Abstract

Efficient supply–demand management in Product-as-a-Service (PaaS) markets requires tools to evaluate pricing strategies while integrating sustainability goals like reuse, efficiency, and carbon footprint reduction. This paper introduces a declarative modeling framework aimed at balancing the three pillars of profitability, cost optimization, and sustainability in PaaS markets. The framework addresses risks such as equipment failure, usage variability, and economic fluctuations, helping providers optimize pricing and operating costs while enabling customers to manage expenses. A declarative model is developed to assess the PaaS market balance to determine optimal leasing offers and requests for quotations. A case study is used to validate the framework, involving devices with specific rental prices and failure rates, as well as customer expectations and budget constraints. Computational experiments demonstrate the model’s practical applicability in real-world scenarios and it can be used by PaaS providers to develop competitive leasing strategies, policymakers to assess market stability, and enterprises to optimize procurement decisions. The findings show that the framework can guide decision making, offering insights into the impact of new technologies, compatibility conditions for leasing offers, and strategies for balancing providers’ profits and customers’ costs. The proposed framework has broad applicability across industries such as manufacturing, healthcare, logistics, and IT infrastructure leasing, where efficient resource allocation and lifecycle management are crucial.

1. Introduction

The concept of Product-as-a-Service (PaaS) represents a paradigm shift in traditional product consumption, transitioning from ownership-based models to service-oriented leasing models [1,2]. This shift aligns with broader trends in the circular economy and sustainability, emphasizing the reuse and/or repair of products, collecting end-of-life products, recycling resulting in the minimization of waste, and responsible resource management [3].

The supply–demand balance in PaaS markets necessitates managing risks and uncertainties arising from variability, economic fluctuations, and equipment failures, all of which significantly impact both providers and customers [4]. Providers face the dual challenge of ensuring profitability while maintaining the lifecycle of leased products, whereas customers need to minimize their costs without compromising access to essential equipment. In such an environment, achieving an equilibrium between leasing offers and requests for quotations becomes a critical objective [5,6].

This paper addresses the need for a comprehensive framework to balance supply and demand in PaaS markets, with a focus on three key pillars:

- Profitability—ensuring providers achieve sustainable margins by optimizing pricing strategies and operating costs.

- Cost optimization—enabling customers to effectively manage expenses while maintaining access to the required equipment.

- Sustainability—promoting practices that extend product life cycles, increase material efficiency, and reduce environmental impact.

The first two of these pillars, focusing on the provider and customer perspectives, emphasize their efforts to achieve the highest profit and lowest cost, respectively. The third pillar, focusing on win-win conditions in the solution space that satisfies the provider and customer, accentuates efforts to develop models of their market to enable the reduction in environmental impact. Studies addressing issues in the field of financial performance of the PaaS market perceived from the perspective of the provider and the user (customer), collected in the results of our previous research [7,8], highlighted the need to develop an easy-to-use and flexible financial assessment model helping practitioners generate profitable solution scenarios for potential PaaS configurations and the financial profitability factors that determine them. In this context, this article fills the gap related to the lack of a model (framework) enabling the assessment of the financial performance and viability of PaaS leading to the supply–demand balance in this market. In other words, the adopted framework aims to model the interrelationships between providers and consumers, implementing a declarative modeling formalism that facilitates the exploration of different leasing scenarios, helping interested parties to define optimal strategies balancing the three main pillars: profitability, costs, and sustainability.

The contribution of this paper is three-fold: (1) a prototype of a declarative model for assessing PaaS market balance, (2) an algorithm for determining leasing offers and requests for quotation balancing the PaaS market, and (3) an assessment of the scalability of the proposed approach on the example of a selected case (evaluation of applicability in real-world scenarios).

Achieving the above objectives enables answering, among others, the following research questions: What impact does the development of new technologies implemented in leased devices have on the PaaS market balance? What compatibility conditions should leasing offers and requests for quotation meet? What are the strategies for finding a trade-off between the providers’ profit and the customers’ costs?

Integration of the providers’ and customers’ business goals into a unified decision-making structure ensures a more comprehensive reflection of real-world scenarios taking into account various factors and conditions. Hence, the necessity of adopting a holistic approach to the problem becomes evident. This paper restricts the factors influencing the trade-off to the providers’ equipment acquisition costs, maintenance costs for leased equipment, rental costs incurred by the customer, costs associated with outsourcing equipment outside the agreed leasing offer, and the scenario in which equilibrium applies to a market with a single provider and customer [9]. This does not mean, however, that the proposed approach cannot be extended to a more complex model involving several providers and several customers and additional costs incurred by the provider (purchasing, holding, ordering, screening and repairing, and recycling costs) and the customer (employment, staff training, allocation of storage areas, and ongoing maintenance of leased equipment).

To validate the framework’s practical applicability, a case study was conducted involving a selection of devices characterized by their rental prices and failure rates. The study also incorporated customer expectations regarding the types and quantities of devices needed, as well as their budget constraints. Computational experiments were performed to evaluate the framework’s effectiveness in real-world scenarios, demonstrating its potential to guide decision making in PaaS markets.

The remainder of this study is structured as follows: Section 2 provides a review of related work in PaaS markets, supply–demand management, and sustainability. Section 3 introduces the proposed framework, including its key components and modeling methodology. Section 4 describes the case study setup and presents the results of the computational experiments. Section 5 discusses the implications of the findings and concludes the paper with future research directions.

2. Literature Review

2.1. PaaS Market

Most PaaS business models are subscription-based, in which customers use the services by paying a membership fee and receiving periodic payments depending on the type of products [10]. Such financial assessment models are based on net present value and total cost of ownership metrics, and are used in frameworks that seek solutions beneficial to all PaaS market stakeholders [11].

In that context, such models are often implemented in game-theoretic framework-driven decision support tools, which enables the analysis of how organizations create, deliver, and capture value [12]. In particular, they enable the assessment of the impact of the volume of leasing products and the possibility of maintaining them, as well as consumer expectations, on the market balance. However, the issues of building PaaS market equilibrium models understood in this way are rarely discussed in the literature on the subject. The most frequently discussed topic in this area is the selection of variants of the PaaS concept leading to a compromise between the level of goal achievement (profit) and the risk associated with it [13].

The risk borne by the provider is mainly related to the costs of servicing the rented equipment influenced by stochastic events such as product failures and the wide geographical distribution of end users [14]. It should be noted that the service costs also depend on the device’s design and, among other things, on its quality (robustness to failure) and the level of advancement of the technology embedded in it. This fact implies the need to address the challenge, omitted in the literature, related to the financial assessment of the impact of the quality of leased equipment on profitability and operational efficiency, and the determination of contract parameters determining the balance of the PaaS market dominated by providers [15,16]. The dominance of providers observed in models of this type results from the transfer of responsibility for maintaining the products to their provider.

Financial assessment of the impact of the quality of leased equipment on profitability and operational efficiency helps in determining the contract parameters determining the balance of the provider-dominated PaaS market.

2.2. Supply–Demand Management

Supply–demand management is critical for PaaS because it directly affects operational efficiency, customer satisfaction, profitability, and scalability. Its primary objective is to effectively balance supply and demand to minimize inefficiencies such as overproduction, stockouts, resource wastage, and unmet customer needs. Achieving this balance directly contributes to reducing resource waste and aligns with the overarching goals of the circular economy (CE) [17]. The CE emphasizes a sustainable production and consumption cycle, encompassing stages such as raw material procurement, design, production, distribution, consumption, collection, and waste recycling. This process is underpinned by practices like sharing, leasing, reusing, repairing, refurbishing, and recycling materials and products to maximize their lifespan [18].

Transitioning from traditional ownership-based models to circular PaaS models is pivotal in aligning profitability with sustainable resource use. In the PaaS framework, products undergo multiple use cycles before recycling, enabling effective demand management for refurbished or pre-owned products [19]. This approach is critical for enhancing both economic and ecological efficiency, reinforcing the circular economy model, where products are rented, serviced, and reused repeatedly.

