The Mediating Effect of the Sustainability Committee on the Relationship of Size of Board of Directors with Environmental Sustainability Disclosures: A Study in the Transportation Sector

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Corporate Governance

2.2. Corporate Governance and Sustainability

3. Methodology

3.1. Sample Data Design

3.2. Explanation of Variables

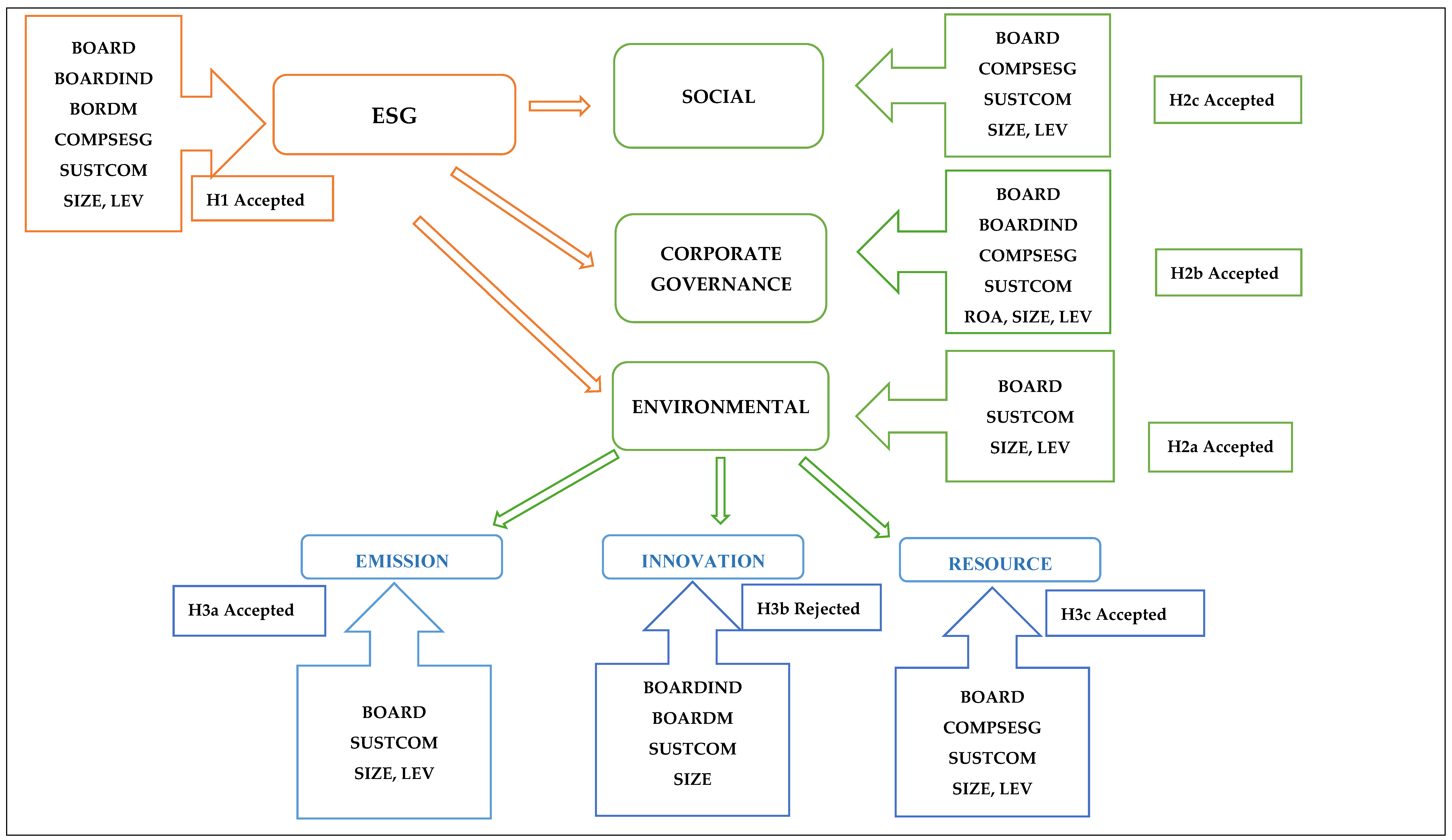

4. Empirical Results and Discussion

4.1. Statistical Evaluation

4.2. Regression Results

4.3. Robustness Test

4.4. Discussion

5. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kuo, K.C.; Yu, H.Y.; Lu, W.M.; Le, T.T. Sustainability and corporate performance: Moderating role of environmental, social, and governance investments in the transportation sector. Sustainability 2022, 14, 4095. [Google Scholar] [CrossRef]

