2.1. Literature Review

The concept of policy uncertainty was first explored by Baker et al. [

13] who introduced an index-based approach to measure economic policy uncertainty by analyzing the frequency of articles discussing economic policy in major newspapers. Later, the same methodology was applied to create other indices, including those for CPU, trade policy uncertainty, and others [

14,

15]. CPU refers to the ambiguity and unpredictability surrounding climate-related policies, including regulatory measures, incentives, and long-term climate goals [

16,

17]. CPU has increased as a result of the evolution of climate change and the occurrence of extreme weather events [

18]. Research based on U.S. survey data by Stroebel and Wurgler [

19] indicated that CPU adversely affects corporate financing and operations. Similarly, Ilhan et al. [

20] found that CPU, based on U.S. carbon emissions and options market data, directly impacts investors’ expectations for high-carbon firms, leading to tail risks and increased financing costs for these companies. Climate policy instability can contribute to energy price volatility, impacting the expectations of businesses and consumers and resulting in market uncertainty [

20,

21]. Hoang [

22] found that the unpredictability of future climate policies compels high-emission U.S. firms to adopt a wait-and-see approach, leading to reduced long-term investments due to regulatory uncertainty. Similarly, Sun et al. [

23] found that U.S. CPU significantly inhibits GI among Chinese firms, as increased uncertainty tends to discourage the development of new environmentally-friendly technologies. However, on the other hand, Gavriilidis [

24] presented an opposing view, suggesting that heightened CPU can actually promote green investments and encourage firms to engage in clean energy R&D. This perspective implies that, under certain circumstances, uncertainty in policy could act as a catalyst for firms to proactively invest in reducing their environmental impact, perhaps as a hedge against potential future regulations. In line with this, Bai et al. [

9] argued that the considerable CPU in China has prompted an increase in governmental environmental regulations, which, in turn, has compelled companies to boost their investments in R&D, particularly in the area of green technology. Bai et al. [

9] found that the uncertainty of climate policy may lead to higher production costs in the short term; enterprises choose to cope with this uncertainty by increasing green R&D investment, strengthening green technological transformation, and upgrading old production equipment, so as to enhance their GI capacity in order to occupy a favorable position in future market competition. Olasehinde-Williams et al. [

25] thought that uncertain climate policies have led investors to pay more attention to sustainable development and environmental considerations. This market-driven approach makes GI key to gaining competitive advantage and expanding market share [

26]. Tian and Li [

27] found that rising CPU can lead to a reduction in carbon emissions in many parts of China, which contributes to mitigating environmental degradation. Shang et al. [

28] found that, in the short term, CPU reduces the demand for non-renewable energy in the United States. However, in the long term, it has a positive impact on the demand for renewable energy, suggesting a shift towards cleaner energy sources as firms and consumers adapt to an uncertain policy landscape.

GI is of paramount importance to China’s sustainable development [

29]. In the face of multiple challenges, such as resource constraints, environmental pollution, and global climate change, GI provides an effective way to balance economic growth and environmental protection [

30,

31]. Through technological innovation and breakthroughs, GI can help to reduce pollutant emissions, improve energy efficiency, and conserve resources, thereby achieving harmonious economic and ecological development [

32]. Existing studies have largely analyzed the factors influencing GI in China through two predominant perspectives. The first perspective is grounded in institutional theory, focusing on the external pressures and supports that shape GI. This line of research emphasizes the role of environmental regulation, including climate policy, as an institutional pressure that drives firms toward sustainable practices, as well as the importance of supportive mechanisms such as green financial policies, which facilitate access to funding and incentives for green projects [

33,

34]. This internal view recognizes that organizational culture, managerial expertise, and innovation capacity are essential components in the pursuit of green development [

35]. These institutional factors are seen as crucial motivators that encourage firms to adopt environmentally friendly technologies and processes in response to regulatory requirements and financial support structures designed to foster a greener economy. Climate risk, inherently tied to carbon emissions, plays a central role in shaping both regulatory environments and organizational strategies [

36]. Xu et al. [

37] pointed that GI becomes a critical mechanism for achieving climate-related targets, as it encompasses the development and adoption of technologies and processes that contribute to environmental sustainability and carbon emission reductions. The second perspective shifts the focus inward, examining the internal characteristics of firms that influence their ability and willingness to pursue GI. Studies in this area have highlighted various internal determinants, such as the availability of financial resources, corporate governance structures, leadership attitudes toward sustainability, and the capabilities of research and development (R&D) teams [

38,

39,

40]. These factors determine whether a firm can effectively respond to both internal ambitions and external pressures to innovate in a way that reduces environmental impact.

