Corporate Social Responsibility and Financial Performance in the Chinese Pharmaceutical Sector: The Roles of Technological Innovation and Media Coverage

Abstract

1. Introduction

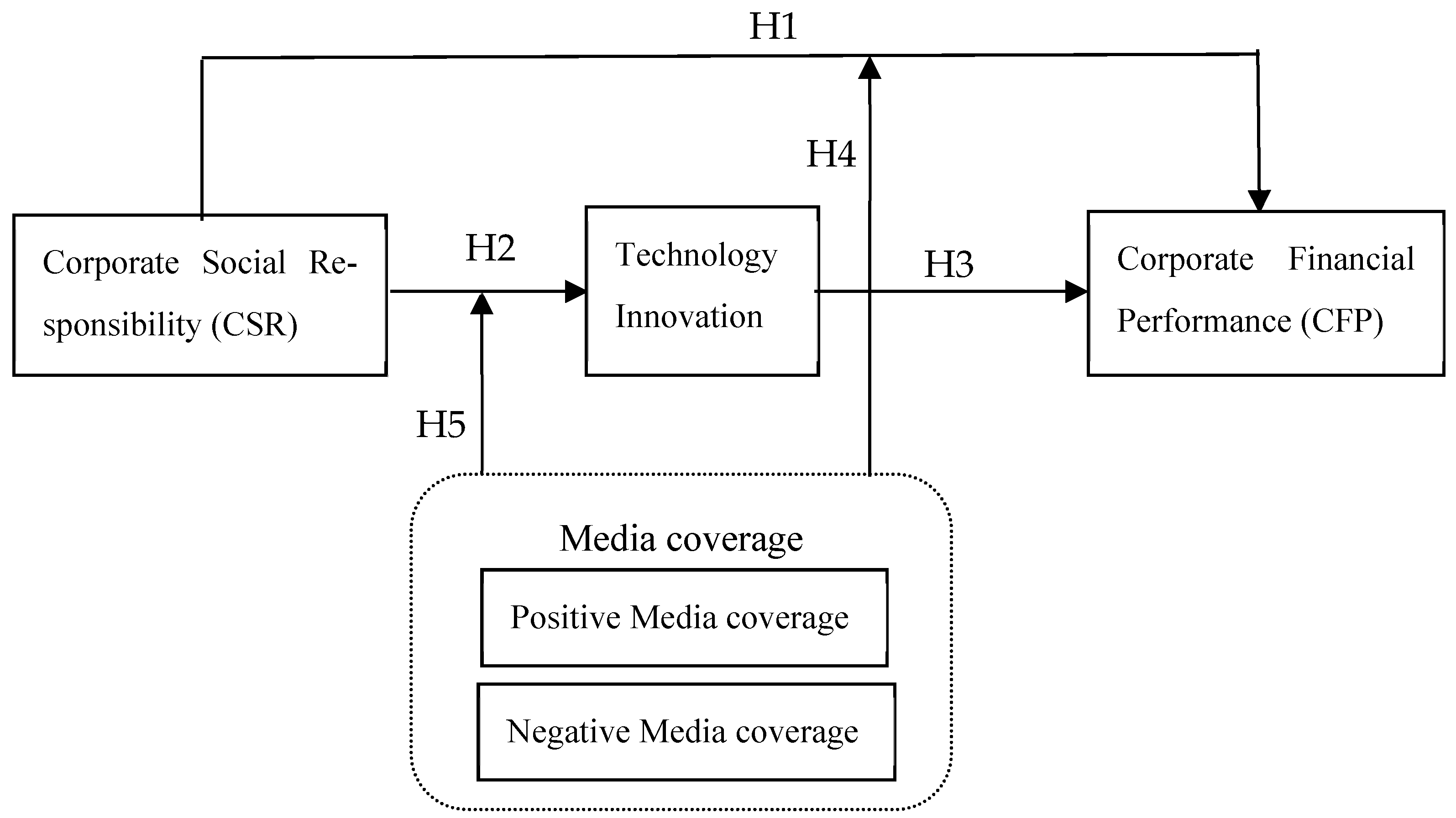

2. Literature Review and Hypothesis

2.1. Corporate Social Responsibility and Corporate Financial Performance

2.2. Mediating Role of Technological Innovation

2.3. Moderating Role of Media Coverage

3. Methodology

3.1. Sample and Data Sources

3.2. Measures

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Mediator Variable

3.2.4. Moderator Variable

3.2.5. Control Variable

3.3. Model Building

4. Empirical Results

4.1. Statistics Description

4.2. Correlation Analysis

4.3. Regression Analysis

4.4. Robustness Tests

4.4.1. Replacing the Dependent Variable

4.4.2. Instrumental Variables (SYS-GMM)

4.4.3. The Bootstrap Test

5. Conclusions and Discussion

- Corporate fulfillment of social responsibility is positively related to CFP, and H1 is valid. Although some studies have shown that there is a negative relationship between CSR and CFP [12], this research using panel data and multiple econometric methods with Chinese pharmaceutical companies as research samples proves that CSR promotes the growth of financial performance [6,43]. Combined with stakeholder theory, RBV, and agency theory, corporations obtain more social resources while reducing corporate agency costs, forming a competitive advantage for corporations, and increasing profits while helping them control costs. Pharmaceutical manufacturers should incorporate the fulfillment of social responsibility into their business strategy [9], which not only creates intangible assets for the enterprise, but also helps the enterprise to avoid risks, thus realizing a high level of financial performance.

- Corporate fulfillment of social responsibility promotes corporate innovation, while corporate innovation partially mediates between CSR and CFP; H2 and H3 are valid. This research tested the positive effect of CSR on technological innovation through a three-step regression analysis [64] and confirmed the existence of the mediating effect of technological innovation [71]. Pharmaceutical companies are oriented to research and development innovation due to the fulfillment of social responsibility. Companies’ participation in social responsibility activities through technological innovation can reduce their financial costs and negative impacts, enhance their innovation initiatives, and increase their profits. For example, optimizing the production process, which not only saves resources and reduces costs but also improves the quality of the product and establishes a good relationship with stakeholders, creates a competitive advantage and improves the financial performance of the company [60].

