A Scorecard Framework Proposal for Improving Software Factories’ Sustainability: A Case Study of a Spanish Firm in the Financial Sector

Abstract

:1. Introduction

2. Background and Literature Review

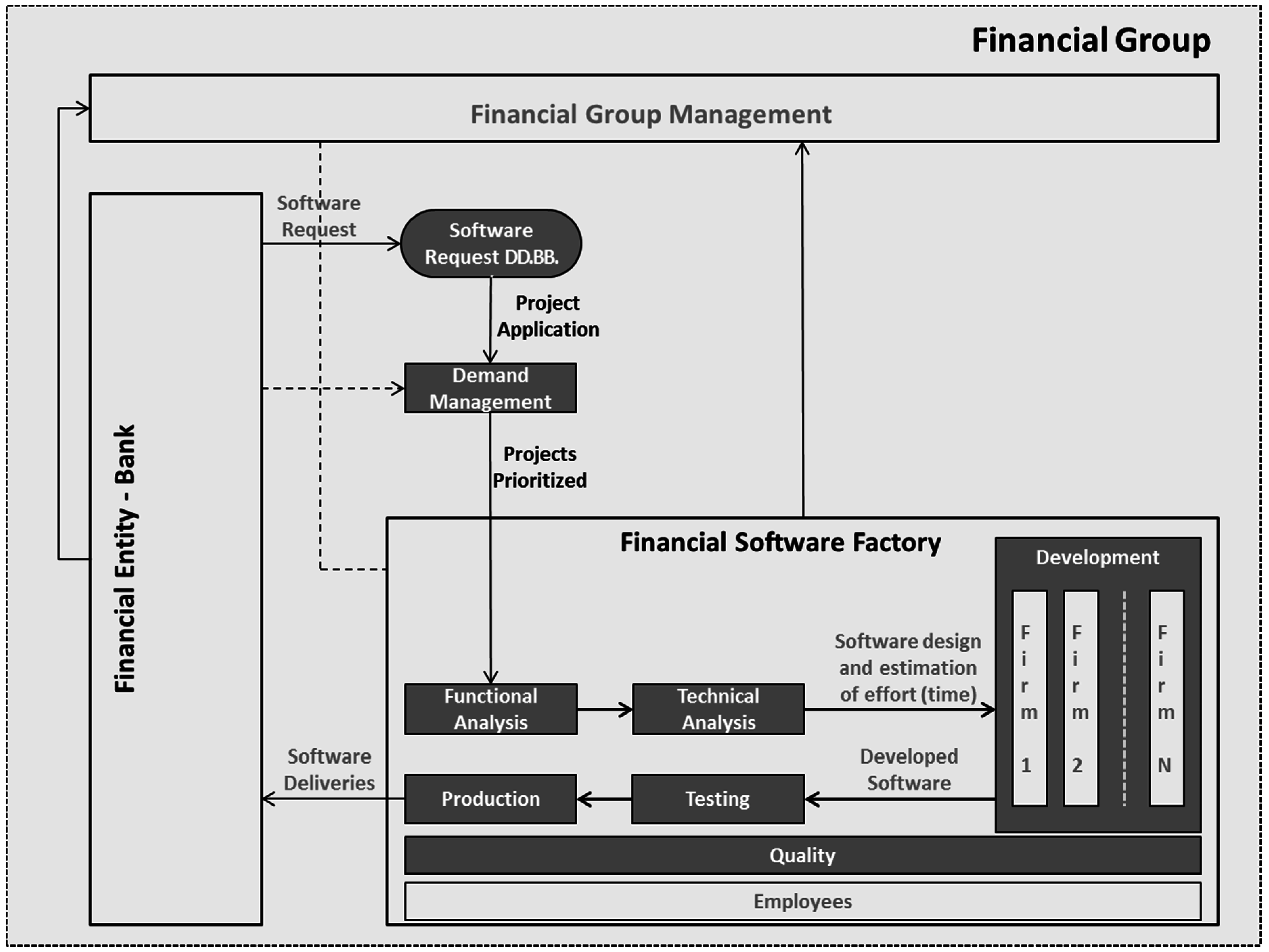

2.1. The Financial Software Factory Scheme

- –

- They work almost exclusively for the financial group, which is both the owner and the principal customer.

