1. Introduction

With the immensity of global environmental challenges and the worsening energy crisis, balancing economic development and environmental protection represents a substantial problem for governments, academia and industry around the world. Multiple incidents, including the British Petroleum oil spill in the Gulf of Mexico and surging PM (Particulate Matter) 2.5 levels in China, have caused governments and businesses to realize the urgency and necessity of a green transformation. An important component of addressing sustainable development issues and environmental degradation will hinge on making up for and improving the lack of social responsibility of corporations [

1,

2]. There is an increasing call for enterprises to develop green businesses and adopt a development mode that considers both ecological and economic benefits, that is, green entrepreneurship, which is recognized by governments, enterprises, customers and other stakeholders. Green entrepreneurship integrates business entrepreneurship and sustainable development, simultaneously considering the sustainable development of the environment, economy and society [

3,

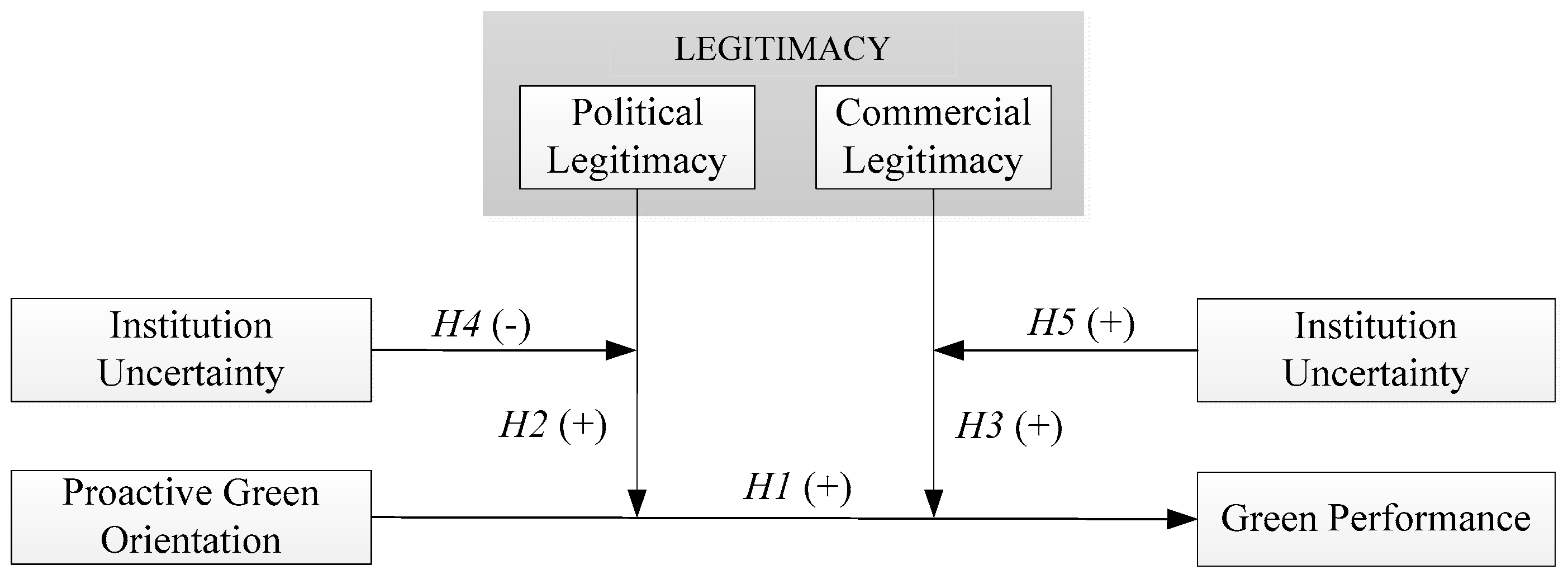

4]. Thus, both business and academia are concerned about whether enterprises with proactive green orientation can truly achieve green performance and how legitimacy constraints influence green startups in achieving green performance.

Green entrepreneurship refers to entrepreneurial behavior in an enterprise’s green innovation of products, services and market development to generate profit while considering environmental protection [

5,

6]. Green entrepreneurship theory developed with the gradual integration of the theories of entrepreneurship and social enterprises. Under the double influence of eco-orientation and market-orientation, enterprises are not likely to be burdened by green entrepreneurship as it will provide vast resources for enterprise development [

7,

8]. With reference to the definition of entrepreneurial orientation by Miller and Friesen (1983) [

9], this study argues that green entrepreneurial companies need to have green entrepreneurial orientation (GEO), which includes green innovation, green risk taking and green proactiveness. Because green entrepreneurial companies need to be socially responsible, it is particularly important for them to acquire legitimacy. Suchman (1995) [

10] proposes that legitimacy refers to external stakeholders’ overall evaluation of the appropriateness of corporate behavior with respect to both social responsibility and other standards, such as competitive advantage and enterprise scale. Breaking through legitimacy constraints and achieving green performance has become the main goal of enterprises involved in green entrepreneurship.

