1. Introduction

REDD+, or Reducing Emissions from Forest Degradation and Deforestation plus conservation, sustainable management of forests and enhancement of forest carbon stocks, is an umbrella for many initiatives that support the implementation of the United Nations Framework Convention on Climate Change (UNFCCC). It was proposed and established to provide incentives for developing countries to protect their forests and, in this way, ensure that they do not contribute to increasing greenhouse gas emissions. In line with broader discussions on ecosystem services and sustainable development, the “+” refers to the importance of conservation and improvements in forest management [

1]. This program has raised high expectations in terms of helping developing countries to reach environmental and economic objectives, all of which are also important from a global perspective. Environmental and economic benefits were to be achieved thanks to the payments, which developing countries would receive to compensate them for their lost opportunity costs related to protecting forests.

Nevertheless, while it was expected that the program would allow developing countries to halt deforestation and benefit economically, it was also feared that many of the potential gains would not be realized because of the poor quality of institutions in countries where the payments would be directed. Several studies questioned the ability of local forest-dependent communities to benefit from REDD+, raising concerns over the likely negative impacts of REDD+ on local livelihoods, equity, poverty, and participatory resource governance [

2,

3]. Based on a cross-country comparison of potential income from an early variant of the present REDD+ initiatives (RED) and institutional quality indicators (Rule of Law and Control of Corruption), Ebeling and Yasué [

4] suggested that “even if lower deforestation rates are achieved, weak governance structures may make it difficult to pass on benefits to rural populations, and corrupt government agencies may show little interest in sharing benefits fairly or supporting bottom-up conservation initiatives, thereby diminishing the potential for human development co-benefits”.

One could expect that the situation has improved since Ebeling and Yasué [

4] published their analysis eight years ago, and that the emphasis put—within the REDD and then REDD+ initiatives—on the institutional readiness of recipient countries has yielded positive results. However, this may not necessarily be the case, given that many studies have reported significant institutional challenges related to the implementation of both REDD+ and other payments for ecosystem services (PES) schemes. REDD+ often serves as an illustration of a large-scale PES scheme because it provides developing countries with payments for protecting their ecosystems, so that those ecosystems provide services used by the payers. In practice, REDD+ is much more complex, and PES constitutes only one of the important instruments to be used within REDD+ [

5,

6]. Meanwhile, PES has already been criticized for reasons similar to those that led to the criticism of REDD+. In particular, it was feared that they may not necessarily deliver on the promise of protecting the environment and improving livelihoods in a situation of imperfect institutions in recipient countries. For example, Vatn [

7] warned about the risk of leaving too much power in PES transactions to intermediaries, who are likely to abuse this power. This is especially evident when one takes into consideration the differences in bargaining power between those intermediaries and ecosystem service providers. It was also noted that PES can crowd out other motivations to protect nature, making environmental protection uncertain when a PES scheme terminates [

7,

8]. These and other problems with PES were summarized by Muradian and colleagues [

9].

Kronenberg and Hubacek [

10] specifically referred to REDD+ as an example of a global PES scheme. They suggested that because of its scale, REDD+ may bring about some of the same significant problems discussed in the context of PES. According to their “ecosystem service curse” hypothesis, countries or communities rich in ecosystem services but with poor quality institutions would be likely to suffer negative consequences from the new capital flows. As in the case of the “resource curse” hypothesis [

11], these problems might be related to rent-seeking (more powerful stakeholders forcing ecosystem service providers out of their land to capture the payments), unequal bargaining power (

i.e., that of ecosystem service providers compared to that of buyers and intermediaries), and the volatility of payments (the changing and unpredictable value of PES over time). All of these problems have already occurred on a relatively small scale within different PES projects, but because of its large scale REDD+ might be the first instance in which these problems occur more frequently or systematically than in any PES scheme so far.

The “ecosystem service curse” hypothesis is closely related to the so-called “REDD paradox” indicated by Sandbrook and colleagues [

12]. They observed that participatory forest management seems to be more effective in terms of forest preservation than the centralized approach, and that various participatory forest management schemes (under informal tenure arrangements) are followed in the case of large areas of forest. Therefore, increasing the value of forest resources through REDD/REDD+ payments may create political incentives to centralize forest governance, which may actually translate into forest loss and degradation, thereby lowering the benefits for the poor if their interests are not accounted for appropriately.

All of the above indicates the key role of institutions in preparing developing countries to gain benefits from REDD+. However, in light of the above concerns, our hypothesis is that—in spite of good intentions and preliminary conditions for participant countries—REDD+ payments are mostly flowing to developing countries with relatively poor institutions. If this is the case, then the potential of REDD+ may be wasted, at least in terms of social co-benefits, which will not likely occur unless good institutions are in place to protect the rights of forest-dependent local communities.

