Sustainability Aspects of Real Estate Development: Lithuanian Case Study of Sports and Entertainment Arenas

Abstract

:1. Introduction

- (1)

- construction of new buildings;

- (2)

- distance service for project target groups;

- (3)

- reconstruction/conversion of the existing property;

- (4)

- rent/ lease of property; and

- (5)

- acquisition of a new property.

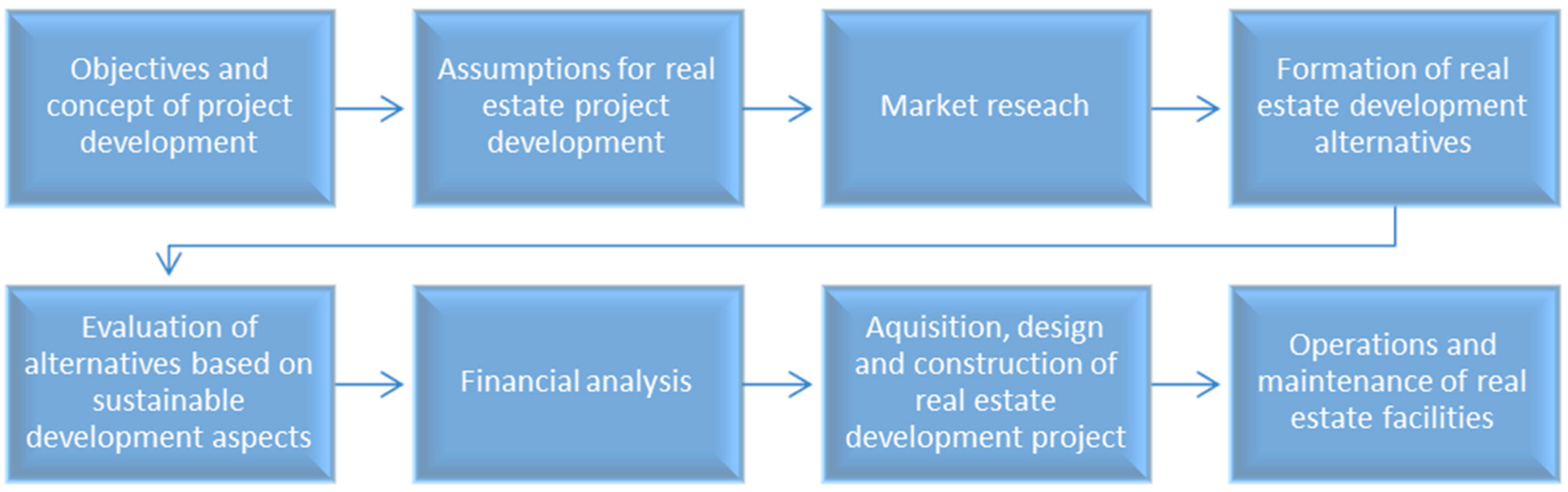

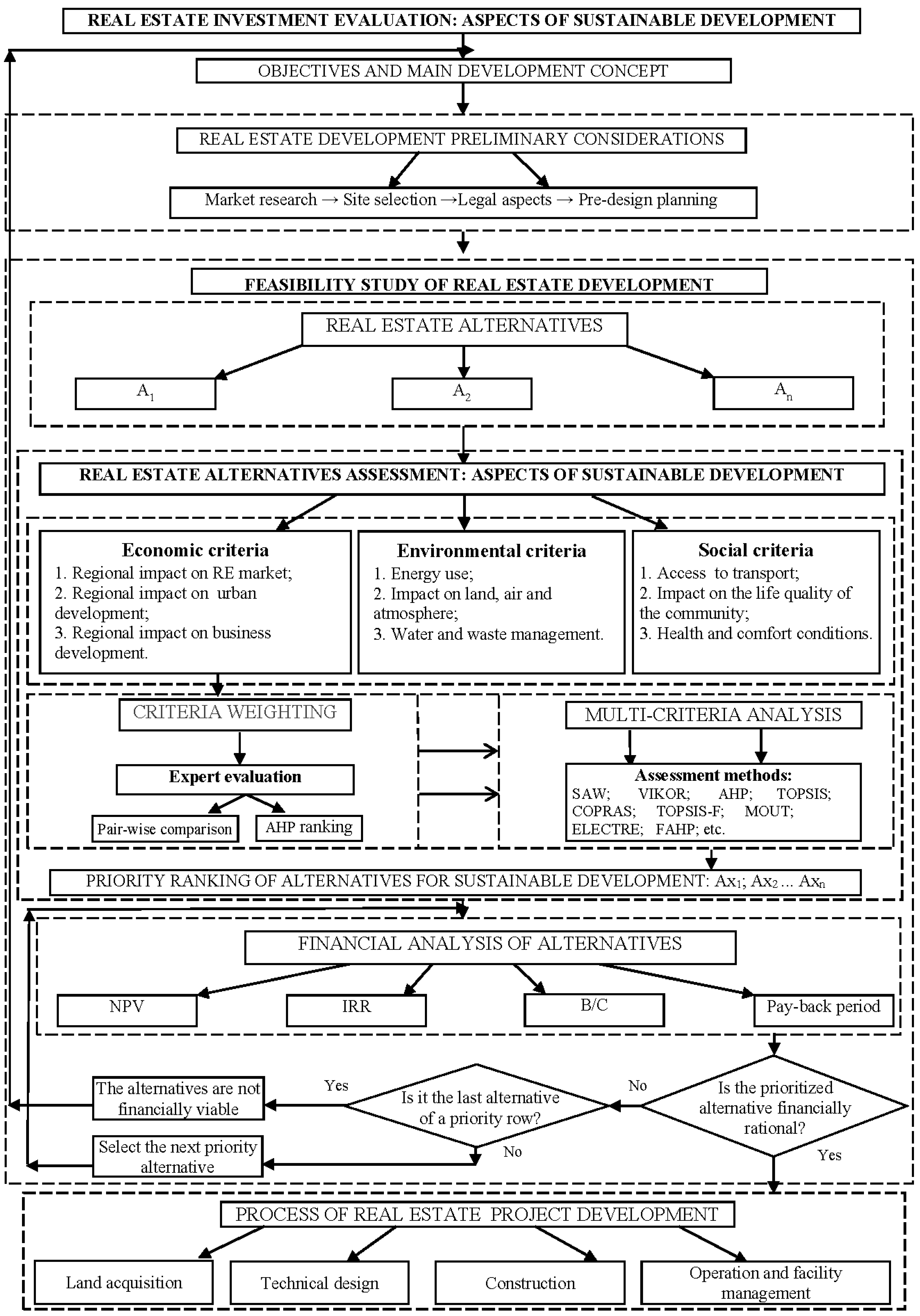

2. Methodology for Real Estate Investment Evaluation Based on Sustainable Development Aspects

- •

- defensive property investment—investment practices that adhere to written law only, i.e., conventional mainstream property investment practice;

- •

- responsible property investment—maximizing the positive effects and minimizing the negative effects of property ownership, management and development on society and the natural environment in a way that is consistent with investor goals and fiduciary responsibilities; and

- •

- sustainable property investment—encompasses the goal of maximizing positive and minimizing negative effects, but it goes one significant step further, since the investor lays down appropriate conditions so that all his (or her) actions are aimed at being sustainable.

3. Lithuanian Case Study of Sports and Entertainment Arenas

3.1. General Information about Lithuanian Multi-Functional Sports and Entertainment Arenas

| Criteria | Min value | Max value |

|---|---|---|

| Capacity for basketball, seats | 2200 | 15,688 |

