1. Introduction

Shifting demographics are creating major concerns about the long-term financial sustainability of old-age pension schemes all around the world. These concerns are particularly pressing in China. For instance, a recent study shows that, in 2012, China’s urban pension fund revenues could not cover expenditures in 19 of its 32 provinces [

1]. Additionally, Gao [

2], Sin [

3] and Ma [

4] estimated the size of the pension fund shortage in urban China to be 2.824 trillion, 9.15 trillion and 18.3 trillion Yuan, respectively. As these figures suggest, the lack of the financial sustainability of China’s urban pension system is a well-established reality. In this article, we ask whether China’s new rural pension system suffers from similar financial shortfalls and challenges.

When dealing with this issue, we must keep in mind two crucial realities about rural pensions in China. First, rural poverty remains a key social problem in China. For example, more than 22% of the elderly rural population live in poverty [

5]. This reality is consistent with the Chinese saying that people are “getting old before getting rich” [

6]. Second, changes in cultural beliefs and family structures have weakened the traditional family, which is the traditional source of social and economic support for the elderly in rural areas [

7]. Considering these two remarks, it is important for China to operate a sustainable rural pension system to ensure the long-term economic security of current and future cohorts of rural pensioners.

This attention to sustainability issues is particularly essential today, because, in 2011, China started implementing the New Type of Rural Social Endowment Insurance (NTRSEI) across the country. Considering the major financial flaws that recently led to the demise of the Old Rural Social Endowment Insurance (ORSEI) [

8] and the current demographic challenges facing a rapidly aging China [

9], sound financial foundations of the new rural pension system must be laid now to avoid future pension policy failures that could hurt the country, especially its already vulnerable elderly rural population. This is why, in the new context of NTRSEI, we need to conduct a prospective study about the financial sustainability of China’s new rural pension system.

Financial sustainability is a core principle of social security [

10,

11]. Drawing on the available literature [

12,

13,

14], we define the financial sustainability of China’s rural pension system simply as a positive financial state in which fund revenues exceed fund expenditures. Existing international studies provide detailed, sophisticated analyses of pension fund revenue and expenditure featuring long-term actuarial estimate models, infinite-horizon models and generational accounting, among other techniques [

15,

16,

17,

18]. For instance, Grande established a general duty pension income and expenditure model [

19]; Annika [

20] and Yasar [

21] constructed an actuarial model for Swedish and Turkish public pensions, respectively. Based on existing models, Barr [

22] proposed that a pension credit crisis was spreading all over the world; Fedotenkov [

23] and Gerrans [

24] took Europe and Australia, respectively, as examples to demonstrate the existence of a global pension crisis. Regarding China’s pension financing, Béland and Yu analyzed contemporary pension politics in China and observed the latest developments of China’s financial pension paradigm. James [

25] identified transition costs and fund devaluation as two of the most important financial challenges facing China’s pension system while advising policymakers to link pensions, financial markets and state-owned enterprises (SOE) reform. Selden assessed China’s pension reform from the perspective of economic development and the need to overcome an enduring urban-rural divide. Wang [

26] calculated the implicit pension debt and transition costs of China’s pension system using computable general equilibrium analysis. Zhou [

27], Gao [

28] and Zheng [

29] also measured China’s pension fund shortage. The results of these studies showed that a financial pension crisis has appeared in China. To meet such financial challenges, scholars offered policy suggestions. For instance, Zeng [

30] advised raising the statutory retirement age; Hu [

31] suggested that China should issue new regulations to improve pension investment, and Ge proposed a plan to collect social security taxes in China. Although China is currently looking at potential reform options to improve the sustainability of its pension system, including its rural component, comprehensive reforms have not yet been enacted, and concerns about the financial sustainability of rural pensions remain strong and unlikely to vanish any time soon [

32,

33].

The literature directly analyzing the sustainability of China’s rural pension system can be divided into two main categories. First, qualitative studies focus on the status, problem and effect factors of that system. For instance, Xie discusses the sustainability of rural pensions in Yunnan Province, while stressing the fact that population aging is a key factor affecting its sustainability [

34]. In another qualitative study, Kou explores the sustainable development capacity of China’s rural pension system from an institutional and a financial perspective [

35]. In another qualitative study, Liu stresses the role of factors, such as government policies and the management of social security accounts, in the sustainability of the rural pension system [

36].

