1. Introduction

Sustainability has become a central axis of corporate legitimacy worldwide. Firms are increasingly expected to manage environmental, social, and governance (ESG) responsibilities alongside financial performance, as capital markets, regulators, and civil society actors exert growing pressure for credible sustainability action [

1,

2,

3]. Despite the rapid diffusion of ESG frameworks and the expansion of disclosure requirements, a persistent “implementation gap” remains: organizational sustainability commitments do not consistently translate into substantive changes in strategy, incentives, or operations. Evidence from emerging markets shows frequent symbolic adoption of ESG policies alongside limited transformation of core routines and governance practices, raising concerns about greenwashing and ceremonial compliance [

4,

5]. This pattern is especially pronounced in fragile institutional contexts—settings in which regulatory rules are inconsistently specified and applied, enforcement capacity is weak, corruption or rent-seeking risks distort compliance incentives, and political volatility produces discontinuous policy signals [

6,

7].

There is broad agreement that senior executives play a decisive role in shaping sustainability trajectories, but less clarity on how this influence actually operates. Much of the literature associates ESG outcomes with governance structures, board characteristics, or CEO demographics, implicitly assuming that leadership effects flow primarily through formal mechanisms. More recent research suggests that executive cognition, professional experience, and values are central in orienting firms toward sustainability, showing that leaders with environmental or sustainability exposure are more likely to improve ESG performance and integrate sustainability into strategic priorities [

8,

9,

10]. These findings imply that organizational differences in sustainability performance may originate not only in structural capabilities but also in how executives interpret, frame, and prioritize sustainability itself.

This issue becomes especially salient in African and other emerging-market environments characterized by institutional voids, policy discontinuity, political contestation, and volatile stakeholder pressures [

6]. Firms in these settings face heightened risks linked to climate vulnerability, social inequality, resource governance, and energy transition challenges, while operating under regulatory regimes in which enforcement is uneven, and expectations are ambiguous. Where these institutional conditions are present at moderate–high levels, executives often exercise greater discretion in interpreting, prioritizing, and translating sustainability demands into internal routines—creating substantial variance in whether ESG commitments remain symbolic or become substantively embedded [

6,

11]. At the same time, expanding sustainability reporting without commensurate behavioral change has sharpened concerns that ESG advances in such contexts may be largely symbolic rather than substantive, reinforcing the need to understand the cognitive processes through which executives distinguish between “compliance theatre” and authentic sustainability enactment.

Although research on corporate sustainability has advanced rapidly, three gaps remain insufficiently addressed. First, most studies infer executive influence on sustainability outcomes from demographic or structural proxies rather than examining the interpretive processes through which leaders make sense of sustainability demands. As a result, executive cognition remains theoretically under-specified. Second, dominant sustainability governance frameworks are largely derived from strong institutional environments and therefore do not fully explain how sustainability is enacted in environments where regulatory guidance is weak and enforcement is inconsistent. Third, while symbolic sustainability and greenwashing are widely documented, the cognitive mechanisms that enable symbolic responses to persist are rarely theorized. These gaps limit our understanding of how executives actually convert external sustainability pressures into organizational action in contexts of institutional fragility.

To address these gaps, this paper advances Executive Sustainability Cognition (ESC) as a distinct theoretical construct rather than a relabeling of executive “green mindset” or sustainability leadership. The novelty lies in reconceptualizing executive cognition as a form of cognitive governance—a governance-substituting mechanism that becomes especially consequential under institutional fragility. Specifically, the paper contributes by (i) shifting the explanatory focus from executive attributes or demographic proxies to a four-stage cognitive process through which sustainability is enacted—attention, framing, prioritization, and translation—and (ii) specifying institutional fragility as a boundary condition under which executives’ interpretive authority and prioritization logics function as a compensatory steering architecture when formal governance systems are weak, symbolic, or decoupled from practice [

11,

12,

13].

Accordingly, the paper develops Executive Sustainability Cognition (ESC) as a governance-relevant process capability through which C-suite executives (i) attend to, (ii) frame, (iii) prioritize, and (iv) translate sustainability imperatives into embedded organizational practices—particularly when institutional signals are ambiguous and enforcement is unreliable. What is new is that, rather than treating executive cognition as a relatively stable “green mindset” or leadership orientation, ESC is theorized as a cognitive governance mechanism that performs internal ordering and accountability functions under conditions of institutional fragility.

The central argument advanced in this paper is that, in fragile institutional environments, executive cognition functions as a form of cognitive governance: when regulatory signals are inconsistent and institutional scaffolding is unreliable, ESC operates as a compensatory steering mechanism that shapes whether sustainability commitments remain symbolic or become substantively embedded [

11,

14]. Where informal governance coordinates behavior through social relations and shared norms, cognitive governance coordinates behavior through executive meaning-making that becomes institutionalized as internal accountability—often complementing formal governance structures, but substituting for them when institutions are weak, or enforcement is unreliable. Our primary contribution is to articulate a context-sensitive conceptual model and a set of propositions that reposition executive cognition as a substitute governance mechanism in contexts with institutional fragility.

By specifying the four-stage ESC process and theorizing how institutional fragility, stakeholder fragmentation, and organizational learning conditions shape the enactment of symbolic versus substantive sustainability, the paper clarifies why firms operating under similar ESG pressures often display sharply divergent sustainability outcomes in settings characterized by weak-governance features [

6,

11]. In doing so, the paper contributes to sustainability governance research by moving beyond structural compliance explanations and identifying executive cognition as a theoretically specified internal governance capability that becomes decisive when formal institutional enforcement is weak or contested.

