Abstract

In this paper, we investigate the effect of an epidemic outbreak on consumer expenditures. In light of scanner panel data on consumers’ debit and credit card transactions, we present empirical evidence that outbreaks cause considerable disruption in total consumer expenditures with significant heterogeneity across categories. Our findings strongly imply that customers alter their behaviors to reduce the risk of infection. The estimated effect of an epidemic outbreak is qualitatively different from that of other macroeconomic factors. The implications of this research provide important guidance for policy interventions and marketing decisions aimed at sustaining economic growth.

1. Introduction

Infectious diseases have become more challenging and more complex to control. For example, the Ebola outbreak in West Africa, one of the deadliest occurrences of an epidemic, has killed more than 11,000 people in six countries since its first report in March 2014 [], and SARS, which originated in China in 2002, has infected over 2700 people and triggered an unprecedented campaign across nations to prevent its spread [].

Inevitably, on top of the direct medical costs of treating patients and implementing different controls for diseases, epidemics have devastating effects on the economy. Restrictions on the transportation of people and goods, commonly imposed in areas where the risk of infection is high, significantly disrupt outputs and exports, and the seeds of future growth are often hindered by undercuts in investment as investors lose their confidence in the market.

Apart from the impact of an epidemic outbreak on production and investment, a considerable negative influence to be noted is that an extreme event often imposes negative shocks on consumer expenditures at the other end. In particular, consumers often avoid travel and shun public places in an attempt to reduce the risk of getting infected, and this disruption in consumption influences the economy considerably. Consistently, conventional wisdom about the effect of a macroeconomic factor, such as gasoline prices and business cycles, is that a key mechanism by which a macroeconomic factor impacts the economy is through disruption of goods and services [].

Accordingly, understanding the indirect, but strong effects of epidemics on consumers’ willingness to buy would provide important implications and guidance for policymakers, as well as practitioners aiming to counteract disruption in the economy. However, little research has investigated how an epidemic outbreak affects individual shopping behaviors and consumption. Instead, studies have generally focused on the total burden of epidemics on populations based on aggregate data [,,].

The attention to individual consumer behaviors has been limited largely because microdata that would enable the measurement of indirect and behavioral effects of epidemics are not widely accessible to academics. Extant studies on extreme events heavily relied on aggregate spending data, which are generally measured at low frequencies, such as on a monthly or quarterly basis, and often subject to revision. Given this limited availability of microdata, attempts to assess the economic impact of epidemics without an understanding of individual consumers’ behaviors can provide only limited implications, because changes in these microeconomic variables are a root of these individual behaviors [].

In this paper, we explore the economic effect of an epidemic outbreak and provide substantive empirical evidence on how epidemic outbreaks impact the consumption and shopping behaviors of consumers. Using scanner panel data on individual consumers’ debit and credit card transactions, we found that the outbreak of an epidemic caused a substantial disruption in consumer expenditures with considerable heterogeneity across expenditure categories. In particular, consumers dramatically cut down expenditures at traditional shopping channels, but exhibited a substantial increase in e-commerce spending.

Our findings are particularly relevant in that the consumers’ response to the epidemic was attributable to a psychological factor, fear of contagion, rather than budgetary constraints. Considering the increasing challenges posed by infectious diseases given advances in transportation efficiency, our paper provides important implications for policy and interventions meant to sustain the economy when epidemics occur. For example, the improved policy environment for establishing and maintaining the e-commerce channel would lessen consumers’ fear of contagion from purchasing goods and services and may help manufacturers and retailers retain their sales. For the realization of sustainable economic growth with increasing concerns about more complicated epidemic outbreaks, of particular importance is the establishment and adoption of e-commerce as an alternative shopping channel.

The paper proceeds as follows. Section 2 explains the outbreak whose effects we will explore in this paper and discusses the related literature on the economic impact of extreme events. Section 3 describes the data. Section 4 presents preliminary analyses and their results. Section 5 provides the estimation methods and results. Finally, Section 6 discusses the implications of our findings, and Section 7 concludes.

