Reforming China’s Pension Scheme for Urban Workers: Liquidity Gap and Policies’ Effects Forecasting

Abstract

:1. Introduction

2. A Basic Pension Model and Its Liquidity Gap Forecasting

2.1. The Revenue of Basic Pension System

2.1.1. The Expenditure of Basic Pension System

2.1.2. The Expenditure of “Old People”

2.1.3. The Expenditure of “Middle People”

2.1.4. The Expenditure of “New People”

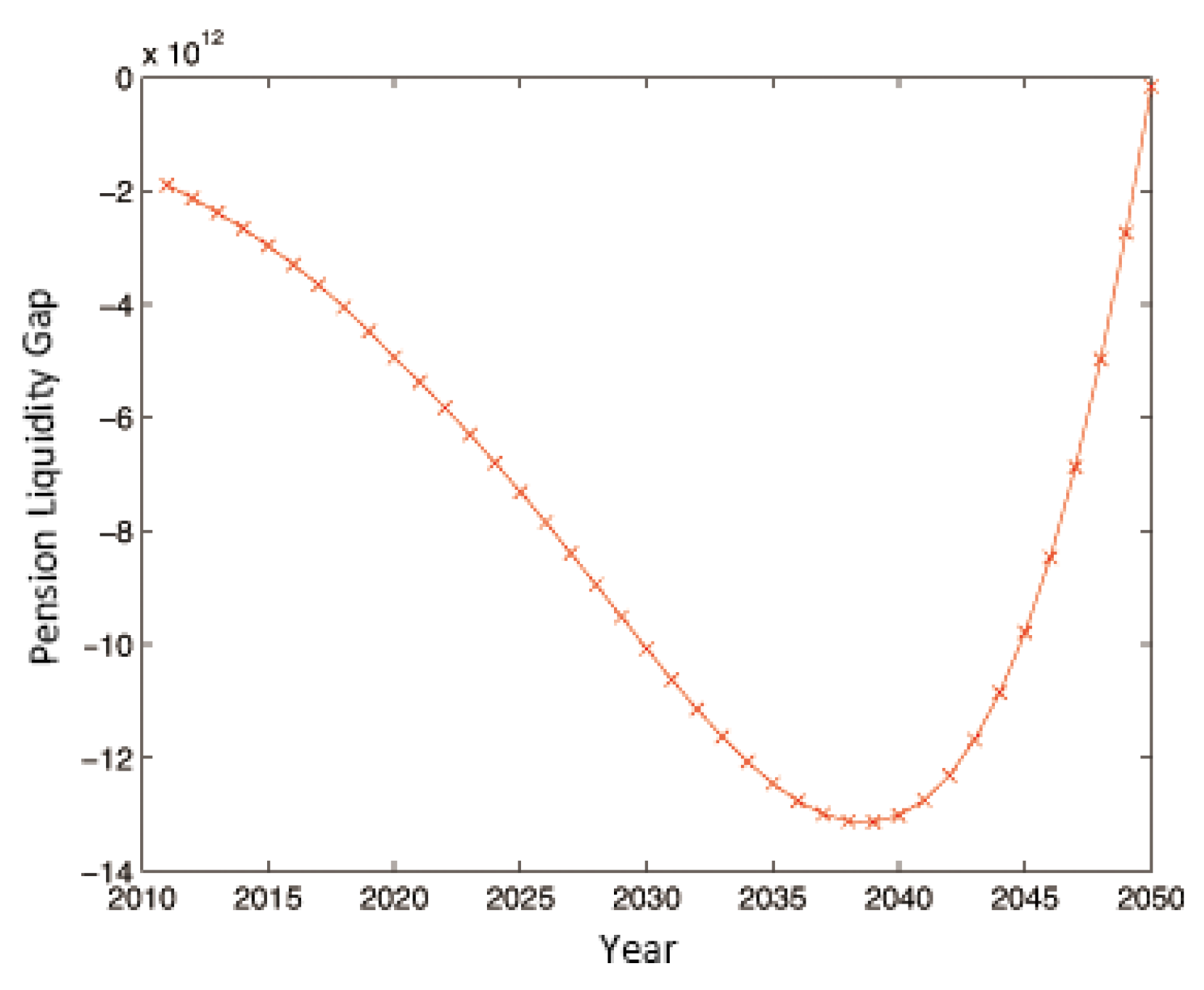

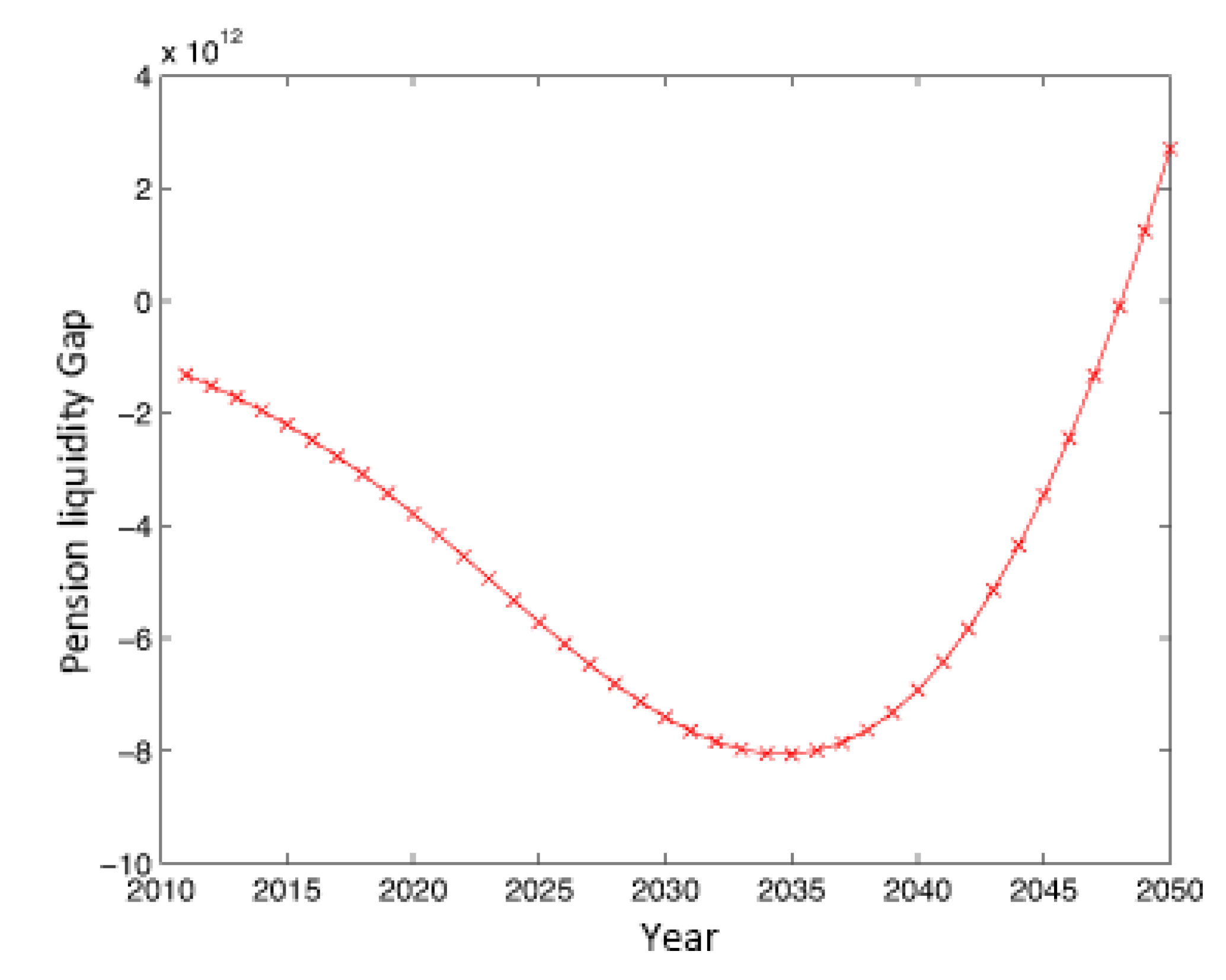

