1. Introduction

The automobile industry is a pillar of China’s economy and a key driver of upstream and downstream industries, as well as job growth [

1]. However, with the intensification of competition in the global market, China’s automobile industry faces several challenges, including lagging behind in technological innovation, the weak international competitiveness of brands, and a shortage of skilled professionals. Particularly in workpiece manufacturing, improving forming quality (e.g., precision casting, stamping defect control) remains a critical yet understudied challenge, as evidenced by recent research on advanced manufacturing techniques [

2]. These issues not only hinder the industry’s growth, but also limit its potential for sustainable development. To maintain its competitive edge, the industry needs to undergo significant upgrades, which are necessary for driving long-term sustainability and competitiveness in a globalized market [

3]. Upgrading China’s automobile industry can foster the growth of related industries, such as parts manufacturing and technology services, optimize the economic structure, and contribute to a more sustainable and resilient national economy, especially in the face of economic fluctuations, which is crucial for the country’s sustainable development goals.

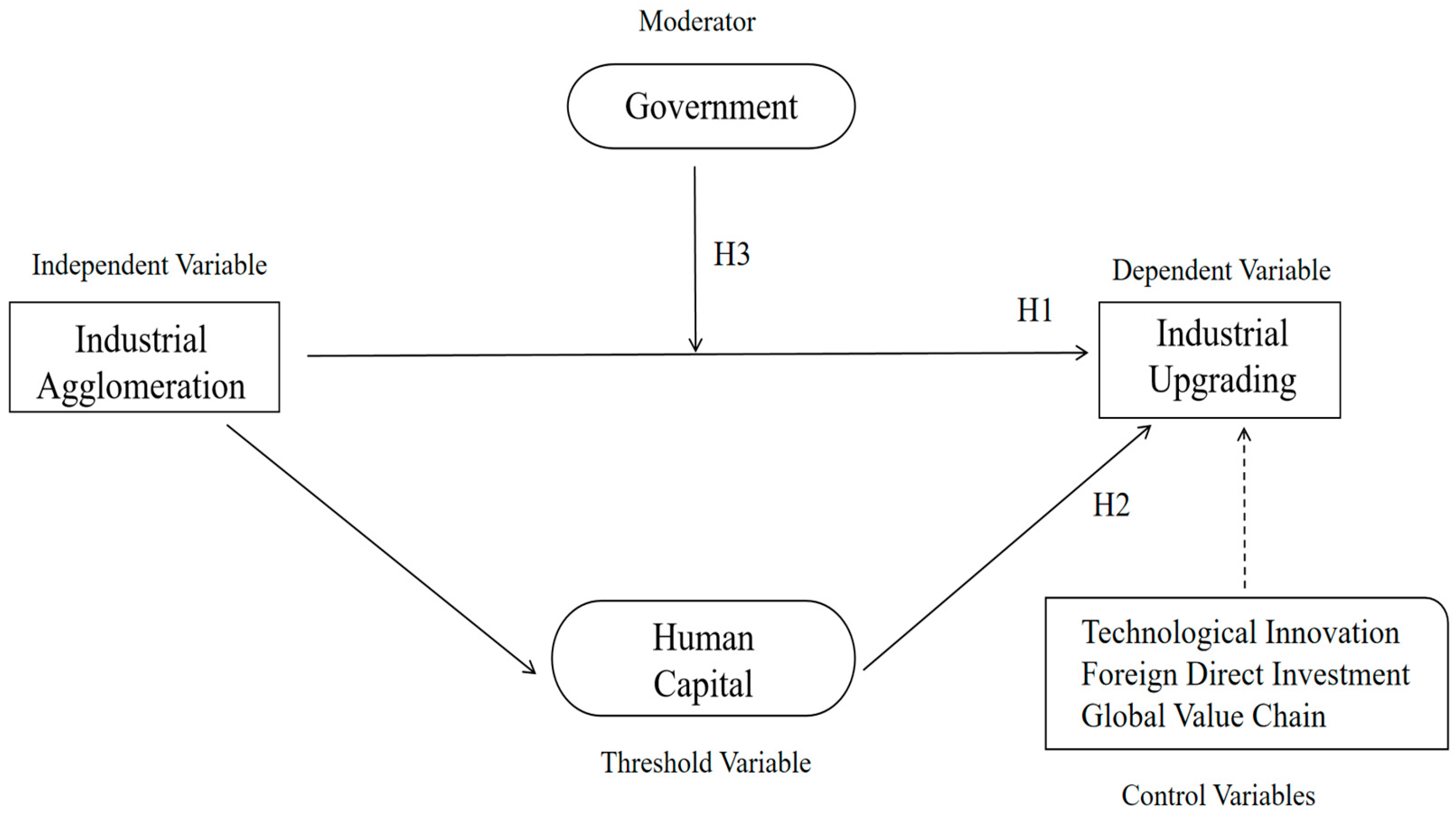

The motivation for this study stems from the critical role of the automobile industry in China’s economic development and the need to address its current challenges. By exploring the impact of industrial agglomeration on the upgrading of China’s automobile industry (UCAI), this research aims to provide actionable insights for policymakers and industry stakeholders to enhance the industry’s competitiveness and sustainability. Specifically, the study seeks to examine how industrial agglomeration influences the upgrading of China’s automobile industry, while also exploring the threshold effect of human capital and the moderating role of government in this process. By doing so, the research contributes to both the academic literature and practical policy formulation, offering a comprehensive understanding of the mechanisms driving industrial upgrading in the context of China’s automobile sector.

