4. Analysis

In today’s highly competitive global environment, construction companies must go beyond improving product quality—they must actively prioritize customer satisfaction to ensure long-term success. The implementation of a customer-oriented quality management system (QMS) supports this by enhancing internal business processes, reducing inefficiencies, and increasing responsiveness to client needs. As a result, the QMS plays a crucial role not only in improving service quality but also in fostering customer loyalty and repeat business. Recent studies confirm this link between customer orientation and sustainable business outcomes. For instance, Adambekova et al. emphasize the importance of aligning quality and investment strategies with Environmental, Social, and Corporate Governance (ESG) principles to enhance stakeholder value and operational sustainability in the financial and construction sectors alike [

26].

The following

Table 1 outlines the research problems related to the impact of customer-oriented quality management systems on profits and customer satisfaction in construction companies.

Each cell of the

Table 1 specifies issues and references pertinent studies.

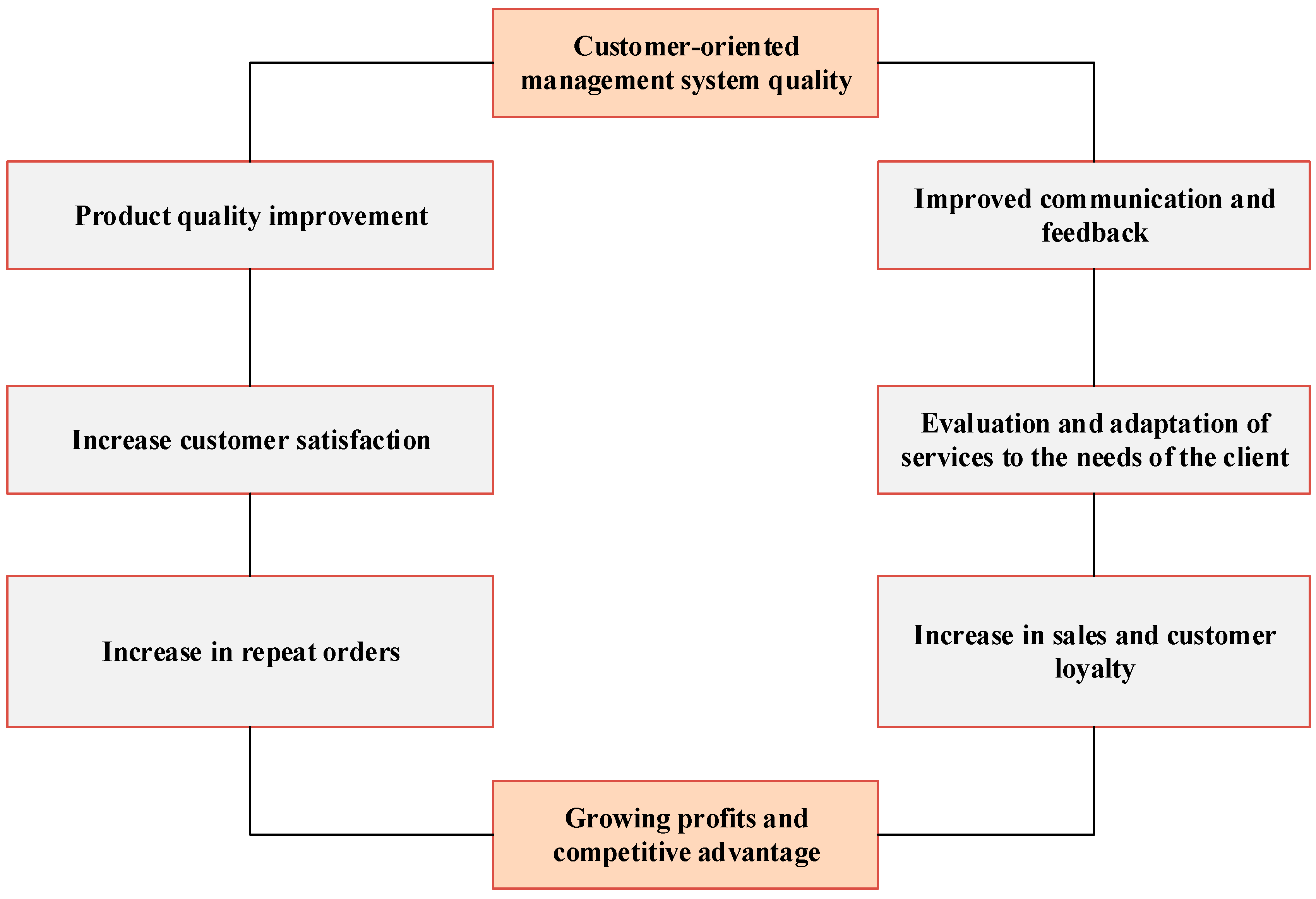

A customer-oriented quality management system (QMS) is a pivotal concept that aligns quality management processes and standards in construction companies with customer needs. This section explores how such systems affect productivity, customer satisfaction, and, ultimately, sales performance (

Figure 2).

The implementation of a QMS significantly enhances product quality, which is a key driver of customer satisfaction. A customer-oriented QMS strengthens feedback mechanisms between companies and their clients, allowing for a clearer understanding of expectations and faster adaptation to changing customer requirements.

Improvements in product quality and feedback processes contribute to increased customer satisfaction. A well-implemented QMS enables companies to tailor their services and products more effectively to customer needs, thus fostering long-term relationships. Satisfied customers are more likely to place repeat orders, which stabilizes sales and improves financial performance.

As customer satisfaction and product quality improve, companies often experience growth in sales volumes and enhanced customer loyalty. These factors collectively contribute to increased profitability and a stronger competitive position in the market.

The regression analysis begins with the identification of key variables to evaluate how different factors influence sales performance in construction companies. The dependent variable in the model is sales volume (SV)—the core outcome being analyzed.

The independent variables include the following: economic efficiency of the QMS (EEQMS); quality management costs (QMCs); product profitability (PP); overall company profitability (OCP); customer satisfaction level (CSL); and company’s period of operation (PO).

EEQMS and QMC are expected to play a central role in shaping sales performance. While an efficiently implemented QMS can improve product quality and increase customer trust, excessive quality-related costs may have a negative short-term impact on financial outcomes if they do not result in tangible improvements.