2. Background

2.1. The MERS Outbreak in Korea

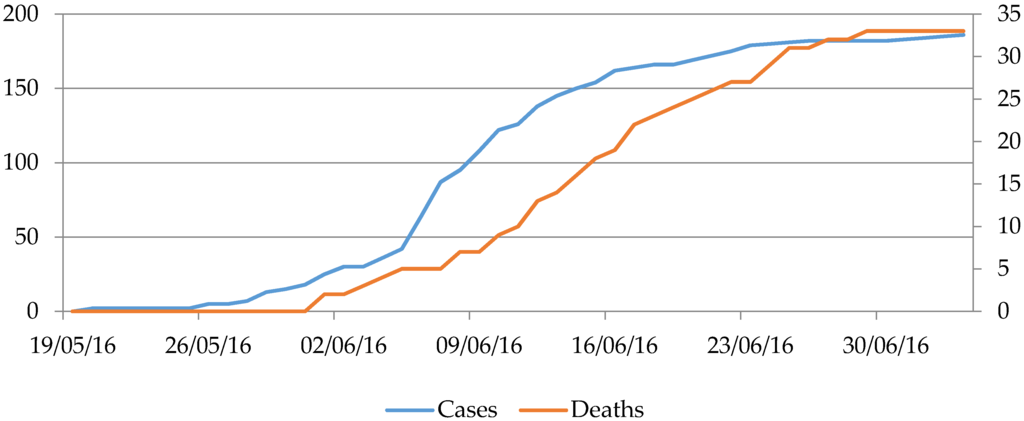

An outbreak of Middle East respiratory syndrome coronavirus (MERS) in South Korea began in May 2015. The outbreak started when a single male from South Korea who had traveled to the Middle East returned and transmitted the infection to the Korean population, in what became the largest outbreak of MERS outside the Middle East. The death toll from the outbreak was 36, with 186 confirmed cases; more than 6500 people in the country were isolated for the possible exposure to the disease. The last new case was reported on 5 July, and the last (36th) death from MERS was announced on 10 July. Figure 1 presents the number of deaths and confirmed cases [].

Figure 1.

Number of cases and death tolls.

The government was highly criticized for underestimating the danger of MERS and withholding the names of health facilities where MERS victims had been treated and visited in the early stage of the outbreak [,,,]. In accordance with widespread MERS fear, over 2200 schools were temporarily closed, and many patients canceled hospital appointments apparently out of fear of being exposed to the disease [].

Given the failure to effectively contain MERS, the South Korean government cut the country’s economic growth forecast for 2015 to 3.1% from the 3.8% projected in the previous year. More specifically, compared to those during the same period in the previous year, retail shops in South Korea faced a 3.4% decrease in sales, and department stores experienced a 16.5% decrease in sales [], according to the Minister of Strategy and Finance. The outbreak also raised international concerns, which led to over 100,000 canceled tourist visits to the nation []. In response, a stimulus package of over $13.5 billion was passed, and a 0.25-percentage-point cut in interest rates was offered by the Central Bank to help cushion the economic fallout from the outbreak [].

2.2. Related Literature

A rich body of literature in economics and marketing explores the impact of macroeconomic factors. For example, researchers describe how firms change their decisions regarding innovation and advertising during a recession with the particular focuses on the effectiveness of these proactive actions [,,] and examine the effect of business cycles on consumer confidence in the context of durable goods and private label sales [,,,]. These studies are, however, typically based on industry- or firm-level sales data and, therefore, provide little information about individual responses to changes in macroeconomic factors [].

As scanner panel data measured at low frequencies have become more widely available to academics, much attention has been paid to more disaggregate data to address the effects of macroeconomic factors on different variables of interest. For example, Gicheva, Hastings and Villas-Boas [] and Ma et al. [] explore the impact of gasoline prices on consumer shopping behaviors using daily scanner panel data and reveal that consumers exploited different avenues to save money on grocery shopping.

Yet, these studies focus on business cycles or gasoline prices, which are qualitatively different from the outbreak of an epidemic. More specifically, unlike epidemic outbreaks, macroeconomic factors, such as business cycles or gasoline prices, impact the economy mainly through disrupting consumers’ ability to buy rather than their psychological willingness to buy. For example, consumers become more price-sensitive as a result of the increasing financial hardship resulting from rising gasoline prices [,,] and rely on a wide range of efforts to save money [,]. Consequently, less is known about how the population responds to a transitory extreme event, such as epidemic outbreaks, and how a psychological factor (fear of contagion), rather than budgetary constraints, influences consumer behaviors.

In one of the few exceptions in the literature addressing an extreme event using high-frequency data, Galbraith and Tkacz [] investigate the economic burden of September 11 on consumption based on daily debit and credit card data. However, their results are subject to a strong restriction in that the data were also aggregated over individual consumers and categories and, therefore, provided limited implications about the effect of an extreme event on individual consumer behaviors. In turn, it is still an open question how the substantive changes in consumer expenditures occurred as a result of an extreme event.

Our paper contributes to these streams of research in the following respects. We explore the economic effect of an extreme event by analyzing how an epidemic outbreak influenced consumers by disrupting psychological willingness to spend. The detailed information on credit and debit cards transactions allowed us to comprehensively determine how changes in shopping behaviors arose from the fear of contagion, which is qualitatively different from other macroeconomic factors. Accordingly, our results have explicit and direct implications for policymakers and managers focused on maintaining sustainable economic growth.

3. Data

Our data come from a mobile phone application design and development firm in Korea. The company developed a household account book application that automatically records credit and debit card transactions. The application’s bookkeeping is based on text messages its users receive from credit card companies and banks. The application is available only in Korea and provided free of charge.

The available information for each transaction in the data included customer identifiers, date, time, amount paid and the name of the retail store. Additionally, retailer types and categories of expenditures were identified based on retail-store names and recorded by the data provider. The data included a variety of expenses, ranging from expenditures at restaurants, grocery stores and cafes to payments for gas and electronics. Although the data do not specify the list of products purchased in a given transaction nor show information about prices or promotions at stores, the extensive range of our data provided us with extremely detailed information on consumers’ shopping behaviors and expenditures on goods and services.

