Policy Uncertainty and the US Ethanol Industry

Abstract

:1. Introduction

2. Background

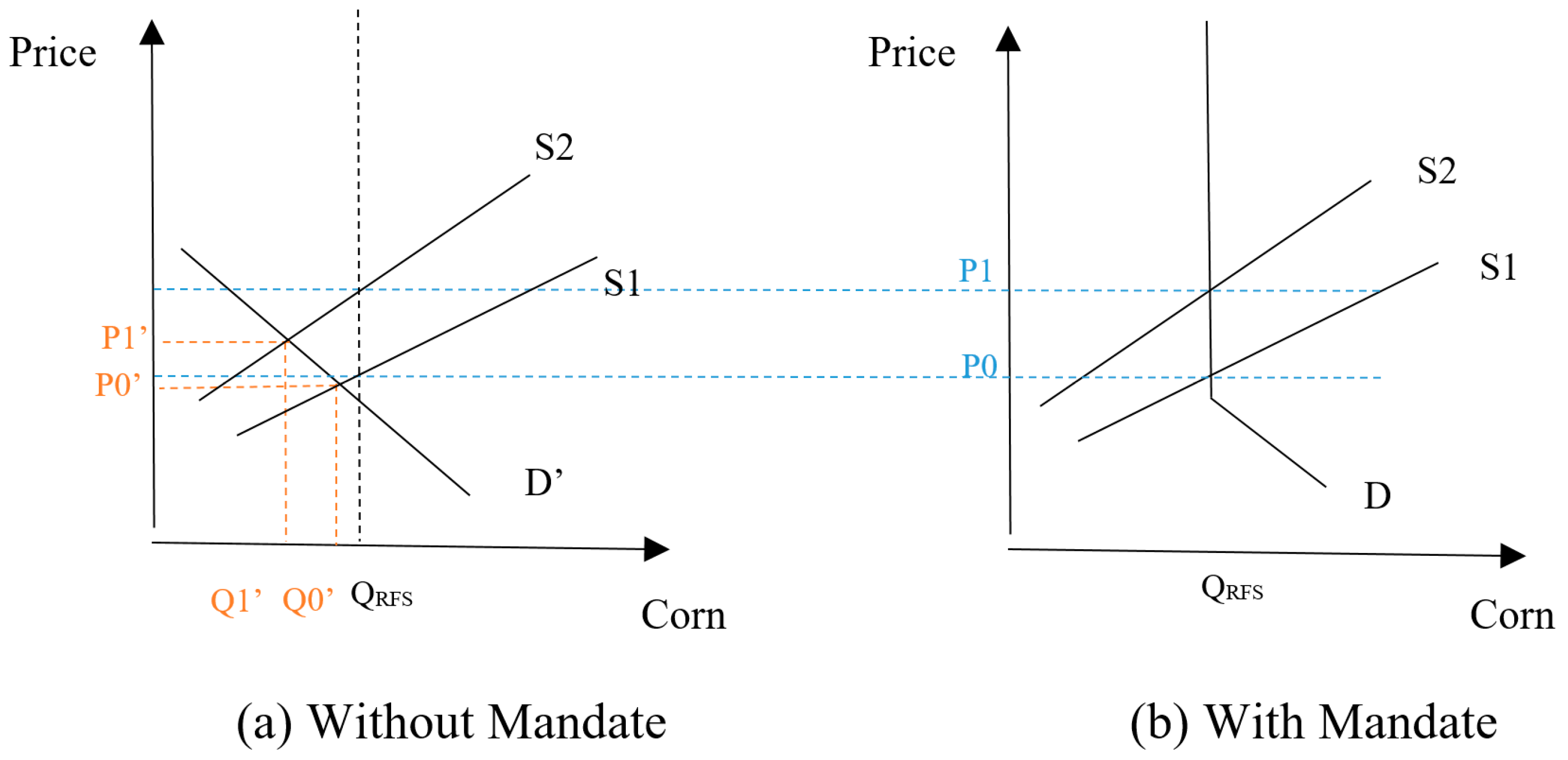

