Abstract

It is of vital importance to examine the relationship between pensions and household consumption/saving because this forms a link between social policy and economic development. Based on theories of absolute income, permanent income, and the life-cycle hypothesis, this paper constructs panel data models to investigate the effect of public pension participation and benefit level on household consumption. Evidence from the China Health and Retirement Longitudinal Study (CHARLS) 2011 and 2013 survey data shows that, compared with those not covered by any public pension program, individuals enrolled in the public pension system tend to consume more within respective income-quantile groups. Moreover, for the retired population, we found lower income groups have a higher marginal propensity to consume than higher income groups. In other words, lower income groups are likely to spend a higher proportion of any increase in pension benefit on consumption than higher income groups. To achieve a virtuous cycle between public pension, household consumption, and economic growth and, thus, a social-economically sustainable development, we suggest that China’s pension system should be extended to cover all in the lowest income group, and the benefit level should be increased gradually to secure a stable expectation for the future and motivate current consumption.

1. Introduction

The dynamic relationship between social security and macroeconomics has long been the concern of scholars as well as policy-makers [1], since a desirable and sustainable social policy should not only serve for the goals of equity and fairness but also have a sound interaction with the socio-economic ecology in which it is embedded. The public pension system, which takes a large proportion of social spending and covers the majority of the population, has a profound interaction with household consumption or saving and, hence, with macroeconomics. The World Bank holds that the primary goal for pension schemes is to be adequate, affordable, sustainable, and robust; and the secondary goal of mandated pension provisions is to make a contribution to economic development [2]. As a consequence, it is of significant importance to identify the vital linkage between public pension and output growth. During the post-crisis era, governments in many countries hope to increase domestic consumption and economic growth by expansion of social security, which is also the strategy adopted in China where domestic demand is insufficient.

However, the relationship between social security and household consumption or saving is still a matter of debate. Some scholars argue that the pension system has crowded out individual saving. Feldstein, for example, claims that the net impact of the pension on individual saving relies on the comparative strength of the “asset substitution effect” versus the “induced retirement effect”: if the former exceeds the later effect, individual saving will decrease; otherwise it is the other way around. Based on the life-cycle model, he then employs US macro data, finding that the stock of capital would have increased by 30%–50% if there had been no pension system [3]. Evidence over the period from 1937 to 1992 shows that the US social security system has decreased personal saving by nearly 60% [4]. David Blake indicates that a national pension system has a positive impact on individual consumption and generates a strong substitution effect on individual saving [5]. However, others contend that no such significant effect exists. Leimer and Lesnoy question Feldstein’s results and re-estimate the model, finding a much weaker effect of the public pension on household saving [6]. Barro argues that transfers from the elderly to the young and the bequest motive could offset the negative impact on saving created by social security, thus making no difference in the end [7]. Modigliani and Sterling apply a life cycle model to examine the effect of pensions on saving rates of 21 OECD countries from 1960 to 1970, discovering the net effect approximates to zero [8].

Within the Chinese context, researchers have explored the impact of public pension systems on household consumption or saving from various perspectives. Following Feldstein’s framework, Feng et al. construct the “pension wealth” variable and find a significant offset effect of pension wealth on urban household savings based on the China Household Income Project 1995 and 1999 surveys [9]; similarly, others reveal that pension wealth has a positive effect on urban residents’ consumption expenditures [10,11]. From the perspective of the coverage rate, employing a follow-up study of rural residents, Yue et al. predict that compared with those not involved in rural old-age social insurance, participants are likely to consume 26% more [12]. Regarding the contribution rate, household consumption is depressed when the contribution rate grows (Bai et al. [13]; Zou et al. [14]). Concerning the benefit level, Li and Zhu observe a limited impact of average pension revenue on household saving [15]. However, Su and Li indicate a positive effect of average pension expenditure on urban household consumption in Shandong province, i.e., every increase of expenditure by 1 yuan results in growth of the urban household’s consumption by 0.0197 yuan [16].