2.2. The Prediction of Liquidity Gap

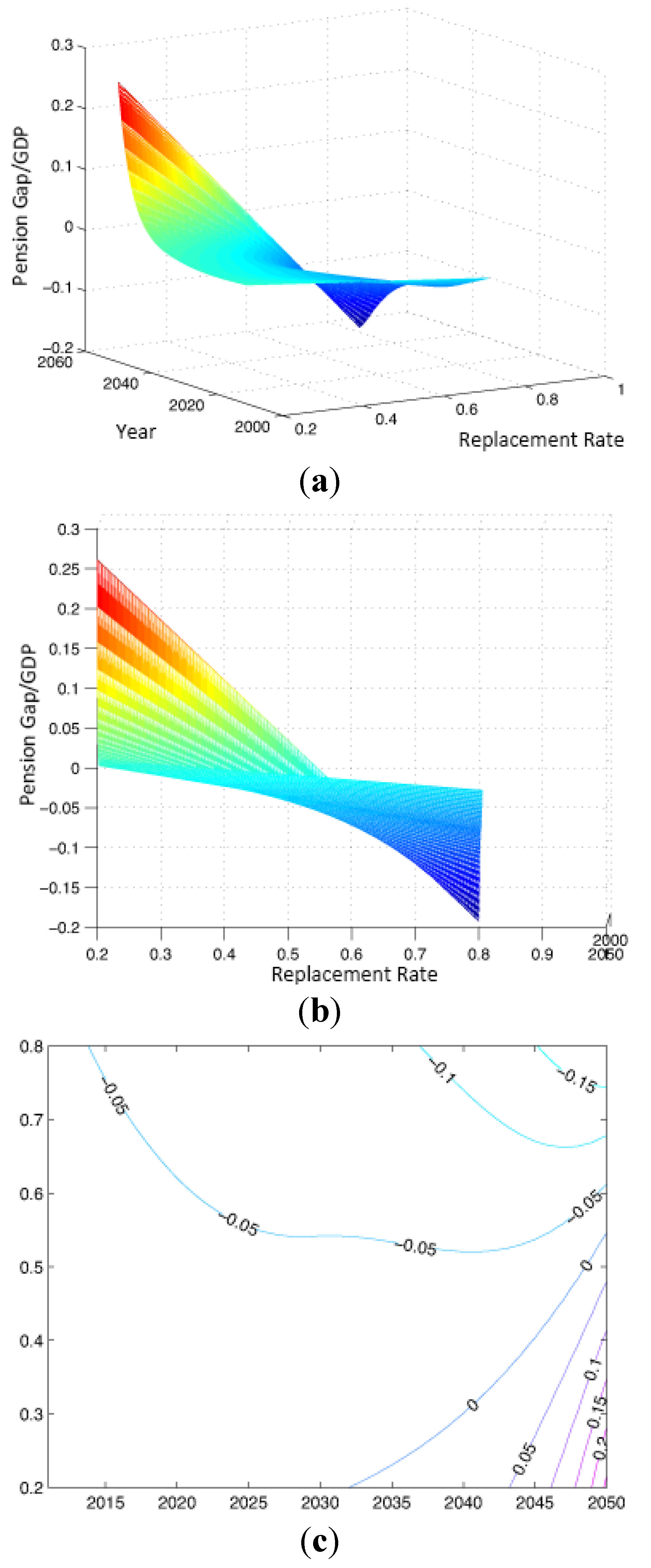

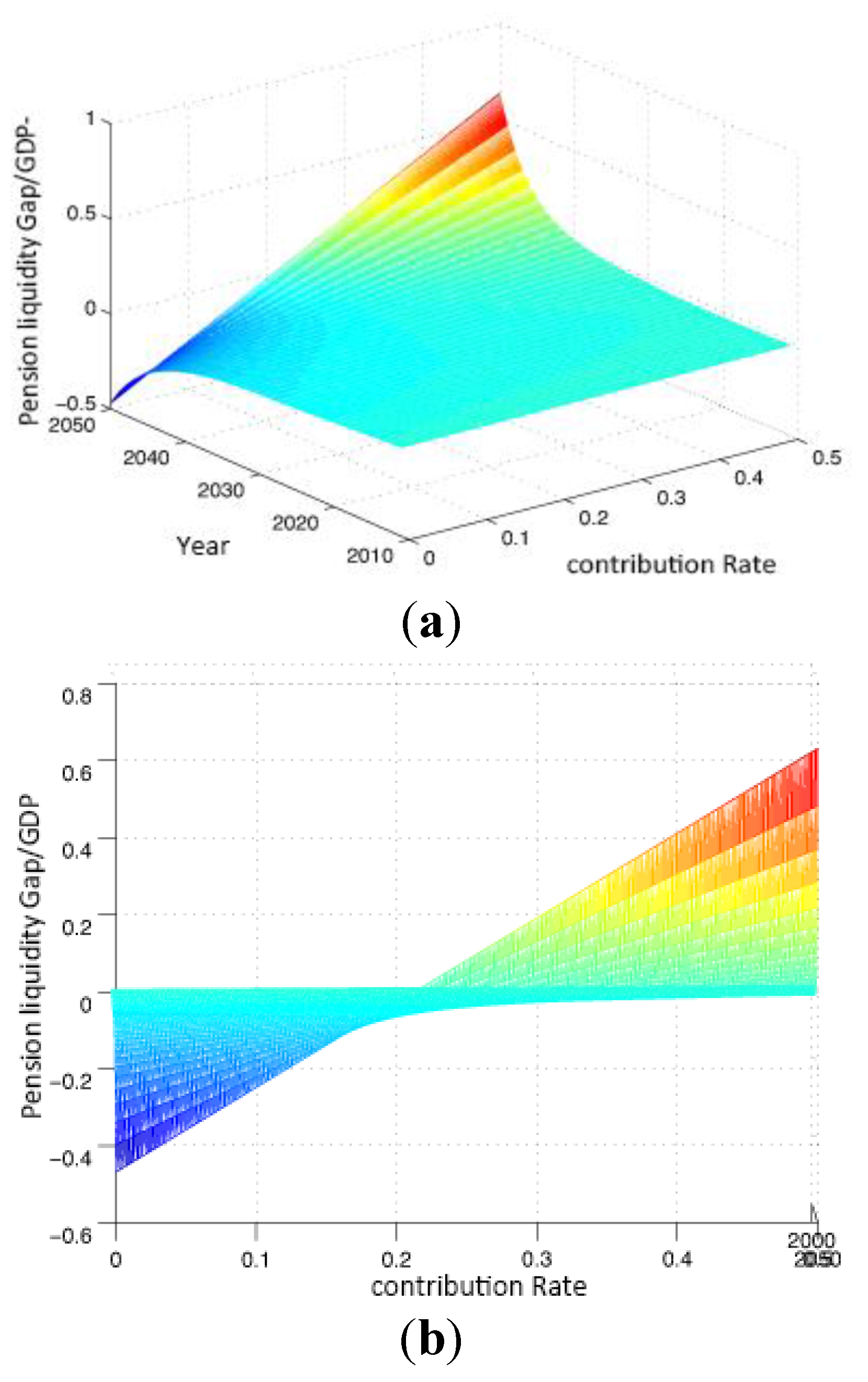

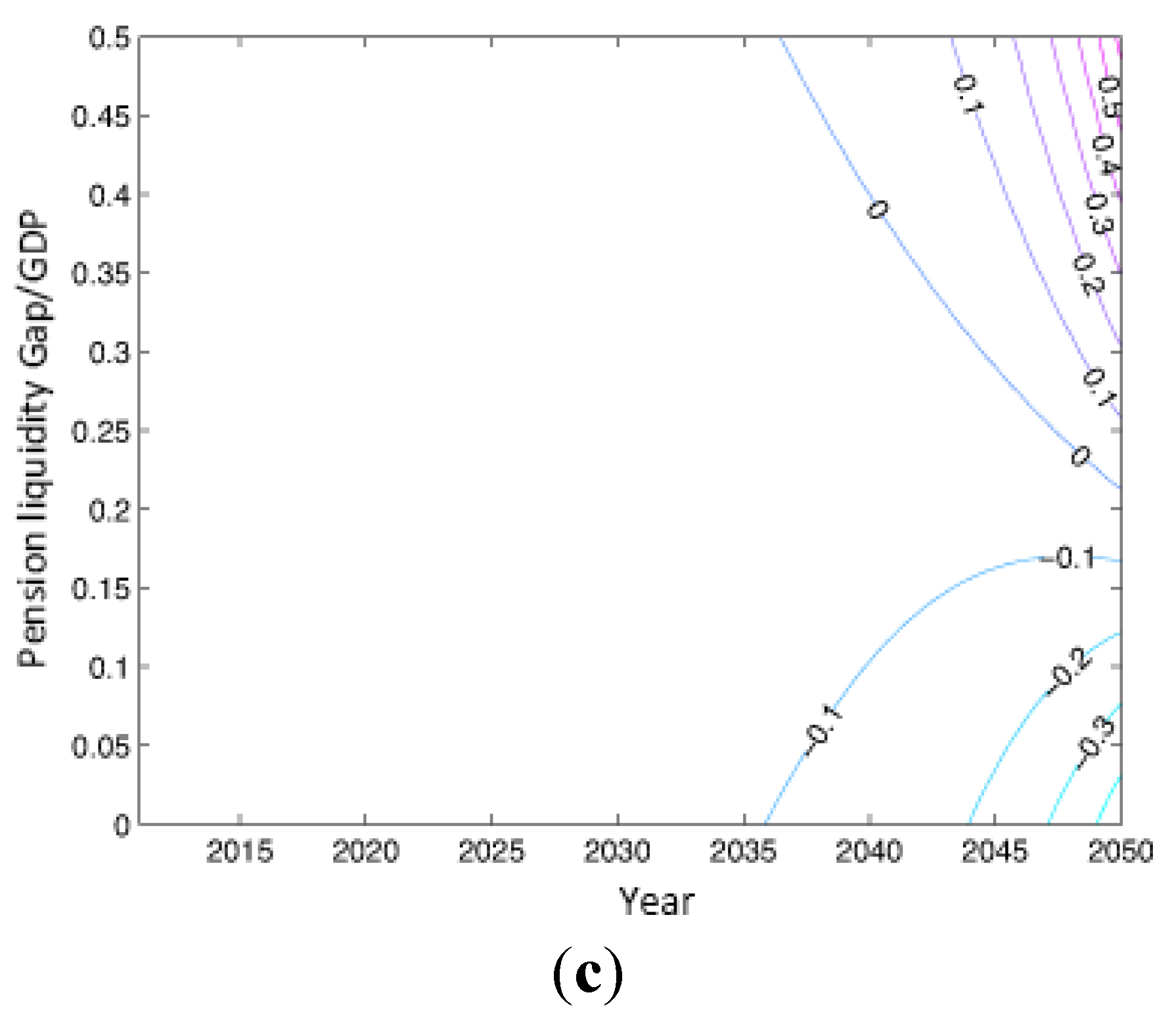

3. Determination of Reasonable Intervals for the Replacement Rate and Contribution Rate

