Which Subsidy Mode Improves the Financial Performance of Renewable Energy Firms? A Panel Data Analysis of Wind and Solar Energy Companies between 2009 and 2014

Abstract

:1. Introduction

2. Literature Review

2.1. Selection and Effects of Subsidy Modes

- (a)

- Selection of renewable energy subsidy modes in China with a review of international experience

- (b)

- Effect of trade disputes on the choice of subsidy mode

- (c)

- Effectiveness of the subsidy mode choices

2.2. Influence of Subsidy on Corporate Financial Performance

3. Model and Hypotheses

3.1. Research Hypotheses

- H1: A direct subsidy has asignificant positive effecton corporate financial performance under the circumstance ofimperfect market-based mechanisms.

- H2: An innovative subsidy can promote corporate profitability more conspicuously than a non-innovative subsidy.

3.2. Sample Selection and Data Source

3.3. Variable Selection and Model Setup

- (1)

- Corporate age. Theoretically, the net profit of an enterprise increases with the number of years it has existed. An enterprise with a longer period of existence may be more capable of making profit because it has accumulated market knowledge and experience. Therefore, corporate age is a variableaffecting corporate netprofit. The years of corporateexistence are taken asa measurement for this variable.

- (2)

- Capital intensity. Increased capital intensity represents the higher proportion of materialized labor consumption in the production costs and the lower proportion of direct labor consumption. This function shows greater capital investment per unit labor than usualand enhances corporate profitability. Capital intensity is valued as the ratio of fixed assets to total employees.

- (3)

- Percentage of the largest shareholder. The percentage of the largest shareholder reflects the distribution of control rights to a certain extent and determines the agency management between ownership and managerial authority. The relationship between the percentage of the largest shareholder and corporate financial performance is uncertain. A viewpoint shows that a positive relationship exists between the two variables because the governing power of the largest shareholder grows with his or her shareholding, thereby reducing the opportunist tendency of managers and promoting corporate value and profitability. An opposite viewpoint holds that the largest shareholder has the largest number of shares, which may enable him or her to infringe upon the interest of small and medium shareholders and the overall corporate interest. Based on the abovementioned analysis, the panel model is established and expressed as