Because proactive green-oriented businesses not only focus on business performance but also must consider social responsibility, the relationship between GEO and green performance will be subject to the restrictions and limitations of the institutional environment. As an institutionally embedded binding mechanism, the study of enterprise legitimacy has attracted attention [

11]. Nevertheless, this research area encompasses two views. The first view takes strategic theory as a starting point and treats legitimacy as a strategic resource that enterprises are prone to lose, claiming that the ultimate goal in seeking legitimacy is to obtain resources that can be mobilized and that securing recognition and legitimacy from external stakeholders will be conducive to start-ups’ ability to realize opportunity and value; this “legitimacy–resources–business growth” model of causal relationships is widely recognized [

12,

13,

14]. However, many scholars have questioned it and propose that legitimacy cannot be considered a key resource for startups in overcoming the disadvantage of starting anew because experienced, reasonable entrepreneurs are more likely to pursue more easily obtained resources to build their business models [

12,

15,

16]. Combining the above arguments, this study tends towards the latter view and argues that legitimacy should exist as an institutionally embedded limiting mechanism and that green-oriented entrepreneurship should not deem legitimacy as a necessary resource but, instead, take appropriate strategic action according to the circumstances.

Based on this analysis, this study focuses on two points. First, because the causal model of “GEO–legitimacy–resources–business growth” does not reflect the essence of legitimacy in green entrepreneurship; a comparative exploration of the impact of varying degrees of legitimacy on the effects between GEO and green performance appears to be more worthwhile, and such studies are rare. Therefore, we have explored the relationship between green proactiveness orientation (GPO) and green performance and described the moderating effect of legitimacy. More importantly, the premise upon which it is possible to integrate the theory of legitimacy and green entrepreneurship theory is the existence of stable and effective systemic rules on which legitimacy evaluations rely; this does not match many transitional economies, including China. Because of the substantial institutional uncertainty created by economies in transition, previous research conclusions have become inapplicable, producing higher heterogeneity in guidelines that judge legitimacy in transition economies [

17]. Thus, in light of the situation of China’s transition economy, we explore the relationship between GPO, legitimacy and green performance under institutional uncertainty.