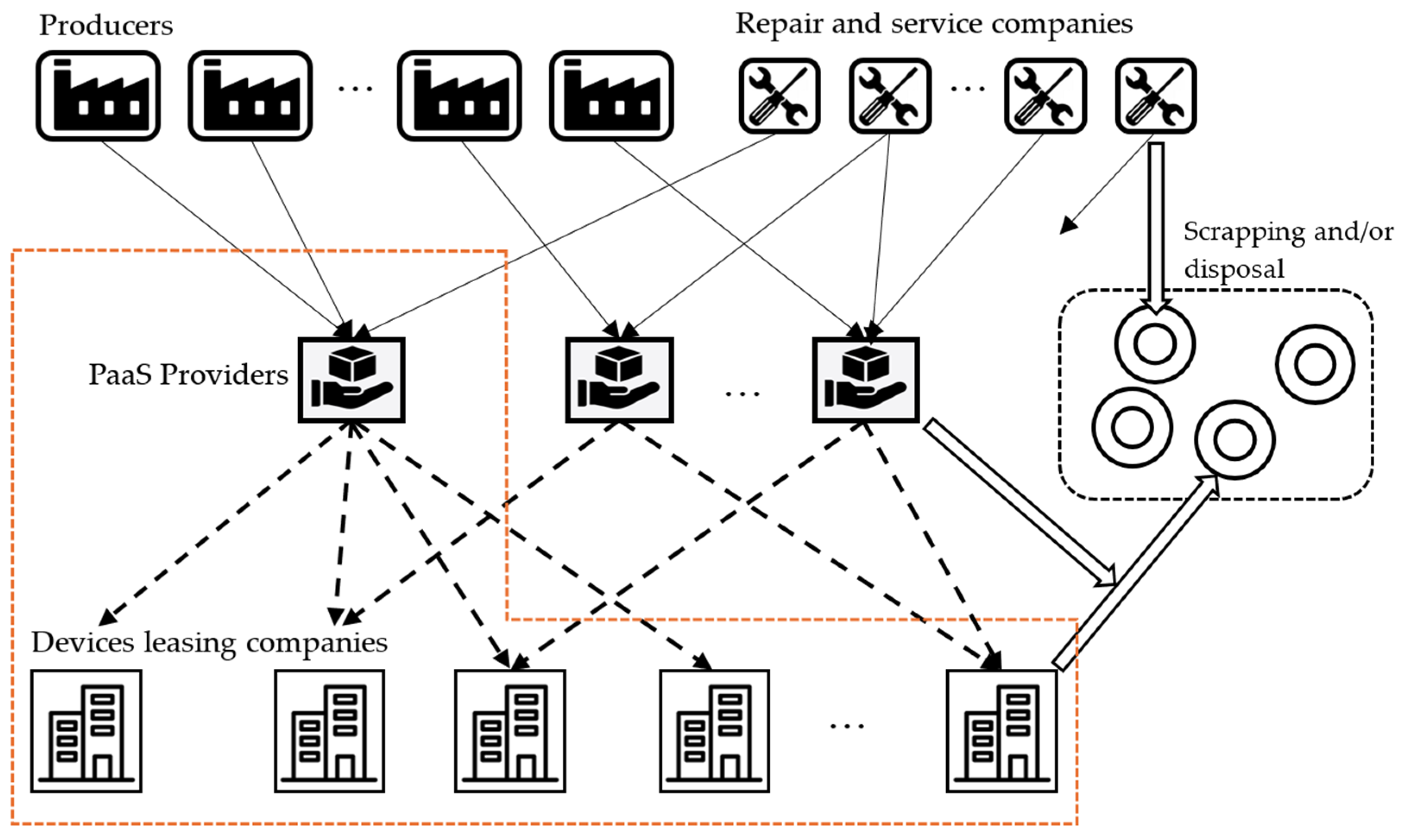

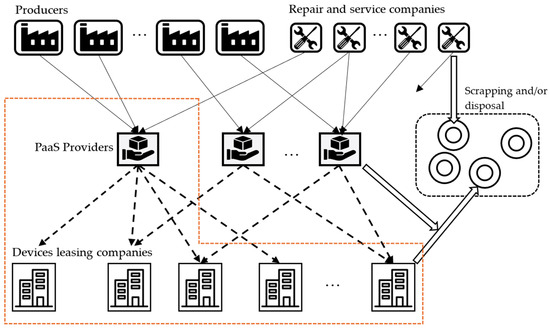

The CE’s success relies on a diverse range of participants and the geographical dispersion of enterprises, consumers, and service providers. Consequently, the logistics infrastructure plays a vital role in connecting these actors. By forming a comprehensive network of supply chains that distribute raw materials, finished products, and tools while supporting service operations, logistics enables sustainable supply chain management [20,21]. This approach integrates environmental and financial considerations into the sourcing, production, and distribution of goods and services. A hypothetical illustration of the connections within the circular economy structure is presented in Figure 1.

Figure 1.

The structure of a hypothetical distributed supply chain network.

2.3. Sustainability

As previously discussed, the CE model typically involves multiple stakeholders, including raw material and energy providers, producers, distributors and/or PaaS providers, end users, repair and maintenance service centers, and recyclers [22]. Together, these entities form a closed supply chain of materials, products, and services [23]. The interactions among the individual links of this supply chain are endogenous, collectively determining equilibrium prices that balance supply and demand. This equilibrium, in turn, dictates the quantity of goods or services exchanged at the determined prices [24,25].

In the context of CE, general equilibrium occurs when partial equilibrium is achieved between supply and demand at each successive link within the closed decentralized supply chain (CDSC) [26,27]. The concept of CDSC equilibrium is crucial for understanding market dynamics and the allocation of resources in economic environments. Such equilibrium is characterized by the absence of surpluses or shortages, stable prices, and minimized environmental impact, achieved through measures such as regulatory compliance and eco-friendly practices.

In the general case, a closed-loop distributed supply chain (CDSC) (hypothetical part of which pictures Figure 1) leverages decentralized networks of suppliers, manufacturers, warehouses, and distribution centers to improve flexibility, robustness, and efficiency shareholders of the PaaS market [25,28,29,30]. This means that CDSC has a significant impact on the PaaS market, influencing key aspects such as cost efficiency, service reliability, sustainability, and customer satisfaction. In particular, it enables faster delivery of spare parts, which reduces downtime, and local service, which ensures faster implementation and repairs, thus facilitating local refurbishment and recycling (i.e., supporting the sustainability goals of PaaS), and prevents dependence on single suppliers, which reduces the risks associated with long-term PaaS contracts. In this context, by seeking solutions that balance supply and demand, we ensure that resource loops are closed and sustainability is embedded in the business model resulting in a more robust, cost-effective, and environmentally responsible economic system.

Implementing PaaS solutions within the CDSC ensures that assets are refurbished, reused, or recycled at the end of their life cycle, further minimizing environmental harm. Similarly, adopting sustainable supply chain management practices—such as engaging third-party providers to temporarily boost capacity—reduces the need for capital investment while maintaining resource efficiency.

Equilibrium models of CE and associated supply chains [31] are usually employed to evaluate the potential impacts of economic, energy, and trade policies on market behavior. These models serve as tools for assessing both consequences of localized decisions by supply chain stakeholders and broader governmental policy making. Their design and support for both local decisions made by the parties (actors) in supply chains and globally made government decisions cannot be overstated [32]. Due to the complex, interdisciplinary nature of the market (connecting intertwining threads of economics, technology, logistics, etc.) and its dynamic characteristics, which relate to constant shifts in supply and demand, available studies of such models are very rare and tend to be overly simplified [33,34]. Most focus on either PaaS-oriented or user-oriented perspectives, neglecting the multi-stakeholder nature of PaaS ecosystems, which include intermediaries, partners, and service providers [35].

Many models in the literature adopt a game-theoretical approach, using game theory to identify optimal strategies among players and achieve Nash Equilibrium [12,36]. However, there is a noticeable gap in models that enable comprehensive financial assessments, which are necessary for providing a holistic understanding and improving operational strategies for both providers and users. Similarly, there is a need for tools that facilitate the determination of real-time pricing strategies tailored to diverse customer segments and service tiers within PaaS. These tools should be capable of predicting demand fluctuations and dynamically adjusting pricing based on market trends.

Addressing these gaps underscores the interdisciplinary challenges of achieving equilibrium in PaaS markets, which span economics, technology, environmental science, and behavioral studies. Meeting these challenges requires integrating technological advancements, customer-centric strategies, and operational excellence. There is a pressing need to develop simple, flexible financial assessment models for PaaS that can help practitioners identify the conditions necessary for financial viability from the perspectives of providers, users, and market administrators, including governmental entities. This gap is attempted to be filled in this paper.

