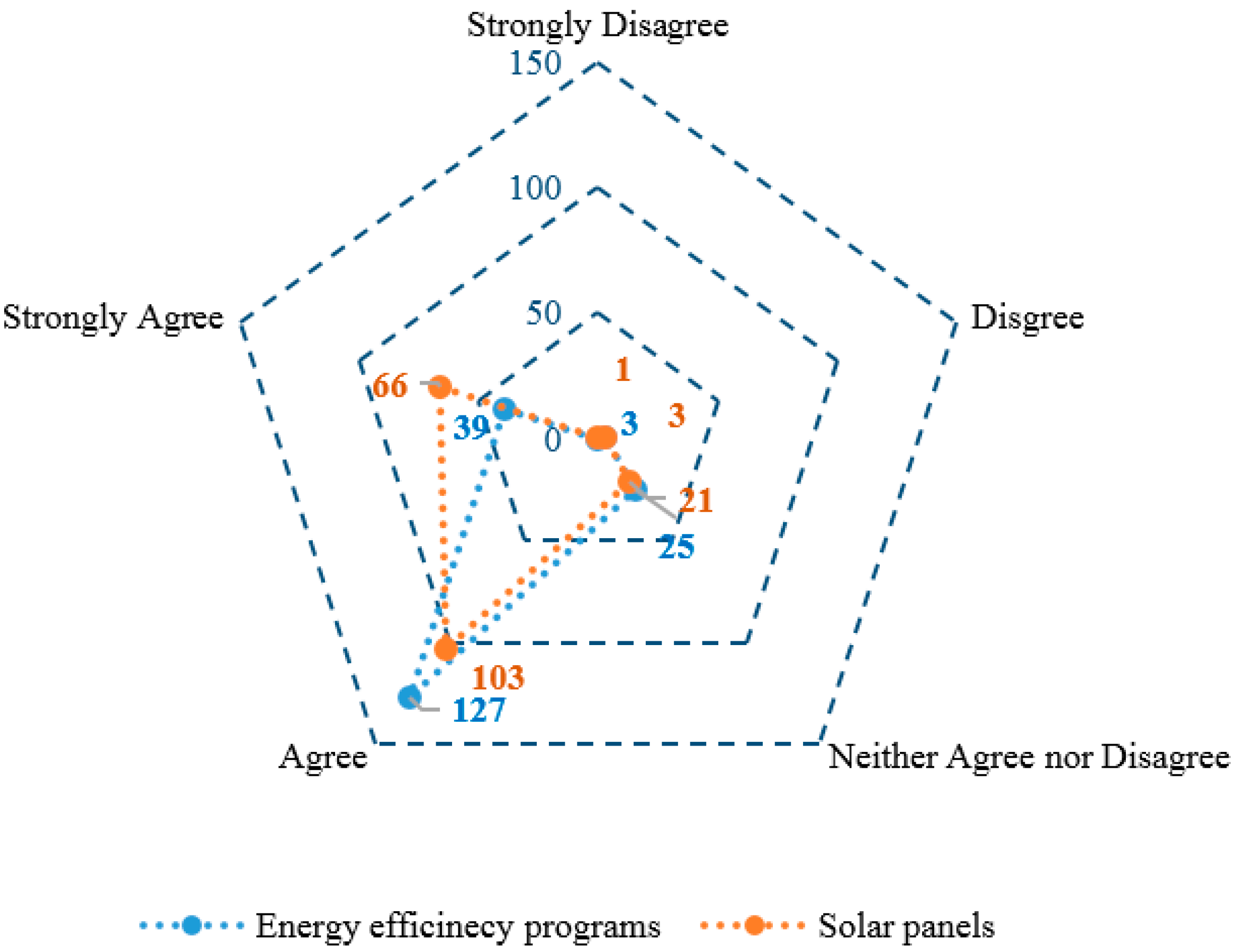

Most consumers agree that there are energy savings with energy efficiency programs or solar panels (

Figure 1), with 87% of participants agreeing that solar panels result in energy savings, while 85% of the participants agreeing that energy efficiency programs encourage them to take actions to make homes energy efficient and save money on energy bills. The sample mean agreement score, based on the calculation from the Likert scale (1–5), for energy efficiency is 4.040 and the sample mean for solar panels is 4.187. Slightly more consumers agree that there are savings for solar panels compared to energy efficiency programs.

Referring to

Figure 2, most participants agree that energy efficiency and solar panels reduce revenues for utilities. More consumers agree (41% of survey participants) than disagree (28%) that energy efficiency programs reduce revenues for utilities, and a high percentage of consumers neither agree nor disagree (31%). Of the survey participants, 74% agree there is a loss of revenues for utilities caused by solar panels while only 10% disagree. The mean agreement score for energy efficiency programs is 3.136 and the mean for solar panels is 3.793. Overall, significantly more consumers agree that there is a loss of revenues due to the penetration of solar panels, compared to energy efficiency programs.