Without sufficient discussion of consumption theories, our understanding of the relationship between social security and household consumption is limited. The consumption theories have evolved from Friedman’s permanent income hypothesis (PIH) to Modigliani and Brumberg’s life-cycle hypothesis (LCH). For the former, consumption is determined by permanent income, typically defined as average income, whereas, for the latter, consumption is determined by lifetime resources. Browning and Crossley (2001) point out that the life-cycle framework is the standard way that economists think about the intertemporal allocation of time, effort, and money, and conclude that the life-cycle framework is a general concept that includes many possible models with empirical contents, and, within the framework, agents make sequential decisions to achieve a coherent or stable goal using currently available information as best they can [17]. More recently, precautionary saving and liquidity constraints have been at the center of research. The precautionary motive for saving is entirely consistent with the basic theory of intertemporal allocation, but is ruled out by the certainty equivalence assumptions that generate the permanent income model; liquidity constraints, by contrast, are ruled out by the assumption in the life-cycle model, an inability to borrow [18]. With the rapid development of the study of consumption over the past few decades, Angus Deaton stands out because of his interconnected contributions to the measurement, theory, and empirical analysis of consumption. He pioneers the analysis of individual dynamic consumption behavior under idiosyncratic uncertainty and liquidity constraints; he also clarifies why researchers must take aggregation issues seriously to understand total consumption and saving, and later research has indeed largely come to address macroeconomic issues through microeconomic data, as such data has increasingly become available [19]. In recent years, life-cycle models have been frequently applied to China’s situation to explain household saving or its flip side, household consumption. Curtis and Lugauer (2015) present a fairly standard model of household life-cycle saving decisions, in which the economy is populated by 95 generations and people live up to 95 years but only agents aged 20 to 95 make decisions, to quantify the impact of demographic changes on household savings rates in Japan, China, and India, finding that decreasing family size increases savings rates for China according to model simulations [20]. Lugauer and Mark (2013) study the role of demographics and income uncertainty in driving the savings rate and discover that decreasing family size and increasing old-age dependency ratio contribute to the growth of savings rates; heightened income uncertainty is also shown to be important in boosting the savings rate as households build buffer-stocks of assets to self-insure against spells of low or no income [21]. In contrast, based on CHFS microdata, Lugauer, Ni, and Yin (2015) examine the impact of family size on household saving by constructing a theoretical life-cycle model that includes finite lifetimes and saving for retirement. The results suggest that Chinese families with fewer dependent children have significantly higher savings rates [22]. Moreover, an overlapping generations model with endogenous labor supply has been used to evaluate the welfare effects of pension reforms, such as potential gains and losses across different generations (Song et al., 2015 [23]).

Although the results vary among different empirical studies and methods adopted, the ways of measuring the public pension effect need to be reexamined: “pension wealth” comes from simulations based strictly on assumptions rather than real data, which may make the estimation biased. In addition, aggregate data may reflect general trends but does not easily uncover individual characteristics. Previous research in macroeconomics to explore consumption and savings, from Keynes onwards, relied considerably on aggregate data with the assumption of “representative consumer” or “average consumer”. Deaton shows that the way to better understand macroeconomics more generally is to study the income and consumption of individuals whose incomes fluctuate in an entirely different way to the average income [24]. In addition, selecting either coverage rates, contribution rates, or benefit levels could only reflect one dimension rather than the whole picture of pension systems. Consequently, this paper aims to investigate the impact of public pensions on household consumption from two dimensions, coverage and benefit level, by the employment of the latest two-wave China Health and Retirement Longitudinal Study (CHARLS) survey data.

This paper is constructed as follows: firstly, it briefly introduces the development and status quo of China’s parallel public pension systems; secondly, by reviewing consumption theories, we construct panel data models to examine whether participation in different pension types and the amount of pension benefits could have an impact on household consumption; and lastly, we discuss the main findings and their implications.

2. Parallel Public Pension Systems in China

With the great transformation of China’s society, China’s pension system has changed from a traditional retirement system, also known as the “state-enterprise model”, based on the planned economy, to an “old-age social insurance” system based on the market economy [25]. The public pension system has gradually expanded its coverage from the employed population to the non-employed population, and from urban areas to rural areas. Currently, there are two main parallel public pension systems in China: a public pension system for urban employees and a public pension system for urban and rural residents.

2.1. Public Pensions for Urban Employees

In 1997, the Chinese government established the Urban Employee’s Basic Old-Age Insurance and extended it throughout cities and towns nationally. Since 2005, the self-employed and flexible working individuals have been covered by the public system. The other separate pension system in urban areas, the public pension for civil servants, has been merged into the Public Pension for Urban Employees since January 2015. In 2013, there were about 382.4 million urban employed, among who 241.77 million urban employees were covered by the public pension system, while 80.41 million retirees were claiming pension benefits. From 1997 to 2013, total pension payments increased rapidly from 125 billion to 1847 billion yuan, while the replacement rate of public pension benefit to social average salary of urban employees dropped gradually from 76% in 1997 to less than 44% in 2013 [26].

2.2. Public Pensions for Urban and Rural Residents

In 1986, the Chinese government established old-age social insurance for rural residents in pilot counties. In 1992, the Ministry of Civil Affairs issued a basic plan for Rural Old-Age Social Insurance, which was financed by personal contributions and collective subsidies. However, fewer and fewer rural residents participate in the pension plan because of their poor financial capacity and the low level of benefits they received. From July 1997, the policy of “old rural pension” began to fade away. Against a background of population ageing, economic crisis and the process of urban-rural integration, New-Rural Old-Age Social Insurance, in which government subsidies were the main source, was set up nationwide in 2009. For a long period of time, urban residents without work had no access to any public pensions. In July 2011, the public pension system for urban residents was set up and, from then on, the pension system gradually expanded nationally. In February 2014, the state put forward a proposal that the new rural pension system and the urban-residents pension system be merged into a unified system, in order to realize a universal public pension system for all residents in the future. The number of participants has increased from 331.82 million with 87.6 million pensioners in 2011, to 497.5 million with 137.68 million pensioners in 2013. The monthly basic pension benefit provided by the central government has increased from 55 yuan (2011) to 70 yuan (2014) [26].

