1. Introduction

The overlapping effects of global value chain restructuring and the rising wave of trade protectionism have significantly increased factor market segmentation and transaction costs across countries, thereby intensifying the divergence in regional innovation efficiency and severely constraining sustainable economic development. For instance, in 2024, the Silicon Valley region accounted for 52% of total venture capital and 39% (Data source: Joint Venture Silicon Valley.

2025 Silicon Valley Index) of unicorn companies (unicorns refer to high-growth startups valued at over USD 1 billion and not yet publicly listed) in the United States, reflecting a spatially polarized pattern of innovation that further exacerbates regional development imbalances [

1]. Pinheiro et al. (2025) [

2] found that in Europe, advanced technological innovation hubs are primarily concentrated in southern Sweden, southern Germany, southeastern France, southeastern England, the Netherlands, Estonia, and Finland, while regions such as Norway (excluding the Oslo area), Denmark (excluding Copenhagen), northwestern Germany, and parts of Eastern Europe are relatively lagging. As the only country in the world that encompasses all industrial categories defined by the United Nations [

3], China is facing a similar dilemma. In 2023, R&D personnel and funding in eastern China were approximately five times (Data source:

China City Statistical Yearbook) greater than those in the western region, while the number of patent applications and unicorn companies was six times (Data source:

CNIPA) and twenty-five times (Data source:

2023 China Unicorn Enterprise Rankings, China Commercial Industry Research Institute) higher, respectively. These figures indicate that high value-added innovation activities in China remain heavily concentrated in the eastern region. Such spatial imbalances in innovation reinforce a negative feedback mechanism—namely, the “innovation siphoning–low-end lock-in” cycle—through channels such as technology premiums and the selective migration of human capital, further widening regional disparities in innovation efficiency [

4,

5,

6] and constraining the sustainability of economic development [

7].

In recent years, the rapid development of the digital economy has emerged as a key driving force behind the sustainable advancement of new economic paradigms. According to

The 2024 Digital Economy Report released by the China Academy of Information and Communications Technology (CAICT), the digital economy accounted for 60% (Data source: CAICT,

2024 Digital Economy Report) of global GDP in 2023. Meanwhile,

Global Innovation Index 2023 published by the World Intellectual Property Organization (WIPO) highlights how the global R&D race triggered by artificial intelligence (AI) has propelled the innovation pace of the digital economy far beyond that of traditional economic models. Against this backdrop, countries around the world are actively formulating digital economy policy frameworks in an effort to foster new technologies and stimulate innovation momentum [

8]. For instance, China has introduced the “Eastern Data, Western Computing” project to optimize national computing power infrastructure; the European Union has leveraged

The Digital Markets Act to dismantle data monopoly barriers; and the United States has promoted digital technology R&D through

The CHIPS and Science Act, strengthening its semiconductor ecosystem. These policy efforts consistently emphasize the role of data technologies in driving diffusion effects—such as digital infrastructure networks—and inclusiveness effects—such as the accessibility of digital finance—to enhance the knowledge and technology absorption capacity of peripheral innovation regions [

9,

10], thereby addressing spatial imbalances rooted in traditional growth models [

11] and narrowing regional disparities in innovation efficiency. As the world’s largest developing country and a core growth pole of the digital economy, China faces considerable risks if technological collaboration between its eastern and western regions remains insufficient. Such disconnection could lead to fragmented markets and a mismatch between technological advancement and consumption upgrading. Combined with increasing external restrictions, these dynamics may amplify industrial chain vulnerabilities and undermine national goals such as carbon neutrality and common prosperity. Therefore, studying how China’s digital economy reshapes disparities in innovation efficiency is not only crucial for the country to overcome the middle-technology trap and reduce supply chain fracture risks, but also offers valuable practical insights for emerging economies striving for technological catch-up and sustainable development.