Although most consumers (41% for energy efficiency and 75% for solar programs) agree that there is a loss of revenues for utilities, they think that it is unfair for utilities to cover the loss of revenues by increasing volumetric electricity price. This study finds that 78% of the survey participants think it is unfair to increase the price due to energy efficiency programs and 75% participants believe it is unfair to increase the price due to the installation of solar panels.

Moreover, the consumers prefer an extra demand charge to an increase in volumetric energy price, with 74% of consumers preferring a demand charge if they install solar panels and 75% consumers preferring a demand charge if they participate in the energy efficiency programs.

To conclude, most consumers agree that energy efficiency programs and installation of solar panels help them save money on energy bills. The number of consumers agreeing that solar panels reduce revenues for utilities is significantly more than that of consumers agreeing energy efficiency programs reduce revenues for utilities. Most consumers think it is unfair for utilities to recover loss of revenues by increasing energy price. Moreover, most consumers, if they hypothetically participate in energy efficiency programs or install solar panels, prefer a surcharge via demand charge to an increase in volumetric energy price.

3.1.2. Willingness to Pay an Extra Fixed Demand Charge

Solar consumers are willing to pay slightly more for an extra demand charge compared to the willingness-to-pay of consumers hypothetically in energy efficiency programs. Of the participants, 74% prefer to pay an extra demand charge of less than 5% of the bill for solar panels, and 26% are willing to pay 5% or more of the bill. In terms of energy efficiency, 76% of participants are willing to pay an extra demand charge of less than 5% of the bill, and the rest are willing to pay 5% or more of the bill. There is evidence that consumers are willing to pay more for renewable energy than for energy efficiency [

22], and this study also finds that the consumers are willing to pay slightly higher for a surcharge on solar energy compared to energy efficiency.

3.2. Preference for an Extra Demand Charge

Table 3 indicates that the demographics of consumers have impacts on their attitudes towards surcharges on solar panels. The consumers with more children are 10.4% (

p < 0.05) more likely to prefer an extra demand charge to an increase in volumetric energy price. These households might have larger variations in energy bills because their habits of using electricity are not as regular as households with fewer children. Therefore, households with more children would prefer more stable rates (i.e., fixed demand charges), under which their bill is less vulnerable to changes in monthly electricity use. Moreover, people aged 31–50 are 12.5% (

p < 0.10) and people aged over 50 are 25.8% (

p < 0.01) more likely to prefer an extra fixed demand charge compared to people aged 21–30, probably because there is less variation associated with their energy usage patterns. Additionally, the consumers with higher education are less likely to prefer an extra fixed demand charge.

The homeowners are 16.9% (

p < 0.01) more likely to choose an extra fixed demand charge if they install solar panels, and 11.7% (

p < 0.10) more likely if they participate in energy efficiency programs compared to the consumers who rent an apartment/house or live in housing accommodations provided by school/company. The consumers obviously respond to an increase in volumetric electricity price in this study since they respond to the average electricity price [

23]. The consumers will constrain their consumption more since an increase in the volumetric electricity price is a clearer message than an extra fixed demand charge. Additionally, some homeowners may consider themselves as already “doing their bit” to save energy by investing in solar panels and energy efficiency, compared to the renters who are less likely to make such investments due to split-incentive problems [

24], and thus the homeowners are less likely to constrain themselves by choosing an increase in volumetric electricity price.

We also examine consumers’ preference toward two surcharge designs on participating energy efficiency programs. However, we fail to reject the null hypothesis that all coefficients are equal to zero. This may indicate a lack of information on more deterministic factors, such as electricity price, years of residence, move probability, consumers’ risk aversion, etc. [

25].

3.3. Consumers’ Attitudes towards Energy Efficiency Programs

Table 4 shows the impacting factors on consumers’ attitudes towards savings due to energy efficiency programs. The female consumers are 12.8% (

p < 0.05) more likely to strongly agree that there are savings due to energy efficiency programs conditional on other variables such as household income, the number of children, education, possibly because females are more environmentally conscious than males [

26]. Elderly consumers are less likely to strongly agree (9.4% for people aged 31–50, 18.3% for people aged over 50) that there are savings caused by energy efficiency programs, which could be explained by risk preference—the elder consumers are more risk-averse in decision-making, especially when weighing financial losses [

27] and an investment in energy efficiency is considered as being risky [

25].

The residents with higher education (higher than college) are 20.1% (p < 0.05) more likely to strongly agree. The more educated consumers may have a greater capacity to understand energy efficiency and have a better understanding of the opportunities of changing consumption, and thus they are more likely to agree there are savings.

