Natural Environmental Change and Firm Sustainable Development in China: The Moderating Effect of Slack Resources and Digital Transformation

Abstract

1. Introduction

2. Literature Review

2.1. Definition and Composite of Natural Environmental Change

2.2. Composite of Sustainable Development

2.3. Natural Environmental Changes, Resource Slack, and Digital Transformation Under the Resource-Based View

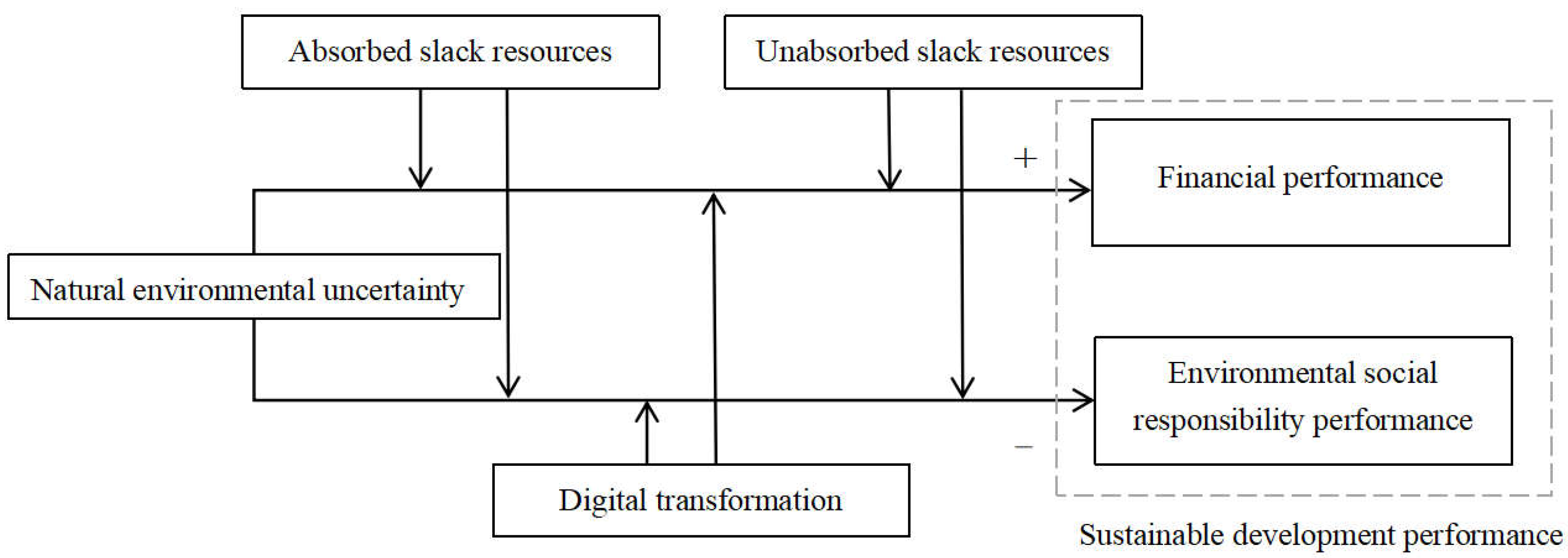

3. Hypothesis Development

3.1. Natural Environmental Change and Firm Sustainable Performance

3.2. The Moderating Effect of Slack Resources

3.2.1. Absorbed Slack Resources

3.2.2. Unabsorbed Slack Resources

3.3. The Moderating Effect of Digital Transformation

4. Methodology

4.1. Sample Selection and Data Source

4.2. Measurement

4.2.1. Dependent Variables

4.2.2. Independent Variable

- (1)

- Construct the original data as a judgment matrix R:R = (I = 1, 2, …, n; j = 1, 2, …, m)

- (2)

- The data of the judgment matrix R are normalized to become the standardized matrix U. Different standardization methods are adopted according to the positive and negative directions of the indicators:rmax and rmin represent the most satisfactory or least satisfactory aspects of different things, respectively, under the same evaluation index (the larger, the more satisfied, or the smaller, the more satisfied).

- (3)

- Calculate the probability Pij of each state and construct the probability matrix:

- (4)

- Calculate the entropy of each evaluation index as:

- (5)

- The entropy weight Wi of the evaluation index i is:

