Enhancing Green Absorptive Capacity, Green Dynamic Capacities and Green Service Innovation to Improve Firm Performance: An Analysis of Structural Equation Modeling (SEM)

Abstract

:1. Introduction

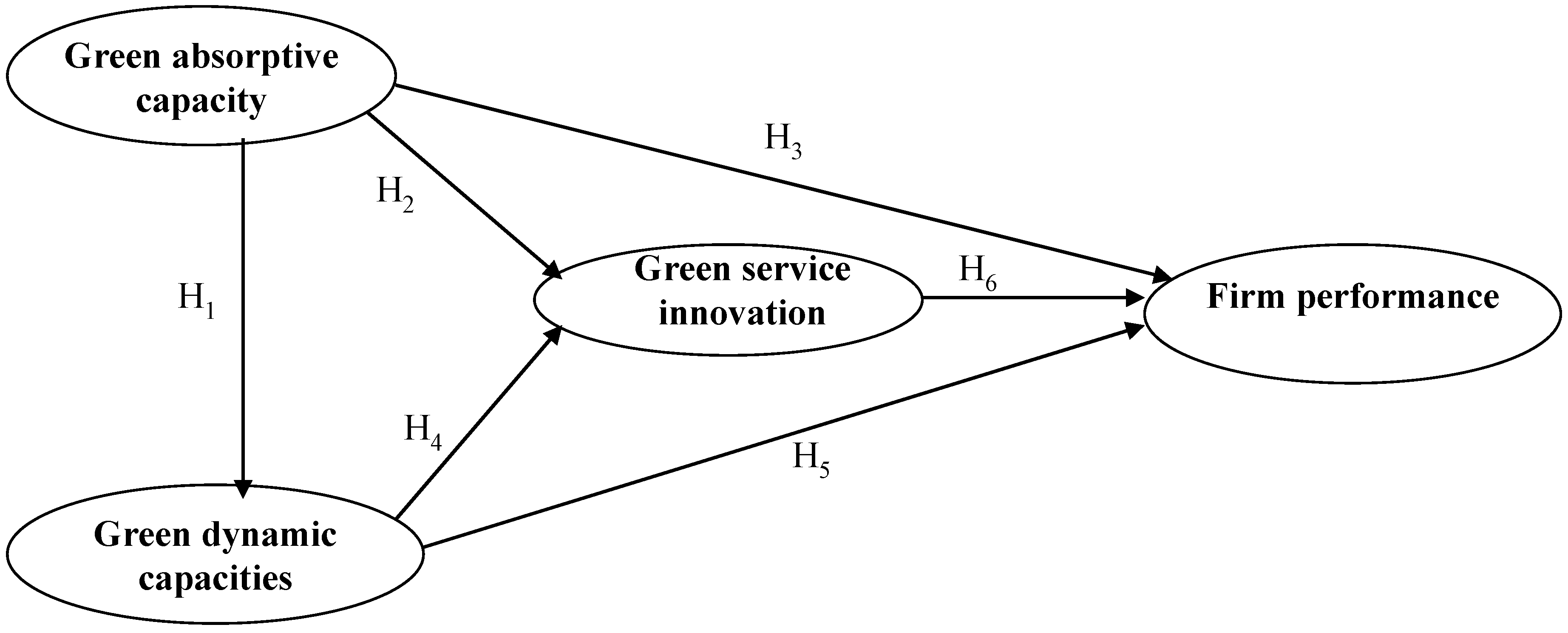

2. Literature Review and Hypothesis Development

Hypothesis 1 (H1). Green Absorptive Capacity Positively Influences Green Dynamic Capabilities.

Hypothesis 2 (H2). Green Absorptive Capacity Positively Influences Green Service Innovation.

Hypothesis 3 (H3). Green Absorptive Capacity Positively Influences Firm Performance.

Hypothesis 4 (H4). Green Dynamic Capabilities Positively Influence Green Service Innovation.

Hypothesis 5 (H5). Green Dynamic Capabilities Positively Influence Firm Performance.

Hypothesis 6 (H6). Green Service Innovation Positively Influences Firm Performance.