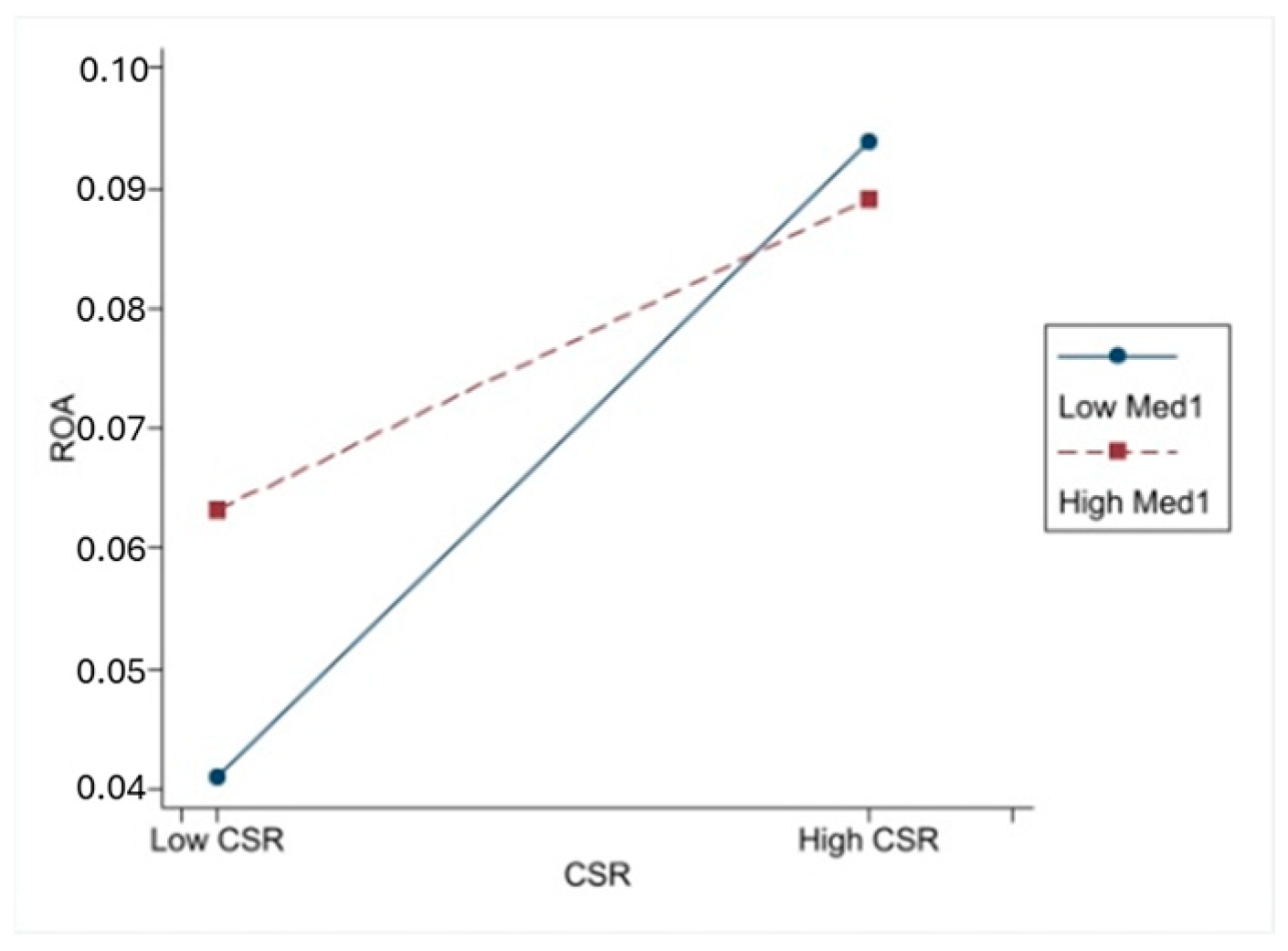

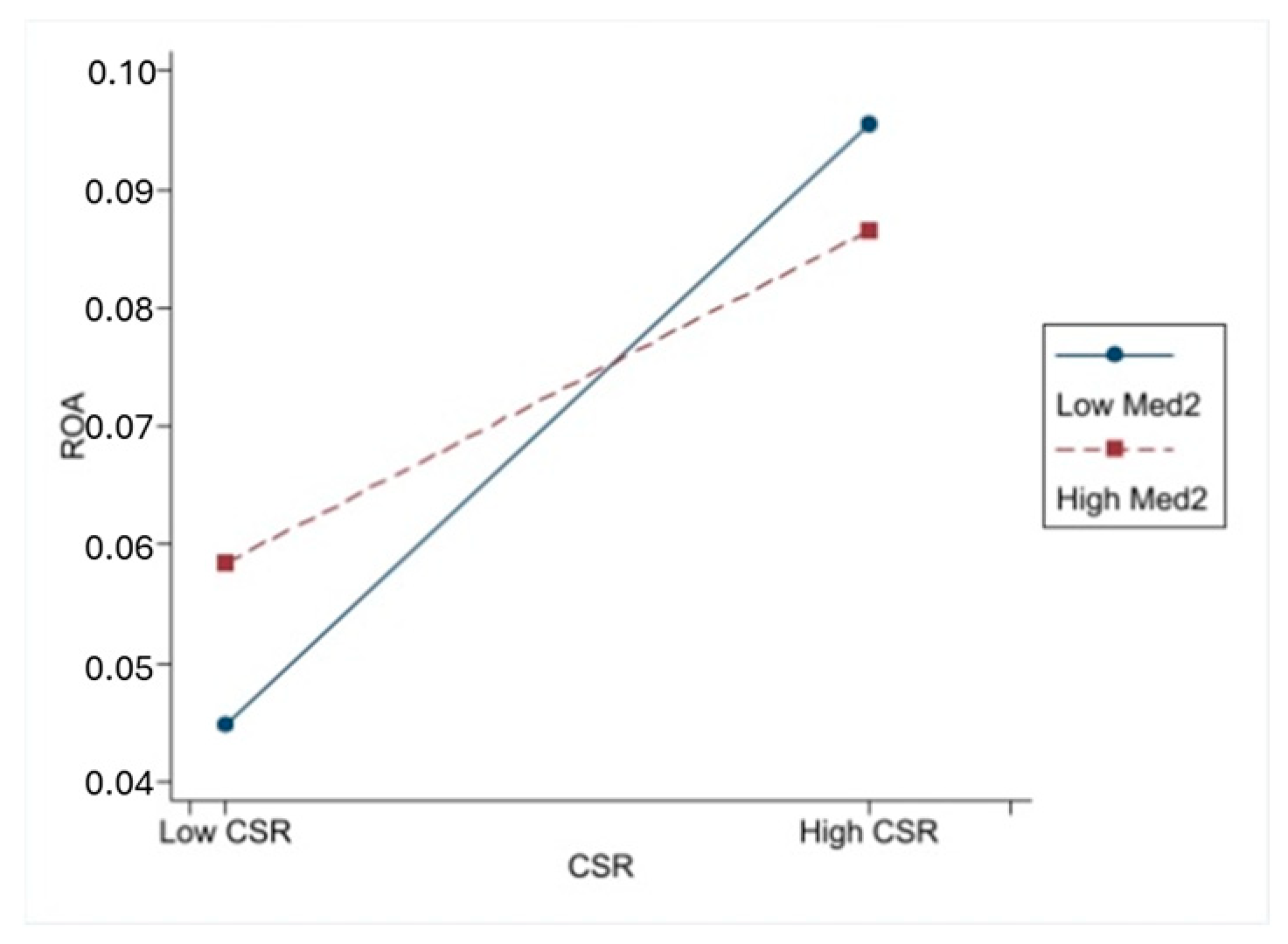

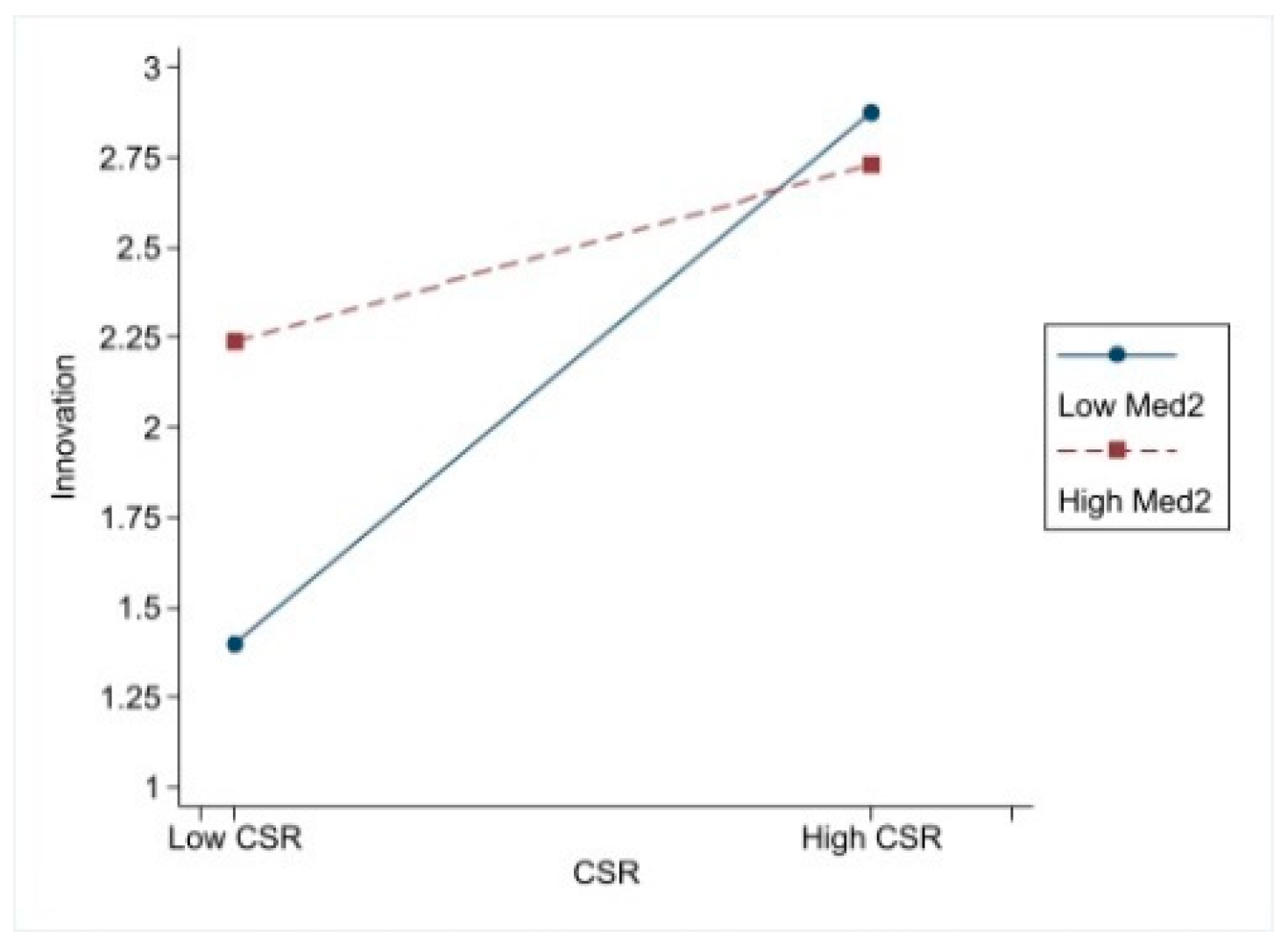

- Positive and negative media coverage has a negative moderating effect on the impact of CSR and CFP as well as CSR and technological innovation, which is accepted for H4b, H4d, H5b, and H5d, but rejected for H4a, H4c, H5a, and H5c. The negative moderating effect of positive media coverage is because positive media coverage exaggerates a firm’s innovation achievements or CSR performance. As a result, the firm has to bear additional liability costs to maintain its image and reputation, which increases operating costs and ultimately affects the firm’s financial performance [37,80,81]. Negative media coverage negative moderating effect is due to the negative coverage may lead to the public’s questioning of the CSR or innovation ability of the enterprise. As a result, the enterprise may be forced to reduce the CSR or innovation investment in the face of the pressure of negative coverage or to use the funds to restore the corporate image and reputation conveniently, which will lead to a decline in the financial performance [27,77,82].

6. Practical Implications

7. Limitation

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Boubaker, S.; Chebbi, K.; Grira, J. Top management inside debt and corporate social responsibility? Evidence from the US. Q. Rev. Econ. Financ. 2020, 78, 98–115. [Google Scholar] [CrossRef]

- Sharma, D.; Chakraborty, S. Corporate social responsibility and financial performance: Does CSR strategic integration matter? Cogent Bus. Manag. 2024, 11, 2392182. [Google Scholar] [CrossRef]

- Chhaparia, P.; Jha, M. Corporate Social Responsibility in India: The Legal Evolution of CSR Policy. Amity Glob. Bus. Rev. 2022, 13, 79. [Google Scholar]

- Çera, G.; Ndou, V. The role of innovation and social media in explaining corporate social responsibility–business sustainability nexus in entrepreneurial SMEs. Eur. J. Innov. Manag. 2024, 184, 114880. [Google Scholar] [CrossRef]

- Coelho, R.; Jayantilal, S.; Ferreira, J.J. The impact of social responsibility on corporate financial performance: A systematic literature review. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1535–1560. [Google Scholar] [CrossRef]

- Ahmad, M.; Wu, Q.; Ahmed, D. Does CSR digitalization improve the sustainable competitive performance of SMEs? Evidence from an emerging economy. Sustain. Account. Manag. Policy J. 2023, 15, 119–147. [Google Scholar] [CrossRef]

- Zhang, C.; Liu, Q.; Ge, G.; Hao, Y.; Hao, H. The impact of government intervention on corporate environmental performance: Evidence from China’s national civilized city award. Financ. Res. Lett. 2021, 39, 101624. [Google Scholar] [CrossRef]

