1. Introduction

The Republic of Korea, also known as Korea, is a heavily energy-dependent country because it ranks ninth in the world with respect to total primary energy consumption. However, it also depends highly on imports for its oil, coal, and natural gas consumption (second in liquefied natural gas imports, third in crude oil imports, fourth in coal imports, and sixth in dry natural gas imports) as it is not blessed with natural resources (43th in total primary energy production) [

1].

Although Korea consumes a lot of energy for its export-oriented industries, such as steel-making, ship-building, and car-making, it pledged to reduce carbon emissions [

2] and it set a goal of using more renewable energy [

3]. Additionally, after the Fukushima disaster in Japan, Korea is trying to moderate nuclear power generation targets [

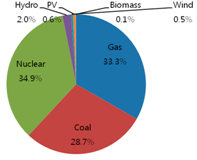

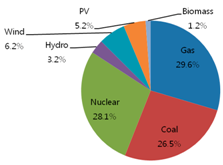

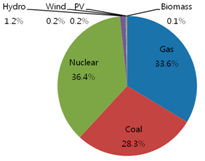

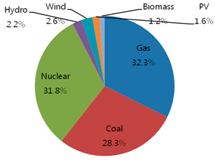

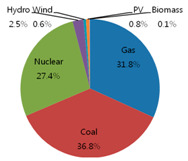

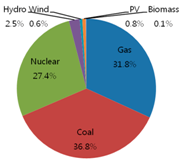

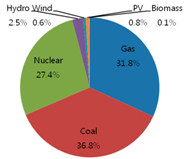

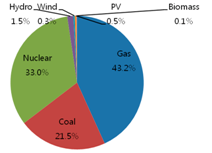

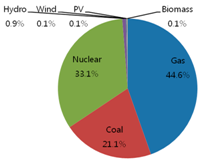

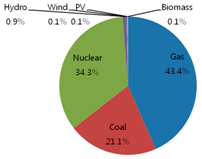

1]. Three identical pie charts in the second row of

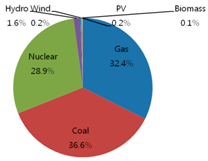

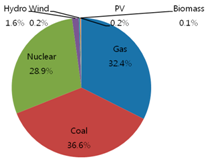

Table 1 show the original energy mix of electricity generation in 2011 where gas accounts for 31.8%, coal 36.8%, nuclear 27.4%, hydro 2.5%, wind 0.6%, photovoltaic (PV) 0.8%, and biomass 0.1%, out of total 68.3 GW with respect to generation capacity. Additionally, three identical pie charts in the second row of

Table 2 show the original energy mix of electricity generation in 2011 where gas accounts for 32.4%, coal 36.6%, nuclear 28.9%, hydro 1.6%, wind 0.2%, PV 0.2%, and biomass 0.1%, out of total 511 million MWh with respect to generation amount [

4]. However, how to optimally mix those energy sources in the future while satisfying carbon emission limits and installing more renewable energy sources becomes a critical problem. Recently, Park

et al. [

5] proposed a bottom-up model (The Integrated Markal-Efom System model) for calculating the optimum renewable energy portfolio in the electricity generation sector of Korea. However, the model only focuses on the generation amounts of renewable sources, such as wind, PV, hydro, and geothermal. Thus, this study aims at developing an optimization model for the future energy mix problem in Korea, which calculates renewable energy amounts as well as fossil energy amounts.

So far, various energy mix or expansion optimization models have been developed [

6,

7,

8,

9,

10] since a simple linear programming model was proposed [

11]. Certain models considered the gap between long term investment and short-term operation [

12], thermal operation in generation expansion planning [

13], unit commitment constraint [

14,

15,

16], and other issues, such as economics, finance, regulation, and uncertainty [

17,

18,

19,

20]. Furthermore, some optimization models have been applied to countries, such as Japan [

21], Iberian countries of Portugal and Spain [

22], and Mexico [

23]. However, the full optimization formulations with full datasets were seldom provided, although certain endeavors exist [

24]. Thus, this study also intends to provide full optimization information for other researchers to easily apply this model to their own energy mix problem.

