Can Policy-Based Agricultural Insurance Promote Agricultural Carbon Emission Reduction? Causal Inference Based on Double Machine Learning

Abstract

1. Introduction

2. Literature Review

3. Policy Background, Theoretical Analysis, and Research Hypotheses

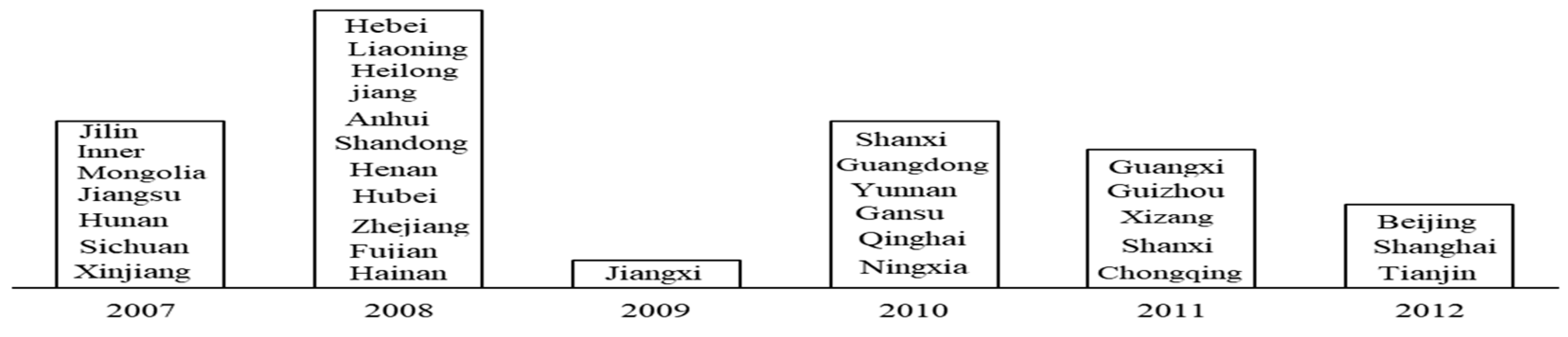

3.1. Policy Background

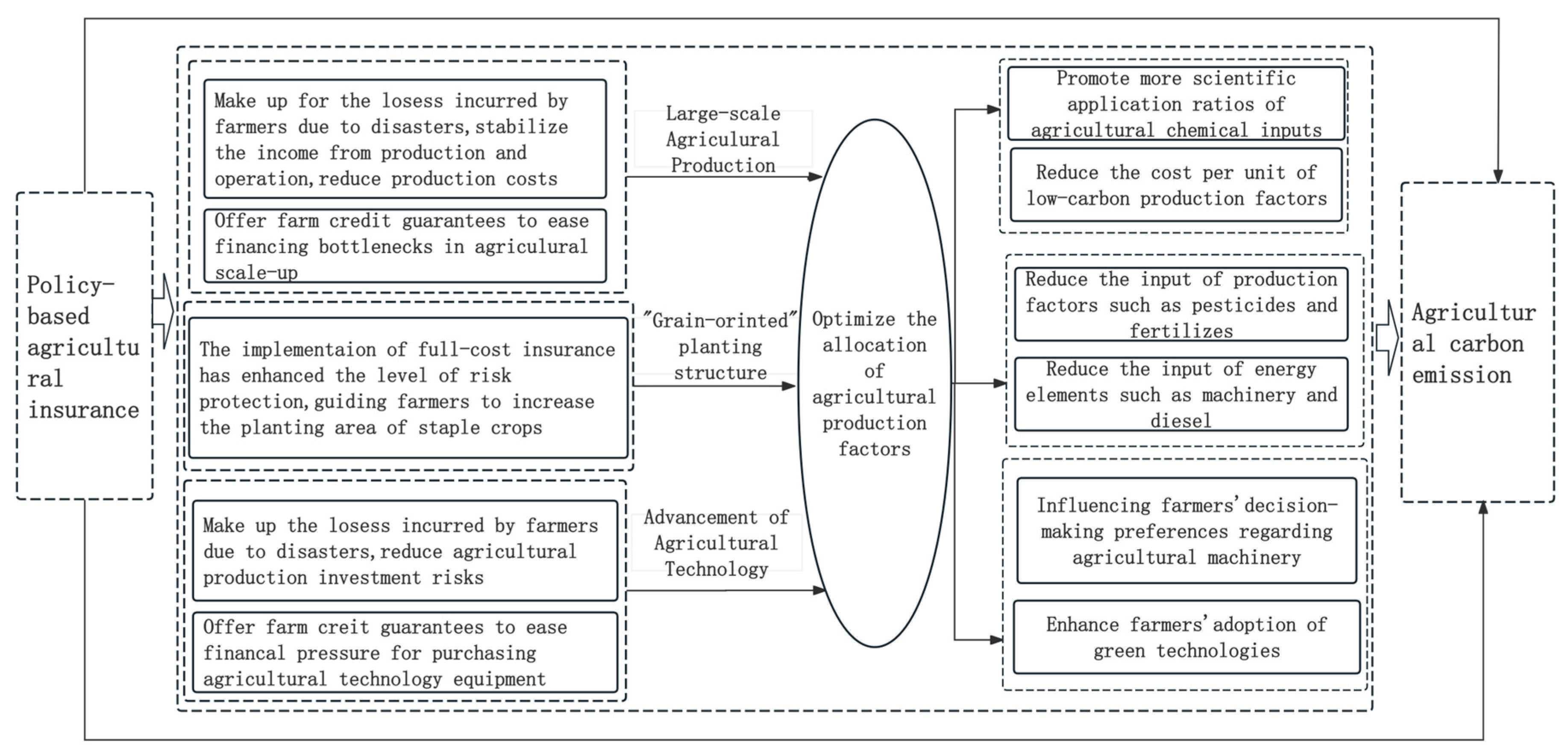

3.2. Theoretical Analysis and Research Hypotheses

3.2.1. Direct Effect

3.2.2. Mediating Effect

4. Research Design

4.1. Model Construction

4.2. Variable Setting and Description

4.2.1. Dependent Variable

4.2.2. Core Explanatory Variables

4.2.3. Control Variables

4.2.4. Mechanism Variables