3. Framework and Modeling Methodology

3.1. Problem Formulation

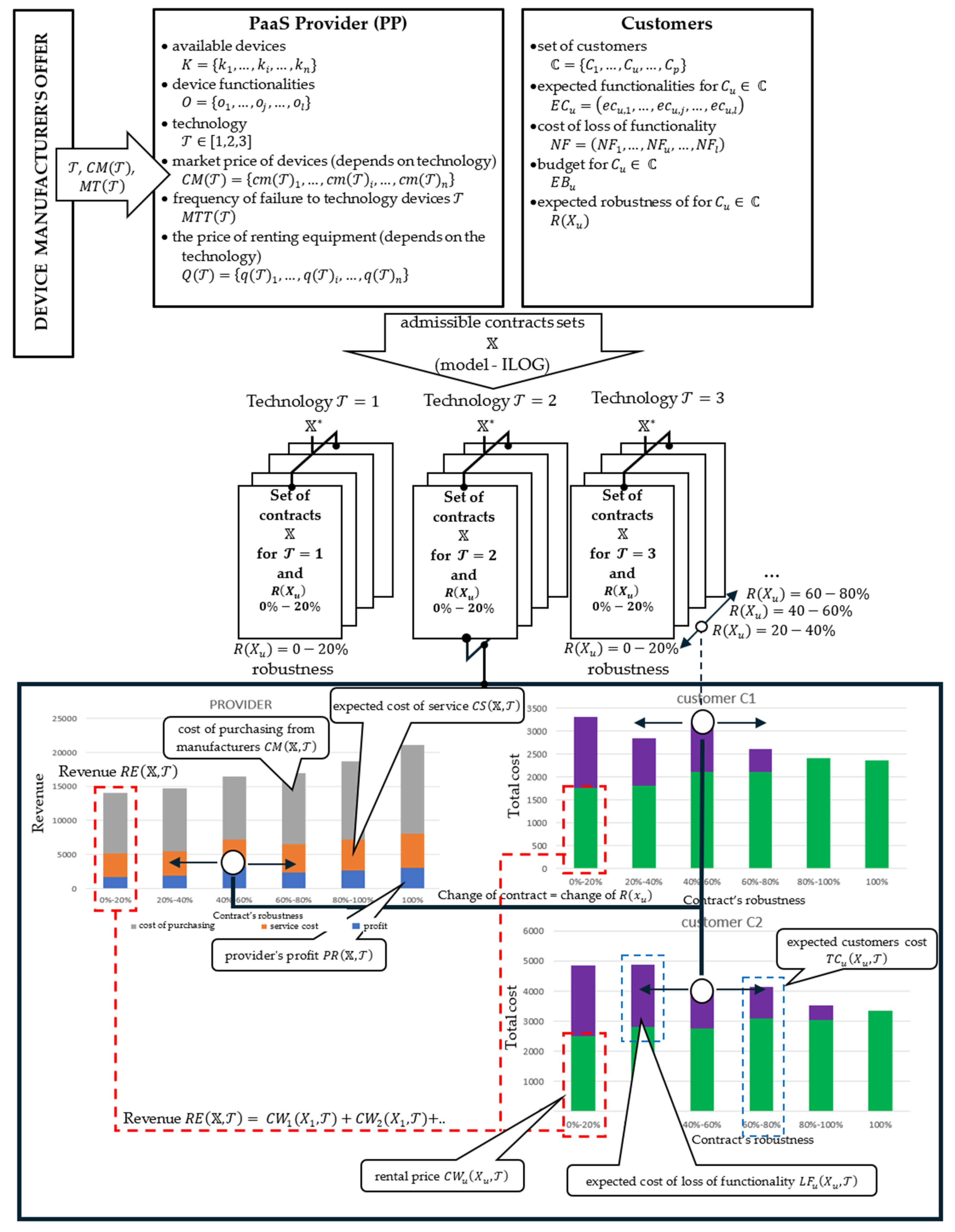

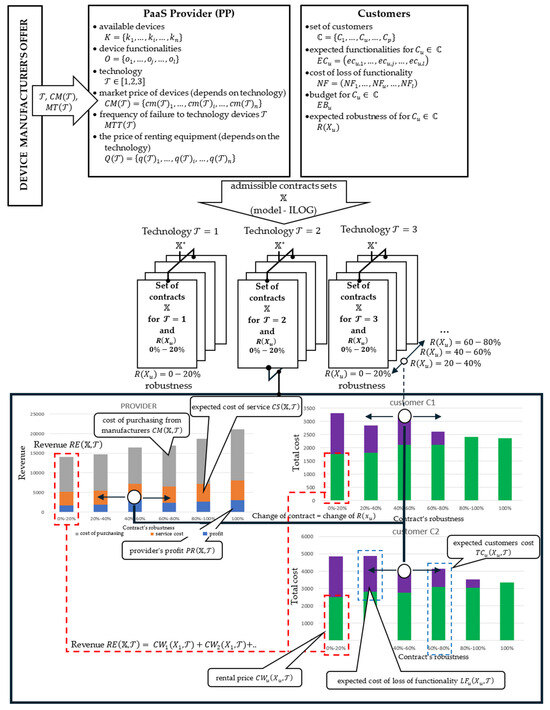

The following considerations are limited only to a certain fragment of the distributed supply chain network structure from Figure 1 (the scope of services provided is shown as an orange dashed line) which includes one PaaS provider with leased devices cooperating with the provider service companies and supported end-users (companies renting devices). A graphical abstract of the idea of determining leasing contracts is presented in Figure 2.

Figure 2.

Stages of tender for leasing contracts.

According to the adopted approach, the idea of which is illustrated in Figure 2, the target lease contract is the result of the balance between the PaaS provider (PP) leasing offer and the customers’ purchase offer. In other words, each variant of the lease contract represents a compromise between the PP’s potential to provide specific functionalities and the needs and financial possibilities of the customer resulting from his business. In the analyzed case, they are described as follows:

- PP leasing offer: It is assumed that PP has a set of types of devices: . Each type of device is characterized by a subset of the functionalities from the set (i.e., ). The functionalities of device can be represented by the sequence , where determines whether the device type has functionality () or not (). The number of devices of a given type is determined by the sequence , where means the number of devices of type . The offered devices are manufactured using various technologies which influence the price of the devices and their reliability. Advanced production technologies (that utilize innovative technologies to improve production processes) are high technology; the classification of technology as low, medium, or high tech can be subjective and context-dependent.

- For the purposes of the constructed model, it is represented by the variable , the value of which conventionally denotes the technological level of devices (the higher the value of , the higher the technological level: 1—“low”, 2—“medium”, 3—“high”). The cost of renting each type of device is determined by the sequence , where is the cost of the device type which depends on the technology in which the device was made. The costs of purchasing/renting devices by PP from the market are determined by the sequence , where determines the cost of purchasing the device by PP which depends on the technology in which the device was made.

- In turn, the costs of servicing the devices are determined by the sequence where determines the cost of servicing the device which depends on the technology in which the device was made.

- Customer purchase offer: There is a set of potential customers looking for a family of sets of devices that meet their expected assumptions. Each customer expects access to a family of subsets of devices that fulfill the functionalities specified by the sequence , where specifies the number of functionalities of type expected by customer . Each customer has a budget , which cannot be exceeded (i.e., the sum of the costs of devices cannot exceed this value). In addition to knowing the leasing costs, the customer wants to be sure that in the event of a failure one or more of the expected functionalities can be replaced by the remaining functional ones.

- A device functionality failure is understood as a situation in which one of its functionality fails and it is no longer available to the customer. As a consequence of this assumption, it becomes possible to introduce the concept of robustness of the proposed lease contract , understood as the ratio of failure scenarios in which the customer still has the full set of required functionalities () to all the considered failure scenarios (): , where means lack of robustness, i.e., for each failure scenario of a single functionality cannot be replaced by another functionality; means full robustness, i.e., for each failure scenario of a single functionality, other rented devices offer it. Each customer determines the minimum robustness level of their purchase offer.

Taking into account the above assumptions, the lease contract, which meets both the sales offer of PP and the purchase offer of the customer , consists of a list of devices represented by the sequence , where means number of type devices offered to customer . The functionalities offered as part of the contract, described with the sequence , can be defined as follows: , where is the number of functionalities made available to customer by the PaaS provider as part of the contract. For a given set of customers , is it possible to prepare a set of contracts for which it is required that each offer guarantees the expected:

- Functionality, i.e., ;

- Budget, i.e., ;

- Number of available devices, i.e., ;

- Robustness level, i.e., .

Meeting the above constraints allows for the designation of a family of admissible lease contracts , which are further assessed in terms of the PaaS provider’s profit and the costs incurred by customers:

- PP’s profit: The provider’s profit resulting from the adopted set of contracts and the technology used depends on many factors, including:

- ○

- The number of leased devices—the so-called redundant contracts (containing a larger number than required) increase the customers’ robustness to the effects of failure;

- ○

- Adopted technology —a higher level of technology reduces the frequency of failures, lowers energy consumption, improves monitoring, and so on;

- ○

- Service costs including travel, service, and disposal of the mentioned components.

It is assumed that it is determined as follows:

where

—revenue from the implementation of contracts : ;

—service costs for the devices offered (under contracts ) depending on the technology adopted ;

—costs of purchasing/renting devices by PP from the manufacturer.

- Customer costs: The costs of incurred by customer consist of two basic elements:

- ○

- Cost of renting devices , resulting directly from the prices of leased devices.

- ○

- Costs of loss of functionality of following its failure. For this reason, the customer incurs additional costs, which can be reduced either by increasing the technology level (higher technology level—lower failure rate) or by increasing the robustness (higher robustness—higher functionality sustainability).

In this approach, is defined as follows:

where , —nominal costs of loss of functionality, and —frequency of failure to technology devices .

This means that the provider’s profit and the costs incurred by customers are influenced by the structure of accepted contracts , determined by the level of technological advancement of the devices offered by the provider, and the level of robustness (where for the customer’s purchase offer.

3.2. Illustrative Example

To illustrate the introduced parameters, let us consider the following example: The provider PP has six types of devices , respectively, in number of units . The device offers six functionalities (Table 1).

Table 1.

Functionalities -th device.

The rental costs of one piece of a specific device (depending on the technology level ) are known (Table 2) as well as the service costs of one piece of device dependent on technology (Table 3). The costs of purchasing one piece of device by PP from the manufacturer’s market, depending on the technology , are also known (Table 4). For each device , the frequency of failures is known , depending on the adopted technology: , , and .

Table 2.

The cost of renting -th device depending on the adopted technology .

Table 3.

Service cost of the -th device depending on the adopted technology .

Table 4.

The cost of purchasing of the -th device depending on the adopted technology .

Customer expects offers that include devices that fulfill the functionalities specified by the sequence , which means that customers want to guarantee two functionalities , three functionalities

, and three functionalities . The cost of purchasing the devices listed in the request for proposal should not exceed the budget allocated for this purpose. Furthermore, as part of the efforts to improve the quality of services provided by customer , the average cost of losing a single functionality has been determined.

Additionally, the budget EUR of the customer is known, and the cost of loss of functionality EUR as a result of the loss of one functionality.

Lease contracts are being sought that align with customer expectations, as the desired functionalities dictate the specifications of the offered devices. At the same time, these contracts must ensure varying levels of robustness (, 33%, 40%, 72%, 90%, and 100%) without exceeding the available budget for the different technological levels }.

The prepared offers are collected in Table 5. For example, an offer with robustness:

Table 5.

robustness offers .

- consists of three pcs of device , one pc of device , and three pc of device , this means that the customer will receive three functionalities , two functionalities , three functionalities , three functionalities , no functionalities , and three functionalities . While this meets the customer’s requirements (two functionalities , three functionalities , and three functionalities ), it also implies that in any failure scenario involving one of the functionalities required by the customer, the remaining available functionalities will not be able to substitute for the missing one.

- consist of three pcs of device , and three pc of device , this means that the customer will receive three functionalities , three functionalities , three functionalities , three functionalities , no functionalities , and three functionalities . While this setup meets the customer’s requirements, it also implies that in three out of nine failure scenarios involving one of the functionalities required by the customer, the remaining available functionalities will be able to substitute for the missing one.

- Etc.