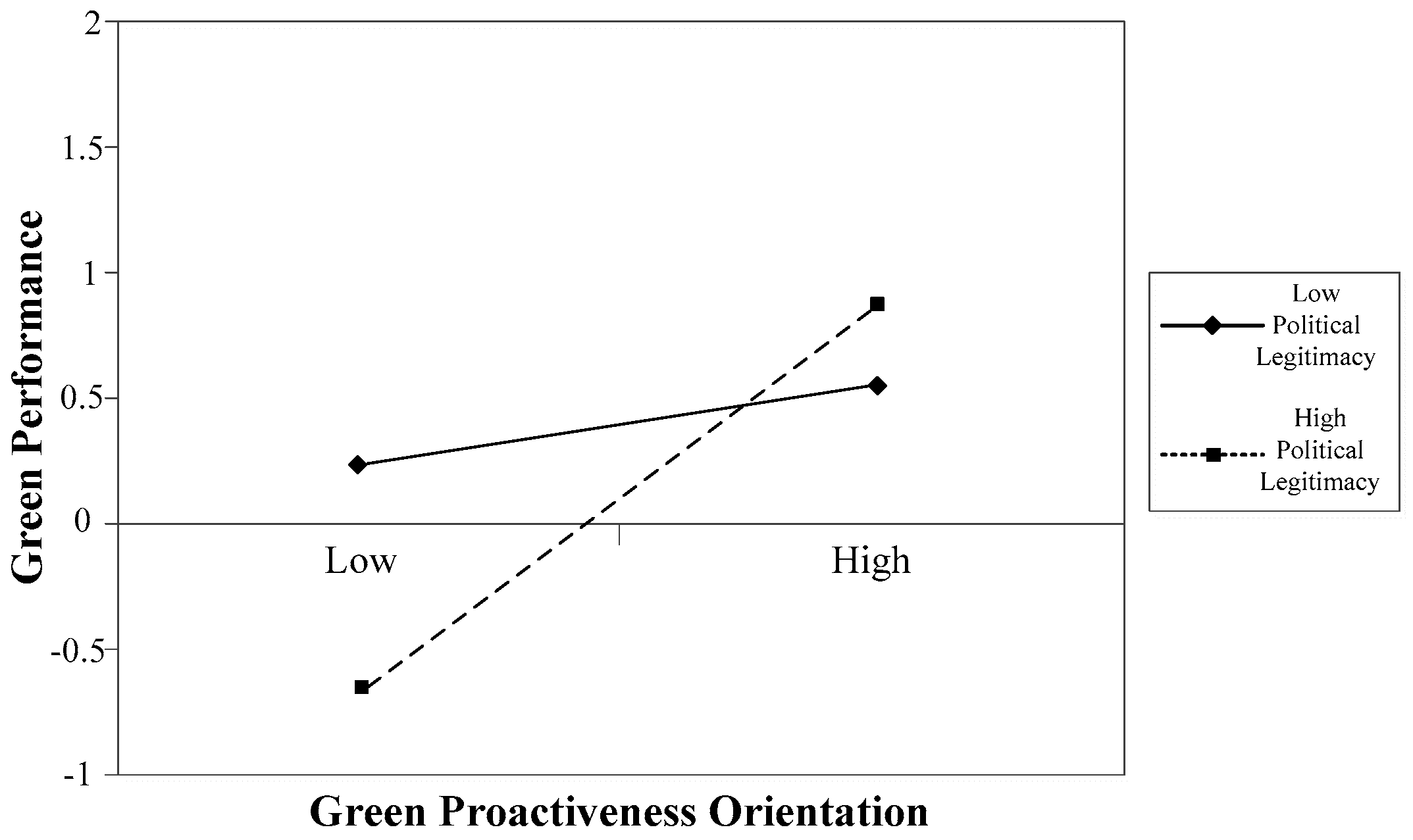

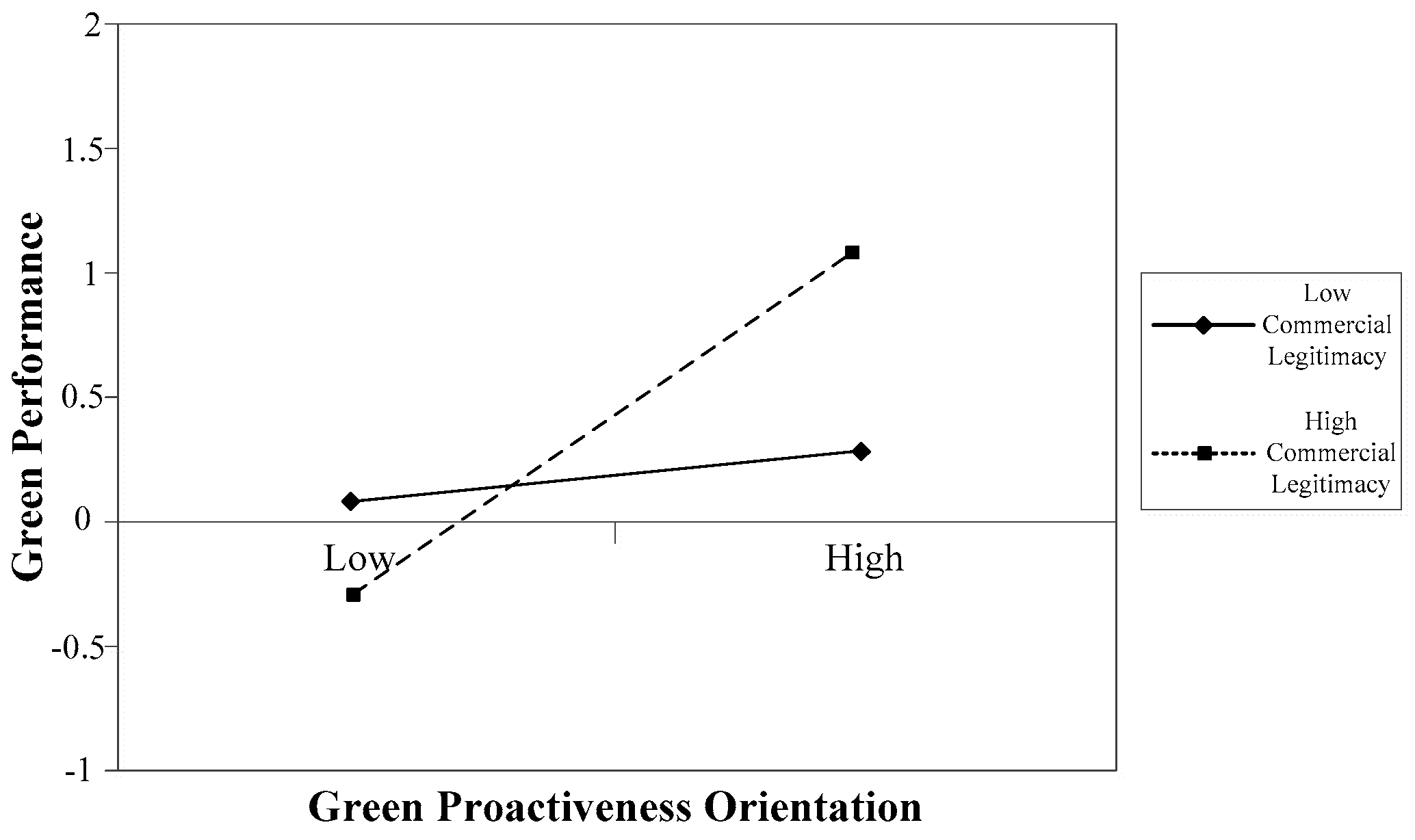

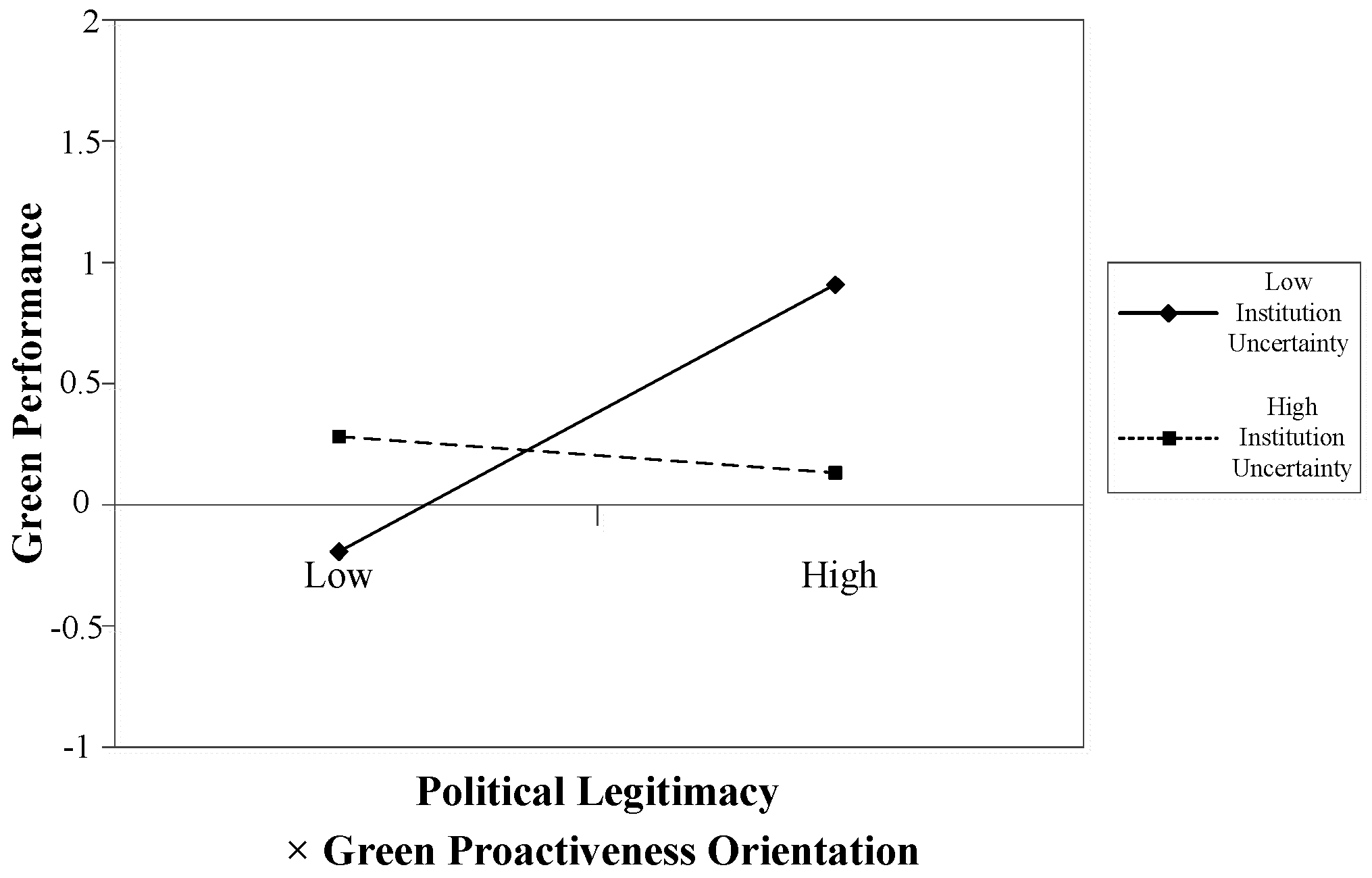

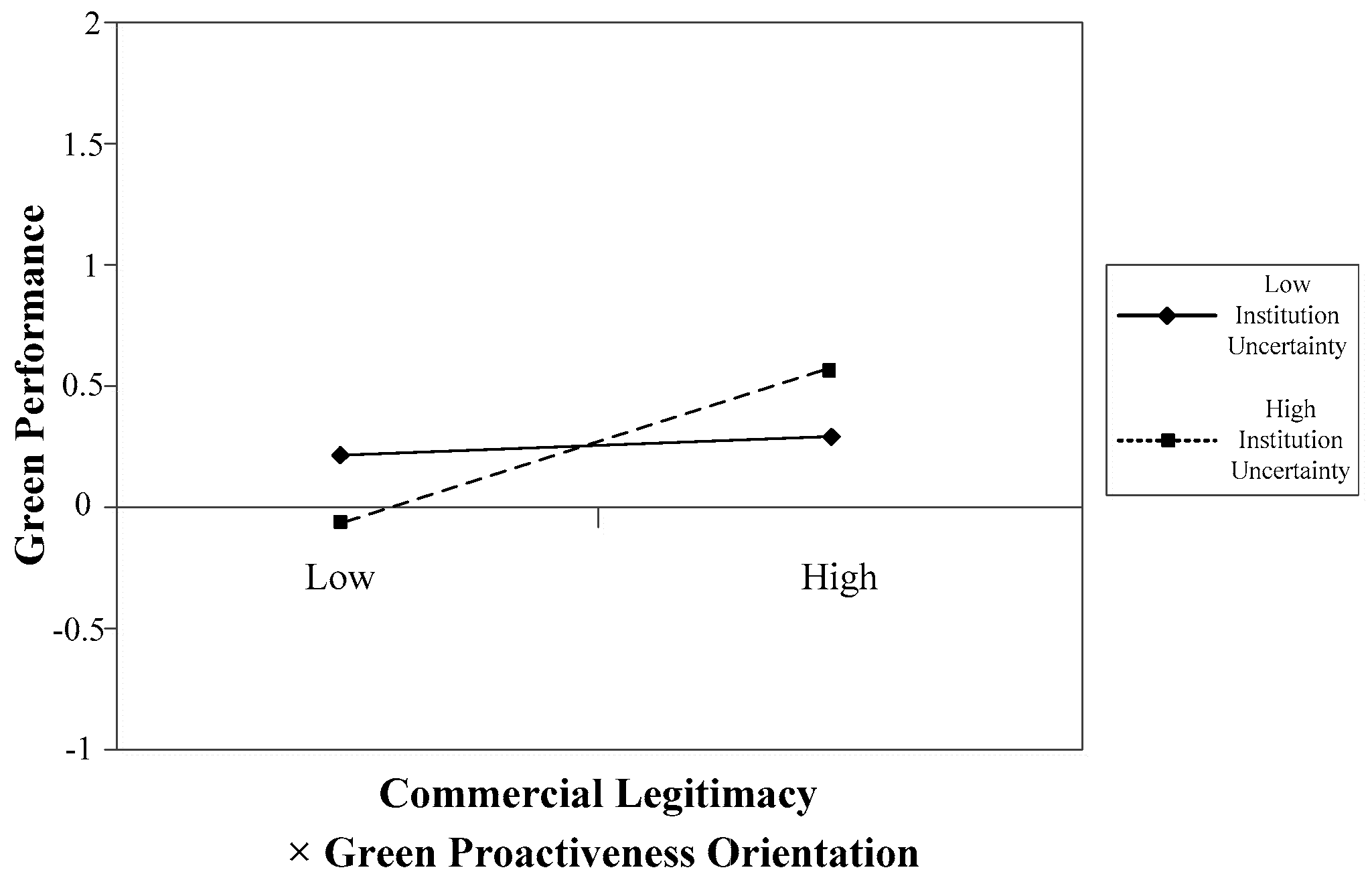

To accomplish the above objectives, 235 valid samples are collected and empirical tests performed. The results show that GPO has a positive impact on green performance and that the degree of political and commercial legitimacy has a positive moderating effect. However, institutional uncertainty undermines the promotional effect of political legitimacy between GPO and green performance while enhancing the promotional effect of commercial legitimacy between them. The structure of the paper is as follows. An extensive review of green entrepreneurship theory based on entrepreneurial orientation, legitimacy and transitional economy theory is addressed in

Section 2 with relevant hypotheses. The method of sample analysis, data gathering and empirical results are discussed in

Section 3.