Regression analysis is thus used to evaluate the trade-off between quality management costs and sales outcomes. The model also incorporates profitability indicators—PP and OCP—which reflect how effectively the company utilizes its resources to generate returns. Customer satisfaction (CSL) is also included, as it is a strong predictor of repeat purchases and long-term revenue stability.

Adding the company’s period of operation (PO) as a control variable allows for capturing the influence of company experience and market presence, which can significantly affect its ability to generate sales.

The regression analysis is based on data from 23 construction companies in Kazakhstan, collected for the year 2023. These companies represent diverse market segments—including residential, commercial, and industrial construction—and vary in size and regional location. This diversity enhances the generalizability and practical relevance of the findings.

Data were obtained from official financial and annual reports, which include both financial metrics (SV, QMC, PP, and OCP) and non-financial indicators (EEQMS and CSL). Utilizing data from a full calendar year ensures an accurate representation of current market conditions, including macroeconomic factors such as inflation, demand fluctuations in the construction sector, and material price volatility.

Thus, this dataset supports the identification of both general patterns and context-specific insights regarding the role of QMSs in enhancing company performance in the Kazakhstani construction industry.

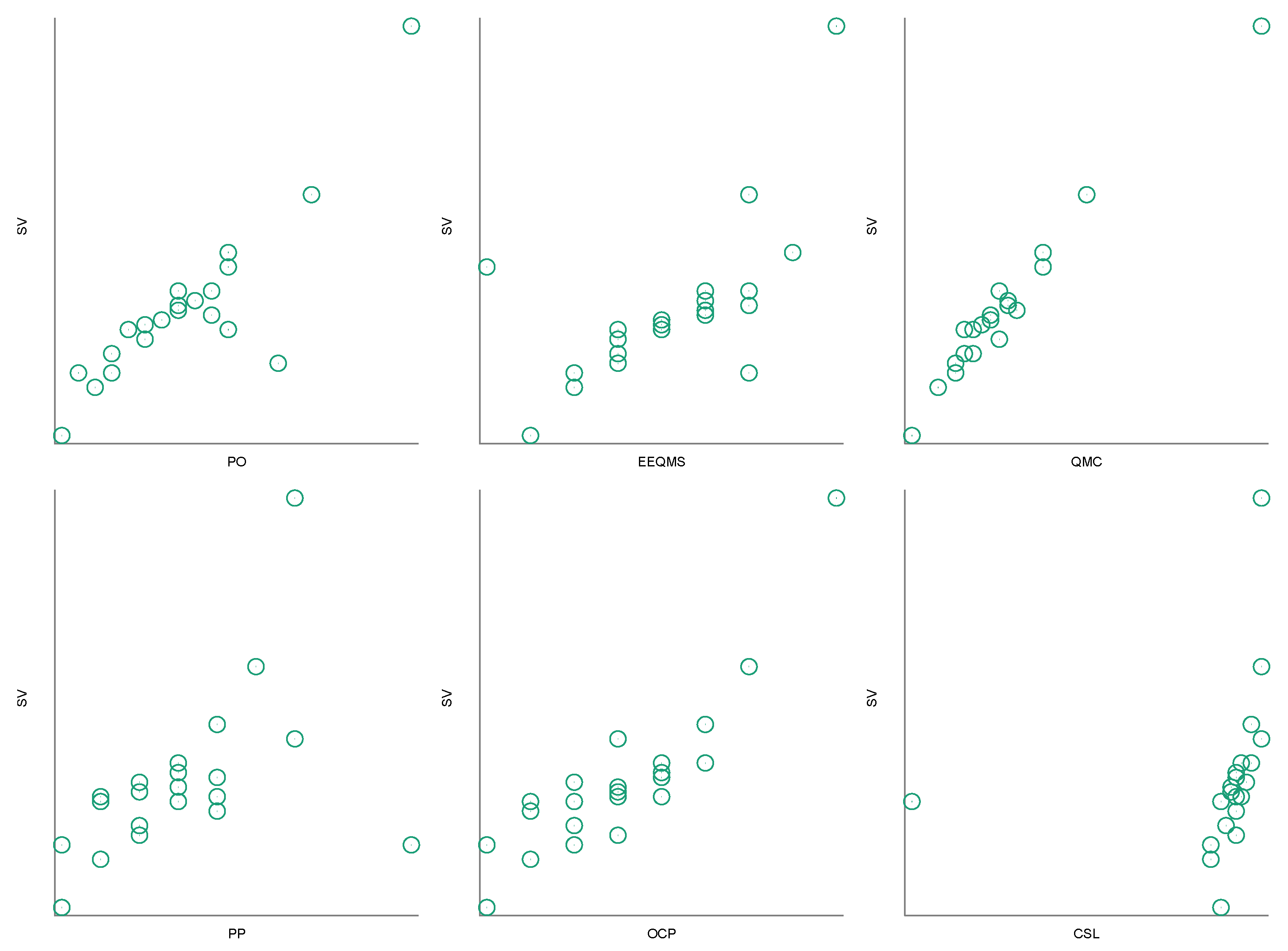

The

Figure 3 demonstrates several positive correlations between key variables and the sales volume (SV) of construction companies. Notably, there is a moderate positive correlation between the company’s period of operation (PO) and its sales volume, indicating that firms with a longer market presence tend to achieve higher sales.

A weak but positive association is observed between the economic efficiency of the quality management system (EEQMS) and sales volume, suggesting that a more efficient QMS implementation may contribute to improved financial outcomes. Similarly, quality management costs (QMCs) show a positive, albeit weaker, correlation with sales, implying that increased investment in quality initiatives may lead to better performance, provided these costs are effectively managed.

Product profitability (PP) also exhibits a positive correlation with sales volume, although this relationship appears to be less pronounced. A stronger and more consistent relationship is identified between overall company profitability (OCP) and sales volume, highlighting the direct impact of broader financial performance on revenue generation.

Among all examined variables, customer satisfaction level (CSL) demonstrates the strongest positive correlation with sales volume, underscoring the critical role of client-oriented quality practices in driving repeat business and long-term financial success.

Overall, the correlation matrix provides valuable insights into the interrelationships among key performance indicators and justifies their inclusion in the regression model developed for this study.

Table 2 presents the results of the statistical tests.

Constant (const): The coefficient is −2.85727, with a p-value of 0.0009, indicating that this variable is significant for the model.

