A Comparison of Wind Energy Investment Alternatives Using Interval-Valued Intuitionistic Fuzzy Benefit/Cost Analysis

Abstract

:1. Introduction

| Year | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 |

| Cum.Capacity (MW) | 7600 | 10,200 | 13,600 | 17,400 | 23,900 | 31,100 | 39,431 | 47,620 | 59,091 |

| Year | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| Cum.Capacity (MW) | 73,949 | 93,901 | 120,715 | 159,079 | 197,943 | 238,435 | 283,132 | 318,644 | 369,597 |

2. Wind Energy Investments

| Year | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 |

| Capacity (MW) | 1530 | 2520 | 3440 | 3760 | 6500 | 7270 | 8133 | 8207 | 11,531 |

| Year | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| Capacity (MW) | 14,701 | 20,286 | 26,952 | 38,478 | 38,989 | 40,943 | 44,929 | 35,692 | 51,473 |

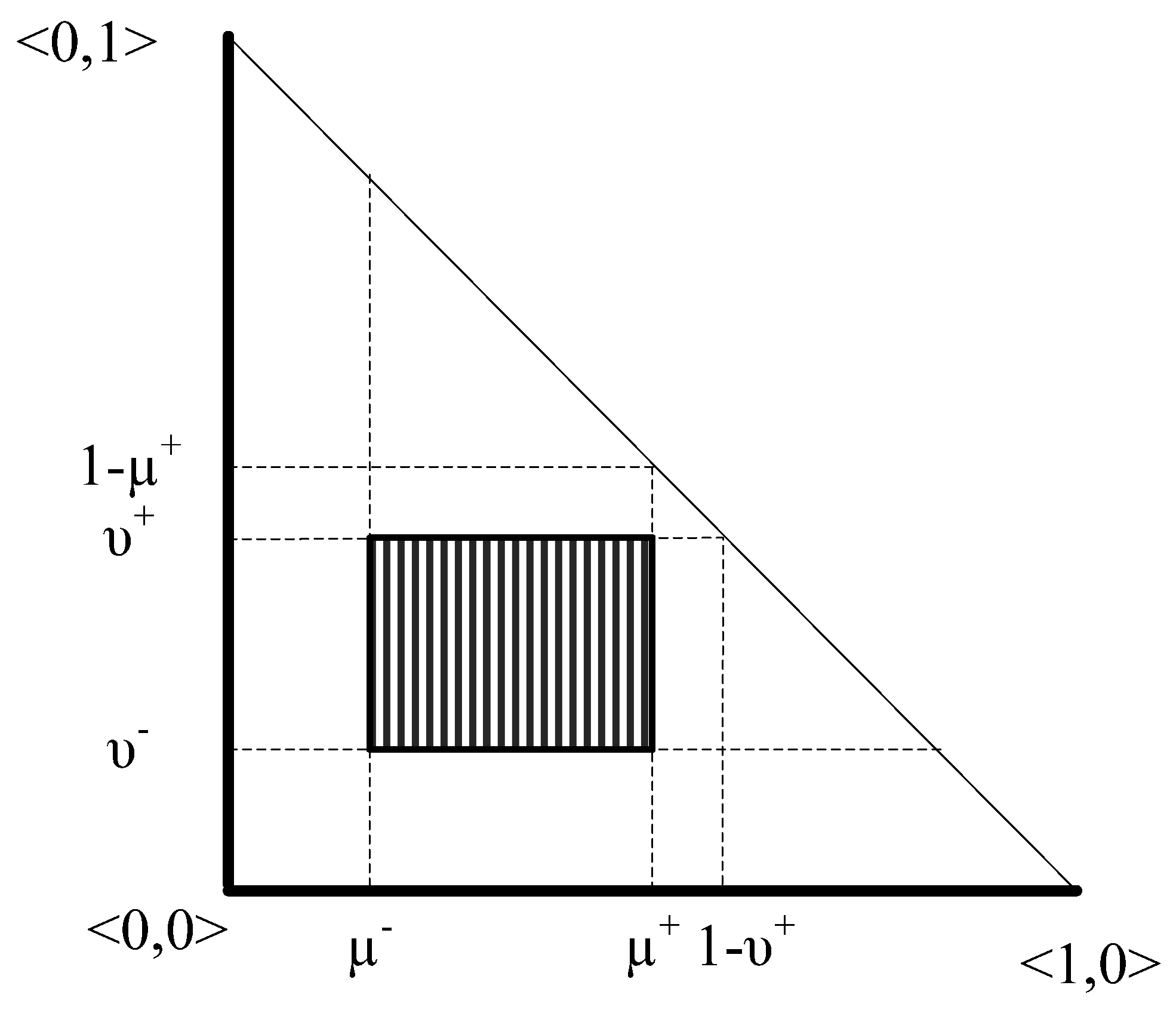

3. Interval Valued Intuitionistic Fuzzy Sets

3.1. Arithmetic Operations for IVIFS

3.2. Aggregation Operators for IVIFS

3.3. Defuzzification of IVIFS

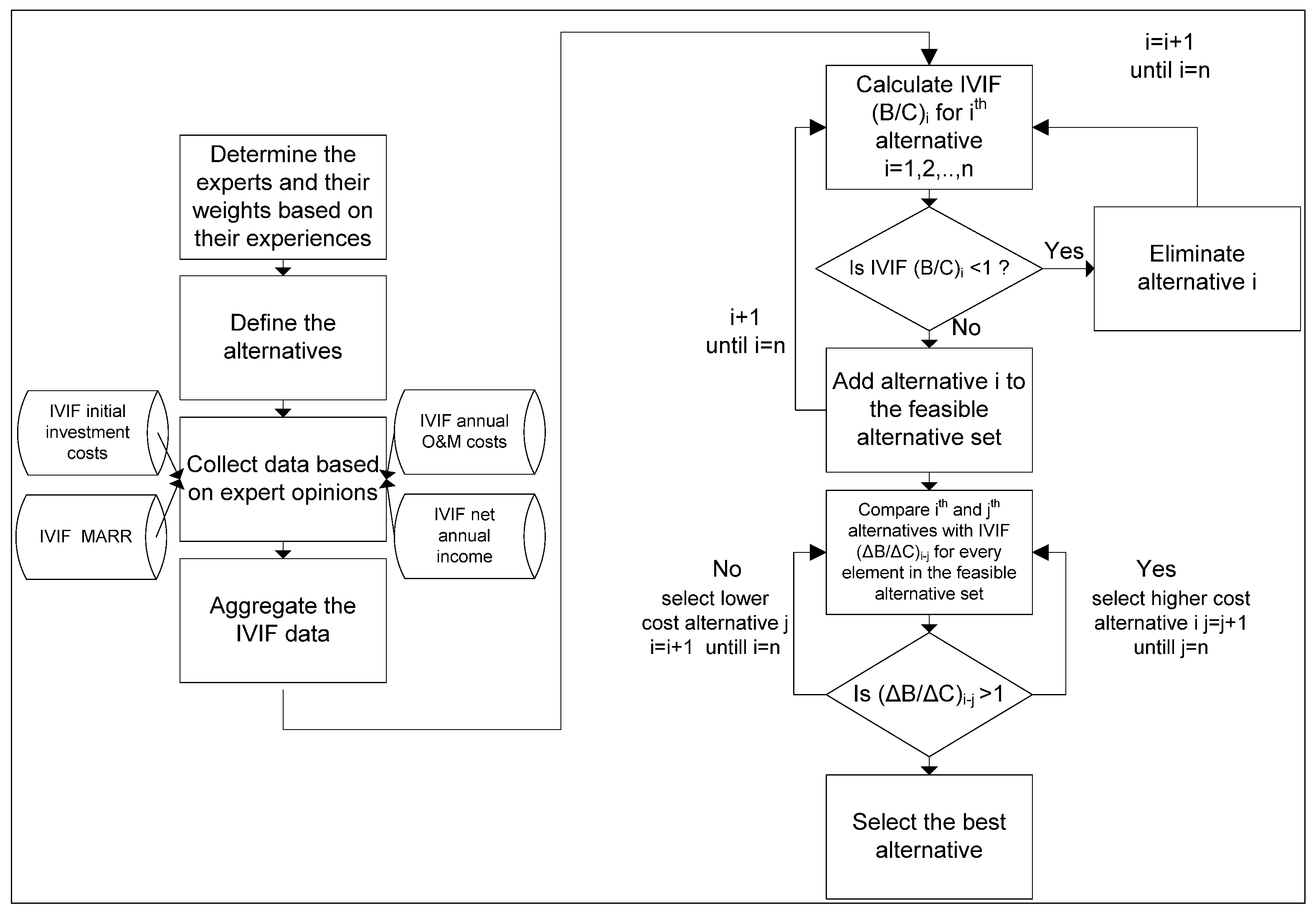