Despite a short history, the public pension for urban and rural residents has rapidly expanded the coverage net to people who have no access to the traditional pension system for employees, which has greatly improved the equity of the public pension systems.

3. Methodology

3.1. Theoretical Framework

According to Keynes’ consumption function of “absolute income assumption”, the marginal growth of current consumption is merely decided by the marginal growth of current income, but displays “diminishing marginal propensity to consume”. Later on, assumptions about relevant income, permanent income and life-cycle income flourished. Ando and Modigliani note that people save for the sake of smoothing lifetime consumption and realizing maximum utility through their lifetime [27]. They build the consumption function as follows:

stands for consumption expenditure; represents permanent income; and represents household wealth assets.

Modigliani also points out that, based on life-cycle theory, the factors influencing savings rates should also include the population structure. In fact, saving behaviors in China could be explained by life-cycle assumptions, and the dependency ratio has had an impact on residents’ saving behavior [28,29]. Curtis et al. (2015) construct a model of overlapping generations (OLG), in which individuals live for 85 years; individuals make no decisions and depend on their parents for consumption before age 20; individuals from 20 to 63 years old work, raise children, and also transfer a portion of their labor income to current retirees by the pay-as-you-go public pension system; retirees above 64 years old live off their accumulated assets, pensions, and family transfers [30]. They build budget constraints for households with children and retirees subjected to each preference as follows:

defines the consumption of an agent in decision-making age j in the year t, where j = 0 corresponds to real-life age 20. Working age people earn return on their assets while contributing proportion of their wages into formal pension systems and transferring as informal family support. The number of dependent children each consumes . The individual’s consumption function (Equation (2)) constraints households’ preferences to maximize their lifetime utility , as is shown in Equation (3), where parameter is the inverse of the elasticity of inter-temporal substitution while is the weight parents put on utility from children’s consumption.

In addition, in the consumption function for retirees, displayed in Equation (4), retirees consume accumulated assets and get financial support both from pension systems and family transfers. Their utility function could be maximized subject to the budget constraints. According to their findings, demographic variations including reduction in family size, age composition, and intergenerational transfer could account for over half of the current household savings rate [30].

Feldstein (1974) introduces the variable of “social security wealth”, namely pension wealth, and constructs the extended life-cycle model. Afterwards, there are a number of indicators adopted to evaluate pension systems. The World Bank suggests four indicators to evaluate the success of pension systems: adequacy, affordability, sustainability, and robustness [2]. Merci constructs an evaluation system comprising three indicators: adequacy, sustainability, and comprehensiveness, among which “adequacy” includes benefit level, tax support and asset growth, making up 40% of the total weight; “sustainability” consists of coverage rate, contribution and population and so on, contributing 35% of the total weight; and “comprehensiveness”, regarding management of the pension fund on the macro-level, constitutes the remaining 25%. This paper focuses on pensioners’ perspective rather than macro governance and, thus, we choose the benefit and the coverage as the main measurements.

To sum up, the development of the consumption function has incorporated relevant variables, such as income, assets, demographics (e.g., family size, age structure, and lifespan), social security, and so forth. As a result, we then build econometric models to investigate the relationship between public pensions and household consumption.

3.2. Panel Data Models

Panel data analysis is increasingly used nowadays since it has the advantage of minimizing endogeneity that is usually present in cross-sectional analysis, especially when appropriate instrumental variables are hard to find. As panel data contains repeated observations on each individual, it opens up the opportunity to compare the same individual under different circumstances, permitting the possibility of using that individual as his or her own control, so that we can come closer to the ideal experimental situation [31]. In other words, panel data models could be used to diminish the biased influence of unobservable time-invariant variables and, hence, guarantee the consistency of estimators and improve the efficiency of the model.

Combining the theories mentioned above, we construct the basic panel data model with the individual-effect as follows:

Let Cons be residents’ consumption expenditure, Inc indicate income, Inc_decile represent income groups with deciles, and Asset represent asset property. The pension is measured in two ways: the enrolment in different pension types and the level of pension benefits, which will be analysed separately in the following sections. Pension enrolment could be regarded as exogenous to some extent, because in China, public pension schemes are regulated by policies according to the Hukou system of household registration and employment status, while participation in public pensions for urban and rural residents is voluntary. For the latter indicator, pension benefits, we try to include income levels, as well as its interaction terms with income groups to eliminate potential endogenous choice of public pension schemes, and to compare the impact of public pensions on household consumption within distinct income quantiles. Demographics include gender, marriage, education, family size, the number of children, Hukou type, and so forth. indicates time-constant variables including unobserved heterogeneity, and indicates time-variant and unobservable factors that may predict the dependent variable. N is the sample size and t is the time period.