QMCs (quality management costs): The coefficient is 0.0172551, with a p-value < 0.0001, suggesting a strong positive relationship between quality management costs and sales volumes. Each unit increase in QMC is associated with an increase in sales volumes (SV) by 0.017.

OCP (overall profitability of the company): The coefficient is 0.173853, with a p-value of 0.0010, indicating that an increase in the overall profitability of the company also has a significant positive impact on sales volumes. Each unit increase in OCP results in an increase in SV by 0.174.

General characteristics of the model: R-squared: 0.981950. The model explains 98.2% of the variation in the dependent variable (SV), indicating high explanatory power. Adjusted R-squared: 0.980144. The adjusted R-squared value also indicates a very high quality of the model, accounting for the number of predictors. F-statistic: 544.0018 with a p-value of 3.67 × 10−18, indicating that the model is overall significant.

White’s test for heteroscedasticity: p-value of 0.705483. Since the p-value is greater than 0.05, we conclude that there is no heteroscedasticity, implying that the variance of the residuals is constant.

White’s test for normality of residuals: p-value of 0.0497393. This value is close to the 0.05 threshold, suggesting a possible deviation from the normal distribution of residuals.

Chow test for structural break: p-value of 0.213026. There is no significant structural break at the 12th observed point, indicating the stability of the model.

Overall, the model demonstrates high explanatory power, with both predictors (QMC and OCP) having a significant positive effect on sales volumes. Diagnostic tests show the absence of heteroscedasticity and structural breaks.

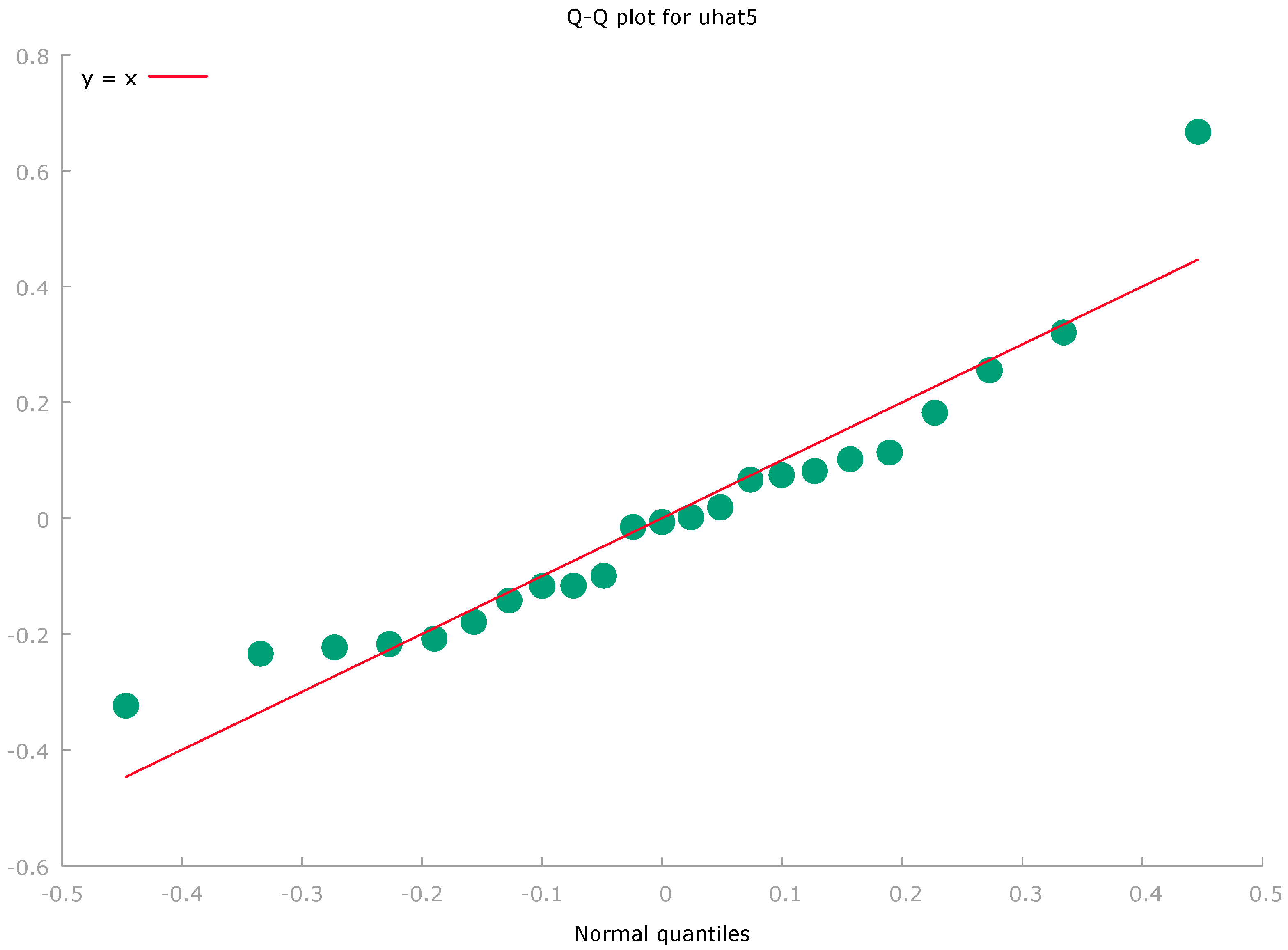

In this

Figure 4, most of the points are close to the reference line, indicating that the residuals are normally distributed for the majority of the sample. However, an outlier is visible on the right side of the plot, which may suggest a slight deviation from normality in the tail of the distribution.

While the bulk of the residuals follow a normal distribution, the slight deviation observed in the upper right corner may indicate the presence of outliers. This observation is consistent with the result of the normality test, which reported a p-value of approximately 0.049, suggesting minor deviations from normality.

The confidence intervals for all coefficients do not include zero, confirming their statistical significance at the 95% confidence level (

Table 3).

The accuracy of the model’s forecast was evaluated based on 23 observations.

Forecast evaluation statistics using 23 observations: Mean Error −8.5922 × 10−16; Root Mean Squared Error 0.21631; Mean Absolute Error 0.16375; Mean Percentage Error −0.76392; Mean Absolute Percentage Error 4.8736; Theil’s U1 0.024682; Bias Proportion, UM 1.686 × 10−29; Regression Proportion, UR 5.1001 × 10−28; Disturbance Proportion, UD 1.