- –

- They usually have a greater demand for requests, more than is possible to complete. There is always a queue of software developments pending.

- –

- They have secured the payment of deliveries, which means that the more software developments that are built, the greater their income.

- –

- Revenues are billed in relation to the use of developments.

- –

- The software development process is usually outsourced to several software companies, but this does not apply to top-level processes such as functional specifications and project management. The payment to outsourced firms is made according to the number of hours budgeted and not by the number of hours it takes to achieve it.

- –

- Demand Management, which aims to collect the top-level user requirements and establish methods for prioritizing demands.

- –

- Functional Analysis, which transforms the identified top-level user requirements into functional requirements.

- –

- Technical Analysis, which is responsible for the technical details of the functional specifications that must be implemented.

- –

- Development, which performs the development, construction and assembling of the requested requirements.

- –

- Testing, which has to validate everything that has been implemented.

- –

- Production, which performs the customer deployment.

- –

- Quality, which assesses the software development processes quality.

2.2. The BSC Framework as a Management System

- –

- What is the productivity of the software factory?

- –

- How does productivity evolve?

- –

- How do the planning and cost of the projects evolve?

- –

- What are the quality developments?

- –

- What is the software factory’s position in the market?

- –

- How is the relationship between the shareholders, customers and employees with the software factory?

- –

- Is the software factory a sustainable business in the medium to long term?

- –

- How do we look to shareholders?

- –

- How do customers see us?

- –

- What must we excel at?

- –

- Can we continue to improve and create value?