Industrial agglomeration refers to the geographical concentration of enterprises and institutions within the same or related industries in a specific area, which has significant implications for industrial upgrading. On the one hand, by fostering resource sharing, creating synergistic effects, and promoting specialized division of labor, enterprises within clusters can reduce costs, accelerate innovation, attract investment, and draw in high-quality talent [

4]. These factors contribute positively to industrial upgrading and the implementation of sustainable practices. However, on the other hand, industrial agglomeration can also lead to negative outcomes, such as path dependence, which may hinder the exploration of new technologies and innovative solutions. Intense competition within clusters can spark price wars, often at the expense of long-term research and development (R&D) and green innovation. Furthermore, resource competition and industrial homogenization may stifle the emergence of new, sustainable technologies and innovations [

5]. Therefore, the relationship between industrial agglomeration and industrial upgrading is complex, with both positive and negative factors at play. This highlights the need for further investigation into the role of agglomeration in driving industrial upgrading. Additionally, few studies have examined its impact on the automobile industry. This research aims to explore how industrial agglomeration influences the upgrading of China’s automobile industry (UCAI).

The influence of industrial agglomeration on industrial upgrading is closely tied to the level of human capital. Specifically, inadequate human capital constrains the ability of agglomeration to stimulate economic growth and improve labor productivity. In contrast, an adequate level of human capital facilitates these processes and fosters sustainable practices [

6,

7]. Here, human capital encompasses both the quantity and quality of the workforce, particularly in terms of education, training, and specialized expertise. This underscores that the mere existence of industrial agglomeration is insufficient to drive desirable economic outcomes, as the quality and capabilities of human capital are crucial in this relationship. Therefore, it is essential to further investigate the threshold effect of human capital in the relationship between industrial agglomeration and industrial upgrading. Understanding the human capital threshold is essential for leveraging industrial clusters to achieve economic growth and sustainability.

Industrial development within a competitive market environment often results in various market failures that can impede overall economic efficiency and growth. These failures typically manifest as negative externalities, which compromise social welfare and environmental sustainability. In this context, government intervention and regulation are crucial for addressing these externalities and facilitating the adoption of more sustainable practices [

8]. Furthermore, government involvement is especially critical in the upgrading of industrial agglomeration areas, particularly in regions with weak industrial foundations. In such areas, local governments and market participants can capitalize on their respective strengths to foster high-quality innovation and enhance local industrial development, ultimately driving economic advancement. In addition to fostering high-quality innovation and enhancing local industrial development, the government can play a pivotal role in several areas. For example, it can provide targeted subsidies for R&D activities, implement tax incentives for green technologies, and establish industrial parks to promote collaboration between enterprises and research institutions. Moreover, the government can address market failures by enforcing environmental regulations and supporting infrastructure development, which are essential for sustainable industrial upgrading [

9]. Therefore, it is crucial to examine how government can successfully moderate the relationship between industrial agglomeration and industrial upgrading, ensuring that the benefits of agglomeration are fully realized.

This study makes several key contributions to the existing literature on industrial agglomeration and industrial upgrading, particularly in the context of China’s automobile industry. First, it extends the theoretical framework of agglomeration economies by providing empirical evidence on how industrial agglomeration influences the upgrading of the automobile industry in an emerging market. While prior studies have largely focused on developed economies, this research fills a critical gap by examining the unique dynamics of industrial upgrading in China, a context characterized by rapid industrialization and significant government intervention. By doing so, it offers new insights into the role of agglomeration in enhancing both industrial competitiveness and sustainability, thereby advancing the literature on agglomeration economies in emerging markets.

Second, this study introduces human capital as a threshold variable in the relationship between industrial agglomeration and industrial upgrading, a perspective that has been underexplored in the existing literature. By demonstrating that the impact of agglomeration on upgrading is contingent upon the level of human capital, this research provides a more nuanced understanding of the mechanisms through which agglomeration drives innovation and productivity. This contribution not only enriches the theoretical discourse on industrial upgrading, but also offers practical implications for policymakers seeking to leverage human capital as a catalyst for sustainable industrial development.

Finally, this study examines the moderating role of government in the relationship between agglomeration and industrial upgrading, addressing a critical gap in the literature. While previous research has acknowledged the importance of government intervention, few studies have systematically analyzed how government policies can enhance the effectiveness of agglomeration in fostering industrial upgrading. By identifying specific mechanisms through which government intervention—such as R&D subsidies, tax incentives, and environmental regulations—can address market failures and promote sustainable practices, this research provides a comprehensive framework for understanding the interplay between agglomeration, government, and industrial upgrading.

Overall, this study not only advances the theoretical understanding of industrial agglomeration and upgrading, but also provides actionable insights for policymakers and industry stakeholders, particularly in the context of China’s automobile industry and other emerging markets.

The structure of this study is organized as follows:

Section 2 presents the literature review and research hypotheses, while

Section 3 outlines the data sources, measurement methods for variables, and model specification.

Section 4 exhibits the results. Finally,

Section 5 presents the discussion and conclusions, which encompass the following components: key findings, theoretical and practical implications, policy recommendations, and limitations and future research.

3. Materials and Methods

3.1. Data Description

3.1.1. Measurement of Dependent Variable

In this study, the dependent variable is industrial upgrading, which is measured using total factor productivity (TFP). This approach is based on the insights provided by Sun and Xi [

30], and Xu [

31], who argue that TFP serves as a robust indicator of industrial upgrading because it reflects the efficiency with which inputs are transformed into outputs, thereby capturing improvements in productivity and technological advancement. This perspective is supported by the work of Solow [

32], who emphasizes that TFP is a critical determinant of long-term economic growth and competitiveness, and is also vital for achieving sustainable development.