Statistics are used to evaluate the accuracy of the model’s forecast based on 23 observations. They assess how well the model predicts the dependent variable values compared to the actual data.

Mean Error: −8.5922 × 10−16. The mean error is nearly zero, indicating that there is no forecast bias; the model does not systematically over- or under-predict values.

Root Mean Squared Error (RMSE): 0.21631. This value indicates good model accuracy, with relatively small deviations between the actual and predicted values.

Mean Absolute Error (MAE): 0.16375. This value suggests small deviations and indicates the model’s good predictive ability.

Mean Percentage Error (MPE): −0.76392. A negative value suggests that the model slightly systematically underestimates the predicted values compared to the actual ones.

Mean Absolute Percentage Error (MAPE): 4.8736%. This value indicates high accuracy of the model, with the average error being approximately 4.87%.

Theil’s U1 Index: 0.024682. This value indicates that the model outperforms the naive forecast and is accurate.

Bias Proportion (UM): 1.686 × 10−29. A very small value indicates that the model has almost no systematic bias.

Regression Proportion (UR): 5.1001 × 10−28. A very low value suggests a good fit between the forecast and the actual trend.

Disturbance Proportion (UD): 1. This value indicates that forecast errors are due solely to unaccounted random factors and not to systematic problems in the model.

Overall, the model demonstrates high forecast accuracy with minimal systematic deviations. The MAPE, RMSE, and Theil’s U1 index values indicate a good fit of the model to the actual data.

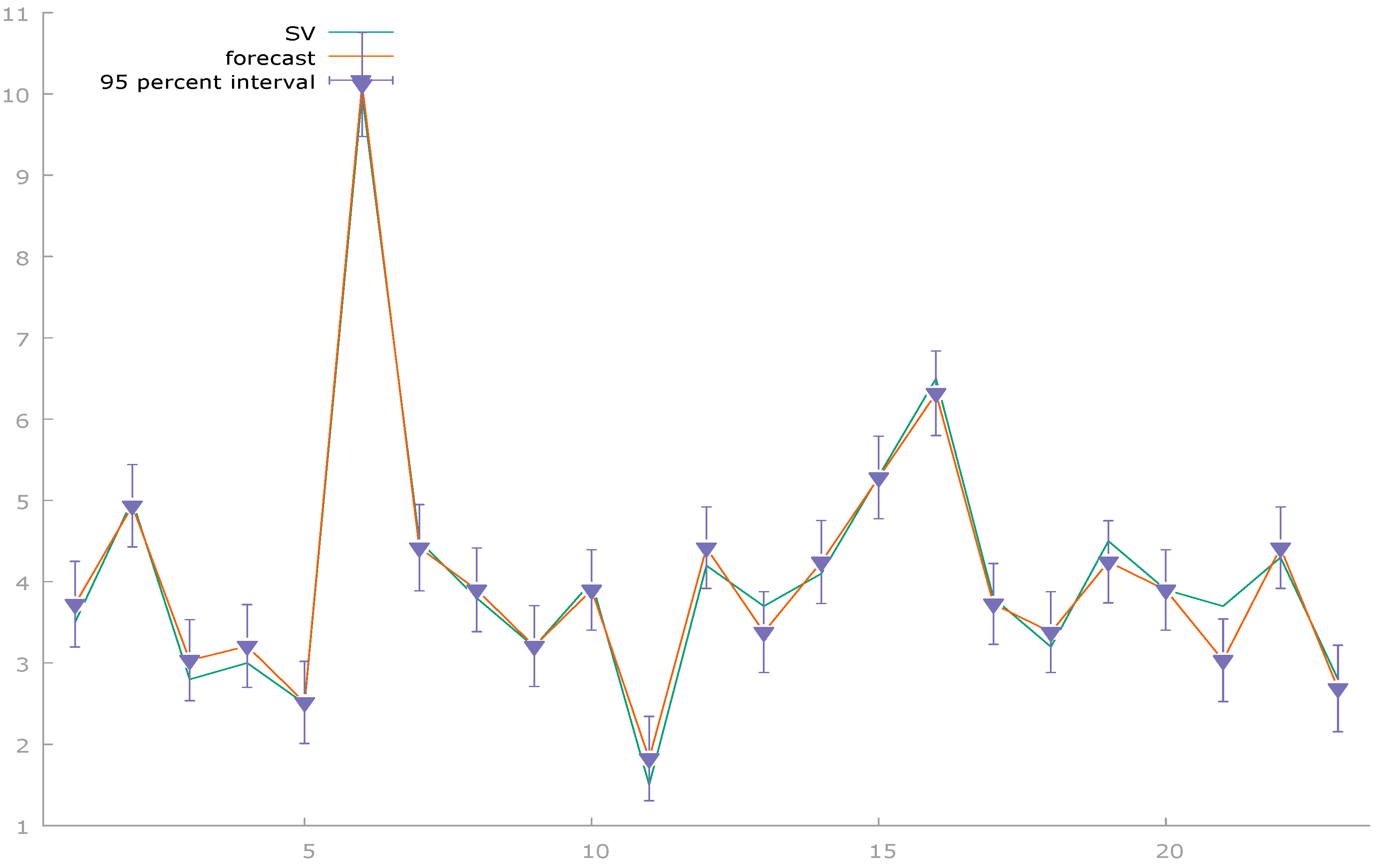

The model demonstrates a high degree of consistency between the forecasted and actual sales volumes. Most predicted values closely align with the observed data, while the narrow confidence intervals indicate strong predictive accuracy (

Figure 5).

Regression analysis confirms that the constructed model possesses substantial explanatory power and is statistically significant for forecasting sales volumes in construction companies. The coefficients for quality management costs (QMCs) and overall company profitability (OCP) are statistically significant at the 95% confidence level (p < 0.001), highlighting their critical influence on sales performance.

The high values of R-squared (0.981950) and adjusted R-squared (0.980144) indicate that the model explains approximately 98% of the variation in the dependent variable, suggesting excellent model fit. Furthermore, low values of Root Mean Square Error (RMSE = 0.21631) and Mean Absolute Percentage Error (MAPE = 4.87%) further validate the model’s forecasting precision.