There are various forms of the panel data model, among which fixed-effect (FE) and random-effect (RE) model are fundamental. In FE models, independent variables are allowed to be correlated with the time-invariant factor while they are not allowed to be correlated with the error term . The most frequently used methods to estimate the fixed effect are within-group estimation and first-difference estimation. In RE models, however, it is assumed that is purely random, a stronger assumption implying that is uncorrelated with the regressors. Estimation is then by a feasible generalized least-square (FGLS) estimator. Advantages of the RE model are that it yields estimates of all coefficients and hence marginal effects; even those of time-invariant regressors can be estimated [32]. Both FE and RE models are based on the assumption that there exist individual effects, otherwise pooled OLS regression should be adopted, especially when regressors are exogenous. Moreover, a standard extension of the individual effects, the two-way-effects model, should be considered when the intercept is allowed to vary over individuals and over time, as demonstrated by Equation (7) below:

where is supposed to be the time effect.

3.3. Data and Variables

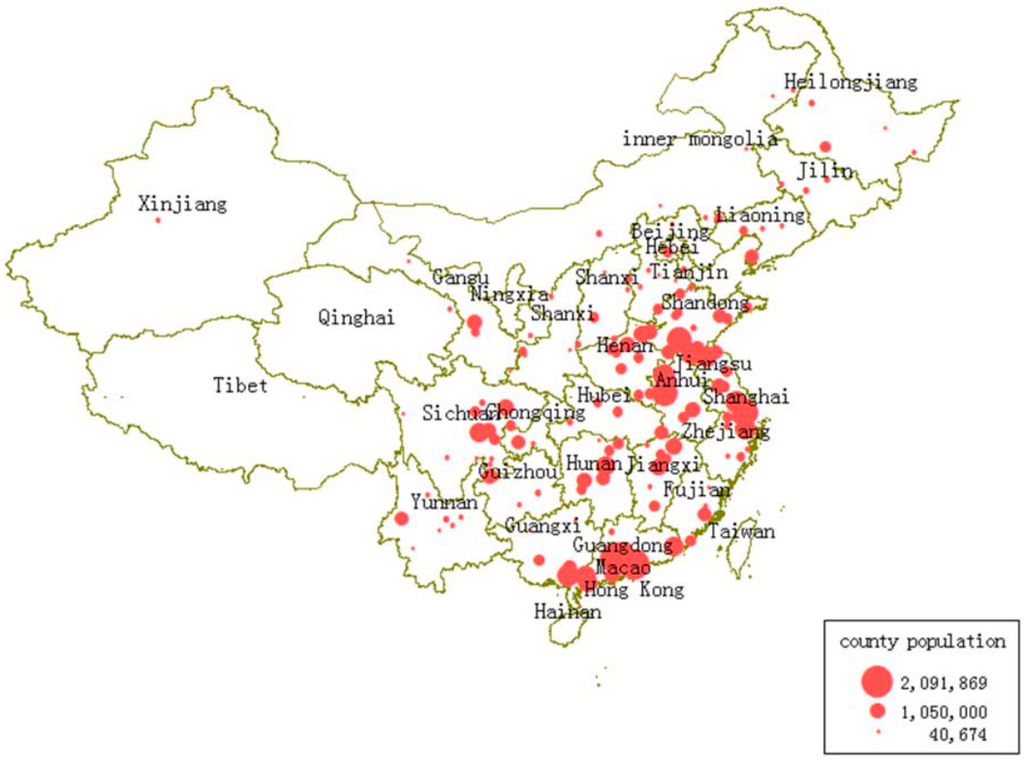

The China Health and Retirement Longitudinal Study (CHARLS) collects a nationally-representative sample of Chinese residents aged 45 and older. Similar in its questionnaire design to the Health and Retirement Study (HRS) in the US, the English Longitudinal Study of Ageing (ELSA) and the Survey of Health and Retirement in Europe (SHARE), CHARLS is not only internationally comparable with other elderly heath and ageing studies but also reflects the unique Chinese experience. The dataset has been widely used to evaluate elderly’s health and economic status, as well as to assess relevant social programs provided to the elderly [33,34,35,36]. The baseline survey of CHARLS was conducted between 2011 and 2012, covering 17,708 individuals in 10,257 households from 28 provinces and autonomous regions in China (Figure 1). The latest survey is the second wave follow-up conducted in 2013.

Figure 1.

The national distribution of sampling counties and districts of CHARLS (refer to CHARLS, 2011 [37]).

CHARLS is comprised of eight modules: (a) demographic background; (b) family; (c) health status and function; (d) health care and insurance; (e) work, retirement and pension; (f) income, expenditure and assets; (g) housing characteristics; and (h) interviewer observation. Variables of interest are summarized and defined in Table 1.

Table 1.

Illustration of the variables.

4. Results of the Analysis

4.1. Descriptive Statistics

According to the CHARLS questionnaire, descriptive statistics of the variables are summarized in Table 2. Personal indicators of household consumption, income (with and without public pensions), and assets are calculated using total indicators divided by the number of household members. Since income and assets are highly skewed-right distributed, outliers less than 1% and above 99% for personal household consumption, income, and assets are excluded in the model in order to avoid the biased estimation introduced by extreme data.

