1. Introduction

Accountancy is continuously developing in line with economic development. In a thriving market economy, it is reasonable for market participants to expect objective information to be readily available regarding a company’s financial situation and profitability. Along these lines, business events to be presented in a company’s annual report should be interpreted in the same way. In Hungary, more than two decades have passed since state-owned companies were privatized and Western-style enterprises were founded. Naturally, this ownership change was accompanied by changes in accounting regulations. After the transition to a market economy in 1992, a new accounting regulation system was introduced with respect to the changes the newly adopted economy demanded. The new accountancy law followed the model of the 4th and 7th directives of the European Union, which included detailed regulation regarding the applicable accounting principles, regular accounting requirements, the content of financial reports, the audit ensuring the soundness and credibility of the financial statement and its publishing.

As part of the accession process to the European Union, accounting regulations were examined which contributed to the improvement of Hungarian accountancy practices. It was proved during the legal harmonization negotiations that, although Hungarian efforts were largely in line with those of the European Union, further recodification of the law, which was carried out in 2000, was necessary to achieve total harmonization. A recodified accounting act—Act C of 2000 on Accounting [

1], —took the European Union’s accounting guidelines and International Accounting Standards (IAS) into consideration, which—in spite of several modifications—has been effective for almost 15 years now. The act also regulates the preparation of annual reports for companies preparing the broader reporting form—reporting balance sheet, income statement and notes to financial statements. This paper seeks the answer the question of whether current Hungarian practice is still valid in changed economic circumstances and whether it satisfies legislative expectations in the light of presenting the content of annual reports. Even during the drafting of the law now in force, enterprises were founded in great number. The market was characterized by businesses which were in their infancies, but typically showing upward trends in economic growth. This fact was also supported by different management theories and corporate life cycle models, which dealt with the successful upward phase of the companies. In this way, the research of a company’s declining phase was pushed into the background. The economic crisis, which began in 2008, focused attention on corporate lifecycle analysis, but today analyses are more likely to be focused on recognizing the declining phase, which highlights the importance of financial reports. The question has arisen as to whether financial statements are capable of signaling problems in time. Does the publishing of the compulsorily presented content of the annual report—which should be prepared along with the annual report—address market expectations? Should the content of the annual report be restructured or is it enough to make a progress in its practical application?

2. The Relation between Corporate Life Cycle Models and Managerial Accounting

The economic crisis has put increased focus on enterprises in the public eye. Enterprises have had to review their strategies, placing the onus of success in designing these strategies on management. Although a growing number of researchers were engaged in investigating the problems faced by enterprises—especially the funding difficulties of small and medium enterprises—even before the crisis, current market challenges are forcing companies to reconsider their future opportunities. The economic crisis has heavily affected Hungary. Managers are having to re-evaluate in which life cycle their companies are, as well as what options they have—with proper planning, regulations, organizational development and motivation—to lead the company to a more mature life cycle (or, rather, to try to at least halt its decline). Companies that have already reached “maturity” have already progressed to the targeted optimal stage. For other companies, the “aging” phase is an unusually big challenge. This article interprets what role should be determined for a controller, in order for management to accomplish the above-mentioned goals.

Numerous researchers have studied corporate life cycle models in the last 50 years—e.g., Adizes (1992) [

2], Göblös and Gömöri (2004) [

3], Greiner (1998) [

4], Hisrich (1991) [

5], Kőhegyi (2001) [

6], Kuczi (2002) [

7], Lippitt and Scmidt (1967) [

8], Salamonné (2006) [

9], Szerb (2000) [

10], Szirmai (2002) [

11], Timmons (1990) [

12]—and described the characteristics of different phases of the corporate life cycle. It is noticeable that, except for the life cycle model of Adizes (1992) [

1], none of the models details the declining phase of a company. This caution might not be accidental as, while there still exists any evidence of actual growth, the last, declining phase of the corporate life cycle is more difficult to evaluate realistically.

