1. Introduction

The concept of the ecosystem provides a systemic way to describe social systems via the business ecosystem [

1], platform ecosystem (mainly information technology based research) [

2,

3], innovation ecosystem [

4,

5,

6], and entrepreneurial ecosystem [

7] and thereby to extract theories of complementary invention and develop indirect network effects. It offers researchers a new concept with which to capture the complexity and dynamic nature of modern industrial systems [

8]. Researchers have used this concept to capture new phenomena that could not be fully explained by previous theories (e.g., Shanzhai cellphones, the ARM versus the Intel ecosystem). As the actors to be considered in investigating new phenomena these days may be dispersed across different firms, industries, or even countries, previous concepts such as subcontracting or supply chains may not be sufficient to portray the whole picture [

8].

Business ecosystem research has now been carried out in many areas such as strategic management, innovation, operations management, and others. Most of the current research has focused on the economic value created by the business ecosystem. For example, Li’s research claimed that the services, tools, or technologies shared in a platform ecosystem could enhance the performance of its members [

9]. However, little research has focused on how the operations of a business ecosystem could have a positive impact on our environment (overall sustainability). As global and regional environmental initiatives have started to emphasize environmental protection, more and more countries and international organizations have begun to recognize the importance of waste management, recycling, reuse, and sustainable development. We feel there is a chance and also a ‘need’ to develop a new stream of business ecosystem research linked to the circular economy, with the aim of contributing to the knowledge of how a leading firm might lead a ‘good’ and ‘sustainable’ ecosystem, in order to maintain both business and environmental value at the same time.

The concept of the circular economy has prospered in recent years, covering the ideas of industrial symbiosis and extended product life [

10]. The manufacturing operations, delivery processes, and waste management of companies have also become significant factors in the consumer’s purchasing decision. In turn, scholars, governments, and industry have started to pay great attention to this area, embracing the idea of the green economy. Recently, this trend has also swept Taiwan. According to The Wall Street Journal, in the past, Taiwan was known as ‘the garbage island’, but it has now become a model of resource recycling [

11]. This huge transformation has necessitated numerous industries to change their old processing patterns.

In the development of industry, Taiwan plays an important role from glass products to high-tech products and from material extracting to manufacturing. In terms of discarded glass bottles, the average annual volume of recycling in 2014 and 2015 had reached 227 thousand tons [

12]. Moreover, about six thousand tons of waste liquid crystal display (LCD) are discarded each year due to the growth of the optoelectronic and high-tech industries [

13]. Such waste glass can cause unpredictable contamination of landfill, incineration, or composting processes. Hence, the treatment of waste glass should be moving in the direction of the recovery and reuse of LCD. The recycling of glass can help to reduce resource consumption, waste, the use of energy, and air and water pollution. Glass recycling industries are being taken more seriously by global policy and environmental trends. However, they face problems in the form of uncertainty about market needs and low profit margins.

Hence, this study seeks to investigate the largest glass recycling firm in Taiwan, Spring Pool Glass, in the hope of learning from their experience of governing their business ecosystem under the circular economy, which has demonstrated both economic and environmental value, in the Asian context.