4. Fuzzy Benefit-Cost Analysis

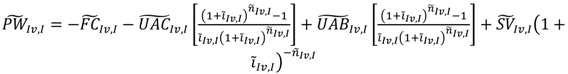

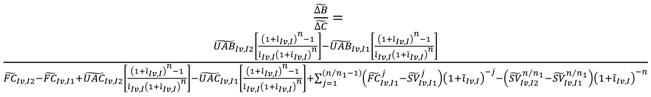

4.1. Interval-Valued Intuitionistic Fuzzy Present Worth Analysis

- ,

- ,

- ,

- ,

4.2. Interval-Valued Intuitionistic Fuzzy Annual Worth Analysis

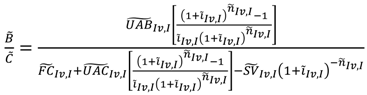

4.3. IVI Fuzzy B/C Analysis Based on PW

4.4. IVI Fuzzy B/C Analysis Based on AW

5. Application

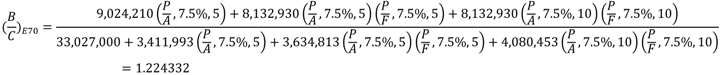

5.1. Crisp Solution

| E70 2.3MW wind turbine × 13 units | E82 3MW wind turbine × 10 units | V112 3.3MW wind turbine × 9 units | |

|---|---|---|---|

| Turbine costs, $ | 22,672,000 | 25,070,000 | 28,449,000 |

| Foundation costs, $ | 3,270,000 | 3,270,000 | 3,270,000 |

| Connection to the system, $ | 3,815,000 | 3,815,000 | 3,815,000 |

| Planning and license costs, $ | 3,270,000 | 3,270,000 | 3,270,000 |

| Initial Investment cost, $ | 33,027,000 | 35,425,000 | 38,804,000 |

| Years | E70 2.3MW wind turbine × 13 units | E82 3MW wind turbine × 10 units | V112 3.3MW wind turbine × 9 units |