2. Optimization Formulation

As mentioned above, Korea is a heavy energy consuming country while pledging to reduce carbon emissions. Thus, the country wants to optimally manage this problem in generating electric energy by considering various factors. Currently, Korea generates electricity from various conventional (gas, coal, and nuclear) and renewable (hydro, wind, PV, and biomass) sources. However, in order to attain the pledged goal of carbon emission reduction, it has to force more renewable amounts to be generated while considering various costs (construction, operation and management, fuel, and carbon emission costs), total electricity demand (including losses and reserves), annual renewable expansion capacity, and renewable portfolio standard (RPS) regulations.

The optimal energy mix model in this study is fundamentally based on the least-cost optimization model in previous research [

4]. However, this model improves the formulation structure, uses updated data, and provides more explanatory computation results.

The objective function of the energy mix problem can be the total cost of electricity generation which consists of construction, operation and& management (O and M), fuel, and CO

2 costs as follows:

Since the energy mix policy is a multi-year one, we may introduce a discount factor [

25] and each cost becomes as follows:

where

denotes number of total project years (2012–2030 in this study),

denotes discount rate (5% in this study [

4]),

denotes the unit construction cost (US$/MW) of energy source

(each energy source has different unit construction cost as shown in

Table 3 [

26,

27], and

denotes installed capacity (MW) of energy source

in year

.

where

denotes unit O and M cost (US$/MWh) of energy source

(each energy source has different unit O and M cost as shown in

Table 3 [

26,

27],

denotes cumulative generation capacity (MW) of energy source

in year

, and

denotes the capacity factor (h) which represents utilized hours of energy source

in a year (each energy source has a different capacity factor as shown in

Table 4 [

28] and maximum hours in a year are 8760 h). Here, it should be noted that the original formulation of Ahn

et al. [

4] omitted the capacity factor while it considered generation-hour-based O and M cost. In order to give consistency, the formulation in this study has the capacity factor.

where

denotes the unit fuel cost (US$/MWh) of energy source

(each energy source has a different unit fuel cost as shown in

Table 3 [

29].

where

denotes the unit CO

2 cost (7.4 US$/tCO

2 in this study and

denotes the emission rate (tCO

2/MWh) of energy source

(each energy source has a different emission rate as shown in

Table 4 [

30]. Here, it should be noted that the original emission rate data of Ahn

et al. [

4] appeared abnormally high. Thus, the original values were scaled down by multiplying the values by 10

−3, which results in a reasonable range.

The total cost of electricity generation can be again expressed as follows:

Now that we have covered the objective function of the energy mix optimization, let us move on to the constraints. The first constraint can be minimal supply requirement for satisfying electricity demand as follows:

where

denotes the loss factor due to transmission loss and internal electricity use (6% in this study),

denotes the level of the electricity supply target as a buffer (1.1 in this study),

denotes the estimated electricity demand for each sector in year

.

data can be obtained from various sources or calculated using the annual demand growth rate. This study follows the tabulated data in previous research [

4]. Here, it should be noted that the original formulation used

in Equation (7); however, this study uses

because the generation amount, including the loss amount, should be greater than the net supply amount. Additionally, while the original formulation used double sigmas, this study uses single sigma in each side of Equation (7), and the sigma for each year is stripped off because this minimal generation constraint can be considered for every year, instead of only once.

The next constraint can be realizable potential constraint as follows:

where

denotes the installed capacity (MW) of energy source

in year

,

denotes the initial generation capacity (MW) of energy source

as provided in

Table 4 [

29], and

denotes the realizable potential of energy source

in year

as partially provided in

Table 5 [

31], which was obtained by a survey from 50 experts in Korea. The potential data for other years can be calculated using interpolation.