4.2.3. Moderating Variables

4.2.4. Control Variables

4.3. Method and Research Model

5. Empirical Results

5.1. Descriptive Statistics

5.2. Correlation Matrix

5.3. Regression Results

5.3.1. Impact of Natural Environmental Change and Sustainable Performance

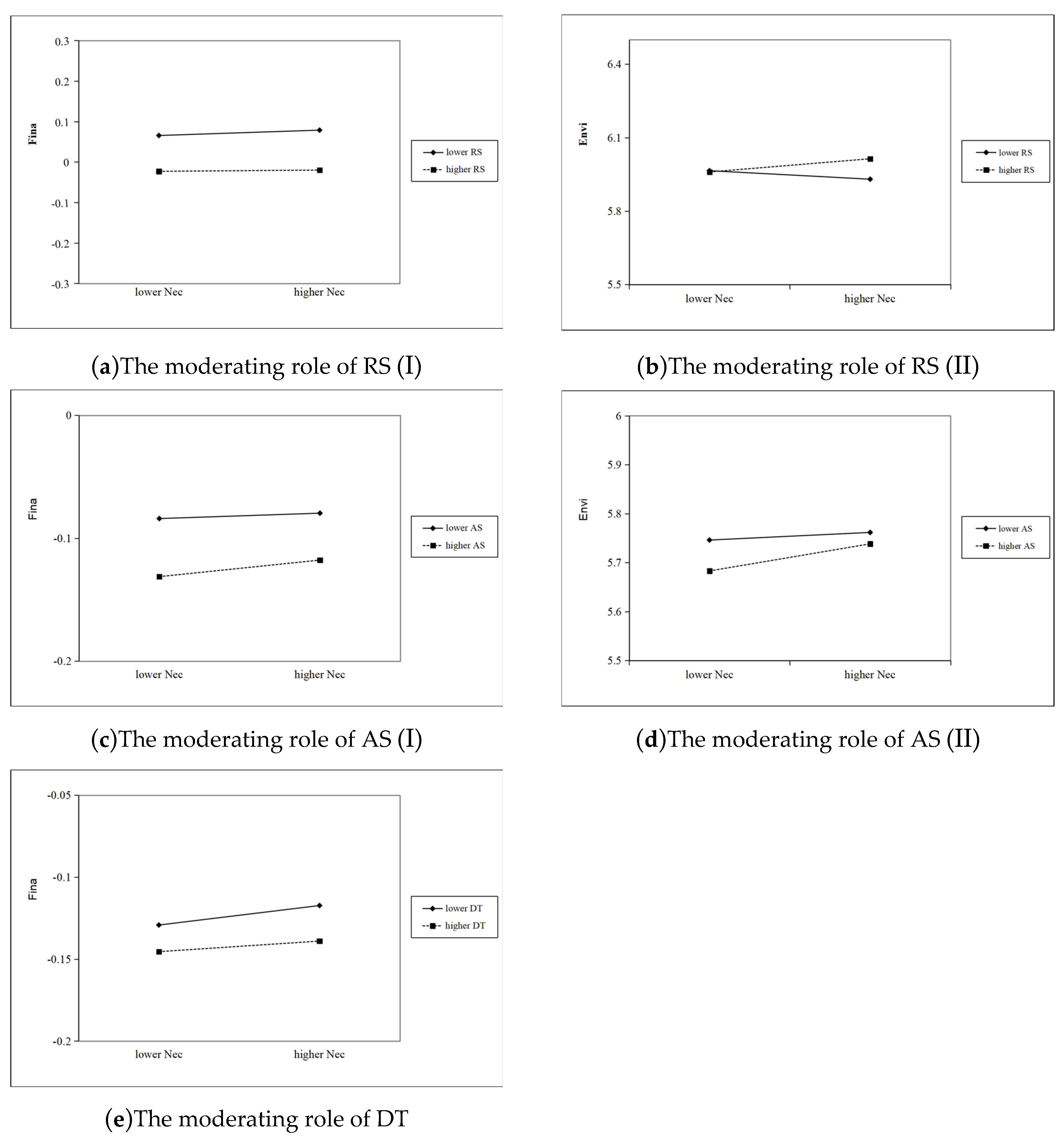

5.3.2. Moderating Effect

5.4. Robustness Test

5.4.1. Substitute Variables

5.4.2. Stricter Fixed-Effects Model

5.5. Endogeneity Issues

5.6. Industry Heterogeneity

5.6.1. High-Tech Enterprises and Non-High-Tech Enterprises

5.6.2. Energy-Intensive Enterprises and Non-Energy-Intensive Enterprises

5.6.3. Manufacturing Industry and Non-Manufacturing Industry

6. Discussion

7. Contribution and Implication

7.1. Theoretical Contribution

7.2. Practical Implications

8. Conclusions and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bertrand, J.L.; Parnaudeau, M. Understanding the economic effects of abnormal weather to mitigate the risk of business failures. J. Bus. Res. 2019, 98, 391–402. [Google Scholar] [CrossRef]

- Prasad, P.; Elmes, M. In the name of the practical: Unearthing the hegemony of pragmatics in the discourse of environmental management. J. Manag. Stud. 2005, 42, 845–867. [Google Scholar] [CrossRef]

- Etzion, D. Research on organizations and the natural environment, 1992–present: A review. J. Manag. 2007, 33, 637–664. [Google Scholar] [CrossRef]

- Pankratz, N.; Bauer, R.; Derwall, J. Climate change, firm performance, and investor surprises. Manag. Sci. 2023, 69, 7352–7398. [Google Scholar] [CrossRef]

- Li, C.; Tang, W.; Liang, F.; Wang, Z. The impact of climate change on corporate ESG performance: The role of resource misallocation in enterprises. J. Clean. Prod. 2024, 445, 141263. [Google Scholar] [CrossRef]

- Elijido-Ten, E.O. Does recognition of climate change related risks and opportunities determine sustainability performance? J. Clean. Prod. 2017, 141, 956–966. [Google Scholar] [CrossRef]

- Tashman, P.; Rivera, J. Ecological uncertainty, adaptation, and mitigation in the US ski resort industry: Managing resource dependence and institutional pressures. Strateg. Manag. J. 2016, 37, 1507–1525. [Google Scholar] [CrossRef]

- Mao, Y.; Li, P.; Li, Y. The relationship between slack resources and organizational resilience: The moderating role of dual learning. Heliyon 2023, 9, e14044. [Google Scholar] [CrossRef]

- Cao, W.; Cai, Z.; Yao, X.; Chen, L. Digital transformation to help carbon neutrality and green sustainable development based on the metaverse. Sustainability 2023, 15, 7132. [Google Scholar] [CrossRef]

- Chapin, F.S., III; Kofinas, G.P.; Folke, C. (Eds.) Principles of Ecosystem Stewardship: Resilience-Based Natural Resource Management in a Changing World; Springer Science & Business Media: New York, NY, USA, 2009. [Google Scholar] [CrossRef]

- Swedlow, B. Cultural surprises as sources of sudden, big policy change. PS Political Sci. Politics 2011, 44, 736–739. [Google Scholar] [CrossRef]

- Li, X. Physical climate change exposure and firms’ adaptation strategy. Strateg. Manag. J. 2024, 46, 750–789. [Google Scholar] [CrossRef]

- He, F.; Hao, J.; Lucey, B. Effects of climate risk on corporate green innovation cycles. Technol. Forecast. Soc. Change 2024, 205, 123447. [Google Scholar] [CrossRef]

- Aguinaldo, M.E.C.; Daddi, T.; Hamza, M.; Gasbarro, F. Climate change perspectives and adaptation strategies of business enterprises: A case study from Italy. Int. J. Sustain. Dev. World Ecol. 2019, 26, 129–140. [Google Scholar] [CrossRef]

- Biermann, F.; Kanie, N.; Kim, R.E. Global governance by goal-setting: The novel approach of the UN Sustainable Development Goals. Curr. Opin. Environ. Sustain. 2017, 26, 26–31. [Google Scholar] [CrossRef]

- Chowdhury, S.B.; DasGupta, R.; Choudhury, B.K.; Sen, N. Evolving alliance between corporate environmental performance and financial performance: A bibliometric analysis and systematic literature review. Bus. Soc. Rev. 2023, 128, 95–131. [Google Scholar] [CrossRef]

- Walsh, P.R. A license to operate? An empirical examination of the influence of environmental and social performance on the financial performance of mining sector firms. Int. J. Innov. Sustain. Dev. 2014, 8, 190–206. [Google Scholar] [CrossRef]

- Shahzad, M.; Qu, Y.; Zafar, A.U.; Rehman, S.U.; Islam, T. Exploring the influence of knowledge management process on corporate sustainable performance through green innovation. J. Knowl. Manag. 2020, 24, 2079–2106. [Google Scholar] [CrossRef]

- Helfat, C.E.; Kaul, A.; Ketchen, D.J., Jr.; Barney, J.B.; Chatain, O.; Singh, H. Renewing the resource-based view: New contexts, new concepts, and new methods. Strateg. Manag. J. 2023, 44, 1357–1390. [Google Scholar] [CrossRef]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Pindyck, R.S. Irreversibilities and the timing of environmental policy. Resour. Energy Econ. 2000, 22, 233–259. [Google Scholar] [CrossRef]

- Williams, S.; Schaefer, A. Small and medium-sized enterprises and sustainability: Managers’ values and engagement with environmental and climate change issues. Bus. Strategy Environ. 2013, 22, 173–186. [Google Scholar] [CrossRef]

- Alam, A.; Du, A.M.; Rahman, M.; Yazdifar, H.; Abbasi, K. SMEs respond to climate change: Evidence from developing countries. Technol. Forecast. Soc. Change 2022, 185, 122087. [Google Scholar] [CrossRef]

- Conz, E.; Magnani, G.; Zucchella, A.; De Massis, A. Responding to unexpected crises: The roles of slack resources and entrepreneurial attitude to build resilience. Small Bus. Econ. 2023, 61, 957–981. [Google Scholar] [CrossRef] [PubMed]

- Adner, R.; Puranam, P.; Zhu, F. What is different about digital strategy? From quantitative to qualitative change. Strategy Sci. 2019, 4, 253–261. [Google Scholar] [CrossRef]