|---|---|---|---|

| 2016–2020 | 3,411,993 | 2,940,010 | 3,528,679 |

| 2021–2025 | 3,634,813 | 3,144,610 | 3,923,479 |

| 2026–2035 | 4,080,453 | 3,553,810 | 4,449,879 |

| E70 2.3MW wind turbine × 13 units | E82 3MW wind turbine × 10 units | V112 3.3MW wind turbine × 9 units | ||||

|---|---|---|---|---|---|---|

| Gross | Net | Gross | Net | Gross | Net | |

| 2016–2020 | 9,024,210 | 5,612,217 | 8,286,300 | 5,346,290 | 10,659,600 | 7,130,921 |

| 2021–2025 | 8,132,930 | 4,498,117 | 7,467,900 | 4,323,290 | 9,606,800 | 5,683,321 |

| 2026–2035 | 8,132,930 | 4,052,477 | 7,467,900 | 3,914,090 | 9,606,800 | 5,156,921 |

| E70 2.3MW wind turbine × 13 units | E82 3MW wind turbine × 10 units | V112 3.3MW wind turbine × 9 units | |

|---|---|---|---|

| NPW, $ | 15,852,372 | 11,424,879 | 23,238,262 |

| B/C | 1.224332 | 1.167969 | 1.29431 |

| Decision | ||

|---|---|---|

| E70 vs. E82 | 2.6726363 | Select E70 |

| V112 vs. E70 | 1.8906222 | Select V112 |

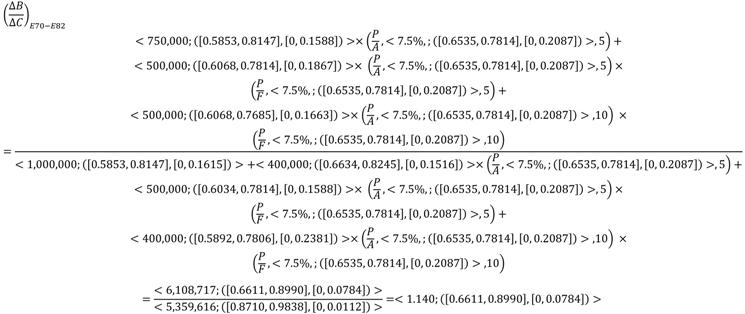

5.2. Intuitionistic Fuzzy Solution

| Possible initial investment costs | IVIFS assigned by three experts | Aggregated IVIFS | |

|---|---|---|---|

| E70 2.3MW | $28,000,000 | ([0.6, 0.9], [0.0, 0.1]), ([0.6, 0.7], [0.1, 0.3]), ([0.5, 0.8], [0.1, 0.2]) | ([0.5817, 0.8217], [0.0000, 0.1783]) |

| $30,000,000 | ([0.5, 0.7],[0.1, 0.2]), ([0.7, 0.8], [0.0, 0.2]), ([0.6, 0.8], [0.0, 0.1]), | ([0.6102, 0.7648], [0.0000, 0.1741]) | |

| $32,000,000 | ([0.7, 0.9], [0.0, 0.1]), ([0.5, 0.8], [0.0, 0.1]), ([0.6, 0.8],[0.0, 0.1]) | ([0.6102, 0.8484], [0.0000, 0.1000]) | |

| E82 3MW | $27,000,000 | ([0.7, 0.9], [0.0, 0.1]), ([0.6, 0.8], [0.0, 0.2]), ([0.7, 0.8], [0.1, 0.2]) | ([0.6634, 0.8484], [0.0000, 0.1516]) |

| $29,000,000 | ([0.7, 0.8],[0.0, 0.1]), ([0.7, 0.8], [0.1, 0.2]), ([0.6, 0.8], [0.1, 0.2]) | ([0.6822, 0.8000], [0.0000, 0.1516]) | |

| $31,000,000 | ([0.6, 0.7], [0.2, 0.3]), ([0.6, 0.8], [0.0, 0.1]), ([0.6, 0.9], [0.0, 0.1]) | ([0.6000, 0.7952], [0.0000, 0.1552]) | |

| V112 3.3MW | $35,000,000 | ([0.5, 0.7], [0.0, 0.3]), ([0.5, 0.7], [0.1, 0.2]), ([0.5, 0.7],[0.1, 0.3]) | ([0.5000, 0.7000], [0.0000, 0.2551]) |

| $36,000,000 | ([0.7, 0.8], [0.0, 0.1]), ([0.6, 0.9], [0.0, 0.2]), ([0.6, 0.8], [0.1, 0.2]) | ([0.6435, 0.8484], [0.0000, 0.1516]) | |

| $37,000,000 | ([0.5, 0.7], [0.2, 0.3]), ([0.7, 0.9], [0.0, 0.1]), ([0.6, 0.9], [0.0, 0.1]) | ([0.6102, 0.8448], [0.0000, 0.1552]) |

| Years | E70 2.3MW wind turbine × 13 units | E82 3MW wind turbine × 10 units | V112 3.3MW wind turbine × 9 units | |||