- Downar, B.; Ernstberger, J.; Reichelstein, S.; Schwenen, S.; Zaklan, A. The impact of carbon disclosure mandates on emissions and financial operating performance. Rev. Account. Stud. 2021, 26, 1137–1175. [Google Scholar] [CrossRef]

- Orazalin, N.S.; Ntim, C.G.; Malagila, J.K. Board sustainability committees, climate change initiatives, carbon performance, and market value. Br. J. Manag. 2024, 35, 295–320. [Google Scholar] [CrossRef]

- Chen, W.; Xie, Y.; He, K. Environmental, social, and governance performance and corporate innovation novelty. Int. J. Innov. Stud. 2024, 8, 109–131. [Google Scholar] [CrossRef]

- Ghosh, S.; Pareek, R.; Nath Sahu, T. How far corporate governance and firms’ characteristics are relevant toward environmental sustainability? An empirical investigation. Rajagiri Manag. J. 2023, 17, 183–197. [Google Scholar] [CrossRef]

- Burki, U.; Ersoy, P.; Dahlstrom, R. Achieving triple bottom line performance in manufacturer-customer supply chains: Evidence from an emerging economy. J. Clean. Prod. 2018, 197, 1307–1316. [Google Scholar] [CrossRef]

- Wang, G.; Bai, S.; Ogden, J.M. Identifying contributions of on-road motor vehicles to urban air pollution using travel demand model data. Transp. Res. Part D Transp. Environ. 2009, 14, 168–179. [Google Scholar] [CrossRef]

- Herold, D.M.; Lee, K.H. Carbon management in the logistics and transportation sector: An overview and new research directions. Carbon Manag. 2017, 8, 79–97. [Google Scholar] [CrossRef]

- Govindan, K.; Kilic, M.; Uyar, A.; Karaman, A.S. Drivers and value-relevance of CSR performance in the logistics sector: A cross-country firm-level investigation. Int. J. Prod. Econ. 2021, 231, 107835. [Google Scholar] [CrossRef]

- Buallay, A. Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Manag. Environ. Qual. Int. J. 2019, 30, 98–115. [Google Scholar] [CrossRef]

- Hussain, N.; Ringini, U.; Orij, R.P. Corporate governance and sustainability performance: Analysis of triple bottom line performance. J. Bus. Ethics 2018, 149, 411–432. [Google Scholar]

- Taliento, M.; Favino, C.; Netti, A. Impact of environmental, social, and governance information on economic performance: Evidence of a corporate ‘sustainability advantage’ from Europe. Sustainability 2019, 11, 1738. [Google Scholar] [CrossRef]

- Brammer, S.; Pavelin, S. Factors influencing the quality of corporate environmental disclosure. Bus. Strateg. Environ. 2008, 17, 120–136. [Google Scholar]

- Da Silva Monteiro, S.M.; Guzman, B.A. The influence of the Portuguese environmental accounting standard on the environmental disclosures in the annual reports of large companies operating in Portugal. Environ. Qual. Manag. 2010, 21, 414–435. [Google Scholar]

- Younis, H.; Sundarakani, B. The impact of firm size, firm age and environmental management certification on the relationship between green supply chain practices and corporate performance. Benchmark. Int. J. 2020, 27, 319–346. [Google Scholar]

- Andrikopoulos, A.; Kriklani, N. Environmental disclosure and financial characteristics of the firm: The case of Denmark. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 55–64. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P.; Phan, P.H. Corporate governance and environmental performance: Is there really a link? Strateg. Manag. J. 2012, 33, 885–913. [Google Scholar]