2.1. Uncertainty Caused by a Fixed Mandate in a Fluctuating Feedstock Production

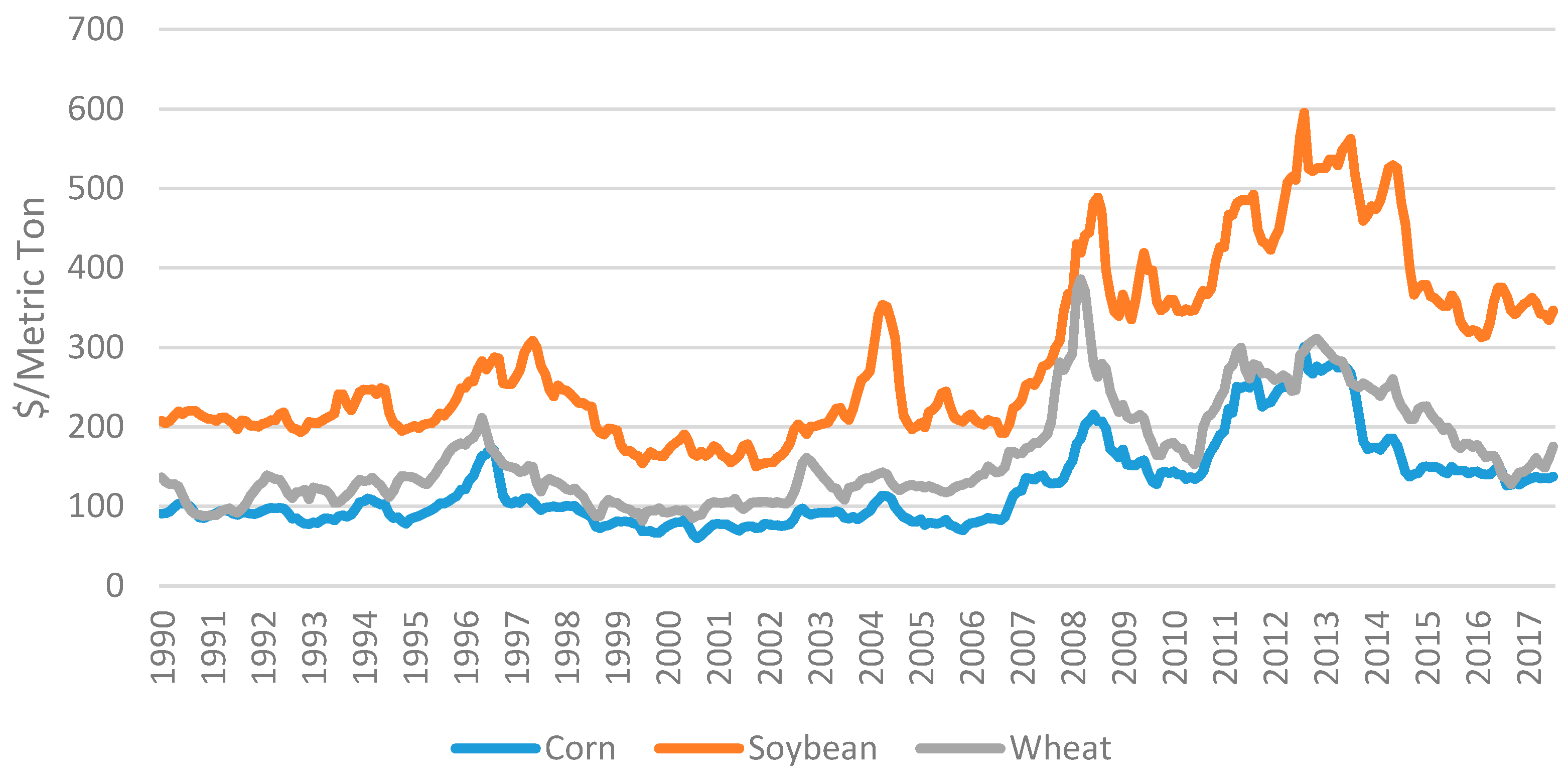

- Feedstock commodities like corn.