Section 4 provides theoretical and managerial implications. The conclusion and research limitation are presented in the final section.

3. Methodology

3.1. Development of Survey Instrument

According to Murphy et al. (1996) [

83], appropriate control variables should be used in studying entrepreneurial performance to avoid performance measurement bias. Therefore, this study used enterprise size, establishment time, sector, business scale and stage of development as control variables.

Based on the extensive theoretical background in the previous section, this study identified the following required measurements. All items were measured on a Likert five scale, where a rating of one indicates that the statement did not fit the reality of the enterprise to which the respondent belongs and a rating of five indicated a high fit. Moreover, the measures of EO has been mentioned in a previous study. This study adopts the scale from Covin and Slevin (1989) [

26] on proactiveness orientation and used three statements to measure GPO.

Table 1 presents the specific statements and factor loadings of GPO.

Political legitimacy and commercial legitimacy belong to enterprises’ external legitimacy, including the recognition of enterprises by governments, regulators, customers, suppliers and partners. Four statements were selected from the discussion of legitimacy in Suchman (1995) [

10] and Rottig and Reus (2009) [

58] to measure political legitimacy and commercial legitimacy.

Table 2 and

Table 3 present these statements and corresponding loading factors, showing a high significance affirmative of the statements.

Institutional uncertainty and market uncertainty are the primary features of transitional economies. Puffer et al. (2010) [

78] and Sheng et al. (2011) [

79] have conducted thorough research on institutional uncertainty from the aspects of policy completeness and operability. Based on their results, five questions were selected to measure institutional uncertainty (

Table 4). In addition, Zhu and Sarkis (2004) [

44] and Yang et al. (2013) [

45] proposed four items to evaluate green performance, which consists of six questions expressed in

Table 5.

3.2. Data Gathering

To test the proposed hypothesis, this study conducted a questionnaire survey. According to Li and Atuahene-Gima’s (2001) [

84] definition of start-ups as enterprises that have been established for no more than eight years, our sample focused on data from start-ups within the last eight years. The survey distribution lasted from February through July 2016. The survey was conducted from February through July 2016, and the study areas are Beijing, Shanghai, Changchun, Shenyang, Hangzhou and Xiamen. These areas have different levels of development (i.e., central developed cities, economically less active cities from the North and coastal cities from the South) to avoid the effects of different levels of regional economic development. Enterprises involved in the research include green construction and materials, green furnishing, green process transformation, low-carbon energy sources, eco-friendly materials, energy-saving equipment, and waste disposal services and training.

The data collection process was divided into three phases. In the first phase, survey questionnaires were distributed through email and 120 responses were gathered. In the second phase, questionnaires were given to MBA students, 110 of whom responded. In the third phase, questionnaires were obtained onsite from mid-level and senior managers of solicited enterprises and from researchers completing the questionnaire face to face, with 63 responses collected. Overall, 297 responses were collected, 62 of which were excluded because of insufficient or incomplete responses. A total of 235 samples were valid and used in the study of 22 variables, making the combination valid based on the requirements stated by Bentler and Chou (1987) that the number of samples must be at least ten times the number of observed variables [

85]. An ANOVA-Test was also conducted on the dependent variable (green performance) of three different groups and no significant difference was found (

t = 0.145 > 0.05), thus, they can be used in combination.

3.3. General Descriptive Analysis

After the large sample was collected, descriptive statistical analysis was carried out. On the one hand, the results of a general descriptive analysis could reflect the basic characteristics of the sampled enterprises. On the other hand, these results could also confirm the versatility and reproducibility of other findings. The results of a general descriptive analysis would help the study by providing salient features of samples, thereby supplementing the assessment of the research objects.

3.4. Examination of Validity

The study measured both content validity and construct validity. Content validity indicates whether the content of the scale can accurately cover the range or extent of the concept or meaning to be measured, and this can usually be measured subjectively [

86]. Construct validity includes both convergent validity and discriminant validity. Convergent validity can be illustrated by composite reliability (hereinafter referred to as CR) and average variance extracted from latent variables (hereinafter referred to as AVE). For discriminant validity, this study referenced Fornell and Larcker (1981) [

87] and carried out tests by comparing the average root mean square values of AVE from various latent variables and the correlation coefficients of these variables.

3.5. Examination of Reliability

The reliability test refers to the level of consistency of measurements by different measurers taken with the same tools, reflecting the degree of approximation of repeated measurements under the same conditions, that is, whether a set of projects measure the same concept. Generally, this test can be carried out by inspecting the internal consistency of the measurement tools [

88]. In the Likert-scale method, the most commonly used method is the L.J. Cronbach α coefficient. Although an α coefficient value of 0.70 is on the lower boundary of the scale, it is still acceptable.