- Amran, A.; Lee, S.P.; Devi, S.S. The influence of governance structure and strategic corporate social responsibility toward sustainability reporting quality. Bus. Strategy Environ. 2014, 23, 17–235. [Google Scholar]

- EmadEldeen, R.; Elbayuomi, A.F.; Elmoursy, H.; Bouaddi, M.; Basuony, M.A.K. Does board diversity drive sustainability? Evidence from UK-Listed Companies. Sustainability 2025, 17, 1177. [Google Scholar] [CrossRef]

- Jeyhunov, A.; Kim, J.D.; Bae, S.M. The effects of board diversity on Korean Companies’ ESG performance. Sustainability 2025, 17, 787. [Google Scholar] [CrossRef]

- De Villiers, C.; Naiker, V.; Van Staden, C.J. The effect of board characteristics on firm environmental performance. J. Manag. 2011, 37, 1636–1663. [Google Scholar]

- Awad, A.B.; Gharios, R.; Abu Khalaf, B.; Seissian, L.A. Board characteristics and bank stock performance: Empirical evidence from the MENA Region. Risks 2024, 12, 81. [Google Scholar] [CrossRef]

- Boone, A.L.; Field, L.C.; Karpoff, J.M.; Raheja, C.G. The determinants of corporate board size and composition: An empirical analysis. J. Financ. Econ. 2007, 85, 66–101. [Google Scholar]

- Pearce, J.A.; Patel, P.C. Board of director efficacy and firm performance variability. Long Range Plann. 2018, 51, 911–926. [Google Scholar]

- Donnelly, R.; Mulcahy, M. Board structure, ownership, and voluntary disclosure in Ireland. Corp. Gov. Int. Rev. 2008, 16, 416–429. [Google Scholar]

- Shrivastava, P.; Addas, A. The impact of corporate governance on sustainability performance. J. Sustain. Finance Invest. 2014, 4, 21–37. [Google Scholar]

- Slawinski, N. Short on Time: The Role of Organizational Time Orientation in Business Sustainability; School of Graduate and Postdoctoral Studies, Western University: London, ON, Canada, 2010. [Google Scholar]

- Liao, L.; Luo, L.; Tang, Q. Gender diversity, board independence, environmental committee and greenhouse gas disclosure. Br. Account. Rev. 2015, 47, 409–425. [Google Scholar]

- Masud, M.A.K.; Nurunnabi, M.; Bae, S.M. The effects of corporate governance on environmental sustainability reporting: Empirical evidence from South Asian countries. Asian J. Sustain. Soc. Responsib. 2018, 3, 3–26. [Google Scholar]

- Katmon, N.; Mohamad, Z.Z.; Norwani, N.M.; Al Farooque, O. Comprehensive board diversity and quality of corporate social responsibility disclosure: Evidence from an emerging market. J. Bus. Ethics 2017, 157, 447–481. [Google Scholar]

- Lipton, M.; Lorsch, J.W. A modest proposal for improved corporate governance: Business source. Bus. Lawyer 1992, 48, 59–77. [Google Scholar]

- Mahoney, L.S.; Thorn, L. An examination of the structure of executive compensation and corporate social responsibility: A Canadian investigation. J. Bus. Ethics 2006, 69, 149–162. [Google Scholar] [CrossRef]

- Haque, F. The effects of board characteristics and sustainable compensation policy on carbon performance of UK firms. Br. Account. Rev. 2017, 49, 347–364. [Google Scholar] [CrossRef]

- Lee, M.T.; Raschke, R.L.; Krishen, A.S. Signaling green! firm ESG signals in an interconnected environment that promote brand valuation. J. Bus. Res. 2022, 138, 1–11. [Google Scholar] [CrossRef]

- Alkaraan, F.; Elmarzouky, M.; Hussainey, K.; Venkatesh, V.G.; Shi, Y.; Gulko, N. Reinforcing green business strategies with Industry 4.0 and governance towards sustainability: Natural-resource-based view and dynamic capability. Bus. Strategy Environ. 2024, 33, 3588–3606. [Google Scholar] [CrossRef]