- Islam, T.; Islam, R.; Pitafi, A.H.; Xiaobei, L.; Rehmani, M.; Irfan, M.; Mubarak, M.S. The impact of corporate social responsibility on customer loyalty: The mediating role of corporate reputation, customer satisfaction, and trust. Sustain. Prod. Consum. 2021, 25, 123–135. [Google Scholar] [CrossRef]

- Bae, G.; Ahn, J.H.; Lim, K.M.; Bae, S. Corporate social responsibility of pharmaceutical industry in Korea. Front. Pharmacol. 2022, 13, 950669. [Google Scholar] [CrossRef]

- Hadj, T.B.; Omri, A.; Al-Tit, A. Mediation role of responsible innovation between CSR strategy and competitive advantage: Empirical evidence for the case of Saudi Arabia enterprises. Manag. Sci. Lett. 2020, 10, 747–762. [Google Scholar] [CrossRef]

- Lin, W.L.; Ho, J.A.; Lee, C.; Ng, S.I. Impact of positive and negative corporate social responsibility on automotive firms’ financial performance: A market-based asset perspective. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1761–1773. [Google Scholar] [CrossRef]

- Ahamed, N.; Tripathi, N.N. Does mandatory corporate social responsibility expenditure by businesses help their stakeholders? Corp. Soc. Responsib. Environ. Manag. 2023, 30, 2292–2303. [Google Scholar] [CrossRef]

- Roth, V. Talking is Silver, Doing is Gold?—The Influence of Corporate Social Responsibility on Corporate Financial Performance. Jr. Manag. Sci. 2021, 6, 637–672. [Google Scholar]

- Li, X.; Esfahbodi, A.; Zhang, Y. The Impact of Corporate Social Responsibility Implementation on Enterprises’ Financial Performance—Evidence from Chinese Listed Companies. Sustainability 2024, 16, 1848. [Google Scholar] [CrossRef]

- Zhang, Y.; Guo, H. Can Pharmaceutical Companies Fulfill Their Social Responsibilities to Promote Corporate Performance? J. Hunan Univ. Financ. Econ. 2019, 35, 25–32. [Google Scholar]

- Costa, J.; Fonseca, J.P. The Impact of Corporate Social Responsibility and Innovative Strategies on Financial Performance. Risks 2022, 10, 103. [Google Scholar] [CrossRef]

- Fosu, E.; Yi, K.; Asiedu, D. The effect of CSR on corporate social performance: Mediating role of corporate image, green innovation and moderating role of corporate identity. Corp. Soc. Responsib. Environ. Manag. 2023, 31, 69–88. [Google Scholar] [CrossRef]

- Chen, P.; Dagestani, A.A.; Kim, S. Corporate social responsibility and green exploratory innovation—The moderating role of three environmental regulations. Technol. Anal. Strateg. Manag. 2023, 36, 3214–3226. [Google Scholar] [CrossRef]

- Bocquet, R.; Le Bas, C.; Mothe, C.; Poussing, N. Are firms with different CSR profiles equally innovative? Empirical analysis with survey data. Eur. Manag. J. 2013, 31, 642–654. [Google Scholar] [CrossRef]