Diagnostic tests support the model’s robustness. White’s test indicates no presence of heteroscedasticity (p = 0.705483), while the Chow test confirms the absence of structural breaks (p = 0.213026). Although the residuals exhibit slight deviations from normality (p = 0.0497393), this does not materially affect the model’s overall reliability or validity.

Taken together, these results confirm the model’s high predictive power and stability, making it well suited for assessing the influence of quality management and profitability on sales volumes in the construction sector.

Building upon these findings, this study proceeds to segment companies through cluster analysis. While regression analysis quantifies relationships between variables, cluster analysis facilitates the identification of company groups based on shared characteristics, providing a deeper understanding of heterogeneity across firms.

The key variables selected for cluster analysis include overall company profitability (OCP), customer satisfaction level (CSL), economic efficiency of the QMS (EEQMS), and period of operation (PO). These indicators reflect both financial outcomes and the company’s ability to effectively implement quality management systems.

By applying k-means clustering, firms can be grouped according to similarity in these variables, enabling the identification of distinct strategic profiles in terms of quality management practices and customer orientation. This segmentation provides the basis for formulating targeted recommendations to enhance performance and competitiveness across company types.

The

Table 4 presents the inter-cluster distances obtained from the k-means cluster analysis, illustrating the differences between the identified clusters. The

Table 5 largest distance is between Cluster 1 and Cluster 3 (18.813), indicating significant differences between them. Conversely, the smallest distance is between Cluster 2 and Cluster 3 (7.364), suggesting a greater similarity between these two clusters. This implies that Clusters 1 and 3 represent more distinct groups of companies, while Clusters 2 and 3 have more common characteristics.

The

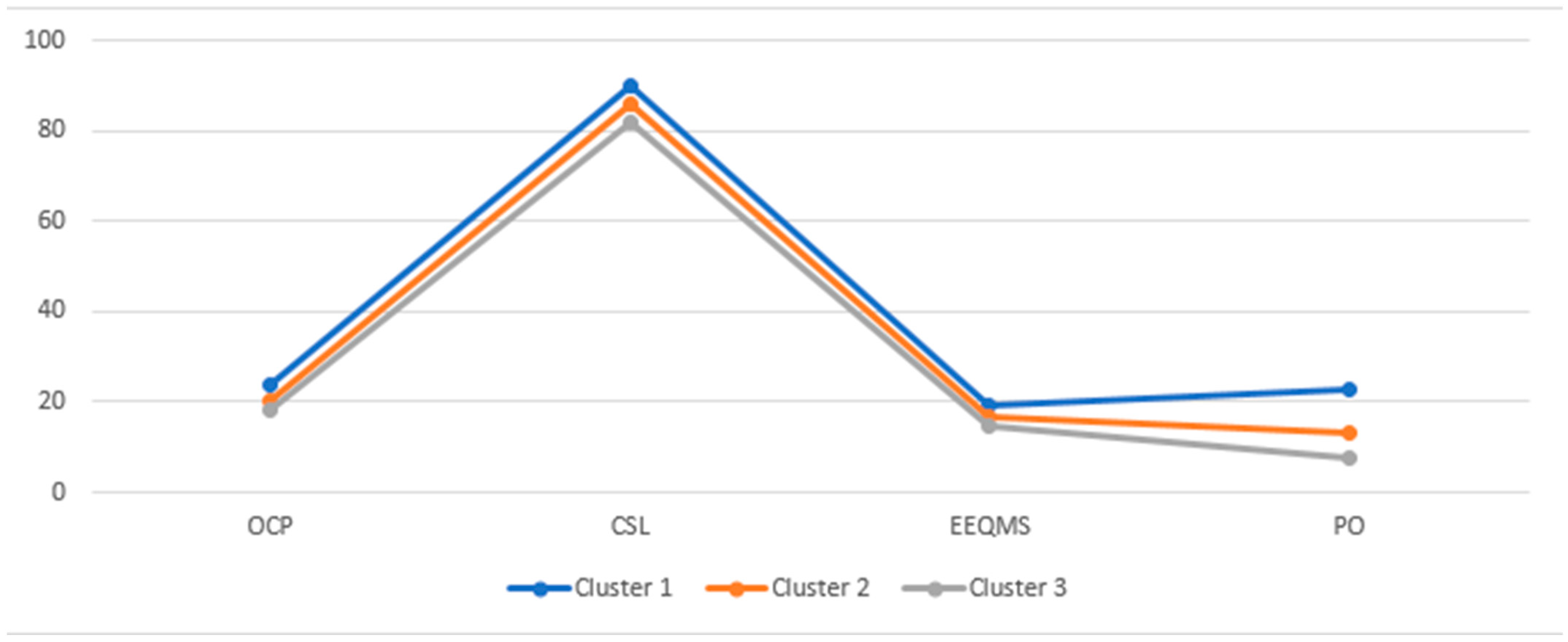

Table 6 shows the average values of key indicators for each cluster, including overall company profitability (OCP), customer satisfaction level (CSL), economic efficiency of the QMS (EEQMS), and the company’s period of operation (PO). Cluster 1 exhibits the highest values for all indicators: OCP = 24.00, CSL = 90.00, EEQMS = 19.00, and PO = 23.00. These high values may indicate that Cluster 1 comprises the most successful companies, characterized by a long period of operation and high customer satisfaction rates. Cluster 2 shows moderate values across all variables, whereas Cluster 3 has the lowest values, particularly for the period of operation (PO = 7.63) and economic efficiency (EEQMS = 14.88). This suggests that Cluster 3 includes companies with a lower efficiency and satisfaction level.

The

Figure 6 presents the average values of key indicators (overall company profitability, customer satisfaction level, economic efficiency of QMS, and the company’s period of operation) for the three selected clusters.

The ANOVA table (

Table 7) presents the results of one-way analysis of variance for the four indicators (OCP, CSL, EEQMS, and PO) with respect to the clusters. All variables have high F-test values and significance levels (

p-value of 0.000 or 0.002), indicating significant differences between clusters for each indicator.

For example, the F-test value for OCP (overall company profitability) is 34.713, reflecting strong differences between clusters. Similarly, the F-value for CSL (customer satisfaction level) is 17.920, and for PO (company’s period of operation) it is 41.405. It is important to note that the clusters were chosen to maximize the differences between observations.

The

Table 8 provides information on the clustering of construction companies in Kazakhstan into three clusters based on various characteristics.

