2.2. Theoretical Analysis and Research Hypotheses

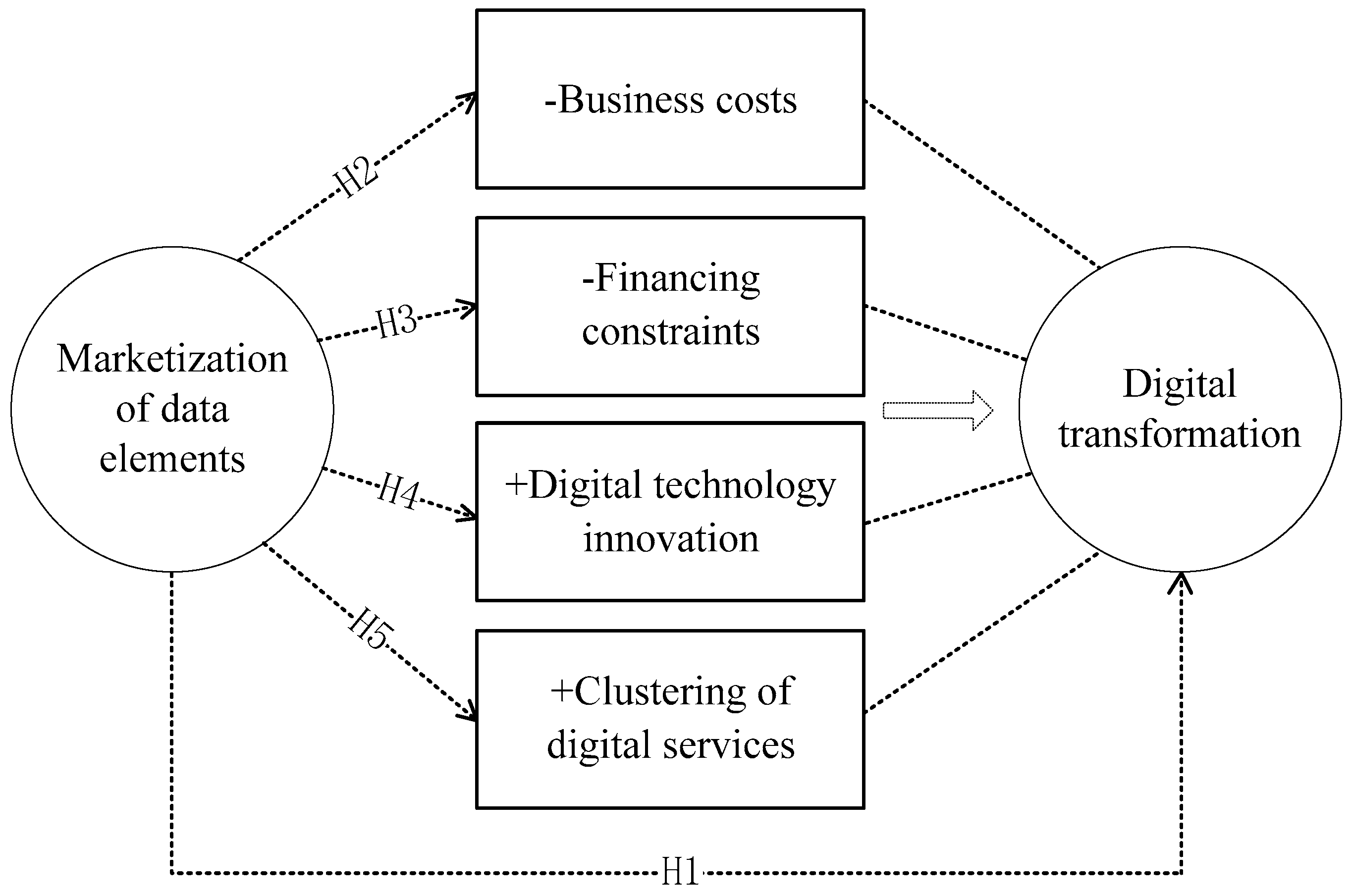

Building on previous research and theoretical analysis, this paper proposes five hypotheses, as illustrated in

Figure 2. The figure depicts both the direct and indirect impact pathways through which the marketization of data elements influences the digital transformation of manufacturing enterprises. The arrows indicate the direction of influence between variables.

