1. Introduction

In 2011, Korea (South Korea) was the seventh biggest country emitter of greenhouse gases (GHG), emitting 697.7 Mt of carbon dioxide equivalent (CO

2e). From 1990 to 2011, Korea’s level of emissions has more than doubled [

1]. To cope with the rapid growth rate of GHG emissions, the Korean government has pledged to the international community to reduce its GHG emissions by 30% by 2020 relative to the projected business-as-usual (BAU) level. A domestic emissions trading scheme (ETS) has been implemented from 2015 as a tool to achieve the reduction target [

2,

3].

However, the current design of the Korean ETS has some special characteristics compared to most existing ETSs. In particular, the Korean ETS regulates indirect emissions from the consumption of electricity, whereas the EU ETS considers only direct emissions. This structural difference of the Korean ETS can lead to double counting in emissions accounting since the activities of generating and consuming electricity require the simultaneous use of emissions allowances [

2,

4,

5,

6]. Nevertheless, the Korean government has pushed accounting for indirect emissions for the following reasons: (1) reducing the electricity intensity of the economy; (2) transferring the carbon price to the consumption side; and (3) equally spreading the burden of emissions abatement across industrial sectors.

This study aims to analyze and compare design options on indirect emissions accounting for the Korean ETS using a computable general equilibrium (CGE) model. CGE models have been used heavily to compare design options for ETSs, including the EU ETS [

7,

8,

9,

10,

11] and Korean ETS [

12,

13]. However, there has been no attempt to simulate indirect emissions accounting, which is inherent in the design of the Korean ETS. In this study, four scenarios on design options on indirect emissions accounting are evaluated in terms of efficiency and equality using the CGE model. In addition, we considered the Renewable Portfolio Standards (RPS) for the electricity sector based on the Korean government’s initiatives.

Our study is significant in that it offers a quantitative analysis of macroeconomic and sectoral effects in response to different design options of the Korean ETS. The result shows that the ETS operates most efficiently when only direct emissions are considered. However, the scenario that includes both direct and indirect emissions provides a competent result in terms of equality by spreading the economic burden of emissions reduction among industries. Scenarios reveal some trade-off situations between efficiency and equality in achieving the carbon mitigation target. We expect that the simulation results based on the Korean economy can also give valuable information to the policy makers in East Asian countries and other countries with similar industrial landscapes.

The rest of this paper is structured as follows.

Section 2 provides a brief overview of the Korean ETS, focusing on the background to implementing the scheme.

Section 3 contains general descriptions of the CGE model used for the analyses.

Section 4 explains the scenario settings. The main results are presented in

Section 5. Lastly, the summary and concluding remarks are provided in

Section 6.

2. Distinctive Features of the Korean ETS

GHG emissions can be classified into different scopes, based on the source of the emissions: Scope 1 emissions are direct emissions from activities owned or controlled by organizations that release emissions straight into the atmosphere. Examples of Scope 1 emissions include emissions from combustion in owned or controlled boilers and owned or controlled vehicles. Scope 2 emissions are associated with the consumption of purchased electricity, heat, steam and cooling. These are indirect emissions that are a consequence of an organization’s activities, but that occur at sources that organizations do not own or control. The most common type of Scope 2 emissions is electricity purchased for own consumption from the national grid [

14,

15,

16,

17,

18].

The definition of GHG emissions by the Korean government includes both Scope 1 and Scope 2 emissions. According to the Framework Act on Low Carbon Green Growth, the term “emissions of greenhouse gases” encompasses “both direct emissions of greenhouse gases, which refers to emissions, discharges, or leaks of greenhouse gases generated as a consequence of human activities, and indirect emissions of greenhouse gases, which refers to discharges of greenhouse gases using electricity or heat (limited to emissions from a heat source generated with fuel or electricity) supplied by another person” [

19]. Ultimately, the Korean ETS regulating domestic GHG emissions covers direct and indirect emissions simultaneously.

The ETSs adopted by major countries and regions (e.g., EU ETS) cover only Scope 1 emissions from fossil fuels burned on site. On the other hand, the Korean ETS regulates both Scopes 1 and 2 emissions simultaneously, which can lead to double counting of emissions, since such activities as generating and consuming electricity require the simultaneous use of emissions allowances. Despite this structural peculiarity, the Korean government has adopted the current ETS design for the following reasons.