| Capacity for concerts, seats | 3000 | 22,000 |

| Max number of visitors | 3044 | 17,000 |

| Number of service area residents | 26,080 | 523,050 |

| Number of annual events | 18 | 200 |

| Number of visitors per year | 50,000 | 500,000 |

| Construction costs, million EUR | 2.89 | 48.95 |

| State investments, million EUR | 0 | 35.42 |

| Investments of EU funds, million EUR | 0 | 12.88 |

| Private investment, million EUR | 0 | 16.22 |

| Annual municipality subsidies, million EUR | 0 | 0.72 |

| Cost per seat, EUR | 1158 | 5532 |

| Investment rate, EUR per resident | 19 | 1109 |

3.2. Development of Criteria System for Multi-Functional Arenas Sustainability Assessment

3.2.1. Social Criteria for Multi-Functional Arenas Assessment

| Indicators | Arenas | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| X1 | X2 | X3 | X4 | X5 | X6 | X7 | X8 | X9 | ||

| Social aspect | Distance from city center, km | 2 | 4 | 2 | 2 | 1 | 2 | 2 | 0 | 5 |

| Service area, km2 | 44 | 401 | 1229 | 52 | 42 | 81 | 110 | 157 | 401 | |

| Additional transportation by public vehicle | Yes | No | No | No | No | No | Yes/No | Yes | No | |

| Number of available parking places | 155 | 400 | 130 | 690 | 100 | 800 | 1500 | 1000 | 1650 | |

| Duration of departure by private transport, min | 10–20 | 20–30 | 10–20 | 10–20 | 10–20 | 10–20 | 10–20 | 20–30 | 20–30 | |

| Annual number of events | 60 | 18 | 200 | 70 | 40 | 60 | 75 | 90 | 100 | |

| Annual number of visitors | 50,000 | 100,000 | 50,000 | 130,000 | 80,000 | 160,000 | 160,600 | 500,000 | 413,000 | |

