Does Implementation of Big Data Analytics Improve Firms’ Market Value? Investors’ Reaction in Stock Market

Abstract

:1. Introduction

- Do announcements about big data technology implementation increase firms’ market value?

- What business condition can influence the size of abnormal returns on stock market prices?

2. Literature Review

3. Theoretical Background and Research Propositions

4. Method and Sample

4.1. Choosing Methodology

4.2. Data

5. Measure

5.1 Categorizing the Data

5.2. Computation of Cumulative Abnormal Returns (CAR)

6. Results

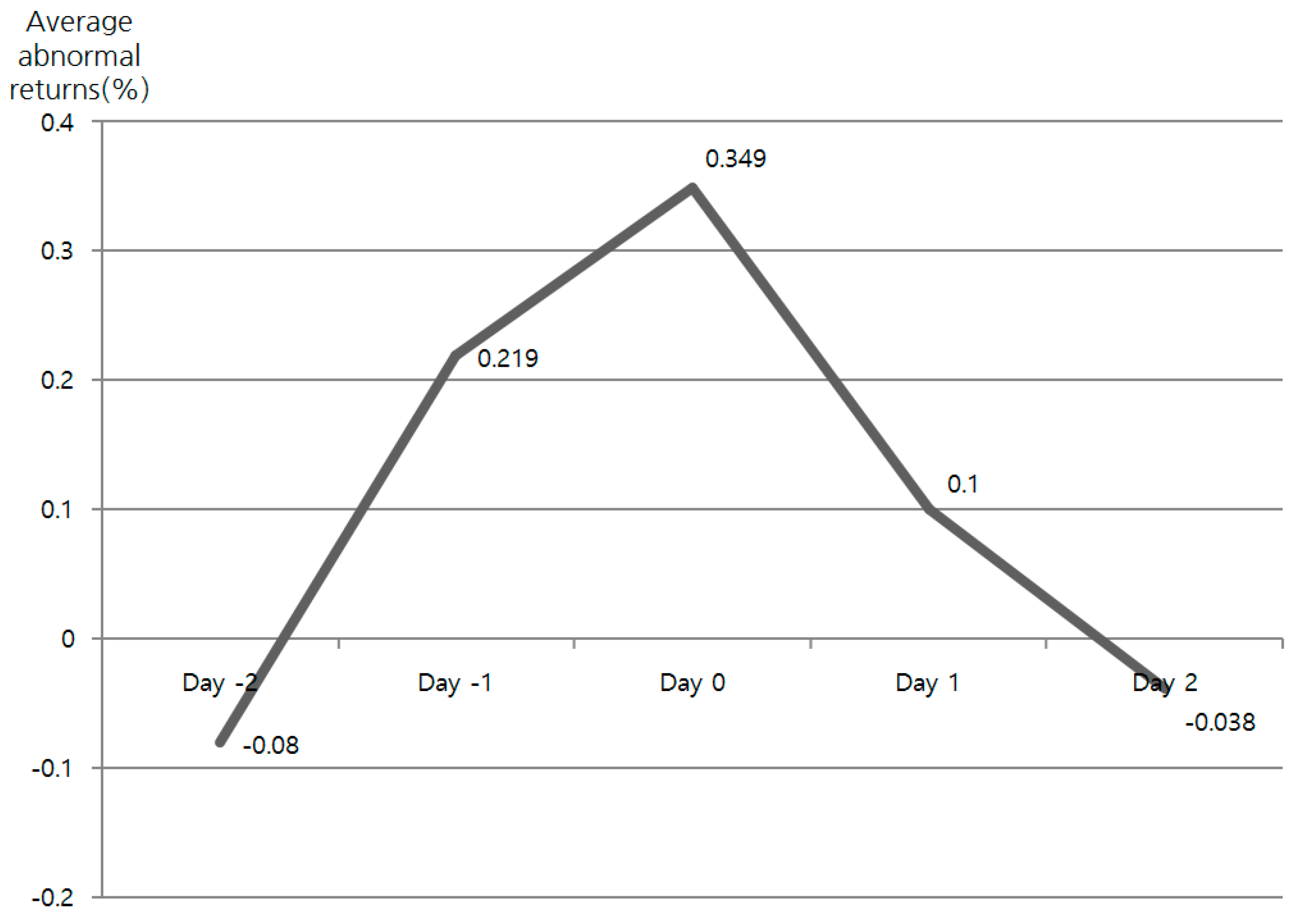

6.1. CARs Results

6.2. Regression Results

7. Comparison

7.1. Big Vendor vs. Small Vendor

7.2. Big Firm vs. Small Firms

8. Conclusions and Discussion

Author Contributions

Conflicts of Interest

References

- Hashem, I.A.T.; Yaqoob, I.; Anuar, N.B.; Mokhtar, S.; Gani, A.; Khan, S.U. The rise of “big data” on cloud computing: Review and open research issues. Inf. Syst. 2015, 47, 98–115. [Google Scholar] [CrossRef]