4.3. Data Sources and Descriptive Statistics

5. Analysis of Empirical Results

5.1. Parallel Trend Test

5.2. Baseline Regression Results

5.3. Robustness Tests

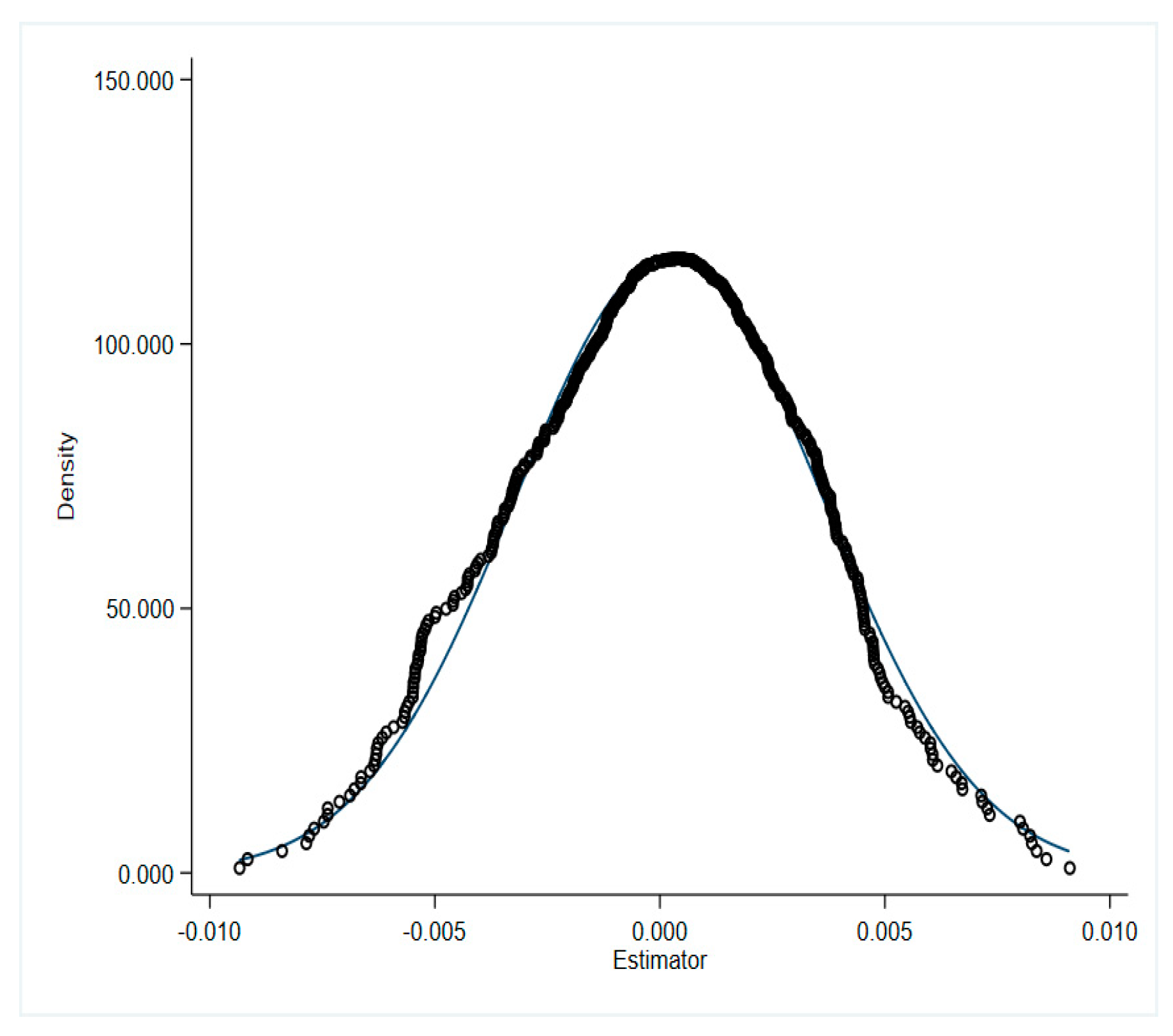

5.3.1. Placebo Test

5.3.2. Exclusion of Municipality Samples

5.3.3. Alteration of Sample Interval

5.3.4. Winsorization

5.3.5. Lagged Explained Variable by One Period

6. Further Analysis

6.1. Mechanism Analysis

6.2. Heterogeneity Analysis

6.2.1. Agricultural Production Function Dimension

6.2.2. Geographical Location Dimension

6.2.3. Environmental Regulation Dimension

7. Conclusions and Policy Recommendations

7.1. Research Conclusions

7.2. Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Jiang, C.; Hao, W.; Ma, J.; Zhang, H. Achieving Sustainability and Carbon Emission Reduction Through Agricultural Socialized Services: Mechanism Testing and Spatial Analysis. Agriculture 2025, 15, 373. [Google Scholar] [CrossRef]

- Tian, Y.; Zhang, J.B.; He, Y.Y. Research on spatial-temporal Charact. and driving factor of agricultural carbon emissions in China. J. Integr. Agric. 2014, 13, 1393–1403. [Google Scholar] [CrossRef]

- Tang, K.; He, C.; Ma, C.; Wang, D. Does carbon farming provide a cost-effective option to mitigate GHG emissions? Evidence from China. Aust. J. Agric. Resour. Econ. 2019, 63, 575–592. [Google Scholar] [CrossRef]