- Ji, H.; Xu, G.; Zhou, Y.; Miao, Z. The Impact of Corporate Social Responsibility on Firms’ Innovation in China: The Role of Institutional Support. Sustainability 2019, 11, 6369. [Google Scholar] [CrossRef]

- Pérez, A.; García de los Salmones, M.d.M.; López-Gutiérrez, C. Market reactions to CSR news in different industries. Corp. Commun. Int. J. 2020, 25, 243–261. [Google Scholar]

- Guo, Z.; Lu, C. Corporate Environmental Performance in China: The Moderating Effects of the Media versus the Approach of Local Governments. Int. J. Environ. Res. Public Health 2020, 18, 150. [Google Scholar] [CrossRef] [PubMed]

- Chang, K.; Shim, H.; Yi, T.D. Corporate social responsibility, media freedom, and firm value. Financ. Res. Lett. 2019, 30, 1–7. [Google Scholar] [CrossRef]

- Wang, L.; Li, Y.; Li, X. Corporate Social Responsibility Disclosure, Media Coverage and Financial Performance: An Empirical Analysis in the Chinese Context. Singap. Econ. Rev. 2020, 69, 251–268. [Google Scholar]

- Cahan, S.F.; Chen, C.; Chen, L.; Nguyen, N.H. Corporate social responsibility and media coverage. J. Bank. Financ. 2015, 59, 409–422. [Google Scholar]

- Kim, M.; Yin, X.; Lee, G. The effect of CSR on corporate image, customer citizenship behaviors, and customers’ long-term relationship orientation. Int. J. Hosp. Manag. 2020, 88, 102520. [Google Scholar]

- Li, Z.; Ling, Z. The Impact of Media Coverage on Enterprise Green Technology Innovation: The Moderating Role of Marketization Level. Manag. Rev. 2020, 32, 132–144. [Google Scholar]

- Wu, S.; Zhang, H.; Wei, T. Corporate Social Responsibility Disclosure, Media Reports, and Enterprise Innovation: Evidence from Chinese Listed Companies. Sustainability 2021, 13, 8466. [Google Scholar] [CrossRef]

- Javed, M.; Hussain, G.; Ali, H. The effects of corporate social responsibility on corporate reputation and firm financial performance: Moderating role of responsible leadership. Corp. Soc. Responsib. Environ. Manag. 2019, 27, 1395–1409. [Google Scholar] [CrossRef]

- McConnell, L. The role of the media in corporate governance: Do the media influence managers’ capital allocation decisions? J. Financ. Econ. 2013, 110, 1–17. [Google Scholar]

- Qing, L.; Alnafrah, I.; Dagestani, A.A. Does green technology innovation benefit corporate financial performance? Investigating the moderating effect of media coverage. Corp. Soc. Responsib. Environ. Manag. 2023, 31, 1722–1740. [Google Scholar] [CrossRef]

- Li, J.C.; Benamraoui, A.; Shah, N.; Mathew, S. Dynamic Capability and Strategic Corporate Social Responsibility Adoption: Evidence from China. Sustainability 2021, 13, 5333. [Google Scholar] [CrossRef]

- Demir, M.; Min, M. Consistencies and discrepancies in corporate social responsibility reporting in the pharmaceutical industry. Sustain. Account. Manag. Policy J. 2019, 10, 333–364. [Google Scholar] [CrossRef]

- Yang, M.; Wang, J.; Maresova, P.; Akbar, M. Can the spending of corporate social responsibility be offset? Evidence from pharmaceutical industry. Econ. Res. Istraz. 2022, 35, 6279–6303. [Google Scholar]

- Huang, Q.; Wan, A.; Elahi, E.; Peng, B.; Li, J. Can corporate social responsibility enhance corporate competitiveness? An empirical analysis based on listed companies in China’s pharmaceutical manufacturing industry. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 2639–2650. [Google Scholar]

- Yang, M.; Maresova, P. Adopting Occupational Health and Safety Management Standards: The Impact on Financial Performance in Pharmaceutical Firms in China. Risk Manag. Healthc. Policy 2020, 13, 1477–1487. [Google Scholar] [CrossRef]

- Thompson, K.; Sheldon, O. The Philosophy of Management; Pitman Publishing: London, UK, 1924. [Google Scholar]

- Li, J.; Fu, T.; Han, S.; Liang, R. Exploring the Impact of Corporate Social Responsibility on Financial Performance: The Moderating Role of Media Attention. Sustainability 2023, 15, 5023. [Google Scholar] [CrossRef]

- Friedman, M. The Social Responsibility of Business is to Increase its Profits. N. Y. Times Mag. 2007, 13, 173–178. [Google Scholar]

- Baboukardos, D. The valuation relevance of environmental performance revisited: The moderating role of environmental provisions. Br. Account. Rev. 2018, 50, 32–47. [Google Scholar] [CrossRef]

- Cantele, S.; Zardini, A. Is sustainability a competitive advantage for small businesses? An empirical analysis of possible mediators in the sustainability–financial performance relationship. J. Clean. Prod. 2018, 182, 166–176. [Google Scholar]

- Ankersmit, L. The contribution of EU public procurement law to corporate social responsibility. Eur. Law J. 2020, 26, 9–26. [Google Scholar]

- Athar, M.; Chughtai, S.; Rashid, D.A. Corporate governance and bank performance: Evidence from banking sector of Pakistan. Corp. Gov. Int. J. Bus. Soc. 2023, 23, 1339–1360. [Google Scholar]

- Li, T.; Meng, X.; Jia, F.; Chen, L.; Wang, L. Do carbon neutrality initiatives affect the shareholder value of firms? Evidence China J. Clean. Prod. 2023, 418, 138115. [Google Scholar]

- Yang, M.; Bento, P.; Akbar, A. Does CSR Influence Firm Performance Indicators? Evidence from Chinese Pharmaceutical Enterprises. Sustainability 2019, 11, 5656. [Google Scholar] [CrossRef]

- El Akremi, A.; Gond, J.-P.; Swaen, V.; De Roeck, K.; Igalens, J. How Do Employees Perceive Corporate Responsibility? Development and Validation of a Multidimensional Corporate Stakeholder Responsibility Scale. J. Manag. 2018, 44, 619–657. [Google Scholar]

- Bhardwaj, P.; Chatterjee, P.; Demir, K.D.; Turut, O. When and how is corporate social responsibility profitable? J. Bus. Res. 2018, 84, 206–219. [Google Scholar]

- Yang, M.; Lin, Q.; Maresova, P. Does Employee Care Trigger Innovation Under a Healthy and Safe Working Environment? Evidence from the Pharmaceutical Industry in China. Healthcare 2021, 9, 194. [Google Scholar] [CrossRef]

- Yi Xie, B.; Zhou, L.; Wei, Y. Does CSR affect the cost of equity capital: Empirical evidence from the targeted poverty alleviation of listed companies in China. PLoS ONE 2020, 15, e0227952. [Google Scholar]

- Jo, H.; Harjoto, M.A. Corporate Governance and Firm Value: The Impact of Corporate Social Responsibility. J. Bus. Ethics 2011, 103, 351–383. [Google Scholar]

- Chen, S.; Song, Y.; Gao, P. Environmental, social, and governance (ESG) performance and financial outcomes: Analyzing the impact of ESG on financial performance. J. Environ. Manag. 2023, 345, 118829. [Google Scholar] [CrossRef]

- Sun, W.; Cui, K. Linking corporate social responsibility to firm default risk. Eur. Manag. J. 2014, 32, 275–287. [Google Scholar] [CrossRef]

- Kim, S.; Lee, G.; Kang, H.-G. Risk management and corporate social responsibility. Strateg. Manag. J. 2021, 42, 202–230. [Google Scholar] [CrossRef]