| Variable Classification | Variable Symbol | Variable Measurement |

|---|---|---|

| Dependent variable | Profit | The net profits |

| Explanatory variables | Dsub | The direct fiscal appropriation |

| NDsub | The sum of market-oriented subsidies | |

| Isub | The sum of technology supply and diffusion subsidies | |

| NIsub | The value of total subsidies minus the innovative ones | |

| Control variables | Age | The number of years enterprise has existed |

| Top | The proportion of the largest shareholder in total shares | |

| Cpl | The ratio of fixed assets to total employees |

4. EmpiricalResults

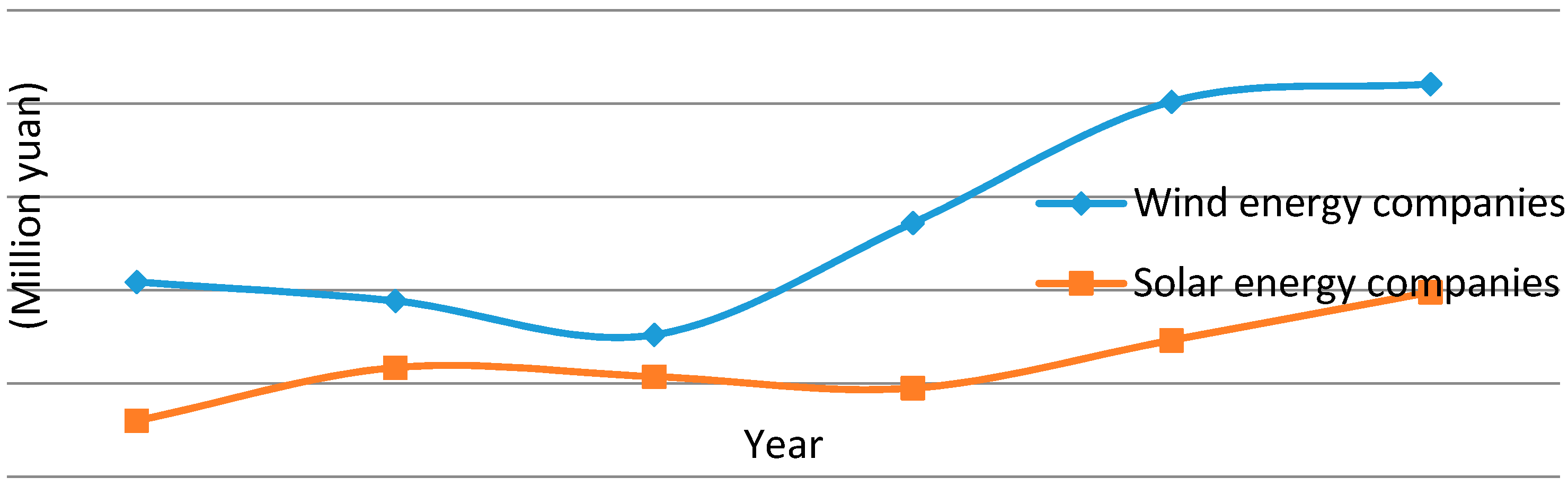

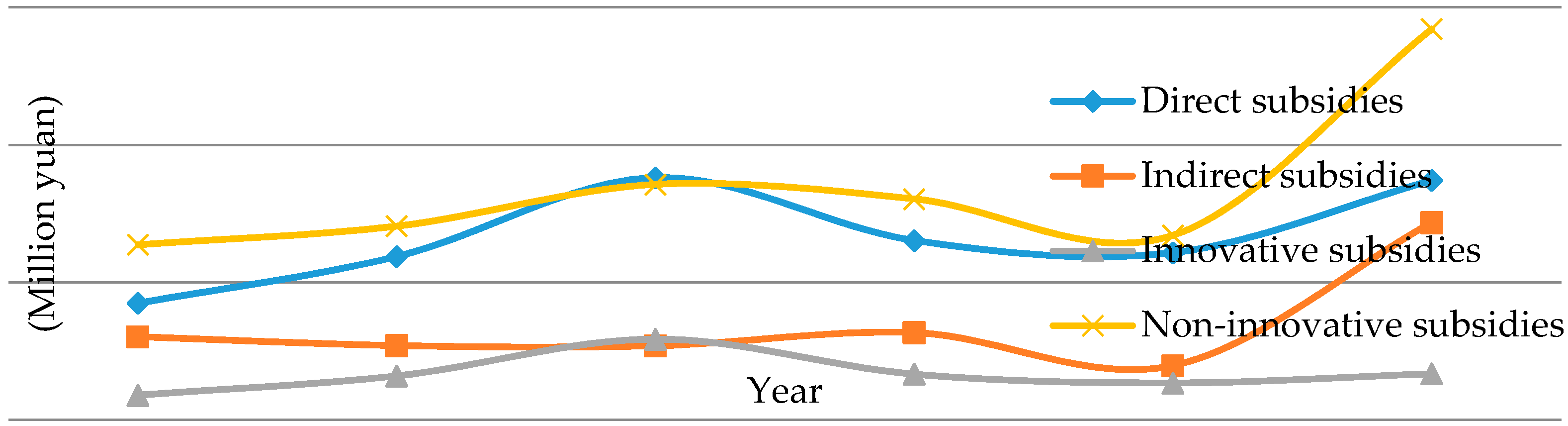

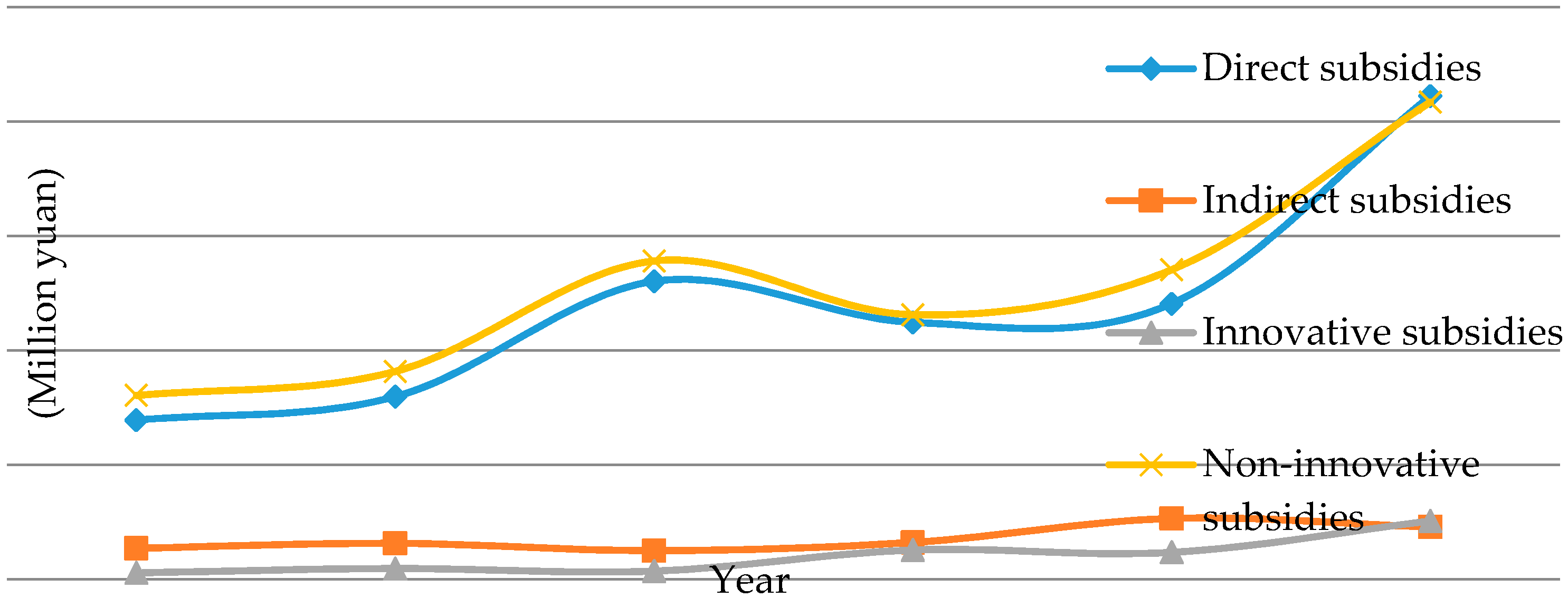

4.1. Descriptive Statistical Analysis

| Variables | Year | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|---|---|