While the conceptual framework proposed here may have broader relevance for organizations operating in institutional ambiguity, its primary intended scope is fragile institutional contexts in emerging markets. For clarity, the term “fragile institutional contexts” is used here as a working category defined not merely by geography, but by a bundle of institutional attributes—regulatory inconsistency, weak enforcement and monitoring capacity, corruption or rent-seeking risks that distort compliance incentives, political volatility and policy discontinuity, and fragmented or competing stakeholder expectations [

6,

7]. Empirically, these conditions are observable in inconsistent regulatory application across firms, limited monitoring capacity, uneven sanctioning of non-compliance, and frequent policy discontinuities that weaken the credibility of long-term sustainability signals.

Although we draw most frequently on examples from Sub-Saharan Africa (and Nigeria in particular) as archetypal illustrations of these dynamics, the theoretical arguments concerning Executive Sustainability Cognition (ESC) are not region-bound. Comparable dynamics may arise in sectors of advanced economies where sustainability regulation remains complex, fragmented, or contested. However, ESC as cognitive governance is expected to be most salient where the defining weak-governance attributes above are present at moderate–high levels, because such conditions expand executive discretion and increase interpretive ambiguity. The framework is therefore expected to be particularly relevant in high-externality, high-discretion sectors (e.g., extractives, energy, and infrastructure) operating under weak-governance conditions, where executive meaning-making may function as a compensatory steering architecture shaping whether ESG commitments remain symbolic or become substantively embedded.

The remainder of the paper is structured as follows.

Section 2 develops the theoretical foundations of ESC.

Section 3 presents the conceptual model and propositions.

Section 4 discusses implications for research, management, and policy.

Section 5 concludes with directions for future research.

3. Conceptual Model and Propositions

Building on the foregoing theoretical synthesis, this paper advances Executive Sustainability Cognition (ESC) as the core mechanism through which sustainability is interpreted, prioritized, and institutionalized in fragile institutional environments. Whereas much of the sustainability governance literature foregrounds formal structures, leadership competencies, or stakeholder pressures, these approaches often imply that enactment follows from rational–technical alignment. The ESC framework instead conceptualizes sustainability enactment as a cognitive–interpretive governance process through which executives stabilize meaning, set priorities, and authorize organizational responses when institutional signals are ambiguous, inconsistent, or weakly enforced.