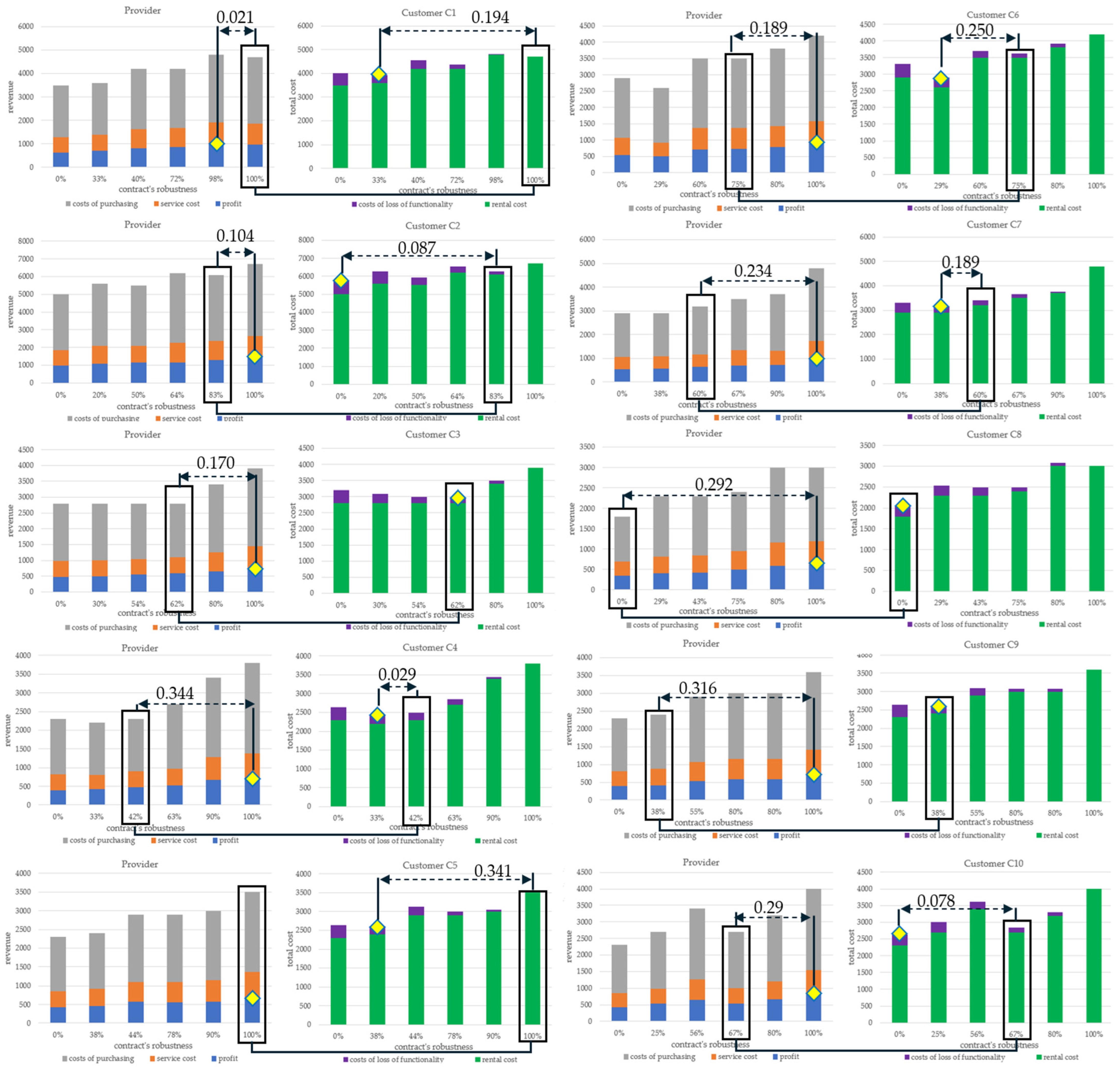

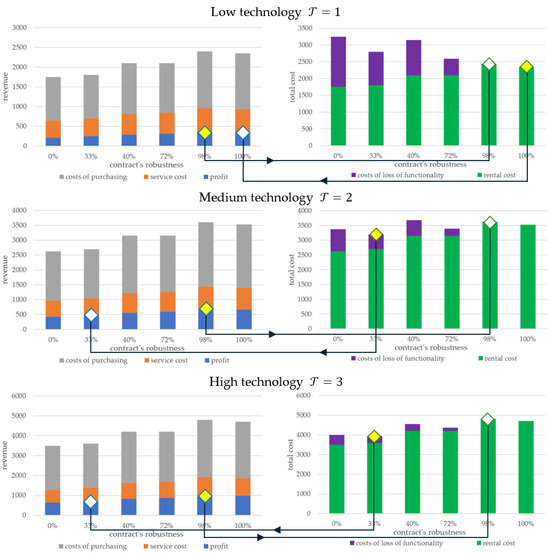

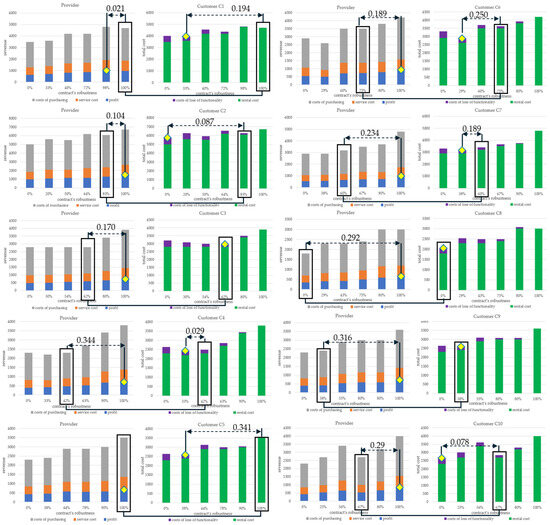

The balance of costs and benefits incurred by the PP and the customer’s expenses is illustrated in Figure 3.

Figure 3.

Balance of PP profits and costs incurred by the customer.

The left side of Figure 3 depicts the revenue of the PP. For various technology levels () and contracts (with robustness , 33%, 40%, 72%, 98%, and 100%), it highlights the cost of device acquisition (gray bars), service costs (orange bars), and provider profit (blue bars). For instance, in the chart corresponding to technology level , the highest revenue for the provider is achieved with an offering of robustness (represented by the yellow diamond). The right side of the figure illustrates the customer’s total costs , which comprise the average loss of functionality cost (purple bars) and the device rental cost (green bars). From the customer’s perspective, the most cost-effective option (yellow diamond) corresponds to the contract with robustness .

Similar discrepancies between the contracts preferred by the PP and the customer are also evident in cases with higher technology levels Specifically, the optimal solution for the provider (highest profit ) is not the optimal solution (lowest cost ) for the customer, and vice versa. This example demonstrates that in practice, it is rarely possible to achieve scenarios that provide the best outcomes for both parties (the provider and the customer) simultaneously. The search for a trade-off between the PP and the customer, thus, focuses on identifying a contract that is closest to their respective partial optimal solutions. This trade-off can be described by the following function:

where

—provider’s profit from the implementation of the contract (in technology );

—the highest possible profit of the provider for contracts of set implemented in technology ;

—customer costs for contract implemented in technology ;

—the lowest possible customer costs , for contracts of set implemented in technology .

The function describes how the PP’s profit and the customer’s costs resulting from the contract deviate from their respective optimal solutions. In this context, the problem reduces to identifying a contract that ensures the minimum value of the function . For instance, in the scenario depicted in Figure 3, the optimal solution is the contract implemented using technology , which guarantees the robustness This contract ensures the lowest value of .

3.3. Declarative Framework

The PP’s planning of a market offer that promises to sign a contract with the customer comes down to determining a compromise (i.e., the trade-off point) between the provider’s capabilities (determined by the number of -th devices at its disposal and the costs of renting individual -th devices) and the customer’s expectations limited by the available budget.

The objective function aims to minimize the value of function representing deviations between both provider and customer from optimum offer , formulated as . When preparing the offers, it is assumed that:

- Each customer’s requirements (such as functionalities and robustness level) and budget constraints are predetermined;

- Each provider’s capabilities (both the type and number of devices for a specific technology ) are predetermined;

- Costs of purchasing of -th type of device by the provider depends on the number of devices ordered;

- Rental prices depend on the technology () in which they are manufactured;

- Prices of the service support include costs related to the transportation as well as the disposal of broken components;

- Loss of functionality does not affect other functionalities within the same -th device.

A mathematical model was developed to determine an optimal contract that balances the provider’s technical capabilities with the customer’s needs and budget. The model includes a defined set of parameters, decision variables, and business constraints that interconnect these variables with the parameters.