Table 2.

Descriptive statistics of variables.

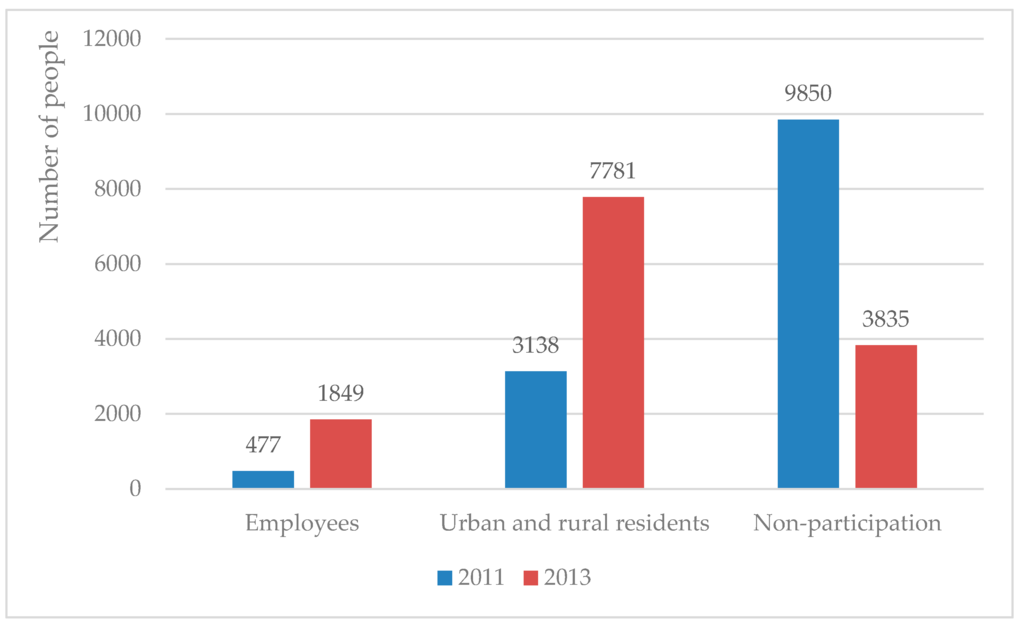

As is shown in Table 2, means of personal household consumption, income, and assets are 6064.26 yuan, 6669.97 yuan, and 34,539.21 yuan, respectively. The average pension benefit for retirees in 2011 and 2013 is 8298.09 yuan. In terms of participation, the paper divides China’s current public pension systems into three categories: (1) the public pension for urban employees, including civil servants’ pension and urban employees’ basic pension which was established in 1997 and adjusted in 2005; (2) the public pension for urban and rural employees, which is a combination of new rural old-age social insurance (introduced in 2009), urban residents’ basic pension (established in 2011) and urban and rural residents’ basic pension; and (3) non-participants in any kind of public pension scheme. It can be seen from Figure 2 that the number of people reported to have employees’ public pensions in the survey increased from 477 in 2011 to 1849 in 2013, while the number of people enrolled in the residents’ public pension increased from 3138 to 7781. Meanwhile, non-participants decreased rapidly from 9850 in 2011 to 3835 in 2013.

Figure 2.

Distribution of participation in various types of public pension systems in 2011 and 2013.

4.2. The Effect of Enrolment in Different Public Pensions on Household Consumption

Based on the theoretical framework discussed above, we construct the two-period panel data model with various forms to analyze the relationship between participation in public pensions and household consumption. Table 3 shows panel models employing methods of pooled OLS, fixed effect, two-way fixed effect, and random effect with robust estimation. The F test in the fixed-effect model suggests that individual effects do exist, which means each individual has their own intercept, thus, the FE model is superior to the pooled OLS. When taking the time effect into consideration and constructing a two-way fixed-effect model, we do not find a statistically significant difference between personal household consumption in 2011 and 2013, as is shown in model (3), Table 3. To further explore whether the individual effect is fixed or random, we turn to the Hausman test, which indicates that we can reject the null hypothesis that the error term is uncorrelated with dependent variables at the significant level of 5%. That is to say, the FE model could be more appropriate than the RE model.

Table 3.

Estimation of the effect of enrolment in different public pensions on household consumption.

In all of the four models in Table 3, the estimated coefficients of interaction terms between enrolment in pensions and income deciles indicate the difference in consumption between people participating in particular types of pension and non-participants, for particular income groups. With regard to the urban employees’ pension system, participants tend to consume 4409 yuan more than non-participants in the fourth-quantile income group, 5249 yuan more in the fifth-quantile income group, and 3576 yuan more in the sixth-quantile income group, as demonstrated in the FE model. With regard to the urban and rural residents’ pension, participants are inclined to consume about 900 yuan, 1386 yuan, 1696 yuan, 1599 yuan, 1074 yuan, 1588 yuan, 1090 yuan, 286 yuan, and 429 yuan more than those without any public pensions within the respective higher income quantiles. This is statistically significant for the third, fourth, fifth, and seventh-quantile income groups. In general, consumption is augmented most for lower income groups, like the third, fourth, and fifth quantile-income individuals.