- Husaini, H.; Nurazi, R.; Saiful, S. Moderating role of risk management effectiveness on corporate social responsibility-corporate performance relationship. Cogent Bus. Manag. 2023, 10, 2194465. [Google Scholar]

- Xie Huo, J.; Zou, H. Green process innovation, green product innovation, and corporate financial performance: A content analysis method. J. Bus. Res. 2019, 101, 697–706. [Google Scholar] [CrossRef]

- Zhang, D.; Rong, Z.; Ji, Q. Green innovation and firm performance: Evidence from listed companies in China. Resour. Conserv. Recycl. 2019, 144, 48–55. [Google Scholar]

- Poussing, N. Does corporate social responsibility encourage sustainable innovation adoption? Empirical evidence from Luxembourg. Corp. Soc. Responsib. Environ. Manag. 2018, 26, 681–689. [Google Scholar]

- Zhu, Q.; Zou, F.; Zhang, P. The role of innovation for performance improvement through corporate social responsibility practices among small and medium-sized suppliers in China. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 341–350. [Google Scholar]

- Canh, N.T.; Liem, N.T.; Thu, P.A.; Khuong, N.V. The Impact of Innovation on the Firm Performance and Corporate Social Responsibility of Vietnamese Manufacturing Firms. Sustainability 2019, 11, 3666. [Google Scholar] [CrossRef]

- Ruan, R.; Chen, W.; Zhu, Z. Linking Environmental Corporate Social Responsibility with Green Innovation Performance: The Mediating Role of Shared Vision Capability and the Moderating Role of Resource Slack. Sustainability 2022, 14, 16943. [Google Scholar] [CrossRef]

- Zhou, H.; Wang, Q.; Zhao, X. Corporate social responsibility and innovation: A comparative study. Ind. Manag. Data Syst. 2020, 120, 863–882. [Google Scholar] [CrossRef]

- Labahn, D.W.; Krapfel, R. Early Supplier Involvement in Customer New Product Development: A Contingency Model of Component Supplier Intentions. J. Bus. Res. 2000, 47, 173–190. [Google Scholar] [CrossRef]

- Cook, K.A.; Romi, A.M.; Sánchez, D.; Sánchez, J.M. The influence of corporate social responsibility on investment efficiency and innovation. J. Bus. Financ. Account. 2019, 46, 494–537. [Google Scholar] [CrossRef]

- Yannan, D.; Ahmed, A.A.A.; Kuo, T.-H.; Malik, H.A.; Nassani, A.A.; Haffar, M.; Suksatan, W.; Iramofu, D.P.F. Impact of CSR, innovation, and green investment on sales growth: New evidence from manufacturing industries of China and Saudi Arabia. Econ. Res.-Ekon. Istraživanja 2021, 35, 4537–4556. [Google Scholar] [CrossRef]

- Wang, C.; Tang, F.; Zhang, Q.; Zhang, W. How does corporate social responsibility contribute to innovation performance? The moderating role of social media strategic capability and big data analytics capability. Eur. J. Innov. Manag. 2023, 28, 631–655. [Google Scholar] [CrossRef]

- Murat Ar, I.; Baki, B. Antecedents and performance impacts of product versus process innovation. Eur. J. Innov. Manag. 2011, 14, 172–206. [Google Scholar] [CrossRef]

- Wernerfelt, B. Adaptation, Specialization, and the Theory of the Firm: Foundations of the Resource-Based View; Cambridge University Press: Cambridge, UK, 2016. [Google Scholar]

- Graafland, J. Competition in technology and innovation, motivation crowding, and environmental policy. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 137–145. [Google Scholar] [CrossRef]

- Lis, B. The Relevance of Corporate Social Responsibility for a Sustainable Human Resource Management: An Analysis of Organizational Attractiveness as a Determinant in Employees’ Selection of a (Potential) Employer. Manag. Rev. 2012, 23, 279–295. [Google Scholar] [CrossRef]

- Cegarra-Navarro, J.-G.; Reverte, C.; Gómez-Melero, E.; Wensley, A.K.P. Linking social and economic responsibilities with financial performance: The role of innovation. Eur. Manag. J. 2016, 34, 530–539. [Google Scholar] [CrossRef]

- Zanjirchi, S.M.; Jalilian, N.; Mehrjardi, M.S. Open innovation: From technology exploitation to creation of superior performance. Asia Pac. J. Innov. Entrep. 2019, 13, 326–340. [Google Scholar] [CrossRef]

- Bahta, D.; Yun, J.; Islam, M.R.; Ashfaq, M. Corporate social responsibility, innovation capability and firm performance: Evidence from SME. Soc. Responsib. J. 2020, 17, 840–860. [Google Scholar] [CrossRef]

- Chen, X. Corporate social responsibility disclosure, media attention and corporate performance. Financ. Account. Newsl. 2018, 2018, 31–34. [Google Scholar]

- Xiang, X.; Liu, C.; Yang, M.; Zhao, X. Confession or justification: The effects of environmental disclosure on corporate green innovation in China. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2735–2750. [Google Scholar]

- Gupta, S.; Nawaz, N.; Tripathi, A.; Muneer, S.; Ahmad, N. Using Social Media as a Medium for CSR Communication, to Induce Consumer–Brand Relationship in the Banking Sector of a Developing Economy. Sustainability 2021, 13, 3700. [Google Scholar] [CrossRef]

- Chen, Z.; Jin, J.; Li, M. Does media coverage influence firm green innovation? The moderating role of regional environment. Technol. Soc. 2022, 70, 102006. [Google Scholar]

- Duan, Y.; Wang, W.; Zhou, W. The multiple mediation effect of absorptive capacity on the organizational slack and innovation performance of high-tech manufacturing firms: Evidence from Chinese firms. Int. J. Prod. Econ. 2020, 229, 107754. [Google Scholar]

- Liang, T.; Zhang, Y.-J.; Qiang, W. Does technological innovation benefit energy firms’ environmental performance? The moderating effect of government subsidies and media coverage. Technol. Forecast. Soc. Change 2022, 180, 121728. [Google Scholar]

- Li, X.; Li, C.; Wang, Z.; Jiao, W.; Pang, Y. The effect of corporate philanthropy on corporate performance of Chinese family firms: The moderating role of religious atmosphere. Emerg. Mark. Rev. 2021, 49, 100757. [Google Scholar] [CrossRef]

- Aula, P.; Mantere, S. Strategic Reputation Management: Towards a Company of Good; Routledge: London, UK, 2008. [Google Scholar]

- Li, W.; Li, W.; Seppänen, V.; Koivumäki, T. Effects of greenwashing on financial performance: Moderation through local environmental regulation and media coverage. Bus. Strategy Environ. 2022, 32, 820–841. [Google Scholar]

- Walker, K.; Wan, F. The Harm of Symbolic Actions and Green-Washing: Corporate Actions and Communications on Environmental Performance and Their Financial Implications. J. Bus. Ethics 2012, 109, 227–242. [Google Scholar]

- Gama, M.A.B.; Lana, J.; Bueno, G.; Marcon, R.; Bandeira-de-Mello, R. Moderating the connections: Media coverage and firm market value. Corp. Gov. Int. J. Bus. Soc. 2022, 23, 607–627. [Google Scholar]

- Graf-Vlachy, L.; Oliver, A.G.; Banfield, R.; König, A.; Bundy, J. Media Coverage of Firms: Background, Integration, and Directions for Future Research. J. Manag. 2019, 46, 36–69. [Google Scholar] [CrossRef]

- Luo, J.; Liu, Q. Corporate social responsibility disclosure in China: Do managerial professional connections and social attention matter? Emerg. Mark. Rev. 2020, 43, 100679. [Google Scholar] [CrossRef]