2.3. The Financial Software Factory, a Case Study

3. Results and Discussion

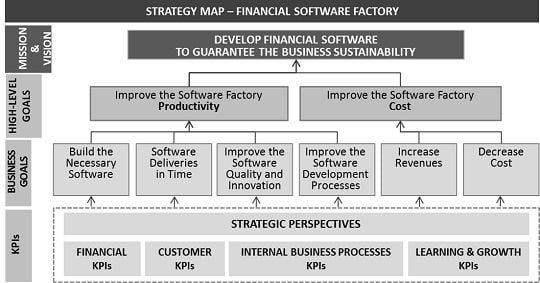

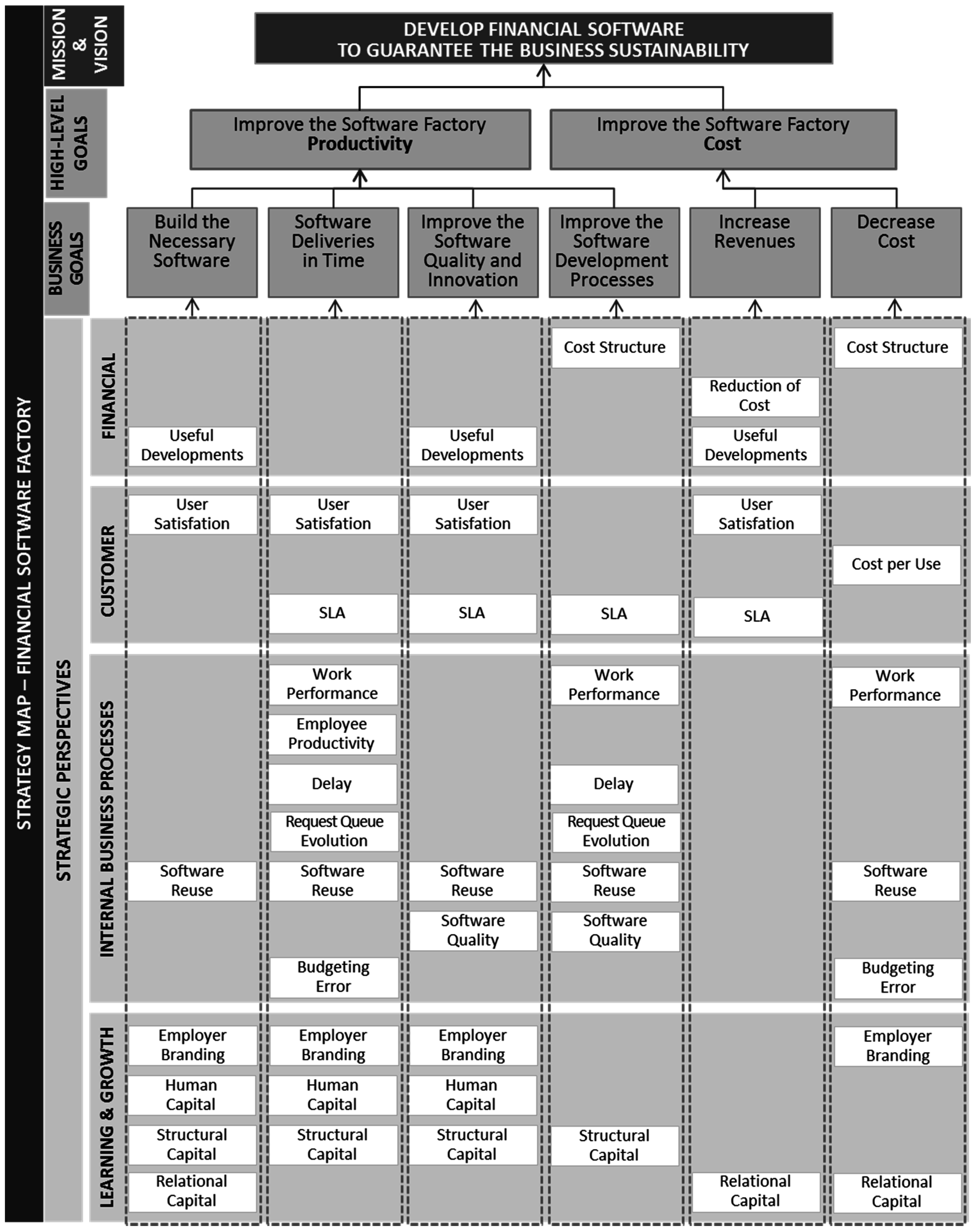

3.1. The Proposed BCS Management Framework

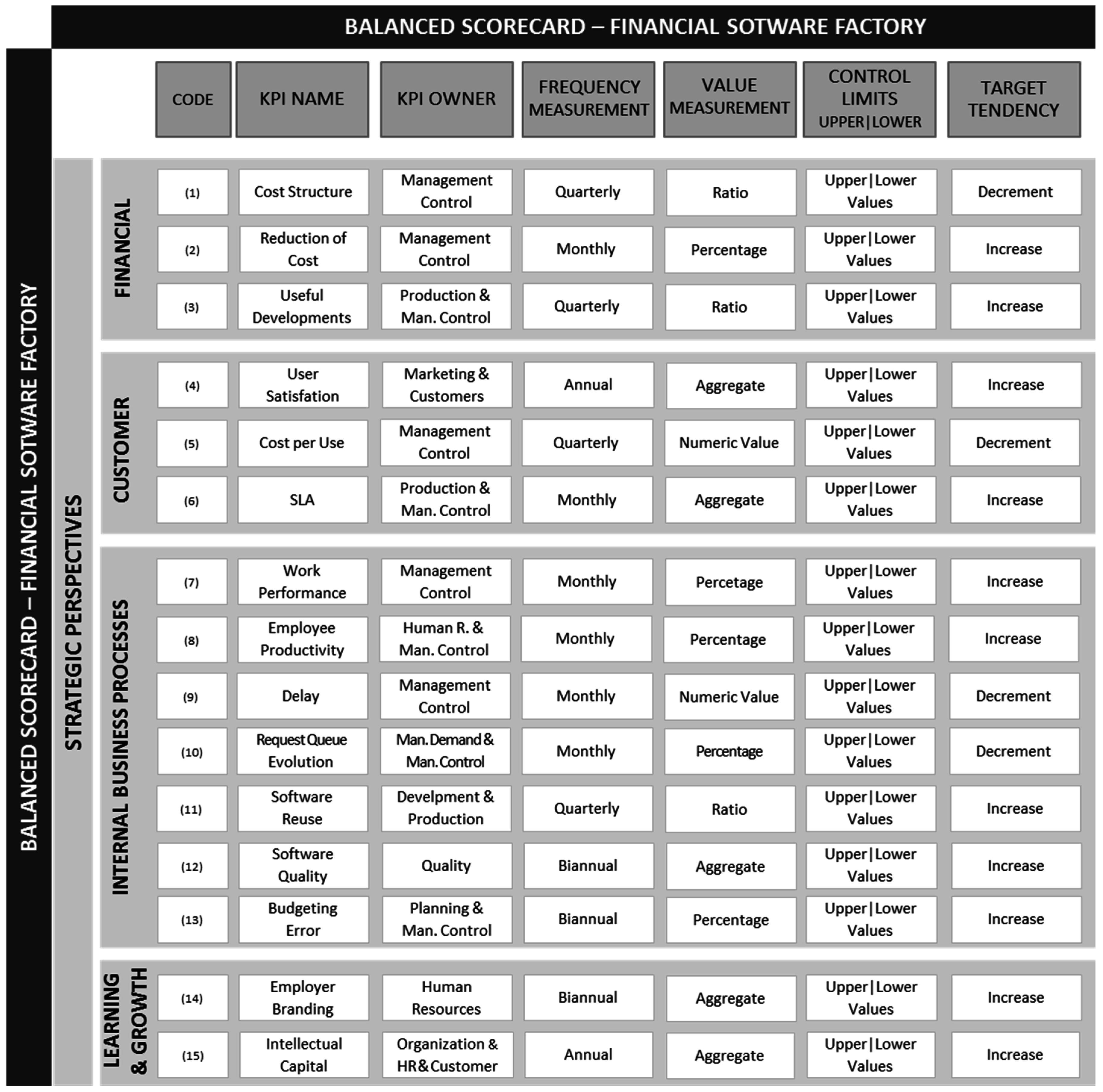

3.2. The Proposed KPIs for the BSC

- –

- KPI Name: All KPIs need a name which should clearly explain what the indicator is about.

- –

- Strategic BSC Perspective: Each KPI is aligned to one of the four BSC strategic perspectives.

- –

- KPI Owner: Identifies the areas or departments that are responsible for controlling each indicator and establishes the system to capture, store and retrieve the data related to this indicator.

- –

- KPQ: Identifies the key performance question (KPQ) that the indicator is helping to answer, and provides the context of why this indicator is being introduced.

- –

- Formula: Identifies how the data will be captured, if it is possible to create a formula, and if the KPI is a simple indicator or if it is composed of other indicators.

- –

- KPI justification and description: In this field the importance of KPI for the organization is justified, how the data needed to measure the indicator are obtained is described and all those relevant facts that should be known about the KPI are explained.

- –

- Transactions: “Transactions” are those events that trigger the execution of a program, object, feature or section of code. Transactions can be triggered by a user request or by calling another transaction previously executed.

- –

- Total Software Factory Cost: We refer to “Total Software Factory Cost” as all costs incurred to make a business model work, including staff cost.

- –