3. Methodology and Measurement

3.1. Data Collection and the Sample

3.2. The Measurement of the Constructs

4. Empirical Results

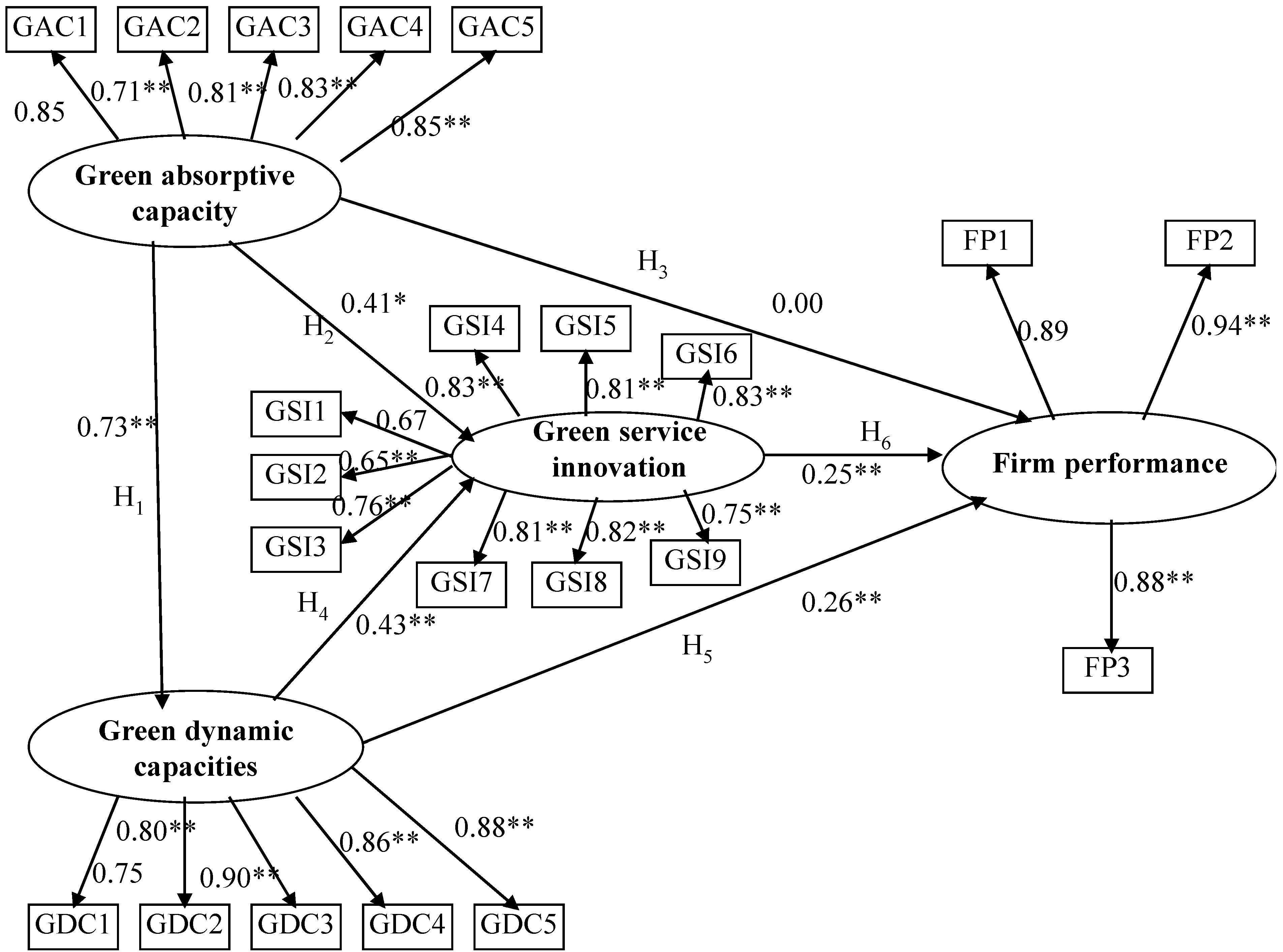

4.1. Results of the Measurement Model

| Constructs | Mean | Standard Deviation | A. | B. | C. |

|---|---|---|---|---|---|

| A. Green Absorptive Capacity | 5.620 | 0.732 | |||

| B. Green Dynamic Capacities | 5.477 | 0.785 | 0.664 ** | ||

| C. Green Service Innovation | 5.531 | 0.722 | 0.650 ** | 0.687 ** | |

| D. Firm Performance | 5.593 | 0.872 | 0.335 ** | 0.412 ** | 0.413 ** |

| Constructs | Number of Items | Number of Factors | Accumulation Percentage of Explained Variance |