- Zhao, X.; Li, X.; Li, Y.; Wang, Z. The impact of digital transformation on firm performance. Ind. Manag. Data Syst. 2024, 124, 2567–2587. [Google Scholar] [CrossRef]

- Liu, Y.; He, Q. Digital transformation, external financing, and enterprise resource allocation efficiency. Manag. Decis. Econ. 2024, 45, 2321–2335. [Google Scholar] [CrossRef]

- Yang, Y.; Guo, J. Can Supplier Concentration Improve Corporate Risk Taking? Moderating Effects of Digital Transformation. Sustainability 2022, 14, 11664. [Google Scholar] [CrossRef]

- Heredia, J.; Castillo-Vergara, M.; Geldes, C.; Gamarra, F.M.C.; Flores, A.; Heredia, W. How do digital capabilities affect firm performance? The mediating role of technological capabilities in the “new normal”. J. Innov. Knowl. 2022, 7, 100171. [Google Scholar] [CrossRef]

- Peng, Y.; Tao, C. Can digital transformation promote enterprise performance?—From the perspective of public policy and innovation. J. Innov. Knowl. 2022, 7, 100198. [Google Scholar] [CrossRef]

- Zhai, H.; Yang, M.; Chan, K.C. Does digital transformation enhance a firm’s performance? Evidence from China. Technol. Soc. 2022, 68, 101841. [Google Scholar] [CrossRef]

- Guo, X.; Li, M.; Wang, Y.; Mardani, A. Does digital transformation improve the firm’s performance? From the perspective of digitalization paradox and managerial myopia. J. Bus. Res. 2023, 163, 113868. [Google Scholar] [CrossRef]

- Guo, L.; Xu, L. The effects of digital transformation on firm performance: Evidence from China’s manufacturing sector. Sustainability 2021, 13, 12844. [Google Scholar] [CrossRef]

- Viete, S.; Erdsiek, D. Mobile information technologies and firm performance: The role of employee autonomy. Inf. Econ. Policy 2020, 51, 100863. [Google Scholar] [CrossRef]

- Elijido-Ten, E.O.; Clarkson, P. Going beyond climate change risk management: Insights from the world’s largest most sustainable corporations. J. Bus. Ethics 2019, 157, 1067–1089. [Google Scholar] [CrossRef]

- Roberts, N. Absorptive capacity, organizational antecedents, and environmental dynamism. J. Bus. Res. 2015, 68, 2426–2433. [Google Scholar] [CrossRef]

- Schilke, O. On the contingent value of dynamic capabilities for competitive advantage: The nonlinear moderating effect of environmental dynamism. Strateg. Manag. J. 2014, 35, 179–203. [Google Scholar] [CrossRef]

- Ling, S.; Gao, H. How does climate risk matter for corporate green innovation? Empirical evidence from heavy-polluting listed companies in China. Front. Energy Res. 2023, 11, 1177927. [Google Scholar] [CrossRef]

- Ren, X.; Li, W.; Li, Y. Climate risk, digital transformation and corporate green innovation efficiency: Evidence from China. Technol. Forecast. Soc. Change 2024, 209, 123777. [Google Scholar] [CrossRef]

- Amran, A.; Ooi, S.K.; Wong, C.Y.; Hashim, F. Business strategy for climate change: An ASEAN perspective. Corp. Soc. Responsib. Environ. Manag. 2016, 23, 213–227. [Google Scholar] [CrossRef]

- Argiles-Bosch, J.M.; Garcia-Blandon, J.; Martinez-Blasco, M. The impact of absorbed and unabsorbed slack on firm profitability: Implications for resource redeployment. In Resource Redeployment and Corporate Strategy; Emerald Group Publishing Limited: Leeds, UK, 2016; pp. 371–395. [Google Scholar]

- Miller, D. The architecture of simplicity. Acad. Manag. Rev. 1993, 18, 116–138. [Google Scholar] [CrossRef]

- Xu, E.; Yang, H.; Quan, J.M.; Lu, Y. Organizational slack and corporate social performance: Empirical evidence from China’s public firms. Asia Pac. J. Manag. 2015, 32, 181–198. [Google Scholar] [CrossRef]

- Symeou, P.C.; Zyglidopoulos, S.; Gardberg, N.A. Corporate environmental performance: Revisiting the role of organizational slack. J. Bus. Res. 2019, 96, 169–182. [Google Scholar] [CrossRef]

- Xie, X.; Zhang, Y. Transformation Through Servitization: How Buffer Resources and Social Capital Support Transformation in Manufacturing Companies. Sustainability 2024, 16, 10728. [Google Scholar] [CrossRef]

- Maiti, M.; Krakovich, V.; Shams, S.R.; Vukovic, D.B. Resource-based model for small innovative enterprises. Manag. Decis. 2020, 58, 1525–1541. [Google Scholar] [CrossRef]

- Gebauer, H.; Fleisch, E.; Lamprecht, C.; Wortmann, F. Growth paths for overcoming the digitalization paradox. Bus. Horiz. 2020, 63, 313–323. [Google Scholar] [CrossRef]

- Alexopoulos, I.; Kounetas, K.; Tzelepis, D. Environmental and financial performance. Is there a win-win or a win-loss situation? Evidence from the Greek manufacturing. J. Clean. Prod. 2018, 197, 1275–1283. [Google Scholar] [CrossRef]

- Alsaifi, K.; Elnahass, M.; Salama, A. Carbon disclosure and financial performance: UK environmental policy. Bus. Strategy Environ. 2020, 29, 711–726. [Google Scholar] [CrossRef]

- Lian, Y.; Ye, T.; Zhang, Y.; Zhang, L. How does corporate ESG performance affect bond credit spreads: Empirical evidence from China. Int. Rev. Econ. Financ. 2023, 85, 352–371. [Google Scholar] [CrossRef]

- Duncan, R.B. Characteristics of organizational environments and perceived environmental uncertainty. Adm. Sci. Q. 1972, 17, 313–327. [Google Scholar] [CrossRef]

- Milliken, F.J. Three types of perceived uncertainty about the environment: State, effect, and response uncertainty. Acad. Manag. Rev. 1987, 12, 133–143. [Google Scholar] [CrossRef]

- Li, Y.; Sun, M.; Yuan, G.; Zhou, Q.; Liu, J. Study on development sustainability of atmospheric environment in Northeast China by rough set and entropy weight method. Sustainability 2019, 11, 3793. [Google Scholar] [CrossRef]

- Huber, G.P.; O’Connell, M.J.; Cummings, L.L. Perceived environmental uncertainty: Effects of information and structure. Acad. Manag. J. 1975, 18, 725–740. [Google Scholar] [CrossRef]

- Dou, Y.; Xue, X.; Zhao, Z.; Luo, X.; Ji, A.; Luo, T. Multi-index evaluation for flood disaster from sustainable perspective: A case study of Xinjiang in China. Int. J. Environ. Res. Public Health 2018, 15, 1983. [Google Scholar] [CrossRef]

- Li, H.; Li, J. Risk governance and sustainability: A scientometric analysis and literature review. Sustainability 2021, 13, 12015. [Google Scholar] [CrossRef]

- Lee, C.C.; Zeng, M.; Luo, K. How does climate change affect food security? Evidence from China. Environ. Impact Assess. Rev. 2024, 104, 107324. [Google Scholar] [CrossRef]