Our data included the records of retail transactions of 11,225 customers. However, among these 11,225 customers, the complete transaction data throughout 2014 and 2015 were available only for 1521 customers. The remaining 9704 customers did not remain registered for the application throughout the sample period due to late registration or dropping out of the service. These customers, on average, remained active only for 67 days and exhibited less than two transactions per month. Thus, we restrict our attention to the 1521 customers.

Table 1 summarizes the shopping behaviors of the 1521 customers. An average customer in this group engaged in 12.33 transactions and spent 633,863 won per month. More specifically, grocery expenditures made up the largest share of total expenditures, followed by expenditures on food outside the home and gasoline/transportation. Such an expenditure pattern is highly similar to that observed in the U.S., where expenditures on food account for a large component after housing expenditures. Table 2 describes the composition of our data and shows that, given that our data collection was based on a mobile phone application, most customers were below 50, and customers in their 20s and 30s accounted for 72.25% of the focal sample.

Table 1.

Number of monthly transactions and expenditures.

Table 2.

Number of customers.

As a sample that is not representative of the general population can produce erroneous inferences, such a sample composition therefore does raise concerns about the generalizability of our results. However, in the absence of systematic research on the economic burden resulting from a transitory extreme event, our data provide an opportunity to conduct such research. Moreover, the distinctive nature of our data, which capture consumers’ purchase and consumption behaviors in considerable detail, provides a comprehensive understanding of customer shopping behaviors not offered by data in other formats. Thus, the current data still provide important implications for practitioners and policymakers regarding sustainable growth in different industries. Nonetheless, we will address this particular aspect of our data later in this paper, after our empirical findings and their implications are discussed in detail.

4. Preliminary Analysis

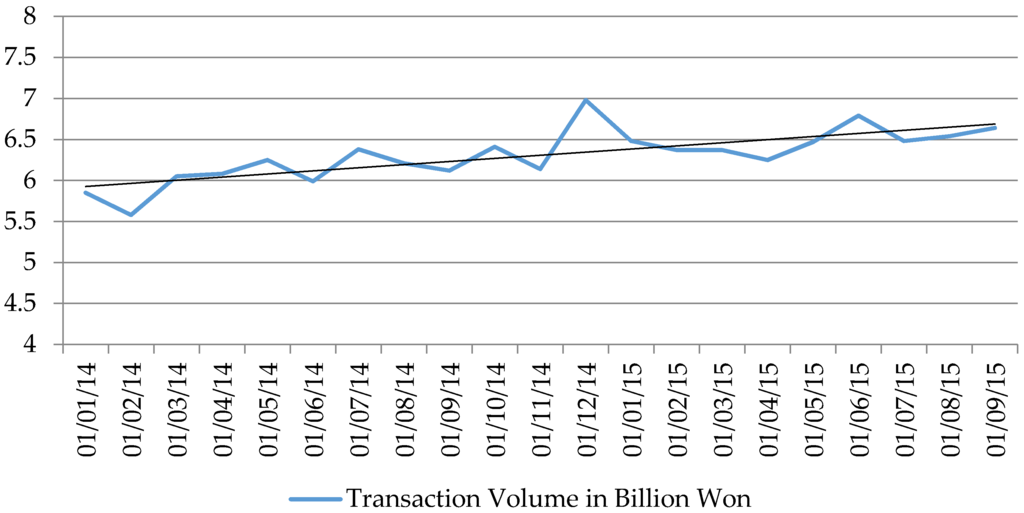

Using our data on credit and debit card purchases, we plotted weekly transactions from January 2014 to August 2015 in Figure 2 with a trend line. The first overarching point in Figure 2 is that the transaction volume exhibited steady growth, far exceeding the growth of the Korean economy. For example, total expenditures of the sample customers in the data increased from 5.85 billion won in January 2014 to 6.64 billion won in September 2015, exhibiting the standard deviation of 0.315 billion won. It is not clear how this pattern arose. This may have been due to the actual growth in debit and credit card transactions, as our sample consists of relatively young customers whose expenditures tend to rise quickly. On the other hand, the growing volume in credit and debit card transactions may have been due to the increased adoption of text services provided by credit and debit card companies. Upon finding the persistent pattern in the data, we understand the importance of this growth in the transaction volume and explicitly controlled for it in later analyses, although the primary purpose of our research did not include the identification of causes for this particular aspect.

Figure 2.

Transaction volume.

Beyond the growth in transaction volumes in 2014 and 2015, another noteworthy point in Figure 2 is that there was high variability around the Christmas holiday, followed by a considerable drop in January. This clear pattern in our data from South Korea is consistent with common behavioral patterns found in other parts of the globe []. In particular, in December 2014, the transaction volume was 7.71% and 13.68% higher, respectively, than in November 2014 and January 2015. We also took this holiday effect into account when evaluating the impact of the MERS outbreak in Korea and explicitly addressed the time trends in our empirical analysis.

Finally, most interesting is our finding that the transaction volume exhibited a significant drop beginning in June 2015. More specifically, the transaction volume in won decreased from 6.79 billion won in June to 6.48 billion won in July. This is particularly interesting in that, first, the period during which the drop occurred coincided with the period during which the MERS outbreak took place in Korea, and second, a considerable drop was not observed during the summer of 2014.