Although Adizes’ typology (1992) [

2] is perhaps the most common, we intend to use Timmons’ (1990) [

11] model to illustrate the role and significance of managerial accounting in corporate life cycle analysis. The main reason for our decision is that the Timmons model is considered to be more transparent. Moreover, his theory was built up using rapidly growing companies, so the main characteristics are given. Before Timmons’ model is presented in detail, Adizes’ model should be also mentioned—even if only to list his interpretation of the life cycles. Adizes divided the corporate life cycle into ten stages:

courtship, infancy, go-go, adolescence, prime, stabile, aristocracy, early-bureaucracy, bureaucracy and death. The problem of growing, aging, flexibility and controllability is presented using a detailed analysis of these stages. In his opinion, the development of life cycles are not inevitable consequences of a company’s size and age; rather, these are affected by its capability of renewal. Although a young company can be characterized by a high level of flexibility, simultaneously, it is difficult to manage. Over time, controllability grows, but the company will become less flexible. Finding a balance can make an organization successful (this is the adolescence stage in Adizes’ model). Obviously, different stages can be monitored in every single company’s life. Probably, there is no chance of skipping stages, but this probability depends on the management and whether they want to urge or delay the occurrence of each stage. We think that the company should reach its peak as soon as possible and stay there for as long as possible, where managerial accounting plays an essential role, information content is appreciated.

Timmons (1990) [

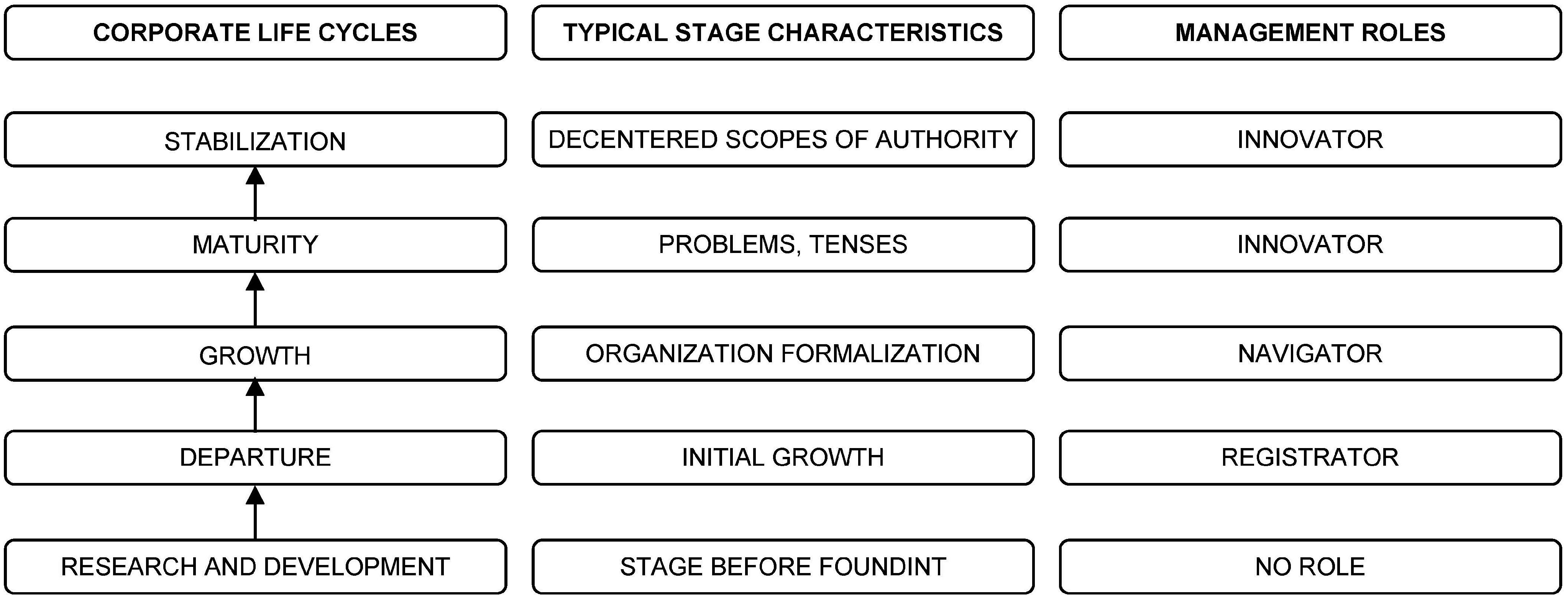

12] divided the corporate life cycle into five stages (

Figure 1), starting from research and development (1–3 years before the foundation), departure (1–3 years of the company), growth (from 4th to 10th year) and through maturity (from year 11 to 15) to the stabilization stage (period after 15th year).