- Chen, S.; Gong, B. Response and adaptation of agriculture to climate change: Evidence from China. J. Dev. Econ. 2021, 148, 102557. [Google Scholar] [CrossRef]

- Wu, K.; Fu, Y.; Kong, D. Does the digital transformation of enterprises affect stock price crash risk? Financ. Res. Lett. 2022, 48, 102888. [Google Scholar] [CrossRef]

- Tyler, B.B.; Caner, T. New product introductions below aspirations, slack and R&D alliances: A behavioral perspective. Strateg. Manag. J. 2016, 37, 896–910. [Google Scholar] [CrossRef]

- Cheng, L. Does digital transformation matter for trade credit provision? Evidence from China. Pac. Basin Financ. J. 2024, 86, 102422. [Google Scholar] [CrossRef]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise digital transformation and capital market performance: Empirical evidence from stock liquidity. Manag. World 2021, 37, 130–144. [Google Scholar]

- Mishra, P.; Yadav, M. Environmental capabilities, proactive environmental strategy and competitive advantage: A natural-resource-based view of firms operating in India. J. Clean. Prod. 2021, 291, 125249. [Google Scholar] [CrossRef]

- Zhu, W.; Lu, S.; Huang, P.; Hu, X.; Wei, J. Predictors of coping behavior during the COVID-19 pandemic: Evidence from China. J. Contingencies Crisis Manag. 2023, 31, 797–808. [Google Scholar] [CrossRef]

- Sun, W.; Chen, S.; Jiao, Y.; Feng, X. How does ESG constrain corporate earnings management? Evidence from China. Financ. Res. Lett. 2024, 61, 104983. [Google Scholar] [CrossRef]

- Wei, L.; Li, M. Digital transformation, financing constraints and firm growth performance–From the perspective of financing channels. Financ. Res. Lett. 2024, 63, 105272. [Google Scholar] [CrossRef]

- Sun, Y.; Yang, Y.; Huang, N.; Zou, X. The impacts of climate change risks on financial performance of mining industry: Evidence from listed companies in China. Resour. Policy 2020, 69, 101828. [Google Scholar] [CrossRef]

- Sharfman, M.P.; Wolf, G.; Chase, R.B.; Tansik, D.A. Antecedents of organizational slack. Acad. Manag. Rev. 1988, 13, 601–614. [Google Scholar] [CrossRef]

- Hart, S.L.; Dowell, G. Invited editorial: A natural-resource-based view of the firm: Fifteen years after. J. Manag. 2011, 37, 1464–1479. [Google Scholar] [CrossRef]

| Target Level | Factor Layer | Indicator Layer | Indicator Measurements | Direction of Indicators |

|---|---|---|---|---|

| Index of natural environmental change | Physical change | Change in annual precipitation X1 | Total average precipitation difference | + |

| Change in average annual temperature X2 | Global mean temperature difference | + | ||

| Annual wind variations X3 | Difference in annual wind speeds | + | ||

| Perceived change | Climate change awareness X4 | Climate risk index | + |

| Typhoon, tsunami, flood, drought, fire, extreme, heavy rain, severe, waterlogging, strong wind, sandstorm, hail, special, drought, hurricane, frost, flood, storm, mudslide, landslide, flood, flood disaster, drought, heavy snow, frost, snow disaster, ice and snow, climate, weather, nature, humidity, water temperature, temperature drop, cold, air temperature, rainfall, temperature, rain, rainy season, rain conditions, freezing, precipitation, early frost, low temperature, high temperature, rain and snow, snowfall, storm, frost, warm winter, severe winter, lightning strike, climate change, snowfall, extreme heat, forest fires, precipitation, blizzard, sandstorm, flood, energy conservation, electricity, energy, cleanliness, ecology, water conservation, environment, green, transformation, solar energy, recycling, utilization rate, wind power, natural gas, recycling, regeneration, high-efficiency photovoltaic, emission reduction, energy consumption reduction, disasters, earthquakes, global warming, tropical storms, water levels, lightning, carbon dioxide, atmosphere, fog, rainfall, precipitation, greenhouse gases |

| Types of Variables | Names of Variables | Symbols | Descriptions |

|---|---|---|---|

| Control variables | Company size | Size | The natural logarithm of the company’s total assets |

| Company age | Age | Year of establishment | |

| Shareholding ratio of the largest shareholder | No1 | Number of shares held by the largest shareholder/total number of shares in the company | |

| Intangible asset ratio | Int | Intangible assets/total assets. | |

| Equity ratio | ER | Total liabilities/total owners’ equity | |

| Asset–liability ratio | Lev | Total liabilities/total assets | |

| Government subsidy intensity | Sub | Natural logarithm of government subsidies received by enterprises | |

| Financing constraints | SA | SA index | |

| Capital intensity | CI | Changes in fixed assets/sales revenue | |

| Cash flow ratio | CF | Net cash flows from operating activities/total assets | |

| Impact of the epidemic | Peri | The dummy variable of “outbreak time (2020)” is 1 after the outbreak, or 0 otherwise. |

| Variables | Samples | Mean | Median | SD | Minimum Value | Maximum Value |

|---|---|---|---|---|---|---|

| Fina | 40,539 | 0.052 | 0.068 | 0.141 | −0.788 | 0.334 |

| Envi | 40,539 | 4.133 | 4.000 | 0.916 | 1.500 | 6.000 |

| Nec | 40,539 | 0.083 | 0.074 | 0.043 | 0.016 | 0.209 |

| RS | 39,775 | 0.162 | 0.125 | 0.131 | 0.013 | 0.691 |

| AS | 40,442 | 0.680 | 0.575 | 0.514 | 0.055 | 3.043 |

| DT | 40,537 | 12.910 | 2.000 | 27.860 | 0.000 | 172.000 |

| Size | 40,537 | 8.351 | 8.146 | 1.288 | 6.024 | 12.570 |

| Age | 40,531 | 18.550 | 18.000 | 6.056 | 5.000 | 34.000 |

| No1 | 40,539 | 0.338 | 0.315 | 0.148 | 0.084 | 0.743 |

| Int | 40,539 | 0.046 | 0.033 | 0.050 | 0.000 | 0.323 |

| ER | 40,539 | 1.056 | 0.661 | 1.319 | 0.053 | 9.101 |

| Lev | 40,539 | 0.408 | 0.398 | 0.205 | 0.050 | 0.901 |

| Sub | 39,873 | 16.290 | 16.290 | 1.525 | 11.720 | 20.220 |

| SA | 40,537 | −3.825 | −3.829 | 0.264 | −4.470 | −3.116 |

| CI | 40,525 | 2.490 | 1.910 | 2.175 | 0.401 | 16.180 |

| Peri | 40,539 | 0.417 | 0.000 | 0.493 | 0.000 | 1.000 |

| CF | 39,918 | 0.048 | 0.047 | 0.068 | −0.161 | 0.242 |

| Fina | Envi | Nec | Size | Age | No1 | Int | ER | Lev | Sub | SA | CI | CF | Peri | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fina | 1 | |||||||||||||

| Envi | 0.194 *** | 1 | ||||||||||||

| Nec | 0.025 *** | 0.014 *** | 1 | |||||||||||

| Size | 0.097 *** | 0.193 *** | 0.040 *** | 1 | ||||||||||

| Age | −0.073 *** | −0.059 *** | 0.045 *** | 0.192 *** | 1 | |||||||||

| No1 | 0.141 *** | 0.089 *** | 0.011 ** | 0.175 *** | −0.109 *** | 1 | ||||||||

| Int | −0.033 *** | −0.051 *** | 0.024 *** | 0.073 *** | 0.028 *** | 0.035 *** | 1 | |||||||