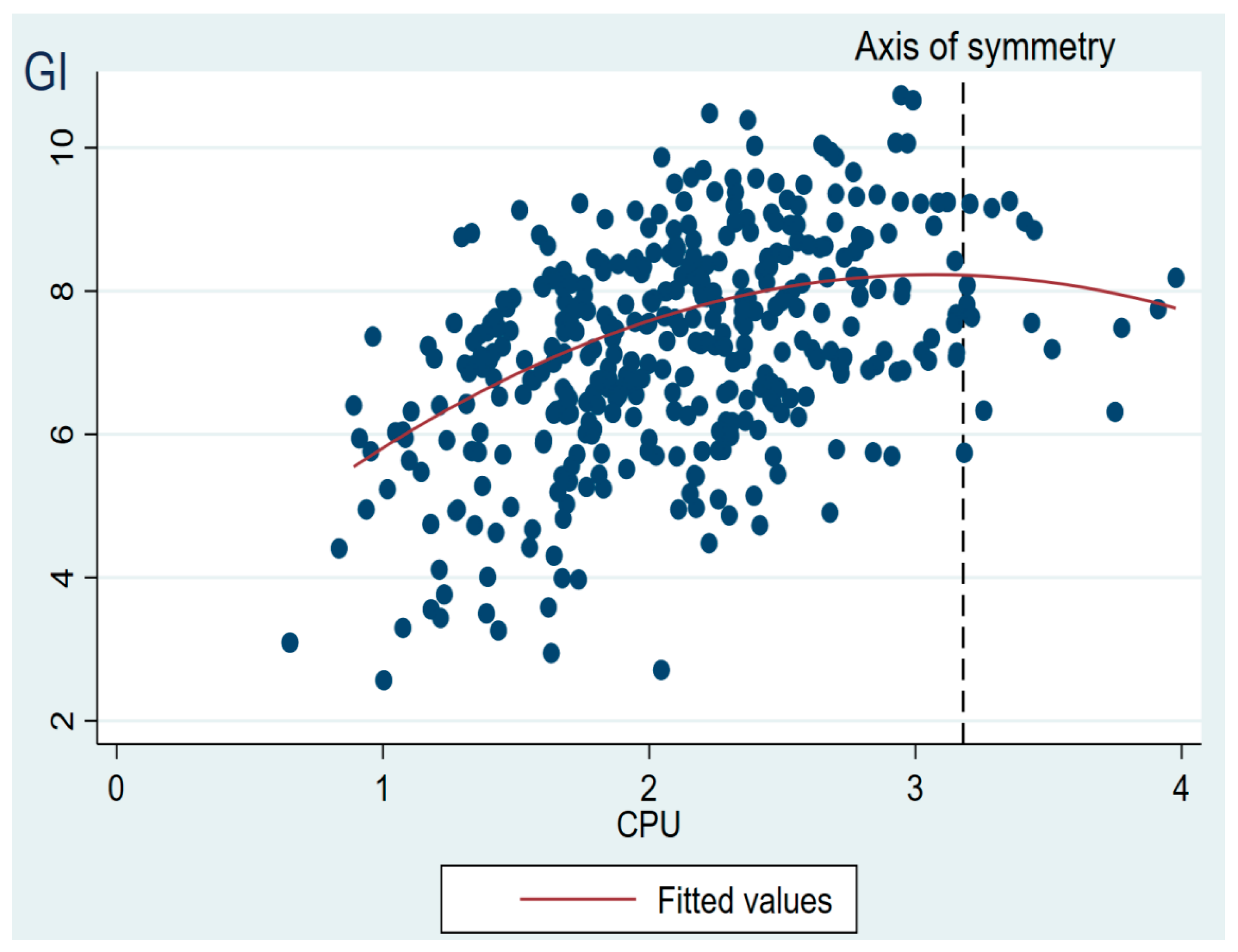

From the above literature review, it can be seen that although the existing literature has examined the impact of CPU on the GI of listed firms, there is still a lack of research on how CPU affects regional innovation. Additionally, existing literature primarily focuses on the linear relationship when analyzing the impact of CPU on GI, often overlooking potential nonlinear effects, without considering that its influence may vary at different intensities of uncertainty.

2.2. Theory and Hypothesis Development

How does CPU affect GI in the region? The realization of GI relies on the joint investment of enterprises and governments, with enterprises undertaking market-driven innovation and governments promoting the construction of innovation environments through financial support and policy guidance. In the context of CPU, changes in innovation decision-making by firms and governments directly determine the level and direction of regional GI.