To test this hypothesis, we look at the relationships between REDD+ income potential (funds already committed to develop REDD+ initiatives in different countries) and different governance indicators in recipient countries. Using data that is 10 years more recent than that used by Ebeling and Yasué [

4], we perform a similar analysis and find that, indeed, the problems persist. In the following section we describe the method we used, and then the results obtained. Next, we discuss these results, referring back to Ebeling and Yasué [

4], Kronenberg and Hubacek [

10], and Sandbrook and colleagues [

12] to determine whether what they suggested can be seen in the modern practice of REDD+.

2. Method and Data

To check how REDD+ payments correlate with the quality of institutions in countries receiving these payments, we used scatter plots and simple correlation analysis.

Data on REDD+ payments come from the Voluntary REDD+ Database (VRD), which is managed by the Food and Agriculture Organization and the World Conservation Monitoring Centre of the United Nations Environment Programme [

13]. The VRD data are collected based on information provided by funders and recipients of REDD+ payments and specified in the agreements that they sign to fund and carry out REDD+ activities. These two data streams are kept separately in the VRD. We used the data provided by funders because these data are more comprehensive. The VRD is based on voluntary reporting, therefore it is not complete. For example, we were not able to distinguish for all countries between the three different phases of the REDD+ process: readiness, demonstration activities, results-based investments. Readiness involves preparation of the relevant strategies, plans, policies, and capacity-building for further implementation of REDD+ activities (this is of key importance from the point of view of ensuring the required institutional quality). Demonstration activities are carried out along with the implementation of the strategies and other measures. Results-based investments have to be fully measured, reported, and verified within relevant agreements. In consequence, we aggregated all types of payments attributable to individual countries into one number. Still, in spite of these difficulties, the VRD is the most complete and detailed database on REDD+ payments available. As of mid-June 2015, the VRD presented almost USD 18 billion worth of REDD+ payments to be distributed between 2006 and 2022.

The VRD presents data for 104 countries, but only 101 of those are the ultimate REDD+ recipient countries (Non-Annex 1, using the UNFCCC nomenclature). The other three countries listed in the VRD are mostly developed countries which only pass funds on to developing countries. REDD+ payments presented in the VRD flow either directly to developing countries, or to developed countries and international organizations which then distribute the funds to developing countries. We only analyzed payments directly sent to 91 recipient developing countries (USD 7.8 billion or nearly 50% of all payments reported in the VRD), as the other streams could not be attributed to specific developing countries.

To ensure comparability between countries, and to make our study consistent with that of Ebeling and Yasué [

4], we expressed REDD+ payments as a share of gross domestic product (GDP). GDP data comes from the World Bank’s World Development Indicators database [

14]. Expressing REDD+ payments as a share of GDP reveals the extent to which these payments can influence a country’s economic situation. From the group of 91 recipient countries identified above, we removed one outlier (Guyana) for which the scheduled REDD+ payments’ share of GDP was 18.73%, which is far above any other country in the sample (the next highest share was 3.34%, and the average share in the sample was 0.54%). Indeed, in the strange case of Guyana, a significant share of funds came from only one funder (Norway), and Norway’s selection of Guyana has been criticized as political [

15].

Indicators describing institutional quality come from another database of the World Bank,

i.e., the World Governance Indices (WGI) [

16]. This is the same database that was used by Ebeling and Yasué [

4], but we used data that is 10 years more recent,

i.e., for the year 2013. We used all six indicators presented in the database (Voice and Accountability, Political Stability and Absence of Violence, Government Effectiveness, Regulatory Quality, Rule of Law, and Control of Corruption) but focused special attention on the latter two. Those two were also used by Ebeling and Yasué [

4], and they seem to be the most relevant in terms of discussing and analyzing the problems of a potential “ecosystem service curse”. Rule of Law summarizes the level of respect for law, property rights, court verdicts, and contracts, as well as the probability of crime. Corruption Control refers to how public power is used for private gain, and it includes different forms of corruption as well as the “capture” of a state by elites and private interests. The values of all of the World Bank’s six governance indicators range between −2.5 and 2.5, with lower values indicating a worse situation.