- Dai, L.; Shen, R.; Zhang, B. Does the media spotlight burn or spur innovation? Rev. Account. Stud. 2021, 26, 343–390. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Nash, R.; Patel, A. New Evidence on the Role of the Media in Corporate Social Responsibility. J. Bus. Ethics 2019, 154, 1051–1079. [Google Scholar] [CrossRef]

- Wang, M.C. The relationship between environmental information disclosure and firm valuation: The role of corporate governance. Qual. Quant. 2016, 50, 1135–1151. [Google Scholar] [CrossRef]

- Zhang, Y.; Peng, S. Media Attention and Enterprise Innovation Performance. Guizhou Univ. Financ. Econ. 2020, 4, 29–39. [Google Scholar]

- Wu, L.; Shao, Z.; Yang, C.; Ding, T.; Zhang, W. The Impact of CSR and Financial Distress on Financial Performance—Evidence from Chinese Listed Companies of the Manufacturing Industry. Sustainability 2020, 12, 6799. [Google Scholar] [CrossRef]

- Arbogast, G.W.; Agrawal, V. Does Corporate Social Responsibility Affect Corporate Profit Margins? J. Manag. Eng. Integr. 2019, 12, 67–77. [Google Scholar] [CrossRef]

- Long, X.; Bu, X.; Xie, P.; Shao, Y. Woman on board, corporate social responsibility and financial performance: New evidence from China. Humanit. Soc. Sci. Commun. 2024, 11, 1–12. [Google Scholar] [CrossRef]

- Pan, X.; Jing, Z.; Song, M.; Ai, B. Innovation resources integration pattern in high-tech entrepreneurial enterprises. Int. Entrep. Manag. J. 2018, 14, 51–66. [Google Scholar]

- Cozza, C.; Malerba, F.; Mancusi, M.L.; Perani, G.; Vezzulli, A. Innovation, profitability and growth in medium and high-tech manufacturing industries: Evidence from Italy. Appl. Econ. 2012, 44, 1963–1976. [Google Scholar] [CrossRef]

- Bartoloni, E. Capital structure and innovation: Causality and determinants. Empirica 2011, 40, 111–151. [Google Scholar] [CrossRef]

- Du, X.; Pei, H.; Du, Y.; Zeng, Q. Media coverage, family ownership, and corporate philanthropic giving: Evidence from China. J. Manag. Organ. 2015, 22, 224–253. [Google Scholar] [CrossRef]

- Zang, Z.; Chen, H. Media coverage and impression management in corporate social responsibility reports. Sustain. Account. Manag. Policy J. 2019, 11, 863–886. [Google Scholar]

- D’Amato, A.; Falivena, C. Corporate social responsibility and firm value: Do firm size and age matter? Empirical evidence from European listed companies. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 909–924. [Google Scholar] [CrossRef]

- Li, X.; Zhang, Z. The effects of corporate social responsibility on innovation and performance of firms in China: A structural equation model analysis. Nankai Bus. Rev. Int. 2024, 15, 660–683. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Hayes, A.F.; Scharkow, M. The relative trustworthiness of inferential tests of the indirect effect in statistical mediation analysis: Does method really matter? Psychol. Sci. 2013, 24, 1918–1927. [Google Scholar] [CrossRef]

- Yu, X. Research on the Impact of Corporate Social Responsibility on Corporate Financial Performance from the Perspective of Innovation Capability; Nankai University: Tianjin, China, 2022. [Google Scholar]

| Variable Type | Variables | Symbol | Definition |

|---|---|---|---|

| Dependent variable | Corporate Financial Performance | CFP | Net profit/total assets |

| Independent variable | Corporate Social Responsibility | CSR | CSR score from Hexun CSR database 0.01 |

| Mediator variable | Technology Innovation | Inn | Net profit/net intangible assets |

| Moderator variable | Positive media coverage | Med1 | The natural logarithm of the number of positive newspaper reports about the enterprise in the CFND database plus 1. |

| Negative media coverage | Med2 | The natural logarithm of the number of negative newspaper reports about the enterprise in the CFND database plus 1. | |

| Control variable | Firm age | Age | The natural logarithm of the sample year minus the year the company was founded |

| Firm size | Size | The natural logarithm of the book value of total assets | |

| Firm leverage | Lev | Ratio of debt to firm assets in book value | |

| Cash flow ratio | CFO | Net cash flows from operating activities of enterprises/total assets | |

| Sales growth rate | Growth | (Sales revenue for the current year- Sales revenue for the previous year)/Sales revenue for the previous year | |

| Intangible assets ratio | Intan | Net intangible assets/total assets | |

| Number of staff | Staff | Natural logarithm of the total number of staff in the company |

| Variables | Obs | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| ROA | 1367 | 0.070 | 0.0657 | −0.139 | 0.252 |

| CSR | 1367 | 0.274 | 0.157 | −0.032 | 0.762 |

| Inn | 1367 | 2.238 | 3.151 | −3.715 | 17.210 |

| Med1 | 1367 | 3.039 | 1.183 | 0 | 6.324 |

| Med2 | 1367 | 2.311 | 1.168 | 0 | 5.521 |

| Age | 1367 | 2.802 | 0.353 | 1.609 | 3.367 |

| Size | 1367 | 22.00 | 0.923 | 19.980 | 24.290 |

| Lev | 1367 | 0.319 | 0.182 | 0.030 | 0.817 |

| CFO | 1367 | 0.063 | 0.061 | −0.112 | 0.230 |

| Growth | 1367 | 0.155 | 0.272 | −0.425 | 1.507 |

| Intan | 1367 | 0.051 | 0.036 | 0.003 | 0.200 |

| Staff | 1367 | 7.759 | 0.980 | 5.659 | 9.942 |

| ROA | CSR | Inn | Med1 | Med2 | Age | Size | Lev | CFO | Growth | Intan | Staff | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 1 | |||||||||||

| CSR | 0.486 *** | 1 | ||||||||||

| Inn | 0.629 *** | 0.300 *** | 1 | |||||||||

| Med1 | 0.220 *** | 0.311 *** | 0.127 *** | 1 | ||||||||

| Med2 | 0.201 *** | 0.294 *** | 0.141 *** | 0.807 *** | 1 | |||||||

| Age | −0.100 *** | −0.076 *** | 0.015 | 0.073 *** | −0.057 ** | 1 | ||||||

| Size | 0.034 | 0.149 *** | 0.023 | 0.506 *** | 0.348 *** | 0.429 *** | 1 | |||||

| Lev | −0.433 *** | −0.202 *** | −0.339 *** | 0.134 *** | 0.117 *** | 0.231 *** | 0.267 *** | 1 | ||||

| CFO | 0.542 *** | 0.253 *** | 0.285 *** | 0.075 *** | 0.043 | 0.004 | 0.034 | −0.273 *** | 1 | |||

| Growth | 0.290 *** | 0.118 *** | 0.142 *** | 0.107 *** | 0.101 *** | −0.123 *** | −0.024 | −0.030 | 0.042 | 1 | ||

| Intan | −0.073 *** | −0.059 ** | −0.444 *** | −0.012 | 0.014 | −0.064 ** | −0.078 *** | 0.091 *** | 0.075 *** | −0.019 | 1 | |

| Staff | 0.056 ** | 0.190 *** | −0.041 | 0.545 *** | 0.429 *** | 0.331 *** | 0.788 *** | 0.333 *** | 0.104 *** | −0.032 | 0.065 ** | 1 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | ROA | Inn | ROA |

