Can High-Tech Ventures Benefit from Government Guanxi and Business Guanxi? The Moderating Effects of Environmental Turbulence

Abstract

:1. Introduction

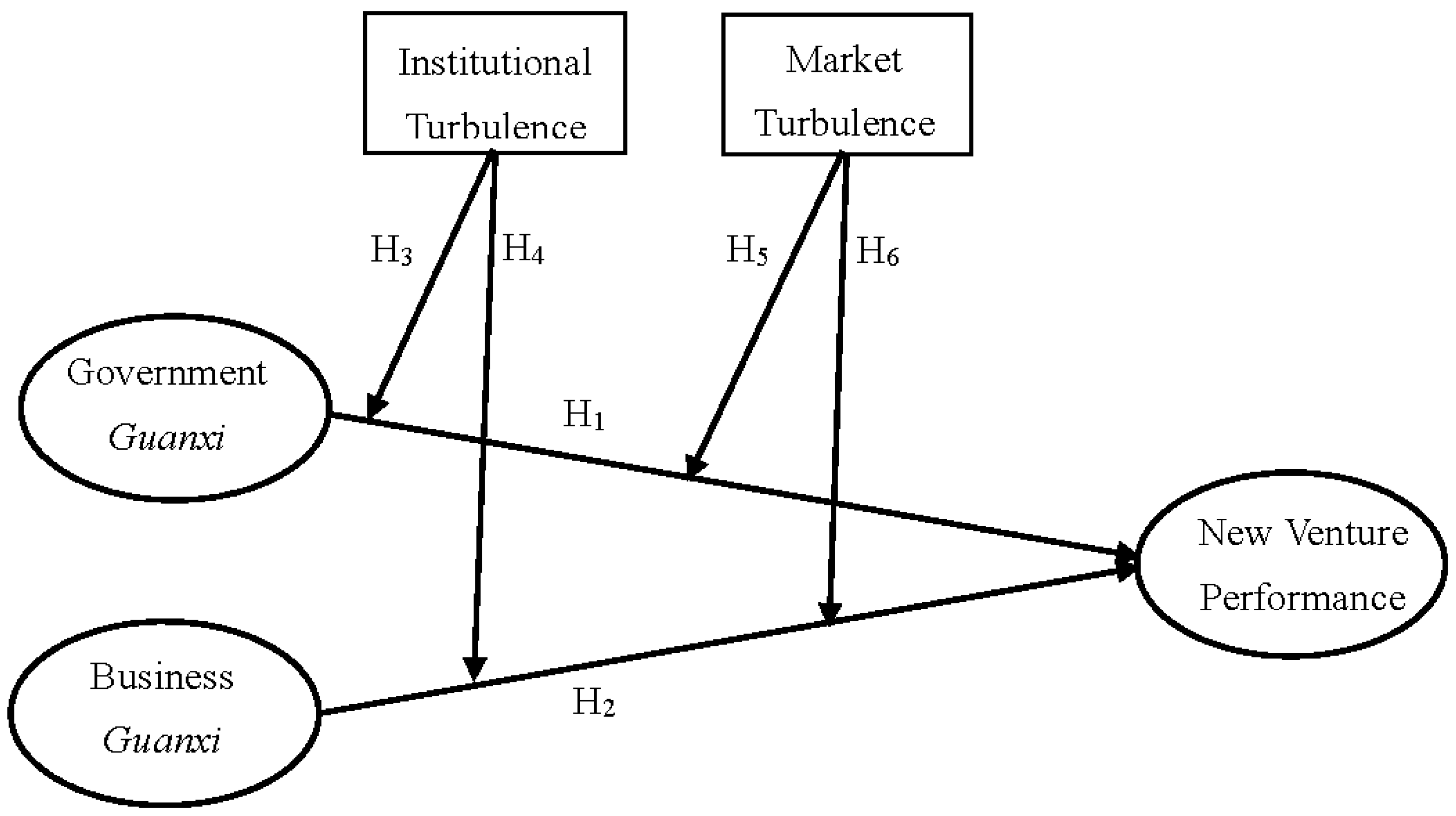

2. A Theoretical Review and Hypothesis Development

2.1. Guanxi Strategy Theory

2.2. Government Guanxi, Business Guanxi and New Venture Performance

2.2.1. Government Guanxi and New Venture Performance

2.2.2. Business Guanxi and New Venture Performance

2.3. Economic Transition: Market Turbulence and Institutional Turbulence

2.3.1. Moderating Effects of Institutional Turbulence

2.3.2. Moderating Effects of Market Turbulence

3. Methods

3.1. The Sample and Data Collection

3.2. The Research Model

3.3. Measures

3.3.1. Government Guanxi

3.3.2. Business Guanxi

3.3.3. Institutional Turbulence

3.3.4. Market Turbulence

3.3.5. New Venture Performance

3.3.6. Control Variables

3.4. Assessment of Measures

4. Results

4.1. Analysis Steps

4.2. Hypothesis Tests and Results

5. Discussion

5.1. Findings

5.2. Theoretical Contributions

5.3. Managerial Implications

5.4. Limitations and Future Research

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Chen, C.C.; Chen, X.P.; Huang, S.S. Chinese guanxi: An integrative review and new directions for future research. Manag. Organ. Rev. 2013, 1, 167–207. [Google Scholar] [CrossRef]

- Guo, C.; Miller, J.K. Guanxi dynamics and entrepreneurial firm creation and development in China. Manag. Organ. Rev. 2010, 2, 267–291. [Google Scholar] [CrossRef]

- Wong, M. Guanxi and its role in business. Chin. Manag. Stud. 2007, 4, 257–276. [Google Scholar] [CrossRef]

- Choi, Y.R.; Jin, J.W. Is the web marketing mix sustainable in China? The mediation effect of dynamic trust. Sustainability 2015, 10, 13610–13630. [Google Scholar] [CrossRef]

- Fei, X. Shehui Diaocha Zibai (Statement Regarding Social Investigations); Shanghai People’s Publishing House: Shanghai, China, 2009. (In Chinese) [Google Scholar]