3. Results

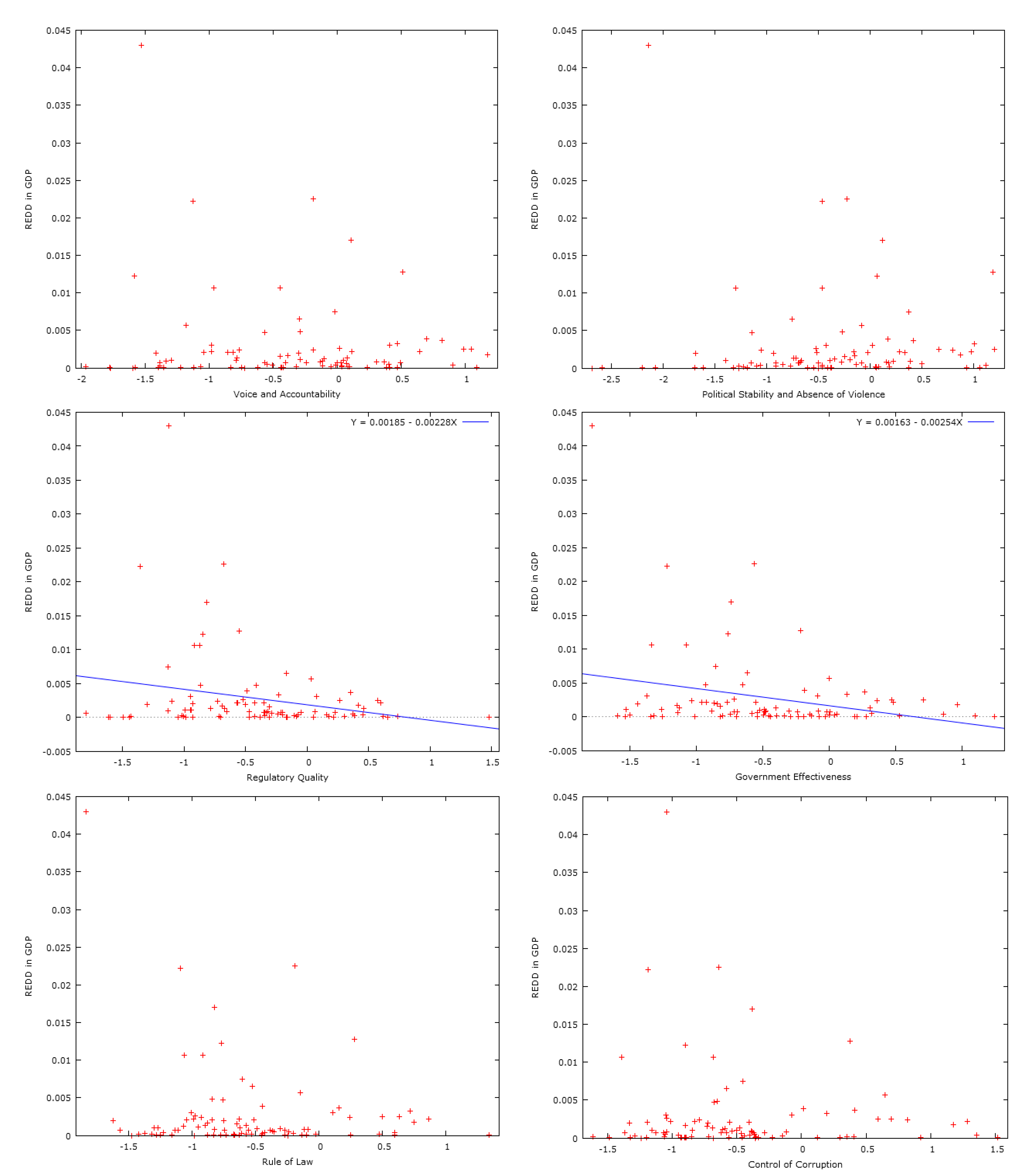

Figure 1 depicts the relationships between the aggregated REDD+ payments scheduled to be paid to developing countries between 2006 and 2022 (expressed as percentage of those countries’ 2013 GDP) and all six WGI indicators. Based on these diagrams we can see that most countries receiving REDD+ payments still perform relatively poorly with regard to those governance indicators that are the most important from the point of view of preventing the negative phenomena related to the so-called ecosystem service curse,

i.e., the Regulatory Quality, Government Effectiveness, Rule of Law and Control of Corruption.