| ER | −0.315 *** | −0.162 *** | 0.035 *** | 0.325 *** | 0.126 *** | 0.003 | 0.019 *** | 1 | ||||||

| Lev | −0.217 *** | −0.143 *** | 0.075 *** | 0.470 *** | 0.161 *** | 0.020 *** | 0.068 *** | 0.801 *** | 1 | |||||

| Sub | 0.096 *** | 0.204 *** | 0.023 *** | 0.646 *** | 0.079 *** | 0.081 *** | 0.017 *** | 0.154 *** | 0.273 *** | 1 | ||||

| SA | 0.072 *** | 0.098 *** | −0.055 *** | −0.053 *** | −0.905 *** | 0.146 *** | −0.024 *** | −0.035 *** | −0.095 *** | −0.008 | 1 | |||

| CI | −0.169 *** | −0.060 *** | −0.005 | 0.024 *** | 0.042 *** | −0.070 *** | 0.061 *** | 0.034 *** | −0.081 *** | −0.119 *** | 0.012 ** | 1 | ||

| CF | 0.329 *** | 0.107 *** | 0.019 *** | 0.110 *** | 0.034 ** | 0.115 *** | 0.062 *** | −0.138 *** | −0.136 *** | 0.118 *** | −0.031 *** | −0.170 *** | 1 | |

| Peri | −0.061 *** | 0.067 *** | 0.151 *** | 0.097 *** | 0.351 *** | −0.088 *** | −0.044 *** | −0.022 *** | −0.022 *** | 0.104 *** | −0.322 *** | 0.063 *** | 0.022 *** | 1 |