Timmons distinguished each period based on the grouping of time, revenue and number of employees, as he argues that the necessary condition for reaching the next stage is the resolution of managerial decision making. The most risky stage is departure (60% of companies fail at this stage)—usually this might last for 1–3 years, but it can take even 7 years too—which requires indirect control, a lot of energy, talent and key people. The growth stage is the start-up stage, when the founders are facing difficulties, mainly in the case of sharing power and decision-making. At the stage of maturity, not survival, but rather profitable operation is the primary goal. The stabilization stage closes the model, which is not particularly detailed by Timmons.

Figure 1.

Corporate life cycles (Timmons) and formation of management role Source: own figure based on Timmon’s (1990) [

12] and Böcskei’s (2013) [

13].

Figure 1.

Corporate life cycles (Timmons) and formation of management role Source: own figure based on Timmon’s (1990) [

12] and Böcskei’s (2013) [

13].

As with Zsupanekné (2008) [

14], Timmons’ model and the stages of the traditional product life cycle are very similar. Both mention a research and development stage, while this is not part of either the company’s or the product’s life cycle. The difference between the product life cycle and Timmons’ model is that Timmons’ model does not engage in the declining period of the corporate life cycle.

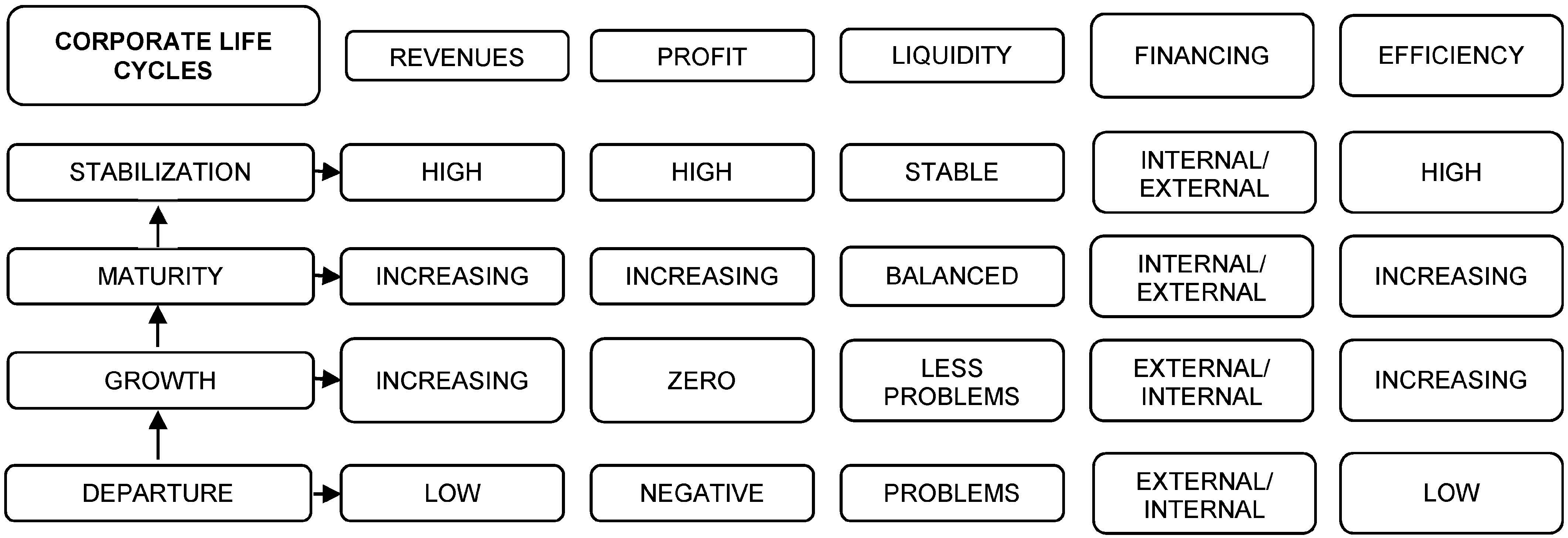

Figure 2.