- Gu, L.; Liu, Y.; Liu, F.; Dong, X.; Dong, Y. Impacts of policy-related agricultural insurance on farmers’ earnings in China’s major grain-producing regions. Financ. Res. Lett. 2024, 69, 106189. [Google Scholar] [CrossRef]

- Li, J.; Peng, Z. Impact of Digital Villages on Agricultural Green Growth Based on Empirical Analysis of Chinese Provincial Data. Sustainability 2024, 16, 9590. [Google Scholar] [CrossRef]

- Zhang, L.; Xu, L.; Gao, M.; Zhou, M. Can Agricultural Credit Promote the Green Transformation of China’s Agriculture? Sustainability 2024, 16, 10944. [Google Scholar] [CrossRef]

- Chakir, R.; Hardelin, J. Crop Insurance and pesticide use in French agriculture: An empirical analysis. Rev. Agric. Environ. Stud.-Rev. D’etudes Agric. Environ. (RAEStud) 2014, 95, 25–50. [Google Scholar] [CrossRef]

- Carter, M.R.; Cheng, L.; Sarris, A. Where and how index insurance can boost the adoption of improved agricultural technologies. J. Dev. Econ. 2016, 118, 59–71. [Google Scholar] [CrossRef]

- Quiggin, J.; Karagiannis, G.; Stanton, J. Crop Insurance and Crop Production: An Empirical Study of Moral Hazard and Adverse Selection. In Economics of Agricultural Crop Insurance: Theory and Evidence; Springer: Dordrecht, The Netherlands, 1994; pp. 253–272. [Google Scholar]

- Hill, R.V.; Kumar, N.; Magnan, N.; Makhija, S.; de Nicola, F.; Spielman, D.J.; Ward, P.S. Ex ante and ex post effects of hybrid index insurance in Bangladesh. J. Dev. Econ. 2019, 136, 1–17. [Google Scholar] [CrossRef]

- Cai, J. The impact of insurance provision on household production and financial decisions. Am. Econ. J. Econ. Policy 2016, 8, 44–88. [Google Scholar] [CrossRef]

- Karlan, D.; Osei, R.; Osei-Akoto, I.; Udry, C. Agricultural decisions after relaxing credit and risk constraints. Q. J. Econ. 2014, 129, 597–652. [Google Scholar] [CrossRef]

- Gunnsteinsson, S. Experimental identification of asymmetric information: Evidence on crop insurance in the Philippines. J. Dev. Econ. 2020, 144, 102414. [Google Scholar] [CrossRef]

- Möhring, N.; Dalhaus, T.; Enjolras, G.; Finger, R. Crop insurance and pesticide use in European agriculture. Agric. Syst. 2020, 184, 102902. [Google Scholar] [CrossRef]

- Rothschild, M.; Stiglitz, J. Equilibrium in Competitive Insurance Markets: An Essay on the Economics of Imperfect Information. In Uncertainty in Economics; Academic Press: Cambridge, MA, USA, 1978; pp. 257–280. [Google Scholar]

- Mishra, A.K.; Nimon, R.W.; El-Osta, H.S. Is moral hazard good for the environment? Revenue insurance and chemical input use. J. Environ. Manag. 2005, 74, 11–20. [Google Scholar] [CrossRef]

- Smith, V.H.; Goodwin, B.K. Crop insurance, moral hazard, and agricultural chemical use. Am. J. Agric. Econ. 1996, 78, 428–438. [Google Scholar] [CrossRef]

- West, T.O.; Post, W.M. Soil organic carbon sequestration rates by tillage and crop rotation: A global data analysis. Soil Sci. Soc. Am. J. 2002, 66, 1930–1946. [Google Scholar] [CrossRef]

- Liu, X.; Yu, Y.; Luan, S. Empirical Study on the Decomposition of Carbon Emission Factors in Agricultural Energy Consumption. In Proceedings of the 4th International Conference on Environmental Science and Material Application (ESMA), Xi’an, China, 15–16 December 2018; IOP Publishing: Bristol, UK, 2019; Volume 252, pp. 15–16. [Google Scholar]