| Profit (million yuan) | Mean | 1043.764 | 941.696 | 759.642 | 1359.855 | 2010.718 | 2105.544 |

| Min | 6.025 | 30.532 | 5.818 | 7.144 | 7.279 | 15.911 | |

| Max | 5393.144 | 3739.722 | 4498.217 | 6852.454 | 12,900.02 | 13,562.37 | |

| Dsub (million yuan) | Mean | 42.408 | 59.390 | 88.061 | 65.223 | 60.787 | 87.084 |

| Min | 0 | 0 | 0.337 | 0 | 0 | 0 | |

| Max | 457.45 | 529.607 | 929.816 | 472.900 | 545.191 | 763.328 | |

| NDsub (million yuan) | Mean | 30.249 | 27.050 | 26.936 | 31.734 | 19.763 | 106.936 |

| Min | 0 | 0 | 0 | 0 | 0 | 0 | |

| Max | 191.543 | 192.718 | 208.888 | 311.754 | 138.789 | 1015.659 | |

| Isub (million yuan) | Mean | 8.982 | 16.013 | 29.386 | 16.615 | 13.439 | 16.804 |

| Min | 0 | 0 | 0 | 0 | 0 | 0 | |

| Max | 86.25 | 98.951 | 477.987 | 68.687 | 61.804 | 86.400 | |

| NIsub (million yuan) | Mean | 63.674 | 70.427 | 85.611 | 80.333 | 67.144 | 142.065 |