- Provost, F.; Fawcett, T. Data science and its relationship to big data and data-driven decision making. Big Data 2013, 1, 51–59. [Google Scholar] [CrossRef] [PubMed]

- Eric, S. Gartner: Top 10 Strategic Technology Trends for 2013. Available online: http://www.forbes.com/sites/ericsavitz/2012/10/23/gartner-top-10-strategic-technology-trends-for 2013/ (accessed on 7 May 2016).

- Cukier, K.; Mayer-Schoenberger, V. The Rise of Big Data: How it’s changing the Way We Think about the World. Foreign Aff. 2013, 92, 28–40. [Google Scholar]

- Power, D.J. Using ‘Big Data’ for analytics and decision support. J. Decis. Syst. 2014, 23, 222–228. [Google Scholar] [CrossRef]

- Lee, J.; Lapira, E.; Bagheri, B.; Kao, H.A. Recent advances and trends in predictive manufacturing systems in big data environment. Manuf. Lett. 2013, 1, 38–41. [Google Scholar] [CrossRef]

- IDC. Worldwide Big Data Technology and Services Forecast, 2015–2019. 2015. Available online: http://www.idc.com/getdoc.jsp?containerId=prUS40560115 (accessed on 7 May 2016).

- Tata Consultancy Services. The Emerging Big Returns on Big Data: A TCS Global Trend Study; Tata Consultancy Services: Mumbai, India, 2013; pp. 1–106. [Google Scholar]

- Bradford, M.; Florin, J. Examining the role of innovation diffusion factors on the implementation success of enterprise resource planning systems. Int. J. Account. Inf. Syst. 2003, 4, 205–225. [Google Scholar] [CrossRef]

- Fui-Hoon Nah, F.; Lee-Shang Lau, J.; Kuang, J. Critical factors for successful implementation of enterprise systems. Bus. Process Manag. J. 2001, 7, 285–296. [Google Scholar] [CrossRef]

- Umble, E.J.; Haft, R.R.; Umble, M.M. Enterprise resource planning: Implementation procedures and critical success factors. Eur. J. Oper. Res. 2003, 146, 241–257. [Google Scholar] [CrossRef]

- Hunton, J.E.; Lippincott, B.; Reck, J.L. Enterprise resource planning systems: Comparing firm performance of adopters and nonadopters. Int. J. Account. Inf. Syst. 2003, 4, 165–184. [Google Scholar] [CrossRef]

- Nicolaou, A.I. Firm performance effects in relation to the implementation and use of enterprise resource planning systems. J. Inf. Syst. 2004, 18, 79–105. [Google Scholar] [CrossRef]

- Hendricks, K.B.; Singhal, V.R.; Stratman, J.K. The impact of enterprise systems on corporate performance: A study of ERP, SCM, and CRM system implementations. J. Oper. Manag. 2007, 25, 65–82. [Google Scholar] [CrossRef]

- Fama, E.F.; Fisher, L.; Jensen, M.C.; Roll, R. The adjustment of stock prices to new information. Int. Econ. Rev. 1969, 10, 1–21. [Google Scholar] [CrossRef]

- Konchitchki, Y.; O’Leary, D.E. Event study methodologies in information systems research. Int. J. Account. Inf. Syst. 2011, 12, 99–115. [Google Scholar] [CrossRef]

- Gartner IT Glossary. 2016. Available online: www.gartner.com/it-glossary/big-data (accessed on 7 May 2016).

- Beyer, M.O.J. Gartner Says Solving ‘Big Data’ Challenge Involves More Than Just Managing Volumes of Data. Available online: http://www.gartner.com/it/page.jsp?id=1731916 (accessed on 27 June 2011).