Corporate life cycles and their main characteristics. Source: own figure based on references.

Figure 2.

Corporate life cycles and their main characteristics. Source: own figure based on references.

Owners of the company and managers (any level of management) face different decision making situations in different stages of the corporate life cycle and depending on their main characteristics (

Figure 2). If the leader does not pay proper attention to the numbers, or to the correlations and business events behind these numbers, then it can easily lead to lack of information, a series of bad decisions and staking instable economic situation. The most important tasks: prepare updated information to managers in favor of effective business decisions and successful operation. Without managerial accounting, the data of financial accounting—which is strictly controlled by the Accounting Act—is used for decision supporting purposes. On the one hand, these data contain less information, because it is processed with delay after the closure of a period, on the other hand, it refers to the past events of the company. Presently, managerial accounting and controlling play an increasingly important role. In the creation of an accounting system, the starting point is the accounting need of management, keeping the legal requirements also in mind. Up to date information provided by managerial accounting is essential for decision making and to inform an organization’s leaders. The criterion when implementing any leader-oriented accounting system is to highlight the future perspective instead of or rather focusing on the analysis of past events.

4. Users of the Financial Statement, Expectations towards the Company in the Relationships of a Value-Oriented Corporate Governance

Accounting is both an internal information system and a source of information to the external environment. The Accounting Act primarily regulates the financial accounting while leaving room for the companies to build their own managerial accounting systems. At the same time, the differentiated information demand of the stakeholders and market actors should be taken into account.

The question here is whether the management of the company or the owners put emphasis on providing adequate information? It is worth noting the similarities among the users of accounting and among the relationships of value-oriented corporate governance (

Table 6). On the basis of the similarities among accounting users (leaders of the economic entities, employees, market actors and the authorities) and the relationships of the value-oriented corporate governance, we would like to emphasize corporate social responsibility which, inter alia, should strongly appear in the Annual Report.

The leaders of economic entities make their decisions primarily on the basis of accounting reports. They need accounting information to measure, evaluate and analyze efficiency, as well as for company audits. The need for information applies to past events, current economic processes and expected events in the future.

Table 6.

Accounting users and the relationships of value-oriented corporate governance.

Table 6.

Accounting users and the relationships of value-oriented corporate governance.

| Accounting users | Users of Accounting Information | Expectations towards the Company | Characteristics of Value-Oriented Corporate Governance |

|---|

| Leaders of economic entities | Management | Efficiency | Increasing company value |

| Employees | Employees | Creating jobs | Workplace security Promotion opportunities |

| Market actors | Owners | Dividend payment | Increasing market share |

| Creditors | Securing interest income | Solvency- and readiness to pay |

| Future investors | Securing yield | Return on investment |

| Business partners(Customers, Suppliers) | Satisfying customers’ needs | Quality products |

| Securing orders | Paying on time |

| Government agencies | Central government | Establishing legitimacy | Calculable tax incomes |

| Local governments |

| State insurance agencies |

Regarding employees, one of the most important needs for information is to ensure that the economic entity is able to run in the foreseeable future and continue its operations. Fluctuation is lower than average in a workplace providing secure, stable living.

Among market actors, the most important actors of the companies are the owners, those legal or natural persons that invest in the given company with the aim of receiving profit in form of dividends. In order to achieve the most efficient operation of the company, market actors shall cooperate in the most dynamic way. When any of the market actors’ interests are violated, that reduces the effectiveness. Therefore, it is not a coincidence that by the envoys of the owner-oriented governance structure, enhancing corporate value is seen as the key to competitiveness. In their view, a company’s operation that is not able to create value is risky and shows that intervention is needed in the short run. Alfred Rappaport drew attention to the important role of the shareholder value and created the SVA model (Creating owner/shareholder value) shareholder value added. According to Rappaport the key to a company’s success is to enhance corporate value which indispensably needs the harmonization of the different stakeholder (market actor’s) interests (Rappaport, 1999 [

15]).

