Price Forecasting of Electricity Markets in the Presence of a High Penetration of Wind Power Generators

Abstract

:1. Introduction

- Electricity price forecasting in a system with high penetration of wind power generators;

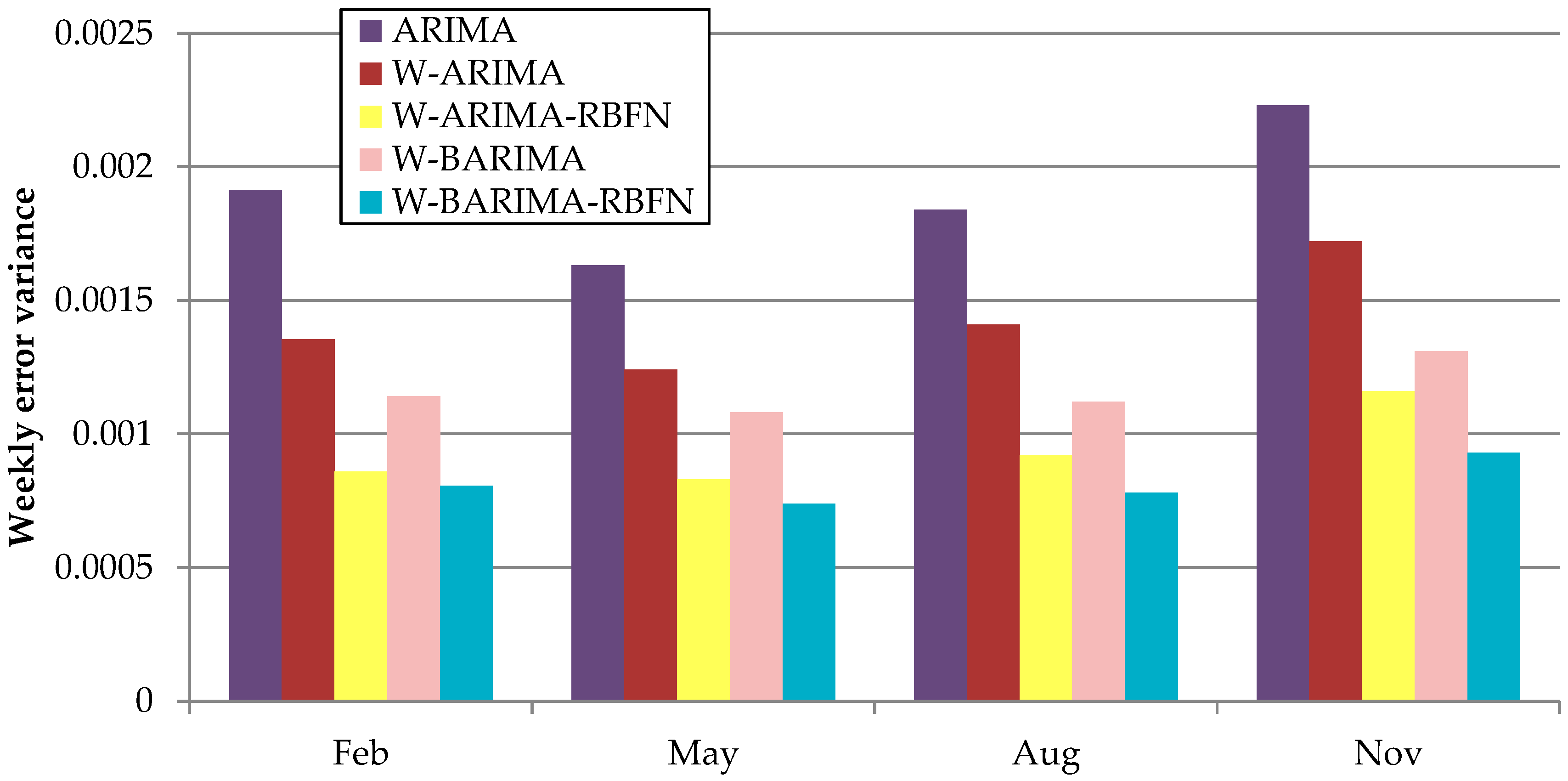

- Considering the effect of wind speed on hourly electricity price;

- Proposing a hybrid forecasting method including WT, Bivariate ARIMA and RBFN.