To measure TFP, this study employs the DEA–Malmquist method, which allows for the assessment of productivity changes over time. The DEA (Data Envelopment Analysis) approach utilizes linear programming to assess the efficiency of decision-making units, while the Malmquist index specifically measures productivity changes by comparing TFP between two periods. This method is well documented in the literature, notably in the work of Färe et al. [

33], who demonstrate the effectiveness of the DEA–Malmquist approach in capturing productivity dynamics across various industries.

We acknowledge that the DEA–Malmquist method has certain limitations, such as sensitivity to outliers and the challenge of distinguishing between statistical noise and actual efficiency differences. Nevertheless, we contend that the DEA–Malmquist method is particularly well suited for our study for several reasons. First, its non-parametric nature allows for greater flexibility, as it does not require specific assumptions regarding the functional form of the production frontier, making it adaptable to the complex dynamics of the automotive industry. Second, the method’s ability to simultaneously handle multiple inputs and outputs is essential for capturing the multifaceted nature of industrial upgrading. Finally, the widespread acceptance of the DEA–Malmquist approach in the literature, especially in the context of efficiency and productivity analysis related to industrial upgrading and agglomeration, enhances the comparability of our findings with existing research.

The DEA–Malmquist method integrates the strengths of both Data Envelopment Analysis (DEA) and the Malmquist productivity index to deliver a dynamic evaluation of productivity shifts. This approach decomposes productivity change into two principal components: efficiency change and technological progress. To analyze alterations in total factor productivity (TFP), we employ the Malmquist productivity index derived from the DEA framework. An index value greater than 1 signifies an enhancement in TFP, indicating potential industrial upgrading, while a value less than 1 reflects a decline, suggesting possible stagnation or regression.

The selection of input and output indicators is crucial for conducting a comprehensive DEA–Malmquist analysis, as the accuracy and relevance of these indicators directly influence the validity of the results. In this study, labor input is quantified by the end-of-year employment figures within the automotive industry, aligning with the methodology established by Qu and Meng [

34]. This choice is justified, as employment levels reflect the industry’s capacity to utilize human resources effectively, which is a critical component of productivity assessments.

Capital input, on the other hand, is represented by the aggregate of fixed and current assets specific to the automotive sector, in accordance with the approach taken by Fu [

35]. By incorporating both fixed and current assets, this indicator captures a broader perspective of the capital available for production, thus providing a more comprehensive view of the industry’s investment.

To measure output, the total production value of the automotive industry is utilized, following the framework set forth by Lu and Wen [

36]. This metric serves as a robust indicator of the industry’s overall performance and economic contribution, encapsulating the value generated from automotive production activities.

TFP is computed using the DEA–Malmquist model, with the TFP value for the base year set at 1. The values for the subsequent years are derived by multiplying the Malmquist index of each year by the TFP value of the preceding year [

37]. The data utilized in this DEA–Malmquist model are sourced from authoritative publications, namely the China Industrial Statistical Yearbook and the China Automotive Industry Yearbook, ensuring that the information is both reliable and relevant, with 2000 used as the base period for deflation.

3.1.2. Measurement of Independent Variable

This study, building on the work of Zhang et al. [

38], employs the method of location quotient (LQ) index to assess the agglomeration degree of the automotive industry. The use of location entropy as a tool for measuring industrial agglomeration is advantageous, as it effectively captures both the distribution of industries and their relative concentration within specific regions. This method allows for comparisons of agglomeration levels across different regions and time periods, revealing the competitive advantages arising from geographic concentration, such as enhanced collaboration among firms, access to specialized labor markets, and the development of regional supply chains [

39]. The measurement formula of industrial agglomeration is as follows:

The variable AGGi denotes the degree of agglomeration of the automobile industry in province i. The term ASi refers to the total output value of the automobile industry in province i, while Si represents the overall industrial output value of that province. AS signifies the total output value of the national automobile industry, and S indicates the total industrial output value of the country. When AGGi > 1, it indicates that province i possesses a comparative advantage in the automobile industry relative to the national context. Conversely, if AGGi < 1, this suggests that the specialization level of the automobile industry in province i is below the national average, indicating a competitive disadvantage. The data are from the China Industrial Statistical Yearbook, China Statistical Yearbook, and China Automotive Industry Yearbook.

3.1.3. Measurement of Threshold Variable and Moderator

The threshold variable identified in this study is human capital, a critical determinant that significantly influences the relationship between industrial agglomeration and industrial upgrading. In this study, human capital is primarily measured by the average years of schooling, which serves as a proxy for the overall educational attainment of the workforce [

40,

41]. It is specifically obtained by calculating the weighted average using the population proportion of each education level and the corresponding years of education. The data of human capital are sourced from the China Statistical Yearbook. While more detailed indicators, such as the number of R&D personnel or the proportion of engineers, would provide a richer understanding of human capital, these data are not consistently available at the provincial level for the entire study period (2000–2020). Nevertheless, average years of schooling is a widely used and accepted measure in the literature, as it captures the general level of education and skills within the workforce, which is a critical component of human capital. Future research could explore more granular measures if data availability improves.

In addition to human capital, the role of government as a moderator variable is examined in this study. Specifically, the government’s influence is assessed through the ratio of regional government general public budget expenditures to GDP [

42,

43]. This metric serves as an indicator of the government’s financial commitment to public services and infrastructure, which are essential for fostering a conducive environment for industrial growth and agglomeration. The data are sourced from the China Statistical Yearbook. While more specific policy indicators, such as industrial subsidies or tax incentives, could provide a more nuanced understanding of government intervention, these data are not consistently available at the provincial level for the entire study period (2000–2020). The ratio of government expenditures to GDP provides a broad measure of government involvement in the economy.