- Paillé, P.; Halilem, N. Systematic review on environmental innovativeness: A knowledge-based resource view. J. Clean. Prod. 2019, 211, 1088–1099. [Google Scholar]

- Chuang, S.-P.; Huang, S.-J. The effect of environmental corporate social responsibility on environmental performance and business competitiveness: The mediation of green information technology capital. J. Bus. Ethics 2018, 150, 991–1009. [Google Scholar] [CrossRef]

- Tang, Y.; Zhu, J.; Ma, W.; Zhao, M. A study on the impact of institutional pressure on carbon information disclosure: The mediating effect of enterprise peer influence. Int. J. Environ. Res. Public Health 2022, 19, 4174. [Google Scholar] [CrossRef]

- Irshad, A.u.R.; Safdar, N.; Younas, Z.I.; Manzoor, W. Impact of corporate governance on firms’ environmental performance: Case study of environmental sustainability-based business scenarios. Sustainability 2023, 15, 7775. [Google Scholar] [CrossRef]

- Muneer, S.; Singh, A.; Choudhary, M.H.; Alshammari, A.S.; Butt, N.A. Does environmental disclosure and corporate governance ensure the financial sustainability of Islamic Banks? Adm. Sci. 2025, 15, 54. [Google Scholar] [CrossRef]

- Bose, S.; Khan, H.Z.; Bakshi, S. Determinants and consequences of sustainable development goals disclosure: International evidence. J. Clean. Prod. 2024, 434, 140021. [Google Scholar] [CrossRef]

- Driss, H.; Drobetz, W.; El Ghoul, S.; Guedhami, O. The Sustainability committee and environmental disclosure: International evidence. J. Econ. Behav. Organ. 2024, 221, 602–625. [Google Scholar]

- Luo, L.; Tang, Q. Corporate governance and carbon performance: Role of carbon strategy and awareness of climate risk. Account. Finance 2021, 61, 2891–2934. [Google Scholar] [CrossRef]

- Orazalin, N. Do board sustainability committees contribute to corporate environmental and social performance? The mediating role of corporate social responsibility strategy. Bus. Strat. Environ. 2020, 29, 140–153. [Google Scholar]

- Dong, Y.; Liang, C.; Wanyin, Z. Board diversity and firm performance: Impact of ESG activities in China. Econ. Res.-Ekon. Istraž. 2023, 36, 1592–1609. [Google Scholar] [CrossRef]

- Litman, T. Toward more comprehensive evaluation of traffic risks and safety strategies. Res. Transp. Bus. Manag. 2018, 29, 127–135. [Google Scholar] [CrossRef]

- Shahrour, M.H.; Rohani, A.; Wojewodzki, M.; Tran, D.V. Carbon performance and financial performance: How R&D makes a difference Pre-and Post-Paris Accord. Int. J. Financ. Econ. 2024, 1–13. [Google Scholar] [CrossRef]

- Handayati, P.; Tham, Y.H.; Yuningsih, Y.; Sun, Z.; Nugroho, T.R.; Rochayatun, S. ESG performance and corporate governance –The moderating role of the big four auditors. J. Risk Financ. Manag. 2025, 18, 31. [Google Scholar] [CrossRef]

- Benlemlih, M.; Arif, M.; Nadeem, M. Institutional ownership and greenhouse gas emissions: A comparative study of the UK and the USA. Br. J. Manag. 2023, 34, 623–647. [Google Scholar] [CrossRef]

- Figge, F.; Hahn, T. Is green and profitable sustainable? Assessing the trade-off between economic and environmental aspects. Int. J. Prod. Econ. 2012, 140, 92–102. [Google Scholar] [CrossRef]

- LSEG ESG Scores. ESG Scores Methodology. 2024. Available online: https://www.lseg.com/en/data-analytics/sustainable-finance/esg-scores (accessed on 14 November 2024).