| Number of annually visited events per resident | 1.91 | 0.19 | 1.18 | 1.33 | 1.40 | 1.19 | 1.00 | 1.63 | 0.79 | |

| Number of leisure zones | 6 | 3 | 2 | 10 | 2 | 9 | 10 | 21 | 22 | |

| Diversity of leisure zones | Café/restaurant Smoking place | Café/restaurant Smoking place | Café/restaurant Smoking place | Café/restaurant Smoking place | Café/restaurant Smoking place | Café/restaurant Smoking place | Café/restaurant Smoking place | Café/restaurant Smoking place | Café/restaurant Smoking place | |

| Adaptability to different events | Space transformation | Space transformation Acoustic adjustment | Space transformation | Space transformation Acoustic adjustment Sound equipment | Space transformation | Space transformation Acoustic adjustment | Space transformation Acoustic adjustment | Space transformation Acoustic adjustment Sound equipment | Space transformation Acoustic adjustment Sound equipment | |

| Type of chairs | Plastic | Soft | Plastic | Soft | Soft | Soft | Soft | Soft | Soft | |

| Innovative solutions for performance of events | Scoreboard | Multipurpose flooring, Ticketing | Entrance, Scoreboard | Ticketing, Entrance, Scoreboard, Information cube | Entrance, Scoreboard | Multipurpose flooring, Entrance, Scoreboard, Information cube | Multipurpose flooring, Ticketing, Entrance, Scoreboard, Information cube | Multipurpose flooring, Ticketing, Scoreboard, Information cube | Multipurpose flooring, Ticketing, Scoreboard, Information cube | |

| Environmental aspect | Building energy efficiency rating, class | C | C | C | C | B | C | C | B | B |

| Specialist for environmental protection | No | No | No | No | No | No | No | No | No | |

| BREEAM/LEED certification | No | No | No | No | No | No | No | Under evaluation of BREEAM In-Use | No | |

| Non-renewable energy | Combined heat and power | Electricity | Combined heat and power | Combined heat and power | Combined heat and power | Electricity | Electricity | Electricity | Electricity | |

| Renewable energy | No | No | No | No | No | No | No | No | No | |

| Energy-saving measures | Water sources | Recuperators,El. sensors, Low-energy bulbs, Water resources | Recuperators, Low-energy bulbs, Water sources | Recuperators, Low-energy bulbs, Water sources | Recuperators, Low-energy bulbs, Water sources | Recuperators, Low-energy bulbs, Water sources | Recuperators, El. sensors, Low-energy bulbs | Recuperators, El. sensors, Low-energy bulbs, Water resources, Energy management | Recuperators, El. sensors, Low-energy bulbs, Water resources | |

| Waste tracking | No | Yes | No | Yes | Yes | Yes | No | Yes | Yes | |

| Recycling | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| Economic aspect | Investment rate, EUR per resident | 246 | 6 | 240 | 321 | 187 | 164 | 98 | 159 | 37 |

| State investments, % of the total | - | - | 100 | 35 | 49 | 35 | 37 | 72 | 17 | |

| EU funds, % of the total | - | - | - | 65 | 51 | 65 | 63 | 28 | - | |

| Private investment, % of the total | 100 | 100 | - | - | - | - | - | - | 83 | |

| Number of full-time employees | 8 | 12 | 28 | 11 | 10 | 14 | 14 | 40 | 17 | |

| Number of part-time employees | - | - | - | 50 | 20 | 25 | 30 | 300 | 100 | |

| Income of non-core business, % | >50 | >50 | 0–10 | 0–10 | 0–10 | >50 | 40–50 | 20–30 | 10–20 | |

| Impact on urban development within the area | Landscape development | Shopping malls, sport complexes | Environment/infrastructure, sport and leisure park | Environment/infrastructure, natural park | Environment/infrastructure, sport complex, natural park, restaurants | Environment/infrastructure, natural park | Environment/infrastructure, shopping mall | Environment/infrastructure, shopping mall, natural park | Leisure park: Aqua park, shopping mall, natural park | |