|---|---|---|---|

| Green Absorptive Capacity | 5 | 1 | 68.428% |

| Green Dynamic Capacities | 5 | 1 | 71.53% |

| Green Service Innovation | 9 | 1 | 59.89% |

| Firm Performance | 3 | 1 | 66.92% |

| Constructs | Items | λ | Cronbach’s α | AVE | The Square Root of AVE |

|---|---|---|---|---|---|

| Green Absorptive Capacity (GAC) | GAC1 | 0.85 | 0.884 | 0.68 | 0.819 |

| GAC2 | 0.71 ** | ||||

| GAC3 | 0.81 ** | ||||

| GAC4 | 0.83 ** | ||||

| GAC5 | 0.85 ** | ||||

| Green Dynamic Capacities (GDC) | GDC1 | 0.75 | 0.899 | 0.70 | 0.837 |

| GDC2 | 0.80 ** | ||||

| GDC3 | 0.90 ** | ||||

| GDC4 | 0.86 ** | ||||

| GDC5 | 0.88 ** | ||||

| Green Service Innovation (GSI) | GSI1 | 0.67 | 0.916 | 0.59 | 0.768 |

| GSI2 | 0.65 ** | ||||

| GSI3 | 0.76 ** | ||||

| GSI4 | 0.83 ** | ||||

| GSI5 | 0.81 ** | ||||

| GSI6 | 0.83 ** | ||||

| GSI7 | 0.81 ** | ||||

| GSI8 | 0.82 ** | ||||

| GSI9 | 0.75 ** | ||||

| Firm Performance (FP) | FP1 | 0.89 | 0.904 | 0.82 | 0.906 |

| FP2 | 0.94 ** | ||||

| FP3 | 0.88 ** |

4.2. Results of the Structural Model

| Fit Measures | Measurement Model Estimates | Criteria |

|---|---|---|

| Absolute Fit Measures | χ2 = 791.41 | Significant |

| SRMR = 0.052 | SRMR < 0.08 | |

| RMSEA = 0.086 | RMSEA < 0.1 | |

| GFI = 0.84 | GFI > 0.80 | |

| Incremental Fit Measures | AGFI = 0.81 | AGFI > 0.80 |

| NFI = 0.88 | NFI > 0.80 | |

| CFI = 0.91 | CFI > 0.90 | |

| IFI = 0.91 | IFI > 0.90 | |

| Parsimonious Fit Measures | PNFI = 0.77 | PNFI > 0.50 |

| PGFI = 0.68 | PGFI > 0.50 | |

| χ2/df = 3.90 | χ2/df < 5 |

| Path | Coefficients | ||

|---|---|---|---|

| Effect | t-Value | ||

| H1: GAC → GDC | |||

| Direct Effect | 0.73 | 12.93 ** | |

| Indirect Effect | -- | -- | |

| Total Effect | 0.73 | 12.93 ** | |

| H2: GAC → GSI | |||

| Direct Effect | 0.41 | 6.40 ** | |

| Indirect Effect | 0.32 | 6.37 ** | |

| Total Effect | 0.73 | 11.96 ** | |

| H3: GAC → FP | |||

| Direct Effect | 0.00 | -0.03 | |

| Indirect Effect | 0.38 | 5.34 ** | |

| Total Effect | 0.37 | 7.00 ** | |

| H4: GDC → GSI | |||

| Direct Effect | 0.43 | 6.57 ** | |

| Indirect Effect | -- | -- | |

| Total Effect | 0.43 | 6.57 ** | |

| H5: GDC → FP | |||

| Direct Effect | 0.26 | 3.04 ** | |

| Indirect Effect | 0.11 | 2.76 ** | |

| Total Effect | 0.37 | 4.60 ** | |

| H6: GSI → FP | |||

| Direct Effect | 0.25 | 2.93 ** | |

| Indirect Effect | -- | -- | |

| Total Effect | 0.25 | 2.93 ** | |

5. Conclusions and Implications

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix

| Constructs | Items |

|---|---|

| Green absorptive capacity | (1) The firm is able to communicate green knowledge across its divisions. |