Second, quantitative studies have contributed to the scholarly discussion about pension sustainability in rural China. For example, Qian and his colleagues develop an actuarial model regarding the financial sustainability of the new rural social pension insurance fund. Based on this model and their analysis, they claim that fund is financially unsustainable [

37]. As for Li, he analyzes the financial situation of the new rural pension system and its pressures on future government expenditures, arguing that the level of sustainability of China’s rural pension system is very low [

38]. In another quantitative study, Feng identifies the main factors, such as the contribution rate and the rate of return on investments, that have a significant impact on the sustainability of the country’s rural pension system [

39]. Finally, Xue finds that both central and local governments can afford their subsidies to new rural social endowment insurance, as long as the Chinese economy can achieve sustainable, stable growth [

40]. Although the literature on the financial sustainability of old-age pensions in China is growing, too little attention has been paid to its ever-expanding rural pension system. In order to help fill this gap, the following article offers a brief overview of the international debate on pension sustainability, formulates an analytical framework for financial sustainability, constructs an actuarial model for China’s rural pension system, measures its pension financial gap and, finally, provides an answer to our basic research question about the sustainability of that system before formulating policy recommendations.

2. The International Pension Sustainability Landscape

Because old-age pensions involve long-term financial commitments on the part of employers, workers and, especially, governments, pension reform is a key policy area in which the concept of sustainability has, in recent times, proven increasingly influential [

41]. This situation is related to the rise of sustainability as a key concept that is ever present in debates about both environmental and socio-economic issues, which points to the distinction between environmental and human sustainability. Clearly, the financial soundness of old-age pension systems belongs to the realm of human sustainability, which is less studied, but every bit as crucial as environmental sustainability. In the best of worlds, citizens, experts and policymakers should care about both sides of the sustainability coin [

42]. In this article, we focus on pension finance as an issue of human sustainability.

In an era of accelerated population aging, pension sustainability has become a major policy concern all around the world [

43,

44,

45,

46]. This is especially true in East Asia, Europe and, to a lesser extent, North America, where population aging is considered a crucial challenge to the financial integrity of existing pension systems [

47]. Considering this, in the name of financial sustainability and in a context of genuine demographic and fiscal concerns, major pension reforms have taken place in countries as diverse as Japan, Canada, Italy and Sweden. Sweden is an especially striking case, because, in the 1990s, after long negotiations between political parties, that country’s pension system was reshaped to guarantee its long-term financial sustainability through the enactment of automatic adjustment mechanisms tying changing benefit levels to demographic and economic variables. Simultaneously, the Swedish reform attempted to protect low-income workers and retirees so that the quest for long-term financial sustainability in old-age pensions was not achieved on their backs [

48]. Ironically, however, the Swedish reform might not be sustainable politically, as automatic cuts in benefits are unpopular, which is putting strong pressure on elected officials to devise a system that might not be as much on “autopilot” as what the founders of the country’s new pension system believed in the 1990s, when they laid its foundation [

49].

A lesser known, yet equally striking, case of pension reform aimed at improving financial sustainability took place in Canada in the mid-1990s. At that time, alarming actuarial reports about the future of the Canada Pension Plan (CPP) pushed federal and provincial officials to contemplate a major reform of the earning-related pension system. Because Canada’s contribution rates were much lower than those of other developed countries, such as France, Germany and Sweden, Canadian policymakers agreed that the main way to improve the long-term financial sustainability of the CPP was to gradually increase the contribution rate, something that was completed by 2003. Additionally, indirect benefit cuts, a new way to invest pension trust fund surpluses and other, more technical changes were adopted. As a result of this reform, CPP program will now be financially sustainable for a period of at least 75 years [

50,

51].

In contrast, the United States has yet to enact comprehensive reform to improve the long-term sustainability of its federal Social Security program. This situation is related to the strong partisan divide over whether benefit cuts or the generation of new revenues should be enacted to make Social Security sustainable for the decades to come. Ironically, however, the lack of significant pension reform in the United States over the last three decades is related to the fact that this country was one of the first to tackle pension sustainability through the adoption of changes to Social Security as early as in 1977 and 1983. Enacted during the Reagan years (1981–1989), the second wave of changes took a bipartisan form and featured a gradual increase in the retirement age from 65 to 67, set to take place between 2000 and 2027 [

52]. Although U.S. Social Security is not facing a short-term financial crisis related to such policy changes, the debate about how to guarantee the long-term sustainability of that program for at least the next 75 years has been taking place in the United States since the Clinton years (1993–2001) [

53].

These remarks about Sweden, Canada and the United States raise a number of issues about the quest for financial sustainability in pensions. First, as the Swedish example suggests, reforms aimed at improving the financial sustainability of pension systems have clear redistributive consequences, and policymakers need to understand how such reforms may affect low-income individuals and other segments of the population. Second, as the Canadian case shows, pension reform enacted in the name of financial sustainability does not have to be centered primarily on benefit cuts, as generating higher revenues is a legitimate way to address future pension shortfall. Finally, as the United States’ 1983 reform points out, increasing the retirement age is another way to improve the long-term sustainability of public pension systems. Although these are issues that Chinese experts and policymakers should keep in mind as they move forward, the first thing to do as far as pension sustainability is concerned is to assess the scope of the potential fiscal challenges facing the country’s rural pension system. This is exactly what we do in the following sections, before spelling out some of the policy implications of our quantitative analysis.