- Total Financial Group Assets: In the banking sector, “Total Assets” are all that a bank owns, including loans, reserves, investment securities and physical assets. “Average of Total Assets” is a usual measurement to identify the size of a bank.

- –

- Total Executed Transactions: “Total Executed Transactions” is the number of times that a transaction is triggered during a predetermined fixed span of time.

- –

- Cost Charged to the Client: “Cost Charged to the Client” is the cost that the customer pays to use the software developments and services offered by the software factory. In this case, the customer is the bank’s business group, and the amount of this cost is related to the number of total transactions executed.

- –

- Budgeted Hours: In the proposed model, a “Budgeted Hour” is the amount of software that the software factory should build in an hour of real time. During the estimating process, the estimates of the size are transformed into hours. We use these hours to monitor the projects.

- –

- Performed Hours: In the proposed model, “Performed Hours” is the amount of software that the software factory had built in an hour of real time.

3.2.1. KPIs for the Financial Perspective

- –

- Reduction and optimization of the expenses of the software factory.

- –

- Sell the developments and services to other companies different from the owning financial group, to recover the development costs with external revenues.

- –

- Delivery of software development must be good quality and useful for the customer. The use of software increases customer loyalty and promotes business sustainability.

KPI Name: Cost Structure

- Strategic BSC Perspective: Financial

- KPI Owner: Management Control

- KPQ: How to evolve the costs of the software factory?