In addition, household assets play critical roles in explaining the difference in household consumption. A one yuan increase in household assets led to a 0.01–0.02 yuan increase in household expenditure. This finding demonstrates the applicability of the absolute income and permanent income hypothesis. The results indicate an inverted-U-shape relationship between age and household consumption: consumption increases with age when individuals are young but decreases with age when individuals get older. Family size was negatively correlated with marginal consumption level, whereas the number of children was positively correlated with household consumption. These results are consistent with the life cycle hypothesis that demographics indeed have a significant role in explaining variations in household consumption.

4.3. The Effect of Pension Benefit on Household Consumption

Apart from participation, another key dimension evaluating public pension systems is the pension benefit. Table 4 shows panel data models with various estimations that explain the relationship between the amount of pension benefit and household spending for those who are eligible to claim pension benefits (sub-dataset). Likewise, the F test in the fixed-effect model suggests that individual effects do exist and the two-way fixed-effect model confirms that the time effect also exists, meaning there is a statistically significant difference between personal household consumption in 2011 and 2013. The Hausman test suggests that we cannot reject the null hypothesis that a random-effect model is reasonable.

Table 4.

Estimation of the effect of pension benefits on household consumption.

Although the estimated coefficients of pension benefits vary among different panel models, a trend could be identified after taking the coefficients of interaction terms into account. The coefficient of the interaction terms becomes negative as the income quantile increases, which implies that the impact of pension benefits on household consumption becomes smaller as income increases. This is especially obvious in the random-effect model. Results from model (4) in Table 4, indicate that, compared with individuals in the first income quantile, one yuan increase in pension benefit for those in the third income quantile group was associated with 0.05 yuan less consumption, though it is not statistically significant. Meanwhile, the marginal propensity to consume decreases slightly by 0.02, and 0.03 for the fourth and the fifth income-quantile groups while it drops significantly by 0.07, 0.11, 0.08, 0.10, and 0.08 for the subsequent higher income groups, respectively, compared with the lowest income group. That is to say, as pension benefit increases, retirees in lower income groups tend to spend a higher proportion of the increase in pension benefit on consumption than retirees in higher income groups.

Moreover, a one-yuan increase in assets brings 0.01 yuan growth in consumption, which is consistent with the permanent income hypothesis. Similar to the result in model 2, Table 3, household scale still has a negative impact on household consumption in models 1–4 in Table 4, which could be attributed to the saving motivation for the future, and thus crowd out current consumption. Years of schooling has a statistically significant positive impact on household consumption (models 1 and 4, Table 4). According to the random-effect model, a one-year increase in education will lead to approximately 140 yuan increase in consumption, which might be explained as due to the more educated consuming beyond the basic level; for example, entertainment, training, and fitness. Additionally, Hukou status allows us to explain the variance of household consumption: people with non-agricultural Hukou tend to spend 904 yuan more on living expenditures than agricultural Hukou holders, as demonstrated in model 4, Table 4.

5. Conclusions, Implications, and Limitations

In order to better answer the question of “how does the public pension system influence individual consumption in China”, this paper constructs panel data models based on the latest and nationally representative CHARLS survey data conducted in 2011 and 2013. Public pensions in China are measured by two dimensional perspectives: one is the participation in various public pension systems, reflecting the coverage of public pension schemes; the other is the amount of pensions, reflecting the benefit level for retirees. The estimation of the effect of enrolment in different public pensions on household consumption shows that individuals participating in the urban employees’ public pension system as well as the urban and rural residents’ public pension system tend to consume more than their non-participating counterparts in respective income-quantile groups (see Table 3). Furthermore, the estimation of the effect of pension benefits on household consumption indicates that lower income groups have a larger marginal propensity to consume than higher income groups with every unit increase of retirees’ pension benefits (see Table 4). Additionally, the results also suggest that the absolute income hypothesis, permanent income hypothesis and life-cycle hypothesis are applicable to explain the relationship between pension and consumption in China because the variables of income and assets, family size, and number of children are statistically significant in some of the models.

What implications we could obtain from the analysis are as follows. As is well known, domestic consumption, together with investment and net export, is one of the three main motives for economic growth. Economic development, in return, would increase the scope and the depth of public pension program, leading to a higher level of welfare and social equity. Such interactions among the public pension, domestic consumption and economic development guarantee the sustainability of a social program in the long run, eventually promoting the individual’s welfare. The implication for future policy-making is that in order to achieve a virtuous cycle of a public pension system and economic development, it is necessary for China to enhance its pension system to cover the most economically vulnerable population (those in the lowest income group). This is because our analyses suggest that lower income groups tend to spend a higher proportion of pension benefit on consumption than higher income groups. Therefore, an increase in pension benefit is likely to have a larger effect on consumption for poor people. Specifically speaking, public pension systems should first cover the lowest-income group, not to leave out anyone in need. Additionally, guaranteeing government subsidies and raising pension benefits step by step, especially for the most vulnerable group, will ensure their confidence in the future and thus may boost consumption for socio-economically sustainable development.

