5.1. Effects of Urban Rail Transit Facilities on Housing Prices

The empirical analysis consists of two parts: the direct effects and the expectation effects of rail transit facilities on housing prices. First, we use a panel data model to assess the direct effect of rail transit facilities on housing prices. We use the average commercial housing prices (

housingp1) as the explained variable. The coefficient on rail transit facilities is estimated when the effects of other variables listed in

Table 3 are controlled. To check the robustness, we also use the residential housing prices (

housingp2) as the explained variable instead of the average commercial housing prices. In China, commercial house refers to buildings used to reside or to generate a profit, either from capital gain or rental income. Residential house refers to commercial house with living space less than 144 square meters. Thus, the term commercial house has a larger scope than a residential house.

Table 7 reports the regression results. Models 1 and 2 are estimated by an ordinary least squares (OLS) estimator using a pooled sample. Random-effect models are shown in the fourth and fifth columns, respectively. Fixed-effect estimates are listed in the last two columns. For the case of this study, the functional form of fixed-effect model is

, while the functional form of random-effect model is

, where

denotes the explanatory variable vector, and

is a fixed or random effect specific to individual (group) or time period. Error variances in fixed-effect model are constant, and intercepts are varying across group or time. In contrast, error variances in random-effect model are randomly distributed across group or time, and intercepts are constant. If we put all the panel data together and do not make any distinction between cross section and time series, we can of course run a regression over all the data using ordinary least squares. This is called a pooled OLS regression. Pooled OLS is often used as a rough and ready means of analyzing the data. It is a simple and quick benchmark to which more sophisticated regressions can be compared. The Hausman test for models with ln

housingp1 as the explained variable suggests that fixed-effect models exhibit better performance than the random-effect models. In contrast, the Hausman test for models with ln

housingp2 as the explained variable suggests that random-effect models exhibit better performance than fixed-effect models. According to the

F statistic, we fail to reject the null hypothesis of coefficients being zero at the 1% level. The adjusted

R2 of each model are greater than 0.85. In particular, the adjusted

R2 for the suggested model (Model 3a) by Hausman test is as high as 0.8636, which indicates that all the independent variables can explain the housing prices variation by 86.36%. Overall, most of the coefficients on the “control” variables in the fifth column are significant at the 5% level or better and have the expected signs.

We shift focus to the impact of urban rail transit facilities on housing prices. The significance of the coefficient on ln

rail in Model 3a precisely verifies our previous deduction. The sign on the coefficient, as expected, is positive, which is consistent with the findings in the case study documented by Seo

et al. [

19]. The magnitude of the coefficient is 0.0233, which means that each one-degree increase in rail transit mileage improves housing prices by 0.0233%. The coefficient, as one would expect, is much smaller in value than most of the other variables, such as per capita GDP, land price, completed investment and population growth, indicating that urban rapid trail transit generates relatively small but significant impact on housing prices. These findings suggest that economic factors such as income, population growth and employment are major determinants of housing prices.