4. Case Study

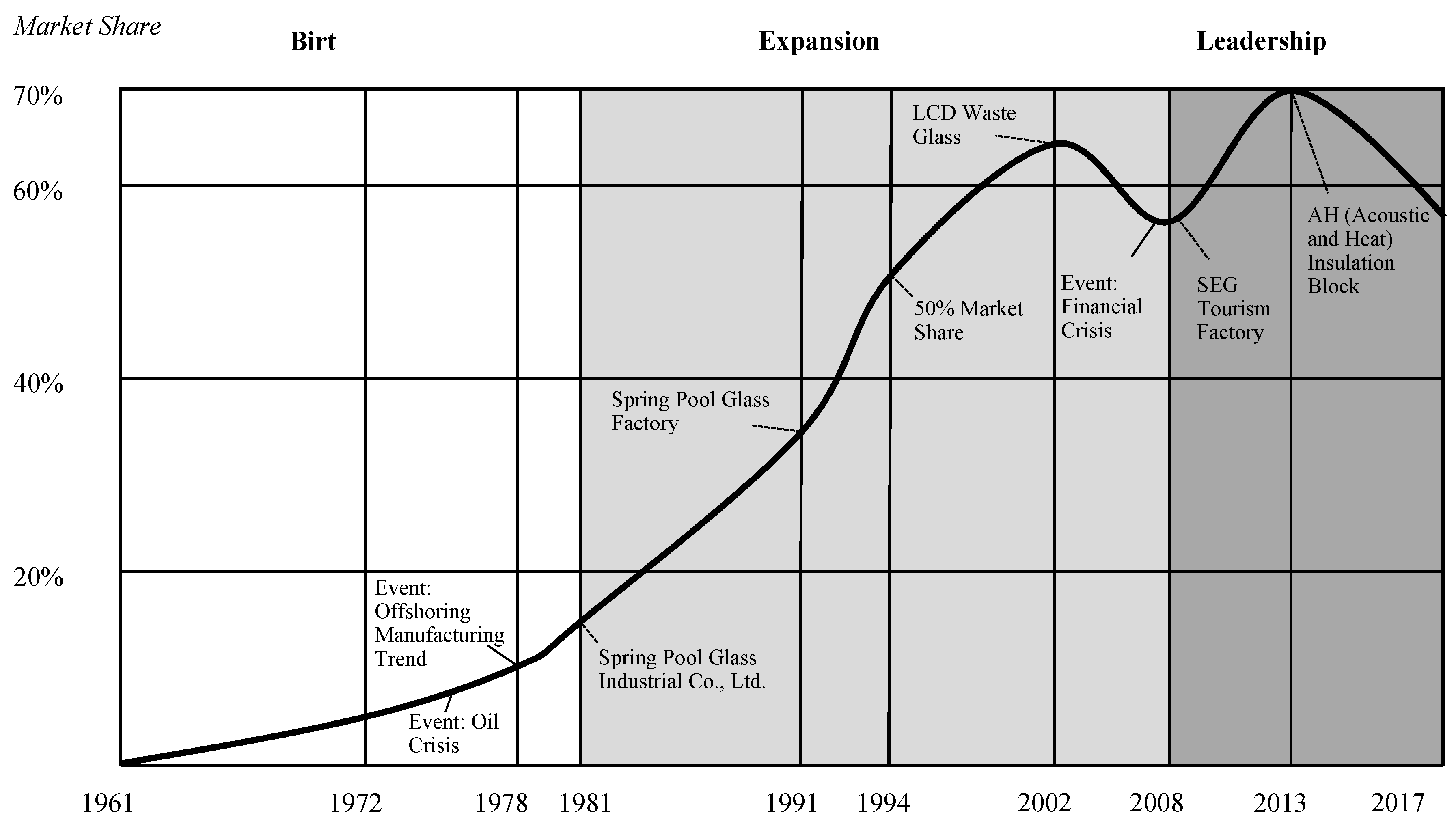

This section will present the case based on the lifecycle of the business ecosystem to demonstrate how Spring Pool Glass captures value and builds up its social networks. This section will also present the story of Spring Pool Glass from a different perspective. In the birth and expansion stages, we will focus on how the entrepreneur built up the firm’s social network and captured value within the ecosystem. In the leadership stage, we will focus on how the company governs its ecosystem. The development of Spring Pool Glass’s ecosystem is presented in

Figure 2.

4.1. Birth Stage: 1972–1980

Before Mr. Wu started Spring Pool Glass in 1972, he had been working in the glass manufacturing industry since his graduation from elementary school in 1961. Initially he joined the Hsinchu Glass Factory to obtain basic knowledge of glass manufacturing. Two years later, he was transferred to the China Glass Industrial Research Institute, a research institute sponsored by the Hsinchu Glass Factory, to learn how to melt glass, mix colors, and make glass artwork. From 1969 to 1972, Mr. Wu served in the military so as to fulfill the mandatory military service required by the Taiwan government.