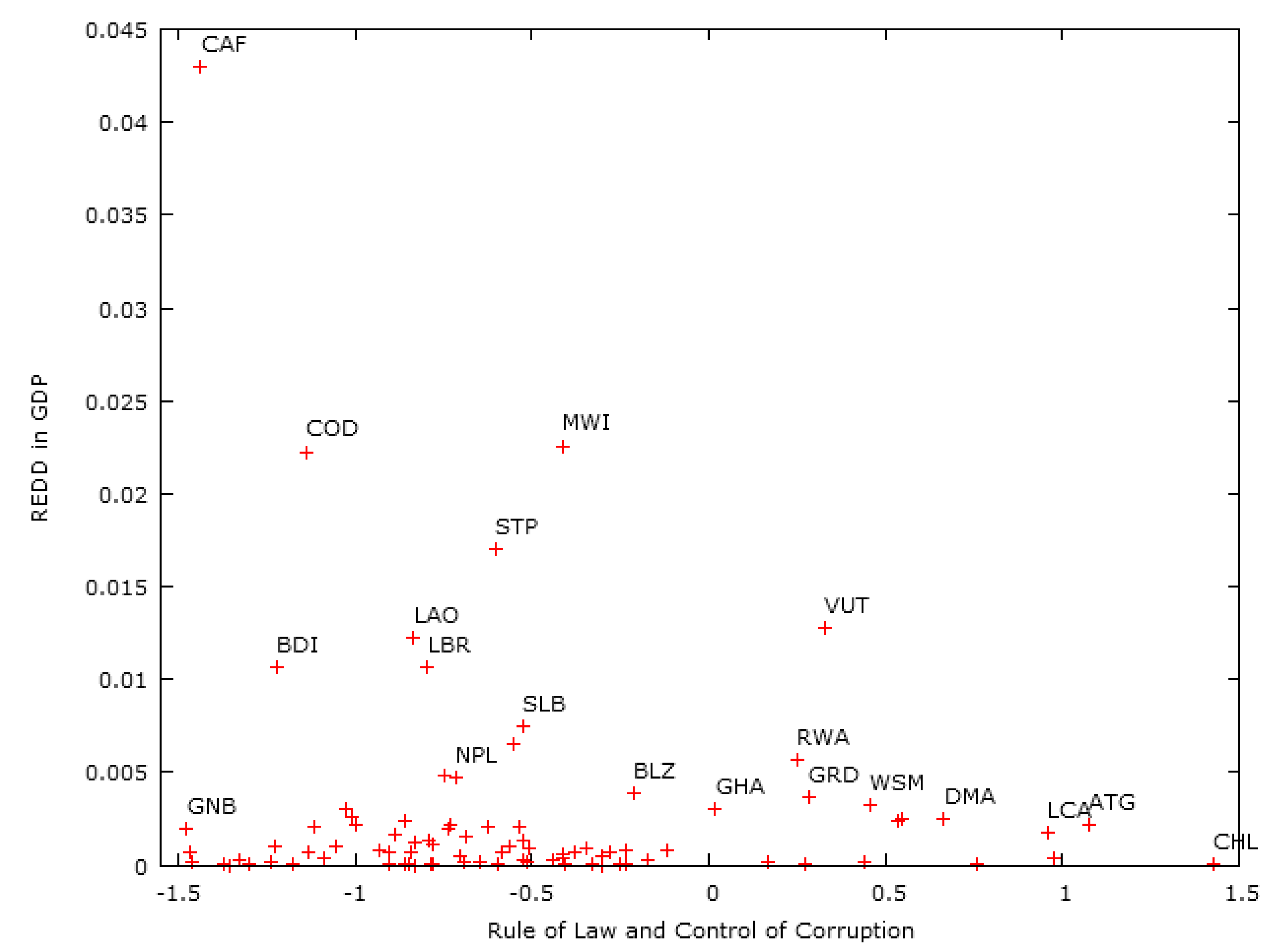

Figure 2 replicates

Figure 3 from Ebeling and Yasué [

4], with two differences: (1) instead of potential annual RED payments, we considered the already agreed-upon REDD+ payments for the period of 2006–2022; (2) we did not log the REDD+ to the GDP ratio, which we did not consider necessary given the message already emerging from the present picture. Like in the case of Ebeling and Yasué [

4], we used an average of two governance indicators: Rule of Law and Control of Corruption. These two indicators provide a very good illustration of a country’s ability to make the best of REDD+ payments. Also, as can be seen in

Figure 1, the performance of the studied countries is very similar with regard to these two indicators.

Based on

Figure 2, we can see that, for the time being, REDD+ income may be a significant source of income for only a few countries. These countries mostly have poor institutional quality levels, with the sole exception of Vanuatu.

Table 1 shows the numbers of countries divided into groups depending on their quality of institutions and the REDD+ payments that they are receiving. Over 96% of REDD+ payments are distributed to countries with very weak institutions (those with an average of Rule of Law and Control of Corruption index below zero).

