Optimal Financing Decisions of Two Cash-Constrained Supply Chains with Complementary Products

Abstract

:1. Introduction

1.1. Motivation

1.2. Review of Literature

- For our government, there are a lot of works that can be done for them, for instance, to conduct the initial public offering (IPO) and stock exchange [26], to set up some government connections with SMEs [27,28], to increase more and more affordable local financing supply [29], to produce a demonstration effect whereby successful SMEs supported by donor-backed programs [29], to implement some financial aid programs that focus on SME scarce availability of collateral [30].

- For SMEs, there are also several ways to solve their financing problems, for example, to increase enterprises’ internal capital efficiency to improve credit constraints [31,32], to seek some venture capitals [33], to get guarantee loans [34,35,36,37,38,39,40,41,42], to obtain pledge loans [43,44,45], to apply collateral loans [40,46,47,48,49,50]. In fact, it is not easy for SMEs to find some suitable guarantees for their financing loans, but it will get easier if SMES and their potential guarantees are members of the same supply chain alliance.

- For a supply chain [51], there exist supply chain effects of bankruptcy due to the financing guarantee, but there are enough incentives for the leader enterprises of a supply chain to help other members to get enough loans in order to preserve competition, improving supply chain efficiency and providing support for the exclusivity rule [52,53]. In some supply chain finance systems, the optimal expected profit under either financing mode would be higher than that in the case of no capital constraint or capital constrained without financing [54,55]. A lot of literatures showed that financing models can have great effects on the operation management of the supply chain members. [56,57,58,59,60,61,62,63,64]

1.3. Contributions

- We propose financing models by extending financing decision participants from a single supply chain [66] into two parallel supply chains with complementary products.

- With regard to all decision participants of two parallel supply chains with complementary products, we prove the best financing way for them is to make a joint financing decision.

1.4. Framework

2. Assumptions, Abbreviations and Notations

2.1. Assumptions

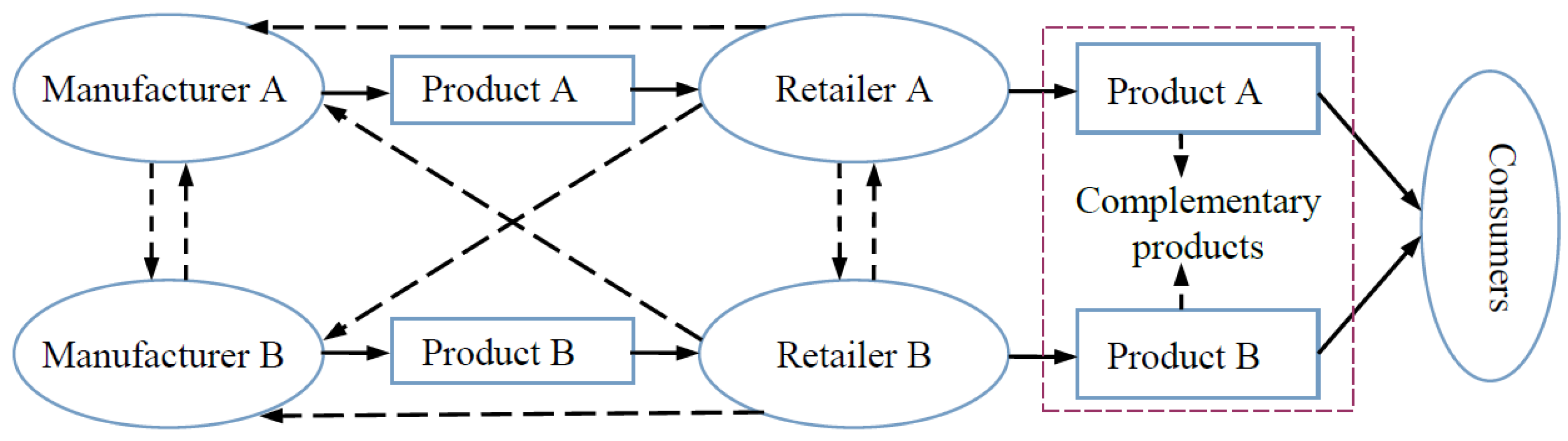

- Assumption 1: Each supply chain consists only of two players, i.e., a manufacturer and a retailer, as shown in Figure 1.

- Assumption 2: All players, lender, manufacturer and retailer, are all rational.

- Assumption 3: Manufacturers cannot afford all their desired production costs only with their initial capitals. Similarly, retailers’ initial capitals cannot fully cover their desired purchasing costs. Only if manufacturers and retailers have cash constraint problems, they will make their effort to get more cash. One of the best choices for manufacturers and retailers is to get some financing loans.