- Other agricultural commodities that compete for land that could be used for feedstock production.

2.2. Uncertainty in Cellulosic Ethanol Production/Distribution Investment

3. Literature Review

4. Analytical Approach

4.1. Yield Probability Distribution Formation

4.2. Modeling Approach

4.3. Analysis design

- Two alternative overall ethanol mandates. We included

- ○

- a baseline scenario without ethanol mandates;

- ○

- a full EISA mandate scenario with a requirement of 56.78 billion liters for corn based ethanol by 2015, and

- Mandate relaxation, under which we ran cases with the corn based mandate reduced by half.

5. Results

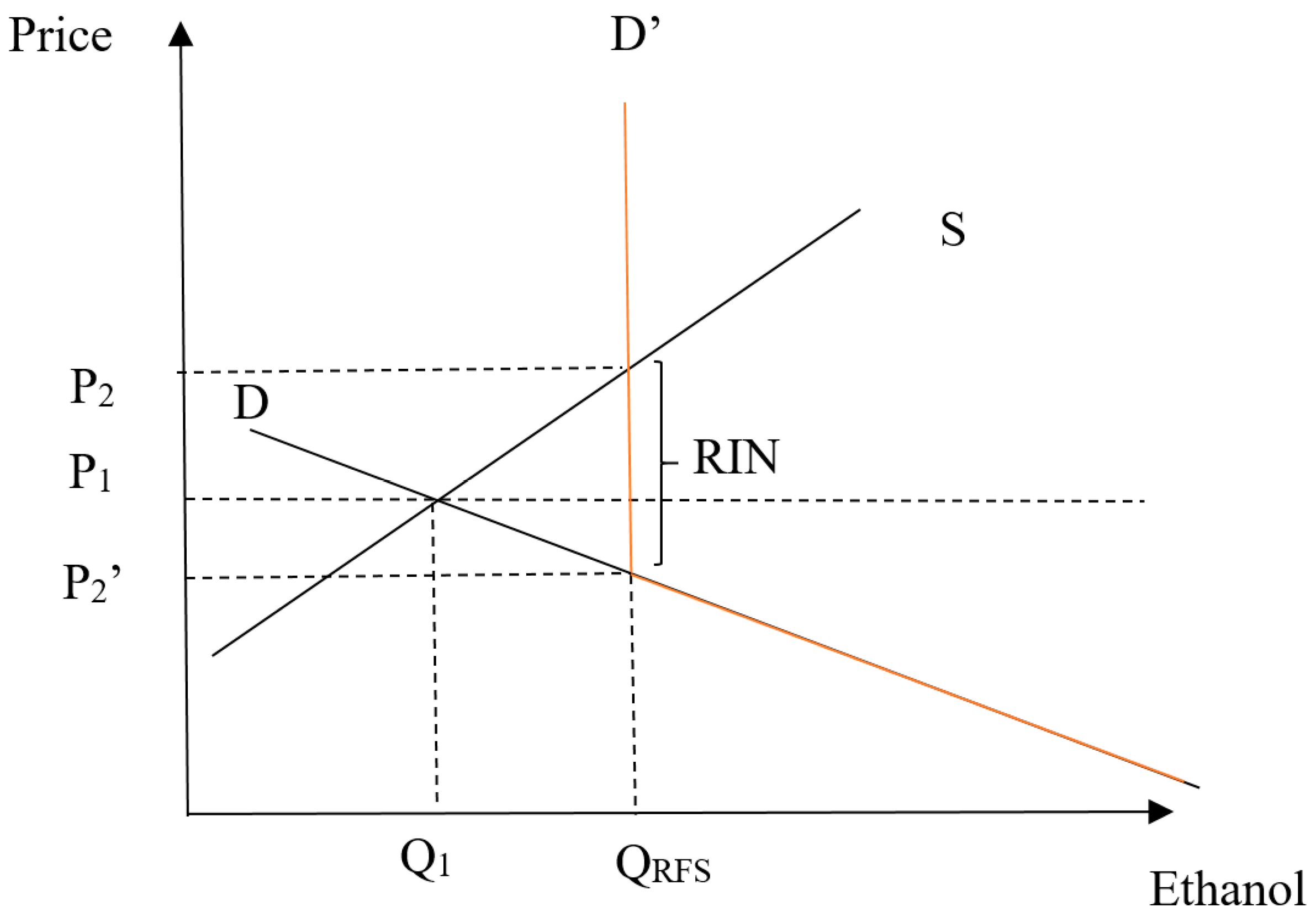

5.1. RFS2 and Corn Ethanol

5.1.1. Crop Ethanol Mandate Sensitivity

5.1.2. Impact on Ethanol Producers

5.2. RFS2 and Cellulosic Ethanol

5.2.1. Production Cost and Uncertainty

5.2.2. Feedstock Uncertainty

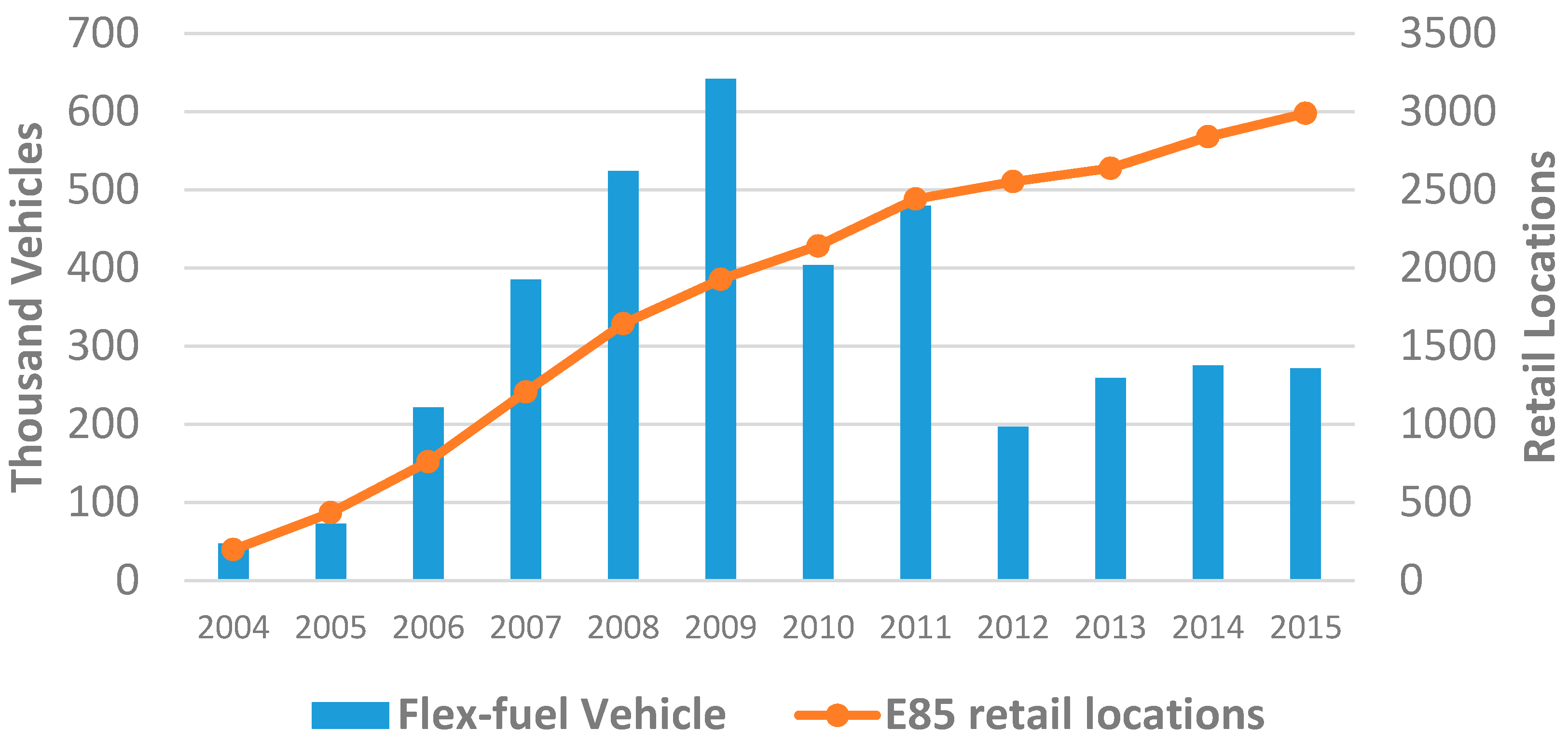

5.3. Demand Uncertainty

6. Conclusions and Discussion

Author Contributions

Conflicts of Interest

References