3.2.2. Environmental Criteria for Multi-Functional Arenas Assessment

3.2.3. Economic Criteria for Multi-Functional Arenas Assessment

3.3. Evaluation Criteria System for Investment into Multi-Functional Arenas

| Evaluation criteria | Arenas | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| X1 | X2 | X3 | X4 | X5 | X6 | X7 | X8 | X9 | |

| Accessibility of arenas, points [5,10] | 9 | 6 | 7 | 8 | 7 | 8 | 9 | 10 | 10 |

| Number of visited events per resident | 1.91 | 0.19 | 1.18 | 1.33 | 1.40 | 1.19 | 1.00 | 1.63 | 0.79 |

| Visitors’ comfort conditions, points [5,10] | 7 | 8 | 6 | 8 | 7 | 8 | 8 | 10 | 10 |

| Building energy performance, points [5,10] | 8 | 8 | 8 | 8 | 9 | 8 | 8 | 9 | 9 |

| Environmental impact of arena’s activities, points [5,10] | 6 | 7 | 6 | 8 | 7 | 8 | 8 | 10 | 8 |

| Innovative technologies employed, points [5,10] | 6 | 7 | 7 | 8 | 7 | 8 | 8 | 10 | 9 |

| Investment rate, EUR per resident | 246 | 6 | 240 | 321 | 187 | 164 | 98 | 159 | 37 |

| Impact on relevant business, points [5,10] | 7 | 6 | 6 | 7 | 7 | 7 | 8 | 9 | 8 |

| Impact on urban development, points [5,10] | 7 | 6 | 7 | 7 | 8 | 8 | 8 | 10 | 9 |

4. Results and Discussion

4.1. Weights of Developed Evaluation Criteria

| Criteria | Subjective weight, % | Weighting by sustainability aspects |

|---|---|---|

| Accessibility of arenas | 5.44 | Social aspect—21.41% |

| Number of visited events per resident | 7.06 | |

| Visitors’ comfort conditions | 8.91 | |

| Building energy performance | 9.61 | Environmental aspect—36.34% |

| Environmental impact of arena’s activities | 11.34 | |

| Innovative technologies employed | 15.39 | |

| Investment rate | 14.35 | Economic aspect—42.25% |

| Impact on relevant businesses | 13.54 | |

| Impact on urban development | 14.36 |

4.2. Evaluation of Investments into Multi-Functional Arenas Based on Sustainability Aspects

| Ranking | Arenas | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| X1 | X2 | X3 | X4 | X5 | X6 | X7 | X8 | X9 | |

| Relative closeness | 0.32 | 0.43 | 0.23 | 0.30 | 0.42 | 0.49 | 0.59 | 0.81 | 0.75 |

| Rank | 7 | 5 | 9 | 8 | 6 | 4 | 3 | 1 | 2 |

| Categories of sustainability | Investment alternative | Rate |

|---|---|---|

| Towards sustainability (0%–49%) | X3 | 23% |

| X4 | 30% | |

| X1 | 32% | |

| X5 | 42% | |

| X2 | 43% | |

| X6 | 49% | |

| Sustainable (50%–79%) | X7 | 59% |

| X9 | 75% | |

| In search of new paradigms (80%–100%) | X8 | 81% |

| Financial criteria | Arenas | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| X1 | X2 | X3 | X4 | X5 | X6 | X7 | X8 | X9 | |

| Annual amount of subsidies per resident, EUR | 3 | - | 2 | 6 | 5 | 2 | - | 2 | - |

| Ranking | Arenas | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| X1 | X2 | X3 | X4 | X5 | X6 | X7 | X8 | X9 | |

| Ranking based on sustainability aspects | 7 | 5 | 9 | 8 | 6 | 4 | 3 | 1 | 2 |

| Ranking based on financial performance | 5 | 1 | 4 | 7 | 6 | 2 | 1 | 3 | 1 |

| Aggregated rank | 12 | 6 | 13 | 15 | 12 | 6 | 4 | 4 | 3 |

| Overall ranking | 4 | 3 | 5 | 6 | 4 | 3 | 2 | 2 | 1 |

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References and Notes

- Ober-Haus Real Estate Advisors. Available online: http://www.ober-haus.lt (accessed on 1 February 2015).

- Real estate market report 2015. Available online: http://www.ober-haus.lt/wp-content/uploads/2015/03/Ober-Haus-Market-Report-Baltic-States-2015.pdf (accessed on 1 March 2015).

- Sorainen. Available online: http://www.sorainen.com (accessed on 1 March 2015).

- BREEAM New Construction. Technical Manual SD5073. 2011. Available online: http://www.breeam.org/breeamGeneralPrint/breeam_non_dom_manual_3_0.pdf (accessed on 22 November 2014).

- LEED v4 BD+C: New Construction. 2013. Available online: http://www.usgbc.org/credits/newconstruction/v4 (accessed on 22 November 2014).

- DGNB System fürGebäude. 2014. Available online: http://www.dgnb-system.de/de/system/kriterien (accessed on 15 May 2014).

- CASBEE for Building (New Construction). Available online: http://www.ibec.or.jp/CASBEE/english/download.htm (accessed on 15 May 2014).

- HQE. Assessment Scheme for the Environmental Performance of Buildings—“Non-residential buildings”—Version 7 June 2012. Available online: http://www.certivea.fr/home (accessed on 15 May 2014).