- Kaisler, S.; Armour, F.; Espinosa, J.A.; Money, W. Big data: Issues and challenges moving forward. In Proceedings of the 46th Hawaii International Conference on System Sciences, Wailea, Maui, HI, USA, 7–10 January 2013. [Google Scholar]

- McKinsey Global Institute. Big Data: The Next Frontier for Innovation, Competition, and Productivity; McKinsey&Company: New York, NY, USA, 2011; pp. 1–20. [Google Scholar]

- Chen, H.; Chiang, R.H.; Storey, V.C. Business intelligence and analytics: From big data to big impact. MIS Q. 2012, 36, 1165–1188. [Google Scholar]

- LaValle, S.; Lesser, E.; Shockley, R.; Hopkins, M.S.; Kruschwitz, N. Big data, analytics and the path from insights to value. MIT Sloan Manag. Rev. 2011, 52, 21. [Google Scholar]

- Hong, K.K.; Kim, Y.G. The critical success factors for ERP implementation: An organizational fit perspective. Inf. Manag. 2002, 40, 25–40. [Google Scholar] [CrossRef]

- Poon, P.; Wagner, C. Critical success factors revisited: Success and failure cases of information systems for senior executives. Decis. Support Syst. 2001, 30, 393–418. [Google Scholar] [CrossRef]

- Ravichandran, T.; Lertwongsatien, C.; Lertwongsatien, C. Effect of information systems resources and capabilities on firm performance: A resource-based perspective. J. Manag. Inf. Syst. 2005, 21, 237–276. [Google Scholar] [CrossRef]

- Hayes, D.C.; Hunton, J.E.; Reck, J.L. Information systems outsourcing announcements: Investigating the impact on the market value of contract-granting firms. J. Inf. Syst. 2000, 14, 109–125. [Google Scholar] [CrossRef]

- Ranganathan, C.; Samarah, I. Enterprise resource planning systems and firm value: An event study analysis. ALSeL 2001, 19, 157–158. [Google Scholar]

- Hayes, D.; Hunton, J.; Reck, J. Market reaction to ERP implementation announcements. J. Inf. Syst. 2001, 15, 3–18. [Google Scholar] [CrossRef]

- Brown, S.J.; Warner, J.B. Using daily stock returns: The case of event studies. J. Financ. Econ. 1985, 14, 3–31. [Google Scholar] [CrossRef]

- Roztocki, N.; Weistroffer, H.R. How do investments in enterprise application integration drive prices? In Proceedings of the 40th Hawaii International Conference on System Sciences (HICSS), Waikoloa, HI, USA, 3–6 January 2007; pp. 1–8. [Google Scholar]

- Im, K.; Dow, K.; Grover, V. Research report: A reexamination of IT investment and the market value of the firm—An event study methodology. Inf. Syst. Res. 2001, 12, 103–117. [Google Scholar] [CrossRef]

- Schroeck, M.; Shockley, R.; Smart, J.; Romero-Morales, D.; Tufano, P. Analytics: The real-world use of big data in financial services. IBM Inst. Bus. Value 2012, 1, 1–22. [Google Scholar]

- Wu, S.I.; Lu, C.L. The relationship between CRM, RM, and business performance: A study of the hotel industry in Taiwan. Int. J. Hosp. Manag. 2012, 31, 276–285. [Google Scholar] [CrossRef]

- Storey, V.C.; Straub, D.W.; Stewart, K.A.; Welke, R.J. A conceptual investigation of the e-commerce industry. Commun. ACM 2000, 43, 117–123. [Google Scholar] [CrossRef]

- Bharadwaj, A.S. A resource-based perspective on information technology capability and firm performance: An empirical investigation. MIS Q. 2000, 24, 169–196. [Google Scholar] [CrossRef]

- Caldeira, M.M.; Ward, J.M. Using resource-based theory to interpret the successful adoption and use of information systems and technology in manufacturing small and medium-sized enterprises. Eur. J. Inf. Syst. 2003, 12, 127–141. [Google Scholar] [CrossRef]

- Lee, J.; Kao, H.A.; Yang, S. Service innovation and smart analytics for industry 4.0 and big data environment. Procedia CIRP 2014, 16, 3–8. [Google Scholar] [CrossRef]

- Wu, X.; Zhu, X.; Wu, G.Q.; Ding, W. Data mining with big data. IEEE Trans. Knowl. Data Eng. 2014, 26, 97–107. [Google Scholar]

- Xu, Y.; Yen, D.C.; Lin, B.; Chou, D.C. Adopting customer relationship management technology. Ind. Manag. Data Syst. 2002, 102, 442–452. [Google Scholar] [CrossRef]