3.1. Reasonable Interval for the Replacement Rate

3.2. Reasonable Interval for the Contribution Rate

4. Evaluations of Government Relevant Policies’ Effects

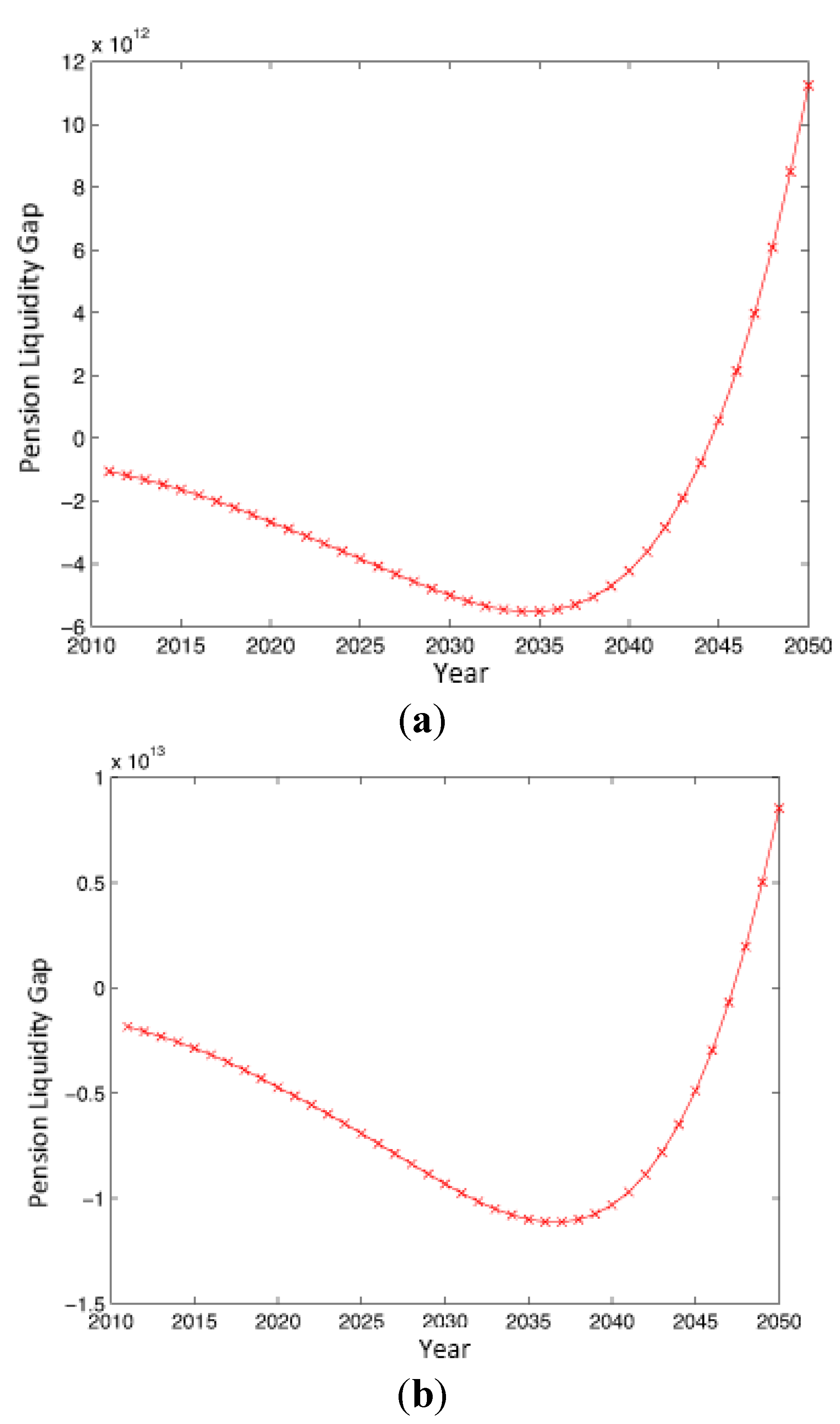

4.1. Policy Effect Forecasting of Income Doubling Plan