- Assumption 4: Lending rates remained unchanged. That is, the lending rate does not depend on financing amount, manufactures and retailers can get the loan with the same rate.

- Assumption 5: There is no defective product.

- Assumption 6: In dual supply chains, manufacturers are dominant, and retailers’ initial capitals are near zero. The probability for manufacturers and retailers to get loan by themselves is less than 1, but the probability for retailers is less than manufactures’.

2.2. Notation

3. A Financing Model of a Single Supply Chain

3.1. Independent Financing Decisions

3.1.1. Independent Financing Decisions of MA

- (1)

- If the lender gives MA a loan, its profit function iswhere ;

- (2)

- If the lender refuses to give MA a loan, its profit function iswhere .

3.1.2. Independent financing decisions of RA

- If RA can get a loan from its lender, its profit function can be determined by:

- If RA failed to get a loan, its profit function can be determined by:

3.1.3. Analyses on Independent Financing Decisions

3.2. Joint Financing Decisions of SCA

3.2.1. A Joint Financing Model

- If the lender provides a loan to SCA, profit functions of MA and RA arewhere ,

- If the lender refused their joint financing contract, the quantity equilibrium of MA's production and RA’s order satisfies . Therefore, their profit functions are written as

3.2.2. Analyses on Joint Financing Decisions

3.3. Comparisons of Independent Decisions and Joint Financing Decisions of SCA

- For MA, One can get its expected profit with the independent financing decision as shown in Equation (30) and its expected profit with the joint financing decision as follows.So their difference iswhich says the joint financing decision is better than the independent financing decision for MA.

- For RA, it is easy to get its expected profits with the independent decisions and joint financing decisions, respectively, as follows:Therefore, their difference iswhich shows RB is rational to make a joint financing decision rather than an independent financing decision.