3. Analytical Framework

3.1. China’s Rural Pension System

Over the past two decades, China has witnessed significant efforts to establish an effective rural pension system. The history of the rural pension system can be divided into three phases: the Old Rural Social Endowment Insurance, or ORSEI (1981–2008); the New Type of Rural Social Endowment Insurance, or NTRSEI (2009–2013); and the Social Endowment Insurance for Urban and Rural Residents, or SEIURR (from 2014) [

54]. Importantly, SEIURR has yet to be implemented across the entire country. Furthermore, the core content of NTRSEI and SEIURR is identical as far as rural residents are concerned, which means NTRSEI remains as the statutory rural pension system in China.

Following

The Guidance to Carry Out the NTRSEI Pilot Project, issued in September, 2009, non-student rural residents aged 16 and older who are ineligible for participation in another public old-age social security program can voluntarily enroll in NTRSEI. Currently, individual contributions vary from 100 to 500 Yuan a year, and participating rural residents aged 60 and over receive a basic monthly pension of 55 Yuan each. The main features of China’s rural pension system are summarized in

Table 1.

Table 1.

Main characteristics of China’s pension system.

Table 1.

Main characteristics of China’s pension system.

| Categories | New Type of Rural Social Endowment Insurance |

|---|

| Year of creation | 2009 |

| Basic approach | Fully funded and pay-as-you-go |

| Basic principles | Guaranteed basics, wide coverage, elasticity and sustainability |

| Guiding ideology | Sharing the pension burden among individuals, collectivities and the state |

| Participation | Voluntary |

| Eligible population | Non-student rural residents aged 16 and older and citizens not eligible to enroll in any other old-age pension scheme |

| Fund sources | Individual contributions, collective subsidies and government subsidies |

| Yearly individual contributions | Choice between 100, 200, 300, 400 and 500 Yuan and above |

| Government payment subsidies | Yearly local government subsidies for pension contributory benefits cannot be lower than 30 Yuan per person, and they are automatically added to each individual pension account |

| Pension structure | Basic pension and individual account pension |

| Eligibility conditions | Reaching 60 years old |

| Basic benefit | 55 Yuan per month, and local governments can increase that basic amount at will |

| Individual account pension | The quotient of the total amount of money in the individual account and 139 |

| Competent authority | Ministry of Human Resources and Social Security |

According to

Table 1, NTRSEI funds should be financed through individual contributions, collective subsidies and government subsidies; an NTRSEI pension includes a basic pension and an individual account pension. In the construction process of China’s NTRSEI, there exists many risks, such as the typically low education level of rural residents, the flawed nature of agency governance, the underdevelopment of information systems and the unsystematic nature of fund operations. These issues make the study of the sustainability of China’s rural pension system necessary.

Conducting new research on the sustainability of that system is particularly important for a number of additional reasons. First, that system covers more individuals than any other pension scheme in China. Second, in part for that reason, policymakers are increasingly interested in the future of the rural pension system. Third, compared to the literature on China’s urban pension system, there is much less scholarship on rural pension development and sustainability in China. Finally, China’s rural pension system relies more on ad hoc governmental support than on sound actuary principles, which means that balancing fund revenues and expenditures is especially important for the Chinese government, from a fiscal standpoint.