2. Proposed Electricity Market Prices Forecasting Method

2.1. Wavelet Transform

2.2. Radial Basis Function Neural Network (RBFN)

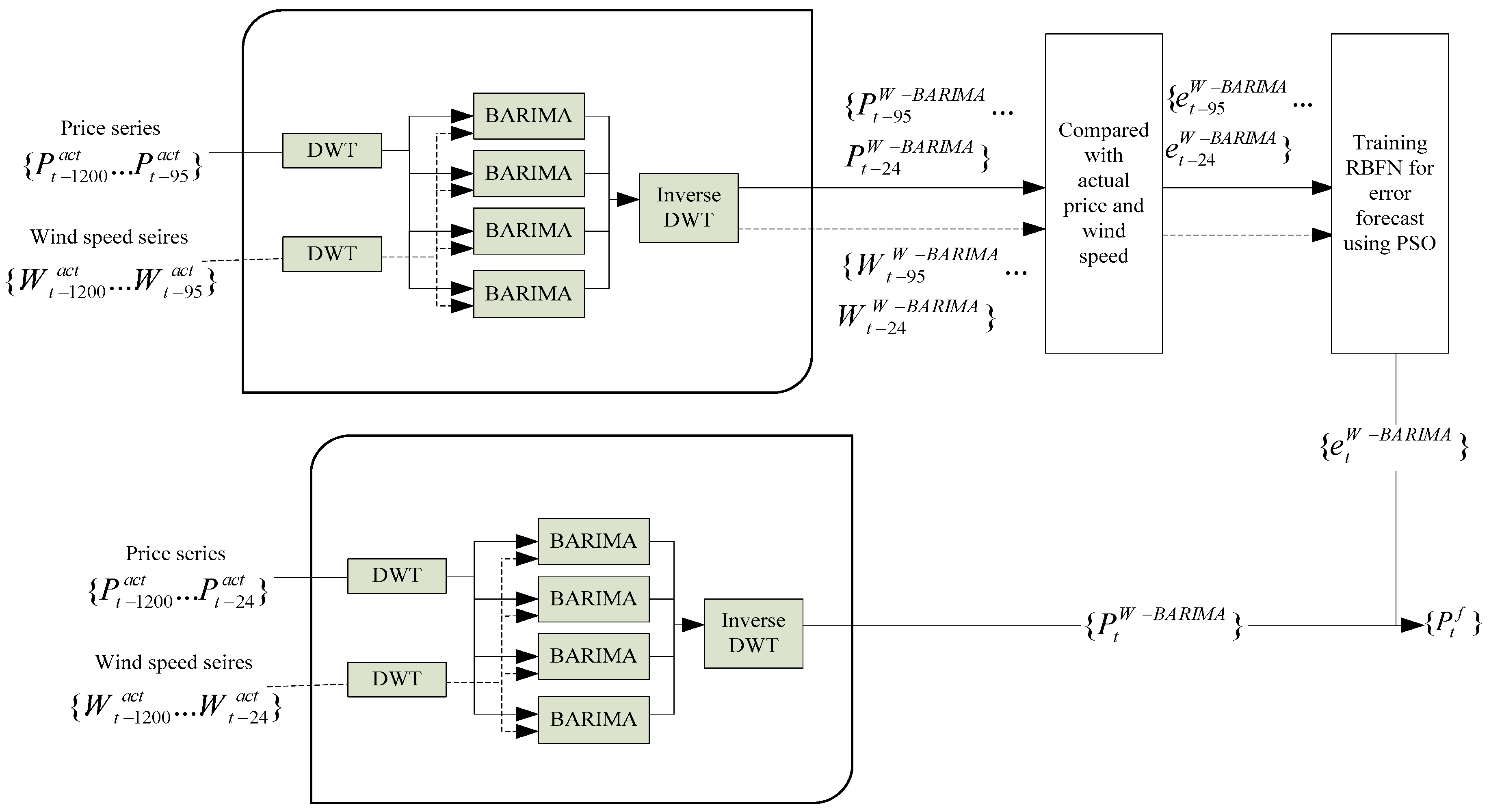

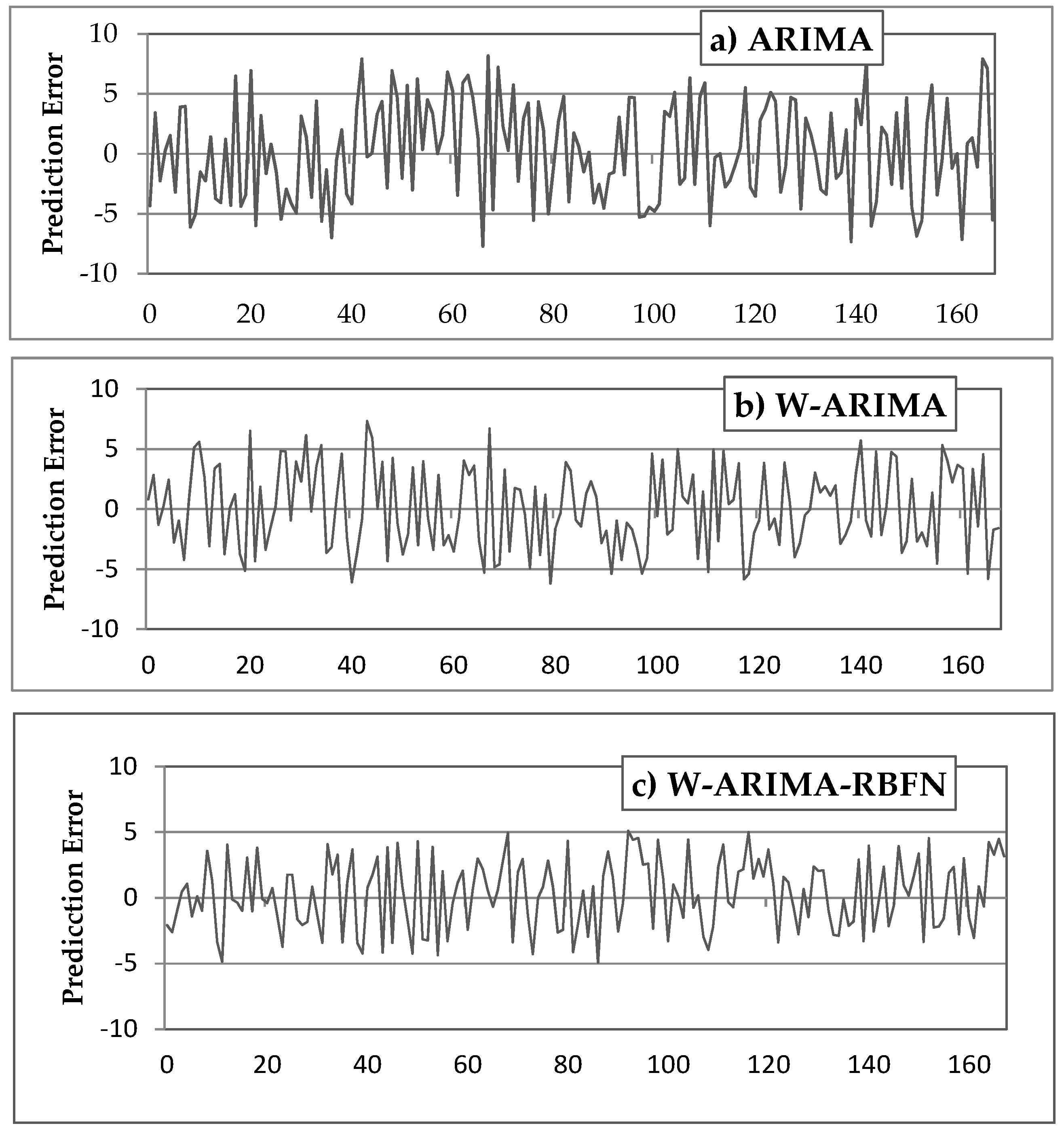

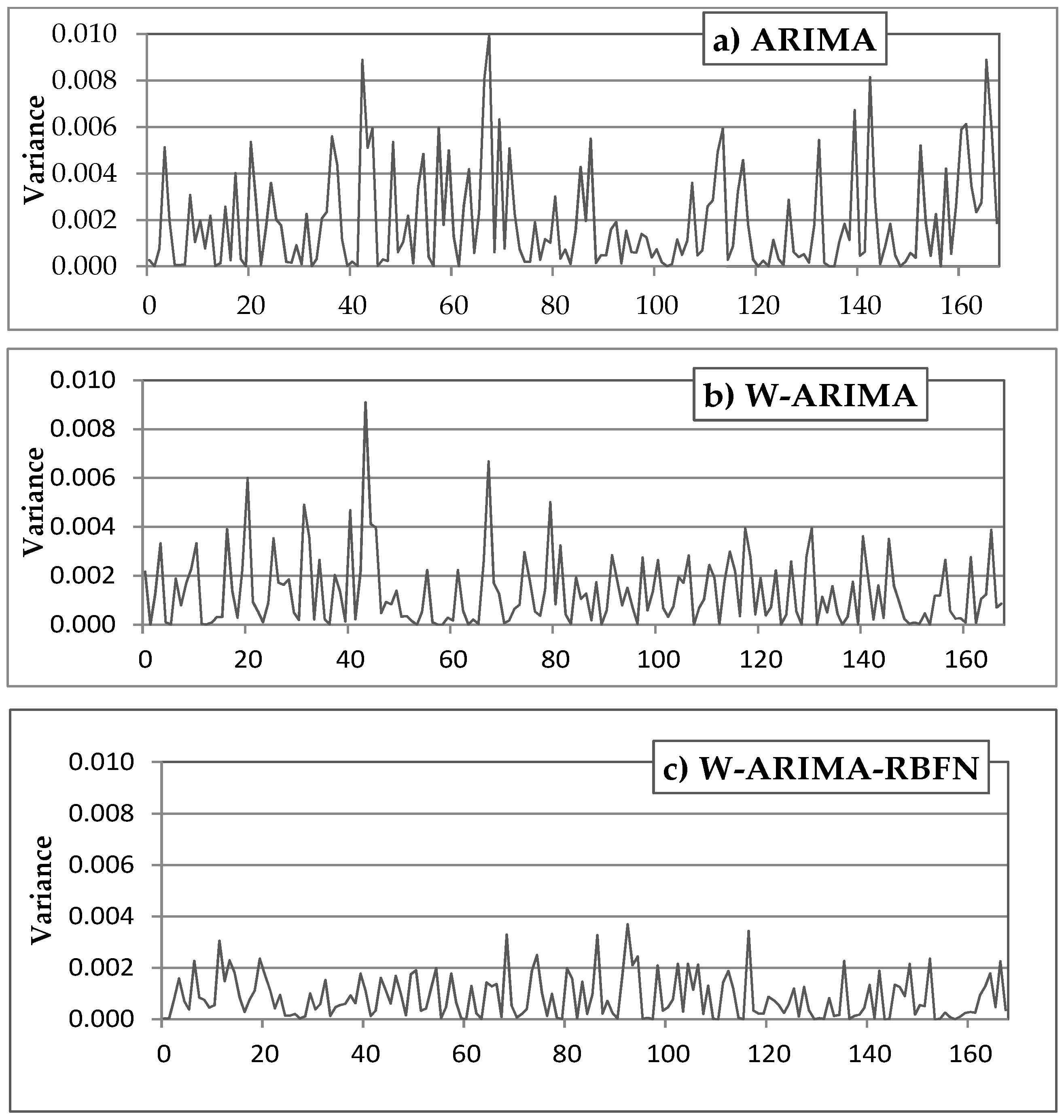

2.3. Bivariate ARIMA-Wavelet and RBFN

3. Prediction Accuracy

4. Numerical Study

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| AR | Autoregressive |

| ARIMA | Auto-Regressive Integrated Moving Average |

| ARMA | Autoregressive moving average |

| BARIMA | Bivariate Auto-Regressive Integrated Moving Average |

| CWT | Continuous Wavelet transform |

| DWT | Discrete Wavelet transform |

| FWT | Fast Wavelet transform |

| IWT | Integrated Wavelet transform |

| GARCH | Generalized autoregressive conditional heteroskedastic |

| NN | Neural Network |

| MA | Moving average |

| PSO | Particle swarm optimization |