- Choi, Y.R.; Gao, D. The role of intermediation in the governance of sustainable Chinese web marketing. Sustainability 2014, 6, 4102–4118. [Google Scholar] [CrossRef]

- Reid, M.F. Institutional preconditions of privatization in market-based political economies: Implications for Jordan. Public Adm. Dev. 1994, 1, 65–77. [Google Scholar] [CrossRef]

- Wong, A.; Fang, S.S.; Tjosvold, D. Developing business trust in government through resource exchange in China. Asia Pac. J. Manag. 2012, 4, 1027–1043. [Google Scholar] [CrossRef]

- Boso, N.; Story, V.M.; Cadogan, J.W. Entrepreneurial orientation, market orientation, network ties, and performance: Study of entrepreneurial firms in a developing economy. J. Bus. Ventur. 2013, 6, 708–727. [Google Scholar] [CrossRef]

- Sheng, S.; Zhou, K.Z.; Li, J.J. The effects of business and political ties on firm performance: Evidence from China. J. Market. 2011, 1, 1–15. [Google Scholar] [CrossRef]

- Banalieva, E.R.; Eddleston, K.A.; Zellweger, T.M. When do family firms have an advantage in transitioning economies? Toward a dynamic institution-based view. Strateg. Manag. J. 2015, 9, 1358–1377. [Google Scholar] [CrossRef]

- Li, J.J.; Poppo, L.; Zhou, K.Z. Do managerial ties in China always produce value? Competition, uncertainty, and domestic vs. foreign firms. Strateg. Manag. J. 2008, 4, 383–400. [Google Scholar] [CrossRef]

- Cao, Q.; Baker, J.; Schniederjans, D. Bullwhip effect reduction and improved business performance through guanxi: An empirical study. Int. J. Prod. Econ. 2014, 1, 217–230. [Google Scholar] [CrossRef]

- Luo, Y.D.; Huang, Y.; Wang, S.L. Guanxi and organizational performance: A meta-analysis. Manag. Organ. Rev. 2012, 1, 139–172. [Google Scholar] [CrossRef]

- Luscher, D.; Robins, G.; Pattison, P.E.; Lomi, A. “Trust me”: Differences in ex pressed and perceived trust relations in an organization. Soc. Netw. 2012, 4, 410–424. [Google Scholar] [CrossRef]