This realizable potential constraint only considers renewable and nuclear sources because they are not rapidly expanded. Here, it should be noted that Equation (8) does not use double sigmas different from previous research [

4] because this maximal potential constraint should be considered for every energy source and for every year.

Another constraint is RPS which requires the minimal portion of electricity generation from renewable energy sources as follows:

where

denotes the installed capacity (MW) of energy source

in year

, and

denotes the obligated rate for renewable energy supply in year

. Ahn

et al. [

4] originally provided the RPS data obtained from KEMCO [

32]. However, the level of the RPS data appeared a somewhat high, which made optimization computation infeasible. Thus, this study uses the updated data from Korean Ministry of Trade, Industry and Energy, which briefly mentioned that the RPS in 2015 is 3%, in 2019 it is 5%, in 2022 it is 8%, and in 2024 and after it is 10%. Based on this data and interpolation, new RPS data for every year was generated as presented in the 10th column of

Table 6.

On top of the above-mentioned RPS, Korean government also requires PV RPS by 2017 (276 GWh in 2012, 591 GWh in 2013, 907 GWh in 2014, 1,235 GWh in 2015, 1577 GWh in 2016, and 1577 GWh in 2017) as follows:

where

denotes the installed capacity (MW) of PV in year

,

denotes the initial generation capacity (MW) of PV as provided in

Table 4,

denotes the capacity factor (h) of PV as provided in

Table 4, and

denotes the obligated amount (GWh) for PV-sourced energy supply in year

, and

denotes the number of PV RPS years (2012–2017 in this study).

3. Optimization Results

The above-developed model for optimal energy mix in Korea with various given, updated, and interpolated data was calculated using Evolver software (Sydney, Australia) [

33], which is a robust commercial optimization code based on hybrid scatter-genetic algorithm. Since the software has been successfully applied to energy-related optimization problems, such as wind farm layout design [

34] and power plant maintenance scheduling [

35], this study also adopts it.

Initially, basic cost-wise optimization was performed with three costs (construction cost in Equation (2), O and M cost in Equation (3), and fuel cost in Equation (4)) and two constraints (minimal supply requirement constraint in Equation (7) and realizable potential constraint in Equation (8)). As seen in the second column of

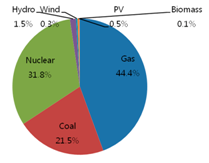

Table 1, the portion of renewable energy sources (hydro, wind, PV, and biomass) is decreasing from 4% (2.5% of hydro + 0.6% of wind + 0.8% of PV + 0.1% of biomass) initially to 3.2% in 2020 to 2.4% in 2030, with respect to generation capacity, because renewable energy sources are not cost-effective. The portion of gas sources is increasing from 31.8%, initially, to 33.3% in 2020, to 44.4% in 2030, while that of coal sources is decreasing from 36.8%, initially, to 28.7% in 2020, to 21.5% in 2030, and that of nuclear sources is fluctuating from 27.4%, initially, to 34.9% in 2020, to 31.8% in 2030.

Table 7 shows the optimized generation capacity from this basic model. As seen in

Table 7, there is no additional capacity installation from any renewable source. Additionally, there is no additional capacity installation from coal sources because it has higher construction and fuel costs over gas sources, as presented in

Table 3.

Table 2 shows a similar energy mix trend with respect to the generation amount.

In order to consider carbon emission problems, the CO

2 cost in Equation (5) was also added to the above basic model. As seen in the third columns of

Table 1 and

Table 2, the energy mix trends from this basic + CO

2 model are similar to those of the basic model because the CO

2 cost does not contribute much when compared with the construction cost.

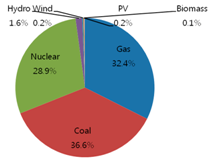

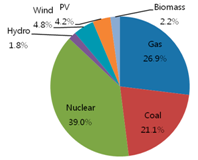

Thus, in order to more actively consider carbon emission problems, the RPS constraint in Equation (9) and PV RPS constraint in Equation (10) were added to the above basic + CO

2 model. As seen in the fourth column of

Table 2, the portion of renewable energy sources from this basic + CO

2 + RPS model is increasing from 2.1%, initially, to 7.6% in 2020, to 13.0% in 2030, with respect to the generation amount because of the RPS constraint.