| RBFN | Radial Basis function neural network |

| WT | Wavelet transform |

| W-ARIMA | Wavelet transform with ARIMA |

| W-ARIMA-RBFN | Wavelet transform with ARIMA and RBFN |

| W-BARIMA | Wavelet transform with BARIMA |

| W-BARIMA-RBFN | Wavelet transform with BARIMA and RBFN |

References

- Shahidehpour, M.; Yamin, H.; Li, Z. Market Operations in Electric Power Systems: Forecasting, Scheduling, and Risk Management; Institute of Electrical and Electronics Engineers, Wiley-Interscience: New York, NY, USA, 2002; ISBN 978-0-471-44337-7. [Google Scholar]

- Crespo Cuaresma, J.; Hlouskova, J.; Kossmeier, S.; Obersteiner, M. Forecasting electricity spot-prices using linear univariate time-series models. Appl. Energy 2004, 77, 87–106. [Google Scholar] [CrossRef]

- Contreras, J.; Espinola, R.; Nogales, F.J.; Conejo, A.J. ARIMA models to predict next-day electricity prices. IEEE Trans. Power Syst. 2003, 18, 1014–1020. [Google Scholar] [CrossRef]

- Garcia, R.C.; Contreras, J.; Akkeren, M.; van Garcia, J.B.C. A GARCH forecasting model to predict day-ahead electricity prices. IEEE Trans. Power Syst. 2005, 20, 867–874. [Google Scholar] [CrossRef]

- MateoGonzalez, A.; MunozSanRoque, A.; Garcia-Gonzalez, J. Modeling and Forecasting Electricity Prices with Input/Output Hidden Markov Models. IEEE Trans. Power Syst. 2005, 20, 13–24. [Google Scholar] [CrossRef]

- Kim, C.; Yu, I.-K.; Song, Y.H. Prediction of system marginal price of electricity using wavelet transform analysis. Energy Convers. Manag. 2002, 43, 1839–1851. [Google Scholar] [CrossRef]

- Yao, S.J.; Song, Y.H.; Zhang, L.Z.; Cheng, X.Y. Prediction of System Marginal Prices by Wavelet Transform and Neural Networks. Electr. Mach. Power Syst. 2000, 28, 983–993. [Google Scholar] [CrossRef]

- Shafie-khah, M.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K. Price forecasting of day-ahead electricity markets using a hybrid forecast method. Energy Convers. Manag. 2011, 52, 2165–2169. [Google Scholar] [CrossRef]

- Huang, C.-M.; Huang, C.-J.; Wang, M.-L. A particle swarm optimization to identifying the ARMAX model for short-term load forecasting. IEEE Trans. Power Syst. 2005, 20, 1126–1133. [Google Scholar] [CrossRef]

- Conejo, A.J.; Plazas, M.A.; Espinola, R.; Molina, A.B. Day-Ahead Electricity Price Forecasting Using the Wavelet Transform and ARIMA Models. IEEE Trans. Power Syst. 2005, 20, 1035–1042. [Google Scholar] [CrossRef]

- Tan, Z.; Zhang, J.; Wang, J.; Xu, J. Day-ahead electricity price forecasting using wavelet transform combined with ARIMA and GARCH models. Appl. Energy 2010, 87, 3606–3610. [Google Scholar] [CrossRef]