4.2. Policy Effect Forecasting of Increasing the Contribution Rate and Reducing the Replacement Rate

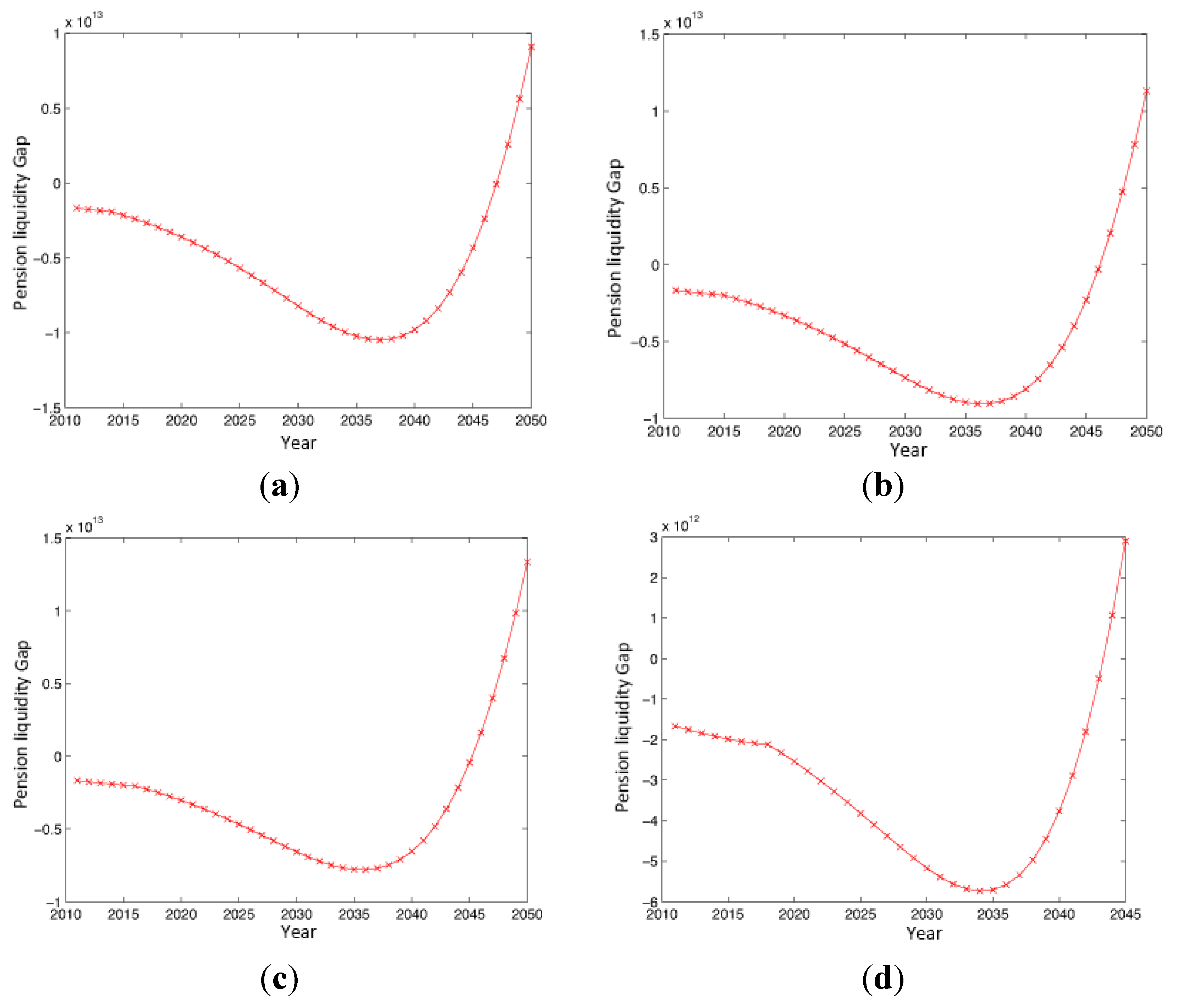

4.3. Policy Effect Forecasting of Delaying the Retirement Age

4.4. Policy Effect Forecasting of Having Two Children