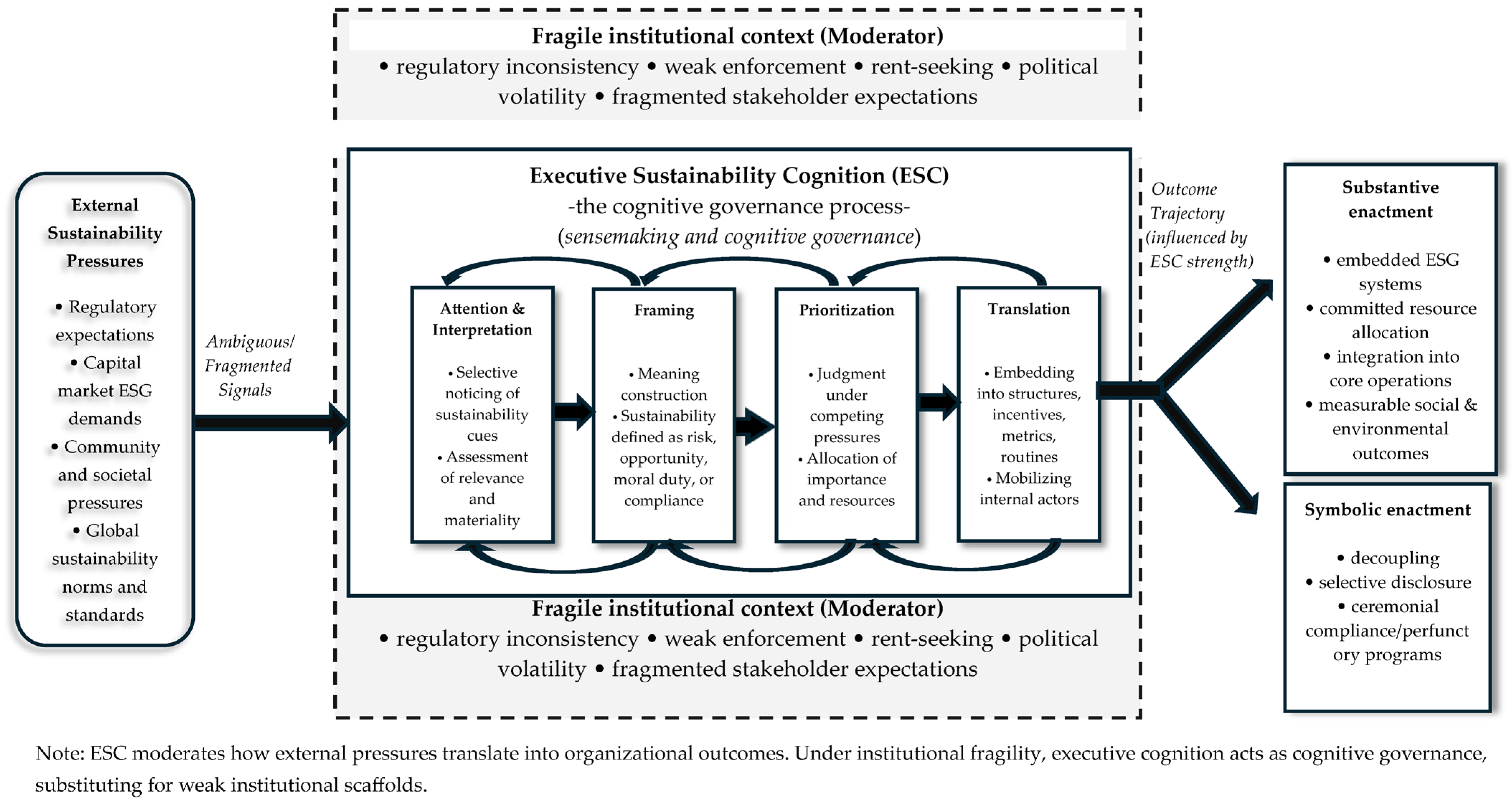

ESC is modeled as a dynamic, multi-stage process comprising four analytically distinct components—attention (selecting which cues matter), framing (constructing interpretive meaning), prioritization (authorizing strategic trade-offs), and translation (institutionalizing commitments). These stages are sequential but not strictly linear. Feedback loops are expected: translation outcomes reshape attentional patterns, and framing can shift as institutional pressures evolve. Sensemaking is treated as the integrative interpretive work that connects these stages: executives notice cues, construct meaning, adjudicate trade-offs, and convert commitments into routines and accountability. These processes collectively explain how sustainability imperatives are translated from contested external pressures into organizational agendas, decision-making processes, and institutionalized practices.

To sharpen parsimony and reduce boundary blurring between stages,

Table 2 summarizes each ESC stage using a core guiding question and illustrative manifestations. This stage clarification also provides a tighter backbone for aligning propositions 1–4 with the ESC sequence.

Figure 1 synthesizes these relationships by illustrating the Executive Sustainability Cognition (ESC) framework, depicting ESC as a multi-stage cognitive governance process that connects external sustainability pressures with both symbolic and substantive sustainability enactment, depending on the degree of institutional fragility.

To strengthen empirical traction and respond to calls for sharper falsifiability, each ESC stage is defined in a way that can be operationalized using observable indicators. Attention can be assessed through the salience of sustainability language in top-management discourse (e.g., CEO letters, earnings calls) or through agenda allocation (e.g., the frequency of sustainability items in strategic meetings). Framing can be captured through content analysis of executive narratives, distinguishing between compliance/risk and opportunity/paradox frames. Prioritization can be proxied through resource allocation choices (e.g., capex/opex devoted to sustainability initiatives, executive compensation links to ESG metrics). Translation can be operationalized through governance and accountability mechanisms (e.g., sustainability KPIs in performance systems, formal routines, incentives, and audit/assurance practices).

The following subsections develop propositions linking the four ESC processes to sustainability enactment outcomes and identify institutional fragility, stakeholder fragmentation, and organizational learning orientation as key boundary conditions that condition these relationships. Accordingly, propositions 1–4 follow the sequential logic of selection → meaning → authorization → institutionalization.

3.1. Attention and Interpretation as an Interpretive Filter of Sustainability Signals

Attention determines which sustainability issues enter the strategic agenda and how they are initially rendered meaningful. Attention is selective rather than neutral; prior experience, cognitive biases, values, and the salience of external cues shape it. Consistent with Upper Echelons Theory, executives differ in their interpretations of sustainability, viewing it as a peripheral burden, an emerging risk, or a strategic opportunity, and these differences have downstream implications for organizational action.

In fragile institutional environments, attention and interpretation become especially consequential because external signals are often contradictory or underspecified. Limited enforcement, weak monitoring, and fluctuating stakeholder expectations necessitate that executives rely more heavily on judgment when determining which pressures warrant a response. Accordingly, attention and interpretation are not simply agenda-setting acts; they constitute the first step in cognitive governance, as they define what counts as “real” and actionable.

Attention and interpretation can be empirically captured through (i) textual salience of ESG themes in executive communications, (ii) agenda time allocation to sustainability topics in board/TMT deliberations, and (iii) responsiveness to external cues such as regulatory announcements, civil-society scrutiny, or investor engagement.

Proposition 1. In fragile institutional contexts, greater executive attention to sustainability cues—observable in the salience and timeliness of sustainability themes in executive communications and in the frequency with which sustainability cues trigger strategic deliberation—is positively associated with the likelihood that sustainability issues become strategically materialized (e.g., incorporated into strategic plans, strategic KPIs, or risk registers), rather than treated as peripheral or episodic.

3.2. Framing and Strategic Orientation

Framing refers to the interpretive process through which executives assign meaning and urgency to sustainability issues. Frames shape whether sustainability is construed as compliance, reputational insurance, moral obligation, or strategic renewal. In environments characterized by ambiguity, framing becomes decisive because it establishes the organization’s posture toward uncertainty and competing demands.

Opportunity-oriented or paradoxical frames legitimize the simultaneous pursuit of economic and sustainability goals, supporting long-term commitment despite volatility. By contrast, narrow compliance or risk-avoidance frames stabilize short-term legitimacy but tend to produce symbolic adoption and minimal investment.

Framing can be operationalized by coding executive narratives (e.g., CEO speeches, letters, interviews) for dominant sustainability frames, distinguishing business-case/compliance/risk frames from opportunity/paradox/integrative frames.

Proposition 2. Executives who predominantly adopt opportunity-oriented or paradoxical sustainability frames—observable through coded executive narratives—are more likely to authorize substantive enactment (e.g., sustained investment and integration into core strategy), whereas executives who predominantly adopt compliance-driven or risk-avoidance frames are more likely to authorize symbolic enactment (e.g., disclosure-focused initiatives with limited operational integration).

3.3. Prioritization Under Competing Institutional Pressures

Sustainability enactment requires judgment about trade-offs among profitability, stakeholder legitimacy, regulatory demands, and long-term resilience. Prioritization captures how executives rank these claims and convert frames into strategic commitment.