- Stefano, D.D.; Fuccella, V.; Vitale, M.P.; Zaccarin, S. The use of different data sources in the analysis of co-authorship networks and scientific performance. Soc. Netw. 2013, 5, 370–381. [Google Scholar] [CrossRef]

- Wu, K.J.; Liao, C.J.; Tseng, M.L.; Chou, P.J. Understanding innovation for sustainable business management capabilities and competencies under uncertainty. Sustainability 2015, 10, 13721–13760. [Google Scholar] [CrossRef]

- Leung, T.K.; Wong, Y.H.; Wong, S. A study of Hong Kong businessmen’s perceptions of the role of “guanxi” in the People’s Republic of China. J. Bus. Ethics 1996, 7, 749–758. [Google Scholar] [CrossRef]

- Chua, R.Y.; Morris, M.W.; Ingram, P. Guanxi vs. networking: Distinctive configuration of affect- and cognition-based trust in the networks of Chinese vs. American managers. J. Int. Bus. Stud. 1996, 3, 490–508. [Google Scholar] [CrossRef]

- Chung, H.F.; Yang, Z.L.; Huang, P.H. How does organizational learning matter in strategic business performance? The contingency role of guanxi networking. J. Bus. Res. 2015, 6, 1216–1224. [Google Scholar] [CrossRef]

- Park, S.H.; Luo, Y. Guanxi and organizational dynamics: Organizational networking in China firms. Strateg. Manag. J. 2001, 5, 455–477. [Google Scholar] [CrossRef]

- Lin, L.H. Cultural and organizational antecedents of guanxi: The Chinese cases. J. Bus. Ethics 2011, 3, 441–451. [Google Scholar] [CrossRef]

- Su, D.J.; Sohn, D.W. Roles of entrepreneurial orientation and guanxi network with parent university in start-ups’ performance: Evidence from university spin-offs in China. Asian J. Technol. Innov. 2015, 1, 1–19. [Google Scholar] [CrossRef]

- Lovett, S.; Simmons, L.C.; Kali, R. Guanxi versus the market: Ethics and efficiency. J. Int. Bus. Stud. 1999, 2, 231–247. [Google Scholar] [CrossRef]

- Su, C.T.; Sirgy, M.J.; Littlefield, J.E. Is guanxi orientation bad, ethically speaking? A study of Chinese enterprises. J. Bus. Ethics 2003, 4, 303–312. [Google Scholar] [CrossRef]

- Wang, K.J.; Lestari, Y.D. Firm competencies on market entry success: Evidence from a high-tech industry in an emerging market. J. Bus. Res. 2013, 12, 2444–2450. [Google Scholar] [CrossRef]

- Chen, M.H.; Chang, Y.Y.; Lee, C.Y. Creative entrepreneurs’ guanxi networks and success: Information and resource. J. Bus. Res. 2015, 4, 900–905. [Google Scholar] [CrossRef]

- Jackson, M.O. Networks in the understanding of economic behaviors. J. Econ. Perspect. 2014, 4, 3–22. [Google Scholar] [CrossRef]

- Peng, M.W.; Luo, Y.D. Managerial ties and firm performance in a transition economy: The nature of a micro-macro link. Acad. Manag. J. 2000, 3, 486–501. [Google Scholar] [CrossRef]

- Bu, N.; Roy, J. Guanxi practice and quality: A comparative analysis of Chinese managers’ business-to-business and business-to-government ties. Manag. Organ. Rev. 2015, 2, 263–287. [Google Scholar] [CrossRef]

- Dacin, M.T.; Oliver, C.; Roy, J. The legitimacy of strategic alliances: An institutional perspective. Strateg. Manag. J. 2007, 2, 169–187. [Google Scholar] [CrossRef]

- Huang, W.Y.; Huang, C.Y.; Dubinsky, A.J. The impact of guanxi on ethical perceptions: The case of Taiwanese salespeople. J. Bus. Bus. Market. 2014, 1, 1–17. [Google Scholar] [CrossRef]

- Söderblom, A.; Samuelsson, M.; Wiklund, J.; Sandberg, R. Inside the black box of outcome additionality: Effects of early-stage government subsidies on resource accumulation and new venture performance. Res. Policy 2015, 8, 1501–1512. [Google Scholar] [CrossRef]