- Amjady, N.; Hemmati, M. Energy price forecasting-problems and proposals for such predictions. IEEE Power Energy Mag. 2006, 4, 20–29. [Google Scholar] [CrossRef]

- Amjady, N. Day-Ahead Price Forecasting of Electricity Markets by a New Fuzzy Neural Network. IEEE Trans. Power Syst. 2006, 21, 887–896. [Google Scholar] [CrossRef]

- Catalão, J.P.S.; Mariano, S.J.P.S.; Mendes, V.M.F.; Ferreira, L.A.F.M. Short-term electricity prices forecasting in a competitive market: A neural network approach. Electr. Power Syst. Res. 2007, 77, 1297–1304. [Google Scholar] [CrossRef]

- Wang, A.J.; Ramsay, B. A neural network based estimator for electricity spot-pricing with particular reference to weekend and public holidays. Neurocomputing 1998, 23, 47–57. [Google Scholar] [CrossRef]

- Szkuta, B.R.; Sanabria, L.A.; Dillon, T.S. Electricity price short-term forecasting using artificial neural networks. IEEE Trans. Power Syst. 1999, 14, 851–857. [Google Scholar] [CrossRef]

- Gao, F.; Guan, X.; Cao, X.-R.; Papalexopoulos, A. Forecasting power market clearing price and quantity using a neural network method. In Proceedings of the 2000 Power Engineering Society Summer Meeting, Seattle, WA, USA, 16–20 July 2000; Volume 4, pp. 2183–2188. [Google Scholar]

- Hong, Y.Y.; Hsiao, C.Y. Locational marginal price forecasting in deregulated electricity markets using artificial intelligence. IEE Proc. Gener. Transm. Distrib. 2002, 149, 621–626. [Google Scholar] [CrossRef]

- Zhang, L.; Luh, P.B. Power market clearing price prediction and confidence interval estimation with fast neural network learning. In Proceedings of the 2002 IEEE Power Engineering Society Winter Meeting, New York, NY, USA, 27–31 January 2002; Volume 1, pp. 268–273. [Google Scholar]

- Rodriguez, C.P.; Anders, G.J. Energy price forecasting in the Ontario competitive power system market. IEEE Trans. Power Syst. 2004, 19, 366–374. [Google Scholar] [CrossRef]

- Bunn, D.W. Forecasting loads and prices in competitive power markets. Proc. IEEE 2000, 88, 163–169. [Google Scholar] [CrossRef]

- Jalili, A.; Ghadimi, N. Hybrid harmony search algorithm and fuzzy mechanism for solving congestion management problem in an electricity market. Complexity 2016, 21, 90–98. [Google Scholar] [CrossRef]

- Hosseini, F.M.; Ghadimi, N. Optimal preventive maintenance policy for electric power distribution systems based on the fuzzy AHP methods. Complexity 2016, 21, 70–88. [Google Scholar] [CrossRef]

- Guo, J.-J.; Luh, P.B. Improving market clearing price prediction by using a committee machine of neural networks. IEEE Trans. Power Syst. 2004, 19, 1867–1876. [Google Scholar] [CrossRef]

- Olamaee, J.; Mohammadi, M.; Noruzi, A.; Hosseini, S.M.H. Day-ahead price forecasting based on hybrid prediction model. Complexity 2016, 21, 156–164. [Google Scholar] [CrossRef]

- Zhang, L.; Luh, P.B. Neural network-based market clearing price prediction and confidence interval estimation with an improved extended Kalman filter method. IEEE Trans. Power Syst. 2005, 20, 59–66. [Google Scholar] [CrossRef]

- Hong, Y.Y.; Hsiao, C.-Y. Locational marginal price forecasting in deregulated electric markets using a recurrent neural network. In Proceedings of the 2001 IEEE Power Engineering Society Winter Meeting, Columbus, OH, USA, 28 January–1 February 2001; Volume 2, pp. 539–544. [Google Scholar]