To understand how such a slowdown in transaction volume occurred in May and June of 2015, we examined the underlying components of expenditures. If the decrease in transaction volume arose from the disruption of consumption due to the fear of infection, it should have been limited to transactions through channels customers considered risky to use. On the other hand, if the drop in the transaction volume in May and June of 2015 was not systematically related to the outbreak, no particular differences should be observed in transaction volumes across categories.

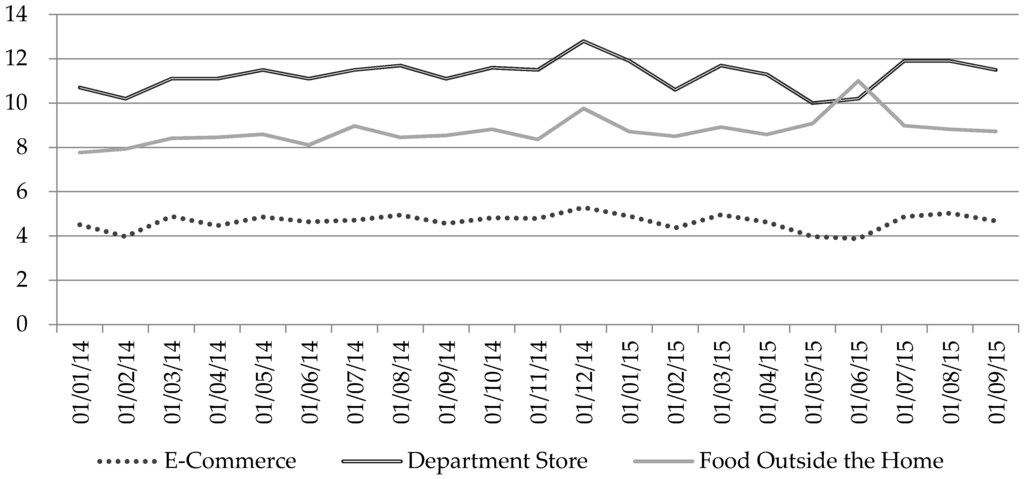

Among nine categories defined by the data provider, we restricted our attention to three that were appropriate for comparison. In particular, we chose two categories that customers would be likely to associate with the risk of contagion and one category that they would not. Figure 3 summarizes the changes in consumer expenditures in these categories between 2014 and 2015. Interestingly, across categories, consumer expenditures exhibited significantly different patterns. Consumers reduced their expenditures at department stores and on food outside the home. By contrast, e-commerce expenditures dramatically increased in May and June of 2015.

Figure 3.

Transaction volume in billion won by category.

Together with the disruption of expenditures at department stores and on food outside the home, the hike in the e-commerce transaction volume supports the argument that the considerable decrease in transaction volume was primarily attributable to consumers’ fear of contagion. This negative impact of the epidemic outbreak on consumer sentiments and behaviors was thus qualitatively different from that of other macroeconomic factors. Upon finding notable patterns in consumer expenditures, we developed formal models to investigate how the fear of infection influenced consumers, which we describe in the next section.

5. Models and Results

5.1. Total Expenditures

Based on credit and debit card transactions information, we explored the effect of the MERS outbreak in Korea with the focus on the changes in consumer total expenditures. The dependent variable is therefore total expenditures per week, and the model is of the following form:

where is consumer i’s total expenditures during week t and is the dummy indicating whether a new case of MERS had been reported in week t, to identify if week t is during the outbreak. Finally, is a set of controls for time trends, including dummies for year, month and Christmas holidays (last three weeks of December). The explanatory variables can be grouped into two sets. The first set estimates the effect of the outbreak, which is of central interest to our research, and the second set, variables indicating time periods and holiday seasons, controls for time trends and the holiday effect, addressed in the preliminary analysis.

Note that the model is specified in log-linear form, and therefore, coefficients are provided in percentages rather than absolute terms, following other studies that explore the macroeconomic effect on consumer expenditures (e.g., []). This is because we observed considerable variation in the magnitude of the expenditures across consumers and over time. However, we noted that the Box–Cox test reveals that the current log specification did not fit best (Table A1). Thus, we provided the estimation results for the model in the linear specification later in this subsection.

The model is estimated by an ordinary least squares regression. We allowed for first-order autocorrelation in the error terms, , as the Durbin–Watson test of the d statistics shows that the hypothesis of no first order serial correlation can be rejected, as shown in Table 3.

Table 3.

Estimation results for Model 1. MERS, Middle East respiratory syndrome coronavirus.

To aid interpretation of the coefficient estimates, note that the estimate of , the coefficient of our primary interest, measures the effect of the outbreak on consumer expenditures. Based on the considerable drop in expenditures during the MERS outbreak, described in the previous section, we expected a negative effect of .