| Dependent Variables | |

|---|---|

| ESG | The overall company score obtained by combining ESG sub-scores (environmental, corporate governance, and social) |

| ENVSCORE | Environmental score |

| CGSCORE | Corporate governance score |

| SOCSCORE | Social score |

| EMISSION | Emission reduction score |

| INNOVATION | Resource usage score |

| RESOURCE | Innovation score |

| Independent Variables | |

| BOARD | Total number of board members |

| BOARDIND | Ratio of the number of independent board members to total members |

| BOARDM | Number of meetings held by the board of directors |

| COMPSESG | Dummy variable with value ‘1’ if there is ESG-related management compensation and ‘0’ otherwise |

| Moderator Variable | |

| SUSTCOM | Dummy variable with value ‘1’ if there is a sustainability committee and ‘0’ otherwise. |

| Control Variables | |

| ROA | The ratio of period profit to lagged total assets |

| SIZE | Logarithm of total assets |

| LEV | Total liabilities to total assets ratio |

| Variables | Mean | Std. Def. | Min. | Maxs. |

|---|---|---|---|---|

| ESG | 58.49 | 21.45 | 0 | 94.57 |

| ENVSCORE | 59.37 | 27.10 | 0 | 99.20 |

| CGSCORE | 55.06 | 20.96 | 0 | 98.05 |

| SOCSCORE | 59.95 | 24.25 | 0 | 97.99 |

| EMISSION | 62.11 | 30.98 | 0 | 99.74 |

| INNOVATION | 46.23 | 34.86 | 0 | 99.73 |

| RESOURCE | 59.46 | 32.76 | 0 | 99.89 |

| BOARD | 13.62 | 4.95 | 6 | 26 |

| BOARDIND | 45.37 | 29.61 | 0 | 100 |

| BOARDM | 8.49 | 3.95 | 2 | 34 |

| COMPSESG | 0.40 | 0.49 | 0 | 1 |

| SUSTCOM | 0.65 | 0.48 | 0 | 1 |

| ROA | 0.05 | 0.05 | −0.29 | 0.42 |

| SIZE | 7.13 | 0.76 | 5.37 | 8.709 |

| LEV | 0.31 | 0.17 | 0 | 1.726 |

| VARIABLES | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) ESG | 1.00 | |||||||||||||||

| (2) ENVSCORE | 0.91 *** | 1.00 | ||||||||||||||

| (3) CGSCORE | 0.71 *** | 0.50 *** | 1.00 | |||||||||||||

| (4) SOCSCORE | 0.94 *** | 0.83 *** | 0.51 *** | 1.00 | ||||||||||||

| (5) EMISSION | 0.85 *** | 0.91 *** | 0.47 *** | 0.78 *** | 1.00 | |||||||||||

| (6) INNOVATION | 0.54 *** | 0.58 *** | 0.42 *** | 0.43 *** | 0.33 *** | 1.00 | ||||||||||

| (7) RESOURCE | 0.84 *** | 0.92 *** | 0.40 *** | 0.81 *** | 0.84 *** | 0.37 *** | 1.00 | |||||||||

| (8) BOARD | 0.53 *** | 0.56 *** | 0.20 *** | 0.52 *** | 0.59 *** | 0.12 *** | 0.55 *** | 1.00 | 2.21 | |||||||

| (9) BOARDIND | 0.10 *** | 0.01 | 0.33 *** | 0.03 | −0.03 | 0.21 *** | −0.06 | −0.36 *** | 1.00 | 1.36 | ||||||

| (10) BORDM | 0.11 *** | 0.10 *** | 0.10 *** | 0.11 *** | 0.11 *** | 0.02 | 0.09 ** | −0.18 *** | 0.20 *** | 1.00 | 1.21 | |||||

| (11) COMPSESG | 0.41 *** | 0.35 *** | 0.32 *** | 0.40 *** | 0.33 *** | 0.15 *** | 0.36 *** | 0.27 *** | 0.09 ** | 0.13 *** | 1.00 | 1.34 | ||||

| (12) SUSTCOM | 0.62 *** | 0.60 *** | 0.46 *** | 0.55 *** | 0.55 *** | 0.31 *** | 0.58 *** | 0.27 *** | 0.19 *** | 0.15 *** | 0.44 *** | 1.00 | 1.46 | |||