| (1) Fina | (2) Envi | |

|---|---|---|

| Nec | 0.108 *** | −0.425 *** |

| (5.55) | (−3.67) | |

| Size | 0.046 *** | 0.253 *** |

| (28.55) | (26.51) | |

| Age | 0.006 *** | 0.045 *** |

| (2.74) | (3.63) | |

| Nol | 0.137 *** | 0.278 *** |

| (13.59) | (4.65) | |

| Int | −0.291 *** | −0.350 *** |

| (−13.06) | (−2.65) | |

| ER | −0.052 *** | −0.029 *** |

| (−49.93) | (−4.65) | |

| Lev | −0.048 *** | −0.850 *** |

| (−5.72) | (−17.00) | |

| Sub | −0.001 | 0.016 *** |

| (−0.74) | (3.67) | |

| SA | 0.043 *** | 1.118 *** |

| (3.86) | (16.92) | |

| CI | −0.015 *** | −0.025 *** |

| (−27.99) | (−8.14) | |

| Peri | −0.170 *** | −0.092 |

| (−6.41) | (−0.59) | |

| CF | 0.356 ** | −0.308 *** |

| (33.04) | (−4.81) | |

| N | 38,632 | 39,271 |

| Year FE | control | control |

| Firm FE | control | control |

| F | 455.83 | 95.39 |

| R2 | 0.241 | 0.062 |

| (3) Fina | (4) Envi | |

|---|---|---|

| Nec | 0.095 *** | −0.464 *** |

| (4.93) | (−3.98) | |

| RS | −0.358 *** | −0.175 ** |

| (−31.34) | (−2.55) | |

| Nec * RS | −0.448 ** | 3.928 *** |

| (−3.49) | (5.08) | |

| Size | 0.032 *** | 0.253 *** |

| (18.99) | (25.22) | |

| Age | 0.006 *** | 0.049 *** |

| (3.15) | (3.95) | |

| Nol | 0.127 *** | −0.248 *** |

| (12.66) | (4.11) | |

| Int | −0.265 *** | −0.392 *** |

| (−11.81) | (−2.90) | |

| ER | −0.051 *** | −0.027 *** |

| (−49.20) | (−4.38) | |

| Lev | −0.048 *** | −0.862 *** |

| (−5.66) | (−17.05) | |

| Sub | 0.002 ** | 0.017 *** |

| (2.39) | (3.87) | |

| SA | 0.052 *** | 1.185 *** |

| (4.61) | (17.51) | |

| CI | −0.006 *** | −0.021 *** |

| (−9.20) | (−5.52) | |

| Peri | −0.166 *** | −0.112 |

| (−6.35) | (−0.71) | |

| CF | 0.339 *** | −0.321 *** |

| (31.64) | (−4.98) | |

| N | 38,632 | 38,632 |

| Year FE | control | control |

| Firm FE | control | control |

| F | 465.06 | 90.07 |

| R2 | 0.263 | 0.065 |

| (5) Fina | (6) Envi | |

|---|---|---|

| Nec | 0.103 *** | −0.439 *** |

| (5.30) | (−3.79) | |

| AS | −0.042 *** | −0.079 *** |

| (−15.16) | (−4.85) | |

| Nec * AS | 0.102 *** | 0.447 ** |

| (3.25) | (2.39) | |

| Size | 0.044 *** | 0.250 *** |

| (27.43) | (26.06) | |

| Age | 0.005 ** | 0.044 *** |

| (2.54) | (3.56) | |

| Nol | 0.130 *** | 0.266 *** |

| (12.95) | (4.46) | |

| Int | −0.238 *** | −0.249 *** |

| (−10.63) | (−1.87) | |

| ER | −0.051 *** | −0.027 *** |

| (−49.35) | (−4.41) | |

| Lev | 0.019 ** | −0.722 *** |

| (2.03) | (−12.77) | |

| Sub | −0.0003 | 0.016 *** |

| (−0.41) | (3.79) | |

| SA | 0.041 *** | 1.112 *** |

| (3.68) | (16.84) | |

| CI | −0.014 *** | −0.025 *** |

| (−27.09) | (−7.85) | |

| Peri | −0.165 *** | −0.083 |

| (−6.24) | (−0.53) | |

| CF | 0.359*** | −0.306 *** |

| (33.33) | (−4.78) | |

| N | 39,188 | 39,188 |

| Year FE | control | control |

| Firm FE | control | control |

| F | 432.69 | 89.11 |

| R2 | 0.246 | 0.063 |

| (7) Fina | (8) Envi | |

|---|---|---|

| Nec | 0.106 *** | −0.418 *** |

| (5.45) | (−3.61) | |

| DT | −0.0003 *** | 0.000 |

| (−7.67) | (1.43) | |

| Nec * DT | −0.001 * | 0.005 |

| (−1.75) | (1.42) | |

| Size | 0.048 *** | 0.252 *** |

| (29.31) | (26.08) | |

| Age | 0.005 ** | 0.046 *** |

| (2.41) | (3.68) | |

| Nol | 0.132 *** | 0.283 *** |

| (13.15) | (4.74) | |

| Int | −0.288 *** | −0.351 *** |

| (−12.97) | (−2.66) | |

| ER | −0.052 *** | −0.029 *** |

| (−50.07) | (−4.62) | |

| Lev | −0.047 *** | −0.851 *** |

| (5.64) | (−17.03) | |

| Sub | −0.0005 | 0.016 *** |

| (−0.62) | (3.65) | |

| SA | 0.037 *** | 1.122 *** |

| (3.33) | (16.94) | |

| CI | −0.015 *** | −0.025 *** |

| (−28.20) | (−8.11) | |

| Peri | −0.163 *** | −0.100 |

| (−6.12) | (−0.64) | |

| CF | 0.355 *** | −0.307 *** |

| (32.95) | (−4.79) | |

| N | 39,270 | 39,270 |

| Year FE | control | control |

| Firm FE | control | control |

| F | 423.75 | 88.19 |

| R2 | 0.242 | 0.062 |

| Fina | Envi | |

|---|---|---|

| Nec | 0.033 *** | −1.661 *** |

| (4.23) | (−2.60) | |

| RS | −0.166 *** | −1.201 *** |

| (−35.44) | (−3.19) | |

| Nec * RS | −0.181 *** | 20.866 *** |

| (−3.44) | (4.93) | |

| Size | 0.012 *** | 1.320 *** |

| (17.14) | (24.00) | |

| Age | 0.002 *** | 0.214 *** |

| (2.91) | (3.16) | |

| Nol | 0.061 *** | 0.822 ** |

| (14.92) | (2.49) | |

| Int | −0.134 *** | −2.11 *** |

| (−14.60) | (−2.86) | |

| ER | −0.004 *** | −0.165 *** |

| (−9.73) | (−4.83) | |

| Lev | −0.131 *** | −4.680 *** |

| (−38.02) | (−16.90) | |

| Sub | 0.001 ** | 0.063 *** |

| (3.45) | (2.63) | |

| SA | 0.028 *** | 6.149 *** |

| (6.09) | (16.59) | |

| CI | −0.004 *** | −0.119 *** |

| (−15.97) | (−5.76) | |

| Peri | −0.076 *** | 0.288 |

| (−7.06) | (0.33) | |

| CF | 0.199 *** | −1.522 *** |

| (45.44) | (−4.31) | |

| N | 38,629 | 38,632 |

| Year FE | control | control |

| Firm FE | control | control |

| F | 567.33 | 88.77 |

| R2 | 0.303 | 0.064 |

| Fina | Envi | |

|---|---|---|

| Nec | 0.036 *** | −1.547 ** |

| (4.61) | (−2.44) | |

| AS | −0.016 *** | −0.466 *** |

| (−14.08) | (−5.22) | |

| Nec * AS | 0.042 *** | 2.203 *** |

| (3.31) | (2.15) | |

| Size | 0.017 *** | 1.309 *** |

| (26.50) | (24.96) | |

| Age | 0.002 ** | 0.186 *** |

| (2.32) | (2.75) | |

| Nol | 0.063 *** | 0.882 *** |

| (15.29) | (2.70) | |

| Int | −0.127 *** | −1.274 ** |

| (−13.81) | (−1.74) | |

| ER | −0.004 *** | −0.165 *** |

| (−9.87) | (−4.88) | |

| Lev | 0.106 ** | −3.867 *** |

| (−27.16) | (−12.50) | |

| Sub | 0.00001 | 0.059 *** |

| (0.04) | (2.49) | |

| SA | 0.022 *** | 5.78 *** |

| (4.92) | (15.99) | |

| CI | −0.008 *** | −0.141 *** |

| (−37.33) | (−8.23) | |

| Peri | −0.076 *** | 0.466 |

| (−6.99) | (0.54) | |

| CF | 0.207 *** | −1.416 *** |

| (46.96) | (−4.04) | |

| N | 39,188 | 39,188 |

| Year FE | control | control |

| Firm FE | control | control |

| F | 517.61 | 88.01 |

| R2 | 0.281 | 0.062 |

| Fina | Envi | |

|---|---|---|

| Nec | 0.038 *** | −1.434 *** |

| (4.71) | (−2.26) | |

| DT | −0.0002 *** | 0.002 |

| (−12.07) | (1.43) | |

| Nec * DT | −0.0008 *** | 0.026 |

| (−3.11) | (1.24) | |