| (2) The firm is able to effectively apply new external green knowledge on commercial purposes. | |

| (3) The firm is able to identify, obtain, and value external green knowledge which is crucial to its operations. | |

| (4) The firm is able to integrate existing green knowledge with new obtained and incorporated green knowledge. | |

| (5) The firm’s organizational structure facilitates the development of the ability to analyze, comprehend, and deduce information from external green knowledge. | |

| Green dynamic capacities | (1) The firm is able to exploit, integrate, combine, create, acquire, share, and convert new environmental technology. |

| (2) The firm is able to effectively deploy resources for the development of green innovations. | |

| (3) The firm is able to effectively coordinate employees to generate green knowledge. | |

| (4) The firm is able to effectively manage and assimilate specialized environmental technology within the firm. | |

| (5) The firm can quickly observe the environment and recognize new environmental opportunities. | |

| Green service innovation | (1) The firm repackages existing products/services based on its concern for the environment. |

| (2) The firm frequently extends products/services based on its concern for the environment. | |

| (3) The firm creates and establishes new lines of products/services based on its concern for the environment. | |

| (4) The firm offers new customer service practices based on its concern for the environment. | |

| (5) The firm offers new practices in selling products/services based on its concern for the environment. | |

| (6) The firm offers new practices in after-sales services based on its commitment to the environment. | |

| (7) The firm offers new practices in new product/service development based on its environmental concerns. | |

| (8) The firm proposes new practices in the promotion of new products/services related to environmental reputation. | |

| (9) The firm proposes new practices related to internal administration and operations based on its environmental concerns. | |

| Firm performance | (1) The firm has better performance than its competitors in sales growth. |

| (2) The firm has better performance than its competitors in market share. | |

| (3) The firm has better performance than its competitors in profitability. |

References

- Chen, Y.S.; Chang, C.H.; Lin, Y.H. The Determinants of Green Radical and Incremental Innovation Performance: Green Shared Vision, Green Absorptive Capacity, and Green Organizational Ambidexterity. Sustainability 2014, 6, 7787–7806. [Google Scholar] [CrossRef]

- Tully, S.M.; Winer, R.S. The role of the beneficiary in willingness to pay for socially responsible products: A meta-analysis. J. Retail. 2014, 90, 255–274. [Google Scholar] [CrossRef]

- Laroche, M.; Bergeron, J.; Barbaro-Forleo, G. Targeting consumers who are willing to pay more for environmentally friendly products. J. Consum. Mark. 2001, 18, 503–520. [Google Scholar] [CrossRef]

- Makower, J.; Pike, C. Strategies for the Green Economy: Opportunities and Challenges in the New World of Business; McGraw-Hill: New York, NY, USA, 2009. [Google Scholar]

- Kalafatis, S.P.; Pollard, M.; East, R.; Tsogas, M.H. Green marketing and Ajzen's theory of planned behaviour: A cross-market examination. J. Consum. Mark. 1999, 16, 441–460. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Lin, C.-Y.; Weng, C.-S. The Influence of Environmental Friendliness on Green Trust: The Mediation Effects of Green Satisfaction and Green Perceived Quality. Sustainability 2015, 7, 10135–10152. [Google Scholar] [CrossRef]

- Bhat, V.N. A blueprint for green product development. Ind. Manag. 1993, 35, 4–7. [Google Scholar]

- Murga-Menoyo, M. Learning for a sustainable economy: Teaching of green competencies in the university. Sustainability 2014, 6, 2974–2992. [Google Scholar] [CrossRef]