| CSR | 0.1065 *** | 2.2767 *** | 0.0830 *** |

| (6.42) | (2.90) | (6.28) | |

| Inn | 0.0103 *** | ||

| (8.38) | |||

| Age | −0.0534 * | −0.2183 | −0.0512 * |

| (−1.80) | (−0.13) | (−1.94) | |

| Size | 0.0006 | 0.3837 | −0.0033 |

| (0.09) | (1.09) | (−0.54) | |

| Lev | −0.0942 *** | −3.7963 *** | −0.0551 *** |

| (−4.83) | (−4.11) | (−3.37) | |

| CFO | 0.2695 *** | 9.3239 *** | 0.1734 *** |

| (6.87) | (4.32) | (5.92) | |

| Growth | 0.0506 *** | 1.1374 *** | 0.0389 *** |

| (9.36) | (4.11) | (9.82) | |

| Intan | −0.1176 * | −35.0461 *** | 0.2437 *** |

| (−1.86) | (−6.78) | (4.60) | |

| Staff | −0.0004 | −0.6229 | 0.0061 |

| (−0.05) | (−1.57) | (0.90) | |

| Constant | 0.1835 | 1.3631 | 0.1695 |

| (1.42) | (0.17) | (1.37) | |

| Observations | 1367 | 1367 | 1367 |

| Number of id | 128 | 128 | 128 |

| Company FE | YES | YES | YES |

| Year FE | YES | YES | YES |

| R-squared | 0.402 | 0.285 | 0.591 |

| F | 26.74 *** | 7.881 *** | 45.35 *** |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | ROA | Inn | ROA | ROA | Inn | ROA |

| CSR | 0.2363 *** | 7.0527 *** | 0.1653 *** | 0.1973 *** | 6.2489 *** | 0.1338 *** |

| (4.55) | (3.23) | (3.80) | (4.61) | (4.08) | (3.79) | |

| Inn | 0.0101 *** | 0.0102 *** | ||||

| (8.16) | (8.19) | |||||

| Med1 | 0.0136 *** | 0.6237 *** | 0.0074 ** | |||

| (3.75) | (3.33) | (2.19) | ||||

| c.Med1#c.CSR | −0.0364 *** | −1.3413 ** | −0.0229 ** | |||

| (−2.90) | (−2.36) | (−2.28) | ||||

| Med2 | 0.0094 *** | 0.5176 *** | 0.0042 | |||

| (3.01) | (3.77) | (1.52) | ||||

| c.Med2#c.CSR | −0.0309 *** | −1.3448 *** | −0.0173 * | |||

| (−2.63) | (−2.84) | (−1.81) | ||||

| Age | −0.0524 * | −0.2044 | −0.0504 * | −0.0487 | −0.0363 | −0.0483 * |

| (−1.78) | (−0.12) | (−1.92) | (−1.65) | (−0.02) | (−1.83) | |

| Size | −0.0039 | 0.1713 | −0.0056 | −0.0022 | 0.2214 | −0.0044 |

| (−0.59) | (0.48) | (−0.89) | (−0.34) | (0.65) | (−0.73) | |

| Lev | −0.0884 *** | −3.5725 *** | −0.0524 *** | −0.0892 *** | −3.5908 *** | −0.0528 *** |

| (−4.50) | (−3.86) | (−3.22) | (−4.60) | (−3.91) | (−3.25) | |

| CFO | 0.2580 *** | 8.8583 *** | 0.1687 *** | 0.2603 *** | 8.8615 *** | 0.1703 *** |

| (6.66) | (4.05) | (5.82) | (6.59) | (4.09) | (5.82) | |

| Growth | 0.0498 *** | 1.0966 *** | 0.0388 *** | 0.0502 *** | 1.1218 *** | 0.0388 *** |

| (9.40) | (3.98) | (9.85) | (9.40) | (4.08) | (9.86) | |

| Intan | −0.1191 * | −35.1029 *** | 0.2345 *** | −0.1196 * | −35.1107 *** | 0.2370 *** |

| (−1.89) | (−6.86) | (4.44) | (−1.91) | (−6.91) | (4.46) | |

| Staff | −0.0007 | −0.6487 * | 0.0058 | −0.0008 | −0.6510 * | 0.0058 |

| (−0.11) | (−1.67) | (0.89) | (−0.12) | (−1.67) | (0.88) | |

| Constant | 0.2353 * | 4.0936 | 0.1941 | 0.2081 | 3.1565 | 0.1760 |

| (1.85) | (0.52) | (1.58) | (1.64) | (0.41) | (1.45) | |

| Observations | 1367 | 1367 | 1367 | 1367 | 1367 | 1367 |

| Number of id | 128 | 128 | 128 | 128 | 128 | 128 |

| Company FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| R-squared | 0.420 | 0.298 | 0.597 | 0.414 | 0.296 | 0.594 |

| F | 26.93 *** | 8.234 *** | 43.61 *** | 26.17 *** | 8.556 *** | 44.94 *** |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | Profit | Profit | Profit | Profit | Profit | Profit |

| CSR | 0.2566 *** | 0.2060 *** | 0.6950 *** | 0.5436 *** | 0.5836 *** | 0.4486 *** |

| (5.52) | (5.33) | (4.58) | (4.08) | (4.60) | (4.08) | |

| Inn | 0.0222 *** | 0.0215 *** | 0.0216 *** | |||

| (6.94) | (6.76) | (6.77) | ||||

| Med1 | 0.0342 *** | 0.0208 ** | ||||

| (3.68) | (2.30) | |||||

| c.Med1#c.CSR | −0.1228 *** | −0.0940 *** | ||||

| (−3.46) | (−3.09) | |||||

| Med2 | 0.0241 *** | 0.0129 | ||||

| (2.73) | (1.57) | |||||

| c.Med2#c.CSR | −0.1125 *** | −0.0834 *** | ||||

| (−3.36) | (−2.89) | |||||

| Age | −0.0921 | −0.0872 | −0.0867 | −0.0823 | −0.0727 | −0.0719 |

| (−1.17) | (−1.22) | (−1.12) | (−1.17) | (−0.95) | (−1.03) | |

| Size | 0.0637 *** | 0.0551 *** | 0.0530 *** | 0.0493** | 0.0574 *** | 0.0526 *** |

| (3.14) | (2.85) | (2.62) | (2.57) | (2.79) | (2.67) | |

| Lev | −0.3664 *** | −0.2820 *** | −0.3472 *** | −0.2706 *** | −0.3470 *** | −0.2694 *** |

| (−6.88) | (−5.87) | (−6.69) | (−5.78) | (−6.85) | (−5.83) | |

| CFO | 0.4414 *** | 0.2343 *** | 0.4068 *** | 0.2167 *** | 0.4144 *** | 0.2229 *** |

| (5.38) | (3.03) | (5.03) | (2.79) | (5.00) | (2.84) | |

| Growth | 0.0925 *** | 0.0672 *** | 0.0909 *** | 0.0674 *** | 0.0904 *** | 0.0662 *** |

| (6.36) | (5.24) | (6.45) | (5.39) | (6.32) | (5.23) | |

| Intan | −0.3289 * | 0.4498 *** | −0.3338 * | 0.4195 *** | −0.3380 ** | 0.4207 *** |

| (−1.91) | (3.10) | (−1.97) | (2.86) | (−2.02) | (2.92) | |

| Staff | −0.0425 *** | −0.0287 * | −0.0425 *** | −0.0285 * | −0.0434 *** | −0.0293 * |

| (−2.64) | (−1.83) | (−2.83) | (−1.88) | (−2.82) | (−1.93) | |

| Constant | −0.6542 * | −0.6845 * | −0.5596 | −0.6475 * | −0.6342 | −0.7024 * |

| (−1.68) | (−1.81) | (−1.48) | (−1.77) | (−1.63) | (−1.86) | |

| Observations | 1367 | 1367 | 1367 | 1367 | 1367 | 1367 |

| Number of id | 128 | 128 | 128 | 128 | 128 | 128 |

| Company FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| R-squared | 0.341 | 0.476 | 0.367 | 0.491 | 0.365 | 0.490 |