Cluster 1, which includes companies such as BI Group and AlmatyStroy LLP, demonstrates an average distance of 3.317. This indicates high efficiency, profitability, and customer satisfaction, characterizing these companies as market leaders with strong performance and stable operations.

Cluster 2 includes companies with average performance, such as JSC KazEngineering, Kazstroypodryad LLP, and Astana Construction LLP. The distances within this cluster range from 1.026 to 5.325, indicating variability in performance and satisfaction. Companies in this cluster exhibit balanced characteristics but have potential for improvement in specific aspects of their operations.

Cluster 3 encompasses companies with lower performance, including AlmatyStroy LLP, Smart Remont Ltd., and BestBuild Kazakhstan LLP. The average distances within this cluster range from 1.392 to 3.929. These companies may face challenges encountered in managing quality, profitability, and customer satisfaction, necessitating significant improvements to reach the performance levels of the companies in Clusters 1 and 2.

Table 9 presents the characteristics of the identified clusters.

Cluster 1: Highly efficient companies in Cluster 1, such as BI Group and AlmatyStroy LLP, demonstrate superior performance across all parameters. The average period of operation (PO) in this cluster is 23 years, reflecting a long and stable market presence. Sales volumes (SV) average 8.25 million tenge, indicating a high level of market activity and success. Quality management costs (QMCs) are notably higher at 400, suggesting significant investment in quality management systems to maintain their high profitability and competitiveness. These companies are likely industry leaders, characterized by their robust performance and established market position.

Cluster 2: Medium-efficiency companies in Cluster 2 include companies such as JSC KazInzhenerin, Kazstroypodryad LLP, and Astana Construction LLP, which exhibit more balanced but moderate performance metrics. The average period of operation is 13.15 years, indicating a stable, though shorter, market presence compared to Cluster 1. Average sales volumes are 4.16 million tenge, lower than those in Cluster 1. Quality management costs in this cluster are 200, representing the average for the sample. Companies in this cluster have potential for growth and can enhance their efficiency by optimizing quality management costs and increasing sales volumes.

Cluster 3: Low-performance companies in Cluster 3 comprise companies such as AlmatyStroy LLC, Parus Construction, and Smart Remont Ltd., which exhibit the lowest performance indicators. The average period of operation is 7.63 years, indicating a shorter market presence compared to the other clusters. Sales volumes average 2.90 million tenge, significantly lower than in the other clusters, suggesting lower market activity and efficiency. Quality management costs average 152.5, reflecting minimal investment in quality management systems and potentially lower product or service quality. Companies in this cluster are likely to face challenges in improving profitability and customer satisfaction.

Summary: Cluster 1 represents the top-performing companies with high sales volumes, extensive operational histories, and significant investments in quality management. Cluster 2 includes mid-level companies that have been in the market longer than the companies in Cluster 3, but still fall short of the leaders. Cluster 3 contains companies with the lowest indicators for all variables, pointing to potential issues in quality management strategies and overall business development.

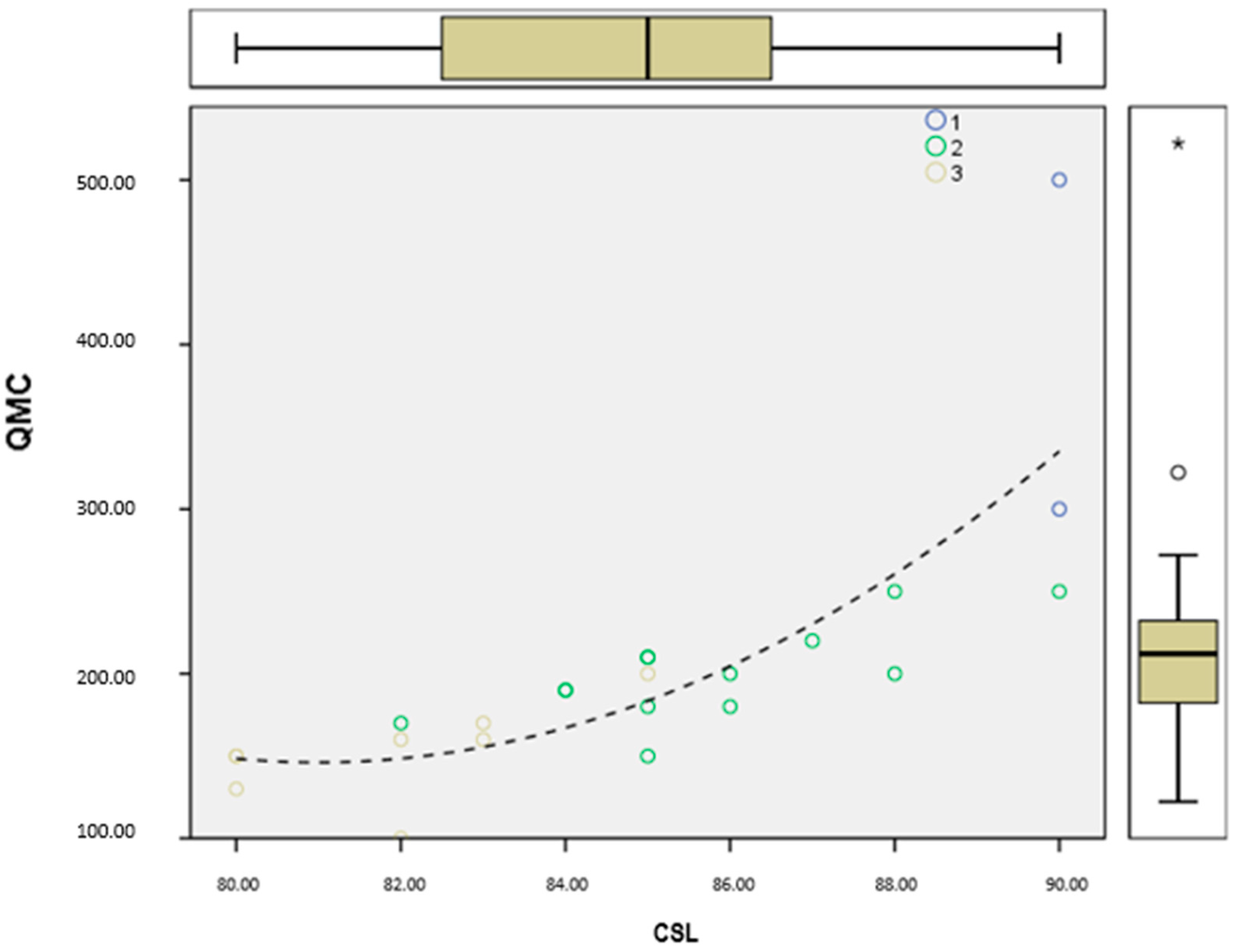

The

Figure 7 illustrates the relationship between quality management costs (QMCs) and customer satisfaction level (CSL) for companies grouped into three clusters. Different colors represent different clusters: blue for Cluster 1, green for Cluster 2, and yellow for Cluster 3. There is a positive relationship between quality management costs and customer satisfaction level: as QMC increases, the CSL also rises. This is confirmed by the trend curve (dashed line), which shows an increase in QMC alongside an increase in CSL.