An in-depth exploration of government and firm innovative investment behavior in an environment of climate policy certainty first requires a systematic analysis of the sources of CPU in China. Although China’s climate policy has maintained stability in terms of long-term goals, including the clearly stated ‘dual-carbon’ target of carbon peaking by 2030 and carbon neutrality by 2060, uncertainties persist in policy adjustments and implementation. Against the backdrop of China’s ‘dual-carbon’ targets, China’s green policies as a whole tend to be strengthened in order to promote emissions reduction and sustainable development [

41]. However, under this long-term goal, there is still some uncertainty and room for adjustment in terms of when and how to reach the peak, as well as the distribution of carbon emission responsibilities among industries and regions of China. There are large differences in technology levels, carbon intensity, and industrial upgrading capabilities among industries, making it difficult to plan a uniform carbon peaking path. In addition, due to China’s vast territory, the different levels of economic development, industrial structure, and energy structure of different regions, resulting in a carbon emissions reduction path, is difficult to cut across the board, the implementation of policies varies from place to place, some regions have a strong industrial transformation capacity, can promote the process of carbon emissions reduction faster, while the traditional energy industry accounted for a high proportion of the region in the process of energy transition faces more challenges, thus exacerbating the uncertainty.

At the same time, when implementing carbon emission reduction policies, local governments often need to seek a balance between multiple objectives, such as economic growth, energy security, and social stability, so the adaptive adjustment of policies has become an inevitable trend [

42]. China is still in the process of industrialization and urbanization, and the stage of economic development determines that carbon emission reduction policies cannot be implemented at the expense of economic growth and employment stability, especially when the downward pressure on the economy increases, and the pace of policies may be adjusted accordingly [

17]. When economic growth slows down or external demand shrinks, the government may appropriately adjust restrictions on energy-consuming industries to ensure short-term economic growth and employment stability. And when the economic environment improves and the optimization of the industrial structure accelerates, the policy may be tightened again to promote the implementation of emission reduction targets with stricter standards. Such adaptive policy adjustments reflect the government’s trade-off between short-term economic fluctuations and long-term low-carbon development strategies, and determine that climate policy may be characterized by phased adjustments in the course of implementation.

Looking at the sources of CPU described above, uncertainty does not exclusively imply risk, but can also lead to flexibility, adaptation, and new opportunities. Traditionally, policy uncertainty is often seen as an unfavorable factor affecting market stability and corporate decision-making, especially in long-term investment, industrial planning, and corporate strategic layout, where too much uncertainty may lead to wait-and-see market players and destabilizing capital flows [

43]. However, policy uncertainty also has a positive effect to a certain extent, as it implies that policies have room for adjustment and can be optimized in accordance with changes in economic development, scientific, and technological progress, and the international environment, so as to find a more suitable development policy in the course of continuous evolution [

44].

On the other hand, a large part of the uncertainty about local climate policy in China also stems from the change of local officials. The formulation and implementation of local policies are heavily influenced by the characteristics of individual officials who occupy key positions of power [

45]. Local government officials play a crucial role in the formulation and execution of policies at the regional level [

46]. Frequent changes in local leadership further complicate the situation, as each new official may bring their own priorities and preferences, often leading to the abandonment of existing policies and the introduction of new initiatives, which contributes significantly to CPU. The current political promotion system of China further strengthens the incentives for new officials to prioritize economic development [

47]. The promotion of local officials depends to a large extent on their performance during their term of office. During their tenure, these officials often see expanding the scale of investment as the most practical approach to improve local economic indicators, which helps boost regional GI efforts. In 2012, the Chinese government proposed to implement an innovation-driven development strategy. China’s appraisal system for local officials determines the importance local governments place on science and technology innovation. Traditionally, local governments mainly conduct performance appraisals around GDP growth, investment attraction, and infrastructure construction, but with the country’s emphasis on innovation-driven development, the weight of innovation appraisals in the appraisal system of local officials has gradually increased. Against this backdrop, CPU is often accompanied by increased China local government investment in innovation. Therefore, this paper proposes Hypotheses 1 and 2:

Hypotheses 1. CPU promotes regional GI.

Hypotheses 2. The higher the CPU, the higher the local government’s investment in innovation.