4. A Joint Financing Model of SCA and SCB

4.1. A Joint Financing Model of SCA and SCB

4.2. Comparison of Different Financing Decisions of SCA and SCB

5. Numerical Study

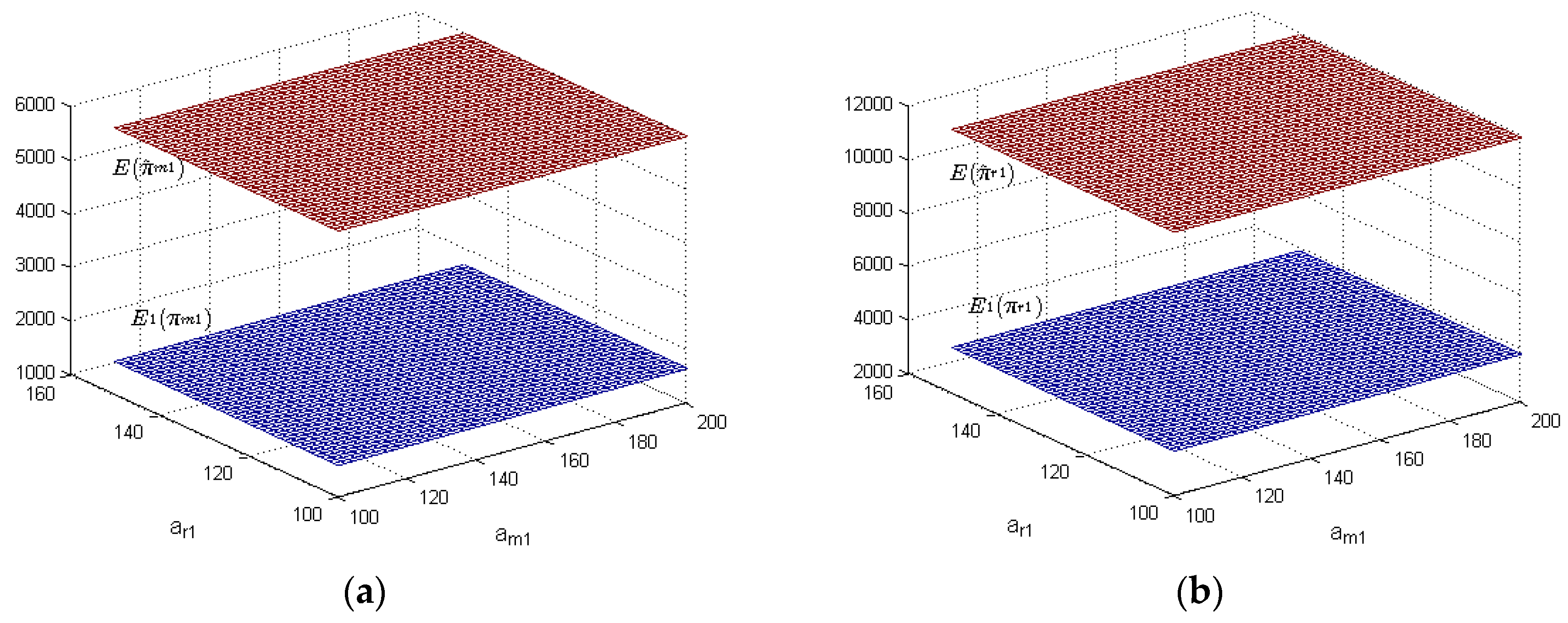

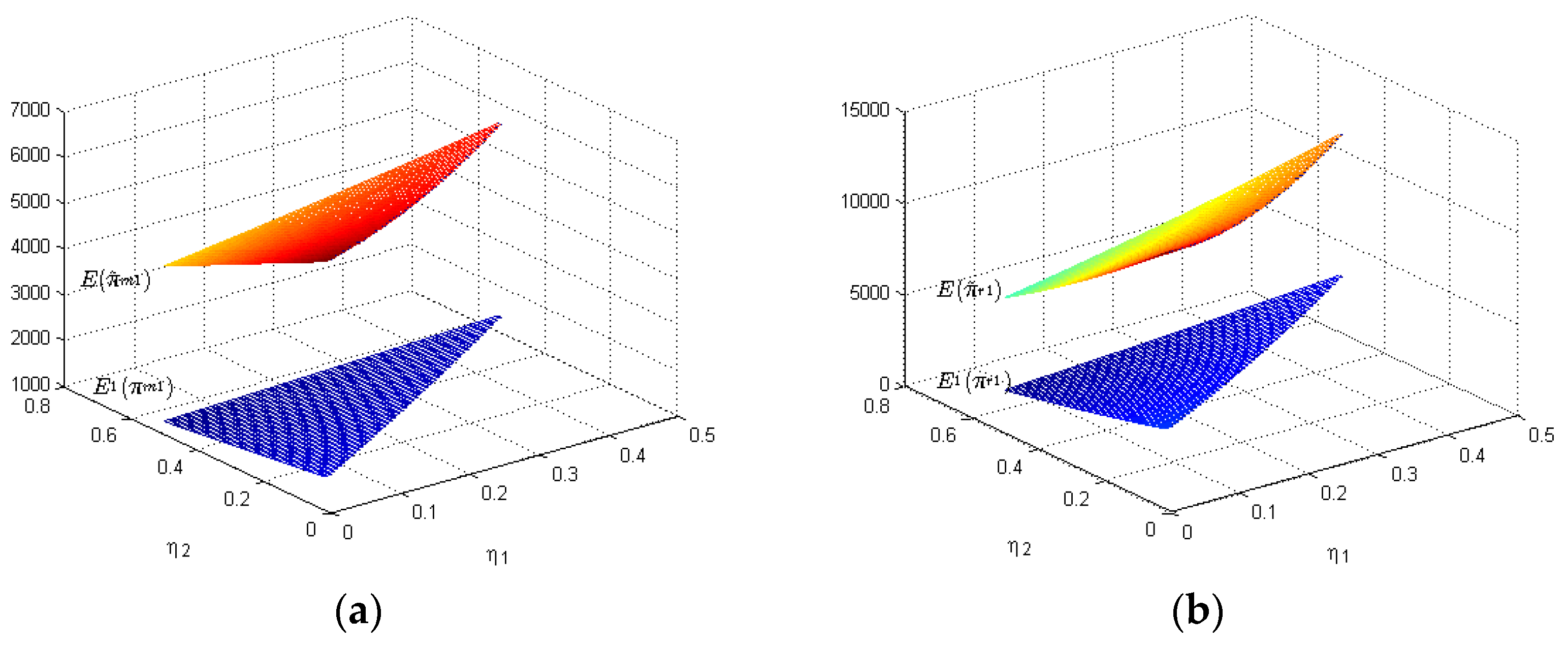

5.1. Simulations for the Financing Model of a Single Supply Chain

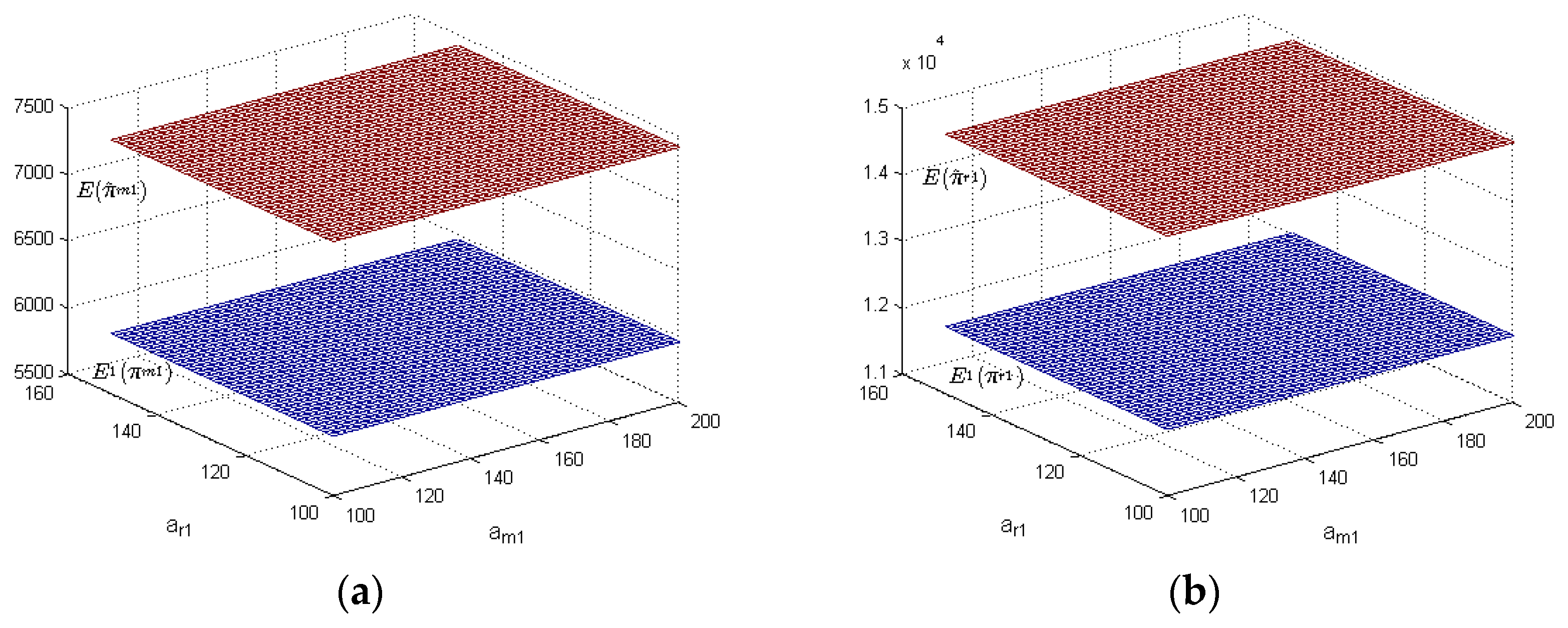

5.2. Simulations for the Joint Financing Model of SCA and SCB

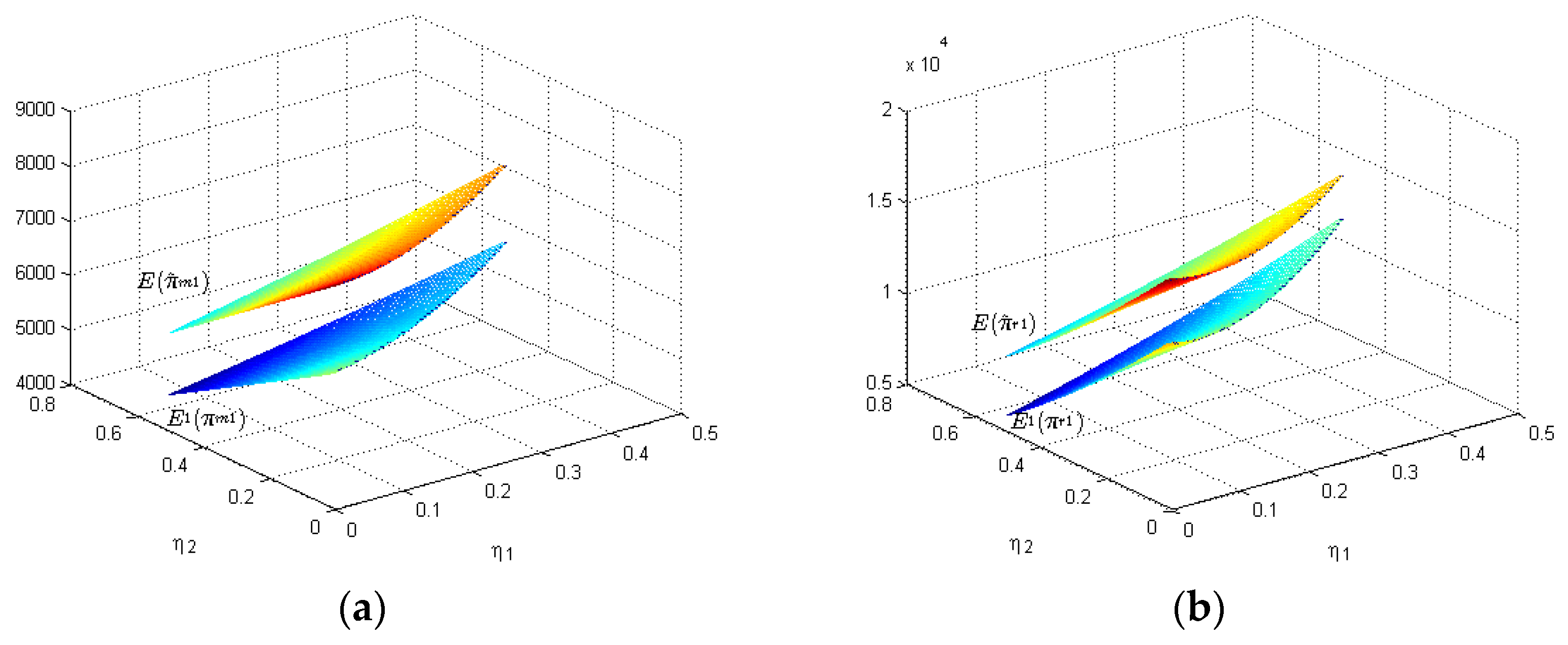

- Both MA and RA can obtain more profits with joint financing decisions than those with independent financing decisions.

- Bigger are cross-price sensitivity coefficients, higher are profits of MA and RA with independent financing decisions and joint financing decisions.

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| SMEs | Small and medium enterprises |

| SCA | The supply chain with the product A |

| SCB | The supply chain with the product B |

| MA | The manufacturer with product A |

| MB | The manufacturer with product B |

| RA | The retailer with product A |