First, the process of power sector privatization in Korea is not fully complete, and the price of electricity is still controlled heavily by the government. Immense political pressure would accompany any increase in the consumer price of electricity to reflect the cost of electricity generation properly. Under this situation, the price of electricity cannot be adjusted properly to reflect the additional cost from emissions by fossil fuel combustion in electricity generation when the ETS is implemented. Thus, the government is imposing a carbon price on electricity consumers by regulating indirect emissions to transfer the burden of emissions abatement partially to the consumption side [

6].

In practice, the Korean ETS only regulates large emitters, such as power plants and manufacturing firms, rather than small emitters, such as households. Thus, from the perspective of political difficulties in policy implementation, imposing the carbon price on electricity use for the industrial sectors by the ETS (with indirect emission accounting) can be a relatively easy way compared to directly adding the carbon price on the retail price of electricity. Since increasing the retail electricity price will directly impact the household consumption and bring about instant opposition and political pressure, ETS regulating the large (direct and indirect) emitters will indirectly affect the household economy.

In terms of the pass through rate of CO

2 costs, the situation in Korea is very different from EU ETS. Empirical studies [

7,

9] estimating the pass through rates of CO

2 costs to power prices in EU countries [

7] found that pass through rates range between 60% and 120% in EU countries under the assumption of perfect competition, while [

9] showed that this rate is over 100% for The Netherlands, Belgium, Germany and France. In addition, [

20] also found that cost pass through rates are close to 100% when the demand is inelastic, while this rate fell to around 80% with elastic demand. However, this pass through rate of the carbon costs can be near zero when the electricity price is regulated [

21], which is similar to the Korean case.

Second, the Korean government stresses “equality” as one of the key principles in operating an ETS, which means that the economic burden of emissions abatement should not be concentrated to a few specific sectors (e.g., energy-intensive sectors, such as cement, iron, steel, chemicals and refining), but shared across industries and major companies. However, many of Korea’s very large companies, such as electronic manufacturers, have very little direct emissions and would not be included in the ETS if indirect emissions were not covered. In addition, some of the top 10 entities would be primarily indirect emitters using electricity as their main energy source. Thus, if the ETS were to regulate only direct emissions, many of the biggest and most promising companies in Korea would be free from the emissions abatement burden, and it would be difficult to meet the equality principle, as abatement costs would be focused on only a few energy-intensive industries [

22]. This is particularly true when the price of electricity cannot be increased freely to reflect the carbon abatement cost. If the ETS only regulates the direct emissions along with a malfunctioning pricing system for electricity (without CO

2 cost pass through from the electricity sector), industries using electricity as their main energy sources will face less economic burden than industries using fossil fuels for their energy sources, leading to disparities among industries.

Third, with poor indigenous energy resources, Korea has to rely on imports to meet almost its entire energy demand. Saving electricity and decreasing the electricity dependency of the economy has become one of the top priority goals of Korea’s energy policy, since substantial amounts of imported primary energy are lost during generation, transmission and distribution of electricity. However, Korea has shown rapid rates of electrification, and the share of electricity in final energy consumption has grown by 5.7% annually, increasing from 10.8% in 1990 to 19.3% in 2012 [

23]. When carbon costs are passed through to consumers appropriately, electricity consumers have incentives to reduce the electricity consumption [

24,

25]. However, the carbon price pass through mechanism of the competitive market does not work in the Korean ETS in the presence of market imperfection and government price regulation on the electricity sector [

6]. Under this background, the Korean ETS covering indirect emissions has been implemented as a demand-side measure, since it makes consumers pay for the additional carbon price when they consume electricity [

2,

6].

Apart from the Korean ETS, other schemes exist that regulate indirect emissions. For example, the China regional level ETSs have been implemented in seven provinces as pilot schemes since 2013 [

26,

27,

28]. The electricity sector in China is also heavily regulated by the government, and the carbon costs cannot be easily passed on to consumers, which may be a cause of market distortions [

6,

27,

28]. Another important consideration for including indirect emissions is that in some provinces, indirect emissions (occurring by using electricity imported from other provinces) account for a significant share of total emissions [

27]. Therefore, all of the regional level ETS pilots in China cover the indirect emissions. Under this scheme, indirect emissions from both electricity generation within the pilot region and imported electricity from outside pilot regions are covered in all of the pilot schemes [

29]. In addition, the Japanese government has proposed the nationwide ETS, including the regulation of indirect emissions for electricity consumers, along with direct emissions for electricity producers. It is also understandable considering the electricity market in Japan, which is controlled by the government. This implies the lack of an appropriate pass through of carbon costs to the final electricity consumers [

6,

30,

31]. The regional level ETS (in Tokyo) has also been implemented in Japan since 2010, which covers both indirect and direct CO

2 emissions from the use of energy [

31]. However, until now, the Korean ETS is the only scheme applied nationwide among the ETSs that have already been implemented.