| Size | 0.019 *** | 1.321 *** |

| (28.9) | (25.01) | |

| Age | 0.002 ** | 0.195 *** |

| (1.99) | (2.88) | |

| Nol | 0.063 *** | 0.982 *** |

| (15.23) | (3.00) | |

| Int | −0.145 *** | −1.870 *** |

| (−15.97) | (−2.59) | |

| ER | −0.005 *** | −0.173 *** |

| (−10.59) | (−5.10) | |

| Lev | −0.131 *** | −4.631 *** |

| (−38.00) | (−16.91) | |

| Sub | −0.000 | 0.055 *** |

| (−0.05) | (2.35) | |

| SA | 0.019 *** | 5.840 *** |

| (4.24) | (16.10) | |

| CI | −0.008 *** | −0.145 *** |

| (−38.57) | (−8.51) | |

| Peri | −0.073 *** | 0.365 |

| (−6.72) | (0.42) | |

| CF | 0.205 *** | −1.426 *** |

| (46.56) | (−4.07) | |

| N | 39,270 | 39,270 |

| Year FE | control | control |

| Firm FE | control | control |

| F | 514.29 | 88.19 |

| R2 | 0.280 | 0.062 |

| Fina | Envi | |

|---|---|---|

| Nec | 0.108 *** | −0.432 *** |

| (5.53) | (−3.74) | |

| lnPatent | 0.002 ** | 0.043 *** |

| (2.53) | (8.89) | |

| Nec * lnPatent | −0.018 + | −0.053 |

| (−1.49) | (−0.74) | |

| Size | 0.046 *** | 0.250 *** |

| (28.41) | (26.17) | |

| Age | 0.006 *** | 0.044 *** |

| (2.74) | (3.52) | |

| Nol | 0.137 *** | 0.276 *** |

| (13.58) | (4.64) | |

| Int | −0.291 *** | −0.364 *** |

| (−13.09) | (−2.76) | |

| ER | −0.052 *** | −0.028 *** |

| (−49.92) | (−4.58) | |

| Lev | −0.048 *** | −0.851 *** |

| (−5.70) | (−17.03) | |

| Sub | −0.001 | 0.015 *** |

| (−0.75) | (3.43) | |

| SA | 0.043 *** | 1.105 *** |

| (3.85) | (16.74) | |

| CI | −0.015 *** | −0.025 *** |

| (−27.90) | (−7.92) | |

| Peri | −0.170 *** | −0.082 |

| (−6.41) | (0.52) | |

| CF | 0.356 *** | −0.303 *** |

| (33.03) | (−4.74) | |

| N | 39,253 | 39,253 |

| Year FE | control | control |

| Firm FE | control | control |

| F | 420.90 | 91.23 |

| R2 | 0.241 | 0.065 |

| (1) Fina | (2) Envi | (2) Fina | (3) Envi | |

|---|---|---|---|---|

| Nec | 0.111 *** | −0.422 *** | 0.097 *** | −0.455 *** |

| (5.68) | (−3.56) | (5.02) | (−3.90) | |

| RS | −0.359 *** | −0.175 *** | ||

| (−31.32) | (−2.54) | |||

| Nec * RS | −0.439 *** | 4.003 *** | ||

| (−3.41) | (5.17) | |||

| Size | 0.046 *** | 0.259 *** | 0.032 *** | 0.252 *** |

| (28.44) | (26.41) | (18.84) | (24.96) | |

| Age | 0.005 *** | 0.046 *** | 0.006 *** | 0.047 *** |

| (2.60) | (3.63) | (3.03) | (3.79) | |

| Nol | 0.136 *** | 0.274 *** | 0.126 *** | 0.256 ** |

| (13.54) | (4.48) | (12.52) | (4.23) | |

| Int | −0.292 *** | −0.368 | −0.267 *** | −0.374 *** |

| (−13.13) | (−2.72) | (−11.90) | (−2.76) | |

| ER | −0.052 *** | −0.031 *** | −0.051 *** | −0.027 *** |

| (−49.74) | (−4.93) | (−48.89) | (−4.36) | |

| Lev | −0.048 *** | −0.855 *** | −0.0471 *** | −0.862 *** |

| (−5.73) | (−16.65) | (−5.70) | (−17.01) | |

| Sub | −0.000 | 0.016 *** | 0.002 *** | 0.016 *** |

| (−0.68) | (3.62) | (2.47) | (3.84) | |

| SA | 0.037 *** | 1.166 *** | 0.048 *** | 1.171 *** |

| (3.39) | (17.17) | (4.27) | (17.25) | |

| CI | −0.015 *** | −0.026 *** | −0.006 *** | −0.021 *** |

| (−27.90) | (−8.29) | (−9.12) | (−5.52) | |

| Peri | −0.169 *** | −0.321 *** | −0.165 *** | −0.093 |

| (−6.37) | (−4.89) | (−6.31) | (−0.59) | |

| CF | 0.357 *** | −0.083 *** | 0.338 *** | −0.321 *** |

| (33.06) | (−0.52) | (31.64) | (−4.97) | |

| N | 39,252 | 39,252 | 38,613 | 38,613 |

| Year FE | control | control | control | control |

| Firm FE | control | control | control | control |

| Province FE | control | control | control | control |

| F | 220.55 | 47.76 | 234.17 | 46.43 |

| R2 | 0.2428 | 0.0649 | 0.265 | 0.067 |

| Fina | Envi | |

|---|---|---|

| Nec | 0.106 *** | −0.433 ** |

| (5.43) | (−3.73) | |

| AS | −0.042 *** | −0.080 *** |

| (−15.22) | (−4.88) | |

| Nec * AS | 0.106 *** | 0.486 *** |

| (3.38) | (2.59) | |

| Size | 0.044 *** | 0.247 *** |

| (27.29) | (25.79) | |

| Age | 0.005 *** | 0.042 *** |

| (2.39) | (3.39) | |

| Nol | 0.129 *** | 0.274 *** |

| (12.90) | (4.58) | |

| Int | −0.239 *** | −0.232 ** |

| (−13.81) | (−1.74) | |

| ER | −0.051 *** | −0.027 *** |

| (−49.16) | (−4.41) | |

| Lev | 0.019 *** | −0.719 *** |

| (2.05) | (−12.70) | |

| Sub | −0.0002 | 0.016 *** |

| (−0.33) | (3.76) | |

| SA | 0.035 *** | 1.099 *** |

| (3.20 ) | (16.58) | |

| CI | −0.014 *** | −0.024 *** |

| (−26.97) | (−7.78) | |

| Peri | −0.163 *** | −0.062 |

| (−6.18) | (−0.40) | |

| CF | 0.359 *** | −0.304 *** |

| (33.37) | (−4.76) | |

| N | 39,169 | 39,169 |

| Year FE | control | control |

| Firm FE | control | control |

| Province FE | control | control |

| F | 218.07 | 45.99 |

| R2 | 0.248 | 0.065 |

| Fina | Envi | |

|---|---|---|

| Nec | 0.109 *** | −0.409 *** |

| (5.58) | (−3.52) | |

| DT | −0.0003 *** | 0.0004 |

| (−7.63) | (1.42) | |

| Nec * DT | −0.001 * | 0.006 |

| (1.80) | (1.53) | |

| Size | 0.048 *** | 0.250 *** |

| (29.20) | (25.79) | |

| Age | 0.005 ** | 0.043 *** |

| (2.27) | (3.51) | |

| Nol | 0.132 *** | 0.292 *** |

| (13.10) | (4.88) | |

| Int | −0.290 *** | −0.334 *** |

| (−13.03) | (2.53) | |

| ER | −0.052 *** | −0.028 *** |

| (−49.88) | (−4.56) | |

| Lev | −0.047 *** | −0.851 *** |

| (−5.63) | (−17.00) | |

| Sub | −0.0004 | 0.016 *** |

| (−0.57) | (3.64) | |

| SA | 0.032 *** | 1.107 *** |

| (2.86) | (16.6) | |

| CI | −0.015 *** | −0.025 *** |

| (−28.11) | (−8.07) | |

| Peri | −0.161 *** | 0.081 |

| (−6.09) | (−0.51) | |

| CF | 0.356 *** | 0.307 *** |

| (32.97) | (−4.79) | |

| N | 39,251 | 39,251 |

| Year FE | control | control |

| Firm FE | control | control |

| Province FE | control | control |

| F | 213.55 | 45.150 |

| R2 | 0.244 | 0.064 |

| Fina | Envi | |

|---|---|---|

| Nec | 0.736 *** | −6.146 *** |

| (4.14) | (−5.18) | |

| Size | 0.044 *** | 0.264 *** |

| (14.56) | (14.50) | |

| Age | 0.005 | 0.050 ** |

| (1.45) | (2.14) | |

| Nol | 0.132 *** | 0.309 *** |

| (8.00) | (2.85) | |

| Int | −0.299 *** | −0.259 |

| (−7.61) | (−1.12) | |

| ER | −0.051 *** | −0.034 *** |

| (−15.21) | (−3.49) | |

| Lev | −0.050 *** | −0.827 *** |

| (−2.81) | (−10.39) | |

| Sub | −0.001 | 0.016 *** |

| (−0.66) | (2.86) | |

| SA | 0.039 ** | 1.164 *** |