The figure also presents the distribution of values across the cluster using box plots, which depict data spread and highlight individual outliers, representing specific companies.

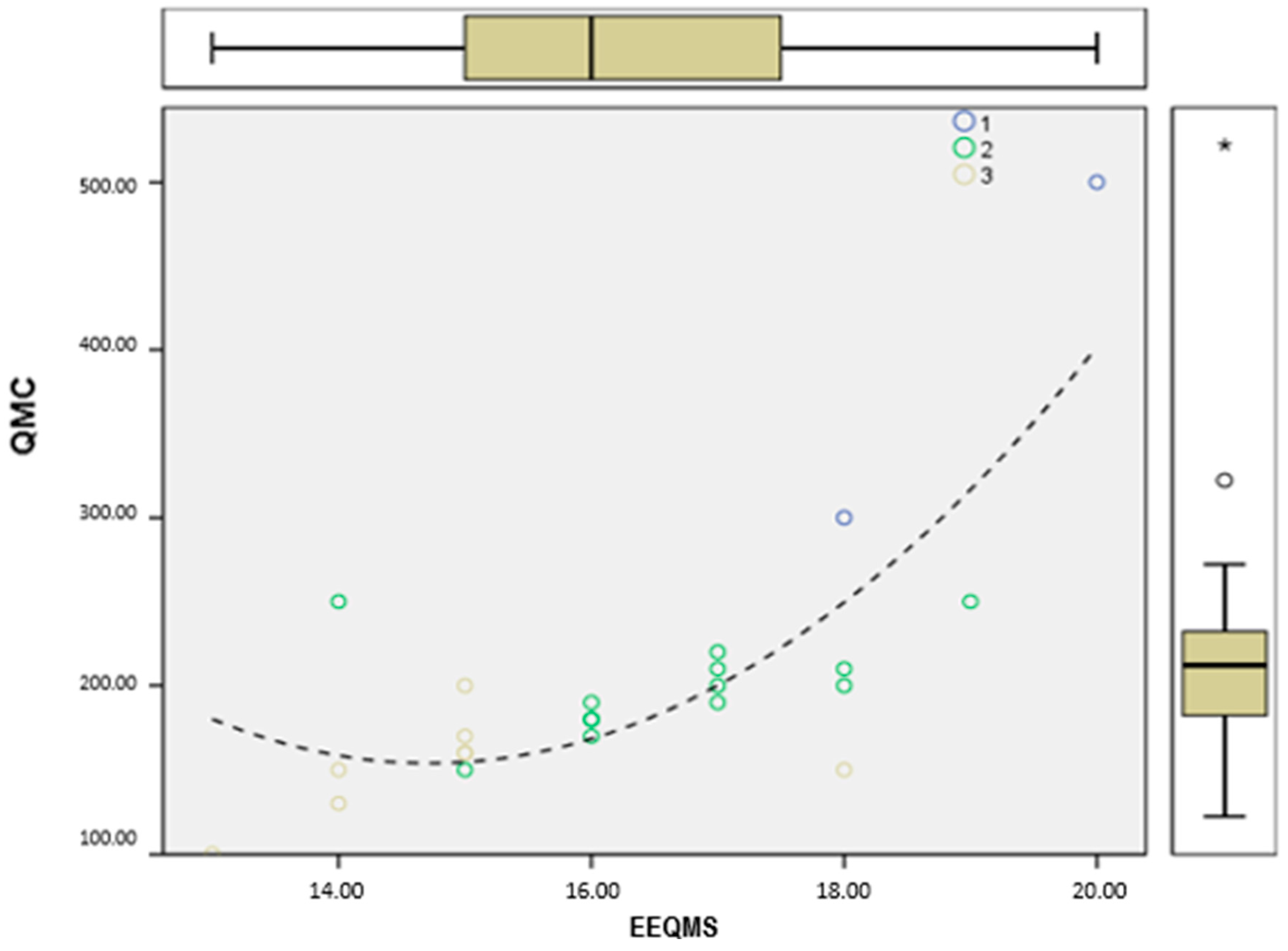

The

Figure 8 illustrates the relationship between the economic efficiency of quality management systems (EEQMS) and quality management costs (QMCs) for companies grouped into three clusters. The clusters are represented by different colors: blue for Cluster 1, green for Cluster 2, yellow for Cluster 3. The figure demonstrates that as the economic efficiency of the QMS increases, the quality management costs also rise, which is confirmed by the dotted trend curve. More economically efficient companies tend to invest more in quality management.