|---|---|---|---|---|---|---|

| 2016–2020 | 3,300,000 | ([0.7, 0.9], [0.0, 0.1]); ([0.6, 0.8], [0.1, 0.2]); ([0.7, 0.8], [0.1, 0.2]) | 2,900,000 | ([0.7, 0.8], [0.0, 0.2]); ([0.5, 0.9], [0.0, 0.1]); ([0.5, 0.8], [0.1, 0.2]) | 3,400,000 | ([0.6, 0.8], [0.0, 0.1]) ; ([0.6, 0.9], [0.0, 0.1]); ([0.7, 0.8], [0.1, 0.2]) |

| 3,400,000 | ([0.7, 0.8], [0.0, 0.1]); ([0.7, 0.8], [0.1, 0.2]); ([0.6, 0.8], [0.1, 0.2]) | 3,000,000 | ([0.6, 0.9], [0.0, 0.1]); ([0.6, 0.7], [0.0, 0.2]); ([0.6, 0.8], [0.0, 0.1]) | 3,500,000 | ([0.6, 0.7], [0.0, 0.2]) ; ([0.5, 0.8], [0.1, 0.2]); ([0.6, 0.8], [0.0, 0.2]) | |

| 3,500,000 | ([0.7, 0.9], [0.0, 0.1]); ([0.6, 0.7], [0.1, 0.2]); ([0.6, 0.8], [0.0, 0.1]) | 3,100,000 | ([0.6, 0.7], [0.0, 0.2]) ; ([0.5, 0.8], [0.1, 0.2]); ([0.6, 0.8], [0.0, 0.2]) | 3,600,000 | ([0.7, 0.8], [0.0, 0.1]); ([0.7, 0.8], [0.1, 0.2]); ([0.6, 0.8], [0.1, 0.2]) | |

| 2021–2025 | 3,500,000 | ([0.6, 0.8], [0.1, 0.2]); ([0.7, 0.8], [0.0, 0.1]); ([0.6, 0.9], [0.0, 0.1]) | 3,000,000 | ([0.6, 0.8], [0.1, 0.2]); ([0.6, 0.7], [0.0, 0.3]); ([0.5, 0.6], [0.2, 0.3]) | 3,900,000 | ([0.5, 0.6], [0.0, 0.3]); ([0.7, 0.9], [0.0, 0.1]); ([0.6, 0.8], [0.0, 0.2]) |

| 3,600,000 | ([0.7, 0.8], [0.0, 0.2]); ([0.6, 0.7], [0.1, 0.3]); ([0.5, 0.7], [0.2, 0.3]) | 3,100,000 | ([0.6, 0.7], [0.1, 0.2]); ([0.7, 0.9], [0.0, 0.1]); ([0.6, 0.7], [0.0, 0.1]) | 4,000,000 | ([0.7, 0.8], [0.1, 0.2]); ([0.7, 0.8], [0.0, 0.2]); ([0.7, 0.9], [0.0, 0.1]) | |

| 3,700,000 | ([0.6, 0.8], [0.0, 0.1]); ([0.5, 0.7], [0.0, 0.1]); ([0.5, 0.8], [0.0, 0.1]) | 3,200,000 | ([0.6, 0.9], [0.0, 0.1]); ([0.6, 0.8], [0.0, 0.2]); ([0.5, 0.8], [0.1, 0.2]) | 4,100,000 | ([0.6, 0.9], [0.0, 0.1]); ([0.7, 0.8], [0.0, 0.1]); ([0.7, 0.9], [0.0, 0.1]) | |

| 2026–2035 | 3,900,000 | ([0.6, 0.8], [0.0, 0.1]); ([0.7, 0.8], [0.0, 0.2]); ([0.5, 0.8], [0.0, 0.2]) | 3,500,000 | ([0.7, 0.8], [0.0, 0.2]); ([0.5, 0.8], [0.0, 0.1]); ([0.5, 0.9], [0.0, 0.1]) | 3,500,000 | ([0.8, 0.9], [0.0, 0.1]); ([0.7, 0.8], [0.0, 0.2]); ([0.6, 0.9], [0.0, 0.1]) |

| 4,000,000 | ([0.7, 0.8], [0.1, 0.2]); ([0.5, 0.8], [0.0, 0.2]); ([0.6, 0.8], [0.0, 0.1]) | 3,600,000 | ([0.7, 0.8], [0.0, 0.1]); ([0.7, 0.8], [0.1, 0.2]); ([0.6, 0.8], [0.0, 0.2]) | 4,000,000 | ([0.5, 0.8], [0.0, 0.1]); ([0.6, 0.8], [0.0, 0.1]); ([0.7, 0.8], [0.0, 0.1]) | |

| 4,100,000 | ([0.7, 0.8], [0.0, 0.1]); ([0.5, 0.6], [0.0, 0.3]); ([0.5, 0.8], [0.0, 0.1]) | 3,700,000 | ([0.5, 0.8], [0.0, 0.2]); ([0.6, 0.8], [0.0, 0.2]); ([0.5, 0.7], [0.0, 0.2]) | 4,500,000 | ([0.7, 0.8], [0.0, 0.1]); ([0.6, 0.8], [0.0, 0.2]); ([0.5, 0.7], [0.0, 0.1]) | |

| Years | E70 2.3MW wind turbine × 13 units | E82 3MW wind turbine × 10 units | V112 3.3MW wind turbine × 9 units | |||

