Abstract

Maritime transport accounts for approximately 3% of global greenhouse gas (GHG) emissions, a figure projected to rise by 17% by 2050 without effective mitigation measures. Achieving zero-emission shipping requires a comprehensive strategy that integrates regulatory frameworks, alternative fuels, and energy-saving technologies. However, existing studies often fail to provide an integrated analysis of regulatory constraints, economic incentives, and technological feasibility. This study bridges this gap by developing an integrated model tailored for international maritime transport, incorporating regulatory constraints, economic incentives, and technological feasibility into a unified framework. The model is developed using a predictive approach to assess decarbonization pathways for global shipping from 2018 to 2035. A multi-criterion decision analysis (MCDA) framework, coupled with techno-economic modeling, evaluates the cost-effectiveness, technology readiness, and adoption potential of alternative fuels, operational strategies, and market-based measures. The results indicate that technical and operational measures alone can reduce emissions by up to 44%, while market-based measures improve the diversity of sustainable fuel adoption. Biofuels, particularly BISVO and BIFAME, emerge as preferred alternatives due to cost-effectiveness, while green hydrogen, ammonia, and biomethanol remain unviable without additional policy support. A strict carbon levy increases transport costs by 46%, whereas flexible compliance mechanisms limit cost increases to 14–25%. The proposed approach provides a robust decision-support framework for policymakers and industry stakeholders, ensuring transparency in evaluating the trade-offs between emissions reductions and economic feasibility, thereby guiding future regulatory strategies.

1. Introduction

Maritime transport is a vital backbone of global trade, yet it contributes roughly 3% of global greenhouse gas (GHG) emissions—a share comparable to industrialized nations like Germany or Japan [1,2]. Without effective mitigation, shipping emissions are projected to rise by about 17% by 2050 [3], posing a serious challenge to international climate goals. Recognizing this, the International Maritime Organization (IMO) has introduced ambitious targets, including a strategy to halve shipping GHG emissions by 2050 (from 2008 levels) and a 2023 revised goal aiming for net-zero emissions in the sector by 2050 [4]. Achieving these targets requires a comprehensive decarbonization strategy encompassing energy efficiency technologies, alternative low-carbon fuels, and market-based measures like carbon pricing [5,6,7]. Consequently, decarbonizing the shipping industry has become an essential component of global climate-mitigation efforts, demanding integrated solutions that align technological innovation with economic and regulatory realities.

In pursuit of these goals, IMO has proposed various measures to accelerate decarbonization in the sector and reduce GHG emissions from ships [8]. Among these efforts, IMO introduced initial measures such as the Energy Efficiency Design Index (EEDI) [9] and the Ship Energy Efficiency Management Plan (SEEMP) [10], conceived to enhance the energy efficiency of vessels built after 2012. More recently, short-term measures such as the Energy Efficiency Existing Ship Index (EEXI) [11] and the Carbon Intensity Indicator (CII) [12] have been implemented. Since November 2022, these measures mandate ships to monitor and improve their energy efficiency to avoid penalties. These initiatives have spurred significant investments in advanced technologies and infrastructure, including cleaner engines, hybrid propulsion systems, optimized hull designs, and more efficient navigation practices. However, while these changes are necessary, they have also increased operational and capital costs, underscoring the importance of international collaboration to ensure their effective implementation and compliance.

Following the 2023 revision of emission targets, attention has shifted to medium-term measures, which are essential for achieving the net-zero goal. These include regulatory frameworks and economic incentives to support decarbonization, such as a GHG levy, flexible compliance mechanisms based on GHG Fuel Intensity (GFI), and feebate systems. These tools aim to drive further emission reductions across the maritime sector. Yet, predicting the technological pathways the industry will adopt remains challenging due to the diversity of vessel types, sizes, ages, and operational profiles—each subject to varying regulatory pressures, fluctuating fuel prices, and rapid technological advancements.

Despite broad agreement on the need for deep cuts in maritime emissions, existing studies often address isolated pieces of the puzzle rather than the whole picture. Prior research has typically focused on individual decarbonization measures—for example, exploring alternative fuels (biofuels, hydrogen, ammonia) [13,14,15,16], evaluating specific energy efficiency improvements [17,18], or examining policy instruments like emission regulations and market-based measures [17,18,19]. Other works have developed global fleet emission models, but these often emphasize one dimension at a time (such as operational changes, a particular alternative fuel, or a carbon levy). What is largely missing is an integrated framework that captures the interaction between technological options, economic factors, and policy constraints. Even advanced Integrated Assessment Models (IAMs) have historically treated international shipping in a cursory manner—typically as a single aggregated sector—thereby overlooking the rich heterogeneity of vessel types and operational decisions [20]. This segmented approach in the literature means we have a limited understanding of how different strategies combine in practice, and how ship owners might navigate complex trade-offs under real-world conditions. In short, a gap exists in current GHG-assessment methods for shipping: no existing study fully integrates regulatory drivers, economic incentives, and technological feasibility into a unified, vessel-level analysis.

Integrated Assessment Models (IAMs) have long served as essential tools for evaluating global climate-mitigation strategies by linking economic systems, technological developments, and policy interventions. However, maritime transport has traditionally received limited attention within these models, despite contributing around 0.7 GtCO2 annually—or approximately 2.8% of global CO2 emissions [20]. In response, recent efforts have been made to enhance the representation of international shipping within IAM frameworks.

For instance, a comparative analysis involving six prominent IAMs—COFFEE, IMAGE, PROMETHEUS, TIAM-UCL, IMACLIM-R, and WITCH—suggests that shipping emissions could be reduced by up to 86% by 2050, primarily through the adoption of low-carbon fuels such as biofuels, renewable alcohols, and green ammonia [20]. Notably, models like COFFEE, IMAGE, and TIAM-UCL offer greater technological granularity by including multiple propulsion systems and fuel pathways, while IMACLIM-R and WITCH focus on a narrower subset of mitigation strategies. These differences highlight the variation in the predictive capacity of IAMs for the maritime sector and underscore the need for higher-resolution modeling.

Nonetheless, IAMs still rely on macroeconomic, sector-wide assumptions, often overlooking ship-specific operational and technological decisions. To address this gap, our approach integrates a sectorial simulation framework with a ship-level techno-economic model using Multi-Criteria Decision Analysis (MCDA). This allows for a more granular evaluation of decarbonization pathways tailored to different vessel types, propulsion technologies, and operational scenarios, supporting realistic and actionable strategies for achieving net-zero emissions.

Literature studies often lack an integrated framework that accounts for the interaction between regulatory pressures, volatility in fuel prices, and specific characteristics of vessels. Furthermore, there appears to be a trend in examining the problem from an economic or environmental perspective, not adequately addressing the broader complexity of deciding which technologies to adopt for different vessel types and operational contexts. Consequently, there is limited understanding of how shipowners navigate uncertainty when faced with multiple factors, including economic incentives, regulatory requirements, and technological feasibility. This paper aims to bridge this gap by developing a predictive model that integrates these aspects, offering information on the likely decarbonization paths for the maritime sector.

The maritime industry is characterized by a wide variety of vessels, from small coastal ships to large transoceanic container vessels, each with unique energy requirements and operational patterns. The introduction of new regulations, such as emission limits and carbon pricing, adds complexity to this environment, requiring shipowners to make decisions under conditions of significant uncertainty. Understanding which technologies will be adopted and how vessel classes will evolve under these changing conditions remains a critical research question. The dynamic interplay between regulatory frameworks, economic incentives, and the availability of alternative fuels further complicates predictions of the sector’s decarbonization pathways. Addressing these uncertainties is essential for developing effective policies and investment strategies to guide the maritime industry toward its decarbonization objectives.

Given this context, the primary objective of this paper is to develop a comprehensive framework to predict the decarbonization pathways of maritime transportation. This framework enables a detailed assessment of transport costs, including capital expenditures (CAPEX), operational expenditures (OPEX) and voyage-related expenditures (VOYEX), fees, and rewards, as well as the emissions associated with the adoption of new technologies over time. By providing these insights, this study seeks to facilitate the evaluation of various decarbonization policies currently under discussion at the IMO.

Building on this integrated framework, our study makes several unique contributions to the literature and practice of sustainable shipping. First, we develop a unified model that merges ship-level decision analytics with sector-wide simulation—offering a holistic perspective that fills a crucial methodological gap in maritime decarbonization research. Second, our model captures the distinct pathways for various segments of the fleet—from small coastal ships to large ocean-going vessels—showing how each segment may optimally combine technologies to meet emissions targets. Third, the integration of detailed cost assessments (CAPEX, OPEX, voyage expenses, carbon fees or credits) with emissions performance delivers a rigorous techno-economic analysis. Lastly, the framework acts as a virtual policy laboratory, revealing how specific policy measures (e.g., carbon levies, fuel intensity standards) influence technology uptake and emissions trajectories across the global fleet. Through these innovations, the study not only addresses a critical research gap but also pushes the envelope of methodological practice in maritime environmental analysis.

The specific research questions addressed in this paper are as follows:

- What are the most likely technological pathways the different ship types will adopt to comply with decarbonization regulations?

- How do fluctuating fuel prices and new regulatory measures influence the adoption of low-carbon technologies by vessels of varying types, sizes, and operational profiles?

- What are the expected costs, including CAPEX, OPEX, VOYEX, fees, and rewards, associated with the implementation of decarbonization measures?