- SBTool 2012. Available online: http://www.iisbe.org/sbtool-2012 (accessed on 15 May 2014).

- Vesta Consulting. Available online: http://www.vestaconsulting.lt/en.html (accessed on 15 December 2014).

- Republic of Lithuania Law on Environmental Impact Assessment of the Proposed Economic Activity. No I-1495. 15 August 1996; (As last amended on 30 June 2008—No X-1654) Vilnius.

- The Lithuanian Law on Construction. Available online: http://www3.lrs.lt/pls/inter3/dokpaieska.showdoc_l?p_id=454053 (accessed on 15 May 2014).

- Methodology for investment projects seeking for financial assistance under European Structural Funds and/or State Budget; amended on 31 December 2014 No 2014/8-337 by Central Project Management Agency. Available online: http://www.esinvesticijos.lt/lt/dokumentai/ investiciju-projektu-kuriems-siekiama-gauti-finansavima-is-europos-sajungos-strukturines-paramos-ir-ar-valstybes-biudzeto-lesu-rengimo-metodika (accessed on 10 January 2015).

- Methodology for the quality review of optimal alternative selection for project implementation; amended on 13 October 2014 No 13 by Managing Authority of EU Structural Funds in 2014–2020. Available online: http://www.esinvesticijos.lt/lt/dokumentai/optimalios-projekto-igyvendinimo-alternatyvos-pasirinkimo-kokybes-vertinimo-metodika (accessed on 17 November 2014).

- ISO TC59 SC 17 Sustainability in buildings and civil engineering works. Available online: http://www.iso.org/iso/standards_development/technical_committees/other_bodies/iso_technical_committee.htm?commid=322621 (accessed on 20 April 2015).

- CEN Technical Committee 350 Sustainability of Construction Works. Available online: http://www.cen.eu/cen/Sectors/Sectors/Construction/SustainableConstruction/Pages/CEN_TC350.aspx (accessed on 20 April 2015).

- SuPerBuilding. Sustainability and performance assessment and benchmarking of building. Available online: http://www.vtt.fi/inf/pdf/technology/2012/T72.pdf (accessed on 20 April 2015).

- OPEN HOUSE. Benchmarking and mainstreaming building sustainability in the UE based on transparency and openness from model to implementation. Available online: http://www.openhouse-fp7.eu/assets/files/D1.5_Baseline_model_and_assessment_methodology.pdf (accessed on 20 April 2015).

- Lowe, C.; Ponce, A. UNEP-FI /SBCI’S financial & sustainability metrics report. An international review of sustainable building performance indicators & benchmarks. Available online: http://www.unepfi.org/fileadmin/documents/metrics_report_01.pdf (accessed on 20 March 2014).

- Sustainable Construction: Realising the Opportunities for Built Environment Professionals. Available online: http://www.rics.org/Global/Europe%20publications/Sustainable%20Construction_Realising%20the%20Opportunities%20(Oct%202013).pdf (accessed on 20 March 2014).

- Sustainability Metrics. Translation and Impact on Property Investment and Management. A report by the Property Working Group of the United Nations Environment Programme Finance Initiative. Available online: http://www.unepfi.org/fileadmin/documents/UNEPFI_SustainabilityMetrics_Web.pdf (accessed on 15 December 2014).

- Principles Responsible Investment for Building responsible property portfolios. A review of current practice by UNEP FI and PRI signatories. UNIEP, 2008. Available online: http://www.unepfi.org/fileadmin/documents/building_responsible_property_portfolios.pdf (accessed on 20 March 2014).

- Sustainable Property Investment & Management Key Issues & Major Challenges. Available online: http://www.joinricsineurope.eu/uploads/files/Sustainable%20Property%20Investment%20and%20management%20RICS%20sept%2008.pdf (accessed on 20 March 2014).

- Principles of responsible investing. Available online: http://www.unpri.org (accessed on 20 April 2015).

- Zielenbach, S. Measuring the impact of community development. Available online: http://www.bostonfed.org/commdev/c&b/2004/fall/measuring.pdf (accessed on 20 April 2015).