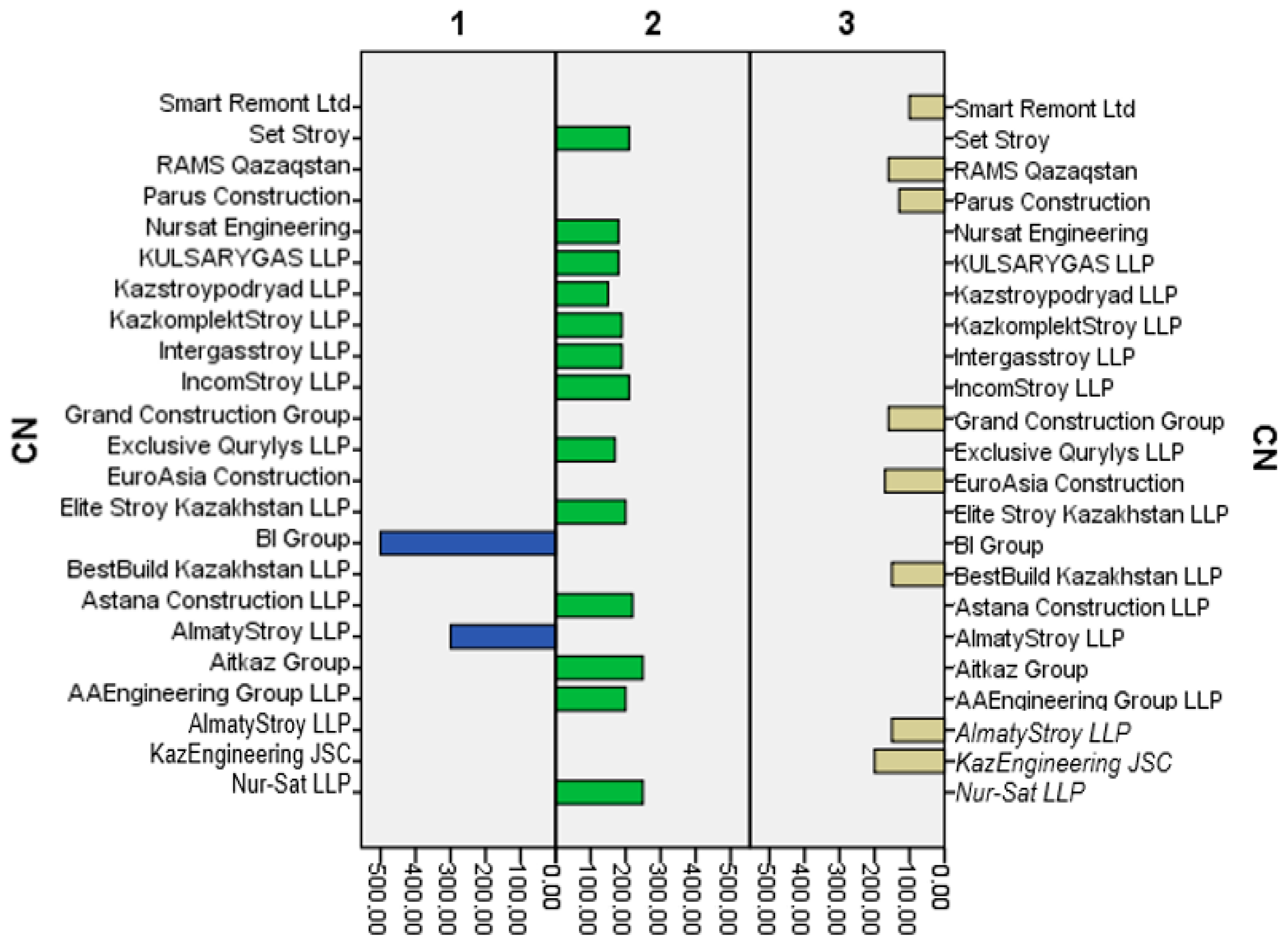

The

Figure 9 illustrates the distribution of quality management costs (QMCs) among construction companies grouped into three clusters. Clusters 1, 2, and 3 are represented by differently colored columns. The table shows that companies in Cluster 1 (BI Group and AlmatyStroy LLP) have significantly higher quality management costs compared to other clusters. In Cluster 2, average QMCs are moderate, with companies such as Kazstroypodryad LLP and Elite Stroy Kazakhstan LLP demonstrating diversity in cost levels. Cluster 3 is characterized by lower QMC values, as seen in companies like Smart Remont Ltd. and Set Stroy.

Companies in Cluster 1 invest more in quality management, which may be linked to their leading positions in the market. Cluster 2 companies exhibit balanced quality costs, while Cluster 3 companies have low QMCs, suggesting a need for optimization in their quality management processes.

The cluster analysis of construction companies reveals significant differences in key indicators of quality management costs (QMCs), economic efficiency (EEQMS), customer satisfaction level (CSL), and the company’s period of operation (PO). Companies in Cluster 1, such as BI Group and AlmatyStroy LLP, are characterized by the highest quality management costs and high indicators of cost effectiveness and customer satisfaction. Large companies, which actively invest in quality, are more likely to achieve leading market positions. Companies in Cluster 2 display stable indicators, suggesting growth opportunities through more effective quality management.

Companies in Cluster 3 have the lowest values across all indicators, especially for quality management costs, which may indicate less developed management processes. Firms such as Smart Remont Ltd. and Set Stroy could face challenges in improving their competitiveness in the market without additional investments in products and services quality.

The results of the analysis emphasize the importance of systematic quality management for improving economic efficiency and customer satisfaction. It is recommended that companies in the second and third clusters review their quality management strategies to enhance efficiency and strengthen their market positions.

The results of this study indicate that quality management is a key factor in improving cost efficiency and customer satisfaction in construction companies.

The results of the regression analysis revealed a significant relationship between quality management costs (QMCs) and profitability indicators, which confirms the importance of investments in quality to achieve high financial results.

The cluster analysis divided companies into three groups based on their quality management cost and performance, highlighting differences in management strategies. Companies in Cluster 1, which actively invest in quality management systems, demonstrate leading positions in profitability and customer satisfaction. In contrast, companies in Clusters 2 and 3 allocate less funding for quality management and, consequently, achieve lower results.

Comparative Analysis with Prior Research. The findings of this study are consistent with several prior works. For example, Gonzalez and Rodriguez identified a positive relationship between customer-oriented QMS implementation and customer satisfaction, which is also evident in our results. Similar associations were reported by Chen and Li and Psomas and Jaca, who emphasized the role of QMSs in improving process efficiency and maintaining consistent quality. Our findings also align with Kaynak, who argued that the integration of QMS practices contributes to enhanced operational performance through standardization and process control.

However, some discrepancies were observed. Unlike Talib et al. [

9], who reported a stronger impact of QMSs on financial outcomes, our results indicate a more moderate effect. This may be explained by the specific structure of the construction sector in Kazakhstan and differences in the maturity level of quality management practices across companies. Furthermore, many international studies are based on larger sample sizes and utilize more sophisticated tools to measure customer satisfaction, which may account for the variation in findings.

Overall, while our study supports the general trends observed in previous research, it also introduces context-specific insights that deepen the understanding of QMS implementation in Kazakhstan’s construction industry.