The remainder of this paper is organized as follows. Section 2 outlines the methodology adopted and the development of the technological pathway model, including the description of the method for ranking technological options. Section 3 presents the results and discussion, encompassing cost analyses, GHG emissions evaluation, the cost-effectiveness of decarbonization measures, and the adoption of alternative fuels and technologies. Section 4 concludes the article by summarizing the findings and highlighting their implications for policy and future research. The Appendix A, Appendix B, Appendix C, Appendix D, Appendix E and Appendix F provide additional details, including the description of the decarbonization measures, the properties of the fuel, and the methodological considerations, to ensure the robustness and reproducibility of this study.

2. Methodology

The methodology developed in this study follows a sectoral Integrated Assessment Modeling (IAM) approach tailored for maritime transport, integrating techno-economic analysis, policy evaluation, and trade-flow modeling. Unlike traditional IAMs that represent maritime transport as a single aggregated sector within broader energy and economic systems, this study focuses exclusively on the shipping industry, incorporating ship-specific decision-making through a Multi-Criteria Decision Analysis (MCDA) framework. This sectoral IAM structure provides a more granular representation of technological pathways, regulatory incentives, and market responses, offering a structured methodology for evaluating maritime decarbonization strategies within the context of global trade and policy dynamics. The feedback loop between maritime transport and the global economy is addressed in Part II of this study, where the GTAP (Global Trade Analysis Project) model is utilized to quantify the economic and GHG emission impacts resulting from the analyzed IMO medium-term measures. For further details, see Pereda et al. [21].

First, the Technological Pathway Model (Section 2.1) applies a Multi-Criteria Decision Analysis (MCDA) approach to rank and select optimal technological alternatives for different ship types based on economic and environmental criteria. Second, the World Trade Flow Simulation Model (Section 2.2) projects the evolution of global maritime trade by simulating fleet operations, technological adoption, and policy impacts on shipping activities. This model integrates economic, environmental, and operational data to assess future trade and fleet dynamics. Finally, the Simulation Matrix (Section 2.3) establishes a structured set of scenarios incorporating varying regulatory frameworks, fuel price trajectories, and technological adoption strategies to explore potential maritime decarbonization pathways. Together, these steps form a comprehensive modeling framework that enables the evaluation of cost-effectiveness, emission-reduction potential, and policy implications of different technological choices.

2.1. Technological Pathway Model

2.1.1. Overview

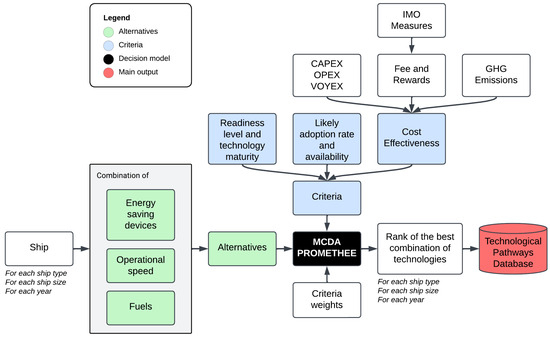

Figure 1 illustrates the decision-making framework for identifying the optimal combinations of technologies to achieve zero-emission maritime transport. The model integrates multiple criteria and alternatives using a Multi-Criteria Decision Analysis (MCDA) approach with the PROMETHEE method.

Figure 1.

Technological pathways model. Notes: The model evaluates combinations of technologies—namely energy-saving devices, operational speeds, and fuel types—for various ship types, sizes, and years. These combinations (shown in green) are assessed as Alternatives using a Multi-Criteria Decision Analysis (MCDA) method. The evaluation is based on Criteria (blue) such as cost-effectiveness, technology readiness, and adoption rates, which consider economic metrics (CAPEX, OPEX, VOYEX), IMO measures, and greenhouse gas (GHG) emissions. The decision model (black) ranks alternatives according to weighted criteria, identifying the best technology combination. The main output (red), stored in the Technological Pathways Database, provides a ranked set of optimized pathways per ship type, size, and year to support decision-making in maritime decarbonization.

The process begins with ship-specific input data, classified by ship type, size, and operational year. Different alternatives are generated as combinations of energy-saving devices (ESDs), operational speed adjustments, and alternative fuels, described in detail in Table 1. The effect of each ESD, operational speed, and alternative fuel, as well as how they are incorporated into the model is explained in Appendix B Evaluation criteria include readiness level and technology maturity, likely adoption rate and availability, and cost-effectiveness, which is influenced by CAPEX, OPEX, VOYEX, GHG emissions, and IMO measures such as fees and rewards.

Table 1.

Combination of alternative technologies considered in the model.

The decision model ranks the combinations of technologies based on weighted criteria to identify the most suitable technological pathways for each type, size, and year. The output of the MCDA model represents the simulated decision of a shipowner for a given ship type, size, and operational year, identifying the most suitable combination of technologies based on the three weighted criteria. This approach allows for ship-specific, year-specific decision-making, with the model dynamically adjusting to technology maturity, availability, and cost-effectiveness. The ranked results are stored in a technological pathways database, providing a comprehensive resource for the decision-making of sustainable shipping.

2.1.2. Ranking of the Technologies

Multi-Criteria Decision Analysis (MCDA) is a decision-making framework designed to evaluate and compare alternatives across multiple, often conflicting, criteria. In this study, MCDA is applied to rank the effectiveness of various GHG abatement technologies, including energy-saving devices, renewable fuels, speed-reduction measures, and market-based mechanisms, against a set of predefined criteria. Each criterion is assigned a weight, reflecting its relative importance, which is then incorporated into the evaluation to provide a balanced comparison of the technologies.

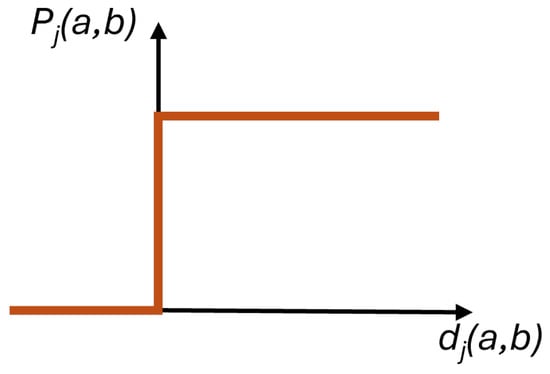

For this analysis, we employ the PROMETHEE (Preference Ranking Organization Method for Enrichment Evaluation) method, a widely used MCDA technique that ranks alternatives through pairwise comparisons based on their performance across the criteria [22]. PROMETHEE involves calculating preference indices and flows, which represent the outranking relationships between different technology options, ultimately producing a ranked list of GHG abatement measures.

Among various MCDA methods, PROMETHEE was selected due to its ability to handle complex decision-making contexts with a large number of alternatives and criteria, which is critical in the evaluation of maritime decarbonization technologies. Compared to AHP, which requires extensive pairwise comparisons and may become impractical with a large number of alternatives, PROMETHEE offers computational efficiency and scalability suitable for analyzing more than 10,000 technology combinations per vessel profile. Additionally, PROMETHEE allows for partial and complete ranking through the calculation of preference flows, providing a more nuanced evaluation than the simple aggregative scoring used in TOPSIS. Moreover, PROMETHEE can manage non-compensatory trade-offs between criteria, aligning with the need to balance cost-effectiveness, technology readiness, and adoption likelihood without overemphasizing any single dimension. These capabilities make PROMETHEE particularly well-suited for this study, where dynamic, year-by-year vessel-specific decision-making is required under uncertainty and evolving technological maturity. Further justification for PROMETHEE’s application, including its mathematical structure and advantages over other MCDA methods, is provided in Appendix D.

Here we considered three criteria to rank the combination of technologies, i.e., the readiness level (technology maturity), the likely adoption rate and availability, and the cost-effectiveness. Importantly, the shipowner decision to adopt a combination of technologies is not predefined or fixed, but rather emerges from the aggregation of individual ship-level decisions across the global fleet. Each year, the model simulates the decision of shipowners for specific ship types and sizes using MCDA rankings based on the three criteria.

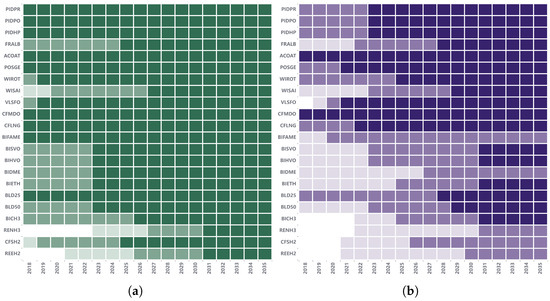

Figure 2 shows the temporal evolution of the first two criteria—technology readiness and adoption likelihood—for various technologies from 2010 to 2035, as implemented in the model (MCDA inputs).

Figure 2.

Technology maturity and availability per year (2018–2035) based on [6,23,24,25,26,27]. (a) Readiness level and technology maturity. (b) Likely adoption rate and availability. Notes: Panel (a) shows the readiness level and maturity of the technologies based on technology readiness level (TRL). A rating of 0 (white) refers to measures that are not available, a rating of 1 (light green) refers to measures with a TRL less than 5, a rating of 2 (green) refers to a TRL of 5/6/7, and, a rating of 3 (dark green) refers to a TRL of 8/9; Panel (b) shows the likely adoption rate and availability. A rating of 0 (white) refers to technologies that are not available, a rating of 1 (light purple) refers to low likely adoption and low global availability, a rating of 2 (purple) refers to moderate likelihood of adoption and moderate global availability, and, a rating of 3 (dark purple) refers to high likely adoption rate and high availability.