| (13) ROA | −0.33 *** | −0.35 *** | −0.15 *** | −0.33 *** | −0.36 *** | −0.13 *** | −0.35 *** | −0.35 *** | 0.14 *** | −0.12 *** | −0.14 *** | −0.25 *** | 1.00 | 1.29 | ||

| (14) SIZE | 0.69 *** | 0.67 *** | 0.39 *** | 0.68 *** | 0.63 *** | 0.47 *** | 0.65 *** | 0.56 *** | −0.01 | 0.16 *** | 0.23 *** | 0.35 *** | −0.42 *** | 1.00 | 1.85 | |

| (15) LEV | 0.36 *** | 0.34 *** | 0.20 *** | 0.34 *** | 0.37 *** | 0.04 | 0.31 *** | 0.35 *** | −0.04 | 0.10 *** | 0.25 *** | 0.17 *** | −0.16 *** | 0.32 *** | 1.00 | 1.22 |

| (16) VIF | Mean VIF | 1.49 | ||||||||||||||

| Independent Variable | ESGS | ENVS | GOVS | SOCS |

|---|---|---|---|---|

| Coef. | Coef. | Coef. | Coef. | |

| BOARD | 0.763 *** (0.052) | 1.153 *** (0.168) | 0.217 (0.141) | 0.737 *** (0.089) |

| BOARDIND | 0.071 *** (0.018) | 0.016 (0.044) | 0.212 *** (0.030) | 0.020 (0.016) |

| BORDM | −0.088 (0.051) | 0.027 (0.155) | −0.230 (0.149) | 0.004 (0.130) |

| COMPSESG | 3.430 ** (1.222) | 0.734 (0.964) | 4.191 *** (1.281) | 5.124 ** (1.837) |

| SUSTCOM | 15.738 *** (1.016) | 21.391 *** (1.261) | 11.504 *** (1.192) | 14.826 *** (1.451) |

| ROA | 1.657 (12.649) | −7.600 (23.070) | 1.860 (16.763) | 2.742 (16.821) |

| SIZE | 12.199 *** (1.687) | 13.768 *** (1.734) | 6.609 *** (1.292) | 14.402 *** (1.816) |

| LEV | 10.512 ** (3.574) | 11.601 *** (3.217) | 6.812 (6.227) | 10.164 ** (4.573) |

| Cons | −56.167 *** (12.908) | −72.671 *** (14.755) | −13.952 * (7.203) | −68.559 *** (15.794) |

| R-squared | 0.68 | 0.64 | 0.36 | 0.61 |

| F Statistics (Prob) | 425.79 (0.000) | 2692.21 (0.000) | 980.39 (0.000) | 1735.21 (0.000) |

| Independent Variable | EMISSION | INNOVATION | RESOURCE |

|---|---|---|---|

| Coef. | Coef. | Coef. | |

| BOARD | 1.995 *** (0.251) | −1.392 *** (0.196) | 1.299 *** (0.287) |

| BOARDIND | 0.028 (0.062) | 0.148 ** (0.068) | −0.052 (0.034) |

| BORDM | 0.447 (0.309) | −1.292 *** (0.284) | 0.082 (0.152) |

| COMPSESG | −0.513 (1.391) | 1.869 (1.987) | 3.390 * (1.867) |

| SUSTCOM | 21.508 *** (1.055) | 12.285 *** (4.083) | 25.017 *** (1.610) |

| ROA | 13.511 (22.077) | 32.582 (36.756) | −5.258 (34.458) |

| SIZE | 11.693 *** (2.987) | 27.185 *** (2.319) | 16.314 *** (1.998) |

| LEV | 19.678 *** (5.231) | −17.512 (10.107) | 7.603 (4.673) |

| Cons | −72.441 *** (19.835) | −129.292 *** (14.402) | −92.364 *** (17.819) |

| R-squared | 0.61 | 0.33 | 0.60 |

| F Statistics (Prob) | 4285.77 (0.000) | 1893.29 (0.000) | 1647.45 (0.000) |

| Independent Variable | ESGS | ENVS | GOVS | SOCS | EMISSION | INNOVATION | RESOURCE |