|---|---|---|---|---|---|---|

| 2016–2020 | 3,300,000 | ([0.6634, 0.8484], [0.0000, 0.1516]) | 2,900,000 | ([0.5924, 0.8484], [0.0000, 0,1596]) | 3,400,000 | ([0.6224, 0.8484], [0.0000, 0.1149]) |

| 3,400,000 | ([0.6822, 0.8000], [0.0000, 0.1516]) | 3,000,000 | ([0.6000, 0.8217], [0.0000, 0.1320]) | 3,500,000 | ([0.5627, 0.7648], [0.0000, 0.2000]) | |

| 3,500,000 | ([0.6435, 0.8217], [0.0000, 0.1516]) | 3,100,000 | ([0.5627, 0.7648], [0.0000, 0.2000]) | 3,600,000 | ([0.6822, 0.8000], [0.0000, 0.1516]) | |

| 2021–2025 | 3,500,000 | ([0.6435, 0.8259], [0.0000, 0.1320]) | 3,000,000 | ([0.5817, 0.7298], [0.0000, 0.2000]) | 3,900,000 | ([0.6822, 0.8000], [0.0000, 0.1516]) |

| 3,600,000 | ([0.7788, 07449], [0.0000, 0.2551]) | 3,100,000 | ([0.6435, 0.8067], [0.0000, 0.1320]) | 4,000,000 | ([0.7000, 0.8259], [0.0000, 0.1741]) | |

| 3,700,000 | ([0.5427, 0.7648], [0.0000, 0.1000]) | 3,200,000 | ([0.5817, 0.8484], [0.0000, 0.1516]) | 4,100,000 | ([0.6634, 0.8680], [0.0000, 0.1000]) | |

| 2026–2035 | 3,900,000 | ([0.6272, 0.8000], [0.0000, 0.1516]) | 3,500,000 | ([0.5924, 0.8259], [0.0000, 0.1320]) | 3,500,000 | ([0.7298, 0.8680], [0.0000, 0.1320]) |

| 4,000,000 | ([0.6102, 0.8000], [0.0000, 0.1741]) | 3,600,000 | ([0.6282, 0.8000], [0.0000, 0.5116]) | 4,000,000 | ([0.5871, 0.8000], [0.0000, 0.1000]) | |

| 4,100,000 | ([0.5924, 0.7361], [0.0000, 0.1552]) | 3,700,000 | ([0.5427, 0.7831], [0.0000, 0.2000]) | 4,500,000 | ([0.6272, 0.7831], [0.0000, 0.1320]) | |

| Years | E70 2.3MW wind turbine × 13 units | Aggregated IVIFS | E82 3MW wind turbine × 10 units | Aggregated IVIFS | V112 3.3MW wind turbine × 9 units | Aggregated IVIFS | |||

|---|---|---|---|---|---|---|---|---|---|

| 2016–2020 | 8,500,000 | ([0.7, 0.9], [0.0, 0.1]); ([0.6, 0.8], [0.1, 0.2]); ([0.7, 0.8], [0.1, 0.2]) | ([0.6634, 0.8484], [0.0000, 0.1516]) | 8,000,000 | ([0.7, 0.8], [0.0, 0.2]); ([0.5, 0.9], [0.0, 0.1]); ([0.5, 0.8], [0.1, 0.2]) | ([0.5924, 0.8484], [0.0000, 0.1516]) | 10,000,000 | ([0.6, 0.8], [0.0, 0.1]) ; ([0.6, 0.9], [0.0, 0.1]); ([0.7, 0.8], [0.1, 0.2]) | ([0.6224, 0.8484], [0.0000, 0.1149]) |

| 9,000,000 | ([0.7, 0.8], [0.0, 0.1]); ([0.7, 0.8], [0.1, 0.2]); ([0.6, 0.8], [0.1, 0.2]) | ([0.6822, 0.8000], [0.0000, 0.1516]) | 8,250,000 | ([0.6, 0.9], [0.0, 0.1]); ([0.6, 0.7], [0.0, 0.2]); ([0.6, 0.8], [0.0, 0.1]) | ([0.6000, 0.8217], [0.0000, 0.1320]) | 10,500,000 | ([0.6, 0.7], [0.0, 0.2]) ; ([0.5, 0.8], [0.1, 0.2]); ([0.6, 0.8], [0.0, 0.2]) | ([0.5627, 0.7648], [0.0000, 0.2000]) | |

| 9,500,000 | ([0.7, 0.9], [0.0, 0.1]); ([0.6, 0.7], [0.1, 0.2]); ([0.6, 0.8], [0.0, 0.1]) | ([0.6435, 0.8217], [0.0000, 0.1320]) | 8,500,000 | ([0.6, 0.7], [0.0, 0.2]) ; ([0.5, 0.8], [0.1, 0.2]); ([0.6, 0.8], [0.0, 0.2]) | ([0.5627, 0.7648], [0.0000, 0.2000]) | 11,000,000 | ([0.7, 0.8], [0.0, 0.1]); ([0.7, 0.8], [0.1, 0.2]); ([0.6, 0.8], [0.1, 0.2]) | ([0.6822, 0.8000], [0.0000, 0.1516]) | |