Prospect theory suggests that firms, when faced with high uncertainty, tend to avoid potential losses rather than actively pursue gains, thus reducing investment or postponing major capital expenditure decisions [

48]. Due to the complexity of climate issues and their long-term nature, policy adjustments are often subject to greater uncertainty, which exposes enterprises to higher risks and unpredictability in their investment decisions [

23]. In an economic environment that is highly dependent on macro policies, firms’ expectations of future market and policy directions directly affect their investment behavior. When the policy direction is unpredictable, enterprises tend to adopt more cautious strategies to reduce potential losses [

43]. The GI output of enterprises depends on their investment in innovation. As firms’ investment behavior is highly dependent on macro policies, higher uncertainty may weaken the stability of firms’ expectations of future markets compared to a stable policy system, which in turn affects their resource allocation and investment strategies. When CPU rises, firms’ expectations of the future policy environment and market demand become more ambiguous, leading them to adjust their investment strategies, preferring to remain on the sidelines or reduce long-term, highly irreversible capital expenditures to avoid possible policy risks. In addition, policy instability may also lead to increased market volatility, further raising firms’ expectations of uncertainty about future cash flows, causing them to favor increasing cash reserves over expanding investments. In addition, the implementation of climate policies has the potential to enhance firms’ financing constraints and increase their financing costs, thereby affecting their investment behavior. Commercial banks are the main source of external financing for enterprises, and when uncertainty rises, commercial banks usually increase loan loss provisions and reduce the supply of high-risk loans for the sake of preventing and avoiding risks, which will increase the cost and difficulty of enterprise loans and bring higher financing costs to enterprises. CPU therefore reduces firms’ investment in innovation.

CPU can inhibit regional GI if it is too high and if CPU discourages firms from investing in innovation more than it increases government investment in innovation. Therefore, this paper proposes Hypotheses 3 and 4:

Hypotheses 3. Regional GI is promoted when CPU is low, and can be hindered if CPU is too high.

Hypotheses 4. CPU hinders firms’ investment in innovation.

Based on the financial deepening theory proposed by Shaw [

49] and McKinnon [

50], improving the financial system can increase the efficiency of capital allocation and help promote social and economic development. At the micro-firm level, CPU can lead to an increase in investment risk for firms. Innovation investments, however, are generally characterized by high risk, low upfront returns, and long lead times, which makes it possible for firms to suffer from external financing constraints when investing in innovation [

51]. In this scenario, when the cost of financing firms’ investment in innovation is high, firms may have less to gain from innovation and thus refrain from making active investments in innovation [

52]. However, if firm investment and financing constraints are relaxed and the cost of financing firms is low, the incentive for firms to make innovative investments increases. Firms’ financing constraints are not only influenced by their own factors (e.g., size, growth, profitability, and asset structure), but also depend to a large extent on the level of financial development in the region [

53]. Regional financial development can alleviate the financing constraints of enterprises and promote their investment in innovation and R&D through various ways. Firstly, as regional financial instruments continue to diversify, and the number of financial institutions increases, the capacity of regional financial systems to channel local savings into productive investments is significantly strengthened. This progression enhances the overall availability of financial resources within the region, thereby improving enterprises’ access to funding and alleviating their financing constraints [

54]. Secondly, the scale effect enhances financial institutions’ ability to manage credit risks and process information. As a result, the cost and risk of fund supply are reduced, information asymmetry between borrowers and lenders is mitigated, and the financing costs and constraints faced by enterprises are effectively alleviated. Financial development can weaken the inhibitory effect of CPU on enterprise R&D investment to provide stronger support for regional GI, thus promoting GI and enabling the overall GI capacity of the region to be continuously enhanced. Therefore, this paper proposes Hypothesis 5:

H5. Financial development enhances the promotion of CPU on regional GI.

China’s market economy system is a mixed economic model in which state-owned enterprises (SOEs) and private enterprises develop together [

55]. SOEs are funded or controlled by the state and directly or indirectly managed by the government, and their business objectives include not only profitability, but also the task of carrying out government policy orientations, such as low-carbon development and green transformation. Compared to the private sector, SOEs enjoy more stable resources in terms of financial support, tax incentives, subsidies, and policy loans, and their sources of funding are relatively abundant even in the face of policy uncertainty [

56]. In addition, SOEs usually have stronger technology R&D capabilities and complete industry chain integration advantages, and can better cope with short-term impacts brought by policy changes [

9]. As a result, SOEs can still maintain stable investment in the face of increased CPU, while private firms may scale back innovation investment due to financing constraints and policy fluctuations. Therefore, the higher the share of SOEs, the less adverse impact CPU has on firms’ GI. This paper proposes Hypothesis 6:

H6. The greater the dominance of SOEs over the economy, the greater the contribution of CPU to regional GI.