| (2.02) | (8.91) | |

| CI | −0.015 *** | −0.027 *** |

| (−12.92) | (−5.38) | |

| Peri | −0.187 *** | 0.026 |

| (−6.41) | (−0.09) | |

| CF | 0.355 *** | −0.294 *** |

| (20.63) | (−3.65) | |

| N | 39,217 | 39,217 |

| Year FE | control | control |

| Firm FE | control | control |

| High-Tech Enterprises | Non-High-Tech Enterprises | |||

|---|---|---|---|---|

| (1) Fina | (2) Envi | (3) Fina | (4) Envi | |

| Nec | 0.106 *** | −0.633 *** | 0.112 *** | −0.323 * |

| (4.35) | (−4.33) | (3.46) | (−1.70) | |

| Size | 0.044 *** | 0.261 *** | 0.048 *** | 0.259 *** |

| (20.58) | (20.42) | (17.47) | (16.24) | |

| Age | 0.004 | 0.071 *** | 0.007 ** | 0.007 |

| (1.63) | (4.59) | (1.99) | (0.33) | |

| Nol | 0.142 *** | 0.387 *** | 0.115 *** | 0.093 |

| (10.65) | (4.87) | (6.81) | (0.93) | |

| Int | −0.434 *** | −0.076 | −0.145 *** | −0.450 ** |

| (−12.92) | (−0.38) | (−4.62) | (−2.44) | |

| ER | −0.059 *** | −0.032 *** | −0.047 *** | −0.026 *** |

| (−40.47) | (−3.67) | (−30.33) | (−2.88) | |

| Lev | −0.040 *** | −0.831 *** | −0.049 *** | −0.788 *** |

| (−3.69) | (−12.74) | (−3.46) | (−9.45) | |

| Sub | −0.000 | 0.024 *** | −0.000 | 0.003 |

| (−0.07) | (4.04) | (−0.02) | (0.51) | |

| SA | 0.029 * | 1.243 *** | 0.000 | 1.099 *** |

| (1.96) | (13.61) | (0.03) | (10.12) | |

| CI | −0.018 *** | −0.023 *** | −0.012 *** | −0.028 *** |

| (−24.19) | (−4.95) | (−15.91) | (−6.38) | |

| Peri | −0.115 *** | −0.347 * | 0.366 *** | 0.351 |

| (−4.71) | (−1.76) | (21.08) | (1.34) | |

| CF | 0.355 *** | −0.321 *** | −0.209 *** | −0.252 ** |

| (24.23) | (−3.88) | (−4.69) | (−2.47) | |

| N | 24,667 | 24,667 | 14,640 | 14,604 |

| Year FE | control | control | control | control |

| Firm FE | control | control | control | control |

| F | 294.92 | 62.37 | 166.72 | 33.71 |

| R2 | 0.249 | 0.065 | 0.238 | 0.060 |

| Energy-Intensive Firms | Non-Energy-Intensive Industries | |||

|---|---|---|---|---|

| (1) Fina | (2) Envi | (3) Fina | (4) Envi | |

| Nec | 0.069 | −0.232 | 0.113 *** | −0.434 *** |

| (1.39) | (−0.80) | (5.36) | (−3.45) | |

| Size | 0.036 *** | 0.249 *** | 0.048 *** | 0.268 *** |

| (8.55) | (9.99) | (27.23) | (25.37) | |

| Age | 0.012 *** | 0.120 *** | 0.004 | 0.026 * |

| (2.79) | (4.72) | (1.50) | (1.89) | |

| Nol | 0.028 | 0.199 | 0.168 *** | 0.366 *** |

| (2.79) | (1.39) | (14.87) | (5.43) | |

| Int | −0.163 *** | −0.613 * | −0.313 *** | −0.220 |

| (−2.62) | (−1.68) | (−13.10) | (−1.55) | |

| ER | −0.066 *** | −0.052 *** | −0.049 *** | −0.026 *** |

| (−28.67) | (−3.88) | (−41.67) | (−3.69) | |

| Lev | −0.018 | −0.483 *** | −0.052 *** | −0.945 *** |

| (0.84) | (−3.87) | (−5.63) | (−17.15) | |

| Sub | 0.003 | 0.012 | −0.000 | 0.017 *** |

| (1.63) | (1.24) | (−0.62) | (3.60) | |

| SA | 0.029 | 1.125 *** | 0.042 *** | 1.187 *** |

| (0.98) | (6.45) | (3.46) | (16.41) | |

| CI | −0.015 *** | −0.024 ** | −0.015 *** | −0.029 *** |

| (−8.35) | (−2.39) | (−27.22) | (−8.85) | |

| Peri | −0.261 *** | −1.367 *** | −0.146 *** | 0.237 |

| (−4.70) | (−4.19) | (21.08) | (1.32) | |

| CF | 0.446 *** | −0.524 *** | 0.324 *** | −0.277 *** |

| (16.32) | (−3.26) | (−4.85) | (−3.98) | |

| N | 6304 | 6304 | 32,967 | 32,967 |

| Year FE | control | control | control | control |

| Firm FE | control | control | control | control |

| F | 24.15 | 62.37 | 166.72 | 88.02 |

| R2 | 0.317 | 0.095 | 0.238 | 0.069 |

| Manufacturing Industry | Non-Manufacturing Industry | |||

|---|---|---|---|---|

| (1) Fina | (2) Envi | (3) Fina | (4) Envi | |

| Nec | 0.109 *** | −0.607 *** | 0.095 *** | −0.093 *** |

| (4.96) | (−4.44) | (2.37) | (−0.42) | |

| Size | 0.044 *** | 0.259 *** | 0.045 ** | 0.262 *** |

| (21.87) | (20.82) | (14.50) | (15.42) | |

| Age | 0.005 ** | 0.067 *** | 0.004 | 0.012 * |

| (2.20) | (4.59) | (1.00) | (−0.52) | |

| Nol | 0.131 *** | 0.353 *** | 0.122 *** | 0.092 *** |

| (10.97) | (4.76) | (5.70) | (0.79) | |

| Int | −0.401 *** | −0.204 *** | −0.121 *** | −0.616 |

| (−13.59) | (−1.12) | (−3.25) | (−3.00) | |

| ER | −0.055 *** | −0.015 *** | −0.049 *** | −0.042 *** |

| (−42.35) | (−1.98) | (−26.63) | (−4.21) | |

| Lev | −0.037 *** | −0.883 *** | −0.068 *** | −0.776 *** |

| (−3.70) | (−14.29) | (−4.10) | (−8.45) | |

| Sub | 0.001 | 0.023 | −0.002 | 0.002 *** |

| (1.39) | (4.10) | (−1.24) | (0.36) | |

| SA | 0.001 * | 1.204 *** | 0.059 *** | 1.092 *** |

| (0.05) | (13.51) | (2.96) | (9.95) | |

| CI | −0.018 *** | −0.034 *** | −0.013 *** | −0.021 *** |

| (−24.22) | (−7.57) | (−15.44) | (−4.60) | |

| Peri | −0.183 *** | −0.348 *** | −0.148 ** | 0.660 |

| (−6.15) | (−1.88) | (−2.65) | (2.15) | |

| CF | 0.346 *** | −0.262 *** | 0.338 *** | −0.436 *** |

| (27.36) | (−3.34) | (16.54) | (−3.90) | |

| N | 27,135 | 27,135 | 12,118 | 12,118 |

| Year FE | control | control | control | control |

| Firm FE | control | control | control | control |

| F | 321.18 | 63.08 | 135.49 | 88.02 |

| R2 | 0.246 | 0.060 | 0.236 | 30.51 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, S.; Tian, M.; Cai, Y.; Fu, X. Natural Environmental Change and Firm Sustainable Development in China: The Moderating Effect of Slack Resources and Digital Transformation. Sustainability 2025, 17, 4232. https://doi.org/10.3390/su17094232

Xu S, Tian M, Cai Y, Fu X. Natural Environmental Change and Firm Sustainable Development in China: The Moderating Effect of Slack Resources and Digital Transformation. Sustainability. 2025; 17(9):4232. https://doi.org/10.3390/su17094232

Chicago/Turabian StyleXu, Shouquan, Ming Tian, Yujie Cai, and Xuan Fu. 2025. "Natural Environmental Change and Firm Sustainable Development in China: The Moderating Effect of Slack Resources and Digital Transformation" Sustainability 17, no. 9: 4232. https://doi.org/10.3390/su17094232

APA StyleXu, S., Tian, M., Cai, Y., & Fu, X. (2025). Natural Environmental Change and Firm Sustainable Development in China: The Moderating Effect of Slack Resources and Digital Transformation. Sustainability, 17(9), 4232. https://doi.org/10.3390/su17094232