- Parameters and sets:

| : | number of devices, where ; |

| number of customers, where ; | |

| : | number of functionalities, where ; |

| : | set of devices, where ; |

| : | set of functionalities, where ; |

| : | set of customers, where ; |

| : | sequence of device availability, where and ; |

| : | sequence of renting costs of -th device depending on the technology , where ; |

| : | set of customers functionalities orders, where ; |

| : | sequence of -th customer’s functionalities order, where and ; |

| : | set of customers budget limitations, where ; |

| : | -th customer’s budget limitation; |

| : | set of customers minimum level of robustness requirements, where ; |

| : | -th customer’s minimum level of robustness requirement, where ; |

| : | sequence of purchasing costs of -th device depending on the technology , where ; |

| : | sequence of service costs of -th device depending on the technology , where ; |

| : | frequency of failure to technology devices ; |

| : | nominal cost of loss the functionality for -th customer. |

| : | set of lease contracts ; |

| : | lease contract of customer , ; |

| : | number of -type devices assigned to the -th customer for given contract ; |

| : | technology level ; |

| : | number of -th functionalites available for -th customer for given contract ; |

| : | cost of contract ; |

| : | robustness of contract ; |

| : | sum of all functionalities in the ; |

| : | additional value to describe the sum of -th functionality redundancy for -th customer; |

| provider’s PP profit from adopted contracts for given technology ; | |

| : | provider’s PP profit from adopted set of contracts for given technology ; |

| : | revenue from the implementation of contracts for given technology ; |

| : | revenue from the implementation of set of contracts ; |

| service costs for the devices offered (under contract ) depending on the technology adopted ; | |

| : | service costs for the devices offered (under contracts ) depending on the technology adopted ; |

| : | costs of purchasing/renting devices by PP from the manufacturer; |

| : | cost of functionality loss for -th customer for given contract and technology ; |

| cost of renting devices; | |

| customer -th costs of contract in technology . |

- Constraints:

- Each lease contract must satisfy customer’s expectations (e.g., expected functionalities , budget , and expected robustness ) and provider’s limitation (e.g., available number of devices ):

- The provider’s profit depends on the revenues obtained (which are influenced by the assumed rental costs ), the costs incurred for servicing the devices (which are influenced by the assumed cost of service ), and their purchase prices (which are influenced by the assumed cost of purchasing devices ):

- The costs of customers depends on the cost of renting devices (which are influenced by the assumed rental costs ), costs of loss of functionality (which are influenced by the assumed frequency of failure devices ), and nominal costs of loss of functionality:

- The adopted objective function assumes minimization of the value representing the trade-off between provider and customers. The components of this function are the values , which represent the degree to which the local extremes are achieved by the provider PP (profit) as well as the customer (costs):

The presented model allows us to answer the following question: what set of lease contracts and technological level guarantees a trade-off (according to the adopted function (23)) between the provider and the customers of set ℂ? The above problem can be formulated as the following (constraint optimization problem):

where , a set of decision variables representing, among others, lease contracts , technology , and determined by the robustness provider’s profits , and customer cost ; is a finite set of domains of decision variables; is a set of constraints specified in Formulas (4)–(22); and is the objective function (23).

To solve the problem (24), one should determine the values of decision variables , for which all the constraints given in the set are satisfied and objective function is minimal. Solving means determining the set of contracts (and technology ) which guarantees a trade-off between the provider and the customers. The example of using the proposed approach is presented in the next section.

The solution of the considered problem (24) was obtained by implementing it in declarative programming environments such as ILOG or Gurobi. Leasing contracts are determined in the process of multiple pruning of the space of admissible solutions (using the mechanisms of constraints propagation and decision variables distribution). The method used is a generalization of the well-known branch and bound approach.

4. Case Study

The developed approach was used to define contracts that were a trade-off (according to the function (3)) between the capabilities of the one PaaS provider (PP) and the requirements of ten customers . The capabilities of PP are the same as in the example from Section 3.2—it has six types of devices with the parameters described in Table 1, Table 2, Table 3 and Table 4.

The provider considers purchase offers from ten customers specifying their expectations by the number of functionalities provided by devices (see Table 6). For example, customer expects that the rented devices will have two functionalities , three functionalities , and three functionalities .

Table 6.

Matrix of the customers () expectations ().

The cost of purchasing the devices should not exceed the customer budget (in euro): , , , , , , , , , and . Furthermore, for each customer, cost of losing a single functionality is EUR.

The answer to the following question is sought: what set of lease contracts and technological level guarantees a trade-off (according to the adopted function (3)) between the provider and the customers of set ?

For this purpose, for the different technological levels () contracts for each customer with robustness in six ranges: , , , , , and were sought.

Using the developed model implemented in the IBM ILOG CPLEX (version: 22.1.1, Intel Core i7-M4800MQ 2.7 GHz and 32 GB RAM), calculations were performed for the given data. The presented solutions of negotiated contracts meet the constraints given in the model. To determine them, a generalized branch and bound approach implemented in the IBM ILOG CPLEX environment was used.

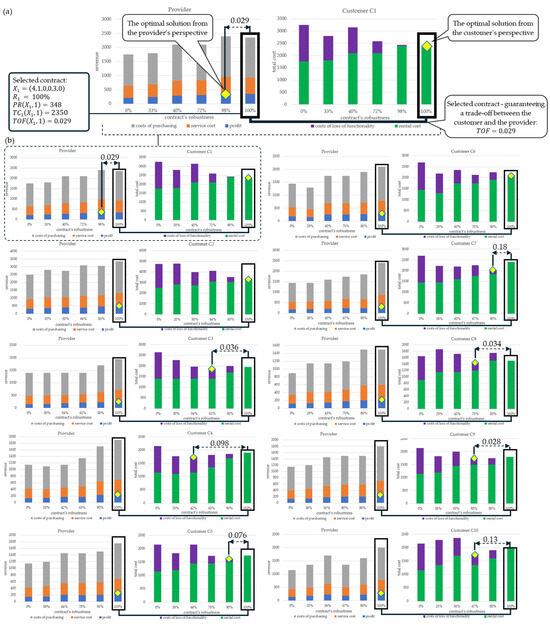

Table 7 summarizes the results of customer contracts corresponding to the -function trade-off points and the assumed technological level of the leased devices. For example, in the case of customer , the trade-off (), minimizing the difference between the local extremes of the customer and PP, is the robustness of eight leased devices at the level of . The determined equilibrium point determines the PP’s profit at the level of 348 EUR with leasing costs at the level of 2350 EUR.

Table 7.

Customer contracts corresponding to -function trade-off points for .

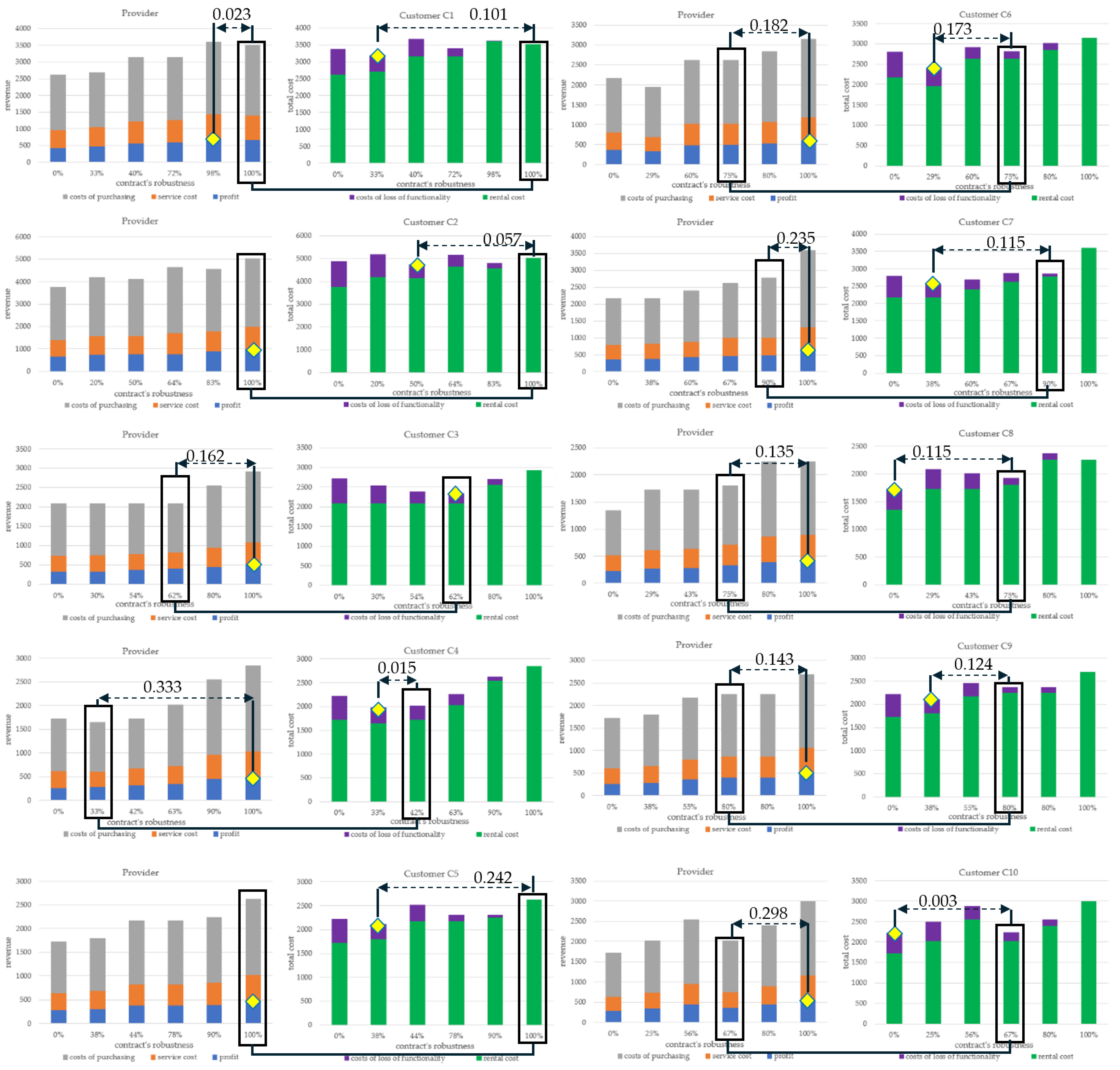

The trade-off contract relating to customer is illustrated in Figure 4a, see the points marked with yellow diamonds designating optimal solutions for the () and PP (). It can be seen that the best (i.e., guaranteeing a trade-off) contract for is in the case of robustness (see the designated ). The rest of the figure, i.e., Figure 4b, illustrates the trade-off in contracts with other customers .