Table 6 shows a more detailed result about the generation amount of each energy source and total renewable percentage of each year, which satisfies the RPS constraint in Equation (9).

Table 1 shows similar trend of renewable energy portion with respect to generation capacity (4%, initially, to 15.8% in 2020, to 27.3% in 2030).

For this basic + CO

2 + RPS model optimization, the initial values of solution vector

were set to all zeros. However, this initial solution vector with zeros could not easily find any feasible solution vector. Thus, this study used a more elaborate initial vector. For the starting values of renewable source installed capacity

, yearly maximum values, instead of zero, were used. For example, if realizable potential in 2012 is 1868 MW and that in 2013 is 2018 MW, the starting value of installed capacity in 2013 becomes 150 MW. Using this improved initial vector, the basic + CO

2 + RPS model could easily find the optimal solution of $623 billion, which consists of $118 billion from construction cost, $66 billion from O and M cost, $370 billion from fuel cost, and $70 billion from CO

2 cost.

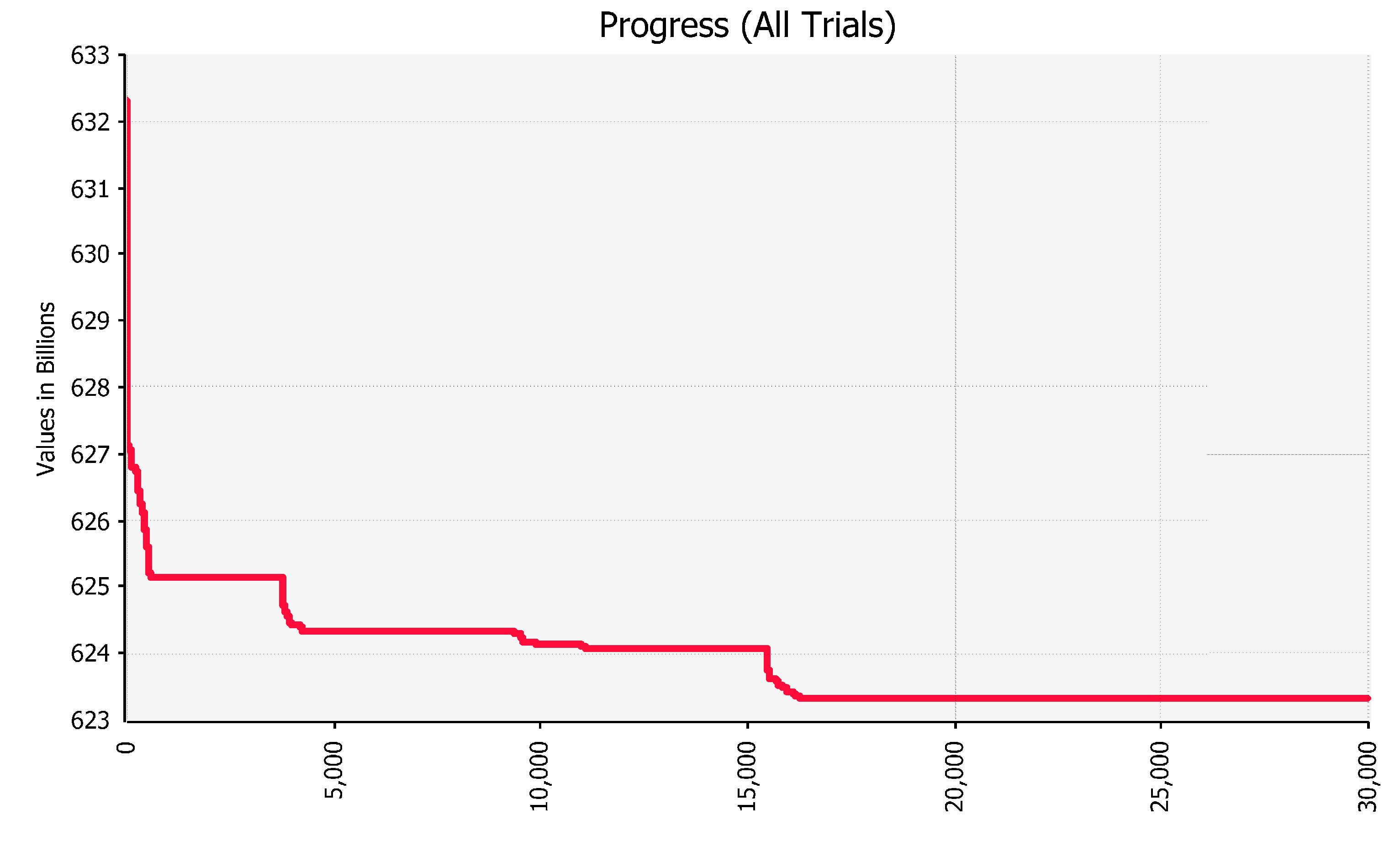

Figure 1 shows the convergence trend of this optimization computation.

Table 8 shows annually installed capacity of each energy source from the basic + CO

2 + RPS model. As seen in the table, there is no additional capacity installation from coal sources, while there are only three installations (6310 MW in 2012, 3262 MW in 2021, and 62 MW in 2030) from gas sources.

The results from the basic + CO

2 + RPS model also satisfy all the constraints.

Table 9 shows the results of the minimal supply requirement constraint. The second column of the table represents the total generation amount in each year and the third column represents the net supply amount, which is calculated by dividing the second column by

. The fourth column represents the demand amount and the fifth column represents the reserve-included demand, which is calculated by multiplying the fourth column and

. Thus, the third column should be greater or equal to the fifth column in this constraint, and results show that this constraint is satisfied.

For the realizable potential constraint, the results satisfy each year’s maximal installation limits as shown in