- Joshi, Y.; Rahman, Z. Predictors of young consumer’s green purchase behaviour. Manag. Environ. Qual. 2016, 4, 452–472. [Google Scholar] [CrossRef]

- Cao, Q.; Simsek, Z.; Jansen, J.J. CEO social capital and entrepreneurial orientation of the firm: Bonding and bridging effects. J. Manag. 2015, 7, 1957–1981. [Google Scholar] [CrossRef]

- Danis, W.M.; Chiaburu, D.S.; Lyles, M.A. The impact of managerial networking intensity and market-based strategies on firm growth during institutional upheaval: A study of small and medium-sized enterprises in a transition economy. J. Int. Bus. Stud. 2010, 2, 287–307. [Google Scholar] [CrossRef]

- Jaworski, B.J.; Kohli, A.K. Market orientation: Antecedents and consequences. J. Market. 1993, 3, 53–70. [Google Scholar] [CrossRef]

- Su, D.J.; Liu, C.L.; Sohn, D.W. Is deploying a high level of entrepreneurial orientation always crucial for sustainable growth of high-tech ventures? Moderating effects of environmental turbulence. Transylv. Rev. 2016, 9, 1515–1533. [Google Scholar]

- Aoun, D. Assessing the economic sustainability of managing protected areas using the CVM and CBA approaches. Manag. Environ. Qual. 2016, 4, 374–389. [Google Scholar] [CrossRef]

- Stam, W.; Elfring, T. Entrepreneurial orientation and new venture performance: The moderating role of intra-and extraindustry social capital. Acad. Manag. J. 2008, 1, 97–111. [Google Scholar] [CrossRef]

- Sherer, P.D.; Lee, K. Institutional change in large law firms: A resource dependency and institutional perspective. Acad. Manag. J. 2002, 1, 102–119. [Google Scholar] [CrossRef]

- Cheng, K.H.; Chiao, Y.C.; Shih, H.Y.; Lee, T.Y.; Cho, T.S. Agglomeration and competition among Chinese cities: An investigation of Taiwanese high-tech foreign direct investment. Growth Chang. 2011, 4, 517–548. [Google Scholar] [CrossRef]

- Su, C.T.; Mitchell, R.K.; Sirgy, M.J. Enabling guanxi management in China: A hierarchical stakeholder model of effective guanxi. J. Bus. Ethics 2007, 3, 301–319. [Google Scholar] [CrossRef]

- Su, Z.F.; Peng, J.S.; Shen, H.; Xiao, T. Technological capability, marketing capability, and firm performance in turbulent conditions. Manag. Organ. Rev. 2013, 1, 115–137. [Google Scholar] [CrossRef]

- Zhang, H. Study on Entrepreneurial Orientation of Multinational Subsidiaries in China: A View of Relational Embeddedness; Economic Science Press: Beijing, China, 2010. [Google Scholar]

- Johanson, M. Entering and participating in the turbulent Russian market: Internationalisation as a search and discovery process. J. East-West Bus. 2002, 4, 61–82. [Google Scholar] [CrossRef]

- Anderson, B.S.; Eshima, Y. The influence of firm age and intangible resources on the relationship between entrepreneurial orientation and firm growth among Japanese SMEs. J. Bus. Ventur. 2013, 3, 413–429. [Google Scholar] [CrossRef]

- Shou, Z.; Chen, J.; Zhu, W.; Yang, L. Firm capability and performance in China: The moderating role of guanxi and institutional forces in domestic and foreign contexts. J. Bus. Res. 2014, 2, 77–82. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. J. Acad. Market. Sci. 1988, 1, 74–94. [Google Scholar] [CrossRef]

- Barrick, M.R.; Bradley, B.H.; Kristof-Brown, A.L.; Colbert, A.E. The moderating role of top management team interdependence: Implications for real teams and working groups. Acad. Manag. J. 2007, 3, 544–557. [Google Scholar] [CrossRef]

- Gajendran, R.S.; Joshi, A. Innovation in globally distributed teams: The role of LMX, communication frequency, and member influence on team decisions. J. Appl. Psychol. 2012, 6, 1252–1261. [Google Scholar] [CrossRef] [PubMed]