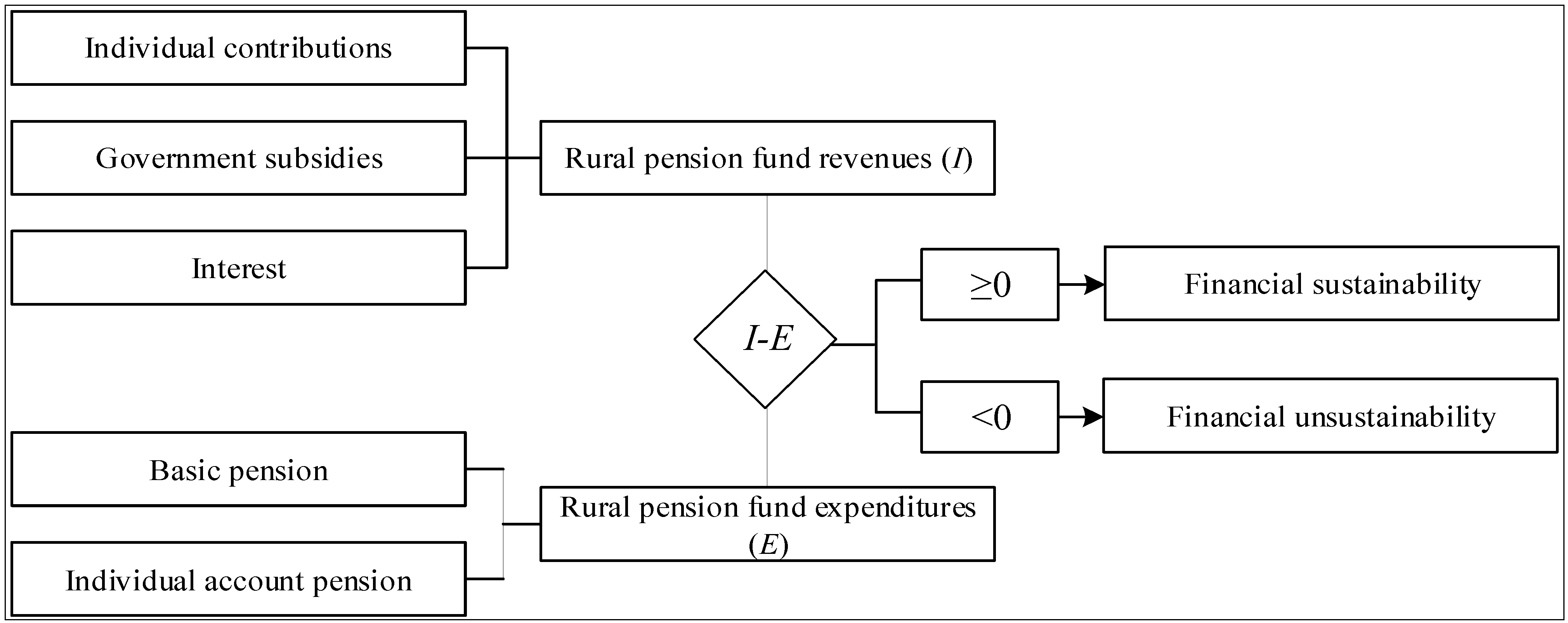

3.2. Relationship among Variables

The first variable needed to assess the sustainability of any pension system is the estimated rural pension fund revenues. According to the Financial Management Regulation of the NTRSEI issued by the Ministry of Finance and the Ministry of Human Resources and Social Security, such revenues include individual contributions, collective subsidies, state subsidies, interests, transfers from the central or local government and other revenues. In practice, the rural pension fund revenues are only composed of individual contributions, government payment subsidies and interests [

55]. The second variable at hand is rural pension fund expenditures. As started in the above-mentioned regulation, they comprise pension expenditures, transfers from the central or local government, turned-over revenues and other expenditures. Yet, actual expenditures only include the basic pension and individual account pension expenditures [

55]. In view of these remarks, we obtain

Figure 1.

Figure 1.

Connotation of financial sustainability of rural pension system in China.

Figure 1.

Connotation of financial sustainability of rural pension system in China.

3.3. Measured Indicators

In line with fundamental NTRSEI principles, the accumulated amount of pension benefits an insured person receives starting the 140th month after retirement and continuing until death has no corresponding income item, and there is no social pooling account. To conform to the social insurance actuarial model, we assume that there is a virtual social pooling account with zero income, and let

It,

Igt,

Ijt,

Irt,

Ist,

Et,

Ezt,

Ect,

Yt and

Ebt, respectively, denote rural pension fund revenues, individual contributions, government subsidies, interests, the virtual social pooling account income, rural pension fund expenditures, normal spending by individual accounts, overspending by individual accounts, accumulated amounts in individual accounts and basic pension expenditures, at year

t. We obtain:

where

Ft is the rural pension funding gap at year

t.

Following The Guidance to Carry Out the NTRSEI Pilot Project and Financial Management Regulation of the NTRSEI, we further have:

due to:

then:

4. Model Specification

4.1. Basic Hypotheses

Because of the account specificity of the rural pension system, we can only assess its funding gap by calculating overspending in both the basic pension and individual accounts. Before doing so, we put forward the following hypotheses: (1) the policy framework of China’s current rural pension system remains stable until 2050; (2) both central and local state subsidies are collectively referred to as state subsidies; (3) state subsidies operate on a pay-as-you-go basis; (4) to facilitate forecasting and due to the regular increase in rural per capita net income, we calculate the ratio between yearly individual contributions and yearly rural per capita net income; (5) according to the

People’s Republic of China Social Insurance Law, the parameters of the rural pension system must be adjusted on a regular basis according to the average personal income growth and inflation level; and (6) demographic forecasting methods and empirical research on China have made much progress in recent decades. Borrowing from existing research [

38,

39,

55], we simply assume that the age distribution of the insured population is the same as the one of the total rural population and that the coverage rate of the new rural pension system is stable over time.