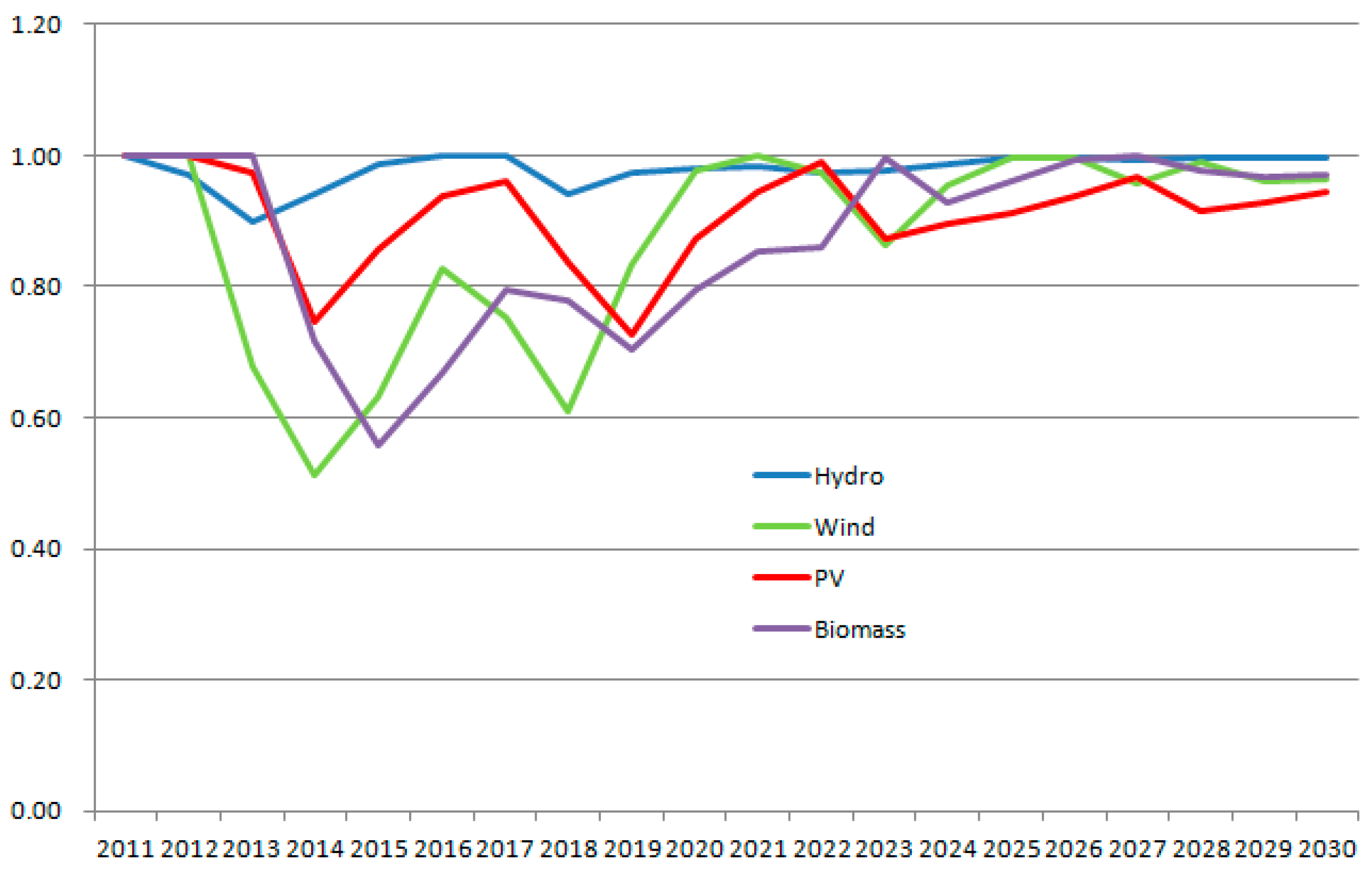

Figure 2. As seen in the figure, the hydro source minimally fluctuates near the maximal installation line, while the wind source maximally fluctuates beneath the line.

The RPS constraint was already mentioned that it was met as observed in

Table 6, and for the PV RPS constraint, the PV generation amounts from 2012 to 2017 are much greater than PV RPS, as shown in

Table 6.

4. Conclusions and Policy Implications

This study proposed an optimal energy mix model for electricity generation in Korea up to 2030. The results showed that from the original energy mix of 32.4% of gas, 36.6% of coal, 28.9% of nuclear, and 2.1% of renewables in 2011, the mix will become 32.3% of gas, 28.3 of coal, 31.8% of nuclear, and 7.6% of renewables in 2020, and 26.9% of gas, 21.1% of coal, 39.0% of nuclear, and 13.0% of renewables in 2030. Contrary to a cost-only optimization model, the model with RPS constraint could produce more environment-friendly energy mix results.

The proposed optimization model improved the exiting optimization formulation (unit of O and M cost, position of loss factor, yearly checking constraint, misused parenthesis,

etc.), used updated data (more recent RPS, scale of emission rate,

etc.), and provided more explanatory computational results. At the same time, this study tried to be as concise as possible by excluding cost-reducing effects which require complicated functions and corresponding coefficient values. Additionally, this study did not consider external costs from environmental damage because its deviation is still too high among experts [

4]. Otherwise, the nuclear portion in the energy mix could be less than current results, which can be a good future research topic.

Furthermore, future study should include more realistic formulation (age structure, scraping factor, etc.), and more up-to-date data (for example, more accurate data from the seventh electricity demand and supply plan and national greenhouse gas reduction targets, and more realistic cost data). This optimization model for nation-wide energy mix planning can be applicable not only to Korea, but also to any country as long as proper data can be collected. Thus, it is expected to see more application of this energy mix model to many other countries in the future for better planning their electricity generation, while including more green energies.