| Min | 0 | 0 | 0.025 | 0.030 | 0 | 0.100 | |

| Max | 459.627 | 545.472 | 660.384 | 552.669 | 556.818 | 834.92 | |

| Age (years) | Mean | 12.231 | 13.231 | 14.231 | 15.231 | 16.231 | 17.231 |

| Min | 1 | 2 | 3 | 4 | 5 | 6 | |

| Max | 21 | 22 | 23 | 24 | 25 | 26 | |

| Top (%) | Mean | 41.519 | 40.210 | 38.978 | 40.796 | 38.802 | 38.261 |

| Min | 18.270 | 8.910 | 8.980 | 8.980 | 8.98 | 8.98 | |

| Max | 70.540 | 70.540 | 66.39 | 73.670 | 67.39 | 67.39 | |

| Cpl (million yuan/per capita) | Mean | 6.698 | 6.375 | 2.770 | 3.409 | 2.966 | 2.913 |

| Min | 0.068 | 0.078 | 0.088 | 0.099 | 0.116 | 0.127 | |

| Max | 98.708 | 109.410 | 18.978 | 27.250 | 14.504 | 16.561 |

| Variables | Year | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|---|---|

| Profit (million yuan) | Mean | 299.286 | 584.069 | 535.731 | 473.818 | 731.002 | 988.946 |

| Min | 2.710 | 31.720 | 0.230 | 5.320 | 0.670 | 0 | |

| Max | 1579.310 | 3868.160 | 3282 | 3252.260 | 4280.990 | 8119.020 | |

| Dsub (million yuan) | Mean | 27.828 | 31.918 | 52.080 | 44.918 | 48.152 | 84.458 |

| Min | 0 | 1.350 | 2.170 | 2.520 | 2.320 | 0.860 | |

| Max | 219.850 | 155.340 | 380.770 | 189.700 | 226.410 | 418.230 | |

| NDsub (million yuan) | Mean | 5.446 | 6.312 | 5.020 | 6.462 | 10.650 | 9.159 |

| Min | 0 | 0 | 0 | 0 | 0 | 0 | |

| Max | 50.000 | 52.780 | 19.400 | 24.220 | 54.880 | 66.039 | |

| Isub (million yuan) | Mean | 1.140 | 1.905 | 1.458 | 5.142 | 4.724 | 10.212 |

| Min | 0 | 0 | 0 | 0 | 0 | 0 | |

| Max | 8.940 | 14.787 | 5.980 | 56.000 | 52.030 | 70.890 | |

| NIsub (million yuan) | Mean | 32.134 | 34.918 | 55.642 | 47.244 | 54.078 | 83.406 |

| Min | 1.160 | 1.350 | 1.220 | 0.640 | 3.710 | 1.34 | |

| Max | 219.850 | 155.340 | 381.660 | 199.700 | 220.260 | 440.320 | |

| Age (years) | Mean | 14.524 | 15.524 | 16.524 | 17.524 | 18.524 | 19.524 |

| Min | 2 | 3 | 4 | 5 | 6 | 7 | |

| Max | 39 | 40 | 41 | 42 | 43 | 44 | |

| Top (%) | Mean | 57.004 | 54.270 | 52.859 | 51.933 | 52.948 | 37.919 |

| Min | 32.71 | 21.97 | 14.82 | 15.670 | 14.790 | 3.620 | |

| Max | 76 | 76 | 74 | 77 | 74 | 57.350 | |

| Cpl (million yuan/per capita) | Mean | 1.463 | 1.827 | 1.696 | 1.624 | 1.622 | 2.510 |

| Min | 0.150 | 0.010 | 0.080 | 0.050 | 0.060 | 0.080 | |

| Max | 10.340 | 14.230 | 13.280 | 9.830 | 9.020 | 19.400 |

4.2. The RegressionAnalysis of Total Samples

| Direct and Indirect Subsidy Modes | Innovativeand Non-Innovative Subsidy Modes | ||||

|---|---|---|---|---|---|

| Explanatory | Fixed Effects | Random Effects | Explanatory | Fixed Effects | Random Effects |

| Cons | 17.3028 *** (9.76) | 17.1614 *** (13.48) | Cons | 17.6254 *** (7.75) | 17.2036 *** (11.25) |