4.2. Calculating Models

4.2.1. Overspending in Individual Accounts

Let

![Sustainability 06 03271 i001]()

,

Lx,t,

a,

b,

Ot,

Mt,

Wt,

C1,

C2,

C3,

![Sustainability 06 03271 i002]()

,

I″,

h,

Kb−t,t,

gy,

i,

Qb,t,

n,

Ezct and

ly,t, respectively, denote the number of participants at year

t, the number of rural population aged

x at year

t, the minimum age of new participants, the retirement age, the coverage rate of the rural pension system at year

t, the total amount of individual account savings at year

t, the average rural per capita net income at year

t, the individual contribution rate, the rate of collective subsidies, the rate of state subsidies, normal premiums at year

t, supplementary premiums at year

t, the number of supplementary payment years, future individual contributions of participants aged

x, the average rate of increase of rural per capita net income, the interest rate, the individual account pension of participants aged

b, the calculating coefficient of the individual account pension and the level of individual account expenditures at year

t. Based on all this, we obtain:

According to Formulas (7) and (8), we have:

The Guidance to Carry Out the NTRSEI Pilot Project allows participants whose number of contribution years is lower than 15 to add supplementary contributions to their individual account, hence:

As stipulated by the

People’s Republic of China Social Insurance Law, “if individuals participating in basic pension insurance passed away due to illness or non-work-related reasons, their dependents can receive funeral subsidies and survivor’s pension”. Therefore, we have:

When

n / 12 is an integer and

y −

b ≤

n / 12,

When

n / 12 is an integer and

y −

b >

n / 12,

When

n / 12 is a non-integer and

y −

b ≤ [

n / 12],

When

n / 12 is a non-integer and

y −

b = [

n / 12] + 1,

When

n / 12 is a non-integer and

y −

b > [

n / 12] + 1,

According to formulas (15)–(19), we obtain:

4.2.2. Basic Pension

Let

Qt,1 and

k1, respectively, denote the basic pension standard at year

t, and the average adjustment rate of the basic pension standard. We have:

4.2.3. Rural Pension Funding Gap

According to Formulas (6), (20) and (21), we have:

5. Results

5.1. Data Collection

- (1)

Time frame. The medium-term plan for the pension system in China extends to 2020, and the long-term plan extends to the 100th anniversary of China’s 1949 revolution [

56]. Considering these time frames, we take 2014–2049 as our calculating period.

- (2)

Participants. Based on The Guidance to Carry Out the NTRSEI Pilot Project, parameter values for the minimum age for new participants, retirement age, the calculating coefficient of the individual account pension and the number of supplementary payment years are 16, 60, 139 and 15, respectively.

- (3)

Interest rate. The interest rate set by The Guidance to Carry Out the NTRSEI Pilot Project is equal to China’s average yearly interest rate on deposits. Averaging the China’s yearly rate from 1999 to 2010, and using it as i, we obtain i = 0.0243.

- (4)

Rural per capita net income. Using the

China Statistical Yearbook, we can find historical data on rural per capita net income and feed these data into a grey system model [

57]. We then obtain the rural per capita net income for 2014 to 2049 and the average rate of increase of per capita rural net income.

- (5)

Basic pension standard at initial year. Survey data [

58] show that the average monthly pension currently received by rural elderly residents is 59.95 Yuan, so

![Sustainability 06 03271 i016]()

.

- (6)

Individual contribution rate, collective subsidies rate and state subsidies rate. From our survey in six counties, we found that the average annual value of individual contributions is 192.04 Yuan. Based on that survey, we also know that, in practice, there are no actual collective subsidies. As for the yearly state subsidies, according to The Guidance to Carry Out the NTRSEI Pilot Project, they are worth 30 Yuan per person. Based on these, we have C1 = 3.73, C2 = 0, C3 = 0.58.

- (7)

The average adjustment rate of the basic pension. Considering the recent nature of NTRSEI, we do not have good historical data about the evolution rate of the basic pension. Using the rate of increase of the per capita consumption expenditure of rural households from 2000 to 2010, displayed in the China Statistical Yearbook and the People’s Republic of China Social Insurance Law, we have m = 10.70% using the simple moving average (SMA) methods.

- (8)

Coverage rate of the new rural pension system. From our survey, we estimate that, in the counties under study, the coverage rate of the rural pension system varied between 85% and 99%. Considering the actual situation in rural China, we estimate that Qt = 95%.

- (9)

Rural demographic data. The basic demographic data are obtained from the

China Population Statistics Yearbook 2013; the population forecasting methods are borrowed from a recent article [

59].

5.2. Calculating the Rural Pension Funding Gap

On the basis of our data collection and Formulas (20)–(22), we have

Table 2.

Table 2.

The rural pension funding gap in China, 2013–2020 (in billion Yuan).

Table 2.