- Pujari, D.; Wright, G.; Peattie, K. Green and competitive: Influences on environmental new product development performance. J. Bus. Res. 2003, 56, 657–671. [Google Scholar] [CrossRef]

- Akenji, L.; Bengtsson, M. Making Sustainable Consumption and Production the Core of Sustainable Development Goals. Sustainability 2014, 6, 513–529. [Google Scholar] [CrossRef]

- Sheu, J.B. Green supply chain collaboration for fashionable consumer electronics products under third-party power intervention—A resource dependence perspective. Sustainability 2014, 6, 2832–2875. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar]

- Daghfous, A. Absorptive capacity and the implementation of knowledge-intensive best practices. SAM Adv. Manag. J. 2004, 69, 21–27. [Google Scholar]

- De Waard, E.; Volberda, H.W.; Soeters, J.L. Drivers of Organizational Responsiveness: Experiences of a military crisis response organization. J. Organ. Des. 2013, 2, 1–14. [Google Scholar] [CrossRef]

- Hamel, G.P.; Prahalad, C. Strategic intent. Harv. Bus. Rev. 1989, 67, 63–76. [Google Scholar] [PubMed]

- Nelson, R.R.; Winter, S.G. An Evolutionary Theory of Economic Change; Harvard University Press: Cambridge, MA, USA, 2009. [Google Scholar]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Helfat, C.E.; Finkelstein, S.; Mitchell, W.; Peteraf, M.; Singh, H.; Teece, D.; Winter, S.G. Dynamic Capabilities: Understanding Strategic Change in Organizations; John Wiley & Sons: Hoboken, NJ, USA, 2009. [Google Scholar]

- Chen, Y.-S.; Chang, C.-H. The determinants of green product development performance: Green dynamic capabilities, green transformational leadership, and green creativity. J. Bus. Eth. 2013, 116, 107–119. [Google Scholar] [CrossRef]

- Lichtenthaler, U. Absorptive capacity, environmental turbulence, and the complementarity of organizational learning processes. Acad. Manag. J. 2009, 52, 822–846. [Google Scholar] [CrossRef]

- Zahra, S.A.; Neubaum, D.O.; Huse, M. Entrepreneurship in medium-size companies: Exploring the effects of ownership and governance systems. J. Manag. 2000, 26, 947–976. [Google Scholar] [CrossRef]

- Chen, J.; Tsou, H.-T. Information technology adoption for service innovation practices and competitive advantage: The case of financial firms. Inf. Res. 2006, 12. Article 314. [Google Scholar]

- Chen, Y.-S.; Lai, S.-B.; Wen, C.-T. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Eth. 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Chen, Y.S. The positive effect of green intellectual capital on competitive advantages of firms. J. Bus. Eth. 2008, 77, 271–286. [Google Scholar] [CrossRef]

- Tsai, W. Knowledge transfer in intraorganizational networks: Effects of network position and absorptive capacity on business unit innovation and performance. Acad. Manag. J. 2001, 44, 996–1004. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Lin, M.-J.J.; Chang, C.-H. The positive effects of relationship learning and absorptive capacity on innovation performance and competitive advantage in industrial markets. Ind. Mark. Manag. 2009, 38, 152–158. [Google Scholar] [CrossRef]

- Lane, P.J.; Salk, J.E.; Lyles, M.A. Absorptive capacity, learning, and performance in international joint ventures. Strateg. Manag. J. 2001, 22, 1139–1161. [Google Scholar] [CrossRef]

- Ali, S.; Green, P.; Robb, A. Measuring top management’s IT governance knowledge absorptive capacity. J. Inf. Syst. 2012, 27, 137–155. [Google Scholar] [CrossRef]

- Koza, M.P.; Lewin, A.Y. The co-evolution of strategic alliances. Organ. Sci. 1998, 9, 255–264. [Google Scholar] [CrossRef]

- Rothaermel, F.T.; Deeds, D.L. Exploration and exploitation alliances in biotechnology: A system of new product development. Strateg. Manag. J. 2004, 25, 201–221. [Google Scholar] [CrossRef]