- Formula:

KPI Name: Reduction of Cost

- Strategic BSC Perspective: Financial

- KPI Owner: Management Control

- KPQ: What is the ratio of costs that are covered by sales to companies outside the group?

- Formula:

KPI Name: Useful Developments

- Strategic BSC Perspective: Financial

- KPI Owner: Production and Management Control

- KPQ: How useful are the developments for the financial group?

- Formula:

3.2.2. KPIs for the Customer Perspective

- –

- To have covered the needs of software.

- –

- Software development must be delivered on time.

- –

- Services prices must be assumed by the client to be equal to the rest of the companies in the sector.

KPI Name: User Satisfaction

- Strategic BSC Perspective: Customer

- KPI Owner: Marketing and Customers

- KPQ: What is the level of customer satisfaction?

- Formula:

KPI Name: Cost per Use

- Strategic BSC Perspective: Customer

- KPI Owner: Management Control

- KPQ: What is the relative cost of software development?

- Formula:

KPI Name: Service Level Agreements (SLA)

- Strategic BSC Perspective: Customer

- KPI Owner: Management Control

- KPQ: What is the level of compliance with the SLA?

- Formula:

3.2.3. KPIs for the Internal Business Process Perspective

- –

- Improve the efficiency and productivity related to software developments.

- –

- Identify cost and time deviations to avoid future problems.

- –

- Improve the quality of software developments.

KPI Name: Work Performance

- Strategic BSC Perspective: Internal Business Process

- KPI Owner: Management Control

- KPQ: What is the Software Factory performance?

- Formula:

KPI Name: Employee Productivity

- Strategic BSC Perspective: Internal Business Process

- KPI Owner: Human Resources and Management Control

- KPQ: What is employee productivity?

- Formula:

KPI Name: Delay

- Strategic BSC Perspective: Internal Business Process

- KPI Owner: Management Control

- KPQ: What is the waiting time for software development deliveries?

- Formula:

KPI Name: Request Queue Evolution

- Strategic BSC Perspective: Internal Business Process

- KPI Owner: Management Demand and Management Control

- KPQ: How does the size of pending software deliveries evolve?

- Formula:

KPI Name: Software Reuse

- Strategic BSC Perspective: Internal Business Process

- KPI Owner: Development and Production

- KPQ: What is the level of software reuse?

- Formula:

KPI Name: Software Quality

- Strategic BSC Perspective: Internal Business Process

- KPI Owner: Quality

- KPQ: What is the quality of software development?

- Formula:

KPI Name: Budgeting Error

- Strategic BSC Perspective: Internal Business Process

- KPI Owner: Planning and Management Control

- KPQ: What is the budget error in software development deliveries?

- Formula:

3.2.4. KPIs for the Learning and Growth Perspective

- –

- Ensure the presence of the best personnel for the company.

- –

- Improve the intellectual capital of the company in order to improve its sustainability.

KPI Name: Employer Branding

- Strategic BSC Perspective: Learning and Growth

- KPI Owner: Human Resources

- KPQ: What is the employer branding of the company?

- Formula:

KPI Name: Intellectual Capital

- Strategic BSC Perspective: Learning and Growth

- KPI Owner: Organization and Human Resources

- KPQ: What is the intellectual capital level of the company?

- Formula:

3.3. The Proposed Financial Software Factory Balanced Scorecard

3.4. The Strategy Map of the Financial Software Factory

3.5. Preliminary Validation Plan

| Data/Year | 2012 | 2014 | Var.% |

| Finished Software Request | 338 | 424 | 25.44% |

| Budgeted Hours | 251,019 | 257,951 | 2.76% |

| Performed Hours | 354,722 | 339,847 | −4.19% |

| Group Revenues | 60,418,000 € | 54,681,000 € | −9.50% |

| Core Transactions | 1,296,439,281 | 1,276,054,739 | −1.57% |

| KPIs/Year | 2012 | 2014 | Var.% |

| Cost per Use | 0.0466 | 0.0429 | −8.05% |

| Work Performance | 70.77 | 75.90 | 7.26% |

| Employee Productivity | 0.56 | 0.65 | 15.93% |

| Budgeting Error | 29.23 | 24.10 | −17.57% |

4. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References and Notes

- Papalexandris, A.; Ioannou, G.; Prastacos, G.P. Implementing the Balanced Scorecard in Greece: A Software Firm’s Experience. Long Range Plan. 2004, 37, 351–366. [Google Scholar] [CrossRef]

- De la Fuente Asprón, R. Medir la Productividad del Desarrollo de Software en Banca. Available online: www.financialtech-mag.com (accessed on 22 June 2013).