The rural pension funding gap in China, 2013–2020 (in billion Yuan).

| Year | Overspending in individual accounts | Basic pension | Rural pension funding gap | Year | Overspending in individual accounts | Basic pension | Rural pension funding gap |

|---|

| 2014 | 0 | 97.800 | −97.800 | 2032 | 10.661 | 796.636 | −807.297 |

| 2015 | 0 | 111.164 | −111.16 | 2033 | 11.920 | 880.609 | −892.529 |

| 2016 | 0 | 125.108 | −125.11 | 2034 | 13.256 | 968.415 | −981.671 |

| 2017 | 0 | 141.306 | −141.31 | 2035 | 14.617 | 1054.158 | −1068.78 |

| 2018 | 0 | 157.426 | −157.43 | 2036 | 16.034 | 1141.636 | −1157.67 |

| 2019 | 0 | 171.777 | −171.78 | 2037 | 17.395 | 1219.556 | −1236.95 |

| 2020 | 0 | 188.270 | −188.27 | 2038 | 18.776 | 1302.434 | −1321.21 |

| 2021 | 0 | 203.413 | −203.41 | 2039 | 19.963 | 1382.961 | −1402.92 |

| 2022 | 0 | 229.779 | −229.78 | 2040 | 21.217 | 1460.986 | −1482.2 |

| 2023 | 3.324 | 265.868 | −269.19 | 2041 | 22.439 | 1540.021 | −1562.46 |

| 2024 | 3.758 | 301.991 | −305.75 | 2042 | 23.567 | 1642.905 | −1666.47 |

| 2025 | 4.362 | 343.570 | −347.93 | 2043 | 24.691 | 1731.715 | −1756.41 |

| 2026 | 4.960 | 390.395 | −395.36 | 2044 | 26.246 | 1840.496 | −1866.74 |

| 2027 | 5.651 | 436.897 | −442.55 | 2045 | 27.516 | 1974.377 | −2001.89 |

| 2028 | 6.430 | 497.762 | −504.19 | 2046 | 29.173 | 2169.385 | −2198.56 |

| 2029 | 7.247 | 562.057 | −569.30 | 2047 | 31.228 | 2433.705 | −2464.93 |

| 2030 | 8.317 | 638.644 | −646.96 | 2048 | 34.372 | 2704.511 | −2738.88 |

| 2031 | 9.381 | 714.883 | −724.26 | 2049 | 38.881 | 3023.426 | −3062.31 |

Table 2 indicates that (1) nationwide overspending in individual accounts would appear in 2023 and grow rapidly until 2049. Specifically, the overspending in individual accounts would rise from 3.32 billion Yuan in 2023 to 38.88 billion Yuan in 2049, thus increasing by 9.92% a year. (2) The total amount spent on the basic pension would increase from 97.80 billion Yuan in 2014 to 3023.43 billion Yuan in 2049, an average yearly increase of 10.30%. The main reason for this rapid anticipated increase in basic pension spending is that the number of rural elderly residents and the average amount of the basic pension are both rising. (3) The rural pension funding gap is the sum of overspending in individual accounts and the basic pension. The rural pension funding gap should increase from 97.80 billion Yuan in 2014 to 3062.31 billion Yuan in 2049, which represents an annual growth rate of 10.34%. Considering the above remarks, it is clear that, as it stands, China’s rural pension system is not financially sustainable.

6. Analysis of the Results

China is now an aging society with more than 91 million elderly people in rural areas alone [

60]. Considering the objective to fight elderly poverty and the rapid increase in the elderly population, the need for a sustainable rural pension system is more pressing than ever. As far as rural pensions are concerned, the recent expansion of NTRSEI coverage can be understood as a major success story [

61,

62,

63]. Yet, the above analysis suggests that NTRSEI is anything but financially sustainable. Considering this, in order to increase the sustainability of China’s new rural pension system, we urge policymakers to explore the following two reform paths:

First, the state could increase its direct fiscal support for that system, a move that would be entirely consistent with the People’s Republic of China Social Insurance Law, which clearly stipulates that “The government shall supplement any shortage in the basic pension insurance fund.” Our first suggestion to address the rural pension funding gap is therefore to transfer money from the state budget to the new rural pension system. In light of this policy advice, the question is whether the Chinese state has the ability to cover such a funding gap out of its general revenues.

According to

The Guidance to Carry Out the NTRSEI Pilot Project and the

People’s Republic of China Social Insurance Law, the fiscal transfer from the central state to NTRSEI is the sum of the rural pension funding gap and state subsidies. Let

Qt,2,

k2,

Ijt and

Eht denote the state subsidies standard at year

t, the increasing rate of the state subsidies standard, the total number of state subsidies at year

t and the transfer payment demand from the state budget at year

t, respectively. We get:

Using the same data collection and Formulas (23)–(25), we obtain

Figure 2.

Figure 2.

The need for transfer payments from the state budget for the rural pension system, 2014–2049.

Figure 2.

The need for transfer payments from the state budget for the rural pension system, 2014–2049.

Data source: Numbers in

Figure 2 are derived from our own calculations.

The need for transfer payments from the state budget for the rural pension system would continue to increase between 2014 and 2049, climbing from 111.89 billion Yuan in 2014 to 3280.12 billion Yuan in 2049, an annual rate of increase of 10.13%. Importantly, there should be no financial crisis in rural pensions as long as the Chinese state transfers such sums to NTRSEI.