Figure 4.

Trade-off in contracts with customers for technology level − detailed customer case (a), all customers cases (b).

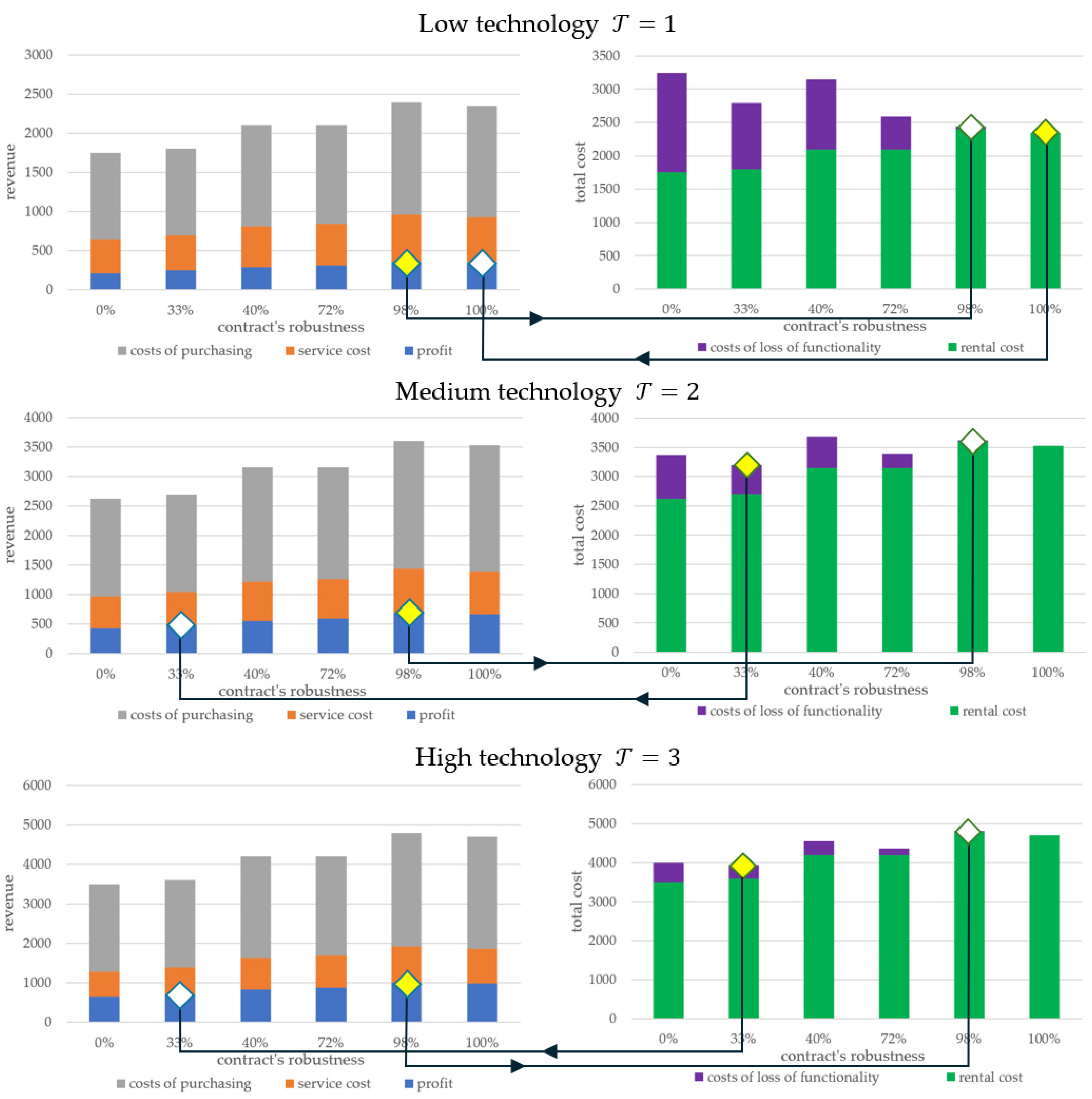

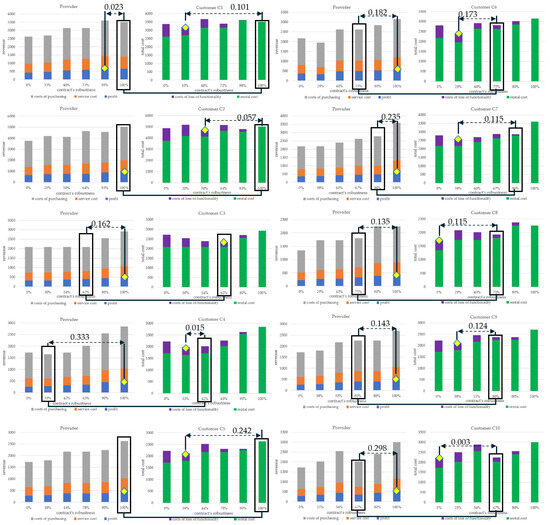

Analogously to the above-described case of the technological level of rented devices, experiments were carried out and the results are summarized in Table 8 and Table 9 and illustrated in Figure 5 and Figure 6, respectively, for the and technology levels.

Table 8.

Customer contracts corresponding to -function trade-off points for technology level .

Table 9.

Customer contracts corresponding to -function trade-off points for .

Figure 5.

Trade-off in contracts with customers for technology level .

Figure 6.

Trade-off in contracts with customers for technology level .

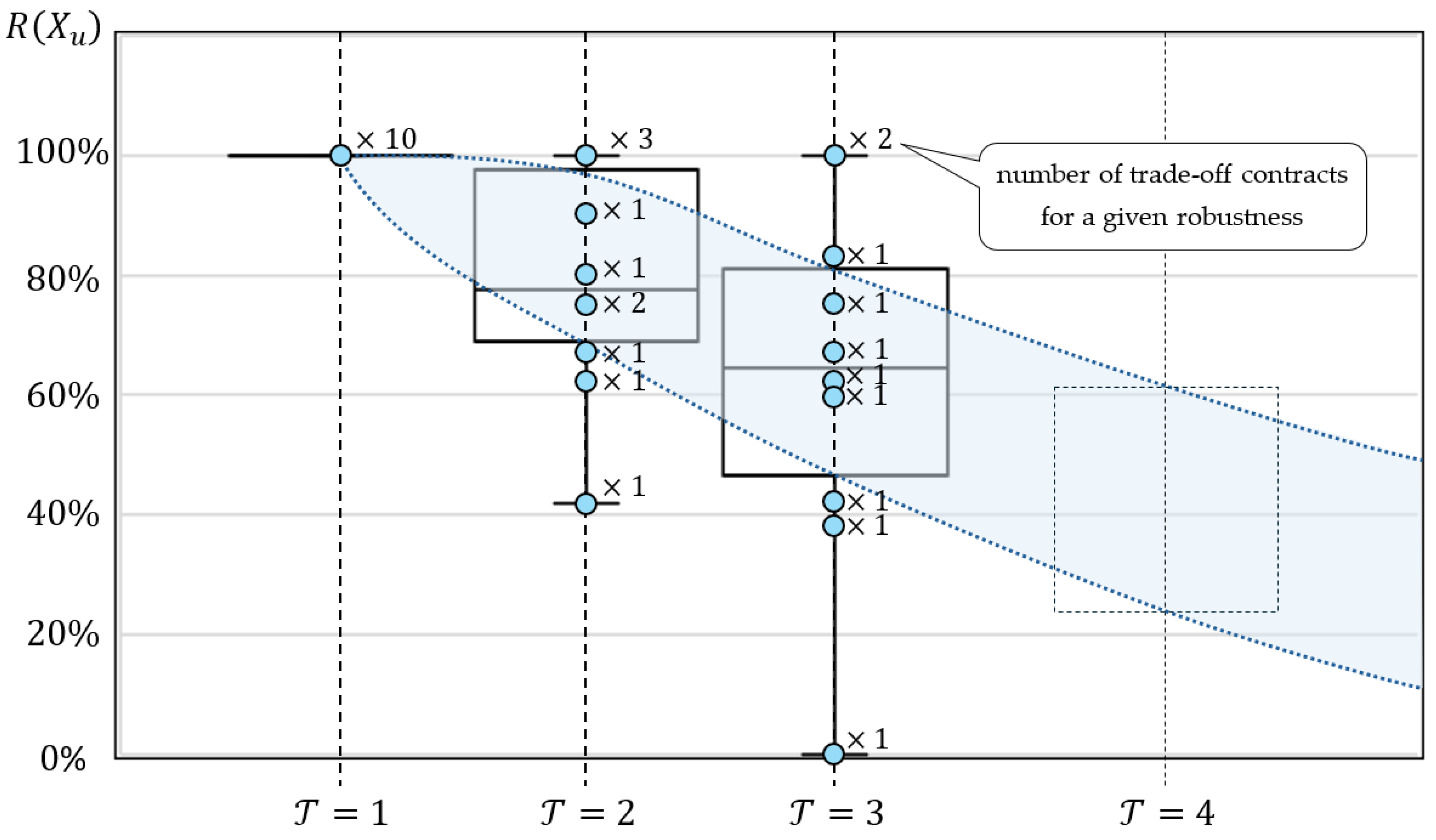

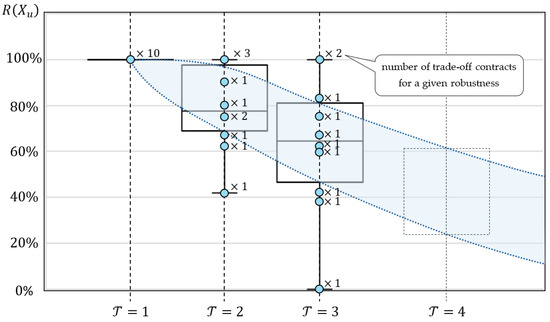

The analysis of the cases presented above shows that the adoption of a higher level of technology results in a lower level of redundancy (robustness of the structure of rented devices) of orders. Comparing, for example, contracts for technology and technology , it turns out that in the case of , for all customers, selected contracts have the robustness of , while in the case of only two contracts have such robustness (customers and ). In other cases, they remain at different levels, even for customer . This means that higher technology replaces the redundancy of rented devices.