- Castellani, V.; Sala, S. Sustainability Indicators Integrating Consumption Patterns in Strategic Environmental Assessment for Urban Planning. Sustainability 2013, 5, 3426–3446. [Google Scholar] [CrossRef]

- Zhang, X.; Wu, Y.; Skitmore, M.; Jiang, S. Sustainable infrastructure projects in balancing urban–rural development: Towards the goal of efficiency and equity. J. Cleaner Prod. 2014. [Google Scholar] [CrossRef]

- McDonald, S.; Malys, N.; Maliene, V. Urban regeneration for sustainable communities: A case study. Technol. Econ. Dev. Econ. 2009, 15, 49–59. [Google Scholar] [CrossRef]

- Boz, M.; El-adaway, I. Creating a Holistic Systems Framework for Sustainability Assessment of Civil Infrastructure Projects. J. Constr. Eng. Manag. 2014. [Google Scholar] [CrossRef]

- Shen, L.; Wu, Y.; Zhang, X. Key Assessment Indicators for the Sustainability of Infrastructure Projects. J. Constr. Eng. Manag. 2011, 137, 441–451. [Google Scholar] [CrossRef]

- Adetola, A.; Goulding, J.; Liyange, C. Collaborative engagement approaches for delivering sustainable infrastructure projects in the AEC sector: A Review. Int. J. Constr. Supply Chain Manag. 2011, 1, 1–24. [Google Scholar] [CrossRef]

- Jakimavičius, M.; Burinskienė, M. Multiple criteria assessment of a new tram line development scenario in Vilnius City public transport system. Transport 2013, 28, 431–437. [Google Scholar] [CrossRef]

- Griškevičiūtė-Gečienė, A.; Burinskienė, M. Towards creating the assessment methodology for urban road transport development projects. Technol. Econ. Dev. Econ. 2012, 18, 651–671. [Google Scholar] [CrossRef]

- Shari, Z.; Soebarto, V. Investigating sustainable practices in the Malaysian office building developments. Constr. Innov. 2014, 14, 17–37. [Google Scholar] [CrossRef]

- Prochorskaite, A.; Maliene, V. Health, well-being and sustainable housing. Int. J. Strateg. Prop. Manag. 2013, 17, 44–57. [Google Scholar] [CrossRef]

- Yates, J. Design and Construction for Sustainable Industrial Construction. J. Constr. Eng. Manag. 2014, 140. [Google Scholar] [CrossRef]

- Xia, B.; Skitmore, M.; Wu, P.; Chen, Q. How Public Owners Communicate the Sustainability Requirements of Green Design-Build Projects. J. Constr. Eng. Manag. 2014, 140. [Google Scholar] [CrossRef]

- Vatalis, K.I.; Manoliadis, O.; Charalampides, G.; Platias, S.; Savvidis, S. Sustainability Components Affecting Decisions for Green Building Projects. Procedia Econ. Financ. 2013, 5, 747–756. [Google Scholar] [CrossRef]

- Vaiškūnaitė, R.; Mieriauskas, P.; Špakauskas, V. Biodiversity impacts assessment in road development in Lithuania. Transport 2012, 27, 187–195. [Google Scholar] [CrossRef]

- Valdes-Vasquez, R.; Klotz, L. Social Sustainability Considerations during Planning and Design: Framework of Processes for Construction Projects. J. Constr. Eng. Manag. 2013, 139, 80–89. [Google Scholar] [CrossRef]

- Mostafa, M.; El-Gohary, N. Stakeholder-Sensitive Social Welfare–Oriented Benefit Analysis for Sustainable Infrastructure Project Development. J. Constr. Eng. Manag. 2014, 140. [Google Scholar] [CrossRef]

- Snieška, V.; Šimkūnaitė, I. Socio-Economic Impact of Infrastructure Investments. Eng. Econ. (Inzinerine Ekonomika) 2009, 3, 16–25. [Google Scholar]

- Wang, N.; Wei, K.; Sun, H. Whole Life Project Management Approach to Sustainability. J. Manag. Eng. 2014, 30, 246–255. [Google Scholar] [CrossRef]

- Swarup, L.; Korkmaz, S.; Riley, D. Project Delivery Metrics for Sustainable, High-Performance Buildings. J. Constr. Eng. Manag. 2011, 137, 1043–1051. [Google Scholar] [CrossRef]

- Bragança, L.; Mateus, R.; Koukkari, H. Building Sustainability Assessment. Sustainability 2010, 2, 2010–2023. [Google Scholar] [CrossRef]

- Markelj, J.; KitekKuzman, M.; Grošelj, P.; Zbašnik-Senegačnik, M. A Simplified Method for Evaluating Building Sustainability in the Early Design Phase for Architects. Sustainability 2014, 6, 8775–8795. [Google Scholar] [CrossRef]

- Waas, T.; Hugé, J.; Block, T.; Wright, T.; Benitez-Capistros, F.; Verbruggen, A. Sustainability Assessment and Indicators: Tools in a Decision-Making Strategy for Sustainable Development. Sustainability 2014, 6, 5512–5534. [Google Scholar] [CrossRef] [Green Version]

- Bragança, L.; Vieira, S.M.; Andrade, J.B. Early Stage Design Decisions: The Way to Achieve Sustainable Buildings at Lower Costs. Sci. World J. 2014. [Google Scholar] [CrossRef]