- Fenton, N.; Bieman, J. Software Metrics: A Rigorous and Practical Approach; CRC Press: Boca Raton, FL, USA, 2014. [Google Scholar]

- Emaldi Abasolo, M. The Software Factories. Dyna (Bilbao) 2007, 82, 330–333. [Google Scholar]

- Murphy, G.C. What is software development productivity, anyway? (keynote). In Proceedings of the 10th Working Conference on Mining Software Repositories (MSR), San Francisco, CA, USA, 18–19 May 2013; IEEE Press: San Francisco, CA, USA, 2013; p. 1. [Google Scholar]

- Brown, A.W.; Lopez Mancisidor, A.; Reyes Oliva, L. Practical Experiences with Software Factory Approaches in Enterprise Software Delivery. In Proceedings of the Sixth International Conference on Software Engineering Advances, ICSEA, Barcelona, Spain, 23–29 October 2011; pp. 465–470. Available online: http://www.thinkmind.org/index.php?view=instance&instance=ICSEA+2011 (accessed on 26 November 2015).

- De Vries, M. Measuring Success with Software Factories. Available online: https://msdn.microsoft.com/en-us/library/bb245774.aspx (accessed on 26 November 2015).

- Kaplan, R.S.; Norton, D.P. The Balanced Scorecard—Measures That Drive Performance. Harv. Bus. Rev. 1992, 70, 71–79. [Google Scholar] [PubMed]

- Kaplan, R.S.; Norton, D.P. The Balanced Scorecard: Translating Strategy into Action; Harvard Business Press: Boston, MA, USA, 1996. [Google Scholar]

- Van Grembergen, W. The Balanced Scorecard and IT Governance. Inf. Syst. Control J. 2000, 2, 40–43. [Google Scholar]

- Martinsons, M.; Davison, R.; Tse, D. The balanced scorecard: a foundation for the strategic management of information systems. Decis. Support Syst. 1999, 25, 71–88. [Google Scholar] [CrossRef]

- Mooraj, S.; Oyon, D.; Hostettler, D. The Balanced Scorecard: A Necessary Good or an Unnecessary Evil? Eur. Manag. J. 1999, 17, 481–491. [Google Scholar] [CrossRef]

- Rodríguez Montequín, V.; Álvarez, C.; Ortega, F.; Villanueva Balsera, J. Scorecard for Improving Software Factories Effectiveness in the Financial Sector. Procedia Technol. 2013, 9, 670–675. [Google Scholar] [CrossRef]

- Djotio Ndie, T.; Tangha, C.; Ekwoge Ekwoge, F. MDA (Model Driven Architecture) as a Software Factory Industrialization Pattern: An Approach for a Pragmatic Software Factories. J. Softw. Eng. Appl. 2010, 3, 561–571. [Google Scholar] [CrossRef]

- Poppendieck, M.; Poppendieck, T. Lean Software Development: An Agile Toolkit; Addison Wesley: Boston, MA, USA, 2003. [Google Scholar]

- Hotle, M.; Landry, S. Application Delivery and Support Organizational Archetypes: The Software Factory. Available online: https://www.gartner.com/doc/980919/application-delivery-support-organizational-archetypes (accessed on 26 November 2015).

- Peredo Valderrama, R.; Canales Cruz, A.; Peredo Valderrama, I. An Approach toward a Software Factory for the Development of Educational Materials under the Paradigm of WBE. Interdiscipl. J. E-Learn. Learn. Objects 2011, 7, 55–67. [Google Scholar]

- Rodríguez Montequín, V.; Álvarez Pérez, C.; Ortega Fernández, F.; Villanueva Balsera, J. Scorecard and KPIs for monitoring software factories effectiveness in the financial sector. Int. J. Inf. Syst. Project Manag. 2013, 1, 29–43. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. Putting the Balanced Scorecard to Work. Harv. Bus. Rev. 1993, 71, 134–140. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. Using the Balanced Scorecard as a Strategic Management System. Harv. Bus. Rev. 2007, 85, 150–161. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. Strategy Maps: Converting Intangible Assets into Tangible Outcomes; Harvard Business School Press: Boston, MA, USA, 2004. [Google Scholar]