- Shi, R.; Irfan, M.; Liu, G.; Yang, X.; Su, X. Analysis of the impact of livestock structure on carbon emissions of animal husbandry: A sustainable way to improving public health and green environment. Front. Public Health 2022, 10, 835210. [Google Scholar] [CrossRef]

- Kahrl, F.; Li, Y.; Su, Y.; Tennigkeit, T.; Wilkes, A.; Xu, J. Greenhouse gas emissions from nitrogen fertilizer use in China. Environ. Sci. Policy 2010, 13, 688–694. [Google Scholar] [CrossRef]

- Pajurek, M.; Mikolajczyk, S.; Warenik-Bany, M. Engine oil from agricultural machinery as a source of PCDD/Fs and PCBs in free-range hens. Environ. Sci. Pollut. Res. 2023, 30, 29834–29843. [Google Scholar] [CrossRef]

- Zhou, P.; Ang, B.W.; Han, J.Y. Total factor carbon emission performance: A Malmquist index analysis. Energy Econ. 2010, 32, 194–201. [Google Scholar] [CrossRef]

- Wu, D.; Zhang, Z.; Liu, D.; Zhang, L.; Li, M.; Khan, M.I.; Cui, S. Calculation and analysis of agricultural carbon emission efficiency considering water–energy–food pressure: Modeling and application. Sci. Total Environ. 2024, 907, 167819. [Google Scholar] [CrossRef] [PubMed]

- Wen, S.; Hu, Y.; Liu, H. Measurement and spatial–temporal characteristics of agricultural carbon emission in China: An internal structural perspective. Agriculture 2022, 12, 1749. [Google Scholar] [CrossRef]

- Gokmenoglu, K.K.; Taspinar, N.; Kaakeh, M. Agriculture-induced environmental Kuznets curve: The case of China. Environ. Sci. Pollut. Res. 2019, 26, 37137–37151. [Google Scholar] [CrossRef] [PubMed]

- Zhu, J.; Wang, M.; Zhang, C. Impact of high-standard basic farmland construction policies on agricultural eco-efficiency: Case of China. Natl. Account. Rev 2022, 4, 147–166. [Google Scholar] [CrossRef]

- Li, S.; Li, M.; Chen, J.; Shao, S.; Tian, Y. Impacts and Internal Mechanisms of High-Standard Farmland Construction on the Reduction of Agricultural Carbon Emission in China. Agriculture 2025, 15, 105. [Google Scholar] [CrossRef]

- Brick, K.; Visser, M. Risk preferences, technology adoption and insurance uptake: A framed experiment. J. Econ. Behav. Organ. 2015, 118, 383–396. [Google Scholar] [CrossRef]

- Antweiler, W.; Copeland, B.R.; Taylor, M.S. Is free trade good for the environment? Am. Econ. Rev. 2001, 91, 877–908. [Google Scholar] [CrossRef]

- Li, J.; Jiang, L.; Zhang, S. How land transfer affects agricultural carbon emissions: Evidence from China. Land 2024, 13, 1358. [Google Scholar] [CrossRef]

- Bai, Z.; Wang, T.; Xu, J.; Li, C. Can agricultural productive services inhibit carbon emissions? Evidence from China. Land 2023, 12, 1313. [Google Scholar] [CrossRef]

- You, H.; Wu, S.; Wu, X.; Guo, X.; Song, Y. The underlying influencing factors of farmland transfer in urbanizing China: Implications for sustainable land use goals. Environ. Dev. Sustain. 2021, 23, 8722–8745. [Google Scholar] [CrossRef]

- Zhang, Z.; Chen, Y.H.; Mishra, A.K.; Ni, M. Effects of agricultural subsidy policy adjustment on carbon emissions: A quasi-natural experiment in China. J. Clean. Prod. 2025, 487, 144603. [Google Scholar] [CrossRef]