Panel (a) shows the technology readiness levels (TRL), ranging from unavailable (white) to high maturity (dark green), while panel (b) displays the likely adoption rate and global availability, from unavailable (white) to high (dark purple). This visualization helps to assess the maturity and adoption trends of emerging technologies over time.

The cost-effectiveness of the combinations of technologies is the third and most important criterion. It is measured in terms of dollars per ton of CO2 equivalent abated (USD/ton CO2e) from a well-to-wake perspective (WTW). It is calculated by dividing the total CO2 emission savings over the remaining operational lifetime of the vessel (which varies according to the specific vessel analyzed) by the implementation costs associated with the technology. Implementation costs are defined as the sum of capital expenditures (CAPEX), operational expenditures (OPEX), voyage-related expenditures (VOYEX), and fees (FEES), minus any financial rewards or incentives (REWARD) that may apply.

Each ship’s cost components—CAPEX, OPEX, and VOYEX—are calculated based on ship type, size, operating profile (e.g., speed), and the specific technology considered. Since each actual ship travels a specific route and only one virtual sample ship is assessed for each combination of type, size, and age, the route distance is taken as a single average value for all virtual ships. This assumption is important because many variables are time-dependent, and at this stage, none of the virtual ships were yet connected to a specific trade flow. This approach allows us to assess the impact of each technology on the Total Cost of Ownership (TCO) [28,29,30,31,32].

In summary, the cost impact of adopting a GHG-reduction measure is estimated by analyzing three key factors: (i) changes in capital costs (CAPEX) associated with the implementation of each alternative, (ii) changes in voyage costs (VOYEX), primarily driven by variations in fuel consumption—whether using heavy fuel oil (HFO) or alternative marine fuels, and (iii) changes in operational and maintenance costs (OPEX) resulting from the adoption of new technologies.

The costs associated with adopting a given technology consider factors such as the potential loss of cargo space—resulting from the need for larger fuel tanks compared to conventional systems (e.g., diesel engines using HFO)—and/or increased travel times due to reduced vessel speeds. Consequently, the model accounts for the possible need for additional vessels to maintain the same transport capacity. In such cases, the corresponding costs—CAPEX, OPEX, and VOYEX—are proportionally allocated across the fleet. A detailed breakdown of these costs is provided in Appendix C.

The emission savings are determined on the basis of actual annual ton-miles delivered and the vessel’s energy consumption, as estimated through the model. Consequently, factors such as the size, type and age of the vessel significantly influence the overall cost-effectiveness assessment, as they affect both the operational characteristics and the potential emission reductions of the vessel. This comprehensive approach enables a multicriteria decision analysis (MCDA) to account for vessel-specific parameters when evaluating the economic and environmental viability of the technology.

The outcomes of the multicriteria decision analysis (MCDA) are strongly influenced by the weightings assigned to each criterion, as these weights represent the relative importance of each factor in the overall evaluation. Higher weights indicate a greater influence on the final decision, thus shaping the ranking and selection of technologies. For this study, a weight of 70% has been assigned to cost effectiveness, reflecting its primary significance in the evaluation. The remaining 30% are equally distributed, with 15% allocated to technology readiness level (maturity) and 15% to the likely adoption rate and availability. This weighting scheme was determined based on the practical decision-making criteria commonly used by shipowners, who prioritize economic viability when adopting new technologies. In the maritime industry, investment decisions are often driven by return on investment (ROI) and total cost of ownership (TCO), especially given the long operational lifetimes and high capital costs of vessels. Therefore, assigning a higher weight to cost-effectiveness reflects real-world priorities where economic feasibility is the dominant factor influencing technology uptake. While technology readiness and availability are also critical, they generally act as constraints rather than primary drivers of decisions. The weighting was applied uniformly across all vessel types and operating environments to maintain consistency and comparability across simulations.

2.2. World Trade Flow Simulation Model

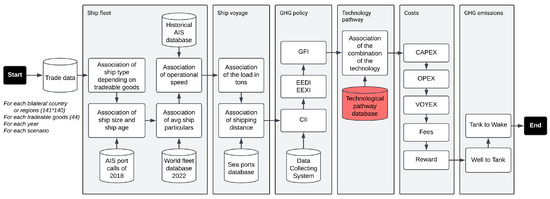

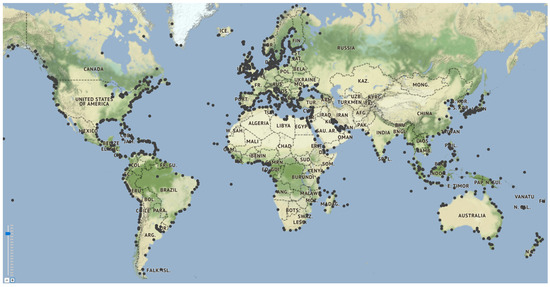

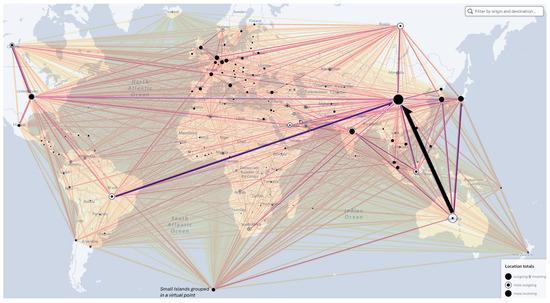

The model starts from a baseline year (2018) using industry data and input parameters and forecasts the global fleet’s evolution through techno-economic modeling to assess the competitiveness of individual vessels in future scenarios. This approach considers the evolving energy efficiency of the fleet during the 2019–2035 period. Algorithms are used to simulate the annual decision-making processes of ship owners and operators concerning fleet management and operations. Figure 3 illustrates the comprehensive framework developed to simulate world trade flows. This framework integrates multiple datasets and processes to analyze trade dynamics, shipping activities, greenhouse gas (GHG) policies, technological pathways, costs, and emissions. The simulation begins with trade data, which encompass bilateral trade between 141 countries or regions (Appendix F.1) for 45 categories of tradeable goods (Appendix F.2), analyzed for each year and scenario. Trade flows are based on the same aggregation as used in the GTAP (Global Trade Analysis Project) is utilized in part II of this study, to calculate the economic and GHG emission impacts of the analyzed IMO medium-term measures. For details, see Pereda et al. [21] model [33]. Regarding global bilateral trade flows, the model utilizes UN Comtrade data, disaggregated by product, to estimate maritime trade volumes. The methodology described in Pereda et al. [34] is applied to derive maritime trade flows from total trade data, including ground and air transportation. An illustration of bilateral trade flows for the year 2019 is available in the Appendix F.4. The trade projections for 2019–2035 are based on population and GDP forecasts derived from the SSP2 scenario provided by the IPCC [35]. An essential aspect of the model is the correlation between the type of cargo and the corresponding ship used for transportation. For example, crude oil and iron ore are typically transported by oil tankers and bulk carriers in sizes commonly employed in the shipping market. Similarly, manufactured goods are generally carried by container ships.

Figure 3.

World trade flow simulation model. Notes: The Technological pathway database (highlighted in red) represents the output of the Technological Pathway Model, which stores the best technology combinations for different scenarios and feeds this information into the model. All data associations and model steps are applied for each bilateral country or region pair (141 × 140), each of the 44 tradeable goods, each year, and each scenario.

The ship fleet module considers eight types of ship, categorized by different sizes, and five age categories of the ship, as detailed in Appendix E. This module links ship types to tradeable goods and associates ship size and age with AIS port call data from 2018. Operational speeds were derived from historical AIS data by ship type and size for the period 2018–2023, ensuring realistic modeling of vessel behavior during this time. Beyond 2023, ships are assumed to maintain their last observed average speed unless altered by scenario-specific measures. This assumption establishes a consistent baseline for evaluating the impact of speed-reduction strategies—such as slow steaming—which are introduced in the model as technical GHG-mitigation options. These scenarios simulate potential responses to varying economic conditions, including shifts in fuel prices and freight rates, thereby indirectly incorporating economic responsiveness into the model. Average ship particulars, such as dimensions and capacities, are sourced from the 2022 global ship fleet database.

The ship voyage module calculates cargo loads based on vessel capacity and type, employing cargo loading factors defined in the 2nd IMO GHG Study (Appendix E.3). Trade routes are linked to geographic shipping distances using a seaport database comprising approximately 1400 port terminals aggregated by region (Appendix F.3). The module further assesses the number of voyages needed and travel times, based on the ship’s average speed. The validation of the ship fleet profile, the total distance traveled, and the transport work is carried out using external datasets (Section 3.1).

The GHG policy module incorporates environmental metrics and standards, such as the Greenhouse Gas Fuel Intensity (GFI), the Energy Efficiency Design Index (EEDI), the Energy Efficiency Existing Ship Index (EEXI), and the Carbon Intensity Indicator (CII). The CII metric is statistically evaluated using data from the current ship and the Data Collecting System (DCS) for 2022.

In the technology pathway module, various technological solutions are evaluated by associating combinations of innovations described in the technological pathway database (see Section 2.1). This database, generated by the MCDA-based Technological Pathway Model, stores the optimized technology combinations per ship type, size, and operational year. These outputs serve as a dynamic input for the World Trade Flow Simulation Model, which assigns these optimal (or scenario-specific) combinations to vessels during simulation runs. This data flow enables realistic modeling of fleet-level decisions on technology adoption, emissions, and costs, ensuring consistency between the decision-making process and trade flow simulations across all scenarios. This interaction and data flow are illustrated in Figure 1 and Figure 3, where the Technological Pathways Database (highlighted in red) links both models.