| RB | The retailer with product B |

| MDA | The market demand for product A |

| MDB | The market demand for product B |

References

- Liu, X.; Zhou, L.; Wu, Y.-C.J. Supply Chain Finance in China: Business Innovation and Theory Development. Sustainability 2015, 7, 14689–14709. [Google Scholar] [CrossRef]

- Ni, J.Z.; Flynn, B.B.; Jacobs, F.R. Impact of product recall announcements on retailers׳ financial value. Int. J. Prod. Econ. 2014, 153, 309–322. [Google Scholar] [CrossRef]

- Wuttke, D.A.; Blome, C.; Henke, M. Focusing the financial flow of supply chains: An empirical investigation of financial supply chain management. Int. J. Prod. Econ. 2013, 145, 773–789. [Google Scholar] [CrossRef]

- Wang, Y.; Zhang, Y. Remanufacturer’s production strategy with capital constraint and differentiated demand. J. Intell. Manuf. 2014, 11, 1–14. [Google Scholar] [CrossRef]

- Sarkar, B.; Sana, S.; Chaudhuri, K. Optimal reliability, production lotsize and safety stockn economic manufacturing quantity model. Int. J. Manag. Sci. Eng. Manag. 2010, 5, 192–202. [Google Scholar]

- Sarkar, B.; Mandal, B.; Sarkar, S. Quality improvement and backorder price discount under controllable lead time in an inventory model. J. Manuf. Syst. 2014, 35, 26–36. [Google Scholar] [CrossRef]

- Sarkar, B.; Majumder, A. Integrated vendor-buyer supply chain model with vendor’s setup cost reduction. Appl. Math. Comput. 2013, 224, 362–371. [Google Scholar] [CrossRef]

- Sarkar, B.; Gupta, H.; Chaudhuri, K.; Goyald, S.K. An integrated inventory model with variable lead time, defective units and delay in payments. Appl. Math. Comput. 2014, 237, 650–658. [Google Scholar] [CrossRef]

- Cárdenas-Barrón, L.; Sarkar, B.; Treviño-Garza, G. Easy and improved algorithms to joint determination of the replenishment lot size and number of shipments for an EPQ model with rework. Appl. Math. Comput. 2013, 18, 132–138. [Google Scholar]

- Sarkar, B.; Saren, S. An inventory model with trade-credit policy and variable deterioration for fixed lifetime products. Ann. Oper. Res. 2014, 229, 677–702. [Google Scholar] [CrossRef]