After Mr. Wu resigned from the military in 1972, he decided to start his own business in the glass recycling industry, sensing its potential. At that time, the industry was dominated by small recyclers. Recyclers would gather waste glass from households (the recycler did not have to pay for this) or factories (over a certain amount of waste glass, these recyclers did have to pay) and sell it to glass manufacturers as an input. Mr. Wu started his business as a self-employed individual, carrying waste glass, mainly cathode ray tube (CRT) monitors and waste glass bottles, with his own scooter and crushing the waste glass in his own backyard. Due to his previous experience and contacts in the glass industry, his initial sales strategy was to provide high-quality recycled glass to small factories so as to build a good reputation.

Next, to enlarge his glass supply, Mr. Wu also started to collect waste glass from other counties and bought a second-hand truck to increase his capacity. However, local factions from other counties were a big challenge to Mr. Wu’s attempts to collect waste glass. He later resolved this problem by using the contacts he had made during his military service and a former colleague from the Hsinchu Glass Factory.

In 1975, when the ‘Taiwan Economic Miracle’ started to boom, the market for waste glass was seen as having a bright future due to the oil crisis. Hence, Mr. Wu bought his first land to use to stack waste glass (2000 m2). During the same period, Mr. Wu also owned his own fleet of trucks, helping him to secure his waste glass supply. However, in 1978, the glass industry in Taiwan went through a depression due to the trend of offshoring manufacturing. Glass factories were not buying waste glass due to the shortage of demand. In order to stack his oversupply of waste glass, Mr. Wu was forced to buy another plot of land in 1978 (this time 10,000 m2 in size). However, this investment later became a great advantage for his company, while there was a high entry barrier for latecomers to the industry.

4.2. Expansion Stage: 1981–2008

In 1981, Mr. Wu established Spring Pool Glass Industrial Co., Ltd. (Hsinchu, Taiwan), to transform his business from a home-run operation to a more structured setting. The company also introduced new automatic machines to classify and smash the waste glass, dramatically increasing its capacity to deal with waste glass from 1 to 50 tons per hour. Overall, in this stage, Spring Pool Glass enlarged its ecosystem on both the demand and the supply side. On the supply side, due to its long-term collaboration with waste glass suppliers, mainly family-based, Spring Pool Glass started to dominate the glass recycling business. On the demand side, due to the increase in its capabilities, Spring Pool Glass was also able to sell these recycled materials (glass) to large factories for manufacturing use. At the time, recycled glass was classified into three different levels according to its quality. The first class was sent to glass factories for manufacturing, the second class was used in ceramics, and the third as a material in cement making.

However, by 1991, nearly 90% of the glass manufacturing industry had migrated to Mainland China or Southeast Asia. Most of Spring Pool Glass’s competitors (in the glass recycling business) had left the Taiwanese market, and many of those that stayed had changed their commercial land-use permits and hence left the glass recycling business. This trend provided Spring Pool Glass with an opportunity to expand its market share. However, at the same time, due to the lack of demand (the migration of glass manufacturing firms), Spring Pool Glass started to invest in research and development (R&D) to search for new channels that might consume its recycled glass. In 1999, Spring Pool Glass invented new technology that remakes recycled glass into an eco-friendly building material, the ‘glass bean’, which later become a high-value-added product. Moreover, at this stage, Spring Pool Glass also gained the ability to analyze the composition of its waste glass on a more scientific basis, which increased its capability for dealing with waste glass.

During this time, the electronics industry started to prosper in Taiwan. A lot of industrial glass waste was produced such as LCD, flat glass, fiber glass, container glass, and sodium silicate glass. Most of the glass manufacturing firms lacked the knowledge to deal with this glass waste as the composition was different from the glass recycled previously. In order to consume this industrial waste glass from the electronics industry, Spring Pool Glass invested more in R&D, seeking opportunities to transform such glass into standalone products. In 2002, Spring Pool Glass cooperated with Company A, the largest manufacturer of LCD glass, ceramics, and related materials, primarily for industrial and scientific applications. Spring Pool Glass purchased Company A’s waste LCD glass and transformed it for use in ceramics and to make cement aggregate. Spring Pool Glass also began to export some recycled glass that was not suitable for Taiwan’s manufacturers to its foreign partners.