|---|---|---|---|---|---|---|---|

| Coef | Coef | Coef | Coef | Coef | Coef | Coef | |

| BOARD | 1.290 *** (0.112) | 1.734 *** (0.192) | 1.347 *** (0.294) | 0.780 *** (0.139) | 2.527 *** (0.314) | −0.614 (0.355) | 1.761 *** (0.343) |

| BOARDIND | 0.062 *** (0.018) | 0.005 (0.045) | 0.191 *** (0.028) | 0.020 (0.016) | 0.018 (0.064) | 0.134 * (0.066) | −0.061 (0.038) |

| BORDM | −0.093 * (0.049) | 0.023 (0.145) | −0.239 (0.130) | 0.004 (0.132) | 0.442 (0.301) | −1.298 *** (0.275) | 0.078 (0.158) |

| COMPSESG | 4.156 *** (1.385) | 1.534 (1.159) | 5.747 *** (1.291) | 5.182 ** (1.921) | 0.219 (1.242) | 2.939 (2.245) | 4.028 * (2.099) |

| SUSTCOM | 27.269 *** (1.822) | 34.101 *** (3.616) | 36.231 *** (3.061) | 15.758 *** (2.742) | 33.149 *** (4.066) | 29.286 *** (5.510) | 35.146 *** (6.466) |

| ROA | 12.318 (14.501) | 4.150 (27.289) | 24.720 * (11.801) | 3.604 (17.068) | −2.748 (28.268) | 48.299 (37.433) | 4.106 (41.252) |

| SIZE | 12.723 *** (1.628) | 14.345 *** (1.728) | 7.732 *** (1.137) | 14.444 *** (1.888) | 12.221 *** (2.998) | 27.957 *** (2.227) | 16.773 *** (2.161) |

| LEV | 12.755 *** (3.368) | 14.073 *** (3.257) | 11.624 * (6.018) | 10.345 ** (4.472) | 21.942 *** (5.402) | −14.206 (9.432) | 9.573 * (5.429) |

| BOARD * SUSTCOM | −0.915 *** (0.125) | −1.008 *** (0.252) | −1.962 *** (0.219) | −0.074 (0.222) | −0.924 ** (0.314) | −1.349 *** (0.381) | −0.804 (0.464) |

| Cons | −66.964 *** (11.953) | −84.571 *** (15.178) | −37.105 *** (5.310) | −69.431 *** (17.051) | −83.341 *** (20.541) | −145.209 *** (12.908) | −101.849 *** (21.469) |

| R-squared | 0.69 | 0.64 | 0.40 | 0.61 | 0.61 | 0.33 | 0.61 |

| F (Prob) | 3233.23 (0.000) | 8886.00 (0.000) | 621.37 (0.000) | 1649.07 (0.000) | 7940.55 (0.000) | 2184.12 (0.000) | 2812.05 (0.000) |

| Independent Variable | ESGS | ENVS | GOVS | SOCS | EMISSION | INNOVATION | RESOURCE |

|---|---|---|---|---|---|---|---|

| Coef | Coef | Coef | Coef | Coef | Coef | Coef | |

| Dependent Variable L1 | 0.541 *** (0.058) | 0.289 *** (0.060) | 0.184 *** (0.071) | 0.601 *** (0.036) | 0.228 *** (0.051) | 0.097 ** (0.046) | 0.302 *** (0.059) |

| BOARD | 1.142 *** (0.282) | 0.617 ** (0.301) | 1.799 *** (0.491) | 1.579 *** (0.219) | 0.526 ** (0.226) | 1.041 *** (0.351) | 1.123 *** (0.330) |

| BOARDIND | 0.043 *** (0.016) | 0.079 *** (0.011) | 0.070 *** (0.023) | −0.019 (0.018) | 0.056 *** (0.014) | 0.087 *** (0.012) | 0.027 * (0.015) |