| Age | 0.0784 (1.45) | 0.0055 (0.27) | Age | 0.1088 (1.10) | −0.0006 (−0.02) |

| Top | 0.0586 (0.16) | −0.1266 (−0.47) | Top | −0.1658 (−0.39) | −0.1724 (−0.56) |

| Cpl | 0.0701 (1.42) | 0.1307 ** (2.72) | Cpl | 0.0360 (0.64) | 0.0979 * (1.89) |

| Dsub | 0.0298 (1.14) | 0.0583 ** (2.28) | Isub-2 | −0.0263 (−1.42) | −0.0093 (−0.57) |

| NDsub | −0.0227 * (−1.69) | −0.0101 (−0.75) | NIsub-2 | 0. 0737 * (2.13) | 0.0973 ** (2.92) |

| Hausman value | 0.0000 | Hausman value | 0.0000 | ||

4.3. Regressive Analysis of Sub-Industries

| Direct and Indirect Subsidy Modes | Innovativeand Non-Innovative Subsidy Modes | ||||

|---|---|---|---|---|---|

| Explanatory | Fixed Effects | Random Effects | Explanatory | Fixed Effects | Random Effects |

| Cons | 10.9574 *** (4.29) | 9.7463 *** (6.16) | Cons | 10.9475 *** (4.27) | 9.7827 *** (6.21) |

| Age | 0.2435 (0.59) | 0.2184 (0.69) | Age | 0.3303 (0.82) | 0.3157 (1.03) |

| Top | 1.0016 * (1.67) | 0.5581 (1.51) | Top | 1.0129 * (1.69) | 0.5112 (1.39) |

| Cpl | 0.2774 ** (2.53) | 0.4573 *** (5.12) | Cpl | 0.2992 ** (2.71) | 0.4811 *** (5.34) |

| Dsub | 0.0293 (1.22) | 0.0460 * (1.96) | Isub | −0.01950 (−1.15) | −0.0069 (−0.40) |

| NDsub | 0.0111 (0.59) | 0.0177 (0.94) | NIsub | 0.0205 (0.76) | 0.0386 (1.47) |

| Hausman value | 0.5797 | Hausman value | 0.0000 | ||

| Direct and Indirect Subsidy Modes | Innovativeand Non-Innovative Subsidy Modes | ||||

|---|---|---|---|---|---|

| Explanatory | Fixed Effects | Random Effects | Explanatory | Fixed Effects | Random Effects |

| Cons | 19.76339 *** (7.01) | 20.07996 *** (8.70) | Cons | 17.0767 *** (4.77) | 17.1926 *** (6.19) |

| Age | 0.0705 (1.07) | 0.0288 (0.91) | Age | 0.1502 (1.39) | 0.0564 (1.58) |

| Top | −0.2355 (−0.49) | −0.4942 (−1.24) | Top | −0.2702 (−0.55) | −0.5373 (−1.36) |

| Capital | 0.0171697 (0.29) | 0.0283 (0.48) | Capital | 0.0132 (0.22) | 0.0003 (0.01) |

| Dsub | −0.0400 (−0.63) | 0.0250 (0.41) | Isub−2 | −0.0484 ** (−2.16) | −0.0524 ** (−2.55) |

| NDsub | −0.0474 ** (−2.47) | −0.0361 * (−1.95) | N Isub−2 | 0.0362 (0.33) | 0.1996 * (1.92) |

| Hausman value | 0.0011 | Hausman value | 0.0036 | ||

4.4. Robust Test

5. Conclusions

- (1)

- Perfecting market-based subsidy mechanisms such as tax, bonus, etc. Tax, bonus, and other subsidy mechanisms granted to renewable energy companies must be detailed according to set standards, such as scale, technological level, and financial performance of renewable energy companies; this strengthens the auditing process prior to the granting of subsidies and increases supervision of the use of subsidies. The enforcement of market-based subsidy mechanisms is more likely to be effective when guaranteed by institutions.Moreover, a reward and punishment system should be established by which the indirect subsidy amount and the type of next year's subsidy will be determined by the previous year’sperformance. For energy companies that perform better, more funds can be granted; for companies with lower performance after subsidies, subsidies should be reduced or even eliminated.