Several limitations of this research deserve mention. Firstly, this research is only to predict the relationship rather than investigate the causal effect between public pensions and household consumption. As a consequence, reversed causality generated by endogeneity might be a potential threat to the validity of the conclusions in predicting results in such a survey data model [38], although efforts have been made to minimize endogeneity by using panel data to eliminate unobservable heterogeneities and by controlling income groups to avoid self-selection of public pension schemes. Secondly, the dynamic relationship between public pensions and household consumption could not be fully captured due to the unavailability of data. It might be helpful to construct dynamic panel data models based on several waves of data to better fit the life-cycle theoretical framework in the future.

Acknowledgments

This research is supported by the National Social Science Foundation of China (Key Project No. 15AJL012) and China Scholarship Council. The first author would like to appreciate the studying experience provided by the Oxford Institute of Population Ageing and would like to thank Kenneth Howse from the institute for his helpful suggestions for the research. We must also give credit to the three anonymous reviewers for their helpful comments and suggestions. Special thanks are also due to Shouji Sun from the University of International Business and Economics and Andy Eggers from the University of Oxford, for their kind guidance on data mining. We are grateful to Maggie Charles from the Language Centre, University of Oxford for her good advice on academic writing. Lastly we acknowledge the support from the CHARLS team from Peking University for all the data provided and interactions online.

Author Contributions

Zhen Li and Qing Zhao conceived and designed the project; Qing Zhao analyzed the data; Taichang Chen contributed analysis tools; Zhen Li and Taichang Chen modified structures of the analysis; Qing Zhao wrote the paper.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Baldock, J.; Manning, N.; Miller, S.; Vickerstaff, S. Social Policy; Oxford University Press: Oxford, UK, 1999; p. 107. [Google Scholar]

- Holzman, R.; Hinz, R. Old-Age Income Support in the 21st Century: An International Perspective on Pension Systems and Reform; The World Bank: Washington, DC, USA, 2005; pp. 55–57. [Google Scholar]

- Feldstein, M. Social security, induced retirement, and aggregate capital accumulation. J. Political Econ. 1974, 82, 905–926. [Google Scholar] [CrossRef]

- Feldstein, M. Social security and saving: New time series evidence. Natl. Tax J. 1996, 49, 151–164. [Google Scholar]

- Blake, D. The impact of wealth on consumption and retirement behaviour in the UK. Appl. Financ. Econ. 2004, 14, 555–576. [Google Scholar] [CrossRef]

- Leimer, D.R.; Lesnoy, S.D. Social-security and private saving: new time-series evidence. J. Political. Econ. 1982, 90, 606–629. [Google Scholar] [CrossRef]

- Barro, R.J.; Macdonald, G.M. Social-security and consumer spending in an international cross-section. J. Public Econ. 1979, 11, 275–289. [Google Scholar] [CrossRef]

- Modigliani, F.; Sterling, A. Determinants of Private Saving with Special Reference to the Role of Social Security—Cross-country Tests. In The Determinants of National Saving and Wealth; Palgrave Macmillan: London, UK, 1983; pp. 24–55. [Google Scholar]

- Feng, J.; He, L.; Sato, H. Public Pension and Household Saving: Evidence from Urban China. J. Comp. Econ. 2011, 39, 470–485. [Google Scholar] [CrossRef]

- Zhang, J. Effects of Social Security Wealth on the Consumption of Chinese Urban Households. J. Shandong Univ. 2008, 3, 105–112. (In Chinese) [Google Scholar]

- Shi, Y.; Wang, M. The Effect of PAYG Pension Insurance on Savings. J. Quant. Tech. Econ. 2010, 3, 96–106. (In Chinese) [Google Scholar]

- Yue, A.; Yang, C.; Chang, F.; Tian, X.; Shi, Y.; Luo, R.; Yi, H. Effects of New Rural Old-Age Social Insurance on Households’ Daily Expenditure. Manag. World 2013, 8, 101–108. (In Chinese) [Google Scholar]

- Bai, C.; Wu, B.; Jin, Y. Effects of the Old-Age Insurance Contribution on Consumption and Savings. Soc. Sci. China 2012, 8, 48–71. (In Chinese) [Google Scholar]

- Zou, H.; Yu, K.; Li, A. A Study on Effects of Pension Insurance and Health Insurance on Urban Household Consumption. Stat. Res. 2013, 30, 60–67. (In Chinese) [Google Scholar]

- Li, X.; Zhu, C. Social Security and China’s Household Saving Rate: An Empirical Study Based on China’s Dynamic Panel Data at the Provincial Level. J. Xiamen Univ. 2011, 3, 24–31. (In Chinese) [Google Scholar]