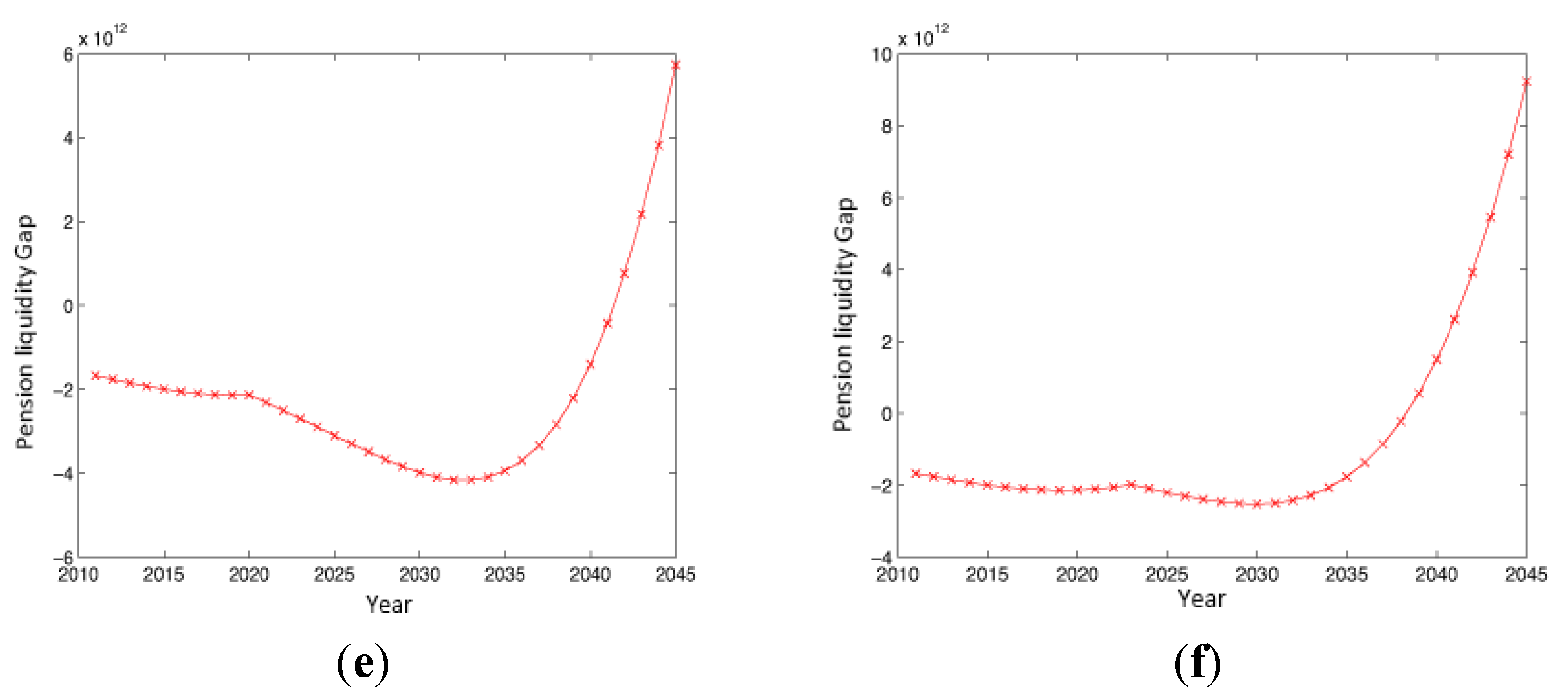

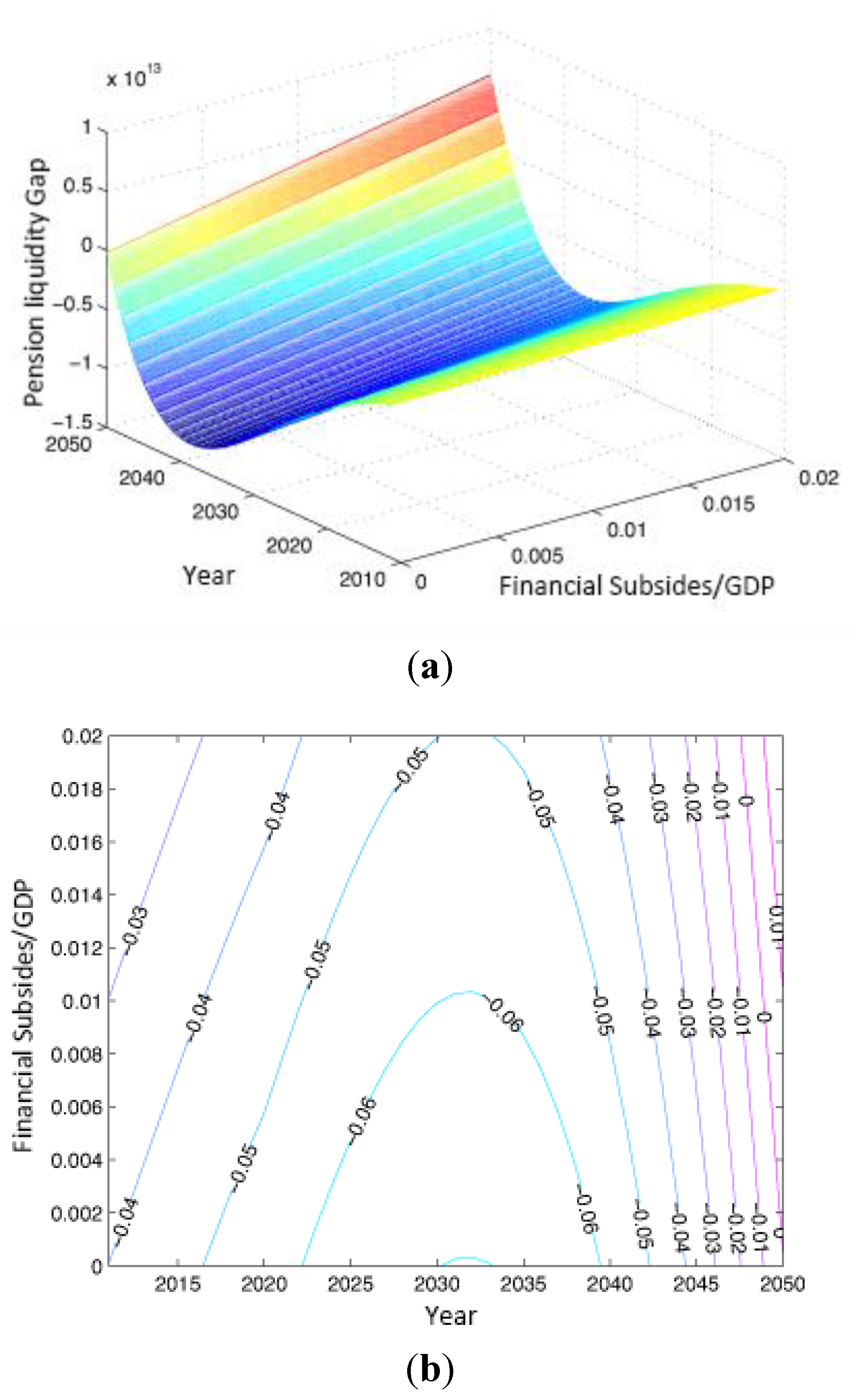

4.5. Policy Effect Forecasting of Fiscal Subsidies Changes

5. Concluding Remarks

Acknowledgments

Author Contributions

Conflicts of Interest

References and Notes

- “Old people” refers to people who have retired before 2006; “Middle people” refers to insured people who started working before 1997 and retired after 2006; “New people” refers to insured participating in work after 1997.