- Renewable Fuels Association. Annual Ethanol Industry Outlook 2017. Available online: http://www.ethanolrfa.org/resources/publications/outlook/ (accessed on 21 September 2017).

- Bracmort, K. The Renewable Fuel Standard (RFS): Cellulosic Biofuels. Congr. Res. Serv. 2015, 31, 1–21. [Google Scholar]

- USDA; Commodity Forecasts. World Agricultural Supply and Demand Estimates. Available online: https://www.usda.gov/oce/commodity/wasde/ (accessed on 28 June 2017).

- USDA National Agricultural Statistics Service Quick Stats—Corn Condition. Available online: https://quickstats.nass.usda.gov/ (accessed on 27 June 2017).

- USDA ERS Feed Grains Custom Query. Available online: https://data.ers.usda.gov/FEED-GRAINS-custom-query.aspx (accessed on 28 June 2017).

- Carriquiry, M.A.; Du, X.; Timilsina, G.R. Second generation biofuels: Economics and policies. Energy Policy 2011, 39, 4222–4234. [Google Scholar] [CrossRef]

- Taheripour, F.; Tyner, W.E. Welfare Assessment of the Renewable Fuel Standard: Economic Efficiency, Rebound Effect, and Policy Interactions in a General Equilibrium Framework. In Modeling, Dynamics, Optimization and Bioeconomics I; Springer Proceedings in Mathematics & Statistics; Springer: Cham, Switzerland, 2014; pp. 613–632. ISBN 978-3-319-04848-2. [Google Scholar]

- Condon, N.; Klemick, H.; Wolverton, A. Impacts of ethanol policy on corn prices: A review and meta-analysis of recent evidence. Food Policy 2015, 51, 63–73. [Google Scholar] [CrossRef]

- Babcock, B.A. Preliminary Assessment of the Drought’s Impacts on Crop Prices and Biofuel Production; CARD Policy Brief 12-PB; Iowa State University: Ames, IA, USA, 2012. [Google Scholar]

- McPhail, L.L.; Babcock, B.A. Impact of US biofuel policy on US corn and gasoline price variability. Energy 2012, 37, 505–513. [Google Scholar] [CrossRef]

- Good, D.; Irwin, S. Ethanol—Does the RFS Matter; Farmdoc Daily; University of Illinois at Urbana-Champaign: Champaign, IL, USA, 2012. [Google Scholar]

- Tyner, W.E.; Taheripour, F.; Hurt, C. Potential Impacts of a Partial Waiver of the Ethanol Blending Rules. 2012. Available online: https://www.semanticscholar.org/paper/Potential-Impacts-of-a-Partial-Waiver-of-the-Ethan-Akridge-Conklin/52cd92316b53e4f847cd0883569e311f96809e19 (accessed on 28 June 2017).