The establishment and operation of a data trading platform are essential for enabling enterprises to exchange information, facilitate knowledge transfer, and enhance the market-oriented utilization of enterprise information assets [

11]. The data element market provides a robust platform for the effective aggregation of data resources, allowing manufacturing enterprises to streamline the acquisition of high-quality data. This empowers these enterprises to undergo transformation and innovation through the utilization of digital capabilities [

12]. By leveraging more effective data analysis and mining techniques, organizations can achieve optimized decision-making processes, thereby significantly enhancing productivity and innovation within the manufacturing sector. Furthermore, the marketization of data elements promotes the optimization of enterprise resource allocation and improves efficiency through synergistic interactions among various factors. Replicable and noncompetitive data elements are gradually replacing traditional production inputs. This transition will optimize the structure of production elements and enhance marginal productivity, leveraging their cost advantages over conventional production resources [

13]. Specifically, data elements play a crucial role in providing comprehensive market insights, optimizing the decision-making process, enhancing supply chain management, and ensuring accurate human resource allocation. These capabilities collectively enable other production factors—such as capital, labor, and technology—to achieve efficient resource allocation and maximize value [

14]. In addition, the marketization of data elements facilitates the dismantling of information barriers across regions and levels. While this development provides abundant and transparent data resources, competition among enterprises has intensified. Consequently, companies must expedite their digital transformation efforts to sustain their competitive advantage, thereby enhancing their responsiveness and market sensitivity. This leads us to the statement of Hypothesis 1:

H1: The marketization of data elements can enhance the digital transformation of manufacturing enterprises.

The digital transformation of manufacturing enterprises requires substantial initial investments, including investments in technology, talent development, process transformation, and effective risk management. These investments not only increase operational costs but heighten the risk-bearing pressure during the transformation process. As companies are expected to independently shoulder the costs and potential losses associated with the transformation, high operational costs may undermine their ability to manage risks and reduce their willingness to pursue digital transformation. In this context, the marketization of data elements provides abundant informational resources. It helps decision-makers identify patterns, trends, and correlations, offering deep insights into business operations. This enables rapid adjustments to production and marketing strategies. This decision optimization can help minimize costs caused by erroneous decisions, improve resource allocation efficiency, and reduce management costs. Moreover, the substantial resource investment and transformation risks highlight the growing need for manufacturing enterprises to pursue collaborative efforts during digital transformation in order to mitigate potential transformation costs [

15]. The data element market serves as a platform for collaborative innovation among enterprises, facilitating the flow and spillover of innovative knowledge across different entities. It enables enterprises to form complementary advantages in data resources, market information, and innovation strategies, empowering them to make precise decisions and predict risks based on data analysis [

16]. For example, General Electric’s (GE) Predix platform, a globally renowned industrial solution, integrates operational data from industrial equipment to provide businesses with precise data services. This helps them quickly identify optimization opportunities in production processes, which not only reduces data acquisition costs but offers reliable support for optimizing production workflows [

17]. Additionally, by innovating the economic system and fostering market transaction habits, market-oriented reforms effectively reduce transaction costs, offering enterprises more stable profit expectations and enhancing financial security for their digital transformation initiatives [

18]. This leads us to the statement of Hypothesis 2:

H2: The marketization of data elements promotes improvements in the digital transformation level of manufacturing enterprises by reducing costs.