Second, in addition to relying on state subsidies to support the rural pension system, policymakers can alter its parameters and design to mitigate factors favoring unsustainability, just as Sweden, Canada and the United States did. Concrete potential policy suggestions to do just this include the following:

(1) Creating dynamic adjustment mechanisms.

The rural pension system should meet the basic economic needs of rural residents, but the increase in spending triggered mainly by population aging should remain under control. Retirement age and account structure are two parameters policymakers may adjust to control such cost increases. For instance, the average payment period of the individual account pension could be shortened simply by increasing the statutory retirement age, which would automatically reduce overspending in the individual accounts. Regarding account structure, it would be appropriate to create a social pooling account for the basic pension. After setting up the social pooling account, the government would put the money to fund the annual basic pension into that account at the beginning of each year. Such a change would be likely to reduce the level of unsustainability of the rural pension system.

(2) Improving the investment practices.

Increasing the return rates of the rural pension fund is just another way to promote greater fund revenues. With this in mind, we advise policymakers that (i) the central government allows the National Council for Social Security Fund (NCSSF) to invest money from the rural pension fund. The NCSSF has the experience and the technological knowhow to make such investments. In fact, “The annual return of China’s Social Security Fund in the past 12 years stood at 8.4%” [

64]. This means that the NCSSF should be able to invest rural pension money in an effective way to increase returns. (ii) To further increase these rates of return, the State Development Bank could issue high-yield special bonds that the pension authorities could buy using money from the rural pension fund. (iii) New investment methods, such as contracted deposits and consignment loans, could also be adopted to further improve returns.

(3) Designing a national pension redistribution mechanism.

China is a large and country in which levels of economic and social development can vary greatly from region to region. This situation creates the coexistence of rural pension fund gaps in some regions of the country and fund surpluses in other regions. To address this territorial and financial issue, authorities could set up a national adjustment fund that could redistribute money across the country by using fund surpluses in some regions to address funding gaps elsewhere in the country.

The People’s Republic of China Social Insurance Law states that “the People’s government of the provinces, autonomous regions and municipalities can combine and implement the New Type of Rural Social Endowment Insurance and Social Endowment Insurance for Urban Residents according to their actual situation.” On February 7, 2014, China’s Premier, Li Keqiang, also chaired an executive meeting of the State Council, which decided to establish a national Social Endowment Insurance for Rural and Urban Residents. It should be noted that the combination of the rural and the urban pension systems will affect their sustainability. We know that: (i) such an integration may cause rural pension benefits to increase; (ii) due to the different financial capacity of rural and urban residents, the unified pension system has to set a minimum individual contribution standard based on rural residents’ capacity; and (iii) the institutional frameworks between NTRSEI and SEIURR are basically identical. Considering all this, we find that the combination of the rural and the urban pension systems should increase pension expenditures and decrease pension revenues. This situation should further undermine the sustainability of the rural pension system. Although one could use a similar method as the one featured in this paper to calculate the sustainability of China’s new integrated pension system, such a system has yet to be implemented everywhere across the country. Hence, this paper only provides a case study to evaluate the sustainability of China’s pension system. Our results are relevant for the implementation of that system relevant across China.

7. Policy Implications

The financial sustainability of old-age pension schemes is an unavoidable issue in contemporary market economies [

65]. As suggested at the beginning of this paper, the risk of financial unsustainability in pensions is widespread, which has forced governments in countries, such as Sweden, Canada, United States and well beyond, to enact major reforms [

66].

This global push for pension sustainability already materialized in China, concerning the basic old-age insurance for enterprise employees. Because the individual accounts of China’s basic old-age insurance for enterprise employees are “empty” and filled with “implicit debt” [

67], experts and policymakers are rightly concerned about the financial sustainability of China’s pension system. This is true because, in China, as elsewhere, avoiding the financial risk of pension unsustainability remains a major challenge. It is in this uncertain financial context that, in 2009, China established its new rural pension system, before implementing it across the country in 2012. Unfortunately, our results show that this new system is not financially sustainable. Taking into account foreign pension reforms, such as those discussed in

Section 2, China should take strong and early action to tackle the current sustainability crisis in rural pensions. Drawing on such international experiences, the policy implications of our findings are as follows:

(1) From a quantitative perspective, our results help explain why China’s new rural pension system is unsustainable, while assessing the approximate scope of that problem. The paper not only evaluates the size of China’s rural pension funding gap, but also identifies the sources of this funding gap, which is essential information for policymakers needing to adjust the basic parameters of NTRSEI to make it more financially sustainable. This means that now is the time for China to improve social security concepts and governance while drawing on recent foreign pension reforms.