The average renewal rate of the global fleet between 2012 and 2020, derived from IHS Maritime Trade data, shows fluctuations between 4.49% and 5.61% annually across vessel types and sizes, including bulk carriers, container ships and crude oil tankers. This renewal rate represents the proportion of new ships delivered each year as a percentage of the previous year’s total fleet size. Although there are variations between ship types and sizes, the model simplifies this by applying a constant annual fleet-renewal rate of 5%. This assumption ensures that the fleet is completely renewed over a 20-year period, aligning with a typical ship’s operational lifetime. Furthermore, the implementation of new technological pathways in the model assumes that 5% of the fleet adopts these advances annually, mirroring the renewal rate. This gradual integration of innovative solutions allows for a realistic projection of decarbonization pathways while maintaining alignment with historical fleet turnover rates. It is worth mentioning that the model does not currently simulate vessel upsizing, and instead models increased transport demand via an increased number of voyages by representative vessels per type and size class.

The cost module provides an economic breakdown that details CAPEX, OPEX, and VOYEX. It also includes considerations for fees and rewards arising from market-based measures. Finally, the GHG emissions module quantifies emissions from two perspectives, using data presented in Table A4: tank-to-wake emissions (TTW), which capture operational emissions directly associated with ship propulsion and energy use, and well-to-tank emissions (WTT), which account for upstream impacts of fuel production, processing, and transportation. It is important to note that costs, fees, rewards, and (GHG) emissions were previously evaluated to determine the cost-effectiveness of each technological combination within the MCDA framework. However, at this point, each virtual sample ship is already linked to a trade flow, which ensures that the travel distances are realistic and the results are more accurate.

Together, these interconnected modules form a robust simulation framework that comprehensively evaluates global trade flows, incorporating environmental and economic dimensions.

2.3. Simulation Matrix—Scenario Development

Table 2 summarizes the key characteristics of the scenarios considered in this study, highlighting their distinct approaches to greenhouse gas (GHG) reduction in the global shipping fleet. All GHG emissions in the scenarios are evaluated using a Well-to-Wake (WTW) perspective, encompassing both upstream and operational emissions associated with fuel production, processing, transport, and ship usage. Each scenario reflects a different combination of regulatory frameworks, operational strategies, and technological adoption pathways, providing a comprehensive analysis of potential outcomes under varying levels of intervention and market-based measures detailed in Appendix A.3. The following list details each scenario, explaining the specific policies, assumptions, and expected impacts on emissions and economic performance:

Table 2.

List of the scenarios considered in the study.

- REF—This scenario acts as the baseline, modeling the global shipping fleet without any new policies or measures aimed at reducing greenhouse gas (GHG) emissions. It reflects actual fleet data from 2018 to 2022 and projects that ships will continue operating at their current speeds through 2035. In this scenario, shipowners are assumed to not invest in energy-saving devices (ESD) or alternative fuels. The purpose of the REF scenario is to demonstrate the potential outcomes of a ‘business-as-usual’ approach, highlighting both the minimal financial investments and the highest potential emissions. It serves as a benchmark for comparing the impact of other, more proactive measures.

- BAUOPT—This scenario builds on current GHG regulations, incorporating short-term measures such as EEDI, EEXI (Appendix A.1), and CII (Appendix A.2) to promote the gradual decarbonization of the global fleet. It assumes an annual 2% reduction in carbon intensity up to 2035. The scenario evaluates all available technologies, assuming that shipowners consistently select the most effective combinations to comply with regulatory standards. BAUOPT explores the optimal scenario where shipowners make well-informed, cost-effective decisions, and shipyards renew 5% of the fleet annually. This scenario is key for understanding the potential of achieving maximum emissions reduction through rational investment and policy adherence.

- BAU20P—This scenario assumes the same regulatory environment as BAUOPT, including compliance with EEDI, EEXI, and CII. In this scenario, shipowners, on average, select combinations of technologies that are 20% below the cost-effectiveness of the optimal option determined by the MCDA ranking, introducing a level of non-optimality that simulates realistic decision-making under uncertainty. While energy-saving devices and alternative fuels remain optional in this scenario, it better reflects the real-world behavior where shipowners may not always make the most optimal investment choices. BAU20P illustrates the potential emissions outcomes when suboptimal decisions are made, offering a more realistic outlook compared to the idealized BAUOPT scenario.

- LEVY—In this scenario, a global carbon pricing mechanism, such as a levy on GHG emissions, is introduced to incentivize shipowners to adopt more aggressive decarbonization strategies. This includes reducing operational speeds, investing in energy-saving devices, and transitioning to alternative fuels. EEDI, EEXI, and CII remain in force, but the levy system provides additional financial motivation to adopt more advanced environmental technologies. The LEVY scenario explores how market-based measures (MBMs) like a carbon levy can accelerate the decarbonization of the shipping industry, highlighting the role of economic incentives in driving significant reductions in emissions through both operational and technological improvements.

- FCMOR—Similar to the LEVY scenario, FCMOR introduces an MBM, but it specifically focuses on a ‘Fuel Compliance Mechanism-Original’ (FCM-original). Like the LEVY scenario, FCMOR enforces compliance with EEDI, EEXI, and CII while examining how the adoption of alternative fuel policies can influence the shipping sector’s decarbonization efforts.

- FCMRE—Building on FCMOR, the FCMRE scenario features a revised version of the fuel consumption mechanism (FCM-revised). This version introduces a sustainability criteria for fuels, ensuring that only those with low WTW emissions are incentivized. While the core features remain, FCMRE tests the effectiveness of adjustments to the original mechanism, providing insights into how incremental policy changes can influence shipowner behavior and emissions outcomes.

- FEEBA—In this scenario, a feebate system is introduced. Under this system, ships that exceed specified emissions thresholds are required to pay a fee, while those that perform better than required can receive rebates. The FEEBA scenario encourages investments in energy-saving technologies, speed reduction, and alternative fuels. Compliance with EEDI, EEXI, and CII is mandatory (Appendix A.1 and Appendix A.2). This scenario investigates the potential effectiveness of financial incentives and penalties in accelerating decarbonization efforts, providing a balanced approach between enforcement and reward to promote significant emissions reductions.

2.4. Assumptions and Limitations

The model is built on a set of well-defined assumptions designed to balance computational feasibility with the complexity inherent in the decarbonization pathways in the maritime environment. Shipowner decision-making is simulated using a multi-criterion decision analysis framework (MCDA), prioritizing technology readiness, adoption likelihood, and cost-effectiveness, while excluding qualitative factors such as market advantages of early adoption. Technological combinations are structured in three dimensions: machinery and fuel supply, energy efficiency technologies, and operational speed. This yields approximately 10,752 options per vessel type, per year, per age, per route, and per scenario, providing a granular foundation for analysis. The model assumes a feasible transition to alternative fuels within the defined timelines, contingent on adequate global infrastructure and availability. Baseline data, which reflect the characteristics of the 2018 fleet and trade flows, underpin the framework, with auxiliary fuel standardized as marine gas oil (MGO) and a constant sea margin of 15% applied in all scenarios. For simplicity, emerging technologies such as carbon capture and storage (CCS) and pilot fuel oil are excluded, while gas transport is modeled exclusively via LNG carriers.

Despite its comprehensive approach, the model recognizes certain limitations associated with long-term forecasting. The precision of the projections depends significantly on assumptions about fuel prices, technology costs, and effectiveness of the reduction-factors that are inherently subject to geopolitical and economic uncertainties. Although global fleet specifications are based on 2018 data to ensure reliability, they may not fully capture minor variations in operational or technical parameters. Additionally, the model does not dynamically account for shifts in global trade flows or potential post-pandemic economic adjustments.

A further limitation relates to the assumption of a constant annual fleet-renewal rate of 5% across all ship types. While this reflects the global average observed over the past decade, it does not capture the heterogeneity in renewal rates between vessel categories, such as the typically higher turnover of container ships compared to bulk carriers. This simplification may affect the accuracy of decarbonization pathway projections at the ship-type level, although it preserves consistency and tractability for global-scale scenario analysis. Future work could enhance model fidelity by incorporating ship-type-specific renewal dynamics where data permit.

In the LEVY scenario where levy revenues are allocated externally to climate adaptation, RD&D, and administrative costs. The model currently does not simulate alternative redistribution mechanisms, such as reinvesting levy income directly into the maritime sector through subsidies or investment support. As a result, the potential impacts of revenue recycling on technology uptake, equity, and transition speed are not assessed in this version.

Furthermore, the model specifically distributes cargo among bulk carriers, oil tankers, container ships, conventional general cargo vessels, and gas carriers, representing more than 90% of the global fleet’s total tonnage (DWT). Other merchant vessels, such as cruise ships and offshore supply vessels, are not considered in this study. Likewise, the analysis does not cover emissions from service vessels, as they fall outside the scope of this research.

These inherent constraints underscore the challenges of predicting long-term maritime pathways.

3. Results and Discussion

This section presents the key findings of the study, starting with the validation of load and transport work to ensure the reliability of the modeling approach. The analysis then explores the evolution of GHG emissions under different policy scenarios, followed by an assessment of transport costs associated with these measures. Additionally, the impact of various policies on the adoption of alternative fuels and technologies is discussed. Finally, the results are compared with those from a similar model, providing context and validation for the study’s conclusions.