- Wong, J.K.-W.; Kuan, K.-L. Implementing ‘BEAM Plus’ for BIM-based sustainability analysis. Autom. Constr. 2014, 44, 163–175. [Google Scholar] [CrossRef]

- VillarinhoRosa, L.; Haddad, A.N. Building Sustainability Assessment throughout Multicriteria Decision Making. J. Constr. Eng. 2013, 2013. Article 578671. [Google Scholar]

- Azhar, S.; Carlton, W.A.; Olsen, D.; Ahmad, I. Building information modelling for sustainable design and LEED rating analysis. Autom. Constr. 2011, 20, 217–224. [Google Scholar] [CrossRef]

- Luetzkendorf, T.; Fan, W.; Lorenz, D. Engaging financial stakeholders: Opportunities for a sustainable built environment. Build. Res. Inf. 2011, 39, 483–503. [Google Scholar] [CrossRef]

- Deng, Y.; Wu, J. Economic returns to residential green building investment: The developers’ perspective. Reg. Sci. Urban Econ. 2014, 47, 35–44. [Google Scholar] [CrossRef]

- Trowbridge, M.J.; Pickell, S.G.; Pyke, C.R.; Jutte, D.P. Building Healthy Communities: Establishing Health and Wellness Metrics for Use Within The Real Estate Industry. Health Affairs 2014, 33, 1923–1929. [Google Scholar] [CrossRef] [PubMed]

- Rakhshan, K.; Friess, W.A.; Tajerzadeh, S. Evaluating the sustainability impact of improved building insulation: A case study in the Dubai residential built environment. Build. Environ. 2013, 67, 105–110. [Google Scholar] [CrossRef]

- Eichholtz, P.; Kok, N.; Yonder, E. Portfolio greenness and the financial performance of REITs. J. Int. Money Finance 2012, 31, 1911–1929. [Google Scholar] [CrossRef]

- Knoepfel, P.; Csikos, P.; Gerber, J.D. Transformation of the Role of the State and of Corporate Land Owners in Urban Development Processes in Light of Sustainable Development. Politische Vierteljahresschrift 2012, 53, 414–443. [Google Scholar]

- Rudžianskaitė–Kvaraciejienė, R.; Apanavičienė, R.; Gelžinis, A. Modelling the effectiveness of PPP road infrastructure projects by applying random forests. J. Civil Eng. Manag. 2015, 21, 290–299. [Google Scholar] [CrossRef]

- Velasquez, M.; Hester, P.T. An Analysis of Multi-Criteria Decision Making Methods. Int. J. Oper. Res. 2013, 10, 56–66. [Google Scholar]

- Aruldoss, M.; Lakshmi, T.M.; Venkatesan, V.P. A Survey on Multi Criteria Decision Making Methods and Its Applications. Am. J. Inf. Syst. 2013, 1, 31–43. [Google Scholar]

- Huang, I.; Keisler, J.; Linkov, I. Multi-Criteria Decision Analysis in Environmental Science: Ten Years of Applications and Trends. Sci. Total Environ. 2011, 409, 3578–3594. [Google Scholar] [CrossRef] [PubMed]

- Antucheviciene, J.; Zakarevicius, A.; Zavadskas, E.K. Measuring congruence of ranking results applying particular MCDM methods. Informatica 2011, 22, 319–338. [Google Scholar]

- Seifried, C.; Clopton, A.W. An alternative view of public subsidy and sport facilities through social anchor theory. City Culture Soc. 2013, 4, 49–55. [Google Scholar] [CrossRef]

- Liu, Y.; Zhao, G.; Wang, S. Case Study VI—The National Stadium BOT Project for Beijing 2008 Olympic Games. In Public—Private Partnership in Infrastructure Development: Case Studies from Asia and Europe; Bauhaus-Universität Weimar: Weimar, Germany, 2009; pp. 130–152. [Google Scholar]

- Liu, T.; Wilkinson, S. Large-scale public venue development and the application of Public—Private Partnerships (PPPs). Int. J. Project Manag. 2013, 32, 88–100. [Google Scholar] [CrossRef]

- Kellison, T.B.; Mondello, M.J. Organisational perception management in sport: The use of corporate pro-environmental behaviour for desired facility referenda outcomes. Sport Manag. Rev. 2012, 15, 500–512. [Google Scholar] [CrossRef]

- Lasley, S.; Turner, J. Home run or strikeout: The dynamics of public opinion on new sports facilities. Soc. Sci. J. 2010, 47, 853–864. [Google Scholar] [CrossRef]

- Coates, D.; Humphreys, B.R. Proximity benefits and voting on stadium and arena subsidies. J. Urban Econ. 2006, 59, 285–299. [Google Scholar] [CrossRef]