3.1.4. Measurement of Control Variables

The control variables included in this study are global value chain (GVC), technological innovation (TI), and foreign direct investment (FDI), each of which impacts the upgrading of the automobile industry in China.

Firstly, the positioning of China’s automobile industry within the global value chain significantly influences its upgrading [

44]. The GVC position index, as referenced in the work of Koopman et al. [

45], is employed to assess this positioning. This index provides a nuanced understanding of how integrated the Chinese automobile sector is within global market dynamics. The GVC data utilized in this analysis are sourced from the OECD-TiVA 2023 database, which offers comprehensive information up to the year 2020.

Secondly, technological innovation is recognized as a pivotal driver for UCAI [

46]. In this study, we measure technological innovation by adopting the methodology put forth by Yu et al. [

47]. Specifically, we calculate the proportion of internal research and development (R&D) expenditure relative to the gross domestic product (GDP) of each province. This proportion is then multiplied by the total output value of the automobile industry within that province. This approach can reflect the level of technological innovation in the automotive industry, allowing for a more comprehensive analysis of how technological innovation contributes to industry upgrading. The data are sourced from China Statistical Yearbook and China Automotive Industry Yearbook. The unit is billion CNY.

Lastly, foreign direct investment is another critical variable impacting the UCAI [

48]. To quantify the influence of FDI, this study follows the methodology established by Shen [

49]. We measure foreign direct investment by examining the proportion of annual automobile output value in relation to the regional GDP for each province. This figure is then multiplied by the total foreign direct investment inflow into the automotive industry. The data are also sourced from the China Statistical Yearbook and China Automotive Industry Yearbook. The unit is billion CNY. The variables, abbreviations, and data sources are summarized in

Table 1.

3.2. Model Specification

In this study, the dynamic panel of System Generalized Method of Moments (GMM) is employed to examine the impact of industrial agglomeration on the UCAI. The Generalized Method of Moments (GMM), as defined by Arellano and Bond [

50], is a robust estimation technique that addresses endogeneity issues using instrumental variables. This method is particularly suitable for dynamic panel data models, as it allows for the inclusion of lagged dependent variables and accounts for unobserved heterogeneity.

Since industrial upgrading is inherently a dynamic process influenced by past performance, the inclusion of the lagged dependent variable in the model is necessary. However, this inclusion may lead to endogeneity issues, potentially biasing the estimation results and affecting the validity of the conclusions. The system GMM estimator is particularly well suited to address these endogeneity concerns, as it leverages both level and differenced equations, utilizing a richer set of instruments and improving estimation efficiency. Moreover, by combining moment conditions from these two equations, system GMM can enhance the robustness and reliability of empirical results.

We used lagged values of the endogenous variables and the dependent variable as instruments, which is a common and well-established practice in dynamic panel data analysis [

51,

52]. These instruments are theoretically relevant because past values of the variables are likely to influence their current values, but are not directly correlated with the error term in the current period. Specifically, the lagged values of the dependent variable help capture the dynamic nature of the relationship, while the lagged values of the endogenous variables address potential simultaneity bias.

The analysis utilizes data from 28 Chinese provinces over a 21-year period (2000–2020), excluding those with missing information. We selected data from 28 Chinese provinces because data for Qinghai, Ningxia, and Tibet were incomplete or unavailable, which would have compromised the consistency and reliability of our analysis. These 28 provinces represent the majority of China’s automobile industry output and cover diverse regional characteristics, ensuring a comprehensive representation of the industry. The period 2000–2020 was chosen because it captures the rapid development and structural changes in China’s automobile industry, characterized by rapid growth, technological advancements, and significant structural changes. This period aligns with China’s accession to the WTO in 2001, which spurred foreign investment and technological modernization, as well as key government policies. Additionally, data from 2000 onward are more consistent and reliable at the provincial level, ensuring the accuracy of our analysis.

To meet the GMM model’s requirement for a short panel (N > T), the data are averaged over three-year intervals, resulting in seven data periods. This approach increases the gap between N and T, thereby enhancing the validity of the GMM model. While this sample size is relatively small, we used the xtabond2 command in Stata, which includes the collapse and small options to handle small sample issues. The collapse option reduces the number of instruments by collapsing the instrument matrix, mitigating the problem of instrument proliferation, which can lead to overfitting and biased estimates in GMM models with limited data. This ensures the model remains parsimonious and efficient. The small option adjusts standard errors to account for finite-sample bias, improving the reliability of hypothesis tests and confidence intervals. Together, these options enhance the efficiency and robustness of the GMM estimates, ensuring our findings are both statistically valid and economically meaningful.

The automotive industry underwent rapid development and significant structural changes during the period from 2000 to 2020. While segmenting the data into smaller sub-periods could provide valuable insights into these dynamics, the current data structure imposes limitations on such an approach due to sample size constraints. To meet the requirements of the GMM model, we aggregated the data into three-year intervals, resulting in seven distinct time periods. Further segmentation of these periods would substantially reduce the sample size, undermining the robustness of the model estimates. Nevertheless, we acknowledge the importance of examining temporal heterogeneity and suggest that future research consider segmenting the data at different stages when larger datasets become available. This would enable a more nuanced analysis of the automotive industry’s evolution over time.