In summary, the main purpose of including indirect emissions within the Korean ETS is to incentivize electricity consumers (industries and households) to reduce electricity consumption, as the current price signal cannot be passed to electricity consumers. Hence, it can be understood that with inclusions of indirect emissions, the Korean government aims to decrease the electricity dependency under rapid electrification trends and the spread the burden of emissions reduction equally across sectors.

4. Scenario Settings

This study analyzes and compares the design options of the Korean ETS using a CGE model. Our model considers only CO2 emissions from fossil fuel combustion to avoid the complexity of analysis and owing to data availability. It is assumed that the entire economy is covered by the ETS. The emissions allowances, which eventually set the level of emissions and emissions reduction of the economy, are first owned by the government and, then, are auctioned to firms requiring carbon credits in producing outputs.

The scenarios are generated on the following options: (1) regulation of only direct emissions within the ETS as a reference scenario; (2) regulation of both direct and indirect emissions within the ETS with double counting; (3) regulation of both direct and indirect emissions within the ETS, along with the exemption of the electricity sector from direct emissions coverage, in order to avoid double counting on emissions allowances; and (4) setting the RPS for the electricity sector within each scenario.

4.1. Direct Emission Scenario

The “direct emissions” (DIR) scenario is assumed to implement an ETS that considers only direct emissions. Under the DIR scenario, the reduction target (emissions constraint) of the Korean economy is equivalent to the total amounts of emissions allowances. The total credit amount is given under the assumption that Korea achieves a target of 30% reduction from the BAU level of emissions in 2020. All other scenarios generated in this research are also modeled on the assumption of achieving the same reduction target in 2020 to guarantee the comparability of the results among scenarios.