- Kaplan, R.S. Conceptual Foundations of the Balanced Scorecard. Handb. Manag. Account. Res. 2008, 3, 1253–1269. [Google Scholar]

- Rohm, H.; Montgomery, D. Link Sustainability to Corporate Strategy Using the Balanced Scorecard; The Balanced Scorecard Institute: Cary, NC, USA, 2011. [Google Scholar]

- Basili, V.; Heidrich, J.; Lindvall, M.; Münch, J.; Regardie, M.; Rombach, D.; Seaman, C.; Trendowicz, A. Bridging the Gap between Business Strategy and Software Development. Available online: aisel.aisnet.org/icis2007/25/ (accessed on 26 November 2015).

- Chi, D.-J.; Hung, H.-F. Is the BSC really helpful for improving performance? Evidence from software companies in China and Taiwan. Afr. J. Bus. Manag. 2011, 5, 224–239. [Google Scholar]

- Eckerson, W.W. Creating Effective KPIs. Available online: http://www.information-management.com/issues/20060601/1056305-1.html (accessed on 26 November 2015).

- Marr, B. How to Design Key Performance Indicators, Management Case Study; The Advanced Performance Institute: Buckinghamshire, UK, 2010. [Google Scholar]

- Etezadi-Amoli, J.; Farhoomand, A.F. A structural model of end user computing satisfaction and user performance. Inf. Manag. 1996, 30, 65–73. [Google Scholar] [CrossRef]

- Tyrinopoulus, Y.; Antoniou, C. Public transit user satisfaction: Variability and policy implications. Transp. Policy 2008, 15, 260–272. [Google Scholar] [CrossRef]

- Del Castillo, J.M.; Benitez, F.G. A Methodology for Modeling and Identifying Users Satisfaction Issues in Public Transport Systems Based on Users Surveys. Procedia-Soc. Behav. Sci. 2012, 54, 1104–1114. [Google Scholar] [CrossRef]

- Alhamad, M.; Dillon, T.; Chang, E. Conceptual SLA framework for cloud computing. In Proceedings of the 4th IEEE International Conference on Digital Ecosystems and Technologies (DEST), Dubai, United Arab Emirates, 13–16 April 2010; pp. 606–610.

- Goo, J.; Kishore, R.; Rao, H.R.; Nam, K. The Role of Service Level Agreements in Relational Management of Information Technology Outsourcing: An Empirical Study. MIS Q. 2009, 33, 119–145. [Google Scholar]

- Morrison, C.J. A Microeconomic Approach to the Measurement of Economic Performance: Productivity Growth, Capacity, Utilization, and Related Performance Indicators; Springer Science & Business Media: Berlin, Germany, 2012. [Google Scholar]

- Sommerville, I. Software Engineering (9th Edition); Pearson Addison Wesley: Boston, MA, USA, 2004. [Google Scholar]

- Huda, M.; Arya, Y.D.S.; Khan, M.H. Quantifying Reusability of Object Oriented Design: A Testability Perspective. J. Softw. Eng. Appl. 2015, 8, 175–183. [Google Scholar] [CrossRef]

- Fuller, T. A Foundation for the Pillars of Software Factories. ACSIJ 2012, 1, 10–17. [Google Scholar]

- Joint Technical Committee ISO/IEC JTC 1/SC7 ISO/IEC 25010:2011 Systems and Software Engineering–Systems and software Quality Requirements and Evaluation (SQuaRE)–System and Software Quality Models 2011.