Under institutional fragility, prioritization becomes both more complex and more powerful because stable external reference points are lacking. When guidance is inconsistent and sanctions uneven, executive prioritization logics—rather than institutional compulsion—determine whether sustainability is treated as a core strategy, a bounded initiative, or a rhetorical commitment. Prioritization, therefore, functions as a governance act because it allocates attention and authorizes trade-offs.

Prioritization can be operationalized through proxies for resource allocation, such as sustainability-linked capital expenditure/operating expenditure, the share of strategic projects with ESG targets, and the presence/weight of ESG indicators in executive incentive schemes.

Proposition 3. The degree to which executives prioritize sustainability objectives in trade-off decisions—observable through resource allocation patterns (capital expenditure/operating expenditure) and ESG weighting in executive incentives—is positively associated with the depth of substantive sustainability enactment, reflected in the extent to which sustainability is embedded in core value-creating activities (rather than bounded CSR or reporting routines).

3.4. Translation from Cognition to Organizational Action

Translation refers to embedding executive interpretations into strategies, resource allocations, governance arrangements, metrics, incentives, and routines. Many sustainability initiatives fail not because leaders lack intent but because translation mechanisms are weak.

In fragile institutional environments—where external enforcement is limited—translation depends heavily on leaders’ capacity to mobilize internal actors, maintain commitment, and construct accountability architectures independent of regulatory pressure. Translation, therefore, represents the decisive point at which cognition becomes institutional reality.

Translation capability can be captured through observable institutionalization mechanisms, including (i) formal governance embedding (e.g., ESG committee mandates with decision rights), (ii) performance measurement routines (ESG KPIs tracked and audited), and (iii) incentive alignment (compensation tied to ESG outcomes).

Proposition 4. Executive translation capability—reflected in the institutionalization of sustainability through formal decision rights (e.g., mandated ESG governance), binding performance measurement routines (ESG KPIs tracked, verified, and reviewed), and incentive alignment—is negatively associated with ESG decoupling (disclosure–practice gaps) and positively associated with sustained substantive sustainability performance over time.

Collectively, propositions 1–4 specify the sequential logic: sustainability outcomes depend not only on what executives say, but also on what they attend to, how they frame, which trade-offs they authorize, and whether these commitments become institutionalized through binding internal accountability.

3.5. Moderating Role of Institutional Fragility

Institutional fragility—manifested in regulatory inconsistency, weak enforcement, rent-seeking dynamics, and socio-political volatility—expands executive discretion and increases interpretive ambiguity. In such environments, external rules often fail to provide credible behavioral guidance, and sustainability outcomes depend more heavily on whether executives can convert cognitive commitments into enforceable internal routines. Accordingly, institutional fragility is expected to condition not only whether sustainability cues are noticed and framed, but more critically, whether they are successfully translated into durable governance arrangements.

This moderating role is particularly salient at the translation stage, as it marks the point at which sustainability cognition becomes institutional reality. Where external enforcement is credible, firms may embed sustainability partly to satisfy regulatory expectations. Where enforcement is weak or unpredictable, translation becomes an internally driven governance effort, requiring executive capacity to create accountability structures that do not rely on state monitoring.

Institutional fragility can be operationalized using national or sector-level indicators (e.g., regulatory quality, rule-of-law scores, corruption/rent-seeking proxies, enforcement capacity indices), as well as observed volatility in sustainability-related policy implementation.

Proposition 5. Institutional fragility positively moderates the translation–enactment link, such that the association between executive translation capability (institutionalization of sustainability via decision rights, metrics, incentives, and routines) and substantive sustainability enactment is stronger where regulatory enforcement is weak, monitoring capacity is low, and policy signals are discontinuous, than in more robust institutional environments.

3.6. ESC and the Boundary Between Symbolic and Substantive Enactment

The ESC model also clarifies how symbolic versus substantive sustainability outcomes emerge. Symbolic enactment occurs when sustainability is cognitively recognized and rhetorically articulated but fails to reshape strategic trade-offs or internal accountability. In other words, symbolic outcomes are not simply the absence of governance structures; rather, they reflect misalignment across ESC stages—particularly between prioritization and translation. Executives may frame sustainability persuasively and include it in public narratives, yet allocate limited resources, avoid binding commitments, or implement weak translation mechanisms, thereby sustaining disclosure–practice decoupling.

Substantive enactment, by contrast, requires coherence: framed sustainability priorities must be elevated into binding commitments through resource allocation, and then embedded in governance routines that stabilize implementation over time. This coherence becomes especially important in fragile contexts, where external monitoring of greenwashing is weak and symbolic compliance is often sufficient for legitimacy.

Symbolic versus substantive enactment can be operationalized using indicators of ESG decoupling (e.g., discrepancies between disclosure scores and operational performance outcomes, recurring controversies, ESG assurance gaps, or lagged inconsistencies between targets and realized improvements).

Proposition 6. The greater the alignment between executive prioritization and translation mechanisms, such that resource allocations and trade-off decisions are matched by binding governance routines, performance metrics, and incentives, the lower the likelihood of symbolic enactment (ESG decoupling) and the higher the likelihood of sustained substantive sustainability performance over time.

3.7. Stakeholder Fragmentation as a Cognitive Amplifier

Fragile institutional environments often feature fragmented and competing stakeholder expectations. Unlike contexts with coherent regulatory and normative guidance, emerging-market firms may face divergent claims from government agencies, host communities, NGOs, employees, investors, and global buyers—often with inconsistent demands and unequal power. This fragmentation raises the interpretive burden on executives and increases the importance of cognitive framing as a governance function.