4.2. Indirect Emissions Double Counting Scenario

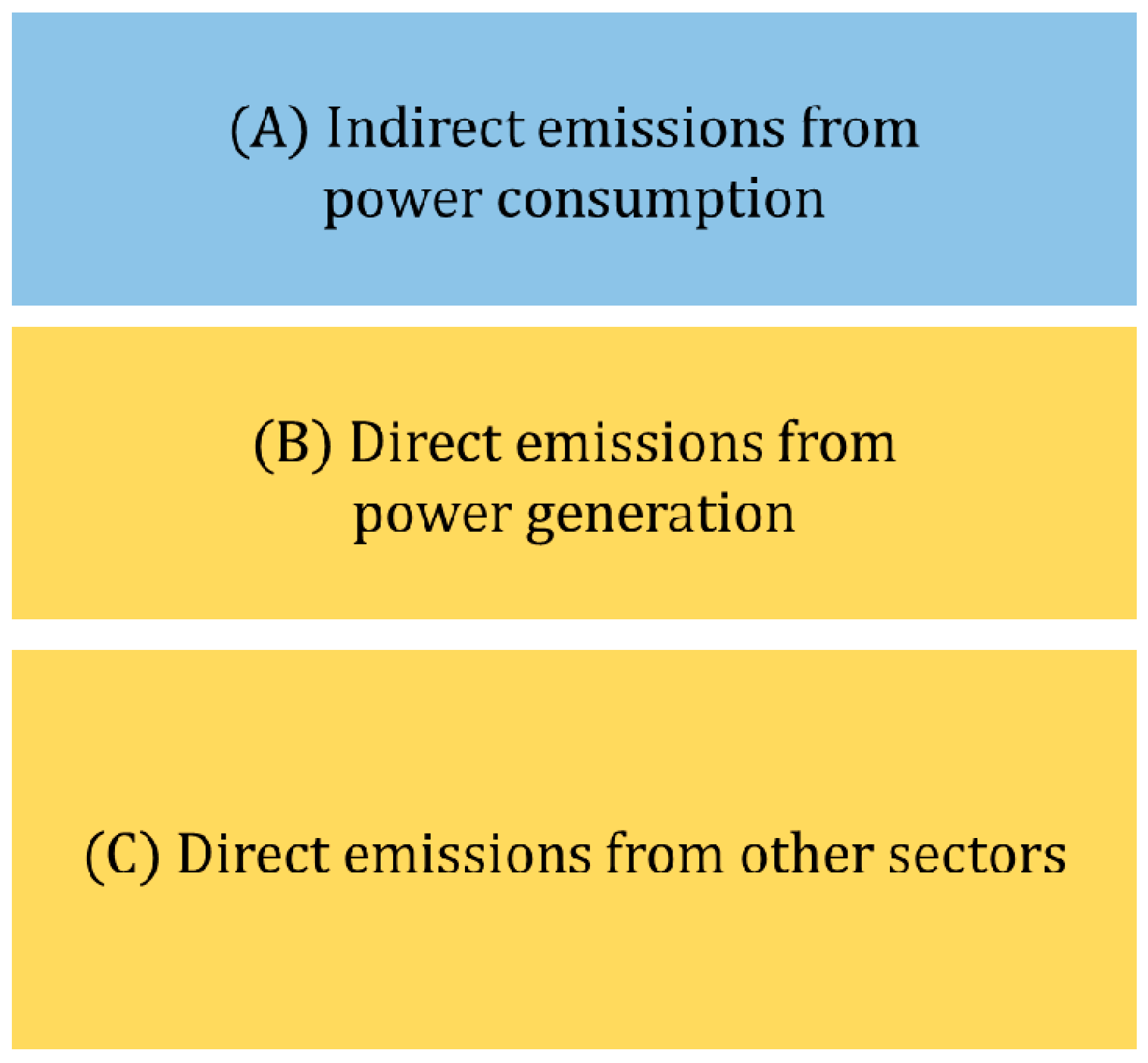

The “indirect emissions double counting” (IND-DC) scenario includes indirect emissions within the ETS. Under this option, double counting occurs in emissions accounting, since generating and consuming electricity require the simultaneous use of emissions allowances. In this case, when the total amount of allowances is the same as the DIR scenario, the actual abatement level will be higher than the reduction target. This is because when double counting occurs, the demand for credits from electricity consumption increases. Thus, if a scheme also covers indirect emissions, it needs to supply more allowances than the total level of direct emissions. This issue is illustrated in

Figure 3. Under the DIR scenario, the amount of allowances needed to achieve the reduction target is {(B) + (C)}, which represents direct emissions from the economy. However, under the IND-DC scenario, the amount of allowances needed is {(A) + (B) + (C)} because of double counting.

Figure 3.

Amount of emissions allowances for each scenario.

Figure 3.

Amount of emissions allowances for each scenario.

Our model shows that under the IND-DC scenario, which fixes the allowances supply equal to the level of the DIR scenario, the actual abatement level in 2020 shows a 41.5% reduction from the BAU level, which is far higher than the reduction target of 30%. Therefore, in order to keep the reduction level at 30% from the BAU by 2020, it is necessary to increase the amount of allowances supplied. Our model calculates that the amount of allowances needed under the IND-DC scenario is estimated to be 25.4% higher than the allowance level for the DIR case. Thus, the value of a carbon credit, measured as a right to emit one ton of CO2e, could be lower than that of other schemes, since more allowances are needed for the same level of emissions from the economy. Hence, the IND-DC scenario can cause credibility problems, especially when implementing linkages with other international carbon markets.

4.3. Exemption of Electricity Sector within the Direct Emissions Coverage Scenario

Another design option for “including indirect emissions” within the ETS is “exempting direct emissions from the electricity sector” (IND-EXE). In this case, emissions from the electricity sector are accounted for only as indirect emissions from electricity consumption. Under this policy alternative, CO

2 emissions arising from generating electricity are transferred entirely to electricity consumers via indirect emissions. This structural design of the ETS can avoid issues of double counting allowances and does not cause credibility problems of carbon credits. In

Figure 3, the amount of allowances for this scenario is set as {(A) + (C)}, which is the same as the DIR scenario, since we assumed that the amount of (A) is equal to the amount of (B) in this model.