3.2.1. Baseline Model

The baseline model is designed to study the direct impact effect of industrial agglomeration on the UCAI. The following baseline model 1 is established:

Among them, i is province. t is time. Upgradei,t is dependent variable, indicating the upgrading of the automobile industry; Upgradei,t−1 represents the lag period of the dependent variable; and AGGi,t represents the independent variable, which signifies industrial agglomeration. Xi,t represents the control variables, including GVC (global value chain), TI (technological innovation) and FDI (foreign direct investment). α0 is the constant term, and εi,t is the random error term. The coefficient α2 represents the direction and magnitude of the impact of industrial agglomeration on the UCAI.

3.2.2. Threshold Effect Model

To examine the threshold role of human capital in the connection between industrial agglomeration and the UCAI, this paper applies the dynamic panel threshold model proposed by Seo et al. [

53]. This model effectively integrates the characteristics of dynamic panel data with threshold effect analysis, thereby facilitating a more nuanced understanding of threshold dynamics while addressing endogeneity concerns. The following dynamic panel threshold model 2 is established for this purpose:

where HC

i,t represents the human capital of province i in year t, serving as the threshold variable for this study. The symbol c denotes the threshold value, while I() indicates the indicator function. β2 and β3 signify the extent of the impact of AGG

i,t on Upgrade

i,t when HC

i,t ≤ c and HC

i,t > c, respectively.

3.2.3. Moderating Effect Model

To examine the moderating role of government in the impact of industrial agglomeration on the UCAI, this study establishes moderating model 3 utilizing system GMM, as follows:

In the equation above, GOVi,t denotes government in province i during year t, while the term AGGi,t*GOVi,t represents the interaction between industrial agglomeration (AGGi,t) and government (GOVi,t). When θ2 and θ3 are significant, it indicates that the government has played a moderating role in the influence of industrial agglomeration on the UCAI.

To analyze the relationships between industrial agglomeration, human capital, government, and the upgrading of China’s automobile industry, we employ a combination of advanced analytical techniques. These techniques are tailored to address the direct, moderating, and threshold effects in our research framework. For clarity, we summarize the analytical approaches in

Table 2.

3.2.4. Interaction Effects Model

To explore the interaction effects between industrial agglomeration, human capital, and government, we included interaction terms between industrial agglomeration (AGG) and human capital (HC), as well as between industrial agglomeration (AGG) and government (GOV), in our regression models. These interaction terms allow us to examine how the combined effects of these factors influence the upgrading of the automotive industry. Based on this approach, we establish model 4 as follows:

where AGG

i,t*GOV

i,t and AGG

i,t*HC

i,t are interaction terms that capture the combined effects of industrial agglomeration with government and human capital, respectively. The interaction terms (ω

3 and ω

4) must be statistically significant to confirm the presence of interaction effects. Additionally, the direction (positive or negative) and magnitude of the coefficients provide insights into how these factors jointly influence industrial upgrading.

4. Results

4.1. Descriptive Statistics

This study examines the impact of industrial agglomeration on the UCAI, incorporating the threshold effect of human capital and the moderating effect of government.

Table 3 presents the descriptive statistics for all variables. The statistical findings indicate that the average value of industrial upgrading is 3.0704 (standard deviation = 2.3097), with a minimum value of 0.2768 and a maximum value of 15.1788, demonstrating significant variability in industrial upgrading across provinces and years. The average value of industrial agglomeration is 1.1627 (standard deviation = 1.4262), with a minimum of 0.0119 and a maximum of 8.5466, reflecting disparities in industrial agglomeration across provinces within the industry. The human capital variable has a mean of 8.6542 (standard deviation = 1.0744), indicating a generally concentrated level of skills in the industry. The government variable shows an average of 0.1937 and a standard deviation of 0.0770, highlighting relatively minor variations in government capacity across provinces, with a minimum of 0.0757 and a maximum of 0.4575. Among the control variables, GVC has a mean of 0.5830, technological innovation averages 2.5193, and FDI has a mean of 2.8040.