In high-fragmentation contexts, framing becomes more consequential because it provides an internal logic for adjudicating claims. Integrative, opportunity-oriented, or paradoxical frames enable executives to treat sustainability as a strategic resilience agenda, enabling continuity even amid stakeholder conflict. By contrast, narrow compliance or risk-avoidance frames typically promote short-term legitimacy management and episodic responses, limiting sustained prioritization.

Stakeholder fragmentation can be operationalized by mapping the diversity and conflict intensity of stakeholder claims (e.g., number and heterogeneity of salient stakeholder groups, controversy and protest data, stakeholder salience indices, or qualitative scoring based on interviews and archival evidence).

Proposition 7. Stakeholder fragmentation positively moderates the framing–prioritization relationship, such that opportunity-oriented/paradoxical frames are more strongly associated with sustained sustainability prioritization (resource allocation and strategic commitment) under high fragmentation, whereas compliance/risk frames are more weakly associated with sustained prioritization under the same conditions.

3.8. Organizational Learning Climate as an Enabler of Translation

Finally, the translation of executive sustainability cognition into practice depends not only on executive intent but also on organizational receptivity. Even when executives prioritize sustainability, implementation can stall if the organization lacks mechanisms for knowledge diffusion, cross-functional coordination, adaptation, and feedback-based improvement. A learning-oriented climate strengthens the likelihood that translation becomes operationally meaningful rather than symbolic.

In particular, organizational learning orientation amplifies the effectiveness of executive translation capability by enabling employees and middle managers to internalize sustainability priorities, experiment with operational routines, share feedback upward, and continuously refine performance systems. In contrast, rigid organizations with weak feedback loops and limited cross-functional collaboration blunt translation, making ESG implementation vulnerable to decoupling.

Organizational learning orientation can be measured through validated survey scales (learning climate, absorptive capacity, psychological safety) and archival proxies such as sustainability training investments, cross-functional ESG team structures, continuous improvement routines linked to ESG, and frequency of internal sustainability performance reviews.

Proposition 8. Organizational learning orientation positively moderates the translation–enactment relationship, such that executive translation capability is more strongly associated with substantive sustainability enactment when learning mechanisms are strong (cross-functional ESG integration, continuous improvement routines, internal feedback loops), than when learning capacity is weak.

3.9. Integrative Model

The ESC model integrates the preceding elements into an account of how sustainability is enacted through cognitive governance. Sustainability enactment begins with executive attention and interpretation, through which leaders filter the multitude of sustainability signals surrounding the firm and determine what is considered salient or material. These interpretations provide the raw material for framing processes. Through framing, executives construct meaning around sustainability, define their organizational stance toward environmental and social tensions, and influence whether sustainability is viewed primarily as a risk, an obligation, or a strategic opportunity.

On this foundation, prioritization processes adjudicate among competing demands. Executives must decide which sustainability issues warrant resource allocation, which tensions can be deferred, and how to manage trade-offs between economic and non-economic goals. These choices, in turn, must be translated into organizational reality. Translation refers to the institutionalization of sustainability commitments through governance structures, metrics, incentive systems, strategies, and everyday routines that embed executive cognition into practice.

Institutional fragility intensifies the consequences of each stage of this process. Weak enforcement, regulatory inconsistency, and political or stakeholder volatility expand executive discretion and increase ambiguity, making the quality of executive cognition more consequential for sustainability outcomes. Alignment across the ESC stages—attention, framing, prioritization, and translation—ultimately determines whether sustainability commitments remain symbolic or become substantively embedded in organizational action. Stakeholder fragmentation and organizational learning conditions further shape how ESC translates into outcomes, strengthening or weakening the pathway from cognition to enactment.

Crucially, the ESC model provides a micro-process explanation for the ESG “implementation gap.” In fragile institutional environments, ESG commitments often emerge at the level of disclosure or formal policy but fail to reshape internal resource allocation, decision routines, or accountability. The ESC framework shows that symbolic outcomes are not random deviations from “good governance” but are frequently produced through misalignments across the four ESC stages—for instance, sustainability cues may be noticed (attention) and publicly narrated (framing), but not prioritized (trade-offs remain unchanged) or translated into binding routines (weak accountability). Conversely, substantive enactment emerges when the stages are coherent and mutually reinforcing.

Table 3 shows how misalignment causes symbolic outcomes.

While the ESC model emphasizes executive cognition as a constructive governance substitute under institutional fragility, it also opens up additional possibilities. In contexts characterized by weak monitoring and high discretion, executive cognition may equally underpin strategic greenwashing, elite capture of sustainability narratives, or selective attention to visible but low-impact ESG initiatives. Thus, ESC should not be assumed to be normatively “good” by default: the same cognitive governance capability that enables substantive embedding may also be deployed to stabilize legitimacy through symbolic responses when executive incentives are misaligned or when sustainability is construed instrumentally. This dual-potential aligns directly with the symbolic–substantive distinction developed in the propositions and reinforces the need for empirical work capable of distinguishing authentic translation from performative enactment.

In this integrative model, sustainability enactment is not conceptualized as a simple compliance response to external rules. Rather, it is the outcome of executive meaning-making under institutional conditions that vary in clarity, enforcement, and stakeholder coherence. ESC therefore functions as a cognitive infrastructure through which firms navigate uncertainty and volatility, shaping whether ESG commitments are translated into institutionalized practices—or remain largely symbolic.