In 1997, the Taiwanese government implemented a new policy, the ‘four-in-one resource recycling project’, seeking to build a complete recycling system in Taiwan. This act brought Spring Pool Glass both advantages and disadvantages. The main advantage was that, due to the government promotion, the overall recycling rate increased. With the involvement of cleaning teams and recyclers, Spring Pool Glass is saved the effort of collecting waste glass with its own fleet of trucks. However, the main disadvantage stemmed from the resulting transparency of the recycling market. All waste glass collected by the cleaning team and recyclers now had a ‘price’ and competitors had to bid to obtain it from the government. To win the bid, Spring Pool Glass had to pay a slightly higher price than it had done previously. Moreover, one of Spring Pool Glass’s strengths, its stakeholder network (for waste glass collection), was limited after the launch of this project.

By the end of the expansion stage, Spring Pool Glass was processing more than 50% of all glass recycling in Taiwan, making it a leading firm in the glass recycling ecosystem. Two main factors enabled Spring Pool Glass to maintain its advantage. First, it had achieved an economic scale that produced a profit. As glass recycling is a very low-margin business, firms need to achieve a certain scale in order to generate a profit. Second, its competitors faced high barriers to entry. Spring Pool Glass had continually aligned its recycling technology with changes in the country’s development. As glass products changed over time (e.g., from household glass waste to LCD waste), Spring Pool Glass was always learning and researching how to recycle the latest waste glass. Any new firm would have to gain this knowledge in order to compete.

4.3. Leadership Stage: 2008 to Present

In 2008, Spring Pool Glass established a brand for its own recycled-glass artwork called SEG (Spring Pool Electrical Handmade Glass). It recruited many senior glass artisans to craft handmade art pieces in its industrial tourism site in Hsinchu. It also established 11 selling points for these recycled art pieces across Taiwan. The purpose was to promote its own branding and inherit Hsinchu City’s glass culture and in turn promote its corporate social responsibility (CSR) and make citizens aware of the importance of recycling. Moreover, in 2013, through its own R&D, Spring Pool Glass developed ‘an insulation block’ from recycled glass, which has excellent soundproofing and heat prevention qualities. This new product has since been used as a building material in the construction industry, bringing higher margins than before.

Since Spring Pool Glass is the leading firm in the glass-recycling ecosystem in Taiwan, there are mechanisms that govern its ecosystem, involving different stakeholders. From the supply side, Spring Pool Glass collects waste glass from households and industrial manufacturing. The household waste glass comes from two channels: first, the cleaning team and recyclers in collaboration with the government (the four-in-one resource recycling project), and second its long-term collaboration with individual recyclers. In the case of industrial glass waste, Spring Pool Glass collects from LCD factories and glass manufacturers. The main reasons these big factories are willing to provide waste glass to Spring Pool Glass are (1) it pays an adequate price, (2) the large amount of land and technology required to deal with industrial glass waste, and (3) Spring Pool Glass’s long-standing good reputation and its CSR campaign promoted through its industrial tourism factory.

From the demand side, Spring Pool Glass is providing recycled materials to manufacturing firms in different industries such as ceramics, asphalt, cement, and glass manufacturing. Glass manufacturers have great incentives to buy recycled materials from Spring Pool Glass due to the subsidies they can receive by participating in the four-in-one resource recycling project. At the same time, Spring Pool Glass is also selling products directly to end customers. It produces three main products from its recycled glass: (1) artistic glass manufactured in its industrial tourism factory, (2) ‘glass beans’ used for paving roads and walls, and (3) ‘insulation blocks’ used as a construction material.

In addition to its supply and demand advantages, Spring Pool Glass is the only company to have joined commercial associations for both the glass manufacturing and glass recycling industries such as the Taiwan Glass Commercial Association, Hsinchu Glass Commercial Association, and Taiwan Resource Recycling Industries Association. This has enlarged Spring Pool Glass’s social network, enabling it to capture value more quickly than its competitors.