Table 3 reports estimation results. Consistent with our expectation, the estimate of is statistically significant and negative. The results imply that customers lowered their expenditures by 7.31% during the outbreak. Such a considerable drop in consumer expenditures is as large as the effect of other macroeconomic factors. For example, Ma et al. [] predicted that a 100% increase in gasoline prices would reduce grocery expenditures by 6%, as consumers would switch from national brands to private labels [] and shift their spending from one store format to another to save money [,,]. This presents strong empirical evidence that the disruption of consumption, resulting from the fear of infection, is important enough to be relevant. Turning to variables controlling for the time trends and the holiday effect, Table 3 reveals that the effects were all statistically significant and intuitive. For example, during the holiday season, consumer expenditures increased by more than 9.96%, consistent with our findings in the preliminary analysis.

Having identified the significant effect of the MERS outbreak, we checked the robustness of the results. First, we replicate the analysis using a different variable to describe the effect of the outbreak. In particular, we used the number of new deaths in week t as a variable, hypothesizing that the disruption of consumption due to the fear of contagion might increase with the number of deaths. Second, while a number of economics and marketing studies employs the log-linear specification to examine consumer expenditures, we recognized that the model in a linear specification had a better fit in describing the impact of the MERS outbreak in our data. Therefore, using the number of new deaths reported during the week to describe the MERS effect and a linear model specification, we developed two additional models in the following forms:

Again, and are the variables of our key interest and measure the effect of the MERS outbreak on consumers’ expenditures.

The results are reported in Table 4. The estimates of and turned out to be statistically significant and negative in all replications, indicating that the effect of the MERS outbreak is significant. More specifically, customers, on average, reduced their expenditures by 1.24%, or by 43,517 won per week, for a unit increase in the number of deaths during the outbreak. Remember that, on average, 5.14 new deaths were reported per week during the outbreak and that total expenditures of an average customer were approximately 158,465 won ($135.44). Then, the current estimation results are fairly similar to the previous findings.

Table 4.

Estimation results for Models 2 and 3.

To sum up, after explicitly controlling for the time trends and heterogeneity across individual customers, we found converging empirical evidence that the MERS outbreak significantly disrupted consumer consumption. These results are consistent with past studies on macroeconomic factors, such as business cycles and gasoline prices. Yet, the findings we report here are particularly important, upon finding the descriptive evidence that the effect of the MERS outbreak arose from the fear of contagion. The effect could therefore differ from those of other macroeconomic factors in how consumer expenditures are influenced. Therefore, we address the underlying reason for the effects of this extreme event on consumer expenditures in the next section.

5.2. Expenditures in E-Commerce and Other Categories

To understand how the large change in expenditures arose more comprehensively, we examine how customers altered their expenditures in the different categories. Based on the preliminary findings that the considerable decrease in transaction volume was attributable to the psychological factor, quantifying changes in customer expenditures in different categories would further assure the importance of the establishment and adoption of e-commerce as an alternative shopping channel for sustainable economic growth during epidemic outbreaks.

Following the previous specification we employed to investigate total expenditures, we attempted to explicitly control for the heterogeneity in the effect of the MERS outbreak across the categories and developed the separate category-expenditure models in the following specification. This specification allowed us to identify mutually exclusive marginal effects of the MERS effect on consumer expenditures across categories, without imposing a restriction on the distributions of error terms for different categories. Similar to previous analyses, we allowed for first-order autocorrelation in the error terms, . Based on the behavioral patterns presented in Section 4, the main goal of our investigation is to quantify the differences in adjustments customers made across categories.

Table 5 gives the coefficient estimates of expenditure models for five categories and their standard errors (see Table A2 for other estimation results). First, focusing on three categories we examined in the preliminary analysis, coefficient estimates of in Table 6 are intuitive and consistent with our expectation. In particular, during the outbreak, consumers reduced their expenditures at department stores to the greatest extent by 18% and lowered expenditures on food outside the home by 8.24%. This statistically and economically significant negative effect is highly consistent with the behavioral patterns described in the preliminary analysis and with the report by the Minister of Strategy and Finance.

Table 5.

Estimation results for Model 4.

Even more important is the finding that, by contrast, consumers increased their e-commerce expenditures by 5.24%. This significant increase in e-commerce expenditures together with the disruption of expenditures at the above two traditional channels, where shopping would be accompanied by the risk of contagion, ensure that the MERS outbreak impacted consumers’ sentiments and consumption to a significant extent and led consumers to switch to e-commerce to prevent possible exposure to the disease.

Turning to consumer expenditures in other categories, Table 5 suggests that, during the MERS outbreak, consumers reduced their spending on recreation and culture by 6.87% and maintained relatively persistent expenditures on groceries. The null effect of on grocery expenditures may appear inconsistent with our prediction, but remember that groceries are often considered less affected by macroeconomic factors because they cannot be postponed []. Thus, we conclude that the estimation results of category expenditure models are intuitive.

In general, studies on macroeconomic factors and their effects on consumer shopping behaviors and consumption have focused on the disruption of economic abilities to explain decreases in spending and changes in store and brand choices. However, the findings we report here indicate that epidemics influence consumer behaviors through the fear of infection and psychological willingness to spend. Our results strongly suggest a qualitative difference between the effect of epidemic outbreaks and the effects of other macroeconomic factors, such as business cycles and gasoline prices. We believe our findings suggest an important implication for sustainable growth in the economy, which we will discuss in a greater detail in the next section.