Summarizing the experiments carried out, the results obtained (collected in Table 7, Table 8 and Table 9) constitute a recommendation for contracts guaranteeing a compromise, i.e., each party obtains a variant of the contract in which it loses the least compared to the local optimal solution (relative to the function (3)). Both the PaaS provider’s capabilities (expressed by the PP leasing offer) and the customer’s needs (expressed by the customer purchase offer) are taken into account. They also allow us to take into account the impact of the external market (cost of purchasing ()) related to access to various technologies .

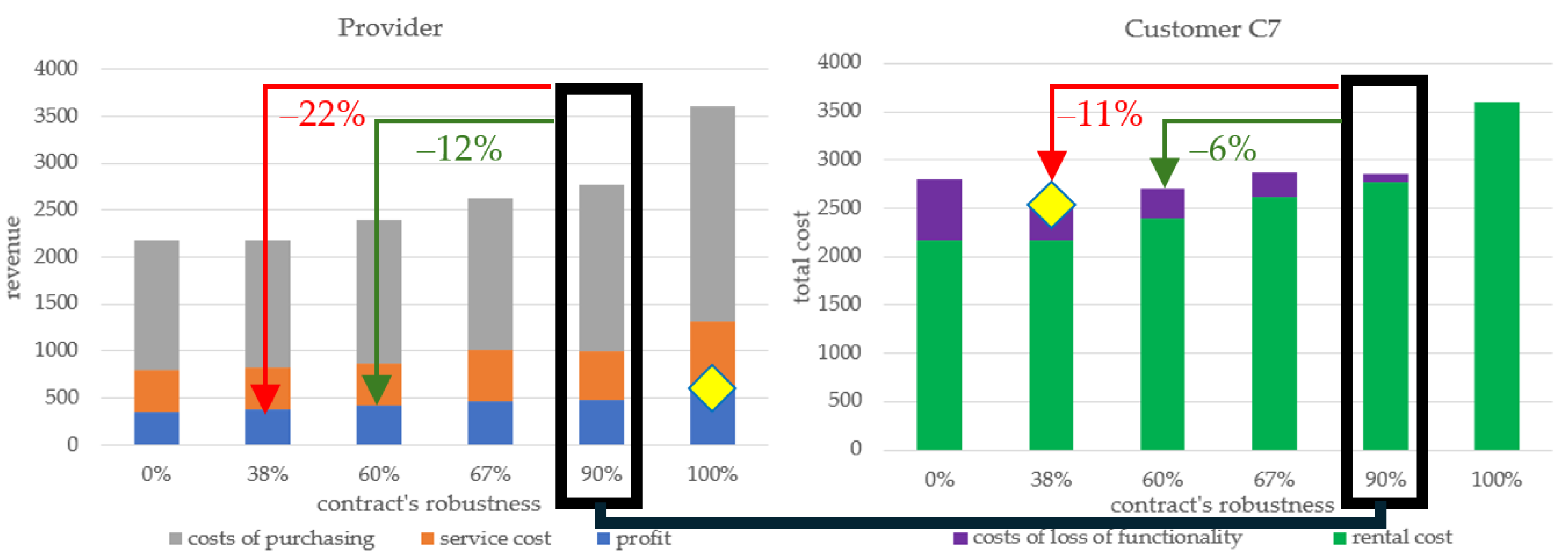

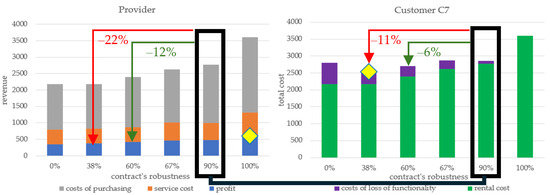

It is worth noting that the developed model can be used to assess sensitivity to changes in negotiated contracts. As an example, let us consider customer : when using technology , they obtained a contract with robustness (see Table 8). Let us assume that this customer does not accept such a contract and is considering a variant in which the costs incurred by them are closer to the estimated minimum, see contracts with robustness or . Accepting these contracts would allow it to reduce costs by 6% and 11%, respectively—see Figure 7. However, it turns out that for the provider, changing the proposed contract also results in a significant change in his profit, amounting to 12% and 22%, respectively. A change exceeding 15% is not acceptable to the provider, so only the first proposal can be the subject of further negotiations. The example presented is just one of many examples of the use of the developed model in the process of establishing leasing contracts.

Figure 7.

Assessing the sensitivity of the provider’s rating to consumer correction.

The observed trend (see Figure 8) of decreasing redundancy (and therefore, the robustness of the ordered set of devices) of the selected contracts with increasing technology level is consistent with common practice.

This coincides with the observation that as the quality of leased devices increases, the user’s involvement in maintaining them decreases (reduction in maintenance costs). Moreover, in the general case, another trade-off takes place, this time between the outlays/costs related to redundancy (guaranteeing the assumed robustness of the offer) and the quality (guaranteeing reduced failure rate) of the leased devices. However, due to the limited volume of the work, examples illustrating this phenomenon were omitted, as well as an analysis of the convergence of the compromise points of the discussed case with the case between the expenses and the costs incurred in connection with the rental of the necessary devices. These threads will be developed in our next work.

The developed model enables a quantitative analysis of the aforementioned findings and facilities tracking their trends. Of course, the discussed above observations depend on the adopted values of parameters such as nominal costs of loss of functionality , frequency of failure to technology devices , service costs for the devices offered , etc. This means that there is no guarantee that this trend will be preserved as well with other values of these parameters. It is also worth noting that the declarative nature of the developed model (characterized by an open structure of the set of constraints) enables the so-called reverse process to be carried out, i.e., the synthesis process in which the values of the above parameters can be determined in such a way that they ensure a specific compromise between the PaaS provider and customers. In such a case, the answer to the following question is sought: are there such parameter values: , , , …, that will guarantee the existence of contracts with specific customer costs and the provider’s profit.

5. Conclusions

This study presents a declarative modeling framework designed to balance supply and demand in PaaS markets by optimizing three key pillars: profitability, cost efficiency, and sustainability. The developed approach integrates financial viability with operational efficiency, allowing both providers and customers to identify trade-offs between leasing offers and requests for quotations. By considering device lifecycle costs, technological advancements, and consumer constraints, the proposed model provides a comprehensive tool for decision making in PaaS environments.

The computational experiments conducted in this study demonstrate the practical applicability of the framework in real-world scenarios. The results confirm that achieving equilibrium between provider and customers requires an adaptive pricing strategy that accounts for device maintenance, failure rates, and redundancy. Furthermore, the findings highlight the importance of balancing technological investment with cost-saving mechanisms to ensure sustainable and profitable PaaS operations. The case study analysis reinforces the notion that optimal contracts rarely align perfectly with the interests of both parties, necessitating structured negotiations guided by trade-off functions.

Due to its declarative nature, the framework remains highly adaptable, allowing enterprises to tailor their parameters and constraints to their specific needs. Organizations operating in dynamic, service-oriented environments—such as mobility services, industrial leasing, or renewable energy systems—are particularly well suited for its application, as they can leverage its flexibility to balance cost, performance, and sustainability. For instance, manufacturing enterprises can use the framework to optimize spare parts logistics and equipment servicing, ensuring a balance between cost efficiency and uptime reliability. Similarly, technology companies offering cloud-based services or subscription-based hardware (e.g., SaaS or Hardware-as-a-Service) can leverage the framework to fine-tune service contracts, dynamically adjusting pricing based on resource usage and infrastructure costs.

A critical contribution of this research is the ability to model and assess sensitivity to changes in contract parameters. By exploring different leasing scenarios, the framework allows stakeholders to evaluate the impact of alternative pricing and redundancy strategies on both profitability and affordability. The observed trends suggest that increasing technology levels lead to decreased redundancy requirements, which aligns with industry practices of prioritizing higher-quality devices to reduce maintenance costs and enhance customer satisfaction.

Future research directions include expanding the framework to accommodate multiple providers and customers, integrating dynamic market conditions, and considering additional cost factors such as logistics, storage, and regulatory compliance. Further refinement of the model could also explore predictive analytics and machine learning techniques to enhance demand forecasting and pricing optimization. Additionally, incorporating real-time data streams could improve decision making by providing more responsive and adaptive pricing mechanisms.

Overall, this study advances the understanding of PaaS market dynamics by providing a structured, data-driven approach to achieving supply–demand balance while promoting financial sustainability and environmental responsibility. The proposed framework serves as a foundation for further exploration of equilibrium models in circular economy-based business models, contributing to the ongoing transformation of traditional ownership-based consumption toward service-oriented solutions.