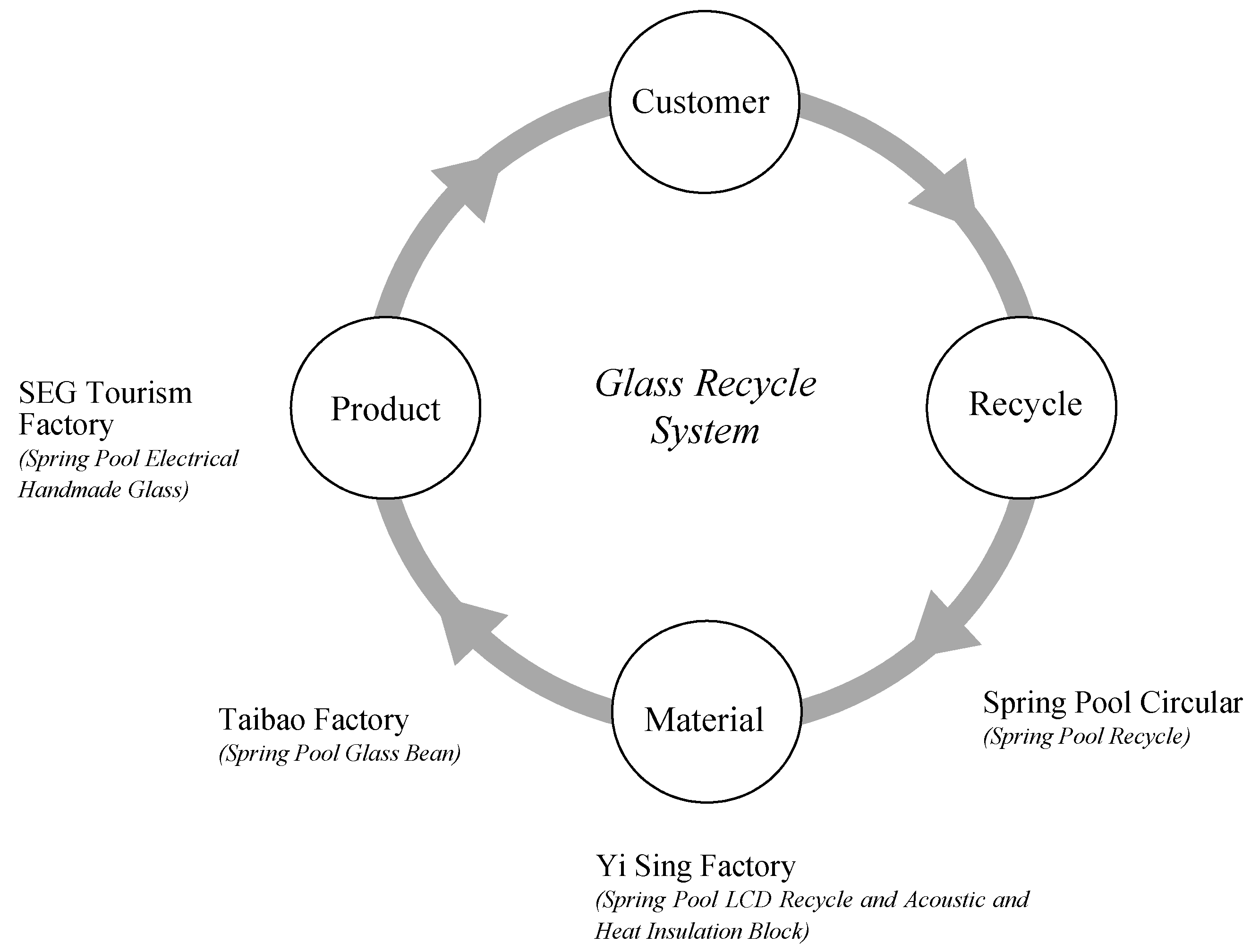

In sum, as of 2017, Spring Pool Glass dealt with 70% of the recycled glass in Taiwan. 70% of its revenue comes from selling recycled materials for reuse, mainly in glass manufacturing, ceramics, asphalt, and cement. 20% of its revenue comes from its sales of building materials, namely the glass bean and the insulation block. 10% of its revenue comes from selling recycled-glass artwork. The corporate image of Spring Pool Glass is that of providing high-quality recycled glass at a reasonable price. The social network of its founder, Mr. Wu, and the company’s ability to capture value have enabled it to become and remain the leading firm in the glass-recycling ecosystem in Taiwan. The recycling ecosystem of Spring Pool Glass is presented in

Figure 3.