3.1. Validation of Load and Transport Work

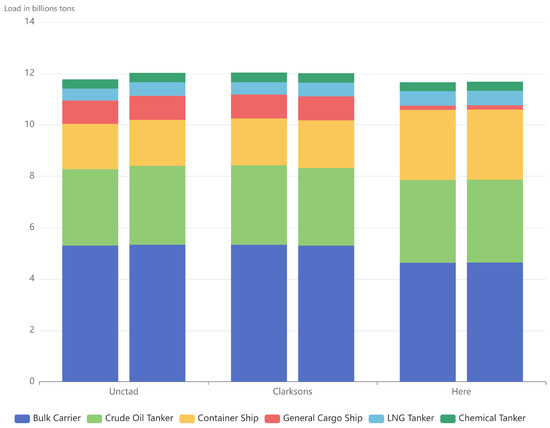

The validation of annual transported load per ship type, as illustrated in Figure 4 and detailed in Table 3, demonstrates the reliability of the model developed in this study compared to data from UNCTAD and Clarksons. The results show a consistent distribution of transported loads across ship types, with bulk carriers dominating the total transported volume, followed by crude oil tankers and container ships. General cargo ships, LNG tankers, and chemical tankers account for smaller proportions, yet their contributions align closely with reference data.

Figure 4.

Validation of annual transported load (in tons) per ship type for the years 2019 (left bars) and 2022 (right bars), compared against data from UNCTAD and Clarksons.

Table 3.

Comparison of the quantity of load transported by sea in tons per ship type for the year 2019.

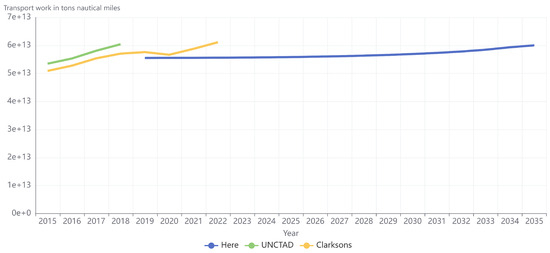

Table 3 provides a detailed comparison of the quantities transported by each ship type for the year 2019. The total transported load estimated by the model deviates by only 1% and 3% from UNCTAD and Clarksons, respectively, confirming the robustness of the overall estimates. While bulk carriers, crude/product oil tankers, and chemical tankers show relatively small errors (ranging from 3% to 13%), larger discrepancies are observed for container ships (−54% relative to UNCTAD) and general cargo ships (82%). These discrepancies can be attributed to a modeling assumption where a portion of the load typically classified as general cargo is considered under container carriers. LNG tankers exhibit moderate deviations, with an error of −21% compared to UNCTAD. These variations highlight the challenges in accurately capturing the transported loads for certain ship types. In parallel, Figure 5 shows that the model prediction for annual seaborne transport work are closely aligned with UNCTAD and Clarksons, confirming its reliability in capturing trends and forecasting global maritime activity.

Figure 5.

Validation of annual total seaborne transport work, expressed in ton-nautical miles, compared with data from UNCTAD and Clarksons.

Overall, the comparison of results across datasets and the stability of the modal distribution over time (as shown for 2019 and 2022 in Figure 4) validate the model’s applicability for analyzing maritime transport trends. Despite some deviations for specific ship types, the agreement in total volumes and the relative consistency across ship types underline the model’s utility for policy development and maritime studies.

3.2. GHG Emissions

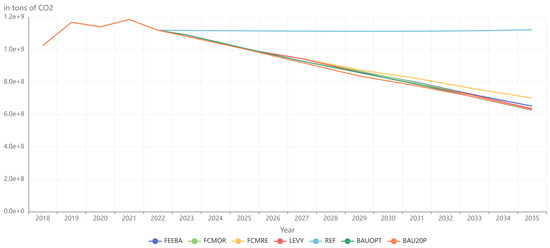

Figure 6 presents the well-to-wake (WTW) greenhouse gas (GHG) emissions trends for the different policy scenarios listed in Table 2. The reference scenario (REF) exhibits a nearly constant trajectory of emissions beyond the initial peak observed in the early 2020s, this reflects a balance between increasing trade volume and gradual improvements in fleet energy efficiency through renewal. This behavior highlights the lack of significant emission reduction without the implementation of energy efficiency measures, market-based policies, or alternative fuels.

Figure 6.

Changes in WTW GHG emissions in tons of CO2 for each scenario. Notes: ‘REF’ stands for reference case; ‘BAUOPT’ means business as usual with optimal selection of technologies, ‘BAU20P’ means business as usual with the combinations of technologies that are 20% below the cost-effectiveness of the optimal option, ‘LEVY’ is a global carbon pricing mechanism, ‘FCMOR’ stand for Fuel Compliance Mechanism—Original, ‘FCMRE’ stand for Fuel Compliance Mechanism—Original, and ‘FEEBA’ refers to a feebate system composed of fees and a rebate.

In contrast, all other scenarios incorporating energy efficiency standards (EEDI, EEXI, and CII compliance), energy-saving devices (ESD), speed-reduction strategies, and alternative fuels show a consistent downward trend in emissions over time. Among these, the scenarios that include a market-based measure (MBM) policy—namely, LEVY (43%), FCMOR (43%), and FEEBA (42%) demonstrate similar reductions in GHG emissions by 2035, with the exception of FCMRE, which achieves a slightly lower reduction of 38%. This suggests that while market-based mechanisms generally lead to significant decarbonization, FCMRE may be less effective than the other MBM policies.

The LEVY scenario results in a steady decline in emissions, comparable to the flexible mechanisms (FCMOR and FCMRE). However, the FCMRE scenario underperforms slightly relative to the FCMOR and LEVY cases, indicating that the modifications introduced in this revised fuel-cycle mechanism may not be as effective in driving emission reductions. The FEEBA scenario achieves a similar reduction in GHG emissions over time. The scenarios BAUOPT (44%) and BAU20P (44%) also show similar reductions in emissions until 2035, being slightly more effective.

Overall, these findings indicate that while all regulatory scenarios lead to substantial and nearly equivalent reductions in GHG emissions by 2035, the key differentiating factors are associated with other criteria analyzed in the following section such as the economic implications and the pace of technological transitions in fuel choices and operational strategies.

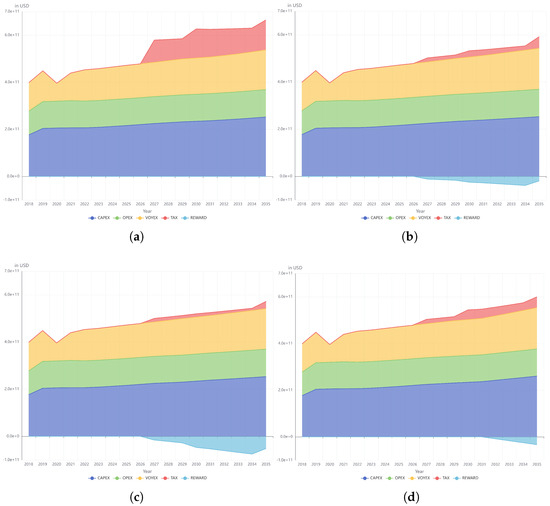

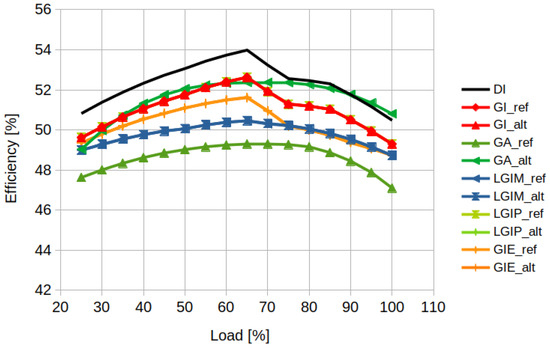

3.3. Transport Cost

Figure 7 illustrates the evolution of total costs in USD for each MBM scenario (LEVY, FCMOR, FCMRE, and FEEBA) while distinguishing five key cost components (CAPEX, OPEX, VOYEX, TAX, and REWARD). In the LEVY scenario (Figure 7a), TAX costs increase progressively over time as carbon pricing mechanisms become more stringent, while CAPEX and OPEX slightly increase as the other MBMs. Notably, this scenario lacks any REWARD incentives, meaning shipowners bear the full cost of compliance. The FCMOR scenario (Figure 7b) follows a similar cost trajectory, but the introduction of REWARD mechanisms offsets part of the taxation burden, leading to lower cumulative costs compared to LEVY. The FCMRE scenario (Figure 7c) exhibits a cost trend similar to FCMOR, though with a higher reduction in TAX contributions by 2035. However, in the current configuration, the rewards are higher than TAX, suggesting that some adjustments of the mechanism are necessary to achieve a better balance between taxation and incentive (rewards should not overcome taxes). The most distinct cost structure is observed in the FEEBA scenario (Figure 7d). Unlike the other MBM policies, FEEBA includes a significant proportion of financial incentives, suitably mitigating the impact of taxation. While TAX costs still rise over time, their overall effect is less pronounced due to the simultaneous increase in REWARD allocations.

Figure 7.