- Williander, M. Absorptive capacity and interpretation system’s impact when ‘going green’: An empirical study of Ford, Volvo Cars and Toyota. Bus. Strateg. Environ. 2007, 16, 202–213. [Google Scholar] [CrossRef]

- Gadrey, J.; Gallouj, F.; Weinstein, O. New modes of innovation: How services benefit industry. Int. J. Serv. Ind. Manag. 1995, 6, 4–16. [Google Scholar] [CrossRef] [Green Version]

- Tidd, J.; Pavitt, K.; Bessant, J. Managing Innovation; Wiley Chichester: Hoboken, NJ, USA, 2001. [Google Scholar]

- Zollo, M.; Winter, S.G. Deliberate learning and the evolution of dynamic capabilities. Organ. Sci. 2002, 13, 339–351. [Google Scholar] [CrossRef]

- Shi, L.H.; Wu, F. Dealing with market dynamism: The role of reconfiguration in global account management. Manag. Int. Rev. 2011, 51, 635–663. [Google Scholar] [CrossRef]

- Kindström, D.; Kowalkowski, C.; Sandberg, E. Enabling service innovation: A dynamic capabilities approach. J. Bus. Res. 2013, 66, 1063–1073. [Google Scholar] [CrossRef]

- Lawson, B.; Samson, D. Developing innovation capability in organisations: A dynamic capabilities approach. Int. J. Innov. Manag. 2001, 5, 377–400. [Google Scholar] [CrossRef]

- Easterby-Smith, M.; Lyles, M.A.; Peteraf, M.A. Dynamic capabilities: Current debates and future directions. Br. J. Manag. 2009, 20, S1–S8. [Google Scholar] [CrossRef]

- Winter, S.G. Understanding dynamic capabilities. Strateg. Manag. J. 2003, 24, 991–995. [Google Scholar] [CrossRef]

- Zahra, S.A.; Sapienza, H.J.; Davidsson, P. Entrepreneurship and dynamic capabilities: A review, model and research agenda*. J. Manag. Stud. 2006, 43, 917–955. [Google Scholar] [CrossRef] [Green Version]

- Macher, J.T.; Mowery, D.C. Measuring dynamic capabilities: Practices and performance in semiconductor manufacturing. Br. J. Manag. 2009, 20, S41–S62. [Google Scholar] [CrossRef]

- Homburg, C.; Pflesser, C. A multiple-layer model of market-oriented organizational culture: Measurement issues and performance outcomes. J. Mark. Res. 2000, 37, 449–462. [Google Scholar] [CrossRef]

- Zott, C. Dynamic capabilities and the emergence of intraindustry differential firm performance: Insights from a simulation study. Strateg. Manag. J. 2003, 24, 97–125. [Google Scholar] [CrossRef]

- Gliedt, T.; Parker, P. Dynamic capabilities for strategic green advantage: Green electricity purchasing in North American firms, SMEs, NGOs and agencies. Glob. Bus. Econ. Rev. 2010, 12, 171–195. [Google Scholar] [CrossRef]

- Salvadó, J.A.; de Castro, G.M.; López, J.E.N.; Verde, M.D. Environmental Innovation and Firm Performance: A Natural Resource-Based View; Palgrave Macmillan: London, UK, 2012. [Google Scholar]

- Damanpour, F.; Evan, W.M. Organizational innovation and performance: The problem of “organizational lag”. Adm. Sci. Q. 1984, 29, 392–409. [Google Scholar] [CrossRef]

- Jansen, J.J.; Van Den Bosch, F.A.; Volberda, H.W. Exploratory innovation, exploitative innovation, and performance: Effects of organizational antecedents and environmental moderators. Manag. Sci. 2006, 52, 1661–1674. [Google Scholar] [CrossRef]

- Han, J.K.; Kim, N.; Srivastava, R.K. Market orientation and organizational performance: Is innovation a missing link? J. Mark. 1998, 62, 30–45. [Google Scholar] [CrossRef]

- Ordanini, A.; Parasuraman, A. Service innovation viewed through a service-dominant logic lens: A conceptual framework and empirical analysis. J. Serv. Res. 2010. [Google Scholar] [CrossRef]