- Meyer, S.; Thompson, W. How Do Biofuel Use Mandates Cause Uncertainty? United States Environmental Protection Agency Cellulosic Waiver Options. Appl. Econ. Perspect. Policy 2012, 34, 570–586. [Google Scholar] [CrossRef]

- Tejeda, H.A. Time-Varying Price Interactions and Risk Management in Livestock Feed Markets—Determining the Ethanol Surge Effect. Available online: https://www.researchgate.net/publication/254384312_Time-Varying_Price_Interactions_and_Risk_Management_in_Livestock_Feed_Markets_-_Determining_the_Ethanol_Surge_Effect (accessed on 12 June 2017).

- Hao, N.; Colson, G.; Seong, B.; Park, C.; Wetzstein, M. Drought, ethanol, and livestock. Energy Econ. 2015, 49, 301–307. [Google Scholar] [CrossRef]

- Dumortier, J.; Kauffman, N.; Hayes, D.J. Uncertainty and Time-to-Build in Bioenergy Crop Production. In Proceedings of the AAEA & WAEA Joint Annual Meeting, San Francisco, CA, USA, 26–28 July 2015. [Google Scholar]

- Miao, R.; Hennessy, D.A.; Babcock, B.A. Investment in Cellulosic Biofuel Refineries: Do Waivable Biofuel Mandates Matter? Am. J. Agric. Econ. 2012, 94, 750–762. [Google Scholar] [CrossRef]

- Schmer, M.R.; Vogel, K.P.; Mitchell, R.B.; Dien, B.S.; Jung, H.G.; Casler, M.D. Temporal and spatial variation in switchgrass biomass composition and theoretical ethanol yield. Agron. J. 2012, 104, 54–64. [Google Scholar] [CrossRef]

- Kim, M.-K.; McCarl, B.A. Uncertainty discounting for land-based carbon sequestration. J. Agric. Appl. Econ. 2009, 41, 1–11. [Google Scholar] [CrossRef]

- Babcock, B.A.; Pouliot, S. Price It and They Will Buy: How E85 Can Break the Blend Wall. 2013. Available online: http://www.card.iastate.edu/products/publications/synopsis/?p=1187 (accessed on 28 June 2017).

- Zhang, Z.; Lohr, L.; Escalante, C.; Wetzstein, M. Food versus fuel: What do prices tell us? Energy Policy 2010, 38, 445–451. [Google Scholar] [CrossRef]

- Hammer, G.L.; Hansen, J.W.; Phillips, J.G.; Mjelde, J.W.; Hill, H.; Love, A.; Potgieter, A. Advances in application of climate prediction in agriculture. Agric. Syst. 2001, 70, 515–553. [Google Scholar] [CrossRef]

- Baker, J.S.; Murray, B.C.; McCarl, B.A.; Feng, S.J.; Johansson, R. Implications of Alternative Agricultural Productivity Growth Assumptions on Land Management, Greenhouse Gas Emissions, and Mitigation Potential. Am. J. Agric. Econ. 2013, 95, 435–441. [Google Scholar] [CrossRef]

- Villavicencio, X.; McCarl, B.A.; Wu, X.M.; Huffman, W.E. Climate change influences on agricultural research productivity. Clim. Chang. 2013, 119, 815–824. [Google Scholar] [CrossRef]

- Beddow, J.M.; Pardey, P.G.; Alston, J.M. The Shifting Global Patterns of Agricultural Productivity. Available online: http://www.choicesmagazine.org/UserFiles/file/article_95.pdf (accessed on 7 November 2017).

- Adams, D.M.; Alig, R.J.; McCarl, B.A.; Murray, B.C. FASOMGHG Conceptual Structure, and Specification: Documentation. Available online: http://agecon2.tamu.edu/people/faculty/mccarl-bruce/papers/1212FASOMGHG_doc.pdf (accessed on 7 November 2017).