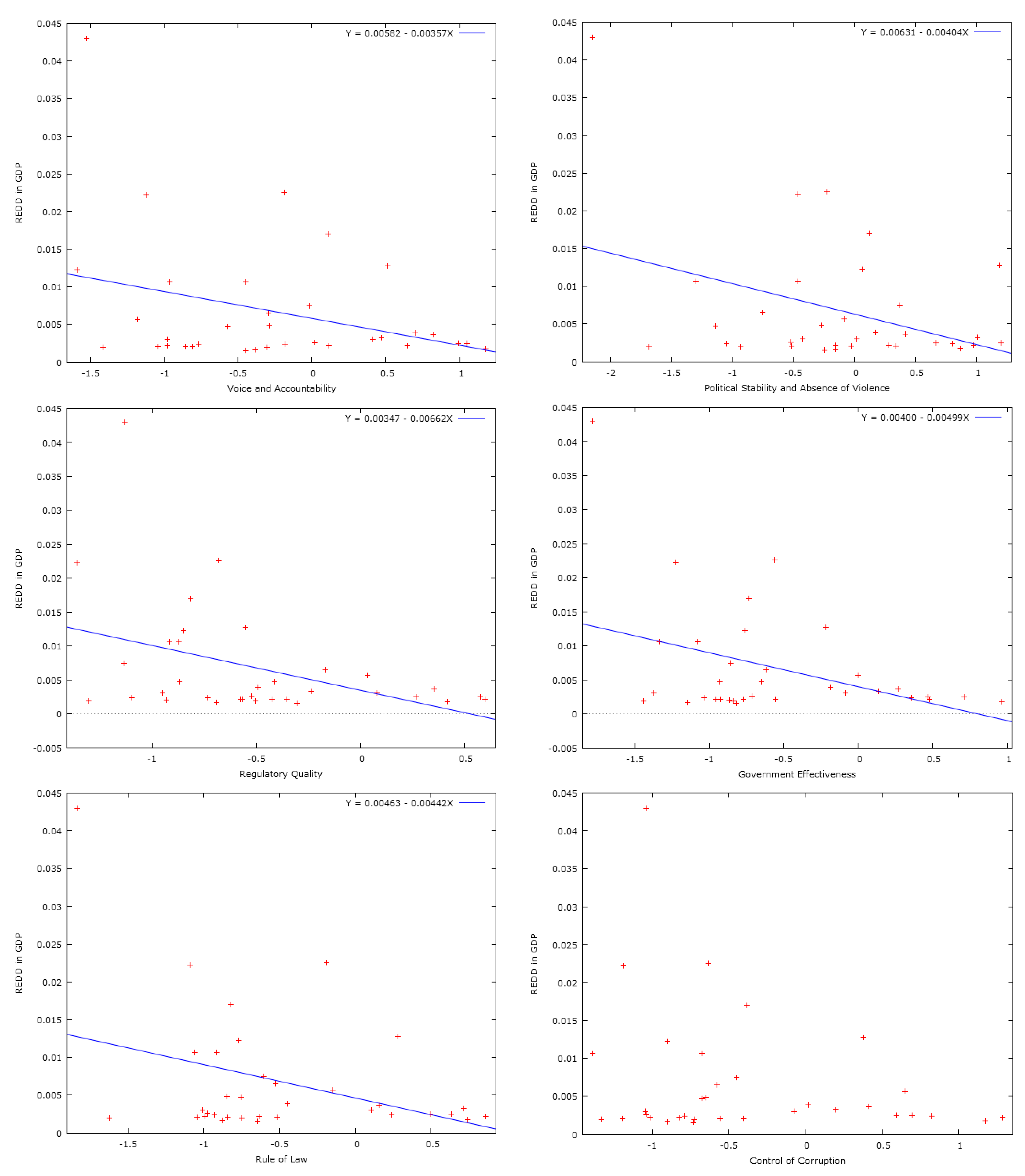

Interestingly, a statistically significant correlation between the REDD+ payments and the quality of institutions is only evident for the sample of 34 countries with the highest shares of REDD+ payments in their GDP (

i.e., where the expected payments exceed 0.15% of GDP) (

Table 2).