- Sarkar, B. A production-inventory model with probabilistic deterioration in two-echelon supply chain management. Appl. Math. Model. 2013, 37, 3138–3151. [Google Scholar] [CrossRef]

- Chong, T.; Lu, L.; Ongena, S. Does Banking Competition Alleviate or Worsen Credit Constraints Faced by Small- and Medium-Sized Enterprises? Evidence from China. J. Bank. Financ. 2013, 37, 3412–3424. [Google Scholar] [CrossRef]

- Dong, Y.; Men, C. SME Financing in Emerging Markets: Firm Characteristics, Banking Structure and Institutions. Emerg. Mark. Financ. Trade 2014, 50, 120–149. [Google Scholar] [CrossRef]

- Ryan, R.M.; O’Toole, C.M.; McCann, F. Does bank market power affect SME financing constraints? J. Bank. Financ. 2014, 49, 495–505. [Google Scholar] [CrossRef]

- Archibald, T.W.; Thomas, L.; Betts, J.; Johnston, R. Should start-up companies be cautious? Inventory policies which maximise survival probabilities. Manag. Sci. 2002, 48, 1161–1174. [Google Scholar] [CrossRef]

- Cressy, R.; Olofsson, C. The financial conditions for Swedish SMEs: Survey and research agenda. Small Bus. Econ. 1997, 9, 179–192. [Google Scholar] [CrossRef]

- Berger, A.N.; Udell, G.F. The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle. J. Bank. Financ. 1998, 22, 613–673. [Google Scholar] [CrossRef]

- Meyer, L.H. The present and future roles of banks in small business finance. J. Bank. Financ. 1998, 22, 1109–1116. [Google Scholar] [CrossRef]

- Bernanke, B.S.; Blinder, A.S. The federal funds rate and the channels of monetary transmission. Am. Econ. Rev. 1992, 82, 901–921. [Google Scholar]

- Boschi, M.; Girardi, A.; Ventura, M. Partial credit guarantees and SMEs financing. J. Financ. Stab. 2014, 15, 182–194. [Google Scholar] [CrossRef]

- Serrasqueiro, Z.; Nunes, P.M. Financing behaviour of Portuguese SMEs in hotel industry. Int. J. Hosp. Manag. 2014, 43, 98–107. [Google Scholar] [CrossRef]

- Wolter, M.; Rösch, D. Cure events in default prediction. Eur. J. Oper. Res. 2014, 238, 846–857. [Google Scholar] [CrossRef]

- You, J.; Wang, L. Financing difficulty and cause analysis of small-and-medium-sized enterprises. J. Tongji Univ. (Nat. Sci.) 2004, 31, 1353–1358. (In Chinese) [Google Scholar]

- Zambaldi, F.; Aranha, F.; Lopes, H.; Politi, R. Credit granting to small firms: A Brazilian case. J. Bus. Res. 2011, 64, 309–315. [Google Scholar] [CrossRef]

- Bădulescu, D.; Bădulescu, A. Financial Constraints Facing SMEs: Some Theory and Evidence. Metal. Int. 2010, 15, 169–173. [Google Scholar]

- Dwyer, B.; Kotey, B. Financing SME Growth: The Role of the National Stock Exchange of Australia and Business Advisors. Aust. Account. Rev. 2015, 25, 114–123. [Google Scholar] [CrossRef]

- Al-Najjar, B. The Effect of Governance Mechanisms on Small and Medium-Sized Enterprise Cash Holdings: Evidence from the United Kingdom. J. Small Bus. Manag. 2015, 53, 303–320. [Google Scholar] [CrossRef]

- Ruziev, K.; Midmore, P. Connectedness and SME Financing in Post-Communist Economies: Evidence from Uzbekistan. J. Dev. Stud. 2015, 51, 586–602. [Google Scholar] [CrossRef]

- Haselip, J.; Desgain, D.; Mackenzie, G. Financing energy SMEs in Ghana and Senegal: Outcomes, barriers and prospects. Energ. Pol. 2014, 65, 369–376. [Google Scholar] [CrossRef]

- Briozzo, A.; Vigier, H. The role of personal loans in the financing of SMEs. Acad. Rev. Latinoam. Adm. 2014, 27, 209–225. [Google Scholar] [CrossRef]

- Andrés, P.D.; Fuente, G.D.; Martín, P.S. Capital budgeting practices in Spain. Bus. Res. Q. 2015, 18, 37–56. [Google Scholar] [CrossRef]

- Goyette, J.; Gallipoli, G. Distortions, Efficiency and the Size Distribution of Firms. J. Macroecon. 2015, 45, 202–221. [Google Scholar] [CrossRef]