4. Discussion and Managerial/Policy Implications

The ESC model reframes sustainability enactment as a cognitively mediated process driven by how C-suite executives notice, interpret, prioritize, and institutionalize sustainability imperatives. This view departs from dominant frameworks that emphasize governance structures, technical ESG systems, or demographic proxies for leadership impact. Instead, it positions executive cognition as a decisive mechanism under institutional fragility, where formal guidance is weak and organizational action depends more heavily on interpretive ordering and internal accountability.

This section outlines the model’s theoretical contributions and practical implications for leaders, boards, policymakers, and executive development in emerging and institutionally volatile contexts. To reduce overlap, we distinguish implications at three levels: executive action (internal sensemaking and translation), governance oversight (board influence on ESC stages), and institutional scaffolding (policy signals and enforcement).

Symbolic versus substantive sustainability enactment is also shaped by structural and contextual factors—such as resource constraints, ownership structures, investor pressure, industry characteristics, and competitive dynamics. These influences may enable or restrict what firms can do in practice. However, the ESC lens remains central because it specifies how executives interpret these constraints and pressures, which ones they treat as material, and whether they translate sustainability into enduring priorities and accountability routines rather than episodic compliance responses. In other words, while structural conditions shape the opportunity set, executive cognition shapes the interpretive and strategic pathway through which sustainability is enacted.

4.1. Theoretical Contributions

This paper makes three primary theoretical contributions to the research on sustainability leadership and governance.

First, it reframes sustainability enactment as fundamentally cognitive work rather than solely a structural or technical process. Much prior research emphasizes reporting systems, governance mechanisms, and organizational capabilities, implicitly assuming that action follows design. The ESC model instead highlights that sustainability outcomes are filtered through executive interpretation. What leaders notice, how they frame issues, and which priorities they construct determine what organizations come to regard as strategically material. By foregrounding cognition, the model expands the explanatory space of sustainability studies, suggesting that variations in sustainability performance often originate at the cognitive level rather than the structural level.

Second, the paper integrates multiple perspectives on executive influence at various levels. By drawing on Upper Echelons Theory, Institutional Theory, Strategic Leadership Theory, and sensemaking research, the ESC model shows how micro-level cognition interacts with macro-level institutional conditions. Sustainability enactment emerges not as a simple response to external mandates, but as an ongoing negotiation between institutional signals and executive judgment. This integration provides a theoretically grounded basis for analyzing sustainability strategies in volatile environments where institutions offer weak or inconsistent normative guidance.

Third, the paper extends sustainability research into fragile institutional contexts by conceptualizing ESC as a substitute governance mechanism. In environments characterized by inconsistent regulation, political interference, weak enforcement, and limited stakeholder scrutiny, formal institutions provide incomplete behavioral guidance. Under such conditions, executive cognition increasingly replaces formal governance systems as the primary driver of organizational behavior. This insight helps explain why firms operating within similar institutional environments nevertheless display widely divergent sustainability outcomes, offering a context-sensitive lens for understanding sustainability in emerging markets.

Collectively, these contributions advance a more robust account of the ESG “implementation gap” by specifying that symbolic enactment often arises not from the absence of ESG structures per se, but from misalignment across cognition and translation: sustainability is noticed and framed rhetorically, yet not prioritized in resource allocation or institutionalized into routines and incentives.

4.2. Managerial Implications for C-Suite Executives

The ESC model also carries significant implications for senior executives responsible for steering organizations through sustainability transitions. A first implication concerns executive attention and environmental scanning. In fragile institutional contexts, sustainability signals are often weak, inconsistent, or contradictory. Executives, therefore, need structured systems for noticing emerging issues early. Practices such as horizon scanning, ESG scenario analysis, and stakeholder-intelligence platforms can enhance attentional acuity, reduce blind spots, and ensure that weak sustainability cues are not ignored until they become crises.

A second implication concerns the organization’s framing of sustainability. How executives narrate sustainability—whether as an opportunity, a risk, or a mere compliance burden—strongly shapes employee engagement, resource allocation, and strategic orientation. Leaders operating in volatile contexts benefit from adopting opportunity-oriented and paradox-embracing frames that recognize constraints but emphasize long-term value creation and resilience.

Third, the model highlights the importance of explicit prioritization mechanisms. C-suite leaders routinely confront tensions between short-term financial performance and long-term sustainability commitments. ESC suggests that these trade-offs are resolved cognitively before they are resolved structurally. Embedding ESG criteria into capital budgeting, integrating sustainability risk into enterprise risk management, and using sustainability scorecards in top-management meetings help anchor sustainability within core strategic choices.

Finally, executives must translate cognition into institutionalized practice. Executive awareness and intention are insufficient unless they are embedded into governance routines, performance systems, and incentive architectures. Practical steps include aligning executive compensation with ESG targets, embedding ESG indicators into performance evaluation, and strengthening internal accountability mechanisms that reduce decoupling between disclosure and operational reality. Without this institutionalization work, sustainability commitments are more likely to remain rhetorical, episodic, or compliance-driven rather than substantively enacted over time.

4.3. Implications for Boards and Governance Actors

Boards of directors have a powerful influence on the development and expression of executive sustainability cognition. The ESC model implies that governance actors should not only oversee sustainability performance, but also shape the cognitive conditions under which executives interpret sustainability demands. One important avenue is leadership selection. Boards can prioritize the recruitment of executives who demonstrate sustainability literacy, cognitive agility, and the ability to navigate complex socio-environmental issues rather than relying solely on traditional financial or operational track records.

Beyond selection, boards can influence ESC stages directly by shaping what executives attend to, how sustainability is framed, what trade-offs are legitimized, and whether translation is enforced through accountability systems. Concretely:

Attention and interpretation (what is noticed): Boards can institutionalize sustainability agenda time by requiring periodic sustainability “issue scans,” assigning board-level oversight of material ESG risks, and mandating executive reporting on emerging stakeholder and regulatory signals.