Urban networks, formed through physical linkages such as transportation and communication infrastructure, serve as interactive systems that facilitate the flow of production factors—including technology, capital, and population—across cities. In essence, they act as the spatial carriers of real economic activity [

12]. Variations in either the number of nodes (cities) or the strength of inter-city connections directly influence the overall scale of urban networks, thereby generating nonlinear impacts on innovation efficiency through network scale effects. Within this framework, the digital economy, characterized by high permeability and near-zero marginal costs, reshapes the expansion pathways of urban network scale and exerts a dual influence on disparities in innovation efficiency [

13,

14]. On the one hand, the non-rival nature of digital technologies breaks the monopoly barriers surrounding access to information and knowledge [

15], reconstructs the flow of technological innovation within innovation networks, redefines data exchange structures in information networks, and transforms factor coordination mechanisms in economic networks. This enables weakly connected entities to bypass traditional “core–periphery” hierarchies and acquire non-redundant technological information through weak ties [

16], thereby reducing technology search and trial-and-error costs and facilitating convergence in innovation efficiency. On the other hand, regions functioning as network hubs with stronger linkages are more likely to benefit from the skill-biased effects of the digital economy, attracting high-skilled labor and capital, and accelerating the exchange and transformation of tacit knowledge. These regions, through frequent innovation interactions [

17], achieve optimized reallocation of innovation resources, resulting in gains in innovation efficiency. In contrast, entities with weak linkages are more susceptible to falling into a “low-efficiency trap” [

18], further exacerbating regional polarization in innovation efficiency.

This study adopts Schumpeter’s theory of innovation as its analytical framework [

19], with a focus on breakthrough innovation driven by technological disruption and new combinations of production factors. It shifts the research perspective from the traditional focus on innovation scale disparities to the concept of innovation efficiency disparities—that is, from measuring differences in technological output volume to evaluating differences in the effectiveness of resource input and output. This perspective aims to transcend the limitations of focusing solely on the expansion of innovation scale and instead uncover the structural contradictions in resource allocation. Existing studies suggest that the development of the digital economy can enhance total factor productivity [

20], accelerate green innovation outputs [

21], and promote disruptive environmental technological innovation [

22], thereby confirming its developmental effects. However, these studies have not sufficiently examined how the digital economy affects disparities in innovation efficiency, nor have they explored the role of complex network structures in this process. Some of the literature has investigated the relationship between the digital economy and innovation scale disparities, particularly in terms of its impact on patent counts and the output value of new products [

23,

24]. Yet, there remains no consensus on whether the digital economy helps narrow innovation scale disparities. Convergence theorists argue that the digital economy can promote technological catch-up in lagging cities by alleviating barriers to factor mobility [

25], improving institutional environments [

6,

26], and accelerating knowledge spillovers [

27]. In contrast, polarization theorists contend that the self-reinforcing nature of data factors and the positive feedback of network effects [

28] allow technologically leading cities to leverage initial data and resource advantages to exert a siphoning effect on innovation factors [

18], thereby intensifying technological decline in peripheral regions [

18,

29]. Other scholars have identified a dynamic, nonlinear relationship in which the digital economy initially widens but later narrows disparities in innovation scale [

30]. Overall, the existing literature has primarily analyzed the digital economy’s influence through the lens of factor allocation and static endowments, with limited attention paid to the role of complex regional network structures in shaping disparities in innovation efficiency.

Existing research on complex networks has primarily focused on the evolution of network topologies [

31,

32] and the identification of urban network functions [

33,

34], presenting a structural orientation and a tendency toward static analysis, while lacking integration with other multidimensional factors. Some scholars have examined the relationship between the digital economy and urban networks, with most emphasizing how digital infrastructure can enhance inter-city interaction intensity and spatial organization patterns through virtual linkages [

35,

36,

37]. However, these studies have yet to explore how this process affects disparities in innovation efficiency or to clarify the specific role played by complex networks. For example, Zhou et al. (2017) [

38] argue that cultivating central network cities helps optimize the structure of innovation networks, thereby improving urban innovation capacity. Sheng et al. (2020) [

39] further suggest that different structural characteristics of urban networks exert heterogeneous impacts on innovation efficiency. Overall, the existing literature has primarily focused on the digital economy’s influence on innovation efficiency and innovation scale disparities, while research on its impact on innovation efficiency disparities remains nearly absent. Moreover, most studies have examined the digital economy’s influence on either network structures or innovation activities in isolation, with few integrating economic, innovation, and information networks within a unified analytical framework. As a result, it is difficult to comprehensively understand the interplay among the digital economy, urban network structures, and disparities in urban innovation efficiency. In this context, adopting a complex network perspective to investigate the impact of the digital economy on innovation efficiency disparities not only reveals the dynamic optimization mechanisms of regional resource allocation driven by data-enabled network topologies but also addresses the “efficiency black box” created by traditional analytical frameworks that overlook variations in node linkage strength. This approach enriches the application of innovation theory in the context of the digital economy. Based on this, the present study seeks to address the following research questions: Can the digital economy help reduce disparities in innovation efficiency? What roles do innovation, information, and economic networks play in this process? How does the effect vary under different configurations of these networks? Are there regional differences in this influence? Answering these questions is crucial for promoting high-quality and coordinated regional innovation. Accordingly, this study utilizes panel data from 264 prefecture-level and above cities in China spanning 2011 to 2022 to empirically examine the impact and mechanisms of the digital economy on urban innovation efficiency disparities from the perspective of complex networks. Furthermore, the study explores the nonlinear effects of the digital economy on innovation efficiency disparities under different levels of development in innovation, information, and economic networks, thereby providing policy recommendations for addressing efficiency imbalances and achieving sustainable growth.