- Berger, A.N.; Schaeck, K. Small and Medium-Sized Enterprises, Bank Relationship Strength, and the Use of Venture Capital. J. Money Credit Bank. 2011, 43, 461–490. [Google Scholar] [CrossRef]

- Booth, J.R.; Booth, L.C. Loan collateral decisions and corporate borrowing costs. J. Money Credit Bank. 2006, 38, 67–90. [Google Scholar] [CrossRef]

- Chakraborty, A.; Hu, C.X. Lending relationships in line-of-credit and nonline-of-credit loans: Evidence from collateral use in small business. J. Financ. Intermed. 2006, 15, 86–107. [Google Scholar] [CrossRef]

- Columba, F.; Gambacorta, L.; Mistrulli, P.E. Mutual Guarantee institutions and small business finance. J. Financ. Stab. 2010, 6, 45–54. [Google Scholar] [CrossRef]

- Garcia-Tabuenca, A.; Crespo-Espert, J.L. Credit guarantees and SME efficiency. Small Bus. Econ. 2010, 35, 113–128. [Google Scholar] [CrossRef]

- Honohan, P. Partial credit guaranteesrinciples and practice. J. Financ. Stab. 2010, 6, 1–9. [Google Scholar] [CrossRef]

- Levitsky, J. Credit guarantee schemes for SMEs–an international review. Small Enterprise Dev. 1997, 8, 4–17. [Google Scholar] [CrossRef]

- Ono, A.; Uesugi, I. Role of collateral and personal guarantees in relationship lending: Evidence from Japan’s SME loan market. J. Money Credit Bank. 2009, 41, 935–960. [Google Scholar] [CrossRef]

- Riding, A.L.; Haines, G. Loan guarantees: Costs of default and benefits to small firms. J. Bus. Ventur. 2001, 16, 595–612. [Google Scholar] [CrossRef]

- Zecchini, S.; Ventura, M. The impact of public guarantees on credit to SMEs. Small Bus. Econ. 2009, 32, 191–206. [Google Scholar] [CrossRef]

- Berger, A.N.; Cerqueiro, G.; Penas, M.F. Does debtor protection really protect debtors? Evidence from the small business credit market. J. Bank. Financ. 2011, 35, 1843–1857. [Google Scholar] [CrossRef]

- Comeig, I.; Fernández-Blanco, M.O.; Ramírez, F. Information acquisition in SME’s relationship lending and the cost of loans. J. Bus. Res. 2014, 68, 1650–1652. [Google Scholar] [CrossRef]

- De Haas, R.; Ferreira, D.; Taci, A. What determines the composition of banks’ loan portfolios? Evidence from transition countries. J. Bank. Financ. 2010, 34, 388–398. [Google Scholar] [CrossRef]

- Buzacott, J.A.; Zhang, R.Q. Inventory Management with Asset-Based Financing. Manag. Sci. 2004, 50, 1274–1292. [Google Scholar] [CrossRef]

- Hofmann, E. Inventory financing in supply chains logistics service provider-approach. Int. J. Phys. Distrib. Logist. Manag. 2009, 39, 716–740. [Google Scholar] [CrossRef]

- Niinimäki, J.-P. Nominal and true cost of loan collateral. J. Bank. Financ. 2011, 35, 2782–2790. [Google Scholar] [CrossRef]

- Rubin, J.; Wagner, R. Destroying collateralsset security and the financing of firms. Appl. Econ. Lett. 2015, 22, 704–709. [Google Scholar] [CrossRef]

- Voordeckers, W.; Steijvers, T. Business Collateral and Personal Commitments in SME Lending. J. Bank. Financ. 2006, 30, 3067–3086. [Google Scholar] [CrossRef]

- Zhao, L.; Huchzermeier, A. Operations–finance interface models: A literature review and framework. Eur. J. Oper. Res. 2015, 244, 905–917. [Google Scholar] [CrossRef]

- Rezaei, J.; Ortt, R.; Trott, P. How SMEs can benefit from supply chain partnerships. Int. J. Prod. Res. 2015, 53, 1527–1543. [Google Scholar] [CrossRef]

- Yang, S.A.; Birge, J.R.; Parker, R.P. The supply chain effects of bankruptcy. Soc. Sci. Electron. Publ. 2015, 61, 2320–2338. [Google Scholar] [CrossRef]

- Yan, N.; Dai, H.; Sun, B. Optimal bi-level Stackelberg strategies for supply chain financing with both capital-constrained buyers and sellers. Appl. Stoch. Models Bus. Ind. 2014, 30, 783–796. [Google Scholar] [CrossRef]