Author Contributions

Conceptualization, E.S., G.B. and Z.B.; methodology, G.B. and G.R.; software, G.B. and G.R.; validation, E.S.; formal analysis, G.B. and Z.B.; investigation, E.S. and G.B.; resources, G.R. and G.B.; data curation, E.S. and G.B.; writing—original draft preparation, Z.B., G.B. and E.S.; writing—review and editing, Z.B. and E.S.; visualization, G.B. and G.R.; supervision, G.R. and Z.B.; project administration, Z.B., E.S. and G.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Vogt Duberg, J.; Sakao, T. How Can Manufacturers Identify the Conditions for Financially Viable Product-as-a-Service? Front. Manuf. Technol. 2024, 4, 1498189. [Google Scholar] [CrossRef]

- Isaksson, O.; Larsson, T.C.; Johansson, P. Towards a Framework for Developing Product/Service Systems. In Functional Thinking for Value Creation; Springer: Berlin/Heidelberg, Germany, 2011; pp. 44–49. [Google Scholar]

- Vishkaei, B.M. Optimal Ordering for Product-as-a-Service Models with Circular Economy Practices. Int. J. Prod. Res. 2024, 1–20. [Google Scholar] [CrossRef]

- Hauschild, M.Z.; McKone, T.E.; Arnbjerg-Nielsen, K.; Hald, T.; Nielsen, B.F.; Mabit, S.E.; Fantke, P. Risk and Sustainability: Trade-Offs and Synergies for Robust Decision Making. Environ. Sci. Eur. 2022, 34, 11. [Google Scholar] [CrossRef]

- Peillon, S.; Medini, K.; Wuest, T. Building Win-Win Value Networks for Product-Service Systems’ Delivery. Int. J. Manuf. Technol. Manag. 2023, 37, 619–637. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, X.; Zhi, B.; Sheng, J. Channel and Bundling Strategies: Forging a “Win-Win” Paradigm in Product and Service Operations. Decis. Support Syst. 2024, 187, 114325. [Google Scholar] [CrossRef]

- Szwarc, E.; Bocewicz, G.; Smutnicki, C.; Banaszak, Z. Preventive Planning of Product-as-a-Service Offers to Maintain the Availability of Required Service Level. Ann. Oper. Res. 2024. [Google Scholar] [CrossRef]

- Szwarc, E.; Golińska-Dawson, P.; Bocewicz, G.; Banaszak, Z. Proactive Resource Maintenance in Product-as-a-Service Business Models: A Constraints Programming Based Approach for MFP Offerings Prototyping. In Advances in Manufacturing IV; Springer: Cham, Switzerland, 2024; pp. 276–289. [Google Scholar]

- Sidarus, N.; Palminteri, S.; Chambon, V. Cost-Benefit Trade-Offs in Decision-Making and Learning. PLoS Comput. Biol. 2019, 15, e1007326. [Google Scholar] [CrossRef]

- Pereira, V.R.; Homrich, A.S.; de Carvalho, M.M. Why Are Companies Moving on towards Product-Service Systems? A Framework for PSS Drivers. Production 2023, 33, e20230004. [Google Scholar] [CrossRef]

- Sakao, T.; Golinska-Dawson, P.; Vogt Duberg, J.; Sundin, E.; Hidalgo Crespo, J.; Riel, A.; Peeters, J.; Green, A.; Mathieux, F. Product-as-a-Service for Critical Raw Materials: Challenges, Enablers, and Needed Research. In Proceedings of the Going Green: Care Innovation, Vienna, Austria, 9–11 May 2023. [Google Scholar]

- Wicaksono, P.A.; Hartini, S.; Sutrisno; Nabila, T.Y. Game Theory Application for Circular Economy Model in Furniture Industry. IOP Conf. Ser. Earth Environ. Sci. 2020, 448, 012061. [Google Scholar] [CrossRef]

- Blüher, T.; Stark, R. Systemic Evaluation of PSS in the Early Concept Phase Using Graph-Based Reasoning. Appl. Sci. 2024, 14, 11241. [Google Scholar] [CrossRef]

- Falatouri, T.; Brandtner, P.; Nasseri, M.; Darbanian, F. Maintenance Forecasting Model for Geographically Distributed Home Appliances Using Spatial-Temporal Networks. Procedia Comput. Sci. 2023, 219, 495–503. [Google Scholar] [CrossRef]

- Patel, J.K. The Importance of Equipment Maintenance Forecasting. Int. J. Mech. Eng. 2021, 8, 7–11. [Google Scholar] [CrossRef]

- Nunes, P.; Santos, J.; Rocha, E. Challenges in Predictive Maintenance—A Review. CIRP J. Manuf. Sci. Technol. 2023, 40, 53–67. [Google Scholar] [CrossRef]

- Kirchherr, J.; Reike, D.; Hekkert, M. Conceptualizing the Circular Economy: An Analysis of 114 Definitions. SSRN Electron. J. 2017, 127, 221–232. [Google Scholar] [CrossRef]

- da Fernandes, S.C.; Pigosso, D.C.A.; McAloone, T.C.; Rozenfeld, H. Towards Product-Service System Oriented to Circular Economy: A Systematic Review of Value Proposition Design Approaches. J. Clean. Prod. 2020, 257, 120507. [Google Scholar] [CrossRef]

- Anilkumar, E.N.; Sridharan, R. Sustainable Supply Chain Management. Int. J. Syst. Dyn. Appl. 2019, 8, 15–52. [Google Scholar] [CrossRef]

- Velenturf, A.P.M.; Purnell, P. Principles for a Sustainable Circular Economy. Sustain. Prod. Consum. 2021, 27, 1437–1457. [Google Scholar] [CrossRef]

- Peng, Y.; Xu, D.; Li, Y.; Wang, K. A Product Service Supply Chain Network Equilibrium Model Considering Capacity Constraints. Math. Probl. Eng. 2020, 2020, 1295072. [Google Scholar] [CrossRef]

- Lahcen, B.; Eyckmans, J.; Rousseau, S.; Dams, Y.; Brusselaers, J. Modelling the Circular Economy: Introducing a Supply Chain Equilibrium Approach. Ecol. Econ. 2022, 197, 107451. [Google Scholar] [CrossRef]

- Zengin, M.; Amin, S.H.; Zhang, G. Closing the Gap: A Comprehensive Review of the Literature on Closed-Loop Supply Chains. Logistics 2024, 8, 54. [Google Scholar] [CrossRef]

- De Giovanni, P. Leveraging the Circular Economy with a Closed-Loop Supply Chain and a Reverse Omnichannel Using Blockchain Technology and Incentives. Int. J. Oper. Prod. Manag. 2022, 42, 959–994. [Google Scholar] [CrossRef]

- Difrancesco, R.M.; Huchzermeier, A. Closed-Loop Supply Chains: A Guide to Theory and Practice. Int. J. Logist. Res. Appl. 2016, 19, 443–464. [Google Scholar] [CrossRef]

- Golpîra, H.; Javanmardan, A. Decentralized Decision System for Closed-Loop Supply Chain: A Bi-Level Multi-Objective Risk-Based Robust Optimization Approach. Comput. Chem. Eng. 2021, 154, 107472. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Moshtagh, M.S.; Moon, I. Pricing, Product Quality, and Collection Optimization in a Decentralized Closed-Loop Supply Chain with Different Channel Structures: Game Theoretical Approach. J. Clean. Prod. 2018, 189, 406–431. [Google Scholar] [CrossRef]

- Massari, G.F.; Nacchiero, R.; Giannoccaro, I. Digital Technologies for Resource Loop Redesign in Circular Supply Chains: A Systematic Literature Review. Resour. Conserv. Recycl. Adv. 2023, 20, 200189. [Google Scholar] [CrossRef]

- Jing, Y.; Li, W. Integrated Recycling-Integrated Production—Distribution Planning for Decentralized Closed-Loop Supply Chain. J. Ind. Manag. Optim. 2018, 14, 511–539. [Google Scholar] [CrossRef]

- Mustafee, N.; Katsaliaki, K.; Taylor, S.J.E. A Review of Literature in Distributed Supply Chain Simulation. In Proceedings of the Winter Simulation Conference 2014, IEEE, Savannah, GA, USA, 7–10 December 2014; pp. 2872–2883. [Google Scholar]

- Cantele, M.; Bal, P.; Kompas, T.; Hadjikakou, M.; Wintle, B. Equilibrium Modeling for Environmental Science: Exploring the Nexus of Economic Systems and Environmental Change. Earths Future 2021, 9, e2020EF001923. [Google Scholar] [CrossRef]

- Liu, W.; Chen, J. The Equilibrium Analysis of Actors’ Decision in Circular Economy System. In Proceedings of the 2010 the 2nd Conference on Environmental Science and Information Application Technology, Wuhan, China, 17–18 July 2010; pp. 187–190. [Google Scholar]

- Nand, A.A.; Menon, R.; Bhattacharya, A.; Bhamra, R. A Review of Sustainability Trade-Offs Affecting Suppliers in Developed and Less Developed Countries. J. Bus. Ind. Mark. 2023, 38, 463–483. [Google Scholar] [CrossRef]

- Liedong, T.A.; Taticchi, P.; Rajwani, T.; Pisani, N. Gracious Growth: How to Manage the Trade-off between Corporate Greening and Corporate Growth. Organ. Dyn. 2022, 51, 100895. [Google Scholar] [CrossRef]

- Garcia-Muiña, F.E.; González-Sánchez, R.; Ferrari, A.M.; Volpi, L.; Pini, M.; Siligardi, C.; Settembre-Blundo, D. Identifying the Equilibrium Point between Sustainability Goals and Circular Economy Practices in an Industry 4.0 Manufacturing Context Using Eco-Design. Soc. Sci. 2019, 8, 241. [Google Scholar] [CrossRef]

- Ye, M.; Han, Q.-L.; Ding, L.; Xu, S. Distributed Nash Equilibrium Seeking in Games With Partial Decision Information: A Survey. Proc. IEEE 2023, 111, 140–157. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).