| 2021–2025 | 7,500,000 | ([0.6, 0.8], [0.1, 0.2]); ([0.7, 0.8], [0.0, 0.1]); ([0.6, 0.9], [0.0, 0.1]) | ([0.6435, 0.8259], [0.0000, 0.2551]) | 7,000,000 | ([0.6, 0.8], [0.1, 0.2]); ([0.6, 0.7], [0.0, 0.3]); ([0.5, 0.6], [0.2, 0.3]) | ([0.6435, 0.7298], [0.0000, 0.2551]) | 9,000,000 | ([0.5, 0.6], [0.0, 0.3]); ([0.7, 0.9], [0.0, 0.1]); ([0.6, 0.8], [0.0, 0.2]) | ([0.6102, 0.8000], [0.0000, 0.1783]) |

| 8,000,000 | ([0.7, 0.8], [0.0, 0.2]); ([0.6, 0.7], [0.1, 0.3]); ([0.5, 0.7], [0.2, 0.3]) | ([0.6272, 0.7449], [0.0000, 0.2551]) | 7,500,000 | ([0.6, 0.7], [0.1, 0.2]); ([0.7, 0.9], [0.0, 0.1]); ([0.6, 0.7], [0.0, 0.1]) | ([0.6435, 0.8067], [0.0000, 0.1320]) | 9,500,000 | ([0.7, 0.8], [0.1, 0.2]); ([0.7, 0.8], [0.0, 0.2]); ([0.7, 0.9], [0.0, 0.1]) | ([0.7000, 0.8259], [0.0000, 0.1741]) | |

| 8,500,000 | ([0.6, 0.8], [0.0, 0.1]); ([0.5, 0.7], [0.0, 0.1]); ([0.5, 0.8], [0.0, 0.1]) | ([0.5427, 0.7648], [0.0000, 0.1000]) | 8,000,000 | ([0.6, 0.9], [0.0, 0.1]); ([0.6, 0.8], [0.0, 0.2]); ([0.5, 0.8], [0.1, 0.2]) | ([0.5817, 0.8484], [0.0000, 0.1516]) | 10,000,000 | ([0.6, 0.9], [0.0, 0.1]); ([0.7, 0.8], [0.0, 0.1]); ([0.7, 0.9], [0.0, 0.1]) | ([0.6634, 0.8680], [0.0000, 0.1000]) | |

| 2026–2035 | 7,500,000 | ([0.6, 0.8], [0.0, 0.1]); ([0.7, 0.8], [0.0, 0.2]); ([0.5, 0.8], [0.0, 0.2]) | ([0.6272, 0.7648], [0.0000, 0.1000]) | 7,000,000 | ([0.7, 0.8], [0.0, 0.2]); ([0.5, 0.8], [0.0, 0.1]); ([0.5, 0.9], [0.0, 0.1]) | ([0.5817, 0.8484], [0.0000, 0.1516]) | 9,000,000 | ([0.8, 0.9], [0.0, 0.1]); ([0.7, 0.8], [0.0, 0.2]); ([0.6, 0.9], [0.0, 0.1]) | ([0.6634, 0.8680], [0.0000, 0.1320]) |

| 8,000,000 | ([0.7, 0.8], [0.1, 0.2]); ([0.5, 0.8], [0.0, 0.2]); ([0.6, 0.8], [0.0, 0.1]) | ([0.6102, 0.8000], [0.0000, 0.1741]) | 7,500,000 | ([0.7, 0.8], [0.0, 0.1]); ([0.7, 0.8], [0.1, 0.2]); ([0.6, 0.8], [0.0, 0.2]) | ([0.6822, 0.8000], [0.0000, 0.1516]) | 9,500,000 | ([0.5, 0.8], [0.0, 0.1]); ([0.6, 0.8], [0.0, 0.1]); ([0.7, 0.8], [0.0, 0.1]) | ([0.5871, 0.8000], [0.0000, 0.1000]) | |

| 8,500,000 | ([0.7, 0.8], [0.0, 0.1]); ([0.5, 0.6], [0.0, 0.3]); ([0.5, 0.8], [0.0, 0.1]) | ([0.6634, 0.8484], [0.0000, 0.1516]) | 8,000,000 | ([0.5, 0.8], [0.0, 0.2]); ([0.6, 0.8], [0.0, 0.2]); ([0.5, 0.7], [0.0, 0.2]) | ([0.5427, 0.7831], [0.0000, 0.2000]) | 10,000,000 | ([0.7, 0.8], [0.0, 0.1]); ([0.6, 0.8], [0.0, 0.2]); ([0.5, 0.7], [0.0, 0.1]) | ([0.6272, 0.7831], [0.0000, 0.1320]) | |

| Possible MARRs | Membership intervals | Aggregated |

|---|---|---|

| 7.0% | ([0.5, 0.6], [0.2, 0.4]), ([0.6, 0.7], [0.2, 0.3]), ([0.5, 0.6], [0.2, 0.3]) | ([0.5427, 0.6435], [0.2, 0.3366]) |

| 7.5% | ([0.7, 0.9], [0.0, 0.1]), ([0.8, 0.9], [0.0, 0.1]), ([0.7, 0.8], [0.0, 0.2]) | ([0.7449, 0.8851], [0, 0.1149]) |

| 8.0% | ([0.6, 0.7], [0.2, 0.3]), ([0.7, 0.8], [0.0, 0.2]), ([0.6, 0.7], [0.1, 0.2]) | ([0.6435, 0.7449], [0, 0.2352]) |

| Alternatives | B/C ratios | NPWs |

|---|---|---|

| E70 | ||

| E82 | ||

| V112 |

6. Conclusions and Future Research Directions

Author Contributions

Conflicts of Interest

References

- Beynaghi, A.; Moztarzadeh, F.; Trencher, G.; Mozafari, M. Energy in sustainability research: A recent rise to prominence. Renew. Sustain. Energy Rev. 2015, 51, 1794–1795. [Google Scholar] [CrossRef]