- (2)

- Increasing the subsidies for technological diffusion.As indicated by previous analysis, technological supply and diffusionsubsidiesare two types of innovative subsidy. The former mainly refers to subsidizing technological R&D, whereas the latter emphasizes technological promotion and demonstration. As revealed by the analysis of annual corporate reports, the R&D subsidies of renewable energy companies account for a considerate percentage, whereas the subsidies used for technological diffusion are insufficient.This weakens the transformation of technological achievements to a certain extent. Therefore, the government should increase the percentage of innovative subsidies such as technique improvement projects, government rewards for demonstration projects and project soft loans allotted for technological diffusion while reinforcing the audit and supervision of subsidies.

- (3)

- Subsidy policies should be reformed to vary from wind energy companies to solar ones. Compared with the policies for wind energy companies, the subsidy policies for solar energy companiesrequiremore urgent improvements.Direct, indirect and innovative subsidies for these types of companies all need reformation. In contrast to direct subsidies, the latter two forms of subsidy should be of particular concern because of their notable negative impact on corporate financial performance.

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Du, W.J.; Chen, G.; Gao, Y. Analysis of Subsidy Modes for Developing New Energy Industry. Econ. Forum 2011, 11, 99–102. (in Chinese). [Google Scholar]

- Xie, X.X.; Wang, Z.Y.; Gao, H. Renewable Energy Subsidy Policy Trends of Developed Countries and the Enlightenment for China. Energy China 2013, 8, 15–19. (in Chinese). [Google Scholar]

- Xiong, L.; Zhou, M.R. A Comparison of Renewable Energy Subsidy Policies between China and US from the Perspective of WTO. Int. Bus. Res. 2011, 5, 13–23. (in Chinese). [Google Scholar]

- Sun, F.B.; Tang, H.X. Institutional Predicament of Renewable Energy Subsidies within the WTO Framework and Solution. J. Kunming Univ. Sci. Technol. Soc. Sci. Ed. 2015, 15, 30–36. (in Chinese). [Google Scholar]

- Steve, C.; Carolyn, F. Canada-Renewable Energy: Implications for WTO Law on Green and Not-So-Green Subsidies. World Trade Rev. 2015, 14, 177–210. [Google Scholar]

- Yan, J.; Zhang, Q.H. Feed-in Tariff of Renewable Energy in China and Its Impact on Macro-economy. Statist. Inf. Forum 2014, 29, 46–51. [Google Scholar]

- Ouyang, X.L.; Lin, B.Q. Impacts of increasing renewable energy subsidies and phasing out fossil fuel subsidies in China. Renew. Sustain. Energy Rev. 2014, 37, 933–942. [Google Scholar] [CrossRef]

- Lesser, J.A. Wind Generation Patterns andthe Economics of WindSubsidies. Electr. J. 2013, 26, 8–16. [Google Scholar]

- Marco, A.D.; Cagliano, A.D.; Nervo, M.L.; Rafele, C. Using System Dynamics to assess the impact of RFID technology on retail operations. Int. J. Prod. Econ. 2012, 135, 333–344. [Google Scholar]

- Sánchez-Braza, A.; Pablo-Romero, M.P. Evaluation of property tax bonus to promote solar thermal systems in Andalusia (Spain). Energy Policy 2014, 67, 832–843. [Google Scholar] [CrossRef]

- Daniel, S. Financing US Renewable Energy Projects in a Post-Subsidy World. Nat. Gas Electr. 2013, 29, 7–10. [Google Scholar]

- Koseoglu, N.M.; van den Bergh, J.C.J.M.; Lacerda, J.S. Allocating subsidies to R&D or to market applications of renewableenergy? Balance and geographical relevance. Energy Sustain. Dev. 2013, 17, 536–545. [Google Scholar]

- Shen, J.F.; Luo, C. Overall review of renewable energy subsidy policies in China-Contradictions of intentions and effects. Renew. Sustain. Energy Rev. 2015, 41, 1478–1488. [Google Scholar] [CrossRef]

- Orvika, R. Subsidies for renewable energy in inflexible power markets. J. Regul. Econ. 2014, 46, 318–343. [Google Scholar]