- Somers, T.M.; Nelson, K. The impact of critical success factors across the stages of enterprise resource planning implementations. In Proceedings of the 34th Annual Hawaii International Conference on System Sciences, Maui, HI, USA, 3–6 January 2001; pp. 10–20. [Google Scholar]

- Kumar, K.B.; Rajan, R.G.; Zingales, L. What determines firm size? Natl. Bur. Econ. Res. 1999, w7208, 1–54. [Google Scholar]

- Russom, P. Big data analytics. In TDWI Best Practices Report, Fourth Quarter; Transforming Data with Intelligence (TDWI): Renton, WA, USA, 2011; pp. 1–35. [Google Scholar]

- Statistical Analysis System. Big Data Analytics: Adoption and Employment Trends, 2012–2017; Statistical Analysis System: Marlow, UK, 2013; pp. 1–24. [Google Scholar]

- Ranganathan, C.; Brown, C.V. ERP investments and the market value of firms: Toward an understanding of influential ERP project variables. Inf. Syst. Res. 2006, 17, 145–161. [Google Scholar] [CrossRef]

- Gartner. Market Share Analysis: Business Intelligence and Analytics Software, 2013. 2014. Available online: https://www.gartner.com/doc/2723017 (accessed on 7 May 2016).

- Gartner. Market Share Analysis: Business Intelligence and Analytics Software, 2014. 2015. Available online: https://www.gartner.com/doc/3083322 (accessed on 7 May 2016).

- Armitage, S. Event study methods and evidence on their performance. J. Econ. Surv. 1995, 9, 25–52. [Google Scholar] [CrossRef]

- Hirshleifer, D.; Shumway, T. Good day sunshine: Stock returns and the weather. J. Financ. 2003, 58, 1009–1032. [Google Scholar] [CrossRef]

- Kamstra, M.J.; Kramer, L.A.; Levi, M.D. Winter blues: A SAD stock market cycle. Am. Econ. Rev. 2003, 93, 324–343. [Google Scholar] [CrossRef]

- Edmans, A.; Garca, D.; Norli, O. Sports sentiment and stock returns. J. Financ. 2007, 62, 1967–1998. [Google Scholar] [CrossRef]

- Kaplanski, G.; Levy, H. Sentiment and stock prices: The case of aviation distasters. J. Financ. Econ. 2010, 95, 174–201. [Google Scholar] [CrossRef]

- Mackinlay, A. Event studies in economics and finance. J. Econ. Lit. 1997, 35, 13–39. [Google Scholar]

- Dixon, W.J.; Mood, A.M. The statistical sign test. J. Am. Stat. Assoc. 1946, 41, 557–566. [Google Scholar] [CrossRef] [PubMed]

- Chai, S.; Kim, M.; Rao, H.R. Firms’ information security investment decisions: Stock market evidence of investors’ behavior. Decis. Support Syst. 2011, 50, 651–661. [Google Scholar] [CrossRef]

| Reference | IS Implementation | Methodology | Variable | Key Findings |

|---|---|---|---|---|

| Hayes et al. (2000) [26] Period: 1990–1997 | Information system outsourcing | Event study methodology |

|

|

| Hayes et al. (2001) [28] Period: 1990–1998 | Enterprise resource planning (ERP) implementation | Event study methodology |

|

|

| Poon and Wagner (2001) [24] | Executive information systems | Personal interviews with several key personnel |

|

|

| Hong and Kim (2002) [23] | Enterprise resource planning (ERP) implementation |

|

|

|

| Hunton et al. (2003) [12] Period: 1990–1998 | Enterprise resource planning (ERP) implementation |

|

|

|

| Ravichandran and Lertwongsatien(2005) [25] | Implementation of information technology | Partial least squares (PLS) with objective performance data (Return on assets and return on sales, sales growth) |

|

|

| Hendricks et al. (2007) [14] Period: 1991–1999 | Enterprise resource planning (ERP), supply Chain management, customer(SCM) relationship management systems(CRM) |

|

|

|

| Company | Text of Announcements |

|---|---|

| The Cheesecake Factory, Inc. | IBM (NYSE: IBM) today announced that The Cheesecake Factory Incorporated (NASDAQ: CAKE), with over 175 restaurant locations across the United States and three licensed locations in the Middle East, is using IBM Big Data analytics to help deliver the highest-quality experience to its guests. |