6. Implications

In this study, we addressed the effect of an epidemic outbreak on consumer expenditures. Using scanner panel data on individual consumers’ debit and credit card transactions, we found that the outbreak of an epidemic caused a substantial disruption of consumer expenditures. However, the negative effect was not prevalent across all categories of expenditures, and the significant drop in expenditures was limited to traditional shopping channels, which consumers are likely to consider risky during an outbreak. By contrast, consumers switched to e-commerce to prevent the possible exposure to the disease.

Based on our empirical findings, one implication we can consider for manufacturers and retailers is that they may lessen the considerable negative shocks of epidemic outbreaks by developing and improving e-commerce as an alternative shopping channel. In many industrialized countries, a significant share of the population uses the Internet, and the rate of online shopping adoption has been persistently growing. For example, among adults in the United States, 84% use the Internet [], and over half (57.4%) of the U.S. population shopped online during 2015 []. A similar pattern was observed in Korea, in that, among population ages three and above, 83.6% used the Internet and 51.3% have bought products or goods online by desktop, mobile, tablet or other online devices in 2014 [].

Despite the considerable increase in the adoption of e-commerce, however, e-commerce still makes up only a minor share of total retail sales. For example, only 7.1% of total retail sales were made through e-commerce in the U.S., and the expenditures through e-commerce constitute the lowest share of the total expenditures, following the expenditures on culture and recreation. One account that can explain the relatively small volume of transactions made through e-commerce is that online retail is still restricted to big names and that only a limited share of small stores are selling products online []. This is largely because attracting customers in an online environment is often considered much more challenging than in a traditional business environment [], as lack of trust, one of the most frequently-cited reasons for consumers not purchasing through e-commerce, could be more problematic for small retailers [].

It is beyond the scope of our paper to do a complete counterfactual analysis. However, we suggest that our empirical findings would be useful for understanding the effect of policies that influence the e-commerce adoption, and a back-of-the-envelope calculation can give some context to our results. For example, suppose that the transaction volume made through e-commerce increased to 10% from 5.36% of the total retail sales, based on the improved policy environment for e-commerce adoption. Such a growth occurred at the expense of department stores, and their retail share decreased to 5.7% from 10.34% of the total retail sales. Then, our findings suggest that the decrease in expenditures at department stores would have remained at 55.12% of its current level.

The implications we provide in this subsection are important particularly for developing countries, where internet access to information networks is expensive and policies promoting trust confidence among e-commerce participants are not yet compatible with international norms. Yet, we caution that our approach in this section is largely descriptive and that the account we propose may not be well suited for conclusive validation and testing based on our data. Furthermore, our analysis should be interpreted with some care, because it does not represent what is commonly considered to motivate individuals and firms to accept e-commerce services [,,,]. Instead, our primary objective in this discussion is to propose a particular implication for practitioners and policymakers and to stimulate further research to investigate our argument.

7. Conclusions

Through a series of analyses, we addressed the effect of an epidemic outbreak on consumer expenditures. Our empirical investigation presented empirical evidence that the outbreak of an epidemic caused a substantial disruption of consumer expenditures, while the negative effect was not prevalent across all categories of expenditures. Our findings are particularly important, in that studies on macroeconomic factors have generally focused on the disruption of economic abilities. However, such an explanation is not appropriate for predicting the effect of an epidemic outbreak, which results from fear of contagion. As a result, the implications of our research provide important guidance for policy intervention and marketing decisions for sustainable growth in the economy despite the more challenging and more complex epidemic outbreaks.

We note the limitation of our study. As the data collection was based on credit and debit card transactions, the data do not contain the information on cash payments and withdrawals, and therefore, the implications we make in this paper may not be eligible when customers engage in a different type of payment method. Moreover, customers in the sample can be considered self-selected given the nature of the data, and the estimation sample is fairly small. Although it is likely that the decision of adopting the household account book application is positively correlated with the adoption of online shopping, ensuring that the composition of our data neither exaggerate the negative shock of the epidemic outbreak on total expenditures nor overstate the consumers’ adjustment we found in our empirical analyses, as a result, our results must be interpreted with caution. However, in the absence of systematic research on the economic burden resulting from an epidemic outbreak, we consider our data as a useful alternative to the existing sources and believe that our findings are important for practitioners and policymakers regarding sustainable growth in different industries.

Acknowledgments

The authors thank their research assistant, Janice Choi, for her contribution to this work. This work was supported by the Hongik University new faculty research support fund.

Author Contributions

Kihoon Hong conceived and designed the empirical model; Eunjung Hyun analyzed the data; Hojin Jung and Minjae Park wrote the paper.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix

Table A1.

Box–Cox test statistics.

| Dependent Variable | Restricted Log Likelihood | Likelihood-ratio Statistic Chi-Squared | p-Value |

|---|---|---|---|

| −660,362.85 | 1.3 × 105 | 0.000 | |

| −623,973.29 | 59,917 | 0.000 | |

| −603,792.15 | 19,554 | 0.000 |

Table A2.