- Chernozhukov, V.; Chetverikov, D.; Demirer, M.; Duflo, E.; Hansen, C.; Newey, W.; Robins, J. Double/Debiased Machine Learning for Treatment and Structural Parameters; Oxford University Press: Oxford, UK, 2018. [Google Scholar]

- Du, Y.; Liu, H.; Huang, H.; Li, X. The carbon emission reduction effect of agricultural policy——Evidence from China. J. Clean. Prod. 2023, 406, 137005. [Google Scholar] [CrossRef]

- Hao, D.; Xu, R.; Du, B.; Yang, J.; Liu, W. Does carbon reduction and sequestration conflict with food security in rural China?—What, why and how? Sci. Total Environ. 2024, 947, 173871. [Google Scholar] [CrossRef]

- Nie, S.; Ji, Q. Impact of increasing the supply of rural finance on agricultural total factor productivity: Evidence from China. Financ. Res. Lett. 2024, 69, 106149. [Google Scholar] [CrossRef]

- Jin, Y.; Wang, X.; Wang, Q. The influence of agricultural insurance on agricultural carbon emissions: Evidence from China’s crop and livestock sectors. Front. Environ. Sci. 2024, 12, 1373184. [Google Scholar] [CrossRef]

- Xie, S.; Zhang, J.; Li, X.; Xia, X.; Chen, Z. The effect of agricultural insurance participation on rural households’ economic resilience to natural disasters: Evidence from China. J. Clean. Prod. 2024, 434, 140123. [Google Scholar] [CrossRef]

- Wan, K.; Yu, X. Optimal governance radius of environmental information disclosure policy: Evidence from China. Econ. Anal. Policy 2024, 83, 618–630. [Google Scholar] [CrossRef]

- Morgenstern, R.D.; Pizer, W.A.; Shih, J.S. Jobs versus the environment: An industry-level perspective. J. Environ. Econ. Manag. 2002, 43, 412–436. [Google Scholar] [CrossRef]

- Weber, J.G.; Key, N.; O’Donoghue, E. Does federal crop insurance make environmental externalities from agriculture worse? J. Assoc. Environ. Resour. Econ. 2016, 3, 707–742. [Google Scholar] [CrossRef]

- Hou, D.; Wang, X. The impact of InsurTech on advancing sustainable specialty agricultural product insurance in China. Front. Sustain. Food Syst. 2024, 8, 1477773. [Google Scholar] [CrossRef]

- Ke, C.; Huang, S.Z. The effect of environmental regulation and green subsidies on agricultural low-carbon production behavior: A survey of new agricultural management entities in Guangdong Province. Environ. Res. 2024, 242, 117768. [Google Scholar] [CrossRef] [PubMed]

| Variable Type | Variable Symbol | Std | N | P50 | Mean | Min | Max |

|---|---|---|---|---|---|---|---|

| Dependent variable | C | 1.097 | 589 | 5.668 | 5.325 | 2.214 | 6.905 |

| Core independent variables | Event | 0.467 | 589 | 1 | 0.679 | 0 | 1 |

| Threshold variable | Scale | 0.193 | 589 | 0.222 | 0.268 | 0.0320 | 1.405 |

| Structure | 0.146 | 589 | 0.670 | 0.664 | 0.354 | 1.065 | |

| Technology | 0.0810 | 586 | 1.067 | 1.066 | 0.811 | 1.488 | |

| Control variable | Diesel | 64.73 | 589 | 48.50 | 63.85 | 0.800 | 487 |

| Plastic | 65,000 | 589 | 53,000 | 72,000 | 441 | 340,000 | |

| Lrrigated | 1574 | 589 | 1527 | 2008 | 109.2 | 6178 | |

| lnFert | 1.191 | 589 | 4.974 | 4.691 | 1.435 | 6.575 | |

| Crop | 3719 | 589 | 4997 | 5427 | 213.1 | 15,000 |

| (1) | |

|---|---|

| C | |

| Event | −0.020 *** |

| (0.007) | |

| _cons | 0.001 |

| (0.002) | |

| Control | Yes |

| Fix Year | Yes |

| Fix City | Yes |

| N | 589 |

| (1) Exclusion of Municipality Samples | (2) Alteration of Sample Interval | (3) Winsorization | (4) Lagged Explained Variable by One Period | |