However, the power sector, which usually has large abatement potential, can entirely avoid burdens for emissions reduction in this case. As a result, the burden from the electricity sector is shifted to other sectors with less abatement potential (i.e., electricity consumers), causing an increased burden for overall industry in the Korean economy.

4.4. Renewable Portfolio Standards Scenario

We consider here Korea’s renewable energy expansion policy, namely, the Renewable Portfolio Standards (RPS), with policy design options for the ETS based on scenario settings as discussed previously: DIR/R, IND-DC/R and IND-EXE/R. “R scenario” is the abbreviation for implementation of “renewable energy expansion policy”. To expand renewable power production and reduce GHG emissions in Korea, the RPS has been implemented since 2012. RPS is a quantity-based regulation for the electricity sector, in which the government sets quotas to ensure that a certain market share of electricity generation comes from renewable energy sources [

50]. Under this scenario, the share of renewable energies in total power production is assumed to increase up to 6% in 2020. An overview of those scenarios is represented briefly in

Table 5.

Table 5.

Overview of scenario setting. BAU, business-as-usual; DIR, direct emissions; IND-DC, indirect emissions double counting; IND-EXE, exempting direct emissions from the electricity sector; RPS, Renewable Portfolio Standards; ETS, emissions trading scheme.

Table 5.

Overview of scenario setting. BAU, business-as-usual; DIR, direct emissions; IND-DC, indirect emissions double counting; IND-EXE, exempting direct emissions from the electricity sector; RPS, Renewable Portfolio Standards; ETS, emissions trading scheme.

| Scenarios | Description |

|---|

| BAU | - ⋅

No obligations for CO2 reduction

|

- ⋅

Base year economy is expanded using various projections to 2020

|

| DIR | - ⋅

30% CO2 reduction from the BAU in 2020

|

- ⋅

Only covers direct emissions within the ETS

|

| IND-DC | - ⋅

30% CO2 reduction from the BAU in 2020

|

- ⋅

Covers both direct and indirect emissions

|

- ⋅

Emission from the electricity sector is double counted

|

- ⋅

The level of allowance supply is 125.4% of the DIR case

|

| IND-EXE | - ⋅

30% CO2 reduction from the BAU in 2020

|

- ⋅

Covers both direct and indirect emissions, exempting the electricity sector from the direct emissions coverage

|

| RPS (DIR/R, IND-DC/R, IND-EXE/R) | - ⋅

Additionally considers the RPS on the electricity sector upon the DIR, IND-DC and IND-EXE scenarios

|

- ⋅

The share of renewable energies in power production is set as 6% in 2020

|

6. Discussion and Conclusions

In this study, we applied a CGE model to analyze and compare the design options of the Korean ETS on indirect emissions accounting. Given that the Korean ETS covers direct emissions, as well as indirect emissions from the consumption of electricity, our analysis results suggest that the ETS option that includes only direct emissions (DIR) is the most efficient way to achieve the reduction target with the lowest economic losses (−0.62% from the BAU GDP level), while the IND-DC scenario shows a slightly higher level of economic losses (−0.71% from the BAU GDP level). In addition, we found that the design option regulating both direct and indirect emissions with double counting of allowances (IND-DC) is also a competent approach for equal sharing of the economic burden of emissions reduction among industries by reducing emissions from the electricity sector and reducing the electricity intensity of the economy.

The results highlight that there are differences between the DIR and IND-DC policy options from various perspectives. Our analysis suggests that the IND-DC option could achieve more equalized burdens of abatement costs across sectors, at the expense of a small amount of additional costs, compared to the DIR scenario. It is important for policy makers to be well informed about the possible effects of various policy options from different viewpoints. The policy makers should choose among design alternatives by considering the degree of cost effectiveness and other policy objectives, such as meeting the equality principle and slowing down the electrification of the economy.

However, the IND-DC scenario by implication contains some problems. For example, it is possible that carbon credits generated under the IND-DC scenario cause credibility problems when implementing linkages with other international carbon markets [

5]. Furthermore, this approach is likely to increase the complexity of operating and maintaining the ETS. For example, the measurement and real-time adjustment of the emissions factor of electricity generation, which determines the carbon price the electricity consumer should pay for indirect emissions, can be very difficult and cause much debate in real market situations.