Changes in costs in USD for each scenario. (a) LEVY. (b) FCMOR. (c) FCMRE. (d) FEEBA. Notes: ‘LEVY’ is a global carbon pricing mechanism, ‘FCMOR’ stand for Fuel Compliance Mechanism—Original, ‘FCMRE’ stand for Fuel Compliance Mechanism—Original, and ‘FEEBA’ refers to a feebate system composed of fees and a rebate.

The primary differences between these scenarios lie in the balance between TAX and REWARD. While LEVY imposes a significant financial burden without compensation, FEEBA, FCMOR, and FCMRE introduce mechanisms that help alleviate these costs, making compliance more economically manageable. CAPEX and OPEX, on the other hand, remain relatively stable across all scenarios, while VOYEX varies slightly, indicating that the variations in total cost primarily stem from the structure of the MBM policy rather than differences in investment or operational expenditures.

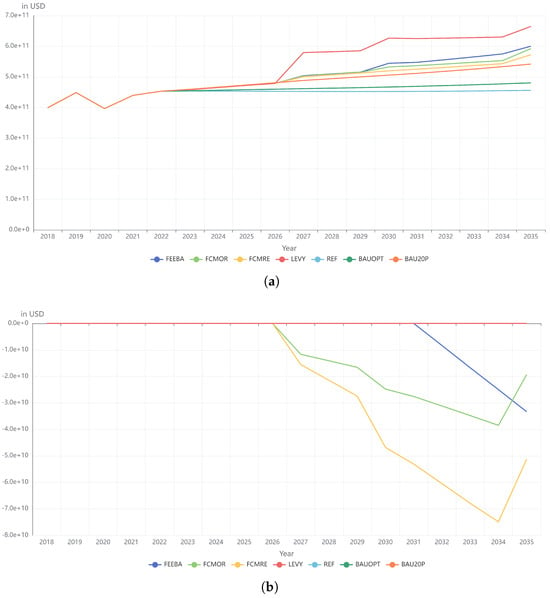

In complement, Figure 8 provides a comparative analysis of the total costs sum (CAPEX + OPEX + VOYEX + TAX) and financial incentives (REWARD) across different policy scenarios. Panel (a) presents the evolution of total costs isolated while panel (b) isolates the evolution of financial rewards under selected market-based measure (MBM) policies. In panel (a), the total costs for all scenarios increase over time, driven by the cumulative impact of investment in decarbonization technologies, operational expenses, and regulatory measures. The REF scenario maintains the lowest cost trajectory, as it does not incorporate any additional compliance expenditures. The BAUOPT and BAU20P scenarios exhibit slightly higher costs by 2035, respectively 5% and 19%, due to the implementation of energy-saving technologies and operational adjustments, such as speed reduction. However, the most notable increases in costs are observed in the MBM policy scenarios, particularly LEVY, which experiences the steepest rise of 46% by 2035. The other MBM scenarios, including FCMOR, FCMRE, and FEEBA, follow similar trajectories, respectively 30%, 25% and 32% by 2035, but their cost growth is moderated by financial incentives, as reflected in panel (b).

Figure 8.

Comparison of costs and rewards in USD among the scenarios. (a) Total costs (CAPEX + OPEX + VOYEX + TAX). (b) REWARD. Notes: ‘REF’ stands for reference case; ‘BAUOPT’ means business as usual with optimal selection of technologies, ‘BAU20P’ means business as usual with the combinations of technologies that are 20% below the cost-effectiveness of the optimal option, ‘LEVY’ is a global carbon pricing mechanism, ‘FCMOR’ stand for Fuel Compliance Mechanism—Original, ‘FCMRE’ stand for Fuel Compliance Mechanism—Original, and ‘FEEBA’ refers to a feebate system composed of fees and a rebate.

Panel (b) highlights the evolution of financial rewards under the FEEBA, FCMOR, and FCMRE scenarios, in contrast to the LEVY scenario, which does not include incentives. The negative values indicate cost reductions due to subsidies or rebates. The FCMRE scenario demonstrates the highest level of rewards over time, offsetting a significant portion of the total compliance costs. The FCMOR and FEEBA scenarios also exhibit financial incentives, though to a lesser extent. This suggests that the revised fuel-cycle mechanism (FCMRE) includes stronger financial compensation mechanisms compared to the original version (FCMOR).

The results demonstrate that while all market-based measure (MBM) policies achieve similar reductions in GHG emissions, their economic impacts differ significantly, influencing their feasibility and adoption by the shipping industry. The LEVY scenario imposes the highest compliance costs due to the absence of financial incentives, placing a greater financial burden on shipowners. In contrast, FEEBA and the fuel-cycle mechanisms (FCMOR and FCMRE) introduce financial rewards that help offset compliance costs, making these policies more economically sustainable. Among them, the FEEBA scenario appears to offer the most balanced approach by integrating penalties with incentives, potentially facilitating broader adoption of decarbonization measures.

The effectiveness of each policy is therefore not solely determined by its capacity to reduce emissions but also by its ability to distribute costs and incentives in a way that ensures both regulatory compliance and financial feasibility. Policies that rely solely on taxation mechanisms may face resistance due to their high economic impact, while those that incorporate financial rewards can alleviate costs and encourage the transition to low-emission technologies. These findings highlight the importance of a balanced approach that combines carbon pricing with well-designed financial incentives to accelerate decarbonization while minimizing economic disruptions in the shipping sector.

3.4. Fuels Adoption

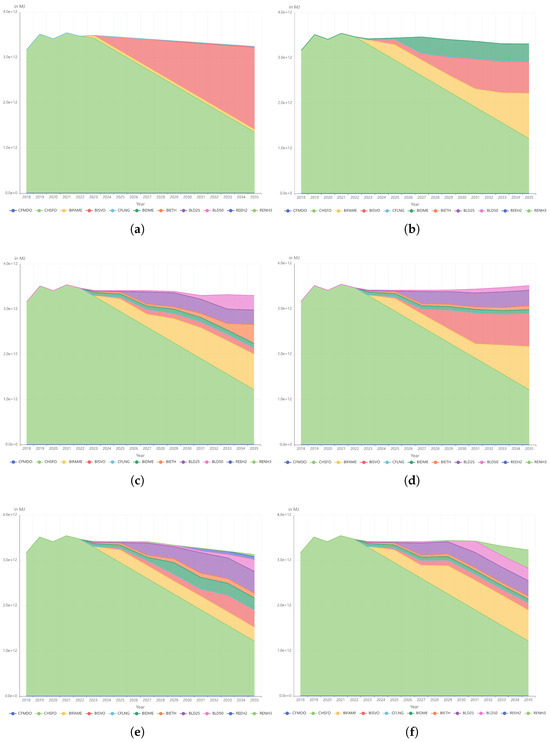

Figure 9 illustrates the projected changes in energy consumption, measured in megajoules (MJ), by fuel type in six different decarbonization policy scenarios from 2018 to 2035. Each panel represents a distinct scenario, incorporating various policy measures and market responses influencing the transition rate from conventional fuels to alternative energy sources.

Figure 9.

Changes in fuel adoption in MJ for each scenario. (a) BAUOPT. (b) BAU20P. (c) LEVY. (d) FCMOR. (e) FCMRE. (f) FEEBA. Notes: CFMDO is the conventional Marine Diesel Oil, CHSFO is the conventional bunker, BIDME is the Dimethyl Ether, BIETH is the Bioethanol, BIFAME is the Fatty Acid Methyl Esters-Biodiesel, BISVO is the Straight Vegetable Oil, BLD25 is a blended fuel with 25% straight vegetable oil (SVO) and 75% very low sulfur fuel oil (VLSFO), while BLD50 increases the biofuel content to 50%, further reducing greenhouse gas emissions.

In panel (a), BAUOPT scenario, a gradual phase-out of conventional heavy fuel oil (CHSFO) is observed, while biofuels, particularly BISVO (red), progressively assume a dominant role. Biodiesel (BIFAME) plays a minor role, indicating limited diversification in fuel options. This outcome is explained by the assumption that, in this scenario, shipowners prioritize the most cost-effective solutions to achieve decarbonization goals without constraints on fuel availability. As a result, fossil fuel dependency remains significant, with CHSFO continuing to play an important role even in 2035.

The BAU20P scenario, shown in panel (b), results in a more balanced distribution of selected biofuels, including BISVO, BIFAME, and BIDME, compared to BAUOPT. A critical observation from this scenario is that the model does not select any of the other sustainable fuel options, such as green methanol, green ammonia, or green hydrogen. This finding underscores the necessity of additional greenhouse gas (GHG) measures to motivate the adoption and integration of a broader range of renewable fuels.

Panel (c) presents the LEVY scenario, which exhibits a similar decline in CHSFO consumption. This scenario also shows a notable increase in the adoption of bio-ethanol (BIETH) and renewable biodiesel (BIFAME), leading to a more diversified fuel mix compared to the business-as-usual scenarios. The increased adoption of multiple alternative fuels highlights the growing influence of financial mechanisms in promoting fuel diversification.

The FCMOR scenario, shown in panel (d), further reinforces this transition by incorporating a substantial share of low-carbon synthetic fuels, particularly BLD25 and BLD50. This shift suggests a stronger regulatory push towards alternative fuel adoption, reducing dependence on conventional fossil fuels.

The FCMRE scenario, displayed in panel (e), demonstrates a more balanced adoption of renewable fuels, with a significant presence of BLD25 and BLD50 alongside BISVO, BIETH, BIFAME, and BIDME. This scenario also shows a noticeable reduction in absolute energy consumption, indicating the widespread implementation of slow steaming and energy efficiency technologies including wind-assisted ship propulsion. The results suggest that, under FCMRE, shipowners are not only shifting towards alternative fuels but are also investing in operational and technological strategies to further reduce emissions and improve energy efficiency.