| F | 11.65 *** | 13.65 *** | 10.74 *** | 13.11 *** | 11.93 *** | 13.62 *** |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | ROA | Inn | ROA |

| L.ROA/L.Inn | 0.4365 *** | 0.3994 *** | 0.3573 *** |

| (0.060) | (0.069) | (0.062) | |

| CSR | 0.1021 *** | 2.5436 *** | 0.0592 *** |

| (0.020) | (0.627) | (0.014) | |

| Inn | 0.0089 *** | ||

| (0.001) | |||

| Age | 0.0089 | 0.9540 *** | −0.0017 |

| (0.005) | (0.218) | (0.007) | |

| Size | −0.0024 | 0.1801 | 0.0003 |

| (0.003) | (0.183) | (0.004) | |

| Lev | −0.0505 *** | −2.2183 *** | −0.0231 ** |

| (0.012) | (0.552) | (0.010) | |

| CFO | 0.2080 *** | 4.4779 *** | 0.1398 *** |

| (0.025) | (1.258) | (0.023) | |

| Growth | 0.0437 *** | 0.6188 | 0.0398 *** |

| (0.007) | (0.374) | (0.006) | |

| Intan | −0.0864 * | −18.1341 *** | 0.2681 *** |

| (0.046) | (4.080) | (0.058) | |

| Staff | 0.0033 | −0.1936 | 0.0016 |

| (0.003) | (0.181) | (0.004) | |

| Constant | 0.0035 | −3.7802 | −0.0328 |

| (0.055) | (3.156) | (0.063) | |

| Observations | 1239 | 1239 | 1239 |

| Number of id | 128 | 128 | 128 |

| Company FE | YES | YES | YES |

| Year FE | YES | YES | YES |

| Hansen | 0.546 | 0.427 | 0.166 |

| AR(1) | 0.000 | 0.000 | 0.000 |

| AR(2) | 0.137 | 0.381 | 0.160 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | ROA | Inn | ROA | ROA | Inn | ROA |

| L.ROA/L.Inn | 0.3947 *** | 0.4033 *** | 0.5361 *** | 0.4200 *** | 0.3535 *** | 0.5270 *** |

| (0.063) | (0.060) | (0.065) | (0.066) | (0.065) | (0.065) | |

| CSR | 0.3504 *** | 10.6187 *** | 0.2752 *** | 0.2470 *** | 8.8340 *** | 0.2149 *** |

| (0.071) | (3.059) | (0.067) | (0.068) | (2.430) | (0.055) | |

| Inn | 0.0099 *** | 0.0098 *** | ||||

| (0.001) | (0.001) | |||||

| Med1 | 0.0219 *** | 0.7836 *** | 0.0161 *** | |||

| (0.004) | (0.247) | (0.004) | ||||

| c.CSR | −0.0689 *** | −2.2285 *** | −0.0551 *** | |||

| (0.017) | (0.806) | (0.016) | ||||

| Med2 | 0.0175 *** | 0.8311 *** | 0.0125 *** | |||

| (0.005) | (0.224) | (0.004) | ||||

| c.CSR | −0.0529 *** | −2.1427 *** | −0.0469 *** | |||

| (0.018) | (0.778) | (0.015) | ||||

| Age | 0.0090 | 1.0680 *** | −0.0022 | 0.0118 * | 0.9185 *** | −0.0013 |

| (0.007) | (0.258) | (0.005) | (0.006) | (0.258) | (0.006) | |

| Size | −0.0017 | −0.0479 | −0.0076 ** | −0.0007 | −0.0818 | −0.0071 ** |

| (0.004) | (0.179) | (0.003) | (0.004) | (0.174) | (0.003) | |

| Lev | −0.0597 *** | −1.9788 *** | 0.0016 | −0.0569 *** | −2.3899 *** | 0.0003 |

| (0.013) | (0.587) | (0.010) | (0.013) | (0.616) | (0.009) | |

| CFO | 0.1920 *** | 4.7745 *** | 0.0802 *** | 0.1885 *** | 4.9975 *** | 0.0915 *** |

| (0.027) | (1.140) | (0.024) | (0.028) | (1.409) | (0.023) | |

| Growth | 0.0424 *** | 0.4412 | 0.0403 *** | 0.0417 *** | 0.5741 | 0.0414 *** |

| (0.006) | (0.309) | (0.007) | (0.008) | (0.361) | (0.007) | |

| Intan | −0.0904 * | −23.7789 *** | 0.2654 *** | −0.0760 | −24.9713 *** | 0.2670 *** |

| (0.049) | (4.553) | (0.049) | (0.050) | (4.721) | (0.046) | |

| Staff | 0.0012 | −0.1357 | 0.0040 | 0.0007 | −0.0608 | 0.0047 |

| (0.004) | (0.170) | (0.003) | (0.004) | (0.197) | (0.003) | |

| Constant | −0.0618 | −1.8588 | 0.0506 | −0.0549 | −0.5655 | 0.0492 |

| (0.065) | (3.493) | (0.055) | (0.062) | (3.302) | (0.052) | |

| Observations | 1239 | 1239 | 1239 | 1239 | 1239 | 1239 |

| Number of id | 128 | 128 | 128 | 128 | 128 | 128 |

| Company FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| Hansen | 0.284 | 0.168 | 0.483 | 0.309 | 0.140 | 0.615 |

| AR(1) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| AR(2) | 0.142 | 0.306 | 0.122 | 0.126 | 0.480 | 0.136 |

| Model | Effect | Observed | Bootstrap | ||

|---|---|---|---|---|---|

| Coefficient | Std. Err. | BootLLIC | BootULIC | ||

| CSR → Inn → ROA | Mediation effect | 0.0235 | 0.0062 | 0.0123 | 0.0368 |

| Direct effect | 0.0830 | 0.0088 | 0.0671 | 0.1012 | |

| Total effect | 0.1065 | ||||

| Model | Effect | Observed | Bootstrap | ||

|---|---|---|---|---|---|

| Coefficient | Std. Err. | BootLLCI | BootULCI | ||

| CSR → Inn → ROA (Med1) | Min Med1 | 0.0409 | 0.0083 | 0.0257 | 0.0586 |

| Mean Med1 | 0.0273 | 0.0059 | 0.0168 | 0.0399 | |

| Max Med1 | 0.0137 | 0.0054 | 0.0037 | 0.0253 | |

| CSR → Inn → ROA (Med2) | Min Med2 | 0.0423 | 0.0085 | 0.0266 | 0.0599 |

| Mean Med2 | 0.0293 | 0.0061 | 0.0185 | 0.0423 | |

| Max Med2 | 0.0163 | 0.0053 | 0.0063 | 0.0270 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, J.; Chaveesuk, S.; Keerativutisest, V. Corporate Social Responsibility and Financial Performance in the Chinese Pharmaceutical Sector: The Roles of Technological Innovation and Media Coverage. Sustainability 2025, 17, 3300. https://doi.org/10.3390/su17083300

Wang J, Chaveesuk S, Keerativutisest V. Corporate Social Responsibility and Financial Performance in the Chinese Pharmaceutical Sector: The Roles of Technological Innovation and Media Coverage. Sustainability. 2025; 17(8):3300. https://doi.org/10.3390/su17083300

Chicago/Turabian StyleWang, Jin, Singha Chaveesuk, and Vasu Keerativutisest. 2025. "Corporate Social Responsibility and Financial Performance in the Chinese Pharmaceutical Sector: The Roles of Technological Innovation and Media Coverage" Sustainability 17, no. 8: 3300. https://doi.org/10.3390/su17083300

APA StyleWang, J., Chaveesuk, S., & Keerativutisest, V. (2025). Corporate Social Responsibility and Financial Performance in the Chinese Pharmaceutical Sector: The Roles of Technological Innovation and Media Coverage. Sustainability, 17(8), 3300. https://doi.org/10.3390/su17083300