4.2. Result of Total Factor Productivity

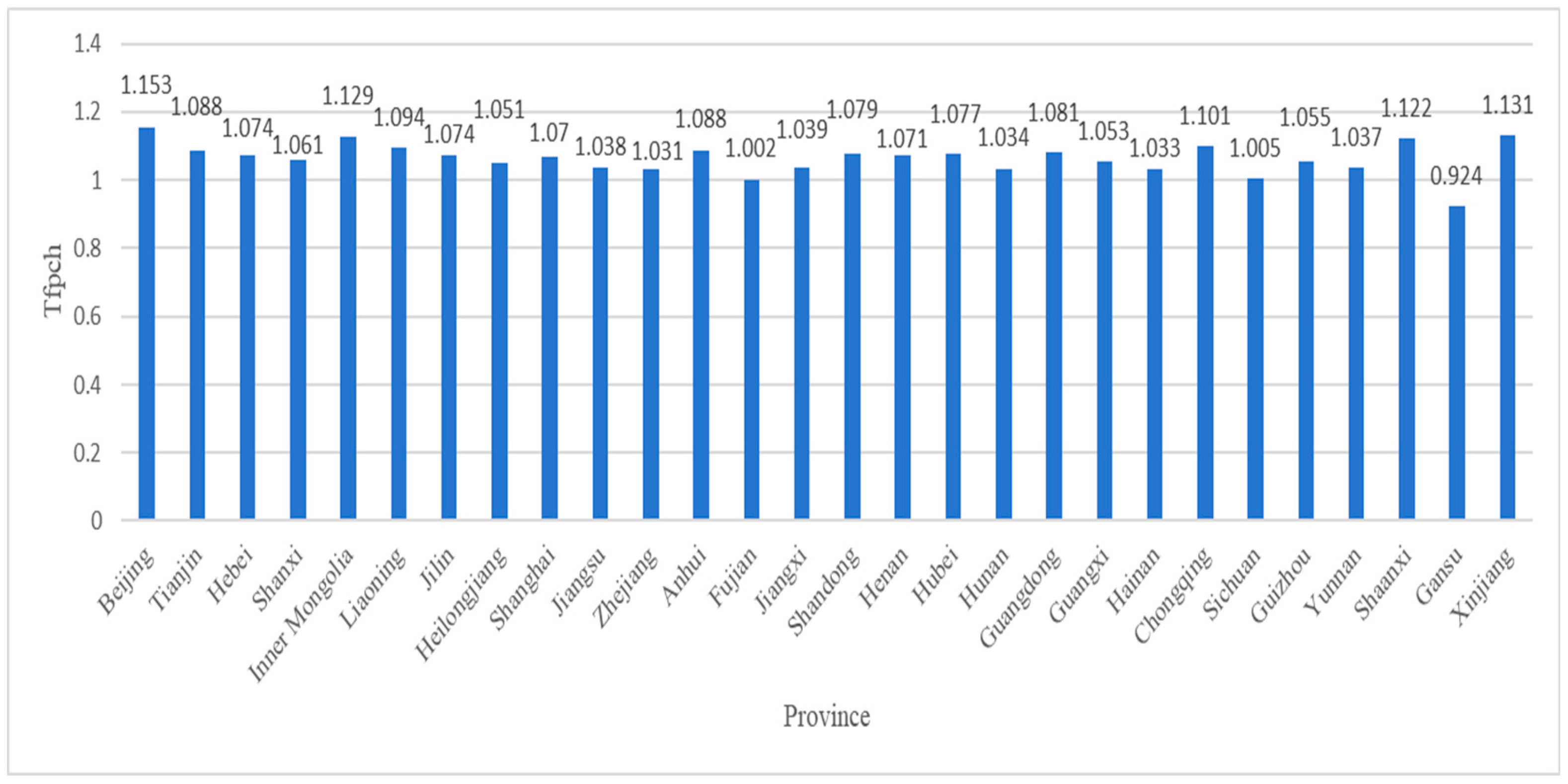

This study employs the DEA–Malmquist method to assess the total factor productivity of the automobile industry across 28 provinces in China from 2000 to 2020, excluding provinces with missing data. TFP is used in this context as a proxy variable for the UCAI.

Table 4 presents the average annual rate of change in total factor productivity, along with its components.

From 2000 to 2020, the average rate of change in total factor productivity (TFP) of China’s automobile industry was 1.063, indicating a growth rate of 6.3% during this period. The rates of change for technological progress and technical efficiency were 1.034 and 1.028, respectively, reflecting growth rates of 3.4% and 2.8%. Thus, the growth in total factor productivity was primarily driven by technological progress. Notably, the automotive industry’s TFP experienced the most significant increases during the periods of 2001–2002 and 2015–2016, with growth rates of 34.6% and 59.1%, respectively. Conversely, negative growth in TFP was observed during the periods of 2007–2008, 2010–2012, 2013–2014, and 2017–2020.

Figure 2 illustrates the average rate of change in total factor productivity (TFP) of the automotive industry across 28 provinces in China (2000–2020). The data reveal that Beijing exhibited the highest average rate of change in TFP at 1.153, corresponding to a growth rate of 15.3%. In contrast, Gansu Province recorded a TFP rate of 0.924, indicating a negative growth rate of 7.6%. Therefore, while the overall TFP in China’s automotive industry has shown an upward trend, certain regions and provinces have experienced negative growth. This highlights the pressing need for further upgrades in TFP within the Chinese automotive sector.

4.3. Results of Baseline Effect

In this paper, the System Generalized Method of Moments (GMM) is employed to analyze the effect of industrial agglomeration on the UCAI, utilizing Stata software for the analysis.

Table 5 displays the results of the baseline regression. It can be observed that the

p-value for AR(1) is 0.049, which is below 0.1; in contrast, the

p-value for AR(2) is 0.421, exceeding 0.1, and the

p-value for the Hansen test is 0.228, which also exceeds 0.1. These results indicate that all conditions of system GMM have been met, confirming the validity of the test outcomes.

L1.Upgrade represents the lagged value of the dependent variable industrial upgrading (Upgrade), with a coefficient of 0.8206. This value is statistically significant at the 1% level, indicating that past performance in automobile industry upgrading significantly influences current upgrading efforts. This finding further supports the rationale for employing the GMM model in this analysis. The coefficient for industrial agglomeration (AGG) is 0.5141 and statistically significant at the 1% level, indicating that a 1% increase in industrial agglomeration leads to a 0.5141% increase in industrial upgrading. This finding supports hypothesis 1 and highlights the economic significance of agglomeration in driving innovation, knowledge spillovers, and economies of scale.

For control variables, global value chain (GVC) and foreign direct investment (FDI) have significant negative effects on the UCAI due to structural dependencies and limited technology transfer. GVC confines domestic firms to low-value-added activities, while foreign firms dominate R&D and branding, stifling local innovation [

54,

55]. FDI prioritizes foreign interests, reducing technology spillovers and suppressing domestic capabilities [

56]. Conversely, technological innovation significantly drives industrial upgrading by enhancing R&D capacities, enabling advancements in product quality and facilitating the transition to high-value-added production [

57].

4.4. Results of Threshold Effect

This paper examines the threshold effect of human capital regarding the connection between industrial agglomeration and the UCAI, utilizing the xthenreg command in Stata software.

Table 6 displays the findings.