Finally, the FEEBA scenario, presented in panel (f), produces results similar to those observed in the FCMRE scenario. Under this scenario, biofuels such as BISVO, BIFAME, and BIETH dominate the new energy supply, with substantial contributions from blended fuels, including BLD50 and BLG25. The increased reliance on these fuels suggests that economic incentives, such as feebate mechanisms, effectively promote the transition to low-carbon energy sources. Additionally, the more significant reduction in absolute energy consumption highlights the succeeded encouragement for operational and technological strategies.

Across all scenarios, the decline in CHSFO consumption is evident; however, the rate of reduction is directly influenced by the fleet-renewal rate constraint. In scenarios with more stringent regulatory measures, such as LEVY, FCMOR, FCMRE, and FEEBA, the shift away from fossil fuels is accompanied by a significant increase in the adoption of biofuels, particularly BISVO, BIFAME, BIETH, and various fuel blends. A critical observation is that the model never selects more expensive sustainable fuels, such as biomethanol, green ammonia, or green hydrogen by 2035, indicating that additional policy interventions or technological advancements may be necessary to make these options more economically viable.

Overall, Figure 9 underscores the essential role of policy design in shaping the future energy landscape of maritime transport. The analysis reveals that regulatory and financial mechanisms significantly accelerate the adoption of alternative fuels. The findings suggest that achieving full decarbonization in the sector will require a combination of market incentives, stringent policies, and strategic investments in renewable energy infrastructure.

3.5. Technologies Adoption

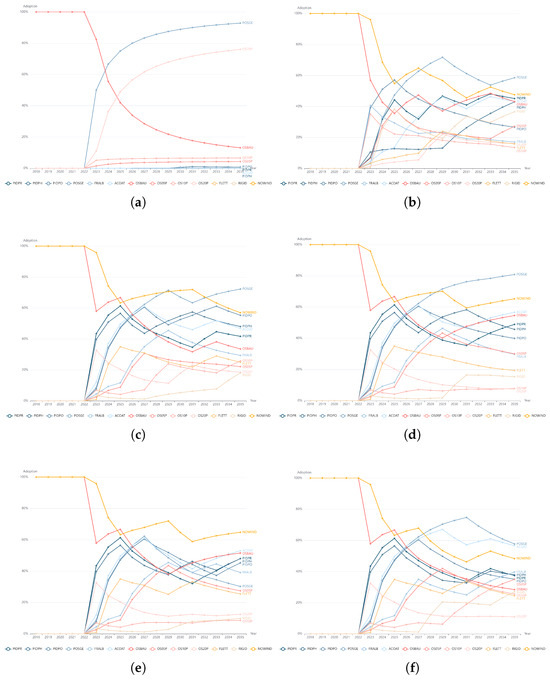

Figure 10 illustrates the evolution of technology adoption in the maritime sector under different policy scenarios. The adoption trends for energy-saving devices, operational speed adjustments, and wind-assisted propulsion systems vary significantly across the six scenarios, reflecting the impact of regulatory and economic incentives on fleet behavior.

Figure 10.

Changes in technology adoption in percent for each scenario. (a) BAUOPT. (b) BAU20P. (c) LEVY. (d) FCMOR. (e) FCMRE. (f) FEEBA. Notes: Energy efficiency devices are represented using a blue gradient, where PIDPR denotes pre-swirl devices, PIDPH refers to high-efficiency propellers, PIDPO represents post-swirl devices, POSGE indicates shaft generators, FRALB corresponds to air lubrication with microbubbles, and ACOAT signifies advanced hull coatings. Operational speed alternatives are depicted using a red gradient, where OSBAU represents the business-as-usual operational speed of the vessel, OS05P indicates a 5% reduction from the current operational speed, OS10P corresponds to a 10% reduction, and OS20P represents a 20% reduction. Wind-assisted propulsion systems are shown using an orange gradient, where FLETT represents Flettner rotors, RIGID corresponds to rigid sails or wings, and NOWIND indicates the absence of a wind-assisted propulsion system. See Appendix B for details.

In panel (a), representing the BAUOPT scenario, the adoption of energy efficiency measures remains limited, with a large and global adoption of shaft generators (POSGE) emerging as the dominant technology. A sharp decline in business-as-usual operational speed (OSBAU) is observed, with a simultaneous increase in slow steaming strategies, particularly at a 20% speed reduction (OS20P). However, the uptake of wind-assisted propulsion remains marginal, suggesting that without regulatory pressure, shipowners prioritize fuel-saving technologies over wind-assisted propulsion.

Panel (b), depicting the BAU20P scenario, follows a similar trend to BAUOPT but exhibits a more diversified technology adoption pattern. Shaft generators (POSGE) still lead the adoption curve, while other energy efficiency measures such as pre-swirl devices (PIDPR), high-efficiency propellers (PIDPH), and hull coatings (ACOAT) gain traction. Wind-assisted propulsion, particularly rigid sails (RIGID) and Flettner rotors (FLETT) see a higher increase compared to the BAUOPT scenario, indicating a shift towards a broader range of fuel-saving strategies.

The LEVY scenario, shown in panel (c), accelerates the adoption of energy-saving technologies, with POSGE, PIDPR, and PIDPH reaching higher adoption levels than in the previous scenarios. The impact of the carbon levy mechanism also leads to a more significant uptake of slow steaming measures, particularly the 5%, 10%, and 20% speed reductions (OS05P, OS10P and OS20P). Wind-assisted propulsion becomes slightly less attractive under this scenario compared to BAU20P scenario.

In panel (d), corresponding to the FCMOR scenario, a broader range of technologies is adopted more extensively. The adoption of pre- and post-swirl devices (PIDPR and PIDPO), hull coatings (ACOAT), and air lubrication systems (FRALB) increases significantly compared to the BAU scenarios. Slow steaming continues to play a key role in emission-reduction strategies, with OS05P adoption surpassing 30% by 2035. Wind-assisted propulsion also experiences a consistent adoption, reflecting a greater shift towards multi-technology solutions.

The FCMRE scenario, depicted in panel (e), follows a similar trajectory to FCMOR but places a stronger emphasis on operational measures. While the adoption of shaft generators (POSGE) is lower compared to other scenarios, this is offset by a significant increase in the adoption of Flettner rotors for wind-assisted propulsion, which reaches its highest level under this policy framework. This shift suggests a greater reliance on renewable propulsion technologies as part of the decarbonization strategy.

Finally, panel (f), representing the FEEBA scenario, exhibits similar results with a large adoption of wind-assisted propulsion and slow steaming strategies, particularly OS05P and OS10P. The adoption of energy-saving devices, operational measures, and wind-assisted propulsion reaches its highest combined levels, indicating that feebate mechanisms provide strong incentives for the adoption of multiple strategies simultaneously. Although shaft generators (POSGE) remain the most widely adopted technology, wind-assisted propulsion systems, particularly rigid sails, and Flettner rotors, gain significant traction. This scenario suggests that a well-structured feebate system effectively encourages the deployment of various decarbonization measures, leading to a more sustainable and technologically diversified fleet.

Across all scenarios, a clear shift away from business-as-usual operational speeds is evident, with slow-steaming strategies gaining substantial adoption. Energy efficiency technologies, particularly shaft generators, pre-swirl devices, and high-efficiency propellers, consistently emerge as preferred options due to their direct impact on fuel savings. The adoption of wind-assisted propulsion varies significantly across scenarios, with its highest uptake observed in the LEVY and FEEBA scenarios, where financial mechanisms create a stronger incentive for its implementation.

Overall, Figure 10 highlights the critical role of policy design in shaping the future adoption of energy-saving technologies in the maritime industry. While business-as-usual scenarios lead to gradual and limited technology adoption, regulatory interventions such as carbon levies, flexible compliance mechanisms, and feebate systems significantly accelerate the uptake of alternative propulsion and operational efficiency measures. These findings emphasize the importance of implementing comprehensive and adaptive policy frameworks to drive maritime decarbonization.

3.6. Comparison with a Similar Model

The methodologies employed in this study and in IMO [37] share similarities in evaluating greenhouse gas-reduction scenarios and their impacts on maritime transport but differ in key assumptions and approaches. Both studies analyze WTW reductions and transport costs under various scenarios and adopt comparable regulatory frameworks, such as EEDI, EEXI, and CII. However, this study incorporates a constrained retrofitting approach, a detailed technology readiness assessment, and a broader range of fuel options based on recent data. Unlike [37], the present methodology accounts for regional trade flows and provides a pathway model to evaluate the adoption of energy efficiency measures individually, ensuring a higher level of granularity. Additionally, this study limits fleet retrofitting to 5% per year and explicitly incorporates the availability of fuels and regional variations, providing a more comprehensive and realistic analysis of decarbonization pathways.

Table 4 presents a comparison of the Well-to-Wake (WTW) reduction and transport cost increase for the year 2030 under different scenarios, comparing the results of this study with those published in [37]. The WTW reductions range from −25% to −27% in this study, closely aligning with the results from [37], which range from −21% to −23%, demonstrating the consistency and accuracy of the model in estimating emissions reductions.

Table 4.

Comparison of the WTW reduction and transport cost increase for 2030 with results published by [37].