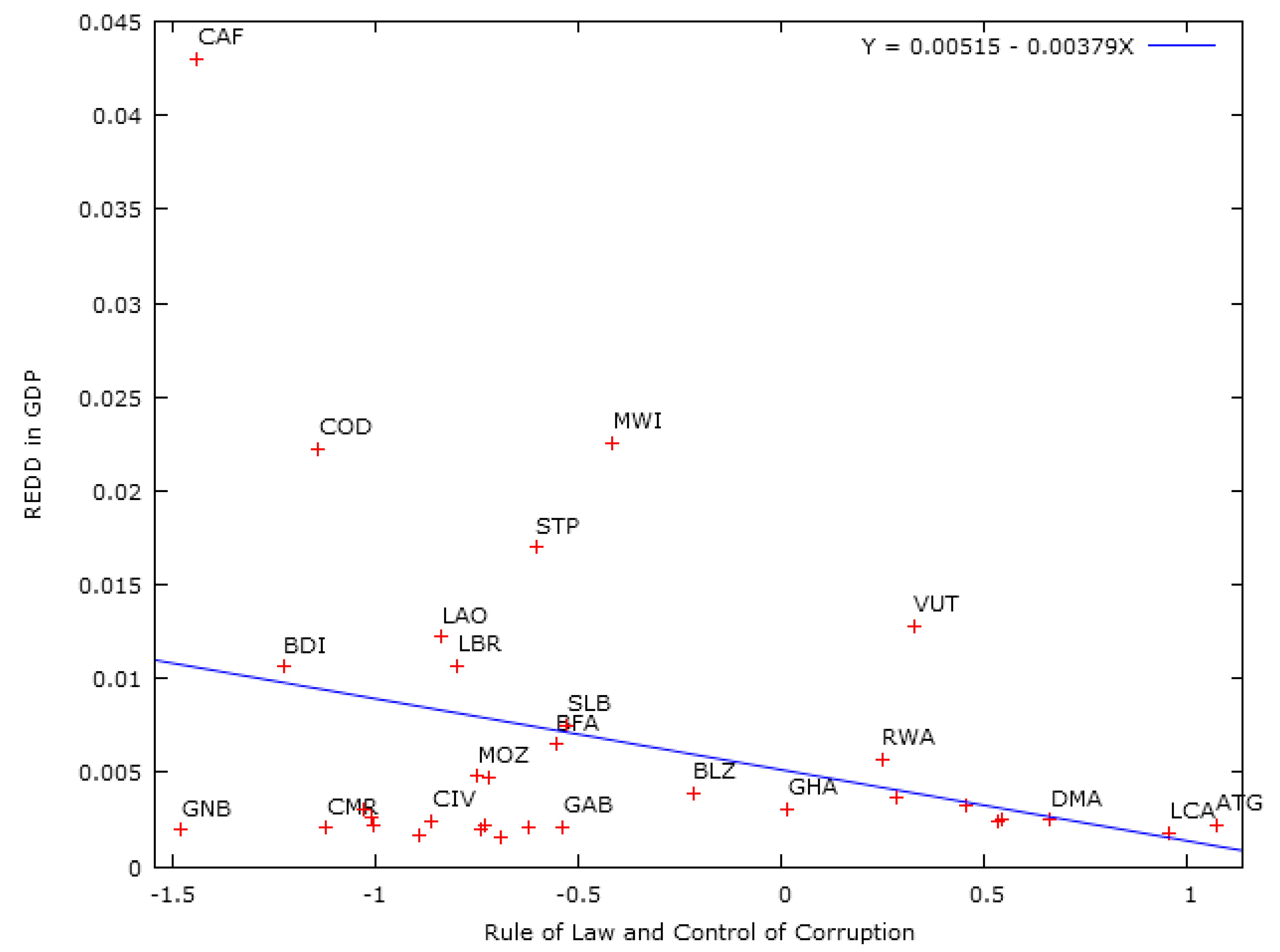

Figure 3 and

Figure 4 replicate

Figure 1 and

Figure 2 for this sample, which allows us to examine the situation in countries where REDD+ payments count more than in the rest of the countries previously analyzed. The only institutional quality indicator that does not exhibit a statistically significant correlation with REDD+ payments in the smaller sample is Control of Corruption. Finally, we also looked at the mean institutional quality indicator used by Ebeling and Yasué [

4] and also found a statistically significant correlation for the smaller sample.

Figure 1.

Relationships between the share of REDD+ payments scheduled for 2006–2022 in GDP (2013) and the World Bank’s governance indices (2013).

Figure 1.

Relationships between the share of REDD+ payments scheduled for 2006–2022 in GDP (2013) and the World Bank’s governance indices (2013).

Figure 2.

Relationship between the share of REDD+ payments scheduled for 2006–2022 in GDP (2013) and an average of Rule of Law and Control of Corruption indicators (2013) (the three-letter country codes are defined by the International Organization for Standardization [

17]).

Figure 2.

Relationship between the share of REDD+ payments scheduled for 2006–2022 in GDP (2013) and an average of Rule of Law and Control of Corruption indicators (2013) (the three-letter country codes are defined by the International Organization for Standardization [

17]).

Table 1.

Number of countries falling into different groups depending on the average of Rule of Law and Control of Corruption indices and the REDD+ income they receive.

Table 1.

Number of countries falling into different groups depending on the average of Rule of Law and Control of Corruption indices and the REDD+ income they receive.

| Quality of institutions (GOV) | Number of countries | REDD+ income (millions of USD) | Share in total REDD+ disbursements |

|---|

| −2.5 to −1.25 | 9 | 308.9 | 1.45% |

| −1.24 to 0 | 66 | 20,249 | 95.01% |

| 0.01 to 1.24 | 15 | 478.2 | 2.24% |

| 1.25 to 2.5 | 1 | 277.2 | 1.30% |

Figure 3.