(2) Our analysis shows the discrepancy between official principles and the actual operation of China’s new rural pension system. The basic, country-wide principles of NTRSEI include financial sustainability and policy compatibility with existing economic and social development levels. Yet, there is a serious budget shortfall in China’s rural pension system, which is at odds with the idea of financial sustainability. Considering the contradiction between this principle and financial reality on the ground, China can optimize NTRSEI by adjusting the basic parameters of the rural pension system to achieve the financial sustainability principle. International experiences also show that the sooner China acts, the better. In particular, China can learn from Canada to take more forceful measures, such as increasing contribution rates and expanding pension fund investment now, rather than waiting for the rural pension system to face an immediate financial crisis.

(3) From a governance perspective, policymakers must realize the need for greater financial sustainability in NTRSEI. Our paper could help foster this broader understanding by quantifying the large scope of the problem facing such policymakers. It is hoped this paper helps policymakers deepen their understanding of financial sustainability issues in rural pensions, so that they can truly address them instead of putting their head in the sand and denying the existence of the problem. Financial sustainability is not only about words, but about concrete policy practices, which is why Chinese experts and policymakers should draw on international experience in domestic pension reform, including when dealing with rural pensions.

(4) More concretely, learning once again from international experience, China should make sure the value of individual account assets does not fall in the short run, while reforming the mechanism through which the interest rates for individual accounts are set. In the long run, policymakers can ask the National Social Security Fund Council to invest and operate rural social endowment insurance funds while improving the operation of the system. Simultaneously, based on the experience of pension reform elsewhere around the world, China should further extend coverage for the social pension funds, increase the age of retirement, develop its capital markets and improve the legal and policy framework surrounding the investment of social pension funds.

(5) Creating a sustainable pension system is not simply about cost containment, which may lead to growing poverty among the rural elderly. This is why we recommend the improvement of the system’s sustainability in the context of adequate pension benefits. Our specific approach is about increasing governmental investment and actively using various financing methods to generate financial sustainability. Part of this sustainability project is to maintain pension benefits that are equal to the basic economic needs of Chinese rural residents. Given that premise, pushing back the retirement age, enhancing the contributions of the working-age population and increasing pension fund investments are better solutions than direct benefit cuts. Hence, our policy recommendations should not cause growing poverty among the rural elderly.

(6) Increasing the central government’s subsidies is the most reliable method to improve the revenue stream available to fund rural pensions. Considering the existence of uneven local fiscal capacities and the related resistance to the integration of the pension system all around China, the central government’s subsidies are the most appropriate and the fairest policy choice. In this context, the central government should also increase basic monthly pensions cross the country, especially in the poorer central and western regions. Meanwhile, the central government should provide more individual contribution subsidies. In poverty-stricken counties, border counties, regions inhabited by ethnic minorities and other areas facing particular socio-economic challenges, China’s central government should even consider paying the entire subsidies available for rural pensions.

8. Conclusions

The new rural pension system is one of the most important social policy systems in China, and great progress has been achieved in implementing NTRSEI. However, experience clearly shows that financial sustainability is a key factor to consider when achieving long-term social policy objectives is concerned. Using social insurance actuarial techniques, this article shows that the rural pension funding gap should rise from 97.80 billion Yuan in 2014 to 3062.31 billion Yuan in 2049, an increase of slightly more than 10% a year. Considering this, the new rural pension system is unsustainable, at least in its current form. However, as suggested above, based on recent international experiences, there are several ways in which policymakers can make the Chinese rural pension system more sustainable over time. We hope our findings and policy recommendations help Chinese pension experts and policymakers create a more sustainable rural pension system, while using a better actuarial framework to assess its long-term sustainability.

, Lx,t, a, b, Ot, Mt, Wt, C1, C2, C3,

, Lx,t, a, b, Ot, Mt, Wt, C1, C2, C3,  , I″, h, Kb−t,t, gy, i, Qb,t, n, Ezct and ly,t, respectively, denote the number of participants at year t, the number of rural population aged x at year t, the minimum age of new participants, the retirement age, the coverage rate of the rural pension system at year t, the total amount of individual account savings at year t, the average rural per capita net income at year t, the individual contribution rate, the rate of collective subsidies, the rate of state subsidies, normal premiums at year t, supplementary premiums at year t, the number of supplementary payment years, future individual contributions of participants aged x, the average rate of increase of rural per capita net income, the interest rate, the individual account pension of participants aged b, the calculating coefficient of the individual account pension and the level of individual account expenditures at year t. Based on all this, we obtain:

, I″, h, Kb−t,t, gy, i, Qb,t, n, Ezct and ly,t, respectively, denote the number of participants at year t, the number of rural population aged x at year t, the minimum age of new participants, the retirement age, the coverage rate of the rural pension system at year t, the total amount of individual account savings at year t, the average rural per capita net income at year t, the individual contribution rate, the rate of collective subsidies, the rate of state subsidies, normal premiums at year t, supplementary premiums at year t, the number of supplementary payment years, future individual contributions of participants aged x, the average rate of increase of rural per capita net income, the interest rate, the individual account pension of participants aged b, the calculating coefficient of the individual account pension and the level of individual account expenditures at year t. Based on all this, we obtain:

.