Expenditure models for other three categories.

| Variable | Health/Medical Expenses | Gasoline/Transportation | Others |

|---|---|---|---|

| MERS | −0.0125 (0.0152) | −0.0236 (0.0237) | −0.1243 (0.0198) |

| Holidays | −0.0018 (0.0048) | 0.0024 (0.0149) | 0.1425 (0.0145) |

| Year | 0.0257 (0.0114) | 0.0389 (0.0122) | 0.0421 (0.0135) |

| February | 0.0235 (0.0112) | 0.0421 (0.0142) | 0.0314 (0.0148) |

| March | 0.0287 (0.0114) | 0.0485 (0.0174) | 0.0402 (0.0143) |

| April | 0.0307 (0.0121) | 0.0501 (0.0175) | 0.0423 (0.0163) |

| May | 0.0348 (0.0128) | 0.0512 (0.0176) | 0.0487 (0.0147) |

| June | 0.0317 (0.0111) | 0.0542 (0.0182) | 0.0523 (0.0175) |

| July | 0.0387 (0.0138) | 0.0602 (0.0192) | 0.0546 (0.0167) |

| August | 0.0410 (0.0128) | 0.0621 (0.0188) | 0.0578 (0.0158) |

| September | 0.0453 (0.0125) | 0.0638 (0.0184) | 0.0621 (0.0176) |

| October | 0.0415 (0.0134) | 0.0628 (0.0172) | 0.0624 (0.0163) |

| November | 0.0487 (0.0121) | 0.0701 (0.0178) | 0.0638 (0.0175) |

| December | 0.0501 (0.0108) | 0.0724 (0.0165) | 0.0582 (0.0164) |

| Intercept | 8.674 (0.0144) | 9.2452 (0.0108) | 10.0214 (0.0088) |

| Number of Observations | 138,298 | 138,384 | 138,410 |

| Number of Customers | 1521 | 1521 | 1521 |

Note: Standard errors are shown in parentheses. * p < 0.05; ** p < 0.01.

References

- Ebola: Mapping the Outbreak. Available online: http://www.bbc.com/news/world-africa-28755033 (accessed on 31 January 2016).

- Severe Acute Respiratory Syndrome (SARS) Multi-Country Outbreak—Update 6. Available online: http://www.who.int/csr/don/2003_03_21/en/ (accessed on 27 April 2016).

- Hamilton, J.D. Causes and Consequences of the Oil Shock of 2007–08; National Bureau of Economic Research: New York, NY, USA, 2009. [Google Scholar]

- Bloom, D.E.; Mahal, A.S. Does the AIDS epidemic threaten economic growth? J. Econ. 1997, 77, 105–124. [Google Scholar] [CrossRef]

- Gubler, D.J. Epidemic dengue/dengue hemorrhagic fever as a public health, social and economic problem in the 21st century. Trends Microbiol. 2002, 10, 100–103. [Google Scholar] [CrossRef]

- Kalia, M. Assessing the economic impact of stress [mdash] The modern day hidden epidemic. Metabolism 2002, 51, 49–53. [Google Scholar] [CrossRef] [PubMed]

- Deleersnyder, B.; Dekimpe, M.G.; Sarvary, M.; Parker, P.M. Weathering tight economic times: The sales evolution of consumer durables over the business cycle. Quantit. Mark. Econ. 2004, 2, 347–383. [Google Scholar] [CrossRef]

- Middle East Respiratory Syndrome Coronavirus (MERS-CoV)—Republic of Korea. Available online: http://www.who.int/csr/don/07-july-2015-mers-korea/en/ (accessed on 31 January 2016).

- Fear in the Air. Available online: http://www.economist.com/news/asia/21653731-fear-air (accessed on 31 January 2016).

- Mers Prompts Hong Kong to Declare ‘Red Alert’ on South Korea Travel. Available online: http://www.newsweek.com/mers-prompts-hong-kong-declare-red-alert-south-korea-travel-341093 (accessed on 31 January 2016).

- South Korea Replaces Health Minister Criticized over MERS Outbreak. Available online: http://www.reuters.com/article/us-health-mers-southkorea-idUSKCN0Q90JJ20150804 (accessed on 31 January 2016).

- South Korean Schools Reopen Despite Widespread MERS Fear. Available online: http://newsok.com/article/feed/852330 (accessed on 31 January 2016).

- Park, J.-M.; Kim, S. Secrecy Surrounding MERS Outbreak Fuels Fear, Confusion In South Korea. Available online: http://www.huffingtonpost.com/2015/06/02/south-korea-mers-outbreak_n_7492380.html (accessed on 31 January 2016).

- Park, M.; Kwon, K.J.; Kim, J.-E. WHO calls MERS Outbreak a ‘Wakeup Call’. Available online: http://edition.cnn.com/2015/06/15/asia/south-korea-mers-outbreak (accessed on 31 January 2016).

- S Korea Cuts Interest Rates to Record Low Amids Mers Concerns. Available online: http://www.bbc.com/news/business-33089930 (accessed on 31 January 2016).