We also find that behavioral factors have impacts on consumers’ preference. The consumers with energy efficiency investment plans and the consumers willing to enroll in a dynamic pricing plan are 13.4% (p < 0.05) and 23.2% (p < 0.01), respectively, more likely to strongly agree that there are savings due to energy efficiency programs. The consumers on Demand Response program are also significantly more likely to strongly agree. These positive relations are intuitive as agreement on savings is supposed to be associated with investment or enrollment plans.

3.4. Consumers’ Attitudes towards Solar Panels

Table 5 shows the determinants of agreements on savings due to solar panels. The consumers from California, where the energy policies are more stringent are 15.0% less likely (

p < 0.10) to strongly agree that there are savings due to PV installation, compared to the consumers from other parts of the United States. This does not necessarily mean that the consumers from California think that there are no savings. It shows that, while 87% consumers from other parts of the United States agree there are savings, the California residents are less likely to strongly agree. The possible reason is that California suffers from insufficient public participation with its stringent policies, and a lack of participation or sense of control stops the consumers from agreeing on the goal of energy efficiency programs as public participation is important in the decision-making of public policies [

28].

Furthermore, the consumers with more children are 7.3% (p < 0.05) more likely to strongly agree that there are savings with the installation of solar panels, indicating their more positive attitudes towards solar energy. The consumers who are attempting to save and have also seen a reduction in energy bills are 14.9% (p < 0.10) more likely to strongly agree that there are savings because they have had the experience of successful savings. Moreover, the consumers with PV investment plans and who are willing to participate in solar metering programs are 6.1% (p < 0.05) and 20.4% (p < 0.01) more likely to strongly agree there are savings, respectively.

3.5. Consumers’ Attitudes towards Fairness of Increasing Prices

Table 6 shows the impacting factors of consumers’ attitudes toward utilities recovering losses of revenues by increasing the volumetric energy price for participants of energy efficiency programs. This study finds that the female consumers are 12.9% (

p < 0.05) less likely to agree that it is fair for utilities to increase the volumetric price. This may be explained in that females are more risk-averse towards potential losses [

29]. Additionally, the consumers with more children are 5.6% (

p < 0.05) more likely to agree that it is fair, which shows they are more compassionate towards utilities’ loss of revenues.

The consumers attempting to save electricity, no matter whether they have seen a reduction in energy bills or not, are about 18% more likely to agree that it is fair for the utilities to increase the volumetric electricity price. It is possible that these consumers are more aware of their energy use and the potential for saving energy, and thus price increases are more acceptable to them.

We also analyze whether the consumers agree that it is fair for utilities to increase the volumetric energy price for solar customers. The results show that the consumers with lower than college level education are slightly (8.2%, p < 0.10) less likely to think it is fair for the utilities to increase the volumetric energy price. In addition, the consumers willing to enroll in a dynamic pricing plan are 10.3% (p < 0.10) more likely to think it is fair for the utilities to increase the energy price.

In addition, we explore the impacting factors of consumers’ attitudes towards loss of revenues for the utilities due to energy efficiency programs or solar panels (see

Appendix,

Table A2 and

Table A3). For energy efficiency programs, the consumers with high summer bills of over

$600 are 11.9% (

p < 0.10) more likely to strongly agree that there is a loss of revenues. Furthermore, the consumers enrolled in the Demand Response program are 12.6% (

p < 0.05) more likely to strongly agree there is a loss of revenues. For solar panels, the consumers in California are 11.6% (

p < 0.10) more likely to strongly agree that there is a loss of revenues. Moreover, the consumers with lower summer bills of less than

$400 are 12.6% (

p < 0.05) more likely to strongly agree. In addition, this study also finds the consumers who have seen reduction in bills after attempting to save and those willing to enroll in the dynamic pricing plan are also more likely to strongly agree. We also examine the impacting factors of consumers’ willingness to pay for an extra demand charge (

Table 7) and with the installation of solar panels (see

Appendix,

Table A4). For solar panels, summer bill is the only variable that shows statistically significant result, and the consumers are less likely to pay over 5% of the bills.

Table 7 shows the impacting factors of consumers’ willingness to pay for an extra demand charge on participating energy efficiency programs. It turns out the female consumers are 12.2% (

p < 0.10) more likely to pay only up to 5% of the bill, which is probably because the female consumers are more sensitive to financial loss, as mentioned above. The consumers actually enrolled in energy efficiency programs are 13.3% (

p < 0.10) more likely to pay a higher percentage (over 5%) of their energy bills. Similarly, consumers with electric vehicles are 32.3% (

p < 0.10) more likely to pay a higher percentage of their bills. The consumers enrolled in energy efficiency programs or those who have electric vehicles are generally more environmentally-concerned, and thus are more willing to pay a higher price for an extra fixed demand charge. In addition, the consumers with higher electricity bills and those enrolled in Demand Response program are less likely to pay more for an extra demand charge.