- Lee, D.J.; Pae, J.H.; Wong, Y.H. A model of close business relationships in China (guanxi). Eur. J. Market. 2001, 35, 51–69. [Google Scholar] [CrossRef]

- Beck, M.; Schenker-Wicki, A. Cooperating with external partners: The importance of diversity for innovation performance. Eur. J. Int. Manag. 2014, 5, 548–569. [Google Scholar] [CrossRef]

- Li, H.Y.; Zhang, Y. The role of managers’ political networking and functional experience in new venture performance: Evidence from China’s transition economy. Strateg. Manag. J. 2007, 8, 791–804. [Google Scholar] [CrossRef]

- Granovetter, M. Economic action and social structure: A theory of embeddedness. Am. J. Sociol. 1985, 3, 481–510. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, Z. Guanxi and organizational dynamics in China: A link between individual and organizational level. J. Bus. Ethics 2006, 4, 375–392. [Google Scholar] [CrossRef]

| Variable Constructs and Measurement Items | Loading |

|---|---|

| Government guanxi (Zhang, 2010) (α = 0.79; CR = 0.93; AVE = 0.65) | |

| 1. The local government (or its officials) keeps its commitments to our managers and firm. | 0.85 |

| 2. The local government (or its officials) does justice to our firm. | 0.80 |

| 3. Our firm and local government (or its officials) trust each other. | 0.83 |

| 4. Our firm and local government (or its officials) frequently communicate with each other. | 0.78 |

| 5. If necessary, our firm and local government (or its officials) often provide various assistance to each other. | 0.87 |

| 6. Our firm and local government (or its officials) often jointly solve some difficulties. | 0.82 |

| 7. Our firm has good guanxi connections with local government authorities (e.g., government-sponsored banks, science and technology bureaus, industrial and commercial bureaus, and tax bureaus) and their officials. | 0.69 |

| Business guanxi (Zhang, 2010) (α = 0.76; CR = 0.88; AVE = 0.56) | |

| 1. Primary business partners (e.g., customers, suppliers, and collaborators) consistently keep their commitments to our firm. | 0.81 |

| 2. Our firm and primary business partners frequently communicate with each other. | 0.77 |

| 3. Primary business partners have good guanxi connections with top managers of our firm. | 0.79 |

| 4. Primary business partners often provide useful suggestions on improving the quality of our products. | 0.76 |

| 5. Primary business partners and our firm often jointly overcome difficulties in product development. | 0.67 |

| 6. Primary business partners are willing to maintain long-term cooperation with our firm. | 0.69 |

| Institutional turbulence (Johanson, 2002) (α = 0.86; CR = 0.87; AVE = 0.62) | |

| 1. The local government acts in a way that leads us to great uncertainty. | 0.79 |

| 2. It is hard to predict the impact of the political system on the market in this region. | 0.81 |

| 3. It is difficult to foresee regional institutional changes. | 0.82 |

| 4. Regional policies are relatively unstable. | 0.73 |

| Market turbulence (Jaworski and Kohli, 1993) (α = 0.87; CR = 0.90; AVE = 0.60) | |

| 1. In our kind of business, customers’ product preferences change quite a bit over time. | 0.82 |

| 2. Our customers tend to look for new products all the time. | 0.85 |

| 3. Our customers are sometimes very price sensitive, but on other occasions, prices are less important. | 0.80 |

| 4. We are witnessing demand for our products and services from customers who never bought them before. | 0.69 |

| 5. New customers tend to have product-related needs that are different from those of our existing customers. | 0.78 |

| 6. We cater to many of the same customers that we used to in the past. | 0.68 |

| new venture performance (Anderson and Eshima, 2013) (α = 0.84; CR = 086; AVE = 0.68) | |

| 1. Sales growth | 0.81 |

| 2. Market share growth | 0.84 |

| 3. Employee growth | 0.82 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