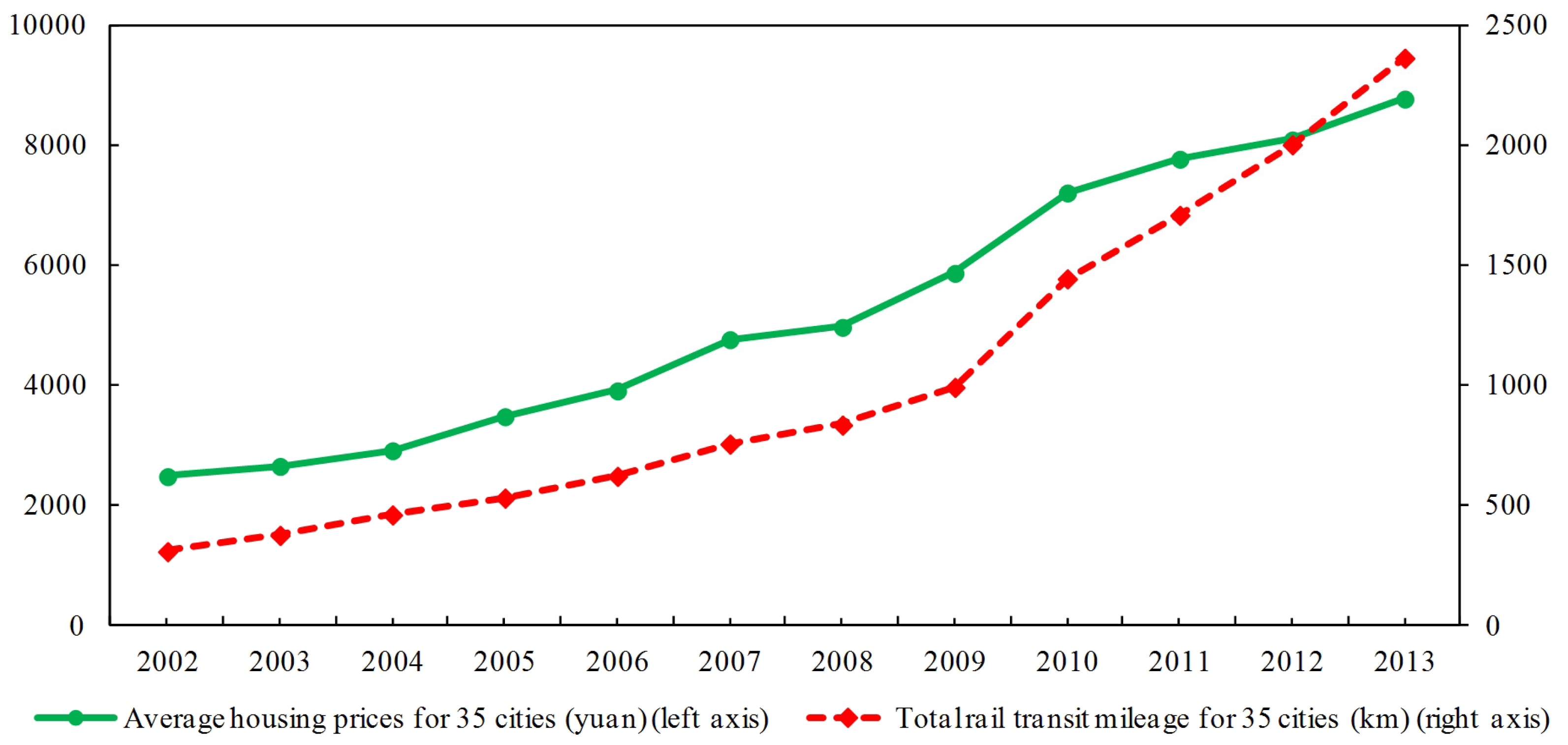

The significant impact of urban rail transit facilities on housing prices suggests that the development of urban rail transit network plays an important role in house price increases in China during the past decade. Consequently, how the rail transit facilities influence the housing price is what we are interested in. There exist two possible channels (direct and scale effects) through which urban rail transit facilities affect housing prices. As previous case studies have shown, one’s proximity to transportation nodes is significantly and positively associated with housing prices, and we refer to this as a direct effect. Compared to other transportation instruments (e.g., bus rail transit systems), metro rail transit systems have an entirely different impact on human activities and even on economic growth patterns. That is, metro rail transit systems extend the boundaries of urban functions due to their speed advantages relative to other mass transit systems, resulting in the convergence of suburban housing prices to central areas. From a microeconomics perspective, metro line system expansions may result in scale effects on housing prices. First, rail transit network developments create extra amenities that may lead to the development of additional accessibility premiums. Second, in terms of ripple effects, rail transit network expansion causes housing prices farther from stations to rise.

Some other findings are noteworthy. First, economic fundamentals such as per capita GDP and unemployment rate exhibit strong effects on the property values. Meanwhile, land price, as the cost proxy, shows strong impact on housing prices, which supports the view that cost drives housing prices [

9,

29,

30]. Theses findings are consistent with the view that economic fundamentals are the major driving factors in determining housing prices [

31,

32,

33,

34]. Second, the coefficient on population is significant and presents the expected sign, which indicates that the demographic factors play an important role in forming housing price bubbles.

Third, housing market factors show strong effects on housing prices. Completed investment in housing markets demonstrates a notable effect, which, to some extent, reflects the developers’ expectations of housing prices. Fourth, scientific resource measured by books per capita generates a significantly positive impact on housing prices. In contrast, the effect of health facility per capita is insignificant. Fifth, the variable primary school per capita generates a significantly negative effect on housing prices, while the effect of the variable colleges per capita is insignificant. These findings imply that the scarcity of primary educational resource may increase housing prices, which is remarkably different from the effects of health facility per capita and scientific resource per capita. From the data set, we observe that the variable primary school per capita shows a diminishing trend with the population growth, which is opposite to health facility per capita and scientific resource per capita. Indeed, if the primary educational resource per capita is scarcer, the houses near the primary school are more expensive in China, which is more obvious in large cities.

5.2. Rail Transit Expectation Effects on Housing Prices

Real estate developers in China are keen to broadly advertise metro housing facilities from the planning of a rail transit line to its opening. While a metro line generally takes approximately 3–4 years to construct, overall transit network plans may be designed a few years earlier. As a result, the public is well informed of plans and of expected opening dates, resulting in differences between this variable and other endogenous variables. Thus, it is of enormous interest to investigate premiums of rail transit facilities on housing prices from the perspective of expectation.

To assess the impact of the expectation of new metro lines on housing price, we estimate different models with different expectation specification.

Table 8 reports the estimates with fixed-effect specification. From the estimates of Model 5, the coefficient on ln

rail is not significant at any significant levels, indicating that expectations of new metro lines 1 year prior to opening cannot generate significant effects on housing prices. Similar situations can be found in Models 6 and 7. Furthermore, coefficients on ln

rail present a diminishing trend form Model 4 to Model 7, which seems to show that, with the planning of new lines, rail transit facilities generate more and more effects on housing prices, although most of the coefficients are insignificant.