5. Discussion

Our research illustrates that continuous value capture is the key to governing a sustainable business ecosystem. Through the case analysis of Spring Pool Glass, we identified five elements of continuous value capture in the glass recycling business.

5.1. Continuous Value Capture to Enter New Markets

Continuous value capture by the leading firm in this circular economy is critical for several reasons. First, the demand and supply of the waste glass industry is unbalanced most of the time. Spring Pool Glass needs to search continually for new uses for its recycled materials, and for new uses for different sources of waste glass. For example, recycled LCD glass is turned into insulation blocks, glass products are turned into glass beans, and other recycled materials that Taiwan’s market cannot consume are exported. These value-capturing activities bring innovative ways of transforming the recycled glass into new products, which brings high value/margins for the company. Second, through the value-capturing activity, the leading firm will play the lead role in joining with other ecosystems to create new business models. For example, Spring Pool Glass has joined the electronics manufacturing ecosystem to recycle its waste LCD glass. Also, by remodeling waste glass, Spring Pool Glass participates in the artwork ecosystem, selling its recycled art pieces. In the recycling business (as a part of the circular economy), continuous value capture, as a mechanism for linking the ecosystem to other ecosystems to create higher margins, is very important.

Balancing and maintaining the proper margins of different stakeholders to retain the overall health of the ecosystem is also critical [

41]. As the margins in the glass recycling business in Taiwan are very low, it is critical that the leading firm supports some of the stakeholders such as individual recyclers and cleaning teams so as to secure the ecosystem.

5.2. Importance of Stakeholder Networks for Enlarging the Business Ecosystem

We have also observed the impact of the entrepreneur’s personal network on the value network, which in turn enlarges its business ecosystem. This echoes the view of Shi and Shi [

7]. The business story of the founder of Spring Pool Glass shows that his personal network has impacted the business throughout the different lifecycles of the business ecosystem. In the birth stage, Mr. Wu’s experience in the Hsinchu Glass Factory and his mandatory military service supported his business expansion by helping him to deal with glass manufacturers and local factions. In the expansion stage, due to the company’s long-term collaboration with individual restaurants and recyclers, the stable supply of waste glass supported its continued growth. In the leadership stage, its cumulated stakeholder network, such as the trust built up with different stakeholders, connections to different companies through commercial associations, and its relationship with the local government, has helped Spring Pool Glass to govern the business ecosystem.

The stakeholder network has also influenced the profit making of Spring Pool Glass. As the supply of waste glass has become market-oriented, for example requiring the purchase of waste glass from LCD factories, glass manufacturing factories, and the government’s cleaning team, its good relationships within its stakeholder network has enabled Spring Pool Glass to continue collecting waste glass for free with its own fleet of trucks.

5.3. Brand Image and CSR

In the recycling industry, brand image and CSR activities are observed to bring positive benefits to firms. This is especially important now that the concept of sustainability has become a trend in the Asian countries. Spring Pool Glass has started to promote its brand and CSR since becoming the leading firm in the ecosystem. Its industrial tourism site has become a very important marketing channel, giving it impact and recognition among the Taiwanese citizens, which has also strengthened its social network. The art pieces crafted at the industrial tourism site are also being sold in several stores across Taiwan, emphasizing its efforts to turn waste glass into art. Moreover, Spring Pool Glass has also cooperated with universities, attending several green building competitions and providing its recycled building materials. These promotions have positioned Spring Pool Glass as not only a glass recycling company, but a pioneer in the recycling business, looking to fulfill its social responsibility.

Moreover, the overall image and CSR of Spring Pool Glass have also influenced the willingness of foreign companies to collaborate with it. For example, Company A is willing to provide its waste LCD glass to Spring Pool Glass in part because of the latter’s overall good image. The story of Spring Pool Glass has illustrated that, even in the circular economy, brand promotion and CSR are important mechanisms for maintaining relationships with stakeholders as the trend of sustainability is influencing Asian countries.