Relationships between the share of REDD+ payments scheduled for 2006–2022 in GDP (2013) and the World Bank’s governance indices (2013) for the sample of 34 countries where REDD+ payments exceed 0.15% of GDP.

Figure 3.

Relationships between the share of REDD+ payments scheduled for 2006–2022 in GDP (2013) and the World Bank’s governance indices (2013) for the sample of 34 countries where REDD+ payments exceed 0.15% of GDP.

Table 2.

Pearson’s correlation coefficients (coefficients statistically significant at a minimum 10% level are in bold).

Table 2.

Pearson’s correlation coefficients (coefficients statistically significant at a minimum 10% level are in bold).

| All 90 countries receiving REDD+ payments | Sample of 34 countries with the share of REDD+ payments in a country’s GDP above 0.15% |

|---|

| Voice and Accountability | −0.117 (p = 0.272) | −0.323 (p = 0.063) |

| Political Stability and Absence of Violence | −0.051 (p = 0.633) | −0.377 (p = 0.028) |

| Government Effectiveness | −0.27 (p = 0.01) | −0.388 (p = 0.024) |

| Regulatory Quality | −0.233 (p = 0.027) | −0.406 (p = 0.017) |

| Rule of Law | −0.165 (p = 0.12) | −0.35 (p = 0.042) |

| Control of Corruption | −0.088 (p = 0.412) | −0.252 (p = 0.151) |

| Mean (Rule of Law + Control of Corruption) | −0.128 (p = 0.23) | −0.306 (p = 0.078) |

Figure 4.

Relationship between the share of REDD+ payments scheduled for 2006–2022 in GDP (2013) and an average of Rule of Law and Control of Corruption indicators (2013) for the sample of 34 countries where REDD+ payments exceed 0.15% of GDP (the three-letter country codes are defined by the International Organization for Standardization [

17]).

Figure 4.

Relationship between the share of REDD+ payments scheduled for 2006–2022 in GDP (2013) and an average of Rule of Law and Control of Corruption indicators (2013) for the sample of 34 countries where REDD+ payments exceed 0.15% of GDP (the three-letter country codes are defined by the International Organization for Standardization [

17]).

4. Discussion and Conclusions

When Ebeling and Yasué [

4] wrote their article, political discussions focused on an earlier variant of REDD+, a compensation mechanism with an acronym based on reducing emissions from deforestation (RED), which had officially been put forward in 2005. REDD became part of UNFCCC negotiations in 2007, broadening the scope of the RED initiative to cover forest degradation, which is another large source of emissions and is particularly important in developing countries [

18]. Finally, other initiatives have developed around the UN-REDD system, which can be captured by the umbrella term of REDD+ and encompass various funds generating options for the initial objective of reducing emissions from deforestation and forest degradation.

Nevertheless, the potential income has not increased, at least not in terms of what has been committed so far and reflected in the VRD, which we used as a source of REDD+ data. Ebeling and Yasué [

4] considered a speculative measure of the impact that REDD payments may have on the economy of recipient countries—the potential annual payments based on forest resources of the different countries, expressed as a percentage of annual GDP. Our measure is more specific, based on real arrangements within which countries have actually committed to transfer REDD+ payments, and we used an aggregated sum over 2006–2022 as a percentage of 2013 GDP (which is the latest data we had for almost all countries) instead of annual flows. In the case of both studies, the share of these funds in GDP has remained negligible (much less than 1% for most countries). In spite of these differences, the values of RED/REDD+ measures in both studies are similar, and those of Ebeling and Yasué [

4] were actually higher than ours. Clearly, the actual REDD+ payments are still very far from the potential payments that the poor countries might receive, judging from their forest resources. In the early years of REDD+ development, REDD+ funds were expected to be “astronomically larger than for existing payment for ecosystem services projects” [

19]. Financing needs for REDD+ for 2010–2015 were estimated at EUR 15–25 billion, and USD 4 billion were committed by the developed countries for 2010–2012 alone during the UNFCCC conference of the parties in 2009 [

1,

20]. Meanwhile, as indicated above, as of mid-June 2015, the VRD presented less than USD 18 billion worth of REDD+ payments to be distributed between 2006 and 2022.