The potential marginal contributions of this study are as follows: First, unlike traditional frameworks that focus on regional attributes and factors, this study adopts a complex network perspective to explore the effects and pathways through which the digital economy influences innovation efficiency disparities under the development of innovation, information, and economic networks. It further identifies the optimization effect of innovation networks, the enhancement effect of information networks, and the moderating effect of economic networks. Second, in contrast to the existing literature that primarily examines disparities in innovation scale, this research focuses on innovation efficiency disparities. Efficiency disparities provide a more direct reflection of the capacity for resource allocation and collaborative effectiveness across regions, especially in contexts of tightening resource constraints. In such settings, pursuing convergence through efficiency is more sustainable than merely expanding factor inputs. Third, this study investigates the dynamic characteristics of the digital economy’s impact on innovation efficiency disparities at different stages of complex network development, with the aim of uncovering practical approaches to strengthen the convergence effects of the digital economy.

The structure of the following content is as follows:

Section 2 provides a theoretical analysis.

Section 3 presents the model and identification strategy.

Section 4 examines the impact and mechanisms through which the digital economy influences innovation efficiency disparities from the perspective of complex networks, along with a series of robustness tests.

Section 5 investigates the nonlinear effects of the digital economy on innovation efficiency disparities under the dynamic development of complex networks, followed by a further heterogeneity test.

Section 6 concludes the study and offers relevant policy recommendations.