- Beach, R.H.; McCarl, B.A. US Agricultural and Forestry Impacts of the Energy Independence and Security Act: FASOM Results and Model Description. Available online: https://yosemite.epa.gov/sab/SABPRODUCT.nsf/962FFB6750050099852577820072DFDE/$File/FASOM+Report_EISA_FR.pdf (accessed on 8 July 2017).

- Schneider, U.A.; McCarl, B.A. Implications of a Carbon Based Energy Tax for US Agriculture. Agric. Resour. Econ. Rev. 2005, 34, 265–279. [Google Scholar] [CrossRef]

- Dantzig, G.B. Linear programming under uncertainty. Manag. Sci. 1955, 1, 197–206. [Google Scholar] [CrossRef]

- Cocks, K.D. Discrete stochastic programming. Manag. Sci. 1968, 15, 72–79. [Google Scholar] [CrossRef]

- Tokgoz, S.; Elobeid, A.; Fabiosa, J.; Hayes, D.J.; Babcock, B.A.; Yu, T.H.E.; Dong, F.; Hart, C.E. Bottlenecks, drought, and oil price spikes: Impact on US ethanol and agricultural sectors. Appl. Econ. Perspect. Policy 2008, 30, 604–622. [Google Scholar] [CrossRef]

- Knittel, C.R.; Meiselman, B.S.; Stock, J.H. The Pass-through of RIN Prices to Wholesale and Retail Fuels under the Renewable Fuel Standard; National Bureau of Economic Research: Cambridge, MA, USA, 2015. [Google Scholar]

- Collins, K. The new world of biofuels: Implications for agriculture and energy. In Proceedings of the EIA Energy Outlook, Modelling and Data Conference, Washington, DC, USA, 2007; Available online: www.pitt.edu/~super4/36011-37001/36841.ppt (accessed on 21 July 2017).

- Bratis, A. NREL Cellulosic Ethanol Cost Target 2012. Available online: https://energy.gov/sites/prod/files/2016/05/f31/day_two_plenary_cellulosic%20cost%20target_bratis.pdf (accessed on 21 September 2017).

- Johnson, E. Integrated enzyme production lowers the cost of cellulosic ethanol. Biofuels Bioprod. Bioref. 2016, 10, 164–174. [Google Scholar] [CrossRef]

- Kumar, R.; Tabatabaei, M.; Karimi, K.; Sárvári Horváth, I. Recent updates on lignocellulosic biomass derived ethanol-A review. Biofuel Res. J. 2016, 3, 347–356. [Google Scholar] [CrossRef]

- Coyle, W.T. Next-Generation Biofuels: Near-Term Challenges and Implications for Agriculture; DIANE Publishing: Collingdale, PA, USA, 2010. [Google Scholar]

- Schnepf, R.; Yacobucci, B.D. Renewable Fuel Standard (RFS): Overview and Issues. Available online: https://www.ifdaonline.org/IFDA/media/IFDA/GR/CRS-RFS-Overview-Issues.pdf (accessed 7 November 2017).

- United States Environmental Protection Agency. Renewable Fuel Pathways II Final Rule to Identify Additional Fuel Pathways under Renewable Fuel Standard Program. Available online: https://www.epa.gov/renewable-fuel-standard-program/renewable-fuel-pathways-ii-final-rule-identify-additional-fuel (accessed on 19 June 2017).

- Langholtz, M.H.; Stokes, B.J.; Eaton, L.M. 2016 Billion-Ton Report: Advancing Domestic Resources for a Thriving Bioeconomy; Oak Ridge National Laboratory: Oak Ridge, TN, USA, 2016.