The cost intensity, representing the total annual costs associated with operational and fuel expenses, as well as regulatory incomes and expenses, shows a similar level of agreement between the two studies. Cost increases range from 14% to 38% in this study, compared to 16% to 40% in [37]. Notably, the scenarios with no flexibility (LEVY and FEEBAT) result in higher cost increases, while scenarios with flexibility (FCMOR and FCMRE) exhibit relatively lower costs.

Overall, the comparison highlights the robustness of the current model in reproducing both emissions reductions and cost impacts across varying policy scenarios. The close alignment with [37] further validates the assumptions and methodologies employed in this study, supporting its use for evaluating future decarbonization strategies in maritime transport.

4. Conclusions

This study developed a comprehensive modeling framework to evaluate technological pathways for decarbonizing maritime transport, integrating Multi-Criteria Decision Analysis (MCDA) with techno-economic simulations. The results indicate that while technical and operational measures, such as slow steaming and energy-saving devices, can reduce emissions by up to 44%, market-based mechanisms (MBMs) significantly accelerate the transition to alternative fuels. Among the policy scenarios analyzed, flexible compliance mechanisms (FCMRO and FCMRE) and feebate systems (FEEBA) result in emissions reductions of 38% and 42%, respectively, by 2035, while a strict carbon levy (LEVY) achieves a 43% reduction but imposes the highest compliance costs, increasing transport costs by 46%. The study also reveals that shipowners prioritize biofuels such as BISVO, BIFAME, and blended fuels (BLD50), while higher-cost alternatives like green hydrogen, biomethanol, and ammonia remain economically unviable without additional policy support.

In comparing the different scenarios, the most decisive factor in reducing emissions across all policy frameworks is the implementation of energy efficiency measures, particularly shaft generators and slow steaming. These measures consistently yield significant emission reductions, even in the absence of alternative fuels. Market-Based Measures such as LEVY and FEEBA drive further reductions by incentivizing broader fuel diversification, notably increasing the adoption of biofuels like BISVO and BIFAME. However, LEVY imposes higher costs without rewards, while FEEBA balances compliance costs with financial incentives, facilitating smoother adoption. Flexible mechanisms (FCMOR, FCMRE) also reduce emissions effectively but require careful calibration of taxes and rewards to avoid excessive subsidies. Overall, technical and operational measures form the foundation of emissions reduction, while MBMs are pivotal for accelerating fuel transition. A combination of both is essential for achieving cost-effective and realistic decarbonization.

This study bridges a critical gap in maritime decarbonization research by offering a holistic assessment of technological and economic trade-offs, integrating regulatory impacts and cost dynamics. Unlike previous studies that focus on isolated aspects such as fuel transition or efficiency measures, our work presents a multi-dimensional evaluation incorporating vessel-specific constraints, fuel market dynamics, and policy interventions. The findings inform regulatory strategies and investment decisions by demonstrating the effectiveness of different MBMs in achieving emissions reductions while maintaining economic viability. This research also provides a robust framework that can be adapted to future policy scenarios, ensuring its relevance for academia, industry, and regulatory bodies.

While this study provides a comprehensive assessment, it relies on a constrained fleet-renewal rate (5%) and assumes static fuel availability, which may not fully capture the complexities of real-world fuel infrastructure development. Additionally, the economic feasibility of alternative fuels is subject to evolving market conditions and policy frameworks, necessitating continuous updates to the model. Future research should explore real-time data integration, enhanced modeling of regional fuel infrastructure constraints, and the inclusion of emerging technologies such as onboard carbon-capture and nuclear propulsion systems to refine predictions and improve decision-making.

Achieving zero-emission maritime transport requires a combination of regulatory measures, financial incentives, and industry-wide technological investments. The study underscores that well-structured MBMs can significantly reduce emissions without imposing excessive economic burdens, but their design must ensure cost distribution fairness and avoid unintended market distortions. Given the substantial variability in policy effectiveness and cost implications observed in this study, it is crucial to conduct thorough impact assessments before implementation. Policymakers must rigorously evaluate different policy configurations and parameter settings—such as levy rates, subsidy levels, and fleet-renewal constraints—to ensure that regulatory frameworks drive the intended environmental benefits without disproportionately affecting specific market segments. Furthermore, industry stakeholders should engage in proactive research and scenario testing to anticipate potential challenges and infrastructure needs, ensuring that alternative fuel adoption is both technically feasible and economically viable in the long term. Without such preemptive analysis, there is a risk of policies being either too lenient to drive meaningful change or too stringent to be practical, leading to economic inefficiencies and resistance from the shipping industry. To enhance the model’s applicability and forward-looking capability, we are currently extending the simulation horizon to 2050, allowing for a more comprehensive analysis of long-term decarbonization pathways and the evolving impacts of regulatory frameworks, fuel infrastructure development, and emerging technologies. This future extension will support more detailed scenario planning and provide stakeholders with practical insights for navigating the mid- to long-term transition to zero-emission shipping.

Author Contributions

Conceptualization, J.-D.C. and P.C.P.; Data curation, J.-D.C., L.F.A. and P.C.P.; Formal analysis, J.-D.C., C.H.M., L.F.A., A.L. and P.C.P.; Funding acquisition, J.-D.C. and P.C.P.; Investigation, J.-D.C., C.H.M., L.F.A. and P.C.P.; Methodology, J.-D.C., C.H.M., L.F.A., A.L. and P.C.P.; Project administration, J.-D.C. and P.C.P.; Software, J.-D.C., C.H.M. and L.F.A.; Supervision, J.-D.C.; Validation, J.-D.C., C.H.M., L.F.A., A.L. and P.C.P.; Visualization, J.-D.C.; Writing—original draft, J.-D.C., C.H.M. and L.F.A.; Writing—review & editing, J.-D.C., C.H.M., L.F.A., A.L. and P.C.P. All authors have read and agreed to the published version of the manuscript.

Funding

This study was partially funded by the Coordination for the Improvement of Higher Education Personnel (CAPES-Brazil), finance code 001, and the National Council for Scientific and Technological Development (CNPq-Brazil), under grants 405923/2022-8 (J.D.C.) and 309238/2020-0 (J.D.C.). We also acknowledge the financial support from the Institute of Economic Research Foundation (FIPE) through Project 5705 (P.P.), as well as research grants from CNPq 304221/2022-8 (P.P.) and FAPESP 2014/50848-9 (P.P.). The opinions, hypotheses, conclusions, and recommendations expressed in this paper are solely those of the authors and do not necessarily reflect the views of the funding agencies.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are unavailable due to privacy restrictions.

Acknowledgments

We sincerely thank everyone who contributed to the development of this paper, as well as the entire Paula Pereda team for their support. Any remaining errors are solely our responsibility.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

Abbreviations

The following abbreviations are used in this manuscript:

| CII | Carbon Intensity Indicator |

| EEDI | Energy Efficiency Design Index |

| EEXI | Energy Efficiency Existing Ship Index |

| FCM | Flexibility Compliance Mechanism |

| FCU | Flexibility Compliance Units |

| GFI | GHG Fuel Intensity |

| IMO | International Maritime Organization |

| IMSF&F | International Maritime Sustainable Fuels and Fund |

| IPCC | Intergovernmental Panel on Climate Change |

| LDC | Least Developed Countries |

| MBM | Market-based measure |

| MEPC | Marine Environment Protection Committee |

| SEEMP | Ship Energy Efficiency Management Plan |

| TTW | tank-to-wake |

| UN | United Nations |

| WTT | well-to-tank |

| WTW | well-to-wake |

| ZEF | zero-emission fuel |

| ZESIS | Zero-Emission Shipping Incentive Scheme |

| ZEV | zero-emission vessel |

| GHG | greenhouse gas |

| MCDA | Multiple Criteria Decision Analysis |

| PROMETHEE | Preference Ranking Organization Method for Enrichment Evaluation |

| ESD | energy-saving devices |

| PIDPR | pre-swirl devices |

| PIDPO | post-swirl devices |

| PIDHP | and high-efficiency propellers |

| FRALB | reduction of skin friction by air lubrication |

| ACOAT | reduction of skin friction by texture of the hull surface |

| WASP | wind-assisted ship propulsion |

| WIROT | wind-assisted ship propulsion by Flettner rotors |

| WISAI | wind-assisted ship propulsion by rigid sails or wings |

| POSGE | shaft generators or power take-off |

| OSBAU | business as usual operational speed of the vessel |

| OS05P | 5% reduction from the business as usual operational speed of the vessel |

| OS10P | 10% reduction from the business as usual operational speed of the vessel |

| OS20P | 20% reduction from the business as usual operational speed of the vessel |

| VLSFO | Very Low Sulphur Fuel Oil |

| CFMDO | Marine Diesel Oil |

| CFLNG | refers to Liquefied Natural Gas |

| BIFAME | Fatty Acid Methyl Esters |

| BISVO | Straight Vegetable Oil |

| BIHVO | Hydrotreated Vegetable Oil |

| BIDME | Dimethyl Ether |

| BIETH | Ethanol |

| BLD25 | fuel consisting of a blend of 25% SVO and 75% VLSFO |

| BLD50 | fuel consisting of a blend of 50% SVO and 50% VLSFO |

| SVO | Straight Vegetable Oil |

| BICH3 | BioMethanol from gasification of biomass |

| RENH3 | Green Ammonia from Hydrogen |

| CFSH2 | Grey hydrogen from steam reforming of natural gas (compressed) |

| REEH2 | Green hydrogen from electrolysis using renewable energy (compressed) |