|---|---|---|---|---|

| C | C | C | C | |

| Event | −0.013 * | −0.021 ** | −0.023 *** | −0.035 ** |

| (0.007) | (0.008) | (0.007) | (0.008) | |

| _cons | 0.001 | 0.001 | −0.000 | 0.000 |

| (0.001) | (0.002) | (0.002) | (0.002) | |

| Control | Yes | Yes | Yes | Yes |

| Fix Year | Yes | Yes | Yes | Yes |

| Fix City | Yes | Yes | Yes | Yes |

| N | 513 | 496 | 589 | 558 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Scale | Structure | Technology | |

| Event | 0.031 *** | 0.019 ** | 0.052 *** |

| (0.006) | (0.008) | (0.009) | |

| _cons | 0.001 | −0.001 | −0.001 |

| (0.003) | (0.002) | (0.003) | |

| Control | Yes | Yes | Yes |

| Fix Year | Yes | Yes | Yes |

| Fix City | Yes | Yes | Yes |

| N | 589 | 589 | 586 |

| (1) Primary Grain-Producing Regions | (2) Non-Primary Grain-Producing Regions | |

|---|---|---|

| C | C | |

| Event | −0.038 * | −0.009 |

| (0.022) | (0.008) | |

| _cons | −0.002 | 0.000 |

| (0.002) | (0.003) | |

| Control | Yes | Yes |

| Fix Year | Yes | Yes |

| Fix City | Yes | Yes |

| N | 247 | 342 |

| (1) Non-Yangtze River Economic Belt Areas | (2) Yangtze River Economic Belt | |

|---|---|---|

| C | C | |

| Event | −0.010 | −0.027 *** |

| (0.011) | (0.009) | |

| _cons | −0.001 | −0.003 |

| (0.003) | (0.004) | |

| Control | Yes | Yes |

| Fix Year | Yes | Yes |

| Fix City | Yes | Yes |

| N | 380 | 209 |

| (1) Low Environmental Regulation Intensity | (2) High Environmental Regulation Intensity | |

|---|---|---|

| C | C | |

| Event | −0.0003 | −0.027 ** |

| (0.016) | (0.011) | |

| _cons | 0.004 | −0.000 |

| (0.003) | (0.004) | |

| Control | Yes | Yes |

| Fix Year | Yes | Yes |

| Fix City | Yes | Yes |

| N | 278 | 311 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dong, Y.; Gu, L. Can Policy-Based Agricultural Insurance Promote Agricultural Carbon Emission Reduction? Causal Inference Based on Double Machine Learning. Sustainability 2025, 17, 4086. https://doi.org/10.3390/su17094086

Dong Y, Gu L. Can Policy-Based Agricultural Insurance Promote Agricultural Carbon Emission Reduction? Causal Inference Based on Double Machine Learning. Sustainability. 2025; 17(9):4086. https://doi.org/10.3390/su17094086

Chicago/Turabian StyleDong, Yuling, and Lili Gu. 2025. "Can Policy-Based Agricultural Insurance Promote Agricultural Carbon Emission Reduction? Causal Inference Based on Double Machine Learning" Sustainability 17, no. 9: 4086. https://doi.org/10.3390/su17094086

APA StyleDong, Y., & Gu, L. (2025). Can Policy-Based Agricultural Insurance Promote Agricultural Carbon Emission Reduction? Causal Inference Based on Double Machine Learning. Sustainability, 17(9), 4086. https://doi.org/10.3390/su17094086