5.4. Company Capabilities and R&D in the Recycling Process

The capabilities a company requires in order to perform the recycling process are critical for the leading firm. The core capability of Spring Pool Glass is that it has been able to maintain low costs and high quality during the recycling process, mainly because it has its own fleet of trucks and because of the efficiency of its factory processing. In addition, the land that Spring Pool Glass has bought has allowed it to provide land piling to subsidiary companies and factories. This has helped the entire glass cluster to perform better, controlling quality and delivery dates. In terms of innovation and learning ability, Spring Pool Glass cooperates with institutes, other companies, and universities, as well as engaging in continuous R&D to support value-capturing activities. Continuous R&D is also very important for enhancing its own capabilities. For example, Spring Pool Glass has developed its own automatic glass-crushing machine, the ability to conduct composition analysis when recycling glass, the ‘insulation block’ generated from recycled LCD and glass, and the ‘glass bean’ generated from recycled glass. Overall, the capabilities of the leading firm are very important in the circular economy. Spring Pool Glass’s main capabilities are the efficiency of its factory processing, its fleet of trucks, its R&D, and its land.

5.5. Reacting to Government Policy regarding the Circular Economy

Government institutions will also affect how leading firms govern their ecosystems. In Taiwan, the government’s four-in-one resource recycling project had an impact on the glass recycling ecosystem by changing the rules within it. It led to citizens in the community, a cleaning squadron, recyclers, and a recycling fund combining to ensure garbage was recycled and reused. This mechanism also ensured that stakeholders in the system gained a reasonable profit.

During the policy shaping process, Spring Pool Glass was highly involved as a keystone firm representing the glass recycling industry. From the government’s point of view, one of the key elements required in order for the four-in-one resource recycling project to succeed was recycling logistics and processing. As these are the key advantages of Spring Pool Glass (it has its own fleet of trucks, strong capabilities in the recycling process, and various production lines), its commitment to and participation in this project is very important.

The four-in-one resource recycling project also imposed two major changes on the way Spring Pool Glass governed its ecosystem. First, due to the government’s efforts to collect household waste, Spring Pool Glass was able to cut down on its own efforts in this regard. However, Spring Pool Glass now had to bid for the government-collected waste glass. This change decreased its previous advantage of having close connections with households and recyclers (social network), but at the same time increased its supply of waste glass. It also brought about another challenge for Spring Pool Glass of how it would consume the increased volume of recycled waste glass. Second, the government’s action provided incentives for glass manufacturers such as Taiwan Glass to purchase recycled glass as their input materials. Glass manufacturers were forced to place a deposit in a government fund, which could be redeemed if the glass manufacturer used recycled glass as its input. In sum, the government’s policy has changed the mechanisms by which the leading firm trades with different stakeholders.

6. Conclusions

This research has identified a set of mechanisms by which the leading glass-recycling firm in Taiwan governs its ecosystem. First, continuous value capture is important for the leading firm as the demand and supply of waste glass are mostly unbalanced. Second, the entrepreneur’s social network has been found to have influenced his business’s development throughout its ecosystem’s lifecycle. Third, brand image and CSR have influenced the company’s relationships with its stakeholders, acting as an invisible force that binds their connections. Moreover, the company’s capabilities in the recycling process determine its costs and quality, which are critical factors to surviving in the glass recycling industry (due to its low margins). Finally, we have also observed that government policy has had a huge impact in reframing the relationships between the various stakeholders.

Theoretically and practically, this research makes several contributions. First, to our understanding, we believe we are breaking new ground in seeking to link the concepts of the business ecosystem and the circular economy, which we believe will be an important research stream in the future, embracing economic and environmental value simultaneously. Second, this research has provided evidence from a different research context than the prior literature. Most research on business ecosystems has focused on (high-margin, profit-driven) industries such as information and communication technology, automobiles, and retail. This research provides a different perspective, investigating how a leading firm governs its ecosystem under low-margin conditions. Finally, as Taiwan is also a pioneer of the circular economy in Asia, this research provides an informative case study illustrating how the leading firm in the recycling ecosystem has adjusted to (1) a new government policy and (2) an increase in silicon-related waste due to regional development. These lessons could also be valuable for the future development of the Southeast Asian countries.

In spite of the rigorous research methods, the case mainly concerns the glass recycling industry alone, which will limit its generalizability to other industries. Future research could be conducted in other recycling industries, as different recycling ecosystems will likely have their own characteristics (related to the recycled materials). We also suggest that future research should seek further opportunities for linking business ecosystem and circular economy research.