3.6. Correlation Analysis

Correlation analysis focuses on the correlation among independent variables, control variables and dependent variables. The correlation coefficient is the commonly used measurement and the method can be the Pearson’s product moment correlation method and the two-sided test. If the correlation coefficient between independent variables is greater than 0.75, the variables are considered too similar and collinearity might be present.

Harman’s single-factor test was used to analyze the entire questionnaire. In the absence of rotation, the explained variance of the first factor extracted exceeded 50%. Thus, it could be determined that there was a serious bias in the common measurement method.

3.7. Regression Analysis

In this study, regression analysis was used to verify the relationship between GPO and startup performance and the moderating effect of legitimacy and institutional uncertainty. The study used three indicators for regression analysis. First, the coefficient of determination of the model reflects the explanatory power of the regression equation for the dependent variable. We used R2 to reflect the fit of the regression equation to avoid an influence from the number of independent variables on R2. Second, the significance level of F. The regression model is said to be valid when the regression coefficient is not 0 at significance value of less than 0.05 or 0.01. Third, the variance inflation factor (VIF index) reflects the collinearity between independent variables. Collinearity is indicated by a large VIF index. When 0< VIF <10, multicollinearity generally does not exist.

5. Theoretical and Managerial Implications

5.1. Theoretical Implications

First, this study confirms a positive relationship between GPO and green performance, meaning start-ups that adopt GPO will have an advantage in achieving green performance. This empirical result shows different conclusions for green entrepreneurship and ordinary entrepreneurship. In the study of entrepreneurial orientation, which does not consider green performance as a prerequisite, a startup that adopts a proactive orientation will not necessarily achieve entrepreneurial performance [

38]. The proactive advantage that pioneers pursue is likely to eventually become a proactive disadvantage, and the relationship between proactiveness orientation and entrepreneurial performance is not a simple linear one. In contrast, there is a linear relationship between GPO and green performance, which is not influenced by the number or the behaviors of the followers. To some extent, these conclusions make up for the lack of research on entrepreneurial orientation and green entrepreneurship. Second, the research findings support the idea that high levels of legitimacy enhance the relationship between GPO and green performance, providing a better understanding of the role of legitimacy between GPO and green performance. Rarely do studies treat legitimacy as an institution-embedded binding mechanism and explore how different levels impact the interaction between GPO and green performance. More specifically, our findings support the idea that a high level of legitimacy enhances the relationship between GPO and green performance. Furthermore, legitimacy under institutional constraint for startups is not negative but positive. Legitimacy constraints can increase the motivation of startups to develop green entrepreneurship. This conclusion also breaks through prejudice to institute pressure to a certain extent. Our findings thus highlight that political legitimacy and commercial legitimacy should be considered when studying the role and the efficacy of GPO.

Lastly, the linkage between institutional theory and green entrepreneurship theory under the conditions of a transitional economy is addressed. As a positive factor, legitimacy can improve the relationship between GPO and green performance, but this conclusion will change against the background of transitional economics. Under a high degree of institutional uncertainty, political legitimacy will become an inhibitory factor, while the promotion of commercial legitimacy will be strengthened. For example, in an environment of highly uncertain institutions caused by gaps in policies and regulations and incomplete green standards for implementation, pioneering GE enterprises continue to exploit policy “loopholes” without being punished. Therefore, the institutional pressure on those enterprises decreases and the drive to gain political legitimacy will decline, inhibiting the promoting effect of political legitimacy between GPO and green performance. Conversely, with increased institutional uncertainty, enterprises need to obtain recognition from the public, suppliers and partners to achieve higher business performance. In this situation, the drive to gain commercial legitimacy will increase and the bidding power of commercial legitimacy on enterprises exerts greater pressure on those enterprises, thus resulting in commercial legitimacy playing a more prominent role in promoting the relationship between GPO and green performance. To a certain extent, this explains why in the transitional economy, Chinese enterprises find it difficult to implement green standards, prefer to seek “Guanxi”, exploit policy “loopholes”, focus excessively on business performance and the pursuit of profit above all else, compete viciously, and suffer from serious product homogeneity, among others. It can be seen that against the background of transitional economics, the effect of institutional legitimacy on the relationship between GPO and green performance is quite different, which is the main reason the factors of institutional uncertainty should be introduced into this article.