Framing (how sustainability is understood): Board chairs and committee leads can shape framing by defining sustainability explicitly as a strategic resilience issue rather than a reputational add-on, requiring executive narratives that connect ESG to long-term business value, and insisting on explicit articulation of trade-offs rather than broad rhetoric.

Prioritization (what is resourced): Boards can influence prioritization through budget scrutiny, through board-level approval gates for sustainability capex, and by requiring ESG integration into capital allocation and strategic planning processes.

Translation (what becomes routine): Boards can strengthen translation by embedding ESG targets into executive performance evaluation, setting ESG-linked compensation and incentive structures, mandating internal controls for ESG data quality, and empowering sustainability committees with decision rights rather than advisory roles only.

These governance interventions complement (rather than duplicate) executive actions by ensuring that sensemaking is converted into binding accountability. Additionally, governance structures themselves can be recalibrated to support executive sense-making. Board-level sustainability committees should move beyond compliance monitoring to engage directly with strategic interpretation, scenario thinking, and longer-term societal implications of corporate action. Evaluation practices may also evolve: instead of focusing exclusively on ESG outcomes, boards can assess senior leaders based on their interpretive capacity—that is, their ability to attend to emerging sustainability issues, frame them rigorously, and integrate them into organizational priorities.

However, boards may face their own cognitive and incentive constraints. In fragile institutional settings, some boards may lack sustainability cognition, defer excessively to short-term financial imperatives, or be exposed to rent-seeking pressures and elite capture dynamics. The ESC lens therefore also implies a board-development agenda: enhancing board sustainability literacy, strengthening governance independence, and developing evaluative routines that reward long-term sustainability performance rather than symbolic disclosures.

Finally, boards can institutionalize feedback loops that connect external stakeholders more directly to executive deliberation. Mechanisms such as structured stakeholder dialogues, board–community interfaces, and periodic sustainability hearings enrich the information environment in which executives operate, broadening the perspectives that inform their strategic judgment. Through these practices, boards do not simply monitor sustainability performance; they help cultivate the cognitive environment that enables executives to move from symbolic to substantive sustainability enactment.

4.4. Policy Implications for Emerging and Fragile Institutional Contexts

The ESC framework has important implications for public policy in settings characterized by institutional fragility. Where regulatory systems are weak or inconsistently enforced, sustainability outcomes depend heavily on how executives interpret ambiguous signals. Strengthening sustainability performance, therefore, requires not only stricter rules but also cognitive and informational infrastructure that reduces ambiguity and supports executive sensemaking. Policy interventions that provide clearer regulatory guidelines, reliable sustainability datasets, and targeted capacity-building programs for corporate leaders can enhance interpretive clarity and reduce symbolic compliance.

A second implication concerns reducing institutional ambiguity. Regulatory inconsistency remains a significant barrier in many emerging markets. Governments can improve the effectiveness of enactment by harmonizing ESG standards, signaling credible enforcement pathways, and offering incentive mechanisms that reward long-term sustainability commitments. Such actions reduce interpretive ambiguity and help align executive judgment with societal sustainability goals.

Finally, the model highlights the value of public–private partnerships as collective sensemaking arenas. In fragile contexts, no single actor possesses complete information or capacity. Collaborations among governments, firms, and civil society can foster shared learning, diffuse best practices, and reduce the cognitive burden on executives confronting complex sustainability dilemmas.

4.5. Implications for Sustainability Practitioners and Educators

The ESC framework also carries practical implications for executive education and sustainability practice. Much current training emphasizes technical ESG knowledge, reporting standards, and compliance tools. While essential, these skills are insufficient in fragile institutional environments where executives must rely heavily on judgment and interpretation. Development initiatives should therefore focus more explicitly on strengthening cognitive capabilities underpinning ESC—systems thinking, paradox navigation, ethical reasoning, cognitive bias awareness, and sensemaking under uncertainty.

Beyond individual capability-building, the ESC perspective also underscores the importance of cultivating organizational learning. Consultants, sustainability officers, and educators can play a strategic role in creating structures that help organizations internalize sustainability knowledge over time. Examples include reflective-practice workshops, scenario simulations, peer-learning forums, and cross-functional platforms that encourage collaboration between strategy, finance, risk, and sustainability teams. Such mechanisms increase the likelihood that sustainability commitments are translated into routines and consistently enacted in practice.

4.6. Overall Significance of the Model

The ESC model emphasizes that sustainability enactment is not merely a function of external pressure or formal governance; it is fundamentally shaped by how executives think, interpret, and decide—especially when institutions provide weak guidance. By articulating the pathways through which cognition influences sustainability outcomes, this paper offers a conceptual foundation for future empirical studies and provides practical direction for leaders navigating complex ESG landscapes.

By connecting interpretive executive processes to the persistence of ESG symbolic adoption, the model provides an explanatory bridge between global sustainability pressures and the observed implementation gap in fragile institutional contexts.

5. Conclusions and Future Research

This paper advances a cognitively anchored understanding of sustainability leadership by introducing Executive Sustainability Cognition (ESC) as a central explanatory mechanism for how firms interpret and enact sustainability, particularly in fragile institutional environments. Departing from leadership models that emphasize formal governance structures, demographic proxies, or technical ESG capabilities, the ESC framework conceptualizes sustainability enactment as a layered process involving attention, interpretive framing, strategic prioritization, and organizational translation. This cognitive pathway becomes especially salient in emerging markets such as Nigeria, where inconsistent regulation, limited stakeholder scrutiny, and fluid institutional dynamics elevate the role of executive judgment in shaping organizational sustainability trajectories.