- Keyuraphan, S.; Thanarak, P.; Ketjoy, N.; Rakwichian, W. Subsidy schemes of renewable energy policy for electricity generation in Thailand. Procedia Eng. 2012, 32, 440–448. [Google Scholar] [CrossRef]

- Zhang, D.; Xiong, W.M.; Tang, C.; Liu, Z.; Zhang, X.L. Determining the appropriate amount of subsidies for wind power: The integrated renewable power planning (IRPP) model and its application in China. Sustain. Energy Technol. Assess. 2014, 6, 141–148. [Google Scholar] [CrossRef]

- Hsu, C.W. Using a system dynamics model to assess the effects of capital subsidies and feed-in tariffs on solar PV installations. Appl. Energy 2012, 100, 205–217. [Google Scholar] [CrossRef]

- Fagiani, R.; Barquín, J.; Hakvoort, R. Risk-based assessment of the cost-efficiency and the effectivity of renewable energy support schemes: Certificate markets versus feed-in tariffs. Energy Policy 2013, 55, 648–661. [Google Scholar] [CrossRef]

- Kong, D.M.; Li, T.S. Whether government subsidies improved firms’ performance and social responsibility? Secur. Mar. Her. 2014, 6, 26–31. (in Chinese). [Google Scholar]

- Beason, R.; Weinstein, D.E. Growth,Economies of Scale, and Targeting in Japan (1955–1990). Rev. Econ. Statist. 1996, 78, 286–295. [Google Scholar] [CrossRef]

- Bergstorm, F. Capital Subsidies and the Performance of Firms. Small Bus. Econ. 2000, 14, 183–193. [Google Scholar] [CrossRef]

- Balsar, C.; Ucdogruk, Y. The Impact of Investment and R&D Subsidieson Firm Performance: Evidence from IstanbulStock Exchange. MIBES Trans. 2008, 2, 1–12. [Google Scholar]

- Lu, A.M.; Huang, D.H. Impact of financial subsidies on the performance of “ST” firms. Oper. Manag. 2015, 5, 102–104. (in Chinese). [Google Scholar]

- Leng, J.F.; Wang, K. The impact of subsidies on the agriculture listed companies’ profitability: An analysis of panel data. J. Jiangxi Agric. 2007, 19, 134–137. (in Chinese). [Google Scholar]

- Faccio, M.; Masulis, R.W.; McConnell, J.J. Political Connections and Corporate Bailouts. J. Financ. 2006, 61, 2597–2635. [Google Scholar] [CrossRef]

- Pan, Y.; Dai, Y.Y.; Li, C.X. Political connections and government subsidies of companies in financial distress: Empirical evidence from Chinese ST listed companies. Nankai Bus. Rev. 2009, 12, 6–17. (in Chinese). [Google Scholar]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, H.; Zheng, Y.; Zhou, D.; Zhu, P. Which Subsidy Mode Improves the Financial Performance of Renewable Energy Firms? A Panel Data Analysis of Wind and Solar Energy Companies between 2009 and 2014. Sustainability 2015, 7, 16548-16560. https://doi.org/10.3390/su71215831

Zhang H, Zheng Y, Zhou D, Zhu P. Which Subsidy Mode Improves the Financial Performance of Renewable Energy Firms? A Panel Data Analysis of Wind and Solar Energy Companies between 2009 and 2014. Sustainability. 2015; 7(12):16548-16560. https://doi.org/10.3390/su71215831

Chicago/Turabian StyleZhang, Huiming, Yu Zheng, Dequn Zhou, and Peifeng Zhu. 2015. "Which Subsidy Mode Improves the Financial Performance of Renewable Energy Firms? A Panel Data Analysis of Wind and Solar Energy Companies between 2009 and 2014" Sustainability 7, no. 12: 16548-16560. https://doi.org/10.3390/su71215831

APA StyleZhang, H., Zheng, Y., Zhou, D., & Zhu, P. (2015). Which Subsidy Mode Improves the Financial Performance of Renewable Energy Firms? A Panel Data Analysis of Wind and Solar Energy Companies between 2009 and 2014. Sustainability, 7(12), 16548-16560. https://doi.org/10.3390/su71215831