- Onar, S.C.; Oztaysi, B.; Otay, I.; Kahraman, C. Multi-expert wind energy technology selection using interval-valued intuitionistic fuzzy sets. Energy 2015, 90, 274–285. [Google Scholar] [CrossRef]

- GWEC Annual Report 2014. Available online: http://www.gwec.net/publications/global-wind-report-2/global-wind-report-2014-annual-market-update/ (accessed on 19 November 2015).

- Onar, S.C.; Kilavuz, T.N. Risk analysis of wind energy investments in Turkey. Human Ecol. Risk Assess. 2015, 21, 1230–1245. [Google Scholar] [CrossRef]

- Ertürk, M. The evaluation of feed-in tariff regulation of Turkey for onshore wind energy based on the economic analysis. Energy Policy 2012, 45, 359–367. [Google Scholar] [CrossRef]

- Uçar, A.; Balo, F. Assessment of wind power potential for turbine installation in coastal areas of Turkey. Renew. Sustain. Energy Rev. 2010, 14, 1901–1912. [Google Scholar] [CrossRef]

- Blank, L.T.; Tarquin, J.A. Engineering Economy, 7th ed.; McGraw-Hill Inc.: New York, NY, USA, 2012. [Google Scholar]

- Zadeh, L.A. Fuzzy Sets. Inf. Control 1989, 8, 338–353. [Google Scholar] [CrossRef]

- Onar, S.C.; Oztaysi, B.; Kahraman, C. Strategic decision selection using hesitant fuzzy TOPSIS and interval type-2 fuzzy AHP: A case study. Int. J. Comput. İntell. Syst. 2014, 7, 1002–1021. [Google Scholar] [CrossRef]

- Behret, H.; Öztayşi, B.; Kahraman, C. A fuzzy inference system for supply chain risk management. Pract. Appl. Intell. Syst. 2012. [Google Scholar] [CrossRef]

- Kaya, I.; Oztaysi, B.; Kahraman, C. A Two-Phased Fuzzy Multicriteria Selection among Public Transportation Investments for Policy-Making and Risk Governance. Int. J. Uncertain. Fuzz. Knowl. Based Syst. 2012. [Google Scholar] [CrossRef]

- Kahraman, C. Multi-criteria decision-making methods and fuzzy sets. In Fuzzy Multi-Criteria Decision Making: Theory and Applications with Recent Developments; Kahraman, C., Ed.; Springer: New York, NY, USA, 2008; pp. 1–18. [Google Scholar]

- Zhang, G.; Lu, J. Model and approach of fuzzy bilevel decision-making for logistics planning problem. J. Enterp. Inf. Manag. 2007, 20, 178–197. [Google Scholar]

- Tüysüz, F.; Kahraman, C. Modeling a flexible manufacturing cell using stochastic Petri nets with fuzzy parameters. Expert Syst. Appl. 2010, 37, 3910–3920. [Google Scholar] [CrossRef]

- Coban, V.; Onar, S.C.; Soyer, A. Analyzing Dynamic Capabilities via Fuzzy cognitive Maps. Intell. Tech. Eng. Manag. 2015. [Google Scholar] [CrossRef]

- Oztaysi, B.; Onar, S.C.; Goztepe, K.; Kahraman, C. Evaluation of research proposals for grant funding using interval-valued intuitionistic fuzzy sets. Soft Comput. 2015. [Google Scholar] [CrossRef]

- Yavuz, M.; Oztaysi, B.; Onar, S.C.; Kahraman, C. Multi-criteria evaluation of alternative-fuel vehicles via a hierarchical hesitant fuzzy linguistic model. Expert Syst. Appl. 2015, 42, 2835–2848. [Google Scholar] [CrossRef]

- Kahraman, C.; Oztaysi, B.; Onar, S.C. A Multicriteria Supplier Selection Model Using Hesitant Fuzzy Linguistic Term Sets. J. Mult.-Valued Log. Soft Comput. 2015, in press. [Google Scholar]

- Miyamoto, S. Fuzzy Multisets and Their Generalizations. Lect. Notes Comput. Sci. 2001, 2235, 225–235. [Google Scholar]

- Kahraman, C.; Oztaysi, B.; Sari, I.U.; Turanoglu, E. Fuzzy analytic hierarchy process with interval type-2 fuzzy sets. Knowl.-Based Syst. 2014, 59, 48–57. [Google Scholar] [CrossRef]

- Oztaysi, B. A Group Decision Making Approach Using Interval Type-2 Fuzzy AHP for Enterprise Information Systems Project Selection. J. Mult.-Valued Log. Soft Comput. 2015, 24, 475–500. [Google Scholar]

- Kahraman, C.; Onar, S.C.; Oztaysi, B. Fuzzy Multicriteria Decision-Making: A Literature Review. Int. J. Comput. Intell. Syst. 2015, 8, 637–666. [Google Scholar] [CrossRef]