- Zhang, K.; Shi, Q. Power Futures Price Forecasting Based on RBF Neural Network. In Proceedings of the 2009 International Conference on Business Intelligence and Financial Engineering, Beijing, China, 24–26 July 2009; pp. 50–52. [Google Scholar]

- Weron, R. Electricity price forecasting: A review of the state-of-the-art with a look into the future. Int. J. Forecast. 2014, 30, 1030–1081. [Google Scholar] [CrossRef]

- Aggarwal, S.K.; Saini, L.M.; Kumar, A. Electricity price forecasting in deregulated markets: A review and evaluation. Int. J. Electr. Power Energy Syst. 2009, 31, 13–22. [Google Scholar] [CrossRef]

- Cadenas, E.; Rivera, W.; Campos-Amezcua, R.; Heard, C. Wind Speed Prediction Using a Univariate ARIMA Model and a Multivariate NARX Model. Energies 2016, 9, 109. [Google Scholar] [CrossRef]

- Zhang, G.P. Time series forecasting using a hybrid ARIMA and neural network model. Neurocomputing 2003, 50, 159–175. [Google Scholar] [CrossRef]

- Yousefi, S.; Weinreich, I.; Reinarz, D. Wavelet-based prediction of oil prices. Chaos Solitons Fractals 2005, 25, 265–275. [Google Scholar] [CrossRef]

- Fernandez, V. Wavelet- and SVM-based forecasts: An analysis of the U.S. metal and materials manufacturing industry. Resour. Policy 2007, 32, 80–89. [Google Scholar] [CrossRef]

- Inicio. Ontology Mapping within an Interactive and Extensible Environment (OMIE). Available online: http://www.omie.es/en/inicio (accessed on 24 August 2017).

- Windfinder.com. Windfinder—Wind, Wave & Weather Reports, Forecasts & Statistics Worldwide. Available online: https://www.windfinder.com (accessed on 25 August 2017).

| Region | Capacity (MW) | Average Wind Speed (Knot) | ||||

|---|---|---|---|---|---|---|

| February | May | August | November | |||

| Galicia | 3238 | 0.172 | 7 | 9 | 6 | 6 |

| Navarra | 976 | 0.052 | 3 | 5 | 5 | 5 |

| Asturias | 414 | 0.022 | 8 | 7 | 7 | 8 |

| Aragon | 1751 | 0.093 | 2 | 4 | 3 | 3 |

| Castilla y Leon | 4540 | 0.241 | 10 | 7 | 8 | 9 |

| Castilla la Mancha | 3761 | 0.199 | 5 | 7 | 6 | 6 |

| C. Valenciana | 1174 | 0.062 | 3 | 4 | 4 | 4 |

| Andalucia | 2993 | 0.159 | 5 | 6 | 5 | 5 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Talari, S.; Shafie-khah, M.; Osório, G.J.; Wang, F.; Heidari, A.; Catalão, J.P.S. Price Forecasting of Electricity Markets in the Presence of a High Penetration of Wind Power Generators. Sustainability 2017, 9, 2065. https://doi.org/10.3390/su9112065

Talari S, Shafie-khah M, Osório GJ, Wang F, Heidari A, Catalão JPS. Price Forecasting of Electricity Markets in the Presence of a High Penetration of Wind Power Generators. Sustainability. 2017; 9(11):2065. https://doi.org/10.3390/su9112065

Chicago/Turabian StyleTalari, Saber, Miadreza Shafie-khah, Gerardo J. Osório, Fei Wang, Alireza Heidari, and João P. S. Catalão. 2017. "Price Forecasting of Electricity Markets in the Presence of a High Penetration of Wind Power Generators" Sustainability 9, no. 11: 2065. https://doi.org/10.3390/su9112065

APA StyleTalari, S., Shafie-khah, M., Osório, G. J., Wang, F., Heidari, A., & Catalão, J. P. S. (2017). Price Forecasting of Electricity Markets in the Presence of a High Penetration of Wind Power Generators. Sustainability, 9(11), 2065. https://doi.org/10.3390/su9112065