- Alam, I. An exploratory investigation of user involvement in new service development. J. Acad. Mark. Sci. 2002, 30, 250–261. [Google Scholar] [CrossRef]

- Hertog, P.D. Knowledge-intensive business services as co-producers of innovation. Int. J. Innov. Manag. 2000, 4, 491–528. [Google Scholar] [CrossRef]

- Tilson, D.; Lyytinen, K.; Baxter, R. A framework for selecting a location based service (LBS) strategy and service portfolio. In Proceedings of the 37th Hawaii International Conference on System Science, Big Island, HI, USA, 5–8 January 2004.

- Stauss, B.; den Hertog, P.; van der Aa, W.; de Jong, M.W. Capabilities for managing service innovation: Towards a conceptual framework. J. Serv. Manag. 2010, 21, 490–514. [Google Scholar] [CrossRef]

- Goldstein, S.M.; Johnston, R.; Duffy, J.; Rao, J. The service concept: The missing link in service design research? J. Oper. Manag. 2002, 20, 121–134. [Google Scholar] [CrossRef]

- Love, J.H.; Roper, S.; Hewitt-Dundas, N. Service innovation, embeddedness and business performance: Evidence from Northern Ireland. Reg. Stud. 2010, 44, 983–1004. [Google Scholar] [CrossRef]

- Chen, Y.S. The drivers of green brand equity: Green brand image, green satisfaction, and green trust. J. Bus. Eth. 2010, 93, 307–319. [Google Scholar] [CrossRef]

- Seggie, S.H.; Kim, D.; Cavusgil, S.T. Do supply chain IT alignment and supply chain interfirm system integration impact upon brand equity and firm performance? J. Bus. Res. 2006, 59, 887–895. [Google Scholar] [CrossRef]

- Shea, J. Instrument relevance in multivariate linear models: A simple measure. Rev. Econ. Stat. 1997, 79, 348–352. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Bentler, P.M.; Bonett, D.G. Significance tests and goodness of fit in the analysis of covariance structures. Psychol. Bull. 1980, 88, 588–606. [Google Scholar] [CrossRef]

- Seyal, A.H.; Rahman, M.N.A.; Rahim, M.M. Determinants of academic use of the Internet: A structural equation model. Behav. Inf. Technol. 2002, 21, 71–86. [Google Scholar] [CrossRef]

- Klein, L.R. Evaluating the potential of interactive media through a new lens: Search versus experience goods. J. Bus. Res. 1998, 41, 195–203. [Google Scholar] [CrossRef]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, Y.-S.; Lin, Y.-H.; Lin, C.-Y.; Chang, C.-W. Enhancing Green Absorptive Capacity, Green Dynamic Capacities and Green Service Innovation to Improve Firm Performance: An Analysis of Structural Equation Modeling (SEM). Sustainability 2015, 7, 15674-15692. https://doi.org/10.3390/su71115674

Chen Y-S, Lin Y-H, Lin C-Y, Chang C-W. Enhancing Green Absorptive Capacity, Green Dynamic Capacities and Green Service Innovation to Improve Firm Performance: An Analysis of Structural Equation Modeling (SEM). Sustainability. 2015; 7(11):15674-15692. https://doi.org/10.3390/su71115674

Chicago/Turabian StyleChen, Yu-Shan, Yu-Hsien Lin, Ching-Ying Lin, and Chih-Wei Chang. 2015. "Enhancing Green Absorptive Capacity, Green Dynamic Capacities and Green Service Innovation to Improve Firm Performance: An Analysis of Structural Equation Modeling (SEM)" Sustainability 7, no. 11: 15674-15692. https://doi.org/10.3390/su71115674

APA StyleChen, Y.-S., Lin, Y.-H., Lin, C.-Y., & Chang, C.-W. (2015). Enhancing Green Absorptive Capacity, Green Dynamic Capacities and Green Service Innovation to Improve Firm Performance: An Analysis of Structural Equation Modeling (SEM). Sustainability, 7(11), 15674-15692. https://doi.org/10.3390/su71115674