- Kahraman, C.; Tolga, E.; Ulukan, Z. Justification of manufacturing technologies using fuzzy benefit-cost ratio analysis. Int. J. Prod. Econ. 2000, 66, 45–52. [Google Scholar] [CrossRef]

- Herbert, G.M.J.; Sreevalsan, S.I.E.; Rajapandian, S. A review of wind energy technologies. Renew. Sustain. Energy Rev. 2007, 11, 1117–1145. [Google Scholar] [CrossRef]

- Sarja, J.; Halonen, V. Wind Turbine Selection Criteria: A Customer Perspective. J. Energy Power Eng. 2013, 7, 1795–1802. [Google Scholar]

- Chowdhury, S.; Zhang, J.; Messac, A.; Castillo, L. Optimizing the arrangement and the selection of turbines for wind farms subject to varying wind conditions. Renew. Energy 2013, 52, 273–282. [Google Scholar] [CrossRef]

- Perkin, S.; Garrett, D.; Jensson, P. Optimal wind turbine selection methodology: A case-study for Búrfell. Icel. Renew. Energy 2015, 75, 165–172. [Google Scholar] [CrossRef]

- Mostafaeipour, A.; Jadidi, M.; Mohammadi, K.; Sedaghat, A. An analysis of wind energy potential and economic evaluation in Zahedan, Iran. Renew. Sustain. Energy Rev. 2014, 30, 641–650. [Google Scholar] [CrossRef]

- Rahimi, S.; Meratizaman, M.; Monadizadeh, S.; Amidpour, M. Techno-economic analysis of wind turbine–PEM (polymer electrolyte membrane) fuel cell hybrid system in standalone area. Energy 2014, 67, 381–396. [Google Scholar] [CrossRef]

- Schallenberg-Rodriguez, J. A methodological review to estimate techno-economical wind energy production. Renew. Sustain. Energy Rev. 2013, 21, 272–287. [Google Scholar] [CrossRef]

- Mohammadi, K.; Mostafaeipour, A. Economic feasibility of developing wind turbines in Aligoodarz, Iran. Energy Convers. Manag. 2013, 76, 645–653. [Google Scholar] [CrossRef]

- EWEA. European Wind Energy Association Report. 2011. Available online: http://www.ewea.org/fileadmin/files/library/publications/reports/EWEA_Annual_Report_2011.pdf (accessed on 19 November 2015).

- Krohn, S.; Morthorst, P.E.; Awerbuch, S. The Economics of Wind Energy. 2009. Available online: http://www.ewea.org/fileadmin/files/library/publications/reports/Economics_of_Wind_Energy.pdf (accessed on 19 November 2015).

- Atanassov, K.T. Intuitionistic Fuzzy Sets. Fuzz. Sets Syst. 1986, 20, 87–96. [Google Scholar] [CrossRef]

- Atanassov, K.T. Intuitionistic Fuzzy Sets: Theory and Applications; Springer: Berlin, Germany, 1999. [Google Scholar]

- Atanassova, L. On interval-valued intuitionistic fuzzy versions of L. Zadeh's extension principle. Issues Intuit. Fuzzy Sets General. Nets 2008, 7, 13–19. [Google Scholar]

- Li, D.F. Extension principles for interval-valued intuitionistic fuzzy sets and algebraic operations. Fuzzy Optim. Decis. Mak. 2011, 10, 45–48. [Google Scholar] [CrossRef]

- Xu, Z.-S. Methods for aggregating interval-valued intuitionistic fuzzy information and their application to decision-making. Control Decis. 2007, 22, 215–219. [Google Scholar]

- Ciabattoni, L.; Grisostomi, M.; Ippoliti, G.; Longhi, S. Fuzzy logic home energy consumption modeling for residential photovoltaic plant sizing in the new Italian scenario. Energy 2014, 74, 359–367. [Google Scholar] [CrossRef]

- Ciabattoni, L.; Ferracuti, F.; Grisostomi, M.; Ippoliti, G.; Longhi, S. Fuzzy logic based economical analysis of photovoltaic energy management. Neurocomputing 2015, 170, 296–305. [Google Scholar] [CrossRef]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kahraman, C.; Cevik Onar, S.; Oztaysi, B. A Comparison of Wind Energy Investment Alternatives Using Interval-Valued Intuitionistic Fuzzy Benefit/Cost Analysis. Sustainability 2016, 8, 118. https://doi.org/10.3390/su8020118

Kahraman C, Cevik Onar S, Oztaysi B. A Comparison of Wind Energy Investment Alternatives Using Interval-Valued Intuitionistic Fuzzy Benefit/Cost Analysis. Sustainability. 2016; 8(2):118. https://doi.org/10.3390/su8020118

Chicago/Turabian StyleKahraman, Cengiz, Sezi Cevik Onar, and Basar Oztaysi. 2016. "A Comparison of Wind Energy Investment Alternatives Using Interval-Valued Intuitionistic Fuzzy Benefit/Cost Analysis" Sustainability 8, no. 2: 118. https://doi.org/10.3390/su8020118

APA StyleKahraman, C., Cevik Onar, S., & Oztaysi, B. (2016). A Comparison of Wind Energy Investment Alternatives Using Interval-Valued Intuitionistic Fuzzy Benefit/Cost Analysis. Sustainability, 8(2), 118. https://doi.org/10.3390/su8020118