6. Conclusions and Policy Implications

6.1. Conclusions

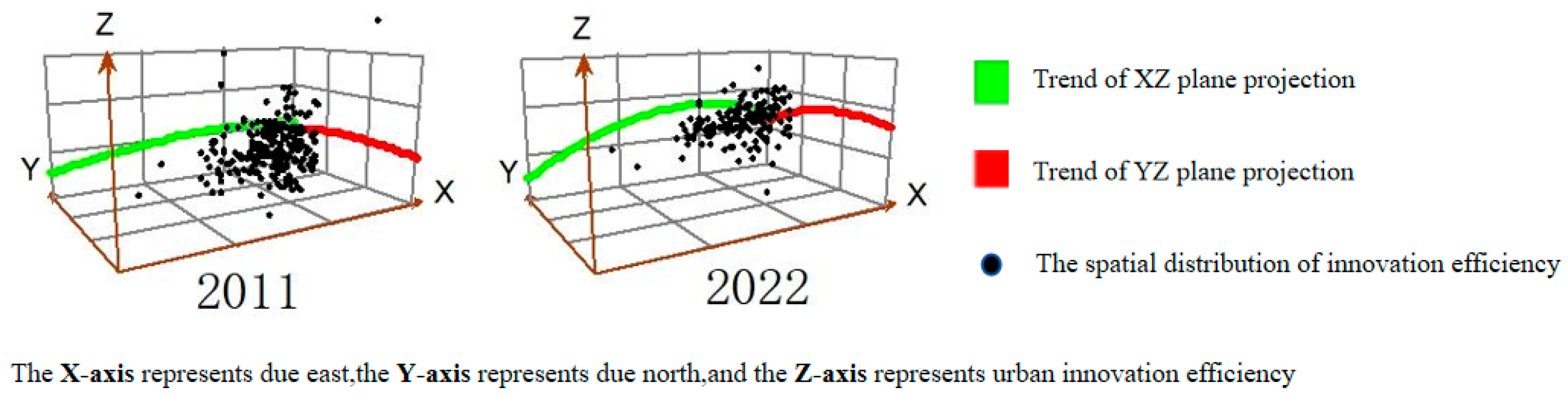

Based on panel data from 264 prefecture-level and above cities in China spanning the period from 2011 to 2022, this study employs fixed effects and two-stage regression models to empirically investigate the impact and mechanisms through which the digital economy affects intercity innovation efficiency disparities, focusing on innovation, information, and economic networks. The main findings are as follows: (1) The digital economy significantly reduces disparities in urban innovation efficiency. This conclusion remains robust after a series of tests for endogeneity and robustness. The digital economy contributes to narrowing these disparities primarily by optimizing innovation networks and strengthening information networks, while economic networks play a positive moderating role in this process. (2) When innovation, information, and economic networks are treated as threshold variables, the impact of the digital economy on innovation efficiency disparities exhibits a nonlinear pattern: it initially widens the gap before ultimately narrowing it. (3) Heterogeneity analyses reveal that the narrowing effect of the digital economy on urban innovation efficiency disparities is mainly driven by digital industrialization. Other dimensions—namely digital infrastructure, industrial digitalization, digital governance, and data value—do not yet show significant effects. The digital economy exerts a stronger narrowing effect on innovation efficiency disparities in southern cities compared to northern cities. It significantly reduces such disparities in cities located southeast of the Hu Huanyong Line, while in the northwest region, it tends to widen the gap; in cities situated directly on the line, its impact is not statistically significant. Furthermore, in large cities, digital economy development effectively narrows innovation efficiency disparities, whereas in smaller cities, it paradoxically exacerbates them.

6.2. Policy Implications

Based on the findings above, this study offers the following policy recommendations:

1. Continue deepening the development of the digital economy and leverage its key role in narrowing the innovation efficiency gap between cities: According to the empirical results, China should prioritize advancing the dimension of digital industrialization while strengthening the other four dimensions of the digital economy to bridge the innovation efficiency gap between cities. First, develop integration across the upstream and downstream digital industry chains, focusing on supporting core technology enterprises such as cloud computing, big data, artificial intelligence, and blockchain in deep collaboration with manufacturing and service industries to cultivate innovative industrial clusters. Considering fiscal investments and technological maturity, it is recommended to initially set up “industry collaboration pilot zones” in core eastern cities such as Shanghai, Suzhou, and Hangzhou, creating replicable experiences. In the medium term, select cities such as Shenzhen and Ningbo to explore pilot projects for incorporating data assets into accounting systems, allowing qualified enterprises to account for data assets as intangible assets. Establish a data asset sandbox mechanism and conduct data value assessments in high-value data scenarios such as finance and healthcare to release data dividends and help narrow the innovation efficiency gap. Secondly, digital infrastructure, industrial digitalization, digital governance, and data value currently have limited effects on narrowing the innovation efficiency gap, and these should be prioritized for medium- to long-term development. For example, the government can collaborate with leading companies such as Huawei and Alibaba to develop smart transportation and energy management systems. Drawing on the practice of Hangzhou’s “City Brain” using AI to optimize traffic signals, this should be scaled up and replicated in cities like Zhengzhou and Xi’an with traffic bottlenecks. Leverage Alibaba Cloud’s “Feitian” scheduling system to dynamically match real-time demands in the industrial internet and encourage companies to continuously upgrade their industrial internet platforms, insisting on data integration to optimize the supply chain in the long term. Continuously improve digital governance and build a dynamic regulatory framework suited to new business models, establishing cross-domain governance conventions, unified data collection standards, and mutual recognition of law enforcement within urban clusters. This will accelerate the interoperability of patent pools and elastic scheduling of computing power resources, enhancing collaborative innovation across cities.

2. Enhance urban network connectivity and continue strengthening urban network construction to enable balanced development of innovation efficiency: First, continue advancing infrastructure construction to solidify the foundation for the flow of elements. Increase the construction of high-speed rail, highways, and aviation infrastructure, reinforcing strategic intercity transport networks, and implementing China’s “Eight Horizontal and Eight Vertical” high-speed rail network plan. Simultaneously, promote the construction of 5G networks, data centers, industrial internet platforms, supercomputing centers, and urban brain systems to increase the coverage and transmission speed of urban information networks. Second, strengthen the radiation and driving role of core cities and foster the development of secondary node cities. Continue promoting the development of urban clusters such as the Beijing-Tianjin-Hebei, Yangtze River Delta, and Pearl River Delta regions, building innovation communities and science and technology corridors within urban clusters or metropolitan areas. Guide leading enterprises in core cities to relocate production bases to secondary cities, accelerating the establishment of a vertical network system linked by industrial chains. Promote the construction of cross-city intellectual property transaction markets and encourage core cities to transfer patents to secondary centers through tax incentives, accelerating the diffusion of technologies. Improve the urban innovation talent cultivation system, establish talent introduction and retention mechanisms, and encourage the cross-city flow and exchange of core talents. Through optimized talent allocation, strengthen the resilience of urban networks and enhance the innovation catch-up capacity of weaker network nodes.