|---|---|---|---|---|---|---|---|

| 1. Firm age | |||||||

| 2. Firm size | 0.22 ** | ||||||

| 3. GG | −0.11 | 0.14 * | 0.65 | ||||

| 4. BG | 0.17 * | 0.26 ** | 0.32 ** | 0.56 | |||

| 5. IT | 0.02 | 0.17 * | 0.37 ** | −0.08 | 0.62 | ||

| 6. MT | 0.09 | 0.07 | −0.10 | 0.47 *** | 0.05 | 0.60 | |

| 7. NVP | 0.03 | 0.09 | 0.15 * | 0.21 ** | 0.11 | 0.11 | 0.68 |

| Means | 3.25 | 46.80 | 5.12 | 5.23 | 5.07 | 5.11 | 5.29 |

| Standard deviation | 0.96 | 15.47 | 1.03 | 0.96 | 1.16 | 1.20 | 1.42 |

| New Venture Performance | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | ||||||||

| β | SE | β | SE | β | SE | β | SE | β | SE | β | SE | |||

| Control Variables | ||||||||||||||

| Firm age | 0.03 | 0.08 | 0.03 | 0.07 | 0.03 | 0.06 | 0.03 | 0.07 | 0.02 | 0.08 | 0.03 | 0.06 | 0.03 | 0.07 |

| Firm size | 0.17 * | 0.08 | 0.16 * | 0.08 | 0.11 * | 0.07 | 0.13 * | 0.08 | 0.13 * | 0.07 | 0.14 * | 0.07 | 0.12 * | 0.07 |

| Main Effects | ||||||||||||||

| GG | 0.23 ** | 0.07 | 0.23 ** | 0.07 | 0.22 ** | 0.06 | 0.21 ** | 0.07 | 0.22 ** | 0.07 | 0.20 ** | 0.08 | ||

| BG | 0.45 *** | 0.07 | 0.47 *** | 0.07 | 0.46 *** | 0.08 | 0.42 *** | 0.10 | 0.44 *** | 0.09 | 0.39 *** | 0.08 | ||

| IT | 0.17 * | 0.06 | 0.16 * | 0.06 | 0.15 * | 0.07 | 0.16 * | 0.08 | 0.16 * | 0.07 | 0.13 * | 0.07 | ||

| MT | −0.04 | 0.07 | −0.05 | 0.06 | −0.04 | 0.07 | −0.06 | 0.07 | −0.05 | 0.06 | −0.07 | 0.06 | ||

| Two-Way Interactions | ||||||||||||||

| GG × IT | −0.08 | 0.08 | −0.07 | 0.09 | ||||||||||

| GG × MT | −0.13 * | 0.07 | −0.16 * | 0.09 | ||||||||||

| BG × IT | 0.01 | 0.08 | 0.02 | 0.08 | ||||||||||

| BG × MT | 0.18 * | 0.08 | 0.22 ** | 0.10 | ||||||||||

| F | 1.32 ** | 4.76 *** | 4.56 *** | 4.28 *** | 4.48 *** | 5.67 *** | 4.82 *** | |||||||

| R2 | 0.05 | 0.18 | 0.17 | 0.16 | 0.17 | 0.22 | 0.18 | |||||||

| Adjusted R2 | 0.04 | 0.16 | 0.15 | 0.13 | 0.14 | 0.19 | 0.16 | |||||||

| ∆ R2 | 0.13 | 0.01 | 0.01 | 0.01 | 0.05 | 0.04 | ||||||||

© 2017 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Su, D.; Du, Q.; Sohn, D.; Xu, L. Can High-Tech Ventures Benefit from Government Guanxi and Business Guanxi? The Moderating Effects of Environmental Turbulence. Sustainability 2017, 9, 142. https://doi.org/10.3390/su9010142

Su D, Du Q, Sohn D, Xu L. Can High-Tech Ventures Benefit from Government Guanxi and Business Guanxi? The Moderating Effects of Environmental Turbulence. Sustainability. 2017; 9(1):142. https://doi.org/10.3390/su9010142

Chicago/Turabian StyleSu, Dejin, Qixia Du, Dongwon Sohn, and Libo Xu. 2017. "Can High-Tech Ventures Benefit from Government Guanxi and Business Guanxi? The Moderating Effects of Environmental Turbulence" Sustainability 9, no. 1: 142. https://doi.org/10.3390/su9010142

APA StyleSu, D., Du, Q., Sohn, D., & Xu, L. (2017). Can High-Tech Ventures Benefit from Government Guanxi and Business Guanxi? The Moderating Effects of Environmental Turbulence. Sustainability, 9(1), 142. https://doi.org/10.3390/su9010142