| BORDM | 0.052 (0.070) | 0.004 (0.069) | 0.043 (0.112) | 0.029 (0.082) | 0.209 *** (0.073) | 0.157 (0.112) | 0.096 (0.079) |

| COMPSESG | 2.167 *** (0.577) | 1.696 *** (0.438) | 3.411 *** (1.143) | 2.685 *** (0.812) | 2.198 *** (0.766) | 1.611 * (0.867) | 3.103 *** (0.801) |

| SUSTCOM | 10.808 *** (2.894) | 14.283 *** (3.793) | 16.459 *** (4.289) | 15.176 *** (2.371) | 13.884 *** (3.116) | 11.506 *** (3.783) | 27.132 *** (3.147) |

| ROA | −4.329 (4.051) | 2.337 (3.468) | −17.543 *** (5.802) | −0.425 (5.035) | −6.383 (4.735) | 15.205 *** (2.662) | −5.976 (6.479) |

| SIZE | 11.628 *** (1.605) | 16.245 *** (3.396) | 16.421 *** (3.353) | 13.143 *** (2.363) | 8.595 *** (2.153) | 9.743 *** (2.090) | 10.616 ** (4.140) |

| LEV | 3.061 ** (1.423) | 4.136 *** (1.480) | 3.940 *** (1.465) | 3.456 * (1.913) | 2.788 * (1.607) | −1.430 (1.471) | 8.353 *** (2.971) |

| BOARD ∗ SUSTCOM | −0.527 ** (0.210) | −0.447 * (0.247) | −1.016 *** (0.277) | −0.857 *** (0.153) | −0.534 *** (0.201) | −0.476 ** (0.238) | −1.327 *** (0.199) |

| Cons | −77.045 *** (10.384) | −91.557 *** (20.420) | −101.221 *** (28.033) | −93.070 *** (15.773) | −28.445 * (16.388) | −53.947 *** (11.633) | −59.195 ** (26.334) |

| Wald chi2 (Prob) | 3486.63 (0.000) | 2063.40 (0.000) | 369.96 (0.000) | 5525.55 (0.000) | 251.44 (0.000) | 491.61 (0.000) | 1065.32 (0.000) |

| Sargan test (Prob) | 32.335 (0.182) | 33.515 (0.148) | 37.582 (0.066) | 37.684 (0.065) | 36.998 (0.075) | 27.285 (0.3945) | 36.972 (0.075) |

| AR (1) (Prob) | −5.037 (0.000) | −3.355 (0.008) | −4.102 (0.000) | −4.673 (0.000) | −3.851 (0.000) | −1.557 (0.031) | −3.437 (0.001) |

| AR (2) (Prob) | 2.112 (0.348) | 0.459 (0.646) | −1.176 (0.240) | 1.304 (0.192) | −0.667 (0.505) | −2.155 (0.119) | −0.398 (0.691) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gürbüz, H.; Gürbüz, C. The Mediating Effect of the Sustainability Committee on the Relationship of Size of Board of Directors with Environmental Sustainability Disclosures: A Study in the Transportation Sector. Sustainability 2025, 17, 3165. https://doi.org/10.3390/su17073165

Gürbüz H, Gürbüz C. The Mediating Effect of the Sustainability Committee on the Relationship of Size of Board of Directors with Environmental Sustainability Disclosures: A Study in the Transportation Sector. Sustainability. 2025; 17(7):3165. https://doi.org/10.3390/su17073165

Chicago/Turabian StyleGürbüz, Habib, and Cennet Gürbüz. 2025. "The Mediating Effect of the Sustainability Committee on the Relationship of Size of Board of Directors with Environmental Sustainability Disclosures: A Study in the Transportation Sector" Sustainability 17, no. 7: 3165. https://doi.org/10.3390/su17073165

APA StyleGürbüz, H., & Gürbüz, C. (2025). The Mediating Effect of the Sustainability Committee on the Relationship of Size of Board of Directors with Environmental Sustainability Disclosures: A Study in the Transportation Sector. Sustainability, 17(7), 3165. https://doi.org/10.3390/su17073165