5.2. Managerial Implications

This study has several managerial implications. First, it finds that proactive green-oriented start-ups have an advantage in achieving green performance. This finding encourages both entrepreneurs and business managers in different industries to take GE actions ahead of their competitors, including the early introduction of new, environmentally friendly products, technology and green management. Senior managers need to often examine future industry trends, learn green development opportunities and act early to cope with change. These actions will help businesses gain a lead in pollution prevention, energy efficiency and safety compared to their peers.

Second, for green startups in different industries, proactiveness is correct, but the external legitimacy constraint should not be discounted. Pioneering green enterprises must not only manage their perception of governments and regulatory agencies but also attach importance to their evaluation by customers, suppliers and partners. The two legitimacies are both an institutional constraint and a positive drive to proactive green enterprises in achieving green performance. However, for the government, the lower the legitimacy of green enterprises, the more likely they are to conduct non-green business activities, and they should be the focus of green supervision and inspection.

Finally, for some Western developed countries, the country’s institutional background is relatively stable. In this context, startups that are developing green entrepreneurship activities must simultaneously pay attention to the constraints of the government and the market, which is very helpful for green startups seeking to achieve green performance. In contrast, in some developing countries, the high degree of institutional uncertainty results in a poor political legitimacy constraint, and many ventures will pursue commercial legitimacy excessively, leading them to engage in vicious competition and produce homogeneous products. Thus, this conclusion is a warning to some governments: in addition to improving institutional standards as soon as possible, to increase the strength of moral propaganda, the government may also need to accelerate the integration of green criteria into society through extensive publicity so that the informal institution of social norms can participate in promoting green business operations.

6. Conclusions

This study reviewed the theory of entrepreneurship, green entrepreneurship theory, legitimacy theory and the theory of economic transition. By administering 235 questionnaires on green startups in China and applying relevant methodologies, we empirically verified the relationship between GPO and green performance, the moderating effect of institutional legitimacy between the two, and the influence of institutional uncertainty on the moderating effect of legitimacy. This research provides a unique perspective on GE, not only in integrating institutional theory and entrepreneurship theory but also by enriching the entrepreneurial scene and contributing to GE theory, legitimacy theory and situational theory.

This study finds that GPO and green performance have a positive correlation. Enterprises engaging in GE ahead of its competitors can obtain an advantage in green performance, including gains in emissions reduction, energy costs and unexpected incidents. In addition, the study concluded that both political and commercial legitimacy play a catalytic role in proactive green-oriented startups achieving green performance. In other words, the pressure exerted by legitimacy constraints is also a driving force, and institutional constraint is a positive variable: green startups must not only obtain recognition from the government and regulatory agencies but also pay attention to their evaluation by partners, customers and suppliers. The two legitimacies are both an institutional constraint and a positive drive to proactive green enterprises in achieving green performance. Considering the transitional economy of China, institutional uncertainty would enhance the promoting effect of commercial legitimacy between GPO and green performance while damaging that of political legitimacy. Because GE needs to balance commercial performance and social responsibility, it is subject to influences from institutional legitimacy. Furthermore, the institutional uncertainty existing in the transitional phase can have an impact on the effect of institutional legitimacy on green enterprises. This study sufficiently demonstrates that when institutional uncertainty is high, Chinese green enterprises tend to seek “guanxi”, exploit policy “loopholes”, pursue profit above all else and compete viciously. Therefore, institutional uncertainty against the background of transitional economics will inhibit the relationship between GPO and green performance, even aggravating market uncertainty and making green strategies no longer feasible for developing countries. Thus, the conclusions will be an important warning for governments.

Although our study integrated institution theory and entrepreneurship theory and contributed to GE theory under the scenario of a transitional economy, it has some limitations. First, the sample data were from Chinese green start-ups, which are generally different from Western enterprises. Whether the conclusions of this study have broader universal applicability is worth further investigation and future research. Second, we focused on the relationship between GPO and green performance and did not involve other dimensions of GEO in the study. In the future, we need to further explore the impact of green innovation and green risk-taking on green performance. Green risk-taking is especially important as its relationship with green performance may be non-linear. Third, the dependent variable that we examined was green performance and not financial performance. Although green performance is an important part of sustainable development, enterprises might be more concerned about the financial performance and green behavior that can provide financial results. The study did not go deeper and analyze when green behavior might bring financial performance to enterprises. Future studies should further explore the relationship between GEO, green performance and financial performance. Fourth, future research may need to address other indicators of external legitimacy as this research only considered political legitimacy and commercial legitimacy. Therefore, the impact of other dimensions of legitimacy such as cognitive legitimacy or moral legitimacy may be worth exploring. Finally, we only examined the influence of institutional uncertainty on the moderating effect of legitimacy in a transitional economy. As a transitional economy includes an important dimension of market uncertainty, future research should focus on patterns of GE behavior under market uncertainty.