- Grieve, J.; Sherry, E. Community benefits of major sport facilities: The Darebin International Sports Centre. Sport Manag. Rev. 2012, 15, 218–229. [Google Scholar] [CrossRef]

- Propheter, G. Are basketball arenas catalysts of economic development? J. Urban Affairs 2012, 34, 441–459. [Google Scholar] [CrossRef]

- Jones, C.; Munday, M.; Roche, N. Can regional sports stadia ever be economically significant? Reg. Sci. Policy Pract. 2010, 2, 63–78. [Google Scholar] [CrossRef]

- Ahlfeldt, G.; Maennig, W. Stadium Architecture and Urban Development from the Perspective of Urban Economics. Int. J. Urban Reg. Res. 2010, 34, 629–646. [Google Scholar] [CrossRef]

- Barghchi, M.; Omar, D.B.; Aman, S.M. Sports Facilities Development and Urban Generation. J. Soc. Sci. 2009, 5, 460–465. [Google Scholar]

- Mallen, C.; Chard, C. “What could be” in Canadian sport facility environmental sustainability. Sport Manag. Rev. 2012, 15, 230–243. [Google Scholar] [CrossRef]

- Mallen, C.; Adams, L.; Stevens, J.; Thompson, L. Environmental sustainability in sport facility management: A Delphi study. Eur. Sport Manag. Q. 2010, 10, 367–389. [Google Scholar] [CrossRef]

- Koukiasa, M. Sustainable Facilities Management within Event Venues. Worldw. Hosp. Tour. Themes 2011, 3, 217–228. [Google Scholar] [CrossRef]

- Biggest Lithuanian arenas. Available online: http://www.topten.lt/didziausios-lietuvos-arenos/ (accessed on 15 September 2014).

- Nine basketball arenas were built in Lithuania within the last five years for 400 million LTL. Available online: http://www.15min.lt/sportas/naujiena/krepsinis/lietuvos-krepsinio-arenos-23-420053 (accesses on 15 September 2014).

- What makes the arenas, established for basketball championship. Available online: http://www.lrt.lt/naujienos/kalba_vilnius/32/78505/kuo_gyvena_krepsinio_cempionatui_gausiai_statytos_arenos_ (accessed on 15 December 2014).

- Official website of Alytus Arena. Available online: http://www.asrc.lt/ (accessed on 15 September 2014).

- Official website of Zalgiris Arena. Available online: http://zalgirioarena.lt/ (accessed on 15 September 2014).

- Official website of Siemens Arena. Available online: http://www.siemens-arena.com/ (accessed on 15 September 2014).

- Official website of Svyturys Arena. Available online: http://svyturioarena.lt/ (accessed on 15 September 2014).

- Official website of Siauliai Arena. Available online: http://www.siauliuarena.lt/ (accessed on 15 September 2014).

- Official website of Cido Arena. Available online: http://www.cidoarena.lt/ (accessed on 15 September 2014).

- Arenas of EuroBasket 2011: Pride of Lithuania. Available online: http://www.basketzone.lt/naujienos/8672-eurobasket-2011-arenos-lietuvos-pasididiavimas-foto.html (accessed on 15 September 2014).

- Official website of Vilnius Entertainment Arena. Available online: http://www.pramoguarena.lt/ (accessed on 15 September 2014).

- Official website of Utena Arena. Available online: http://www.sportas.utena.lm.lt/ (accessed on 15 September 2014).

- Official website of Kedainiai Arena. Available online: http://kedainiu-arena.lt/ (accessed on 15 September 2014).

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Apanavičienė, R.; Daugėlienė, A.; Baltramonaitis, T.; Maliene, V. Sustainability Aspects of Real Estate Development: Lithuanian Case Study of Sports and Entertainment Arenas. Sustainability 2015, 7, 6497-6522. https://doi.org/10.3390/su7066497

Apanavičienė R, Daugėlienė A, Baltramonaitis T, Maliene V. Sustainability Aspects of Real Estate Development: Lithuanian Case Study of Sports and Entertainment Arenas. Sustainability. 2015; 7(6):6497-6522. https://doi.org/10.3390/su7066497

Chicago/Turabian StyleApanavičienė, Rasa, Ala Daugėlienė, Tautvydas Baltramonaitis, and Vida Maliene. 2015. "Sustainability Aspects of Real Estate Development: Lithuanian Case Study of Sports and Entertainment Arenas" Sustainability 7, no. 6: 6497-6522. https://doi.org/10.3390/su7066497

APA StyleApanavičienė, R., Daugėlienė, A., Baltramonaitis, T., & Maliene, V. (2015). Sustainability Aspects of Real Estate Development: Lithuanian Case Study of Sports and Entertainment Arenas. Sustainability, 7(6), 6497-6522. https://doi.org/10.3390/su7066497