| (NASDAQ: CAKE) | |

| 26 February 2013 | |

| Cardinal Health, Inc. |

|

| (NYSE: CAH) | |

| 13 May 2013 | |

| BlackRock, Inc. | Splunk Inc. (NASDAQ: SPLK), provider of the leading software platform for real-time operational intelligence, today announced that BlackRock is significantly expanding its usage of Splunk® Enterprise. BlackRock Technology initially deployed Splunk software in 2012 and saw immediate success. Due to the proven value from the initial deployment, BlackRock recently decided to triple the size of its Splunk Enterprise license to address a broader range of requirements. Leading security teams consider all data to be security-relevant and need a solution that can scale with the exponentially growing volumes of data and perform big data security analytics. The use of Splunk software helps firms create a more effective big data security infrastructure to counter emerging and advanced threats. |

| (NYSE: BLK) | |

| 5 November 2013 | |

| Verizon Communications, Inc. | Verizon Enterprise Solutions today announced collaboration with Cloudera, a leader in enterprise analytic data management powered by Apache Hadoop, to provide cloud-based big data analytics services to Verizon Cloud clients. Cloudera is the latest in the growing list of enterprise-class services being configured to run on the new Verizon Cloud, providing clients the flexibility to develop their own big data analytics applications based on the Apache Hadoop open source framework. |

| (NYSE: VZ) | |

| 7 November 2013 | |

| Joy Global | IBM (NYSE: IBM) and Joy Global (NYSE: JOY), a worldwide leader in high-productivity mining solutions, today announced that Joy Global selected IBM Big Data and Analytics technology—including IBM’s advanced predictive analytics software and optimization solutions—to enhance the ability of Joy Global Smart Services to improve mining machine performance, while reducing downtime and costs. |

| (NYSE: JOY) | |

| 28 October 2014 | |

| Cisco Systems, Inc. |

|

| (NASDAQ: CSCO) | |

| 29 October 2014 | |

| Cerner Corporation | Cloudera, the leader in enterprise analytic data management powered by Apache Hadoop™, today announced that Cerner Corp. (CERN), a long-time leader in the health IT space, is powering its Big Data platform with a Cloudera enterprise data hub to create a holistic understanding of the healthcare system and to improve patient outcomes. |

| (NASDAQ: CERN) | |

| 12 February 2015 | |

| Yahoo! Inc. | Splunk Inc. (NASDAQ: SPLK), provider of the leading software platform for real-time Operational Intelligence, today announced that Yahoo has implemented Hunk®: Splunk Analytics for Hadoop and NoSQL Data Stores and Splunk® Enterprise. With a Hunk enterprise adoption license, Yahoo employees use Hunk to explore, analyze and visualize data from its Hadoop environment, which stores more than 600 petabytes of data. Yahoo teams are also analyzing more than 150 terabytes of machine data per day in Splunk Enterprise for use cases including IT operations, applications delivery, security, and business analytics. |

| (NASDAQ: YHOO) | |

| 17 February 2015 | |

| Harte Hanks, Inc. | Harte Hanks (NYSE: HHS), a leader in developing customer relationships, experiences and defining interaction led marketing, and MapR Technologies, Inc.; provider of the top-ranked distribution for Apache™ Hadoop®, today announced Harte Hanks is using the MapR Distribution including Hadoop to evolve Harte Hanks’ big data solutions. By adopting the MapR data platform, Harte Hanks enhances the performance, scalability, and flexibility of its solutions, enabling its clients to more easily and quickly migrate, analyze, and store massive quantities of data. |