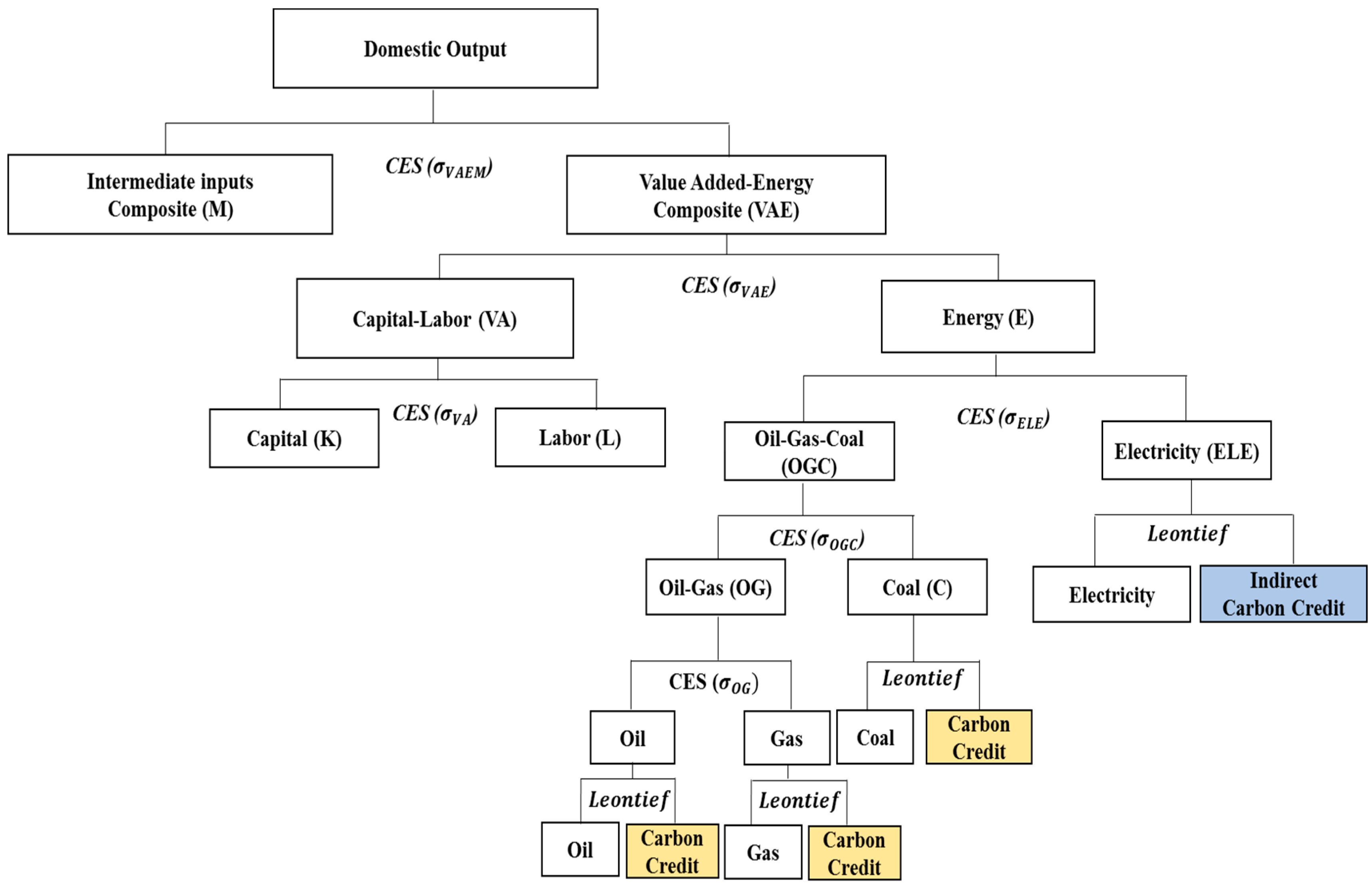

The limitation of this research lies in the assumptions on the key parameters (e.g., the elasticities of substitution in production functions) in building the CGE model. The production of commodities is represented by the nested CES functions. Additionally, the values for substitution elasticities among production factors are adopted from the analysis based on the OECD countries [

32]. Further research may require estimation and adaption of the Korean-specific elasticities of substitutions in building the model to draw more reliable simulation results.