3. Implement differentiated regional digital policies to narrow the regional innovation efficiency gap: On the one hand, implement differentiated “digital tax” policies to provide tax reductions and other subsidies to digital economy enterprises in western cities, while offering innovation subsidies to eastern cities’ enterprises that transfer digital technologies to the west, promoting cross-city development of digital technologies and innovation efficiency. At the same time, strengthen talent cultivation and introduction in western cities to ensure a talent base for the development of the digital economy. In cities like Chengdu and Xi’an, establish digital technology transformation centers offering services such as patent evaluation and financing connections to accelerate the “late-mover advantage” of western cities and lay the digital foundation for improving innovation efficiency in the western region. On the other hand, focus on leading digital technologies and ecosystem building, supporting leading enterprises to build industrial internet platforms and digital transformation exchange centers, and promoting the R&D of cutting-edge technologies such as artificial intelligence and quantum information. Form a “core enterprises + SMEs” collaborative innovation network. Additionally, deepen the “Eastern Data, Western Computing” project, guiding the transfer of computing power to western hubs, optimizing resource allocation efficiency through cross-regional data flow, avoiding redundant construction and homogeneous competition, releasing the “innovation diffusion” from eastern cities, and accelerating the absorption of digital technologies in western cities to drive a gradient leap in innovation efficiency.

7. Limitations and Further Research

This study has some limitations. First, in terms of indicator setting, due to the availability of urban data, the human capital input indicators primarily focus on quantitative measures, which fail to fully capture differences in the quality of the subjects. Additionally, the innovation environment cannot yet quantify institutional culture and soft factors. Output indicators also do not account for intangible benefits such as knowledge spillovers. The use of the entropy weight method to calculate secondary indicator evaluation indices may fail to overcome the problem of excessive reliance on data distribution characteristics, which may lead to an underestimation of some theoretically important indicators. Furthermore, the DEA method is sensitive to data quality and indicator selection, and can also be influenced by outliers. Second, this study uses the Baidu Index to represent intercity information flow. However, the Baidu Index reflects “potential attention” rather than “actual behavior”, and is influenced by factors such as algorithm weight adjustments and search channel diversions (e.g., differences between mobile and PC platforms), making it difficult to accurately capture the actual intercity information flow. Finally, there are significant differences in the policy environment, industrial base, and social culture of digital economies across different countries. Although the discussion of China as an emerging economy can offer some reference for other developing or emerging economies, it is still necessary to base the analysis on the specific economic conditions of each country. A comprehensive comparative analysis of the similarities and differences in the relationship between digital economy and innovation efficiency gaps is required to extract universally applicable laws and experiences.

As for future research directions, first, the current study is based on urban-level data in China. Future research could delve deeper into the industrial or enterprise level in China, exploring how the digital economy influences the innovation efficiency gap through mechanisms such as cross-organizational collaboration and cross-regional cooperation from a more mesoscopic or microscopic perspective. Second, this study mainly investigates the direct effects of the digital economy on the innovation efficiency gap. Future studies could incorporate spatial econometrics to analyze the spatial spillover effects brought about by the flow of network elements, the diffusion paths, and impact range of networks, as well as identify the radiation or siphoning effects of core cities on the innovation efficiency of peripheral cities. Third, subject to data availability, this research could be extended to major countries globally. By comparing the differences in the role of digital economies on urban innovation efficiency at different stages of development and under different institutional contexts, the international applicability of the findings could be enhanced. Lastly, with the rise in geopolitical risks and trade protectionism, the risks associated with digital economies, such as cybersecurity and data monopolies, have become increasingly prominent. Future research could incorporate network resilience into the analytical framework, exploring how cities can build more digitally integrated urban network structures to maintain the stability and sustainability of innovation efficiency when facing external shocks.

_Li.png)