Although the scale of the program seems smaller now than it seemed eight years ago, when Ebeling and Yasué [

4] published their article, the institutional problems that they highlighted remain similarly important. Our diagrams are remarkably similar to that of Ebeling and Yasué [

4], despite the fact that several important initiatives have been taken up so far to make sure that REDD+ payments are received by countries with relatively good institutions. Indeed, in response to the different concerns about potential threats related to weak institutions, numerous measures have been taken by the developers of REDD+ to ensure that quality institutions are in place before the payments are disbursed. For example, the safeguards against the violation of human rights and adverse effects on indigenous peoples and other local forest-dependent communities were incorporated into the REDD+ documents in December 2010 [

1]. Perhaps the most important measure of caution was that the first phase of REDD+ development in any country would be to develop the institutional capacity to design REDD+ strategies, as agreed in Cancun in December 2010. This was meant to be achieved through stakeholder dialogue, strengthening of institutions, and demonstration activities, all of which were meant to translate into capacity-building, and ultimately into high quality strategies, action plans, policies, and measures [

1].

Discussions on governance of REDD+ refer to different levels: from on-the-ground management of specific projects and forests [

21] to large-scale international negotiations [

22], warranting the political support and funding for REDD+ initiatives. Many unexpected problems have made the development of REDD+ challenging, including difficulties in negotiations within the UNFCCC and on-the-ground implementation (such as the complexity of forest governance in developing countries) [

18]. Different authors have focused on different institutional issues which, according to them, required the most urgent attention. For example, Brown

et al. [

23] suggested that the most important issue was to design appropriate procedural standards (such as those regulating assessment, monitoring, and verification mechanisms). This was particularly important from the perspective of ensuring the effective implementation of REDD+ at the international level—to make sure that the program is well-organized and ready for further and more specific adjustments on the part of the participating countries. However, inasmuch as national governments play an important role in the institutional architecture of REDD+, national level institutional quality indicators are of particular relevance, and they do not translate into institutional quality within each country. Therefore, the fact that national level institutional quality indicators remain poor should be of particular concern in the further development of the REDD+ initiatives.

From the point of view of the “ecosystem service curse” hypothesis, whereby payments for ecosystem services (including those offered within REDD+) might lead to socio-economic problems in recipient countries [

10], indicators such as Rule of Law and Control of Corruption are of particular importance. The poor performance in these two indicators might be related in particular to the problems of rent-seeking and exploitation of unequal bargaining power. Obviously, these are also related to all of the other governance indicators discussed in the present article. Indeed, the “fragile” or “failing states” are often dominated by private interests and are unlikely to ensure the equitable and environmentally desirable distribution of benefits, nor the most effective forest management [

24], as depicted in the “REDD paradox” hypothesis [

12]. Because of the still-limited scale of the REDD+ initiatives, these problems may not lead to large negative socio-economic consequences as of yet. Nevertheless, they may lead to significant counterproductive effects of REDD+ implementation at the level of individual projects and forest-dependent communities. Increasing the market value of forests, in situations where there are poor indictors for Rule of Law and Control of Corruption (and, indeed, also the other indicators representing institutional quality), may lead to rent-seeking behavior by powerful elites or governments,

i.e., assuming control of forests to ensure that national REDD+ commitments are met, forcing the poor out of the land that they have been using, and potentially forcing them to encroach on new, pristine areas [

2,

3,

10,

25]. From the point of view of sustainability of local communities, it is also important to take into account the uncertainty about long-term financing for REDD+ [

26]. Indeed, the volatility of payments and lack of long-term security were also considered as part of the “ecosystem service curse” hypothesis.

The institutional problems described in this article are the most pronounced in those countries receiving the most significant REDD+ payments. Although positive examples are also available, such as Vanuatu (the only country that receives a larger share of REDD+ payments in GDP that has better institutions than other countries in this situation), they are still the exception rather than the rule. Interestingly, although all of the arrangements directed to Vanuatu were intended for institutional readiness, so far our principal institutional quality indicator (mean of Rule of Law and Control of Corruption) has remained on the same level in this country between 2006 and 2013. Meanwhile, several countries identified by Ebeling and Yasué [

4] as being in a particularly bad situation are still among those in the worst situation in our sample,

i.e., the Democratic Republic of the Congo and Liberia.

The main objective of our short paper has been to check whether the problems observed eight years ago by Ebeling and Yasué [

4] continue to persist, or whether the situation has improved. Given that the problems persist and the scale of REDD+ payments is likely to grow (as it has not yet reached the levels already expected several years ago), increasing attention has to be paid to ensuring proper institutional quality in recipient countries to avoid the problems associated with the “ecosystem service curse” and the “REDD paradox” hypotheses. Further research is necessary to explore what those countries that should benefit from REDD+ are actually prepared to derive these benefits, and how the benefits and costs (or negative consequences) of this program might be felt by the different stakeholders. More complete data on REDD+ payments (compared to that which is available within the VRD) would also allow for a more focused and specific approach to the study of these relationships. Nevertheless, it can be said that special care must be taken when distributing the funds in countries with poor institutions, as the potential positive results of REDD+ might be undermined by the institutions’ inability to prevent important problems related to these new capital flows from arising.