For manufacturing enterprises, significant investment costs and financing constraints represent critical challenges in progressing toward digital transformation [

19]. Because of the opacity of information in the capital market, the risk-averse nature of financial institutions, and the misallocation of capital resources, enterprises in China generally face more severe financing constraints [

20]. The advancement of the marketization of data elements offers a novel solution to mitigate this dilemma. By enhancing the transparency of enterprise operations, the marketization of data elements enables investors and financial institutions to more accurately evaluate the value and risks associated with enterprises. This process effectively reduces the barriers to financing caused by information asymmetry, thereby lowering both the cost and difficulty of securing funding [

21]. Furthermore, when companies successfully alleviate their financing constraints through the marketization of data elements, they can allocate greater resources and attention to corporate innovation and management transformation. This, in turn, fosters a virtuous cycle. At the same time, the deeper development of the data element market can also help financial institutions accelerate their digital upgrades by leveraging digital technologies to accurately identify the funding needs and potential risks of manufacturing enterprises during their digital transformation process. For example, JPMorgan Chase in the United States uses a data-driven risk assessment system to design differentiated financial support plans for enterprises. This data-driven service capability provides strong financial backing for the digital transformation of manufacturing enterprises [

22]. This leads us to the statement of Hypothesis 3:

H3: The marketization of data elements enhances the digital transformation of manufacturing companies by reducing financing constraints.

The marketization of data elements plays a critical role in optimizing and innovating the digital economy ecosystem by connecting various elements, strengthening collaboration, and promoting development. It provides comprehensive foundational support for the integration and innovation of digital technologies. By enhancing data exchange and cooperation across different industries and sectors within a region, enterprises and research institutions can establish collaborative networks to jointly develop data-driven innovative technologies, thereby contributing to the increase in the region’s technological intensity [

23]. Digital technology serves as a crucial foundation for the digital transformation of enterprises. The digital transformation process of enterprises involves the development and implementation of digital technologies within their production and operational frameworks [

24]. The widespread application of digital technologies enables enterprises to gain profound market insights through advanced data analytics, facilitating more effective marketing and personalized customer services. For example, the state-owned China National Energy Investment Group has integrated data from various transportation equipment, including operational, failure, and maintenance data, and codeveloped over 20 specialized data analysis tools and models. These tools are used to analyze the efficiency and reliability of transportation equipment, offering users solutions for collaborative manufacturing and the optimization of transportation assets [

25]. The integration and innovation of digital technologies are driving unprecedented transformations in enterprises, injecting vitality into their sustained growth and competitive advantage. Furthermore, the marketization of data elements is often accompanied by improvements in urban digital infrastructure, such as high-speed internet and data centers. These infrastructures provide reliable support for the implementation of digital technologies, enhancing the efficiency and quality of professional services. This leads us to the statement of Hypothesis 4:

H4: The marketization of data elements accelerates the digital transformation of manufacturing enterprises by enhancing the level of regional digital technology innovation.

Digital transformation encompasses more than merely upgrading technology; it involves profound alterations in business models and the methodologies through which value is generated [

26]. Manufacturing companies must investigate innovative business models, including service-oriented manufacturing and personalized customization, to effectively address the demands of the digital economy era [

27]. This innovation process requires substantial digital talent, such as data analysts and software developers [

28]. People with relevant expertise are essential for the implementation, maintenance, and optimization of digital technologies. The advancement of the marketization of data elements has enhanced the appeal and competitiveness of cities in the realm of digital services. This development has facilitated the agglomeration of enterprises and talent, leading to the formation of dynamic clusters within the digital service sector. For instance, the Panyu Artificial Intelligence and Digital Economy Pilot Zone in Guangzhou, China, has taken the lead in nationwide data element market reforms, bringing together over 3000 enterprises in data-related fields. It has empowered more than 850,000 businesses and driven nearly CNY 50 billion in economic benefits [

29]. The dense digital service industry provides specialized consulting services for the digital transformation of manufacturing enterprises, helping them assess their current status, plan transformation paths, and develop feasible digital strategies tailored to the specific needs and characteristics of each enterprise. The digital culture and innovation environment fostered by the concentration of digital services also help enterprises build a shared understanding of digital transformation, promoting changes in organizational culture and work practices. This leads us to the statement of Hypothesis 5:

H5: The marketization of data elements enhances the digital transformation of manufacturing enterprises by enhancing the clustering effect of the digital service industry.