Table 6 reveals a threshold value of human capital (HC) at 8.5099, situated within a robust 95% confidence interval of 7.9338 to 9.0859, indicating a statistically significant threshold effect in the analyzed relationship. The linearity test further supports this finding, with a

p-value significant at the 1% level, validating the presence of a threshold relationship.

The dynamic panel threshold model proposed by Seo et al. [

53] is particularly well suited for our dataset, as its modified structure ensures an adequate number of observations for reliably estimating threshold effects. With a total of 196 observations, our model exhibits strong statistical power, facilitating the accurate detection of threshold effects [

58]. The bootstrap

p-value for linearity is 0.000, confirming the statistical significance and robustness of our findings [

59]. Overall, the identified threshold value of human capital not only underscores the precision of our estimates, but also reinforces our conclusions regarding the impact of industrial agglomeration on the upgrading of the automobile industry.

The analysis demonstrates that industrial agglomeration exerts no notable positive influence on the upgrading of China’s automobile industry when HC levels fall below 8.5099. However, once human capital exceeds this threshold, the effect becomes strongly positive (coefficient = 0.8348), highlighting the critical role of a skilled workforce in unlocking the benefits of agglomeration. This finding supports hypothesis 2 and has important policy implications. It suggests that investments in education and training are essential for enabling firms to fully leverage the advantages of industrial agglomeration, such as knowledge spillovers and collaborative innovation. Regions with lower levels of human capital may struggle to achieve industrial upgrading, even in the presence of strong agglomeration effects.

4.5. Results of Moderating Effect

This study further verifies the moderating effect of government on the impact of industrial agglomeration on the UCAI, as presented in

Table 7. The analysis was conducted using the System Generalized Method of Moments (GMM) approach and implemented through Stata software.

The results, presented in

Table 7, show that while industrial agglomeration has a positive and significant effect on upgrading (coefficient = 0.8789), the interaction term between government intervention and agglomeration (GOV_AGG) is negative and significant (−2.0297). This suggests that the current capacity of the Chinese government is not sufficient to fully support the benefits of agglomeration, potentially due to inefficiencies in policy implementation or resource allocation [

60]. These findings underscore the need for improved governance and more effective policy frameworks to enhance the impact of industrial agglomeration. For instance, targeted subsidies, infrastructure investments, and innovation incentives could help amplify the positive effects of agglomeration while mitigating its limitations.

4.6. Results of Interaction Effects

To address the potential interaction effects between industrial agglomeration, human capital, and government, we included interaction terms in our regression models, which were implemented using the System GMM method in Stata. The results are presented in

Table 8.

The interaction term between industrial agglomeration and human capital (HC_AGG) is positively significant (ω4 = 0.7401,

p < 0.01), indicating that the presence of a highly skilled workforce enhances the positive impact of industrial agglomeration on industrial upgrading. This suggests that regions with higher levels of human capital are better able to leverage the benefits of agglomeration, such as knowledge spillovers, collaborative innovation, and economies of scale [

61].

In contrast, the interaction term between industrial agglomeration and government intervention (GOV_AGG) is negatively significant (ω3 = −10.0660, p < 0.01). This result suggests that the current capabilities of the Chinese government may not be sufficient to fully leverage the benefits of industrial agglomeration. This underscores the need for improved governance and more effective policy frameworks to enhance the impact of industrial agglomeration.

The results of model 4 demonstrate that industrial agglomeration, human capital, and government intervention jointly influence the upgrading of the automotive industry. While human capital enhances the positive impact of agglomeration, the current capabilities of the Chinese government may not be sufficient to fully leverage the benefits of agglomeration. These findings underscore the importance of aligning government policies and human capital development with industrial agglomeration strategies to promote sustainable industrial upgrading.

4.7. Robustness Checks

To further validate the reliability of our results, we conducted a series of robustness checks using alternative model specifications and estimation methods, referencing the studies of Yang et al. [

62] and Wang et al. [

63], as shown in

Table 9.

First, in Column (1), we introduced an additional control variable, environmental regulation (ER), measured as the ratio of industrial pollution treatment investment to industrial added value. The results indicate that industrial agglomeration (AGG) remains positively significant at the 1% level, consistent with our baseline findings.

In Columns (2) and (3), we employed fixed effects (FE) and random effects (RE) models to address potential unobserved heterogeneity. Both models confirm that industrial agglomeration has a significantly positive impact on industrial upgrading, with coefficients significant at the 5% and 10% levels, respectively. The Hausman test yields a p-value of 0.0024, strongly favoring the fixed effects model over the random effects model, further supporting the robustness of our findings.

Finally, in Column (4), we utilized the Difference GMM (DIFF-GMM) method to address potential endogeneity and dynamic panel bias. The results remain consistent with our baseline System GMM (SYS-GMM) estimates, as industrial agglomeration continues to exhibit a positive and statistically significant effect at the 1% level. Diagnostic tests for DIFF-GMM, including the AR(1) and AR(2) tests, confirm the absence of second-order serial correlation, while the Hansen test indicates valid instruments (p = 0.247).

Overall, the robustness checks across different model specifications and estimation methods consistently support our baseline conclusion that industrial agglomeration significantly promotes the upgrading of China’s automotive industry. These findings underscore the reliability and generalizability of our results.

5. Discussion and Conclusions

This study investigates the influence of industrial agglomeration on the upgrading of China’s automobile industry, while also exploring the threshold effect of human capital and the moderating role of government. The findings provide valuable insights into the mechanisms driving industrial upgrading and offer important implications for theory, policy, and practice.