| (NYSE: HHS) | |

| 13 August 2015 |

| (a) Firm Size(Revenue) | |

| Minimum | $70,000 |

| Maximum | $233,715,000 |

| Mean | $27,964,710 |

| Standard deviation | $45,415,917 |

| Median | $6,538,600 |

| (b) Number of Employee | |

| Minimum | 81 |

| Maximum | 239,000 |

| Mean | 42,646 |

| Standard deviation | 57,771.57 |

| Median | 18,000 |

| (c) Total Assets | |

| Minimum | $117,000 |

| Maximum | $2,417,121,000 |

| Mean | $27,965,000 |

| Standard deviation | $448,202 |

| Median | $11,462,000 |

| (d) Frequency of Year | |

| 2010 | 3 |

| 2011 | 3 |

| 2012 | 9 |

| 2013 | 13 |

| 2014 | 8 |

| 2015 | 18 |

| (e) Industry | |

| Service | 39 |

| Non-service | 15 |

| (f) Big Data Analytics Solution Vendors | |

| Large vendors such as SAP, Oracle, IBM and SAS | 28 |

| Other small vendors | 26 |

| (g) Sector | |

| Information technology firms | 18 |

| Non-tech firm | 36 |

| Event Window | Parametric Tests | Nonparametric Tests | ||

|---|---|---|---|---|

| Mean CAR (%) | Z | Positive: Negative Signs of CARs | Z | |

| (−2,2) | 0.11 | 2.94 ** | 38:16 | 2.98 ** |

| (−1,1) | 0.26 | 2.60 ** | 36:18 | 2.35 ** |

| (−1,0) | 0.22 | 1.95 * | 35:19 | 2.20 ** |

| (0,1) | 0.25 | 1.84 * | 31:23 | 1.02 |

| Variables | Coefficient | t-Score | p-Value |

|---|---|---|---|

| Sector of firms | 0.104 | 0.810 | NS |

| industry | −0.054 | −0.421 | NS |

| Firm size(revenue) | −0.353 | −2.738 | 0.009 |

| Vendors | 0.313 | 2.413 | 0.02 |

| R2 | 0.203 | ||

| Adjusted R2 | 0.138 | ||

| F-value | 3.123 (significant at 0.023) | ||

| Event Window * Sig. at 0.10. **Sig. at 0.05 | Parametric Tests | Nonparametric Tests | ||

|---|---|---|---|---|

| Mean CAR (%) | Z | Positive: Negative Signs of CARs | Z | |

| Big vendor (n = 22) | ||||

| (−2,2) | 0.28 | 1.88 * | 14:8 | 1.31 |

| (−1,1) | 0.13 | 0.83 | 13:9 | 0.84 |

| (−1,0) | 0.09 | 0.68 | 13:9 | 0.84 |

| (0,1) | 0.10 | 0.41 | 10:12 | 0.38 |

| Small vendor (n = 32) | ||||

| (−2,2) | 0.72 | 2.20 ** | 23:9 | 2.48 ** |

| (−1,1) | 1.24 | 2.68 ** | 23:9 | 2.48 ** |

| (−1,0) | 0.74 | 2.28 ** | 23:9 | 2.48 ** |

| (0,1) | 0.72 | 1.79 * | 20:12 | 1.41 |

| Event Window * Sig. at 0.10. **Sig. at 0.05 | Parametric Tests | Nonparametric Tests | ||

|---|---|---|---|---|

| Mean CAR (%) | Z | Positive: Negative Signs of CARs | Z | |

| Big firms (n = 28) | ||||

| (−2,2) | 0.81 | 2.74 ** | 21:7 | 2.64 ** |

| (−1,1) | 1.37 | 2.82 ** | 19:9 | 1.90 * |

| (−1,0) | 0.79 | 1.70 | 20:8 | 2.22 ** |

| (0,1) | 0.71 | 2.08 ** | 17:11 | 1.16 |

| Small firms (n = 26) | ||||

| (−2,2) | 0.28 | 1.39 | 17:9 | 1.52 |

| (−1,1) | 0.16 | 0.83 | 17:9 | 1.52 |

| (−1,0) | 0.06 | 1.05 | 15:11 | 0.71 |

| (0,1) | 0.26 | 0.49 | 14:12 | 0.31 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, H.; Kweon, E.; Kim, M.; Chai, S. Does Implementation of Big Data Analytics Improve Firms’ Market Value? Investors’ Reaction in Stock Market. Sustainability 2017, 9, 978. https://doi.org/10.3390/su9060978

Lee H, Kweon E, Kim M, Chai S. Does Implementation of Big Data Analytics Improve Firms’ Market Value? Investors’ Reaction in Stock Market. Sustainability. 2017; 9(6):978. https://doi.org/10.3390/su9060978

Chicago/Turabian StyleLee, Hansol, Eunkyung Kweon, Minkyun Kim, and Sangmi Chai. 2017. "Does Implementation of Big Data Analytics Improve Firms’ Market Value? Investors’ Reaction in Stock Market" Sustainability 9, no. 6: 978. https://doi.org/10.3390/su9060978

APA StyleLee, H., Kweon, E., Kim, M., & Chai, S. (2017). Does Implementation of Big Data Analytics Improve Firms’ Market Value? Investors’ Reaction in Stock Market. Sustainability, 9(6), 978. https://doi.org/10.3390/su9060978