- Frankenberger, K.D.; Graham, R.C. Should firms increase advertising expenditures during recessions? MSI Rep. 2003, 3, 65–85. [Google Scholar]

- Srinivasan, R.; Rangaswamy, A.; Lilien, G.L. Turning adversity into advantage: Does proactive marketing during a recession pay off? Int. J. Res. Mark. 2005, 22, 109–125. [Google Scholar] [CrossRef]

- Allenby, G.M.; Jen, L.; Leone, R.P. Economic trends and being trendy: The influence of consumer confidence on retail fashion sales. J. Bus. Econ. Stat. 1996, 14, 103–111. [Google Scholar]

- Kumar, V.; Leone, R.P.; Gaskins, J.N. Aggregate and disaggregate sector forecasting using consumer confidence measures. Int. J. Forecast. 1995, 11, 361–377. [Google Scholar] [CrossRef]

- Lamey, L.; Deleersnyder, B.; Dekimpe, M.G.; Steenkamp, J.-B.E. How business cycles contribute to private-label success: Evidence from the United States and Europe. J. Mark. 2007, 71, 1–15. [Google Scholar] [CrossRef]

- Ma, Y.; Ailawadi, K.L.; Gauri, D.K.; Grewal, D. An empirical investigation of the impact of gasoline prices on grocery shopping behavior. J. Mark. 2011, 75, 18–35. [Google Scholar] [CrossRef]

- Gicheva, D.; Hastings, J.; Villas-Boas, S. Investigating Income Effects in Scanner Data: Do Gasoline Prices Affect Grocery Purchases? Am. Econ. Rev. 2010, 100, 480–484. [Google Scholar] [CrossRef]

- Allenby, G.M.; Rossi, P.E. Quality perceptions and asymmetric switching between brands. Mark. Sci. 1991, 10, 185–204. [Google Scholar] [CrossRef]

- Du, R.Y.; Kamakura, W.A. Where did all that money go? Understanding how consumers allocate their consumption budget. J. Mark. 2008, 72, 109–131. [Google Scholar] [CrossRef]

- Jacobe, D. High gas prices causing consumer spending cuts. Gallup News Service, (May 24). 2016. Available online: http://www. gallup.com/poll/22918/high-gas-prices-causing-consumer-spendingcuts.aspx (accessed on 22 November 2010).

- Galbraith, J.W.; Tkacz, G. Analyzing Economic Effects of September 11 and Other Extreme Events Using Debit and Payments System Data. Can. Public Policy 2013, 39, 119–134. [Google Scholar] [CrossRef]

- Ailawadi, K.L.; Pauwels, K.; Steenkamp, J.-B.E. Private-label use and store loyalty. J. Mark. 2008, 72, 19–30. [Google Scholar] [CrossRef]

- Bell, D.R.; Ho, T.-H.; Tang, C.S. Determining where to shop: Fixed and variable costs of shopping. J. Mark. Res. 1998, XXXV, 352–369. [Google Scholar] [CrossRef]

- Bhatnagar, A.; Ratchford, B.T. A model of retail format competition for non-durable goods. Int. J. Mark. Res. 2004, 21, 39–59. [Google Scholar] [CrossRef]

- Luchs, R.; Inman, J.J.; Shankar, V. Channel Blurring: A Study of Cross-Retail Format Shopping Among US Households; working paper; Katz Graduate School of Business, University of Pittsburgh: Pittsburgh, PA, USA, 2007. [Google Scholar]

- Perrin, A.; Duggan, M. Americans’ Internet Access: 2000–2015. Available online: http://www.pewinternet.org/2015/06/26/americans-internet-access-2000-2015/ (accessed on 27 April 2016).

- Five 2015 Ecommerce Stats and Trends You Should Know About. Available online: http://www.pixelmedia.com/blog/5-ecommerce-stats-trends-you-should-know-about (accessed on 31 January 2016).

- Survey on the Internet Usage. Available online: http://isis.kisa.or.kr/board/?pageId=060300&bbsId=10&itemId=327&pageIndex=1 (accessed on 27 April 2016).

- Online Retailing: Britain, Europe, US and Canada 2015. Available online: http://www.retailresearch.org/onlineretailing.php (accessed on 27 April 2016).

- Bhattacherjee, A. Acceptance of e-commerce services: The case of electronic brokerages. IEEE Trans. Syst. Man Cybern. Part A: Syst. Hum. 2000, 30, 411–420. [Google Scholar] [CrossRef]

- Grabner-Kräuter, S.; Kaluscha, E.A. Empirical research in on-line trust: A review and critical assessment. Int. J. Hum.-Comput. Stud. 2003, 58, 783–812. [Google Scholar] [CrossRef]

- Agarwal, R.; Prasad, J. The role of innovation characteristics and perceived voluntariness in the acceptance of information technologies. Decis. Sci. 1997, 28, 557–582. [Google Scholar] [CrossRef]

- Brancheau, J.C.; Wetherbe, J.C. The adoption of spreadsheet software: Testing innovation diffusion theory in the context of end-user computing. Inf. Syst. Res. 1990, 1, 115–143. [Google Scholar] [CrossRef]

- Karahanna, E.; Straub, D.W.; Chervany, N.L. Information technology adoption across time: A cross-sectional comparison of pre-adoption and post-adoption beliefs. MIS Q. 1999, 23, 183–213. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations; Simon and Schuster: New York, NY, USA, 2010. [Google Scholar]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).