- Laurin, A.; Robson, W.B. Ottawa’s Pension Gap: The Growing and Under-Reported Cost of Federal Employee Pensions; C.D. Howe Institute: Toronto, ON, Canada, 2011. [Google Scholar]

- Van Duijn, M.; Lindeboom, M.; Lundborg, P.; Mastrogiacomo, M. Pension plans and retirement replacements rates in the Netherlands. 2009. Available online: http://www.cpb.nl/en/publication/pension-plans-and-retirement-replacement-rates-netherlands (accessed on 5 August 2015).

- Verbič, M.; Spruk, R. Aging population and public pensions: Theory and evidence. 2011. Available online: http://mpra.ub.uni-muenchen.de/38914/ (accessed on 5 August 2015).

- Antolin, P.; Whitehouse, E. Filling the pension gap: Coverage and value of voluntary retirement savings. Available online: http://www.oecd-ilibrary.org/social-issues-migration-health/filling-the-pension-gap_227200770711?crawler=true (accessed on 5 August 2015).

- Elmendorf, D.W.; Sheiner, L.M. Should America save for its old age? Fiscal policy, population aging, and national saving. J. Econ. Pers. 2000, 14, 57–74. [Google Scholar]

- Rother, P.C.; Catenaro, M.; Schwab, G. Aging and pensions in the Euro Area Survey and Projection Results; World Bank: Washington, DC, USA, 2003. [Google Scholar]

- Alessie, R.; Kapteyn, A. Household saving in the Netherlands. Res. Econ. 2001, 55, 61–82. [Google Scholar] [CrossRef]

- Borsch-Supan, A. Mind the Gap: The Effectiveness of Incentives to Boost Retirement Saving in Europe. Available online: https://ub-madoc.bib.uni-mannheim.de/2569/ (accessed on 5 August 2015).

- Borsch-Supan, A.H.; Wilke, C.B. Reforming the German Public Pension System. In Proceedings of Annual Meeting of the American Economic Association, Boston, MA, USA, 6 January 2006; pp. 2–3.

- Herrera, C. Long-Term Returns and Replacement Rates in Mexico’s Pension System. Available online: https://www.bbvaresearch.com/en/publicaciones/long-term-returns-and-replacement-rates-in-mexicos-pension-system/ (accessed on 5 August 2015).

- Kortleve, N.; Ponds, E. How to Close the Funding Gap in Dutch Pension Plans? Impact on Generations; Center for Retirement Research, Boston College: Boston, MA, USA, 2010. [Google Scholar]

- Yi, Z. Estimating the Impacts of Demographic and Policy Changes on Pension Deficit a Simple Method and Application to China. Available online: http://www.eaber.org/node/21822 (accessed on 5 August 2015).

- Disney, R. Declining public pensions in an era of demographic ageing: Will private provision fill the gap? Eur. Econ. Rev. 2000, 44, 957–973. [Google Scholar] [CrossRef]

- Hinz, R.; Holzmann, R.; Tuesta, D.; Takayama, N. Matching Contributions for Pensions: A Review of International Experience; World Bank: Washington, DC, USA, 2012. [Google Scholar]

- Willmore, L. Universal pensions for developing countries. World Dev. 2007, 35, 24–51. [Google Scholar] [CrossRef]

- The Report to the Eighteenth National Congress of the Communist Party of China’s pointed out, “by 2020, we should double its 2010 GDP and per capita income for both urban and rural residents.”

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, X.; Zhang, Y.; Fang, L.; Li, Y.; Pan, W. Reforming China’s Pension Scheme for Urban Workers: Liquidity Gap and Policies’ Effects Forecasting. Sustainability 2015, 7, 10876-10894. https://doi.org/10.3390/su70810876

Liu X, Zhang Y, Fang L, Li Y, Pan W. Reforming China’s Pension Scheme for Urban Workers: Liquidity Gap and Policies’ Effects Forecasting. Sustainability. 2015; 7(8):10876-10894. https://doi.org/10.3390/su70810876

Chicago/Turabian StyleLiu, Xiaoxing, Ying Zhang, Lin Fang, Yuanxue Li, and Wenqing Pan. 2015. "Reforming China’s Pension Scheme for Urban Workers: Liquidity Gap and Policies’ Effects Forecasting" Sustainability 7, no. 8: 10876-10894. https://doi.org/10.3390/su70810876

APA StyleLiu, X., Zhang, Y., Fang, L., Li, Y., & Pan, W. (2015). Reforming China’s Pension Scheme for Urban Workers: Liquidity Gap and Policies’ Effects Forecasting. Sustainability, 7(8), 10876-10894. https://doi.org/10.3390/su70810876