- Szulczyk, K.B. Which is a better transportation fuel-butanol or ethanol? Int. J. Energy Environ. 2010, 1, 501–512. [Google Scholar]

- Tyner, W.E. Policy Update: The US Renewable Fuel Standard up against the Wall; Taylor & Francis: Abingdon, UK, 2013. [Google Scholar]

- US EPA. Notice of Decision Regarding Requests for a Waiver of the Renewable Fuel Standard. Federal Register Vol. 77, No. 228. Available online: https://www.gpo.gov/fdsys/pkg/FR-2012-11-27/pdf/2012-28586.pdf (accessed on 19 September 2017).

| EISA Target | EPA Final Rule | |

|---|---|---|

| 2010 | 0.38 | 0.02 |

| 2011 | 0.95 | 0.02 |

| 2012 | 1.89 | 0.04 |

| 2013 | 3.79 | 0.00 |

| 2014 | 6.62 | 0.06 |

| 2015 | 11.36 | 0.47 |

| 2016 | 16.09 | 0.87 |

| 2017 | 20.82 | 1.18 |

| 2018 | 26.50 | 0.90 (proposed) |

| 2019 | 32.18 | |

| 2020 | 39.75 | |

| 2021 | 51.10 | |

| 2022 | 60.57 |

| Price ($/MT) | Full RFS2, Normal Yield | Effects of 2012 Production Short-Fall Scenarios | |||

|---|---|---|---|---|---|

| Full RFS2 and Short-Fall | %Δ from Base | Relaxed RFS2 by 50% and Short-Fall | %Δ from Base | ||

| Corn | $215.87 | $417.89 | 94% | $242.35 | 12% |

| Soybeans | $413.95 | $429.10 | 4% | $477.78 | 15% |

| Wheat | $245.49 | $374.49 | 52% | $251.30 | 2% |

| Sorghum | $208.92 | $402.07 | 92% | $234.24 | 12% |

| Rice | $307.72 | $372.78 | 21% | $306.92 | 0% |

| Oats | $278.10 | $363.32 | 31% | $318.84 | 15% |

| Barley | $236.85 | $334.02 | 41% | $237.22 | 0% |

| Fed Beef * | $10.89 | $11.89 | 9% | 11.44 | 5% |

| Price Index | Production Index | ||

|---|---|---|---|

| Full RFS | RFS Relaxed 50% | Full RFS2 | RFS2 Relaxed 50% |

| 134.7 | 109.6 | 85.9 | 86.7 |

| Crop Ethanol Mandate in Billion Liters (Billion Gallons in Parentheses) | Normal Yields | 2012 Drought Regression Scenario |

|---|---|---|

| Full RFS2 (15) | $215.87 | $417.89 |

| 53.00 (14) | $206.82 | $388.15 |

| 49.21 (13) | $204.56 | $369.83 |

| 45.42 (12) | $204.56 | $351.11 |

| 41.63 (11) | $204.56 | $336.72 |

| 37.85 (10) | $204.56 | $314.07 |

| 34.07 (9) | $204.56 | $297.71 |

| 30.28 (8) | $204.56 | $285.69 |

| 26.50 (7) | $204.56 | $276.03 |

| Baseline (0) | $204.56 | $242.35 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jones, J.P.H.; Wang, Z.M.; McCarl, B.A.; Wang, M. Policy Uncertainty and the US Ethanol Industry. Sustainability 2017, 9, 2056. https://doi.org/10.3390/su9112056

Jones JPH, Wang ZM, McCarl BA, Wang M. Policy Uncertainty and the US Ethanol Industry. Sustainability. 2017; 9(11):2056. https://doi.org/10.3390/su9112056

Chicago/Turabian StyleJones, Jason P. H., Zidong M. Wang, Bruce A. McCarl, and Minglu Wang. 2017. "Policy Uncertainty and the US Ethanol Industry" Sustainability 9, no. 11: 2056. https://doi.org/10.3390/su9112056

APA StyleJones, J. P. H., Wang, Z. M., McCarl, B. A., & Wang, M. (2017). Policy Uncertainty and the US Ethanol Industry. Sustainability, 9(11), 2056. https://doi.org/10.3390/su9112056