- Yan, N.; Sun, B. Comparative analysis of supply chain financing strategies between different financing modes. J. Ind. Manag. Optim. 2015, 11, 1073–1087. [Google Scholar] [CrossRef]

- Annadurai, K.; Uthayakumar, R. Analysis of partial trade credit financing in a supply chain by EOQ-based model for decaying items with shortages. Int. J. Adv. Manuf. Technol. 2012, 61, 1139–1159. [Google Scholar] [CrossRef]

- Feng, Y.; Mu, Y.; Hu, B.; Kumar, A. Commodity options purchasing and credit financing under capital constraint. Int. J. Prod. Econ. 2014, 153, 230–237. [Google Scholar] [CrossRef]

- Jing, B.; Chen, X.; Cai, G.G. Equilibrium financing in a distribution channel with capital constraint. Prod. Oper. Manag. 2012, 21, 1090–1101. [Google Scholar] [CrossRef]

- Jing, B.; Seidmann, A. Finance sourcing in a supply chain. Decis. Support Syst. 2014, 58, 15–20. [Google Scholar] [CrossRef]

- Popa, V. The Financial Supply Chain Management New Solution for Supply Chain Resilience. Amfiteatru Econ. J. 2013, 15, 140–153. [Google Scholar]

- Randall, W.S.; Theodore Farris, M. Supply chain financing: Using cash-to-cash variables to strengthen the supply chain. Int. J. Phys. Distrib. Logist. Manag. 2009, 39, 669–689. [Google Scholar] [CrossRef]

- Teng, J.-T.; Chang, C.-T.; Chern, M.-S. Vendor-buyer inventory models with trade credit financing under both non-cooperative and integrated environments. Int. J. Syst. Sci. 2012, 43, 2050–2061. [Google Scholar] [CrossRef]

- Thangam, A.; Uthayakumar, R. Two-echelon trade credit financing for perishable items in a supply chain when demand depends on both selling price and credit period. Comput. Ind. Eng. 2009, 57, 773–786. [Google Scholar] [CrossRef]

- Yan, N.; Sun, B. Coordinating loan strategies for supply chain financing with limited credit. OR Spectr. 2013, 35, 1039–1058. [Google Scholar] [CrossRef]

- Petersen, M.A.; Rajan, R.G. Trade creditheories and evidence. Rev. Financ. Stud. 1997, 10, 661–691. [Google Scholar] [CrossRef]

- Raghavan, N.S.; Mishra, V.K. Short-term financing in a cash-constrained supply chain. Int. J. Prod. Econ. 2011, 134, 407–412. [Google Scholar] [CrossRef]

| Notation | Description | Unit |

|---|---|---|

| , | Initial capitals of MA and MB, respectively. | Million dollar |

| , | Initial capitals of RA and RB, respectively. | Million dollar |

| , | Financing amounts of MA and MB, respectively. | Million dollar |

| , | Financing amounts of RA and RB, respectively. | Million dollar |

| , | Production quantities of MA and MB, respectively. | Standard quantity unit(SQU) |

| , | Order quantities of RA and RB, respectively. | SQU |

| , | Unit production costs of products A and B, respectively. | Million dollar/SQU |

| , | Salvage values of unsold products A and B, respectively. | Million dollar |

| , | Retailers’ purchase prices of the products A and B, respectively. | Million dollar/SQU |

| , | Unit sales prices of the products A and B, respectively. | Million dollar/SQU |

| lending rates | Percentage/year | |

| deposit rates | Percentage/year | |

| , | probability for manufacturers and retailers to get loan by themselves, respectively | Null |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; Chen, T.; Xin, B. Optimal Financing Decisions of Two Cash-Constrained Supply Chains with Complementary Products. Sustainability 2016, 8, 429. https://doi.org/10.3390/su8050429

Li Y, Chen T, Xin B. Optimal Financing Decisions of Two Cash-Constrained Supply Chains with Complementary Products. Sustainability. 2016; 8(5):429. https://doi.org/10.3390/su8050429

Chicago/Turabian StyleLi, Yuting, Tong Chen, and Baogui Xin. 2016. "Optimal Financing Decisions of Two Cash-Constrained Supply Chains with Complementary Products" Sustainability 8, no. 5: 429. https://doi.org/10.3390/su8050429

APA StyleLi, Y., Chen, T., & Xin, B. (2016). Optimal Financing Decisions of Two Cash-Constrained Supply Chains with Complementary Products. Sustainability, 8(5), 429. https://doi.org/10.3390/su8050429