Other important creditors are those organizations and individuals, especially credit institutions that pass temporarily funds to economic entities in return of interest payments. Creditors gain a relatively certain, predetermined income owing to the interest rates fixed in advance. Implementation of significant capital investment projects need the involvement of external funds. Creditors have to take into account not only the solvency, but the solvability of the company, as well.

Among the market actors potential future investors are those individuals or organizations that own funds for investment and look for opportunities and forms of investment that promise the greatest returns at the same risk. Companies need to consider whether the return on investments exceed the cost of capital. An investment is acceptable if its Net Present Value (NPV) is zero or positive. In case NPV = 0, than the Internal Rate of Return (IRR) equals to the Weighted Average Cost of Capital (WACC), that is the corporate value is constant. The Internal Rate of Return (IRR) describes return on equity as a percentage value, when the Net Present Value (NPV) that is to say the Return on Investment is zero. In case of enhancing shareholder value the aim is to increase the value of the company, i.e., the Net Present Value of the investment should be greater than zero, so the Internal Rate of Return is more than the Weighted Average Cost Of Capital (NPV > 0, IRR > WACC).

Among market actors, the business partners of an economic entity are its customers and suppliers. In unfavorable economic conditions, companies might need to face with shrinking market opportunities. Furthermore, attention must be paid to the fact that the action of selling products (providing services) is separated in time from receiving the payment, hence the solvency and liquidity of the economic entity becomes increasingly important. Legislators realized the need for regulation in this area. The entrepreneur have to issue an invoice within 15 days after the fulfillment otherwise may be subject to fines. Despite the invoice was issued in time, the solvability of the customers was not regulated so this regulation did not solve the liquidity problems of the companies. Today, it seems that this problem was solved when a common EU regulation came into force, saying that if the parties does not set the deadline for payment in arrears/paying the debt/obligation in a separate contract, the arrears must be paid/obligations must be met within thirty days after the receipt of invoice or the payment notice of the entitled. Economic entities may deviate from this main rule in case they fix the deadline for payment in a contract in which case the deadline must not exceed sixty days.

Finally, authorities must be mentioned here, to whom the economic entities are required to pay taxes, levies and fees beyond information and reporting requirements. Among others, these incomes secure the funds necessary for the government to finance public expenditures in order that public responsibilities are met in full.

5. Socially Responsible Behavior in the Financial Statement

Global economic, social and environmental changes inspire companies to behave in an increasingly responsible way towards their direct or indirect environment. But what does responsible employer behavior, also known as CSR (Corporate Social Responsibility) mean? According to the strategic interpretation of responsibility, companies must behave in a responsible manner towards their environment and the society as a whole. We would like to raise attention to a unique and broad reading of responsibility that should appear in the financial statements and also in the Annual Report not included in the financial statement. According to this interpretation, companies have to be able to operate in the long run; otherwise, market actors must not be deceived. Legislators also included these expectations in the Accounting Act, namely by laying down the principle of going concern that prevails the adequacy for future operations and continuation of activities. Legislators treated with great importance the principle of going concern, as the enforcement of other principles are based on their existence. This meaning that in case the principle of going concern not prevails, the accounting principles cannot be applicable.

As the person authorized to represent the company has to sign the Annual Report, one can rightfully hope that publishing the content of “the Annual Report is socially responsible” can get a place in the social responsibility of numerous companies in the near future.

6. Conclusions

It is extraordinarily important for a corporation to recognize in time if it is not able to increase value since this requires an immediate intervention. In order to maintain the operability, the ability for renewal and its time interval are key questions. We can answer a definite “yes” to the question whether the reports to be compulsorily prepared annually are suitable for indicating the problems. We have to answer a “no” to the question whether the reports to be prepared once per annum are just sufficient. The reason for this is that we do not live in a static environment. The more dynamic an economic environment is, the bigger role the question of time plays. Thanks to the accountancy and, last but not least, the development of technology, we can prepare up-to-date analyses from the accounting statements. All of that requires an essential teamwork within the corporation in which the controller has to play a major role. Typical tasks of a controller are the following: establishing the corporate value through cost planning and pricing, assessing the possible risk factors, monitoring the plan and actual data regularly, recognizing the relations of cause and effect, informing the management.