- Yilmaz, M.; O’Connor, R.V. An Empirical Investigation into Social Productivity of a Software Process: An Approach by Using the Structural Equation Modeling. In Systems, Software and Service Process Improvement; Springer: Berlin, Germany, 2011; Volume 172, pp. 155–166. [Google Scholar]

- Chunping, Y.; Xi, L. The Study on Employer Brand Strategy in Private Enterprises from the Perspective of Human Resource Management. Energy Procedia 2011, 5, 2087–2091. [Google Scholar] [CrossRef]

- App, S.; Merk, J.; Büttgen, M. Employer Branding: Sustainable HRM as a Competitive Advantage in the Market for High-Quality Employees. Manag. Rev. 2012, 23, 262–278. [Google Scholar]

- Kumar, V.; Christodoulopoulou, A. Sustainability and Branding: An Integrated Perspective. Ind. Market. Manag. 2014, 43, 6–15. [Google Scholar] [CrossRef]

- Nagy, I. How to Measure your Employer Branding ROI. Available online: http://www.social-hire.com/social-recruiting-advice/2151/how-to-measure-your-employer-branding-roi (accessed on 7 July 2015).

- Minchington, B. 2014 Employer Branding Global Trends Study Report; Employer Brand International—EBI: Torrensville, Australia, 2014. [Google Scholar]

- Örnek, A.Ş.; Ayas, S. The Relationship between Intellectual Capital, Innovative Work Behavior and Business Performance Reflection. Procedia 2015, 195, 1387–1395. [Google Scholar] [CrossRef]

- Wu, I.-L.; Chen, J.-L. A stage-based diffusion of IT innovation and the BSC performance impact: A moderator of technology-organization-environment. Technol. Forec. Soc. Change 2014, 88, 76–90. [Google Scholar] [CrossRef]

- Software Engineering Institute. Capability Maturity Model Integration (CMMI®) Version 1.3. Available online: http://cmmiinstitute.com/ (accessed on 15 September 2015).

- Office of Government Commerce. PRINCE2®:2009 (Projects IN Controlled Environments). Available online: https://www.axelos.com/best-practice-solutions/prince2 (accessed on 15 September 2015).

- Van Grembergen, W.; de Haes, S. Measuring and Improving IT Governance through the Balanced Scorecard. Inf. Syst. Control J. 2005, 2, 35–42. [Google Scholar]

- Van Grembergen, W.; Saull, R.; de Haes, S. Linking the IT Balanced Scorecard to the Business Objectives at a Major Canadian Financial Group. J. Inf. Technol. Case Appl. Res. 2003, 5, 23–50. [Google Scholar] [CrossRef]

- Kathuria, R.; Joshi, M.P.; Porth, S.J. Organizational alignment and performance: past, present and future. Manag. Decis. 2007, 45, 503–517. [Google Scholar]

- Basili, V.; Heidrich, J.; Lindvall, M.; Münch, J.; Regardie, M.; Rombach, D.; Seaman, C.; Trendowicz, A. Linking Software Development and Business Strategy Through Measurement. IEEE Comput. 2010, 43, 57–65. [Google Scholar] [CrossRef]

- Towers Watson. Effective Model validation—Embedding Trust. Available online: https://www.towerswatson.com/en/Insights/IC-Types/Ad-hoc-Point-of-View/Insights/2013/Insights-Model-validation (accessed on 26 November 2015).

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Álvarez, C.; Rodríguez, V.; Ortega, F.; Villanueva, J. A Scorecard Framework Proposal for Improving Software Factories’ Sustainability: A Case Study of a Spanish Firm in the Financial Sector. Sustainability 2015, 7, 15999-16021. https://doi.org/10.3390/su71215800

Álvarez C, Rodríguez V, Ortega F, Villanueva J. A Scorecard Framework Proposal for Improving Software Factories’ Sustainability: A Case Study of a Spanish Firm in the Financial Sector. Sustainability. 2015; 7(12):15999-16021. https://doi.org/10.3390/su71215800

Chicago/Turabian StyleÁlvarez, César, Vicente Rodríguez, Francisco Ortega, and Joaquín Villanueva. 2015. "A Scorecard Framework Proposal for Improving Software Factories’ Sustainability: A Case Study of a Spanish Firm in the Financial Sector" Sustainability 7, no. 12: 15999-16021. https://doi.org/10.3390/su71215800

APA StyleÁlvarez, C., Rodríguez, V., Ortega, F., & Villanueva, J. (2015). A Scorecard Framework Proposal for Improving Software Factories’ Sustainability: A Case Study of a Spanish Firm in the Financial Sector. Sustainability, 7(12), 15999-16021. https://doi.org/10.3390/su71215800