5.1. Key Findings and Implications

The baseline model reveals that industrial agglomeration significantly promotes the upgrading of China’s automobile industry. This is primarily achieved through knowledge spillovers, economies of scale, and enhanced collaboration among firms. The concentration of firms fosters innovation, improves production processes, and enhances product quality, creating a competitive ecosystem that drives sustainable development. However, it is important to acknowledge that industrial agglomeration may also have negative effects, such as increased competition for resources, rising costs, and potential environmental degradation. In the context of China, these challenges could manifest as overcapacity in certain regions or inefficiencies in resource allocation. Policymakers must address these issues by implementing balanced regional development strategies and promoting sustainable practices within agglomerated areas [

64].

The dynamic panel threshold model highlights the critical role of human capital as a threshold factor in the relationship between industrial agglomeration and industry upgrading. A skilled workforce is essential for fully leveraging the benefits of agglomeration, such as innovation and productivity gains. When human capital levels are below a certain threshold, firms struggle to exploit these advantages, limiting the positive impacts of agglomeration. Conversely, higher levels of human capital enable firms to drive innovation and efficiency, significantly enhancing the upgrading process. This underscores the need for targeted education and training programs to equip the workforce with advanced skills, particularly in emerging areas such as electric vehicles and autonomous driving technologies [

7].

The analysis of the moderating effect demonstrates that government plays a crucial role in amplifying the benefits of industrial agglomeration. By addressing market failures, providing infrastructure, and implementing supportive policies, the government can facilitate knowledge spillovers, innovation, and collaboration among industry players. However, ineffective or excessive government intervention could lead to inefficiencies or distortions in the market. Therefore, it is essential for governments to adopt a balanced approach, focusing on creating a conducive regulatory environment while avoiding overregulation. Local governments must strengthen their capabilities in resource allocation, policy implementation, and coordination among stakeholders to ensure that the advantages of agglomeration are effectively harnessed for industrial upgrading [

65,

66].

5.2. Theoretical and Practical Implications

This study contributes to the theoretical understanding of industrial agglomeration by highlighting the interplay between agglomeration, human capital, and government intervention in driving industry upgrading. It extends the existing literature by incorporating threshold and moderating effects, providing a more nuanced perspective on the mechanisms underlying industrial upgrading. From a practical standpoint, these findings offer actionable insights for policymakers and industry stakeholders. Our results suggest that fostering industrial agglomeration alone is insufficient; targeted investments in human capital and supportive government policies are essential for sustainable industrial upgrading. Specifically, fostering industrial clusters, investing in human capital development, and enhancing government capacity are critical strategies for promoting sustainable growth in China’s automobile industry.

5.3. Policy Recommendations

Based on these findings, the following policy recommendations are proposed:

Firstly, efforts should be made to promote industrial agglomeration by encouraging the formation of industry-specific zones to facilitate collaboration and innovation while addressing potential negative effects, such as resource competition and environmental concerns. Policymakers should focus on creating incentives for firms to cluster together, such as developing shared infrastructure, providing logistical support, and offering financial incentives for sustainable practices. Additionally, regional development strategies should be implemented to prevent overcapacity and ensure balanced growth across different areas. By fostering a collaborative ecosystem, industrial agglomeration can drive innovation and efficiency while minimizing its adverse impacts.

Secondly, it is crucial to invest in human capital by developing targeted education and training programs to equip the workforce with advanced skills, ensuring that firms can fully leverage the benefits of agglomeration. Collaborations between educational institutions and industry players should be strengthened to align curricula with market needs, particularly in emerging fields such as electric vehicles, autonomous driving, and advanced manufacturing techniques. Furthermore, fostering a culture of lifelong learning will help workers adapt to rapidly changing technological landscapes, ensuring sustained growth in the sector and maintaining a competitive edge on a global scale.

Thirdly, enhancing government capacity is essential to maximize the benefits of industrial agglomeration. This involves strengthening the government’s ability to implement effective policies, allocate resources efficiently, and foster collaboration among stakeholders. Policymakers should develop clear metrics for evaluating policy success, improve coordination among stakeholders, and create a transparent governance framework. By addressing market failures and providing a supportive regulatory environment, the government can amplify the positive effects of agglomeration while mitigating potential inefficiencies. Proactive government involvement is key to transforming regional automobile hubs into centers of innovation and excellence.

5.4. Limitations and Future Research

This study has certain limitations that should be acknowledged. Firstly, our research focuses on direct relationships, moderating effects, and threshold effects, and does not explore mediation effects. While the Baron and Kenny model is a widely used approach for mediation analysis, it was not employed in this study because our research design does not center on indirect pathways. Future studies could examine mediation effects using advanced techniques, such as the Baron and Kenny model or structural equation modeling, to provide a more comprehensive understanding of the mechanisms driving industrial upgrading.

Secondly, due to data availability constraints, our measurement of human capital is limited to average years of schooling. Although widely used, this proxy may not fully capture the quality and structure of human capital, such as the proportion of engineers or R&D personnel. Similarly, the measurement of government intervention is restricted to the ratio of regional government general public budget expenditures to GDP. While this indicator provides a broad measure of government involvement, it does not capture more specific policy instruments, such as industrial subsidies, tax incentives, or targeted support for innovation. Future research could incorporate more granular measures to better understand the role of human capital and government intervention in industrial upgrading.

Thirdly, while we employed the DEA–Malmquist method to measure industrial upgrading through total factor productivity (TFP), this approach is sensitive to outliers and cannot distinguish between statistical noise and actual efficiency differences. Future studies could consider combining DEA with other methods, such as bootstrapping DEA or Stochastic Frontier Analysis (SFA), to further enhance the robustness of the results.