- Su, C.; Li, X. The Impact of Social Security on Urban Residents’ Consumption: A Case of Shandong Province. J. Shandong Univ. 2012, 6, 81–86. (In Chinese) [Google Scholar]

- Browning, M.; Crossley, T.F. The Life-Cycle Model of Consumption and Saving. J. Econ Perspect. 2001, 15, 3–22. [Google Scholar] [CrossRef]

- Deaton, A. Understanding Consumption; Oxford University Press: New York, NY, USA, 1992; p. 177. [Google Scholar]

- The Royal Swedish Academy of Sciences. Angus Deaton: Consumption, Poverty and Welfare. Available online: http://www.nobelprize.org/nobel_prizes/economic-sciences/laureates/2015/advanced-economicsciences2015.pdf (accessed on 3 August 2016).

- Curtis, C.C.; Lugauer, S. Demographics and Aggregate Household Saving in Japan, China and India; NBER Working Paper No. 21555; NBER: Cambridge, MA, USA, 2015. [Google Scholar]

- Lugauer, S.; Mark, N.C. The Role of Household Saving in the Economic Rise of China; HKIMR Working Paper No. 04/2013; HKIMR: Hong Kong, China, 2013. [Google Scholar]

- Lugauer, S.; Ni, J.; Yin, Z. Micro-Data Evidence on Family Size and Chinese Household Saving Rates. Available online: https://ideas.repec.org/p/nod/wpaper/023.html (accessed on 1 August 2016).

- Song, Z.; Storesletten, K.; Wang, Y.; Zilibotti, F. Sharing High Growth across Generations: Pensions and Demographic Transition in China. Am. Econ. J.: Macroecon. 2015, 7, 1–39. [Google Scholar] [CrossRef]

- The Royal Swedish Academy of Sciences. Consumption, Great and Small. The Prize in Economic Sciences 2015. Available online: https://www.nobelprize.org/nobel_prizes/economic-sciences/laureates/2015/popular-economicsciences2015.pdf (accessed on 1 August 2016).

- Chen, T. Pension System in China: An Overview. In International Handbook of Ageing and Public Policy; Harper, S., Hamblin, K., Eds.; Edward Elgar: Cheltenham, UK, 2014; pp. 318–331. [Google Scholar]

- National Bureau of Statistics of China. China Statistical Yearbook 2014. Available online: http://www.stats.gov.cn/tjsj/ndsj/2014/indexch.htm (accessed on 20 April 2016).

- Ando, A.; Modigliani, F. The life-cycle hypothesis of saving—aggregate implications and tests. Am. Econ. Rev. 1963, 53, 55–84. [Google Scholar]

- Zhang, S. Age Structure, Social Insurance and Urban Residents’ Saving. J. Zhongnan Univ. Econ. Law 2009, 3, 78–83. (In Chinese) [Google Scholar]

- Zhong, S.; Li, K. The Impact of Dependence Ratio on Household Savings Rate. Chin. J. Popul. Sci. 2009, 1, 42–51. (In Chinese) [Google Scholar]

- Curtis, C.C.; Lugauer, S.; Mark, N.C. Demographic Patterns and Household Saving in China. Am. Econ. J. Macroecon. 2015, 7, 58–94. [Google Scholar] [CrossRef]

- Deaton, A. The Analysis of Household Surveys: A Microeconometric Approach to Development Policy; The Johns Hopkins University Press: Washington, DC, USA, 2000; pp. 105–106. [Google Scholar]

- Cameron, A.C.; Trivedi, P.K. Microeconometrics Using Stata; Stata Press: College Station, TX, USA, 2009; pp. 231–232. [Google Scholar]

- Zhao, Y.; Hu, Y.; Smith, J.P.; Strauss, J.; Yang, G. Cohort profile: China Health and Retirement Longitudinal Study (CHARLS). Int. J. Epidemiol. 2014, 43, 61–68. [Google Scholar] [CrossRef]

- Hou, J.; Li, K. The aging of the Chinese population and the cost of health care. Soc. Sci. J. 2011, 48, 514–526. [Google Scholar] [CrossRef]

- Li, X.; Zhang, W. The impacts of health insurance on health care utilization among the older people in China. Soc. Sci. Med. 2013, 85, 59–65. [Google Scholar] [CrossRef] [PubMed]

- Chen, T.; Turner, J. Gender and public pensions in China: Do pensions reduce the gender gap in compensation? Sustainability 2015, 7, 1355–1369. [Google Scholar] [CrossRef]

- China Health and Ageing Longitudinal Studies (CHARLS) Users Guide: 2011–2012 Baseline Survey. Available online: http://charls.ccer.edu.cn/ (accessed on 27 January 2016).

- Chen, T.; Leeson, G.; Liu, C. Living arrangements and intergenerational monetary transfers of older Chinese. Ageing Soc. 2016. [Google Scholar] [CrossRef]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).