The conceptual model integrates insights from Upper Echelons Theory, Institutional Theory, Strategic Leadership Theory, and sensemaking to reveal how micro-level cognition interacts with macro-level institutional pressures. By doing so, it explains why firms operating under similar external conditions often exhibit divergent sustainability outcomes—differences rooted not primarily in resources or structures but in how executives perceive, ascribe meaning to, and act upon sustainability pressures. The related propositions suggest that sustainability leadership encompasses not only what executives do, but also how they think, particularly in uncertain situations. This cognitive emphasis offers a theoretical lens for understanding both high-performing sustainability exemplars and firms that exhibit symbolic or inconsistent ESG behaviors.

5.1. Contributions to Research and Practice

Conceptually, the paper contributes three key insights.

First, it positions ESC as a substitute governance mechanism, extending sustainability scholarship into fragile institutional contexts where formal ESG infrastructures are weak or unreliable.

Second, it bridges micro-cognitive processes with organizational and institutional analysis, offering a more integrated framework for studying sustainability leadership.

Third, it provides a fine-grained basis for analyzing how sustainability strategies emerge, evolve, or stall within executive decision systems.

Practically, the model provides boards, policymakers, and organizational leaders with a framework for diagnosing and strengthening sustainability leadership. It suggests that enhancing sustainability outcomes requires not only governance reforms but also targeted development of executive cognitive capacities, strengthened organizational learning systems, and clearer regulatory signals that support coherent sensemaking.

As a conceptual theory-building paper, this study has limitations. The ESC framework is not empirically tested here; therefore, the propositions remain theoretically grounded but unvalidated. Executive cognition may also be context-dependent, shaped by sectoral externalities, ownership structures, organizational resources, and cross-institutional variation. Accordingly, the model is best treated as an interpretive lens and research agenda that specifies plausible mechanisms, rather than a definitive explanatory account. Empirical studies are required to test boundary conditions, establish measurement validity, and assess the comparative explanatory power of ESC vis-à-vis structural and institutional drivers.

5.2. Future Research Directions

As a conceptual contribution, the ESC model opens several avenues for empirical validation and theoretical refinement. A first priority is the empirical testing of the four ESC processes—attention, interpretation, prioritization, and translation—across different sectors and institutional environments. Operationalizing these processes and examining their links to sustainability outcomes would enable researchers to assess the explanatory power of ESC relative to more traditional governance or structural variables. Comparative studies between emerging and developed markets could also illuminate how institutional robustness moderates the effects of executive cognition.

To guide operationalization, future studies may capture each ESC stage using complementary indicators: (i) attention via sustainability salience in CEO/TMT communications (annual reports, earnings calls, speeches) and agenda allocation in governance minutes; (ii) framing via systematic content analysis distinguishing compliance/risk frames from opportunity/paradox frames; (iii) prioritization via resource allocation patterns, ESG-linked capital expenditure/operating expenditure, and incentive weighting in compensation systems; and (iv) translation via governance embedding (committee decision rights), KPI routines, assurance mechanisms, and incentive alignment.

Beyond testing relationships, future research would benefit from multi-method examinations of executive sensemaking in practice. In-depth qualitative approaches, such as cognitive interviewing, ethnography of top management teams, or executive diary studies, can capture how leaders interpret sustainability cues in real time, while quantitative designs can develop measurement scales for ESC and subject the propositions to longitudinal or multilevel testing.

Several research designs are especially plausible. First, content analysis of executive discourse (CEO letters, speeches, earnings calls) can generate time-varying measures of attention and framing, which can be linked to panel ESG performance data. Second, matched firm-level panel datasets in emerging markets can test whether cognitive governance indicators predict divergence in ESG outcomes under similar institutional pressures. Third, mixed-method designs combining interviews with sustainability officers and archival governance documentation can triangulate translation mechanisms and detect disclosure–practice decoupling. Fourth, surveys of top management teams can directly measure cognitive orientations, prioritization logics, and learning climate, enabling multilevel modeling of ESC processes and moderators.

Another promising line of inquiry concerns the interaction between ESC and organizational structures. Governance systems, sustainability committees, and digital ESG tools may either amplify or dampen the influence of executive cognition, particularly in data-poor or fragile institutional contexts. Understanding these interactions would clarify whether cognition substitutes for weak structures or is most effective when coupled with them.

A further research direction is to explore the antecedents of ESC. Executive national culture, professional identity, ethical orientation, and exposure to sustainability discourses are likely to influence how leaders perceive sustainability. Explaining why cognition varies among executives facing similar external pressures would deepen the micro foundations of sustainability governance.

Finally, future work could examine ESC as a mechanism for cross-firm diffusion of sustainability practices. Investigating how cognitive frames travel across supply chains, industry networks, and public–private partnerships may reveal how shared meaning systems accelerate or impede collective sustainability action, particularly in emerging-market settings.

5.3. Conclusions

As global sustainability pressures intensify and institutional environments become increasingly heterogeneous, understanding how executives think about sustainability—not simply how they structure it—becomes essential. The ESC model provides a theory-driven foundation for analyzing this cognitive terrain, explaining variation in sustainability enactment where traditional models fall short. By shifting attention from structures and outputs to cognition and interpretation, the model offers scholars and practitioners a more nuanced lens for understanding the drivers of authentic, strategic, and context-sensitive sustainability leadership. It is hoped that this framework will catalyze new empirical work, inform executive development, and support more adaptive and meaningful sustainability transitions across diverse organizational and institutional settings.